Total | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Invesco Advantage International Fund | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fund Summary | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Investment Objective(s) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Fund’s investment objective is to seek capital appreciation. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fees and Expenses of the Fund | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in the Invesco Funds. More information about these and other discounts is available from your financial professional and in the section “Shareholder Account Information—Initial Sales Charges (Class A Shares Only)” on page A-3 of the prospectus and the section “Purchase, Redemption and Pricing of Shares-Purchase and Redemption of Shares” on page L-1 of the statement of additional information (SAI). Investors may pay commissions and/or other forms of compensation to an intermediary, such as a broker, for transactions in Class Y and Class R6 shares, which are not reflected in the table or the Example below. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Shareholder Fees (fees paid directly from your investment) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| A contingent deferred sales charge may apply in some cases. See “Shareholder Account Information-Contingent Deferred Sales Charges (CDSCs).” | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Example. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. This Example does not include commissions and/or other forms of compensation that investors may pay on transactions in Class Y and Class R6 shares. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain equal to the Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement for the contractual period above and the Total Annual Fund Operating Expenses thereafter. Although your actual costs may be higher or lower, based on these assumptions, your costs would be: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| You would pay the following expenses if you did not redeem your shares: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Portfolio Turnover. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the Example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 43% of the average value of its portfolio. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Principal Investment Strategies of the Fund | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Fund seeks to achieve its investment objective by investing primarily in a broad range of international equity securities and other types of investments, including derivatives. Invesco Advisers, Inc.’s (Invesco or the Adviser) Global Asset Allocation (GAA) Team evaluates market conditions on at least a monthly basis to determine the portfolio’s investments that the team expects to perform well based on an evaluation of the market environment. As part of its evaluation, the GAA Team considers, among other things, certain factors such as earnings quality and profitability, price momentum, valuation metrics, market capitalization and historical volatility. The GAA Team may also invest in the securities comprising one or more factor indices when determining the Fund’s exposure to a particular factor. The Fund may invest without limit in all types of equity securities, including common stock, rights and warrants, depositary receipts, and other securities or instruments whose prices are linked to the value of common stock. The Fund may gain exposure to equity investments through listed and over-the-counter options. There are no restrictions on where the Fund may invest geographically or on the amount of the Fund’s assets that can be invested in foreign securities, including with respect to securities of issuers in developing and emerging markets (i.e., those that are in the early stages of their industrial cycles). Under normal market conditions, the Fund will invest in securities of issuers located in different countries throughout the world. The Fund normally invests in securities of issuers located in at least three countries outside the United States. The Fund may invest in securities denominated in U.S. dollars or local foreign currencies. The Fund does not limit its investments to issuers in a particular market capitalization range and at times may invest a substantial portion of its assets in one or more particular market capitalization ranges. The Fund may, from time to time, invest a substantial portion of its assets in a particular industry or sector. The Fund may also invest in the securities of other investment companies, including exchange-traded funds (ETFs), subject to any limitations imposed by the Investment Company Act of 1940 or any exemptive relief therefrom, in order to obtain exposure to the asset classes, investment strategies and types of securities it seeks to invest in. These may include investment companies that are sponsored and/or advised by the Adviser or an affiliate, as well as non-affiliated investment companies. The Fund may use leverage through the use of derivatives, borrowing and other leveraging strategies in an attempt to enhance the Fund’s returns. Leverage occurs when the investments in derivatives create greater economic exposure than the amount invested. Using derivatives often allows the portfolio managers to implement their views more efficiently and to gain more exposure to an asset class than investing in more traditional assets such as stocks would allow. The Fund may also use derivatives to seek income or capital gain, to hedge market risks or hedge against the risks of other investments, to hedge foreign currency exposure, or as a substitute for direct investment in a particular asset class, investment strategy or security type. The Fund’s use of derivatives may involve the purchase and sale of swaps (including equity index swaps), futures (including equity index futures), options (including writing (selling) put and call options on equities, equity indices and ETFs), forward foreign currency contracts and other related instruments and techniques. The Fund may also use other types of derivatives that are consistent with its investment objective and investment strategies. The Fund can borrow money to purchase additional securities, another form of leverage. Although the amount of borrowing will vary from time to time, the amount of leveraging from borrowings will not exceed one-third of the Fund’s total assets. The Fund can take long positions in investments that are believed to be undervalued and short positions in investments that are believed to be overvalued or which are established for hedging purposes, including long and short positions in equities and equity-sensitive convertibles, derivatives or other types of securities. The Fund’s use of derivatives and the leveraged investment exposure created by the use of derivatives are expected to be significant. The Fund’s overall long or short positioning can vary based on market and economic conditions, and the Fund may take both long and short positions simultaneously. The Fund can seek to take advantage of arbitrage opportunities in equity, debt, currency and currency prices and market volatility. The Fund may hold significant levels of cash and cash equivalent instruments, including affiliated money market funds, as margin or collateral for the Fund’s obligations under derivatives transactions. The Fund’s portfolio managers consider selling a security or other investment, or taking an offsetting long position, (1) for risk control purposes, (2) when its income or potential for return deteriorates or (3) when it otherwise no longer meets Invesco’s investment selection criteria. The Fund may engage in active and frequent trading of portfolio securities. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Principal Risks of Investing in the Fund | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| As with any mutual fund investment, loss of money is a risk of investing. An investment in the Fund is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency. The risks associated with an investment in the Fund can increase during times of significant market volatility. The principal risks of investing in the Fund are: Risks of Investing in Stocks. The value of the Fund’s portfolio may be affected by changes in the stock markets. Stock markets may experience significant short-term volatility and may fall sharply at times. Adverse events in any part of the equity or fixed-income markets may have unexpected negative effects on other market segments. Different stock markets may behave differently from each other and U.S. stock markets may move in the opposite direction from one or more foreign stock markets. The prices of individual stocks generally do not all move in the same direction at the same time. A variety of factors can negatively affect the price of a particular company’s stock. These factors may include, but are not limited to: poor earnings reports, a loss of customers, litigation against the company, general unfavorable performance of the company’s sector or industry, or changes in government regulations affecting the company or its industry. To the extent that securities of a particular type are emphasized (for example foreign stocks, stocks of small- or mid-cap companies, growth or value stocks, or stocks of companies in a particular industry), fund share values may fluctuate more in response to events affecting the market for those types of securities. Risks of Foreign Investing. Foreign securities are subject to special risks. Securities traded in foreign markets may be less liquid and more volatile than those traded in U.S. markets. Foreign issuers are usually not subject to the same accounting and disclosure requirements that U.S. companies are subject to, which may make it difficult for the Fund to evaluate a foreign company’s operations or financial condition. A change in the value of a foreign currency against the U.S. dollar will result in a change in the U.S. dollar value of investments denominated in that foreign currency and in the value of any income or distributions the Fund may receive on those investments. The value of foreign investments may be affected by exchange control regulations, foreign taxes, higher transaction and other costs, delays in the settlement of transactions, changes in economic or monetary policy in the United States or abroad, expropriation or nationalization of a company’s assets, or other political and economic factors. In addition, due to the inter-relationship of global economies and financial markets, changes in political and economic factors in one country or region could adversely affect conditions in another country or region. Investments in foreign securities may also expose the Fund to time-zone arbitrage risk. Foreign securities may trade on weekends or other days when the Fund does not price its shares. As a result, the value of the Fund’s net assets may change on days when you will not be able to purchase or redeem the Fund’s shares. At times, the Fund may emphasize investments in a particular country or region and may be subject to greater risks from adverse events that occur in that country or region. Foreign securities and foreign currencies held in foreign banks and securities depositories may be subject to only limited or no regulatory oversight. Risks of Developing and Emerging Markets. Investments in developing and emerging markets are subject to all the risks associated with foreign investing, however, these risks may be magnified in developing and emerging markets. Developing or emerging market countries may have less well-developed securities markets and exchanges that may be substantially less liquid than those of more developed markets. Settlement procedures in developing or emerging markets may differ from those of more established securities markets, and settlement delays may result in the inability to invest assets or to dispose of portfolio securities in a timely manner. Securities prices in developing or emerging markets may be significantly more volatile than is the case in more developed nations of the world, and governments of developing or emerging market countries may also be more unstable than the governments of more developed countries. Such countries’ economies may be more dependent on relatively few industries or investors that may be highly vulnerable to local and global changes. Developing or emerging market countries also may be subject to social, political or economic instability. The value of developing or emerging market countries’ currencies may fluctuate more than the currencies of countries with more mature markets. Investments in developing or emerging market countries may be subject to greater risks of government restrictions, including confiscatory taxation, expropriation or nationalization of a company’s assets, restrictions on foreign ownership of local companies, restrictions on withdrawing assets from the country, protectionist measures, and practices such as share blocking. In addition, the ability of foreign entities to participate in privatization programs of certain developing or emerging market countries may be limited by local law. Investments in securities of issuers in developing or emerging market countries may be considered speculative. Risks of Derivative Investments. Derivatives may be volatile and may involve significant risks. The underlying security, obligor or other instrument on which a derivative is based, or the derivative itself, may not perform as expected. For some derivatives, it is possible to lose more than the amount invested in the derivative investment. In addition, some derivatives have the potential for unlimited loss, regardless of the size of the Fund’s initial investment. Certain derivative investments held by the Fund may be illiquid, making it difficult to close out an unfavorable position. Derivative transactions may require the payment of premiums, and may increase portfolio turnover. Derivatives are subject to credit risk, since the Fund may lose money on a derivative investment if the issuer or counterparty fails to pay the amount due. As a result of these risks, the Fund could realize little or no income or lose money from the investment. Derivatives may also be harder to value, less tax efficient and subject to changing government regulation that could impact the Fund’s ability to use certain derivatives or their cost. Recently, the SEC proposed new regulations related to the use of derivatives and related instruments by registered investment companies that could impact the Fund’s ability to engage in derivatives transactions. Derivatives strategies may not always be successful. For example, derivatives used for hedging or to gain or limit exposure to a particular market segment may not provide the expected benefits, particularly during adverse market conditions. These risks are greater for the Fund than other mutual funds that do not use derivatives to the same degree. In addition, pursuant to rules implemented under financial reform legislation, certain over-the-counter derivatives are required to be executed on a regulated market and/or cleared through a clearinghouse, which may result in increased margin requirements and costs for the Fund. Entering into a derivative transaction with a clearinghouse may entail further risks and costs, including the counterparty risk of the clearinghouse and the futures commission merchant through which the Fund accesses the clearinghouse. Risks of Hedging. The Fund may engage in “hedging” strategies, including through the use of options, futures and other derivatives in an effort to protect assets from losses due to declines in the value of the Fund’s portfolio. There are risks in the use of these investment and trading strategies. There can be no assurance that the hedging strategies used will be successful in avoiding losses, and hedged positions may perform less favorably in generally rising markets than unhedged positions. If the Fund uses a hedging strategy at the wrong time or judges market conditions incorrectly, the strategy could reduce the Fund’s return. In some cases, derivatives or other investments may be unavailable, or the investment adviser may choose not to use them under market conditions when their use, in hindsight, may be determined to have been beneficial to the Fund. No assurance can be given that the investment adviser will employ hedging strategies with respect to all or any portion of the Fund’s assets. Risks of Leverage. Certain derivatives and other investments of the Fund may involve leverage. Leverage may be created when an investment exposes the Fund to a risk of loss that exceeds the amount invested. Certain derivatives and other investments provide the potential for investment gain or loss that may be several times greater than the change in the value of an underlying security, asset, interest rate, index or currency, resulting in the potential for a loss that may be substantially greater than the amount invested. Some derivatives and other leveraged investments have the potential for unlimited loss, regardless of the size of the initial investment. Because leverage can magnify the effects of changes in the value of the Fund and make the Fund’s share price more volatile, a shareholder’s investment in the Fund will tend to be more volatile, resulting in larger gains or losses in response to the fluctuating prices of the Fund’s investments. Risks of Borrowing and Leverage. The Fund can borrow up to one-third of the value of its assets (including the amount borrowed), as permitted under the Investment Company Act of 1940. It can use those borrowings for a number of purposes, including purchasing securities, which creates “leverage.” In that case, changes in the value of the Fund’s investments will have a larger effect on its share price than if it did not borrow. Borrowing results in interest payments to the lenders and related expenses. Borrowing for investment purposes might reduce the Fund’s return if the yield on the securities purchased is less than those borrowing costs. The Fund may also borrow to meet redemption obligations or for temporary and emergency purposes. Risks of Long/Short Holdings. Under certain conditions, even if the value of the Fund’s long positions are rising, this could be offset by declining values of the Fund’s short positions. Conversely, it is possible that rising values of the Fund’s short positions could be offset by declining values of the Fund’s long positions. In either scenario the Fund may experience losses. In a market where the value of both the Fund’s long and short positions are declining, the Fund may experience substantial losses. Risks of Other Equity Securities. Most convertible securities are subject to the risks and price fluctuations of the underlying stock. They may be subject to the risk that the issuer will not be able to pay interest or dividends when due and their market value may change based on changes in the issuer’s credit rating or the market’s perception of the issuer’s creditworthiness. Some convertible preferred stocks have a conversion or call feature that allows the issuer to redeem the stock before the conversion date, which could diminish the potential for capital appreciation on the investment. The fixed dividend rate of preferred stocks may cause their prices to behave more like those of debt securities. If interest rates rise, the value of preferred stock having a fixed dividend rate tends to fall. Preferred stock generally ranks behind debt securities in claims for dividends and assets of the issuer in a liquidation or bankruptcy. The price of a warrant does not necessarily move parallel to the price of the underlying security and is generally more volatile than that of the underlying security. Rights are similar to warrants, but normally have a shorter duration. The market for rights or warrants may be very limited and it may be difficult to sell them promptly at an acceptable price. Rights and warrants have no voting rights, receive no dividends and have no rights with respect to the assets of the issuer. Risks of Small- and Mid-Cap Companies. Small-cap companies may be either established or newer companies, including “unseasoned” companies that have typically been in operation for less than three years. Mid-cap companies are generally companies that have completed their initial start-up cycle, and in many cases have established markets and developed seasoned market teams. While smaller companies might offer greater opportunities for gain than larger companies, they also may involve greater risk of loss. They may be more sensitive to changes in a company’s earnings expectations and may experience more abrupt and erratic price movements. Small- and mid-cap companies’ securities may trade in lower volumes and it might be harder for the Fund to dispose of its holdings at an acceptable price when it wants to sell them. Small- and mid-cap companies may not have established markets for their products or services and may have fewer customers and product lines. They may have more limited access to financial resources and may not have the financial strength to sustain them through business downturns or adverse market conditions. Since small- and mid-cap companies typically reinvest a high proportion of their earnings in their business, they may not pay dividends for some time, particularly if they are newer companies. Small- and mid-cap companies may have unseasoned management or less depth in management skill than larger, more established companies. They may be more reliant on the efforts of particular members of their management team and management changes may pose a greater risk to the success of the business. It may take a substantial period of time before the Fund realizes a gain on an investment in a small- or mid-cap company, if it realizes any gain at all. Dividend Risk. There is no guarantee that the issuers of the stocks held by the Fund will declare dividends in the future or that, if dividends are declared, they will remain at their current levels or increase over time. Depending on market conditions, dividend paying stocks that also meet the Fund’s investment criteria may not be widely available for purchase by the Fund. This may increase the volatility of the Fund’s returns and may limit the ability of the Fund to produce current income while remaining fully diversified. High-dividend stocks may not experience high earnings growth or capital appreciation. The Fund’s performance during a broad market advance could suffer because dividend paying stocks may not experience the same capital appreciation as non-dividend paying stocks. Eurozone Investment Risks. Certain of the regions in which the Fund may invest, including the European Union (EU), currently experience significant financial difficulties. Following the global economic crisis that began in 2008, some of these countries have depended on, and may continue to be dependent on, the assistance from others such as the European Central Bank (ECB) or other governments or institutions, and failure to implement reforms as a condition of assistance could have a significant adverse effect on the value of investments in those and other European countries. In addition, countries that have adopted the euro are subject to fiscal and monetary controls that could limit the ability to implement their own economic policies, and could voluntarily abandon, or be forced out of, the euro. Such events could impact the market values of Eurozone and various other securities and currencies, cause redenomination of certain securities into less valuable local currencies, and create more volatile and illiquid markets. Additionally, the United Kingdom’s intended departure from the EU, commonly known as “Brexit,” may have significant political and financial consequences for Eurozone markets, including greater market volatility and illiquidity, currency fluctuations, deterioration in economic activity, a decrease in business confidence and an increased likelihood of a recession in the United Kingdom. Depositary Receipts Risk. Investing in depositary receipts involves the same risks as direct investments in foreign securities. In addition, the underlying issuers of certain depositary receipts are under no obligation to distribute shareholder communications or pass through any voting rights with respect to the deposited securities to the holders of such receipts. The Fund may therefore receive less timely information or have less control than if it invested directly in the foreign issuer. Risks of Investments in Other Investment Companies. As an investor in another investment company, the Fund would be subject to the risks of that investment company’s portfolio. Investing in another investment company may also involve paying a premium above the value of that investment company’s portfolio securities and is subject to a ratable share of that investment company’s expenses, including its advisory and administration expenses. The Fund does not intend to invest in other investment companies unless it is believed that the potential benefits of the investment justify the payment of any premiums, expenses or sales charges. The Investment Company Act of 1940 also imposes limitations on mutual funds’ investments in other investment companies. The Fund may also invest in exchange-traded funds (ETFs), which are subject to all the risks of investing in investment companies as described above. Because ETFs are listed on national stock exchanges and are traded like stocks listed on an exchange, shares of ETFs potentially may trade at a discount or a premium to their net asset value. Investments in ETFs are also subject to brokerage and other trading costs, which could result in greater expenses to the Fund. Industry and Sector Focus. At times the Fund may increase the relative emphasis of its investments in a particular industry or sector. The prices of stocks of issuers in a particular industry or sector may go up and down in response to changes in economic conditions, government regulations, availability of basic resources or supplies, or other events that affect that industry or sector more than others. To the extent that the Fund increases the relative emphasis of its investments in a particular industry or sector, its share values may fluctuate in response to events affecting that industry or sector. To some extent that risk may be limited by the Fund’s policy of not concentrating its investments in any one industry. Liquidity Risks. Securities that are difficult to value or to sell promptly at an acceptable price are generally referred to as “illiquid” investments. If it is required to sell investments quickly or at a particular time (including sales to meet redemption requests) the Fund could realize a loss on illiquid investments. Risks of Arbitrage. Arbitrage risk is the risk that securities purchased pursuant to a strategy intended to take advantage of a perceived relation-ship between the value of two or more securities may not perform as expected. Risks of Money Market Instruments. The Fund may invest in money market instruments. Money market instruments are short-term, US dollar-denominated debt instruments issued or guaranteed by domestic and foreign corporations and financial institutions, the U.S. government, its agencies and instrumentalities and other entities. Money market instruments include certificates of deposit, commercial paper, repurchase agreements, treasury bills, certain asset-backed securities and other short term debt obligations that have a final maturity, as defined under rules under the Investment Company Act of 1940, of 397 days or less. They may have fixed, variable or floating interest rates. Money market instruments are subject to certain risks, including the risk that an issuer of an obligation that the Fund holds might have its credit rating downgraded or might default on its obligations, or that interest rates might rise sharply, causing the value of the Fund’s investments to fall. Cash/Cash Equivalents Risk. In rising markets, holding cash or cash equivalents will negatively affect the Fund’s performance relative to its benchmark. Active Trading Risk. Active trading of portfolio securities may result in added expenses, a lower return and increased tax liability. Management Risk. The Fund is actively managed and depends heavily on the Adviser’s judgment about markets, interest rates or the attractive-ness, relative values, liquidity, or potential appreciation of particular investments made for the Fund’s portfolio. The Fund could experience losses if these judgments prove to be incorrect. Additionally, legislative, regulatory, or tax developments may adversely affect management of the Fund and, therefore, the ability of the Fund to achieve its investment objective. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Performance Information | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

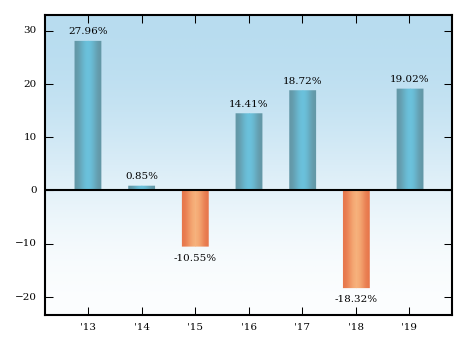

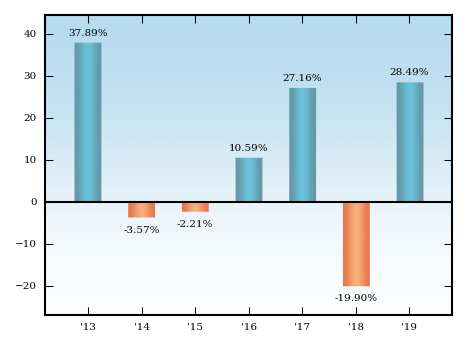

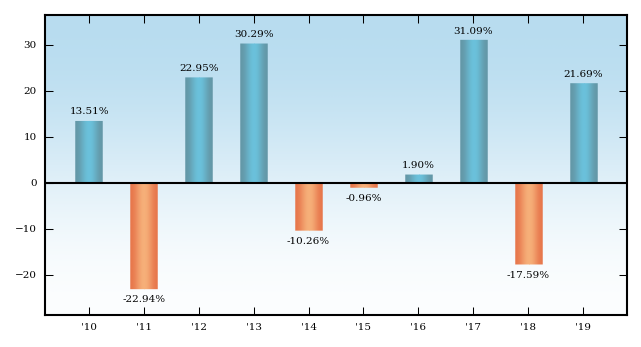

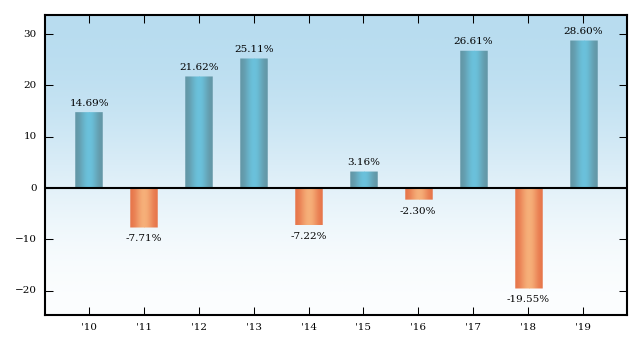

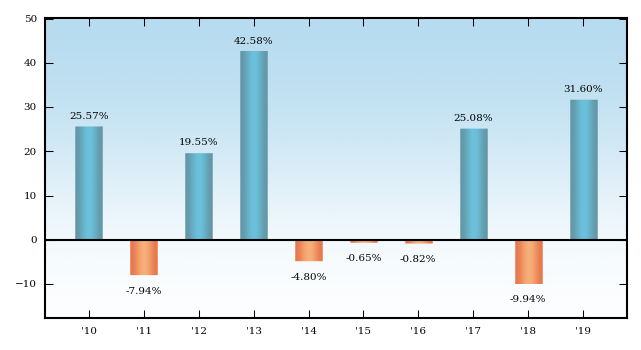

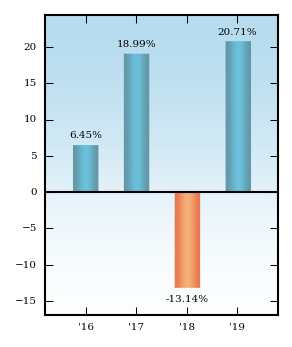

| The bar chart and performance table provide an indication of the risks of investing in the Fund. The Fund has adopted the performance of the Oppenheimer Global Multi-Asset Growth Fund (the predecessor fund) as the result of a reorganization of the predecessor fund into the Fund, which was consummated after the close of business on May 24, 2019 (the “Reorganization”). Prior to the Reorganization, the Fund had not yet commenced operations. The bar chart shows changes in the performance of the predecessor fund and the Fund from year to year as of December 31. For periods prior to February 28, 2020, performance shown is that of the Fund using its previous investment strategy. Therefore, the past performance shown for periods prior to February 28, 2020 may have differed had the Fund’s current investment strategy been in effect. The performance table compares the predecessor fund’s and the Fund’s performance to that of one or more broad measures of market performance. For more information on the benchmarks used see the “Benchmark Descriptions” section of the prospectus. The Fund’s (and the predecessor fund’s) past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. The returns shown for periods ending on or prior to May 24, 2019 are those of the Class A, Class C, Class R and Class Y shares of the predecessor fund. Class R6 shares’ returns shown for the periods ending on or prior to May 24, 2019 are those of the Class I shares of the predecessor fund. Class A, Class C, Class R and Class Y shares, respectively, of the Fund after the close of business on May 24, 2019. Class I shares of the predecessor fund were reorganized into Class R6 shares of the Fund after the close of business on May 24, 2019. Class A, Class C, Class R, Class Y and Class R6 shares’ returns of the Fund will be different from the returns of the predecessor fund as they have different expenses. Performance for Class A shares has been restated to reflect the Fund’s applicable sales charge. Class R5 shares of the Fund have less than a calendar year of performance; therefore, the returns shown are those of the Fund’s and the predecessor fund’s Class A shares. Although the Class R5 shares are invested in the same portfolio of securities, Class R5 shares’ returns of the Fund will be different from Class A returns of the Fund and the predecessor fund as they have different expenses. Updated performance information is available on the Fund’s website at www.invesco.com/us. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Annual Total Returns | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The bar chart does not reflect sales loads. If it did, the annual total returns shown would be lower. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Best Quarter (ended March 31, 2019): 9.70% Worst Quarter (ended December 31, 2018): -10.91% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Average Annual Total Returns (for the periods ended December 31, 2019) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown, and after-tax returns shown are not relevant to investors who hold their Fund shares through tax-advantaged arrangements, such as 401(k) plans, 529 college savings plans or individual retirement accounts. After-tax returns are shown for Class A shares only and after-tax returns for other classes will vary. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||