| OMB APPROVAL | ||||

| OMB Number: | 3235-0570 | |||

| Expires: | January 31, 2017 | |||

| Estimated average burden | ||||

| hours per response: | 20.6 | |||

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-06463

AIM International Mutual Funds (Invesco International Mutual Funds)

(Exact name of registrant as specified in charter)

11 Greenway Plaza, Suite 1000 Houston, Texas 77046

(Address of principal executive offices) (Zip code)

Philip A. Taylor 11 Greenway Plaza, Suite 1000 Houston, Texas 77046

(Name and address of agent for service)

Registrant’s telephone number, including area code: (713) 626-1919

Date of fiscal year end: 10/31

Date of reporting period: 10/31/14

Item 1. Report to Stockholders.

Letters to Shareholders

|

Philip Taylor |

Dear Shareholders: This annual report includes information about your Fund, including performance data and a complete list of its investments as of the close of the reporting period. Inside, your Fund’s portfolio managers discuss how they managed your Fund and the factors that affected its performance during the reporting period. I hope you find this report of interest. During the reporting period covered by this report, the US economy showed signs of continued improvement. After contracting in the first quarter of 2014, the economy expanded strongly in the second quarter and unemployment trended lower. Much of the credit for this improvement goes to the US Federal Reserve (the Fed), which undertook an extraordinary asset purchase program following the global financial crisis. The Fed’s goal was to jumpstart the economy by encouraging banks to lend more, businesses to hire more and consumers to spend more. Signs of a stronger US economy prompted the Fed to reduce, | |

| or “taper,” its asset purchase program. Despite this, interest rates remained near historical low levels due largely to heavy investor demand for bonds. While signs of economic improvement were evident in the US, European economies showed signs of weakening. That, together with geopolitical uncertainty and worries about the first diagnosed cases of Ebola outside of Africa, caused increased volatility in US and European equities. | ||

Extended periods of market strength can lull investors into complacency – just as prolonged periods of market weakness or volatility can discourage investors from initiating long-term investment plans. That’s why Invesco has always encouraged investors to work with a professional financial adviser who can stress the importance of starting to save and invest early and the importance of adhering to a disciplined investment plan – when times are good and when they’re uncertain. A financial adviser who knows your unique financial situation, investment goals and risk tolerance can be an invaluable partner as you seek to achieve your financial goals. He or she can offer a long-term perspective when markets are volatile and time-tested advice and guidance when your financial situation or investment goals change.

Timely information when and where you want it

Invesco’s efforts to help investors achieve their financial objectives include providing individual investors and financial professionals with timely information about the markets, the economy and investing – whenever and wherever they want it.

Our website, invesco.com/us, offers a wide range of market insights and investment perspectives. On the website, you’ll find detailed information about our funds, including prices, performance, holdings and portfolio manager commentaries. You can access information about your individual Invesco account whenever it’s convenient for you; just complete a simple, secure online registration. Use the “Log In” box on our home page to get started.

Invesco’s mobile app for iPad® (available free from the App StoreSM) allows you to obtain the same detailed information about your Fund and the same investment insights from our investment leaders, market strategists, economists and retirement experts on the go. You also can watch portfolio manager videos and have instant access to Invesco news and updates wherever you may be.

In addition to the resources accessible on our website and through our mobile app, you can obtain timely updates to help you stay informed about the markets, the economy and investing by connecting with Invesco on Twitter, LinkedIn or Facebook. You can access our blog at blog.invesco.us.com. Our goal is to provide you the information you want, when and where you want it.

Have questions?

For questions about your account, feel free to contact an Invesco client services representative at 800 959 4246. For Invesco-related questions or comments, please email me directly at phil@invesco.com.

All of us at Invesco look forward to serving your investment management needs for many years to come. Thank you for investing with us.

Sincerely,

Philip Taylor

Senior Managing Director, Invesco Ltd.

iPad is a trademark of Apple Inc., registered in the US and other countries. App Store is a service mark of Apple Inc. Invesco Distributors, Inc. is not affiliated with Apple Inc.

2 Invesco Asia Pacific Growth Fund

|

Bruce Crockett |

Dear Fellow Shareholders: There are a variety of factors that can impact investment performance, many of which are uncontrollable by us as investors. These factors can include various economic trends and geopolitical developments. While the members of the Invesco Funds Board, which I chair, can’t dictate the performance of the Invesco funds, be assured that your Board works diligently throughout the year to focus on how your investments are managed. Our job is to represent you and your interests on a variety of fund management-related matters. We regularly monitor how the portfolio management teams of the Invesco funds are performing in light of ever-changing and often unpredictable economic and market conditions. We review the investment strategies and investment process employed by each fund’s management team as explained in the fund’s prospectus. | |

| Perhaps our most significant responsibility is conducting the annual review of the funds’ |

advisory and sub-advisory contracts with Invesco Advisers and its affiliates. This annual review, which is required by the Investment Company Act of 1940, focuses on the nature and quality of the services Invesco provides as the adviser to the Invesco funds and the reasonableness of the fees that it charges for those services. Each year, we spend months carefully reviewing information from Invesco that allows us to evaluate the quality of its services and the reasonableness of its fees. We also use information from a variety of independent sources, including materials provided by the independent senior officer of the Invesco funds, who reports directly to the independent trustees on the Board. Additionally, we meet with legal counsel and review performance and fee data prepared for us by Lipper Inc., an independent, third-party firm widely recognized as a leader in its field.

After a careful review, the members of the Invesco Funds Board approved the continuation of advisory and sub-advisory contracts with Invesco Advisers and its affiliates. Be assured that your Board will continue working on behalf of fund shareholders, keeping your needs and interests uppermost in our minds.

As always, please contact me at bruce@brucecrockett.com with any questions or concerns you may have. On behalf of the Board, we look forward to continuing to represent your interests and serving your needs.

Sincerely,

Bruce L. Crockett

Independent Chair

Invesco Funds Board of Trustees

3 Invesco Asia Pacific Growth Fund

Management’s Discussion of Fund Performance

4 Invesco Asia Pacific Growth Fund

5 Invesco Asia Pacific Growth Fund

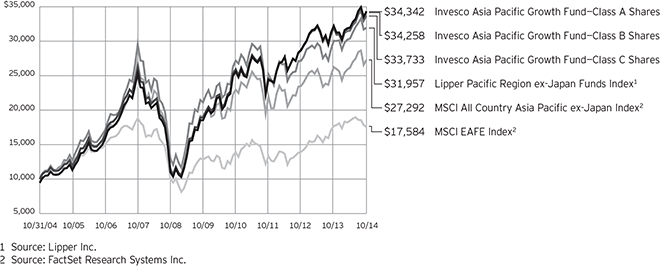

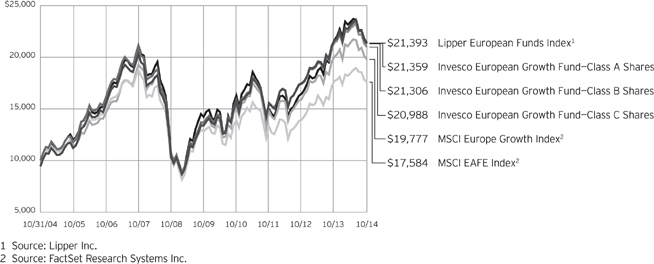

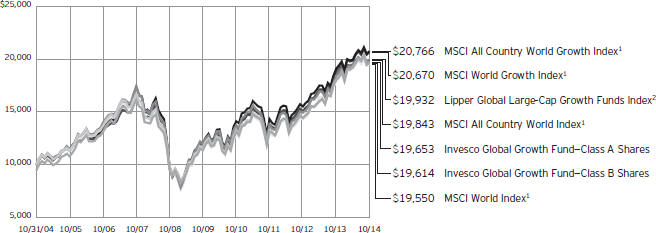

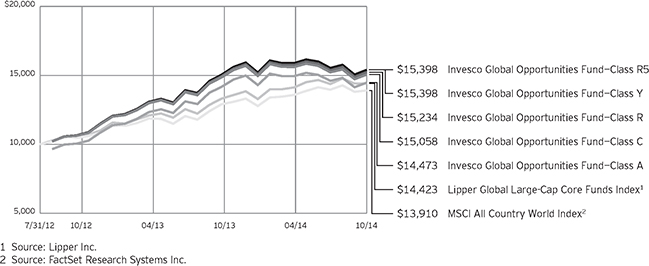

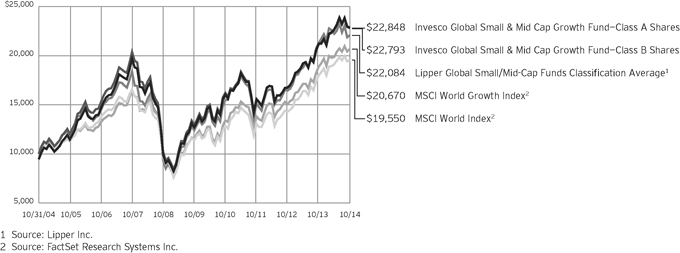

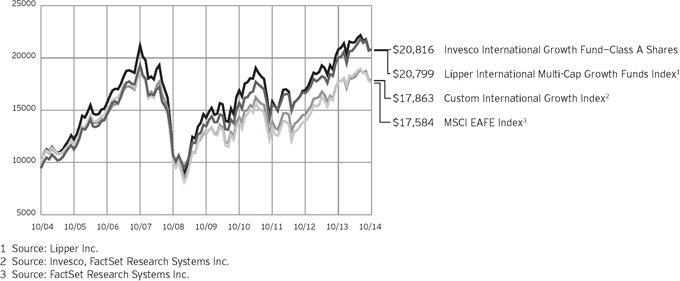

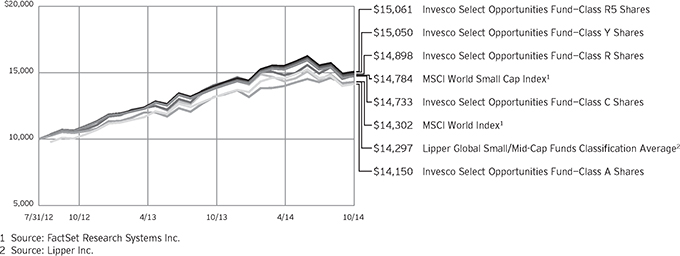

Your Fund’s Long-Term Performance

Results of a $10,000 Investment – Oldest Share Class(es)

Fund and index data from 10/31/04

continued from page 8

6 Invesco Asia Pacific Growth Fund

7 Invesco Asia Pacific Growth Fund

Invesco Asia Pacific Growth Fund’s investment objective is long-term growth of capital.

| n | Unless otherwise stated, information presented in this report is as of October 31, 2014, and is based on total net assets. |

| n | Unless otherwise noted, all data provided by Invesco. |

| n | To access your Fund’s reports/prospectus, visit invesco.com/fundreports. |

8 Invesco Asia Pacific Growth Fund

Schedule of Investments

October 31, 2014

Investment Abbreviations:

| ADR | – American Depositary Receipt | |

| PDR | – Philippine Depositary Receipt | |

| REIT | – Real Estate Investment Trust |

Notes to Schedule of Investments:

| (a) | Non-income producing security. |

| (b) | The money market fund and the Fund are affiliated by having the same investment adviser. |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

9 Invesco Asia Pacific Growth Fund

Statement of Assets and Liabilities

October 31, 2014

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

10 Invesco Asia Pacific Growth Fund

Statement of Operations

For the year ended October 31, 2014

| Investment income: |

| |||

| Dividends (net of foreign withholding taxes of $1,688,331) |

$ | 24,402,493 | ||

| Dividends from affiliated money market funds |

33,024 | |||

| Total investment income |

24,435,517 | |||

| Expenses: |

||||

| Advisory fees |

7,429,046 | |||

| Administrative services fees |

203,198 | |||

| Custodian fees |

553,643 | |||

| Distribution fees: |

||||

| Class A |

1,337,661 | |||

| Class B |

178,316 | |||

| Class C |

927,124 | |||

| Transfer agent fees |

1,587,868 | |||

| Trustees’ and officers’ fees and benefits |

42,038 | |||

| Other |

282,481 | |||

| Total expenses |

12,541,375 | |||

| Less: Fees waived and expense offset arrangement(s) |

(124,660 | ) | ||

| Net expenses |

12,416,715 | |||

| Net investment income |

12,018,802 | |||

| Realized and unrealized gain (loss) from: |

||||

| Net realized gain (loss) from: |

||||

| Investment securities |

26,996,118 | |||

| Foreign currencies |

(453,564 | ) | ||

| 26,542,554 | ||||

| Change in net unrealized appreciation (depreciation) of: |

||||

| Investment securities (net of foreign taxes on holdings of $1,367,842) |

15,301,499 | |||

| Foreign currencies |

(295,407 | ) | ||

| 15,006,092 | ||||

| Net realized and unrealized gain |

41,548,646 | |||

| Net increase in net assets resulting from operations |

$ | 53,567,448 | ||

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

11 Invesco Asia Pacific Growth Fund

Statement of Changes in Net Assets

For the years ended October 31, 2014 and 2013

| 2014 | 2013 | |||||||

| Operations: |

||||||||

| Net investment income |

$ | 12,018,802 | $ | 6,288,256 | ||||

| Net realized gain |

26,542,554 | 40,343,992 | ||||||

| Change in net unrealized appreciation |

15,006,092 | 31,144,966 | ||||||

| Net increase in net assets resulting from operations |

53,567,448 | 77,777,214 | ||||||

| Distributions to shareholders from net investment income: |

||||||||

| Class A |

(4,576,835 | ) | (3,012,794 | ) | ||||

| Class B |

(30,319 | ) | — | |||||

| Class C |

(134,057 | ) | — | |||||

| Class Y |

(1,264,757 | ) | (540,337 | ) | ||||

| Total distributions from net investment income |

(6,005,968 | ) | (3,553,131 | ) | ||||

| Distributions to shareholders from net realized gains: |

||||||||

| Class A |

(28,052,371 | ) | (9,721,485 | ) | ||||

| Class B |

(1,182,957 | ) | (603,903 | ) | ||||

| Class C |

(5,230,262 | ) | (1,852,367 | ) | ||||

| Class Y |

(6,036,431 | ) | (1,304,896 | ) | ||||

| Total distributions from net realized gains |

(40,502,021 | ) | (13,482,651 | ) | ||||

| Share transactions–net: |

||||||||

| Class A |

(3,644,054 | ) | 53,882,110 | |||||

| Class B |

(7,240,752 | ) | (6,880,003 | ) | ||||

| Class C |

(854,323 | ) | 9,131,466 | |||||

| Class Y |

129,189,934 | 54,724,041 | ||||||

| Net increase in net assets resulting from share transactions |

117,450,805 | 110,857,614 | ||||||

| Net increase in net assets |

124,510,264 | 171,599,046 | ||||||

| Net assets: |

||||||||

| Beginning of year |

795,476,124 | 623,877,078 | ||||||

| End of year (includes undistributed net investment income of $11,301,321 and $5,675,461, respectively) |

$ | 919,986,388 | $ | 795,476,124 | ||||

Notes to Financial Statements

October 31, 2014

NOTE 1—Significant Accounting Policies

Invesco Asia Pacific Growth Fund (the “Fund”) is a series portfolio of AIM International Mutual Funds (Invesco International Mutual Funds) (the “Trust”). The Trust is a Delaware statutory trust registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end series management investment company consisting of eight separate portfolios, each authorized to issue an unlimited number of shares of beneficial interest. The assets, liabilities and operations of each portfolio are accounted for separately. Information presented in these financial statements pertains only to the Fund. Matters affecting each portfolio or class will be voted on exclusively by the shareholders of such portfolio or class.

The Fund’s investment objective is long-term growth of capital.

The Fund currently consists of four different classes of shares: Class A, Class B, Class C and Class Y. Class A shares are sold with a front-end sales charge unless certain waiver criteria are met and under certain circumstances load waived shares may be subject to contingent deferred sales charges (“CDSC”). Class C shares are sold with a CDSC. Class Y shares are sold at net asset value. Effective November 30, 2010, new or additional investments in Class B shares are no longer permitted. Existing shareholders of Class B shares may continue to reinvest dividends and capital gains distributions in Class B shares until they convert to Class A shares. Also, shareholders in Class B shares will be able to exchange those shares for Class B shares of other Invesco Funds offering such shares until they convert to Class A shares. Generally, Class B shares will automatically convert to Class A shares on or about the month-end, which is at least eight years after the date of purchase. Redemption of Class B shares prior to the conversion date will be subject to a CDSC.

The following is a summary of the significant accounting policies followed by the Fund in the preparation of its financial statements.

| A. | Security Valuations — Securities, including restricted securities, are valued according to the following policy. |

A security listed or traded on an exchange (except convertible securities) is valued at its last sales price or official closing price as of the close of the customary trading session on the exchange where the security is principally traded, or lacking any sales or official closing price on a particular day, the security may be valued at the closing bid price on that day. Securities traded in the over-the-counter market are valued based on prices furnished by independent pricing services or market makers. When such securities are valued by an independent pricing service they

12 Invesco Asia Pacific Growth Fund

may be considered fair valued. Futures contracts are valued at the final settlement price set by an exchange on which they are principally traded. Listed options are valued at the mean between the last bid and ask prices from the exchange on which they are principally traded. Options not listed on an exchange are valued by an independent source at the mean between the last bid and ask prices. For purposes of determining net asset value per share, futures and option contracts generally are valued 15 minutes after the close of the customary trading session of the New York Stock Exchange (“NYSE”).

Investments in open-end and closed-end registered investment companies that do not trade on an exchange are valued at the end of day net asset value per share. Investments in open-end and closed-end registered investment companies that trade on an exchange are valued at the last sales price or official closing price as of the close of the customary trading session on the exchange where the security is principally traded.

Debt obligations (including convertible securities) and unlisted equities are fair valued using an evaluated quote provided by an independent pricing service. Evaluated quotes provided by the pricing service may be determined without exclusive reliance on quoted prices, and may reflect appropriate factors such as institution-size trading in similar groups of securities, developments related to specific securities, dividend rate (for unlisted equities), yield (for debt obligations), quality, type of issue, coupon rate (for debt obligations), maturity (for debt obligations), individual trading characteristics and other market data. Debt obligations are subject to interest rate and credit risks. In addition, all debt obligations involve some risk of default with respect to interest and/or principal payments.

Foreign securities’ (including foreign exchange contracts) prices are converted into U.S. dollar amounts using the applicable exchange rates as of the close of the NYSE. If market quotations are available and reliable for foreign exchange-traded equity securities, the securities will be valued at the market quotations. Because trading hours for certain foreign securities end before the close of the NYSE, closing market quotations may become unreliable. If between the time trading ends on a particular security and the close of the customary trading session on the NYSE, events occur that the Adviser determines are significant and make the closing price unreliable, the Fund may fair value the security. If the event is likely to have affected the closing price of the security, the security will be valued at fair value in good faith using procedures approved by the Board of Trustees. Adjustments to closing prices to reflect fair value may also be based on a screening process of an independent pricing service to indicate the degree of certainty, based on historical data, that the closing price in the principal market where a foreign security trades is not the current value as of the close of the NYSE. Foreign securities’ prices meeting the approved degree of certainty that the price is not reflective of current value will be priced at the indication of fair value from the independent pricing service. Multiple factors may be considered by the independent pricing service in determining adjustments to reflect fair value and may include information relating to sector indices, American Depositary Receipts and domestic and foreign index futures. Foreign securities may have additional risks including exchange rate changes, potential for sharply devalued currencies and high inflation, political and economic upheaval, the relative lack of issuer information, relatively low market liquidity and the potential lack of strict financial and accounting controls and standards.

Securities for which market prices are not provided by any of the above methods may be valued based upon quotes furnished by independent sources. The last bid price may be used to value equity securities. The mean between the last bid and ask prices is used to value debt obligations, including corporate loans.

Securities for which market quotations are not readily available or became unreliable are valued at fair value as determined in good faith by or under the supervision of the Trust’s officers following procedures approved by the Board of Trustees. Issuer specific events, market trends, bid/ask quotes of brokers and information providers and other market data may be reviewed in the course of making a good faith determination of a security’s fair value.

The Fund may invest in securities that are subject to interest rate risk, meaning the risk that the prices will generally fall as interest rates rise and, conversely, the prices will generally rise as interest rates fall. Specific securities differ in their sensitivity to changes in interest rates depending on their individual characteristics. Changes in interest rates may result in increased market volatility, which may affect the value and/or liquidity of certain of the Fund’s investments.

Valuations change in response to many factors including the historical and prospective earnings of the issuer, the value of the issuer’s assets, general economic conditions, interest rates, investor perceptions and market liquidity. Because of the inherent uncertainties of valuation, the values reflected in the financial statements may materially differ from the value received upon actual sale of those investments.

| B. | Securities Transactions and Investment Income — Securities transactions are accounted for on a trade date basis. Realized gains or losses on sales are computed on the basis of specific identification of the securities sold. Interest income (net of withholding tax, if any) is recorded on the accrual basis from settlement date. Dividend income (net of withholding tax, if any) is recorded on the ex-dividend date. |

The Fund may periodically participate in litigation related to Fund investments. As such, the Fund may receive proceeds from litigation settlements. Any proceeds received are included in the Statement of Operations as realized gain (loss) for investments no longer held and as unrealized gain (loss) for investments still held.

Brokerage commissions and mark ups are considered transaction costs and are recorded as an increase to the cost basis of securities purchased and/or a reduction of proceeds on a sale of securities. Such transaction costs are included in the determination of net realized and unrealized gain (loss) from investment securities reported in the Statement of Operations and the Statement of Changes in Net Assets and the net realized and unrealized gains (losses) on securities per share in the Financial Highlights. Transaction costs are included in the calculation of the Fund’s net asset value and, accordingly, they reduce the Fund’s total returns. These transaction costs are not considered operating expenses and are not reflected in net investment income reported in the Statement of Operations and Statement of Changes in Net Assets, or the net investment income per share and ratios of expenses and net investment income reported in the Financial Highlights, nor are they limited by any expense limitation arrangements between the Fund and the investment adviser.

The Fund allocates income and realized and unrealized capital gains and losses to a class based on the relative net assets of each class.

| C. | Country Determination — For the purposes of making investment selection decisions and presentation in the Schedule of Investments, the investment adviser may determine the country in which an issuer is located and/or credit risk exposure based on various factors. These factors include the laws of the country under which the issuer is organized, where the issuer maintains a principal office, the country in which the issuer derives 50% or more of its total revenues and the country that has the primary market for the issuer’s securities, as well as other criteria. Among the other criteria that may be evaluated for making this determination are the country in which the issuer maintains 50% or more of its assets, the type of security, financial guarantees and enhancements, the nature of the collateral and the sponsor organization. Country of issuer and/or credit risk exposure has been determined to be the United States of America, unless otherwise noted. |

13 Invesco Asia Pacific Growth Fund

| D. | Distributions — Distributions from net investment income and net realized capital gain, if any, are generally declared and paid annually and recorded on the ex-dividend date. The Fund may elect to treat a portion of the proceeds from redemptions as distributions for federal income tax purposes. |

| E. | Federal Income Taxes — The Fund intends to comply with the requirements of Subchapter M of the Internal Revenue Code of 1986, as amended (the “Internal Revenue Code”), necessary to qualify as a regulated investment company and to distribute substantially all of the Fund’s taxable earnings to shareholders. As such, the Fund will not be subject to federal income taxes on otherwise taxable income (including net realized capital gain) that is distributed to shareholders. Therefore, no provision for federal income taxes is recorded in the financial statements. |

The Fund recognizes the tax benefits of uncertain tax positions only when the position is more likely than not to be sustained. Management has analyzed the Fund’s uncertain tax positions and concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions. Management is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next 12 months.

The Fund files tax returns in the U.S. Federal jurisdiction and certain other jurisdictions. Generally, the Fund is subject to examinations by such taxing authorities for up to three years after the filing of the return for the tax period.

| F. | Expenses — Fees provided for under the Rule 12b-1 plan of a particular class of the Fund and which are directly attributable to that class are charged to the operations of such class. All other expenses are allocated among the classes based on relative net assets. |

| G. | Accounting Estimates — The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America (“GAAP”) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period including estimates and assumptions related to taxation. Actual results could differ from those estimates by a significant amount. In addition, the Fund monitors for material events or transactions that may occur or become known after the period-end date and before the date the financial statements are released to print. |

| H. | Indemnifications — Under the Trust’s organizational documents, each Trustee, officer, employee or other agent of the Trust is indemnified against certain liabilities that may arise out of the performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts, including the Fund’s servicing agreements, that contain a variety of indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. The risk of material loss as a result of such indemnification claims is considered remote. |

| I. | Foreign Currency Translations — Foreign currency is valued at the close of the NYSE based on quotations posted by banks and major currency dealers. Portfolio securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollar amounts at date of valuation. Purchases and sales of portfolio securities (net of foreign taxes withheld on disposition) and income items denominated in foreign currencies are translated into U.S. dollar amounts on the respective dates of such transactions. The Fund does not separately account for the portion of the results of operations resulting from changes in foreign exchange rates on investments and the fluctuations arising from changes in market prices of securities held. The combined results of changes in foreign exchange rates and the fluctuation of market prices on investments (net of estimated foreign tax withholding) are included with the net realized and unrealized gain or loss from investments in the Statement of Operations. Reported net realized foreign currency gains or losses arise from (1) sales of foreign currencies, (2) currency gains or losses realized between the trade and settlement dates on securities transactions, and (3) the difference between the amounts of dividends, interest, and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign currency gains and losses arise from changes in the fair values of assets and liabilities, other than investments in securities at fiscal period end, resulting from changes in exchange rates. |

The Fund may invest in foreign securities, which may be subject to foreign taxes on income, gains on investments or currency repatriation, a portion of which may be recoverable. Foreign taxes, if any, are recorded based on the tax regulations and rates that exist in the foreign markets in which the Fund invests and are shown in the Statement of Operations.

| J. | Forward Foreign Currency Contracts — The Fund may engage in foreign currency transactions either on a spot (i.e. for prompt delivery and settlement) basis or through forward foreign currency contracts to manage or minimize currency or exchange rate risk. |

The Fund may also enter into forward foreign currency contracts for the purchase or sale of a security denominated in a foreign currency in order to “lock in” the U.S. dollar price of that security, or the Fund may also enter into forward foreign currency contracts that do not provide for physical settlement of the two currencies, but instead are settled by a single cash payment calculated as the difference between the agreed upon exchange rate and the spot rate at settlement based upon an agreed upon notional amount (non-deliverable forwards). The Fund will set aside liquid assets in an amount equal to daily mark-to-market obligation for forward foreign currency contracts.

A forward foreign currency contract is an obligation between two parties (“Counterparties”) to purchase or sell a specific currency for an agreed-upon price at a future date. The use of forward foreign currency contracts does not eliminate fluctuations in the price of the underlying securities the Fund owns or intends to acquire but establishes a rate of exchange in advance. Fluctuations in the value of these contracts are measured by the difference in the contract date and reporting date exchange rates and are recorded as unrealized appreciation (depreciation) until the contracts are closed. When the contracts are closed, realized gains (losses) are recorded. Realized and unrealized gains (losses) on the contracts are included in the Statement of Operations. The primary risks associated with forward foreign currency contracts include failure of the Counterparty to meet the terms of the contract and the value of the foreign currency changing unfavorably. These risks may be in excess of the amounts reflected in the Statement of Assets and Liabilities.

14 Invesco Asia Pacific Growth Fund

NOTE 2—Advisory Fees and Other Fees Paid to Affiliates

The Trust has entered into a master investment advisory agreement with Invesco Advisers, Inc. (the “Adviser” or “Invesco”). Under the terms of the investment advisory agreement, the Fund pays an advisory fee to the Adviser based on the annual rate of the Fund’s average daily net assets as follows:

| Average Daily Net Assets | Rate | |||||

| First $250 million |

0 | .935% | ||||

| Next $250 million |

0 | .91% | ||||

| Next $500 million |

0 | .885% | ||||

| Next $1.5 billion |

0 | .86% | ||||

| Next $2.5 billion |

0 | .835% | ||||

| Next $2.5 billion |

0 | .81% | ||||

| Next $2.5 billion |

0 | .785% | ||||

| Over $10 billion |

0 | .76% | ||||

For the year ended October 31, 2014, the effective advisory fees incurred by the Fund was 0.91%.

Under the terms of a master sub-advisory agreement between the Adviser and each of Invesco Asset Management Deutschland GmbH, Invesco Asset Management Limited, Invesco Asset Management (Japan) Limited, Invesco Australia Limited, Invesco Hong Kong Limited, Invesco Senior Secured Management, Inc. and Invesco Canada Ltd. (collectively, the “Affiliated Sub-Advisers”) the Adviser, not the Fund, may pay 40% of the fees paid to the Adviser to any such Affiliated Sub-Adviser(s) that provide(s) discretionary investment management services to the Fund based on the percentage of assets allocated to such Sub-Adviser(s).

The Adviser has contractually agreed, through at least June 30, 2015, to waive advisory fees and/or reimburse expenses of all shares to the extent necessary to limit total annual fund operating expenses after fee waiver and/or expense reimbursement (excluding certain items discussed below) of Class A, Class B, Class C and Class Y shares to 2.25%, 3.00%, 3.00% and 2.00%, respectively, of average daily net assets. In determining the Adviser’s obligation to waive advisory fees and/or reimburse expenses, the following expenses are not taken into account, and could cause the total annual fund operating expenses after fee waiver and/or expense reimbursement to exceed the numbers reflected above: (1) interest; (2) taxes; (3) dividend expense on short sales; (4) extraordinary or non-routine items; and (5) expenses that the Fund has incurred but did not actually pay because of an expense offset arrangement. Unless Invesco continues the fee waiver agreement, it will terminate on June 30, 2015. The fee waiver agreement cannot be terminated during its term. The Adviser did not waive fees and/or reimburse expenses during the period under this expense limitation.

Further, the Adviser has contractually agreed, through at least June 30, 2016, to waive the advisory fee payable by the Fund in an amount equal to 100% of the net advisory fees the Adviser receives from the affiliated money market funds on investments by the Fund of uninvested cash in such affiliated money market funds.

For the year ended October 31, 2014, the Adviser waived advisory fees of $121,693.

The Trust has entered into a master administrative services agreement with Invesco pursuant to which the Fund has agreed to pay Invesco for certain administrative costs incurred in providing accounting services to the Fund. For the year ended October 31, 2014, expenses incurred under the agreement are shown in the Statement of Operations as Administrative services fees.

The Trust has entered into a transfer agency and service agreement with Invesco Investment Services, Inc. (“IIS”) pursuant to which the Fund has agreed to pay IIS a fee for providing transfer agency and shareholder services to the Fund and reimburse IIS for certain expenses incurred by IIS in the course of providing such services. IIS may make payments to intermediaries that provide omnibus account services, sub-accounting services and/or networking services. All fees payable by IIS to intermediaries that provide omnibus account services or sub-accounting are charged back to the Fund, subject to certain limitations approved by the Trust’s Board of Trustees. For the year ended October 31, 2014, the expenses incurred under the agreement are shown in the Statement of Operations as Transfer agent fees.

The Trust has entered into master distribution agreements with Invesco Distributors, Inc. (“IDI”) to serve as the distributor for the Class A, Class B, Class C and Class Y shares of the Fund. The Trust has adopted plans pursuant to Rule 12b-1 under the 1940 Act with respect to the Fund’s Class A, Class B and Class C shares (collectively, the “Plans”). The Fund, pursuant to the Plans, pays IDI compensation at the annual rate of 0.25% of the Fund’s average daily net assets of Class A shares and 1.00% of the average daily net assets of each class of Class B and Class C shares. Of the Plan payments, up to 0.25% of the average daily net assets of each class of shares may be paid to furnish continuing personal shareholder services to customers who purchase and own shares of such classes. Any amounts not paid as a service fee under the Plans would constitute an asset-based sales charge. Rules of the Financial Industry Regulatory Authority (“FINRA”) impose a cap on the total sales charges, including asset-based sales charges, that may be paid by any class of shares of the Fund. For the year ended October 31, 2014, expenses incurred under the Plans are shown in the Statement of Operations as Distribution fees.

Front-end sales commissions and CDSC (collectively, the “sales charges”) are not recorded as expenses of the Fund. Front-end sales commissions are deducted from proceeds from the sales of Fund shares prior to investment in Class A shares of the Fund. CDSC are deducted from redemption proceeds prior to remittance to the shareholder. During the year ended October 31, 2014, IDI advised the Fund that IDI retained $177,782 in front-end sales commissions from the sale of Class A shares and $8,995, $10,471 and $15,671 from Class A, Class B and Class C shares, respectively, for CDSC imposed on redemptions by shareholders.

Certain officers and trustees of the Trust are officers and directors of the Adviser, IIS and/or IDI.

15 Invesco Asia Pacific Growth Fund

NOTE 3—Additional Valuation Information

GAAP defines fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date, under current market conditions. GAAP establishes a hierarchy that prioritizes the inputs to valuation methods, giving the highest priority to readily available unadjusted quoted prices in an active market for identical assets (Level 1) and the lowest priority to significant unobservable inputs (Level 3), generally when market prices are not readily available or are unreliable. Based on the valuation inputs, the securities or other investments are tiered into one of three levels. Changes in valuation methods may result in transfers in or out of an investment’s assigned level:

| Level 1 — | Prices are determined using quoted prices in an active market for identical assets. |

| Level 2 — | Prices are determined using other significant observable inputs. Observable inputs are inputs that other market participants may use in pricing a security. These may include quoted prices for similar securities, interest rates, prepayment speeds, credit risk, yield curves, loss severities, default rates, discount rates, volatilities and others. |

| Level 3 — | Prices are determined using significant unobservable inputs. In situations where quoted prices or observable inputs are unavailable (for example, when there is little or no market activity for an investment at the end of the period), unobservable inputs may be used. Unobservable inputs reflect the Fund’s own assumptions about the factors market participants would use in determining fair value of the securities or instruments and would be based on the best available information. |

The following is a summary of the tiered valuation input levels, as of October 31, 2014. The level assigned to the securities valuations may not be an indication of the risk or liquidity associated with investing in those securities. Because of the inherent uncertainties of valuation, the values reflected in the financial statements may materially differ from the value received upon actual sale of those investments.

During the year ended October 31, 2014, there were transfers from Level 1 to Level 2 of $230,609,169 and from Level 2 to Level 1 of $113,167,338, due to foreign fair value adjustments.

| Level 1 | Level 2 | Level 3 | Total | |||||||||||||

| Australia |

$ | — | $ | 101,109,696 | $ | — | $ | 101,109,696 | ||||||||

| China |

151,922,663 | 54,715,958 | — | 206,638,621 | ||||||||||||

| Hong Kong |

88,436,523 | 26,737,725 | — | 115,174,248 | ||||||||||||

| Indonesia |

20,843,168 | 67,354,191 | — | 88,197,359 | ||||||||||||

| Malaysia |

20,853,333 | 19,491,319 | — | 40,344,652 | ||||||||||||

| Philippines |

44,960,904 | 44,601,014 | — | 89,561,918 | ||||||||||||

| Singapore |

21,139,185 | 55,185,319 | — | 76,324,504 | ||||||||||||

| South Korea |

— | 28,266,834 | — | 28,266,834 | ||||||||||||

| Taiwan |

— | 25,821,269 | — | 25,821,269 | ||||||||||||

| Thailand |

21,006,952 | 51,809,178 | — | 72,816,130 | ||||||||||||

| United States |

59,771,991 | — | — | 59,771,991 | ||||||||||||

| Total Investments |

$ | 428,934,719 | $ | 475,092,503 | $ | — | $ | 904,027,222 | ||||||||

NOTE 4—Expense Offset Arrangement(s)

The expense offset arrangement is comprised of transfer agency credits which result from balances in demand deposit accounts used by the transfer agent for clearing shareholder transactions. For the year ended October 31, 2014, the Fund received credits from this arrangement, which resulted in the reduction of the Fund’s total expenses of $2,967.

NOTE 5—Trustees’ and Officers’ Fees and Benefits

Trustees’ and Officers’ Fees and Benefits include amounts accrued by the Fund to pay remuneration to certain Trustees and Officers of the Fund. Trustees have the option to defer compensation payable by the Fund, and Trustees’ and Officers’ Fees and Benefits also include amounts accrued by the Fund to fund such deferred compensation amounts. Those Trustees who defer compensation have the option to select various Invesco Funds in which their deferral accounts shall be deemed to be invested. Finally, certain current Trustees were eligible to participate in a retirement plan that provided for benefits to be paid upon retirement to Trustees over a period of time based on the number of years of service. The Fund may have certain former Trustees who also participate in a retirement plan and receive benefits under such plan. Trustees’ and Officers’ Fees and Benefits include amounts accrued by the Fund to fund such retirement benefits. Obligations under the deferred compensation and retirement plans represent unsecured claims against the general assets of the Fund.

NOTE 6—Cash Balances

The Fund is permitted to temporarily carry a negative or overdrawn balance in its account with State Street Bank and Trust Company, the custodian bank. Such balances, if any at period end, are shown in the Statement of Assets and Liabilities under the payable caption Amount due custodian. To compensate the custodian bank for such overdrafts, the overdrawn Fund may either (1) leave funds as a compensating balance in the account so the custodian bank can be compensated by earning the additional interest; or (2) compensate by paying the custodian bank at a rate agreed upon by the custodian bank and Invesco, not to exceed the contractually agreed upon rate.

16 Invesco Asia Pacific Growth Fund

NOTE 7—Distributions to Shareholders and Tax Components of Net Assets

Tax Character of Distributions to Shareholders Paid During the Fiscal Years Ended October 31, 2014 and 2013:

| 2014 | 2013 | |||||||

| Ordinary income |

$ | 6,005,968 | $ | 3,553,131 | ||||

| Long-term capital gain |

40,502,021 | 13,482,651 | ||||||

| Total distributions |

$ | 46,507,989 | $ | 17,035,782 | ||||

Tax Components of Net Assets at Period-End:

| 2014 | ||||

| Undistributed ordinary income |

$ | 11,489,788 | ||

| Undistributed long-term gain |

26,802,298 | |||

| Net unrealized appreciation — investments |

224,028,205 | |||

| Net unrealized appreciation (depreciation) — other investments |

(145,147 | ) | ||

| Temporary book/tax differences |

(131,942 | ) | ||

| Shares of beneficial interest |

657,943,186 | |||

| Total net assets |

$ | 919,986,388 | ||

The difference between book-basis and tax-basis unrealized appreciation (depreciation) is due to differences in the timing of recognition of gains and losses on investments for tax and book purposes. The Fund’s net unrealized appreciation difference is attributable primarily to wash sales and passive foreign investment companies.

The temporary book/tax differences are a result of timing differences between book and tax recognition of income and/or expenses. The Fund’s temporary book/tax differences are the result of the trustee deferral of compensation and retirement plan benefits.

Capital loss carryforward is calculated and reported as of a specific date. Results of transactions and other activity after that date may affect the amount of capital loss carryforward actually available for the Fund to utilize. Capital losses generated in years beginning after December 22, 2010 can be carried forward for an unlimited period, whereas previous losses expire in eight tax years. Capital losses with an expiration period may not be used to offset capital gains until all net capital losses without an expiration date have been utilized. Capital loss carryforwards with no expiration date will retain their character as either short-term or long-term capital losses instead of as short-term capital losses as under prior law. The ability to utilize capital loss carryforwards in the future may be limited under the Internal Revenue Code and related regulations based on the results of future transactions.

The Fund does not have a capital loss carryforward as of October 31, 2014.

NOTE 8—Investment Securities

The aggregate amount of investment securities (other than short-term securities, U.S. Treasury obligations and money market funds, if any) purchased and sold by the Fund during the year ended October 31, 2014 was $219,668,928 and $110,306,835, respectively. Cost of investments on a tax basis includes the adjustments for financial reporting purposes as of the most recently completed federal income tax reporting period-end.

| Unrealized Appreciation (Depreciation) of Investment Securities on a Tax Basis | ||||

| Aggregate unrealized appreciation of investment securities |

$ | 241,920,475 | ||

| Aggregate unrealized (depreciation) of investment securities |

(17,892,270 | ) | ||

| Net unrealized appreciation of investment securities |

$ | 224,028,205 | ||

Cost of investments for tax purposes is $679,999,017.

NOTE 9—Reclassification of Permanent Differences

Primarily as a result of differing book/tax treatment of foreign currency transactions, on October 31, 2014, undistributed net investment income was decreased by $386,974 and undistributed net realized gain was increased by $386,974. This reclassification had no effect on the net assets of the Fund.

17 Invesco Asia Pacific Growth Fund

NOTE 10—Share Information

| Summary of Share Activity | ||||||||||||||||

| Years ended October 31, | ||||||||||||||||

| 2014(a) | 2013 | |||||||||||||||

| Shares | Amount | Shares | Amount | |||||||||||||

| Sold: |

||||||||||||||||

| Class A |

3,593,919 | $ | 115,311,135 | 5,889,455 | $ | 189,661,022 | ||||||||||

| Class B |

13,322 | 396,533 | 60,321 | 1,805,112 | ||||||||||||

| Class C |

522,102 | 15,457,978 | 932,471 | 27,957,828 | ||||||||||||

| Class Y |

5,784,873 | 182,921,092 | 3,751,686 | 121,128,269 | ||||||||||||

| Issued as reinvestment of dividends: |

||||||||||||||||

| Class A |

986,444 | 29,474,930 | 371,809 | 11,455,419 | ||||||||||||

| Class B |

39,872 | 1,117,602 | 19,368 | 562,054 | ||||||||||||

| Class C |

178,309 | 4,967,702 | 59,702 | 1,722,404 | ||||||||||||

| Class Y |

206,630 | 6,182,381 | 47,330 | 1,460,123 | ||||||||||||

| Automatic conversion of Class B shares to Class A shares: |

||||||||||||||||

| Class A |

154,084 | 4,883,279 | 134,345 | 4,441,862 | ||||||||||||

| Class B |

(164,822 | ) | (4,883,279 | ) | (146,371 | ) | (4,441,862 | ) | ||||||||

| Reacquired: |

||||||||||||||||

| Class A |

(4,840,275 | ) | (153,313,398 | ) | (4,730,060 | ) | (151,676,193 | ) | ||||||||

| Class B |

(132,579 | ) | (3,871,608 | ) | (160,134 | ) | (4,805,307 | ) | ||||||||

| Class C |

(725,341 | ) | (21,280,003 | ) | (687,635 | ) | (20,548,766 | ) | ||||||||

| Class Y |

(1,892,515 | ) | (59,913,539 | ) | (2,107,171 | ) | (67,864,351 | ) | ||||||||

| Net increase in share activity |

3,724,023 | $ | 117,450,805 | 3,435,116 | $ | 110,857,614 | ||||||||||

| (a) | There are entities that are record owners of more than 5% of the outstanding shares of the Fund and in the aggregate own 23% of the outstanding shares of the Fund. IDI has an agreement with these entities to sell Fund shares. The Fund, Invesco and/or Invesco affiliates may make payments to these entities, which are considered to be related to the Fund, for providing services to the Fund, Invesco and/or Invesco affiliates including but not limited to services such as securities brokerage, distribution, third party record keeping and account servicing. The Fund has no knowledge as to whether all or any portion of the shares owned of record by these entities are also owned beneficially. |

18 Invesco Asia Pacific Growth Fund

NOTE 11—Financial Highlights

The following schedule presents financial highlights for a share of the Fund outstanding throughout the periods indicated.

| Net asset value, beginning of period |

Net investment income(a) |

Net gains (losses) on securities (both realized and unrealized) |

Total from investment operations |

Dividends from net investment income |

Distributions from net realized gains |

Total distributions |

Net

asset value, end of period(b) |

Total return(c) |

Net assets, end of period (000’s omitted) |

Ratio

of expenses to average net assets with fee waivers and/or expenses absorbed |

Ratio

of expenses to average net assets without fee waivers and/or expenses absorbed |

Ratio of net investment income to average net assets |

Portfolio turnover(d) |

|||||||||||||||||||||||||||||||||||||||||||

| Class A |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Year ended 10/31/14 |

$ | 33.45 | $ | 0.48 | $ | 1.47 | $ | 1.95 | $ | (0.27 | ) | $ | (1.70 | ) | $ | (1.97 | ) | $ | 33.43 | 6.54 | % | $ | 551,539 | 1.47 | %(e) | 1.48 | %(e) | 1.52 | %(e) | 15 | % | |||||||||||||||||||||||||

| Year ended 10/31/13 |

30.65 | 0.30 | 3.35 | 3.65 | (0.20 | ) | (0.65 | ) | (0.85 | ) | 33.45 | 12.16 | 555,505 | 1.47 | 1.49 | 0.95 | 18 | |||||||||||||||||||||||||||||||||||||||

| Year ended 10/31/12 |

28.42 | 0.26 | 4.34 | 4.60 | (0.27 | ) | (2.10 | ) | (2.37 | ) | 30.65 | 17.77 | 457,964 | 1.54 | 1.55 | 0.89 | 16 | |||||||||||||||||||||||||||||||||||||||

| Year ended 10/31/11 |

30.30 | 0.28 | (1.68 | ) | (1.40 | ) | (0.23 | ) | (0.25 | ) | (0.48 | ) | 28.42 | (4.67 | ) | 385,828 | 1.53 | 1.55 | 0.93 | 27 | ||||||||||||||||||||||||||||||||||||

| Year ended 10/31/10 |

22.23 | 0.23 | 8.12 | 8.35 | (0.28 | ) | — | (0.28 | ) | 30.30 | 37.97 | 429,596 | 1.60 | 1.61 | 0.91 | 25 | ||||||||||||||||||||||||||||||||||||||||

| Class B |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Year ended 10/31/14 |

31.29 | 0.23 | 1.37 | 1.60 | (0.04 | ) | (1.70 | ) | (1.74 | ) | 31.15 | 5.74 | 14,714 | 2.22 | (e) | 2.23 | (e) | 0.77 | (e) | 15 | ||||||||||||||||||||||||||||||||||||

| Year ended 10/31/13 |

28.74 | 0.06 | 3.14 | 3.20 | — | (0.65 | ) | (0.65 | ) | 31.29 | 11.32 | 22,421 | 2.22 | 2.24 | 0.20 | 18 | ||||||||||||||||||||||||||||||||||||||||

| Year ended 10/31/12 |

26.73 | 0.04 | 4.10 | 4.14 | (0.03 | ) | (2.10 | ) | (2.13 | ) | 28.74 | 16.94 | 27,112 | 2.29 | 2.30 | 0.14 | 16 | |||||||||||||||||||||||||||||||||||||||

| Year ended 10/31/11 |

28.58 | 0.05 | (1.59 | ) | (1.54 | ) | (0.06 | ) | (0.25 | ) | (0.31 | ) | 26.73 | (5.41 | ) | 30,394 | 2.28 | 2.30 | 0.18 | 27 | ||||||||||||||||||||||||||||||||||||

| Year ended 10/31/10 |

21.02 | 0.04 | 7.69 | 7.73 | (0.17 | ) | — | (0.17 | ) | 28.58 | 36.98 | 40,299 | 2.35 | 2.36 | 0.16 | 25 | ||||||||||||||||||||||||||||||||||||||||

| Class C |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Year ended 10/31/14 |

31.11 | 0.23 | 1.36 | 1.59 | (0.04 | ) | (1.70 | ) | (1.74 | ) | 30.96 | 5.73 | 95,277 | 2.22 | (e) | 2.23 | (e) | 0.77 | (e) | 15 | ||||||||||||||||||||||||||||||||||||

| Year ended 10/31/13 |

28.58 | 0.06 | 3.12 | 3.18 | — | (0.65 | ) | (0.65 | ) | 31.11 | 11.31 | 96,520 | 2.22 | 2.24 | 0.20 | 18 | ||||||||||||||||||||||||||||||||||||||||

| Year ended 10/31/12 |

26.60 | 0.04 | 4.07 | 4.11 | (0.03 | ) | (2.10 | ) | (2.13 | ) | 28.58 | 16.91 | 79,959 | 2.29 | 2.30 | 0.14 | 16 | |||||||||||||||||||||||||||||||||||||||

| Year ended 10/31/11 |

28.44 | 0.05 | (1.58 | ) | (1.53 | ) | (0.06 | ) | (0.25 | ) | (0.31 | ) | 26.60 | (5.41 | ) | 76,962 | 2.28 | 2.30 | 0.18 | 27 | ||||||||||||||||||||||||||||||||||||

| Year ended 10/31/10 |

20.92 | 0.04 | 7.65 | 7.69 | (0.17 | ) | — | (0.17 | ) | 28.44 | 36.97 | 85,918 | 2.35 | 2.36 | 0.16 | 25 | ||||||||||||||||||||||||||||||||||||||||

| Class Y |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Year ended 10/31/14 |

33.57 | 0.57 | 1.47 | 2.04 | (0.36 | ) | (1.70 | ) | (2.06 | ) | 33.55 | 6.80 | 258,457 | 1.22 | (e) | 1.23 | (e) | 1.77 | (e) | 15 | ||||||||||||||||||||||||||||||||||||

| Year ended 10/31/13 |

30.75 | 0.39 | 3.35 | 3.74 | (0.27 | ) | (0.65 | ) | (0.92 | ) | 33.57 | 12.43 | 121,030 | 1.22 | 1.24 | 1.20 | 18 | |||||||||||||||||||||||||||||||||||||||

| Year ended 10/31/12 |

28.52 | 0.33 | 4.35 | 4.68 | (0.35 | ) | (2.10 | ) | (2.45 | ) | 30.75 | 18.07 | 58,843 | 1.29 | 1.30 | 1.14 | 16 | |||||||||||||||||||||||||||||||||||||||

| Year ended 10/31/11 |

30.39 | 0.35 | (1.68 | ) | (1.33 | ) | (0.29 | ) | (0.25 | ) | (0.54 | ) | 28.52 | (4.43 | ) | 35,862 | 1.28 | 1.30 | 1.18 | 27 | ||||||||||||||||||||||||||||||||||||

| Year ended 10/31/10 |

22.28 | 0.30 | 8.14 | 8.44 | (0.33 | ) | — | (0.33 | ) | 30.39 | 38.31 | 32,436 | 1.35 | 1.36 | 1.16 | 25 | ||||||||||||||||||||||||||||||||||||||||

| (a) | Calculated using average shares outstanding. |

| (b) | Includes redemption fees added to shares of beneficial interest which were less than $0.005 per share for the fiscal years ended October 31, 2012 and prior. |

| (c) | Includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset value and returns for shareholder transactions. Does not include sales charges and is not annualized for periods less than one year, if applicable. |

| (d) | Portfolio turnover is calculated at the fund level and is not annualized for periods less than one year, if applicable. |

| (e) | Ratios are based on average daily net assets (000’s) of $535,065, $17,832, $92,712 and $172,645 for Class A, Class B, Class C and Class Y shares, respectively. |

19 Invesco Asia Pacific Growth Fund

Report of Independent Registered Public Accounting Firm

To the Board of Trustees of AIM International Mutual Funds (Invesco International Mutual Funds)

and Shareholders of Invesco Asia Pacific Growth Fund:

In our opinion, the accompanying statement of assets and liabilities, including the schedule of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Invesco Asia Pacific Growth Fund (one of the funds constituting AIM International Mutual Funds (Invesco International Mutual Funds), hereafter referred to as the “Fund”) at October 31, 2014, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at October 31, 2014 by correspondence with the custodian, provide a reasonable basis for our opinion.

PRICEWATERHOUSECOOPERS LLP

December 23, 2014

Houston, Texas

20 Invesco Asia Pacific Growth Fund

Calculating your ongoing Fund expenses

Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, which may include sales charges (loads) on purchase payments or contingent deferred sales charges on redemptions, if any; and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period May 1, 2014 through October 31, 2014.

Actual expenses

The table below provides information about actual account values and actual expenses. You may use the information in this table, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the table under the heading entitled “Actual Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The table below also provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return.

The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs, such as sales charges (loads) on purchase payments or contingent deferred sales charges on redemptions, if any. Therefore, the hypothetical information is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

| Class | Beginning Account Value (05/01/14) |

ACTUAL | HYPOTHETICAL (5% annual return before expenses) |

Annualized Expense Ratio |

||||||||||||||||||||

| Ending Account Value (10/31/14)1 |

Expenses Paid During Period2 |

Ending Account Value (10/31/14) |

Expenses Paid During Period2 |

|||||||||||||||||||||

| A | $ | 1,000.00 | $ | 1,073.90 | $ | 7.58 | $ | 1,017.90 | $ | 7.38 | 1.45 | % | ||||||||||||

| B | 1,000.00 | 1,070.10 | 11.48 | 1,014.12 | 11.17 | 2.20 | ||||||||||||||||||

| C | 1,000.00 | 1,069.80 | 11.48 | 1,014.12 | 11.17 | 2.20 | ||||||||||||||||||

| Y | 1,000.00 | 1,075.30 | 6.28 | 1,019.16 | 6.11 | 1.20 | ||||||||||||||||||

| 1 | The actual ending account value is based on the actual total return of the Fund for the period May 1, 2014 through October 31, 2014, after actual expenses and will differ from the hypothetical ending account value which is based on the Fund’s expense ratio and a hypothetical annual return of 5% before expenses. |

| 2 | Expenses are equal to the Fund’s annualized expense ratio as indicated above multiplied by the average account value over the period, multiplied by 184/365 to reflect the most recent fiscal half year. |

21 Invesco Asia Pacific Growth Fund

Approval of Investment Advisory and Sub-Advisory Contracts

22 Invesco Asia Pacific Growth Fund

23 Invesco Asia Pacific Growth Fund

Tax Information

Form 1099-DIV, Form 1042-S and other year–end tax information provide shareholders with actual calendar year amounts that should be included in their tax returns. Shareholders should consult their tax advisors.

The following distribution information is being provided as required by the Internal Revenue Code or to meet a specific state’s requirement.

The Fund designates the following amounts or, if subsequently determined to be different, the maximum amount allowable for its fiscal year ended October 31, 2014:

| Federal and State Income Tax |

||||

| Long-Term Capital Gain Distributions |

$ | 40,502,021 | ||

| Qualified Dividend Income* |

99.92 | % | ||

| Corporate Dividends Received Deduction* |

0.00 | % | ||

| U.S. Treasury Obligations* |

0.00 | % | ||

| Foreign Taxes |

$ | 0.0597 | per share | |

| Foreign Source Income |

$ | 0.9301 | per share | |

| * | The above percentages are based on ordinary income dividends paid to shareholders during the Fund’s fiscal year. |

24 Invesco Asia Pacific Growth Fund

Trustees and Officers

The address of each trustee and officer is AIM International Mutual Funds (Invesco International Mutual Funds) (the “Trust”), 11 Greenway Plaza, Suite 1000, Houston, Texas 77046-1173. The trustees serve for the life of the Trust, subject to their earlier death, incapacitation, resignation, retirement or removal as more specifically provided in the Trust’s organizational documents. Each officer serves for a one year term or until their successors are elected and qualified. Column two below includes length of time served with predecessor entities, if any.

| Name, Year of Birth and Position(s) Held with the Trust |

Trustee and/ or Officer Since |

Principal Occupation(s) During Past 5 Years |

Number of Funds in Fund Complex Overseen by |

Other Directorship(s) Past 5 Years | ||||

| Interested Persons | ||||||||

| Martin L. Flanagan1 — 1960 Trustee |

2007 | Executive Director, Chief Executive Officer and President, Invesco Ltd. (ultimate parent of Invesco and a global investment management firm); Advisor to the Board, Invesco Advisers, Inc. (formerly known as Invesco Institutional (N.A.), Inc.); Trustee, The Invesco Funds; Vice Chair, Investment Company Institute; and Member of Executive Board, SMU Cox School of Business

Formerly: Chairman and Chief Executive Officer, Invesco Advisers, Inc. (registered investment adviser); Director, Chairman, Chief Executive Officer and President, IVZ Inc. (holding company), INVESCO Group Services, Inc. (service provider) and Invesco North American Holdings, Inc. (holding company); Director, Chief Executive Officer and President, Invesco Holding Company Limited (parent of Invesco and a global investment management firm); Director, Invesco Ltd.; Chairman, Investment Company Institute and President, Co-Chief Executive Officer, Co-President, Chief Operating Officer and Chief Financial Officer, Franklin Resources, Inc. (global investment management organization). |

144 | None | ||||

| Philip A. Taylor2 — 1954 Trustee, President and Principal Executive Officer |

2006 | Head of North American Retail and Senior Managing Director, Invesco Ltd.; Director, Co-Chairman, Co-President and Co-Chief Executive Officer, Invesco Advisers, Inc. (formerly known as Invesco Institutional (N.A.), Inc.) (registered investment adviser); Director, Chairman, Chief Executive Officer and President, Invesco Management Group, Inc. (formerly known as Invesco Aim Management Group, Inc.) (financial services holding company); Director and President, INVESCO Funds Group, Inc. (registered investment adviser and registered transfer agent); Director and Chairman, Invesco Investment Services, Inc. (formerly known as Invesco Aim Investment Services, Inc.) (registered transfer agent) and IVZ Distributors, Inc. (formerly known as INVESCO Distributors, Inc.) (registered broker dealer); Director, President and Chairman, Invesco Inc. (holding company) and Invesco Canada Holdings Inc. (holding company); Chief Executive Officer, Invesco Corporate Class Inc. (corporate mutual fund company) and Invesco Canada Fund Inc. (corporate mutual fund company); Director, Chairman and Chief Executive Officer, Invesco Canada Ltd. (formerly known as Invesco Trimark Ltd./Invesco Trimark Ltèe) (registered investment adviser and registered transfer agent); Trustee, President and Principal Executive Officer, The Invesco Funds (other than AIM Treasurer’s Series Trust (Invesco Treasurer’s Series Trust) and Short-Term Investments Trust); Trustee and Executive Vice President, The Invesco Funds (AIM Treasurer’s Series Trust (Invesco Treasurer’s Series Trust) and Short-Term Investments Trust only); Director, Invesco Investment Advisers LLC (formerly known as Van Kampen Asset Management); Director, Chief Executive Officer and President, Van Kampen Exchange Corp.

Formerly: Director and Chairman, Van Kampen Investor Services Inc.; Director, Chief Executive Officer and President, 1371 Preferred Inc. (holding company) and Van Kampen Investments Inc.; Director and President, AIM GP Canada Inc. (general partner for limited partnerships) and Van Kampen Advisors, Inc.; Director and Chief Executive Officer, Invesco Trimark Dealer Inc. (registered broker dealer); Director, Invesco Distributors, Inc. (formerly known as Invesco Aim Distributors, Inc.) (registered broker dealer); Manager, Invesco PowerShares Capital Management LLC; Director, Chief Executive Officer and President, Invesco Advisers, Inc.; Director, Chairman, Chief Executive Officer and President, Invesco Aim Capital Management, Inc.; President, Invesco Trimark Dealer Inc. and Invesco Trimark Ltd./Invesco Trimark Ltèe; Director and President, AIM Trimark Corporate Class Inc. and AIM Trimark Canada Fund Inc.; Senior Managing Director, Invesco Holding Company Limited; Director and Chairman, Fund Management Company (former registered broker dealer); President and Principal Executive Officer, The Invesco Funds (AIM Treasurer’s Series Trust (Invesco Treasurer’s Series Trust), and Short-Term Investments Trust only); President, AIM Trimark Global Fund Inc. and AIM Trimark Canada Fund Inc. |

144 | None | ||||

| Wayne W. Whalen3 — 1939 Trustee |

2010 | Of Counsel, and prior to 2010, partner in the law firm of Skadden, Arps, Slate, Meagher & Flom LLP, legal counsel to certain funds in the Fund Complex | 144 | Director of the Mutual fund Directors Forum, a nonprofit membership organization for investment directors; Chairman and Director of the Abraham Lincoln Presidential Library Foundation; and Director of the Stevenson Center for Democracy |

| 1 | Mr. Flanagan is considered an interested person (within the meaning of Section 2(a)(19) of the 1940 Act) of the Trust because he is an officer of the Adviser to the Trust, and an officer and a director of Invesco Ltd., ultimate parent of the Adviser. |

| 2 | Mr. Taylor is considered an interested person (within the meaning of Section 2(a)(19) of the 1940 Act) of the Trust because he is an officer and a director of the Adviser. |

| 3 | Mr. Whalen is retiring effective December 31, 2014. He has been deemed to be an interested person of the Trust because of his prior service as counsel to the predecessor funds of certain Invesco open-end funds and his affiliation with the law firm that served as counsel to such predecessor funds and the Invesco closed-end funds. |

T-1 Invesco Asia Pacific Growth Fund

Trustees and Officers—(continued)

| Name, Year of Birth and Position(s) Held with the Trust |

Trustee and/ or Officer Since |

Principal Occupation(s) During Past 5 Years |

Number of Funds in Fund Complex Overseen by |

Other Directorship(s) Past 5 Years | ||||

| Independent Trustees | ||||||||

| Bruce L. Crockett — 1944 Trustee and Chair |

1992 | Chairman, Crockett Technologies Associates (technology consulting company)

Formerly: Director, Captaris (unified messaging provider); Director, President and Chief Executive Officer, COMSAT Corporation; Chairman, Board of Governors of INTELSAT (international communications company); ACE Limited (insurance company); and Investment Company Institute |

144 | ALPS (Attorneys Liability Protection Society) (insurance company) | ||||

| David C. Arch — 1945 Trustee |

2010 | Chairman of Blistex Inc., a consumer health care products manufacturer | 144 | Board member of the Illinois Manufacturers’ Association; Member of the Board of Visitors, Institute for the Humanities, University of Michigan; Member of the Audit Committee of the Edward-Elmhurst Hospital | ||||

| Frank S. Bayley — 1939 Trustee |

2001 | Retired. Formerly: Director, Badgley Funds Inc. (registered investment company) (2 portfolios) and General Partner and Of Counsel, law firm of Baker & McKenzie, LLP | 144 | Director and Chairman, C.D. Stimson Company (a real estate investment company); Trustee, The Curtis Institute of Music | ||||

| James T. Bunch — 1942 Trustee |

2003 | Managing Member, Grumman Hill Group LLC (family office private equity investments)

Formerly: Founder, Green Manning & Bunch Ltd. (investment banking firm) (1988-2010); Executive Committee, United States Golf Association; and Director, Policy Studies, Inc. and Van Gilder Insurance Corporation |

144 | Chairman, Board of Governors, Western Golf Association; Chairman, Evans Scholars Foundation; and Director, Denver Film Society | ||||

| Rodney F. Dammeyer — 1940 Trustee |

2010 | Chairman of CAC,LLC, (private company offering capital investment and management advisory services)

Formerly: Prior to 2001, Managing Partner at Equity Group Corporate Investments; Prior to 1995, Chief Executive Officer of Itel Corporation (formerly Anixter International); Prior to 1985, experience includes Senior Vice President and Chief Financial Officer of Household International, Inc., Executive Vice President and Chief Financial Officer of Northwest Industries, Inc. and Partner of Arthur Andersen & Co.; From 1987 to 2010, Director/Trustee of investment companies in the Van Kampen Funds complex |

144 | Director of Quidel Corporation and Stericycle, Inc. | ||||

| Albert R. Dowden — 1941 Trustee |

2000 | Director of a number of public and private business corporations, including the Boss Group, Ltd. (private investment and management); Nature’s Sunshine Products, Inc. and Reich & Tang Funds (5 portfolios) (registered investment company)

Formerly: Director, Homeowners of America Holding Corporation/Homeowners of America Insurance Company (property casualty company); Director, Continental Energy Services, LLC (oil and gas pipeline service); Director, CompuDyne Corporation (provider of product and services to the public security market) and Director, Annuity and Life Re (Holdings), Ltd. (reinsurance company); Director, President and Chief Executive Officer, Volvo Group North America, Inc.; Senior Vice President, AB Volvo; Director of various public and private corporations; Chairman, DHJ Media, Inc.; Director, Magellan Insurance Company; and Director, The Hertz Corporation, Genmar Corporation (boat manufacturer), National Media Corporation; Advisory Board of Rotary Power International (designer, manufacturer, and seller of rotary power engines); and Chairman, Cortland Trust, Inc. (registered investment company) |

144 | Director of: Nature’s Sunshine Products, Inc., Reich & Tang Funds, Homeowners of America Holding Corporation/ Homeowners of America Insurance Company, the Boss Group | ||||

| Jack M. Fields — 1952 Trustee |

1997 | Chief Executive Officer, Twenty First Century Group, Inc. (government affairs company); Owner and Chief Executive Officer, Dos Angeles Ranch, L.P. (cattle, hunting, corporate entertainment); and Discovery Global Education Fund (non-profit)

Formerly: Chief Executive Officer, Texana Timber LP (sustainable forestry company); Director of Cross Timbers Quail Research Ranch (non-profit); and member of the U.S. House of Representatives |

144 | Insperity, Inc. (formerly known as Administaff) | ||||

| Prema Mathai-Davis — 1950 Trustee |

1998 | Retired. Formerly: Chief Executive Officer, YWCA of the U.S.A. | 144 | None | ||||

| Larry Soll — 1942 Trustee |

2003 | Retired. Formerly: Chairman, Chief Executive Officer and President, Synergen Corp. (a biotechnology company) | 144 | None | ||||

| Hugo F. Sonnenschein — 1940 Trustee |

2010 | President Emeritus and Honorary Trustee of the University of Chicago and the Adam Smith Distinguished Service Professor in the Department of Economics at the University of Chicago. Prior to 2000, President of the University of Chicago | 144 | Trustee of the University of Rochester and a member of its investment committee; Member of the National Academy of Sciences and the American Philosophical Society; Fellow of the American Academy of Arts and Sciences |

T-2 Invesco Asia Pacific Growth Fund

Trustees and Officers—(continued)

| Name, Year of Birth and Position(s) Held with the Trust |

Trustee and/ or Officer Since |

Principal Occupation(s) During Past 5 Years |

Number of Funds in Fund Complex Overseen by |

Other Directorship(s) Past 5 Years | ||||

| Independent Trustees—(continued) | ||||||||

| Raymond Stickel, Jr. — 1944 Trustee |

2005 | Retired. Formerly: Director, Mainstay VP Series Funds, Inc. (25 portfolios) and Partner, Deloitte & Touche | 144 | None | ||||

| Suzanne H. Woolsey — 1941 Trustee |

2014 | Chief Executive Officer of Woolsey Partners LLC | 144 | Emeritus Chair of the Board of Trustees of the Institute for Defense Analyses; Trustee of Colorado College; Trustee of California Institute of Technology; Prior to 2014, Director of Fluor Corp.; Prior to 2010, Trustee of the German Marshall Fund of the United States; Prior to 2010 Trustee of the Rocky Mountain Institute | ||||

| Other Officers | ||||||||

| Russell C. Burk — 1958 Senior Vice President and Senior Officer |

2005 | Senior Vice President and Senior Officer, The Invesco Funds | N/A | N/A | ||||

| John M. Zerr — 1962 Senior Vice President, Chief Legal Officer and Secretary |

2006 | Director, Senior Vice President, Secretary and General Counsel, Invesco Management Group, Inc. (formerly known as Invesco Aim Management Group, Inc.) and Van Kampen Exchange Corp.; Senior Vice President, Invesco Advisers, Inc. (formerly known as Invesco Institutional (N.A.), Inc.) (registered investment adviser); Senior Vice President and Secretary, Invesco Distributors, Inc. (formerly known as Invesco Aim Distributors, Inc.); Director, Vice President and Secretary, Invesco Investment Services, Inc. (formerly known as Invesco Aim Investment Services, Inc.) and IVZ Distributors, Inc. (formerly known as INVESCO Distributors, Inc.); Director and Vice President, INVESCO Funds Group, Inc.; Senior Vice President, Chief Legal Officer and Secretary, The Invesco Funds; Manager, Invesco PowerShares Capital Management LLC; Director, Secretary and General Counsel, Invesco Investment Advisers LLC (formerly known as Van Kampen Asset Management); Secretary and General Counsel, Invesco Capital Markets, Inc. (formerly known as Van Kampen Funds Inc.) and Chief Legal Officer, PowerShares Exchange-Traded Fund Trust, PowerShares Exchange-Traded Fund Trust II, PowerShares India Exchange-Traded Fund Trust, PowerShares Actively Managed Exchange-Traded Fund Trust; and PowerShares Actively Managed Exchange-Traded Commodity Fund Trust