Exhibit 99.1

Consolidated Financial Statements of

LORUS THERAPEUTICS INC.

Years ended May 31, 2011, 2010 and 2009

|

KPMG LLP

Chartered Accountants

Adelaide Centre

333 Bay Street Suite 4600

Toronto ON M5H 2S5

Canada

|

Telephone (416) 777-8500

Fax (416) 777-8818

Internet www.kpmg.ca

|

INDEPENDENT AUDITORS' REPORT

To the Shareholders and Board of Directors

We have audited the accompanying consolidated financial statements of Lorus Therapeutics Inc., which comprise the consolidated balance sheets as at May 31, 2011 and May 31, 2010, the consolidated statements of operations and comprehensive income, deficit and cash flows for each of the years in the three-year period ended May 31, 2011, and notes, comprising a summary of significant accounting policies and other explanatory information.

Management's Responsibility for the Consolidated Financial Statements

Management is responsible for the preparation and fair presentation of these consolidated financial statements in accordance with Canadian generally accepted accounting principles, and for such internal control as management determines is necessary to enable the preparation of consolidated financial statements that are free from material misstatement, whether due to fraud or error.

Auditors' Responsibility

Our responsibility is to express an opinion on these consolidated financial statements based on our audits. We conducted our audits in accordance with Canadian generally accepted auditing standards. Those standards require that we comply with ethical requirements and plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free from material misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the consolidated financial statements. The procedures selected depend on our judgment, including the assessment of the risks of material misstatement of the consolidated financial statements, whether due to fraud or error. In making those risk assessments, we consider internal control relevant to the entity's preparation and fair presentation of the consolidated financial statements in order to design audit procedures that are appropriate in the circumstances. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of accounting estimates made by management, as well as evaluating the overall presentation of the consolidated financial statements.

We believe that the audit evidence we have obtained in our audits is sufficient and appropriate to provide a basis for our audit opinion.

|

KPMG LLP is a Canadian limited liability partnership and a member firm of the KPMG

network of independent member firms affiliated with KPMG International Cooperative

(“KPMG International”), a Swiss entity.

KPMG Canada provides services to KPMG LLP.

|

Page 2

Opinion

In our opinion, the consolidated financial statements present fairly, in all material respects, the consolidated financial position of Lorus Therapeutics Inc. as at May 31, 2011 and May 31, 2010 and its consolidated results of its operations and its consolidated cash flows for each of the years in the three-year period ended May 31, 2011 in accordance with Canadian generally accepted accounting principles.

Emphasis of Matter

Without qualifying our opinion, we draw attention to Note 1 in the financial statements, which indicates that Lorus Therapeutics Inc. is in the development stage and, as such, no substantial revenue has been generated from its operating activities. Accordingly, the Company depends on its ability to raise financing in order to discharge its commitments and liabilities in the normal course of business. These conditions, along with other matters as set forth in Note 1, indicate the existence of a material uncertainty that may cast significant doubt about Lorus Therapeutics Inc.'s ability to continue as a going concern.

Chartered Accountants, Licensed Public Accountants

Toronto, Canada

August 25, 2011

LORUS THERAPEUTICS INC.

Consolidated Balance Sheets

(Expressed in thousands of Canadian dollars)

May 31, 2011 and 2010

|

2011

|

2010

|

|||||||

|

Assets

|

||||||||

|

Current assets:

|

||||||||

|

Cash and cash equivalents (note 9)

|

$ | 911 | $ | 667 | ||||

|

Short-term investments (notes 4 and 9)

|

– | 247 | ||||||

|

Prepaid expenses and other assets

|

388 | 636 | ||||||

| 1,299 | 1,550 | |||||||

|

Fixed assets (note 5)

|

99 | 147 | ||||||

|

Goodwill

|

606 | 606 | ||||||

| $ | 2,004 | $ | 2,303 | |||||

|

Liabilities and Shareholders' Equity (Deficiency)

|

||||||||

|

Current liabilities:

|

||||||||

|

Accounts payable

|

$ | 215 | $ | 387 | ||||

|

Accrued liabilities

|

944 | 1,458 | ||||||

|

Promissory note payable (note 16)

|

– | 1,000 | ||||||

| 1,159 | 2,845 | |||||||

|

Shareholders' equity (deficiency):

|

||||||||

|

Share capital (note 6):

|

||||||||

|

Common shares

|

168,787 | 163,920 | ||||||

|

Stock options

|

1,156 | 3,704 | ||||||

|

Contributed surplus

|

18,988 | 14,875 | ||||||

|

Warrants

|

1,032 | 1,039 | ||||||

|

Deficit accumulated during development stage

|

(189,118 | ) | (184,080 | ) | ||||

| 845 | (542 | ) | ||||||

|

Basis of presentation (note 1)

|

||||||||

|

Contingencies, commitments and guarantees (note 14)

|

||||||||

|

Subsequent events (note 17)

|

||||||||

| $ | 2,004 | $ | 2,303 | |||||

See accompanying notes to consolidated financial statements.

On behalf of the Board:

"Denis R. Burger" Director

"Aiping H. Young" Director

1

LORUS THERAPEUTICS INC.

Consolidated Statements of Operations and Comprehensive Income

(Expressed in thousands of Canadian dollars, except for per common share data)

|

Period from

|

||||||||||||||||

|

inception on

|

||||||||||||||||

|

September 5,

|

||||||||||||||||

|

1986 to

|

||||||||||||||||

| Years ended May 31, |

May 31,

|

|||||||||||||||

|

2011

|

2010

|

2009

|

2011

|

|||||||||||||

|

Revenue

|

$ | – | $ | 131 | $ | 184 | $ | 1,171 | ||||||||

|

Expenses:

|

||||||||||||||||

|

Research and development (note 11)

|

2,298 | 2,517 | 3,757 | 128,812 | ||||||||||||

|

General and administrative

|

2,101 | 2,964 | 2,958 | 62,940 | ||||||||||||

|

Stock-based compensation (note 7)

|

526 | 176 | 446 | 9,120 | ||||||||||||

|

Depreciation and amortization of fixed assets

|

56 | 86 | 189 | 9,873 | ||||||||||||

|

Cost of sales

|

– | – | – | 105 | ||||||||||||

| 4,981 | 5,743 | 7,350 | 210,850 | |||||||||||||

|

Other expenses (income):

|

||||||||||||||||

|

Interest

|

71 | 54 | 707 | 4,093 | ||||||||||||

|

Accretion in carrying value of convertible debentures (note 13)

|

– | 80 | 1,707 | 4,983 | ||||||||||||

|

Amortization of deferred financing costs (note 13)

|

– | – | – | 412 | ||||||||||||

|

Interest

|

(14 | ) | (21 | ) | (270 | ) | (12,271 | ) | ||||||||

| 57 | 113 | 2,144 | (2,783 | ) | ||||||||||||

|

Loss from operations

|

(5,038 | ) | (5,725 | ) | (9,310 | ) | (206,896 | ) | ||||||||

|

|

||||||||||||||||

|

Gain on repurchase of convertible debentures and transfer of assets (note 13)

|

– | 11,006 | – | 11,006 | ||||||||||||

|

Gain on sale of shares (notes 1(b) and 14)

|

– | 50 | 450 | 6,799 | ||||||||||||

|

Net (loss) earnings for the period and other comprehensive (loss) income

|

$ | (5,038 | ) | $ | 5,331 | $ | (8,860 | ) | $ | (189,091 | ) | |||||

|

Basic and diluted (loss) earnings per common share

|

$ | (0.38 | ) | $ | 0.57 | $ | (1.08 | ) | ||||||||

|

Weighted average number of common shares outstanding used in the calculation of (in thousands):

|

||||||||||||||||

|

Basic (loss) earnings per share

|

13,157 | 9,364 | 8,236 | |||||||||||||

|

Diluted (loss) earnings per share

|

13,157 | 9,379 | 8,236 | |||||||||||||

See accompanying notes to consolidated financial statements.

2

LORUS THERAPEUTICS INC.

Consolidated Statements of Deficit

(Expressed in thousands of Canadian dollars)

|

Period from

|

||||||||||||||||

|

inception on

|

||||||||||||||||

|

September 5,

|

||||||||||||||||

|

1986 to

|

||||||||||||||||

| Years ended May 31, |

May 31,

|

|||||||||||||||

|

2011

|

2010

|

2009

|

2011

|

|||||||||||||

|

Deficit, beginning of period, as previously reported

|

$ | (184,080 | ) | $ | (189,411 | ) | $ | (180,551 | ) | $ | – | |||||

|

Change in accounting policy

|

– | – | – | (27 | ) | |||||||||||

|

Deficit, beginning of period, as restated

|

(184,080 | ) | (189,411 | ) | (180,551 | ) | (27 | ) | ||||||||

|

Net (loss) earnings for the period

|

(5,038 | ) | 5,331 | (8,860 | ) | (189,091 | ) | |||||||||

|

Deficit, end of period

|

$ | (189,118 | ) | $ | (184,080 | ) | $ | (189,411 | ) | $ | (189,118 | ) | ||||

See accompanying notes to consolidated financial statements.

3

Consolidated Statements of Cash Flows

(Expressed in thousands of Canadian dollars)

|

Period from

|

||||||||||||||||

|

inception on

|

||||||||||||||||

|

September 5,

|

||||||||||||||||

|

1986 to

|

||||||||||||||||

|

Years ended May 31,

|

May 31,

|

|||||||||||||||

|

2011

|

2010

|

2009

|

2011

|

|||||||||||||

|

Cash flows from operating activities:

|

||||||||||||||||

|

Net (loss) earnings for the period

|

$ | (5,038 | ) | $ | 5,331 | $ | (8,860 | ) | $ | (189,091 | ) | |||||

|

Items not involving cash:

|

||||||||||||||||

|

Gain on repurchase of convertible debentures and transfer of assets (note 13)

|

– | (11,006 | ) | – | (11,006 | ) | ||||||||||

|

Gain on sale of shares (notes 1(b) and 14)

|

– | (50 | ) | (450 | ) | (6,799 | ) | |||||||||

|

Stock-based compensation

|

526 | 176 | 446 | 9,120 | ||||||||||||

|

Interest on convertible debentures

|

– | 15 | 707 | 3,983 | ||||||||||||

|

Accretion in carrying value of convertible debentures

|

– | 80 | 1,707 | 4,983 | ||||||||||||

|

Amortization of deferred financing costs

|

– | – | – | 412 | ||||||||||||

|

Depreciation and amortization of fixed assets and acquired patents and licenses

|

56 | 86 | 189 | 22,434 | ||||||||||||

|

Other

|

– | (8 | ) | (10 | ) | 437 | ||||||||||

|

Change in non-cash operating working capital (note 12)

|

(1,438 | ) | 1,655 | (942 | ) | (237 | ) | |||||||||

|

Cash used in operating activities

|

(5,894 | ) | (3,721 | ) | (7,213 | ) | (165,764 | ) | ||||||||

|

Cash flows from financing activities:

|

||||||||||||||||

|

Issuance of debentures, net of

|

||||||||||||||||

|

issuance costs

|

– | – | – | 12,948 | ||||||||||||

|

Payment on settlement of convertible debentures, including transaction costs (note 13)

|

– | (3,521 | ) | – | (3,521 | ) | ||||||||||

|

Proceeds on sale of shares, net of arrangement costs (note 14(d))

|

– | – | 600 | 6,899 | ||||||||||||

|

Issuance of common shares and warrants, net of issuance costs (note 6)

|

5,899 | 2,287 | 3,207 | 157,571 | ||||||||||||

|

Cash provided by (used in) financing activities

|

5,899 | (1,234 | ) | 3,807 | 173,897 | |||||||||||

|

Cash flows from investing activities:

|

||||||||||||||||

|

Maturity (purchase) of investments, net

|

247 | 250 | 6,304 | (3 | ) | |||||||||||

|

Business acquisition, net of cash received

|

– | – | – | (539 | ) | |||||||||||

|

Acquired patents and licenses

|

– | – | – | (715 | ) | |||||||||||

|

Additions to fixed assets

|

(8 | ) | (2 | ) | (176 | ) | (6,313 | ) | ||||||||

|

Proceeds on sale of fixed assets

|

– | – | – | 348 | ||||||||||||

|

Cash provided by (used in) investing activities

|

239 | 248 | 6,128 | (7,222 | ) | |||||||||||

|

Increase (decrease) in cash and cash equivalents

|

244 | (4,707 | ) | 2,722 | 911 | |||||||||||

|

Cash and cash equivalents, beginning of period

|

667 | 5,374 | 2,652 | – | ||||||||||||

|

Cash and cash equivalents, end of period

|

$ | 911 | $ | 667 | $ | 5,374 | $ | 911 | ||||||||

Supplemental cash flow information (note 12)

See accompanying notes to consolidated financial statements.

4

LORUS THERAPEUTICS INC.

Notes to Consolidated Financial Statements

(Tabular amounts in thousands of Canadian dollars, except per share amounts)

Years ended May 31, 2011, 2010 and 2009

|

1.

|

Basis of presentation:

|

|

|

(a)

|

Going concern:

|

Lorus Therapeutics Inc. (the "Company") has not earned substantial revenue from its drug candidates and, is therefore, considered to be in the development stage. The continuation of the Company's research and development activities is dependent upon the Company's ability to successfully fund its cash requirements through a combination of equity financing and payments from strategic partners. The Company has no current sources of significant payments from strategic partners and has not earned any revenue in the past year.

These consolidated financial statements have been prepared on a going concern basis in accordance with Canadian generally accepted accounting principles ("Canadian GAAP"). The going concern basis of presentation assumes that the Company will continue in operation for the foreseeable future and be able to realize its assets and discharge its liabilities and commitments in the normal course of business. There is significant doubt about the appropriateness of the use of the going concern basis because management has forecasted that the Company's current level of cash and cash equivalents and short-term investments, including the funds available by way of the financing and commitment letter described in note 17, will only be sufficient to execute its current planned expenditures for the next 10 to 12 months without further financing. The Company is actively pursuing financing alternatives to provide additional funding. Management believes that it will complete one or more arrangements in sufficient time to continue to execute its planned expenditures without interruption. However, there can be no assurance that the capital will be available as necessary to meet these continuing expenditures, or if the capital is available, that it will be on terms acceptable to the Company. The issuance of common shares by the Company could result in significant dilution in the equity interest of existing shareholders. There can be no assurance that the Company will be able to obtain sufficient financing to meet future operational needs. As a result, there is a significant doubt as to whether the Company will be able to continue as a going concern and realize its assets and pay its liabilities as they fall due.

The consolidated financial statements do not reflect adjustments that would be necessary if the going concern assumption were not appropriate. If the going concern basis were not appropriate for these consolidated financial statements, then adjustments would be necessary in the carrying value of the assets and liabilities, the reported revenue and expenses and the balance sheets classifications used.

5

LORUS THERAPEUTICS INC.

Notes to Consolidated Financial Statements (continued)

(Tabular amounts in thousands of Canadian dollars, except per share amounts)

Years ended May 31, 2011, 2010 and 2009

|

1.

|

Basis of presentation (continued):

|

|

|

(b)

|

Reorganization:

|

On November 1, 2006, the Company was incorporated as 6650309 Canada Inc. pursuant to the provisions of the Canada Business Corporations Act and did not carry out any active business from the date of incorporation to July 10, 2007. From its incorporation to July 10, 2007, the Company was a wholly owned subsidiary of 4325231 Canada Inc., formerly Lorus Therapeutics Inc. ("Old Lorus").

On July 10, 2007, the Company and Old Lorus completed a plan of arrangement and corporate reorganization (the "Arrangement"). As part of the Arrangement, all of the assets and liabilities of Old Lorus (including all of the shares of its subsidiaries held by it), with the exception of certain future tax assets were transferred, directly or indirectly, from Old Lorus to the Company. Securityholders in Old Lorus exchanged their securities in Old Lorus for equivalent securities in the Company (the "Exchange") and the Board of Directors and management of Old Lorus continued as the Board of Directors and management of the Company.

In connection with the Arrangement, the Company received cash consideration of approximately $8.5 million less an escrowed amount of $600 thousand related to the indemnification (received in July 2008), before transaction costs. After completion of the Arrangement, the Company is not related to Old Lorus, which was subsequently renamed Global Summit Real Estate Inc.

Under the Arrangement, the Company and its subsidiaries agreed to indemnify Old Lorus and its directors, officers and employees from and against all damages, losses, expenses (including fines and penalties), other third party costs and legal expenses, to which any of them may be subject arising out of various matters discussed in note 14(d).

As part of the Arrangement, the Company changed its name to Lorus Therapeutics Inc. and continued as a biopharmaceutical company, specializing in the research and development of pharmaceutical products and technologies for the management of cancer as a continuation of the business of Old Lorus.

6

LORUS THERAPEUTICS INC.

Notes to Consolidated Financial Statements (continued)

(Tabular amounts in thousands of Canadian dollars, except per share amounts)

Years ended May 31, 2011, 2010 and 2009

|

1.

|

Basis of presentation (continued):

|

The Arrangement has been accounted for on a continuity of interest basis and, accordingly, the consolidated financial statements of the Company reflect the financial position, results of operations and cash flows as if the Company has always carried on the business formerly carried on by Old Lorus. Consequently, all comparative figures presented in these consolidated financial statements include those of Old Lorus.

|

|

(c)

|

Share consolidation:

|

The Company's Board of Directors approved a 1-for-30 share consolidation which became effective May 25, 2010. The share consolidation affected all of the Company's common shares, stock options and warrants outstanding at the effective time. Fractional shares were not issued. Prior to consolidation, the Company had approximately 298 million shares outstanding. Following the share consolidation, the Company had approximately 9.9 million common shares outstanding. In these consolidated financial statements, all references to number of shares, stock options and warrants in the current and past periods have been adjusted to reflect the impact of the consolidation. All amounts based on the number of shares, stock options or warrants, unless otherwise specified, such as earnings (loss) per share and weighted average issuance price in the case of stock options have been adjusted to reflect the impact of 1-for-30 share consolidation.

|

2.

|

Changes in accounting policies:

|

There were no new accounting policies adopted in the year ended May 31, 2011.

7

LORUS THERAPEUTICS INC.

Notes to Consolidated Financial Statements (continued)

(Tabular amounts in thousands of Canadian dollars, except per share amounts)

Years ended May 31, 2011, 2010 and 2009

|

3.

|

Significant accounting policies:

|

|

|

(a)

|

Principles of consolidation:

|

The consolidated financial statements have been prepared by management in accordance with Canadian generally accepted accounting principles ("GAAP").

The consolidated financial statements include the accounts of the Company and its 80% owned subsidiary, NuChem Pharmaceuticals Inc. ("NuChem"). On May 31, 2009, its wholly owned subsidiary, GeneSense Technologies Inc. ("GeneSense") was wound up and its operations and net assets assumed by Lorus Therapeutics, the parent company. On June 19, 2009, the Company disposed of its shares of Pharma Immune Inc. ("Pharma Immune") (note 13). The results of operations for acquisitions are included in these consolidated financial statements from the date of acquisition. All significant intercompany balances and transactions have been eliminated on consolidation.

|

|

(b)

|

Revenue recognition:

|

Revenue includes product sales, service, license and royalty revenue.

The Company recognizes revenue from product sales and provision of services when persuasive evidence of an arrangement exists, delivery has occurred, the Company's price to the customer is fixed or determinable and collectability is reasonably assured. The Company allows customers to return product. Provisions for these returns are estimated based on historical return and exchange levels, and third-party data with respect to inventory levels in the Company's distribution channels.

Revenue from multiple element arrangements consisting of non-refundable license fees, receipt of milestone payments, royalty and delivery of services over a defined term are recognized in accordance with Emerging Issues Committee Abstract No. 142, Revenue Arrangements with Multiple Deliverables. The Company recognizes the non-refundable license fee as revenue when the technology license is delivered, the fee is fixed or determinable, collection of the amount was probable and there is no continuing involvement or obligation to perform under the arrangement. Any milestone payment subsequently received from the customer is recognized when the customer acknowledges achievement of the milestone, when the fee is fixed or determinable and collection of the amount is probable. If the multiple deliverables in an arrangement do not meet the criteria for separation, the proceeds from the entire arrangement are deferred and recognized as revenue on a proportionate performance basis, or over the term of the arrangement.

8

LORUS THERAPEUTICS INC.

Notes to Consolidated Financial Statements (continued)

(Tabular amounts in thousands of Canadian dollars, except per share amounts)

Years ended May 31, 2011, 2010 and 2009

|

3.

|

Significant accounting policies (continued):

|

|

|

(c)

|

Financial instruments:

|

Financial instrument classification:

Management determines the classification of financial assets and financial liabilities at initial recognition and, except in very limited circumstances, the classification is not changed subsequent to initial recognition. The classification depends on the purpose for which the financial instruments were acquired, their characteristics and/or management's intent. Transaction costs with respect to instruments not classified as held-for-trading are recognized as an adjustment to the cost of the underlying instruments and amortized using the effective interest method.

The Company's financial instruments were classified in the following categories:

|

|

(i)

|

Cash and cash equivalents:

|

Cash and cash equivalents are classified as held-for-trading investments and measured at fair value. By virtue of the nature of these assets, fair value is generally equal to cost plus accrued interest. Where applicable, any significant change in market value would result in a gain or loss being recognized in the consolidated statements of operations and comprehensive income.

The Company considers unrestricted cash on hand and in banks, term deposits and guaranteed investment certificates with original maturities of three months or less as cash and cash equivalents.

|

|

(ii)

|

Short-term investments:

|

Short-term investments are liquid Canadian government or corporate instruments having original maturity dates greater than three months and less than one year and are classified as held-to-maturity investments, except where the Company does not intend to, or cannot reasonably expect to hold the investment to maturity, in which case, the investment is designated as held-for-trading. Held-to-maturity investments are measured at amortized cost using the effective interest rate method, while held-for-trading investments are measured at fair value and the resulting gain or loss is recognized in the consolidated statements of operations and comprehensive income.

9

LORUS THERAPEUTICS INC.

Notes to Consolidated Financial Statements (continued)

(Tabular amounts in thousands of Canadian dollars, except per share amounts)

Years ended May 31, 2011, 2010 and 2009

|

3.

|

Significant accounting policies (continued):

|

Upon adoption of CICA Handbook Section 3855, Financial Instruments - Recognition and Measurement ("Section 3855"), on June 1, 2007, the Company designated certain corporate instruments then having maturities greater than one year previously carried at amortized cost as held-for-trading investments. This change in accounting policy resulted in a decrease in the carrying amount of these investments of $27 thousand and a corresponding increase in the opening deficit at June 1, 2007. The Company recognized a net unrealized gain in the consolidated statements of operations and comprehensive income for the year ended May 31, 2011 of nil (2010 - $8 thousand, 2009 - $10 thousand).

The Company invests in high-quality fixed income government and corporate investments with low credit risk.

|

|

(iii)

|

Accounts payable and accrued liabilities:

|

Accounts payable and accrued liabilities and promissory note payable are typically short-term in nature and classified as other financial liabilities. These liabilities are carried at amortized cost.

|

|

(iv)

|

Secured convertible debentures:

|

The secured convertible debentures, prior to their repurchase in June 2009, were classified as other financial liabilities and accounted for at amortized cost using the effective interest method. The deferred financing charges related to the secured convertible debentures for the periods presented were included as part of the carrying value of the secured convertible debentures and were amortized using the effective interest method.

|

|

(v)

|

Embedded derivatives:

|

Where applicable, the Company separates embedded derivatives from a related host contract and measures those embedded derivatives at fair value. Subsequent changes in fair value of embedded derivatives are recognized in the consolidated statements of operations and comprehensive income in the period in which the change occurs. In the periods presented, the Company did not identify any embedded derivatives that require separation from the related host contract.

10

LORUS THERAPEUTICS INC.

Notes to Consolidated Financial Statements (continued)

(Tabular amounts in thousands of Canadian dollars, except per share amounts)

Years ended May 31, 2011, 2010 and 2009

|

3.

|

Significant accounting policies (continued):

|

|

|

(vi)

|

Transaction costs:

|

Transaction costs directly attributable to the acquisition or issuance of financial assets or liabilities are accounted for as part of the respective asset or liability's carrying value at inception except for held-for-trading securities where the costs are expensed immediately.

|

|

(vii) Fair value hierarchy:

|

All financial instruments are required to be measured at fair value on initial recognition, except for certain related party transactions. Financial instruments are required to be measured at fair value at each reporting. Financial instruments have been ranked using a three-level hierarchy that reflects the significance of the inputs used in making the fair value measurements:

|

|

•

|

Level 1 - applies to assets or liabilities for which there are quoted prices in active markets for identical assets or liabilities.

|

|

|

•

|

Level 2 - applies to assets or liabilities for which there are inputs other than quoted prices that are observable for the asset or liability such as quoted prices for similar assets or liabilities in active markets; quoted prices for identical assets or liabilities in markets with insufficient volume or infrequent transactions (less active markets); or model-derived valuations in which significant inputs are observable or can be derived principally from, or corroborated by, observable market data.

|

|

|

•

|

Level 3 - applies to assets or liabilities for which there are unobservable inputs to the valuation methodology that are significant to the measurement of the fair value of the assets or liabilities.

|

See note 9 for a breakdown of these financial instruments.

11

LORUS THERAPEUTICS INC.

Notes to Consolidated Financial Statements (continued)

(Tabular amounts in thousands of Canadian dollars, except per share amounts)

Years ended May 31, 2011, 2010 and 2009

|

3.

|

Significant accounting policies (continued):

|

|

|

(d)

|

Fixed assets:

|

Fixed assets are recorded at cost less accumulated depreciation and amortization. The Company records depreciation and amortization at rates that charge operations with the cost of the assets over their estimated useful lives on a straight-line basis as follows:

|

Furniture and equipment

|

Over 3 to 5 years

|

|

|

(e)

|

Research and development:

|

Research costs are charged to expense as incurred. Development costs, including the cost of drugs for use in clinical trials, are expensed as incurred unless they meet the criteria under Canadian GAAP for deferral and amortization. No development costs have been deferred to date.

|

|

(f)

|

Goodwill:

|

Goodwill represents the excess of the purchase price over the fair value of net identifiable assets acquired in the GeneSense business combination. Goodwill acquired in a business combination is tested for impairment on an annual basis and at any other time if an event occurs or circumstances change that would indicate that impairment may exist. The impairment test is carried out in two steps.

In the first step, the carrying amount of the reporting unit including goodwill is compared with its fair value. When the fair value of a reporting unit including goodwill exceeds its carrying amount, goodwill of the reporting unit is not considered to be impaired and the second step of the impairment test is unnecessary.

The second step is carried out when the carrying amount of a reporting unit exceeds its fair value, in which case, the implied fair value of the reporting unit's goodwill is compared with its carrying amount to measure the amount of the impairment loss if any. The implied fair value of goodwill is determined in the same manner as the value of goodwill is determined in a business combination.

The Company has identified no impairment relating to goodwill for 2011, 2010 and 2009.

12

LORUS THERAPEUTICS INC.

Notes to Consolidated Financial Statements (continued)

(Tabular amounts in thousands of Canadian dollars, except per share amounts)

Years ended May 31, 2011, 2010 and 2009

|

3.

|

Significant accounting policies (continued):

|

|

|

(g)

|

Impairment of long-lived assets:

|

The Company reviews long-lived assets which include fixed assets and intangible assets with finite useful lives for impairment annually or more frequently if events or changes in circumstances indicate that the carrying amount of the assets may not be recoverable. If the sum of the undiscounted expected future cash flows expected to result from the use and eventual disposition of an asset is less than its carrying amount, it is considered to be impaired. An impairment loss is measured at the amount by which the carrying amount of the asset exceeds its fair value, which is estimated as the expected future cash flows discounted at a rate proportionate with the risks associated with the recovery of the asset.

The Company has identified no impairment relating to long-lived assets for 2011, 2010 and 2009.

|

|

(h)

|

Stock-based compensation:

|

The Company has a stock-based compensation plan (the "Plan") available to officers, directors, employees and consultants with grants under the Plan approved by the Company's Board of Directors. Under the Plan, the exercise price of each option equals the closing trading price of the Company's stock on the day prior to the grant. Vesting is provided for at the discretion of the Board of Directors and the expiration of options is to be no greater than 10 years from the date of grant.

The Company uses the fair value based method of accounting for employee awards granted under the Plan. The Company calculates the fair value of each stock option grant using the Black-Scholes Option Pricing model at the grant date. The stock-based compensation cost of the options is recognized as stock-based compensation expense over the relevant vesting period of the stock options. Actual forfeitures are accounted for as they occur.

Stock options awarded to non-employees are accounted for using the fair value method and expensed as the service or product is received. The Company calculates the fair value of each stock option grant using the Black-Scholes Option Pricing model at the grant date. Consideration paid on the exercise of stock options and warrants is credited to common shares.

13

LORUS THERAPEUTICS INC.

Notes to Consolidated Financial Statements (continued)

(Tabular amounts in thousands of Canadian dollars, except per share amounts)

Years ended May 31, 2011, 2010 and 2009

|

3.

|

Significant accounting policies (continued):

|

The Company has a deferred share unit plan that provides directors the option of receiving payment for their services in the form of share units rather than common shares or cash. Share units entitle the director to elect to receive, on termination of his or her services with the Company, an equivalent number of common shares, or the cash equivalent of the market value of the common shares at that future date. For units issued under this plan, the Company records an expense and a liability equal to the market value of the shares issued. The accumulated liability is adjusted for market fluctuations on a quarterly basis. There are currently no units issued under this plan.

The Company has an alternate compensation plan ("2009 ACP") that provides directors and senior management ("participants") with the option of receiving director's fees, salary, bonuses or other remuneration ("Remuneration") in common shares rather than cash. Under the plan, the participant receives an allotment from treasury of such number of shares as will be equivalent to the cash value of the Remuneration determined by dividing the Remuneration by the weighted average closing common share price for the five trading days prior to payment date (the "5-day VWAP"). The issue price of the shares is the 5-day VWAP. There are currently no shares allotted for issuance under this plan.

|

|

(i)

|

Investment tax credits:

|

The Company is entitled to Canadian federal and provincial investment tax credits, which are earned as a percentage of eligible research and development expenditures incurred in each taxation year. Investment tax credits are accounted for as a reduction of the related expenditure for items of a current nature and a reduction of the related asset cost for items of a long-term nature, provided that the Company has reasonable assurance that the tax credits will be realized. Investment tax credits receivable at May 31, 2011 of $196 thousand are classified as prepaid expenses and other assets (2010 - $400 thousand).

14

LORUS THERAPEUTICS INC.

Notes to Consolidated Financial Statements (continued)

(Tabular amounts in thousands of Canadian dollars, except per share amounts)

Years ended May 31, 2011, 2010 and 2009

|

3.

|

Significant accounting policies (continued):

|

|

|

(j)

|

Income taxes:

|

Income taxes are accounted for using the asset and liability method. Under this method, future tax assets and liabilities are recorded for the future tax consequences attributable to differences between the financial statement carrying amounts of assets and liabilities and their respective tax bases, and operating loss and research and development expenditure carryforwards. Future tax assets and liabilities are measured using enacted or substantively enacted tax rates expected to apply when the asset is realized or the liability is settled. The effect on future tax assets and liabilities of a change in tax rates is recognized in income in the year that enactment or substantive enactment occurs. A valuation allowance is recorded if it is not more likely than not that some portion of or all of a future tax asset will be realized.

|

|

(k)

|

(Loss) earnings per share:

|

Basic (loss) earnings per common share is calculated by dividing the (loss) earnings for the year by the weighted average number of common shares outstanding during the year. Diluted (loss) earnings per common share is calculated by dividing the loss for the year by the sum of the weighted average number of common shares outstanding and the dilutive common equivalent shares outstanding during the year. Common equivalent shares consist of the shares issuable upon exercise of stock options and warrants as applicable, calculated using the treasury stock method. Common equivalent shares are not included in the calculation of the weighted average number of shares outstanding for diluted loss per common share when the effect would be anti-dilutive.

|

|

(l)

|

Segmented information:

|

The Company is organized and operates as one operating segment, the research and development of anti-cancer therapies. Substantially all of the Company's identifiable assets as at May 31, 2011 and 2010 are located in Canada.

|

|

(m)

|

Foreign currency translation:

|

Foreign currency transactions are translated into Canadian dollars at rates prevailing on the transaction dates. Monetary assets and liabilities are translated into Canadian dollars at the rates in effect on the balance sheets dates. Gains or losses resulting from these transactions are accounted for in the loss for the period and are not significant.

15

LORUS THERAPEUTICS INC.

Notes to Consolidated Financial Statements (continued)

(Tabular amounts in thousands of Canadian dollars, except per share amounts)

Years ended May 31, 2011, 2010 and 2009

|

3.

|

Significant accounting policies (continued):

|

|

|

(n)

|

Use of estimates:

|

The preparation of financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenue and expenses during the reporting periods. Actual results could differ from those estimates and assumptions. Significant areas requiring the use of management estimates include the historical valuation of the convertible debentures, fair value of guarantees, fair value of the obligation for indemnifications provided on the Arrangement between the Company and Old Lorus, the fair value of long-lived assets and the determination of impairment thereon, the economic lives of intangible assets, the recoverability of future income tax assets, the determination of fair values of financial instruments, as well as the determination of stock-based compensation and the fair value of warrants issued.

|

|

(o)

|

Recent Canadian accounting pronouncements not yet adopted:

|

The Canadian Accounting Standards Board requires all Canadian publicly accountable entities to adopt International Financial Reporting Standards ("IFRS") for years beginning on or after January 1, 2011. The Company's first annual filing under IFRS will be for the year ended May 31, 2012; its first quarterly filing under IFRS will be for the quarter ending August 31, 2011 and will include IFRS comparative figures for the period ended August 31, 2010. Accordingly, the Company's adoption date for IFRS is June 1, 2011, but its transition date is June 1, 2010 in order to present IFRS comparative figures in the Company's 2011 consolidated financial statements.

IFRS uses a conceptual framework similar to Canadian GAAP, however, there are significant differences in recognition, measurement and disclosure. Given the nature of the Company's business and the make-up of its current balance sheets, IFRS could have an impact on its reported financial statements. The Company's implementation of IFRS will require the Company to make and disclose certain policy choices and increase the amount of disclosure necessary to fulfill its IFRS reporting obligations.

16

LORUS THERAPEUTICS INC.

Notes to Consolidated Financial Statements (continued)

(Tabular amounts in thousands of Canadian dollars, except per share amounts)

Years ended May 31, 2011, 2010 and 2009

|

4.

|

Short-term investments:

|

|

Less than

|

Greater than

|

|||||||||||||||

|

one year

|

one year

|

Yield to

|

||||||||||||||

|

2011

|

maturities

|

maturities

|

Total

|

maturity

|

||||||||||||

|

|

||||||||||||||||

|

Corporate investments (guaranteed investment certificates)

|

$ | – | $ | – | $ | – | – | |||||||||

|

Less than

|

Greater than

|

|||||||||||||||

|

one year

|

one year

|

Yield to

|

||||||||||||||

|

2010

|

maturities

|

maturities

|

Total

|

maturity

|

||||||||||||

|

|

||||||||||||||||

|

Corporate investments (guaranteed investment certificates)

|

$ | 247 | $ | – | $ | 247 | – | |||||||||

Certain corporate investments, totalling $247 thousand at May 31, 2010, have been designated as held-for-trading investments, and have been classified as short-term investments on the consolidated balance sheets. These investments were carried at fair value. The net increase in fair value for the year ended May 31, 2010 amounted to $8 thousand (2009 - $10 thousand) and has been included in the consolidated statements of operations and comprehensive income in interest income.

17

LORUS THERAPEUTICS INC.

Notes to Consolidated Financial Statements (continued)

(Tabular amounts in thousands of Canadian dollars, except per share amounts)

Years ended May 31, 2011, 2010 and 2009

|

5.

|

Fixed assets:

|

|

Accumulated

|

||||||||||||

|

depreciation

|

||||||||||||

|

and

|

Net book

|

|||||||||||

|

2011

|

Cost

|

amortization

|

value

|

|||||||||

|

Furniture and equipment

|

$ | 2,914 | $ | 2,815 | $ | 99 | ||||||

|

Accumulated

|

||||||||||||

|

depreciation

|

||||||||||||

|

and

|

Net book

|

|||||||||||

|

2010

|

Cost

|

amortization

|

value

|

|||||||||

|

Furniture and equipment

|

$ | 2,907 | $ | 2,760 | $ | 147 | ||||||

18

LORUS THERAPEUTICS INC.

Notes to Consolidated Financial Statements (continued)

(Tabular amounts in thousands of Canadian dollars, except per share amounts)

Years ended May 31, 2011, 2010 and 2009

|

6.

|

Share capital:

|

|

|

(a)

|

Continuity of common shares and warrants:

|

|

Common shares

|

Warrants

|

|||||||||||||||

|

Number

|

Amount

|

Number

|

Amount

|

|||||||||||||

|

(In thousands)

|

(In thousands)

|

|||||||||||||||

|

Balance, May 31, 2008

|

7,255 | $ | 158,743 | – | $ | – | ||||||||||

|

Interest payments (note 13)

|

354 | 707 | – | – | ||||||||||||

|

Issuance of units (b)

|

951 | 2,790 | 571 | 417 | ||||||||||||

|

Balance, May 31, 2009

|

8,560 | 162,240 | 571 | 417 | ||||||||||||

|

Interest payments (note 13)

|

7 | 15 | – | – | ||||||||||||

|

Issuance of units (b)

|

1,366 | 1,665 | 755 | 622 | ||||||||||||

|

Balance, May 31, 2010

|

9,933 | 163,920 | 1,326 | 1,039 | ||||||||||||

|

Expiry of warrants (c)

|

– | – | (571 | ) | (417 | ) | ||||||||||

|

Issuance of units (b)

|

4,170 | 3,226 | 4,170 | 1,032 | ||||||||||||

|

Issuance of units (b)

|

1,582 | 1,641 | – | – | ||||||||||||

|

Expiry of warrants (c)

|

– | – | (755 | ) | (622 | ) | ||||||||||

|

Balance, May 31, 2011

|

15,685 | $ | 168,787 | 4,170 | $ | 1,032 | ||||||||||

|

|

(b)

|

Share issuances:

|

December 2010 Private Placement:

On December 1, 2010, pursuant to a private placement, the Company issued 1.6 million common shares in exchange for gross cash consideration of $1.66 million. The total costs associated with the transaction were approximately $20 thousand. Mr. Herbert Abramson, a director of the Corporation, subscribed for 1,410,000 common shares, representing approximately 89% of the total number of common shares issued through the private placement. No commission was paid in connection with the private placement.

19

LORUS THERAPEUTICS INC.

Notes to Consolidated Financial Statements (continued)

(Tabular amounts in thousands of Canadian dollars, except per share amounts)

Years ended May 31, 2011, 2010 and 2009

|

6.

|

Share capital (continued):

|

November 2010 Rights Offering:

On August 27, 2010 the Company announced a proposed rights offering as described below including a $4 million standby purchase agreement from a director of the Company, Mr. Herbert Abramson. Mr. Abramson also provided the Company with interim financing by way of three $500 thousand monthly loans, advanced on August 11, 2010, September 13, 2010 and October 5, 2010. The loans were unsecured, had a six-month term (or the earlier of the closing of the rights issue) and bore interest at the annual rate of 10%. All three notes were repaid upon the close of the rights offering described below.

On September 27, 2010, Lorus filed a final short-form prospectus in each of the provinces of Canada in connection with a distribution to its shareholders in eligible jurisdictions outside the United States of rights exercisable for units of the Company (the "Rights Offering").

Under the Rights Offering, holders of common shares of the Company as of October 12, 2010, the record date, received one right for each common share held as of the record date. Each two rights entitled the holder thereof to purchase a unit of the Company at a price of $1.11 per unit. Each unit consisted of one common share of the Company and one warrant to purchase an additional common share of the Company at a price of $1.33 until May 2012.

A total of 4.2 million units of the Company at a price of $1.11 per unit were issued in connection with the Rights Offering. As a result of the Rights Offering, Lorus issued 4.2 million common shares and 4.2 million common share purchase warrants for net proceeds of $4.2 million.

In connection with the Rights Offering, the Company secured a standby purchase arrangement of $4 million by Mr. Abramson, one of the Company's directors. Mr. Abramson agreed to make an investment such that the minimum gross proceeds of the proposed Rights Offering would be $4 million. No fee was payable to Mr. Abramson for this commitment. In accordance with the terms of the standby purchase agreement, Mr. Abramson subscribed for 3.6 million of the 4.2 million units of the Rights Offering for $4.0 million.

20

LORUS THERAPEUTICS INC.

Notes to Consolidated Financial Statements (continued)

(Tabular amounts in thousands of Canadian dollars, except per share amounts)

Years ended May 31, 2011, 2010 and 2009

|

6.

|

Share capital (continued):

|

The total costs associated with the transaction were approximately $370 thousand. The Company has allocated the net proceeds of the Rights Offering to the common shares and the common share purchase warrants based on their estimated relative fair values. Based on relative fair values, $3.2 million of the net proceeds were allocated to the common shares and $1.0 million to the common share purchase warrants.

November 2009 Private Placement:

On November 27, 2009, pursuant to a private placement, the Company issued 1.366 million common shares and 683 thousand common share purchase warrants in exchange for cash consideration of $2.5 million. This amount includes the principal amount of $1.0 million originally received by way of a loan from a director on October 6, 2009, which was applied to subscribe for units of the Company ("Units") as part of the private placement. In addition, the Company issued 72 thousand brokers' warrants to purchase an equivalent number of common shares at $2.40 until May 27, 2011. The total costs associated with the transaction were approximately $250 thousand which included the $77 thousand which represented the fair value of the brokers' warrants. The Company has allocated the net proceeds of the private placement to the common shares and the common share purchase warrants based on their relative fair values. Based on relative fair values, $1.7 million of the net proceeds was allocated to the common shares and $622 thousand to the common share purchase warrants.

21

LORUS THERAPEUTICS INC.

Notes to Consolidated Financial Statements (continued)

(Tabular amounts in thousands of Canadian dollars, except per share amounts)

Years ended May 31, 2011, 2010 and 2009

|

6.

|

Share capital (continued):

|

August 2008 Rights Offering:

On June 25, 2008, the Company filed a short-form prospectus for a Rights Offering to its shareholders. Under the Rights Offering, holders of the Company's common shares as of July 9, 2008 (the "Record Date") received one right for each common share held as of the Record Date. Each four rights entitled the holder thereof to purchase a Unit. Each Unit consists of one common share of the Company at $3.90 and a one-half common share purchase warrant to purchase additional common shares of the Company at $4.53 until August 7, 2010. All unexercised rights expired on August 7, 2008. Pursuant to the Rights Offering, the Company issued 951 thousand common shares and 571 thousand common share purchase warrants in exchange for cash consideration of $3.7 million. The total costs associated with the transaction were approximately $500 thousand. The Company has allocated the net proceeds of $3.2 million received from the issuance of the Units to the common shares and the common share purchase warrants based on their relative fair values. The fair value of the common share purchase warrants has been determined based on an option-pricing model. The resulting allocation based on relative fair values resulted in the allocation of $2.8 million to the common shares and $417 thousand to the common share purchase warrants.

|

|

(c)

|

Expiry of warrants:

|

The warrants issued on August 7, 2008 expired unexercised on August 10, 2010. This expiry resulted in a transfer of the value attributed to the expired warrants of $417 thousand to contributed surplus.

The warrants issued on November 27, 2009 expired unexercised on May 27, 2011. This expiry resulted in a transfer of the value attributed to the expired warrants of $622 thousand to contributed surplus.

22

LORUS THERAPEUTICS INC.

Notes to Consolidated Financial Statements (continued)

(Tabular amounts in thousands of Canadian dollars, except per share amounts)

Years ended May 31, 2011, 2010 and 2009

|

6.

|

Share capital (continued):

|

|

|

(d)

|

Contributed surplus:

|

|

2011

|

2010

|

2009

|

||||||||||

|

Balance, beginning of year

|

$ | 14,875 | $ | 10,744 | $ | 9,181 | ||||||

|

Cancellation and forfeiture of stock options (note 7)

|

3,074 | 317 | 1,563 | |||||||||

|

Expiry of warrants

|

1,039 | – | – | |||||||||

|

Equity portion of secured convertible debenture (note 13)

|

– | 3,814 | – | |||||||||

|

Balance, end of year

|

$ | 18,988 | $ | 14,875 | $ | 10,744 | ||||||

|

|

(e)

|

Continuity of stock options:

|

|

2011

|

2010

|

2009

|

||||||||||

|

Balance, beginning of the year

|

$ | 3,704 | $ | 3,845 | $ | 4,961 | ||||||

|

Stock option expense

|

526 | 176 | 446 | |||||||||

|

Cancellation and forfeiture of stock options (note 7)

|

(3,074 | ) | (317 | ) | (1,562 | ) | ||||||

|

Balance, end of year

|

$ | 1,156 | $ | 3,704 | $ | 3,845 | ||||||

|

|

(f)

|

Alternate compensation plans:

|

The Company did not issue any share units under its deferred share unit plan or allot any shares for issuance under its 2009 ACP.

23

LORUS THERAPEUTICS INC.

Notes to Consolidated Financial Statements (continued)

(Tabular amounts in thousands of Canadian dollars, except per share amounts)

Years ended May 31, 2011, 2010 and 2009

|

6.

|

Share capital (continued):

|

|

|

(g)

|

Employee share purchase plan:

|

The Company' has an employee share purchase plan ("ESPP"). The purpose of the ESPP is to assist the Company in retaining the services of its employees, to secure and retain the services of new employees and to provide incentives for such persons to exert maximum efforts for the success of the Company. The ESPP provides a means by which employees of the Company may purchase common shares of the Company at a discount through accumulated payroll deductions with each offering having a three-month duration. Participants may authorize payroll deductions of up to 15% of their base compensation for the purchase of common shares under the ESPP. For the year ended May 31, 2011, 6,652 (2010 - 3,159; 2009 - 7,966) common shares have been purchased under the ESPP, and the Company has recognized an expense of $1 thousand (2010 - $2 thousand; 2009 - $3 thousand) related to this plan in these consolidated financial statements.

|

|

(h)

|

Earnings per share:

|

For the year ended May 31, 2010, the determination of diluted earnings per share includes in the calculation all common shares potentially issuable upon the exercise of stock options and share purchase warrants, using the treasury stock method. Diluted earnings per share, using the treasury stock method, assumes outstanding stock options and share purchase warrants are exercised at the beginning of the period, and the Company's common shares are purchased at the average market price during the period from the funds derived on the exercise of these outstanding options and share purchase warrants. Stock options and share purchase warrants with a strike price above the average market price for the period were excluded from the calculation of fully diluted earnings per share as to include them would have increased the earnings per share.

24

LORUS THERAPEUTICS INC.

Notes to Consolidated Financial Statements (continued)

(Tabular amounts in thousands of Canadian dollars, except per share amounts)

Years ended May 31, 2011, 2010 and 2009

|

7.

|

Stock-based compensation:

|

Stock option plan:

Under the Company's stock option plan, options may be granted to directors, officers, employees and consultants of the Company to purchase up to a maximum of 15% of the total number of outstanding common shares, currently estimated at 2,352,000 options. Options are granted at the fair market value of the common shares on the date immediately preceding the date of the grant. Options vest at various rates (immediate to three years) and have a term of 10 years. Stock option transactions for the three years ended May 31, 2011 are summarized as follows:

|

2011

|

2010

|

2009

|

||||||||||||||||||||||

|

Weighted

|

Weighted

|

Weighted

|

||||||||||||||||||||||

|

average

|

average

|

average

|

||||||||||||||||||||||

|

exercise

|

exercise

|

exercise

|

||||||||||||||||||||||

|

Options

|

price

|

Options

|

price

|

Options

|

price

|

|||||||||||||||||||

|

Outstanding, beginning of year

|

672,901 | $ | 6.60 | 562,358 | $ | 8.66 | 547,874 | $ | 13.52 | |||||||||||||||

|

Granted

|

1,049,700 | 1.01 | 189,406 | 2.41 | 170,807 | 3.39 | ||||||||||||||||||

|

Forfeited

|

(537,023 | ) | 6.76 | (78,863 | ) | 11.24 | (156,323 | ) | 19.94 | |||||||||||||||

|

Outstanding, end of year

|

1,185,578 | 1.58 | 672,901 | 6.60 | 562,358 | 8.66 | ||||||||||||||||||

|

Exercisable, end of year

|

662,316 | $ | 1.99 | 439,452 | $ | 8.54 | 323,555 | $ | 11.39 | |||||||||||||||

25

LORUS THERAPEUTICS INC.

Notes to Consolidated Financial Statements (continued)

(Tabular amounts in thousands of Canadian dollars, except per share amounts)

Years ended May 31, 2011, 2010 and 2009

|

7.

|

Stock-based compensation (continued):

|

The following table summarizes information about stock options outstanding at May 31, 2011:

|

Options outstanding

|

Options exercisable

|

|||||||||||||||

|

Weighted

|

||||||||||||||||

|

average

|

Weighted

|

Weighted

|

||||||||||||||

|

remaining

|

average

|

average

|

||||||||||||||

|

Range of

|

contractual

|

exercise

|

exercise

|

|||||||||||||

|

exercise prices

|

Options

|

life (years)

|

price

|

Options

|

price

|

|||||||||||

| $0.89 - $ 1.05 | 1,005,740 | 9.6 | $ | 1.00 | 502,870 | $ | 1.00 | |||||||||

| $1.06 - $ 4.99 | 103,329 | 7.7 | 2.61 | 82,937 | 2.62 | |||||||||||

| $5.00 - $18.00 | 76,509 | 5.5 | 7.74 | 76,509 | 7.74 | |||||||||||

| 1,185,578 | 9.2 | 1.58 | 662,316 | 1.99 | ||||||||||||

For the year ended May 31, 2011, stock option expense comprised $186 thousand (2010 - $83 thousand; 2009 - $127 thousand) related to research and development and $340 thousand (2010 - $93 thousand; 2009 - $319 thousand) related to general and administrative expenses.

The following assumptions were used in the Black-Scholes option pricing model to determine the fair value of stock options granted during the year:

|

2011

|

2010

|

2009

|

|

|

Risk-free interest rate

|

1.50% - 1.85%

|

2.44% - 2.60%

|

2.00% - 3.50%

|

|

Expected volatility

|

117% - 119%

|

82% - 124%

|

76%

|

|

Expected dividend yield

|

–

|

–

|

–

|

|

Expected life of options

|

5 years

|

5 years

|

5 years

|

|

Weighted average fair value of options granted or modified during the year

|

$0.83

|

$1.43

|

$2.16

|

The Company has assumed no forfeiture rate as adjustments for actual forfeitures are made in the year they occur.

26

LORUS THERAPEUTICS INC.

Notes to Consolidated Financial Statements (continued)

(Tabular amounts in thousands of Canadian dollars, except per share amounts)

Years ended May 31, 2011, 2010 and 2009

|

8.

|

Capital risk management:

|

The Company's objectives when managing capital are to:

|

|

(a)

|

maintain its ability to continue as a going concern in order to provide returns to shareholders and benefits to other stakeholders;

|

|

|

(b)

|

maintain a flexible capital structure which optimizes the cost of capital at acceptable risk; and

|

|

|

(c)

|

ensure sufficient cash resources to fund its research and development activity, to pursue partnership and collaboration opportunities and to maintain ongoing operations.

|

At May 31, 2011, the capital structure of the Company consisted of equity comprised of share capital, warrants, stock options, contributed surplus and deficit. The Company manages its capital structure and makes adjustments to it in light of economic conditions. The Company, upon approval from its Board of Directors, will balance its overall capital structure through new share issuances, acquiring or disposing of assets, adjusting the amount of cash and short-term investment balances or by undertaking other activities as deemed appropriate under the specific circumstances. The Company has forecasted that its current capital resources will not be sufficient to carry its research and development plans and operations for more than the next twelve months (note 1(a)) without additional financing.

The Company is not subject to externally imposed capital requirements and the Company's overall strategy with respect to capital risk management remains unchanged from the year ended May 31, 2010.

27

LORUS THERAPEUTICS INC.

Notes to Consolidated Financial Statements (continued)

(Tabular amounts in thousands of Canadian dollars, except per share amounts)

Years ended May 31, 2011, 2010 and 2009

|

9.

|

Financial instruments and risk management:

|

|

|

(a)

|

Financial instruments:

|

The Company has classified its financial instruments as follows:

|

2011

|

2010

|

|||||||

|

Financial assets:

|

||||||||

|

Cash and cash equivalents, consisting of term deposits and guaranteed investment certificates at fair value

|

$ | 911 | $ | 667 | ||||

|

Short-term investments, held-for-trading, recorded at fair value

|

– | 247 | ||||||

|

Financial liabilities:

|

||||||||

|

Accounts payable, measured at amortized cost

|

215 | 387 | ||||||

|

Accrued liabilities, measured at amortized cost

|

944 | 1,458 | ||||||

|

Promissory note payable, measured at amortized cost

|

– | 1,000 | ||||||

Fair value estimates are made at a specific point in time, based on relevant market information and information about the financial instrument. These estimates are subjective in nature and involve uncertainties and matters of significant judgment and, therefore, cannot be determined with precision. Changes in assumptions could significantly affect the estimates.

Cash and cash equivalents, short-term investments, other assets, accounts payable, accrued liabilities and promissory note payable:

Due to the short period to maturity of the financial instruments, the carrying values as presented in the consolidated balance sheets are reasonable estimates of fair value.

Financial instruments potentially exposing the Company to a concentration of credit risk consist principally of short-term investments. The Company mitigates this risk by investing in high grade fixed income securities.

28

LORUS THERAPEUTICS INC.

Notes to Consolidated Financial Statements (continued)

(Tabular amounts in thousands of Canadian dollars, except per share amounts)

Years ended May 31, 2011, 2010 and 2009

|

9.

|

Financial instruments and risk management (continued):

|

Assets measured at fair value on a recurring basis as of May 31, 2011 and May 31, 2010 were as follows:

|

2011

|

Level 1

|

Level 2

|

Level 3

|

Total

|

||||||||||||

|

Assets:

|

||||||||||||||||

|

Cash and cash equivalents

|

$ | 911 | $ | – | $ | – | $ | 911 | ||||||||

|

Short-term investments, consisting of guaranteed investment certificates

|

– | – | – | – | ||||||||||||

| $ | 911 | $ | – | $ | – | $ | 911 | |||||||||

|

2010

|

Level 1

|

Level 2

|

Level 3

|

Total

|

||||||||||||

|

Assets:

|

||||||||||||||||

|

Cash and cash equivalents

|

$ | 667 | $ | – | $ | – | $ | 667 | ||||||||

|

Short-term investments, consisting of guaranteed investment certificates

|

247 | – | – | 247 | ||||||||||||

| $ | 914 | $ | – | $ | – | $ | 914 | |||||||||

|

|

(b)

|

Financial risk management:

|

The Company has exposure to credit risk, liquidity risk and market risk. The Company's Board of Directors has the overall responsibility for the oversight of these risks and reviews the Company's policies on an ongoing basis to ensure that these risks are appropriately managed.

|

|

(i)

|

Credit risk:

|

Credit risk is the risk of financial loss to the Company if a customer, partner or counterparty to a financial instrument fails to meet its contractual obligations, and arises principally from the Company's cash and cash equivalents and short-term investments. The carrying amount of the financial assets represents the maximum credit exposure.

29

LORUS THERAPEUTICS INC.

Notes to Consolidated Financial Statements (continued)

(Tabular amounts in thousands of Canadian dollars, except per share amounts)

Years ended May 31, 2011, 2010 and 2009

|

9.

|

Financial instruments and risk management (continued):

|

The Company manages credit risk for its cash and cash equivalents and short-term investments by maintaining minimum standards of R1 low or A low investments and the Company invests only in highly rated Canadian corporations with debt securities that are traded on active markets and are capable of prompt liquidation.

|

|

(ii)

|

Liquidity risk:

|

Liquidity risk is the risk that the Company will not be able to meet its financial obligations as they come due. To the extent that the Company does not believe it has sufficient liquidity to meet its current obligations, the Board considers securing additional funds through equity, debt or partnering transactions. The Company manages its liquidity risk by continuously monitoring forecasts and actual cash flows. Refer to note 1(a) for further discussion on the Company's ability to continue as a going concern.

|

|

(iii)

|

Market risk:

|

Market risk is the risk that changes in market prices, such as interest rates, foreign exchange rates and equity prices will affect the Company's income or the value of its financial instruments.

The Company is subject to interest rate risk on its cash and cash equivalents and short-term investments. The Company does not believe that the results of operations or cash flows would be affected to any significant degree by a sudden change in market interest rates relative to interest rates on the investments, owing to the relative short-term nature of the investments. The Company does not have any material interest bearing liabilities subject to interest rate fluctuations.

30

LORUS THERAPEUTICS INC.

Notes to Consolidated Financial Statements (continued)

(Tabular amounts in thousands of Canadian dollars, except per share amounts)

Years ended May 31, 2011, 2010 and 2009

|

9.

|

Financial instruments and risk management (continued):

|

Financial instruments potentially exposing the Company to foreign exchange risk consist principally of accounts payable and accrued liabilities. The Company holds minimal amounts of U.S. dollar denominated cash, purchasing on an as needed basis to cover U.S. dollar denominated payments. At May 31, 2011, U.S. dollar denominated accounts payable and accrued liabilities amounted to $254 thousand (2010 - $270 thousand). Assuming all other variables remain constant, a 10% depreciation or appreciation of the Canadian dollar against the U.S. dollar would result in an increase or decrease in loss for the year and comprehensive loss of $25 thousand (2010 - $27 thousand). The Company does not have any forward exchange contracts to hedge this risk.

The Company does not invest in equity instruments of other corporations.

|

10.

|

Income taxes:

|

Income tax recoveries attributable to losses from operations differ from the amounts computed by applying the combined Canadian federal and provincial income tax rates to pre-tax income from operations primarily as a result of the provision of a valuation allowance on net future income tax benefits.

Significant components of the Company's future tax assets are as follows:

|

2011

|

2010

|

|||||||

|

Non-capital loss carryforwards

|

$ | 2,918 | $ | 2,197 | ||||

|

Research and development expenditures

|

4,596 | 4,237 | ||||||

|

Fixed assets book over tax depreciation

|

529 | 529 | ||||||

|

Intangible asset

|

3,139 | 3,115 | ||||||

|

Ontario harmonization tax credit

|

302 | 347 | ||||||

|

Ontario Research and Development Tax Credit

|

228 | 172 | ||||||

|

Future tax assets

|

11,712 | 10,597 | ||||||

|

Valuation allowance

|

(11,712 | ) | (10,597 | ) | ||||

| $ | – | $ | – | |||||

31

LORUS THERAPEUTICS INC.

Notes to Consolidated Financial Statements (continued)

(Tabular amounts in thousands of Canadian dollars, except per share amounts)

Years ended May 31, 2011, 2010 and 2009

|

10.

|

Income taxes (continued):

|

During the year ended May 31, 2010, the Company reached a settlement with the convertible debenture holders (note 13) which resulted in an accounting gain of $11.0 million. For tax purposes, this transaction resulted in a taxable capital gain of $5.7 million. There are no taxes payable on this gain as the Company has sufficient capital and non-capital losses to offset the gain.

In assessing the realizable benefit from future tax assets, management considers whether it is more likely than not that some portion or all of the future tax assets will not be realized. The ultimate realization of future tax assets is dependent on the generation of future taxable income during the years in which those temporary differences become deductible. Management considers projected future taxable income, uncertainties related to the industry in which the Company operates and tax planning strategies in making this assessment. Due to the Company's stage of development and operations, and uncertainties related to the industry in which the Company operates, the tax benefit of the above amounts has been completely offset by a valuation allowance.

The Company has undeducted research and development expenditures, totalling $18.4 million that can be carried forward indefinitely. In addition, the Company has non-capital loss carryforwards of $11.7 million. To the extent that the non-capital loss carryforwards are not used, they expire as follows:

|

2015

|

$ | 10 | ||

|

2026

|

11 | |||

|

2027

|

4 | |||

|

2028

|

4,994 | |||

|

2029

|

3,753 | |||

|

2030

|

16 | |||

|

2031

|

2,883 | |||

| $ | 11,671 | |||

32

LORUS THERAPEUTICS INC.

Notes to Consolidated Financial Statements (continued)

(Tabular amounts in thousands of Canadian dollars, except per share amounts)

Years ended May 31, 2011, 2010 and 2009

|

10.

|

Income taxes (continued):

|

Income tax rate reconciliation:

|

2011

|

2010

|

2009

|

||||||||||

|

Income tax expense (recovery) based on statutory rate of 29.5% (2010 - 32.6%, 2009 - 33.3%)

|

$ | (1,488 | ) | $ | 1,738 | $ | (2,950 | ) | ||||

|

Expiry of losses

|

– | 46 | 247 | |||||||||

|

Change in valuation allowance

|

1,116 | (1,552 | ) | 3,068 | ||||||||

|

Non-deductible accretion, stock-based compensation and capital gains

|

164 | (1,694 | ) | 582 | ||||||||

|

Ontario harmonization tax credit

|

– | – | (260 | ) | ||||||||

|

Change in substantively enacted tax rates

|

199 | 1,643 | 299 | |||||||||

|

Adjustment of prior year research and development expenditures

|

– | – | (856 | ) | ||||||||

|

Other

|

9 | (181 | ) | (130 | ) | |||||||

| $ | – | $ | – | $ | – | |||||||

|

11.

|

Research and development programs:

|

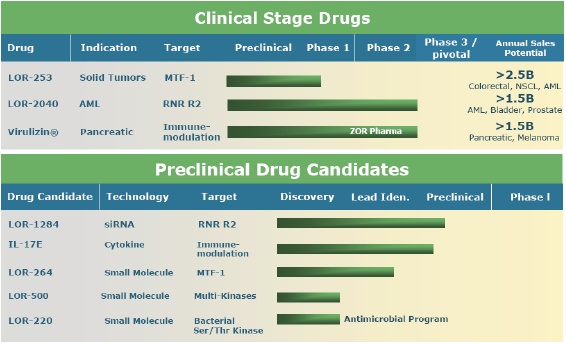

The Company has product candidates in three classes of anticancer therapies:

|

|

•

|

small molecule therapies based on anti-angiogenic, anti-proliferative and anti-metastatic agents;

|

|

|

•

|

RNA-targeted (antisense and siRNA) therapies, based on synthetic segments of DNA or RNA designed to bind to the messenger RNA that is responsible for the production of proteins over-expressed in cancer cells; and

|

|

|

•

|

immunotherapy, based on macrophage-stimulating biological response modifiers.

|