| Summary Prospectus | February 28, 2018 |

Invesco Select Opportunities

Fund

Class: A (IZSAX), C (IZSCX), R

(IZSRX), Y (IZSYX)

Before you invest, you may want to review the Fund’s prospectus,

which contains more information about the Fund and its risks. You can find the Fund’s prospectus and other information about the Fund online at www.invesco.com/prospectus. You can also get this information at no cost by calling (800) 959-4246

or by sending an e-mail request to ProspectusRequest@invesco.com. The Fund’s prospectus and statement of additional information, both dated February 28, 2018 (as each may be amended or supplemented), are incorporated by reference into this

Summary Prospectus and may be obtained, free of charge, at the Web site, phone number or e-mail address noted above.

Investment Objective(s)

The Fund's investment objective is long-term growth of capital.

Fees and Expenses of the Fund

This table describes the fees and expenses that you may pay if you buy

and hold shares of the Fund.

You may qualify

for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in the Invesco Funds. More information about these and other discounts is available from your financial professional and in the section

“Shareholder Account Information – Initial Sales Charges (Class A Shares Only)” on page A-3 of the prospectus and the section “Purchase, Redemption and Pricing of Shares-Purchase and Redemption of Shares” on page L-1 of

the statement of additional information (SAI). Investors may pay commissions and/or other forms of compensation to an intermediary, such as a broker, for transactions in Class Y shares, which are not reflected in the table or the Example

below.

| Shareholder Fees (fees paid directly from your investment) | ||||

| Class: | A | C | R | Y |

| Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) | 5.50% | None | None | None |

| Maximum Deferred Sales Charge (Load) (as a percentage of original purchase price or redemption proceeds, whichever is less) | None 1 | 1.00% | None | None |

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | ||||

| Class: | A | C | R | Y |

| Management Fees | 0.80% | 0.80% | 0.80% | 0.80% |

| Distribution and/or Service (12b-1) Fees | 0.25 | 1.00 | 0.50 | None |

| Other Expenses | 0.68 | 0.68 | 0.68 | 0.68 |

| Acquired Fund Fees and Expenses | 0.02 | 0.02 | 0.02 | 0.02 |

| Total Annual Fund Operating Expenses | 1.75 | 2.50 | 2.00 | 1.50 |

| Fee Waiver and/or Expense Reimbursement2 | 0.72 | 0.72 | 0.72 | 0.72 |

| Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement | 1.03 | 1.78 | 1.28 | 0.78 |

| 1 | A contingent deferred sales charge may apply in some cases. See “Shareholder Account Information-Contingent Deferred Sales Charges (CDSCs).” |

| 2 | Invesco Advisers, Inc. (Invesco or the Adviser) has contractually agreed to waive advisory fees and/or reimburse expenses to the extent necessary to limit Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement (excluding Acquired Fund Fees and Expenses and certain items discussed in the SAI) of Class A, Class C, Class R and Class Y shares to 1.02%, 1.77%, 1.27% and 0.77%, respectively, of the Fund's average daily net assets (the “expense limits”). Invesco has also contractually agreed to waive a portion of the |

| Fund's management fee in an amount equal to the net management fee that Invesco earns on the Fund's investments in certain affiliated funds, which will have the effect of reducing the Acquired Fund Fees and Expenses. Unless Invesco continues the fee waiver agreements, they will terminate on February 28, 2019 and June 30, 2019, respectively. During their terms, the fee waiver agreements cannot be terminated or amended to increase the expense limits or reduce the advisory fee waiver without approval of the Board of Trustees. |

Example. This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds.

The Example assumes that you invest $10,000 in the

Fund for the time periods indicated and then redeem all of your shares at the end of those periods. This Example does not include commissions and/or other forms of compensation that investors may pay on transactions in Class Y shares. The Example

also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain equal to the Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement in the first year and the Total Annual

Fund Operating Expenses thereafter.

Although

your actual costs may be higher or lower, based on these assumptions, your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |

| Class A | $649 | $1,004 | $1,383 | $2,443 |

| Class C | $281 | $ 710 | $1,266 | $2,782 |

| Class R | $130 | $ 558 | $1,011 | $2,269 |

| Class Y | $ 80 | $ 403 | $ 750 | $1,729 |

You would pay the following

expenses if you did not redeem your shares:

| 1 Year | 3 Years | 5 Years | 10 Years | |

| Class A | $649 | $1,004 | $1,383 | $2,443 |

| Class C | $181 | $ 710 | $1,266 | $2,782 |

| Class R | $130 | $ 558 | $1,011 | $2,269 |

| Class Y | $ 80 | $ 403 | $ 750 | $1,729 |

Portfolio Turnover. The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result

in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual Fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s

portfolio turnover rate was 30% of the average value of its portfolio.

1

Invesco Select Opportunities Fund

invesco.com/usSOPP-SUMPRO-1

Principal Investment Strategies of the Fund

The Fund generally invests in equity securities of

small-capitalization domestic and foreign issuers, including securities of issuers located in emerging markets countries, i.e., those that are in the early stages of their industrial cycle. The principal types of equity securities in which the Fund

invests are common and preferred stock, convertible securities, rights and warrants to purchase common stock and depositary receipts.

The Fund may invest up to 10% of its net assets in

fixed-income securities such as investment-grade debt securities and longer-term U.S. government securities

In selecting securities, the portfolio managers seek

to identify issuers that they believe are undervalued based on various valuation measures and have strong long-term growth prospects. In evaluating issuers, the portfolio managers emphasize several factors such as the quality of the issuer’s

management team, their commitment to securing a competitive advantage, and the issuer’s sustainable growth potential. The portfolio managers’ focused investment approach often results in the Fund holding a more limited number of

securities than other funds with a similar investment strategy.

The portfolio managers typically consider whether to

sell a security in any of four circumstances: 1) a more attractive investment opportunity is identified, 2) the full value of the investment is deemed to have been realized, 3) there has been a fundamental negative change in the

management strategy of the issuer, or 4) there has been a fundamental negative change in the competitive environment.

The Fund may at times invest a significant amount of

its assets in cash and cash equivalents if the portfolio managers are not able to find equity securities that meet their investment criteria. As a result, the Fund may not achieve its investment objective.

Principal Risks of Investing in the Fund

As with any mutual fund investment, loss of money is a risk of

investing. An investment in the Fund is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency. The risks associated with an investment in the Fund can increase during

times of significant market volatility. The principal risks of investing in the Fund are:

Cash/Cash Equivalents Risk. In rising markets, holding cash or cash equivalents will negatively affect the Fund’s performance relative to its benchmark.

Convertible Securities Risk. The market values of convertible securities are affected by market interest rates, the risk of actual issuer default on interest or principal payments and the value of the underlying common stock into which the

convertible security may be converted. Additionally, a convertible security is subject to the same types of market and issuer risks as apply to the underlying common stock. In addition, certain convertible securities are subject to involuntary

conversions and may undergo principal write-downs upon the occurrence of certain triggering events, and, as a result, are subject to an increased risk of loss. Convertible securities may be rated below investment grade.

Debt Securities Risk. The prices of debt securities held by the Fund will be affected by changes in interest rates, the creditworthiness of the issuer and other factors. An increase in prevailing interest rates typically causes the value of

existing debt securities to fall and often has a greater impact on longer-duration debt securities and higher quality debt securities. Falling interest rates will cause the Fund to reinvest the proceeds of debt securities that have been repaid by

the issuer at lower interest rates. Falling interest rates may also reduce the Fund’s distributable income because interest payments on floating rate debt instruments held by the Fund will decline. The Fund could lose money on investments in

debt securities if the issuer or borrower fails to meet its obligations to make interest payments and/or to repay principal in a timely manner. Changes in an issuer’s financial strength, the market’s perception of such strength or in the

credit rating of the issuer or the security may affect the value of debt securities. The Adviser’s credit

analysis may fail to anticipate such changes, which could result in

buying a debt security at an inopportune time or failing to sell a debt security in advance of a price decline or other credit event.

Depositary Receipts Risk. Investing in depositary receipts involves the same risks as direct investments in foreign securities. In addition, the underlying issuers of certain depositary receipts are under no obligation to distribute shareholder

communications or pass through any voting rights with respect to the deposited securities to the holders of such receipts. The Fund may therefore receive less timely information or have less control than if it invested directly in the foreign

issuer.

Emerging Markets Securities

Risk. Emerging markets (also referred to as developing markets) are generally subject to greater market volatility, political, social and economic instability, uncertain trading markets and more governmental

limitations on foreign investment than more developed markets. In addition, companies operating in emerging markets may be subject to lower trading volume and greater price fluctuations than companies in more developed markets. Securities law and

the enforcement of systems of taxation in many emerging market countries may change quickly and unpredictably. In addition, investments in emerging markets securities may also be subject to additional transaction costs, delays in settlement

procedures, and lack of timely information.

Foreign Securities Risk. The Fund's foreign investments may be adversely affected by political and social instability, changes in economic or taxation policies, difficulty in enforcing obligations, decreased liquidity or increased volatility.

Foreign investments also involve the risk of the possible seizure, nationalization or expropriation of the issuer or foreign deposits (in which the Fund could lose its entire investments in a certain market) and the possible adoption of foreign

governmental restrictions such as exchange controls. Unless the Fund has hedged its foreign securities risk, foreign securities risk also involves the risk of negative foreign currency rate fluctuations, which may cause the value of securities

denominated in such foreign currency (or other instruments through which the Fund has exposure to foreign currencies) to decline in value. Currency exchange rates may fluctuate significantly over short periods of time. Currency hedging strategies,

if used, are not always successful.

Geographic Focus Risk. The Fund may from time to time invest a substantial amount of its assets in securities of issuers located in a single country or a limited number of countries. Adverse economic, political or social conditions in those

countries may therefore have a significant negative impact on the Fund’s investment performance.

Investing in the European Union Risk. Investments in certain countries in the European Union are susceptible to high economic risks associated with high levels of debt, such as investments in sovereign debt of Greece, Italy and Spain. Efforts of the member

states to further unify their economic and monetary policies may increase the potential for the downward movement of one member state’s market to cause a similar effect on other member states’ markets. Separately, the European Union

faces issues involving its membership, structure, procedures and policies. The exit of one or more member states from the European Union, such as the United Kingdom (UK) which has announced its intention to exit, would place its currency and banking

system in jeopardy. The exit by the UK or other member states will likely result in increased volatility, illiquidity and potentially lower economic growth in the affected markets, which will adversely affect the Fund’s

investments.

Limited Number of Holdings

Risk. Because the Fund holds a more limited number of securities than other funds with a similar investment strategy. As a result, each investment has a greater effect on the Fund’s overall performance and any

change in the value of these securities could significantly affect the value of your investment in the Fund.

Management Risk.

The Fund is actively managed and depends heavily on the Adviser’s judgment about markets, interest rates or the attractiveness, relative values, liquidity, or potential appreciation of particular investments made for the Fund’s

portfolio. The Fund could experience losses if these judgments prove to be incorrect. Additionally, legislative,

2

Invesco Select Opportunities Fund

invesco.com/usSOPP-SUMPRO-1

regulatory, or tax developments may adversely affect management of the

Fund and, therefore, the ability of the Fund to achieve its investment objective.

Market Risk. The

market values of the Fund’s investments, and therefore the value of the Fund’s shares, will go up and down, sometimes rapidly or unpredictably. Market risk may affect a single issuer, industry or section of the economy, or it may affect

the market as a whole. Individual stock prices tend to go up and down more dramatically than those of certain other types of investments, such as bonds. During a general downturn in the financial markets, multiple asset classes may decline in value.

When markets perform well, there can be no assurance that specific investments held by the Fund will rise in value.

Preferred Securities Risk. Preferred securities are subject to issuer-specific and market risks applicable generally to equity securities. Preferred securities also may be subordinated to bonds or other debt instruments, subjecting them to a

greater risk of non-payment, may be less liquid than many other securities, such as common stocks, and generally offer no voting rights with respect to the issuer.

Sector Focus Risk.

The Fund may from time to time invest a significant amount of its assets (i.e. over 25%) in one market sector or group of related industries. In this event, the Fund’s performance will depend to a greater extent on the overall condition of the

sector or group of industries and there is increased risk that the Fund will lose significant value if conditions adversely affect that sector or group of industries.

Small- and Mid-Capitalization Companies Risks. Small- and mid-capitalization companies tend to be more vulnerable to changing market conditions, may have little or no operating history or track record of success, and may have more limited product lines and markets,

less experienced management and fewer financial resources than larger companies. These companies’ securities may be more volatile and less liquid than those of more established companies, and their returns may vary, sometimes significantly,

from the overall securities market.

U.S. Government Obligations Risk. Obligations of U.S. Government agencies and authorities receive varying levels of support and may not be backed by the full faith and credit of the U.S. Government, which could affect the Fund’s ability to recover

should they default. No assurance can be given that the U.S. Government will provide financial support to its agencies and authorities if it is not obligated by law to do so.

Value Investing Style Risk. A value investing style subjects the Fund to the risk that the valuations never improve or that the returns on value equity securities are less than returns on other styles of investing or the overall stock

market.

Warrants Risk. Warrants may be significantly less valuable or worthless on their expiration date and may also be postponed or terminated early, resulting in a partial or total loss. Warrants may also be illiquid.

Performance Information

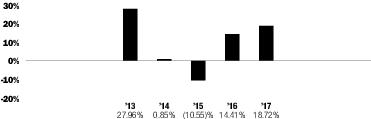

The bar chart and performance table provide an indication of the risks

of investing in the Fund. The bar chart shows changes in the performance of the Fund from year to year as of December 31. The performance table compares the Fund's performance to that of a style specific benchmark, a broad-based securities market

benchmark and a peer group benchmark (in that order) comprised of funds with investment objectives and strategies similar to those of the Fund. For more information on the benchmarks used see the “Benchmark Descriptions” section in the

prospectus. The Fund's past performance (before and after taxes) is not necessarily an indication of its future performance.

Updated performance information is available on the

Fund's Web site at www.invesco.com/us.

Annual Total Returns

The bar chart does not reflect sales loads. If it did, the annual

total returns shown would be lower.

Best Quarter (ended

September 30, 2016): 9.87%

Worst Quarter (ended September 30, 2015): -12.26%

Worst Quarter (ended September 30, 2015): -12.26%

| Average Annual Total Returns (for the period ended December 31, 2017) | |||

| 1

Year |

5

Years |

Since

Inception | |

| Class A shares: Inception (8/3/2012) | |||

| Return Before Taxes | 12.18% | 8.18% | 10.05% |

| Return After Taxes on Distributions | 12.18 | 7.88 | 9.67 |

| Return After Taxes on Distributions and Sale of Fund Shares | 6.89 | 6.39 | 7.91 |

| Class C shares: Inception (8/3/2012) | 16.89 | 8.61 | 10.41 |

| Class R shares: Inception (8/3/2012) | 18.47 | 9.16 | 10.94 |

| Class Y shares: Inception (8/3/2012) | 19.10 | 9.70 | 11.50 |

| MSCI All Country World Small Cap Index (Net) (reflects reinvested dividends net of withholding taxes, but reflects no deductions for fees, expenses or other taxes) | 23.81 | 12.36 | 13.53 |

| MSCI World IndexSM (Net) (reflects reinvested dividends net of withholding taxes, but reflects no deductions for fees, expenses or other taxes) | 22.40 | 11.64 | 12.14 |

| Lipper Global Small/Mid-Cap Funds Classification Average | 26.26 | 12.48 | 13.56 |

After-tax returns are calculated using the

historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor's tax situation and may differ from those shown, and after-tax returns shown are

not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. After-tax returns are shown for Class A shares only and after-tax returns for other classes will

vary.

Management of the Fund

Investment Adviser: Invesco Advisers, Inc. (Invesco or the

Adviser)

Investment Sub-Adviser: Invesco Canada Ltd.

| Portfolio Managers | Title | Length of Service on the Fund |

| Virginia Au | Portfolio Manager (lead) | 2012 |

| Robert Mikalachki | Portfolio Manager | 2012 |

| Jason Whiting | Portfolio Manager | 2012 |

Purchase and Sale of Fund

Shares

You may purchase, redeem or exchange shares of the Fund

on any business day through your financial adviser, through our Web site at www.invesco.com/us, by mail to Invesco Investment Services, Inc., P.O. Box 219078, Kansas City, MO 64121-9078, or by telephone at 800-959-4246.

3

Invesco Select Opportunities Fund

invesco.com/usSOPP-SUMPRO-1

There are no minimum investments for Class R shares

for fund accounts. The minimum investments for Class A, C and Y shares for fund accounts are as follows:

| Type of Account | Initial

Investment Per Fund |

Additional

Investments Per Fund |

| Asset or fee-based accounts managed by your financial adviser | None | None |

| Employer Sponsored Retirement and Benefit Plans and Employer Sponsored IRAs | None | None |

| IRAs and Coverdell ESAs if the new investor is purchasing shares through a systematic purchase plan | $25 | $25 |

| All other types of accounts if the investor is purchasing shares through a systematic purchase plan | 50 | 50 |

| IRAs and Coverdell ESAs | 250 | 25 |

| All other accounts | 1,000 | 50 |

Tax Information

The Fund’s distributions generally are taxable to you as

ordinary income, capital gains, or some combination of both, unless you are investing through a tax-advantaged arrangement, such as a 401(k) plan or individual retirement account, in which case your distributions may be taxed as ordinary income when

withdrawn from the tax-advantaged account.

Payments to

Broker-Dealers and Other Financial Intermediaries

If you

purchase the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and the Fund’s distributor or its related companies may pay the intermediary for the sale of Fund shares and related services. These payments

may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson or financial adviser to recommend the Fund over another investment. Ask your salesperson or financial adviser or visit your financial

intermediary’s Web site for more information.

4

Invesco Select Opportunities Fund

invesco.com/usSOPP-SUMPRO-1

| Summary Prospectus | February 28, 2018 |

Invesco Select Opportunities

Fund

Class: R5 (IZSIX), R6

(IZFSX)

Before you invest, you may want to review the Fund’s prospectus,

which contains more information about the Fund and its risks. You can find the Fund’s prospectus and other information about the Fund online at www.invesco.com/prospectus. You can also get this information at no cost by calling (800) 959-4246

or by sending an e-mail request to ProspectusRequest@invesco.com. The Fund’s prospectus and statement of additional information, both dated February 28, 2018 (as each may be amended or supplemented), are incorporated by reference into this

Summary Prospectus and may be obtained, free of charge, at the Web site, phone number or e-mail address noted above.

Investment Objective(s)

The Fund’s investment objective is long-term growth of

capital.

Fees and Expenses of the Fund

This table describes the fees and expenses that you may pay if you buy

and hold shares of the Fund. Investors may pay commissions and/or other forms of compensation to an intermediary, such as a broker, for transactions in Class R6 shares, which are not reflected in the table or the Example below.

| Shareholder Fees (fees paid directly from your investment) | ||

| Class: | R5 | R6 |

| Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) | None | None |

| Maximum Deferred Sales Charge (Load) (as a percentage of original purchase price or redemption proceeds, whichever is less) | None | None |

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | ||

| Class: | R5 | R6 |

| Management Fees | 0.80% | 0.80% |

| Distribution and/or Service (12b-1) Fees | None | None |

| Other Expenses | 0.58 | 0.58 |

| Acquired Fund Fees and Expenses | 0.02 | 0.02 |

| Total Annual Fund Operating Expenses | 1.40 | 1.40 |

| Fee Waiver and/or Expense Reimbursement1 | 0.62 | 0.62 |

| Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement | 0.78 | 0.78 |

| 1 | Invesco Advisers, Inc. (Invesco or the Adviser) has contractually agreed to waive advisory fees and/or reimburse expenses to the extent necessary to limit Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement (excluding Acquired Fund Fees and Expenses and certain items discussed in the SAI) of each of Class R5 and Class R6 shares to 0.77% of the Fund's average daily net assets (the “expense limits”). Invesco has also contractually agreed to waive a portion of the Fund's management fee in an amount equal to the net management fee that Invesco earns on the Fund's investments in certain affiliated funds, which will have the effect of reducing the Acquired Fund Fees and Expenses. Unless Invesco continues the fee waiver agreements, they will terminate on February 28, 2019 and June 30, 2019, respectively. During their terms, the fee waiver agreements cannot be terminated or amended to increase the expense limits or reduce the advisory fee waiver without approval of the Board of Trustees. |

Example. This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds.

The Example assumes that you invest $10,000 in the

Fund for the time periods indicated and then redeem all of your shares at the end of those periods. This Example does not include commissions and/or other forms of

compensation that investors may pay on transactions in Class R6

shares. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain equal to the Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement in the first year and

the Total Annual Fund Operating Expenses thereafter.

Although your actual costs may be higher or lower,

based on these assumptions, your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |

| Class R5 | $80 | $382 | $707 | $1,626 |

| Class R6 | $80 | $382 | $707 | $1,626 |

Portfolio Turnover. The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result

in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual Fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s

portfolio turnover rate was 30% of the average value of its portfolio.

Principal Investment Strategies of the Fund

The Fund generally invests in equity securities of

small-capitalization domestic and foreign issuers, including securities of issuers located in emerging markets countries, i.e., those that are in the early stages of their industrial cycle. The principal types of equity securities in which the Fund

invests are common and preferred stock, convertible securities, rights and warrants to purchase common stock and depositary receipts.

The Fund may invest up to 10% of its net assets in

fixed-income securities such as investment-grade debt securities and longer-term U.S. government securities

In selecting securities, the portfolio managers seek

to identify issuers that they believe are undervalued based on various valuation measures and have strong long-term growth prospects. In evaluating issuers, the portfolio managers emphasize several factors such as the quality of the issuer’s

management team, their commitment to securing a competitive advantage, and the issuer’s sustainable growth potential. The portfolio managers’ focused investment approach often results in the Fund holding a more limited number of

securities than other funds with a similar investment strategy.

The portfolio managers typically consider whether to

sell a security in any of four circumstances: 1) a more attractive investment opportunity is identified, 2) the full value of the investment is deemed to have been

1

Invesco Select Opportunities Fund

invesco.com/usSOPP-SUMPRO-2

realized, 3) there has been a fundamental negative change in the

management strategy of the issuer, or 4) there has been a fundamental negative change in the competitive environment.

The Fund may at times invest a significant amount of

its assets in cash and cash equivalents if the portfolio managers are not able to find equity securities that meet their investment criteria. As a result, the Fund may not achieve its investment objective.

Principal Risks of Investing in the Fund

As with any mutual fund investment, loss of money is a risk of

investing. An investment in the Fund is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency. The risks associated with an investment in the Fund can increase during

times of significant market volatility. The principal risks of investing in the Fund are:

Cash/Cash Equivalents Risk. In rising markets, holding cash or cash equivalents will negatively affect the Fund’s performance relative to its benchmark.

Convertible Securities Risk. The market values of convertible securities are affected by market interest rates, the risk of actual issuer default on interest or principal payments and the value of the underlying common stock into which the

convertible security may be converted. Additionally, a convertible security is subject to the same types of market and issuer risks as apply to the underlying common stock. In addition, certain convertible securities are subject to involuntary

conversions and may undergo principal write-downs upon the occurrence of certain triggering events, and, as a result, are subject to an increased risk of loss. Convertible securities may be rated below investment grade.

Debt Securities Risk. The prices of debt securities held by the Fund will be affected by changes in interest rates, the creditworthiness of the issuer and other factors. An increase in prevailing interest rates typically causes the value of

existing debt securities to fall and often has a greater impact on longer-duration debt securities and higher quality debt securities. Falling interest rates will cause the Fund to reinvest the proceeds of debt securities that have been repaid by

the issuer at lower interest rates. Falling interest rates may also reduce the Fund’s distributable income because interest payments on floating rate debt instruments held by the Fund will decline. The Fund could lose money on investments in

debt securities if the issuer or borrower fails to meet its obligations to make interest payments and/or to repay principal in a timely manner. Changes in an issuer’s financial strength, the market’s perception of such strength or in the

credit rating of the issuer or the security may affect the value of debt securities. The Adviser’s credit analysis may fail to anticipate such changes, which could result in buying a debt security at an inopportune time or failing to sell a

debt security in advance of a price decline or other credit event.

Depositary Receipts Risk. Investing in depositary receipts involves the same risks as direct investments in foreign securities. In addition, the underlying issuers of certain depositary receipts are under no obligation to distribute shareholder

communications or pass through any voting rights with respect to the deposited securities to the holders of such receipts. The Fund may therefore receive less timely information or have less control than if it invested directly in the foreign

issuer.

Emerging Markets Securities

Risk. Emerging markets (also referred to as developing markets) are generally subject to greater market volatility, political, social and economic instability, uncertain trading markets and more governmental

limitations on foreign investment than more developed markets. In addition, companies operating in emerging markets may be subject to lower trading volume and greater price fluctuations than companies in more developed markets. Securities law and

the enforcement of systems of taxation in many emerging market countries may change quickly and unpredictably. In addition, investments in emerging markets securities may also be subject to additional transaction costs, delays in settlement

procedures, and lack of timely information.

Foreign Securities Risk. The Fund's foreign investments may be adversely affected by political and social instability, changes in economic or taxation policies, difficulty in enforcing obligations, decreased liquidity or increased volatility.

Foreign investments also involve the risk of the possible seizure, nationalization or expropriation of the issuer or foreign deposits (in which the Fund could lose its entire investments in a certain market) and the possible adoption of foreign

governmental restrictions such as exchange controls. Unless the Fund has hedged its foreign securities risk, foreign securities risk also involves the risk of negative foreign currency rate fluctuations, which may cause the value of securities

denominated in such foreign currency (or other instruments through which the Fund has exposure to foreign currencies) to decline in value. Currency exchange rates may fluctuate significantly over short periods of time. Currency hedging strategies,

if used, are not always successful.

Geographic Focus Risk. The Fund may from time to time invest a substantial amount of its assets in securities of issuers located in a single country or a limited number of countries. Adverse economic, political or social conditions in those

countries may therefore have a significant negative impact on the Fund’s investment performance.

Investing in the European Union Risk. Investments in certain countries in the European Union are susceptible to high economic risks associated with high levels of debt, such as investments in sovereign debt of Greece, Italy and Spain. Efforts of the member

states to further unify their economic and monetary policies may increase the potential for the downward movement of one member state’s market to cause a similar effect on other member states’ markets. Separately, the European Union

faces issues involving its membership, structure, procedures and policies. The exit of one or more member states from the European Union, such as the United Kingdom (UK) which has announced its intention to exit, would place its currency and banking

system in jeopardy. The exit by the UK or other member states will likely result in increased volatility, illiquidity and potentially lower economic growth in the affected markets, which will adversely affect the Fund’s

investments.

Limited Number of Holdings

Risk. The Fund holds a more limited number of securities than other funds with a similar investment strategy. As a result, each investment has a greater effect on the Fund’s overall performance and any change

in the value of these securities could significantly affect the value of your investment in the Fund.

Management Risk.

The Fund is actively managed and depends heavily on the Adviser’s judgment about markets, interest rates or the attractiveness, relative values, liquidity, or potential appreciation of particular investments made for the Fund’s

portfolio. The Fund could experience losses if these judgments prove to be incorrect. Additionally, legislative, regulatory, or tax developments may adversely affect management of the Fund and, therefore, the ability of the Fund to achieve its

investment objective.

Market Risk. The market values of the Fund’s investments, and therefore the value of the Fund’s shares, will go up and down, sometimes rapidly or unpredictably. Market risk may affect a single issuer, industry or section

of the economy, or it may affect the market as a whole. Individual stock prices tend to go up and down more dramatically than those of certain other types of investments, such as bonds. During a general downturn in the financial markets, multiple

asset classes may decline in value. When markets perform well, there can be no assurance that specific investments held by the Fund will rise in value.

Preferred Securities Risk. Preferred securities are subject to issuer-specific and market risks applicable generally to equity securities. Preferred securities also may be subordinated to bonds or other debt instruments, subjecting them to a

greater risk of non-payment, may be less liquid than many other securities, such as common stocks, and generally offer no voting rights with respect to the issuer.

Sector Focus Risk.

The Fund may from time to time invest a significant amount of its assets (i.e. over 25%) in one market sector or group of related industries. In this event, the Fund’s performance will depend to a greater

2

Invesco Select Opportunities Fund

invesco.com/usSOPP-SUMPRO-2

extent on the overall condition of the sector or group of industries

and there is increased risk that the Fund will lose significant value if conditions adversely affect that sector or group of industries.

Small- and Mid-Capitalization Companies Risks. Small- and mid-capitalization companies tend to be more vulnerable to changing market conditions, may have little or no operating history or track record of success, and may have more limited product lines and markets,

less experienced management and fewer financial resources than larger companies. These companies’ securities may be more volatile and less liquid than those of more established companies, and their returns may vary, sometimes significantly,

from the overall securities market.

U.S. Government Obligations Risk. Obligations of U.S. Government agencies and authorities receive varying levels of support and may not be backed by the full faith and credit of the U.S. Government, which could affect the Fund’s ability to recover

should they default. No assurance can be given that the U.S. Government will provide financial support to its agencies and authorities if it is not obligated by law to do so.

Value Investing Style Risk. A value investing style subjects the Fund to the risk that the valuations never improve or that the returns on value equity securities are less than returns on other styles of investing or the overall stock

market.

Warrants Risk. Warrants may be significantly less valuable or worthless on their expiration date and may also be postponed or terminated early, resulting in a partial or total loss. Warrants may also be illiquid.

Performance Information

The bar chart and performance table provide an indication of the risks

of investing in the Fund. The bar chart shows changes in the performance of the Fund from year to year as of December 31. The performance table compares the Fund's performance to that of a style specific benchmark, a broad-based securities market

benchmark and a peer group benchmark (in that order) comprised of funds with investment objectives and strategies similar to those of the Fund. For more information on the benchmarks used see the “Benchmark Descriptions” section in the

prospectus. The Fund's past performance (before and after taxes) is not necessarily an indication of its future performance.

Updated performance information is available on the

Fund's Web site at www.invesco.com/us.

Annual Total Returns

Best Quarter (ended

September 30, 2016): 10.02%

Worst Quarter (ended September 30, 2015): -12.24%

Worst Quarter (ended September 30, 2015): -12.24%

| Average Annual Total Returns (for the periods ended December 31, 2017) | |||

| 1

Year |

5

Years |

Since

Inception | |

| Class R5 shares: Inception (8/3/2012) | |||

| Return Before Taxes | 19.02% | 9.70% | 11.50% |

| Return After Taxes on Distributions | 19.02 | 9.39 | 11.11 |

| Return After Taxes on Distributions and Sale of Fund Shares | 10.76 | 7.63 | 9.11 |

| Class R6 shares1: Inception (9/24/2012) | 19.03 | 9.69 | 11.48 |

| MSCI All Country World Small Cap Index (Net) (reflects reinvested dividends net of withholding taxes, but reflects no deductions for fees, expenses or other taxes) | 23.81 | 12.36 | 13.53 |

| MSCI World IndexSM (Net) (reflects reinvested dividends net of withholding taxes, but reflects no deductions for fees, expenses or other taxes) | 22.40 | 11.64 | 12.14 |

| Lipper Global Small/Mid-Cap Funds Classification Average | 26.26 | 12.48 | 13.56 |

| 1 | Class R6 shares’ performance shown prior to the inception date is that of Class A shares at net asset value (NAV) and includes the 12b-1 fees applicable to Class A shares. Class A shares’ performance reflects any applicable fee waivers or expense reimbursements. The inception date of the Fund’s Class A shares is August 3, 2012. |

After-tax returns are calculated using the historical

highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor's tax situation and may differ from those shown, and after-tax returns shown are not relevant

to investors who hold their Fund shares through tax-advantaged arrangements, such as 401(k) plans, 529 college savings plans or individual retirement accounts. After-tax returns are shown for Class R5 shares only and after-tax returns for other

classes will vary.

Management of the Fund

Investment Adviser: Invesco Advisers, Inc. (Invesco or the

Adviser)

Investment Sub-Adviser: Invesco Canada Ltd.

| Portfolio Managers | Title | Length of Service on the Fund |

| Virginia Au | Portfolio Manager (lead) | 2012 |

| Robert Mikalachki | Portfolio Manager | 2012 |

| Jason Whiting | Portfolio Manager | 2012 |

Purchase and Sale of Fund

Shares

You may purchase, redeem or exchange shares of the Fund

on any business day through your financial adviser or by telephone at 800-959-4246.

There is no minimum initial investment for Employer

Sponsored Retirement and Benefit Plans investing through a retirement platform that administers at least $2.5 billion in retirement plan assets. All other Employer Sponsored Retirement and Benefit Plans must meet a minimum initial investment of at

least $1 million in each Fund in which it invests.

The minimum initial investment for all other

institutional investors is $10 million, unless such investment is made by (i) an investment company, as defined under the Investment Company Act of 1940, as amended (1940 Act), that is part of a family of investment companies which own in the

aggregate at least $100 million in securities, or (ii) an account established with a 529 college savings plan managed by Invesco, in which case there is no minimum initial investment.

There are no minimum investment amounts for Class R6

shares held through retail omnibus accounts maintained by an intermediary, such as a broker, that (i) generally charges an asset-based fee or commission in

3

Invesco Select Opportunities Fund

invesco.com/usSOPP-SUMPRO-2

addition to those described in this prospectus, and (ii) maintains

Class R6 shares and makes them available to retail investors.

Tax Information

The Fund’s distributions generally are taxable to you as

ordinary income, capital gains, or some combination of both, unless you are investing through a tax-advantaged arrangement, such as a 401(k) plan, 529 college savings plan or individual retirement account. Any distributions from a 401(k) plan or

individual retirement account may be taxed as ordinary income when withdrawn from such plan or account.

Payments to Broker-Dealers and Other Financial

Intermediaries

If you purchase the Fund through a broker-dealer

or other financial intermediary (such as a bank), the Fund’s distributor or its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the

broker-dealer or other intermediary and your salesperson or financial adviser to recommend the Fund over another investment. Ask your salesperson or financial adviser or visit your financial intermediary’s Web site for more information.

4

Invesco Select Opportunities Fund

invesco.com/usSOPP-SUMPRO-2