Before you invest, you may want to review the Fund’s prospectus, which contains more information about the Fund and its risks. You can find the Fund’s prospectus, reports to shareholders, and other information about the Fund online at www.invesco.com/prospectus. You can also get this information at no cost by calling (800) 959-4246 or by sending an e-mail request to ProspectusRequest@invesco.com. The Fund’s prospectus and statement of additional information, both dated August 28, 2019 (as each may be amended or supplemented), are incorporated by reference into this Summary Prospectus and may be obtained, free of charge, at the website, phone number or e-mail address noted above.

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on the Fund’s website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by enrolling at invesco.com/edelivery.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Fund, you can call (800) 959-4246 to let the Fund know you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held with your financial intermediary or all funds held with the fund complex if you invest directly with the Fund.

Investment Objective(s)

The Fund’s investment objective is to seek capital appreciation.

Fees and Expenses of the Fund

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund.

You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in the Invesco Funds. More information about these and other discounts is available from your financial professional and in the section “Shareholder Account Information—Initial Sales Charges (Class A Shares Only)” on page A-3 of the prospectus and the section “Purchase, Redemption and Pricing of Shares-Purchase and Redemption of Shares” on page L-1 of the statement of additional information (SAI). Investors may pay commissions and/or other forms of compensation to an intermediary, such as a broker, for transactions in Class Y shares, which are not reflected in the table or the Example below.

| Shareholder Fees (fees paid directly from your investment) |

| |||||||||||||||||||

| Class: | A | C | R | Y | ||||||||||||||||

| Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) | 5.50 | % | None | None | None | |||||||||||||||

| Maximum Deferred Sales Charge (Load) (as a percentage of original purchase price or redemption proceeds, whichever is less) | None | 1 | 1.00 | % | None | None | ||||||||||||||

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) |

| |||||||||||||||||||

| Class: | A | C | R | Y | ||||||||||||||||

| Management Fees |

0.78 | % | 0.78 | % | 0.78 | % | 0.78 | % | ||||||||||||

| Distribution and/or Service (12b-1) Fees |

0.25 | 1.00 | 0.50 | None | ||||||||||||||||

| Other Expenses2 |

0.30 | 0.30 | 0.30 | 0.30 | ||||||||||||||||

| Total Annual Fund Operating Expenses |

1.33 | 2.08 | 1.58 | 1.08 | ||||||||||||||||

| Fee Waiver and/or Expense Reimbursement3 |

0.06 | 0.07 | 0.06 | 0.06 | ||||||||||||||||

| Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement |

1.27 | 2.01 | 1.52 | 1.02 | ||||||||||||||||

| 1 | A contingent deferred sales charge may apply in some cases. See “Shareholder Account Information-Contingent Deferred Sales Charges (CDSCs).” |

| 2 | “Other Expenses” have been restated to reflect current fees. |

| 3 | Invesco Advisers, Inc. (Invesco or the Adviser) has contractually agreed to waive advisory fees and/or reimburse expenses to the extent necessary to limit Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement (excluding certain items discussed in the SAI) of Class A, Class C, Class R and Class Y shares to 1.27%, 2.01%, 1.52% and 1.02%, respectively, of the Fund’s average daily net assets (the “expense limits”) through May 31, 2021. During its term, the fee waiver agreement cannot be terminated or amended to increase the expense limits without approval of the Board of Trustees. |

Example. This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds.

The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. This Example does not include commissions and/or other forms of compensation that investors may pay on transactions in Class Y shares. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain equal to the Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement for the contractual period above and the Total Annual Fund Operating Expenses thereafter.

| 1 Invesco Oppenheimer Global Focus Fund | invesco.com/us O-GLF-SUMPRO-1 |

Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||||||||||||||||

| Class A |

$ | 672 | $ | 937 | $ | 1,228 | $ | 2,053 | ||||||||||||

| Class C |

$ | 304 | $ | 638 | $ | 1,105 | $ | 2,399 | ||||||||||||

| Class R |

$ | 155 | $ | 487 | $ | 849 | $ | 1,868 | ||||||||||||

| Class Y |

$ | 104 | $ | 331 | $ | 584 | $ | 1,306 | ||||||||||||

You would pay the following expenses if you did not redeem your shares:

| 1 Year | 3 Years | 5 Years | 10 Years | |||||||||||||||||

| Class A |

$ | 672 | $ | 937 | $ | 1,228 | $ | 2,053 | ||||||||||||

| Class C |

$ | 204 | $ | 638 | $ | 1,105 | $ | 2,399 | ||||||||||||

| Class R |

$ | 155 | $ | 487 | $ | 849 | $ | 1,868 | ||||||||||||

| Class Y |

$ | 104 | $ | 331 | $ | 584 | $ | 1,306 | ||||||||||||

Portfolio Turnover. The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the Example, affect the Fund’s performance. During the most recent fiscal year, the predecessor fund’s (defined below) portfolio turnover rate was 46% of the average value of its portfolio.

Principal Investment Strategies of the Fund

The Fund invests mainly in common stocks of U.S. and foreign companies. The Fund can invest without limit in foreign securities in any country, including countries with developed or emerging markets. Typically, the Fund will invest a substantial portion of its assets in issuers in a number of different foreign countries. The Fund does not limit its investments to companies in a particular capitalization range or region. Under normal market conditions, the Fund will typically hold between 35 and 55 stocks.

In selecting investments for the Fund’s portfolio, the portfolio manager looks primarily for companies he believes are undervalued (i.e., there is a substantial difference between the current market price of the company and what the portfolio manager believes the company to be worth). A security may be undervalued because the market is not fully pricing an issuer’s current intrinsic value, the market does not properly assess the company’s assets, the market does not yet recognize its future potential, or the issuer may be temporarily out of favor. The Fund seeks to realize gains in the prices of those securities if and when other investors recognize their real or prospective worth. While the Fund primarily invests in stocks of companies the portfolio manager has determined to be “undervalued,” over time this may result in the Fund’s portfolio having exposure to stocks with the characteristics of both “value” and “growth” stocks. Growth companies are companies whose earnings and stock prices are expected to increase at a faster rate than the overall market.

Principal Risks of Investing in the Fund

As with any mutual fund investment, loss of money is a risk of investing. An investment in the Fund is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency. The risks associated with an investment in the Fund can increase during times of significant market volatility. The principal risks of investing in the Fund are:

Risks of Investing in Stocks. The value of the Fund’s portfolio may be affected by changes in the stock markets. Stock markets may experience significant short-term volatility and may fall sharply at times. Adverse events in any part of the equity or fixed-income markets may have unexpected negative effects on other market segments. Different stock markets may behave differently from each other and U.S. stock markets may move in the opposite direction from one or more foreign stock markets. The prices of individual stocks generally do not all move in the same direction at the same time. A variety of factors can negatively affect the price of a particular

company’s stock. These factors may include, but are not limited to: poor earnings reports, a loss of customers, litigation against the company, general unfavorable performance of the company’s sector or industry, or changes in government regulations affecting the company or its industry. To the extent that securities of a particular type are emphasized (for example foreign stocks, stocks of small- or mid-cap companies, growth or value stocks, or stocks of companies in a particular industry), fund share values may fluctuate more in response to events affecting the market for those types of securities.

Risks of Focused Investing. Although the Fund is a diversified fund, it normally focuses its investments in a relatively small number of issuers, which may make the value of its shares more volatile than if it invested more widely. At times, the Fund may hold a significant portion of its assets in companies in a particular industry or market sector. As a result, events (such as changes in economic conditions, government regulations, market declines, or the availability of basic resources or supplies) that affect that particular industry or sector more than others may have a greater effect on the Fund’s performance. It might also be more difficult for the Fund to sell portfolio securities at a price it considers appropriate if it holds larger blocks of stock because it invests in fewer issuers.

Risks of Foreign Investing. Foreign securities are subject to special risks. Securities traded in foreign markets may be less liquid and more volatile than those traded in U.S. markets. Foreign issuers are usually not subject to the same accounting and disclosure requirements that U.S. companies are subject to, which may make it difficult for the Fund to evaluate a foreign company’s operations or financial condition. A change in the value of a foreign currency against the U.S. dollar will result in a change in the U.S. dollar value of investments denominated in that foreign currency and in the value of any income or distributions the Fund may receive on those investments. The value of foreign investments may be affected by exchange control regulations, foreign taxes, higher transaction and other costs, delays in the settlement of transactions, changes in economic or monetary policy in the United States or abroad, expropriation or nationalization of a company’s assets, or other political and economic factors. In addition, due to the inter-relationship of global economies and financial markets, changes in political and economic factors in one country or region could adversely affect conditions in another country or region. Investments in foreign securities may also expose the Fund to time-zone arbitrage risk. Foreign securities may trade on weekends or other days when the Fund does not price its shares. As a result, the value of the Fund’s net assets may change on days when you will not be able to purchase or redeem the Fund’s shares. At times, the Fund may emphasize investments in a particular country or region and may be subject to greater risks from adverse events that occur in that country or region. Foreign securities and foreign currencies held in foreign banks and securities depositories may be subject to only limited or no regulatory oversight.

Risks of Developing and Emerging Markets. Investments in developing and emerging markets are subject to all the risks associated with foreign investing, however, these risks may be magnified in developing and emerging markets. Developing or emerging market countries may have less well-developed securities markets and exchanges that may be substantially less liquid than those of more developed markets. Settlement procedures in developing or emerging markets may differ from those of more established securities markets, and settlement delays may result in the inability to invest assets or to dispose of portfolio securities in a timely manner. Securities prices in developing or emerging markets may be significantly more volatile than is the case in more developed nations of the world, and governments of developing or emerging market countries may also be more unstable than the governments of more developed countries. Such countries’ economies may be more dependent on relatively few industries or investors that may be highly vulnerable to local and global changes. Developing or emerging market countries also may be subject to social, political or economic instability. The value of developing or emerging market countries’ currencies may fluctuate more than the currencies of countries with more mature markets. Investments in developing or emerging market countries may be subject to

| 2 Invesco Oppenheimer Global Focus Fund | invesco.com/us O-GLF-SUMPRO-1 |

greater risks of government restrictions, including confiscatory taxation, expropriation or nationalization of a company’s assets, restrictions on foreign ownership of local companies, restrictions on withdrawing assets from the country, protectionist measures, and practices such as share blocking. In addition, the ability of foreign entities to participate in privatization programs of certain developing or emerging market countries may be limited by local law. Investments in securities of issuers in developing or emerging market countries may be considered speculative.

Eurozone Investment Risks. Certain of the regions in which the Fund may invest, including the European Union (EU), currently experience significant financial difficulties. Following the global economic crisis that began in 2008, some of these countries have depended on, and may continue to be dependent on, the assistance from others such as the European Central Bank (ECB) or other governments or institutions, and failure to implement reforms as a condition of assistance could have a significant adverse effect on the value of investments in those and other European countries. In addition, countries that have adopted the euro are subject to fiscal and monetary controls that could limit the ability to implement their own economic policies, and could voluntarily abandon, or be forced out of, the euro. Such events could impact the market values of Eurozone and various other securities and currencies, cause redenomination of certain securities into less valuable local currencies, and create more volatile and illiquid markets. Additionally, the United Kingdom’s intended departure from the EU, commonly known as “Brexit,” may have significant political and financial consequences for Eurozone markets, including greater market volatility and illiquidity, currency fluctuations, deterioration in economic activity, a decrease in business confidence and an increased likelihood of a recession in the United Kingdom.

Risks of Value Investing. Value investing entails the risk that if the market does not recognize that a fund’s securities are undervalued, the prices of those securities might not appreciate as anticipated. A value approach could also result in fewer investments that increase rapidly during times of market gains and could cause a fund to underperform funds that use a growth or non-value approach to investing. Value investing has gone in and out of favor during past market cycles and when value investing is out of favor or when markets are unstable, the securities of “value” companies may underperform the securities of “growth” companies.

Risks of Growth Investing. If a growth company’s earnings or stock price fails to increase as anticipated, or if its business plans do not produce the expected results, the value of its securities may decline sharply. Growth companies may be newer or smaller companies that may experience greater stock price fluctuations and risks of loss than larger, more established companies. Newer growth companies tend to retain a large part of their earnings for research, development or investments in capital assets. Therefore, they may not pay any dividends for some time. Growth investing has gone in and out of favor during past market cycles and is likely to continue to do so. During periods when growth investing is out of favor or when markets are unstable, it may be more difficult to sell growth company securities at an acceptable price. Growth stocks may also be more volatile than other securities because of investor speculation.

Risks of Small- and Mid-Cap Companies. Small-cap companies may be either established or newer companies, including “unseasoned” companies that have typically been in operation for less than three years. Mid-cap companies are generally companies that have completed their initial start-up cycle, and in many cases have established markets and developed seasoned market teams. While smaller companies might offer greater opportunities for gain than larger companies, they also may involve greater risk of loss. They may be more sensitive to changes in a company’s earnings expectations and may experience more abrupt and erratic price movements. Small- and mid-cap companies’ securities may trade in lower volumes and it might be harder for the Fund to dispose of its holdings at an acceptable price when it wants to sell them. Small- and mid-cap companies may not have established markets for their products or services and may have fewer customers and product lines. They may have more limited access to financial resources and may not have the financial strength to sustain them through business downturns or adverse market conditions. Since small- and mid-cap companies

typically reinvest a high proportion of their earnings in their business, they may not pay dividends for some time, particularly if they are newer companies. Small- and mid-cap companies may have unseasoned management or less depth in management skill than larger, more established companies. They may be more reliant on the efforts of particular members of their management team and management changes may pose a greater risk to the success of the business. It may take a substantial period of time before the Fund realizes a gain on an investment in a small- or mid-cap company, if it realizes any gain at all.

Performance Information

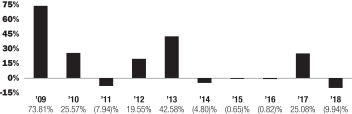

The bar chart and performance table provide an indication of the risks of investing in the Fund. The Fund has adopted the performance of the Oppenheimer Global Focus Fund (the predecessor fund) as the result of a reorganization of the predecessor fund into the Fund, which was consummated after the close of business on May 24, 2019 (the “Reorganization”). Prior to the Reorganization, the Fund had not yet commenced operations. The bar chart shows changes in the performance of the predecessor fund from year to year as of December 31. The performance table compares the predecessor fund’s performance to that of a broad-based securities market benchmark. For more information on the benchmark used see the “Benchmark Descriptions” section of the prospectus. The Fund’s (and the predecessor fund’s) past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future.

The returns shown for periods ending on or prior to May 24, 2019 are those of the Class A, Class C, Class R and Class Y shares of the predecessor fund. Class A, Class C, Class R and Class Y shares of the predecessor fund were reorganized into Class A, Class C, Class R and Class Y shares, respectively, of the Fund after the close of business on May 24, 2019. Class A, Class C, Class R and Class Y shares’ returns of the Fund will be different from the returns of the predecessor fund as they have different expenses. Performance for Class A shares has been restated to reflect the Fund’s applicable sales charge.

Updated performance information is available on the Fund’s website at www.invesco.com/us.

Annual Total Returns

The bar chart does not reflect sales loads. If it did, the annual total returns shown would be lower.

Class A shares year-to-date (ended June 30, 2019): 21.57%

Best Quarter (ended June 30, 2009): 41.47%

Worst Quarter (ended September 30, 2011): -18.95%

| Average Annual Total Returns (for the periods ended December 31, 2018) |

| ||||||||||||||

| 1 Year |

5 Years |

10 Years | |||||||||||||

| Class A shares: Inception (10/01/2007) |

|||||||||||||||

| Return Before Taxes |

-14.89 | % | -0.03 | % | 13.08 | % | |||||||||

| Return After Taxes on Distributions |

-16.25 | -0.61 | 12.71 | ||||||||||||

| Return After Taxes on Distributions and Sale of Fund Shares |

-8.78 | -0.24 | 10.85 | ||||||||||||

| Class C shares: Inception (10/01/2007) |

-11.48 | 0.35 | 12.86 | ||||||||||||

| Class R Shares: Inception (10/01/2007) |

-10.16 | 0.86 | 13.44 | ||||||||||||

| Class Y Shares: Inception (10/01/2007) |

-9.73 | 1.36 | 14.05 | ||||||||||||

| MSCI All Country World Index (Net) (reflects reinvested dividends net of withholding taxes, but reflects no deductions for fees, expenses or other taxes) |

-9.41 | 4.26 | 9.46 | ||||||||||||

| 3 Invesco Oppenheimer Global Focus Fund | invesco.com/us O-GLF-SUMPRO-1 |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown, and after-tax returns shown are not relevant to investors who hold their Fund shares through tax-advantaged arrangements, such as 401(k) plans or individual retirement accounts. After-tax returns are shown for Class A shares only and after-tax returns for other classes will vary.

Management of the Fund

Investment Adviser: Invesco Advisers, Inc.

| Portfolio Manager | Title | Length of Service on the Fund | ||

| Randall Dishmon |

Portfolio Manager | 2019 (predecessor fund 2007) |

Purchase and Sale of Fund Shares

You may purchase, redeem or exchange shares of the Fund on any business day through your financial adviser, through our website at www.invesco.com/us, by mail to Invesco Investment Services, Inc., P.O. Box 219078, Kansas City, MO 64121-9078, or by telephone at 800-959-4246.

There are no minimum investments for Class R shares for fund accounts. The minimum investments for Class A, C and Y shares for fund accounts are as follows:

| Type of Account | Initial Investment Per Fund |

Additional Investments Per Fund | ||||||||

| Asset or fee-based accounts managed by your financial adviser | None | None | ||||||||

| Employer Sponsored Retirement and Benefit Plans and Employer Sponsored IRAs | None | None | ||||||||

| IRAs and Coverdell ESAs if the new investor is purchasing shares through a systematic purchase plan | $25 | $25 | ||||||||

| All other types of accounts if the investor is purchasing shares through a systematic purchase plan | 50 | 50 | ||||||||

| IRAs and Coverdell ESAs | 250 | 25 | ||||||||

| All other accounts | 1,000 | 50 | ||||||||

Tax Information

The Fund’s distributions generally are taxable to you as ordinary income, capital gains, or some combination of both, unless you are investing through a tax-advantaged arrangement, such as a 401(k) plan or individual retirement account, in which case your distributions may be taxed as ordinary income when withdrawn from the tax-advantaged account.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and the Fund’s distributor or its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson or financial adviser to recommend the Fund over another investment. Ask your salesperson or financial adviser or visit your financial intermediary’s website for more information.

| 4 Invesco Oppenheimer Global Focus Fund | invesco.com/us O-GLF-SUMPRO-1 |

Before you invest, you may want to review the Fund’s prospectus, which contains more information about the Fund and its risks. You can find the Fund’s prospectus, reports to shareholders, and other information about the Fund online at www.invesco.com/prospectus. You can also get this information at no cost by calling (800) 959-4246 or by sending an e-mail request to ProspectusRequest@invesco.com. The Fund’s prospectus and statement of additional information, both dated August 28, 2019 (as each may be amended or supplemented), are incorporated by reference into this Summary Prospectus and may be obtained, free of charge, at the website, phone number or e-mail address noted above.

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on the Fund’s website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by enrolling at invesco.com/edelivery.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Fund, you can call (800) 959-4246 to let the Fund know you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held with your financial intermediary or all funds held with the fund complex if you invest directly with the Fund.

Investment Objective(s)

The Fund’s investment objective is to seek capital appreciation.

Fees and Expenses of the Fund

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. Investors may pay commissions and/or other forms of compensation to an intermediary, such as a broker, for transactions in Class R6 shares, which are not reflected in the table or the Example below.

| Shareholder Fees (fees paid directly from your investment) |

| |||||||||

| Class: | R5 | R6 | ||||||||

| Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) | None | None | ||||||||

| Maximum Deferred Sales Charge (Load) (as a percentage of original purchase price or redemption proceeds, whichever is less) | None | None | ||||||||

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) |

| |||||||||

| Class: | R5 | R6 | ||||||||

| Management Fees | 0.78 | % | 0.78 | % | ||||||

| Distribution and/or Service (12b-1) Fees | None | None | ||||||||

| Other Expenses |

0.14 | 1 | 0.09 | 2 | ||||||

| Total Annual Fund Operating Expenses | 0.92 | 0.87 | ||||||||

| Fee Waiver and/or Expense Reimbursement3 | 0.02 | 0.02 | ||||||||

| Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement | 0.90 | 0.85 | ||||||||

| 1 | “Other Expenses” are based on estimated amounts for the current fiscal year. |

| 2 | “Other Expenses” have been restated to reflect current fees. |

| 3 | Invesco Advisers, Inc. (Invesco or the Adviser) has contractually agreed to waive advisory fees and/or reimburse expenses to the extent necessary to limit Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement (excluding certain items discussed in the statement of additional information (SAI)) of Class R5 and Class R6 shares to 0.90% |

| and 0.85%, respectively, of the Fund’s average daily net assets (the “expense limits”) through May 31, 2021. During its term, the fee waiver agreement cannot be terminated or amended to increase the expense limits without approval of the Board of Trustees. |

Example. This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds.

The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. This Example does not include commissions and/or other forms of compensation that investors may pay on transactions in Class R6 shares. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain equal to the Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement for the contractual period above and the Total Annual Fund Operating Expenses thereafter.

Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||||||||||||||||

| Class R5 |

$ | 92 | $ | 289 | $ | 505 | $ | 1,128 | ||||||||||||

| Class R6 |

$ | 87 | $ | 273 | $ | 478 | $ | 1,069 | ||||||||||||

Portfolio Turnover. The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the Example, affect the Fund’s performance. During the most recent fiscal year, the predecessor fund’s (defined below) portfolio turnover rate was 46% of the average value of its portfolio.

| 1 Invesco Oppenheimer Global Focus Fund | invesco.com/us O-GLF-SUMPRO-2 |

Principal Investment Strategies of the Fund

The Fund invests mainly in common stocks of U.S. and foreign companies. The Fund can invest without limit in foreign securities in any country, including countries with developed or emerging markets. Typically, the Fund will invest a substantial portion of its assets in issuers in a number of different foreign countries. The Fund does not limit its investments to companies in a particular capitalization range or region. Under normal market conditions, the Fund will typically hold between 35 and 55 stocks.

In selecting investments for the Fund’s portfolio, the portfolio manager looks primarily for companies he believes are undervalued (i.e., there is a substantial difference between the current market price of the company and what the portfolio manager believes the company to be worth). A security may be undervalued because the market is not fully pricing an issuer’s current intrinsic value, the market does not properly assess the company’s assets, the market does not yet recognize its future potential, or the issuer may be temporarily out of favor. The Fund seeks to realize gains in the prices of those securities if and when other investors recognize their real or prospective worth. While the Fund primarily invests in stocks of companies the portfolio manager has determined to be “undervalued,” over time this may result in the Fund’s portfolio having exposure to stocks with the characteristics of both “value” and “growth” stocks. Growth companies are companies whose earnings and stock prices are expected to increase at a faster rate than the overall market.

Principal Risks of Investing in the Fund

As with any mutual fund investment, loss of money is a risk of investing. An investment in the Fund is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency. The risks associated with an investment in the Fund can increase during times of significant market volatility. The principal risks of investing in the Fund are:

Risks of Investing in Stocks. The value of the Fund’s portfolio may be affected by changes in the stock markets. Stock markets may experience significant short-term volatility and may fall sharply at times. Adverse events in any part of the equity or fixed-income markets may have unexpected negative effects on other market segments. Different stock markets may behave differently from each other and U.S. stock markets may move in the opposite direction from one or more foreign stock markets. The prices of individual stocks generally do not all move in the same direction at the same time. A variety of factors can negatively affect the price of a particular company’s stock. These factors may include, but are not limited to: poor earnings reports, a loss of customers, litigation against the company, general unfavorable performance of the company’s sector or industry, or changes in government regulations affecting the company or its industry. To the extent that securities of a particular type are emphasized (for example foreign stocks, stocks of small- or mid-cap companies, growth or value stocks, or stocks of companies in a particular industry), fund share values may fluctuate more in response to events affecting the market for those types of securities.

Risks of Focused Investing. Although the Fund is a diversified fund, it normally focuses its investments in a relatively small number of issuers, which may make the value of its shares more volatile than if it invested more widely. At times, the Fund may hold a significant portion of its assets in companies in a particular industry or market sector. As a result, events (such as changes in economic conditions, government regulations, market declines, or the availability of basic resources or supplies) that affect that particular industry or sector more than others may have a greater effect on the Fund’s performance. It might also be more difficult for the Fund to sell portfolio securities at a price it considers appropriate if it holds larger blocks of stock because it invests in fewer issuers.

Risks of Foreign Investing. Foreign securities are subject to special risks. Securities traded in foreign markets may be less liquid and more volatile than those traded in U.S. markets. Foreign issuers are usually not subject to the same accounting and disclosure requirements that U.S. companies are subject to, which may make it difficult for the Fund to evaluate a foreign compa-

ny’s operations or financial condition. A change in the value of a foreign currency against the U.S. dollar will result in a change in the U.S. dollar value of investments denominated in that foreign currency and in the value of any income or distributions the Fund may receive on those investments. The value of foreign investments may be affected by exchange control regulations, foreign taxes, higher transaction and other costs, delays in the settlement of transactions, changes in economic or monetary policy in the United States or abroad, expropriation or nationalization of a company’s assets, or other political and economic factors. In addition, due to the inter-relationship of global economies and financial markets, changes in political and economic factors in one country or region could adversely affect conditions in another country or region. Investments in foreign securities may also expose the Fund to time-zone arbitrage risk. Foreign securities may trade on weekends or other days when the Fund does not price its shares. As a result, the value of the Fund’s net assets may change on days when you will not be able to purchase or redeem the Fund’s shares. At times, the Fund may emphasize investments in a particular country or region and may be subject to greater risks from adverse events that occur in that country or region. Foreign securities and foreign currencies held in foreign banks and securities depositories may be subject to only limited or no regulatory oversight.

Risks of Developing and Emerging Markets. Investments in developing and emerging markets are subject to all the risks associated with foreign investing, however, these risks may be magnified in developing and emerging markets. Developing or emerging market countries may have less well-developed securities markets and exchanges that may be substantially less liquid than those of more developed markets. Settlement procedures in developing or emerging markets may differ from those of more established securities markets, and settlement delays may result in the inability to invest assets or to dispose of portfolio securities in a timely manner. Securities prices in developing or emerging markets may be significantly more volatile than is the case in more developed nations of the world, and governments of developing or emerging market countries may also be more unstable than the governments of more developed countries. Such countries’ economies may be more dependent on relatively few industries or investors that may be highly vulnerable to local and global changes. Developing or emerging market countries also may be subject to social, political or economic instability. The value of developing or emerging market countries’ currencies may fluctuate more than the currencies of countries with more mature markets. Investments in developing or emerging market countries may be subject to greater risks of government restrictions, including confiscatory taxation, expropriation or nationalization of a company’s assets, restrictions on foreign ownership of local companies, restrictions on withdrawing assets from the country, protectionist measures, and practices such as share blocking. In addition, the ability of foreign entities to participate in privatization programs of certain developing or emerging market countries may be limited by local law. Investments in securities of issuers in developing or emerging market countries may be considered speculative.

Eurozone Investment Risks. Certain of the regions in which the Fund may invest, including the European Union (EU), currently experience significant financial difficulties. Following the global economic crisis that began in 2008, some of these countries have depended on, and may continue to be dependent on, the assistance from others such as the European Central Bank (ECB) or other governments or institutions, and failure to implement reforms as a condition of assistance could have a significant adverse effect on the value of investments in those and other European countries. In addition, countries that have adopted the euro are subject to fiscal and monetary controls that could limit the ability to implement their own economic policies, and could voluntarily abandon, or be forced out of, the euro. Such events could impact the market values of Eurozone and various other securities and currencies, cause redenomination of certain securities into less valuable local currencies, and create more volatile and illiquid markets. Additionally, the United Kingdom’s intended departure from the EU, commonly known as “Brexit,” may have significant political and financial consequences for Eurozone markets, including greater market volatility and illiquidity, currency

| 2 Invesco Oppenheimer Global Focus Fund | invesco.com/us O-GLF-SUMPRO-2 |

fluctuations, deterioration in economic activity, a decrease in business confidence and an increased likelihood of a recession in the United Kingdom.

Risks of Value Investing. Value investing entails the risk that if the market does not recognize that a fund’s securities are undervalued, the prices of those securities might not appreciate as anticipated. A value approach could also result in fewer investments that increase rapidly during times of market gains and could cause a fund to underperform funds that use a growth or non-value approach to investing. Value investing has gone in and out of favor during past market cycles and when value investing is out of favor or when markets are unstable, the securities of “value” companies may underperform the securities of “growth” companies.

Risks of Growth Investing. If a growth company’s earnings or stock price fails to increase as anticipated, or if its business plans do not produce the expected results, the value of its securities may decline sharply. Growth companies may be newer or smaller companies that may experience greater stock price fluctuations and risks of loss than larger, more established companies. Newer growth companies tend to retain a large part of their earnings for research, development or investments in capital assets. Therefore, they may not pay any dividends for some time. Growth investing has gone in and out of favor during past market cycles and is likely to continue to do so. During periods when growth investing is out of favor or when markets are unstable, it may be more difficult to sell growth company securities at an acceptable price. Growth stocks may also be more volatile than other securities because of investor speculation.

Risks of Small- and Mid-Cap Companies. Small-cap companies may be either established or newer companies, including “unseasoned” companies that have typically been in operation for less than three years. Mid-cap companies are generally companies that have completed their initial start-up cycle, and in many cases have established markets and developed seasoned market teams. While smaller companies might offer greater opportunities for gain than larger companies, they also may involve greater risk of loss. They may be more sensitive to changes in a company’s earnings expectations and may experience more abrupt and erratic price movements. Small- and mid-cap companies’ securities may trade in lower volumes and it might be harder for the Fund to dispose of its holdings at an acceptable price when it wants to sell them. Small- and mid-cap companies may not have established markets for their products or services and may have fewer customers and product lines. They may have more limited access to financial resources and may not have the financial strength to sustain them through business downturns or adverse market conditions. Since small- and mid-cap companies typically reinvest a high proportion of their earnings in their business, they may not pay dividends for some time, particularly if they are newer companies. Small- and mid-cap companies may have unseasoned management or less depth in management skill than larger, more established companies. They may be more reliant on the efforts of particular members of their management team and management changes may pose a greater risk to the success of the business. It may take a substantial period of time before the Fund realizes a gain on an investment in a small- or mid-cap company, if it realizes any gain at all.

Performance Information

The bar chart and performance table provide an indication of the risks of investing in the Fund. The Fund has adopted the performance of the Oppenheimer Global Focus Fund (the predecessor fund) as the result of a reorganization of the predecessor fund into the Fund, which was consummated after the close of business on May 24, 2019 (the “Reorganization”). Prior to the Reorganization, the Fund had not yet commenced operations. The bar chart shows changes in the performance of the predecessor fund from year to year as of December 31. The performance table compares the predecessor fund’s performance to that of a broad-based securities market benchmark. For more information on the benchmark used see the “Benchmark Descriptions” section of the prospectus. The Fund’s (and the predecessor fund’s) past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future.

Class R6 shares’ returns shown for periods ending on or prior to May 24, 2019 are those of the Class I shares of the predecessor fund. Class I shares of the predecessor fund were reorganized into Class R6 shares of the Fund after the close of business on May 24, 2019. Class R6 shares’ returns of the Fund will be different from Class I shares’ returns of the predecessor fund as they have different expenses.

Class R5 shares of the Fund have less than a calendar year of performance; therefore, the returns shown are those of the Fund’s and predecessor fund’s Class A shares. Although the Class R5 shares are invested in the same portfolio of securities, Class R5 shares’ returns of the Fund will be different from Class A returns of the Fund and predecessor fund as they have different expenses.

Updated performance information is available on the Fund’s website at www.invesco.com/us.

Annual Total Returns

Class R6 shares year-to-date (ended June 30, 2019): 21.80%

Best Quarter (ended September 30, 2013): 14.07%

Worst Quarter (ended December 31, 2018): -16.76%

| Average Annual Total Returns (for the periods ended December 31, 2018) |

| |||||||||||||||||||

| 1 Year |

5 Years |

10 Years |

Since Inception | |||||||||||||||||

| Class R6 shares: Inception (08/28/2012) |

||||||||||||||||||||

| Return Before Taxes |

-9.56 | % | 1.55 | % | — | 8.68 | % | |||||||||||||

| Return After Taxes on Distributions |

-10.43 | 1.11 | — | 8.28 | ||||||||||||||||

| Return After Taxes on Distributions and Sale of Fund Shares |

-5.08 | 1.11 | — | 6.85 | ||||||||||||||||

| Class R5 shares1: Inception (05/24/2019) |

-9.94 | 1.11 | 13.73 | % | — | |||||||||||||||

| MSCI All Country World Index (Net) (reflects reinvested dividends net of withholding taxes, but reflects no deductions for fees, expenses or other taxes) (Inception: 08/28/2012) |

-9.41 | 4.26 | — | 7.68 | ||||||||||||||||

| 1 | Class R5 shares’ performance shown prior to the inception date (after the close of business on May 24, 2019) is that of the predecessor fund’s Class A shares at net asset value (NAV) and includes the 12b-1 fees applicable to Class A shares. Class A shares’ performance reflects any applicable fee waivers and/or expense reimbursements. The inception date of the predecessor fund’s Class A shares is October 1, 2007. |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown, and after-tax returns shown are not relevant to investors who hold their Fund shares through tax-advantaged arrangements, such as 401(k) plans, 529 college savings plans or individual retirement accounts. After-tax returns are shown for Class R6 shares only and after-tax returns for other classes will vary.

Management of the Fund

Investment Adviser: Invesco Advisers, Inc.

| Portfolio Manager | Title | Length of Service on the Fund | ||

| Randall Dishmon |

Portfolio Manager | 2019 (predecessor fund 2007) |

Purchase and Sale of Fund Shares

You may purchase, redeem or exchange shares of the Fund on any business day through your financial adviser or by telephone at 800-959-4246.

There is no minimum initial investment for Employer Sponsored Retirement and Benefit Plans investing through a retirement platform that administers at least $2.5 billion in retirement plan assets. All other Employer Sponsored Retirement and Benefit Plans must meet a minimum initial investment of at least $1 million in each Fund in which it invests.

| 3 Invesco Oppenheimer Global Focus Fund | invesco.com/us O-GLF-SUMPRO-2 |

The minimum initial investment for all other institutional investors is $1 million, unless such investment is made by (i) an investment company, as defined under the Investment Company Act of 1940, as amended (1940 Act), that is part of a family of investment companies which own in the aggregate at least $100 million in securities, or (ii) an account established with a 529 college savings plan managed by Invesco, in which case there is no minimum initial investment.

There are no minimum investment amounts for Class R6 shares held through retail omnibus accounts maintained by an intermediary, such as a broker, that (i) generally charges an asset-based fee or commission in addition to those described in this prospectus, and (ii) maintains Class R6 shares and makes them available to retail investors.

Tax Information

The Fund’s distributions generally are taxable to you as ordinary income, capital gains, or some combination of both, unless you are investing through a tax-advantaged arrangement, such as a 401(k) plan, 529 college savings plan or individual retirement account. Any distributions from a 401(k) plan or individual retirement account may be taxed as ordinary income when withdrawn from such plan or account.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund’s distributor or its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson or financial adviser to recommend the Fund over another investment. Ask your salesperson or financial adviser or visit your financial intermediary’s website for more information.

| 4 Invesco Oppenheimer Global Focus Fund | invesco.com/us O-GLF-SUMPRO-2 |