UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number |

811-06463 | |

| AIM International Mutual Funds (Invesco International Mutual Funds) | ||

| (Exact name of registrant as specified in charter) | ||

| 11 Greenway Plaza, Suite 1000 Houston, Texas 77046 | ||

| (Address of principal executive offices) (Zip code) | ||

| Sheri Morris 11 Greenway Plaza, Suite 1000 Houston, Texas 77046 | ||

| (Name and address of agent for service) | ||

| Registrant’s telephone number, including area code: | (713) 626-1919 | |||

| Date of fiscal year end: | 10/31 | |||

| Date of reporting period: | 10/31/22 | |||

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

(a) The Registrant’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 is as follows:

(b) Not applicable.

| Annual Report to Shareholders | October 31, 2022 | |

Invesco Advantage International Fund

Nasdaq:

A: QMGAX ∎ C: QMGCX ∎ R: QMGRX ∎ Y: QMGYX ∎ R5: GMAGX ∎ R6: QMGIX

Management’s Discussion of Fund Performance

|

| ||||

| For the fiscal year ended October 31, 2022, Class A shares of Invesco Advantage International Fund (the Fund), at net asset value (NAV), outperformed the MSCI All Country World ex USA Index. |

| |||

| Your Fund’s long-term performance appears later in this report. |

| |||

| Fund vs. Indexes |

| |||

| Total returns, 10/31/21 to 10/31/22, at net asset value (NAV). Performance shown does not include applicable contingent deferred sales charges (CDSC) or front-end sales charges, which would have reduced performance. |

| |||

| Class A Shares |

-14.34 | % | ||

| Class C Shares |

-14.94 | |||

| Class R Shares |

-14.53 | |||

| Class Y Shares |

-14.12 | |||

| Class R5 Shares |

-14.02 | |||

| Class R6 Shares |

-14.10 | |||

| MSCI All Country World ex USA Index▼ |

-24.73 | |||

| Source(s): ▼RIMES Technologies Corp. |

||||

Market conditions and your Fund

For the fiscal year ended October 31, 2022, the Fund at NAV reported negative absolute performance as equity market volatility was sparked by Russia’s invasion of Ukraine, rising commodity prices, rampant global inflation and central banks shifting toward tighter monetary policy.

At the beginning of the fiscal year, international developed equity markets were mostly positive, despite rising inflation and the emergence of the Omicron COVID-19 variant. Pandemic-related supply chain disruptions and labor shortages intensified at the end of 2021, resulting in broadly higher costs for companies and consumers. Meanwhile, emerging market equities began the fiscal year with declines, due in part to COVID-19 concerns and China’s ongoing regulatory tightening in the private education and technology sectors and slowing economic growth.

The first half of 2022 brought steep decline for equity markets as Russia’s invasion of Ukraine exacerbated inflationary pressures, disrupting already strained supply chains and increasing shortages of oil, gas and raw materials, with the price of oil rising sharply. Inflation headwinds continued into the third quarter of 2022, with the US Federal Reserve, the European Central Bank and the Bank of England all raising interest rates in response. In contrast, the People’s Bank of China lowered its policy rate and the Bank of Japan kept rates the same. Emerging market equities were further hampered by a strengthening US dollar.

During October 2022, developed market equities rebounded and were in positive territory for October. Developed market equities outperformed emerging market equities, which declined primarily driven by weakness in China as Chinese markets reacted to the reappointment of President Xi and his authority, with no signs of the country’s zero-COVID-19 policy being relaxed. Despite the

rebound in October for developed market equities, at the end of the fiscal year, trailing one-year returns for developed market equities and emerging market equities were both in negative territory.

Against this backdrop, we believe the Fund’s positioning toward options-based defense and overweight exposure to low volatility and value stocks proved beneficial as low volatility and value stocks outperformed the benchmark and the options-based defense buffered equity market drawdowns during the fiscal year.

Unlike the cap-weighted benchmark, which overweights the largest companies and underweights smaller companies, the Fund buys stocks based on multiple characteristics that have proven to be important drivers of returns. These characteristics, or factors, are widely known as value, momentum, quality and low or minimum volatility. While the Fund’s relative positioning during the fiscal year ultimately resulted in outperformance, we continue to believe equity portfolios should be constructed with intentional exposures to a diversified set of identifiable risk factors. We believe, based on the team’s research, that doing so allows the Fund to better target its exposure to rewarded risks over a full market cycle.

Please note that the Fund’s strategy utilizes derivative instruments that include futures, options and total return swaps. Therefore, some of the strategy performance, both positive and negative, can be attributed to these instruments. Derivatives can be a cost-effective way to gain exposure to asset classes. However, derivatives may amplify traditional investment risks through the creation of leverage and may be less liquid than traditional securities.

Thank you for your continued investment in Invesco Advantage International Fund. As always, we welcome your comments and questions.

Portfolio manager(s):

Mark Ahnrud

John Burrello

Chris Devine

Scott Hixon

Christian Ulrich

Scott Wolle

The views and opinions expressed in management’s discussion of Fund performance are those of Invesco Advisers, Inc. and its affiliates. These views and opinions are subject to change at any time based on factors such as market and economic conditions. These views and opinions may not be relied upon as investment advice or recommendations, or as an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but Invesco Advisers, Inc. makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

See important Fund and, if applicable, index disclosures later in this report.

| 2 | Invesco Advantage International Fund |

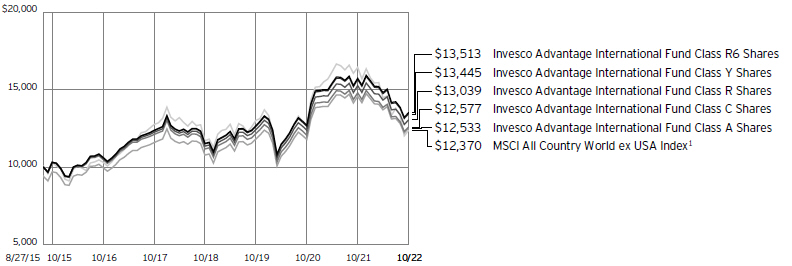

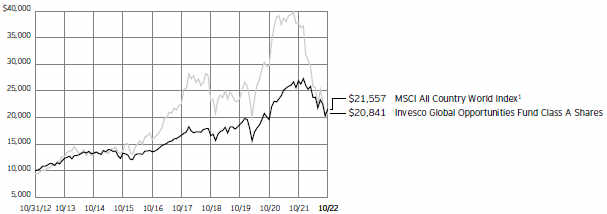

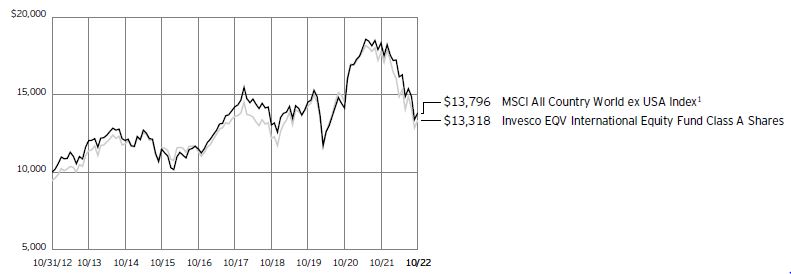

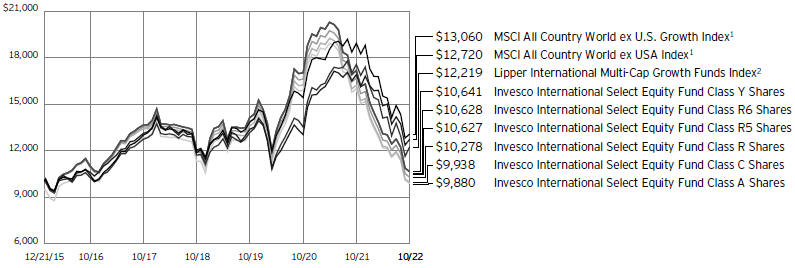

Your Fund’s Long-Term Performance

Results of a $10,000 Investment – Oldest Share Class(es)

Fund and index data from 8/27/15

1 Source: RIMES Technologies Corp.

Past performance cannot guarantee future results.

The data shown in the chart include reinvested distributions, applicable sales charges and Fund expenses including management

fees. Index results include reinvested dividends, but they do not reflect sales charges. Performance of the peer group, if applicable, reflects fund expenses and management fees;

performance of a market index does not. Performance shown in the chart does not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

| 3 | Invesco Advantage International Fund |

| Average Annual Total Returns |

| |||

| As of 10/31/22, including maximum applicable sales charges |

| |||

| Class A Shares |

||||

| Inception (8/27/15) |

3.19 | % | ||

| 5 Years |

0.36 | |||

| 1 Year |

-19.06 | |||

| Class C Shares |

||||

| Inception (8/27/15) |

3.25 | % | ||

| 5 Years |

0.78 | |||

| 1 Year |

-15.69 | |||

| Class R Shares |

||||

| Inception (8/27/15) |

3.77 | % | ||

| 5 Years |

1.27 | |||

| 1 Year |

-14.53 | |||

| Class Y Shares |

||||

| Inception (8/27/15) |

4.21 | % | ||

| 5 Years |

1.72 | |||

| 1 Year |

-14.12 | |||

| Class R5 Shares |

||||

| Inception |

4.15 | % | ||

| 5 Years |

1.71 | |||

| 1 Year |

-14.02 | |||

| Class R6 Shares |

||||

| Inception (8/27/15) |

4.28 | % | ||

| 5 Years |

1.78 | |||

| 1 Year |

-14.10 | |||

Effective May 24, 2019, Class A, Class C, Class R, Class Y and Class I shares of the Oppenheimer Global Multi-Asset Growth Fund, (the predecessor fund), were reorganized into Class A, Class C, Class R, Class Y and Class R6 shares, respectively, of the Invesco Oppenheimer Global Multi-Asset Growth Fund. Note: The Fund was subsequently renamed the Invesco Advantage International Fund (the Fund). Returns shown above, for periods ending on or prior to May 24, 2019, for Class A, Class C, Class R, Class Y and Class R6 shares are those for Class A, Class C, Class R, Class Y and Class I shares of the predecessor fund. Share class returns will differ from the predecessor fund because of different expenses.

Class R5 shares incepted on May 24, 2019. Performance shown on and prior to that date is that of the predecessor fund’s Class A shares at net asset value and includes the 12b-1 fees applicable to Class A shares.

The performance data quoted represent past performance and cannot guarantee future results; current performance may be lower or higher. Please visit invesco.com/ performance for the most recent month-end performance. Performance figures reflect reinvested distributions, changes in net asset value and the effect of the maximum sales charge unless otherwise stated. Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares. Investment return and principal value will

fluctuate so that you may have a gain or loss when you sell shares.

Class A share performance reflects the maximum 5.50% sales charge, and Class C share performance reflects the applicable contingent deferred sales charge (CDSC) for the period involved. The CDSC on Class C shares is 1% for the first year after purchase. Class R, Class Y, Class R5 and Class R6 shares do not have a front-end sales charge or a CDSC; therefore, performance is at net asset value.

The performance of the Fund’s share classes will differ primarily due to different sales charge structures and class expenses.

Fund performance reflects any applicable fee waivers and/or expense reimbursements. Had the adviser not waived fees and/or reimbursed expenses currently or in the past, returns would have been lower. See current prospectus for more information.

| 4 | Invesco Advantage International Fund |

Invesco Advantage International Fund’s investment objective is to seek capital appreciation.

| ∎ | Unless otherwise stated, information presented in this report is as of October 31, 2022, and is based on total net assets. |

| ∎ | Unless otherwise noted, all data is provided by Invesco. |

| ∎ | To access your Fund’s reports/prospectus, visit invesco.com/fundreports. |

About indexes used in this report

| ∎ | The MSCI All Country World ex USA® Index is an index considered representative of developed and emerging stock markets, excluding the US. The index is computed using the net return, which withholds applicable taxes for non-resident investors. |

| ∎ | The Fund is not managed to track the performance of any particular index, including the index(es) described here, and consequently, the performance of the Fund may deviate significantly from the performance of the index(es). |

| ∎ | A direct investment cannot be made in an index. Unless otherwise indicated, index results include reinvested dividends, and they do not reflect sales charges. Performance of the peer group, if applicable, reflects fund expenses; performance of a market index does not. |

| This report must be accompanied or preceded by a currently effective Fund prospectus, which contains more complete information, including sales charges and expenses. Investors should read it carefully before investing. |

| NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEE |

| 5 | Invesco Advantage International Fund |

Fund Information

Portfolio Composition

| By sector | % of total net assets | ||||

| Financials |

14.62 | % | |||

| Health Care |

9.07 | ||||

| Consumer Discretionary |

8.63 | ||||

| Industrials |

8.58 | ||||

| Energy |

6.72 | ||||

| Consumer Staples |

6.55 | ||||

| Information Technology |

5.89 | ||||

| Materials |

5.84 | ||||

| Communication Services |

5.70 | ||||

| Utilities |

2.03 | ||||

| Real Estate |

1.16 | ||||

| Money Market Funds Plus Other Assets Less Liabilities |

25.21 | ||||

Top 10 Equity Holdings*

| % of total net assets | |||||||

| 1. |

Roche Holding AG | 2.22 | % | ||||

| 2. |

Shell PLC | 1.88 | |||||

| 3. |

Novartis AG | 1.77 | |||||

| 4. |

TotalEnergies SE | 1.16 | |||||

| 5. |

British American Tobacco PLC | 1.12 | |||||

| 6. |

Toyota Motor Corp. | 1.02 | |||||

| 7. |

Sanofi | 0.97 | |||||

| 8. |

SK Hynix, Inc. | 0.94 | |||||

| 9. |

Takeda Pharmaceutical Co. Ltd. | 0.94 | |||||

| 10. |

AP Moller - Maersk A/S, Class B | 0.90 | |||||

The Fund’s holdings are subject to change, and there is no assurance that the Fund will continue to hold any particular security.

| * | Excluding money market fund holdings, if any. |

Data presented here are as of October 31, 2022.

| 6 | Invesco Advantage International Fund |

October 31, 2022

| Shares | Value | |||||||

|

|

||||||||

| Common Stocks & Other Equity Interests–74.12% |

| |||||||

| Australia–2.65% |

||||||||

| Australia & New Zealand Banking Group Ltd. |

236 | $ | 3,847 | |||||

|

|

||||||||

| BHP Group Ltd. |

4,900 | 117,325 | ||||||

|

|

||||||||

| Coles Group Ltd. |

599 | 6,251 | ||||||

|

|

||||||||

| Commonwealth Bank of Australia |

95 | 6,341 | ||||||

|

|

||||||||

| Fortescue Metals Group Ltd. |

3,466 | 32,345 | ||||||

|

|

||||||||

| Glencore PLC |

7,830 | 44,753 | ||||||

|

|

||||||||

| Goodman Group |

394 | 4,291 | ||||||

|

|

||||||||

| Macquarie Group Ltd. |

47 | 5,067 | ||||||

|

|

||||||||

| National Australia Bank Ltd. |

284 | 5,873 | ||||||

|

|

||||||||

| Newcrest Mining Ltd. |

1,665 | 18,387 | ||||||

|

|

||||||||

| Rio Tinto Ltd. |

2,237 | 125,328 | ||||||

|

|

||||||||

| Rio Tinto PLC |

3,088 | 160,670 | ||||||

|

|

||||||||

| Telstra Group Ltd.(a) |

7,720 | 19,357 | ||||||

|

|

||||||||

| Wesfarmers Ltd. |

268 | 7,762 | ||||||

|

|

||||||||

| Woodside Energy Group Ltd. |

788 | 18,256 | ||||||

|

|

||||||||

| Woolworths Group Ltd. |

284 | 5,989 | ||||||

|

|

||||||||

| 581,842 | ||||||||

|

|

||||||||

| Austria–0.16% |

||||||||

| OMV AG |

756 | 34,807 | ||||||

|

|

||||||||

| Belgium–0.68% |

||||||||

| Anheuser-Busch InBev S.A./N.V. |

2,615 | 130,981 | ||||||

|

|

||||||||

| UCB S.A. |

252 | 19,002 | ||||||

|

|

||||||||

| 149,983 | ||||||||

|

|

||||||||

| Brazil–2.18% |

||||||||

| B3 S.A. – Brasil, Bolsa, Balcao |

20,100 | 58,524 | ||||||

|

|

||||||||

| Banco do Brasil S.A. |

3,700 | 26,517 | ||||||

|

|

||||||||

| CCR S.A. |

1,900 | 4,767 | ||||||

|

|

||||||||

| Centrais Eletricas Brasileiras S.A. |

600 | 5,787 | ||||||

|

|

||||||||

| ENGIE Brasil Energia S.A. |

600 | 4,672 | ||||||

|

|

||||||||

| Gerdau S.A., Preference Shares |

1,100 | 5,483 | ||||||

|

|

||||||||

| Itau Unibanco Holding S.A., Preference Shares |

1,900 | 11,182 | ||||||

|

|

||||||||

| Itausa S.A., Preference Shares |

2,100 | 4,366 | ||||||

|

|

||||||||

| Localiza Rent a Car S.A. |

300 | 4,097 | ||||||

|

|

||||||||

| Petroleo Brasileiro S.A., Preference Shares |

30,700 | 177,169 | ||||||

|

|

||||||||

| Telefonica Brasil S.A. |

2,800 | 22,392 | ||||||

|

|

||||||||

| TIM S.A. |

4,200 | 10,733 | ||||||

|

|

||||||||

| Vale S.A. |

9,700 | 126,060 | ||||||

|

|

||||||||

| WEG S.A. |

1,600 | 12,477 | ||||||

|

|

||||||||

| XP,Inc.,BDR(a) |

189 | 3,472 | ||||||

|

|

||||||||

| 477,698 | ||||||||

|

|

||||||||

| Chile–0.23% |

||||||||

| Banco de Chile |

57,551 | 5,200 | ||||||

|

|

||||||||

| Cencosud S.A. |

4,096 | 5,508 | ||||||

|

|

||||||||

| Cia Sud Americana de Vapores S.A. |

191,999 | 13,297 | ||||||

|

|

||||||||

| Falabella S.A. |

1,696 | 3,315 | ||||||

|

|

||||||||

| Sociedad Quimica y Minera de Chile S.A., Class B, Preference Shares |

252 | 23,655 | ||||||

|

|

||||||||

| 50,975 | ||||||||

|

|

||||||||

| Shares | Value | |||||||

|

|

||||||||

| China–6.93% |

||||||||

| Agricultural Bank of China Ltd., H Shares |

123,000 | $ | 35,060 | |||||

|

|

||||||||

| Air China Ltd., H Shares(a) |

8,000 | 5,566 | ||||||

|

|

||||||||

| Alibaba Group Holding Ltd.(a) |

17,300 | 137,733 | ||||||

|

|

||||||||

| Aluminum Corp. of China Ltd., H Shares |

14,000 | 3,997 | ||||||

|

|

||||||||

| Anhui Conch Cement Co. Ltd., H Shares |

2,000 | 5,155 | ||||||

|

|

||||||||

| ANTA Sports Products Ltd. |

1,600 | 14,072 | ||||||

|

|

||||||||

| Autohome, Inc., ADR |

175 | 4,571 | ||||||

|

|

||||||||

| Baidu, Inc., A Shares(a) |

2,200 | 21,110 | ||||||

|

|

||||||||

| Bank of China Ltd., H Shares |

294,000 | 94,773 | ||||||

|

|

||||||||

| Bank of Communications Co. Ltd., H Shares |

85,000 | 41,415 | ||||||

|

|

||||||||

| Beijing Enterprises Holdings Ltd. |

2,000 | 5,068 | ||||||

|

|

||||||||

| BOC Hong Kong Holdings Ltd. |

2,000 | 6,222 | ||||||

|

|

||||||||

| Brilliance China Automotive Holdings Ltd. |

6,000 | 2,584 | ||||||

|

|

||||||||

| BYD Co. Ltd., H Shares |

1,500 | 33,602 | ||||||

|

|

||||||||

| China CITIC Bank Corp. Ltd., H Shares |

36,000 | 13,577 | ||||||

|

|

||||||||

| China Coal Energy Co. Ltd., H Shares |

9,000 | 6,629 | ||||||

|

|

||||||||

| China Construction Bank Corp., H Shares |

151,000 | 80,237 | ||||||

|

|

||||||||

| China Feihe Ltd.(b) |

7,000 | 4,037 | ||||||

|

|

||||||||

| China Galaxy Securities Co. Ltd., H Shares |

15,500 | 5,807 | ||||||

|

|

||||||||

| China Gas Holdings Ltd. |

3,000 | 2,661 | ||||||

|

|

||||||||

| China Hongqiao Group Ltd. |

12,500 | 8,840 | ||||||

|

|

||||||||

| China Jinmao Holdings Group Ltd. |

34,000 | 4,497 | ||||||

|

|

||||||||

| China Life Insurance Co. Ltd., H Shares |

16,000 | 17,387 | ||||||

|

|

||||||||

| China Longyuan Power Group Corp. Ltd., H Shares |

4,000 | 4,577 | ||||||

|

|

||||||||

| China Merchants Bank Co. Ltd., H Shares |

4,000 | 13,153 | ||||||

|

|

||||||||

| China Merchants Port Holdings Co. Ltd. |

8,000 | 9,351 | ||||||

|

|

||||||||

| China Minsheng Banking Corp. Ltd., H Shares |

9,000 | 2,613 | ||||||

|

|

||||||||

| China Oilfield Services Ltd., H Shares |

8,000 | 9,006 | ||||||

|

|

||||||||

| China Overseas Land & Investment Ltd. |

30,500 | 58,222 | ||||||

|

|

||||||||

| China Petroleum & Chemical Corp., H Shares |

184,000 | 72,687 | ||||||

|

|

||||||||

| China Railway Group Ltd., H Shares |

24,000 | 10,419 | ||||||

|

|

||||||||

| China Resources Land Ltd. |

18,000 | 56,431 | ||||||

|

|

||||||||

| China Shenhua Energy Co. Ltd., H Shares |

6,500 | 17,091 | ||||||

|

|

||||||||

| China Taiping Insurance Holdings Co. Ltd. |

4,600 | 3,182 | ||||||

|

|

||||||||

| China Tower Corp. Ltd., H Shares(b) |

132,000 | 11,942 | ||||||

|

|

||||||||

| China Vanke Co. Ltd., H Shares |

2,300 | 2,955 | ||||||

|

|

||||||||

| CITIC Ltd. |

6,000 | 5,375 | ||||||

|

|

||||||||

| COSCO SHIPPING Holdings Co. Ltd., H Shares |

6,850 | 7,394 | ||||||

|

|

||||||||

| CSPC Pharmaceutical Group Ltd. |

20,640 | 21,227 | ||||||

|

|

||||||||

| ENN Energy Holdings Ltd. |

900 | 8,928 | ||||||

|

|

||||||||

| Geely Automobile Holdings Ltd. |

2,000 | 2,142 | ||||||

|

|

||||||||

| Great Wall Motor Co. Ltd., H Shares |

4,500 | 4,893 | ||||||

|

|

||||||||

| Haier Smart Home Co. Ltd., H Shares |

3,000 | 7,510 | ||||||

|

|

||||||||

| Hengan International Group Co. Ltd. |

1,500 | 5,822 | ||||||

|

|

||||||||

| Industrial & Commercial Bank of China Ltd., H Shares |

283,000 | 122,691 | ||||||

|

|

||||||||

| JD Health International, Inc.(a)(b) |

700 | 3,842 | ||||||

|

|

||||||||

| JD.com, Inc., A Shares |

3,316 | 61,919 | ||||||

|

|

||||||||

| Kingsoft Corp. Ltd. |

1,800 | 5,449 | ||||||

|

|

||||||||

| Kunlun Energy Co. Ltd. |

6,000 | 3,585 | ||||||

|

|

||||||||

| Lenovo Group Ltd. |

12,000 | 9,561 | ||||||

|

|

||||||||

| Li Ning Co. Ltd. |

2,500 | 12,938 | ||||||

|

|

||||||||

| Longfor Group Holdings Ltd.(b) |

7,000 | 8,921 | ||||||

|

|

||||||||

| Lufax Holding Ltd., ADR |

1,276 | 2,029 | ||||||

|

|

||||||||

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

| 7 | Invesco Advantage International Fund |

| Shares | Value | |||||||

|

|

||||||||

| China–(continued) |

||||||||

| NetEase, Inc. |

2,600 | $ | 28,929 | |||||

|

|

||||||||

| Nongfu Spring Co. Ltd., H Shares(b) |

9,000 | 45,247 | ||||||

|

|

||||||||

| NXP Semiconductors N.V. |

126 | 18,406 | ||||||

|

|

||||||||

| People’s Insurance Co. Group of China Ltd. (The), H Shares |

14,000 | 3,868 | ||||||

|

|

||||||||

| PetroChina Co. Ltd., H Shares |

188,000 | 71,869 | ||||||

|

|

||||||||

| PICC Property & Casualty Co. Ltd., H Shares |

8,000 | 7,380 | ||||||

|

|

||||||||

| Ping An Insurance (Group) Co. of China Ltd., H Shares |

9,000 | 36,016 | ||||||

|

|

||||||||

| Postal Savings Bank of China Co. Ltd., H Shares(b) |

37,000 | 17,174 | ||||||

|

|

||||||||

| Shandong Weigao Group Medical Polymer Co. Ltd., H Shares |

4,000 | 5,516 | ||||||

|

|

||||||||

| Shenzhou International Group Holdings Ltd. |

800 | 5,522 | ||||||

|

|

||||||||

| Sino Biopharmaceutical Ltd. |

19,000 | 9,202 | ||||||

|

|

||||||||

| Sunny Optical Technology Group Co. Ltd. |

600 | 5,205 | ||||||

|

|

||||||||

| Tencent Holdings Ltd. |

1,300 | 34,112 | ||||||

|

|

||||||||

| Tingyi Cayman Islands Holding Corp. |

8,000 | 12,521 | ||||||

|

|

||||||||

| Trip.com Group Ltd., ADR(a) |

248 | 5,612 | ||||||

|

|

||||||||

| Want Want China Holdings Ltd. |

34,000 | 22,328 | ||||||

|

|

||||||||

| Yankuang Energy Group Co. Ltd., H Shares |

14,000 | 39,477 | ||||||

|

|

||||||||

| Zijin Mining Group Co. Ltd., H Shares |

26,000 | 24,752 | ||||||

|

|

||||||||

| ZTO Express (Cayman), Inc., ADR |

441 | 7,448 | ||||||

|

|

||||||||

| 1,521,039 | ||||||||

|

|

||||||||

| Colombia–0.04% |

||||||||

| Bancolombia S.A., Preference Shares |

1,355 | 8,574 | ||||||

|

|

||||||||

| Czech Republic–0.04% |

||||||||

| CEZ A.S. |

252 | 8,241 | ||||||

|

|

||||||||

| Denmark–1.64% |

||||||||

| AP Moller – Maersk A/S, Class B |

95 | 198,361 | ||||||

|

|

||||||||

| Carlsberg A/S, Class B |

32 | 3,768 | ||||||

|

|

||||||||

| Coloplast A/S, Class B |

47 | 5,237 | ||||||

|

|

||||||||

| Danske Bank A/S |

1,465 | 23,617 | ||||||

|

|

||||||||

| Novo Nordisk A/S, Class B |

1,182 | 128,454 | ||||||

|

|

||||||||

| 359,437 | ||||||||

|

|

||||||||

| Finland–0.40% |

||||||||

| Fortum OYJ |

1,260 | 17,738 | ||||||

|

|

||||||||

| Nokia OYJ |

10,492 | 46,580 | ||||||

|

|

||||||||

| Nordea Bank Abp |

1,938 | 18,521 | ||||||

|

|

||||||||

| Sampo OYJ, Class A |

126 | 5,758 | ||||||

|

|

||||||||

| 88,597 | ||||||||

|

|

||||||||

| France–6.04% |

||||||||

| Air Liquide S.A. |

126 | 16,458 | ||||||

|

|

||||||||

| AXA S.A. |

677 | 16,708 | ||||||

|

|

||||||||

| BNP Paribas S.A. |

2,064 | 96,694 | ||||||

|

|

||||||||

| Bouygues S.A. |

677 | 19,307 | ||||||

|

|

||||||||

| Carrefour S.A. |

1,670 | 26,862 | ||||||

|

|

||||||||

| Cie de Saint-Gobain |

993 | 40,568 | ||||||

|

|

||||||||

| Cie Generale des Etablissements Michelin S.C.A. |

1,087 | 27,688 | ||||||

|

|

||||||||

| Credit Agricole S.A. |

3,245 | 29,421 | ||||||

|

|

||||||||

| Danone S.A. |

1,024 | 50,911 | ||||||

|

|

||||||||

| ENGIE S.A. |

5,230 | 67,935 | ||||||

|

|

||||||||

| EssilorLuxottica S.A. |

126 | 19,958 | ||||||

|

|

||||||||

| Hermes International |

6 | 7,771 | ||||||

|

|

||||||||

| Kering S.A. |

47 | 21,514 | ||||||

|

|

||||||||

| Shares | Value | |||||||

|

|

||||||||

| France–(continued) |

||||||||

| L’Oreal S.A. |

110 | $ | 34,536 | |||||

|

|

||||||||

| LVMH Moet Hennessy Louis Vuitton SE |

110 | 69,396 | ||||||

|

|

||||||||

| Orange S.A. |

4,367 | 41,667 | ||||||

|

|

||||||||

| Pernod Ricard S.A. |

63 | 11,053 | ||||||

|

|

||||||||

| Safran S.A. |

236 | 26,240 | ||||||

|

|

||||||||

| Sanofi |

2,473 | 213,535 | ||||||

|

|

||||||||

| Societe Generale S.A. |

3,198 | 73,304 | ||||||

|

|

||||||||

| Thales S.A. |

95 | 12,074 | ||||||

|

|

||||||||

| TotalEnergies SE |

4,663 | 254,834 | ||||||

|

|

||||||||

| Vinci S.A. |

1,150 | 105,682 | ||||||

|

|

||||||||

| Vivendi SE |

4,994 | 40,855 | ||||||

|

|

||||||||

| 1,324,971 | ||||||||

|

|

||||||||

| Germany–5.32% |

||||||||

| adidas AG |

47 | 4,597 | ||||||

|

|

||||||||

| Allianz SE |

268 | 48,250 | ||||||

|

|

||||||||

| BASF SE |

1,938 | 86,998 | ||||||

|

|

||||||||

| Bayer AG |

756 | 39,771 | ||||||

|

|

||||||||

| Bayerische Motoren Werke AG |

898 | 70,570 | ||||||

|

|

||||||||

| Continental AG |

142 | 7,365 | ||||||

|

|

||||||||

| Daimler Truck Holding AG(a) |

898 | 23,961 | ||||||

|

|

||||||||

| Deutsche Bank AG |

6,554 | 62,561 | ||||||

|

|

||||||||

| Deutsche Boerse AG |

47 | 7,647 | ||||||

|

|

||||||||

| Deutsche Post AG |

1,654 | 58,684 | ||||||

|

|

||||||||

| Deutsche Telekom AG |

4,679 | 88,628 | ||||||

|

|

||||||||

| E.ON SE |

3,844 | 32,206 | ||||||

|

|

||||||||

| Evonik Industries AG |

898 | 16,555 | ||||||

|

|

||||||||

| Fresenius Medical Care AG & Co. KGaA |

473 | 13,083 | ||||||

|

|

||||||||

| Fresenius SE & Co. KGaA |

1,843 | 42,433 | ||||||

|

|

||||||||

| Henkel AG & Co. KGaA, Preference Shares |

567 | 35,738 | ||||||

|

|

||||||||

| Mercedes-Benz Group AG |

2,127 | 123,177 | ||||||

|

|

||||||||

| Merck KGaA |

315 | 51,367 | ||||||

|

|

||||||||

| Muenchener Rueckversicherungs-Gesellschaft AG in Muenchen, Class R |

32 | 8,455 | ||||||

|

|

||||||||

| RWE AG |

473 | 18,231 | ||||||

|

|

||||||||

| Sartorius AG, Preference Shares |

16 | 5,647 | ||||||

|

|

||||||||

| Siemens AG |

1,056 | 115,440 | ||||||

|

|

||||||||

| Siemens Energy AG |

748 | 8,734 | ||||||

|

|

||||||||

| Volkswagen AG, Preference Shares |

1,544 | 197,354 | ||||||

|

|

||||||||

| 1,167,452 | ||||||||

|

|

||||||||

| Greece–0.06% |

||||||||

| Hellenic Telecommunications Organization S.A. |

882 | 13,867 | ||||||

|

|

||||||||

| Hong Kong–1.57% |

||||||||

| CK Asset Holdings Ltd. |

6,000 | 33,183 | ||||||

|

|

||||||||

| CK Hutchison Holdings Ltd. |

27,500 | 136,344 | ||||||

|

|

||||||||

| CK Infrastructure Holdings Ltd. |

5,000 | 23,772 | ||||||

|

|

||||||||

| CLP Holdings Ltd. |

1,000 | 6,709 | ||||||

|

|

||||||||

| Henderson Land Development Co. Ltd. |

2,000 | 4,898 | ||||||

|

|

||||||||

| Hong Kong & China Gas Co. Ltd. (The) |

7,292 | 5,623 | ||||||

|

|

||||||||

| Jardine Matheson Holdings Ltd. |

900 | 41,436 | ||||||

|

|

||||||||

| Power Assets Holdings Ltd. |

2,500 | 11,961 | ||||||

|

|

||||||||

| Prudential PLC |

3,371 | 31,287 | ||||||

|

|

||||||||

| Sun Hung Kai Properties Ltd. |

4,500 | 48,454 | ||||||

|

|

||||||||

| 343,667 | ||||||||

|

|

||||||||

| Hungary–0.15% |

||||||||

| MOL Hungarian Oil & Gas PLC |

1,875 | 11,262 | ||||||

|

|

||||||||

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

| 8 | Invesco Advantage International Fund |

| Shares | Value | |||||||

|

|

||||||||

| Hungary–(continued) |

||||||||

| OTP Bank Nyrt |

1,008 | $ | 22,065 | |||||

|

|

||||||||

| 33,327 | ||||||||

|

|

||||||||

| Indonesia–1.21% |

||||||||

| PT Adaro Energy Indonesia Tbk |

64,800 | 16,510 | ||||||

|

|

||||||||

| PT Astra International Tbk |

64,700 | 27,527 | ||||||

|

|

||||||||

| PT Bank Central Asia Tbk |

62,500 | 35,218 | ||||||

|

|

||||||||

| PT Bank Mandiri (Persero) Tbk |

38,300 | 25,912 | ||||||

|

|

||||||||

| PT Bank Negara Indonesia (Persero) Tbk |

20,700 | 12,455 | ||||||

|

|

||||||||

| PT Bank Rakyat Indonesia (Persero) Tbk |

33,800 | 10,059 | ||||||

|

|

||||||||

| PT Kalbe Farma Tbk |

34,200 | 4,496 | ||||||

|

|

||||||||

| PT Merdeka Copper Gold Tbk(a) |

45,300 | 10,923 | ||||||

|

|

||||||||

| PT Telkom Indonesia (Persero) Tbk |

416,500 | 117,462 | ||||||

|

|

||||||||

| PT United Tractors Tbk |

2,100 | 4,353 | ||||||

|

|

||||||||

| 264,915 | ||||||||

|

|

||||||||

| Ireland–0.17% |

||||||||

| CRH PLC |

1,008 | 36,268 | ||||||

|

|

||||||||

| Israel–0.02% |

||||||||

| Check Point Software Technologies |

32 | 4,135 | ||||||

|

|

||||||||

| Italy–1.30% |

||||||||

| Assicurazioni Generali S.p.A. |

2,662 | 39,962 | ||||||

|

|

||||||||

| Atlantia S.p.A. |

1,271 | 28,364 | ||||||

|

|

||||||||

| Enel S.p.A. |

1,985 | 8,877 | ||||||

|

|

||||||||

| Eni S.p.A. |

6,570 | 86,459 | ||||||

|

|

||||||||

| Ferrari N.V. |

79 | 15,590 | ||||||

|

|

||||||||

| Intesa Sanpaolo S.p.A. |

24,845 | 47,440 | ||||||

|

|

||||||||

| Poste Italiane S.p.A.(b) |

1,812 | 15,815 | ||||||

|

|

||||||||

| UniCredit S.p.A. |

3,403 | 42,265 | ||||||

|

|

||||||||

| 284,772 | ||||||||

|

|

||||||||

| Japan–13.55% |

||||||||

| Asahi Group Holdings Ltd. |

900 | 25,192 | ||||||

|

|

||||||||

| Astellas Pharma, Inc. |

3,600 | 49,523 | ||||||

|

|

||||||||

| Bridgestone Corp. |

1,600 | 57,662 | ||||||

|

|

||||||||

| Canon, Inc. |

2,300 | 48,937 | ||||||

|

|

||||||||

| Chugai Pharmaceutical Co. Ltd. |

1,000 | 23,187 | ||||||

|

|

||||||||

| Dai-ichi Life Holdings, Inc. |

400 | 6,328 | ||||||

|

|

||||||||

| Daiichi Sankyo Co. Ltd. |

900 | 28,859 | ||||||

|

|

||||||||

| Denso Corp. |

200 | 9,931 | ||||||

|

|

||||||||

| Eisai Co. Ltd. |

400 | 24,123 | ||||||

|

|

||||||||

| FUJIFILM Holdings Corp. |

1,100 | 50,291 | ||||||

|

|

||||||||

| Hitachi Ltd. |

1,500 | 67,946 | ||||||

|

|

||||||||

| Honda Motor Co. Ltd. |

7,200 | 163,238 | ||||||

|

|

||||||||

| Hoya Corp. |

100 | 9,324 | ||||||

|

|

||||||||

| ITOCHU Corp. |

3,500 | 90,541 | ||||||

|

|

||||||||

| Japan Post Holdings Co. Ltd. |

16,100 | 108,151 | ||||||

|

|

||||||||

| Japan Tobacco, Inc. |

2,500 | 41,419 | ||||||

|

|

||||||||

| Kao Corp. |

100 | 3,753 | ||||||

|

|

||||||||

| KDDI Corp. |

1,800 | 53,152 | ||||||

|

|

||||||||

| Kirin Holdings Co. Ltd. |

400 | 5,882 | ||||||

|

|

||||||||

| Komatsu Ltd. |

1,600 | 30,625 | ||||||

|

|

||||||||

| Kyocera Corp. |

600 | 29,946 | ||||||

|

|

||||||||

| Mitsubishi Corp. |

4,200 | 113,788 | ||||||

|

|

||||||||

| Mitsubishi Electric Corp. |

2,800 | 24,652 | ||||||

|

|

||||||||

| Mitsubishi Estate Co. Ltd. |

1,000 | 12,573 | ||||||

|

|

||||||||

| Mitsubishi UFJ Financial Group, Inc. |

29,500 | 139,848 | ||||||

|

|

||||||||

| Mitsui & Co. Ltd. |

7,700 | 170,413 | ||||||

|

|

||||||||

| Shares | Value | |||||||

|

|

||||||||

| Japan–(continued) |

||||||||

| Mitsui Fudosan Co. Ltd. |

400 | $ | 7,662 | |||||

|

|

||||||||

| Mizuho Financial Group, Inc. |

7,570 | 81,687 | ||||||

|

|

||||||||

| Murata Manufacturing Co. Ltd. |

300 | 14,717 | ||||||

|

|

||||||||

| Nexon Co. Ltd. |

300 | 5,024 | ||||||

|

|

||||||||

| Nintendo Co. Ltd. |

900 | 36,675 | ||||||

|

|

||||||||

| Nippon Telegraph & Telephone Corp. |

3,700 | 101,851 | ||||||

|

|

||||||||

| Nissan Motor Co. Ltd. |

12,600 | 40,170 | ||||||

|

|

||||||||

| Nomura Holdings, Inc. |

5,000 | 16,215 | ||||||

|

|

||||||||

| NTT Data Corp. |

300 | 4,349 | ||||||

|

|

||||||||

| Olympus Corp. |

700 | 14,770 | ||||||

|

|

||||||||

| Oriental Land Co. Ltd. |

200 | 26,769 | ||||||

|

|

||||||||

| ORIX Corp. |

4,000 | 58,578 | ||||||

|

|

||||||||

| Otsuka Holdings Co. Ltd. |

800 | 25,638 | ||||||

|

|

||||||||

| Panasonic Holdings Corp. |

8,200 | 58,669 | ||||||

|

|

||||||||

| Recruit Holdings Co. Ltd. |

800 | 24,554 | ||||||

|

|

||||||||

| Renesas Electronics Corp.(a) |

2,300 | 19,261 | ||||||

|

|

||||||||

| Secom Co. Ltd. |

400 | 22,790 | ||||||

|

|

||||||||

| Sekisui House Ltd. |

1,000 | 16,618 | ||||||

|

|

||||||||

| Seven & i Holdings Co. Ltd. |

1,200 | 44,797 | ||||||

|

|

||||||||

| Shionogi & Co. Ltd. |

400 | 18,530 | ||||||

|

|

||||||||

| SoftBank Corp. |

2,800 | 27,605 | ||||||

|

|

||||||||

| SoftBank Group Corp. |

1,600 | 68,808 | ||||||

|

|

||||||||

| Sompo Holdings, Inc. |

600 | 24,980 | ||||||

|

|

||||||||

| Sony Group Corp. |

2,000 | 135,425 | ||||||

|

|

||||||||

| Sumitomo Corp. |

4,900 | 62,426 | ||||||

|

|

||||||||

| Sumitomo Mitsui Financial Group, Inc. |

3,800 | 106,609 | ||||||

|

|

||||||||

| Suzuki Motor Corp. |

500 | 16,870 | ||||||

|

|

||||||||

| Takeda Pharmaceutical Co. Ltd. |

7,738 | 205,000 | ||||||

|

|

||||||||

| Tokio Marine Holdings, Inc. |

1,300 | 23,485 | ||||||

|

|

||||||||

| Tokyo Electron Ltd. |

100 | 26,446 | ||||||

|

|

||||||||

| Toshiba Corp. |

100 | 3,483 | ||||||

|

|

||||||||

| Toyota Industries Corp. |

400 | 20,591 | ||||||

|

|

||||||||

| Toyota Motor Corp. |

16,100 | 223,318 | ||||||

|

|

||||||||

| 2,973,654 | ||||||||

|

|

||||||||

| Luxembourg–0.47% |

||||||||

| ArcelorMittal S.A. |

4,585 | 102,653 | ||||||

|

|

||||||||

| Malaysia–0.33% |

||||||||

| CIMB Group Holdings Bhd. |

7,300 | 8,521 | ||||||

|

|

||||||||

| IHH Healthcare Bhd. |

8,300 | 10,443 | ||||||

|

|

||||||||

| Malayan Banking Bhd. |

5,200 | 9,447 | ||||||

|

|

||||||||

| Petronas Chemicals Group Bhd. |

7,500 | 13,839 | ||||||

|

|

||||||||

| Public Bank Bhd. |

23,500 | 22,228 | ||||||

|

|

||||||||

| Tenaga Nasional Bhd. |

4,300 | 7,662 | ||||||

|

|

||||||||

| 72,140 | ||||||||

|

|

||||||||

| Mexico–0.65% |

||||||||

| Arca Continental S.A.B. de C.V. |

1,300 | 10,649 | ||||||

|

|

||||||||

| Fomento Economico Mexicano S.A.B. de C.V., Series CPO |

900 | 6,461 | ||||||

|

|

||||||||

| Grupo Bimbo S.A.B. de C.V., Series A |

4,300 | 16,648 | ||||||

|

|

||||||||

| Grupo Financiero Banorte S.A.B. de C.V., Class O |

1,200 | 9,754 | ||||||

|

|

||||||||

| Grupo Financiero Inbursa S.A.B. de C.V., Class O(a) |

6,600 | 12,182 | ||||||

|

|

||||||||

| Grupo Mexico S.A.B. de C.V., Class B |

3,900 | 14,139 | ||||||

|

|

||||||||

| Grupo Televisa S.A.B., Series CPO |

4,700 | 4,986 | ||||||

|

|

||||||||

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

| 9 | Invesco Advantage International Fund |

| Shares | Value | |||||||

|

|

||||||||

| Mexico–(continued) |

||||||||

| Wal-Mart de Mexico S.A.B. de C.V., Series V |

17,273 | $ | 66,719 | |||||

|

|

||||||||

| 141,538 | ||||||||

|

|

||||||||

| Netherlands–3.61% |

||||||||

| ASML Holding N.V. |

173 | 81,555 | ||||||

|

|

||||||||

| EXOR N.V.(a) |

69 | 4,637 | ||||||

|

|

||||||||

| EXOR N.V.(a) |

104 | 6,985 | ||||||

|

|

||||||||

| Heineken Holding N.V. |

189 | 12,906 | ||||||

|

|

||||||||

| ING Groep N.V. |

6,806 | 66,850 | ||||||

|

|

||||||||

| Koninklijke Ahold Delhaize N.V. |

2,915 | 81,348 | ||||||

|

|

||||||||

| Koninklijke DSM N.V. |

268 | 31,558 | ||||||

|

|

||||||||

| Koninklijke KPN N.V. |

7,089 | 19,831 | ||||||

|

|

||||||||

| Koninklijke Philips N.V. |

5,152 | 65,232 | ||||||

|

|

||||||||

| Shell PLC |

14,856 | 411,780 | ||||||

|

|

||||||||

| Wolters Kluwer N.V. |

95 | 10,097 | ||||||

|

|

||||||||

| 792,779 | ||||||||

|

|

||||||||

| Peru–0.06% |

||||||||

| Credicorp Ltd. |

95 | 13,904 | ||||||

|

|

||||||||

| Philippines–0.13% |

||||||||

| International Container Terminal Services, Inc. |

2,960 | 8,864 | ||||||

|

|

||||||||

| Manila Electric Co. |

1,430 | 7,432 | ||||||

|

|

||||||||

| SM Prime Holdings, Inc. |

23,400 | 12,788 | ||||||

|

|

||||||||

| 29,084 | ||||||||

|

|

||||||||

| Poland–0.06% |

||||||||

| Polski Koncern Naftowy ORLEN S.A. |

488 | 5,616 | ||||||

|

|

||||||||

| Powszechna Kasa Oszczednosci Bank Polski S.A. |

1,418 | 7,731 | ||||||

|

|

||||||||

| 13,347 | ||||||||

|

|

||||||||

| Russia–0.00% |

||||||||

| PhosAgro PJSC, GDR(c) |

1 | 0 | ||||||

|

|

||||||||

| Sberbank of Russia PJSC(a)(c) |

9,800 | 0 | ||||||

|

|

||||||||

| Tatneft PJSC(c) |

1,980 | 0 | ||||||

|

|

||||||||

| VTB Bank PJSC(a)(c) |

9,716,000 | 0 | ||||||

|

|

||||||||

| 0 | ||||||||

|

|

||||||||

| Singapore–0.47% |

||||||||

| DBS Group Holdings Ltd. |

500 | 12,073 | ||||||

|

|

||||||||

| Oversea-Chinese Banking Corp. Ltd. |

5,700 | 48,813 | ||||||

|

|

||||||||

| Singapore Telecommunications Ltd. |

16,200 | 28,599 | ||||||

|

|

||||||||

| STMicroelectronics N.V. |

142 | 4,435 | ||||||

|

|

||||||||

| United Overseas Bank Ltd. |

500 | 9,802 | ||||||

|

|

||||||||

| 103,722 | ||||||||

|

|

||||||||

| South Africa–1.50% |

||||||||

| Absa Group Ltd. |

1,048 | 11,403 | ||||||

|

|

||||||||

| Anglo American PLC |

2,930 | 87,649 | ||||||

|

|

||||||||

| Bid Corp. Ltd. |

315 | 5,071 | ||||||

|

|

||||||||

| Capitec Bank Holdings Ltd. |

142 | 14,692 | ||||||

|

|

||||||||

| Discovery Ltd.(a) |

977 | 6,399 | ||||||

|

|

||||||||

| FirstRand Ltd. |

4,301 | 15,079 | ||||||

|

|

||||||||

| Gold Fields Ltd. |

1,544 | 12,323 | ||||||

|

|

||||||||

| Grindrod Ltd. |

362 | 205 | ||||||

|

|

||||||||

| Impala Platinum Holdings Ltd. |

1,229 | 12,589 | ||||||

|

|

||||||||

| MTN Group Ltd. |

3,450 | 24,427 | ||||||

|

|

||||||||

| Naspers Ltd., Class N |

124 | 12,840 | ||||||

|

|

||||||||

| Nedbank Group Ltd. |

740 | 8,769 | ||||||

|

|

||||||||

| Shares | Value | |||||||

|

|

||||||||

| South Africa–(continued) |

||||||||

| Remgro Ltd. |

1,182 | $ | 8,798 | |||||

|

|

||||||||

| Sanlam Ltd. |

3,088 | 8,988 | ||||||

|

|

||||||||

| Sasol Ltd. |

1,922 | 32,321 | ||||||

|

|

||||||||

| Shoprite Holdings Ltd. |

2,458 | 31,313 | ||||||

|

|

||||||||

| Sibanye Stillwater Ltd. |

2,726 | 6,376 | ||||||

|

|

||||||||

| Standard Bank Group Ltd. |

3,293 | 30,796 | ||||||

|

|

||||||||

| 330,038 | ||||||||

|

|

||||||||

| South Korea–2.00% |

||||||||

| Hyundai Mobis Co. Ltd. |

252 | 38,666 | ||||||

|

|

||||||||

| KB Financial Group, Inc. |

457 | 15,373 | ||||||

|

|

||||||||

| NAVER Corp. |

55 | 6,520 | ||||||

|

|

||||||||

| Samsung Electronics Co. Ltd. |

3,450 | 143,463 | ||||||

|

|

||||||||

| Samsung SDI Co. Ltd. |

32 | 16,505 | ||||||

|

|

||||||||

| Shinhan Financial Group Co. Ltd. |

488 | 12,415 | ||||||

|

|

||||||||

| SK Hynix, Inc. |

3,560 | 206,033 | ||||||

|

|

||||||||

| 438,975 | ||||||||

|

|

||||||||

| Spain–2.34% |

||||||||

| Aena SME S.A.(a)(b) |

32 | 3,765 | ||||||

|

|

||||||||

| Amadeus IT Group S.A.(a) |

173 | 9,006 | ||||||

|

|

||||||||

| Banco Bilbao Vizcaya Argentaria S.A. |

10,886 | 55,941 | ||||||

|

|

||||||||

| Banco Santander S.A. |

42,679 | 110,411 | ||||||

|

|

||||||||

| CaixaBank S.A. |

10,697 | 35,446 | ||||||

|

|

||||||||

| Iberdrola S.A. |

12,714 | 129,151 | ||||||

|

|

||||||||

| Industria de Diseno Textil S.A. |

331 | 7,497 | ||||||

|

|

||||||||

| Repsol S.A. |

4,065 | 55,306 | ||||||

|

|

||||||||

| Telefonica S.A. |

30,579 | 105,693 | ||||||

|

|

||||||||

| 512,216 | ||||||||

|

|

||||||||

| Sweden–1.22% |

||||||||

| Atlas Copco AB, Class A |

693 | 7,399 | ||||||

|

|

||||||||

| Epiroc AB, Class A |

410 | 6,269 | ||||||

|

|

||||||||

| H & M Hennes & Mauritz AB, Class B |

1,308 | 13,160 | ||||||

|

|

||||||||

| Investor AB, Class B(d) |

4,852 | 79,174 | ||||||

|

|

||||||||

| Skandinaviska Enskilda Banken AB, Class A |

725 | 7,643 | ||||||

|

|

||||||||

| Swedbank AB, Class A |

1,575 | 23,467 | ||||||

|

|

||||||||

| Telefonaktiebolaget LM Ericsson, Class B |

8,350 | 46,392 | ||||||

|

|

||||||||

| Telia Co. AB |

5,609 | 14,853 | ||||||

|

|

||||||||

| Volvo AB, Class B |

4,206 | 68,773 | ||||||

|

|

||||||||

| 267,130 | ||||||||

|

|

||||||||

| Switzerland–3.26% |

||||||||

| ABB Ltd. |

2,505 | 69,540 | ||||||

|

|

||||||||

| Accelleron Industries AG(a) |

54 | 916 | ||||||

|

|

||||||||

| Cie Financiere Richemont S.A. |

189 | 18,486 | ||||||

|

|

||||||||

| Geberit AG |

16 | 7,106 | ||||||

|

|

||||||||

| Holcim AG |

709 | 32,161 | ||||||

|

|

||||||||

| Novartis AG |

4,789 | 388,151 | ||||||

|

|

||||||||

| Partners Group Holding AG |

15 | 13,445 | ||||||

|

|

||||||||

| SGS S.A. |

2 | 4,408 | ||||||

|

|

||||||||

| Swatch Group AG (The), BR |

79 | 17,762 | ||||||

|

|

||||||||

| Swisscom AG |

44 | 21,723 | ||||||

|

|

||||||||

| UBS Group AG |

7,720 | 122,231 | ||||||

|

|

||||||||

| Zurich Insurance Group AG |

47 | 20,040 | ||||||

|

|

||||||||

| 715,969 | ||||||||

|

|

||||||||

| Taiwan–3.60% |

||||||||

| ASE Technology Holding Co. Ltd., ADR |

658 | 3,349 | ||||||

|

|

||||||||

| Asustek Computer, Inc. |

4,000 | 29,204 | ||||||

|

|

||||||||

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

| 10 | Invesco Advantage International Fund |

| Shares | Value | |||||||

|

|

||||||||

| Taiwan–(continued) |

||||||||

| Catcher Technology Co. Ltd. |

1,000 | $ | 5,250 | |||||

|

|

||||||||

| Cathay Financial Holding Co. Ltd. |

3,000 | 3,509 | ||||||

|

|

||||||||

| Chailease Holding Co. Ltd. |

1,155 | 5,319 | ||||||

|

|

||||||||

| Chang Hwa Commercial Bank Ltd. |

7,000 | 3,597 | ||||||

|

|

||||||||

| Cheng Shin Rubber Industry Co. Ltd. |

3,000 | 3,001 | ||||||

|

|

||||||||

| China Development Financial Holding Corp. |

11,000 | 3,999 | ||||||

|

|

||||||||

| China Steel Corp. |

15,000 | 12,473 | ||||||

|

|

||||||||

| Chunghwa Telecom Co. Ltd., ADR |

2,426 | 83,479 | ||||||

|

|

||||||||

| CTBC Financial Holding Co. Ltd. |

25,000 | 15,774 | ||||||

|

|

||||||||

| Delta Electronics, Inc. |

1,000 | 7,970 | ||||||

|

|

||||||||

| E Ink Holdings, Inc. |

21,000 | 133,292 | ||||||

|

|

||||||||

| E.Sun Financial Holding Co. Ltd. |

8,000 | 5,749 | ||||||

|

|

||||||||

| Evergreen Marine Corp. Taiwan Ltd. |

800 | 3,415 | ||||||

|

|

||||||||

| Far EasTone Telecommunications Co. Ltd. |

11,000 | 24,107 | ||||||

|

|

||||||||

| First Financial Holding Co. Ltd. |

16,120 | 12,357 | ||||||

|

|

||||||||

| Formosa Chemicals & Fibre Corp. |

2,000 | 4,304 | ||||||

|

|

||||||||

| Formosa Plastics Corp. |

6,000 | 15,448 | ||||||

|

|

||||||||

| Hon Hai Precision Industry Co. Ltd. |

6,000 | 19,041 | ||||||

|

|

||||||||

| Hua Nan Financial Holdings Co. Ltd. |

10,000 | 6,518 | ||||||

|

|

||||||||

| MediaTek, Inc. |

1,000 | 18,219 | ||||||

|

|

||||||||

| Mega Financial Holding Co. Ltd. |

15,125 | 14,009 | ||||||

|

|

||||||||

| Nan Ya Plastics Corp. |

6,000 | 12,687 | ||||||

|

|

||||||||

| Nan Ya Printed Circuit Board Corp. |

1,000 | 6,517 | ||||||

|

|

||||||||

| Novatek Microelectronics Corp. |

1,000 | 7,447 | ||||||

|

|

||||||||

| Pegatron Corp. |

12,000 | 21,893 | ||||||

|

|

||||||||

| Quanta Computer, Inc. |

14,000 | 29,661 | ||||||

|

|

||||||||

| Realtek Semiconductor Corp. |

1,000 | 7,882 | ||||||

|

|

||||||||

| Taiwan Cooperative Financial Holding Co. Ltd. |

17,150 | 13,269 | ||||||

|

|

||||||||

| Taiwan Mobile Co. Ltd. |

8,000 | 23,597 | ||||||

|

|

||||||||

| Taiwan Semiconductor Manufacturing Co. Ltd., ADR |

2,521 | 155,168 | ||||||

|

|

||||||||

| Unimicron Technology Corp. |

14,000 | 53,755 | ||||||

|

|

||||||||

| Uni-President Enterprises Corp. |

3,000 | 6,086 | ||||||

|

|

||||||||

| United Microelectronics Corp., ADR |

1,268 | 7,519 | ||||||

|

|

||||||||

| Wan Hai Lines Ltd. |

1,645 | 3,439 | ||||||

|

|

||||||||

| Yuanta Financial Holding Co. Ltd. |

13,798 | 8,412 | ||||||

|

|

||||||||

| 790,715 | ||||||||

|

|

||||||||

| Turkey–0.17% |

||||||||

| Eregli Demir ve Celik Fabrikalari TAS |

14,872 | 23,703 | ||||||

|

|

||||||||

| Ford Otomotiv Sanayi A.S. |

646 | 12,599 | ||||||

|

|

||||||||

| 36,302 | ||||||||

|

|

||||||||

| United Kingdom–6.29% |

||||||||

| Ashtead Group PLC |

142 | 7,390 | ||||||

|

|

||||||||

| Associated British Foods PLC |

457 | 7,057 | ||||||

|

|

||||||||

| AstraZeneca PLC |

394 | 46,224 | ||||||

|

|

||||||||

| Aviva PLC |

5,656 | 27,093 | ||||||

|

|

||||||||

| BAE Systems PLC |

7,594 | 70,924 | ||||||

|

|

||||||||

| Barclays PLC |

57,204 | 97,393 | ||||||

|

|

||||||||

| BP PLC(d) |

32,486 | 180,224 | ||||||

|

|

||||||||

| British American Tobacco PLC |

6,191 | 244,579 | ||||||

|

|

||||||||

| BT Group PLC |

12,745 | 18,945 | ||||||

|

|

||||||||

| Coca-Cola Europacific Partners PLC |

347 | 16,326 | ||||||

|

|

||||||||

| Compass Group PLC |

851 | 17,923 | ||||||

|

|

||||||||

| Diageo PLC |

1,512 | 62,334 | ||||||

|

|

||||||||

| Experian PLC |

173 | 5,499 | ||||||

|

|

||||||||

| Haleon PLC(a) |

1,119 | 3,437 | ||||||

|

|

||||||||

| HSBC Holdings PLC |

8,413 | 43,152 | ||||||

|

|

||||||||

| Shares | Value | |||||||

|

|

||||||||

| United Kingdom–(continued) |

||||||||

| Imperial Brands PLC |

2,710 | $ | 65,977 | |||||

|

|

||||||||

| Lloyds Banking Group PLC |

153,416 | 73,839 | ||||||

|

|

||||||||

| National Grid PLC |

2,741 | 29,824 | ||||||

|

|

||||||||

| NatWest Group PLC |

11,264 | 30,249 | ||||||

|

|

||||||||

| Reckitt Benckiser Group PLC |

394 | 26,103 | ||||||

|

|

||||||||

| RELX PLC |

740 | 19,891 | ||||||

|

|

||||||||

| SSE PLC |

1,717 | 30,652 | ||||||

|

|

||||||||

| Standard Chartered PLC |

4,474 | 26,690 | ||||||

|

|

||||||||

| Tesco PLC |

30,138 | 74,294 | ||||||

|

|

||||||||

| Unilever PLC |

725 | 32,978 | ||||||

|

|

||||||||

| Vodafone Group PLC |

103,869 | 121,044 | ||||||

|

|

||||||||

| 1,380,041 | ||||||||

|

|

||||||||

| United Republic of Tanzania–0.03% |

||||||||

| AngloGold Ashanti Ltd. |

504 | 6,586 | ||||||

|

|

||||||||

| United States–3.59% |

||||||||

| Atlassian Corp., Class A(a) |

47 | 9,528 | ||||||

|

|

||||||||

| Ferguson PLC |

32 | 3,487 | ||||||

|

|

||||||||

| GSK PLC |

914 | 14,978 | ||||||

|

|

||||||||

| JBS S.A. |

2,400 | 11,597 | ||||||

|

|

||||||||

| Nestle S.A. |

1,197 | 130,283 | ||||||

|

|

||||||||

| Roche Holding AG |

1,465 | 486,894 | ||||||

|

|

||||||||

| Stellantis N.V. |

8,948 | 120,801 | ||||||

|

|

||||||||

| Swiss Re AG |

126 | 9,349 | ||||||

|

|

||||||||

| 786,917 | ||||||||

|

|

||||||||

| Vietnam–0.00% |

||||||||

| Vietnam Dairy Products JSC |

2 | 6 | ||||||

|

|

||||||||

| Total Common Stocks & Other Equity Interests |

|

16,262,283 | ||||||

|

|

||||||||

| Principal Amount |

||||||||

| Event-Linked Bonds–0.41% |

||||||||

| Multinational–0.41% |

||||||||

| Alturas RE Segregated Account, Catastrophe Linked Notes, 0.00%, 12/31/2022(b)(c)(e) |

$ | 1,000 | 0 | |||||

|

|

||||||||

| Eden RE II Ltd., Class A, Catastrophe Linked Notes, 0.00%, |

720 | 7,979 | ||||||

|

|

||||||||

| Limestone Re Ltd., Class A, Catastrophe Linked Notes, 0.00%, |

1,175 | 1,416 | ||||||

|

|

||||||||

| Sector Re V Ltd., Series 2019-1, Class A, Catastrophe Linked Notes, 0.00%, 03/01/2024(b)(c)(e) |

120,000 | 81,303 | ||||||

|

|

||||||||

| Total Event-Linked Bonds (Cost $122,895) |

|

90,698 | ||||||

|

|

||||||||

| Shares | ||||||||

| Preferred Stocks–0.26% |

||||||||

| Multinational–0.26% |

||||||||

| Harambee Re Ltd., Pfd.(c) |

15 | 1,403 | ||||||

|

|

||||||||

| Lion Rock Re Ltd., Series S, Pfd.(c) |

25 | 1,573 | ||||||

|

|

||||||||

| Mt. Logan Re Ltd., Pfd.(c) |

116 | 48,578 | ||||||

|

|

||||||||

| Thopas Re Ltd., Pfd.(c) |

5 | 1,362 | ||||||

|

|

||||||||

| Turing Re Ltd., Series 2019-1, Pfd.(b)(c) |

885 | 2,386 | ||||||

|

|

||||||||

| Viribus Re Ltd., Pfd.(c) |

33,312 | 2,104 | ||||||

|

|

||||||||

| Total Preferred Stocks (Cost $241,561) |

|

57,406 | ||||||

|

|

||||||||

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

| 11 | Invesco Advantage International Fund |

| Shares | Value | |||||||

|

|

||||||||

| Money Market Funds–19.58% |

||||||||

| Invesco Government & Agency Portfolio, Institutional Class, |

1,503,463 | $ | 1,503,463 | |||||

|

|

||||||||

| Invesco Liquid Assets Portfolio, Institutional

Class, |

1,073,794 | 1,074,009 | ||||||

|

|

||||||||

| Invesco Treasury Portfolio, Institutional Class, 3.08%(f)(g) |

1,718,243 | 1,718,243 | ||||||

|

|

||||||||

| Total Money Market Funds (Cost $4,295,609) |

|

4,295,715 | ||||||

|

|

||||||||

| TOTAL INVESTMENTS IN SECURITIES |

|

20,615,404 | ||||||

|

|

||||||||

| Investments Purchased with Cash Collateral from Securities on Loan |

| |||||||

| Money Market Funds–0.30% |

||||||||

| Invesco Private Government Fund, 3.18%(f)(g)(h) |

18,242 | 18,242 | ||||||

|

|

||||||||

| Shares | Value | |||||||

|

|

||||||||

| Money Market Funds–(continued) |

||||||||

| Invesco Private Prime Fund, 3.28%(f)(g)(h) |

46,647 | $ | 46,646 | |||||

|

|

||||||||

| Total Investments Purchased with Cash Collateral from Securities on Loan (Cost $64,884) |

64,888 | |||||||

|

|

||||||||

| TOTAL INVESTMENTS IN SECURITIES–94.67% |

|

20,770,990 | ||||||

|

|

||||||||

| OTHER ASSETS LESS LIABILITIES–5.33% |

|

1,169,139 | ||||||

|

|

||||||||

| NET ASSETS–100.00% |

$ | 21,940,129 | ||||||

|

|

||||||||

Investment Abbreviations:

| ADR | - American Depositary Receipt |

| BDR | - Brazilian Depositary Receipt |

| BR | - Bearer Shares |

| CPO | - Certificates of Ordinary Participation |

| GDR | - Global Depositary Receipt |

| Pfd. | - Preferred |

Notes to Schedule of Investments:

| (a) | Non-income producing security. |

| (b) | Security purchased or received in a transaction exempt from registration under the Securities Act of 1933, as amended (the “1933 Act”). The security may be resold pursuant to an exemption from registration under the 1933 Act, typically to qualified institutional buyers. The aggregate value of these securities at October 31, 2022 was $203,827, which represented less than 1% of the Fund’s Net Assets. |

| (c) | Security valued using significant unobservable inputs (Level 3). See Note 3. |

| (d) | All or a portion of this security was out on loan at October 31, 2022. |

| (e) | Zero coupon bond issued at a discount. |

| (f) | Affiliated issuer. The issuer and/or the Fund is a wholly-owned subsidiary of Invesco Ltd., or is affiliated by having an investment adviser that is under common control of Invesco Ltd. The table below shows the Fund’s transactions in, and earnings from, its investments in affiliates for the fiscal year ended October 31, 2022. |

| Value October 31, 2021 |

Purchases at Cost |

Proceeds from Sales |

Change in Unrealized Appreciation |

Realized (Loss) |

Value October 31, 2022 |

Dividend Income | ||||||||||||||||||||||

| Investments in Affiliated Money Market Funds: | ||||||||||||||||||||||||||||

| Invesco Government & Agency Portfolio, Institutional Class |

$ 705,491 | $ 6,944,368 | $ (6,146,396 | ) | $ - | $ - | $1,503,463 | $11,395 | ||||||||||||||||||||

| Invesco Liquid Assets Portfolio, Institutional Class |

880,433 | 4,960,263 | (4,766,539 | ) | 182 | (330) | 1,074,009 | 14,248 | ||||||||||||||||||||

| Invesco Treasury Portfolio, Institutional Class |

806,276 | 7,936,421 | (7,024,454 | ) | - | - | 1,718,243 | 16,429 | ||||||||||||||||||||

| Investments Purchased with Cash Collateral from Securities on Loan: | ||||||||||||||||||||||||||||

| Invesco Private Government Fund |

- | 203,776 | (185,534 | ) | - | - | 18,242 | 100* | ||||||||||||||||||||

| Invesco Private Prime Fund |

- | 481,483 | (434,821 | ) | 4 | (20) | 46,646 | 269* | ||||||||||||||||||||

| Total |

$2,392,200 | $20,526,311 | $(18,557,744 | ) | $186 | $(350) | $4,360,603 | $42,441 | ||||||||||||||||||||

| * | Represents the income earned on the investment of cash collateral, which is included in securities lending income on the Statement of Operations. Does not include rebates and fees paid to lending agent or premiums received from borrowers, if any. |

| (g) | The rate shown is the 7-day SEC standardized yield as of October 31, 2022. |

| (h) | The security has been segregated to satisfy the commitment to return the cash collateral received in securities lending transactions upon the borrower’s return of the securities loaned. See Note 1J. |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

| 12 | Invesco Advantage International Fund |

| Open Exchange-Traded Index Options Written | ||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||

| Description | Type of Contract |

Expiration Date |

Number of Contracts |

Exercise Price |

Notional Value* |

Value | ||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||

| Equity Risk |

||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||

| MSCI EAFE Index |

Call | 11/18/2022 | 40 | USD | 1,770.00 | USD | 7,080,000 | $ | (120,600 | ) | ||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||

| MSCI Emerging Markets Index |

Call | 11/18/2022 | 35 | USD | 930.00 | USD | 3,255,000 | (5,163 | ) | |||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||

| Subtotal – Exchange-Traded Index Call Options Written |

(125,763 | ) | ||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||

| Equity Risk |

||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||

| MSCI EAFE Index |

Put | 11/18/2022 | 40 | USD | 1,550.00 | USD | 6,200,000 | (12,200 | ) | |||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||

| MSCI Emerging Markets Index |

Put | 11/18/2022 | 35 | USD | 820.00 | USD | 2,870,000 | (26,425 | ) | |||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||

| Subtotal – Exchange-Traded Index Put Options Written |

(38,625 | ) | ||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||

| Total Index Options Written |

$ | (164,388 | ) | |||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||

| * | Notional Value is calculated by multiplying the Number of Contracts by the Exercise Price by the multiplier. |

| Open Futures Contracts(a) | ||||||||||||||||||||

| Long Futures Contracts | Number of Contracts |

Expiration Month |

Notional Value |

Value | Unrealized Appreciation (Depreciation) |

|||||||||||||||

| Currency Risk |

||||||||||||||||||||

| Canadian Dollar |

24 | December-2022 | $ | 1,761,720 | $ | (38,605 | ) | $ (38,605 | ) | |||||||||||

| Equity Risk |

||||||||||||||||||||

| S&P/TSX 60 Index |

11 | December-2022 | 1,901,655 | 15,216 | 15,216 | |||||||||||||||

| Subtotal-Long Futures Contracts |

(23,389 | ) | (23,389 | ) | ||||||||||||||||

| Short Futures Contracts |

||||||||||||||||||||

| Equity Risk |

||||||||||||||||||||

| MSCI EAFE Index |

79 | December-2022 | (6,935,805 | ) | 334,639 | 334,639 | ||||||||||||||

| MSCI Emerging Markets Index |

71 | December-2022 | (3,030,280 | ) | 409,551 | 409,551 | ||||||||||||||

| Subtotal-Short Futures Contracts |

744,190 | 744,190 | ||||||||||||||||||

| Total Futures Contracts |

$ | 720,801 | $720,801 | |||||||||||||||||

| (a) | Futures contracts collateralized by $624,516 cash held with Merrill Lynch International, the futures commission merchant. |

| Open Over-The-Counter Total Return Swap Agreements(a) | ||||||||||||||||||||||||||||||||||||||||||

| Counterparty | Pay/ Receive |

Reference Entity | Floating Rate Index |

Payment Frequency |

Number of Contracts |

Maturity Date | Notional Value | Upfront Payments |

Value | Unrealized Appreciation |

||||||||||||||||||||||||||||||||

| Equity Risk |

||||||||||||||||||||||||||||||||||||||||||

| BNP Paribas S.A. |

Receive | MSCI EAFE Minimum Volatility Daily Net Total Return Index | |

SOFR + 0.340% |

|

Monthly | 936 | February-2023 | USD | 1,575,906 | $- | $ | 39,293 | $39,293 | ||||||||||||||||||||||||||||

| Goldman Sachs International |

Receive | MSCI Emerging Markets Minimum Volatility Daily Net Total Return Index | |

SOFR + 0.700% |

|

Monthly | 378 | December-2022 | USD | 630,149 | - | 2,657 | 2,657 | |||||||||||||||||||||||||||||

| Goldman Sachs International |

Receive | MSCI Emerging Markets Minimum Volatility Daily Net Total Return Index | |

SOFR + 0.700% |

|

Monthly | 345 | December-2022 | USD | 575,136 | - | 2,426 | 2,426 | |||||||||||||||||||||||||||||

| Goldman Sachs International |

Receive | MSCI Emerging Markets Minimum Volatility Daily Net Total Return Index | |

SOFR + 0.700% |

|

Monthly | 334 | December-2022 | USD | 556,798 | - | 2,348 | 2,348 | |||||||||||||||||||||||||||||

| Total - Total Return Swap Agreements |

|

$- | $ | 46,724 | $46,724 | |||||||||||||||||||||||||||||||||||||

| (a) | The Fund receives or pays payments based on any positive or negative return on the Reference Entity, respectively. |

Abbreviations:

SOFR – Secured Overnight Financing Rate

USD – U.S. Dollar

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

| 13 | Invesco Advantage International Fund |

Statement of Assets and Liabilities

October 31, 2022

| Assets: |

||||

| Investments in unaffiliated securities, at value |

$ | 16,410,387 | ||

|

|

||||

| Investments in affiliated money market funds, at value |

4,360,603 | |||

|

|

||||

| Other investments: |

||||

| Variation margin receivable - futures contracts |

491,719 | |||

|

|

||||

| Unrealized appreciation on swap agreements - OTC |

46,724 | |||

|

|

||||

| Deposits with brokers: |

||||

| Cash collateral - exchange-traded futures contracts |

624,516 | |||

|

|

||||

| Cash |

288,834 | |||

|

|

||||

| Foreign currencies, at value (Cost $48,187) |

47,991 | |||

|

|

||||

| Receivable for: |

||||

| Fund shares sold |

46,895 | |||

|

|

||||

| Dividends |

105,334 | |||

|

|

||||

| Interest |

404 | |||

|

|

||||

| Investment for trustee deferred compensation and retirement plans |

12,014 | |||

|

|

||||

| Other assets |

40,449 | |||

|

|

||||

| Total assets |

22,475,870 | |||

|

|

||||

| Liabilities: |

||||

| Other investments: |

||||

| Options written, at value (premiums received $291,991) |

164,388 | |||

|

|

||||

| Swaps payable - OTC |

4,658 | |||

|

|

||||

| Payable for: |

||||

| Investments purchased |

209,957 | |||

|

|

||||

| Fund shares reacquired |

14,157 | |||

|

|

||||

| Collateral upon return of securities loaned |

64,884 | |||

|

|

||||

| Accrued fees to affiliates |

8,677 | |||

|

|

||||

| Accrued trustees’ and officers’ fees and benefits |

799 | |||

|

|

||||

| Accrued other operating expenses |

56,207 | |||

|

|

||||

| Trustee deferred compensation and retirement plans |

12,014 | |||

|

|

||||

| Total liabilities |

535,741 | |||

|

|

||||

| Net assets applicable to shares outstanding |

$ | 21,940,129 | ||

|

|

||||

| Net assets consist of: |

||||

| Shares of beneficial interest |

$ | 23,239,810 | ||

|

|

||||

| Distributable earnings (loss) |

(1,299,681 | ) | ||

|

|

||||

| $ | 21,940,129 | |||

|

|

||||

| Net Assets: |

||||

| Class A |

$ | 12,411,623 | ||

|

|

||||

| Class C |

$ | 2,920,495 | ||

|

|

||||

| Class R |

$ | 3,520,688 | ||

|

|

||||

| Class Y |

$ | 3,076,025 | ||

|

|

||||

| Class R5 |

$ | 9,872 | ||

|

|

||||

| Class R6 |

$ | 1,426 | ||

|

|

||||

| Shares outstanding, no par value, with an unlimited number of shares authorized: |

| |||

| Class A |

1,233,478 | |||

|

|

||||

| Class C |

301,918 | |||

|

|

||||

| Class R |

354,167 | |||

|

|

||||

| Class Y |

302,331 | |||

|

|

||||

| Class R5 |

974 | |||

|

|

||||

| Class R6 |

140 | |||

|

|

||||

| Class A: |

||||

| Net asset value per share |

$ | 10.06 | ||

|

|

||||

| Maximum offering price per share |

$ | 10.65 | ||

|

|

||||

| Class C: |

||||

| Net asset value and offering price per share |

$ | 9.67 | ||

|

|

||||

| Class R: |

||||

| Net asset value and offering price per share |

$ | 9.94 | ||

|

|

||||

| Class Y: |

||||

| Net asset value and offering price per share |

$ | 10.17 | ||

|

|

||||

| Class R5: |

||||

| Net asset value and offering price per share |

$ | 10.14 | ||

|

|

||||

| Class R6: |

||||

| Net asset value and offering price per share |

$ | 10.19 | ||

|

|

||||

| * | At October 31, 2022, securities with an aggregate value of $33,753 were on loan to brokers. |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

| 14 | Invesco Advantage International Fund |

Statement of Operations