424B3 PALAC CORE 333-220103 2019 Combined Document

PRUDENTIAL ANNUITIES LIFE ASSURANCE CORPORATION

A Prudential Financial Company

One Corporate Drive, Shelton, Connecticut 06484

OPTIMUM XTRASM

Flexible Premium Deferred Annuities

PROSPECTUS: APRIL 29, 2019

This prospectus describes one flexible premium deferred annuity (the “Annuity”) issued by Prudential Annuities Life Assurance Corporation (“Prudential Annuities®”, “we”, “our”, or “us”) exclusively through LPL Financial Corporation. If you are receiving this prospectus, it is because you currently own this prospectus. The Annuity was offered as an individual annuity contract or as an interest in a group annuity. The Annuity has different features and benefits that may be appropriate for you based on your financial situation, your age and how you intend to use the Annuity. This Prospectus describes the important features of the Annuity. This prospectus is being provided for informational or educational purposes only and does not take into account the investment objectives or financial situation of any client or prospective clients. The information is not intended as investment advice and is not a recommendation about managing or investing your retirement savings. Clients seeking information regarding their particular investment needs should contact a financial professional. The Annuity or certain of its investment options and/or features may not be available in all states. In addition, the selling broker-dealer firm through which this Annuity is sold may decline to make available to its customers certain of the optional features and investment options offered generally under the Annuity. Alternatively, the firm may restrict the optional benefits that it makes available to its customers (e.g., by imposing a lower maximum issue age for certain optional benefits than what is prescribed generally under the Annuity). The selling broker-dealer firm may not make available or may not recommend the Annuity based on certain criteria. Please speak to your financial professional for further details. For the variations specific to Annuities approved for sale by the New York State Insurance Department, see Appendix E. The guarantees provided by the variable annuity contracts and the optional benefits are the obligations of and subject to the claims paying ability of Prudential Annuities. Certain terms are capitalized in this Prospectus. Those terms are either defined in the Glossary of Terms or in the context of the particular section. Because the Optimum XTra Annuity grants credits with respect to your Purchase Payments, the expenses of the Optimum XTra Annuity may be higher than expenses for an Annuity without a credit. In addition, the amount of the credits that you receive under the Optimum XTra Annuity may be more than offset over time by the additional fees and charges associated with the credit.

IMPORTANT INFORMATION

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the annual and semi-annual shareholder reports for portfolios available under your contract will no longer be sent by mail, unless you specifically request paper copies of the reports from us. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from us electronically anytime at our website www.prudential.com. You may elect to receive all future shareholder reports in paper free of charge by calling 1-888-778-2888. Your election to receive reports in paper will apply to all portfolios available under your contract.

THE SUB-ACCOUNTS

Each Sub-account of Prudential Annuities Life Assurance Corporation Variable Account B invests in an underlying mutual fund portfolio. Currently, portfolios of the following underlying mutual funds are being offered: Advanced Series Trust and Wells Fargo Variable Trust. See the following page for a complete list of Sub-accounts.

PLEASE READ THIS PROSPECTUS

Please read this Prospectus and the current prospectuses for the underlying mutual funds. Keep them for future reference.

Please note that if you purchase this Annuity within a tax advantaged retirement plan, such as an IRA, SEP-IRA, Roth IRA, 401(a) plan, or non-ERISA 403(b) plan, you will get no additional tax advantage through the Annuity itself. Because there is no additional tax advantage when a variable annuity is purchased through one of these plans, the reasons for purchasing the Annuity inside a qualified plan are limited to the ability to elect a living benefit, a death benefit, the opportunity to annuitize the contract and the various investment options, which might make the Annuity an appropriate investment for you. You should consult your tax and financial adviser regarding such features and benefits prior to purchasing this Annuity for use with a tax-qualified plan.

AVAILABLE INFORMATION

We have also filed a Statement of Additional Information that is available from us, without charge, upon your request. The contents of the Statement of Additional Information are described at the end of this prospectus under “Contents of Statement of Additional Information”. The Statement of Additional Information is incorporated by reference into this prospectus. This Prospectus is part of the registration statement we filed with the SEC regarding this offering. Additional information on us and this offering is available in the registration statement and the exhibits thereto. You may review and obtain copies of these materials at no cost to you, by contacting us. These documents, as well as documents incorporated by reference, may also be obtained through the SEC’s Internet Website (www.sec.gov) for this registration statement as well as for other registrants that file electronically with the SEC. Please see “How to Contact Us” later in this prospectus for our Service Office Address.

In compliance with U.S. law, Prudential Annuities delivers this prospectus to current contract owners that reside outside of the United States. In addition, we may not market or offer benefits, features or enhancements to prospective or current contract owners while outside of the United States.

The Annuity is NOT a deposit or obligation of, or issued, guaranteed or endorsed by, any bank, and are NOT insured or guaranteed by the U.S. government, the Federal Deposit Insurance Corporation (FDIC), the Federal Reserve Board or any other agency. An investment in an annuity involves investment risks, including possible loss of value, even with respect to amounts allocated to the AST Government Money Market Sub-account.

THESE SECURITIES HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION OR ANY STATE SECURITIES COMMISSION NOR HAS THE COMMISSION OR ANY STATE SECURITIES COMMISSION PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE. OPTIMUM XTRASM IS A SERVICE MARK OR REGISTERED TRADEMARK OF THE PRUDENTIAL INSURANCE COMPANY OF AMERICA AND IS USED UNDER LICENSE BY ITS AFFILIATES.

FOR FURTHER INFORMATION CALL: 1-888-PRU-2888 or at www.prudentialannuities.com

|

| |

Statement of Additional Information Dated: April 29, 2019 | Prospectus Dated: April 29, 2019 |

INVESTMENT OPTIONS

Please note that you may not allocate Purchase Payments to the AST Investment Grade Bond Portfolio or the target date bond

portfolios (e.g., AST Bond Portfolio 2025)

Advanced Series Trust

AST Academic Strategies Asset Allocation Portfolio

AST Balanced Asset Allocation Portfolio

AST BlackRock Low Duration Bond Portfolio

AST BlackRock/Loomis Sayles Bond Portfolio

AST Bond Portfolio 2019

AST Bond Portfolio 2020

AST Bond Portfolio 2021

AST Bond Portfolio 2022

AST Bond Portfolio 2023

AST Bond Portfolio 2024

AST Bond Portfolio 2025

AST Bond Portfolio 2026

AST Bond Portfolio 2027

AST Bond Portfolio 2028

AST Bond Portfolio 2029

AST Bond Portfolio 2030

AST Capital Growth Asset Allocation Portfolio

AST Cohen & Steers Realty Portfolio

AST Government Money Market Portfolio

AST Hotchkis & Wiley Large-Cap Value Portfolio

AST International Growth Portfolio

AST International Value Portfolio

AST Investment Grade Bond Portfolio

AST J.P. Morgan International Equity Portfolio

AST Loomis Sayles Large-Cap Growth Portfolio

AST MFS Growth Allocation Portfolio

AST MFS Growth Portfolio

AST Mid-Cap Growth Portfolio

AST Neuberger Berman/LSV Mid-Cap Value Portfolio

AST Preservation Asset Allocation Portfolio

AST Small-Cap Growth Opportunities Portfolio

AST Small-Cap Growth Portfolio

AST Small-Cap Value Portfolio

AST T. Rowe Price Large-Cap Growth Portfolio

AST T. Rowe Price Large-Cap Value Portfolio

AST Templeton Global Bond Portfolio

AST WEDGE Capital Mid-Cap Value Portfolio

AST Western Asset Core Plus Bond Portfolio

Wells Fargo Variable Trust:

Wells Fargo VT International Equity — Class 1

Wells Fargo VT Omega Growth — Class 1

CONTENTS

|

| |

GLOSSARY OF TERMS | |

SUMMARY OF CONTRACT FEES AND CHARGES | |

EXPENSE EXAMPLES | |

SUMMARY | |

INVESTMENT OPTIONS | |

WHAT ARE THE INVESTMENT OBJECTIVES AND POLICIES OF THE PORTFOLIOS? | |

WHAT ARE THE FIXED ALLOCATIONS? | |

FEES AND CHARGES | |

WHAT ARE THE CONTRACT FEES AND CHARGES? | |

WHAT CHARGES APPLY TO THE FIXED ALLOCATIONS? | |

WHAT CHARGES APPLY IF I CHOOSE AN ANNUITY PAYMENT OPTION? | |

EXCEPTIONS/REDUCTIONS TO FEES AND CHARGES | |

PURCHASING YOUR ANNUITY | |

WHAT ARE OUR REQUIREMENTS FOR PURCHASING THE ANNUITY? | |

MANAGING YOUR ANNUITY | |

MAY I CHANGE THE OWNER, ANNUITANT AND BENEFICIARY DESIGNATIONS? | |

MAY I RETURN MY ANNUITY IF I CHANGE MY MIND? | |

MAY I MAKE ADDITIONAL PURCHASE PAYMENTS? | |

MAY I MAKE SCHEDULED PAYMENTS DIRECTLY FROM MY BANK ACCOUNT? | |

MAY I MAKE PURCHASE PAYMENTS THROUGH A SALARY REDUCTION PROGRAM? | |

MANAGING YOUR ACCOUNT VALUE | |

HOW AND WHEN ARE PURCHASE PAYMENTS INVESTED? | |

HOW DO I RECEIVE CREDITS UNDER THE OPTIMUM XTRA ANNUITY? | |

HOW ARE CREDITS APPLIED TO ACCOUNT VALUE UNDER THE OPTIMUM XTRA ANNUITY? | |

ARE THERE RESTRICTIONS OR CHARGES ON TRANSFERS BETWEEN INVESTMENT OPTIONS? | |

DO YOU OFFER DOLLAR COST AVERAGING? | |

DO YOU OFFER ANY AUTOMATIC REBALANCING PROGRAMS? | |

ARE ANY ASSET ALLOCATION PROGRAMS AVAILABLE? | |

WHAT IS THE BALANCED INVESTMENT PROGRAM? | |

MAY I GIVE MY FINANCIAL PROFESSIONAL PERMISSION TO FORWARD TRANSACTION INSTRUCTIONS? | |

MAY I AUTHORIZE MY THIRD PARTY INVESTMENT ADVISOR TO MANAGE MY ACCOUNT? | |

HOW DO THE FIXED ALLOCATIONS WORK? | |

HOW DO YOU DETERMINE RATES FOR FIXED ALLOCATIONS? | |

HOW DOES THE MARKET VALUE ADJUSTMENT WORK? | |

WHAT HAPPENS WHEN MY GUARANTEE PERIOD MATURES? | |

ACCESS TO ACCOUNT VALUE | |

WHAT TYPES OF DISTRIBUTIONS ARE AVAILABLE TO ME? | |

ARE THERE TAX IMPLICATIONS FOR DISTRIBUTIONS FROM NONQUALIFIED ANNUITIES? | |

CAN I WITHDRAW A PORTION OF MY ANNUITY? | |

HOW MUCH CAN I WITHDRAW AS A FREE WITHDRAWAL? | |

CAN I MAKE PERIODIC WITHDRAWALS FROM MY ANNUITY DURING THE ACCUMULATION PERIOD? | |

DO YOU OFFER A PROGRAM FOR WITHDRAWALS UNDER SECTIONS 72(t) AND 72(q) OF THE INTERNAL REVENUE CODE? | |

WHAT ARE REQUIRED MINIMUM DISTRIBUTIONS AND WHEN WOULD I NEED TO MAKE THEM? | |

CAN I SURRENDER MY ANNUITY FOR ITS VALUE? | |

WHAT IS A MEDICALLY-RELATED SURRENDER AND HOW DO I QUALIFY? | |

WHAT TYPES OF ANNUITY OPTIONS ARE AVAILABLE? | |

HOW AND WHEN DO I CHOOSE THE ANNUITY PAYMENT OPTION? | |

HOW ARE ANNUITY PAYMENTS CALCULATED? | |

LIVING BENEFITS | |

DO YOU OFFER BENEFITS DESIGNED TO PROVIDE INVESTMENT PROTECTION FOR OWNERS WHILE THEY ARE ALIVE? | |

GUARANTEED RETURN OPTION PLUS II (GRO Plus II) | |

HIGHEST DAILY GUARANTEED RETURN OPTION II (HD GRO II) | |

GUARANTEED RETURN OPTION Plus 2008 (GRO Plus 2008) | |

HIGHEST DAILY GUARANTEED RETURN OPTIONSM (HD GROSM) | |

GUARANTEED MINIMUM WITHDRAWAL BENEFIT (GMWB) | |

|

| |

GUARANTEED MINIMUM INCOME BENEFIT (GMIB) | |

LIFETIME FIVE INCOME BENEFIT (LIFETIME FIVE) | |

SPOUSAL LIFETIME FIVESM INCOME BENEFIT (SPOUSAL LIFETIME FIVESM) | |

HIGHEST DAILY LIFETIME FIVE INCOME BENEFIT (HD5) | |

HIGHEST DAILY LIFETIME SEVEN INCOME BENEFIT (HD7) | |

SPOUSAL HIGHEST DAILY LIFETIME SEVEN INCOME BENEFIT (SHD7) | |

HIGHEST DAILY LIFETIME 7 PLUS INCOME BENEFIT (HD 7 Plus) | |

SPOUSAL HIGHEST DAILY LIFETIME 7 PLUS INCOME BENEFIT (SHD7 Plus) | |

HIGHEST DAILY LIFETIME 6 PLUS INCOME BENEFIT (HD 6 Plus) | |

SPOUSAL HIGHEST DAILY LIFETIME 6 PLUS INCOME BENEFIT (SHD6 Plus) | |

DEATH BENEFIT | |

WHAT TRIGGERS THE PAYMENT OF A DEATH BENEFIT? | |

BASIC DEATH BENEFIT | |

OPTIONAL DEATH BENEFITS | |

PRUDENTIAL ANNUITIES’ ANNUITY REWARDS | |

PAYMENT OF DEATH BENEFITS | |

EXCEPTIONS TO AMOUNT OF DEATH BENEFIT | |

VALUING YOUR INVESTMENT | |

HOW IS MY ACCOUNT VALUE DETERMINED? | |

WHAT IS THE SURRENDER VALUE OF MY ANNUITY? | |

HOW AND WHEN DO YOU VALUE THE SUB-ACCOUNTS? | |

HOW DO YOU VALUE FIXED ALLOCATIONS? | |

WHEN DO YOU PROCESS AND VALUE TRANSACTIONS? | |

WHAT HAPPENS TO MY UNITS WHEN THERE IS A CHANGE IN DAILY ASSET-BASED CHARGES? | |

TAX CONSIDERATIONS | |

NONQUALIFIED ANNUITIES | 162 |

QUALIFIED ANNUITIES | 166 |

GENERAL INFORMATION | |

HOW WILL I RECEIVE STATEMENTS AND REPORTS? | |

WHO IS PRUDENTIAL ANNUITIES? | |

WHAT ARE SEPARATE ACCOUNTS? | |

WHAT IS THE LEGAL STRUCTURE OF THE UNDERLYING FUNDS? | |

WHO DISTRIBUTES ANNUITIES OFFERED BY PRUDENTIAL ANNUITIES? | |

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE | |

FINANCIAL STATEMENTS | |

HOW TO CONTACT US | |

INDEMNIFICATION | |

LEGAL PROCEEDINGS | |

CONTENTS OF THE STATEMENT OF ADDITIONAL INFORMATION | |

| |

APPENDIX A – CONDENSED FINANCIAL INFORMATION ABOUT SEPARATE ACCOUNT B ACCUMULATION UNIT VALUES | |

APPENDIX B – CALCULATION OF OPTIONAL DEATH BENEFITS | |

APPENDIX C – ADDITIONAL INFORMATION ON ASSET ALLOCATION PROGRAMS | |

APPENDIX D – FORMULA UNDER HIGHEST DAILY LIFETIME FIVE INCOME BENEFIT | |

APPENDIX E – ANNUITIES APPROVED FOR SALE BY THE NEW YORK STATE INSURANCE DEPARTMENT | |

APPENDIX F – FORMULA UNDER GRO PLUS 2008 | |

APPENDIX G – FORMULA UNDER HIGHEST DAILY LIFETIME SEVEN INCOME BENEFIT AND SPOUSAL HIGHEST DAILY LIFETIME SEVEN INCOME BENEFIT | |

APPENDIX H – FORMULA FOR HIGHEST DAILY LIFETIME 7 PLUS INCOME BENEFIT AND SPOUSAL HIGHEST DAILY LIFETIME 7 PLUS INCOME BENEFIT | |

APPENDIX I – SPECIAL CONTRACT PROVISIONS FOR ANNUITIES ISSUED IN CERTAIN STATES | |

APPENDIX J – FORMULA FOR HIGHEST DAILY LIFETIME 6 PLUS INCOME BENEFIT AND SPOUSAL HIGHEST DAILY LIFETIME 6 PLUS INCOME BENEFIT | |

APPENDIX K – FORMULA FOR GRO PLUS II | |

APPENDIX L – FORMULA FOR HIGHEST DAILY GRO | |

APPENDIX M – FORMULA FOR HIGHEST DAILY GRO II | |

GLOSSARY OF TERMS

Many terms used within this Prospectus are described within the text where they appear. The description of those terms are not repeated in this Glossary of Terms.

Account Value: The value of each allocation to a Sub-account (also referred to as a “variable investment option”) plus any Fixed Allocation prior to the Annuity Date, increased by any earnings, and/or less any losses, distributions and charges. The Account Value is calculated before we assess any applicable Contingent Deferred Sales Charge (“CDSC” or “surrender charge”) and/or, unless the Account Value is being calculated on an annuity anniversary, any fee that is deducted from the Annuity annually in arrears. The Account Value is determined separately for each Sub-account and for each Fixed Allocation, and then totaled to determine the Account Value for your entire Annuity. The Account Value of each MVA Fixed Allocation on any day other than its Maturity Date may be calculated using a market value adjustment. The Account Value includes any Credits we applied to your purchase payments that we are entitled to take back under certain circumstances. With respect to the Highest Daily Lifetime Five Income Benefit election, Account Value includes the value of any allocation to the Benefit Fixed Rate Account.

Adjusted Purchase Payments: As used in the discussion of certain optional benefits in this prospectus and elsewhere, Adjusted purchase payments are purchase payments, increased by any Credits applied to your Account Value in relation to such Purchase Payments, and decreased by any charges deducted from such purchase payments.

Annual Income Amount: This is the annual amount of income you are eligible for life under the optional benefits.

Annuitization: The application of Account Value to one of the available annuity options for the Owner to begin receiving periodic payments for life (or joint lives), for a guaranteed minimum number of payments or for life with a guaranteed minimum number of payments.

Annuity Date: The date you choose for annuity payments to commence. Unless we agree otherwise, for Annuities issued on or after November 20, 2006, the Annuity Date must be no later than the first day of the calendar month coinciding with or next following the later of: (a) the oldest Owner’s or Annuitant’s 95th birthday, and (b) the fifth anniversary of the Issue Date, whichever occurs first.

Annuity Year: A 12-month period commencing on the Issue Date of the Annuity and each successive 12-month period thereafter.

Benefit Fixed Rate Account: A fixed investment option offered as part of this Annuity that is used only if you have elected the optional Highest Daily Lifetime Five Benefit. Amounts allocated to the Benefit Fixed Rate Account earn a fixed rate of interest, and are held within our general account. You may not allocate Purchase Payments to the Benefit Fixed Rate Account. Rather, Account Value is transferred to and from the Benefit Fixed Rate Account only under the pre-determined mathematical formula of the Highest Daily Lifetime Five Income Benefit.

Code: The Internal Revenue Code of 1986, as amended from time to time.

Combination 5% Roll-up And HAV Death Benefit: We offer an optional Death Benefit that, for an additional cost, provides an enhanced level of protection for your beneficiary(ies) by providing the greater of the Highest Anniversary Value Death Benefit and a 5% annual increase on purchase payments adjusted for withdrawals.

Contingent Deferred Sales Charge (CDSC): This is a sales charge that may be deducted when you make a full or partial withdrawal under your Annuity. We refer to this as a “contingent” charge because it can be imposed only if you make a withdrawal. The charge is a percentage of each applicable Purchase Payment that is being withdrawn. The period during which a particular percentage applies is measured from the Issue Date of the Annuity.

Enhanced Beneficiary Protection Death Benefit: An optional Death Benefit that, for an additional cost, provides an enhanced level of protection for your beneficiary(ies) by providing amounts in addition to the basic Death Benefit that can be used to offset federal and state taxes payable on any taxable gains in your Annuity at the time of your death. We no longer offer the Enhanced Beneficiary Protection Death Benefit.

Excess Income: All or a portion of a Lifetime Withdrawal that exceeds the Annual Income Amount for that benefit year is considered excess income (“Excess Income”). Each withdrawal of Excess Income proportionally reduces the Annual Income Amount for future benefit years.

Fixed Allocation: An investment option that offers a fixed rate of interest for a specified Guarantee Period during the accumulation period. Certain Fixed Allocations are subject to a market value adjustment if you withdraw Account Value prior to the Fixed Allocation’s maturity (MVA Fixed Allocation).

Free Look: Under state insurance laws, you have the right, during a limited period of time, to examine your Annuity and decide if you want to keep it or cancel it. This right is referred to as your “free look” right. The length of this time period depends on the laws of your state, and may vary depending on whether your purchase is a replacement or not.

Good Order: An instruction received by us, utilizing such forms, signatures, and dating as we require, which is sufficiently complete and clear that we do not need to exercise any discretion to follow such instructions. In your Annuity contract, we use the term “In Writing” to refer to this general requirement.

Guarantee Period: A period of time during the accumulation period where we credit a fixed rate of interest on a Fixed Allocation.

Guaranteed Minimum Income Benefit (GMIB): An optional benefit that, for an additional cost, after a seven-year waiting period, guarantees your ability to begin receiving income from your Annuity in the form of annuity payments based on your total purchase payments and an annual increase

of 5% on such purchase payments adjusted for withdrawals (called the “Protected Income Value”), regardless of the impact of Sub-account performance on your Account Value. We no longer offer GMIB.

Guaranteed Minimum Withdrawal Benefit (GMWB): An optional benefit that, for an additional cost, guarantees your ability to withdraw amounts over time equal to an initial principal value, regardless of the impact of Sub-account performance on your Account Value. We no longer offer GMWB.

Guaranteed Return Option Plus 2008(GRO Plus 2008)/Highest Daily® Guaranteed Return Option (Highest Daily GRO)/Guaranteed Return Option Plus II (GRO Plus II)/Highest Daily® Guaranteed Return Option II (HD GRO II): Each of GRO Plus 2008, Highest Daily GRO, GRO Plus II, and HD GRO II is a separate optional benefit that, for an additional cost, guarantees a minimum Account Value at one or more future dates and that requires your participation in a program that may transfer your Account Value according to a predetermined mathematical formula. Each benefit has different features, so please consult the pertinent benefit description in the section of the prospectus entitled “Living Benefits”. Certain of these benefits are no longer available for election.

Highest Anniversary Value Death Benefit (“HAV”): An optional Death Benefit that, for an additional cost, provides an enhanced level of protection for your beneficiary(ies) by providing a death benefit equal to the greater of the basic Death Benefit and the Highest Anniversary Value, less proportional withdrawals. We no longer offer HAV.

Highest Daily Lifetime® Five Income Benefit: An optional benefit that, for an additional cost, guarantees your ability to withdraw an annual amount equal to a percentage of a guaranteed benefit base called the Total Protected Withdrawal Value. Subject to our rules regarding the timing and amount of withdrawals, we guarantee these withdrawal amounts, regardless of the impact of Sub-account performance on your Account Value. We no longer offer Highest Daily Lifetime Five.

Highest Daily Lifetime® Seven Income Benefit: An optional benefit for an additional charge, that guarantees your ability to withdraw amounts equal to a percentage of a guaranteed benefit base called the Protected Withdrawal Value. Subject to our rules regarding the timing and amount of withdrawals, we guarantee these withdrawal amounts, regardless of the impact of Sub-account performance on your Account Value. Highest Daily Lifetime Seven is the same class of optional benefits as our Highest Daily Lifetime Five Income Benefit, but differs (among other things) with respect to how the Protected Withdrawal Value is calculated and how the lifetime withdrawals are calculated. We no longer offer Highest Daily Lifetime Seven.

Highest Daily Lifetime® 7 Plus Income Benefit: An optional benefit that is available for an additional charge. The benefit guarantees your ability to withdraw amounts equal to a percentage of a guaranteed benefit base called the Protected Withdrawal Value. Subject to our rules regarding the timing and amount of withdrawals, we guarantee these withdrawal amounts, regardless of the impact of Sub-account performance on your Account Value. Highest Daily Lifetime 7 Plus is the same class of optional benefit as our Highest Daily Lifetime Seven Income Benefit, but differs (among other things) with respect to how the Protected Withdrawal Value is calculated and how the lifetime withdrawals are calculated. We no longer offer Highest Daily Lifetime 7 Plus.

Highest Daily Lifetime® 6 Plus Income Benefit: An optional benefit that is available for an additional charge. The benefit guarantees your ability to withdraw amounts equal to a percentage of a guaranteed benefit base called the Protected Withdrawal Value. Subject to our rules regarding the timing and amount of withdrawals, we guarantee these withdrawal amounts, regardless of the impact of Sub-account performance on your Account Value. Highest Daily Lifetime 6 Plus is the same class of optional benefit as our Highest Daily Lifetime 7 Plus Income Benefit, but differs (among other things) with respect to how the Protected Withdrawal Value is calculated and how the lifetime withdrawals are calculated. We no longer offer Highest Daily Lifetime 6 Plus.

Highest Daily® Value Death Benefit (“HDV”): An optional benefit that, for an additional cost, provides an enhanced level of protection for your beneficiary(ies) by providing a death benefit equal to the greater of the basic Death Benefit and the Highest Daily Value, less proportional withdrawals. We no longer offer HDV.

Interim Value: The value of the MVA Fixed Allocations on any date other than the Maturity Date. The Interim Value is equal to the initial value allocated to the MVA Fixed Allocations plus all interest credited to the MVA Fixed Allocations as of the date calculated, less any transfers or withdrawals from the MVA Fixed Allocations. The Interim Value does not include the effect of any MVA.

Issue Date: The effective date of your Annuity.

Key Life: Under the Beneficiary Continuation Option, the person whose life expectancy is used to determine payments.

Lifetime Five Income Benefit: An optional benefit that, for an additional cost, guarantees your ability to withdraw an annual amount equal to a percentage of an initial principal value called the Protected Withdrawal Value. Subject to our rules regarding the timing and amount of withdrawals, we guarantee these withdrawal amounts, regardless of the impact of Sub-account performance on your Account Value. We no longer offer Lifetime Five.

MVA: A market value adjustment used in the determination of Account Value of an MVA Fixed Allocation on any day more than 30 days prior to the Maturity Date of such MVA Fixed Allocation.

Owner: With an Annuity issued as an individual annuity contract, the Owner is either an eligible entity or person named as having ownership rights in relation to the Annuity. With an Annuity issued as a certificate under a group annuity contract, the “Owner” refers to the person or entity who has the rights and benefits designated as to the “Participant” in the certificate.

Service Office: The place to which all requests and payments regarding an Annuity are to be sent. We may change the address of the Service Office at any time. Please see the section of this prospectus entitled “How to Contact Us” for the Service Office address.

Spousal Highest Daily Lifetime® Seven Income Benefit: An optional benefit that, for an additional charge, guarantees your ability to withdraw amounts equal to a percentage of a guaranteed benefit base called the Protected Withdrawal Value. Subject to our rules regarding the timing and amount of withdrawals, we guarantee these withdrawal amounts, regardless of the impact of Sub-account performance on your Account Value. The benefit is the spousal version of the Highest Daily Lifetime Seven Income Benefit and is the same class of optional benefit as our Highest Daily Lifetime Five Income Benefit, but differs (among other things) with respect to how the Protected Withdrawal Value is calculated and to how the lifetime withdrawals are calculated. We no longer offer Spousal Highest Daily Lifetime Seven.

Spousal Highest Daily Lifetime® 7 Plus Income Benefit: An optional benefit that, for an additional charge, guarantees your ability to withdraw amounts equal to a percentage of a guaranteed benefit base called the Protected Withdrawal Value. Subject to our rules regarding the timing and amount of withdrawals, we guarantee these withdrawal amounts, regardless of the impact of Sub-account performance on your Account Value. The benefit is the spousal version of the Highest Daily Lifetime 7 Plus Income Benefit and is the same class of optional benefit as our Spousal Highest Daily Lifetime Seven Income Benefit, but differs (among other things) with respect to how the Protected Withdrawal Value is calculated and to how the lifetime withdrawals are calculated. We no longer offer Spousal Highest Daily Lifetime 7 Plus.

Spousal Highest Daily Lifetime® 6 Plus Income Benefit: An optional benefit that, for an additional charge, guarantees your ability to withdraw amounts equal to a percentage of a guaranteed benefit base called the Protected Withdrawal Value. Subject to our rules regarding the timing and amount of withdrawals, we guarantee these withdrawal amounts, regardless of the impact of Sub-account performance on your Account Value. The benefit is the spousal version of the Highest Daily Lifetime 6 Plus Income Benefit and is the same class of optional benefit as our Spousal Highest Daily Lifetime 7 Plus Income Benefit, but differs (among other things) with respect to how the Protected Withdrawal Value is calculated and to how the lifetime withdrawals are calculated. We no longer offer Spousal Highest Daily Lifetime 6 Plus.

Spousal Lifetime Five Income Benefit: An optional benefit that, for an additional cost, guarantees until the later death of two Designated Lives (as defined in this Prospectus) the ability to withdraw an annual amount equal to a percentage of an initial principal value called the Protected Withdrawal Value. Subject to our rules regarding the timing and amount of withdrawals, we guarantee these withdrawal amounts, regardless of the impact of Sub-account performance on your Account Value. We no longer offer Spousal Lifetime Five.

Sub-account: We issue your Annuity through our separate account. See “What is the Separate Account?” under the General Information section. The separate account invests in underlying mutual fund portfolios. From an accounting perspective, we divide the separate account into a number of sections, each of which corresponds to a particular underlying mutual fund portfolio. We refer to each such section of our separate account as a “Sub-account”.

Surrender Value: The value of your Annuity available upon surrender prior to the Annuity Date. It equals the Account Value as of the date we price the surrender minus any applicable CDSC, Annual Maintenance Fee, any Tax Charge and the charge for any optional benefits and any additional amounts we applied to your purchase payments that we may be entitled to recover under certain circumstances. The surrender value may be calculated using a MVA with respect to amounts in any MVA Fixed Allocation.

Unit: A measure used to calculate your Account Value in a Sub-account during the accumulation period.

Unit Value: Each Variable Sub-Account has a separate value for its Units (this is analogous to, but not the same as, the share price of a mutual fund).

Valuation Day: Every day the New York Stock Exchange is open for trading or any other day the Securities and Exchange Commission requires mutual funds or unit investment trusts to be valued, not including any day: (1) trading on the NYSE is restricted; (2) an emergency, as determined by the SEC, exists making redemption or valuation of securities held in the Separate Account impractical; or (3) the SEC, by order, permits the suspension or postponement for the protection of security holders.

SUMMARY OF CONTRACT FEES AND CHARGES

Below is a summary of the fees and charges for the Annuity. Some fees and charges are assessed against the Annuity while others are assessed against assets allocated to the Sub-accounts. The fees and charges that are assessed against an Annuity include any applicable Contingent Deferred Sales Charge, Transfer Fee, Tax Charge and Annual Maintenance Fee. The charges that are assessed against the Sub-accounts are the Mortality and Expense Risk charge, the charge for Administration of the Annuity, any applicable Distribution Charge and the charge for certain optional benefits you elect. Certain optional benefits deduct a charge from each Annuity based on a percentage of a “protected value.” Each underlying mutual fund portfolio assesses a fee for investment management, other expenses and, with some mutual funds, a 12b-1 fee. The prospectus for each underlying mutual fund provides more detailed information about the expenses for the underlying mutual funds.

The following tables provide a summary of the fees and charges you will pay if you surrender your Annuity or transfer Account Value among investment options. These fees and charges are described in more detail within this Prospectus.

FOR CHARGES SPECIFIC TO CONTRACTS ISSUED IN NEW YORK STATE, PLEASE REFER TO APPENDIX E – ANNUITIES APPROVED FOR SALE BY THE NEW YORK STATE INSURANCE DEPARTMENT

|

|

TRANSACTION FEES AND CHARGES |

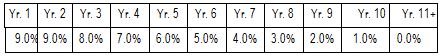

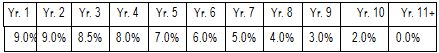

CONTINGENT DEFERRED SALES CHARGES (CDSC) FOR THE ANNUITY 1

OPTIMUM XTRA

|

| | | | | | | | | | |

Yr. 1 | Yr. 2 | Yr. 3 | Yr. 4 | Yr. 5 | Yr. 6 | Yr. 7 | Yr. 8 | Yr. 9 | Yr. 10 | Yr. 11+ |

9.0% | 9.0% | 8.0% | 7.0% | 6.0% | 5.0% | 4.0% | 3.0% | 2.0% | 1.0% | 0.0% |

| |

1 | The Contingent Deferred Sales Charges, if applicable, are assessed upon surrender or withdrawal. The charge is a percentage of each applicable Purchase Payment deducted upon surrender or withdrawal. The period during which a particular percentage applies is measured from the Issue Date of the Annuity. Purchase Payments are withdrawn on a “first-in, first-out” basis. |

|

| |

OTHER TRANSACTION FEES AND CHARGES (assessed against the Annuity) |

FEE/CHARGE | OPTIMUM XTRA |

Transfer Fee 2 | $15.00 maximum currently, $10.00 |

Tax Charge 3 | 0% to 3.5% |

| |

2 | Currently, we deduct the fee after the 20th transfer each Annuity Year. We guarantee that the number of charge free transfers per Annuity Year will never be less than 8. |

| |

3 | In some states a tax is payable, either when purchase payments are received, upon surrender or when the Account Value is applied under an annuity option. The Tax Charge is assessed as a percentage of purchase payments, Surrender Value, or Account Value, as applicable. We reserve the right to deduct the charge either at the time the tax is imposed, upon a full surrender of the Annuity, or upon annuitization. See the subsection “Tax Charge” under “Fees and Charges” in this Prospectus. |

The following table provides a summary of the periodic fees and charges you will pay while you own your Annuity, excluding the underlying portfolio annual expenses. These fees and charges are described in more detail within this Prospectus.

|

| |

PERIODIC FEES AND CHARGES (assessed against the Annuity) |

FEE/CHARGE | OPTIMUM XTRA |

Annual Maintenance Fee 4 | Lesser of $35 or 2% of Account Value |

Beneficiary Continuation Option Only | Lesser of $30 or 2% of Account Value |

|

| |

ANNUAL FEES/CHARGES OF THE SUB-ACCOUNTS 6 (assessed as a percentage of the daily net assets of the Sub-accounts) |

FEE/CHARGE | OPTIMUM XTRA |

Mortality & Expense Risk Charge 6 | 1.60% |

Administration Charge 6 | 0.15% |

Settlement Service Charge 7 | 1.40% (qualified); 1.00% (nonqualified) |

Total Annual Charges of The Sub-accounts (excluding settlement service charge) | 1.75% |

| |

4 | Assessed annually on the Annuity’s anniversary date or upon surrender. For beneficiaries who elect the Beneficiary Continuation Option, the fee is only applicable if Account Value is less than $25,000 at the time the fee is assessed. |

| |

5 | These charges are deducted daily and apply to the Sub-accounts only. |

| |

6 | The combination of the Mortality and Expense Risk Charge and Administration Charge is referred to as the “Insurance Charge” elsewhere in this Prospectus. |

| |

7 | The Mortality & Expense Risk Charge and the Administration Charge do not apply if you are a beneficiary under the Beneficiary Continuation Option. The Settlement Service Charge applies only if your beneficiary elects the Beneficiary Continuation Option. |

The following table sets forth the charge for each optional benefit under the Annuity. The fees for these optional benefits would be in addition to the fees set forth in the tables above. The first column shows the charge for each optional benefit on a maximum and current basis. Then, we show the total expenses you would pay for an Annuity if you purchased the relevant optional benefit. More specifically, we show the total charge for the optional benefit plus the Total Annualized Insurance Fees/Charges applicable to the Annuity. Where the charges cannot actually be totaled (because they are assessed against different base values), we show both individual charges. In general, we reserve the right to increase the charge to the maximum charge indicated, upon any step-up or reset under the benefit, or new election of the benefit. However, we have no present intention of doing so. The total charge column depicts the sum of the applicable Insurance Charge and the charge for the particular optional benefit.

|

| | |

YOUR OPTIONAL BENEFIT FEES AND CHARGES 9 |

OPTIONAL BENEFIT | OPTIONAL

BENEFIT FEE/

CHARGE | TOTAL ANNUAL

CHARGE 10 for OPTIMUM

XTRA |

GRO PLUS II | | |

Current and Maximum Charge 10 (assessed against Sub-account net assets) | 0.60% | 2.35% |

HIGHEST DAILY GRO II | | |

Current and Maximum Charge 10 (assessed against Sub-account net assets) | 0.60% | 2.35% |

HIGHEST DAILY LIFETIME 6 PLUS (HD 6 PLUS) | | |

Maximum Charge 11 (assessed against greater of Account Value and PWV) | 1.50% | 1.75% + 1.50% |

Current Charge (assessed against greater of Account Value and PWV) | 0.85% | 1.75% + 0.85% |

HIGHEST DAILY LIFETIME 6 PLUS WITH LIFETIME INCOME ACCELERATOR (LIA) | | |

Maximum Charge 11 (assessed against greater of Account Value and PWV) | 2.00% | 1.75% + 2.00% |

Current Charge (assessed against greater of Account Value and PWV) | 1.20% | 1.75% + 1.20% |

SPOUSAL HIGHEST DAILY LIFETIME 6 PLUS | | |

Maximum Charge 11 (assessed against greater of Account Value and PWV) | 1.50% | 1.75% + 1.50% |

Current Charge (assessed against greater of Account Value and PWV) | 0.95% | 1.75% + 0.95% |

GUARANTEED RETURN OPTION PLUS 2008

(GRO Plus 2008) | | |

Maximum Charge 11 (assessed against Sub-account net assets) | 0.75% | 2.50% |

Current Charge (assessed against Sub-account net assets) (if elected on or after May 1, 2009) | 0.60% | 2.35% |

HIGHEST DAILY GUARANTEED RETURN OPTION

(HD GRO) | | |

Current and Maximum Charge 10 (if elected on or after May 1, 2009) (assessed against Sub-account net assets) | 0.75% | 2.50% |

GUARANTEED MINIMUM WITHDRAWAL BENEFIT (GMWB) | | |

Maximum Charge 11 (assessed against Sub-account net assets) | 1.00% | 2.75% |

Current Charge (assessed against Sub-account net assets) | 0.35% | 2.10% |

GUARANTEED MINIMUM INCOME BENEFIT

(GMIB) | | |

Maximum Charge 11 (assessed against PIV) | 1.00% | 1.75% + 1.00% |

Current Charge (assessed against PIV) | 0.50% | 1.75% + 0.50% |

|

| | |

YOUR OPTIONAL BENEFIT FEES AND CHARGES 9 |

OPTIONAL BENEFIT | OPTIONAL

BENEFIT FEE/

CHARGE | TOTAL ANNUAL

CHARGE 10 for OPTIMUM

XTRA |

LIFETIME FIVE INCOME BENEFIT | | |

Maximum Charge 11 (assessed against Sub-account net assets) | 1.50% | 3.25% |

Current Charge (assessed against Sub-account net assets) | 0.60% | 2.35% |

SPOUSAL LIFETIME FIVE INCOME BENEFIT | | |

Maximum Charge 11 (assessed against Sub-account net assets) | 1.50% | 3.25% |

Current Charge (assessed against Sub-account net assets) | 0.75% | 2.50% |

HIGHEST DAILY LIFETIME FIVE INCOME BENEFIT | | |

Maximum Charge 11 | 1.50% | 3.25% |

Current Charge | 0.60% | 2.35% |

HIGHEST DAILY LIFETIME SEVEN INCOME BENEFIT | | |

Maximum Charge 11 (assessed against the PWV) | 1.50% | 1.75% + 1.50% |

Current Charge (assessed against the PWV) | 0.60% | 1.75% + 0.60% |

HIGHEST DAILY LIFETIME SEVEN WITH BENEFICIARY INCOME OPTION (BIO) | | |

Maximum Charge 11 (assessed against the PWV) | 2.00% | 1.75% + 2.00% |

Current Charge (assessed against the PWV) | 0.95% | 1.75% + 0.95% |

HIGHEST DAILY LIFETIME SEVEN WITH LIFETIME INCOME ACCELERATOR (LIA) | | |

Maximum Charge 11 (assessed against the PWV) | 2.00% | 1.75% + 2.00% |

Current Charge (assessed against the PWV) | 0.95% | 1.75% + 0.95% |

SPOUSAL HIGHEST DAILY LIFETIME SEVEN INCOME BENEFIT | | |

Maximum Charge 11 (assessed against the PWV) | 1.50% | 1.75% + 1.50% |

Current Charge (assessed against the PWV) | 0.75% | 1.75% + 0.75% |

SPOUSAL HIGHEST DAILY LIFETIME SEVEN WITH BENEFICIARY INCOME OPTION (BIO) | | |

Maximum Charge 11 (assessed against the PWV) | 2.00% | 1.75% + 2.00% |

Current Charge (assessed against the PWV) | 0.95% | 1.75% + 0.95% |

HIGHEST DAILY LIFETIME 7 PLUS | | |

Maximum Charge 11 (assessed against the greater of Account Value and PWV) | 1.50% | 1.75% + 1.50% |

Current Charge (assessed against the greater of Account Value and PWV) | 0.75% | 1.75% + 0.75% |

HIGHEST DAILY LIFETIME 7 PLUS WITH BENEFICIARY INCOME OPTION (BIO) | | |

Maximum Charge 11 (assessed against the greater of Account Value and PWV) | 2.00% | 1.75% + 2.00% |

Current Charge (assessed against the greater of Account Value and PWV) | 1.10% | 1.75% + 1.10% |

SPOUSAL HIGHEST DAILY LIFETIME 7 PLUS | | |

Maximum Charge 11 (assessed against the greater of Account Value and PWV) | 1.50% | 1.75% + 1.50% |

Current Charge (assessed against the greater of Account Value and PWV) | 0.90% | 1.75% + 0.90% |

HIGHEST DAILY LIFETIME 7 PLUS WITH LIFETIME INCOME ACCELERATOR (LIA) | | |

Maximum Charge 11 (assessed against the greater of Account Value and PWV) | 2.00% | 1.75% + 2.00% |

Current Charge (assessed against the greater of Account Value and PWV) | 1.10% | 1.75% + 1.10% |

|

| | |

YOUR OPTIONAL BENEFIT FEES AND CHARGES 9 |

OPTIONAL BENEFIT | OPTIONAL

BENEFIT FEE/

CHARGE | TOTAL ANNUAL

CHARGE 10 for OPTIMUM

XTRA |

SPOUSAL HIGHEST DAILY LIFETIME 7 PLUS WITH BENEFICIARY INCOME OPTION (BIO) | | |

Maximum Charge 11 (assessed against the greater of Account Value and PWV) | 2.00% | 1.75% + 2.00% |

Current Charge (assessed against the greater of Account Value and PWV) | 1.10% | 1.75% + 1.10% |

ENHANCED BENEFICIARY PROTECTION DEATH BENEFIT | | |

Current and Maximum Charge 10 (assessed against Sub-account net assets) | 0.25% | 2.00% |

HIGHEST ANNIVERSARY VALUE DEATH BENEFIT (“HAV”) | | |

Current and Maximum Charge 10 (assessed against Sub-account net assets) | 0.25% | 2.00% |

COMBINATION 5% ROLL-UP AND HAV DEATH BENEFIT | | |

Current and Maximum Charge 10 (assessed against Sub-account net assets) | 0.50% | 2.25% |

HIGHEST DAILY VALUE DEATH BENEFIT (“HDV”) | | |

Current and Maximum Charge 10 (assessed against Sub-account net assets) | 0.50% | 2.25% |

Please refer to the section of this Prospectus that describes each optional benefit for a complete description of the benefit, including any restrictions or limitations that may apply. |

| |

8 | GRO Plus II: Charge for this benefit is assessed against the daily net assets of the Sub-accounts. The 2.35% total annual charge applies. |

Highest Daily GRO II: Charge for this benefit is assessed against the daily net assets of the Sub-accounts. The 2.35% total annual charge applies.

Highest Daily Lifetime 6 Plus: Charge for this benefit is assessed against the greater of Account Value and Protected Withdrawal Value. As discussed in the description of the benefit, the charge is taken out of the Sub-accounts and the DCA Fixed Rate Options, if applicable. Under certain circumstances, we may not deduct the charge or may only deduct a portion of the charge (see the description of the benefit for details). 0.85% is in addition to 1.75% annual charge of amounts invested in the Sub-accounts. This benefit is no longer available for new elections.

Highest Daily Lifetime 6 Plus with LIA: Charge for this benefit is assessed against the greater of Account Value and Protected Withdrawal Value. As discussed in the description of the benefit, the charge is taken out of the Sub-accounts and the DCA Fixed Rate Options, if applicable. Under certain circumstances, we may not deduct the charge or may only deduct a portion of the charge (see the description of the benefit for details). 1.20% is in addition to 1.75% annual charge of amounts invested in the Sub-accounts. This benefit is no longer available for new elections.

Spousal Highest Daily Lifetime 6 Plus: Charge for this benefit is assessed against the greater of Account Value and Protected Withdrawal Value. As discussed in the description of the benefit, the charge is taken out of the Sub-accounts and the DCA Fixed Rate Options, if applicable. Under certain circumstances, we may not deduct the charge or may only deduct a portion of the charge (see the description of the benefit for details). 0.95% is in addition to 1.75% annual charge of amounts invested in the Sub-accounts. This benefit is no longer available for new elections.

GRO Plus 2008: Charge for the benefit is assessed against the daily net assets of the Sub-accounts. For elections prior to May 1, 2009, the charge is 0.35% of Sub-account assets, for a 2.10% total annual charge. For elections on or after May 1, 2009, the charge is 0.60%, for a total annual charge of 2.35%. This benefit is no longer available.

Highest Daily GRO: Charge for this benefit is assessed against the daily net assets of the Sub-accounts. If you elected the benefit prior to May 1, 2009, the fees are as follows: The current charge is .35% of Sub-account assets, and 2.10% total annual charge applies. For elections on or after May 1, 2009, the charge is 0.60%, for a total annual charge of 2.35%. This benefit is no longer available.

Guaranteed Minimum Withdrawal Benefit: Charge for this benefit is assessed against the daily net assets of the Sub-accounts. 2.10% total annual charge applies. This benefit is no longer available for new elections.

Guaranteed Minimum Income Benefit: Charge for this benefit is assessed against the GMIB Protected Income Value (“PIV”). As discussed in the description of the benefit, the charge is taken out of the Sub-accounts and the Fixed Allocations. 0.50% of PIV is in addition to 1.75% annual charge. This benefit is no longer available for new elections.

Lifetime Five Income Benefit: Charge for this benefit is assessed against the daily net assets of the Sub-accounts. 2.35% total annual charge applies. This benefit is no longer available for new elections.

Spousal Lifetime Five Income Benefit: Charge for this benefit is assessed against the daily net assets of the Sub-accounts. 2.50% total annual charge applies. This benefit is no longer available for new elections.

Highest Daily Lifetime Five Income Benefit: Charge for this benefit is assessed against the daily net assets of the Sub-accounts. 2.35% total annual charge applies. This benefit is no longer available for new elections.

Highest Daily Lifetime Seven: 0.60% of PWV is in addition to 1.75% annual charge. PWV is described in the Living Benefits section of this Prospectus. This benefit is no longer available for new elections.

Highest Daily Lifetime Seven with BIO: Charge for this benefit is assessed against the Protected Withdrawal Value (“PWV”). As discussed in the description of the benefit, the charge is taken out of the Sub-accounts. 0.95% of PWV is in addition to 1.75% annual charge. This benefit is no longer available for new elections.

Highest Daily Lifetime Seven with LIA: Charge for this benefit is assessed against the Protected Withdrawal Value (“PWV”). As discussed in the description of the benefit, the charge is taken out of the Sub-accounts. 0.95% of PWV is in addition to 1.75% annual charge. This benefit is no longer available for new elections.

Spousal Highest Daily Lifetime Seven with BIO: Charge for this benefit is assessed against the Protected Withdrawal Value (“PWV”). As discussed in the description of the benefit, the charge is taken out of the Sub-accounts. 0.95% of PWV is in addition to 1.75% annual charge. This benefit is no longer available for new elections.

Spousal Highest Daily Lifetime Seven: Charge for this benefit is assessed against the Protected Withdrawal Value (“PWV”). As discussed in the description of the benefit, the charge is taken out of the Sub-accounts. 0.75% of PWV is in addition to 1.75% annual charge. This benefit is no longer available for new elections.

Highest Daily Lifetime 7 Plus: Charge for this benefit is assessed against the greater of Account Value and Protected Withdrawal Value. As discussed in the description of the benefit, the charge is taken out of the Sub-accounts. 0.75% is in addition to 1.75% annual charge. This benefit is no longer available for new elections.

Highest Daily Lifetime 7 Plus with BIO: Charge for this benefit is assessed against the greater of Account Value and Protected Withdrawal Value. As discussed in the description of the benefit, the charge is taken out of the Sub-accounts. 1.10% is in addition to 1.75% annual charge. This benefit is no longer available for new elections.

Highest Daily Lifetime 7 Plus with LIA: Charge for this benefit is assessed against the greater of Account Value and Protected Withdrawal Value. As discussed in the description of the benefit, the charge is taken out of the Sub-accounts. 1.10% is in addition to 1.75% annual charge. This benefit is no longer available for new elections.

Spousal Highest Daily Lifetime 7 Plus: Charge for this benefit is assessed against the greater of Account Value and Protected Withdrawal Value. As discussed in the description of the benefit, the charge is taken out of the Sub-accounts. 0.90% is in addition to 1.75% annual charge. This benefit is no longer available for new elections.

Spousal Highest Daily Lifetime 7 Plus with BIO: Charge for this benefit is assessed against the greater of Account Value and Protected Withdrawal Value. As discussed in the description of the benefit, the charge is taken out of the Sub-accounts. 1.10% is in addition to 1.75% annual charge. This benefit is no longer available for new elections.

Enhanced Beneficiary Protection Death Benefit: Charge for this benefit is assessed against the daily net assets of the Sub-accounts. 2.00% total annual charge applies. This benefit is no longer available for new elections.

Highest Anniversary Value Death Benefit: Charge for this benefit is assessed against the daily net assets of the Sub-accounts. 0.25% charge results in 2.00% total annual charge.

Combination 5% Roll-Up and HAV Death Benefit: Charge for this benefit is assessed against the daily net assets of the Sub-accounts. 0.50% charge results in 2.25% total annual charge.

Highest Daily Value Death Benefit: Charge for this benefit is assessed against the daily net assets of the Sub-accounts. 2.25% total annual charge applies. This benefit is no longer available for new elections.

| |

9 | The Total Annual Charge includes the Insurance Charge and Distribution Charge (if applicable) assessed against the daily net assets allocated to the Sub-accounts. If you elect more than one optional benefit, the Total Annual Charge would be increased to include the charge for each optional benefit. With respect to GMIB, the 0.50% charge is assessed against the GMIB Protected Income Value. With respect to Highest Daily Lifetime Seven, Spousal Highest Daily Lifetime Seven, Highest Daily Lifetime 7 Plus, Spousal Highest Daily Lifetime 7 Plus, Highest Daily Lifetime 6 Plus and Spousal Highest Daily Lifetime 6 Plus the charge is assessed against the Protected Withdrawal Value (greater of PWV and Account Value, for the “Plus” benefits). With respect to each of Highest Daily Lifetime Seven, Spousal Highest Daily Lifetime Seven, Highest Daily Lifetime 7 Plus, Spousal Highest Daily Lifetime 7 Plus, Highest Daily Lifetime 6 Plus and Spousal Highest Daily Lifetime 6 Plus one-fourth of the annual charge is deducted quarterly. These optional benefits are not available under the Beneficiary Continuation Option. |

| |

10 | Our reference in the fee table to “current and maximum” charge does not mean that we have the authority to increase the charge for Annuities that already have been issued. Rather, the reference indicates that there is no maximum charge to which the current charge could be increased for existing Annuities. However, our State filings may have included a provision allowing us to impose an increased charge for newly-issued Annuities. |

| |

11 | We reserve the right to increase the charge up to the maximum charge indicated, upon any step-up or reset under the benefit, or new election of the benefit. |

The following table provides the range (minimum and maximum) of the total annual expenses for the underlying mutual funds (“Portfolios”) as of December 31, 2018 before any contractual waivers and expense reimbursements. Each figure is stated as a percentage of the underlying Portfolio’s average daily net assets.

|

| | |

TOTAL ANNUAL UNDERLYING PORTFOLIO OPERATING EXPENSES |

| MINIMUM | MAXIMUM |

Total Underlying Portfolio Operating Expense | 0.57% | 2.49% |

The following are the total annual expenses for each underlying mutual fund (“Portfolio”) as of December 31, 2018, except as noted and except if the underlying portfolio’s inception date is subsequent to December 31, 2018 and do not necessarily reflect the fees you may incur. The “Total Underlying Annual Portfolio Operating Expenses” reflect the combination of the underlying Portfolio’s investment management fee, other expenses, any 12b-1 fees, and certain other expenses. Each figure is stated as a percentage of the underlying Portfolio’s average daily net assets. For certain of the Portfolios, a portion of the management fee has been contractually waived and/or other expenses have been contractually partially reimbursed, which is shown in the table. The following expenses are deducted by the underlying Portfolio before it provides Prudential Annuities with the daily net asset value. The underlying Portfolio information was provided by the underlying mutual funds and has not been independently verified by us. See the prospectuses or statements of additional information of the underlying Portfolios for further details. The current prospectus and statement of additional information for the underlying Portfolios can be obtained by calling 1-888-PRU-2888, or at www.prudentialannuities.com

|

| | | | | | | | | |

UNDERLYING PORTFOLIO ANNUAL EXPENSES |

(as a percentage of the average daily net assets of the underlying Portfolios) |

For the year ended December 31, 2018 |

FUNDS | Management Fees | Other Expenses | Distribution (12b-1) Fees | Dividend Expense on Short Sales | Broker Fees and Expenses on Short Sales | Acquired Portfolio Fees & Expenses | Total Annual Portfolio Operating Expenses | Fee Waiver or Expense Reimbursement | Net Annual Fund Operating Expenses |

AST Academic Strategies Asset Allocation Portfolio* | 0.64% | 0.02% | 0.11% | 0.04% | 0.00% | 0.62% | 1.43% | 0.01% | 1.42% |

AST Balanced Asset Allocation Portfolio | 0.15% | 0.01% | 0.00% | 0.00% | 0.00% | 0.79% | 0.95% | 0.00% | 0.95% |

AST BlackRock Low Duration Bond Portfolio* | 0.48% | 0.07% | 0.25% | 0.00% | 0.00% | 0.00% | 0.80% | 0.06% | 0.74% |

AST BlackRock/Loomis Sayles Bond Portfolio* | 0.46% | 0.03% | 0.25% | 0.00% | 0.06% | 0.00% | 0.80% | 0.04% | 0.76% |

AST Bond Portfolio 2019 | 0.47% | 0.16% | 0.25% | 0.00% | 0.00% | 0.00% | 0.88% | 0.00% | 0.88% |

AST Bond Portfolio 2020* | 0.47% | 0.31% | 0.25% | 0.00% | 0.00% | 0.00% | 1.03% | 0.10% | 0.93% |

AST Bond Portfolio 2021 | 0.47% | 0.16% | 0.25% | 0.00% | 0.00% | 0.00% | 0.88% | 0.00% | 0.88% |

AST Bond Portfolio 2022* | 0.47% | 0.22% | 0.25% | 0.00% | 0.00% | 0.00% | 0.94% | 0.01% | 0.93% |

AST Bond Portfolio 2023* | 0.47% | 0.42% | 0.25% | 0.00% | 0.00% | 0.00% | 1.14% | 0.21% | 0.93% |

AST Bond Portfolio 2024 | 0.47% | 0.19% | 0.25% | 0.00% | 0.00% | 0.00% | 0.91% | 0.00% | 0.91% |

AST Bond Portfolio 2025* | 0.47% | 0.22% | 0.25% | 0.00% | 0.00% | 0.00% | 0.94% | 0.01% | 0.93% |

AST Bond Portfolio 2026 | 0.47% | 0.09% | 0.25% | 0.00% | 0.00% | 0.00% | 0.81% | 0.00% | 0.81% |

AST Bond Portfolio 2027 | 0.47% | 0.08% | 0.25% | 0.00% | 0.00% | 0.00% | 0.80% | 0.00% | 0.80% |

AST Bond Portfolio 2028* | 0.47% | 0.24% | 0.25% | 0.00% | 0.00% | 0.00% | 0.96% | 0.03% | 0.93% |

AST Bond Portfolio 2029* | 0.47% | 1.77% | 0.25% | 0.00% | 0.00% | 0.00% | 2.49% | 1.56% | 0.93% |

AST Bond Portfolio 2030 | 0.47% | 0.08% | 0.25% | 0.00% | 0.00% | 0.00% | 0.80% | 0.00% | 0.80% |

AST Capital Growth Asset Allocation Portfolio | 0.15% | 0.01% | 0.00% | 0.00% | 0.00% | 0.79% | 0.95% | 0.00% | 0.95% |

AST Cohen & Steers Realty Portfolio | 0.83% | 0.03% | 0.25% | 0.00% | 0.00% | 0.00% | 1.11% | 0.00% | 1.11% |

AST Government Money Market Portfolio | 0.30% | 0.02% | 0.25% | 0.00% | 0.00% | 0.00% | 0.57% | 0.00% | 0.57% |

AST Hotchkis & Wiley Large-Cap Value Portfolio* | 0.56% | 0.02% | 0.25% | 0.00% | 0.00% | 0.00% | 0.83% | 0.01% | 0.82% |

AST International Growth Portfolio* | 0.81% | 0.03% | 0.25% | 0.00% | 0.00% | 0.00% | 1.09% | 0.02% | 1.07% |

AST International Value Portfolio | 0.81% | 0.04% | 0.25% | 0.00% | 0.00% | 0.00% | 1.10% | 0.00% | 1.10% |

AST Investment Grade Bond Portfolio* | 0.47% | 0.02% | 0.25% | 0.00% | 0.00% | 0.00% | 0.74% | 0.04% | 0.70% |

AST J.P. Morgan International Equity Portfolio | 0.70% | 0.06% | 0.25% | 0.00% | 0.00% | 0.00% | 1.01% | 0.00% | 1.01% |

AST Loomis Sayles Large-Cap Growth Portfolio* | 0.71% | 0.01% | 0.25% | 0.00% | 0.00% | 0.00% | 0.97% | 0.06% | 0.91% |

AST MFS Growth Allocation Portfolio* | 0.67% | 0.05% | 0.25% | 0.00% | 0.00% | 0.00% | 0.97% | 0.01% | 0.96% |

AST MFS Growth Portfolio* | 0.71% | 0.02% | 0.25% | 0.00% | 0.00% | 0.00% | 0.98% | 0.01% | 0.97% |

AST Mid-Cap Growth Portfolio | 0.81% | 0.02% | 0.25% | 0.00% | 0.00% | 0.00% | 1.08% | 0.00% | 1.08% |

AST Neuberger Berman/LSV Mid-Cap Value Portfolio | 0.72% | 0.02% | 0.25% | 0.00% | 0.00% | 0.00% | 0.99% | 0.00% | 0.99% |

AST Preservation Asset Allocation Portfolio | 0.15% | 0.01% | 0.00% | 0.00% | 0.00% | 0.78% | 0.94% | 0.00% | 0.94% |

AST Small-Cap Growth Opportunities Portfolio | 0.77% | 0.03% | 0.25% | 0.00% | 0.00% | 0.00% | 1.05% | 0.00% | 1.05% |

AST Small-Cap Growth Portfolio | 0.72% | 0.02% | 0.25% | 0.00% | 0.00% | 0.00% | 0.99% | 0.00% | 0.99% |

AST Small-Cap Value Portfolio | 0.72% | 0.03% | 0.25% | 0.00% | 0.00% | 0.06% | 1.06% | 0.00% | 1.06% |

AST T. Rowe Price Large-Cap Growth Portfolio* | 0.68% | 0.01% | 0.25% | 0.00% | 0.00% | 0.00% | 0.94% | 0.04% | 0.90% |

AST T. Rowe Price Large-Cap Value Portfolio* | 0.66% | 0.02% | 0.25% | 0.00% | 0.00% | 0.00% | 0.93% | 0.04% | 0.89% |

AST Templeton Global Bond Portfolio | 0.63% | 0.05% | 0.25% | 0.00% | 0.00% | 0.00% | 0.93% | 0.00% | 0.93% |

AST WEDGE Capital Mid-Cap Value Portfolio* | 0.78% | 0.04% | 0.25% | 0.00% | 0.00% | 0.00% | 1.07% | 0.01% | 1.06% |

AST Western Asset Core Plus Bond Portfolio | 0.51% | 0.01% | 0.25% | 0.00% | 0.00% | 0.00% | 0.77% | 0.00% | 0.77% |

Wells Fargo VT International Equity Fund - Class 1* | 0.80% | 0.26% | 0.00% | 0.00% | 0.00% | 0.01% | 1.07% | 0.37% | 0.70% |

Wells Fargo VT Omega Growth Fund - Class 1* | 0.60% | 0.21% | 0.00% | 0.00% | 0.00% | 0.00% | 0.81% | 0.06% | 0.75% |

|

|

AST Academic Strategies Asset Allocation Portfolio

The Manager has contractually agreed to waive 0.007% of its investment management fees through June 30, 2020. This arrangement may not be terminated or modified prior to June 30, 2020 without the prior approval of the Trust’s Board of Trustees. |

AST BlackRock Low Duration Bond Portfolio

The Manager has contractually agreed to waive 0.057% of its investment management fee through June 30, 2020. This arrangement may not be terminated or modified prior to June 30, 2020 without the prior approval of the Trust’s Board of Trustees. |

AST BlackRock/Loomis Sayles Bond Portfolio

The Manager has contractually agreed to waive 0.035% of its investment management fee through June 30, 2020. This arrangement may not be terminated or modified prior to June 30, 2020 without the prior approval of the Trust’s Board of Trustees. |

|

|

AST Bond Portfolio 2020

The Manager has contractually agreed to waive a portion of its investment management fee and/or reimburse certain expenses of the Portfolio so that the Portfolio's investment management fee plus other expenses (exclusive of certain expenses as described more fully in the Trust’s Statement of Additional Information) do not exceed 0.930% of the Portfolio's average daily net assets through June 30, 2020. Expenses waived/reimbursed by the Manager may be recouped by the Manager within the same fiscal year during which such waiver/reimbursement is made if such recoupment can be realized without exceeding the expense limit in effect at the time of the recoupment for that fiscal year. This arrangement may not be terminated or modified prior to June 30, 2020 without the prior approval of the Trust’s Board of Trustees. |

AST Bond Portfolio 2022

The Manager has contractually agreed to waive a portion of its investment management fee and/or reimburse certain expenses of the Portfolio so that the Portfolio's investment management fee plus other expenses (exclusive of certain expenses as described more fully in the Trust’s Statement of Additional Information) do not exceed 0.930% of the Portfolio's average daily net assets through June 30, 2020. Expenses waived/reimbursed by the Manager may be recouped by the Manager within the same fiscal year during which such waiver/reimbursement is made if such recoupment can be realized without exceeding the expense limit in effect at the time of the recoupment for that fiscal year. This arrangement may not be terminated or modified prior to June 30, 2020 without the prior approval of the Trust’s Board of Trustees. |

AST Bond Portfolio 2023

The Manager has contractually agreed to waive a portion of its investment management fee and/or reimburse certain expenses of the Portfolio so that the Portfolio's investment management fee plus other expenses (exclusive of certain expenses as described more fully in the Trust’s Statement of Additional Information) do not exceed 0.930% of the Portfolio's average daily net assets through June 30, 2020. Expenses waived/reimbursed by the Manager may be recouped by the Manager within the same fiscal year during which such waiver/reimbursement is made if such recoupment can be realized without exceeding the expense limit in effect at the time of the recoupment for that fiscal year. This arrangement may not be terminated or modified prior to June 30, 2020 without the prior approval of the Trust’s Board of Trustees. |

AST Bond Portfolio 2025

The Manager has contractually agreed to waive a portion of its investment management fee and/or reimburse certain expenses of the Portfolio so that the Portfolio's investment management fee plus other expenses (exclusive of certain expenses as described more fully in the Trust’s Statement of Additional Information) do not exceed 0.930% of the Portfolio's average daily net assets through June 30, 2020. Expenses waived/reimbursed by the Manager may be recouped by the Manager within the same fiscal year during which such waiver/reimbursement is made if such recoupment can be realized without exceeding the expense limit in effect at the time of the recoupment for that fiscal year. This arrangement may not be terminated or modified prior to June 30, 2020 without the prior approval of the Trust’s Board of Trustees. |

AST Bond Portfolio 2028

The Manager has contractually agreed to waive a portion of its investment management fee and/or reimburse certain expenses of the Portfolio so that the Portfolio's investment management fee plus other expenses (exclusive of certain expenses as described more fully in the Trust’s Statement of Additional Information) do not exceed 0.930% of the Portfolio's average daily net assets through June 30, 2020. Expenses waived/reimbursed by the Manager may be recouped by the Manager within the same fiscal year during which such waiver/reimbursement is made if such recoupment can be realized without exceeding the expense limit in effect at the time of the recoupment for that fiscal year. This arrangement may not be terminated or modified prior to June 30, 2020 without the prior approval of the Trust’s Board of Trustees. |

AST Bond Portfolio 2029

The Manager has contractually agreed to waive a portion of its investment management fee and/or reimburse certain expenses of the Portfolio so that the Portfolio's investment management fee plus other expenses (exclusive of certain expenses as described more fully in the Trust’s Statement of Additional Information) do not exceed 0.930% of the Portfolio's average daily net assets through June 30, 2020. Expenses waived/reimbursed by the Manager may be recouped by the Manager within the same fiscal year during which such waiver/reimbursement is made if such recoupment can be realized without exceeding the expense limit in effect at the time of the recoupment for that fiscal year. This arrangement may not be terminated or modified prior to June 30, 2020 without the prior approval of the Trust’s Board of Trustees. |

AST Hotchkis & Wiley Large-Cap Value Portfolio

The Manager has contractually agreed to waive 0.009% of its investment management fee through June 30, 2020. This arrangement may not be terminated or modified prior to June 30, 2020 without the prior approval of the Trust’s Board of Trustees. |

AST International Growth Portfolio

The Manager has contractually agreed to waive 0.02% of its investment management fee through June 30, 2020. This arrangement may not be terminated or modified prior to June 30, 2020 without the prior approval of the Trust’s Board of Trustees. |

AST Investment Grade Bond Portfolio

The Distributor has contractually agreed to waive a portion of its distribution and service (12b-1) fee. The waiver provides for a reduction in the distribution and service fee based on the average daily net assets of the Portfolio. This contractual waiver does not have an expiration or termination date, and may not be modified or discontinued. |

AST Loomis Sayles Large-Cap Growth Portfolio

The Manager has contractually agreed to waive 0.060% of its investment management fee through June 30, 2020. This arrangement may not be terminated or modified prior to June 30, 2020 without the prior approval of the Trust’s Board of Trustees. |

AST MFS Growth Allocation Portfolio

The Manager has contractually agreed to waive 0.013% of its investment management fee through June 30, 2020. This arrangement may not be terminated or modified prior to June 30, 2020 without the prior approval of the Trust’s Board of Trustees. |

AST MFS Growth Portfolio

The Manager has contractually agreed to waive 0.014% of its investment management fee through June 30, 2020. This arrangement may not be terminated or modified prior to June 30, 2020 without the prior approval of the Trust’s Board of Trustees. |

AST T. Rowe Price Large-Cap Growth Portfolio

The Manager has contractually agreed to waive 0.036% of its investment management fee through June 30, 2020. This arrangement may not be terminated or modified prior to June 30, 2020 without the prior approval of the Trust’s Board of Trustees. |

AST T. Rowe Price Large-Cap Value Portfolio

The Manager has contractually agreed to waive 0.040% of its investment management fee through June 30, 2020. This arrangement may not be terminated or modified prior to June 30, 2020 without the prior approval of the Trust’s Board of Trustees. |

AST WEDGE Capital Mid-Cap Value Portfolio

The Manager has contractually agreed to waive 0.010% of its investment management fee through June 30, 2020. This arrangement may not be terminated or modified prior to June 30, 2020 without the prior approval of the Trust’s Board of Trustees. |

Wells Fargo VT International Equity Fund - Class 1

The Manager has committed through April 30, 2020, to waive fees and/or reimburse expenses to the extent necessary to cap the Fund's Total Annual Fund Operating Expenses After Fee Waiver at 0.69% for Class 1 and 0.94% for Class 2. Brokerage commissions, stamp duty fees, interest, taxes, acquired fund fees and expenses and extraordinary expenses are excluded from the cap. After this time, the cap may be increased or the commitment to maintain the cap may be terminated only with the approval of the Board of Trustees. |

Wells Fargo VT Omega Growth Fund - Class 1

The Manager has committed through April 30, 2020, to waive fees and/or reimburse expenses to the extent necessary to cap the Fund's Total Annual Fund Operating Expenses After Fee Waiver at the amounts shown above. Brokerage commissions, stamp duty fees, interest, taxes, acquired fund fees and expenses and extraordinary expenses are excluded from the cap. After this time, the cap may be increased or the commitment to maintain the cap may be terminated only with the approval of the Board of Trustees. |

EXPENSE EXAMPLES

These examples are intended to help you compare the cost of investing in our Annuity with the cost of investing in other variable annuities.

Below are examples for each Annuity showing what you would pay in expenses at the end of the stated time periods had you invested $10,000 in the Annuity and your investment has a 5.0% return each year.

The examples reflect the fees and charges listed below for each Annuity as described in “Summary of Contract Fees and Charges”:

| |

▪ | Distribution Charge (if applicable) |

| |

▪ | Contingent Deferred Sales Charge |

| |

▪ | The maximum combination of optional benefit charges |

The examples also assume the following for the period shown:

| |

▪ | You allocate all of your Account Value to the Sub-account with the maximum gross total annual portfolio operating expenses, and those expenses remain the same each year* |

| |

▪ | For each charge, we deduct the maximum charge rather than the current charge |

| |

▪ | You make no withdrawals of your Account Value |

| |

▪ | You make no transfers, or other transactions for which we charge a fee |

| |

▪ | You elect the Highest Daily Lifetime 6 Plus with Combination 5.0% Roll-up and HAV Death Benefit, which are the maximum combination of optional benefit charges. There is no other optional benefit combination that would result in higher maximum charges than those shown in the examples. |

| |

▪ | No purchase payment credit is granted under the Annuity. |

Amounts shown in the examples are rounded to the nearest dollar.

| |

* | Note: Not all portfolios offered as Sub-accounts may be available depending on optional benefit selection, the applicable jurisdiction and selling firm. |

THE EXAMPLES ARE ILLUSTRATIVE ONLY – THEY SHOULD NOT BE CONSIDERED A REPRESENTATION OF PAST OR FUTURE EXPENSES OF THE UNDERLYING MUTUAL FUNDS OR THEIR PORTFOLIOS – ACTUAL EXPENSES WILL BE LESS THAN THOSE SHOWN DEPENDING UPON WHICH OPTIONAL BENEFIT YOU ELECT OTHER THAN INDICATED IN THE EXAMPLES OR IF YOU ALLOCATE ACCOUNT VALUE TO ANY OTHER AVAILABLE SUB-ACCOUNTS.

Expense Examples are provided as follows: 2

|

| | | | |

| Assuming Maximum Fees and Expenses of any of the Portfolios Available |

1 Year | 3 Years | 5 Years | 10 Years |

If you surrender your annuity at the end of the applicable time period: | $1,599 | $2,890 | $4,076 | $7,021 |

If you annuitize your annuity at the end of the applicable time period: 1 | $699 | $2,090 | $3,476 | $6,921 |

If you do not surrender your annuity: | $699 | $2,090 | $3,476 | $6,921 |

| |

1. | If you own Optimum Xtra, your ability to annuitize in the first 3 Annuity Years may be limited. |

| |

2. | Expense examples calculations for Optimum Xtra are not adjusted to reflect the purchase credit. If the purchase credit were reflected in the calculations, expenses would be higher. |

For information relating to accumulation Unit Values pertaining to the sub-accounts, please see Appendix A – condensed Financial Information About Separate Account B.

SUMMARY

Optimum XTra

This Summary describes key features of the variable annuity described in this Prospectus. It is intended to help give you an overview, and to point you to sections of the prospectus that provide greater detail. This Summary is intended to supplement the prospectus, so you should not rely on the Summary alone for all the information you need to know before purchase. You should read the entire Prospectus for a complete description of the variable annuity. Your financial professional can also help you if you have questions.

What is a variable annuity? A variable annuity is a contract between you and an insurance company. It is designed to help you save money for retirement, and provide income during your retirement. With the help of your financial professional, you choose how to invest your money within your annuity (subject to certain restrictions; see “Investment Options”). Any allocation that is recommended to you by your financial professional may be different than automatic asset transfers that may be made under the Annuity, such as under a pre-determined mathematical formula used with an optional living benefit. The value of your annuity will rise or fall depending on whether the investment options you choose perform well or perform poorly. Investing in a variable annuity involves risk and you can lose your money. By the same token, investing in a variable annuity can provide you with the opportunity to grow your money through participation in mutual fund-type investments. Your financial professional will help you choose the investment options that are suitable for you based on your tolerance for risk and your needs.

Variable annuities also offer a variety of optional guarantees to receive an income for life through withdrawals or provide minimum death benefits for your beneficiaries, or minimum account value guarantees. These benefits provide a degree of insurance in the event your annuity performs poorly. These optional benefits are available for an extra cost, and are subject to limitations and conditions more fully described later in this Prospectus. The guarantees are based on the long-term financial strength of the insurance company.

What does it mean that my variable annuity is “tax-deferred”? Because variable annuities are issued by an insurance company, you pay no taxes on any earnings from your annuity until you withdraw the money. You may also transfer among your investment options without paying a tax at the time of the transfer. Until you withdraw the money, tax deferral allows you to keep money invested that would otherwise go to pay taxes. When you take your money out of the variable annuity, however, you will be taxed on the earnings at ordinary income tax rates rather than lower capital gains rates. If you withdraw earnings before you reach age 59 1/2, you also may be subject to a 10% federal tax penalty.

Please note that if you purchase this Annuity within a tax advantaged retirement plan, such as an IRA, SEP-IRA, Roth IRA, 401(a) plan, or non-ERISA 403(b) plan, you will get no additional tax advantage through the Annuity itself. Because there is no additional tax advantage when a variable annuity is purchased through one of these plans, the reasons for purchasing the Annuity inside a qualified plan are limited to the ability to elect a living benefit, a death benefit, the opportunity to annuitize the contract and the various investment options, which might make the Annuity an appropriate investment for you. You should consult your tax and financial adviser regarding such features and benefits prior to purchasing this Annuity for use with a tax-qualified plan.

What variable annuities are offered in this Prospectus? This Prospectus describes the variable annuity listed below. With the help of your financial professional, you choose the annuity based on your time horizon, liquidity needs, and desire for credits. The annuity described in this prospectus is:

How do I purchase the variable annuity? This Annuity is no longer available for new purchases. Our eligibility criteria for purchasing the Annuities are as follows:

|

| | |

Product | Maximum Age for

Initial Purchase | Minimum Initial Purchase Payment |

Optimum XTra | 75 | $10,000 |