UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

|

Investment Company Act file number |

811- 6490 | |||||

|

|

| |||||

|

|

Dreyfus Premier Investment Funds, Inc. |

| ||||

|

|

(Exact name of Registrant as specified in charter) |

| ||||

|

|

|

| ||||

|

|

c/o The Dreyfus Corporation 200 Park Avenue New York, New York 10166 |

| ||||

|

|

(Address of principal executive offices) (Zip code) |

| ||||

|

|

|

| ||||

|

|

Janette E. Farragher, Esq. 200 Park Avenue New York, New York 10166 |

| ||||

|

|

(Name and address of agent for service) |

| ||||

|

| ||||||

|

Registrant's telephone number, including area code: |

(212) 922-6000 | |||||

|

|

| |||||

|

Date of fiscal year end:

|

12/31 |

| ||||

|

Date of reporting period: |

12/31/11 |

| ||||

The following N-CSR relates only to the Registrant’s series listed below and does not affect the other series of the Registrant, which has a different fiscal year end and, therefore, different N-CSR reporting requirements. A separate N-CSR Form will be filed for this series, as appropriate.

DREYFUS PREMIER INVESTMENT FUNDS, INC.

- Dreyfus Global Real Estate Securities Fund

- Dreyfus Large Cap Equity Fund

- Dreyfus Large Cap Growth Fund

| Dreyfus |

| Global Real Estate |

| Securities Fund |

ANNUAL REPORT December 31, 2011

Save time. Save paper. View your next shareholder report online as soon as it’s available. Log into www.dreyfus.com and sign up for Dreyfus eCommunications. It’s simple and only takes a few minutes.

The views expressed in this report reflect those of the portfolio manager only through the end of the period covered and do not necessarily represent the views of Dreyfus or any other person in the Dreyfus organization. Any such views are subject to change at any time based upon market or other conditions and Dreyfus disclaims any responsibility to update such views.These views may not be relied on as investment advice and, because investment decisions for a Dreyfus fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dreyfus fund.

| Not FDIC-Insured • Not Bank-Guaranteed • May Lose Value |

|

Contents | |

|

THE FUND | |

| 2 |

A Letter from the Chairman and CEO |

| 3 |

Discussion of Fund Performance |

| 6 |

Fund Performance |

| 8 |

Understanding Your Fund’s Expenses |

| 8 |

Comparing Your Fund’s Expenses With Those of Other Funds |

| 9 |

Statement of Investments |

| 13 |

Statement of Assets and Liabilities |

| 14 |

Statement of Operations |

| 15 |

Statement of Changes in Net Assets |

| 17 |

Financial Highlights |

| 20 |

Notes to Financial Statements |

| 33 |

Report of Independent Registered Public Accounting Firm |

| 34 |

Important Tax Information |

| 35 |

Proxy Results |

| 36 |

Information About the Renewal of the Fund’s Management Agreement |

| 41 |

Board Members Information |

| 43 |

Officers of the Fund |

|

FOR MORE INFORMATION | |

|

Back Cover |

Dreyfus

Global Real Estate

Securities Fund

The Fund

A LETTER FROM THE CHAIRMAN AND CEO

Dear Shareholder:

We present to you this annual report for Dreyfus Global Real Estate Securities Fund, covering the 12-month period from January 1, 2011, through December 31, 2011. For information about how the fund performed during the reporting period, as well as general market perspectives, we provide a Discussion of Fund Performance on the pages that follow.

The generally mild returns produced by the U.S. stock market in 2011 belie the pronounced volatility affecting equities over much of the year. Day-to-day market movements were often tumultuous, driven by macroeconomic developments ranging from catastrophic natural disasters in Japan to an unprecedented downgrade of long-term U.S. debt securities and the resurgence of a sovereign debt crisis in Europe. Still, U.S. corporations achieved record-setting profits, on average, even as market valuations dropped below historical norms.A fundamentals-based investment approach proved relatively ineffective in a market fueled mainly by emotion, causing most active portfolio managers to lag market averages.

We are hopeful that equity investors will adopt a more rational perspective in 2012. Our economic forecast calls for a mild acceleration of the U.S. recovery as the domestic banking system regains strength, credit conditions loosen and housing markets begin a long-awaited convalescence. Of course, we encourage you to talk with your financial adviser to help ensure that your investment objectives are properly aligned with your risk tolerance in pursuing potential market opportunities in 2012.

Thank you for your continued confidence and support.

Jonathan R. Baum

Chairman and Chief Executive Officer

The Dreyfus Corporation

January 17, 2012

2

DISCUSSION OF FUND PERFORMANCE

For the period of January 1, 2011, through December 31, 2011, as provided by Peter Zabierek and Dean Frankel, Portfolio Managers, Urdang Securities Management, Inc., Sub-Investment Adviser

Fund and Market Performance Overview

For the 12-month period ended December 31, 2011, Dreyfus Global Real Estate Securities Fund’s Class A shares produced a total return of –5.74%, Class C shares returned –6.36% and Class I shares returned –5.41%.1 In comparison, the FTSE EPRA/NAREIT Developed Index, the fund’s benchmark, achieved a total return of –5.82% for the same period.2

Macroeconomic disappointments throughout the world weighed on real estate stocks during much of 2011, resulting in a moderate loss for the benchmark.The fund produced returns that were roughly in line with the benchmark as successful security selections in the United States, United Kingdom and Hong Kong were balanced by shortfalls in Singapore, Japan and Europe.

The Fund’s Investment Approach

The fund seeks to maximize total return consisting of capital appreciation and current income by investing at least 95% of its assets in companies principally engaged in the real estate sector. The fund normally invests approximately 60% of its assets in companies located outside the United States, and invests in at least 10 different countries. The fund also may invest in companies located in emerging markets and in companies of any market capitalization. Our proprietary approach quantifies investment opportunity both from a real estate and stock perspective.

Global Economic Developments Roiled Real Estate Markets

Global real estate markets responded in diverse ways to the macroeconomic developments of 2011. Rising rents and lower borrowing costs supported many of the world’s commercial property markets early in the year, but a series of unexpected setbacks later derailed the rally, particularly in Europe and Asia.

| The Fund | 3 |

DISCUSSION OF FUND PERFORMANCE (continued)

Investors in Asian markets worried about inflation-fighting measures in China, Hong Kong and Singapore, including higher interest rates, tighter loan restrictions and new regulations intended to promote affordable residential prices. In addition, global investors engaged in a “flight to quality” toward traditional safe havens as recession fears intensified in the global economy. As a result, commercial rents and occupancy rates in Hong Kong peaked over the summer, the supply of commercial space exceeded demand in Singapore, and rents in Japan failed to rise as many expected as the nation recovered from natural disasters.

Real estate stocks in Europe were hurt by a sovereign debt crisis, which restricted lending by financially stressed banks. The negative economic effects of austerity measures adopted by many European governments also undermined commercial property values.

On the other hand, real estate stocks fared better in the United States and Canada as these markets continued to recover from the financial crisis of 2008. Despite headwinds including a credit-rating downgrade of long-term U.S. government debt, U.S. and Canadian markets benefited from the global flight to quality and economic growth rates that ranked among the most robust in the developed world. Strength in these markets was especially pronounced among well-established office, retail and residential properties, but student housing projects and other less familiar property types lagged market averages.

Winners and Losers Produced Benchmark-Like Returns

In this environment, we intensified our focus on the United States and Canada, which together comprised approximately half of the fund’s assets as of year-end. The fund’s security selection strategy proved particularly effective in Canada, where eldercare properties specialist Chartwell Seniors Housing Real Estate Investment Trust benefited from renewed interest from investors fleeing other markets. The fund also avoided the brunt of weakness in China through underweighted exposure to the market.

Laggards during 2011 included Norwegian Property ASA, which lost value amid Europe’s sovereign debt crisis despite sound business fundamentals, strong management and Norway’s lack of membership in the European Union. Real estate stocks in Japan fell sharply in the

4

wake of the earthquake and tsunami, causing Kenedix Realty Investment to lose value in spite of its focus on the Tokyo market and a secure dividend yield.

Finding Attractive Values in Certain Markets

Although we expect the global economic rebound to remain intact, market volatility may remain elevated as the European debt crisis takes its toll on the region. Europe’s troubles also could undermine Asian markets whose economies rely on exports to the developed world.We expect better conditions in the United States, where risks and potential rewards appear evenly balanced.

We believe the fund is well positioned for this scenario. We have identified a number of opportunities in Hong Kong, where we believe many stocks were punished more severely than warranted, and in Singapore, where real estate investment trusts provide generous dividend yields supported by high rents and a growing local economy. A benchmark-neutral position in the United States reflects our balanced view of the domestic commercial real estate market, but Canadian real estate stocks have become more richly valued and we intend to reduce the fund’s exposure there.

January 17, 2012

| Equity funds are subject generally to market, market sector, market liquidity, issuer and investment | |

| style risks, among other factors, to varying degrees, all of which are more fully described in the | |

| fund’s prospectus. | |

| The fund’s performance will be influenced by political, social and economic factors affecting | |

| investments in foreign companies. Special risks associated with investments in foreign companies | |

| include exposure to currency fluctuations, less liquidity, less developed or less efficient trading | |

| markets, lack of comprehensive company information, political instability and differing auditing | |

| and legal standards.These risks are enhanced in emerging market countries. | |

| 1 | Total returns include reinvestment of dividends and any capital gains paid, and does not take into |

| consideration the maximum initial sales charge in the case of Class A shares, or the applicable | |

| contingent deferred sales charges imposed on redemptions in the case of Class C shares. Had these | |

| charges been reflected, returns would have been lower. Past performance is no guarantee of future | |

| results. Share price and investment return fluctuate such that upon redemption fund shares may be | |

| worth more or less than their original cost. Return figures provided reflect the absorption of certain | |

| fund expenses by The Dreyfus Corporation pursuant to an undertaking in effect through May 1, | |

| 2012, at which time it may be extended, terminated or modified. | |

| 2 | SOURCE: LIPPER INC. — Reflects reinvestment of net dividends and, where applicable, |

| capital gain distributions.The FTSE European Public Real Estate Association (EPRA) National | |

| Association of Real Estate Investment Trusts (NAREIT) Developed Global Real Estate | |

| Securities Index is an unmanaged index designed to track the performance of listed real estate | |

| companies and REITs worldwide. Investors cannot invest directly in any index. |

| The Fund | 5 |

FUND PERFORMANCE

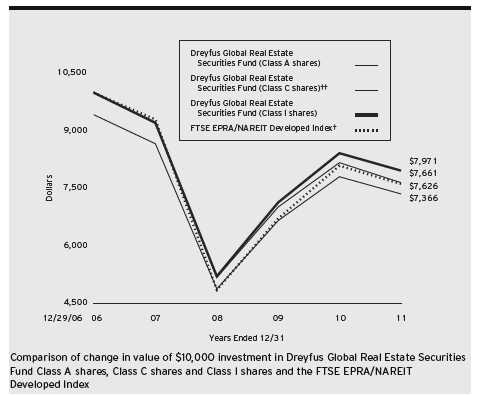

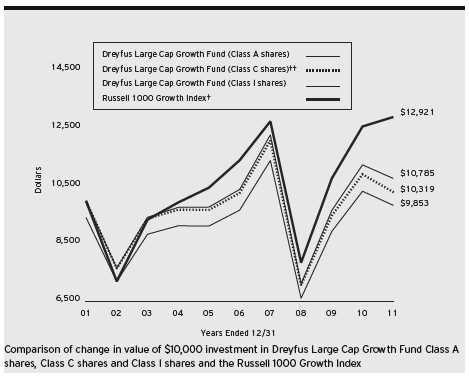

| † | Source: Lipper Inc. |

| †† | The total return figures presented for Class C shares of the fund reflect the performance of the fund’s Class A shares |

| for the period prior to 9/13/08 (the inception date for Class C shares), adjusted to reflect the applicable sales load for | |

| each share class. | |

| Past performance is not predictive of future performance. | |

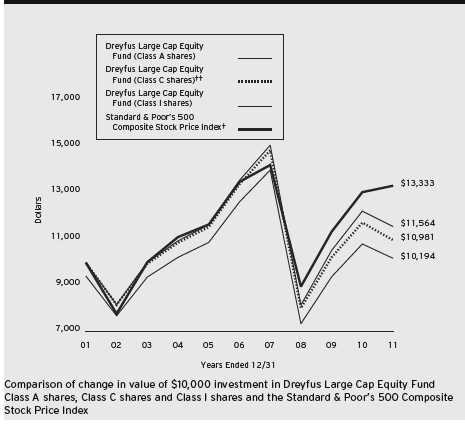

| The above graph compares a $10,000 investment made in each of the Class A, Class C and Class I shares of Dreyfus | |

| Global Real Estate Securities Fund on 12/29/06 (inception date) to a $10,000 investment made in the FTSE | |

| EPRA/NAREIT Developed Index (the “Index”) on that date. All dividends and capital gain distributions are | |

| reinvested. | |

| The fund’s performance shown in the line graph above takes into account the maximum initial sales charge on Class A | |

| shares and all other applicable fees and expenses on all classes.The Index is an unmanaged market-capitalization | |

| weighted index designed to measure the performance of exchange-listed real estate companies and REITs worldwide. | |

| Unlike a mutual fund, the Index is not subject to charges, fees and other expenses. Investors cannot invest directly in any | |

| index. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in | |

| the Financial Highlights section of the prospectus and elsewhere in this report. | |

6

| Average Annual Total Returns as of 12/31/11 | |||||||

| Inception | From | ||||||

| Date | 1Year | 5 Years | Inception | ||||

| Class A shares | |||||||

| with maximum sales charge (5.75%) | 12/29/06 | –11.14% | –5.93% | –5.92% | |||

| without sales charge | 12/29/06 | –5.74% | –4.81% | –4.80% | |||

| Class C shares | |||||||

| with applicable redemption charge † | 9/13/08 | –7.28% | –5.19%†† | –5.18%†† | |||

| without redemption | 9/13/08 | –6.36% | –5.19%†† | –5.18%†† | |||

| Class I shares | 12/29/06 | –5.41% | –4.44% | –4.43% | |||

| FTSE EPRA/NAREIT | |||||||

| Developed Index | 12/31/06 | –5.82% | –5.28% | –5.28% | |||

| Past performance is not predictive of future performance.The fund’s performance shown in the graph and table does not | |

| reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. | |

| † | The maximum contingent deferred sales charge for Class C shares is 1% for shares redeemed within one year of the |

| date of purchase. | |

| †† | The total return performance figures presented for Class C shares of the fund reflect the performance of the fund’s |

| Class A shares for the period prior to 9/13/08 (the inception date for Class C shares), adjusted to reflect the | |

| applicable sales load for each share class. | |

| The Fund | 7 |

UNDERSTANDING YOUR FUND’S EXPENSES (Unaudited)

As a mutual fund investor, you pay ongoing expenses, such as management fees and other expenses. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds.You also may pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial adviser.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in Dreyfus Global Real Estate Securities Fund from July 1, 2011 to December 31, 2011. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

Expenses and Value of a $1,000 Investment

assuming actual returns for the six months ended December 31, 2011

| Class A | Class C | Class I | ||||

| Expenses paid per $1,000† | $ | 7.58 | $ | 10.86 | $ | 5.34 |

| Ending value (after expenses) | $ | 890.70 | $ | 889.30 | $ | 892.90 |

COMPARING YOUR FUND’S EXPENSES

WITH THOSE OF OTHER FUNDS (Unaudited)

Using the SEC’s method to compare expenses

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the fund with those of other funds.All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

Expenses and Value of a $1,000 Investment

assuming a hypothetical 5% annualized return for the six months ended December 31, 2011

| Class A | Class C | Class I | ||||

| Expenses paid per $1,000† | $ | 8.08 | $ | 11.57 | $ | 5.70 |

| Ending value (after expenses) | $ | 1,017.19 | $ | 1,013.71 | $ | 1,019.56 |

| Expenses are equal to the fund’s annualized expense ratio of 1.59% for Class A, 2.28% for Class C and 1.12% |

| for Class I, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half |

| year period). |

8

| STATEMENT OF INVESTMENTS |

| December 31, 2011 |

| Common Stocks—98.1% | Shares | Value ($) | |

| Australia—8.6% | |||

| Commonwealth Property Office Fund | 2,490,850 | 2,432,993 | |

| Goodman Group | 2,644,290 | 1,541,608 | |

| Mirvac Group | 3,494,470 | 4,217,482 | |

| Westfield Group | 868,310 | 6,936,107 | |

| Westfield Retail Trust | 2,088,370 | 5,318,593 | |

| 20,446,783 | |||

| Bermuda—.2% | |||

| Orient-Express Hotels, Cl. A | 59,890 a | 447,378 | |

| Brazil—.4% | |||

| Iguatemi Empresa de Shopping Centers | 57,800 | 1,074,037 | |

| Canada—4.4% | |||

| Allied Properties Real Estate Investment Trust | 42,350 | 1,050,904 | |

| Boardwalk Real Estate Investment Trust | 35,740 | 1,769,547 | |

| Chartwell Seniors Housing | |||

| Real Estate Investment Trust | 649,990 | 5,423,229 | |

| First Capital Realty | 94,630 | 1,606,968 | |

| RioCan Real Estate Investment Trust | 18,700 | 485,145 | |

| 10,335,793 | |||

| Finland—.4% | |||

| Sponda | 243,790 | 984,436 | |

| France—3.0% | |||

| Unibail-Rodamco | 40,090 | 7,207,016 | |

| Germany—1.0% | |||

| Alstria Office REIT | 190,040 | 2,261,836 | |

| Hong Kong—10.7% | |||

| China Overseas Land & Investment | 2,496,600 | 4,172,465 | |

| Hang Lung Properties | 666,000 | 1,895,115 | |

| Hongkong Land Holdings | 439,000 | 1,993,060 | |

| Hysan Development | 423,000 | 1,388,832 | |

| Link REIT | 750,000 | 2,761,826 | |

| Sun Hung Kai Properties | 939,000 | 11,769,841 | |

| Wharf Holdings | 310,900 | 1,405,067 | |

| 25,386,206 |

| The Fund | 9 |

STATEMENT OF INVESTMENTS (continued)

| Common Stocks (continued) | Shares | Value ($) | ||

| Japan—8.2% | ||||

| Aeon Mall | 73,600 | 1,562,458 | ||

| Kenedix Realty Investment | 305 | 887,619 | ||

| Mitsubishi Estate | 320,000 | 4,781,084 | ||

| Mitsui Fudosan | 337,000 | 4,912,485 | ||

| Mori Trust Sogo REIT | 341 | 2,782,227 | ||

| Nippon Building Fund | 258 | 2,111,732 | ||

| Sumitomo Realty & Development | 94,000 | 1,646,252 | ||

| United Urban Investment | 646 | 732,698 | ||

| 19,416,555 | ||||

| Netherlands—.7% | ||||

| Corio | 26,020 | 1,131,692 | ||

| Vastned Retail | 12,520 | 560,657 | ||

| 1,692,349 | ||||

| Norway—.8% | ||||

| Norwegian Property | 1,512,990 | 1,861,877 | ||

| Singapore—4.3% | ||||

| CapitaCommercial Trust | 679,000 | 552,288 | ||

| CapitaLand | 1,114,000 | 1,898,107 | ||

| CapitaMall Trust | 1,293,000 | 1,694,692 | ||

| CDL Hospitality Trusts | 562,000 | 669,434 | ||

| Fortune Real Estate Investment Trust | 3,375,000 | 1,646,956 | ||

| Global Logistic Properties | 1,259,000 a | 1,703,516 | ||

| Keppel Land | 436,000 | 746,247 | ||

| Mapletree Industrial Trust | 1,632,000 | 1,352,608 | ||

| 10,263,848 | ||||

| Sweden—1.2% | ||||

| Wihlborgs Fastigheter | 207,220 | 2,740,030 | ||

| Switzerland—1.3% | ||||

| PSP Swiss Property | 35,720a | 2,989,026 | ||

| United Kingdom—5.6% | ||||

| British Land | 268,860 | 1,931,106 | ||

| Capital & Counties Properties | 1,085,890 | 3,113,047 | ||

| Land Securities Group | 444,360 | 4,385,495 | ||

10

| Common Stocks (continued) | Shares | Value ($) | |

| United Kingdom (continued) | |||

| London & Stamford Property | 956,990 | 1,605,089 | |

| Unite Group | 870,120 | 2,270,160 | |

| 13,304,897 | |||

| United States—47.3% | |||

| Alexandria Real Estate Equities | 38,760 | 2,673,277 | |

| Boston Properties | 40,700 | 4,053,720 | |

| Brandywine Realty Trust | 212,190 | 2,015,805 | |

| Brookfield Office Properties | 135,130 | 2,118,308 | |

| Camden Property Trust | 39,780 | 2,475,907 | |

| Colonial Properties Trust | 96,060 | 2,003,812 | |

| CommonWealth REIT | 135,680 | 2,257,715 | |

| CubeSmart | 86,290 | 918,126 | |

| DDR | 96,880 | 1,179,030 | |

| Digital Realty Trust | 40,920 | 2,728,136 | |

| Duke Realty | 163,910 | 1,975,115 | |

| Equity Residential | 112,990 | 6,443,820 | |

| Essex Property Trust | 17,450 | 2,451,900 | |

| HCP | 92,670 | 3,839,318 | |

| Health Care REIT | 95,200 | 5,191,256 | |

| Home Properties | 38,060 | 2,191,114 | |

| Host Hotels & Resorts | 189,690 | 2,801,721 | |

| Hudson Pacific Properties | 62,250 | 881,460 | |

| Hyatt Hotels, Cl. A | 27,070 a | 1,018,915 | |

| Kimco Realty | 222,610 | 3,615,186 | |

| LaSalle Hotel Properties | 65,580 | 1,587,692 | |

| Liberty Property Trust | 74,710 | 2,307,045 | |

| Macerich | 98,250 | 4,971,450 | |

| Mack-Cali Realty | 69,440 | 1,853,354 | |

| National Retail Properties | 171,490 | 4,523,906 | |

| ProLogis | 183,230 | 5,238,546 | |

| Public Storage | 35,240 | 4,738,370 | |

| Regency Centers | 49,780 | 1,872,724 | |

| RLJ Lodging Trust | 46,390 | 780,744 |

| The Fund | 11 |

STATEMENT OF INVESTMENTS (continued)

| Common Stocks (continued) | Shares | Value ($) | |||

| United States (continued) | |||||

| Simon Property Group | 97,260 | 12,540,704 | |||

| SL Green Realty | 47,940 | 3,194,722 | |||

| Sunstone Hotel Investors | 144,180 | a | 1,175,067 | ||

| UDR | 92,180 | 2,313,718 | |||

| Ventas | 128,910 | 7,106,808 | |||

| Vornado Realty Trust | 65,590 | 5,041,247 | |||

| 112,079,738 | |||||

| Total Investments (cost $242,333,307) | 98.1 | % | 232,491,805 | ||

| Cash and Receivables (Net) | 1.9 | % | 4,393,683 | ||

| Net Assets | 100.0 | % | 236,885,488 | ||

| REIT—Real Estate Investment Trust | |||||

| a Non-income producing security. | |||||

| Portfolio Summary (Unaudited)† | |||||

| Value (%) | Value (%) | ||||

| Diversified REITs | 18.4 | Industrial | 4.2 | ||

| Office | 18.2 | Hotels | 3.6 | ||

| Retail | 10.3 | Self Storage | 2.4 | ||

| Health Care | 9.1 | Freestanding | 1.9 | ||

| Real Estate Services | 8.4 | Specialty | 1.1 | ||

| Regional Malls | 8.1 | Residential | .7 | ||

| Multifamily | 7.5 | ||||

| Shopping Centers | 4.2 | 98.1 | |||

| † Based on net assets. | |||||

| See notes to financial statements. | |||||

12

| STATEMENT OF ASSETS AND LIABILITIES |

| December 31, 2011 |

| Cost | Value | |||

| Assets ($): | ||||

| Investments in securities—See Statement of Investments | 242,333,307 | 232,491,805 | ||

| Cash | 1,160,092 | |||

| Cash denominated in foreign currencies | 1,186,381 | 1,167,242 | ||

| Receivable for investment securities sold | 6,828,721 | |||

| Dividends receivable | 1,103,139 | |||

| Receivable for shares of Common Stock subscribed | 836,315 | |||

| Prepaid expenses | 30,446 | |||

| 243,617,760 | ||||

| Liabilities ($): | ||||

| Due to The Dreyfus Corporation and affiliates—Note 3(c) | 242,708 | |||

| Bank loan payable—Note 2 | 5,000,000 | |||

| Payable for shares of Common Stock redeemed | 1,016,647 | |||

| Payable for investment securities purchased | 446,613 | |||

| Interest payable—Note 2 | 983 | |||

| Accrued expenses | 25,321 | |||

| 6,732,272 | ||||

| Net Assets ($) | 236,885,488 | |||

| Composition of Net Assets ($): | ||||

| Paid-in capital | 274,051,736 | |||

| Accumulated distributions in excess of investment income—net | (2,633,434) | |||

| Accumulated net realized gain (loss) on investments | (24,693,808) | |||

| Accumulated net unrealized appreciation (depreciation) | ||||

| on investments and foreign currency transactions | (9,839,006) | |||

| Net Assets ($) | 236,885,488 | |||

| Net Asset Value Per Share | ||||

| Class A | Class C | Class I | ||

| Net Assets ($) | 2,066,242 | 394,780 | 234,424,466 | |

| Shares Outstanding | 302,047 | 58,406 | 34,716,374 | |

| Net Asset Value Per Share ($) | 6.84 | 6.76 | 6.75 | |

| See notes to financial statements. | ||||

| The Fund | 13 |

| STATEMENT OF OPERATIONS |

| Year Ended December 31, 2011 |

| Investment Income ($): | ||

| Income: | ||

| Cash dividends (net of $278,013 foreign taxes withheld at source): | ||

| Unaffiliated issuers | 5,973,845 | |

| Affiliated issuers | 5,271 | |

| Interest | 478 | |

| Total Income | 5,979,594 | |

| Expenses: | ||

| Management fee—Note 3(a) | 1,945,229 | |

| Custodian fees—Note 3(c) | 113,254 | |

| Professional fees | 72,080 | |

| Registration fees | 54,034 | |

| Directors’ fees and expenses—Note 3(d) | 30,976 | |

| Shareholder servicing costs—Note 3(c) | 20,655 | |

| Prospectus and shareholders’ reports | 16,977 | |

| Loan commitment fees—Note 2 | 2,866 | |

| Distribution fees—Note 3(b) | 2,444 | |

| Interest expense—Note 2 | 983 | |

| Miscellaneous | 20,628 | |

| Total Expenses | 2,280,126 | |

| Less—reduction in expenses due to undertaking—Note 3(a) | (1,200) | |

| Less—reduction in fees due to earnings credits—Note 3(c) | (24) | |

| Net Expenses | 2,278,902 | |

| Investment Income—Net | 3,700,692 | |

| Realized and Unrealized Gain (Loss) on Investments—Note 4 ($): | ||

| Net realized gain (loss) on investments and foreign currency transactions | 9,149,411 | |

| Net realized gain (loss) on forward foreign currency exchange contracts | (40,201) | |

| Net Realized Gain (Loss) | 9,109,210 | |

| Net unrealized appreciation (depreciation) on | ||

| investments and foreign currency transactions | (26,677,193) | |

| Net Realized and Unrealized Gain (Loss) on Investments | (17,567,983) | |

| Net (Decrease) in Net Assets Resulting from Operations | (13,867,291) | |

| See notes to financial statements. | ||

14

STATEMENT OF CHANGES IN NET ASSETS

| Year Ended December 31, | ||||

| 2011 | 2010 | |||

| Operations ($): | ||||

| Investment income—net | 3,700,692 | 1,568,758 | ||

| Net realized gain (loss) on investments | 9,109,210 | 5,141,911 | ||

| Net unrealized appreciation | ||||

| (depreciation) on investments | (26,677,193) | 11,734,559 | ||

| Net Increase (Decrease) in Net Assets | ||||

| Resulting from Operations | (13,867,291) | 18,445,228 | ||

| Dividends to Shareholders from ($): | ||||

| Investment income—net: | ||||

| Class A Shares | (41,829) | (62,237) | ||

| Class C Shares | (5,238) | (6,541) | ||

| Class I Shares | (6,128,543) | (5,615,484) | ||

| Total Dividends | (6,175,610) | (5,684,262) | ||

| Capital Stock Transactions ($): | ||||

| Net proceeds from shares sold: | ||||

| Class A Shares | 1,038,288 | 1,507,247 | ||

| Class C Shares | 370,801 | 162,622 | ||

| Class I Shares | 157,797,881 | 58,618,368 | ||

| Dividends reinvested: | ||||

| Class A Shares | 38,234 | 55,319 | ||

| Class C Shares | 5,084 | 5,499 | ||

| Class I Shares | 1,720,687 | 1,798,041 | ||

| Cost of shares redeemed: | ||||

| Class A Shares | (580,624) | (60,318) | ||

| Class C Shares | (140,411) | (16,590) | ||

| Class I Shares | (43,892,760) | (19,313,174) | ||

| Increase (Decrease) in Net Assets | ||||

| from Capital Stock Transactions | 116,357,180 | 42,757,014 | ||

| Total Increase (Decrease) in Net Assets | 96,314,279 | 55,517,980 | ||

| Net Assets ($): | ||||

| Beginning of Period | 140,571,209 | 85,053,229 | ||

| End of Period | 236,885,488 | 140,571,209 | ||

| Distributions in excess of | ||||

| investment income—net | (2,633,434) | (3,547,886) | ||

| The Fund | 15 |

STATEMENT OF CHANGES IN NET ASSETS (continued)

| Year Ended December 31, | ||||

| 2011 | 2010 | |||

| Capital Share Transactions: | ||||

| Class A | ||||

| Shares sold | 140,304 | 213,190 | ||

| Shares issued for dividends reinvested | 5,466 | 7,537 | ||

| Shares redeemed | (80,702) | (8,403) | ||

| Net Increase (Decrease) in Shares Outstanding | 65,068 | 212,324 | ||

| Class C | ||||

| Shares sold | 49,908 | 22,942 | ||

| Shares issued for dividends reinvested | 738 | 760 | ||

| Shares redeemed | (19,215) | (2,575) | ||

| Net Increase (Decrease) in Shares Outstanding | 31,431 | 21,127 | ||

| Class I | ||||

| Shares sold | 21,673,063 | 8,425,440 | ||

| Shares issued for dividends reinvested | 248,289 | 250,142 | ||

| Shares redeemed | (6,128,211) | (2,831,447) | ||

| Net Increase (Decrease) in Shares Outstanding | 15,793,141 | 5,844,135 | ||

| See notes to financial statements. | ||||

16

FINANCIAL HIGHLIGHTS

Please note that the financial highlights information in the following tables for the fund’s Class A and Class I shares represents the financial highlights of the Class A and Institutional shares, respectively, of the fund’s predecessor, BNY Hamilton Global Real Estate Securities Fund (“Hamilton Global Real Estate Securities Fund”), before the fund commenced operations as of the close of business on September 12, 2008, and represents the performance of the fund’s Class A and Class I shares thereafter. Before the fund commenced operations, all of the net assets of the Hamilton Global Real Estate Securities Fund were transferred to the fund in exchange for Class A and Class I shares of the fund in a tax-free reorganization.Total return shows how much your investment in the fund would have increased (or decreased) during each period, assuming you had reinvested all dividends and distributions.These figures have been derived from the fund’s and the fund’s predecessor’s financial statements.

| Year Ended December 31, | ||||||||||

| Class A Shares† | 2011 | 2010 | 2009 | 2008 | 2007 | |||||

| Per Share Data ($): | ||||||||||

| Net asset value, beginning of period | 7.41 | 6.56 | 5.02 | 9.04 | 10.00 | |||||

| Investment Operations: | ||||||||||

| Investment income—neta | .10 | .05 | .08 | .16 | .18 | |||||

| Net realized and unrealized | ||||||||||

| gain (loss) on investments | (.52) | 1.07 | 1.74 | (4.08) | (.97) | |||||

| Total from Investment Operations | (.42) | 1.12 | 1.82 | (3.92) | (.79) | |||||

| Distributions: | ||||||||||

| Dividends from investment income—net | (.15) | (.27) | (.28) | (.10) | (.17) | |||||

| Net asset value, end of period | 6.84 | 7.41 | 6.56 | 5.02 | 9.04 | |||||

| Total Return (%)b | (5.74) | 17.15 | 36.38 | (43.60) | (8.00) | |||||

| Ratios/Supplemental Data (%): | ||||||||||

| Ratio of total expenses | ||||||||||

| to average net assets | 1.57 | 1.67 | 4.36 | 1.62 | 1.58 | |||||

| Ratio of net expenses | ||||||||||

| to average net assets | 1.55 | 1.60 | 1.60 | 1.41 | 1.50 | |||||

| Ratio of net investment income | ||||||||||

| to average net assets | 1.36 | .74 | 1.44 | 1.83 | 1.87 | |||||

| Portfolio Turnover Rate | 80.41 | 86.02 | 97.43 | 79 | 73 | |||||

| Net Assets, end of period ($ x 1,000) | 2,066 | 1,756 | 162 | 12 | 52 | |||||

| † Represents information for Class A shares of the fund’s predecessor, Hamilton Global Real Estate Securities Fund, |

| through September 12, 2008. |

| a Based on average shares outstanding at each month end. |

| b Exclusive of sales charge. |

See notes to financial statements.

| The Fund | 17 |

FINANCIAL HIGHLIGHTS (continued)

| Year Ended December 31, | ||||||||

| Class C Shares | 2011 | 2010 | 2009 | 2008a | ||||

| Per Share Data ($): | ||||||||

| Net asset value, beginning of period | 7.32 | 6.50 | 5.02 | 7.78 | ||||

| Investment Operations: | ||||||||

| Investment income—netb | .05 | .00c | .04 | .01 | ||||

| Net realized and unrealized | ||||||||

| gain (loss) on investments | (.51) | 1.07 | 1.75 | (2.74) | ||||

| Total from Investment Operations | (.46) | 1.07 | 1.79 | (2.73) | ||||

| Distributions: | ||||||||

| Dividends from investment income—net | (.10) | (.25) | (.31) | (.03) | ||||

| Net asset value, end of period | 6.76 | 7.32 | 6.50 | 5.02 | ||||

| Total Return (%)d | (6.36) | 16.48 | 35.35 | (34.92)e | ||||

| Ratios/Supplemental Data (%): | ||||||||

| Ratio of total expenses to average net assets | 2.50 | 2.45 | 2.91 | 2.46f | ||||

| Ratio of net expenses to average net assets | 2.29 | 2.35 | 2.35 | 2.35f | ||||

| Ratio of net investment income | ||||||||

| to average net assets | .63 | .02 | .71 | .67f | ||||

| Portfolio Turnover Rate | 80.41 | 86.02 | 97.43 | 79 | ||||

| Net Assets, end of period ($ x 1,000) | 395 | 198 | 38 | 6 | ||||

| a | From September 13, 2008 (commencement of initial offering) to December 31, 2008. |

| b | Based on average shares outstanding at each month end. |

| c | Amount represents less than $.01 per share. |

| d | Exclusive of sales charge. |

| e | Not annualized. |

| f | Annualized. |

See notes to financial statements.

18

| Year Ended December 31, | ||||||||||

| Class I Shares† | 2011 | 2010 | 2009 | 2008 | 2007 | |||||

| Per Share Data ($): | ||||||||||

| Net asset value, beginning of period | 7.33 | 6.49 | 5.02 | 9.04 | 10.00 | |||||

| Investment Operations: | ||||||||||

| Investment income—neta | .13 | .10 | .14 | .16 | .20 | |||||

| Net realized and unrealized | ||||||||||

| gain (loss) on investments | (.52) | 1.05 | 1.70 | (4.06) | (.98) | |||||

| Total from Investment Operations | (.39) | 1.15 | 1.84 | (3.90) | (.78) | |||||

| Distributions: | ||||||||||

| Dividends from investment income—net | (.19) | (.31) | (.37) | (.12) | (.18) | |||||

| Net asset value, end of period | 6.75 | 7.33 | 6.49 | 5.02 | 9.04 | |||||

| Total Return (%) | (5.41) | 17.91 | 36.94 | (43.38) | (7.83) | |||||

| Ratios/Supplemental Data (%): | ||||||||||

| Ratio of total expenses | ||||||||||

| to average net assets | 1.11 | 1.17 | 1.33 | 1.24 | 1.34 | |||||

| Ratio of net expenses | ||||||||||

| to average net assets | 1.11 | 1.17 | 1.18 | 1.19 | 1.25 | |||||

| Ratio of net investment income | ||||||||||

| to average net assets | 1.81 | 1.51 | 2.55 | 2.24 | 1.97 | |||||

| Portfolio Turnover Rate | 80.41 | 86.02 | 97.43 | 79 | 73 | |||||

| Net Assets, end of period ($ x 1,000) | 234,424 | 138,618 | 84,854 | 48,255 | 51,140 | |||||

| † Represents information for Institutional shares of the fund’s predecessor, Hamilton Global Real Estate Securities |

| Fund, through September 12, 2008. |

| a Based on average shares outstanding at each month end. |

See notes to financial statements.

| The Fund | 19 |

NOTES TO FINANCIAL STATEMENTS

NOTE 1—Significant Accounting Policies:

Dreyfus Global Real Estate Securities Fund (the “fund”) is a separate diversified series of Dreyfus Premier Investment Funds, Inc. (the “Company”), which is registered under the Investment Company Act of 1940, as amended (the “Act”), as an open-end management investment company and operates as a series company currently offering nine series, including the fund.The fund’s investment objective is to maximize total return consisting of capital appreciation and current income. The Dreyfus Corporation (the “Manager” or “Dreyfus”), a wholly-owned subsidiary of The Bank of New York Mellon Corporation (“BNY Mellon”), serves as the fund’s investment adviser. Urdang Securities Management, Inc. (“Urdang”) serves as the fund’s sub-investment advisor. Urdang is a wholly-owned subsidiary of BNY Mellon and an affiliate of Dreyfus.

MBSC Securities Corporation (the “Distributor”), a wholly-owned subsidiary of Dreyfus, is the distributor of the fund’s shares.The fund is authorized to issue 250 million shares of $.001 par value Common Stock.The fund currently offers three classes of shares: Class A (100 million shares authorized), Class C (50 million shares authorized) and Class I (100 million shares authorized). Class A shares are subject to a sales charge imposed at the time of purchase. Class C shares are subject to a contingent deferred sales charge (“CDSC”) imposed on Class C shares redeemed within one year of purchase. Class I shares are sold at net asset value per share only to institutional investors. Other differences between the classes include the services offered to and the expenses borne by each class, the allocation of certain transfer agency costs and certain voting rights. Income, expenses (other than expenses attributable to a specific class), and realized and unrealized gains or losses on investments are allocated to each class of shares based on its relative net assets.

The Company accounts separately for the assets, liabilities and operations of each series. Expenses directly attributable to each series are

20

charged to that series’ operations; expenses which are applicable to all series are allocated among them on a pro rata basis.

The Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) is the exclusive reference of authoritative U.S. generally accepted accounting principles (“GAAP”) recognized by the FASB to be applied by nongovernmental entities. Rules and interpretive releases of the Securities and Exchange Commission (“SEC”) under authority of federal laws are also sources of authoritative GAAP for SEC registrants. The fund’s financial statements are prepared in accordance with GAAP, which may require the use of management estimates and assumptions.Actual results could differ from those estimates.

The Company enters into contracts that contain a variety of indemnifications.The fund’s maximum exposure under these arrangements is unknown.The fund does not anticipate recognizing any loss related to these arrangements.

(a) Portfolio valuation: The fair value of a financial instrument is the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (i.e. the exit price). GAAP establishes a fair value hierarchy that prioritizes the inputs of valuation techniques used to measure fair value.This hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements).

Additionally, GAAP provides guidance on determining whether the volume and activity in a market has decreased significantly and whether such a decrease in activity results in transactions that are not orderly. GAAP requires enhanced disclosures around valuation inputs and techniques used during annual and interim periods.

| The Fund | 21 |

NOTES TO FINANCIAL STATEMENTS (continued)

Various inputs are used in determining the value of the fund’s investments relating to fair value measurements.These inputs are summarized in the three broad levels listed below:

Level 1—unadjusted quoted prices in active markets for identical investments.

Level 2—other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.).

Level 3—significant unobservable inputs (including the fund’s own assumptions in determining the fair value of investments).

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. Valuation techniques used to value the fund’s investments are as follows:

Investments in securities are valued at the last sales price on the securities exchange or national securities market on which such securities are primarily traded. Securities listed on the National Market System for which market quotations are available are valued at the official closing price or, if there is no official closing price that day, at the last sales price. Securities not listed on an exchange or the national securities market, or securities for which there were no transactions, are valued at the average of the most recent bid and asked prices, except for open short positions, where the asked price is used for valuation purposes. Bid price is used when no asked price is available. Registered investment companies that are not traded on an exchange are valued at their net asset value.All preceding securities are categorized within Level 1 of the fair value hierarchy.

22

Fair valuing of securities may be determined with the assistance of a pricing service using calculations based on indices of domestic securities and other appropriate indicators, such as prices of relevant American Depository Receipts and futures contracts. Utilizing these techniques may result in transfers between Level 1 and Level 2 of the fair value hierarchy.

When market quotations or official closing prices are not readily available, or are determined not to reflect accurately fair value, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded (for example, a foreign exchange or market), but before the fund calculates its net asset value, the fund may value these investments at fair value as determined in accordance with the procedures approved by the Board of Directors. Certain factors may be considered when fair valuing investments such as: fundamental analytical data, the nature and duration of restrictions on disposition, an evaluation of the forces that influence the market in which the securities are purchased and sold, and public trading in similar securities of the issuer or comparable issuers. These securities are either categorized as Level 2 or 3 depending on the relevant inputs used.

For restricted securities where observable inputs are limited, assumptions about market activity and risk are used and are categorized within Level 3 of the fair value hierarchy.

Investments denominated in foreign currencies are translated to U.S. dollars at the prevailing rates of exchange. Forward foreign currency exchange contracts (“forward contracts”) are valued at the forward rate. These securities are generally categorized within Level 2 of the fair value hierarchy.

| The Fund | 23 |

NOTES TO FINANCIAL STATEMENTS (continued)

The following is a summary of the inputs used as of December 31, 2011 in valuing the fund’s investments:

| Level 2—Other | Level 3— | |||

| Level 1— | Significant | Significant | ||

| Unadjusted | Observable | Unobservable | ||

| Quoted Prices | Inputs | Inputs | Total | |

| Assets ($) | ||||

| Investments in Securities: | ||||

| Equity Securities— | ||||

| Domestic† | 112,079,738 | — | — | 112,079,738 |

| Equity Securities— | ||||

| Foreign† | 120,412,067 | — | — | 120,412,067 |

| † See Statement of Investments for additional detailed categorizations. | ||||

In May 2011, FASB issued Accounting Standards Update (“ASU”) No. 2011-04 “Amendments to Achieve Common FairValue Measurement and Disclosure Requirements in GAAP and International Financial Reporting Standards (“IFRS”)” (“ASU 2011-04”). ASU 2011-04 includes common requirements for measurement of and disclosure about fair value between GAAP and IFRS. ASU 2011-04 will require reporting entities to disclose the following information for fair value measurements categorized within Level 3 of the fair value hierarchy: quantitative information about the unobservable inputs used in the fair value measurement, the valuation processes used by the reporting entity and a narrative description of the sensitivity of the fair value measurement to changes in unobservable inputs and the interrelationships between those unobservable inputs. In addition, ASU 2011-04 will require reporting entities to make disclosures about amounts and reasons for all transfers in and out of Level 1 and Level 2 fair value measurements.The new and revised disclosures are effective for interim and annual reporting periods beginning after December 15, 2011. At this time, management is evaluating the implications of ASU 2011-04 and its impact on the financial statements.

(b) Foreign currency transactions: The fund does not isolate that portion of the results of operations resulting from changes in foreign

24

exchange rates on investments from the fluctuations arising from changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss on investments.

Net realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized on securities transactions between trade and settlement date, and the difference between the amounts of dividends, interest, and foreign withholding taxes recorded on the fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the value of assets and liabilities other than investments resulting from changes in exchange rates. Foreign currency gains and losses on investments are included with net realized and unrealized gain or loss on investments.

(c) Securities transactions and investment income: Securities transactions are recorded on a trade date basis. Realized gains and losses from securities transactions are recorded on the identified cost basis. Dividend income is recognized on the ex-dividend date and interest income, including, where applicable, accretion of discount and amortization of premium on investments, is recognized on the accrual basis.

Investing in foreign markets may involve special risks and considerations not typically associated with investing in the U.S. These risks include revaluation of currencies, high rates of inflation, repatriation restrictions on income and capital, and adverse political and economic developments. Moreover, securities issued in these markets may be less liquid, subject to government ownership controls and delayed settlements, and their prices may be more volatile than those of comparable securities in the U.S.

(d) Affiliated issuers: Investments in other investment companies advised by Dreyfus are defined as “affiliated” in the Act.

| The Fund | 25 |

NOTES TO FINANCIAL STATEMENTS (continued)

The fund may invest in shares of certain affiliated investment companies also advised or managed by Dreyfus. Investments in affiliated investment companies for the period ended December 31, 2011 were as follows:

| Affiliated | |||||

| Investment | Value | Value | Net | ||

| Company | 12/31/2010 ($) | Purchases ($) | Sales ($) | 12/31/2011 ($) | Assets (%) |

| Dreyfus | |||||

| Institutional | |||||

| Preferred | |||||

| Plus Money | |||||

| Market | |||||

| Fund | 4,159,000 | 112,677,000 | 116,836,000 | — | — |

(e) Dividends to shareholders: Dividends are recorded on the ex-dividend date. Dividends from investment income-net and dividends from net realized capital gains, if any, are normally declared and paid annually, but the fund may make distributions on a more frequent basis to comply with the distribution requirements of the Internal Revenue Code of 1986, as amended (the “Code”).To the extent that net realized capital gains can be offset by capital loss carryovers, it is the policy of the fund not to distribute such gains. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

(f) Federal income taxes: It is the policy of the fund to continue to qualify as a regulated investment company, if such qualification is in the best interests of its shareholders, by complying with the applicable provisions of the Code, and to make distributions of taxable income sufficient to relieve it from substantially all federal income and excise taxes.

As of and during the period ended December 31, 2011, the fund did not have any liabilities for any uncertain tax positions.The fund recognizes interest and penalties, if any, related to uncertain tax positions as income tax expense in the Statement of Operations. During the period, the fund did not incur any interest or penalties.

26

Each of the tax years in the four-year period ended December 31, 2011 remains subject to examination by the Internal Revenue Service and state taxing authorities.

At December 31, 2011, the components of accumulated earnings on a tax basis were as follows: accumulated capital losses $18,733,400 and unrealized depreciation $16,236,750. In addition, the fund had $1,201,129 of capital losses realized after October 31, 2011, which were deferred for tax purposes to the first day of the following fiscal year. Also, the fund deferred for tax purposes late year ordinary losses of $1,067,314 to the first day of the following fiscal year.

Under the Regulated Investment Company Modernization Act of 2010 (the “2010 Act”), the fund will be permitted to carry forward capital losses incurred in taxable years beginning after December 22, 2010 (“post-enactment losses”) for an unlimited period. Furthermore, post-enactment capital loss carryovers will retain their character as either short-term or long-term capital losses rather than short-term as they were under previous statute. The 2010 Act requires post-enactment losses to be utilized before the utilization of losses incurred in taxable years prior to the effective date of the 2010 Act (“pre-enactment losses”). As a result of this ordering rule, pre-enactment losses may be more likely to expire unused.

The accumulated capital loss carryover is available for federal income tax purposes to be applied against future net securities profits, if any, realized subsequent to December 31, 2011. If not applied, $1,249,319 of the carryover expires in fiscal 2016 and $17,484,081 expires in fiscal 2017.

The tax character of distributions paid to shareholders during the fiscal periods ended December 31, 2011 and December 31, 2010 were as follows: ordinary income $6,175,610 and $5,684,262, respectively.

| The Fund | 27 |

NOTES TO FINANCIAL STATEMENTS (continued)

During the period ended December 31, 2011, as a result of permanent book to tax differences, primarily due to the tax treatment for foreign currency gains and losses, excess distribution and passive foreign investment companies, the fund increased accumulated undistributed investment income-net by $3,389,370, decreased accumulated net realized gain (loss) on investments by $3,077,323 and decreased paid-in capital by $312,047. Net assets and net asset value per share were not affected by this reclassification.

NOTE 2—Bank Lines of Credit:

The fund participates with other Dreyfus-managed funds in a $225 million unsecured credit facility led by Citibank, N.A. and a $300 million unsecured credit facility provided by The Bank of NewYork Mellon, a subsidiary of BNY Mellon and an affiliate of Dreyfus, (each, a “Facility”), each to be utilized primarily for temporary or emergency purposes, including the financing of redemptions. In connection therewith, the fund has agreed to pay its pro rata portion of commitment fees for each Facility. Interest is charged to the fund based on rates determined pursuant to the terms of the respective Facility at the time of borrowing.

The average amount of borrowings outstanding under the Facilities during the period ended December 31, 2011, was approximately $52,300 with a related weighted average annualized interest rate of 1.88%.

NOTE 3—Management Fee, Sub-Investment Advisory Fee and Other Transactions With Affiliates:

(a) Pursuant to a management agreement with Dreyfus, the management fee is computed at an annual rate of .95% of the value of the fund’s average daily net assets and is payable monthly.

Dreyfus has agreed, from May 1, 2011 until May 1, 2012, to waive receipt of its fee and/or assume the expenses of the fund so that the direct expenses of none of the classes (excluding taxes, interest expense,

28

brokerage commissions, commitment fees on borrowings, shareholder services fees, Rule 12b-1 fees and extraordinary expenses) exceed 1.25% of the value of the fund’s average daily net assets.

Dreyfus had contractually agreed, from January 1, 2011, through April 30, 2011, to waive receipt of its fees and/or assume the expenses of the fund so that the direct expenses of Class I shares (excluding taxes, interest expense, brokerage commissions, commitment fees on borrowings and extraordinary expenses) did not exceed 1.20% of the value of Class I shares’ average daily net assets.

Dreyfus had also agreed, from January 1, 2011, through April 30, 2011, to waive receipt of its fees and/or assume the expenses of the fund so that the direct expenses of Class A and Class C shares (excluding taxes, interest expense, brokerage commissions, commitment fees on borrowings, shareholder services fees, Rule 12b-1 fees and extraordinary expenses) did not exceed 1.35% of the value of Class A and Class C shares’ average daily net assets.

The reduction in expenses, pursuant to the undertakings, amounted to $1,200 during the period ended December 31, 2011.

Pursuant to a sub-investment advisory agreement between Dreyfus and Urdang, Dreyfus pays Urdang a monthly fee at an annual rate of .46% of the value of the fund’s average daily net assets.

During the period ended December 31, 2011, the Distributor retained $1,632 from commissions earned on sales of the fund’s Class A shares and $23 from CDSCs on redemptions of the fund’s Class C shares.

(b) Under the Distribution Plan (the “Plan”) adopted pursuant to Rule 12b-1 under the Act, Class C shares pay the Distributor for distributing its shares at an annual rate of .75% of the value of the average daily net assets of Class C shares. During the period ended December 31, 2011, Class C shares were charged $2,444 pursuant to the Plan.

| The Fund | 29 |

NOTES TO FINANCIAL STATEMENTS (continued)

(c) Under the Shareholder Services Plan, Class A and Class C shares pay the Distributor at an annual rate of .25% of the value of their average daily net assets for the provision of certain services.The services provided may include personal services relating to shareholder accounts, such as answering shareholder inquiries regarding the fund and providing reports and other information, and services related to the maintenance of shareholder accounts.The Distributor may make payments to Service Agents (a securities dealer, financial institution or other industry professional) in respect of these services.The Distributor determines the amounts to be paid to Service Agents. During the period ended December 31, 2011, Class A and Class C shares were charged $4,777 and $815, respectively, pursuant to the Shareholder Services Plan.

The fund compensates Dreyfus Transfer, Inc., a wholly-owned subsidiary of Dreyfus, under a transfer agency agreement for providing personnel and facilities to perform transfer agency services for the fund. During the period ended December 31, 2011, the fund was charged $7,223 pursuant to the transfer agency agreement, which is included in Shareholder servicing costs in the Statement of Operations.

The fund has arrangements with the custodian and cash management bank whereby the fund may receive earnings credits when positive cash balances are maintained, which are used to offset custody and cash management fees. For financial reporting purposes, the fund includes net earnings credits as an expense offset in the Statement of Operations.

The fund compensates The Bank of New York Mellon under a cash management agreement for performing cash management services related to fund subscriptions and redemptions. During the period ended December 31, 2011, the fund was charged $844 pursuant to the cash management agreement, which is included in Shareholder servicing costs in the Statement of Operations.These fees were partially offset by earnings credits of $24.

30

The fund also compensates The Bank of New York Mellon under a custody agreement for providing custodial services for the fund. During the period ended December 31, 2011, the fund was charged $113,254 pursuant to the custody agreement.

During the period ended December 31, 2011, the fund was charged $6,402 for services performed by the Chief Compliance Officer.

The components of “Due to The Dreyfus Corporation and affiliates” in the Statement of Assets and Liabilities consist of: management fees $195,259, Rule 12b-1 distribution plan fees $251, shareholder services plan fees $511, custodian fees $40,329, chief compliance officer fees $5,295 and transfer agency per account fees $1,412, which are offset against an expense reimbursement currently in effect in the amount of $349.

(d) Each Board member also serves as a Board member of other funds within the Dreyfus complex. Annual retainer fees and attendance fees are allocated to each fund based on net assets.

NOTE 4—Securities Transactions:

The aggregate amount of purchases and sales of investment securities, excluding short-term securities and forward contracts, during the period ended December 31, 2011, amounted to $276,857,900 and $159,593,535, respectively.

Forward Foreign Currency Exchange Contracts: The fund enters into forward contracts in order to hedge its exposure to changes in foreign currency exchange rates on its foreign portfolio holdings, to settle foreign currency transactions or as a part of its investment strategy. When executing forward contracts, the fund is obligated to buy or sell a foreign currency at a specified rate on a certain date in the future.

| The Fund | 31 |

NOTES TO FINANCIAL STATEMENTS (continued)

With respect to sales of forward contracts, the fund incurs a loss if the value of the contract increases between the date the forward contract is opened and the date the forward contract is closed.The fund realizes a gain if the value of the contract decreases between those dates.With respect to purchases of forward contracts, the fund incurs a loss if the value of the contract decreases between the date the forward contract is opened and the date the forward contract is closed.The fund realizes a gain if the value of the contract increases between those dates. Any realized gain or loss which occurred during the period is reflected in the Statement of Operations.The fund is exposed to foreign currency risk as a result of changes in value of underlying financial instruments. The fund is also exposed to credit risk associated with counterparty nonperformance on these forward contracts, which is typically limited to the unrealized gain on each open contract. At December 31, 2011, there were no forward contracts outstanding.

The following summarizes the average market value of derivatives outstanding during the period ended December 31, 2011:

| Average Market Value ($) | |

| Forward contracts | 296,587 |

At December 31, 2011, the cost of investments for federal income tax purposes was $248,731,051; accordingly, accumulated net unrealized depreciation on investments was $16,239,246, consisting of $10,377,118 gross unrealized appreciation and $26,616,364 gross unrealized depreciation.

32

| REPORT OF INDEPENDENT REGISTERED |

| PUBLIC ACCOUNTING FIRM |

Shareholders and Board of Directors Dreyfus Global Real Estate Securities Fund

We have audited the accompanying statement of assets and liabilities, including the statement of investments, of Dreyfus Global Real Estate Securities Fund (one of the series comprising Dreyfus Premier Investment Funds, Inc.) as of December 31, 2011, and the related statement of operations for the year then ended, the statement of changes in net assets for each of the two years in the period then ended, and financial highlights for each of the four years in the period then ended.These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits. The financial highlights for the period ended December 31, 2007 were audited by other auditors whose report dated February 28, 2008, expressed an unqualified opinion on such financial highlights.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States).Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement.We were not engaged to perform an audit of the Fund’s internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion.An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements and financial highlights, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of December 31, 2011 by correspondence with the custodian and others.We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Dreyfus Global Real Estate Securities Fund at December 31, 2011, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the four years in the period then ended, in conformity with U.S. generally accepted accounting principles.

| New York, New York |

| February 28, 2012 |

| The Fund | 33 |

IMPORTANT TAX INFORMATION (Unaudited)

In accordance with federal tax law, the fund hereby designates 11.70% of the ordinary dividends paid during the fiscal year ended December 31, 2011 as qualifying for the corporate dividends received deduction. For the fiscal year ended December 31, 2011, certain dividends paid by the fund may be subject to a maximum tax rate of 15%, as provided for by the Jobs and Growth Tax Relief Reconciliation Act of 2003. Of the distributions paid during the fiscal year, $1,878,501 represents the maximum amount that may be considered qualified dividend income. Shareholders will receive notification in early 2012 of the percentage applicable to the preparation of their 2011 income tax returns.

34

PROXY RESULTS (Unaudited)

The Company held a special meeting of shareholders on May 31, 2011.The proposal considered at the meeting, and the results, are as follows:

| Shares | |||

| Votes For | Authority Withheld | ||

| To elect additional Board Members: | |||

| Joseph S. DiMartino† | 119,515,411 | 644,860 | |

| Philip L. Toia† | 119,502,800 | 657,471 | |

| Robin A. Melvin† | 119,566,042 | 594,229 |

| † Each new Board member’s term commenced on May 31, 2011. |

| In addition Gordon J. Davis, Esq., David P. Feldman and Lynn Martin continue as Board members of the Company. |

| The Fund | 35 |

| INFORMATION ABOUT THE RENEWAL OF THE |

| FUND’S MANAGEMENT AGREEMENT (Unaudited) |

At a meeting of the fund’s Board of Directors held on July 12, 2011, the Board considered the renewal of the fund’s Management Agreement, pursuant to which Dreyfus provides the fund with investment advisory and administrative services (the “Agreement”), and the Sub-Investment Advisory Agreement (together, the “Agreements”), pursuant to which Urdang Securities Management, Inc. (the “Sub-Adviser”) provides day-to-day management of the fund’s investments. The Board members, none of whom are “interested persons” (as defined in the Investment Company Act of 1940, as amended) of the fund, were assisted in their review by independent legal counsel and met with counsel in executive session separate from representatives of Dreyfus and the Sub-Adviser. In considering the renewal of the Agreements, the Board considered all factors that it believed to be relevant, including those discussed below. The Board did not identify any one factor as dispositive, and each Board member may have attributed different weights to the factors considered.

Analysis of Nature, Extent, and Quality of Services Provided to the Fund.The Board considered information previously provided to them in presentations from Dreyfus representatives regarding the nature, extent, and quality of the services provided to funds in the Dreyfus fund complex, and Dreyfus representatives confirmed that there had been no material changes in this information. Dreyfus provided the number of open accounts in the fund, the fund’s asset size and the allocation of fund assets among distribution channels. Dreyfus also had previously provided information regarding the diverse intermediary relationships and distribution channels of funds in the Dreyfus fund complex and Dreyfus’ corresponding need for broad, deep, and diverse resources to be able to provide ongoing shareholder services to each distribution channel, including the distribution channel(s) for the fund.

The Board also considered research support available to, and portfolio management capabilities of, the fund’s portfolio management personnel and that Dreyfus also provides oversight of day-to-day fund operations, including fund accounting and administration and assistance in meeting legal and regulatory requirements.The Board also considered Dreyfus’

36

extensive administrative, accounting, and compliance infrastructures, as well as Dreyfus’ supervisory activities over the Sub-Adviser.The Board also considered portfolio management’s brokerage policies and practices (including policies and practices regarding soft dollars) and the standards applied in seeking best execution.

Comparative Analysis of the Fund’s Performance and Management Fee and Expense Ratio.The Board reviewed reports prepared by Lipper, Inc. (“Lipper”), an independent provider of investment company data, which included information comparing (1) the fund’s performance with the performance of a group of comparable funds (the “Performance Group”) and with a broader group of funds (the “Performance Universe”), all for various periods ended May 31, 2011, and (2) the fund’s actual and contractual management fees and total expenses with those of a group of comparable funds (the “Expense Group”) and with a broader group of funds (the “Expense Universe”), the information for which was derived in part from fund financial statements available to Lipper as of May 31, 2011. Dreyfus previously had furnished the Board with a description of the methodology Lipper used to select the Performance Group and Performance Universe and the Expense Group and Expense Universe.

Dreyfus representatives stated that the usefulness of performance comparisons may be affected by a number of factors, including different investment limitations that may be applicable to the fund and comparison funds.The Board discussed the results of the comparisons and noted that the fund’s total return performance was variously above and below the Performance Group and Performance Universe medians for the periods shown. Dreyfus also provided a comparison of the fund’s calendar year total returns to the returns of the fund’s benchmark index.

The Board also reviewed the range of actual and contractual management fees and total expenses of the Expense Group and Expense Universe funds and discussed the results of the comparisons.The Board noted that

| The Fund | 37 |

| INFORMATION ABOUT THE RENEWAL OF THE FUND’S |

| MANAGEMENT AGREEMENT (Unaudited) (continued) |

the fund’s contractual management fee was above the Expense Group median and the fund’s actual management fee and total expense ratio were above the Expense Group and Expense Universe medians.

Dreyfus representatives noted that Dreyfus has contractually agreed to waive receipt of its fees and/or assume the expenses of the fund, until May 1, 2012, so that annual direct fund operating expenses (excluding Rule 12b-1 fees, shareholder services fees, taxes, interest expense, brokerage commissions, commitment fees on borrowings and extraordinary expenses) do not exceed 1.25% of the value of the fund’s average daily net assets.

Dreyfus representatives reviewed with the Board the management or investment advisory fees (1) paid by funds advised or administered by Dreyfus that are in the same Lipper category as the fund and (2) paid to Dreyfus or the Sub-Adviser or its affiliates for advising any separate accounts and/or other types of client portfolios that are considered to have similar investment strategies and policies as the fund (the “Similar Clients”), and explained the nature of the Similar Clients.They discussed differences in fees paid and the relationship of the fees paid in light of any differences in the services provided and other relevant factors.The Board considered the relevance of the fee information provided for the Similar Clients to evaluate the appropriateness and reasonableness of the fund’s management fee.

The Board considered the fee to the Sub-Adviser in relation to the fee paid to Dreyfus by the fund and the respective services provided by the Sub-Adviser and Dreyfus.The Board also noted the Sub-Adviser’s fee is paid by Dreyfus (out of its fee from the fund) and not the fund.

Analysis of Profitability and Economies of Scale. Dreyfus representatives reviewed the expenses allocated and profit received by Dreyfus and the resulting profitability percentage for managing the fund, and the method used to determine the expenses and profit. The Board

38

concluded that the profitability results were not unreasonable, given the services rendered and service levels provided by Dreyfus. The Board also noted the expense limitation arrangement and its effect on Dreyfus’ profitability. The Board previously had been provided with information prepared by an independent consulting firm regarding Dreyfus’ approach to allocating costs to, and determining the profitability of, individual funds and the entire Dreyfus fund complex.The consulting firm also had analyzed where any economies of scale might emerge in connection with the management of a fund.

The Board’s counsel stated that the Board should consider the profitability analysis (1) as part of their evaluation of whether the fees under the Agreements bear a reasonable relationship to the mix of services provided by Dreyfus and the Sub-Adviser, including the nature, extent and quality of such services, and (2) in light of the relevant circumstances for the fund and the extent to which economies of scale would be realized if the fund grows and whether fee levels reflect these economies of scale for the benefit of fund shareholders. Since Dreyfus, and not the fund, pays the Sub-Adviser pursuant to the Sub-Investment Advisory Agreement, the Board did not consider the Sub-Adviser’s profitability to be relevant to its deliberations. Dreyfus representatives also noted that, as a result of shared and allocated costs among funds in the Dreyfus fund complex, the extent of economies of scale could depend substantially on the level of assets in the complex as a whole, so that increases and decreases in complex-wide assets can affect potential economies of scale in a manner that is disproportionate to, or even in the opposite direction from, changes in the fund’s asset level.The Board also considered potential benefits to Dreyfus and the Sub-Adviser from acting as investment adviser and sub-investment adviser, respectively, and noted the soft dollar arrangements in effect for trading the fund’s investments.

| The Fund | 39 |

| INFORMATION ABOUT THE RENEWAL OF THE FUND’S |

| MANAGEMENT AGREEMENT (Unaudited) (continued) |

At the conclusion of these discussions, the Board agreed that it had been furnished with sufficient information to make an informed business decision with respect to the renewal of the Agreements. Based on the discussions and considerations as described above, the Board concluded and determined as follows.

-

The Board concluded that the nature, extent and quality of the services provided by Dreyfus and the Sub-Adviser are adequate and appropriate.

-

The Board generally was satisfied with the fund’s overall performance.

-

The Board concluded that the fees paid to Dreyfus and the Sub- Adviser were reasonable in light of the considerations described above.

-

The Board determined that the economies of scale which may accrue to Dreyfus and its affiliates in connection with the management of the fund had been adequately considered by Dreyfus in connection with the fee rate charged to the fund pursuant to the Agreement and that, to the extent in the future it were determined that material economies of scale had not been shared with the fund, the Board would seek to have those economies of scale shared with the fund.

The Board considered these conclusions and determinations, along with information received on a routine and regular basis throughout the year. In addition, it should be noted that the Board’s consideration of the contractual fee arrangements for this fund had the benefit of a number of years of reviews of prior or similar agreements during which lengthy discussions took place between the Board and Dreyfus representatives. Certain aspects of the arrangements may receive greater scrutiny in some years than in others, and the Board’s conclusions may be based, in part, on their consideration of the same or similar arrangements in prior years.The Board determined that renewal of the Agreements was in the best interests of the fund and its shareholders.

40

BOARD MEMBERS INFORMATION (Unaudited)

| Joseph S. DiMartino (68) |

| Chairman of the Board (1995) |

| Principal Occupation During Past 5Years: |

| • Corporate Director and Trustee |

| Other Public Company Board Memberships During Past 5Years: |

| • CBIZ (formerly, Century Business Services, Inc.), a provider of outsourcing functions for small |

| and medium size companies, Director (1997-present) |

| • Sunair Services Corporation, a provider of certain outdoor-related services to homes and |

| businesses, Director (2005-2009) |

| • The Newark Group, a provider of a national market of paper recovery facilities, paperboard |

| mills and paperboard converting plants, Director (2000-2010) |

| No. of Portfolios for which Board Member Serves: 164 |

| ——————— |

| Gordon J. Davis (70) |

| Board Member (1993) |

| Principal Occupation During Past 5Years: |

| • Partner in the law firm of Dewey & LeBoeuf LLP |

| Other Public Company Board Memberships During Past 5Years: |

| • Consolidated Edison, Inc., a utility company, Director (1997-present) |

| • The Phoenix Companies Inc., a life insurance company, Director (2000-present) |

| No. of Portfolios for which Board Member Serves: 42 |

| ——————— |

| David P. Feldman (72) |

| Board Member (1991) |

| Principal Occupation During Past 5Years: |

| • Corporate Director and Trustee |

| Other Public Company Board Memberships During Past 5Years: |