UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| (Mark One) | ||

ý |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the fiscal year ended December 31, 2011, or |

||

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the transition period from to . |

Commission file number: 1-6948

SPX Corporation

(Exact Name of Registrant as Specified in Its Charter)

| Delaware (State or Other Jurisdiction of Incorporation or Organization) |

38-1016240 (I.R.S. Employer Identification No.) |

13515 Ballantyne Corporate Place

Charlotte, NC 28277

(Address of Principal Executive Offices) (Zip Code)

Registrant's telephone number, including area code: 704-752-4400

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class

|

Name of Each Exchange on Which Registered | |

|---|---|---|

| Common Stock, Par Value $10.00 | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirement for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ý Yes o No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer," and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ý | Accelerated filer o | Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No ý

The aggregate market value of the voting stock held by non-affiliates of the registrant as of July 2, 2011 was $4,240,290,403. The determination of affiliate status for purposes of the foregoing calculation is not necessarily a conclusive determination for other purposes.

The number of shares outstanding of the registrant's common stock as of February 21, 2012 was 51,239,636.

Documents incorporated by reference: Portions of the Registrant's Proxy Statement for its Annual Meeting to be held on May 3, 2012 are incorporated by reference into Part III of this Annual Report on Form 10-K.

(All currency and share amounts are in millions, except per share data)

Forward-Looking Information

Some of the statements in this document and any documents incorporated by reference constitute "forward-looking statements" within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"). These statements relate to future events or our future financial performance and involve known and unknown risks, uncertainties and other factors that may cause our businesses' or our industries' actual results, levels of activity, performance or achievements to be materially different from those expressed or implied by any forward-looking statements. Such statements may address our plans, our strategies, our prospects, changes and trends in our business and the markets in which we operate under the heading "Management's Discussion and Analysis of Financial Condition and Results of Operations" ("MD&A") or in other sections of this document. In some cases, you can identify forward-looking statements by terminology such as "may," "could," "would," "should," "expect," "plan," "anticipate," "intend," "believe," "estimate," "predict," "project," "potential" or "continue" or the negative of those terms or other comparable terminology. These statements are only predictions. Actual events or results may differ materially because of market conditions in our industries or other factors, and forward-looking statements should not be relied upon as a prediction of actual results. In addition, management's estimates of future operating results are based on our current complement of businesses, which is subject to change. All the forward-looking statements are qualified in their entirety by reference to the factors discussed in this document under the heading "Risk Factors" and in any documents incorporated by reference that describe risks and factors that could cause results to differ materially from those projected in these forward-looking statements. We undertake no obligation to update or publicly revise these forward-looking statements to reflect events or circumstances that arise after the date of this document.

We were incorporated in Muskegon, Michigan in 1912 as the Piston Ring Company and adopted our current name in 1988. Since 1968, we have been incorporated under the laws of Delaware, and we have been listed on the New York Stock Exchange since 1972.

We are a global, multi-industry manufacturer of highly specialized, engineered solutions with operations in over 35 countries and sales in over 150 countries around the world. In 2011, an estimated 28% of our revenues were from sales into emerging markets.

Our Flow Technology segment is the strategic foundation of our business, accounting for approximately 37% of our revenues in 2011, with global investments in food and beverage, power and energy and general industrial markets. Within these markets, we are a leading provider of highly engineered process equipment. Our core strengths include product breadth, global capabilities and the ability to create custom engineered solutions for diverse flow processes. Over the past several years, we have expanded our scale, customer relevance and global capabilities resulting in a positive impact on how we are perceived in the marketplace. We believe there are attractive organic and acquisition opportunities to continue to expand our Flow Technology segment in the future.

In addition to Flow Technology, we also have leading market positions in power generation and U.S. power transmission and distribution markets. Excluding Flow Technology, our sales of power and energy infrastructure equipment and services were approximately 26% of total 2011 revenues. Our primary power and energy infrastructure products include cooling systems, large scale stationary and rotating heat exchangers, pollution control systems, and transformers. We supply various forms of these technologies into many types of traditional and alternative power generation facilities. We are well positioned to benefit from new or retrofit investments in natural gas, coal, nuclear, solar and geothermal power plants.

We are a leading supplier of medium power transformers for the U.S. market. The medium power transformers we manufacture range from a base rating of 10 Mega Volt Ampere ("MVA") to 100 MVA and are uniquely designed to meet the requirements of each customer and substation. We also have expanded our manufacturing capacity to increase our ability to produce large power transformers (greater than 100 MVA). This expansion was substantially completed in 2011 and we expect to begin shipping units from the expanded facility in 2012.

Throughout all of our businesses, we focus on a number of operating initiatives, including innovation and new product development, continuous improvement driven by lean methodologies, supply chain management, expansion in emerging markets, information technology infrastructure improvement, and organizational and talent development. These initiatives are intended to, among other things, capture synergies within our businesses to ultimately drive revenues, profit margin and cash

1

flow growth. We believe that our businesses are well positioned for long-term growth based on our operating initiatives, the potential within the current markets served and the potential for expansion into additional markets.

Our strategy is aimed at creating shareholder value through our continuous improvement initiatives, acquisitions in our core markets as well as other actions. Within this strategy we also focus on environmental sustainability and conducting our business with a high level of ethics and integrity.

Unless otherwise indicated, amounts provided throughout this Annual Report on Form 10-K relate to continuing operations only.

We aggregate our operating segments into four reportable segments: Flow Technology, Test and Measurement, Thermal Equipment and Services and Industrial Products and Services. The factors considered in determining our aggregated segments are the economic similarity of the businesses, the nature of products sold or services provided, production processes, types of customers and distribution methods. In determining our segments, we apply the threshold criteria of the Segment Reporting Topic of the Accounting Standards Codification ("Codification") to operating income or loss of each segment before considering impairment and special charges, pensions and postretirement expense, stock-based compensation and other indirect corporate expenses ("Segment income"). This is consistent with the way our chief operating decision maker evaluates the results of each segment. For more information on the results of our segments, including revenues by geographic area, see Note 5 to our consolidated financial statements.

Flow Technology

Our Flow Technology segment had revenues of $2,042.0, $1,662.2 and $1,634.1 in 2011, 2010, and 2009, respectively. On December 22, 2011, within our Flow Technology segment, we completed the acquisition of Clyde Union (Holdings) S.A.R.L. ("Clyde Union"), a global supplier of pump technologies utilized in oil and gas processing, power generation and other industrial applications. Clyde Union had revenues of $447.8 and $403.4 in 2011 and 2010, respectively, which, apart from $13.6 since the date of acquisition, have not been included in our results of operations. The Flow Technology segment designs, manufactures and markets products and solutions that are used to process, blend, filter, dry, meter and transport fluids with a focus on original equipment installation and turnkey projects as well as comprehensive aftermarket support services. Primary offerings include engineered pumps, valves, mixers, heat exchangers, and dehydration and filtration technologies. Global end markets, including food and beverage, power and energy and general industrial processing are served by core brands, such as SPX Flow Technology, APV, ClydeUnion, Lightnin, Waukesha Cherry-Burrell, Anhydro, Bran&Luebbe, Copes-Vulcan, Johnson Pump, M&J Valves, Plenty, Hankison, Gerstenberg Schröder, GD Engineering, Dollinger Filtration, Pneumatic Products, Delair, Deltech and Jemaco. Competitors in these diversified end markets include GEA Group AG, Flowserve, Alfa Laval AB, Sulzer and IDEX Corporation. Channels to market consist of stocking distributors, manufacturers' representatives and direct sales. The segment continues to focus on innovation and new product development, optimizing its global footprint while taking advantage of cross-product integration opportunities and increasing its competitive position in global end markets. Flow Technology's solutions focus on key business drivers, such as product flexibility, process optimization, sustainability and safety.

Test and Measurement

Our Test and Measurement segment had revenues of $1,067.8, $924.0 and $810.4 in 2011, 2010 and 2009, respectively. This segment engineers and manufactures branded, technologically advanced test and measurement products used on a global basis across the transportation, telecommunications and utility industries. Primary offerings include specialty automotive diagnostic service tools, fare-collection systems and portable cable and pipe locators. Our Service Solutions business accounted for 85% of this segment's revenue in 2011. Through this business, we sell specialty automotive diagnostic service tools to franchised vehicle dealers of original equipment manufacturers ("OEM"s), as well as aftermarket franchised and independent repair facilities, under brand names including OTC, Actron, AutoXray, Tecnotest, Autoboss and Robinair. The major competitors to these product lines are Snap-on Incorporated and the Bosch Group. We are a primary global provider of diagnostic service tools for motor vehicle manufacturers' dealership networks such as those associated with General Motors, Volkswagen, Chrysler Group LLC, Ford, Renault, Nissan, BMW, Jaguar, Land Rover, John Deere, Honda and Harley Davidson.

The segment also sells automated fare-collection systems to municipal bus and rail transit systems, as well as ride ticket vending systems, primarily to municipalities within the North American market. Our portable cable and pipe locator line is composed of electronic testing, monitoring and inspection equipment for locating and identifying metallic sheathed fiber optic cable, horizontal boring guidance systems and inspection cameras. The segment sells this product line globally to a wide customer base, including utility and construction companies, municipalities and telecommunication companies.

2

On January 23, 2012, we entered into an agreement to sell our Service Solutions business to Robert Bosch GmbH for cash proceeds of $1,150.0. We expect the sale to close during the first half of 2012, resulting in a net gain of approximately $450.0. The sale is subject to customary closing conditions, including the receipt of regulatory approvals in multiple jurisdictions. We have reported Service Solutions within continuing operations in the accompanying consolidated financial statements, as the sale of the business was not deemed probable as of December 31, 2011. Revenues and operating profit for Service Solutions totaled $910.5 and $59.0, respectively, during the year ended December 31, 2011. We expect to report Service Solutions as a discontinued operation beginning in the first quarter of 2012.

Thermal Equipment and Services

Our Thermal Equipment and Services segment had revenues of $1,644.2, $1,602.1 and $1,595.5 in 2011, 2010 and 2009, respectively. This segment engineers, manufactures and services thermal heat transfer products. Primary offerings include dry, evaporative and hybrid cooling systems, rotating and stationary heat exchangers and pollution control systems for the power generation, HVAC and industrial markets, as well as boilers and heating and ventilation products for the commercial and residential markets. The primary distribution channels for the Thermal Equipment and Services segment are direct to customers, independent manufacturing representatives, third-party distributors and retailers. The segment has a balanced presence geographically, with a strong presence in North America, Europe, and South Africa.

Approximately 60% of the segment's 2011 revenues were from sales to the power generation market. The segment's primary power products and services are sold under the brand names of SPX Cooling Systems, Marley, Balcke-Duerr, Ceramic, Yuba, Ecolaire and Recold, among others, with the major competitors to these product and service lines being Evapco, Inc., GEA Group AG, Alstom SA, Siemens AG, Hamon & Cie, Baltimore Aircoil Company, Thermal Engineering International, SHOUHANG IHW Resources Saving Technology Co., Harbin Air Conditioning Co., and Beijing Longyuan Cooling Technology Co.

Declining demand from the power generation market and increased competition in China had a negative impact on the segment's revenues and profits during 2011. Due to this decline, coupled with an expectation that a significant market recovery was not likely in the near-term, we determined that the goodwill and indefinite-lived intangible assets of the segment's SPX Heat Transfer Inc. subsidiary were impaired and, thus, recorded impairment charges in 2011 of $28.3 (see Note 8 to our consolidated financial statements for additional details on these impairment charges).

On December 30, 2011, we completed the formation of a joint venture with Shanghai Electric Group Co., Ltd. ("Shanghai Electric"). The joint venture will supply dry cooling systems and moisture separator reheater products and services to the power sector in China as well as other selected regions of the world. We contributed and sold certain assets of our dry cooling products business in China to the joint venture in consideration for (i) a 45% ownership interest in the joint venture and (ii) cash payments of RMB 96.7, with RMB 51.5 received on January 18, 2012, RMB 25.8 to be received by December 31, 2012, and the remaining payment contingent upon the joint venture achieving defined sales order volumes. In addition, we are licensing our dry cooling and moisture separator reheater technologies to the joint venture for which we will receive a royalty. We also will continue to manufacture dry cooling components in our China factories and have entered into an exclusive supply agreement with the joint venture for these products. We believe that this arrangement increases our ability to compete in China, as Shanghai Electric has a well-established presence in the region (see Note 4 to our consolidated financial statements for additional details).

The segment's boiler products include a complete line of gas and oil fired cast iron boilers for heating in residential and commercial applications, as well as ancillary equipment. The segment's primary boiler products competitors are Burnham Holdings, Inc. and Buderus.

The segment's heating and ventilation product line includes i) baseboard, wall unit and portable heaters, ii) commercial cabinet and infrared heaters, iii) thermostats and controls, iv) air curtains and v) circulating fans. The segment sells heating and ventilation products under the Berko, Qmark, Farenheat and Leading Edge brand names, with the principal competitors being TPI Corporation, Ouellet, King Electric, Systemair Mfg. LLC, Cadet Manufacturing Company and Dimplex North America Ltd. for heating products and TPI Corporation, Broan-NuTone LLC and Airmaster Fan Company for ventilation products.

The segment's South African subsidiary has a Black Economic Empowerment shareholder, which holds a noncontrolling 25.1% interest.

Industrial Products and Services

Our Industrial Products and Services segment had revenues of $707.9, $698.5 and $805.6 in 2011, 2010 and 2009, respectively. Of the segment's 2011 revenues, approximately 34% were from the sale of power transformers into the U.S. transmission and distribution market. We are a leading provider of medium sized transformers (10 - 100 MVA) in the United

3

States. We sell transformers under the Waukesha Electric brand name. Typical customers for this product line are public and privately held utilities. Our key competitors in this market include ABB Ltd. (Kuhlman Electric Corporation), GE-Prolec and Hyundai. During 2011, we expanded our Waukesha, WI facility in order to increase our ability to manufacture large power transformers (100 - 1,200 MVA) and expect to begin shipping large power transformers during 2012.

Additionally, this segment designs and manufactures industrial tools and hydraulic units, precision machine components for the aerospace industry, crystal growing machines for the solar power generation market, broadcast antenna systems, communications and signal monitoring systems, and precision controlled industrial ovens and chambers. The primary distribution channels for the Industrial Products and Services segment are direct to customers, independent manufacturing representatives and third-party distributors.

We regularly review and negotiate potential acquisitions in the ordinary course of business, some of which are or may be material. We will continue to pursue acquisitions and we may consider acquisitions of businesses with more than $1,000.0 in annual revenues.

On August 24, 2011, in our Flow Technology segment, we entered into an agreement to purchase Clyde Union, a global supplier of pump technologies utilized in oil and gas processing, power generation and other industrial applications. On November 1, 2011, and again upon consummation of the acquisition on December 22, 2011, we executed amendments to that agreement. The amended agreement provides for an initial payment of 500.0 British Pounds ("GBP"), less debt assumed and other adjustments of GBP 11.0. In addition, the purchase price includes a potential earn-out payment (equal to Annual 2012 Group EBITDA (as defined in the related agreement) × 10, less GBP 475.0). In no event shall the earn-out payment be less than zero or more than GBP 250.0. The sellers of Clyde Union also contributed GBP 25.0 of cash to the acquired business at the time of sale.

We financed the acquisition with available cash and committed senior secured financing. See Note 12 to the consolidated financial statements for further details on the senior secured financing.

On October 31, 2011, in our Flow Technology segment, we completed the acquisition of e&e Verfahrenstechnik GmbH ("e&e"), a supplier of extraction, evaporation, vacuum and freeze drying technologies to the global food and beverage, pharmaceutical and bioenergy industries for a purchase price of approximately 11.7 Euros, net of cash assumed of 3.8 Euros, with an additional potential earn-out of 3.5 Euros. e&e had revenues of approximately 15.3 Euros in the twelve months prior to the date of acquisition.

In March 2011, in our Flow Technology segment, we completed the acquisition of B.W. Murdoch Ltd. ("Murdoch"), an engineering company supplying processing solutions for the food and beverage industry, for a purchase price of $8.1. Murdoch had revenues of approximately $13.0 in the twelve months prior to the date of acquisition.

In March 2011, in our Test and Measurement segment, we completed the acquisition of substantially all of the assets of Teradyne Inc.'s Diagnostic Solutions business ("DS"), a global supplier of diagnostic solutions for transportation OEMs and automotive dealerships, for a purchase price of $40.2. DS had revenues of approximately $42.0 in the twelve months prior to the date of acquisition.

As part of our operating strategy, we regularly review and negotiate potential divestitures in the ordinary course of business, some of which are or may be material. As a result of this continuous review, we determined that certain of our businesses would be better strategic fits with other companies or investors. We report businesses or asset groups as discontinued operations when the operations and cash flows of the business or asset group have been or are expected to be eliminated, when we do not expect to have any continuing involvement with the business or asset group after the disposal transaction, and when we have met these additional six criteria:

- •

- Management has approved a plan to sell the business or asset group;

- •

- The business or asset group is available for immediate sale;

- •

- An active program to sell the business or asset group has been initiated;

- •

- The sale of the business or asset group is probable within one year;

- •

- The marketed sales value of the business or asset group is reasonable in relation to its current fair value; and

- •

- It is unlikely that the plan to divest the business or asset group will be significantly altered or withdrawn.

4

The following businesses, all of which had been sold by December 31, 2011, met the above requirements and therefore have been reported as discontinued operations for all periods presented:

Business

|

Quarter Discontinued |

Quarter Sale Closed |

|||||

|---|---|---|---|---|---|---|---|

Cooling Spain Packaging business ("Cooling Spain") |

Q4 2010 | Q4 2010 | |||||

P.S.D., Inc. ("PSD") |

Q2 2009 | Q1 2010 | |||||

Automotive Filtration Solutions business ("Filtran") |

Q4 2008 | Q4 2009 | |||||

Dezurik |

Q3 2008 | Q1 2009 | |||||

We have a joint venture, EGS Electrical Group, LLC and Subsidiaries ("EGS"), with Emerson Electric Co., in which we hold a 44.5% interest. Emerson Electric Co. controls and operates the joint venture. EGS operates primarily in the United States, Brazil, Canada and France, and is engaged in the manufacture of electrical fittings, hazardous location lighting and power conditioning products. We account for our investment under the equity method of accounting, on a three-month lag basis. We typically receive our share of this joint venture's earnings in cash dividends paid quarterly. See Note 9 to our consolidated financial statements for more information on EGS.

As previously noted, on December 30, 2011, we completed the formation of a joint venture with Shanghai Electric. The joint venture will supply dry cooling systems and moisture separator reheater products and services to the power sector in China as well as other selected regions of the world. We contributed and sold certain assets of our dry cooling products business in China to the joint venture in consideration for (i) a 45% ownership interest in the joint venture and (ii) cash payments totaling RMB 96.7, with RMB 51.5 received on January 18, 2012, RMB 25.8 to be received by December 31, 2012, and the remaining RMB payment contingent upon the joint venture achieving defined sales order volumes. We are accounting for our investment in this joint venture under the equity method of accounting. See Note 4 to our consolidated financial statements for additional details.

We are a multinational corporation with operations in over 35 countries. Our export sales from the United States were $388.9, $328.2 and $289.6 in 2011, 2010, and 2009, respectively.

See Note 5 to our consolidated financial statements for more information on our international operations.

We are actively engaged in research and development programs designed to improve existing products and manufacturing methods and to develop new products to better serve our current and future customers. These efforts encompass all our products with divisional engineering teams coordinating their resources. We place particular emphasis on the development of new products that are compatible with, and build upon, our manufacturing and marketing capabilities.

We spent $77.6, $69.5 and $58.7 in 2011, 2010 and 2009, respectively, on research activities relating to the development and improvement of our products.

We own over 700 domestic patents and 300 foreign patents, including approximately 60 patents that were issued in 2011, covering a variety of our products and manufacturing methods. We also own a number of registered trademarks. Although in the aggregate our patents and trademarks are of considerable importance in the operation of our business, we do not consider any single patent or trademark to be of such importance that its absence would adversely affect our ability to conduct business as presently constituted. We are both a licensor and licensee of patents. For more information, please refer to "Risk Factors."

We manufacture many of the components used in our products; however, our strategy includes outsourcing components and sub-assemblies to other companies where strategically and economically beneficial. In instances where we depend on third-party suppliers for outsourced products or components, we are subject to the risk of customer dissatisfaction with the quality or performance of the products we sell due to supplier failure. In addition, business difficulties experienced by a third-party supplier can lead to the interruption of our ability to obtain the outsourced product and ultimately to our inability to supply

5

products to our customers. We believe that we generally will be able to continue to obtain adequate supplies of key products or appropriate substitutes at reasonable costs.

We are subject to potential increases in the prices of many of our key raw materials, including petroleum-based products, steel and copper. In recent years, we have generally been able to offset increases in raw material costs mainly through effective price increases. Occasionally, we are subject to long-term supplier contracts, which may increase our exposure to pricing fluctuations.

Because of our diverse products and services, as well as the wide geographic dispersion of our production facilities, we use numerous sources for the raw materials needed in our operations. We are not significantly dependent on any one or a limited number of suppliers, and we have been able to obtain suitable quantities of raw materials at competitive prices.

Although our businesses are in highly competitive markets, our competitive position cannot be determined accurately in the aggregate or by segment since we and our competitors do not offer all the same product lines or serve all the same markets. In addition, specific reliable comparative figures are not available for many of our competitors. In most product groups, competition comes from numerous concerns, both large and small. The principal methods of competition are service, product performance, technical innovation and price. These methods vary with the type of product sold. We believe that we compete effectively on the basis of each of these factors as they apply to the various products and services offered. See "Segments" above for a discussion of our competitors.

See "MD&A — Critical Accounting Policies and Use of Estimates — Contingent Liabilities," "Risk Factors" and Note 14 to our consolidated financial statements for information regarding environmental matters.

At December 31, 2011, we had approximately 18,000 employees. Eleven domestic collective bargaining agreements cover approximately 1,100 employees. We also have various collective labor arrangements covering certain non-U.S. employee groups. While we generally have experienced satisfactory labor relations, we are subject to potential union campaigns, work stoppages, union negotiations and other potential labor disputes.

See Part III, Item 10 of this report for information about our executive officers.

No customer or group of customers that, to our knowledge, are under common control accounted for more than 10% of our consolidated revenues for any period presented.

Our businesses maintain sufficient levels of working capital to support customer requirements, particularly inventory. We believe that our businesses' sales and payment terms are generally similar to those of our competitors.

Many of our businesses closely follow changes in the industries and end markets that they serve. In addition, certain businesses have seasonal fluctuations. Revenues for our Test and Measurement segment primarily follow customer-specified program launch timing for diagnostic systems and service equipment. Demand for products in our Thermal Equipment and Services segment is correlated to contract timing on large construction contracts and is also driven by seasonal weather patterns, both of which may cause significant fluctuations from period to period. Historically, our businesses generally tend to be stronger in the second half of the year.

Our website address is www.spx.com. Information on our website is not incorporated by reference herein. We file reports with the Securities and Exchange Commission ("SEC"), including our annual report on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K, and any amendments to these reports. Copies of these reports are available free of charge on our website as soon as reasonably practicable after we file the reports with the SEC. The SEC also maintains a website at www.sec.gov that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. Additionally, you may read and copy any materials that we file with the SEC at the SEC's Public Reference Room at 100 F Street, NE, Washington, DC 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330.

6

(All currency and share amounts are in millions, except per share data)

You should consider the risks described below and elsewhere in our documents filed with the SEC before investing in any of our securities. We may amend, supplement or add to the risk factors described below from time to time in future reports filed with the SEC.

Many of the industries in which we operate are cyclical or are subject to industry events, and our results have been and could be affected as a result.

Many of the business areas in which we operate are subject to general economic cycles or industry events. Certain of our businesses are subject to specific industry cycles or events, including, but not limited to:

- •

- The oil and gas, chemical, mining and petrochemical markets;

- •

- Food and beverage markets;

- •

- Decisions made by automotive manufacturers and franchise dealers;

- •

- The electric power and infrastructure markets and events; and

- •

- The correlation between demand for cooling systems and towers and contract timing on large construction projects, which may cause significant fluctuations in revenues and profits from period to period.

Cyclical changes and specific market events could also affect sales of products in our other businesses. The downturns in the business cycles of our different operations may occur at the same time, which could exacerbate any adverse effects on our business. See "MD&A — Segment Results of Operations." In addition, certain of our businesses have seasonal fluctuations. Historically, our businesses generally tend to be stronger in the second half of the year.

Difficulties presented by international economic, political, legal, accounting and business factors could negatively affect our interests and business effort.

We are an increasingly global company, with a significant portion of our sales taking place outside the United States. In 2011, over 50% of our revenues were generated outside the United States and we expect that over 50% of our revenues will be generated outside the United States in 2012. We have placed a particular emphasis on expanding our presence in emerging markets.

As part of our strategy, we manage businesses with manufacturing facilities worldwide. Our reliance on non-U.S. revenues and non-U.S. manufacturing bases exposes us to a number of risks, including:

- •

- Credit risk or financial condition of local customers and distributors could affect our ability to market our products or

collect receivables;

- •

- Significant competition could come from local or long-time participants in non-U.S. markets who

may have significantly greater market knowledge and substantially greater resources than we do;

- •

- Local customers may have a preference for locally-produced products;

- •

- Failure to comply with U.S. or non-U.S. laws regulating trade, such as the U.S. Foreign Corrupt Practices Act,

could result in adverse consequences, including fines, criminal sanctions, or loss of access to markets;

- •

- Regulatory or political systems or barriers may make it difficult or impossible to enter or remain in new markets. In

addition, these barriers may impact our existing businesses, including making it more difficult for them to grow;

- •

- Local political, economic and social conditions, including the possibility of hyperinflationary conditions and political

instability could adversely impact our operations;

- •

- Domestic and foreign customs and tariffs may make it difficult or impossible for us to move our products or assets across

borders in a cost-effective manner;

- •

- Transportation and shipping expenses add cost to our products;

- •

- Complications related to shipping, including delays due to weather, labor action, or customs, may impact our profit margins or lead to lost business;

7

- •

- Nationalization of private enterprises could harm our business;

- •

- Government embargoes or foreign trade restrictions such as anti-dumping duties, as well as the imposition of

trade sanctions by the United States or the European Union against a class of products imported by us from, sold by us and exported to, or the loss of "normal trade relations" status with, countries

in which we conduct business could significantly increase our cost of products imported into the United States or Europe or reduce our sales and harm our business;

- •

- Environmental and other laws and regulations could increase our costs or limit our ability to run our business;

- •

- Our ability to obtain supplies from foreign vendors and ship products internationally may be impaired during times of

crisis or otherwise;

- •

- It may be difficult or impossible to protect our intellectual property;

- •

- Local, regional or worldwide hostilities could impact our operations; and

- •

- Distance, language and cultural differences may make it more difficult to manage the business and employees, and to effectively market our products and services.

Health conditions and other factors affecting social and economic activity in China, South Africa and other emerging markets or affecting the movement of people and products into and from these countries to our major markets, including North America and Europe, could have a significant negative effect on our operations.

Given the importance of our international sales and sourcing of manufacturing, the occurrence of any risk described above could have a material adverse effect on our financial position, results of operations or cash flows.

Currency conversion risk could have a material impact on our reported results of business operations.

Our operating results are translated into U.S. dollars for reporting purposes. The strengthening or weakening of the U.S. dollar could result in unfavorable translation effects as the results of transactions in foreign countries are translated into U.S. dollars. In addition, sales and purchases in currencies other than the U.S. dollar expose us to fluctuations in foreign currencies relative to the U.S. dollar. Increased strength of the U.S. dollar will increase the effective price of our products sold in U.S. dollars into other countries, which may have a material adverse effect on sales or require us to lower our prices, and also decrease our reported revenues or margins in respect of sales conducted in foreign currencies to the extent we are unable or determine not to increase local currency prices. Likewise, decreased strength of the U.S. dollar could have a material adverse effect on the cost of materials and products purchased overseas.

A portion of our revenues is generated through long-term fixed-price contracts, which entail risks including cost overruns, inflation, delays and credit and other counterparty risks.

A portion of our revenues and earnings is generated through long-term fixed-price contracts, particularly in our Thermal Equipment and Services and Flow Technology segments. We recognize revenues from certain of these contracts using the percentage-of-completion method of accounting whereby revenues and expenses, and thereby profit, in a given period are determined based on our estimates as to the project status and the costs remaining to complete a particular project.

Estimates of total revenues and cost at completion are subject to many variables, including the length of time to complete a contract. In addition, contract delays may negatively impact these estimates and our revenues and earnings results for affected periods.

To the extent that we underestimate the remaining cost to complete a project, we may overstate the revenues and profit in a particular period. Further, certain of these contracts provide for penalties or liquidated damages for failure to timely perform our obligations under the contract, or require that we, at our expense, correct and remedy to the satisfaction of the other party certain defects. Because some of our long-term contracts are at a fixed price, we face the risk that cost overruns or inflation may exceed, erode or eliminate our expected profit margin, or cause us to record a loss on our projects. Additionally, customers of our long-term contracts may suffer financial difficulties that make them unable to pay for a project when completed, or they may decide not to pay us, either as a matter of corporate decision-making or in response to changes in local laws and regulations. We cannot assure you that expenses or losses for uncollectible billings relating to our long-term fixed-price contracts will not have a material adverse effect on our revenues and earnings.

8

Worldwide economic conditions could negatively impact our businesses.

The general worldwide depressed economic conditions that began in 2008 continue to affect many industries, including industries in which we or our customers operate. These conditions could negatively impact our businesses by adversely affecting, among other things, our:

- •

- Revenues;

- •

- Profits;

- •

- Margins;

- •

- Cash flows;

- •

- Suppliers' and distributors' ability to perform and the availability and costs of materials and subcontracted services;

- •

- Customers' orders;

- •

- Order cancellation activity or delays on existing orders;

- •

- Customers' ability to access credit; and

- •

- Customers' ability to pay amounts due to us.

While it is difficult to predict the duration or severity of these conditions, our projections for 2012 assume a generally improving economy. If economic conditions fail to improve, the negative impact on our businesses could increase or continue for longer than we expect. See MD&A for further discussion of how these conditions have affected our businesses to date and how they may affect them in the future.

Our indebtedness may affect our business and may restrict our operating flexibility.

At December 31, 2011, we had $2,001.1 in total indebtedness. On that same date, we had $485.3 of available borrowing capacity under our revolving credit facilities after giving effect to $30.9 of outstanding borrowings on the foreign trade revolving loan facility and $83.8 reserved for outstanding letters of credit. In addition, we had $408.6 of available issuance capacity under our foreign trade facility after giving effect to $791.4 reserved for outstanding letters of credit. At December 31, 2011, our cash and equivalents balance was $551.0. See MD&A and Note 12 to our consolidated financial statements for further discussion. We may incur additional indebtedness in the future, including indebtedness incurred to finance, or which is assumed in connection with, acquisitions. We may renegotiate or refinance our senior credit facilities, senior notes or other debt facilities, or enter into additional agreements that have different or more stringent terms. The level of our indebtedness could:

- •

- Limit our ability to obtain, or obtain on favorable terms, additional debt financing for working capital, capital

expenditures or acquisitions;

- •

- Limit our flexibility in reacting to competitive and other changes in the industry and economic conditions;

- •

- Limit our ability to pay dividends on our common stock;

- •

- Coupled with a substantial decrease in net operating cash flows due to economic developments or adverse developments in

our business, make it difficult to meet debt service requirements; and

- •

- Expose us to interest rate fluctuations to the extent existing borrowings are, and any new borrowings may be, at variable rates of interest, which could result in higher interest expense and interest payments in the event of increases in interest rates.

Our ability to make scheduled payments of principal or pay interest on, or to refinance, our indebtedness and to satisfy our other debt obligations will depend upon our future operating performance, which may be affected by general economic, financial, competitive, legislative, regulatory, business and other factors beyond our control. In addition, we cannot assure that future borrowings or equity financing will be available for the payment or refinancing of our indebtedness. If we are unable to service our indebtedness, whether in the ordinary course of business or upon an acceleration of such indebtedness, we may pursue one or more alternative strategies, such as restructuring or refinancing our indebtedness, selling assets, reducing or delaying capital expenditures, revising implementation of or delaying strategic plans or seeking additional equity capital. Any of these actions could have a material adverse effect on our business, financial condition, results of operations and stock price. In addition, we cannot assure that we would be able to take any of these actions, that these actions would enable us to continue to satisfy our capital requirements, or that these actions would be permitted under the terms of our various debt agreements.

9

Numerous banks in many countries are syndicate members in our credit facility. Failure of one or more of our larger lenders, or several of our smaller lenders, could significantly reduce availability of our credit, which could harm our liquidity.

We may not be able to finance future needs or adapt our business plan to react to changes in economic or business conditions because of restrictions placed on us by our senior credit facilities and any existing or future instruments governing our other indebtedness.

Our senior credit facilities, the indentures governing our senior notes and agreements governing our other indebtedness contain, or future or revised instruments may contain, a number of restrictions and covenants that limit our ability to make distributions or other payments to our investors and creditors unless certain financial tests or other criteria are satisfied. We also must comply with certain specified financial ratios and tests. Our subsidiaries may also be subject to restrictions on their ability to make distributions to us. In addition, our senior credit facilities, indentures governing our senior notes and any other agreements contain or may contain additional affirmative and negative covenants. Existing restrictions are described more fully in the MD&A and Note 12 to our consolidated financial statements. Each of these restrictions could affect our ability to operate our business and may limit our ability to take advantage of potential business opportunities, such as acquisitions.

If we do not comply with the covenants and restrictions contained in our senior credit facilities, indentures governing our senior notes and agreements governing our other indebtedness, we could be in default under those agreements, and the debt, together with accrued interest, could then be declared immediately due and payable. If we default under our senior credit facilities, the lenders could cause all our outstanding debt obligations under our senior credit facilities to become due and payable or require us to apply all of our cash to repay the indebtedness we owe. If our debt is accelerated, we may not be able to repay or refinance our debt. Even if we are able to obtain new financing, we may not be able to repay our debt or borrow sufficient funds to refinance it. In addition, any default under our senior credit facilities, indentures governing our senior notes or agreements governing our other indebtedness could lead to an acceleration of debt under other debt instruments that contain cross-acceleration or cross-default provisions. If the indebtedness under our senior credit facilities is accelerated, we may not have sufficient assets to repay amounts due under our senior credit facilities, senior notes or other debt securities then outstanding. Our ability to comply with these provisions of our senior credit facilities, indentures governing our senior notes and agreements governing our other indebtedness will be affected by changes in the economic or business conditions or other events beyond our control. Complying with our covenants may also cause us to take actions that are not favorable to us and may make it more difficult for us to successfully execute our business strategy and compete, including against companies that are not subject to such restrictions.

We are subject to laws, regulations and potential liability relating to claims, complaints and proceedings, including those relating to environmental and other matters.

We are subject to various laws, ordinances, regulations and other requirements of government authorities in the United States and other nations. With respect to acquisitions, divestitures and continuing operations, we may acquire or retain liabilities of which we are not aware, or of a different character or magnitude than expected. Additionally, changes in laws, ordinances, regulations or other governmental policies may significantly increase our expenses and liabilities.

We face environmental exposures including, for example, those relating to discharges from and materials handled as part of our operations, the remediation of soil and groundwater contaminated by petroleum products or hazardous substances or wastes, and the health and safety of our employees. We may be liable for the costs of investigation, removal or remediation of hazardous substances or petroleum products on, under, or in our current or formerly owned or leased property, or from a third-party disposal facility that we may have used, without regard to whether we knew of, or caused, the presence of the contaminants. The presence of, or failure to properly remediate, these substances may have adverse effects, including, for example, substantial investigative or remedial obligations and limitations on the ability to sell or rent affected property or to borrow funds using affected property as collateral. New or existing environmental matters or changes in environmental laws or policies could lead to material costs for environmental compliance or cleanup. There can be no assurance that these liabilities and costs will not have a material adverse effect on our financial position, results of operations or cash flows. See Note 14 to our consolidated financial statements for further discussion.

Numerous claims, complaints and proceedings arising in the ordinary course of business, including those relating to litigation matters (e.g., class actions, derivative lawsuits and contracts, intellectual property and competitive claims), environmental matters, and risk management matters (e.g., product and general liability, automobile, and workers' compensation claims), have been filed or are pending against us and certain of our subsidiaries. From time to time, we face actions by governmental authorities, both in and outside the United States. Additionally, we may become subject to significant claims of which we are currently unaware or the claims of which we are aware may result in our incurring a significantly greater

10

liability than we anticipate. Our insurance may be insufficient or unavailable (e.g., because of insurer insolvency) to protect us against potential loss exposures. We have increased our self-insurance limits over the past several years, which has increased our uninsured exposure.

We devote significant time and expense to defense against the various claims, complaints and proceedings brought against us, and we cannot assure you that the expenses or distractions from operating our businesses arising from these defenses will not increase materially.

We cannot assure you that our accruals and right to indemnity and insurance will be sufficient, that recoveries from insurance or indemnification claims will be available or that any of our current or future claims or other matters will not have a material adverse effect on our financial position, results of operations or cash flows. See "MD&A — Critical Accounting Policies and Use of Estimates — Contingent Liabilities."

Changes in tax laws and regulations or other factors could cause our income tax rate to increase, potentially reducing our net income and adversely affecting our cash flows.

As a global manufacturing company, we are subject to taxation in various jurisdictions around the world. In preparing our financial statements, we calculate our effective income tax rate based on current tax laws and regulations and the estimated taxable income within each of these jurisdictions. Our effective income tax rate, however, may be higher due to numerous factors, including changes in tax laws or regulations. An effective income tax rate significantly higher than our expectations could have an adverse effect on our business, results of operations, and liquidity.

Officials in some of the jurisdictions in which we do business have proposed, or announced that they are reviewing, tax changes that could potentially increase taxes, and other revenue-raising laws and regulations. Any such changes in tax laws or regulations could impose new restrictions, costs or prohibitions on existing practices as well as reduce our net income and adversely affect our cash flows.

Changes in key estimates and assumptions, such as discount rates, assumed long-term return on assets, assumed long-term trends of future cost, and accounting and legislative changes, as well as actual investment returns on our pension plan assets and other actuarial factors, could affect our results of operations and cash flows.

We have defined benefit pension and postretirement plans, including both qualified and non-qualified plans, which cover a portion of our salaried and hourly employees and retirees including a portion of our employees and retirees in foreign countries. As of December 31, 2011, these plans were underfunded by $511.7. The determination of funding requirements and pension expense or income associated with these plans involves significant judgment, particularly with respect to discount rates, long-term returns on assets, long-term trends of future costs and other actuarial assumptions. If our assumptions change significantly due to changes in economic, legislative and/or demographic experience or circumstances, our pension and other benefit plans' expense, funded status and our cash contributions to such plans could be negatively impacted. In addition, the difference between our actual investment returns and our long-term return on assets assumptions could result in a change to our pension plans' expense, funded status and our required contributions to the plans. Changes in regulations or law could also significantly impact our obligations. For example, See "MD&A — Critical Accounting Policies and Use of Estimates" for the impact that changes in certain assumptions used in the calculation of our costs and obligations associated with these plans could have on our results of operations and financial position.

The price and availability of raw materials may adversely affect our results.

We are exposed to a variety of market risks, including inflation in the prices and shortages of raw materials. In recent years, we have faced significant volatility in the prices of many of our key raw materials, including petroleum-based products, steel and copper. Increases in the prices of raw materials or shortages or allocations of materials may have a material adverse effect on our financial position, results of operations or cash flows, as we may not be able to pass cost increases on to our customers, or our sales may be reduced. We are subject to long-term supplier contracts that may increase our exposure to pricing fluctuations.

11

Our failure to successfully integrate acquisitions could have a negative effect on our operations; our acquisitions could cause financial difficulties.

Our acquisitions involve a number of risks and present financial, managerial and operational challenges, including:

- •

- Adverse effects on our reported operating results due to charges to earnings, including impairment charges associated with

goodwill and other intangibles;

- •

- Diversion of management attention from running our businesses;

- •

- Integration of technology, operations, personnel and financial and other systems;

- •

- Increased expenses;

- •

- Increased foreign operations, often with unique issues relating to corporate culture, compliance with legal and regulatory

requirements and other challenges;

- •

- Assumption of known and unknown liabilities and exposure to litigation;

- •

- Increased levels of debt or dilution to existing shareholders; and

- •

- Potential disputes with the sellers of acquired businesses, technology, services or products.

In addition, internal controls over financial reporting of acquired companies may not be up to required standards. Issues may exist that could rise to the level of significant deficiencies or, in some cases, material weaknesses, particularly with respect to foreign companies or non-public U.S. companies.

Our integration activities may place substantial demands on our management, operational resources and financial and internal control systems. Customer dissatisfaction or performance problems with an acquired business, technology, service or product could also have a material adverse effect on our reputation and business.

We may not achieve the expected cost savings and other benefits of our acquisitions.

We strive for and expect to achieve cost savings in connection with our acquisitions, including: (i) manufacturing process and supply chain rationalization; (ii) streamlining redundant administrative overhead and support activities; and (iii) restructuring and repositioning sales and marketing organizations to eliminate redundancies. Cost savings expectations are estimates that are inherently difficult to predict and are necessarily speculative in nature, and we cannot assure you that we will achieve expected, or any, cost savings. In addition, we cannot assure you that unforeseen factors will not offset the estimated cost savings or other benefits from our acquisitions. As a result, anticipated benefits could be delayed, differ significantly from our estimates and the other information contained in this report, or not be realized.

Our failure to successfully complete acquisitions could negatively affect us.

We may not be able to consummate desired acquisitions, which could materially impact our growth rate, results of operations, future cash flows and stock price. Our ability to achieve our goals depends upon, among other things, our ability to identify and successfully acquire companies, businesses and product lines, to effectively integrate them and to achieve cost effectiveness. We may also be unable to raise any additional funds necessary to consummate these acquisitions. In addition, decreases in our stock price may adversely affect our ability to consummate acquisitions. Competition for acquisitions in our business areas may be significant and result in higher prices for businesses, including businesses that we may target, which may also affect our acquisition rate or benefits achieved from our acquisitions.

We operate in highly competitive industries. Our failure to compete effectively could harm our business.

We operate in a highly competitive environment, competing on the basis of product offerings, technical capabilities, quality, service and pricing. We have a number of competitors, some of which are large, with substantial technological and financial resources, brand recognition and established relationships with global service providers. Some of our competitors have low cost structures, support from governments in their home countries, or both. In addition, new competitors may enter the industry. Competitors may be able to offer lower prices, additional products or services or a more attractive mix of products or services, or services or other incentives that we cannot or will not match. These competitors may be in a stronger position to respond quickly to new or emerging technologies and may be able to undertake more extensive marketing campaigns, and make more attractive offers to potential customers, employees and strategic partners.

12

Our strategy to outsource various elements of the products we sell subjects us to the business risks of our suppliers, which could have a material adverse impact on our operations.

In areas where we depend on third-party suppliers for outsourced products or components, we are subject to the risk of customer dissatisfaction with the quality or performance of the products we sell due to supplier failure. In addition, business difficulties experienced by a third-party supplier can lead to the interruption of our ability to obtain the outsourced product and ultimately our inability to supply products to our customers. Third-party supplier business interruptions can include, but are not limited to, work stoppages and union negotiations and other labor disputes. Current economic conditions could impact the ability of suppliers to access credit and thus impair their ability to provide us quality product in a timely manner, or at all.

Dispositions or our failure to successfully complete dispositions could negatively affect us.

Our dispositions involve a number of risks and present financial, managerial and operational challenges, including diversion of management attention from running our core businesses, increased expense associated with the dispositions, potential disputes with the customers or suppliers of the disposed businesses, potential disputes with the acquirers of the disposed businesses and a potential dilutive effect on our earnings per share. If dispositions are not completed in a timely manner there may be a negative effect on our cash flows and/or our ability to execute our strategy. See "Business," "MD&A — Results of Discontinued Operations," and Note 4 to our consolidated financial statements for the status of our divestitures.

Increases in the number of shares of our outstanding common stock could adversely affect our common stock price or dilute our earnings per share.

Sales of a substantial number of shares of common stock into the public market, or the perception that these sales could occur, could have a material adverse effect on our stock price. As of December 31, 2011, we had the ability to issue up to an additional 5.0 shares as restricted stock, restricted stock units, or stock options under our 2002 Stock Compensation Plan, as amended in 2006. Additionally, we may issue a significant number of additional shares, in connection with acquisitions or otherwise. We also have a shelf registration statement for 8.3 shares of common stock that may be issued in connection with acquisitions. Additional shares issued would have a dilutive effect on our earnings per share.

The loss of key personnel and any inability to attract and retain qualified employees could have a material adverse effect on our operations.

We are dependent on the continued services of our leadership team. The loss of these personnel without adequate replacement could have a material adverse effect on our operations. Additionally, we need qualified managers and skilled employees with technical and manufacturing industry experience in many locations in order to operate our business successfully. From time to time, there may be a shortage of skilled labor, which may make it more difficult and expensive for us to attract and retain qualified employees. If we were unable to attract and retain sufficient numbers of qualified individuals or our costs to do so were to increase significantly, our operations could be materially adversely affected.

If the fair value of any of our reporting units is insufficient to recover the carrying value of the goodwill and other intangibles of the respective reporting unit, a material non-cash charge to earnings could result.

At December 31, 2011, we had goodwill and other intangible assets, net of $3,030.0. We conduct annual impairment testing to determine if we will be able to recover all or a portion of the carrying value of goodwill and indefinite-lived intangibles. In addition, we review goodwill and indefinite-lived intangible assets for impairment more frequently if impairment indicators arise. If the fair value is insufficient to recover the carrying value of our goodwill and indefinite-lived intangibles, we may be required to record a material non-cash charge to earnings.

The fair values of our reporting units generally are based on discounted cash flow projections that are believed to be reasonable under current and forecasted circumstances, the results of which form the basis for making judgments about carrying values of the reported net assets of our reporting units. Other considerations are also incorporated, including comparable industry price multiples. Many of our businesses closely follow changes in the industries and end markets that they serve. Accordingly, we consider estimates and judgments that affect the future cash flow projections, including principal methods of competition such as volume, price, service, product performance and technical innovations and estimates associated with cost improvement initiatives, capacity utilization, and assumptions for inflation and foreign currency changes. We monitor impairment indicators across all of our businesses. Significant changes in market conditions and estimates or judgments used to determine expected future cash flows that indicate a reduction in carrying value may give, and have given, rise to impairments in the period that the change becomes known.

13

We are subject to work stoppages, union negotiations, labor disputes and other matters associated with our labor force, which may adversely impact our operations and cause us to incur incremental costs.

At December 31, 2011, we had approximately 18,000 employees. Eleven domestic collective bargaining agreements cover approximately 1,100 employees. We also have various collective labor arrangements covering certain non-U.S. employee groups. We are subject to potential union campaigns, work stoppages, union negotiations and other potential labor disputes. Further, we may be subject to work stoppages, which are beyond our control, at our suppliers or customers.

Our technology is important to our success, and failure to develop new products may result in a significant competitive disadvantage.

We believe that the development and protection of our intellectual property rights is critical to the success of our business. In order to maintain our market positions and margins, we need to continually develop and introduce high quality, technologically advanced and cost effective products on a timely basis, in many cases in multiple jurisdictions around the world. The failure to do so could result in a significant competitive disadvantage.

Additionally, despite our efforts to protect our proprietary rights, unauthorized parties or competitors may copy or otherwise obtain and use our products or technology. The steps we have taken may not prevent unauthorized use of our technology, particularly in foreign countries where the laws may not protect our proprietary rights as fully as in the United States. Expenses in connection with defending our rights may be material.

If we are unable to protect our information systems against data corruption, cyber-based attacks or network security breaches, our operations could be disrupted.

We are increasingly dependent on information technology networks and systems, including the Internet, to process, transmit and store electronic information. In particular, we depend on our information technology infrastructure for electronic communications among our locations around the world and between our personnel and suppliers and customers. Security breaches of this infrastructure can create system disruptions, shutdowns or unauthorized disclosure of confidential information. If we are unable to prevent or adequately respond to such breaches, our operations could be disrupted or we may suffer financial damage or loss because of lost or misappropriated information.

Cost reduction actions may affect our business.

Cost reduction actions often result in charges against earnings. These charges can vary significantly from period to period and, as a result, we may experience fluctuations in our reported net income and earnings per share due to the timing of restructuring actions, which in turn can have a material adverse effect on our financial position, results of operations or cash flows.

Our current and planned products may contain defects or errors that are detected only after delivery to customers. If that occurs, our reputation may be harmed and we may face additional costs.

We cannot assure you that our product development, manufacturing and integration testing will be adequate to detect all defects, errors, failures and quality issues that could impact customer satisfaction or result in claims against us with regard to our products. As a result, we may have, and from time to time have had, to replace certain components and/or provide remediation in response to the discovery of defects in products that are shipped. The occurrence of any defects, errors, failures or quality issues could result in cancellation of orders, product returns, diversion of our resources, legal actions by our customers or our customers' end users and other losses to us or to our customers or end users, and could also result in the loss of or delay in market acceptance of our products and loss of sales, which would harm our business and adversely affect our revenues and profitability.

We could be affected by laws or regulations enacted in response to concerns regarding climate change.

Changes in laws or regulations enacted in response to concerns over potential climate change could increase our costs or impact markets for our products. However, we cannot currently estimate the effects, if any, of changes in climate change-related laws or regulations on our business.

14

Provisions in our corporate documents and Delaware law may delay or prevent a change in control of our company, and accordingly, we may not consummate a transaction that our shareholders consider favorable.

Provisions of our Certificate of Incorporation and By-laws may inhibit changes in control of our company not approved by our Board. These provisions include, for example: a staggered board of directors; a prohibition on shareholder action by written consent; a requirement that special shareholder meetings be called only by our Chairman, President or Board; advance notice requirements for shareholder proposals and nominations; limitations on shareholders' ability to amend, alter or repeal the By-laws; enhanced voting requirements for certain business combinations involving substantial shareholders; the authority of our Board to issue, without shareholder approval, preferred stock with terms determined in its discretion; and limitations on shareholders' ability to remove directors. In addition, we are afforded the protections of Section 203 of the Delaware General Corporation Law, which could have similar effects. In general, Section 203 prohibits us from engaging in a "business combination" with an "interested shareholder" (each as defined in Section 203) for at least three years after the time the person became an interested shareholder unless certain conditions are met. These protective provisions could result in our not consummating a transaction that our shareholders consider favorable or discourage entities from attempting to acquire us, potentially at a significant premium to our then-existing stock price.

15

ITEM 1B. Unresolved Staff Comments

Not applicable.

The following is a summary of our principal properties, as of December 31, 2011, classified by segment:

| |

|

|

Approximate Square Footage |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

|

No. of Facilities |

||||||||||

| |

Location | Owned | Leased | |||||||||

| |

|

|

(in millions) |

|||||||||

Flow Technology |

11 states and 21 foreign countries | 72 | 4.2 | 2.1 | ||||||||

Test and Measurement |

5 states and 9 foreign countries | 32 | 0.8 | 1.0 | ||||||||

Thermal Equipment and Services |

12 states and 7 foreign countries | 37 | 3.7 | 2.4 | ||||||||

Industrial Products and Services |

11 states and 4 foreign countries | 26 | 1.4 | 0.6 | ||||||||

Total |

167 | 10.1 | 6.1 | |||||||||

In addition to manufacturing plants, we lease our corporate office in Charlotte, NC, our Asia Pacific center in Shanghai, China, our European shared service center in Manchester, United Kingdom and various sales, service and other locations throughout the world. We consider these properties, as well as the related machinery and equipment, to be well maintained and suitable and adequate for their intended purposes.

We are subject to legal proceedings and claims that arise in the normal course of business. In our opinion, these matters are either without merit or of a kind that should not have a material effect individually or in the aggregate on our financial position, results of operations, or cash flows. However, we cannot assure you that these proceedings or claims will not have a material effect on our financial position, results of operations, or cash flows.

See "Risk Factors," "MD&A — Critical Accounting Policies and Estimates — Contingent Liabilities," and Note 14 to our consolidated financial statements for further discussion of legal proceedings.

ITEM 4. Mine Safety Disclosures

Not applicable.

16

ITEM 5. Market For Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Our common stock is traded on the New York Stock Exchange under the symbol "SPW."

Set forth below are the high and low sales prices for our common stock as reported on the New York Stock Exchange composite transaction reporting system for each quarterly period during the years 2011 and 2010, together with dividend information.

| |

High | Low | Dividends per Share |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|

2011 |

||||||||||

4th Quarter |

$ | 63.46 | $ | 42.00 | $ | 0.25 | ||||

3rd Quarter |

85.58 | 45.31 | 0.25 | |||||||

2nd Quarter |

86.45 | 73.71 | 0.25 | |||||||

1st Quarter |

85.97 | 70.57 | 0.25 | |||||||

| |

High | Low | Dividends per Share |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|

2010 |

||||||||||

4th Quarter |

$ | 71.83 | $ | 62.06 | $ | 0.25 | ||||

3rd Quarter |

64.14 | 51.36 | 0.25 | |||||||

2nd Quarter |

70.85 | 51.45 | 0.25 | |||||||

1st Quarter |

67.21 | 54.16 | 0.25 | |||||||

The actual amount of each quarterly dividend, as well as each declaration date, record date and payment date is subject to the discretion of the Board of Directors, and the target dividend level may be adjusted during the year at the discretion of the Board of Directors. The factors the Board of Directors consider in determining the actual amount of each quarterly dividend includes our financial performance and ongoing capital needs, our ability to declare and pay dividends under the terms of our credit facilities and any other debt instruments, and other factors deemed relevant.

There were no repurchases of common stock during the three months ended December 31, 2011. The approximate number of shareholders of record of our common stock as of February 21, 2012 was 3,615.

17

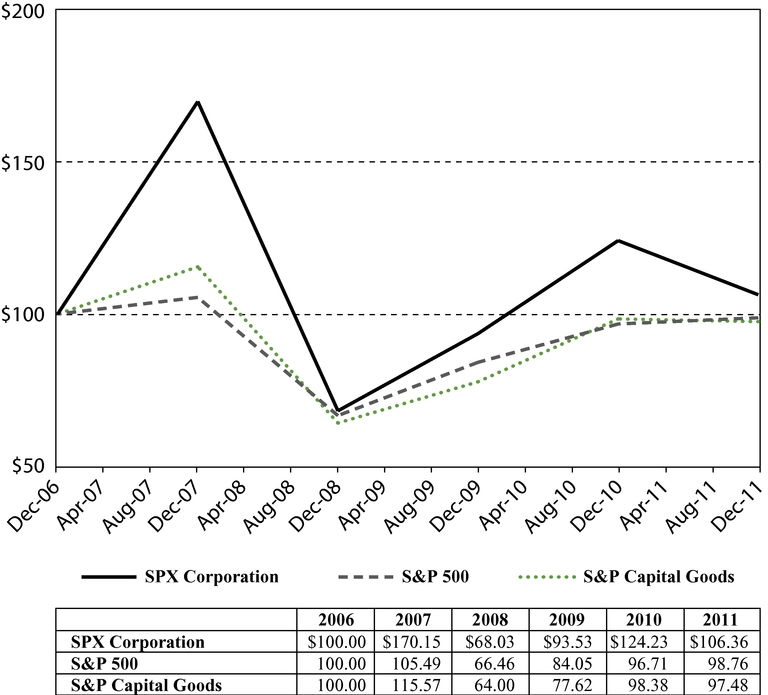

This graph shows a five year comparison of cumulative total returns for SPX, the S&P Composite Index and the S&P Capital Goods Index. The graph assumes an initial investment of $100 on December 31, 2006 and the reinvestment of dividends.

18

ITEM 6. Selected Financial Data

| |

As of and for the year ended December 31, | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2011 | 2010 | 2009 | 2008 | 2007 | |||||||||||

| |

(In millions, except per share amounts) |

|||||||||||||||

Summary of Operations |

||||||||||||||||

Revenues(1) |

$ | 5,461.9 | $ | 4,886.8 | $ | 4,845.6 | $ | 5,826.6 | $ | 4,532.5 | ||||||

Operating income(2)(3) |

338.9 | 343.2 | 171.0 | 471.6 | 407.5 | |||||||||||

Other expense, net(4) |

(56.3 | ) | (21.3 | ) | (19.7 | ) | (1.2 | ) | (2.3 | ) | ||||||

Interest expense, net(5) |

(91.3 | ) | (107.4 | ) | (84.6 | ) | (105.1 | ) | (71.1 | ) | ||||||

Equity earnings in joint ventures |

28.4 | 30.2 | 29.4 | 45.5 | 39.9 | |||||||||||

Income from continuing operations before income taxes |

219.7 | 244.7 | 96.1 | 410.8 | 374.0 | |||||||||||

Income tax provision(6) |

(34.4 | ) | (53.1 | ) | (47.1 | ) | (152.3 | ) | (84.2 | ) | ||||||

Income from continuing operations |

185.3 | 191.6 | 49.0 | 258.5 | 289.8 | |||||||||||

Income (loss) from discontinued operations, net of tax(4)(7) |