| Summary Prospectus |

February 26, 2021 |

Invesco Asia Pacific Growth Fund

Class: A (ASIAX), C (ASICX), Y (ASIYX), R6 (ASISX)

Before you invest, you may want

to review the Fund’s prospectus, which contains more information about the Fund and its risks. You can find the Fund’s prospectus, reports to shareholders, and other

information about the Fund online at www.invesco.com/prospectus. You can also get this information at no cost by calling (800) 959-4246 or by sending an e-mail request to

ProspectusRequest@invesco.com. The Fund’s prospectus and statement of additional information, both dated February 26, 2021 (as each may be amended or supplemented), are

incorporated by reference into this Summary Prospectus and may be obtained, free of charge, at the website, phone number or e-mail address noted above.

Investment

Objective(s)

The Fund's investment objective is long-term growth of

capital.

Fees and Expenses of the Fund

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund.

You may

qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least

$50,000 in the Invesco Funds. More

information about these and other discounts is available from your financial professional and in the

section “Shareholder Account Information – Initial Sales Charges (Class A Shares Only)” on page A-3 of the prospectus and the section “Purchase, Redemption and Pricing of Shares-Purchase and Redemption of Shares” on page L-1 of

the statement of additional information (SAI). The table and Examples below do not reflect any transaction fees that may be charged by financial intermediaries, or commissions that a shareholder may be required to

pay directly to its financial intermediary when buying or selling Class Y or Class R6 shares.

Shareholder Fees (fees paid directly from your investment)

| Class: |

A |

C |

Y |

R6 |

| Maximum Sales

Charge (Load) Imposed on Purchases (as a percentage of offering price) |

5.50% |

None |

None |

None |

| | ||||

| Maximum

Deferred Sales Charge (Load) (as a percentage of original purchase price or redemption proceeds, whichever

is less) |

1None |

1.00% |

None |

None |

| | ||||

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

| Class: |

A |

C |

Y |

R6 |

| Management Fees |

0.91% |

0.91% |

0.91% |

0.91% |

| | ||||

| Distribution and/or Service (12b-1) Fees |

0.25 |

1.00 |

None |

None |

| | ||||

| Other Expenses |

0.29 |

0.29 |

0.29 |

0.09 |

| | ||||

| Acquired Fund Fees and Expenses |

0.02 |

0.02 |

0.02 |

0.02 |

| | ||||

| Total Annual Fund Operating Expenses |

1.47 |

2.22 |

1.22 |

1.02 |

| | ||||

| Fee Waiver and/or Expense Reimbursement2 |

0.01 |

0.01 |

0.01 |

0.01 |

| | ||||

| Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement |

1.46 |

2.21 |

1.21 |

1.01 |

| | ||||

1

A contingent deferred sales charge may apply in some cases. See “Shareholder Account

Information-Contingent Deferred Sales Charges (CDSCs).”

2

Invesco Advisers, Inc. (Invesco or the Adviser) has contractually agreed to waive a portion of

the Fund's management fee in an amount equal to the net management fee that Invesco earns on the Fund's

investments in certain affiliated funds, which will have the effect of

reducing the Acquired Fund Fees and Expenses. Unless Invesco continues the fee waiver agreement, it will terminate on June 30, 2022.

During its term, the fee waiver agreement cannot be terminated or amended to reduce the advisory fee waiver without approval of the Board of Trustees.

Example. This Example is

intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds.

The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. This Example does not include

commissions and/or other forms of compensation that investors may pay on transactions in Class Y and Class

R6 shares. The Example also assumes that your investment has a 5% return each year and that the

Fund’s operating expenses remain equal to the Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement in the first year and the Total Annual Fund Operating Expenses thereafter.

Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

| |

1 Year |

3 Years |

5 Years |

10 Years |

| Class

A |

690$ |

988$ |

1,308$ |

2,210$ |

| | ||||

| Class

C |

324$ |

693$ |

1,189$ |

2,364$ |

| | ||||

| Class

Y |

123$ |

386$ |

669$ |

1,476$ |

| | ||||

| Class

R6 |

103$ |

324$ |

562$ |

1,247$ |

| | ||||

You would pay the following expenses if you did not redeem your shares:

| |

1 Year |

3 Years |

5 Years |

10 Years |

| Class

A |

690$ |

988$ |

1,308$ |

2,210$ |

| | ||||

| Class

C |

224$ |

693$ |

1,189$ |

2,364$ |

| | ||||

| Class

Y |

123$ |

386$ |

669$ |

1,476$ |

| | ||||

| Class

R6 |

103$ |

324$ |

562$ |

1,247$ |

| | ||||

Portfolio Turnover. The Fund pays transaction costs, such as

commissions, when it buys and sells securities (or “turns over” its portfolio). A higher

portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the Example, affect the Fund’s

performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 27% of the average value of its portfolio.

1 Invesco Asia

Pacific Growth Fund

invesco.com/usAPG-SUMPRO-1

Principal Investment Strategies of the Fund

The Fund invests, under normal circumstances, at least 80% of its net assets (plus any borrowings for investment purposes) in securities of issuers in the Asia Pacific region (except

Japanese issuers), and in derivatives and other instruments that have economic characteristics similar to such securities. The Fund uses various criteria to determine whether an issuer is in the Asia Pacific region, including

whether (1) it is organized under the laws of a country in the Asia Pacific region, (2) it has a principal office in a country in the Asia Pacific region, (3) it derives 50% or more of its total revenues from business in countries in the

Asia Pacific region, or (4) its securities are trading principally on a security exchange, or in an

over-the-counter market, in a country in the Asia Pacific region.

The Fund invests primarily in equity securities, including common and preferred

stock, and depositary receipts. The Fund’s common stock investments also include China-A shares (shares of companies based in mainland China that trade on the Shanghai Stock Exchange and the Shenzhen Stock Exchange).

The Fund invests primarily in securities that are considered by the

Fund’s portfolio managers to have potential for earnings or revenue growth.

The Fund may invest in the securities of issuers of all capitalization sizes and may

invest a significant amount of its net assets in the securities of small- and mid-capitalization issuers.

The Fund may invest up to 100% of its net assets in foreign

securities, including securities of issuers located in emerging markets countries, i.e., those that are

generally in the early stages of their industrial cycles.

The Fund can invest in derivative instruments including futures

contracts and forward foreign currency contracts. The Fund can use forward foreign currency contracts to

hedge against adverse movements in the foreign currencies in which portfolio securities are denominated; though the Fund has not historically used these instruments. The Fund can use futures contracts to gain exposure to the broad

market in connection with managing cash balances or to hedge against downside risk.

The portfolio managers employ a disciplined investment strategy that emphasizes

fundamental research. The fundamental research primarily focuses on identifying quality growth companies and is supported by quantitative analysis, portfolio construction and risk management. Investments for the portfolio are selected bottom-up

on a security-by-security basis. The focus is on the strengths of individual issuers, rather than sector or

country trends. The portfolio managers’ strategy primarily focuses on identifying issuers that they believe have sustainable earnings growth, efficient capital allocation, and attractive prices.

The Fund’s portfolio managers may consider selling a security

for several reasons, including when (1) its price changes such that they believe it has become too

expensive, (2) the original investment thesis for the company is no longer valid, or (3) a more compelling investment opportunity is identified.

Principal Risks of Investing in the Fund

As with any mutual fund investment, loss of money is a risk of investing. An investment in the Fund is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency. The risks associated with an investment in the Fund can increase during times of significant market volatility. The

principal risks of investing in the Fund are:

Market Risk. The market values of the Fund’s investments, and therefore the value of the Fund’s shares, will go up and down, sometimes rapidly or unpredictably. Market risk may

affect a single issuer, industry or section of the economy, or it may affect the market as a whole. The value of the Fund’s investments may go up or down due to general market conditions which are not specifically related to

the particular issuer, such as real or perceived adverse economic conditions, changes in the general

outlook for revenues or corporate earnings, changes in interest or currency rates, regional or global

instability, natural or environmental disasters,

widespread disease or other public health issues, war, acts of terrorism or adverse investor sentiment

generally. During a general downturn in the financial markets, multiple asset classes may decline in value. When markets perform well, there can be no assurance that specific investments held by the Fund will rise in

value.

Investing in Stocks Risk. The value of the Fund’s portfolio may be affected by changes in the stock markets. Stock markets may experience

significant short-term volatility and may fall or rise sharply at times. Adverse events in any part of the

equity or fixed-income markets may have unexpected negative effects on other market segments. Different stock

markets may behave differently from each other and U.S. stock markets may move in the opposite direction

from one or more foreign stock markets.

The prices of individual stocks

generally do not all move in the same direction at the same time. However, individual stock prices tend to go up and down more dramatically than those of certain other types of investments, such as bonds. A variety of factors can

negatively affect the price of a particular company’s stock. These factors may include, but are not

limited to: poor earnings reports, a loss of customers, litigation against the company, general unfavorable

performance of the company’s sector or industry, or changes in government regulations affecting the company or its industry. To the extent that securities of a particular type are emphasized (for example foreign stocks, stocks of

small- or mid-cap companies, growth or value stocks, or stocks of companies in a particular industry), fund share values may fluctuate more in response to events affecting the market for those types of securities.

Asia Pacific Region Risk (ex-Japan). The level of development of the economies of countries in the Asia Pacific region varies greatly. Furthermore, since the economies of the countries in the region are largely intertwined, if an economic recession is

experienced by any of these countries, it will likely adversely impact the economic performance of other

countries in the region. Certain economies in the region may be adversely affected by increased

competition, high inflation rates, undeveloped financial services sectors, currency fluctuations or restrictions, political and social instability and increased economic volatility.

Investments in companies located or operating in China involve risks not associated with investments in Western nations, such as nationalization, expropriation, or confiscation of property;

difficulty in obtaining information necessary for investigations into and/or litigation against Chinese

companies, as well as in obtaining and/or enforcing judgments; limited legal remedies for shareholders;

alteration or discontinuation of economic reforms; military conflicts, either internal or with other countries; inflation, currency fluctuations and fluctuations in inflation and interest rates that may have negative effects on the economy and

securities markets of China; and China’s dependency on the economies of other Asian countries, many of

which are developing countries. Export growth continues to be a major driver of China’s rapid

economic growth. As a result, a reduction in spending on Chinese products and services, the institution of additional tariffs or other trade barriers, including as a result of heightened trade tensions between China and the United States, or a downturn in

any of the economies of China’s key trading partners may have an adverse impact on the Chinese

economy. In addition, certain securities issued by companies located or operating in China, such as China

A-shares, are subject to trading restrictions, quota limitations, and clearing and settlement risks. The inability of the Public Company Accounting Oversight Board (“PCAOB”) to inspect audit work papers and practices of

PCAOB-registered accounting firms in China with respect to their audit work of U.S. reporting companies may

impose significant additional risks associated with investments in China.

Emerging Markets Securities Risk. Emerging markets (also referred to as developing markets) are generally subject to greater market volatility, political, social and economic instability,

uncertain trading markets and more governmental limitations on foreign investment than more developed

markets. In addition, companies operating in emerging markets may be subject to lower trading volume and

greater price fluctuations than companies in more developed markets. Companies in emerging market

2 Invesco Asia

Pacific Growth Fund

invesco.com/usAPG-SUMPRO-1

countries generally may be subject to less stringent regulatory, disclosure, financial reporting, accounting, auditing and recordkeeping standards than companies in more developed countries. As a

result, information, including financial information, about such companies may be less available and

reliable which can impede the Fund’s ability to evaluate such companies. Securities law and the

enforcement of systems of taxation in many emerging market countries may change quickly and unpredictably, and the ability to bring and enforce actions, or to obtain information needed to pursue or enforce such actions, may be limited.

In addition, investments in emerging markets securities may be subject to additional transaction costs,

delays in settlement procedures, unexpected market closures, and lack of timely information.

Foreign Securities Risk. The Fund's foreign investments may be adversely affected by political and social instability, changes in economic or

taxation policies, difficulty in enforcing obligations, decreased liquidity or increased volatility.

Foreign investments also involve the risk of the possible seizure, nationalization or expropriation of the issuer or foreign deposits (in which the Fund could lose its entire investments in a certain market) and the possible adoption of foreign governmental

restrictions such as exchange controls. Unless the Fund has hedged its foreign securities risk, foreign

securities risk also involves the risk of negative foreign currency rate fluctuations, which may cause the

value of securities denominated in such foreign currency (or other instruments through which the Fund has exposure to foreign currencies) to decline in value. Currency exchange rates may fluctuate significantly over short periods of

time. Currency hedging strategies, if used, are not always successful. For instance, currency forward

contracts, if used by the Fund, could reduce performance if there are unanticipated changes in currency

exchange rates.

Geographic Focus Risk. The Fund may from time to time have a substantial amount of its assets invested in securities of issuers located in a

single country or a limited number of countries. Adverse economic, political or social conditions in those

countries may therefore have a significant negative impact on the Fund’s investment performance.

Depositary Receipts Risk. Investing in depositary receipts involves the same risks as direct investments in foreign securities. In addition, the

underlying issuers of certain depositary receipts are under no obligation to distribute shareholder

communications or pass through any voting rights with respect to the deposited securities to the holders of such receipts. The Fund may therefore receive less timely information or have less control than if it invested directly in the foreign

issuer.

Preferred Securities Risk. Preferred securities are subject to issuer-specific and market risks applicable generally to equity securities. Preferred securities also may be subordinated to bonds or other debt instruments, subjecting them to a greater risk of

non-payment, may be less liquid than many other securities, such as common stocks, and generally offer no

voting rights with respect to the issuer.

Risks of

Growth Investing. If a growth company’s earnings or stock price fails to increase as anticipated, or

if its business plans do not produce the expected results, the value of its securities may decline sharply. Growth companies may be newer or smaller companies that may experience greater stock price fluctuations and risks of loss than

larger, more established companies. Newer growth companies tend to retain a large part of their earnings

for research, development or investments in capital assets. Therefore, they may not pay any dividends for some time. Growth investing has gone in and out of favor during past market cycles and is likely to continue to do so. During periods when growth

investing is out of favor or when markets are unstable, it may be more difficult to sell growth company

securities at an acceptable price. Growth stocks may also be more volatile than other securities because of

investor speculation.

Small- and Mid-Capitalization

Companies Risks. Investing in securities of small- and mid-capitalization companies involves greater risk

than customarily is associated with investing in larger, more established companies. Stocks of small- and

mid-capitalization companies tend to be more vulnerable to changing market conditions, may have little or no

operating history or track record

of success, and may have more limited product lines and markets, less experienced management and fewer

financial resources than larger companies. These companies’ securities may be more volatile and less

liquid than those of more established companies. They may be more sensitive to changes in a company’s earnings expectations and may experience more abrupt and erratic price movements. Smaller companies’ securities often trade

in lower volumes and in many instances, are traded over-the-counter or on a regional securities exchange,

where the frequency and volume of trading is substantially less than is typical for securities of larger

companies traded on national securities exchanges. Therefore, the securities of smaller companies may be subject to wider price fluctuations and it might be harder for the Fund to dispose of its holdings at an acceptable price when

it wants to sell them. Since small- and mid-cap companies typically reinvest a high proportion of their earnings in their business, they may not pay dividends for some time, particularly if they are newer companies. It may take a

substantial period of time to realize a gain on an investment in a small- or mid-cap company, if any gain is

realized at all. The Fund measures the market capitalization of an issuer at the time of

investment.

Sector Focus Risk. The Fund may from time to time have a significant amount of its assets invested in one market sector or group of

related industries. In this event, the Fund’s performance will depend to a greater extent on the

overall condition of the sector or group of industries and there is increased risk that the Fund will lose significant value if conditions adversely affect that sector or group of industries.

Derivatives Risk. The value of a derivative instrument depends largely on (and is derived from) the value of an underlying security, currency, commodity, interest rate, index or other asset

(each referred to as an underlying asset). In addition to risks relating to the underlying assets, the use

of derivatives may include other, possibly greater, risks, including counterparty, leverage and liquidity risks. Counterparty risk is the risk that the counterparty to the derivative contract will default on its obligation to pay the Fund the amount owed or otherwise

perform under the derivative contract. Derivatives create leverage risk because they do not require payment

up front equal to the economic exposure created by holding a position in the derivative. As a result, an adverse change in the value of the underlying asset could result in the Fund sustaining a loss that is substantially greater than the amount invested in

the derivative or the anticipated value of the underlying asset, which may make the Fund’s returns

more volatile and increase the risk of loss. Derivative instruments may also be less liquid than more traditional investments and the Fund may be unable to sell or close out its derivative positions at a desirable time or price. This risk may be more acute under

adverse market conditions, during which the Fund may be most in need of liquidating its derivative positions.

Derivatives may also be harder to value, less tax efficient and subject to changing government regulation

that could impact the Fund’s ability to use certain derivatives or their cost. Derivatives strategies may not always be successful. For example, derivatives used for hedging or to gain or limit exposure to a particular market segment may

not provide the expected benefits, particularly during adverse market conditions.

Money Market Fund Risk. Although money market funds generally seek to preserve the value of an investment at $1.00 per share, the Fund may lose money by investing in money market funds. A

money market fund's sponsor has no legal obligation to provide financial support to the money market fund.

The credit quality of a money market fund's holdings can change rapidly in certain markets, and the default of a single holding could have an adverse impact on the money market fund's share price. A money market fund's share price can also be negatively

affected during periods of high redemption pressures, illiquid markets and/or significant market

volatility.

Management Risk. The Fund is actively managed and depends heavily on the Adviser’s judgment about markets, interest rates or the attractiveness, relative values, liquidity, or

potential appreciation of particular investments made for the Fund’s portfolio. The Fund could experience

3 Invesco Asia

Pacific Growth Fund

invesco.com/usAPG-SUMPRO-1

losses if these judgments prove to be incorrect. Additionally, legislative, regulatory, or tax developments may adversely affect management of the Fund and, therefore, the ability of the Fund to

achieve its investment objective.

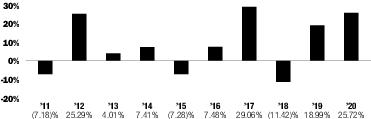

Performance Information

The bar chart and performance table provide an indication of the risks of investing in the Fund. The bar chart shows

changes in the performance of the Fund from year to year as of December 31. The performance table compares

the Fund's performance to that of a broad-based/style-specific securities market benchmark and a peer group benchmark comprised of funds with investment objectives and strategies similar to those of the Fund (in that order). The Fund's past performance (before and after taxes) is not necessarily an indication of its future performance.

Updated performance information is available on the Fund's website at

www.invesco.com/us.

Annual Total Returns

The bar chart does not reflect sales loads. If it did, the annual total returns shown would be

lower.

| Class A shares |

Period Ending |

Returns |

| Best Quarter |

June 30, 2020 |

19.79% |

| Worst Quarter |

March 31, 2020 |

-17.70% |

Average Annual Total Returns (for the periods ended December 31, 2020)

| |

Inception

Date |

1

Year |

5

Years |

10

Years |

| Class A |

|

|

|

|

| Return Before Taxes |

11/3/1997 |

18.80% |

11.68% |

7.66% |

| Return After Taxes on Distributions |

|

16.63 |

10.13 |

6.48 |

| Return After Taxes on Distributions and Sale of Fund

Shares |

|

12.30 |

9.06 |

6.04 |

| | ||||

| Class C |

11/3/1997 |

23.77 |

12.10 |

7.63 |

| | ||||

| Class Y |

10/3/2008 |

26.06 |

13.24 |

8.54 |

| | ||||

| Class R6 |

4/4/2017 |

26.31 |

113.32 |

18.45 |

| | ||||

| MSCI All Country Asia Pacific ex-Japan Index (Net)

(reflects reinvested dividends net of withholding

taxes, but reflects no deductions for fees,

expenses or other taxes) |

|

22.44 |

12.93 |

6.21 |

| | ||||

| Lipper Pacific Region ex-Japan Funds Index |

|

37.38 |

14.06 |

7.33 |

| | ||||

1

Performance includes returns of the Fund’s Class A shares at net asset value and

includes the 12b-1 fees applicable to that class. Class A shares’ performance reflects any applicable

fee waivers and/or expense reimbursements.

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor's tax situation and may differ from those shown, and after-tax returns

shown are not relevant to investors who hold their Fund shares through tax-advantaged arrangements, such as

401(k) plans, 529 college savings plans or individual retirement accounts. After-tax returns are shown for Class A shares only and after-tax returns for other classes will vary.

Management of the Fund

Investment Adviser: Invesco Advisers, Inc. (Invesco or the Adviser)

| Portfolio Managers |

Title |

Length of Service on the Fund |

| Shuxin Cao |

Portfolio

Manager (lead) |

1999

|

| | ||

| Brent Bates |

Portfolio

Manager |

2011

|

| | ||

| Mark Jason |

Portfolio

Manager |

2007

|

| | ||

Purchase and

Sale of Fund Shares

You may purchase, redeem or exchange shares of the Fund

on any business day through your financial adviser or by telephone at 800-959-4246. Shares of the Fund,

other than Class R6 shares, may also be purchased, redeemed or exchanged on any business day through our website at www.invesco.com/us or by mail to Invesco Investment Services, Inc., P.O. Box 219078, Kansas City, MO

64121-9078.

The minimum investments for Class A, C and

Y shares for fund accounts are as follows:

| Type of Account |

Initial

Investment Per Fund |

Additional Investments

Per Fund |

| Asset or fee-based accounts managed by your financial adviser |

None |

None |

| | ||

| Employer Sponsored Retirement and Benefit Plans and Employer Sponsored IRAs |

None |

None |

| | ||

| IRAs and Coverdell ESAs if the new investor is purchasing shares through a systematic purchase plan |

$25 |

$25 |

| | ||

| All other types of accounts if the investor is purchasing shares through a systematic purchase plan |

50 |

50 |

| | ||

| IRAs and Coverdell ESAs |

250 |

25 |

| | ||

| All other accounts |

1,000 |

50 |

| | ||

With respect to Class R6 shares, there is no minimum initial investment for Employer Sponsored Retirement and Benefit Plans investing through a retirement platform that administers at least

$2.5 billion in retirement plan assets. All other Employer Sponsored Retirement and Benefit Plans must meet

a minimum initial investment of at least $1 million in each Fund in which it invests.

For all other institutional investors purchasing Class R6 shares,

the minimum initial investment is $1 million, unless such investment is made by (i) an investment company,

as defined under the Investment Company Act of 1940, as amended (1940 Act), that is part of a family of investment companies which own in the aggregate at least $100 million in securities, or (ii) an account established with a 529

college savings plan managed by Invesco, in which case there is no minimum initial investment.

There are no minimum investment amounts for Class R6 shares held

through retail omnibus accounts maintained by an intermediary, such as a broker, that (i) generally charges

an asset-based fee or commission in addition to those described in this prospectus, and (ii) maintains Class R6 shares and makes them available to retail investors.

Tax Information

The Fund’s distributions generally are taxable to you as ordinary income, capital gains, or some combination of both, unless you are investing through a tax-advantaged arrangement, such as a

401(k) plan, 529 college savings plan or individual retirement account. Any distributions from a 401(k) plan or individual retirement account may be taxed as ordinary income when withdrawn from such plan or account.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase the Fund through a broker-dealer or other financial intermediary (such as a bank), the

Fund, the Fund’s distributor or its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and

your salesperson or financial adviser to recommend the Fund over another investment. Ask your salesperson

or financial adviser or visit your financial intermediary’s website for more information.

4 Invesco Asia

Pacific Growth Fund

invesco.com/usAPG-SUMPRO-1