DWS Core Equity Fund

Summary Prospectus | February 1, 2023

|

Class/Ticker

|

A

|

SUWAX

|

C

|

SUWCX

|

R

|

SUWTX

|

R6

|

SUWZX

|

INST

|

SUWIX

|

S

|

SCDGX

|

Before you invest, you may want to review the fund’s prospectus, which contains more information about the fund and its risks. You can find the fund’s prospectus, reports to shareholders, Statement of Additional Information (SAI) and other information about the fund online at dws.com/mutualpros. You can also get this information at no cost by e-mailing a request to service@dws.com, calling (800) 728-3337 or asking your financial representative. The Prospectus and SAI, both dated February 1, 2023, as may be revised or supplemented from time to time, are incorporated by reference into this Summary Prospectus.

Investment Objective

The fund seeks long-term growth of capital, current income and growth of income.

Fees and Expenses

These are the fees and expenses you may pay when you buy, hold and sell shares. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the tables and examples below. You may qualify for sales charge discounts in Class A shares if you and your immediate family invest, or agree to invest in the future, at least $50,000 in DWS funds. More information about these and other discounts and waivers is available from your financial representative and in Choosing a Share Class in the prospectus (p. 45), Sales Charge Waivers and Discounts Available Through Intermediaries in the prospectus (Appendix B, p. 101) and Purchase and Redemption of Shares in the fund’s SAI (p. II-15).

SHAREHOLDER FEES (paid directly from your investment)

|

|

A

|

C

|

R

|

R6

|

INST

|

S

|

|

Maximum sales charge (load)

imposed on purchases, as %

of offering price

|

5.75

|

None

|

None

|

None

|

None

|

None

|

|

Maximum deferred sales

charge (load), as % of

redemption proceeds1

|

None

|

1.00

|

None

|

None

|

None

|

None

|

|

Account Maintenance Fee

(annually, for fund account

balances below $10,000 and

subject to certain exceptions)

|

$20

|

$20

|

None

|

None

|

None

|

$20

|

ANNUAL FUND OPERATING EXPENSES

(expenses that you pay each year as a % of the value of your investment)

(expenses that you pay each year as a % of the value of your investment)

|

|

A

|

C

|

R

|

R6

|

INST

|

S

|

|

Management fee

|

0.35

|

0.35

|

0.35

|

0.35

|

0.35

|

0.35

|

|

Distribution/service (12b-1)

fees

|

0.23

|

1.00

|

0.50

|

None

|

None

|

None

|

|

Other expenses

|

0.25

|

0.24

|

0.39

|

0.13

|

0.22

|

0.21

|

|

Total annual fund operating

expenses

|

0.83

|

1.59

|

1.24

|

0.48

|

0.57

|

0.56

|

|

Fee waiver/expense reim-

bursement

|

0.00

|

0.00

|

0.00

|

0.00

|

0.01

|

0.00

|

|

Total annual fund operating

expenses after fee waiver/

expense reimbursement

|

0.83

|

1.59

|

1.24

|

0.48

|

0.56

|

0.56

|

1 Investments of $1,000,000 or more may be eligible to buy Class A shares without a sales charge (load), but may be subject to a contingent deferred sales charge of 1.00% if redeemed within 12 months of the original purchase date and 0.50% if redeemed within the following six months.

The Advisor has contractually agreed through January 31, 2024 to waive its fees and/or reimburse fund expenses to the extent necessary to maintain the fund’s total annual operating expenses (excluding certain expenses such as extraordinary expenses, taxes, brokerage, interest expense and acquired fund fees and expenses) at a ratio no higher than 0.56% for Institutional Class. The agreement may only be terminated with the consent of the fund’s Board.

EXAMPLE

This Example is intended to help you compare the cost of investing in the fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the fund's operating expenses (including one year of capped expenses in each period for Institutional Class) remain the same. Class C shares generally convert automatically to Class A shares after 8 years. The information presented in the Example for Class C

1

reflects the conversion of Class C shares to Class A shares after 8 years. See “Class C Shares” in the “Choosing a Share Class” section of the prospectus for more information. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

Years

|

A

|

C

|

R

|

R6

|

INST

|

S

|

|

1

|

$655

|

$262

|

$126

|

$49

|

$57

|

$57

|

|

3

|

825

|

502

|

393

|

154

|

182

|

179

|

|

5

|

1,009

|

866

|

681

|

269

|

317

|

313

|

|

10

|

1,541

|

1,685

|

1,500

|

604

|

713

|

701

|

You would pay the following expenses if you did not redeem your shares:

|

Years

|

A

|

C

|

R

|

R6

|

INST

|

S

|

|

1

|

$655

|

$162

|

$126

|

$49

|

$57

|

$57

|

|

3

|

825

|

502

|

393

|

154

|

182

|

179

|

|

5

|

1,009

|

866

|

681

|

269

|

317

|

313

|

|

10

|

1,541

|

1,685

|

1,500

|

604

|

713

|

701

|

PORTFOLIO TURNOVER

The fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover may indicate higher transaction costs and may mean higher taxes if you are investing in a taxable account. These costs are not reflected in annual fund operating expenses or in the expense example, and can affect the fund's performance. During the most recent fiscal year, the fund’s portfolio turnover rate was 28% of the average value of its portfolio.

Principal Investment Strategies

Main investments. Under normal circumstances, the fund invests at least 80% of total assets, determined at the time of purchase, in equities, mainly common stocks. For purposes of this 80% investment limitation, the term total assets is defined as net assets, plus the amount of any borrowings for investment purposes. Although the fund can invest in companies of any size and from any country, it invests primarily in large US companies. Portfolio management may favor securities from different industries and companies at different times.

Management process. In choosing stocks, portfolio management uses proprietary quantitative models to identify and acquire holdings for the fund. The quantitative models are research based and identify primarily fundamental factors, including valuation, momentum, profitability, earnings and sales growth, which have been effective sources of return historically. These are dynamic models with different factor weights for different industry groupings. The fund’s portfolio is constructed based on this quantitative process that strives to maximize returns while maintaining a risk profile similar to the fund’s benchmark index.

Portfolio management may sell a security when its quantitative model indicates that other investments are more attractive, when the company no longer meets performance or risk expectations, or to maintain portfolio characteristics similar to the fund’s benchmark.

All investment decisions are made within risk parameters set by portfolio management. The factors considered and models used by portfolio management may be adjusted from time to time and may favor different types of securities from different industries and companies at different times.

Portfolio management may also consider environmental, social and governance (ESG) factors that it believes to be financially material.

Derivatives. Portfolio management may use put options, which are a type of derivative (a contract whose value is based on, for example, indices, currencies or securities), for hedging and volatility management purposes.

The fund may also use other types of derivatives (i) for hedging purposes; (ii) for risk management; (iii) for non-hedging purposes to seek to enhance potential gains; or (iv) as a substitute for direct investment in a particular asset class or to keep cash on hand to meet shareholder redemptions.

Securities lending. The fund may lend securities (up to one-third of total assets) to approved institutions, such as registered broker-dealers, banks and pooled investment vehicles.

Main Risks

There are several risk factors that could hurt the fund’s performance, cause you to lose money or cause the fund’s performance to trail that of other investments. The fund may not achieve its investment objective, and is not intended to be a complete investment program. An investment in the fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency.

Stock market risk. When stock prices fall, you should expect the value of your investment to fall as well. Stock prices can be hurt by poor management on the part of the stock’s issuer, shrinking product demand and other business risks. These may affect single companies as well as groups of companies. The market as a whole may not favor the types of investments the fund makes, which could adversely affect a stock’s price, regardless of how well the company performs, or the fund’s ability to sell a stock at an attractive price. There is a chance that stock prices overall will decline because stock markets tend to move in cycles, with periods of rising and falling prices. Events in the US and global financial markets, including actions taken by the US Federal Reserve or foreign central banks to stimulate or stabilize economic growth, may at times result in unusually high market volatility which could negatively affect performance. High market volatility may also

2

DWS Core Equity Fund

Summary Prospectus February 1, 2023

result from significant shifts in momentum of one or more specific stocks due to unusual increases or decreases in trading activity. Momentum can change quickly, and securities subject to shifts in momentum may be more volatile than the market as a whole and returns on such securities may drop precipitously. To the extent that the fund invests in a particular geographic region, capitalization or sector, the fund’s performance may be affected by the general performance of that region, capitalization or sector.

Market disruption risk. Economies and financial markets throughout the world are becoming increasingly interconnected, which increases the likelihood that events or conditions in one country or region will adversely impact markets or issuers in other countries or regions. The value of the fund’s investments may be negatively affected by adverse changes in overall economic or market conditions, such as the level of economic activity and productivity, unemployment and labor force participation rates, inflation or deflation (and expectations for inflation or deflation), interest rates, demand and supply for particular products or resources including labor, and debt levels and credit ratings, among other factors. Such adverse conditions may contribute to an overall economic contraction across entire economies or markets, which may negatively impact the profitability of issuers operating in those economies or markets, including the investments held by the fund. In addition, geopolitical and other events, including war, terrorism, economic uncertainty, trade disputes, public health crises and related geopolitical events have led, and in the future may lead, to disruptions in the US and world economies and markets, which may increase financial market volatility and have significant adverse direct or indirect effects on the fund and its investments. Adverse market conditions or disruptions could cause the fund to lose money, experience significant redemptions, and encounter operational difficulties. Although multiple asset classes may be affected by adverse market conditions or a particular market disruption, the duration and effects may not be the same for all types of assets.

Russia's recent military incursions in Ukraine have led to, and may lead to, additional sanctions being levied by the United States, European Union and other countries against Russia. Russia's military incursions and the resulting sanctions could adversely affect global energy, commodities and financial markets and thus could affect the value of the fund's investments. The extent and duration of the military action, sanctions and resulting market disruptions are impossible to predict, but could be substantial.

Other market disruption events include the pandemic spread of the novel coronavirus known as COVID-19, which at times has caused significant uncertainty, market volatility, decreased economic and other activity, increased government activity, including economic stimulus measures, and supply chain disruptions. The full effects, duration and costs of the COVID-19 pandemic are impossible to predict, and the circumstances surrounding the

COVID-19 pandemic will continue to evolve including the risk of future increased rates of infection due to significant portions of the population remaining unvaccinated and/or the lack of effectiveness of current vaccines against new variants. The pandemic has affected and may continue to affect certain countries, industries, economic sectors, companies and investment products more than others, may exacerbate existing economic, political, or social tensions and may increase the probability of an economic recession or depression. The fund and its investments may be adversely affected by the effects of the COVID-19 pandemic.

Adverse market conditions or particular market disruptions, such as those caused by Russian military action and the COVID-19 pandemic, may magnify the impact of each of the other risks described in this “MAIN RISKS” section and may increase volatility in one or more markets in which the fund invests leading to the potential for greater losses for the fund.

Security selection risk. The securities in the fund’s portfolio may decline in value. Portfolio management could be wrong in its analysis of industries, companies, economic trends, ESG factors, the relative attractiveness of different securities or other matters.

Quantitative model risk. The fund’s strategy relies heavily on quantitative models and the analysis of specific metrics to construct the fund’s portfolio. The impact of these metrics on a stock’s performance can be difficult to predict, and stocks that previously possessed certain desirable quantitative characteristics may not continue to demonstrate those same characteristics in the future. In addition, relying on quantitative models entails the risk that the models themselves may be limited or incorrect, that the data on which the models rely may be incorrect or incomplete, and that the Advisor may not be successful in selecting companies for investment or determining the weighting of particular stocks in the fund’s portfolio. Any of these factors could cause the fund to underperform funds with similar strategies that do not select stocks based on quantitative analysis.

Medium-sized company risk. Medium-sized company stocks tend to be more volatile than large company stocks. Because stock analysts are less likely to follow medium-sized companies, less information about them is available to investors. Industry-wide reversals may have a greater impact on medium-sized companies, since they lack the financial resources of larger companies. Medium-sized company stocks are typically less liquid than large company stocks.

Focus risk. To the extent that the fund focuses its investments in particular industries, asset classes or sectors of the economy, any market price movements, regulatory or technological changes, or economic conditions affecting companies in those industries, asset classes or sectors may have a significant impact on the fund’s performance.

3

DWS Core Equity Fund

Summary Prospectus February 1, 2023

The fund may become more focused in particular industries, asset classes or sectors of the economy as a result of changes in the valuation of the fund’s investments or fluctuations in the fund’s assets, and the fund is not required to reduce such exposures under these circumstances.

Derivatives risk. Derivatives involve risks different from, and possibly greater than, the risks associated with investing directly in securities and other more traditional investments. Risks associated with derivatives may include the risk that the derivative is not well correlated with the security, index or currency to which it relates; the risk that derivatives may result in losses or missed opportunities; the risk that the fund will be unable to sell the derivative because of an illiquid secondary market; the risk that a counterparty is unwilling or unable to meet its obligation, which risk may be heightened in derivative transactions entered into “over-the-counter” (i.e., not on an exchange or contract market); and the risk that the derivative transaction could expose the fund to the effects of leverage, which could increase the fund's exposure to the market and magnify potential losses.

Securities lending risk. Securities lending involves the risk that the fund may lose money because the borrower of the loaned securities fails to return the securities in a timely manner or at all. A delay in the recovery of loaned securities could interfere with the fund’s ability to vote proxies or settle transactions. The fund could also lose money in the event of a decline in the value of the collateral provided for the loaned securities, or a decline in the value of any investments made with cash collateral or even a loss of rights in the collateral should the borrower of the securities fail financially while holding the securities.

Counterparty risk. A financial institution or other counterparty with whom the fund does business, or that underwrites, distributes or guarantees any investments or contracts that the fund owns or is otherwise exposed to, may decline in financial health and become unable to honor its commitments. This could cause losses for the fund or could delay the return or delivery of collateral or other assets to the fund.

Liquidity risk. In certain situations, it may be difficult or impossible to sell an investment and/or the fund may sell certain investments at a price or time that is not advantageous in order to meet redemption requests or other cash needs. Unusual market conditions, such as an unusually high volume of redemptions or other similar conditions could increase liquidity risk for the fund.

Pricing risk. If market conditions make it difficult to value some investments, the fund may value these investments using more subjective methods, such as fair value pricing. In such cases, the value determined for an investment could be different from the value realized upon such investment’s sale. As a result, you could pay more than the market value when buying fund shares or receive less than the market value when selling fund shares.

Operational and technology risk. Cyber-attacks, disruptions or failures that affect the fund’s service providers or counterparties, issuers of securities held by the fund, or other market participants may adversely affect the fund and its shareholders, including by causing losses for the fund or impairing fund operations. For example, the fund’s or its service providers’ assets or sensitive or confidential information may be misappropriated, data may be corrupted and operations may be disrupted (e.g., cyber-attacks, operational failures or broader disruptions may cause the release of private shareholder information or confidential fund information, interfere with the processing of shareholder transactions, impact the ability to calculate the fund’s net asset value and impede trading). Market events and disruptions also may trigger a volume of transactions that overloads current information technology and communication systems and processes, impacting the ability to conduct the fund’s operations.

While the fund and its service providers may establish business continuity and other plans and processes that seek to address the possibility of and fallout from cyber-attacks, disruptions or failures, there are inherent limitations in such plans and systems, including that they do not apply to third parties, such as fund counterparties, issuers of securities held by the fund or other market participants, as well as the possibility that certain risks have not been identified or that unknown threats may emerge in the future and there is no assurance that such plans and processes will be effective. Among other situations, disruptions (for example, pandemics or health crises) that cause prolonged periods of remote work or significant employee absences at the fund’s service providers could impact the ability to conduct the fund’s operations. In addition, the fund cannot directly control any cybersecurity plans and systems put in place by its service providers, fund counterparties, issuers of securities held by the fund or other market participants.

Past Performance

How a fund's returns vary from year to year can give an idea of its risk; so can comparing fund performance to overall market performance (as measured by an appropriate market index). Past performance may not indicate future results. All performance figures below assume that dividends and distributions were reinvested. For more recent performance figures, go to dws.com (the Web site does not form a part of this prospectus) or call the telephone number included in this prospectus.

Prior to May 31, 2013, the fund had a sub-advisor and a different investment management team that operated with a different investment strategy. Performance would have been different if the fund’s current investment strategy had been in effect.

4

DWS Core Equity Fund

Summary Prospectus February 1, 2023

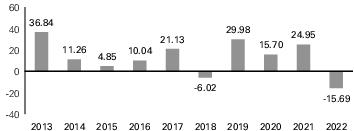

CALENDAR YEAR TOTAL RETURNS (%) (Class A)

These year-by-year returns do not include sales charges, if any, and would be lower if they did. Returns for other classes were different and are not shown here.

|

|

Returns

|

Period ending

|

|

Best Quarter

|

19.18%

|

June 30, 2020

|

|

Worst Quarter

|

-20.96%

|

March 31, 2020

|

Average Annual Total Returns

(For periods ended 12/31/2022 expressed as a %)

(For periods ended 12/31/2022 expressed as a %)

After-tax returns (which are shown only for Class A and would be different for other classes) reflect the historical highest individual federal income tax rates, but do not reflect any state or local taxes. Your actual after-tax returns may be different. After-tax returns are not relevant to shares held in an IRA, 401(k) or other tax-advantaged investment plan.

|

|

Class

Inception

|

1

Year

|

5

Years

|

10

Years

|

|

Class A before tax

|

8/2/1999

|

-20.54

|

7.01

|

11.56

|

|

After tax on distribu-

tions

|

|

-22.10

|

4.70

|

9.32

|

|

After tax on distribu-

tions and sale of fund

shares

|

|

-10.89

|

5.42

|

9.08

|

|

Class C before tax

|

12/29/2000

|

-16.32

|

7.46

|

11.36

|

|

Class R before tax

|

5/1/2012

|

-16.06

|

7.85

|

11.73

|

|

INST Class before tax

|

8/19/2002

|

-15.45

|

8.59

|

12.57

|

|

Class S before tax

|

5/31/1929

|

-15.44

|

8.58

|

12.54

|

|

Russell 1000® Index

(reflects no deduction for

fees, expenses or taxes)

|

|

-19.13

|

9.13

|

12.37

|

|

|

Class

Inception

|

1

Year

|

5

Years

|

Since

Inception

|

|

Class R6 before tax

|

8/25/2014

|

-15.38

|

8.67

|

9.90

|

|

Russell 1000® Index

(reflects no deduction for

fees, expenses or taxes)

|

|

-19.13

|

9.13

|

9.98

|

Management

Investment Advisor

DWS Investment Management Americas, Inc.

Portfolio Manager(s)

Pankaj Bhatnagar, PhD, Head of Investment Strategy Equity. Portfolio Manager of the fund. Began managing the fund in 2013.

Arno V. Puskar, Senior Portfolio Manager Equity. Portfolio Manager of the fund. Began managing the fund in 2016.

Di Kumble, CFA, Senior Portfolio Manager Equity. Portfolio Manager of the fund. Began managing the fund in 2016.

Purchase and Sale of Fund Shares

Minimum Initial Investment ($)

|

|

Non-IRA

|

IRAs

|

UGMAs/

UTMAs

|

Automatic

Investment

Plans

|

|

A C

|

1,000

|

500

|

1,000

|

500

|

|

R

|

None

|

N/A

|

N/A

|

N/A

|

|

R6

|

None

|

N/A

|

N/A

|

N/A

|

|

INST

|

1,000,000

|

N/A

|

N/A

|

N/A

|

|

S

|

2,500

|

1,000

|

1,000

|

1,000

|

For participants in all group retirement plans, and in certain fee-based and wrap programs approved by the Advisor, there is no minimum initial investment and no minimum additional investment for Class A, C and S shares. For Section 529 college savings plans, there is no minimum initial investment and no minimum additional investment for Class S shares and Class R6 shares. The minimum initial investment for Class S shares may be waived for eligible intermediaries that have agreements with DDI to offer Class S shares in their brokerage platforms when such Class S shares are held in omnibus accounts on such brokerage platforms. In certain instances, the minimum initial investment may be waived for Institutional Class shares. For more information regarding available Institutional Class investment minimum waivers, see “Institutional Class Shares – Investment Minimum” in the “Choosing a Share Class” section of the prospectus. There is no minimum additional investment for Institutional Class, Class R and Class R6 shares. The minimum additional investment in all other instances is $50.

To Place Orders

|

Mail

|

All Requests

|

DWS

PO Box 219151

Kansas City, MO 64121-9151

|

|

Expedited Mail

|

DWS

430 West 7th Street

Suite 219151

Kansas City, MO 64105-1407

|

|

|

Web Site

|

dws.com

|

|

|

Telephone

|

(800) 728-3337, M – F 8 a.m. – 7 p.m. ET

|

|

|

Hearing Impaired

|

For hearing impaired assistance, please

call us using a relay service

|

|

The fund is generally open on days when the New York Stock Exchange is open for regular trading. If you invest with the fund directly through the transfer agent, you can open a new fund account (Class S shares only) and make an initial investment on the Internet at dws.com, by using the mobile app or by mail. You can make additional investments or sell shares of the fund on any business day by visiting the fund’s Web site, by using the mobile app, by

5

DWS Core Equity Fund

Summary Prospectus February 1, 2023

mail, or by telephone; however you may have to elect certain privileges on your initial account application. The ability to open new fund accounts and to transact online or using the mobile app varies depending on share class and account type. If you are working with a financial representative, contact your financial representative for assistance with buying or selling fund shares. A financial representative separately may impose its own policies and procedures for buying and selling fund shares.

Class R shares are generally available only to certain retirement plans, which may have their own policies or instructions for buying and selling fund shares. Class R6 shares are generally available only to certain qualifying plans and programs, which may have their own policies or instructions for buying and selling fund shares. Institutional Class shares are generally available only to qualified institutions. Class S shares are available through certain intermediary relationships with financial services firms, or can be purchased by establishing an account directly with the fund’s transfer agent.

Tax Information

The fund's distributions are generally taxable to you as ordinary income or capital gains, except when your investment is in an IRA, 401(k), or other tax-advantaged investment plan. Any withdrawals you make from such tax- advantaged investment plans, however, may be taxable to you.

Payments to Broker-Dealers and

Other Financial Intermediaries

Other Financial Intermediaries

If you purchase shares of the fund through a broker-dealer or other financial intermediary (such as a bank), the fund, the Advisor, and/or the Advisor’s affiliates may pay the intermediary for the sale of fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the fund over another investment. Ask your salesperson or visit your financial intermediary’s Web site for more information.

No such payments are made with respect to Class R6 shares. To the extent the fund makes such payments with respect to another class of its shares, the expense is borne by the other share class.

6

DWS Core Equity Fund

Summary Prospectus February 1, 2023 DCEF-SUM