| Summary Prospectus |

February 28, 2022 |

Invesco Advantage International Fund

Class: A (QMGAX), C (QMGCX), R (QMGRX), Y (QMGYX), R5 (GMAGX), R6 (QMGIX)

Before you invest, you may want to review the Fund’s

prospectus, which contains more information about the Fund and its risks. You can find the Fund’s prospectus, reports to shareholders, and other information about the Fund

online at www.invesco.com/prospectus. You can also get this information at no cost by calling (800) 959-4246 or by sending an e-mail request to ProspectusRequest@invesco.com. The

Fund’s prospectus and statement of additional information, both dated February 28, 2022 (as each may be amended or supplemented), are incorporated by reference into this Summary Prospectus and may be obtained, free of charge, at the website, phone number or e-mail address noted above.

Investment Objective(s)

The Fund’s investment objective is to seek capital appreciation.

Fees and Expenses of the Fund

This table describes the fees and expenses that you may pay if you buy, hold and sell shares of the Fund.

The table and Examples below do not reflect any transaction

fees that may be charged by financial intermediaries or

commissions that a shareholder may be required to pay directly

to its financial intermediary when buying or selling Class Y or

Class R6 shares. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least

$50,000 in the Invesco Funds. More

information about these and other discounts is available from your financial professional and in the section “Shareholder Account Information – Initial Sales Charges (Class A Shares Only)” on page A-3 of the prospectus and the

section “Purchase, Redemption and Pricing of Shares – Purchase and Redemption of Shares” on page L-1 of the statement of additional information (SAI).

Shareholder Fees (fees paid directly from your investment)

| Class: |

A |

C |

R |

Y |

R5 |

R6 |

| Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

5.50% |

None |

None |

None |

None |

None |

| | ||||||

| Maximum Deferred Sales Charge (Load) (as a percentage of original purchase price or redemption proceeds, whichever is less) |

None1 |

1.00% |

None |

None |

None |

None |

| | ||||||

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

| Class: |

A |

C |

R |

Y |

R5 |

R6 |

| Management Fees |

0.49% |

0.49% |

0.49% |

0.49% |

0.49% |

0.49% |

| | ||||||

| Distribution and/or Service (12b-1) Fees |

0.23 |

1.00 |

0.50 |

None |

None |

None |

| | ||||||

| Other Expenses |

1.55 |

1.55 |

1.55 |

1.55 |

1.36 |

1.36 |

| | ||||||

| Acquired Fund Fees and Expenses |

0.02 |

0.02 |

0.02 |

0.02 |

0.02 |

0.02 |

| | ||||||

| Total Annual Fund Operating Expenses |

2.29 |

3.06 |

2.56 |

2.06 |

1.87 |

1.87 |

| | ||||||

| Fee Waiver and/or Expense Reimbursement2

|

1.40 |

1.42 |

1.42 |

1.42 |

1.23 |

1.23 |

| | ||||||

| Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement |

0.89 |

1.64 |

1.14 |

0.64 |

0.64 |

0.64 |

| | ||||||

1

A contingent deferred sales charge may apply in some cases. See “Shareholder Account

Information-Contingent Deferred Sales Charges (CDSCs).”

2

Invesco Advisers, Inc. (Invesco or the Adviser) has contractually agreed to waive advisory

fees and/or reimburse expenses to the extent necessary to limit Total Annual Fund

Operating Expenses After Fee Waiver and/or

Expense Reimbursement (excluding certain items discussed in the SAI) of Class A, Class C, Class R, Class Y, Class R5 and Class R6 shares to 0.85%, 1.60%, 1.10%, 0.60%, 0.60% and 0.60%, respectively, of the Fund’s average daily net assets (the

“expense limits”). Unless Invesco continues the fee waiver agreement, it will terminate on

February 28, 2023. During its term, the fee waiver agreement cannot be terminated or amended to increase the expense limits without approval of the Board of

Trustees.

Example. This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds.

The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem

all of your shares at the end of those periods. This Example does not include commissions and/or other forms of compensation that investors may pay on transactions in Class Y and Class R6 shares. The Example also assumes that your

investment has a 5% return each year and that the Fund’s operating expenses remain equal to the Total

Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement in the first year and the

Total Annual Fund Operating Expenses thereafter.

Although your actual costs may be higher or lower, based on these assumptions, your costs would

be:

| |

1 Year |

3 Years |

5 Years |

10 Years |

| Class A |

$636 |

$1,099 |

$1,587 |

$2,928 |

| | ||||

| Class C |

$267 |

$812 |

$1,482 |

$3,093 |

| | ||||

| Class R |

$116 |

$661 |

$1,233 |

$2,789 |

| | ||||

| Class Y |

$65 |

$508 |

$977 |

$2,276 |

| | ||||

| Class R5 |

$65 |

$468 |

$896 |

$2,090 |

| | ||||

| Class R6 |

$65 |

$468 |

$896 |

$2,090 |

| | ||||

You would pay the following expenses if you did not redeem your shares:

| |

1 Year |

3 Years |

5 Years |

10 Years |

| Class A |

$636 |

$1,099 |

$1,587 |

$2,928 |

| | ||||

| Class C |

$167 |

$812 |

$1,482 |

$3,093 |

| | ||||

| Class R |

$116 |

$661 |

$1,233 |

$2,789 |

| | ||||

| Class Y |

$65 |

$508 |

$977 |

$2,276 |

| | ||||

| Class R5 |

$65 |

$468 |

$896 |

$2,090 |

| | ||||

| Class R6 |

$65 |

$468 |

$896 |

$2,090 |

| | ||||

Portfolio Turnover. The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover

rate may indicate higher transaction costs and

1 Invesco Advantage International Fund

invesco.com/usO-GLMAG-SUMPRO-1

may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in

annual fund operating expenses or in the Example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 141% of the average value of its portfolio.

Principal Investment Strategies of the Fund

The Fund seeks to achieve its investment objective by investing mainly in a broad range of international equity securities and other types of investments, including derivatives. Invesco Advisers,

Inc.’s (Invesco or the Adviser) Global Asset Allocation (GAA) Team evaluates market conditions on at

least a monthly basis to determine the portfolio’s investments that the team expects to perform well based on an evaluation of the market environment. As part of its evaluation, the GAA Team considers, among other things, certain factors such as earnings

quality and profitability, price momentum, valuation metrics, market capitalization and historical volatility. The GAA Team may also invest in the securities comprising one or more factor indices when determining the Fund’s

exposure to a particular factor.

The Fund may invest without limit in all types of equity securities, including common

stock, depositary receipts, and other securities or instruments whose prices are linked to the value of common stock.

There are no restrictions on where the Fund may invest geographically or on the amount of the Fund’s assets that can be invested in foreign securities, including with respect to

securities of issuers in developing and emerging markets (i.e., those that are generally in the early stages of their industrial cycles). Under normal market conditions, the Fund will invest in securities of issuers located in different

countries throughout the world. The Fund normally invests in securities of issuers located in at least three

countries outside the United States. The Fund may invest in securities denominated in U.S. dollars or local

foreign currencies. The Fund does not limit its investments to issuers in a particular market capitalization range and at times may invest a substantial portion of its assets in one or more particular market capitalization ranges. The

Fund may, from time to time, invest a substantial portion of its assets in a particular industry or sector.

The Fund may also invest in the securities of other investment companies, including exchange-traded funds (ETFs), subject to any limitations imposed by the Investment Company Act of

1940, as amended (1940 Act), or any rules thereunder, in order to obtain exposure to the asset classes,

investment strategies and types of securities it seeks to invest in. These may include investment companies that are sponsored and/or advised by the Adviser or an affiliate, as well as non-affiliated investment companies.

The Fund may use leverage through the use of derivatives, borrowing and other

leveraging strategies in an attempt to enhance the Fund’s returns. Leverage occurs when the investments in derivatives create greater economic exposure than the amount invested. Using derivatives often allows the portfolio managers to implement their

views more efficiently and to gain more exposure to an asset class than investing in more traditional assets

such as stocks would allow. The Fund may gain exposure to equity investments through listed and

over-the-counter options. The Fund may also use derivatives to seek income or capital gain, to hedge market risks or hedge against the risks of other investments, to hedge foreign currency exposure, or as a substitute for direct

investment in a particular asset class, investment strategy or security type. The Fund’s use of derivatives may involve the purchase and sale of swaps (including equity index swaps), futures (including equity index futures), options

(including writing (selling) put and call options on equities, equity indices and ETFs), forward foreign

currency contracts and other related instruments and techniques. The Fund may also use other types of

derivatives that are consistent with its investment objective and investment strategies. The Fund can borrow

money to purchase additional securities, another form of leverage. Although the amount of borrowing will

vary from time to time, the amount of leveraging from borrowings will not exceed one-third of the Fund’s total assets. The Fund can take long positions in investments that are believed to

be undervalued and short positions in investments that are believed to be overvalued or which are established for hedging purposes, including long and short positions in equities and

equity-sensitive convertibles, derivatives or other types of securities. The Fund’s use of derivatives and the leveraged investment exposure created by the use of derivatives are expected to be significant.

The

Fund’s overall long or short positioning can vary based on market and economic conditions, and the Fund may take both long and short positions simultaneously. The Fund can seek to take advantage of arbitrage opportunities in equity, debt, currency and

currency prices and market volatility.

The Fund may hold significant levels of cash and cash equivalent instruments, including affiliated money market funds, as margin or collateral for the Fund’s obligations under

derivatives transactions. The Fund’s portfolio managers may consider selling a security or other investment, or taking an off-setting long position, (1) for risk control purposes, (2) when its income or potential for return

deteriorates or (3) when it otherwise no longer meets Invesco’s investment selection criteria.

In attempting to meet its investment objective or to manage subscription and redemption requests, the Fund may engage in active and frequent trading of portfolio

securities.

Principal Risks of Investing in the Fund

As with

any mutual fund investment, loss of money is a risk of investing. An investment in the Fund is not a

deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other

governmental agency. The risks associated with an investment in the Fund can increase during times of significant market volatility. The principal risks of investing in the Fund

are:

Market Risk. The market values of the Fund’s investments, and therefore the value of the Fund’s shares, will go up and

down, sometimes rapidly or unpredictably. Market risk may affect a single issuer, industry or section of

the economy, or it may affect the market as a whole. The value of the Fund’s investments may go up or down due to general market conditions that are not specifically related to the particular issuer, such as real or perceived adverse economic

conditions, changes in the general outlook for revenues or corporate earnings, changes in interest or currency rates, regional or global instability, natural or environmental disasters, widespread disease or other public health

issues, war, acts of terrorism or adverse investor sentiment generally. During a general downturn in the

financial markets, multiple asset classes may decline in value. When markets perform well, there can be no

assurance that specific investments held by the Fund will rise in value.

Investing in Stocks Risk. The value of the Fund’s portfolio may be affected by changes in the stock markets. Stock markets may experience significant short-term volatility and may fall or

rise sharply at times. Adverse events in any part of the equity or fixed-income markets may have unexpected

negative effects on other market segments. Different stock markets may behave differently from each other and U.S. stock markets may move in the opposite direction from one or more foreign stock markets.

The prices of individual stocks generally do not all move in the same direction at the same time.

However, individual stock prices tend to go up and down more dramatically than those of certain other types of investments, such as bonds. A variety of factors can negatively affect the price of a particular company’s stock.

These factors may include, but are not limited to: poor earnings reports, a loss of customers, litigation against the company, general unfavorable performance of the company’s sector or industry, or changes in government regulations

affecting the company or its industry. To the extent that securities of a particular type are emphasized (for

example foreign stocks, stocks of small- or mid-cap companies, growth or value stocks, or stocks of

companies in a particular industry), fund share values may fluctuate more in response to events affecting the market for those types of securities.

2 Invesco Advantage International Fund

invesco.com/usO-GLMAG-SUMPRO-1

Foreign Securities Risk. The Fund's foreign investments may be adversely affected by political and social instability, changes in economic or taxation policies, difficulty in

enforcing obligations, decreased liquidity or increased volatility. Foreign investments also involve the risk of the possible seizure, nationalization or expropriation of the issuer or foreign deposits (in which the Fund could lose its entire

investments in a certain market) and the possible adoption of foreign governmental restrictions such as exchange controls. Foreign companies generally may be subject to less stringent regulations than U.S. companies, including

financial reporting requirements and auditing and accounting controls, and may therefore be more

susceptible to fraud or corruption. There may be less public information available about foreign companies

than U.S. companies, making it difficult to evaluate those foreign companies. Unless the Fund has hedged its

foreign currency exposure, foreign securities risk also involves the risk of negative foreign currency rate

fluctuations, which may cause the value of securities denominated in such foreign currency (or other instruments through which the Fund has exposure to foreign currencies) to decline in value. Currency exchange rates may fluctuate

significantly over short periods of time. Currency hedging strategies, if used, are not always

successful.

Emerging Market Securities Risk. Emerging markets (also referred to as developing markets) are generally subject to greater market volatility, political, social and economic instability,

uncertain trading markets and more governmental limitations on foreign investment than more developed

markets. In addition, companies operating in emerging markets may be subject to lower trading volume and

greater price fluctuations than companies in more developed markets. Such countries’ economies may be

more dependent on relatively few industries or investors that may be highly vulnerable to local and global

changes. Companies in emerging market countries generally may be subject to less stringent regulatory, disclosure, financial reporting, accounting, auditing and recordkeeping standards than companies in more developed countries. As a

result, information, including financial information, about such companies may be less available and

reliable, which can impede the Fund’s ability to evaluate such companies. Securities law and the

enforcement of systems of taxation in many emerging market countries may change quickly and unpredictably, and the ability to bring and enforce actions (including bankruptcy, confiscatory taxation, expropriation, nationalization of a

company’s assets, restrictions on foreign ownership of local companies, restrictions on withdrawing assets from the country, protectionist measures and practices such as share blocking), or to obtain information needed to

pursue or enforce such actions, may be limited. In addition, the ability of foreign entities to participate

in privatization programs of certain developing or emerging market countries may be limited by local law. Investments in emerging market securities may be subject to additional transaction costs, delays in settlement procedures, unexpected market

closures, and lack of timely information.

Geographic Focus Risk. The Fund may from time to time have a substantial amount of its assets invested in securities of issuers located in a single country or a limited number of

countries. Adverse economic, political or social conditions in those countries may therefore have a significant negative impact on the Fund’s investment performance.

European Investment Risk. The Economic and Monetary Union of the European Union (the “EU”) requires compliance with restrictions on inflation rates, deficits, interest

rates, debt levels and fiscal and monetary controls, each of which may significantly affect every country in Europe. Decreasing imports or exports, changes in governmental or EU regulations on trade, changes in the exchange rate of the euro, the

default or threat of default by an EU member country on its sovereign debt, and recessions in an EU member

country may have a significant adverse effect on the economies of EU member countries. Responses to financial problems by EU countries may not produce the desired results, may limit future growth and economic recovery, or may result in social unrest or have

other unintended consequences. Further defaults or restructurings by governments and other

entities of their debt could have additional adverse effects

on economies, financial markets, and asset valuations around the world. A number of countries in Eastern

Europe remain relatively undeveloped and can be particularly sensitive to political and economic developments. Separately, the EU faces issues involving its membership, structure, procedures and policies. The exit of one or more member states from

the EU, such as the recent departure of the United Kingdom (known as “Brexit”), would place its

currency and banking system in jeopardy. The exit by the United Kingdom or other member states will likely

result in increased volatility, illiquidity and potentially lower economic growth in the affected markets, which will adversely affect the Fund’s investments.

Derivatives Risk. The value of a derivative instrument depends largely on (and is derived from) the value of an underlying security, currency, commodity, interest rate, index or other asset

(each referred to as an underlying asset). In addition to risks relating to the underlying assets, the use

of derivatives may include other, possibly greater, risks, including counterparty, leverage and liquidity risks. Counterparty risk is the risk that the counterparty to the derivative contract will default on its obligation to pay the Fund the amount owed or otherwise

perform under the derivative contract. Derivatives create leverage risk because they do not require payment

up front equal to the economic exposure created by holding a position in the derivative. As a result, an adverse change in the value of the underlying asset could result in the Fund sustaining a loss that is substantially greater than the amount invested in

the derivative or the anticipated value of the underlying asset, which may make the Fund’s returns

more volatile and increase the risk of loss. Derivative instruments may also be less liquid than more traditional investments and the Fund may be unable to sell or close out its derivative positions at a desirable time or price. This risk may be more acute under

adverse market conditions, during which the Fund may be most in need of liquidating its derivative positions.

Derivatives may also be harder to value, less tax efficient and subject to changing government regulation

that could impact the Fund’s ability to use certain derivatives or their cost. Derivatives strategies may not always be successful. For example, derivatives used for hedging or to gain or limit exposure to a particular market segment may

not provide the expected benefits, particularly during adverse market conditions.

Borrowing Risk. Borrowing money to buy securities exposes the Fund to leverage and will cause the Fund’s share price to be more

volatile because leverage will exaggerate the effect of any increase or decrease in the value of the

Fund’s portfolio securities. Borrowing money may also require the Fund to liquidate positions when it may not be advantageous to do so. In addition, the Fund will incur interest expenses and other fees on borrowed money. There can be no assurance that the

Fund’s borrowing strategy will enhance and not reduce the Fund’s returns.

Short Position Risk. Because the Fund’s potential loss on a short position arises from increases in the value of the asset sold short, the Fund will incur a loss on a short position,

which is theoretically unlimited, if the price of the asset sold short increases from the short sale price. The counterparty to a short position or other market factors may prevent the Fund from closing out a short position at a

desirable time or price and may reduce or eliminate any gain or result in a loss. In a rising market, the

Fund’s short positions will cause the Fund to underperform the overall market and its peers that do

not engage in shorting. If the Fund holds both long and short positions, and both positions decline simultaneously, the short positions will not provide any buffer (hedge) from declines in value of the Fund’s long positions. Certain

types of short positions involve leverage, which may exaggerate any losses, potentially more than the actual cost of the investment, and will increase the volatility of the Fund’s returns.

Small- and Mid-Capitalization Companies Risk. Investing in securities of small- and mid-capitalization companies involves greater risk than customarily is associated with investing in larger,

more established companies. Stocks of small- and mid-capitalization companies tend to be more vulnerable to

changing market conditions, may have little or no operating history or track record of success, and may have more limited

3 Invesco Advantage International Fund

invesco.com/usO-GLMAG-SUMPRO-1

product lines and markets, less experienced management and fewer financial resources than larger companies. These

companies’ securities may be more volatile and less liquid than those of more established companies.

They may be more sensitive to changes in a company’s earnings expectations and may experience more

abrupt and erratic price movements. Smaller companies’ securities often trade in lower volumes and in many instances, are traded over-the-counter or on a regional securities exchange, where the frequency and volume of trading

is substantially less than is typical for securities of larger companies traded on national securities

exchanges. Therefore, the securities of smaller companies may be subject to wider price fluctuations and it

might be harder for the Fund to dispose of its holdings at an acceptable price when it wants to sell them. Since small- and mid-cap companies typically reinvest a high proportion of their earnings in their business, they may not pay

dividends for some time, particularly if they are newer companies. It may take a substantial period of time to realize a gain on an investment in a small- or mid-cap company, if any gain is realized at all.

Depositary Receipts Risk. Investing in depositary receipts involves the same risks as direct investments in foreign securities. In addition, the

underlying issuers of certain depositary receipts are under no obligation to distribute shareholder

communications or pass through any voting rights with respect to the deposited securities to the holders of such receipts. The Fund may therefore receive less timely information or have less control than if it invested directly in the foreign

issuer.

Investment Companies Risk. Investing in other investment companies could result in the duplication of certain fees, including management and

administrative fees, and may expose the Fund to the risks of owning the underlying investments that the

other investment company holds.

Sector Focus Risk. The Fund may from time to time have a significant amount of its assets invested in one market sector or group of

related industries. In this event, the Fund’s performance will depend to a greater extent on the

overall condition of the sector or group of industries and there is increased risk that the Fund will lose significant value if conditions adversely affect that sector or group of industries.

Arbitrage Risk. Arbitrage risk is the risk that securities purchased pursuant to a strategy intended to take advantage of a perceived relation- ship between the value of two or more

securities may not perform as expected.

LIBOR Transition Risk. The Fund may have investments in financial instruments that utilize the London Interbank Offered Rate (“LIBOR”) as the reference or benchmark rate for

variable interest rate calculations. LIBOR is intended to measure the rate generally at which banks can lend and borrow from one another in the relevant currency on an unsecured basis. Regulators and financial industry working groups in

several jurisdictions have worked over the past several years to identify alternative reference rates

(“ARRs”) to replace LIBOR and to assist with the transition to the new ARRs. In connection with the transition, on March 5, 2021 the UK Financial Conduct Authority (FCA), the regulator that oversees LIBOR, announced that the majority of LIBOR rates would cease to be

published or would no longer be representative on January 1, 2022. Consequently, the publication of most

LIBOR rates ceased at the end of 2021, but a selection of widely used USD LIBOR rates continues to be published until June 2023 to allow for an orderly transition away from these rates. Additionally, key regulators have instructed banking institutions to cease

entering into new contracts that reference these USD LIBOR settings after December 31, 2021, subject to

certain limited exceptions.

There remains uncertainty and risks relating to the continuing LIBOR transition and its effects on the

Fund and the instruments in which the Fund invests. For example, there can be no assurance that the composition or characteristics of any ARRs or financial instruments in which the Fund invests that utilize ARRs will be similar to or

produce the same value or economic equivalence as LIBOR or that these instruments will have the same volume

or liquidity. Additionally, although regulators have generally prohibited banking institutions from entering into new contracts that

reference those USD LIBOR settings that continue to exist,

there remains uncertainty and risks relating to certain “legacy” USD LIBOR instruments that

were issued or entered into before December 31, 2021 and the process by which a replacement interest rate will be identified and implemented into these instruments when USD LIBOR is ultimately discontinued. The effects of such uncertainty and risks

in “legacy” USD LIBOR instruments held by the Fund could result in losses to the Fund.

Money Market Fund Risk. Although money market funds generally seek to preserve the value of an investment at $1.00 per share, the Fund may

lose money by investing in money market funds. A money market fund's sponsor has no legal obligation to

provide financial support to the money market fund. The credit quality of a money market fund's holdings can

change rapidly in certain markets, and the default of a single holding could have an adverse impact on the

money market fund's share price. A money market fund's share price can also be negatively affected during periods of high redemption pressures, illiquid markets and/or significant market volatility.

Active Trading Risk. Active trading of portfolio securities may result in added expenses, a lower return and increased tax liability.

Management Risk. The Fund is actively managed and depends heavily on the Adviser’s judgment about markets, interest rates or the attractiveness, relative values, liquidity, or

potential appreciation of particular investments made for the Fund’s portfolio. The Fund could experience losses if these judgments prove to be incorrect. Additionally, legislative, regulatory, or tax developments may

adversely affect management of the Fund and, therefore, the ability of the Fund to achieve its investment

objective.

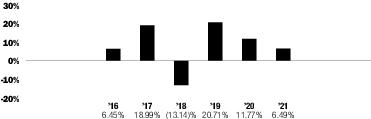

Performance Information

The bar chart and performance table provide an indication of the risks of investing in the Fund. The Fund has adopted the performance of the Oppenheimer Global Multi-Asset Growth Fund (the predecessor fund) as the result of a reorganization of the predecessor

fund into the Fund, which was consummated after the close of business on May 24, 2019 (the

“Reorganization”). Prior to the Reorganization, the Fund had not yet commenced operations.

The bar chart shows changes in the performance of the predecessor fund and the Fund from year to year as of

December 31. For periods prior to February 28, 2020, performance shown is that of the Fund using its

previous investment strategy. Therefore, the past performance shown for periods prior to February 28, 2020 may have differed had the Fund’s current investment strategy been in effect. The performance table compares the predecessor

fund’s and the Fund’s performance to that of one or more broad measures of market performance. The Fund’s (and the predecessor fund’s) past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future.

The returns shown for periods ending on or prior to May 24, 2019 are those of the

Class A, Class C, Class R and Class Y shares of the predecessor fund. Class R6 shares’ returns shown for the periods ending on or prior to May 24, 2019 are those of the Class I shares of the predecessor fund. Class A, Class C, Class R, Class Y and Class I

shares of the predecessor fund were reorganized into Class A, Class C, Class R, Class Y and Class R6

shares, respectively, of the Fund after the close of business on May 24, 2019. Class A, Class C, Class R,

Class Y and Class R6 shares’ returns of the Fund will be different from the returns of the predecessor fund as they have different expenses. Performance for Class A shares has been restated to reflect the Fund’s applicable sales charge.

Fund performance reflects any applicable fee waivers and expense reimbursements.

Performance returns would be lower without applicable fee waivers and expense reimbursements.

Updated performance information is available on the Fund’s website at

www.invesco.com/us.

4 Invesco Advantage International Fund

invesco.com/usO-GLMAG-SUMPRO-1

Annual Total Returns

The bar chart does not reflect sales loads. If it did, the annual total returns shown would be lower.

| Class A |

Period Ended |

Returns |

| Best Quarter |

December 31, 2020 |

15.00% |

| Worst Quarter |

March 31, 2020 |

-18.72% |

Average Annual Total Returns (for the periods ended December 31, 2021)

| |

Inception Date |

1 Year |

5 Years |

Since

Inception |

| Class A |

|

|

|

|

| Return Before Taxes |

8/27/2015 |

0.63% |

7.01% |

6.37% |

| Return After Taxes on Distributions |

|

-3.35 |

5.71 |

5.01 |

| Return After Taxes on Distributions and Sale of Fund Shares |

|

1.35 |

5.16 |

4.58 |

| | ||||

| Class C |

8/27/2015 |

4.81 |

7.44 |

6.54 |

| | ||||

| Class R |

8/27/2015 |

6.26 |

7.96 |

7.07 |

| | ||||

| Class Y |

8/27/2015 |

6.78 |

8.45 |

7.53 |

| | ||||

| Class R51

|

5/24/2019 |

6.80 |

8.39 |

7.45 |

| | ||||

| Class R6 |

8/27/2015 |

6.77 |

8.51 |

7.61 |

| | ||||

| MSCI ACWI ex USA® Index (Net) (reflects reinvested dividends net of withholding taxes, but reflects no deduction for fees, expenses or other taxes)2 |

|

7.82 |

9.61 |

8.05 |

| | ||||

1

Performance shown prior to the inception date is that of the predecessor fund's Class A

shares at net asset value and includes the 12b-1 fees applicable to that class. Although invested in the

same portfolio of securities, Class R5 shares' returns of the Fund will be different from Class A shares' returns of the predecessor fund as they have different expenses.

2

From the inception date of the oldest share class.

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor's tax situation and may differ from those shown, and after-tax returns

shown are not relevant to investors who hold their Fund shares through tax-advantaged arrangements, such as

401(k) plans, 529 college savings plans or individual retirement accounts. After-tax

returns are shown for Class A shares only and after-tax returns for other classes will vary.

Management of the Fund

Investment Adviser: Invesco Advisers, Inc.

| Portfolio Managers |

Title |

Length of Service on the Fund |

| Mark Ahnrud, CFA |

Portfolio Manager |

2019 |

| | ||

| John Burrello, CFA |

Portfolio Manager |

2019 |

| | ||

| Chris Devine, CFA |

Portfolio Manager |

2019 |

| | ||

| Scott Hixon, CFA |

Portfolio Manager |

2019 |

| | ||

| Christian Ulrich, CFA |

Portfolio Manager |

2019 |

| | ||

| Scott Wolle, CFA |

Portfolio Manager |

2019 |

| | ||

Purchase and Sale of Fund Shares

You may purchase, redeem or exchange shares of the Fund on any business day through your financial adviser or by telephone at 800-959-4246. Shares of the Fund, other than Class

R5 and Class R6 shares, may also be purchased, redeemed or exchanged on any business day through our website at www.invesco.com/us or by mail to Invesco Investment Services, Inc., P.O. Box 219078, Kansas City, MO

64121-9078.

The minimum

investments for Class A, C, R and Y shares for fund accounts are as follows:

| Type of Account |

Initial

Investment Per Fund |

Additional

Investments Per Fund |

| Asset or fee-based accounts managed by your financial adviser |

None |

None |

| | ||

| Employer Sponsored Retirement and Benefit Plans and Employer Sponsored IRAs |

None |

None |

| | ||

| IRAs and Coverdell ESAs if the new investor is purchasing shares through a systematic purchase plan |

$25 |

$25 |

| | ||

| All other types of accounts if the investor is purchasing shares through a systematic purchase plan |

50 |

50 |

| | ||

| IRAs and Coverdell ESAs |

250 |

25 |

| | ||

| All other accounts |

1,000 |

50 |

| | ||

With respect to Class R5 and Class R6 shares, there is no minimum initial investment for Employer Sponsored Retirement and Benefit Plans investing through a retirement platform that

administers at least $2.5 billion in retirement plan assets. All other Employer Sponsored Retirement and

Benefit Plans must meet a minimum initial investment of at least $1 million in each Fund in which it

invests.

For all other institutional investors purchasing Class R5 or Class R6 shares, the

minimum initial investment in each share class is $1 million, unless such investment is made by (i) an investment company, as defined under the Investment Company Act of 1940, as amended (1940 Act), that is part of a family of investment companies which

own in the aggregate at least $100 million in securities, or (ii) an account established with a 529 college

savings plan managed by Invesco, in which case there is no minimum initial investment.

There are no minimum investment amounts for Class R6 shares held through retail

omnibus accounts maintained by an intermediary, such as a broker, that (i) generally charges an asset-based fee or commission in addition to those described in this prospectus, and (ii) maintains Class R6 shares and makes them available to retail

investors.

Tax Information

The

Fund’s distributions generally are taxable to you as ordinary income, capital gains, or some combination of both, unless you are investing through a tax-advantaged arrangement, such as a 401(k) plan, 529 college savings plan or individual retirement account. Any

distributions from a 401(k) plan or individual retirement account may be taxed as ordinary income when

withdrawn from such plan or account.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund, the Fund’s distributor or its related companies may pay the intermediary

for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson or financial adviser to recommend the Fund over another

investment. Ask your salesperson or financial adviser or visit your financial intermediary’s website

for more information.

5 Invesco Advantage International Fund

invesco.com/usO-GLMAG-SUMPRO-1