UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-06463

AIM International Mutual Funds (Invesco International Mutual Funds)

(Exact name of registrant as specified in charter)

11 Greenway Plaza, Suite 1000 Houston, Texas 77046

(Address of principal executive offices) (Zip code)

Sheri Morris

11 Greenway Plaza, Suite 1000

Houston, Texas 77046

(Name and address of agent for service)

Registrant’s telephone number, including area code: (713) 626-1919

Date of fiscal year end: April 30

Date of reporting period: 4/30/2019

Item 1. Reports to Stockholders.

|

Annual Report

|

|

4/30/2019

|

| ||

|

|

||||||

|

Invesco Oppenheimer Global Focus Fund*

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund. Instead, the reports will be made available on the Fund’s website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by enrolling at invesco.com/edelivery.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Fund, you can call 800 959 4246 to let the Fund know you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held with your financial intermediary or all funds held with the fund complex if you invest directly with the Fund.

*Prior to the close of business on May 24, 2019, the Fund’s name was Oppenheimer Global Focus Fund. See Important Update on the following page for more information. |

| |||||

Important Update

On October 18, 2018, Massachusetts Mutual Life Insurance Company, an indirect corporate parent of OppenheimerFunds, Inc. and its subsidiaries OFI Global Asset Management, Inc., OFI SteelPath, Inc. and OFI Advisors, LLC, announced that it had entered into an agreement whereby Invesco Ltd., a global investment management company would acquire OppenheimerFunds and its subsidiaries (together “OppenheimerFunds”). After the close of business on May 24, 2019 Invesco Ltd. completed the acquisition of OppenheimerFunds. This Fund was included in that acquisition and as of that date, became part of the Invesco family of funds. Please visit oppenheimerfunds.com for more information or call Invesco’s Client Services team at 800-959-4246.

| 4 | ||||

| 8 | ||||

| 11 | ||||

| 13 | ||||

| 16 | ||||

| 18 | ||||

| 20 | ||||

| 21 | ||||

| 26 | ||||

| 39 | ||||

| 40 | ||||

| Portfolio Proxy Voting Policies and Guidelines; Updates to Statement of Investments | 41 | |||

| 42 | ||||

| 43 | ||||

| 44 | ||||

| 58 | ||||

Class A Shares

AVERAGE ANNUAL TOTAL RETURNS AT 4/30/19

| Class A Shares of the Fund | ||||||

| Without Sales Charge | With Sales Charge | MSCI All Country

| ||||

| 1-Year

|

9.11% | 2.83% | 5.06% | |||

| 5-Year

|

6.84 | 5.58 | 6.96 | |||

| 10-Year

|

14.71 | 14.03 | 11.11 | |||

Performance data quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Fund returns include changes in share price, reinvested distributions, and a 5.75% maximum applicable sales charge except where “without sales charge” is indicated. Current performance may be lower or higher than the performance quoted. Returns do not consider capital gains or income taxes on an individual’s investment. Returns for periods of less than one year are cumulative and not annualized. For performance data current to the most recent month-end, visit oppenheimerfunds.com or call 1.800.CALL OPP (225.5677). See Fund prospectuses and summary prospectuses for more information on share classes, sales charges and new fee agreements, if any.

3 INVESCO OPPENHEIMER GLOBAL FOCUS FUND

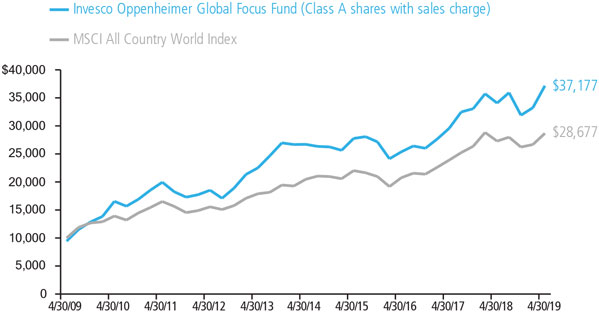

During the reporting period, the Invesco Oppenheimer Global Focus Fund‘s Class A shares (without sales charge) returned 9.11%, outperforming its benchmark, the MSCI All Country World Index (MSCI ACWI), which returned 5.06%.

MARKET ANALYSIS

COMPARISON OF CHANGE IN VALUE OF $10,000 HYPOTHETICAL INVESTMENTS IN:

4 INVESCO OPPENHEIMER GLOBAL FOCUS FUND

5 INVESCO OPPENHEIMER GLOBAL FOCUS FUND

6 INVESCO OPPENHEIMER GLOBAL FOCUS FUND

7 INVESCO OPPENHEIMER GLOBAL FOCUS FUND

REGIONAL ALLOCATION

Portfolio holdings and allocations are subject to change. Percentages are as of April 30, 2019, and are based on the total market value of investments.

For more current Fund holdings, please visit oppenheimerfunds.com.

8 INVESCO OPPENHEIMER GLOBAL FOCUS FUND

Share Class Performance

AVERAGE ANNUAL TOTAL RETURNS WITHOUT SALES CHARGE AS OF 4/30/19

| |

Inception Date |

|

1-Year | 5-Year | 10-Year | |||||||||||||||

| Class A (GLVAX) |

10/1/07 | 9.11 | % | 6.84 | % | 14.71 | % | |||||||||||||

| Class C (GLVCX) |

10/1/07 | 8.28 | 6.03 | 13.84 | ||||||||||||||||

| Class I1 (GLVIX) |

8/28/12 | 9.56 | 7.30 | 11.85 | 2 | |||||||||||||||

| Class R (GLVNX) |

10/1/07 | 8.84 | 6.57 | 14.41 | ||||||||||||||||

| Class Y (GLVYX) |

10/1/07 | 9.36 | 7.10 | 15.04 |

AVERAGE ANNUAL TOTAL RETURNS WITH SALES CHARGE AS OF 4/30/19

| |

Inception Date |

|

1-Year | 5-Year | 10-Year | |||||||||||||||

| Class A (GLVAX) |

10/1/07 | 2.83 | % | 5.58 | % | 14.03 | % | |||||||||||||

| Class C (GLVCX) |

10/1/07 | 7.28 | 6.03 | 13.84 | ||||||||||||||||

| Class I1 (GLVIX) |

8/28/12 | 9.56 | 7.30 | 11.85 | 2 | |||||||||||||||

| Class R (GLVNX) |

10/1/07 | 8.84 | 6.57 | 14.41 | ||||||||||||||||

| Class Y (GLVYX) |

10/1/07 | 9.36 | 7.10 | 15.04 |

1. Pursuant to the closing of the transaction described in the Notes to Financial Statements, after the close of business on May 24, 2019, Class I shares were reorganized as Class R6 shares.

2. Shows performance since inception.

Performance data quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Returns do not consider capital gains or income taxes on an individual’s investment. For performance data current to the most recent month-end, visit oppenheimerfunds.com or call 1.800. CALL OPP (225.5677). Fund returns include changes in share price, reinvested distributions, and the applicable sales charge: for Class A shares, the current maximum initial sales charge of 5.75%; and for Class C shares, the contingent deferred sales charge of 1% for the 1-year period. There is no sales charge for Class I, Class R and Class Y shares. Returns for periods of less than one year are cumulative and not annualized. See Fund prospectuses and summary prospectuses for more information on share classes, sales charges and new fee agreements, if any.

The Fund’s performance is compared to the performance of the MSCI All Country World Index. The MSCI All Country World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The Index is unmanaged and cannot be purchased directly by investors. While index comparisons may be useful to provide a benchmark for the Fund’s performance, it must be noted that the Fund’s investments are not limited to the investments comprising the Index. Index performance includes reinvestment of income, but does not reflect transaction costs, fees, expenses or taxes. Index performance is shown for illustrative purposes only as a benchmark for the Fund’s performance, and does not predict or depict performance of

9 INVESCO OPPENHEIMER GLOBAL FOCUS FUND

the Fund. The Fund’s performance reflects the effects of the Fund’s business and operating expenses.

The views in the Fund Performance Discussion represent the opinions of this Fund’s portfolio manager(s) and are not intended as investment advice or to predict or depict the performance of any investment. These views are as of the close of business on April 30, 2019, and are subject to change based on subsequent developments. The Fund’s portfolio and strategies are subject to change.

Before investing in any of the Invesco Oppenheimer funds, investors should carefully consider a fund’s investment objectives, risks, charges and expenses. Fund prospectuses and summary prospectuses contain this and other information about the funds, and may be obtained by asking your financial advisor, visiting oppenheimerfunds.com, or calling 1.800.CALL OPP (225.5677). Read prospectuses and summary prospectuses carefully before investing.

Shares of Invesco Oppenheimer funds are not deposits or obligations of any bank, are not guaranteed by any bank, are not insured by the FDIC or any other agency, and involve investment risks, including the possible loss of the principal amount invested.

10 INVESCO OPPENHEIMER GLOBAL FOCUS FUND

Fund Expenses. As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, which may include sales charges (loads) on purchase payments and/or contingent deferred sales charges on redemptions; and (2) ongoing costs, including management fees; distribution and service fees; and other Fund expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000.00 invested at the beginning of the period and held for the entire 6-month period ended April 30, 2019.

Actual Expenses. The first section of the table provides information about actual account values and actual expenses. You may use the information in this section for the class of shares you hold, together with the amount you invested, to estimate the expense that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600.00 account value divided by $1,000.00 = 8.60), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During 6 Months Ended April 30, 2019” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes. The second section of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio for each class of shares, and an assumed rate of return of 5% per year for each class before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example for the class of shares you hold with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as front-end or contingent deferred sales charges (loads). Therefore, the “hypothetical” section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

11 INVESCO OPPENHEIMER GLOBAL FOCUS FUND

| Actual | Beginning Account Value November 1, 2018 |

Ending Account Value April 30, 2019 |

Expenses Paid During 6 Months Ended April 30, 2019 |

|||||||||||||||||

| Class A |

$ | 1,000.00 | $ | 1,164.90 | $ | 6.73 | ||||||||||||||

| Class C |

1,000.00 | 1,160.40 | 10.82 | |||||||||||||||||

| Class I |

1,000.00 | 1,167.40 | 4.52 | |||||||||||||||||

| Class R |

1,000.00 | 1,163.40 | 8.13 | |||||||||||||||||

| Class Y |

1,000.00 | 1,166.20 | 5.49 | |||||||||||||||||

| Hypothetical |

||||||||||||||||||||

| (5% return before expenses) |

||||||||||||||||||||

| Class A |

1,000.00 | 1,018.60 | 6.28 | |||||||||||||||||

| Class C |

1,000.00 | 1,014.83 | 10.09 | |||||||||||||||||

| Class I |

1,000.00 | 1,020.63 | 4.22 | |||||||||||||||||

| Class R |

1,000.00 | 1,017.31 | 7.58 | |||||||||||||||||

| Class Y |

1,000.00 | 1,019.74 | 5.12 | |||||||||||||||||

Expenses are equal to the Fund’s annualized expense ratio for that class, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). Those annualized expense ratios, excluding indirect expenses from affiliated funds, based on the 6-month period ended April 30, 2019 are as follows:

| Class | Expense Ratios | |||||||

| Class A |

1.25 | % | ||||||

| Class C |

2.01 | |||||||

| Class I |

0.84 | |||||||

| Class R |

1.51 | |||||||

| Class Y |

1.02 | |||||||

The expense ratios reflect voluntary and/or contractual waivers and/or reimbursements of expenses by the Fund’s Manager. Some of these undertakings may be modified or terminated at any time, as indicated in the Fund’s prospectus. The “Financial Highlights” tables in the Fund’s financial statements, included in this report, also show the gross expense ratios, without such waivers or reimbursements and reduction to custodian expenses, if applicable.

12 INVESCO OPPENHEIMER GLOBAL FOCUS FUND

STATEMENT OF INVESTMENTS April 30, 2019

13 INVESCO OPPENHEIMER GLOBAL FOCUS FUND

STATEMENT OF INVESTMENTS Continued

Footnotes to Statement of Investments

1. Non-income producing security.

2. Represents securities sold under Rule 144A, which are exempt from registration under the Securities Act of 1933, as amended. These securities have been determined to be liquid under guidelines established by the Board of Trustees. These securities amount to $3,871,489 or 0.59% of the Fund’s net assets at period end.

3. Rate shown is the 7-day yield at period end.

4. Is or was an affiliate, as defined in the Investment Company Act of 1940, as amended, at or during the reporting period, by virtue of the Fund owning at least 5% of the voting securities of the issuer or as a result of the Fund and the issuer having the same investment adviser. Transactions during the reporting period in which the issuer was an affiliate are as follows:

| Shares April 30, 2018 |

Gross Additions |

Gross Reductions |

Shares April 30, 2019 |

|||||||||||||

| Investment Company |

||||||||||||||||

| Invesco Oppenheimer Institutional Government Money Market Fund, Cl. Ea | 13,242,126 | 172,796,190 | 183,406,915 | 2,631,401 | ||||||||||||

| Value | Income | Realized Gain (Loss) |

Change in Unrealized Gain (Loss) |

|||||||||||||

| Investment Company |

||||||||||||||||

| Invesco Oppenheimer Institutional Government Money Market Fund, Cl. Ea | $ | 2,631,401 | $ | 156,145 | $ | — | $ | — | ||||||||

a. Prior to May 24, 2019, this fund was named Oppenheimer Institutional Government Money Market Fund.

14 INVESCO OPPENHEIMER GLOBAL FOCUS FUND

STATEMENT OF INVESTMENTS Continued

Footnotes to Statement of Investments (Continued)

Distribution of investments representing geographic holdings, as a percentage of total investments at value, is as follows:

| Geographic Holdings (Unaudited) | Value | Percent | ||||||

| United States |

$ | 407,185,463 | 62.4% | |||||

| China |

93,171,274 | 14.4 | ||||||

| Denmark |

57,036,826 | 8.7 | ||||||

| United Kingdom |

32,952,841 | 5.0 | ||||||

| Japan |

18,801,744 | 2.9 | ||||||

| Switzerland |

12,790,199 | 1.9 | ||||||

| Israel |

12,735,507 | 1.9 | ||||||

| Germany |

11,191,775 | 1.7 | ||||||

| Russia |

7,107,957 | 1.1 | ||||||

|

|

|

|||||||

| Total |

$ | 652,973,586 | 100.0% | |||||

|

|

|

|||||||

See accompanying Notes to Financial Statements.

15 INVESCO OPPENHEIMER GLOBAL FOCUS FUND

STATEMENT OF ASSETS AND LIABILITIES April 30, 2019

|

|

||||

| Assets |

||||

| Investments, at value—see accompanying statement of investments: |

||||

| Unaffiliated companies (cost $463,875,021) |

$ | 650,342,185 | ||

| Affiliated companies (cost $2,631,401) |

2,631,401 | |||

|

|

|

|||

| 652,973,586 | ||||

|

|

||||

| Cash |

104,671 | |||

|

|

||||

| Receivables and other assets: |

||||

| Dividends |

1,450,847 | |||

| Shares of beneficial interest sold |

474,728 | |||

| Other |

29,555 | |||

|

|

|

|||

| Total assets

|

|

655,033,387

|

| |

|

|

||||

| Liabilities |

||||

| Payables and other liabilities: |

||||

| Shares of beneficial interest redeemed |

889,057 | |||

| Distribution and service plan fees |

44,178 | |||

| Trustees’ compensation |

12,136 | |||

| Shareholder communications |

8,001 | |||

| Other |

50,409 | |||

|

|

|

|||

| Total liabilities

|

|

1,003,781

|

| |

|

|

||||

| Net Assets |

$ | 654,029,606 | ||

|

|

|

|||

|

|

||||

| Composition of Net Assets |

||||

| Par value of shares of beneficial interest |

$ | 11,954 | ||

|

|

||||

| Additional paid-in capital |

469,453,081 | |||

|

|

||||

| Total distributable earnings |

184,564,571 | |||

|

|

|

|||

| Net Assets |

$ | 654,029,606 | ||

|

|

|

|||

16 INVESCO OPPENHEIMER GLOBAL FOCUS FUND

STATEMENT OF ASSETS AND LIABILITIES Continued

| Net Asset Value Per Share |

||||||

| Class A Shares: | ||||||

| Net asset value and redemption price per share (based on net assets of $155,251,326 and 2,864,153 shares of beneficial interest outstanding) | $ | 54.20 | ||||

| Maximum offering price per share (net asset value plus sales charge of 5.75% of offering price)

|

$

|

57.51

|

| |||

| Class C Shares: | ||||||

| Net asset value, redemption price (excludes applicable contingent deferred sales charge) and offering price per share (based on net assets of $55,890,721 and 1,112,018 shares of beneficial interest outstanding)

|

$

|

50.26

|

| |||

| Class I Shares: | ||||||

| Net asset value, redemption price and offering price per share (based on net assets of $131,074,070 and 2,339,446 shares of beneficial interest outstanding)

|

$

|

56.03

|

| |||

| Class R Shares: | ||||||

| Net asset value, redemption price (excludes applicable contingent deferred sales charge) and offering price per share (based on net assets of $9,894,955 and 187,454 shares of beneficial interest outstanding)

|

$

|

52.79

|

| |||

| Class Y Shares: | ||||||

| Net asset value, redemption price and offering price per share (based on net assets of $301,918,534 and 5,450,746 shares of beneficial interest outstanding) | $ | 55.39 | ||||

See accompanying Notes to Financial Statements.

17 INVESCO OPPENHEIMER GLOBAL FOCUS FUND

OF OPERATIONS For the Year Ended April 30, 2019

| Investment Income |

||||||

| Dividends: |

||||||

| Unaffiliated companies (net of foreign withholding taxes of $285,328) |

$ | 5,743,570 | ||||

| Affiliated companies |

156,145 | |||||

| Interest |

1,863 | |||||

| Total investment income

|

|

5,901,578

|

|

|||

| Expenses |

||||||

| Management fees |

4,723,358 | |||||

| Distribution and service plan fees: |

||||||

| Class A |

355,133 | |||||

| Class C |

561,438 | |||||

| Class R |

42,123 | |||||

| Transfer and shareholder servicing agent fees: |

||||||

| Class A |

286,543 | |||||

| Class C |

109,600 | |||||

| Class I |

31,852 | |||||

| Class R |

16,629 | |||||

| Class Y |

543,280 | |||||

| Shareholder communications: |

||||||

| Class A |

1,566 | |||||

| Class C |

1,036 | |||||

| Class I |

211 | |||||

| Class R |

340 | |||||

| Class Y |

24,118 | |||||

| Custodian fees and expenses |

35,699 | |||||

| Borrowing fees |

17,342 | |||||

| Trustees’ compensation |

8,837 | |||||

| Other |

78,366 | |||||

| Total expenses |

6,837,471 | |||||

| Less reduction to custodian expenses |

(256 | ) | ||||

| Less waivers and reimbursements of expenses |

(7,630 | ) | ||||

| Net expenses |

6,829,585 | |||||

| Net Investment Loss |

(928,007 | ) |

18 INVESCO OPPENHEIMER GLOBAL FOCUS FUND

STATEMENT

OF OPERATIONS Continued

|

|

||||||||

| Realized and Unrealized Gain (Loss) |

||||||||

| Net realized gain (loss) on: |

||||||||

| Investment transactions in unaffiliated companies |

$ | 674,966 | ||||||

| Foreign currency transactions |

(12,924 | ) | ||||||

|

|

|

|||||||

| Net realized gain |

662,042 | |||||||

|

|

||||||||

| Net change in unrealized appreciation/(depreciation) on: |

||||||||

| Investment transactions in unaffiliated companies |

57,598,113 | |||||||

| Translation of assets and liabilities denominated in foreign currencies |

12,977 | |||||||

|

|

|

|||||||

| Net change in unrealized appreciation/(depreciation)

|

|

57,611,090

|

|

|||||

|

|

||||||||

| Net Increase in Net Assets Resulting from Operations |

$ | 57,345,125 | ||||||

|

|

|

|||||||

See accompanying Notes to Financial Statements.

19 INVESCO OPPENHEIMER GLOBAL FOCUS FUND

STATEMENTS OF CHANGES IN NET ASSETS

| Year Ended April 30, 2019 |

Year Ended April 30, 20181 |

|||||||||

|

| ||||||||||

| Operations |

||||||||||

| Net investment loss |

$ | (928,007 | ) | $ | (2,128,792 | ) | ||||

|

| ||||||||||

| Net realized gain |

662,042 | 51,681,617 | ||||||||

|

| ||||||||||

| Net change in unrealized appreciation/(depreciation) |

57,611,090 | 30,249,994 | ||||||||

|

|

| |||||||||

| Net increase in net assets resulting from operations

|

|

57,345,125

|

|

|

79,802,819

|

|

||||

|

| ||||||||||

| Dividends and/or Distributions to Shareholders |

||||||||||

| Dividends and distributions declared: |

||||||||||

| Class A |

(5,161,344 | ) | (2,594,170 | ) | ||||||

| Class C |

(2,126,031 | ) | (1,074,244 | ) | ||||||

| Class I |

(3,303,642 | ) | (1,639,598 | ) | ||||||

| Class R |

(316,929 | ) | (154,768 | ) | ||||||

| Class Y |

(9,705,305 | ) | (4,644,076 | ) | ||||||

|

|

| |||||||||

| Total dividends and distributions declared

|

|

(20,613,251

|

)

|

|

(10,106,856

|

)

|

||||

|

| ||||||||||

| Beneficial Interest Transactions |

||||||||||

| Net increase (decrease) in net assets resulting from beneficial interest transactions: |

||||||||||

| Class A |

(919,943 | ) | (14,112,784 | ) | ||||||

| Class C |

(4,647,399 | ) | (1,812,804 | ) | ||||||

| Class I |

20,421,920 | 13,566,182 | ||||||||

| Class R |

1,584,945 | (2,300 | ) | |||||||

| Class Y |

20,840,692 | (19,053,832 | ) | |||||||

|

|

| |||||||||

| Total beneficial interest transactions

|

|

37,280,215

|

|

|

(21,415,538

|

)

|

||||

|

| ||||||||||

| Net Assets |

||||||||||

| Total increase |

74,012,089 | 48,280,425 | ||||||||

|

| ||||||||||

| Beginning of period |

580,017,517 | 531,737,092 | ||||||||

|

|

| |||||||||

| End of period |

$ | 654,029,606 | $ | 580,017,517 | ||||||

|

|

| |||||||||

1. Prior period amounts have been conformed to current year presentation. See Notes to Financial Statements, Note

2– New Accounting Pronouncements for further details.

See accompanying Notes to Financial Statements.

20 INVESCO OPPENHEIMER GLOBAL FOCUS FUND

| Class A | Year Ended April 30, 2019 |

Year Ended April 30, 2018 |

Year Ended April 30, 2017 |

Year Ended April 29, 20161 |

Year Ended 2015 |

|||||||||||||||

|

|

||||||||||||||||||||

| Per Share Operating Data |

||||||||||||||||||||

| Net asset value, beginning of period |

$51.71 | $45.73 | $39.26 | $42.91 | $42.01 | |||||||||||||||

|

|

||||||||||||||||||||

| Income (loss) from investment operations: |

||||||||||||||||||||

| Net investment income (loss)2 |

(0.13) | (0.24) | (0.12) | (0.08) | 0.02 | |||||||||||||||

| Net realized and unrealized gain (loss) |

4.48 | 7.15 | 6.59 | (3.57) | 1.63 | |||||||||||||||

|

|

|

|||||||||||||||||||

| Total from investment operations |

4.35 | 6.91 | 6.47 | (3.65) | 1.65 | |||||||||||||||

|

|

||||||||||||||||||||

| Dividends and/or distributions to shareholders: |

||||||||||||||||||||

| Distributions from net realized gain |

(1.86) | (0.93) | 0.00 | 0.00 | (0.75) | |||||||||||||||

|

|

||||||||||||||||||||

| Net asset value, end of period |

$54.20 | $51.71 | $45.73 | $39.26 | $42.91 | |||||||||||||||

|

|

|

|||||||||||||||||||

|

|

||||||||||||||||||||

| Total Return, at Net Asset Value3 |

9.11% | 15.17% | 16.51% | (8.53)% | 3.94% | |||||||||||||||

|

|

||||||||||||||||||||

| Ratios/Supplemental Data |

||||||||||||||||||||

| Net assets, end of period (in thousands) |

$155,251 | $148,492 | $145,248 | $176,181 | $231,060 | |||||||||||||||

|

|

||||||||||||||||||||

| Average net assets (in thousands) |

$146,939 | $145,310 | $151,991 | $204,746 | $266,375 | |||||||||||||||

|

|

||||||||||||||||||||

| Ratios to average net assets:4 |

||||||||||||||||||||

| Net investment income (loss) |

(0.26)% | (0.47)% | (0.29)% | (0.20)% | 0.04% | |||||||||||||||

| Expenses excluding specific expenses listed below |

1.25% | 1.28% | 1.30% | 1.30% | 1.31% | |||||||||||||||

| Interest and fees from borrowings |

0.00%5 | 0.00%5 | 0.00%5 | 0.00%5 | 0.00% | |||||||||||||||

|

|

|

|||||||||||||||||||

| Total expenses6 |

1.25% | 1.28% | 1.30% | 1.30% | 1.31% | |||||||||||||||

| Expenses after payments, waivers and/or reimbursements and reduction to custodian expenses | 1.25%7 | 1.27% | 1.30%7 | 1.30%7 | 1.31%7 | |||||||||||||||

|

|

||||||||||||||||||||

| Portfolio turnover rate |

46% | 63% | 59% | 89% | 102% | |||||||||||||||

1. Represents the last business day of the Fund’s reporting period.

2. Per share amounts calculated based on the average shares outstanding during the period.

3. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Sales charges are not reflected in the total returns. Total returns are not annualized for periods less than one full year. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

4. Annualized for periods less than one full year.

5. Less than 0.005%.

6. Total expenses including indirect expenses from affiliated fund fees and expenses were as follows:

| Year Ended April 30, 2019 |

1.25 | % | ||||

| Year Ended April 30, 2018 |

1.28 | % | ||||

| Year Ended April 30, 2017 |

1.30 | % | ||||

| Year Ended April 29, 2016 |

1.30 | % | ||||

| Year Ended April 30, 2015 |

1.31 | % | ||||

7. Waiver was less than 0.005%.

See accompanying Notes to Financial Statements.

21 INVESCO OPPENHEIMER GLOBAL FOCUS FUND

FINANCIAL HIGHLIGHTS Continued

| Class C | Year Ended April 30, 2019 |

Year Ended April 30, 2018 |

Year Ended April 30, 2017 |

Year Ended April 29, 20161 |

Year Ended April 30, 2015 | ||||||||||||||||||||||||||

| Per Share Operating Data |

|||||||||||||||||||||||||||||||

| Net asset value, beginning of period | $48.45 | $43.23 | $37.39 | $41.18 | $40.65 | ||||||||||||||||||||||||||

| Income (loss) from investment operations: |

|||||||||||||||||||||||||||||||

| Net investment loss2 |

(0.49) | (0.59) | (0.42) | (0.37) | (0.30) | ||||||||||||||||||||||||||

| Net realized and unrealized gain (loss) |

4.16 | 6.74 | 6.26 | (3.42) | 1.58 | ||||||||||||||||||||||||||

| Total from investment operations | 3.67 | 6.15 | 5.84 | (3.79) | 1.28 | ||||||||||||||||||||||||||

| Dividends and/or distributions to shareholders: |

|||||||||||||||||||||||||||||||

| Distributions from net realized gain |

(1.86) | (0.93) | 0.00 | 0.00 | (0.75) | ||||||||||||||||||||||||||

| Net asset value, end of period |

$50.26 | $48.45 | $43.23 | $37.39 | $41.18 | ||||||||||||||||||||||||||

| Total Return, at Net Asset Value3 | 8.28% | 14.29% | 15.62% | (9.20)% | 3.16% | ||||||||||||||||||||||||||

| Ratios/Supplemental Data |

|||||||||||||||||||||||||||||||

| Net assets, end of period (in thousands) |

$55,891 | $58,385 | $54,019 | $70,795 | $89,540 | ||||||||||||||||||||||||||

| Average net assets (in thousands) |

$56,182 | $56,515 | $59,990 | $79,329 | $92,759 | ||||||||||||||||||||||||||

| Ratios to average net assets:4 |

|||||||||||||||||||||||||||||||

| Net investment loss |

(1.02)% | (1.23)% | (1.06)% | (0.96)% | (0.75)% | ||||||||||||||||||||||||||

| Expenses excluding specific expenses listed below |

2.01% | 2.03% | 2.06% | 2.06% | 2.07% | ||||||||||||||||||||||||||

| Interest and fees from borrowings |

0.00%5 | 0.00%5 | 0.00%5 | 0.00%5 | 0.00% | ||||||||||||||||||||||||||

| Total expenses6 |

2.01% | 2.03% | 2.06% | 2.06% | 2.07% | ||||||||||||||||||||||||||

| Expenses after payments, waivers and/or reimbursements and reduction to custodian expenses | 2.01%7 | 2.02% | 2.06%7 | 2.06%7 | 2.07%7 | ||||||||||||||||||||||||||

| Portfolio turnover rate |

46% | 63% | 59% | 89% | 102% | ||||||||||||||||||||||||||

1. Represents the last business day of the Fund’s reporting period.

2. Per share amounts calculated based on the average shares outstanding during the period.

3. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Sales charges are not reflected in the total returns. Total returns are not annualized for periods less than one full year. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

4. Annualized for periods less than one full year.

5. Less than 0.005%.

6. Total expenses including indirect expenses from affiliated fund fees and expenses were as follows:

| Year Ended April 30, 2019 |

2.01 | % | ||||

| Year Ended April 30, 2018 |

2.03 | % | ||||

| Year Ended April 30, 2017 |

2.06 | % | ||||

| Year Ended April 29, 2016 |

2.06 | % | ||||

| Year Ended April 30, 2015 |

2.07 | % | ||||

7. Waiver was less than 0.005%.

See accompanying Notes to Financial Statements.

22 INVESCO OPPENHEIMER GLOBAL FOCUS FUND

FINANCIAL HIGHLIGHTS Continued

| Class I | Year Ended April 30, 2019 |

Year Ended April 30, 2018 |

Year Ended April 30, 2017 |

Year Ended April 29, 20161 |

Year Ended April 30, 2015 | ||||||||||||||||||||||||||

| Per Share Operating Data |

|||||||||||||||||||||||||||||||

| Net asset value, beginning of period | $53.16 | $46.80 | $40.00 | $43.53 | $42.42 | ||||||||||||||||||||||||||

| Income (loss) from investment operations: |

|||||||||||||||||||||||||||||||

| Net investment income (loss)2 |

0.08 | (0.02) | 0.05 | 0.08 | 0.18 | ||||||||||||||||||||||||||

| Net realized and unrealized gain (loss) |

4.65 | 7.31 | 6.75 | (3.61) | 1.68 | ||||||||||||||||||||||||||

| Total from investment operations | 4.73 | 7.29 | 6.80 | (3.53) | 1.86 | ||||||||||||||||||||||||||

| Dividends and/or distributions to shareholders: |

|||||||||||||||||||||||||||||||

| Distributions from net realized gain |

(1.86) | (0.93) | 0.00 | 0.00 | (0.75) | ||||||||||||||||||||||||||

| Net asset value, end of period |

$56.03 | $53.16 | $46.80 | $40.00 | $43.53 | ||||||||||||||||||||||||||

| Total Return, at Net Asset Value3 | 9.56% | 15.65% | 17.00% | (8.11)% | 4.40% | ||||||||||||||||||||||||||

| Ratios/Supplemental Data |

|||||||||||||||||||||||||||||||

| Net assets, end of period (in thousands) |

$131,074 | $98,443 | $75,145 | $72,137 | $18,703 | ||||||||||||||||||||||||||

| Average net assets (in thousands) |

$106,260 | $86,389 | $72,417 | $54,326 | $15,286 | ||||||||||||||||||||||||||

| Ratios to average net assets:4 |

|||||||||||||||||||||||||||||||

| Net investment income (loss) |

0.15% | (0.05)% | 0.13% | 0.20% | 0.43% | ||||||||||||||||||||||||||

| Expenses excluding specific expenses listed below |

0.85% | 0.85% | 0.86% | 0.86% | 0.87% | ||||||||||||||||||||||||||

| Interest and fees from borrowings |

0.00%5 | 0.00%5 | 0.00%5 | 0.00%5 | 0.00% | ||||||||||||||||||||||||||

| Total expenses6 |

0.85% | 0.85% | 0.86% | 0.86% | 0.87% | ||||||||||||||||||||||||||

| Expenses after payments, waivers and/or reimbursements and reduction to custodian expenses | 0.85%7 | 0.85%7 | 0.86%7 | 0.86%7 | 0.87%7 | ||||||||||||||||||||||||||

| Portfolio turnover rate |

46% | 63% | 59% | 89% | 102% | ||||||||||||||||||||||||||

1. Represents the last business day of the Fund’s reporting period.

2. Per share amounts calculated based on the average shares outstanding during the period.

3. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Sales charges are not reflected in the total returns. Total returns are not annualized for periods less than one full year. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

4. Annualized for periods less than one full year.

5. Less than 0.005%.

6. Total expenses including indirect expenses from affiliated fund fees and expenses were as follows:

| Year Ended April 30, 2019 |

0.85 | % | ||||

| Year Ended April 30, 2018 |

0.85 | % | ||||

| Year Ended April 30, 2017 |

0.86 | % | ||||

| Year Ended April 29, 2016 |

0.86 | % | ||||

| Year Ended April 30, 2015 |

0.87 | % | ||||

7. Waiver was less than 0.005%.

See accompanying Notes to Financial Statements.

23 INVESCO OPPENHEIMER GLOBAL FOCUS FUND

FINANCIAL HIGHLIGHTS Continued

| Class R | Year Ended April 30, 2019 |

Year Ended April 30, 2018 |

Year Ended April 30, 2017 |

Year Ended April 29, 20161 |

Year Ended April 30, 2015 | ||||||||||||||||||||||||||

| Per Share Operating Data |

|||||||||||||||||||||||||||||||

| Net asset value, beginning of period | $50.53 | $44.82 | $38.57 | $42.27 | $41.50 | ||||||||||||||||||||||||||

| Income (loss) from investment operations: |

|||||||||||||||||||||||||||||||

| Net investment loss2 |

(0.26) | (0.36) | (0.23) | (0.18) | (0.12) | ||||||||||||||||||||||||||

| Net realized and unrealized gain (loss) |

4.38 | 7.00 | 6.48 | (3.52) | 1.64 | ||||||||||||||||||||||||||

| Total from investment operations | 4.12 | 6.64 | 6.25 | (3.70) | 1.52 | ||||||||||||||||||||||||||

| Dividends and/or distributions to shareholders: |

|||||||||||||||||||||||||||||||

| Distributions from net realized gain |

(1.86) | (0.93) | 0.00 | 0.00 | (0.75) | ||||||||||||||||||||||||||

| Net asset value, end of period |

$52.79 | $50.53 | $44.82 | $38.57 | $42.27 | ||||||||||||||||||||||||||

| Total Return, at Net Asset Value3 | 8.84% | 14.88% | 16.21% | (8.76)% | 3.70% | ||||||||||||||||||||||||||

| Ratios/Supplemental Data |

|||||||||||||||||||||||||||||||

| Net assets, end of period (in thousands) |

$9,895 | $7,812 | $6,898 | $7,709 | $8,113 | ||||||||||||||||||||||||||

| Average net assets (in thousands) |

$8,530 | $8,228 | $7,066 | $7,813 | $6,980 | ||||||||||||||||||||||||||

| Ratios to average net assets:4 |

|||||||||||||||||||||||||||||||

| Net investment loss |

(0.52)% | (0.73)% | (0.56)% | (0.46)% | (0.30)% | ||||||||||||||||||||||||||

| Expenses excluding specific expenses listed below |

1.51% | 1.53% | 1.56% | 1.55% | 1.53% | ||||||||||||||||||||||||||

| Interest and fees from borrowings |

0.00%5 | 0.00%5 | 0.00%5 | 0.00%5 | 0.00% | ||||||||||||||||||||||||||

| Total expenses6 |

1.51% | 1.53% | 1.56% | 1.55% | 1.53% | ||||||||||||||||||||||||||

| Expenses after payments, waivers and/or reimbursements and reduction to custodian expenses | 1.51%7 | 1.52% | 1.56%7 | 1.55%7 | 1.53%7 | ||||||||||||||||||||||||||

| Portfolio turnover rate |

46% | 63% | 59% | 89% | 102% | ||||||||||||||||||||||||||

1. Represents the last business day of the Fund’s reporting period.

2. Per share amounts calculated based on the average shares outstanding during the period.

3. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Sales charges are not reflected in the total returns. Total returns are not annualized for periods less than one full year. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

4. Annualized for periods less than one full year.

5. Less than 0.005%.

6. Total expenses including indirect expenses from affiliated fund fees and expenses were as follows:

| Year Ended April 30, 2019 |

1.51 | % | ||||

| Year Ended April 30, 2018 |

1.53 | % | ||||

| Year Ended April 30, 2017 |

1.56 | % | ||||

| Year Ended April 29, 2016 |

1.55 | % | ||||

| Year Ended April 30, 2015 |

1.53 | % | ||||

7. Waiver was less than 0.005%.

See accompanying Notes to Financial Statements.

24 INVESCO OPPENHEIMER GLOBAL FOCUS FUND

FINANCIAL HIGHLIGHTS Continued

| Class Y | Year Ended April 30, 2019 |

Year Ended April 30, 2018 |

Year Ended April 30, 2017 |

Year Ended April 29, 20161 |

Year Ended April 30, 2015 | ||||||||||||||||||||||||||

| Per Share Operating Data |

|||||||||||||||||||||||||||||||

| Net asset value, beginning of period | $52.67 | $46.46 | $39.78 | $43.38 | $42.35 | ||||||||||||||||||||||||||

| Income (loss) from investment operations: |

|||||||||||||||||||||||||||||||

| Net investment income (loss)2 |

(0.01) | (0.12) | (0.00)3 | 0.02 | 0.08 | ||||||||||||||||||||||||||

| Net realized and unrealized gain (loss) |

4.59 | 7.26 | 6.68 | (3.62) | 1.70 | ||||||||||||||||||||||||||

| Total from investment operations | 4.58 | 7.14 | 6.68 | (3.60) | 1.78 | ||||||||||||||||||||||||||

| Dividends and/or distributions to shareholders: |

|||||||||||||||||||||||||||||||

| Distributions from net realized gain |

(1.86) | (0.93) | 0.00 | 0.00 | (0.75) | ||||||||||||||||||||||||||

| Net asset value, end of period |

$55.39 | $52.67 | $46.46 | $39.78 | $43.38 | ||||||||||||||||||||||||||

| Total Return, at Net Asset Value4 | 9.36% | 15.44% | 16.79% | (8.28)% | 4.22% | ||||||||||||||||||||||||||

| Ratios/Supplemental Data |

|||||||||||||||||||||||||||||||

| Net assets, end of period (in thousands) |

$301,919 | $266,886 | $250,427 | $109,761 | $132,678 | ||||||||||||||||||||||||||

| Average net assets (in thousands) |

$278,695 | $271,461 | $127,129 | $119,119 | $135,104 | ||||||||||||||||||||||||||

| Ratios to average net assets:5 |

|||||||||||||||||||||||||||||||

| Net investment income (loss) |

(0.03)% | (0.24)% | (0.01)% | 0.04% | 0.20% | ||||||||||||||||||||||||||

| Expenses excluding specific expenses listed below |

1.02% | 1.04% | 1.05% | 1.05% | 1.07% | ||||||||||||||||||||||||||

| Interest and fees from borrowings |

0.00%6 | 0.00%6 | 0.00%6 | 0.00%6 | 0.00% | ||||||||||||||||||||||||||

| Total expenses7 |

1.02% | 1.04% | 1.05% | 1.05% | 1.07% | ||||||||||||||||||||||||||

| Expenses after payments, waivers and/or reimbursements and reduction to custodian expenses | 1.02%8 | 1.03% | 1.05%8 | 1.05%8 | 1.05% | ||||||||||||||||||||||||||

| Portfolio turnover rate |

46% | 63% | 59% | 89% | 102% | ||||||||||||||||||||||||||

1. Represents the last business day of the Fund’s reporting period.

2. Per share amounts calculated based on the average shares outstanding during the period.

3. Less than $0.005 per share.

4. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Sales charges are not reflected in the total returns. Total returns are not annualized for periods less than one full year. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

5. Annualized for periods less than one full year.

6. Less than 0.005%.

7. Total expenses including indirect expenses from affiliated fund fees and expenses were as follows:

| Year Ended April 30, 2019 |

1.02 | % | ||||

| Year Ended April 30, 2018 |

1.04 | % | ||||

| Year Ended April 30, 2017 |

1.05 | % | ||||

| Year Ended April 29, 2016 |

1.05 | % | ||||

| Year Ended April 30, 2015 |

1.07 | % | ||||

8. Waiver was less than 0.005%.

See accompanying Notes to Financial Statements.

25 INVESCO OPPENHEIMER GLOBAL FOCUS FUND

NOTES TO FINANCIAL STATEMENTS April 30, 2019

1. Organization

Oppenheimer Global Focus Fund* (the “Fund”) is a diversified open-end management investment company registered under the Investment Company Act of 1940 (“1940 Act”), as amended. The Fund’s investment objective is to seek capital appreciation. The Fund’s investment adviser is OFI Global Asset Management, Inc. (“OFI Global” or the “Manager”), a wholly-owned subsidiary of OppenheimerFunds, Inc. (“OFI” or the “Sub-Adviser”). The Manager has entered into a sub-advisory agreement with OFI.

The Fund offers Class A, Class C, Class I, Class R and Class Y shares. Class A shares are sold at their offering price, which is normally net asset value plus a front-end sales charge.

Class C and Class R shares are sold without a front-end sales charge but may be subject to a contingent deferred sales charge (“CDSC”). Class R shares are sold only through retirement plans. Retirement plans that offer Class R shares may impose charges on those accounts. Class I and Class Y shares are sold to certain institutional investors or intermediaries without either a front-end sales charge or a CDSC, however, the intermediaries may impose charges on their accountholders who beneficially own Class I and Class Y shares. All classes of shares have identical rights and voting privileges with respect to the Fund in general and exclusive voting rights on matters that affect that class alone. Earnings, net assets and net asset value per share may differ due to each class having its own expenses, such as transfer and shareholder servicing agent fees and shareholder communications, directly attributable to that class. Class A, C and R shares have separate distribution and/or service plans under which they pay fees. Class I and Class Y shares do not pay such fees.

The following is a summary of significant accounting policies followed in the Fund’s preparation of financial statements in accordance with accounting principles generally accepted in the United States (“U.S. GAAP”).

2. Significant Accounting Policies

Security Valuation. All investments in securities are recorded at their estimated fair value, as described in Note 3.

Foreign Currency Translation. The books and records of the Fund are maintained in U.S. dollars. Any foreign currency amounts are translated into U.S. dollars on the following basis:

(1) Value of investment securities, other assets and liabilities — at the exchange rates prevailing at market close as described in Note 3.

(2) Purchases and sales of investment securities, income and expenses — at the rates of exchange prevailing on the respective dates of such transactions.

Although the net assets and the values are presented at the foreign exchange rates at market close, the Fund does not isolate the portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes

*Effective after the close of business on May 24, 2019, the Fund was reorganized as Invesco Oppenheimer Global Focus Fund, a series portfolio of AIM International Mutual Funds (Invesco International Mutual Funds).

26 INVESCO OPPENHEIMER GLOBAL FOCUS FUND

NOTES TO FINANCIAL STATEMENTS Continued

2. Significant Accounting Policies (Continued)

in prices of securities held. Such fluctuations are included with the net realized and unrealized gains or losses from investments shown in the Statement of Operations.

For securities, which are subject to foreign withholding tax upon disposition, realized and unrealized gains or losses on such securities are recorded net of foreign withholding tax.

Reported net realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized between the trade and settlement dates on securities transactions, the difference between the amounts of dividends, interest, and foreign withholding tax reclaims recorded on the Fund’s books, and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the value of assets and liabilities other than investments in securities, resulting from changes in the exchange rate.

Allocation of Income, Expenses, Gains and Losses. Income, expenses (other than those attributable to a specific class), gains and losses are allocated on a daily basis to each class of shares based upon the relative proportion of net assets represented by such class. Operating expenses directly attributable to a specific class are charged against the operations of that class.

Dividends and Distributions to Shareholders. Dividends and distributions to shareholders, which are determined in accordance with income tax regulations and may differ from U.S. GAAP, are recorded on the ex-dividend date. Income and capital gain distributions, if any, are declared and paid annually or at other times as determined necessary by the Manager.

Investment Income. Dividend income is recorded on the ex-dividend date or upon ex-dividend notification in the case of certain foreign dividends where the ex-dividend date may have passed. Non-cash dividends included in dividend income, if any, are recorded at the fair value of the securities received. Withholding taxes on foreign dividends, if any, and capital gains taxes on foreign investments, if any, have been provided for in accordance with the Fund’s understanding of the applicable tax rules and regulations. Interest income, if any, is recognized on an accrual basis. Discount and premium, which are included in interest income on the Statement of Operations, are amortized or accreted daily.

Custodian Fees. “Custodian fees and expenses” in the Statement of Operations may include interest expense incurred by the Fund on any cash overdrafts of its custodian account during the period. Such cash overdrafts may result from the effects of failed trades in portfolio securities and from cash outflows resulting from unanticipated shareholder redemption activity. The Fund pays interest to its custodian on such cash overdrafts, to the extent they are not offset by positive cash balances maintained by the Fund, at a rate equal to the Federal Funds Rate plus 2.00%. The “Reduction to custodian expenses” line item, if applicable, represents earnings on cash balances maintained by the Fund during the period. Such interest expense and other custodian fees may be paid with these earnings.

27 INVESCO OPPENHEIMER GLOBAL FOCUS FUND

NOTES TO FINANCIAL STATEMENTS Continued

2. Significant Accounting Policies (Continued)

Security Transactions. Security transactions are recorded on the trade date. Realized gains and losses on securities sold are determined on the basis of identified cost.

Indemnifications. The Fund’s organizational documents provide current and former Trustees and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the Fund. In the normal course of business, the Fund may also enter into contracts that provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against the Fund. The risk of material loss from such claims is considered remote.

Federal Taxes. The Fund intends to comply with provisions of the Internal Revenue Code applicable to regulated investment companies and to distribute substantially all of its investment company taxable income, including any net realized gain on investments not offset by capital loss carryforwards, if any, to shareholders. Therefore, no federal income or excise tax provision is required. The Fund files income tax returns in U.S. federal and applicable state jurisdictions. The statute of limitations on the Fund’s tax return filings generally remains open for the three preceding fiscal reporting period ends. The Fund has analyzed its tax positions for the fiscal year ended April 30, 2019, including open tax years, and does not believe there are any uncertain tax positions requiring recognition in the Fund’s financial statements.

The tax components of capital shown in the following table represent distribution requirements the Fund must satisfy under the income tax regulations, losses the Fund may be able to offset against income and gains realized in future years and unrealized appreciation or depreciation of securities and other investments for federal income tax purposes.

| Undistributed Net Investment Income |

Undistributed Long-Term Gain |

Accumulated Loss Carryforward1,2 |

Net Unrealized Appreciation Based on cost of Securities and Other Investments for Federal Income Tax Purposes | |||

| $— |

$2,339,731 | $— | $182,237,456 |

1. During the reporting period, the Fund did not utilize any capital loss carryforward.

2. During the previous reporting period, the Fund utilized $14,111,329 of capital loss carryforward to offset capital gains realized in that fiscal year.

Net investment income (loss) and net realized gain (loss) may differ for financial statement and tax purposes. The character of dividends and distributions made during the fiscal year from net investment income or net realized gains are determined in accordance with federal income tax requirements, which may differ from the character of net investment income or net realized gains presented in those financial statements in accordance with U.S. GAAP. Also, due to timing of dividends and distributions, the fiscal year in which amounts are distributed may differ from the fiscal year in which the income or net realized gain was recorded by the Fund.

28 INVESCO OPPENHEIMER GLOBAL FOCUS FUND

NOTES TO FINANCIAL STATEMENTS Continued

2. Significant Accounting Policies (Continued)

Accordingly, the following amounts have been reclassified for the reporting period. Net assets of the Fund were unaffected by the reclassifications.

| Reduction to Paid-in Capital |

Reduction to Accumulated Net Loss3 | |

| $546,430 |

$546,430 |

3. $392,082 all of which was long-term capital gain, was distributed in connection with Fund share redemptions.

The tax character of distributions paid during the reporting periods:

| Year Ended April 30, 2019 |

Year Ended April 30, 2018 |

|||||||

| Distributions paid from: |

||||||||

| Ordinary income |

$ | 1,807,376 | $ | 7,779,241 | ||||

| Long-term capital gain |

18,805,875 | 2,327,615 | ||||||

|

|

|

|||||||

| Total |

$ | 20,613,251 | $ | 10,106,856 | ||||

|

|

|

|||||||

The aggregate cost of securities and other investments and the composition of unrealized appreciation and depreciation of securities and other investments for federal income tax purposes at period end are noted in the following table. The primary difference between book and tax appreciation or depreciation of securities and other investments, if applicable, is attributable to the tax deferral of losses or tax realization of financial statement unrealized gain or loss.

| Federal tax cost of securities |

$ | 470,728,726 | ||

| Federal tax cost of other investments |

86,775 | |||

|

|

|

|||

| Total federal tax cost |

$ | 470,815,501 | ||

|

|

|

|||

| Gross unrealized appreciation |

$ | 191,824,362 | ||

| Gross unrealized depreciation |

(9,586,906 | ) | ||

|

|

|

|||

| Net unrealized appreciation |

$ | 182,237,456 | ||

|

|

|

Use of Estimates. The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

New Accounting Pronouncements. In March 2017, Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”), ASU 2017-08. This provides guidance related to the amortization period for certain purchased callable debt securities held at a premium. The ASU is effective for annual periods beginning after December 15, 2018, and interim periods within those annual periods. The Manager has evaluated the impacts of these changes on the financial statements and there are no material impacts.

During August 2018, the Securities and Exchange Commission (the “SEC”) issued Final

29 INVESCO OPPENHEIMER GLOBAL FOCUS FUND

NOTES TO FINANCIAL STATEMENTS Continued

2. Significant Accounting Policies (Continued)

Rule Release No. 33-10532 (the “Rule”), Disclosure Update and Simplification. The rule amends certain financial statement disclosure requirements to conform to U.S. GAAP. The amendments to Rule 6-04.17 of Regulation S-X (balance sheet) remove the requirement to separately state the book basis components of net assets: undistributed (over-distribution of) net investment income (“UNII”), accumulated undistributed net realized gains (losses), and net unrealized appreciation (depreciation) at the balance sheet date. Instead, consistent with U.S. GAAP, funds will be required to disclose total distributable earnings. The amendments to Rule 6-09 of Regulation S-X (statement of changes in net assets) remove the requirement to separately state the sources of distributions paid. Instead, consistent with U.S. GAAP, funds will be required to disclose the total amount of distributions paid, except that any tax return of capital must be separately disclosed. The amendments also remove the requirement to parenthetically state the book basis amount of UNII on the statement of changes in net assets. The requirements of the Rule were effective November 5, 2018, and the Fund’s Statement of Assets and Liabilities and Statement of Changes in Net Assets for the current reporting period have been modified accordingly. In addition, certain amounts within the Fund’s Statement of Changes in Net Assets for the prior fiscal period have been modified to conform to the Rule.

3. Securities Valuation

The Fund calculates the net asset value of its shares as of 4:00 P.M. Eastern Time, on each day the New York Stock Exchange (the “Exchange” or “NYSE”) is open for trading, except in the case of a scheduled early closing of the Exchange, in which case the Fund will calculate net asset value of the shares as of the scheduled early closing time of the Exchange.

The Fund’s Board has adopted procedures for the valuation of the Fund’s securities and has delegated the day-to-day responsibility for valuation determinations under those procedures to the Manager. The Manager has established a Valuation Committee which is responsible for determining a fair valuation for any security for which market quotations are not readily available. The Valuation Committee’s fair valuation determinations are subject to review, approval and ratification by the Fund’s Board at least quarterly or more frequently, if necessary.

Valuation Methods and Inputs

Securities are valued primarily using unadjusted quoted market prices, when available, as supplied by third party pricing services or broker-dealers.

The following methodologies are used to determine the market value or the fair value of the types of securities described below:

Equity securities traded on a securities exchange (including exchange-traded derivatives other than futures and futures options) are valued based on the official closing price on the principal exchange on which the security is traded, as identified by the Manager, prior to the time when the Fund’s assets are valued. If the official closing price is unavailable, the security is valued at the last sale price on the principal exchange on which it is traded, or if no sales occurred, the security is valued at the mean between the quoted bid and asked prices.

30 INVESCO OPPENHEIMER GLOBAL FOCUS FUND

NOTES TO FINANCIAL STATEMENTS Continued

3. Securities Valuation (Continued)

Over-the-counter equity securities are valued at the last published sale price, or if no sales occurred, at the mean between the quoted bid and asked prices. Events occurring after the close of trading on foreign exchanges may result in adjustments to the valuation of foreign securities to more accurately reflect their fair value as of the time when the Fund’s assets are valued.

Shares of a registered investment company that are not traded on an exchange are valued at that investment company’s net asset value per share.

Securities for which market quotations are not readily available, or when a significant event has occurred that would materially affect the value of the security, are fair valued either (i) by a standardized fair valuation methodology applicable to the security type or the significant event as previously approved by the Valuation Committee and the Fund’s Board or (ii) as determined in good faith by the Manager’s Valuation Committee. The Valuation Committee considers all relevant facts that are reasonably available, through either public information or information available to the Manager, when determining the fair value of a security. Those standardized fair valuation methodologies include, but are not limited to, valuing securities at the last sale price or initially at cost and subsequently adjusting the value based on: changes in company specific fundamentals, changes in an appropriate securities index, or changes in the value of similar securities which may be further adjusted for any discounts related to security-specific resale restrictions. When possible, such methodologies use observable market inputs such as unadjusted quoted prices of similar securities, observable interest rates, currency rates and yield curves. The methodologies used for valuing securities are not necessarily an indication of the risks associated with investing in those securities nor can it be assured that the Fund can obtain the fair value assigned to a security if it were to sell the security.

Classifications

Each investment asset or liability of the Fund is assigned a level at measurement date based on the significance and source of the inputs to its valuation. Various data inputs may be used in determining the value of each of the Fund’s investments as of the reporting period end. These data inputs are categorized in the following hierarchy under applicable financial accounting standards:

1) Level 1-unadjusted quoted prices in active markets for identical assets or liabilities (including securities actively traded on a securities exchange)

2) Level 2-inputs other than unadjusted quoted prices that are observable for the asset or liability (such as unadjusted quoted prices for similar assets and market corroborated inputs such as interest rates, prepayment speeds, credit risks, etc.)

3) Level 3-significant unobservable inputs (including the Manager’s own judgments about assumptions that market participants would use in pricing the asset or liability).

The inputs used for valuing securities are not necessarily an indication of the risks associated with investing in those securities.

The Fund classifies each of its investments in investment companies which are publicly

31 INVESCO OPPENHEIMER GLOBAL FOCUS FUND

NOTES TO FINANCIAL STATEMENTS Continued

3. Securities Valuation (Continued)

offered as Level 1. Investment companies that are not publicly offered, if any, are classified as Level 2 in the fair value hierarchy.

The table below categorizes amounts that are included in the Fund’s Statement of Assets and Liabilities at period end based on valuation input level:

| Level 1— Unadjusted Quoted Prices |

Level 2— Other Significant |

Level 3— Significant Unobservable Inputs |

Value | |||||||||||||

| Assets Table |

||||||||||||||||

| Investments, at Value: |

||||||||||||||||

| Common Stocks |

||||||||||||||||

| Consumer Discretionary |

$ | 192,823,306 | $ | 47,998,974 | $ | — | $ | 240,822,280 | ||||||||

| Financials |

62,442,337 | 16,102,211 | — | 78,544,548 | ||||||||||||

| Health Care |

40,674,445 | 69,826,946 | — | 110,501,391 | ||||||||||||

| Industrials |

21,631,569 | 10,368,753 | — | 32,000,322 | ||||||||||||

| Information Technology |

173,410,301 | — | — | 173,410,301 | ||||||||||||

| Materials |

— | 15,063,343 | — | 15,063,343 | ||||||||||||

| Investment Company |

2,631,401 | — | — | 2,631,401 | ||||||||||||

|

|

|

|||||||||||||||

| Total Assets |

$ | 493,613,359 | $ | 159,360,227 | $ | — | $ | 652,973,586 | ||||||||

|

|

|

|||||||||||||||

Forward currency exchange contracts and futures contracts, if any, are reported at their unrealized appreciation/depreciation at measurement date, which represents the change in the contract’s value from trade date. All additional assets and liabilities included in the above table are reported at their market value at measurement date.

For the reporting period, there were no transfers between levels.

4. Investments and Risks

Risks of Foreign Investing. The Fund may invest in foreign securities which are subject to special risks. Securities traded in foreign markets may be less liquid and more volatile than those traded in U.S. markets. Foreign issuers are usually not subject to the same accounting and disclosure requirements that U.S. companies are subject to, which may make it difficult for the Fund to evaluate a foreign company’s operations or financial condition. A change in the value of a foreign currency against the U.S. dollar will result in a change in the U.S. dollar value of investments denominated in that foreign currency and in the value of any income or distributions the Fund may receive on those investments. The value of foreign investments may be affected by exchange control regulations, foreign taxes, higher transaction and other costs, delays in the settlement of transactions, changes in economic or monetary policy in the United States or abroad, expropriation or nationalization of a company’s assets, or other political and economic factors. In addition, due to the inter-relationship of global economies and financial markets, changes in political and economic factors in one country or region could adversely affect conditions in another country or region. Investments in foreign securities may also expose the Fund to time-zone arbitrage risk. Foreign securities may trade on weekends or other days when the Fund does not price its shares. At times, the Fund may emphasize

32 INVESCO OPPENHEIMER GLOBAL FOCUS FUND

NOTES TO FINANCIAL STATEMENTS Continued

4. Investments and Risks (Continued)

investments in a particular country or region and may be subject to greater risks from adverse events that occur in that country or region. Foreign securities and foreign currencies held in foreign banks and securities depositories may be subject to limited or no regulatory oversight.

Investments in Affiliated Funds. The Fund is permitted to invest in other mutual funds advised by the Manager (“Affiliated Funds”). Affiliated Funds are management investment companies registered under the 1940 Act, as amended. The Manager is the investment adviser of, and the Sub-Adviser provides investment and related advisory services to, the

Affiliated Funds. When applicable, the Fund’s investments in Affiliated Funds are included in the Statement of Investments. Shares of Affiliated Funds are valued at their net asset value per share. As a shareholder, the Fund is subject to its proportional share of the Affiliated Funds’ expenses, including their management fee. The Manager will waive fees and/or reimburse Fund expenses in an amount equal to the indirect management fees incurred through the Fund’s investment in the Affiliated Funds.

Each of the Affiliated Funds in which the Fund invests has its own investment risks, and those risks can affect the value of the Fund’s investments and therefore the value of the Fund’s shares. To the extent that the Fund invests more of its assets in one Affiliated Fund than in another, the Fund will have greater exposure to the risks of that Affiliated Fund.

Investments in Money Market Instruments. The Fund is permitted to invest its free cash balances in money market instruments to provide liquidity or for defensive purposes. The Fund may invest in money market instruments by investing in Class E shares of Invesco Oppenheimer Institutional Government Money Market Fund (“IGMMF”), which is an Affiliated

Fund. IGMMF is regulated as a money market fund under the 1940 Act, as amended. The Fund may also invest in money market instruments directly or in other affiliated or unaffiliated money market funds.

Equity Security Risk. Stocks and other equity securities fluctuate in price. The value of the Fund’s portfolio may be affected by changes in the equity markets generally. Equity markets may experience significant short-term volatility and may fall sharply at times. Different markets may behave differently from each other and U.S. equity markets may move in the opposite direction from one or more foreign stock markets. Adverse events in any part of the equity or fixed-income markets may have unexpected negative effects on other market segments.

The prices of individual equity securities generally do not all move in the same direction at the same time and a variety of factors can affect the price of a particular company’s securities. These factors may include, but are not limited to, poor earnings reports, a loss of customers, litigation against the company, general unfavorable performance of the company’s sector or industry, or changes in government regulations affecting the company or its industry.

5. Market Risk Factors

The Fund’s investments in securities and/or financial derivatives may expose the Fund to

33 INVESCO OPPENHEIMER GLOBAL FOCUS FUND

NOTES TO FINANCIAL STATEMENTS Continued

5. Market Risk Factors (Continued)

various market risk factors:

Commodity Risk. Commodity risk relates to the change in value of commodities or commodity indexes as they relate to increases or decreases in the commodities market. Commodities are physical assets that have tangible properties. Examples of these types of assets are crude oil, heating oil, metals, livestock, and agricultural products.

Credit Risk. Credit risk relates to the ability of the issuer of debt to meet interest and principal payments, or both, as they come due. In general, lower-grade, higher-yield debt securities are subject to credit risk to a greater extent than lower-yield, higher-quality securities.

Equity Risk. Equity risk relates to the change in value of equity securities as they relate to increases or decreases in the general market.

Foreign Exchange Rate Risk. Foreign exchange rate risk relates to the change in the U.S. dollar value of a security held that is denominated in a foreign currency. The U.S. dollar value of a foreign currency denominated security will decrease as the dollar appreciates against the currency, while the U.S. dollar value will increase as the dollar depreciates against the currency.

Interest Rate Risk. Interest rate risk refers to the fluctuations in value of fixed-income securities resulting from the inverse relationship between price and yield. For example, an increase in general interest rates will tend to reduce the market value of already issued fixed-income investments, and a decline in general interest rates will tend to increase their value. In addition, debt securities with longer maturities, which tend to have higher yields, are subject to potentially greater fluctuations in value from changes in interest rates than obligations with shorter maturities.

Volatility Risk. Volatility risk refers to the magnitude of the movement, but not the direction of the movement, in a financial instrument’s price over a defined time period. Large increases or decreases in a financial instrument’s price over a relative time period typically indicate greater volatility risk, while small increases or decreases in its price typically indicate lower volatility risk.

6. Shares of Beneficial Interest

The Fund has authorized an unlimited number of $0.001 par value shares of beneficial interest of each class. Transactions in shares of beneficial interest were as follows:

| Year Ended April 30, 2019 | Year Ended April 30, 2018 | |||||||||||||||||

| Shares | Amount | Shares | Amount | |||||||||||||||

| Class A |

||||||||||||||||||

| Sold |

488,290 | $ | 25,088,454 | 426,122 | $ | 21,860,005 | ||||||||||||

| Dividends and/or distributions reinvested |

111,675 | 5,092,381 | 51,406 | 2,566,178 | ||||||||||||||

| Redeemed |

(607,672 | ) | (31,100,778 | ) | (781,779 | ) | (38,538,967 | ) | ||||||||||

|

|

|

|||||||||||||||||

| Net decrease |

(7,707 | ) | $ | (919,943 | ) | (304,251 | ) | $ | (14,112,784 | ) | ||||||||

|

|

|

|||||||||||||||||

34 INVESCO OPPENHEIMER GLOBAL FOCUS FUND

NOTES TO FINANCIAL STATEMENTS Continued

6. Shares of Beneficial Interest (Continued)

| Year Ended April 30, 2019 | Year Ended April 30, 2018 | |||||||||||||||||

| Shares | Amount | Shares | Amount | |||||||||||||||

| Class C |

||||||||||||||||||

| Sold |

152,895 | $ | 7,202,424 | 201,491 | $ | 9,729,803 | ||||||||||||

| Dividends and/or distributions reinvested |

49,054 | 2,079,902 | 22,459 | 1,053,791 | ||||||||||||||

| Redeemed |

(294,971 | ) | (13,929,725 | ) | (268,525 | ) | (12,596,398) | |||||||||||

|

|

|

|||||||||||||||||

| Net decrease |

(93,022 | ) | $ | (4,647,399 | ) | (44,575 | ) | $ | (1,812,804) | |||||||||

|

|

|

|||||||||||||||||

| Class I |

||||||||||||||||||

| Sold |

908,696 | $ | 43,054,151 | 1,182,169 | $ | 63,701,177 | ||||||||||||

| Dividends and/or distributions reinvested |

70,201 | 3,303,642 | 31,992 | 1,639,274 | ||||||||||||||

| Redeemed |

(491,186 | ) | (25,935,873 | ) | (968,014 | ) | (51,774,269) | |||||||||||

|

|

|

|||||||||||||||||

| Net increase |

487,711 | $ | 20,421,920 | 246,147 | $ | 13,566,182 | ||||||||||||

|

|

|

|||||||||||||||||

| Class R |

||||||||||||||||||

| Sold |

60,022 | $ | 3,005,653 | 53,471 | $ | 2,638,870 | ||||||||||||

| Dividends and/or distributions reinvested |

7,118 | 316,388 | 3,132 | 152,979 | ||||||||||||||

| Redeemed |

(34,273 | ) | (1,737,096 | ) | (55,922 | ) | (2,794,149) | |||||||||||

|

|

|

|||||||||||||||||

| Net increase (decrease) |

32,867 | $ | 1,584,945 | 681 | $ | (2,300) | ||||||||||||

|

|

|

|||||||||||||||||

| Class Y |

||||||||||||||||||

| Sold |

2,297,925 | $ | 118,606,099 | 2,020,633 | $ | 103,119,701 | ||||||||||||

| Dividends and/or distributions reinvested |

205,504 | 9,566,198 | 87,921 | 4,467,276 | ||||||||||||||

| Redeemed |

(2,119,769 | ) | (107,331,605 | ) | (2,431,771 | ) | (126,640,809) | |||||||||||

|

|

|

|||||||||||||||||

| Net increase (decrease) |

383,660 | $ | 20,840,692 | (323,217 | ) | $ | (19,053,832) | |||||||||||

|

|

|

|||||||||||||||||

7. Purchases and Sales of Securities

The aggregate cost of purchases and proceeds from sales of securities, other than short-term obligations and investments in IGMMF, for the reporting period were as follows:

| Purchases | Sales | |||||||||

| Investment securities |

$ | 299,425,040 | $ | 273,292,409 | ||||||

8. Fees and Other Transactions with Affiliates

Management Fees. Under the investment advisory agreement, the Fund pays the Manager a management fee based on the daily net assets of the Fund at an annual rate as shown in the following table:

| Fee Schedule | ||

| Up to $500 million |

0.80% | |

| Next $500 million |

0.75 | |

| Over $1 billion |

0.72 |

The Fund’s effective management fee for the reporting period was 0.79% of average annual net assets before any applicable waivers.