Exhibit 99.1

ANNUAL INFORMATION FORM

FOR THE YEAR ENDED DECEMBER 31, 2017

March 27, 2018

Contents

| I. | INTRODUCTION AND FORWARD-LOOKING STATEMENTS | 1 |

| II. | CORPORATE STRUCTURE | 3 |

| III. | THE COMPANY | 4 |

| IV. | Risk Factors and Uncertainties | 18 |

| V. | DIVIDENDS | 35 |

| VI. | DESCRIPTION OF CAPITAL STRUCTURE | 35 |

| VII. | Market For Securities | 36 |

| VIII. | Directors And Officers | 37 |

| IX. | AUDIT COMMITTEE | 41 |

| X. | Legal Proceedings and Regulatory Actions | 43 |

| XI. | Interest of Management and Others in Material Transactions | 44 |

| XII. | Transfer Agent and Registrar | 44 |

| XIII. | Material Contracts | 44 |

| XIV. | Interest of Experts | 44 |

| XV. | Additional Information | 45 |

| I. | INTRODUCTION AND FORWARD-LOOKING STATEMENTS |

The information contained in this Annual Information Form is stated as at December 31, 2017, unless otherwise indicated. If the context otherwise requires or unless otherwise indicated, “Aptose”, the “Company”, “we”, “us” and “our” refer collectively to Aptose Biosciences Inc., 5955 Airport Road Suite #228, Mississauga, Ontario, Canada, L4V 1R9, and to its subsidiaries, Aptose Biosciences U.S. Inc., Aptose Suisse GmbH and NuChem Pharmaceuticals Inc.

Unless otherwise indicated, all dollar amounts are expressed in US dollars and references to “$” are US dollars.

Certain statements in this Annual Information Form (“AIF”) may constitute “forward-looking” statements which involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. When used in this AIF, such statements use such words as “anticipate”, “contemplate”, “continue”, “believe”, “plan”, “estimate”, “expect”, “intend”, “will”, “should”, “may”, “hope” and other similar terminology. These statements reflect current expectations regarding future events and operating performance and speak only as of the date of this AIF. Forward-looking statements include, among others:

| · | our ability to obtain the substantial capital we require to fund research and operations; |

| · | our business strategy; |

| · | our clinical development plans; |

| · | our plans to secure and maintain strategic partnerships to assist in the further development of our product candidates and to build our pipeline; |

| · | our plans to conduct clinical trials and preclinical programs; |

| · | our ability to accrue appropriate numbers and types of patients; |

| · | our ability to file and maintain intellectual property to protect our pharmaceutical assets; |

| · | our reliance on external contract research/manufacturing organizations for certain activities; |

| · | potential exposure to legal actions and potential need to take action against other entities; |

| · | our expectations regarding the progress and the successful and timely completion of the various stages of our drug discovery, drug synthesis and formulation, preclinical and clinical studies and the regulatory approval process; |

| · | our plans, objectives, expectations and intentions; and |

| · | other statements including words such as “anticipate”, “contemplate”, “continue”, “believe”, “plan”, “estimate”, “expect”, “intend”, “will”, “should”, “may”, and other similar expressions. |

The forward-looking statements reflect our current views with respect to future events, are subject to significant risks and uncertainties, and are based upon a number of estimates and assumptions that, while considered reasonable by us, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors could cause our actual results, performance or achievements to be materially different from any future results, performance, or achievements that may be expressed or implied by such forward-looking statements, including, among others:

| 1 |

| · | our ability to obtain the substantial capital we require to fund research and operations; |

| · | our lack of product revenues and history of operating losses; |

| · | our early stage of development, particularly the inherent risks and uncertainties associated with (i) developing new drug candidates generally, (ii) demonstrating the safety and efficacy of these drug candidates in clinical studies in humans, and (iii) obtaining regulatory approval to commercialize these drug candidates; |

| · | our drug candidates require time-consuming and costly preclinical and clinical testing and regulatory approvals before commercialization; |

| · | clinical studies and regulatory approvals of our drug candidates are subject to delays, and may not be completed or granted on expected timetables, if at all, and such delays may increase our costs and could delay our ability to generate revenue; |

| · | the regulatory approval process; |

| · | our ability to recruit patients for clinical trials; |

| · | the progress of our clinical trials; |

| · | our ability to find and enter into agreements with potential partners; |

| · | our ability to attract and retain key personnel; |

| · | our ability to obtain and maintain patent protection; |

| · | our ability to protect our intellectual property rights and not infringe on the intellectual property rights of others; |

| · | our reliance on external contract research/manufacturing organizations for certain activities; |

| · | our ability to comply with applicable governmental regulations and standards; |

| · | development or commercialization of similar products by our competitors, many of which are more established and have or have access to greater financial resources than us; |

| · | commercialization limitations imposed by intellectual property rights owned or controlled by third parties; |

| · | our business is subject to potential product liability and other claims; |

| · | potential exposure to legal actions and potential need to take action against other entities; |

| · | our ability to maintain adequate insurance at acceptable costs; |

| · | further equity financing may substantially dilute the interests of our shareholders; |

| · | changing market conditions; and |

| 2 |

| · | other risks detailed from time-to-time in our on-going quarterly filings, annual information forms, annual reports and annual filings with Canadian securities regulators and the United States Securities and Exchange Commission (“SEC”), and those which are discussed under the heading “Risk Factors and Uncertainties” in this document. |

Should one or more of these risks or uncertainties materialize, or should the assumptions set out in the section entitled “ Risk Factors and Uncertainties” underlying those forward-looking statements prove incorrect, actual results may vary materially from those described herein. These forward-looking statements are made as of the date of this AIF, and we do not intend, and do not assume any obligation, to update these forward-looking statements, except as required by law. Such statements may not prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Investors are cautioned that forward-looking statements are not guarantees of future performance and accordingly investors are cautioned not to put undue reliance on forward-looking statements due to the inherent uncertainty therein. New factors emerge from time to time, and it is not possible for management of the Company to predict all of these factors or to assess in advance the impact of each such factor on the Company’s business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statement.

| II. | CORPORATE STRUCTURE |

Lorus Therapeutics Inc. (“Old Lorus”) was incorporated on September 5, 1986 under the name RML Medical Laboratories Inc. pursuant to the Business Corporations Act (Ontario). On October 28, 1991, RML Medical Laboratories Inc. amalgamated with Mint Gold Resources Ltd., resulting in Old Lorus becoming a reporting issuer (as defined under applicable securities law) in Ontario, on such date. On August 25, 1992, Old Lorus changed its name to IMUTEC Corporation. On November 27, 1996, Old Lorus changed its name to Imutec Pharma Inc., and on November 19, 1998, Old Lorus changed its name to Lorus Therapeutics Inc. On October 1, 2005, Old Lorus continued under the Canada Business Corporations Act.

On July 10, 2007 (the “Arrangement Date”), Old Lorus completed a plan of arrangement and corporate reorganization with, among others, 6650309 Canada Inc. (“New Lorus”), 6707157 Canada Inc. and Pinnacle International Lands, Inc. As a result of the plan of arrangement and reorganization, each common share of Old Lorus was exchanged for one common share of New Lorus and the assets (excluding certain deferred tax assets) and liabilities of Old Lorus (including all of the shares of its subsidiaries) were transferred, directly or indirectly, to New Lorus and/or its subsidiaries. New Lorus continued the business of Old Lorus after the Arrangement Date with the same officers and employees and continued to be governed by the same board of directors as Old Lorus prior to the Arrangement Date.

On August 28, 2014, New Lorus changed its name from Lorus Therapeutics Inc. to Aptose Biosciences Inc. and on October 1, 2014 we consolidated our outstanding common shares (the “Common Shares”) on the basis of one post-consolidation Common Share for each twelve pre-consolidation Common Shares.

The address of the Company’s head and registered office is 5955 Airport Road Suite #228, Mississauga, Ontario, Canada, L4V 1R9 and our phone number is (647) 479-9828. Our corporate website is www.aptose.com. The contents of the website and items accessible through the website are specifically not incorporated in this AIF by reference.

Aptose has three subsidiaries: Aptose Biosciences U.S. Inc. (“Aptose USA”), a company incorporated under the laws of Delaware, USA, Aptose Suisse GmbH (“Aptose Suisse”) a company incorporated under the laws of the canton of Zug, Switzerland and NuChem Pharmaceuticals Inc. (“NuChem”), a company incorporated under the laws of Ontario, Canada. Aptose owns 100% of the issued and outstanding voting share capital of Aptose USA and Aptose Suisse and 80% of the issued and outstanding voting share capital of NuChem.

| 3 |

| III. | THE COMPANY |

Aptose is a science-driven biotechnology company advancing highly differentiated agents to treat unmet medical needs in life-threatening cancers, such as acute myeloid leukemia (“AML”), high-risk myelodysplastic syndromes (“MDS”) and other hematologic malignancies. Based on insights into the genetic and epigenetic profiles of certain cancers and patient populations, Aptose is building a pipeline of novel and targeted oncology therapies directed at dysregulated processes and signaling pathways in cancer cells, and this strategy is intended to optimize efficacy and quality of life by minimizing the cytotoxic side effects associated with conventional therapies. Our product pipeline includes cancer drug candidates that exert potent activity as stand-alone agents and that enhance the activities of other anticancer agents without causing overlapping toxicities. Indeed, we believe our targeted products can emerge as first-in-class or best-in-class agents that deliver single agent benefit and may serve as part of a combination therapeutic strategy for specific populations of cancer patients.

We believe the future of cancer treatment and management lies in the prospective selection and treatment of patients having malignancies that are genetically or epigenetically predisposed to response based on a drug’s unique mechanism of action. We are of the view that many drugs currently approved for the treatment and management of cancer are not selective for the specific genetic alterations (targets) that cause the patient’s tumor and hence lead to significant toxicities due to off-target effects. Aptose’s strategy is to develop agents that target underlying disease-promoting mutations or altered pathways within a patient population, and we intend to apply this strategy across several therapeutic indications in oncology, including hematologic malignancies and solid tumor indications.

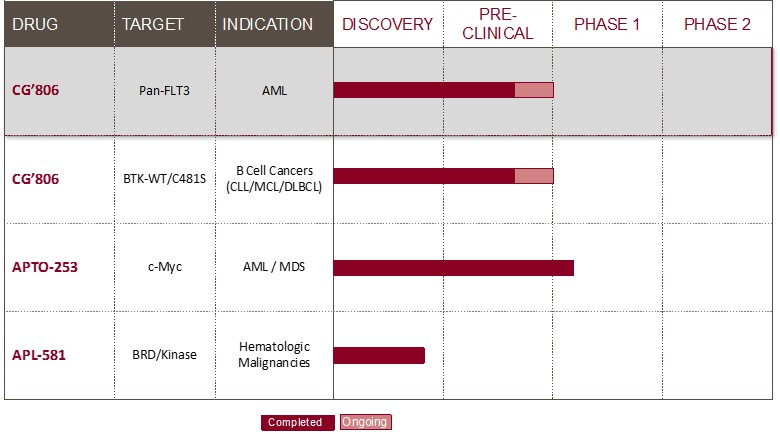

Aptose has one clinical-stage program, one late-preclinical program, and a third program that is discovery-stage and partnered with another company. CG026806 (“CG’806”), Aptose’s pan-FLT3 / pan-Bruton’s tyrosine kinase (“BTK”) inhibitor, is currently in late preclinical development and moving toward investigational new drug (“IND”) submission. Development of CG’806 is intended for the treatment of patients with relapsed / refractory AML and patients having certain B-cell malignancies. APTO-253 is Aptose’s second program and at the Phase 1b clinical stage for the treatment of patients with relapsed / refractory blood cancers, including AML and high-risk MDS under an IND allowed by the United States Food and Drug Administration (“FDA”) to evaluate APTO-253 as a therapeutic agent dosed on a weekly administration schedule for the treatment of certain hematologic malignancies. The APTO-253 program is currently on clinical hold and awaiting a new clinical batch of drug product to be manufactured and released.

Aptose’s leadership team comprises accomplished industry, financial and clinical research professionals who are dedicated to building a comprehensive anticancer drug pipeline and clinical development programs focused on targeted therapeutics directed against dysregulated oncogenic processes in patients with life-threatening hematologic malignancies.

The common shares of the Company are currently listed on the NASDAQ Capital Market (“NASDAQ”) under the symbol “APTO” and on the Toronto Stock Exchange (“TSX”) under the symbol “APS”.

Products

As noted above, Aptose is committed to the development of anticancer drugs that target aberrant oncologic signaling that underlie a particular life-threatening malignancy. This targeted approach is intended to impact the disease-causing events in cancer cells without affecting normal processes within cells. Such an approach requires that we first identify critical underlying oncogenic mechanisms in cancer cells and then develop a therapeutic that selectively impacts such oncogenic mechanisms. As a multi-kinase pan-FLT3 / BTK inhibitor, CG’806 targets multiple critical pathways that overlap to lead to the proliferation of cancer cells, including the B-cell receptor signaling pathway and FLT3 receptor pathways that converge at various points in the signaling cascade. Further, Aptose created the APTO-253 small molecule targeted drug that inhibits expression of the c-Myc oncogene and is under development as a novel therapy for AML and the related MDS.

| 4 |

The following table sets forth various product conditions in our pipeline and their respective stages of development.

CG’806

Overview

In June 2016, we announced a definitive agreement with South Korean company CrystalGenomics, Inc. (“CG”), granting us an exclusive option to research, develop and commercialize CG’806 in all countries of the world except the Republic of Korea and China, for all fields of use. CG’806 is a highly potent, orally bioavailable non-covalent small molecule being developed for AML and certain B cell malignancies because of its actions as a pan-FLT3/pan-BTK inhibitor. We paid $1.0 million to CG to acquire the option. Should we elect to exercise the option, upon exercise, we would pay an additional $2.0 million in cash or combination of cash and common shares, and would receive full development and commercial rights for the program in all territories outside of the Republic of Korea and China. The option fee is due on the earlier of (i) filing of an IND application with the FDA, (ii) first dosage of a human in a clinical trial or (iii) or June 2018.

CG’806 exhibits a picomolar IC50 toward the FMS-like tyrosine kinase 3 (FLT3) with the Internal Tandem Duplication (“FLT3-ITD”), potency against the wild type FLT3 and a host of mutant forms of FLT3, as well as single-digit nanomolar IC50’s against BTK and its C481S mutant (“BTK-C481S”). Consequently, CG’806 is characterized as a pan-FLT3/pan-BTK inhibitor. Further, CG’806 suppresses a small group of other relevant oncogenic kinases/pathways (including CSF1R, Aurora kinases (“AURK”), TRK, and the AKT and ERK pathways) that are operative in AML and certain B cell malignancies, but does not inhibit the TEC, EGFR and ErbB2/4 kinases that are responsible for safety concerns with certain other kinase inhibitors.

| 5 |

As a potent inhibitor of FLT3-ITD, CG’806 may become an effective therapy in a high-risk subset of AML patients. This is because the FLT3-ITD mutation occurs in approximately 30% of patients with AML and is associated with a poor prognosis. In murine xenograft studies of human AML (FLT3-ITD), CG’806 administered orally once daily for 14 days resulted in tumor elimination without measurable toxicity. Importantly, CG’806 targets other oncogenic kinases which may also be operative in FLT3-ITD AML, thereby potentially allowing the agent to become an important therapeutic option for a broader group of this difficult-to-treat AML patient population. The findings that CG’806 targets all forms of FLT3 and several other key oncogenic pathways, and that CG’806 was well tolerated from a safety perspective during efficacy studies, suggest that CG’806 may also have applicability in treating patients, particularly those over the age of 65, who cannot tolerate other therapies.

Separate from the AML and FLT3 story, overexpression of the BTK enzyme can drive oncogenic signaling of certain B cell malignancies, such as chronic lymphocytic leukemia (“CLL”), mantle cell lymphoma (“MCL”), diffuse large cell B cell lymphoma (“DLBCL”) and others. Therapy of these patients with covalent, irreversible BTK inhibitors, such as ibrutinib, that target the active site Cysteine (“Cys”) residue of BTK can be beneficial in many patients. However, therapy with covalent BTK inhibitors can select for BTK with a C481S mutation, thereby conferring resistance to covalent BTK inhibitors. Furthermore, approximately half of CLL patients have discontinued treatment with ibrutinib after 3.4 years of therapy. Discontinuation of ibrutinib is due to the development of drug resistance (in particular, patients have malignancies that developed the BTK-C481S mutation), or due to refractory disease (patient tumors did not respond to ibrutinib) or intolerance (side effects led to discontinuation of ibrutinib), according to a study performed at The Ohio State University. The C481S mutation is observed in 5-10% of the patients, while 40-45% of the patients were intolerant or refractory to ibrutinib. As a non-covalent, reversible inhibitor of BTK, CG’806 does not rely on the Cysteine 481 residue (“C481”) for inhibition of the BTK enzyme. Indeed, recent X-ray crystallographic studies (with wild type and C481S BTK) demonstrated that CG’806 binds productively to the BTK active site in a manner that is indifferent to the presence or absence of mutations at the 481 residue. Moreover, in vitro studies demonstrated that CG’806 kills B cell malignancy cell lines on average approximately 1500 times more potently than ibrutinib, and CG’806 demonstrated a high degree of safely in animal efficacy studies. Consequently, patients who are resistant, refractory or intolerant to ibrutinib or other commercially approved or development-stage BTK inhibitors with B cell malignancies may continue to be sensitive to CG’806 therapy. This is particularly true since CG’806 inhibits the wild type and mutant forms of BTK, as well as other kinases/pathways that drive the survival and proliferation of B cell malignancies

Role of BTK in B-cell signaling

BTK, a member of the TEC family kinase, is an essential element of B-cell receptor (“BCR”) signaling, which is required for B-cell maturation, survival and proliferation. It is an upstream activator of multiple pro-survival / anti-apoptotic pathways, including the NF-KB, mTOR-AKT and ERK pathways. BTK is overexpressed in malignant cells from patients with various B-cell malignancies, such as CLL, MCL, AML, and DLBCL. Disruption of BCR signaling via inhibition of BTK, has been shown to lead to clinical remissions in these patients.

| 6 |

CG’806 as a Non-covalent, Reversible Kinase Inhibitor

Binding studies of CG’806 have confirmed non-covalent, reversible inhibition of BTK, FLT3-ITD and Aurora Kinase A. Commercially-approved, covalent BTK inhibitors possess a Michael acceptor to react with C481 in BTK and irreversibly inactivate the BTK enzyme. In contrast, CG’806 does not require reactivity with the C481 residue for inhibition of the BTK enzyme, thereby allowing CG’806 to inhibit the wild type and C481 mutant form of the BTK enzyme.

Preclinical In Vitro Evaluation of CG’806

CG’806 is a potent inhibitor of BTK and FLT3 wild types, as well as the BTK C481S and FLT3-ITD mutants, which represent major sources of therapy relapse or are negative prognostic signals in patients. In enzymatic assays, CG’806 has demonstrated potency against the BTK C481S mutant with an IC50 of 2.5 nM. CG’806 also has potent activity against the FLT-ITD mutation, occurring in 30-35% of AML patients, with an IC50 against the purified enzyme of 0.8 nM (800pM). Likewise, CG’806 exerts low nM IC50 values against the FLT3 enzyme having various mutations in the tyrosine kinase domain (TKD) and the Gatekeeper region. Similarly, CG’806 demonstrated picomolar potency against Aurora A (IC50 0.4 nM). Notably, CG’806 is a potent inhibitor of interleukin-2-inducible T-cell kinase (“ITK”), at approximately 4 nM. ITK is speculated to play a role in suppressing activated T-cell function, hence inhibition of ITK alleviates this suppression, and provides for a potential immunomodulatory anti-tumor mechanism. Finally, CG’806 does not exhibit any inhibition of epidermal growth factor receptor (“EGFR”), TEC or ErbB2/4 kinases. Inhibition of one or more of these kinases has been speculated to contribute to the toxicity observed from the commercially approved BTK inhibitor.

BTK is overexpressed in the blast cells of approximately 80% of AML patients as compared to normal peripheral blood mononuclear cells (PBMCs) in healthy subjects. Researchers have shown that BTK inhibition attenuates the proliferation and survival of FLT3-ITD primary AML blasts and AML cell lines, as well as inhibits the downstream activation of FLT3-ITD-dependent Myc and STAT5 kinases. We believe that CG’806 is the only drug in development that inhibits both FLT3-ITD and BTK pathways reported to synergize to drive the proliferation and survival of AML.

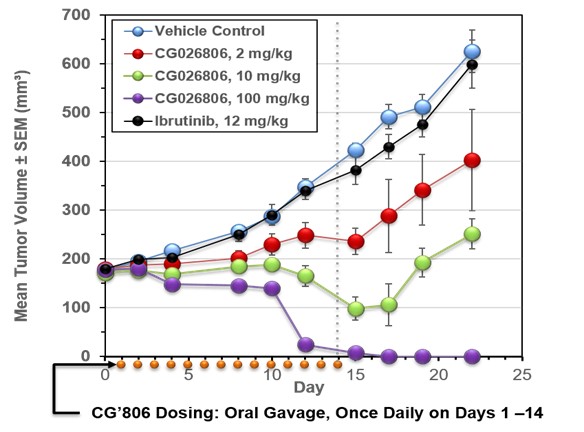

CG’806 Xenograft Studies

In vivo subcutaneous AML tumor models of anti-cancer efficacy revealed CG’806 induced rapid and sustained tumor eradication (Figure 1). CG’806 was administered orally once daily, for 14 days. Moreover, CG’806 exhibited the sustained tumor elimination post therapy, while demonstrating no impact to murine body weight, no impacts to hematology cell counts or visible organ toxicities – necropsy and clinical pathology findings did not reveal any abnormal observations. A maximum tolerated dose has not yet been identified with murine xenograft studies, having been performed up to 450 mg/kg orally for 14 days (CG preliminary toxicity data).

| 7 |

Figure 1. Efficacy of CG’806 in MV4-11 xenograft model.

MV4-11 tumor bearing mice were administered an oral suspension once daily for 14 days of CG’806 at 2 mg/kg (blue line), 10 mg/kg (green line) or 100 mg/kg (red line), Ibrutinib, 12 mg/kg (turquoise line), or vehicle (Control; black line) with 7-day post-treatment follow-up. Tumor volumes and body weights were measured 3 times weekly.

CG’806 Intellectual Property

A Patent Cooperation Treaty (PCT) application providing composition of matter and use protection for CG’806 was filed in late 2013, with a potential expiry in 2033 before extension opportunities, across all major geographies.

CG’806 Manufacturing and Preclinical Progress

We have invested significant time, effort and capital to create a scalable chemical synthetic route for the manufacture of CG’806 drug substance, to develop an oral formulation for clinical development, and to study the actions of CG’806 in various preclinical biological pathway studies. Our efforts to develop the scalable chemical synthetic route have taken longer than anticipated and thus pushed the timeline for the IND submission and initiation of the first-in-human Phase I clinical trial further into the future than we had originally anticipated. We now have solved the synthetic route, can scale the manufacture of API, and now have manufactured and delivered a batch of API which was used for Dose Range Finding Studies that were performed and completed in early January, 2018. Currently we are manufacturing a multi-kg batch of GLP grade API (drug substance) for use in GLP toxicology studies. We also reported that we selected the oral formulation that we intend to take into the GLP toxicology studies and the first-in-human clinical trials. In addition, R&D funds are being utilized to support exploratory formulation studies in an ongoing effort to craft superior formulations for CG’806. Provided we are able to manufacture CG’806 for both the non-clinical (GLP) studies and clinical trial, complete the non-clinical studies, and receive a favorable approval from the FDA on our IND submission and continue on the anticipated timeline, we expect to initiate a first-in-human Phase I clinical trial by late 2018. The total direct costs of such activities and to reach the submission of the IND are currently expected to range between US$3 million and US$4.5 million. However any interruptions or additional studies in these activities could cause a delay in the anticipated commencement of the Phase I trial. Greater granularity on the timing of the IND submission and clinical trial will be provided in the coming months. CG’806 is being developed with the intent to deliver the agent as an oral therapeutic and to develop it in parallel for AML and for appropriate B cell malignancies (likely CLL). As clinical trials are lengthy, complex, costly, and uncertain processes, an estimate of the future costs is not reasonable at this time.

| 8 |

Developments in 2017

On January 23, 2017, we announced that we would prioritize our resources toward the development of CG’806 and temporarily delay clinical activities with APTO-253, in order to elucidate the cause of recent manufacturing setbacks related to the intravenous formulation of APTO-253, with the intention of restoring the molecule to a state supporting clinical development and partnering. Although we have two compelling cancer drugs, resources could support the full development activities of only one at this time. Recent advances with CG’806 elevated this agent as having the best risk-reward profile to pursue with those resources. Such data established CG’806 as a well-differentiated pan-FLT3 inhibitor that demonstrates tumor eradication in the absence of toxicity in AML xenograft models, and it is on track for development as a therapy for certain AML patients. In addition, CG’806 is a potent non-covalent inhibitor of proliferation among certain BTK-driven B-cell derived cancer cells. The encouraging properties of CG’806, including its potency against well-established targets in diseases of severe medical need, warrant expeditious advancement and prioritization of resources toward this molecule.

On May 7, 2017, we presented preclinical data for our pan-FLT3/pan-BTK inhibitor CG’806 at the 2017 American Association for Cancer Research (AACR) Conference for Hematologic Malignancies: Translating Discoveries to Novel Therapies in Boston, MA. Two separate presentations highlighting CG’806 were presented. In one presentation, our scientists, with researchers from the Knight Cancer Institute at Oregon Health & Science University (OHSU), presented data relating to the potency of CG’806 against samples derived from patients with various hematologic malignancies. In a separate presentation, our scientists, with researchers from the MD Anderson Cancer Center, presented data demonstrating CG’806’s potent activity against AML cells harboring wild type or specific mutant forms of FLT3.

In September 2017 the USPTO informed us that the patent has been awarded. The patent claims numerous compounds, including the CG’806 compound, pharmaceutical compositions comprising the CG’806 compound, and methods of treating various diseases caused by abnormal or uncontrolled activation of protein kinases.

On December 11, 2017 at the American Society of Hematology Annual Meeting, we presented with the OHSU Knight Cancer Institute preclinical data demonstrating that CG’806, a pan-FLT3/pan-BTK inhibitor, has broad and potent drug activity against AML, CLL and other hematologic disease subtypes. We also announced the presentation of preclinical data from research led by The University of Texas MD Anderson Cancer Center demonstrating that CG’806 exerts a profound anti-leukemia effect in human and murine leukemia cell lines harboring FLT-3 ITD mutations, mutations that are usually associated with very poor prognoses in leukemia patients. In addition, CG’806 induces apoptosis, or programmed cell death, in AML patient samples by multiple mechanisms and is able to overcome resistance that is seen with other FLT3 inhibitors. The data were highlighted in poster presentations on December 10 and 11, 2017 at the American Society of Hematology Annual Meeting.

| 9 |

On December 26, 2017, we announced that the FDA has granted orphan drug designation to CG’806 for the treatment of patients with AML. Orphan drug designation is granted by the FDA to encourage companies to develop therapies for the treatment of diseases that affect fewer than 200,000 individuals in the United States. Orphan drug status provides research and development tax credits, an opportunity to obtain grant funding, exemption from FDA application fees and other benefits. If CG’806 is approved to treat AML, the orphan drug designation provides Aptose with seven years of marketing exclusivity.

On March 15, 2018, we announced two abstracts related to the mechanistic properties of CG’806 in AML cells and in B cell malignancy cells have been accepted for poster presentations at the upcoming 2018 Annual Meeting of the American Association for Cancer Research (AACR).

APTO-253

Overview

APTO-253, the Company’s second program, is a novel small molecule therapeutic agent that inhibits expression of the c-Myc oncogene, leading to cell cycle arrest and programmed cell death (apoptosis) in human-derived solid tumor and hematologic cancer cells, without causing general myelosuppression of the healthy bone marrow. The c-Myc oncogene is overexpressed in hematologic cancers, including AML. C-Myc is a transcription factor that regulates cell growth, proliferation, differentiation and apoptosis, and overexpression amplifies new sets of genes to promote oncogenesis. APTO-253 dramatically down-regulates expression of the c-Myc oncogene in AML cells and depletes those cells of the c-Myc oncoprotein, leading to apoptotic cell death in AML cells. Thus APTO-253 may serve as safe and effective c-Myc inhibitor for AML that combines well with other agents and does not impact the normal bone marrow.

APTO-253 was being evaluated by us in a Phase Ib clinical trial in patients with relapsed / refractory hematologic malignancies, particularly AML and MDS before being placed on clinical hold by the FDA in November 2015. If and when the APTO-253 clinical trial is re-initiated, upon completion of the dose-escalation stage of the study and determination of the appropriate dose, the plan would be to enroll additional AML patients for a disease-specific single-agent expansion cohorts. For future development, upon selection of a lead hematologic indication from this Phase Ib study, combination of APTO-253 with a standard therapy would be considered.

As previously disclosed, the Phase Ib trial was placed on clinical hold in order to solve a chemistry-based formulation issue, and the chemistry of the API and the formulation had undergone minor modifications to deliver a stable and soluble drug product for return to the clinical setting. In December 2016, we announced that we had successfully manufactured multiple non-GMP batches of a new drug product formulation for APTO-253, including a batch that had been stable and soluble for over six months. However, the 40L batch that was the intended clinical supply encountered an unanticipated mishap during the filling process that compromised the stability of that batch of drug product. On January 23, 2017, we announced that the root cause and corrective action studies would take longer than originally expected and that we would temporarily delay clinical activities with APTO-253 in order to elucidate the cause of manufacturing setback, with the intention of restoring the molecule to a state supporting clinical development and partnering. Formal root cause analyses studies have now been completed and have identified the reason for the drug product stability failure, and we have established a corrective and prevention action plan for the manufacture of future batches of drug product. Given these findings, we have manufactured a new GMP clinical supply of drug product and are in the process of performing studies required to demonstrate the fitness of the drug product for clinical usage, and then we plan to present the findings to the FDA in the second quarter of 2018 with the hope of having the clinical hold removed by the end of the second quarter of 2018 and returning APTO-253 to the clinical trial soon thereafter. The total direct costs of such activities to reach the presentation of the findings to the FDA are currently expected to range between US$1 million and US$1.5 million. Investors are cautioned that there can be no assurance that the FDA will remove the clinical hold.

| 10 |

In the event the clinical hold is removed by the FDA, based on our current estimates and the information available to us at this time, we expect to complete the clinical drug product manufacture, initiate studies to investigate additional drug delivery methods for APTO-253 and to initiate additional non-clinical studies for solid tumor and hematologic development. As preparing, submitting, and advancing applications for regulatory approval, developing drugs and drug product and clinical trials are sometimes complex, costly, and time consuming processes, an estimate of the future costs is not reasonable at this time.

Solid Tumors

In January 2011, Aptose announced the first patient enrolment in a Phase I dose-escalation study for APTO-253 in patients with advanced or metastatic solid tumors who are unresponsive to conventional therapy or for which no effective therapy is available. The study was initially being conducted at Memorial Sloan-Kettering Cancer Center in New York. Objectives of the study included determination or characterization of the safety profile, maximum tolerated dose, and antitumor activity of APTO-253, as well as pharmacokinetics and a recommended Phase II dose for subsequent clinical trials.

In June 2012, MD Anderson Cancer Center in Houston was added as a second site under the direction of Dr. Jennifer Wheler as the principal investigator. In addition, Aptose announced that the study had successfully completed the accelerated drug dose escalation stage (Stage 1), with further escalation under way in the non-accelerated dose escalation stage (Stage 2) for the purpose of determining the maximal tolerated dose level and recommended Phase II dose. The addition of a second site expanded patient availability for enrollment.

In January 2013, Aptose announced that Phase I clinical study of APTO-253 has successfully escalated to the target dose level based on predicted and observed clinical effects without limitation by toxicity. The success of this study allowed Aptose to initiate a biomarker clinical investigation to further explore the effects of the drug at relevant doses determined in the clinical trial.

In April 2013, Aptose announced that studies demonstrated the antitumor activity of APTO-253 in animal models of human NSCLC with a dose-response effect in NSCLC.

In July 2013, Aptose announced the results of the Phase 1 clinical trial of APTO-253. In this first-in-man dose-escalation clinical study, APTO-253 demonstrated a favorable safety profile, as well as encouraging signs of antitumor activity. The design of this trial consisted of APTO-253 as a single agent in patients with advanced solid tumors resistant to multiple standard therapies. The study enrolled 27 patients, all of which had failed a median of four prior chemotherapies. Although this was primarily a dose-escalation safety study, efficacy and pharmacokinetics were also explored.

The clinical trial enrolled patients at seven dose levels ranging from 20 to 229 mg/m2. Of the 27 patients enrolled, 17 were evaluable for efficacy. Of these 17 patients, seven (41%) achieved stable disease by Response Evaluation Criteria In Solid Tumors (“RECIST”). This included patients with colorectal, lung, appendiceal, liver and uterine cancers. Dose related activity was demonstrated at the higher dose levels (176 and 229 mg/m2). At these two highest dose levels, four of five evaluable patients (80%) achieved sustained stable disease by RECIST ranging from 5.6 months to 8 months, representative of disease control. Of these, a patient with non-small cell lung cancer at the highest dose level additionally demonstrated non-index tumor shrinkage.

| 11 |

The safety assessment indicated that APTO-253 was well tolerated at all dose levels tested in this trial. The dose escalation was not limited by toxicity. The most common adverse event was Grade 1 or 2 fatigue seen in three patients. There was one Grade 3 toxicity, asymptomatic low blood phosphate level that was reversible by supplementation with phosphates. The pharmacokinetic profile was consistent with the predictive profile seen preclinically, and the elimination profile and half-life in patients were suggestive of a very rapid distribution phase and prolonged retention.

Multi-Targeting Bromodomain Program

In November 2015, Aptose entered into a definitive agreement with Moffitt Cancer Center (“Moffitt”) for exclusive global rights to potent, multi-targeting, single-agent inhibitors for the treatment of hematologic and solid tumor cancers. These small molecule agents are inhibitors of the Bromodomain and Extra-Terminal motif (“BET”) protein family members, which simultaneously target specific kinase enzymes. The molecules developed by Moffitt exhibited potency against the BET family members and specific oncogenic kinases which, when inhibited, are synergistic with BET inhibition. Under the agreement, Aptose would gain access to the drug candidates developed by Moffitt and the underlying intellectual property covering the chemical modifications enabling potent bromodomain (“BRD”) inhibition on the chemical backbone of a kinase inhibitor.

In January 2017, Aptose terminated the collaboration with Moffitt for the development of the dual BRD4 / JAK2 inhibitor program.

Multi-Targeting Epigenetic Program

In November 2015, Aptose announced an exclusive drug discovery partnership with Laxai Avanti Life Sciences (“LALS”) for their expertise in next generation epigenetic-based therapies. Under the agreement, LALS was to be responsible for developing multiple clinical candidates, including optimizing candidates that exert dual BRD4 / kinase inhibitory activity. Based on available resources, Aptose halted further investment in the collaboration with LALS in late 2016. However, the program delivered novel intellectual property and hit molecules for further optimization. As a consequence, Aptose may choose to out-license the program.

On March 7, 2018, we entered into an exclusive global license agreement with Ohm Oncology (“OHM”), an affiliate of LALS that was formed in 2016 to advance the clinical development of compelling molecules derived from the LALS initiative, for the development, manufacture and commercialization of APL-581, as well as related molecules from Aptose’s dual bromodomain and extra-terminal domain motif (BET) protein and kinase inhibitor program. Under the agreement, Aptose will retain reacquisition rights to certain molecules, while OHM/LALS will have the rights to develop and sublicense all other molecules. Aptose will receive a nominal upfront cash payment and is eligible to receive up to $125 million of additional payments based on the achievement of certain development, regulatory and sales milestones, as well as significant royalties on future sales generated from the program, if any.

Clinical Indications for Aptose Programs

Acute Myeloid Leukemia

AML is a rapidly progressing cancer of the blood and bone marrow characterized by the uncontrolled proliferation of dysfunctional myeloblasts that do not mature into healthy blood cells. It is the most common form of acute leukemia in adults. The American Cancer Society estimates [there will be] approximately 19,520 new cases of AML and approximately 10,670 deaths from AML in the United States in 2018. [Standard induction therapy with chemotherapy is successful in many AML patients, but the majority of these patients will relapse with treatment refractory disease. The average age of a patient with AML is 67 years. Approximately 48% patients less than age 60, and 34% of patients greater than or equal to age 60, with residual disease after induction therapy will achieve a remission, as reported by Datamonitor Healthcare.

| 12 |

Myelodysplastic Syndromes

MDS are a group of blood and bone marrow disorders. In MDS, stem cells do not mature normally, and the number of blasts (immature cells) and dysplastic (abnormally developed) cells increases. Also, the number of healthy mature cells decreases, meaning there are fewer normal red blood cells, white blood cells, and platelets. The numbers of blood cells are often called blood cell counts. Because of the decrease in healthy cells, people with MDS often have anemia (a lowered blood cell count), and may have neutropenia (a low white blood cell count) and thrombocytopenia (a low platelet count). Also, the chromosomes (long strands of genes) in the bone marrow cells may be abnormal. According to the American Cancer Society, there are approximately 13,000 new cases of MDS annually in the United States. Additionally, Datamonitor Healthcare reports median survival in higher risk MDS patients may range between five months and two years. There are several subtypes of MDS, and some subtypes of MDS may eventually turn into AML.

Specialized Skill and Knowledge

The business of the Company requires personnel with specialized skills and knowledge in oncology. Researchers must be able to design and implement studies to assess the efficacy of anticancer drugs. Specialized knowledge and skills relating to chemistry and formulation process development are also needed. Such knowledge and skills are needed to develop product specific analytical methods and formulation processes. The Company’s business also requires clinical and regulatory expertise and knowledge. The Company has trained scientists and personnel with broad experience in these fields.

Competitive Conditions

The biotechnology and pharmaceutical industries are characterized by rapidly evolving technology and intense competition. There are numerous companies in these industries that are focusing their efforts on activities similar to ours. Some of these are companies with established positions in the pharmaceutical industry and may have substantially more financial and technical resources, more extensive research and development capabilities, and greater marketing, distribution, production and human resources than Aptose. In addition, we face competition from other companies for opportunities to enter into partnerships with biotechnology and pharmaceutical companies and academic institutions.

Competition with our potential products may include chemotherapeutic agents, monoclonal antibodies, antisense therapies, small molecules, immunotherapies, vaccines and other biologics with novel mechanisms of action. These drugs may kill cancer cells indiscriminately, or through a targeted approach, and some have the potential to be used in non-cancer indications. We also expect that we will experience competition from established and emerging pharmaceutical and biotechnology companies that have other forms of treatment for the cancers that we target, including drugs currently in development for the treatment of cancer that employ a number of novel approaches for attacking these cancer targets. Cancer is a complex disease with more than 100 indications requiring drugs for treatment. The drugs in competition with our potential drugs have specific targets for attacking the disease, targets which are not necessarily the same as ours. These competitive drugs, however, could potentially also be used together in combination therapies with our drugs to manage the disease. Other factors that could render our potential products less competitive may include the stage of development, where competitors’ products may achieve earlier commercialization, as well as superior patent protection, better safety profiles, or a preferred cost-benefit profile.

| 13 |

Components

Standard raw materials, component parts, and products required by the Company in pursuing its activities are supplied from reputable companies active in the biotechnology industry. Pricing is predictable as there are many alternatives of such supplies that are readily available.

Intangible Properties

We believe that our issued patents and pending applications are important in establishing and maintaining a competitive position with respect to our products and technology.

As of March 27, 2018, we are the owner of record of 6 issued U.S. patents, which together provide coverage for the APTO-253 compound, it’s pharmaceutical composition and methods of treating various cancers with APTO-253, including solid tumors and leukemia. The APTO-253 ccomposition of matter patent expires in 2028 in the United States and 2026 in other countries. We also hold 17 international (non-U.S.) patents which together provide coverage for APTO-253, three of which are issued European patents, validated in at least eight countries in Europe. Our patents also include several compounds that are similar to APTO-253, which provide protection from competitors seeking to develop anticancer products that are related in chemical structure to APTO-253.

On September 12, 2017, we announced that United States Patent and Trademark Office (“USPTO”) has issued a patent (number 9,758,508) entitled “2,3-dihydro-isoindole-1-on derivative as BTK kinase suppressant, and pharmaceutical composition including same”. The patent claims numerous compounds, including the CG’806 compound, pharmaceutical compositions comprising the CG’806 compound, and methods of treating various diseases. The patent is expected to provide protection until December of 2033.

Environmental Protection

The Company’s research and development activities involve the controlled use of hazardous and radioactive materials and, accordingly, the Company is subject to federal, provincial and local laws and regulations governing the use, manufacture, storage, handling and disposal of such materials and certain waste products. To the knowledge of the Company, compliance with such environmental laws and regulations does not and will not have any significant impact on its capital spending, profits or competitive position within the normal course of its operating activities. There can be no assurance, however, that the Company will not be required to incur significant costs to comply with environmental laws and regulations in the future or that its operations, business or assets will not be materially adversely affected by current or future environmental laws or regulations.

Employees

As at December 31, 2017, we employed 18 full-time persons and 2 part-time persons in research and drug development and administration activities. Four of our employees hold Ph.D.’s and numerous others hold degrees and designations such as MSc, BSc, CPA (CA), CPA (California) and MBA. To encourage a focus on achieving long-term performance, employees and members of the board of directors of the Company (the “Board”) have the ability to acquire an ownership interest in the Company through Aptose’s share option and alternate compensation plans.

| 14 |

None of our employees are unionized, and we consider our relations with our employees to be good.

Government Regulation

Overview

Our overall regulatory strategy is to work with the appropriate government departments which regulate the use and sale of therapeutic drug products. This includes Health Canada in Canada, the FDA in the United States, the European Medicines Agency in Europe, and other local regulatory agencies with oversight of preclinical studies, clinical trials and marketing of therapeutic products. Where possible, we intend to take advantage of opportunities for accelerated development of drugs designed to treat rare and serious or life-threatening diseases. We also intend to pursue priority evaluation of any application for marketing approval filed in Canada, the United States or the European Union and to file additional drug applications in other markets where commercial opportunities exist. We may not be able to pursue these opportunities successfully.

Regulation(s) by government authorities in Canada, the United States, and the European Union are significant factors in guiding our current research and drug development activities. To clinically test, manufacture and market drug products for therapeutic use, we must be in compliance with guidance and regulations established by the regulatory agencies in the countries in which we currently operate or intend to operate.

The laws of most of these countries require the licensing of manufacturing facilities, carefully controlled research and the extensive testing of products. Biotechnology companies must establish the safety and efficacy of their new products in clinical trials; they must establish and comply with current GMP(s) for the manufacturing of the product and control over marketing activities before being allowed to market a product. The safety and efficacy of a new drug must be shown through human clinical trials of the drug carried out in accordance with the guidance and regulations established by local and federal regulatory agencies.

The process of completing clinical trials and obtaining regulatory approval for a new drug takes a number of years and requires the expenditure of substantial resources. Once a new drug or product license application is submitted, regulatory agencies may not review the application in a timely manner and may not approve the product. Even after a New Drug Application (“NDA”) submission has occurred and/or approval has been obtained, further studies, including post-marketing studies, may be required to provide additional data on efficacy and safety necessary to confirm the approved indication or to gain approval for the use of the new drug as a treatment for clinical indications other than those for which the new drug was initially tested. Also, regulatory agencies require post-marketing surveillance programs to monitor a new drug’s side effects, safety and long term effects of the product. A serious safety or effectiveness problem involving an approved new drug may result in a regulatory agency mandating a withdrawal of the new drug from the market and possible civil action. It is possible that we could encounter such difficulties or excessive costs in our efforts to secure necessary approvals, which could delay or prevent us from manufacturing or marketing our products.

In addition to the regulatory product approval framework, biotechnology companies, including Aptose, are subject to regulation under local, provincial, state and federal law, including requirements regarding occupational safety, laboratory practices, environmental protection and hazardous substance control, and may be subject to other present and future local, provincial, state, federal and foreign regulation, including possible future regulation of the biotechnology industry.

| 15 |

Regulation in Canada

In Canada, the manufacture and sale of new drugs are controlled by Health Canada. New drugs must pass through a number of testing stages, including pre-clinical testing and human clinical trials. Pre-clinical testing involves testing the new drug’s chemistry, pharmacology and toxicology in vitro and in vivo. Successful results (that is, potentially valuable pharmacological activity combined with an acceptable low level of toxicity) enable the developer of the new drug to file a clinical trial application to begin clinical trials involving humans.

To study a drug in Canadian patients, a clinical trial application submission must be filed with Health Canada. The clinical trial application submission must contain specified information, including the results of the pre-clinical tests completed at the time of the submission and any available information regarding use of the drug in humans. In addition, since the method of manufacture may affect the efficacy and safety of a new drug, information on manufacturing methods and standards and the stability of the drug substance and dosage form must be presented. Production methods and quality control procedures must be in place to ensure an acceptably pure product, essentially free of contamination, and to ensure uniformity with respect to all quality aspects.

In addition, all federally regulated trials must be approved and monitored by an independent committee of doctors, scientists, advocates and others to ensure safety and ethical standards. These committees are called Institutional Review Boards (“IRBs”) or Ethics Review Boards (“ERBs”). The review boards study and approve all study-related documents before a clinical trial begins and also carefully monitor data to detect benefit or harm, and validity of results.

Provided Health Canada does not reject a clinical trial application submission and IRB or ERB approval has been obtained, clinical trials can begin. Clinical trials for product candidates in Canada, as in the United States, are generally carried out in three phases. Phase I involves studies to evaluate toxicity and ideal dose levels in healthy humans. The new drug is administered to human patients who have met the clinical trial entry criteria to determine pharmacokinetics, human tolerance and prevalence of any adverse side effects. Phases II and III involve therapeutic studies. In Phase II, efficacy, dosage, side effects and safety are established in a small number of patients who have the disease or disorder that the new drug is intended to treat. In Phase III, there are controlled clinical trials in which the new drug is administered to a large number of patients who are likely to receive benefit from the new drug. In Phase III, the effectiveness of the new drug in patients is compared to that of standard accepted methods of treatment in order to provide sufficient data for the statistical proof of safety and efficacy for the new drug.

If clinical studies establish that a new drug has value, the manufacturer submits a new drug submission application to Health Canada for marketing approval. The new drug submission contains all information known about the new drug, including the results of pre-clinical testing and clinical trials. Information about a substance contained in new drug submission includes its proper name, its chemical name, and details on its method of manufacturing and purification, and its biological, pharmacological and toxicological properties. The new drug submission also provides information about the dosage form of the new drug, including a quantitative listing of all ingredients used in its formulation, its method of manufacture, manufacturing facility information, packaging and labelling, the results of stability tests, and its diagnostic or therapeutic claims and side effects, as well as details of the clinical trials to support the safety and efficacy of the new drug. Furthermore, for biological products, an on-site evaluation is completed to assess the production process and manufacturing facility. It is required prior to the issuance of a notice of compliance. All aspects of the new drug submission are critically reviewed by Health Canada. If a new drug submission is found satisfactory, a notice of compliance is issued permitting the new drug to be sold for the approved use. In Canada, an establishment license must be obtained prior to marketing the product.

| 16 |

Health Canada has a policy of priority evaluation of new drug submissions for all drugs intended for serious or life-threatening diseases for which no drug product has received regulatory approval in Canada and for which there is reasonable scientific evidence to indicate that the proposed new drug is safe and may provide effective treatment.

The monitoring of a new drug does not cease once it is on the market. For example, a manufacturer of a new drug must report any new information received concerning serious side effects, as well as the failure of the new drug to produce desired effects. If Health Canada determines it to be in the interest of public health, a notice of compliance for a new drug may be suspended and the new drug may be removed from the market.

A post surveillance program involves clinical trials conducted after a drug is marketed (referred to as Phase IV studies in the United States) and is an important source of information on as yet undetected adverse outcomes, especially in populations that may not have been involved in the premarketing trials (e.g., children, the elderly, pregnant women) and the drug’s long-term morbidity and mortality profile. Regulatory authorities may require companies to conduct Phase IV studies as a condition of market approval. Companies often conduct post-marketing studies in the absence of a regulatory mandate.

An exception to the foregoing requirements relating to the manufacture and sale of a new drug is the limited authorization that may be available in respect of the sale of new drugs for emergency treatment. Under the special access program, Health Canada may authorize the sale of a quantity of a new drug for human use to a specific practitioner for the emergency treatment of a patient under the practitioner’s care. Prior to authorization, the practitioner must supply Health Canada with information concerning the medical emergency for which the new drug is required, such data as is in the possession of the practitioner with respect to the use, safety and efficacy of the new drug, the names of the institutions at which the new drug is to be used and such other information as may be requested by Health Canada. In addition, the practitioner must agree to report to both the drug manufacturer and Health Canada the results of the new drug’s use in the medical emergency, including information concerning adverse reactions, and must account to Health Canada for all quantities of the new drug made available.

The Canadian regulatory approval requirements for new drugs outlined above are similar to those of other major pharmaceutical markets. While the testing carried out in Canada is often acceptable for the purposes of regulatory submissions in other countries, individual regulatory authorities may request supplementary testing during their assessment of any submission. Therefore, the clinical testing conducted under Health Canada authorization or the approval of regulatory authorities of other countries may not be accepted by regulatory authorities outside Canada or other countries.

Regulation in the United States

In the United States, the FDA controls and investigates the investigation, manufacturing, and sale of new drugs. New drugs require FDA approval of a NDA prior to commercial sale. In the case of certain biological products, a Biological License Application (“BLA”) must be obtained prior to marketing and batch releasing. As in Canada, to obtain marketing approval, data from adequate and well-controlled human clinical trials, demonstrating to the FDA’s satisfaction a new drug’s safety and effectiveness for its intended use, are required. Data are generated in studies conducted pursuant to an IND submission, similar to that required for a clinical trial application in Canada. Clinical trials with human subjects are characterized as Phase I, Phase II and Phase III trials or a combination thereof. In a marketing application, the manufacturer must also demonstrate the identity, potency, quality and purity of the active ingredients of the new drug involved, and the stability of those ingredients. Further, the manufacturing facilities, equipment, processes and quality controls for the new drug must comply with the FDA’s current [Good Manufacturing Practice] regulations for drugs or biological products both in a pre-licensing inspection before product licensing and in subsequent periodic inspections after licensing. An establishment license grants the sponsor permission to fabricate, package, label, distribute, import, wholesale or test of the newly approved drug.

| 17 |

Federally regulated trials must be approved and monitored by an independent committee of doctors, scientists, advocates and others to ensure safety and ethical standards. These committees are called IRBs or ERBs. The review boards study and approve all study-related documents before a clinical trial begins and also carefully monitor data to detect benefit or harm, and validity of results.

The above describes briefly what is necessary for a new drug to be approved for marketing in North America. The European Medicines Agency and Japanese Pharmaceuticals and Medical Devices Agency are also important regulatory authorities in drug development. Together with the FDA, they are the three International Conference on Harmonization parties which oversee the three largest markets for drug sales.

Financings

In October 2017, we entered into a Common Shares Purchase Agreement (the “Purchase Agreement”) with Aspire Capital Fund, LLC (“Aspire Capital”) to sell up to US $15.5 million of common shares to Aspire Capital. Under the terms of the Purchase Agreement, Aspire Capital has made an initial purchase of 357,143 common shares at a price of $1.40 per share, representing gross proceeds of approximately $500,000 ($324,000 net of share issue costs). Under the terms of the Purchase Agreement, Aspire Capital has committed to purchase up to an aggregate of $15.0 million of our common shares, at our request from time to time during a 30-month period beginning on the effective date of a registration statement related to the transaction and at prices based on the market price at the time of each sale. Under terms of the Purchase Agreement, we also issued 321,429 common shares to Aspire Capital as consideration for Aspire Capital entering into the Purchase Agreement. Subsequent to the year end, we issued an additional 3.2 million common shares under the Purchase agreement for gross proceeds of approximately $8.9 million.

We intend to use this equity arrangement as an additional option to assist us in achieving our capital objectives. The equity line provides us with the opportunity to regularly raise capital at prevailing market prices, at our sole discretion providing us with the ability to better manage our cash resources.

| IV. | Risk Factors and Uncertainties |

Investing in our securities involves a high degree of risk. Before making an investment decision with respect to our Common Shares, you should carefully consider the following risk factors. Additional risks not currently known by us or that we consider immaterial at the present time may also impair our business, financial condition, prospects or results of operations. If any of the following risks occur, our business, financial condition, prospects or results of operations would likely be materially adversely affected. In that case, the trading price of our Common Shares could decline and you may lose all or part of the money you paid to buy our Common Shares. The risks set out below are not the only risks and uncertainties we currently face; other risks may arise in the future.

Risks Related to our Business

We are an early stage development company.

We are at an early stage of development. In the past five years, none of our potential products has obtained regulatory approval for commercial use and sale in any country and as such, no significant revenues have resulted from product sales. Significant additional investment will be necessary to complete the development of any of our product candidates. Preclinical and clinical trial work must be completed before our potential products could be ready for use within the markets that we have identified. We may fail to develop any products, obtain regulatory approvals, enter clinical trials or commercialize any products. We do not know whether any of our potential product development efforts will prove to be effective, meet applicable regulatory standards, obtain the requisite regulatory approvals, be capable of being manufactured at a reasonable cost or be accepted in the marketplace. We also do not know whether sales, license fees or related royalties will allow us to recoup any investment we make in the commercialization of our products.

| 18 |

The product candidates we are currently developing are not expected to be commercially viable for at least the next several years and we may encounter unforeseen difficulties or delays in commercializing our product candidates. In addition, our potential products may not be effective or may cause undesirable side effects.

Our product candidates require significant funding to reach regulatory approval assuming positive clinical results. For example, our product candidate APTO-253 began enrolment in a Phase I clinical trial in patients with relapsed or refractory hematologic malignancies and was placed on clinical hold by the FDA following a voluntary suspension of dosing by us. We are currently working with the FDA to have such hold lifted, but significant additional funding or a partnership will be necessary to complete a restarted Phase I clinical and, if required, Phase II or Phase III clinical trials. Such funding for our product candidates may be difficult, or impossible to raise in the public or private markets or through partnerships. If funding or partnerships are not readily attainable, the development of our product candidates may be significantly delayed or stopped altogether. The announcement of a delay or discontinuation of development would likely have a negative impact on our share price.

We need to raise additional capital.

We have an ongoing need to raise additional capital. To obtain the necessary capital, we must rely on some or all of the following: additional share issues, debt issuances (including promissory notes), collaboration agreements or corporate partnerships and grants and tax credits to provide full or partial funding for our activities. Additional funding may not be available on terms that are acceptable to us or in amounts that will enable us to carry out our business plan.

Our need for capital may require us to:

| • | engage in equity financings that could result in significant dilution to existing investors; |

| • | delay or reduce the scope of or eliminate one or more of our development programs; |

| • | obtain funds through arrangements with collaborators or others that may require us to relinquish rights to technologies, product candidates or products that we would otherwise seek to develop or commercialize ourselves; |

| • | license rights to technologies, product candidates or products on terms that are less favourable to us than might otherwise be available; |

| • | considerably reduce operations; or |

| • | cease our operations. |

| 19 |

We have a history of operating losses. We expect to incur net losses and we may never achieve or maintain profitability.

We have not been profitable since our inception in 1986. We reported net losses of $11.7 million in the fiscal year ended December 31, 2017, $14.2 million in the fiscal year ended December 31, 2016, $11.7 million in the fiscal year ended December 31, 2015, and as of December 31, 2017, we had an accumulated deficit of $247 million.

We have not generated any significant revenue to date and it is possible that we will never have sufficient product sales revenue (if any) to achieve profitability. We expect to continue to incur losses for at least the next several years as we or our collaborators and licensees pursue clinical trials and research and development efforts. To become profitable, we, either alone or with our collaborators and licensees, must successfully develop, manufacture and market our current product candidates APTO-253 or CG’806 as well as continue to identify, develop, manufacture and market new product candidates. It is possible that we will never have significant product sales revenue or receive royalties on our licensed product candidates. If funding is insufficient at any time in the future, we may not be able to develop or commercialize our products, take advantage of business opportunities or respond to competitive pressures.

We currently do not earn any revenues from our drug candidates and are therefore considered to be in the development stage. The continuation of our research and development activities and the commercialization of the targeted therapeutic products are dependent upon our ability to successfully finance and complete our research and development programs through a combination of equity financing and payments from strategic partners. We have no current sources of significant payments from strategic partners.

Clinical trials are long, expensive and uncertain processes and the FDA or Health Canada may ultimately not approve any of our product candidates. We may never develop any commercial drugs or other products that generate revenues.

In the past five years, none of our product candidates has received regulatory approval for commercial use and sale in North America. We cannot market a pharmaceutical product in any jurisdiction until it has completed thorough preclinical testing and clinical trials in addition to that jurisdiction’s extensive regulatory approval process. Approval in one country does not assure approval in another country. In general, significant research and development and clinical studies are required to demonstrate the safety and effectiveness of our product candidates before we can submit any regulatory applications.

Clinical trials are long, expensive and uncertain processes. Clinical trials may not be commenced or completed on schedule and the FDA or Health Canada or any other regulatory body may not ultimately approve our product candidates for commercial sale. The clinical trials of any of our drug candidates could be unsuccessful, which would prevent us from advancing, commercializing or partnering the drug.

Even if the results of our preclinical studies or clinical trials are initially positive, it is possible that we will obtain different results in the later stages of drug development or that results seen in clinical trials will not continue with longer term treatment. Positive results in Phase I clinical trials may not be repeated in larger Phase II or Phase III clinical trials.

Our preclinical studies and clinical trials may not generate positive results that will allow us to move towards the commercial use and sale of our product candidates. Furthermore, negative preclinical or clinical trial results may cause our business, financial condition, or results of operations to be materially adversely affected. For example, our Phase Ib clinical trial of APTO-253 in patients with AML was placed on clinical hold by the FDA in November 2015 and since that time the Company has encountered manufacturing setbacks which have further delayed the return of APTO-253 to the clinic. There can be no assurance that the clinical hold will be lifted by the FDA, that the Company will have the resources, or that we will decide, to continue the development of APTO-253. Even if the Phase Ib of APTO-253 is continued, there is a long development path ahead that will take many years to complete and is prone to the risks of failure or delays inherent in drug development. Likewise, our CG’806 product candidate has not yet entered clinical trials and it is expected to undergo many years of testing and regulatory examinations prior to any potential regulatory approvals.

| 20 |

Preparing, submitting and advancing applications for regulatory approval is complex, expensive and time intensive and entails significant uncertainty. A commitment of substantial resources to conduct time-consuming research, preclinical studies and clinical trials is required if we are to complete development of our products.

Clinical trials of our products require that we identify and enroll a large number of patients with the illness under investigation. We may not be able to enroll a sufficient number of appropriate patients to complete our clinical trials in a timely manner, particularly in smaller indications and indications where there is significant competition for patients. If we experience difficulty in enrolling a sufficient number of patients to conduct our clinical trials, we may need to delay or terminate ongoing clinical trials and will not accomplish objectives material to our success. Delays in planned patient enrolment or lower than anticipated event rates in our current clinical trials or future clinical trials also may result in increased costs, program delays, or both.

In addition, unacceptable toxicities or adverse side effects may occur at any time in the course of preclinical studies or human clinical trials or, if any product candidates are successfully developed and approved for marketing, during commercial use of any approved products. The appearance of any unacceptable toxicities or adverse side effects could interrupt, limit, delay or abort the development of any of our product candidates or, if previously approved, necessitate their withdrawal from the market. Furthermore, disease resistance or other unforeseen factors may limit the effectiveness of our potential products.

Our failure to develop safe, commercially viable drugs would substantially impair our ability to generate revenues and sustain our operations and would materially harm our business and adversely affect our share price.

We may not achieve our projected development goals in the time frames we announce and expect.

We set goals for, and make public statements regarding, the expected timing of the accomplishment of objectives material to our success, such as the submission of IND, the commencement and completion of clinical trials and the expected costs to develop our product candidates. The actual timing and costs of these events can vary dramatically due to factors within and beyond our control, such as delays or failures in our IND submissions or clinical trials, issues related to the manufacturing of drug supply, uncertainties inherent in the regulatory approval process, market conditions and interest by partners in our product candidates among other things. We may not make regulatory submissions or receive regulatory approvals as planned; our clinical trials may not be completed; or we may not secure partnerships for any of our product candidates. Any failure to achieve one or more of these milestones as planned would have a material adverse effect on our business, financial condition and results of operations.

| 21 |

Delays in clinical testing could result in delays in commercializing our product candidates and our business may be substantially harmed.

We cannot predict whether any clinical trials will begin as planned, will need to be restructured or will be completed on schedule, or at all. Our product development costs will increase if we experience delays in clinical testing. Significant clinical trial delays could shorten any periods during which we may have the exclusive right to commercialize our product candidates or allow our competitors to bring products to market before us, which would impair our ability to successfully commercialize our product candidates and may harm our financial condition, results of operations and prospects. The recommencement and completion of clinical trials for our products, including the APTO-253 phase I clinical trial and the IND submission and phase I clinical trial for CG’806, may be delayed for a number of reasons, including delays related, but not limited, to:

| • | failure by regulatory authorities to grant permission to proceed or placing the clinical trial on hold; |

| • | patients failing to enroll or remain in our trials at the rate we expect; |

| • | suspension or termination of clinical trials by regulators for many reasons, including concerns about patient safety or failure of our contract manufacturers to comply with cGMP requirements; |

| • | any changes to our manufacturing process that may be necessary or desired; |

| • | delays or failure to obtain GMP-grade clinical supply from contract manufacturers of our products necessary to conduct clinical trials; |

| • | product candidates demonstrating a lack of safety or efficacy during clinical trials; |

| • | patients choosing an alternative treatment for the indications for which we are developing any of our product candidates or participating in competing clinical trials; |

| • | patients failing to complete clinical trials due to dissatisfaction with the treatment, side effects or other reasons; |

| • | reports of clinical testing on similar technologies and products raising safety and/or efficacy concerns; |

| • | competing clinical trials and scheduling conflicts with participating clinicians; |