Summary

Prospectus | December 1, 2019

DWS Large Cap Focus

Growth Fund

| Class/Ticker | T | SGGTX |

Before you invest, you may want

to review the fund’s prospectus, which contains more information about the fund and its risks. You can find the fund’s prospectus, reports to shareholders, Statement of Additional Information (SAI) and

other information about the fund online at dws.com/mutualpros. You can also get this information at no cost by e-mailing a request to service@dws.com, calling (800) 728-3337 or asking your financial representative.

The Prospectus and SAI, both dated December 1, 2019, as supplemented, are incorporated by reference into this Summary Prospectus.

Beginning on January 1, 2021, as permitted by

regulations adopted by the Securities and Exchange Commission, paper copies of the fund’s annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies

of the reports. Instead, the reports will be made available on the fund’s Web site (dws.com), and you will be notified by mail each time a report is posted and provided with a Web site link to access the

report.

If you already elected to receive

shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the fund electronically anytime

by contacting your financial intermediary (such as a broker-dealer or bank), or if you are a direct investor, by calling (800) 728-3337 or sending an email request to service@dws.com.

You may elect to receive all

future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If

you invest directly with the fund, you can call (800) 728-3337 or send an email request to service@dws.com to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will

apply to all funds held in your account if you invest through your financial intermediary or all funds held with DWS if you invest directly with the fund.

Investment Objective

The fund seeks long-term growth

of capital.

Fees and Expenses

These are the fees and expenses you

may pay when you buy and hold shares. You may qualify for sales charge discounts if you invest at least $250,000 in Class T shares in the fund. More information about these discounts is

available from your financial representative and

in the Investing in the Fund section in the prospectus (p. 10) and Purchase and Redemption of Shares in the fund’s SAI (p. II-14).

SHAREHOLDER FEES (paid directly from your investment)

| Maximum sales charge (load) imposed on purchases, as % of offering price | 2.50 |

ANNUAL FUND OPERATING

EXPENSES

(expenses that you pay each year as a % of the value of your investment)

(expenses that you pay each year as a % of the value of your investment)

| Management fee | 0.62 |

| Distribution/service (12b-1) fees | 0.25 |

| Other expenses1 | 0.37 |

| Total annual fund operating expenses | 1.24 |

| Fee waiver/expense reimbursement | 0.12 |

| Total annual fund operating expenses after fee waiver/expense reimbursement | 1.12 |

1 ”Other expenses“ for Class T are based on estimated amounts for the current fiscal year.

The Advisor has contractually

agreed through November 30, 2020 to waive its fees and/or reimburse fund expenses to the extent necessary to maintain the fund’s total annual operating expenses (excluding certain expenses such as extraordinary

expenses, taxes, brokerage, interest expense and acquired fund fees and expenses) at a ratio no higher than 1.12% for Class T shares. The agreement may only be terminated with the consent of the fund’s Board.

EXAMPLE

This Example is intended to help

you compare the cost of investing in the fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the fund for the time periods indicated and then redeem all of your shares

at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the fund's operating expenses (including one year of capped expenses in each period)

1

remain the same. Although your actual costs may be

higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |

| $361 | $622 | $903 | $1,702 |

PORTFOLIO TURNOVER

The fund pays transaction costs,

such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover may indicate higher transaction costs and may mean higher taxes if you are investing in a

taxable account. These costs are not reflected in annual fund operating expenses or in the expense example, and can affect the fund's performance. During the most recent fiscal year, the fund’s portfolio

turnover rate was 26% of the average value of its portfolio.

Principal Investment

Strategies

Main investments. Under normal circumstances, the fund invests at least 80% of net assets, plus the amount of any borrowings for investment purposes, in large US companies that are similar in size to the

companies in the Russell 1000® Growth Index (generally the 1,000 largest publicly traded companies in the United States). The fund’s equity investments are mainly common stocks, but may also include other types of

equities such as preferred stocks or convertible securities. The fund may also invest up to 20% of its assets in stocks and other securities of companies not publicly traded in the United States. The fund normally

expects to invest in a portfolio consisting of approximately 40 issuers, although this number can vary depending on market conditions.

Management process. Portfolio management aims to add value through stock selection. In choosing securities, portfolio management employs a risk-balanced bottom-up selection process to identify companies it

believes are well-positioned and that have above average and sustainable growth potential.

Portfolio management utilizes a

proprietary investment process designed to identify attractive investments by utilizing proprietary research conducted by in-house analysts. The investment process also takes into consideration various valuation

metrics to assess the attractiveness of stocks and assists portfolio management in devising allocations among investable securities.

All investment decisions are made

within risk parameters set by portfolio management. Portfolio management may favor different types of securities from different industries and companies at different times.

Portfolio management will

normally sell a stock when its price fully reflects portfolio management’s estimate of its fundamental value, its fundamentals have deteriorated, other investments offer better opportunities or in the course of

adjusting the fund’s exposure to a given sector.

Portfolio management may consider

information about Environmental, Social and Governance (ESG) issues in its fundamental research process and when making investment decisions.

Securities lending. The fund may lend securities (up to one-third of total assets) to approved institutions, such as registered broker-dealers, banks and pooled investment vehicles.

Main Risks

There are several risk factors

that could hurt the fund’s performance, cause you to lose money or cause the fund’s performance to trail that of other investments. The fund may not achieve its investment objective, and is not intended to

be a complete investment program. An investment in the fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency.

Stock market risk. When stock prices fall, you should expect the value of your investment to fall as well. Stock prices can be hurt by poor management on the part of the stock’s issuer, shrinking

product demand and other business risks. These may affect single companies as well as groups of companies. The market as a whole may not favor the types of investments the fund makes, which could adversely affect a

stock’s price, regardless of how well the company performs, or the fund’s ability to sell a stock at an attractive price. There is a chance that stock prices overall will decline because stock markets tend

to move in cycles, with periods of rising and falling prices. Events in the US and global financial markets, including actions taken by the US Federal Reserve or foreign central banks to stimulate or stabilize

economic growth, may at times result in unusually high market volatility which could negatively affect performance. Further, geopolitical and other events, including war, terrorism, economic uncertainty, trade

disputes and related geopolitical events have led, and in the future may lead, to increased short-term market volatility, which may disrupt securities markets and have adverse long-term effects on US and world

economies and markets. To the extent that the fund invests in a particular geographic region, capitalization or sector, the fund’s performance may be affected by the general performance of that region,

capitalization or sector.

Growth investing risk. As a category, growth stocks may underperform value stocks (and the stock market as a whole) over any period of time. Because the prices of growth stocks are based largely on the

expectation of future earnings, growth stock prices can decline rapidly and significantly in reaction to negative news about such factors as earnings, the economy, political developments, or other news.

Focus risk. To the extent that the fund focuses its investments in particular industries, asset classes or sectors of the economy, any market price movements, regulatory

| 2 | DWS Large Cap Focus Growth Fund |

Summary

Prospectus December 1, 2019

or technological changes, or economic conditions

affecting companies in those industries, asset classes or sectors may have a significant impact on the fund’s performance.

Focus risk – limited number

of securities. To the extent that the fund pursues a strategy of investing in a limited number of securities, it will have a relatively large exposure to the risks of each individual security and may be

more volatile than a fund that invests more broadly.

Security selection risk. The securities in the fund’s portfolio may decline in value. Portfolio management could be wrong in its analysis of industries, companies, economic trends, the relative

attractiveness of different securities or other matters.

Securities lending risk. Any decline in the value of a portfolio security that occurs while the security is out on loan is borne by the fund and will adversely affect performance. Also, there may be delays in

recovery of securities loaned or even a loss of rights in the collateral should the borrower of the securities fail financially while holding the security.

Counterparty risk. A financial institution or other counterparty with whom the fund does business, or that underwrites, distributes or guarantees any investments or contracts that the fund owns or is

otherwise exposed to, may decline in financial health and become unable to honor its commitments. This could cause losses for the fund or could delay the return or delivery of collateral or other assets to the

fund.

Foreign investment risk. The fund faces the risks inherent in foreign investing. Adverse political, economic or social developments, as well as US and foreign government actions such as the imposition of tariffs,

economic and trade sanctions or embargoes, could undermine the value of the fund’s investments, prevent the fund from realizing the full value of its investments or prevent the fund from selling securities it

holds. In June 2016, citizens of the United Kingdom approved a referendum to leave the European Union (EU) and in March 2017, the United Kingdom initiated the formal process of withdrawing from the EU. Significant

uncertainty exists regarding the United Kingdom’s anticipated withdrawal from the EU and any adverse economic and political effects such withdrawal may have on the United Kingdom, other EU countries and the

global economy.

Financial reporting standards for

companies based in foreign markets differ from those in the US. Additionally, foreign securities markets generally are smaller and less liquid than US markets. To the extent that the fund invests in non-US dollar

denominated foreign securities, changes in currency exchange rates may affect the US dollar value of foreign securities or the income or gain received on these securities.

Liquidity risk. In certain situations, it may be difficult or impossible to sell an investment and/or the fund may sell certain investments at a price or time that is not advantageous in order to meet

redemption requests or other cash needs. Unusual market conditions, such as an unusually high volume of redemptions or other similar conditions could increase liquidity risk for the fund.

ESG investing risk. When portfolio management considers ESG factors in its fundamental research process and when making investment decisions, there is a risk that the fund may forgo otherwise attractive

investment opportunities or increase or decrease its exposure to certain types of issuers and, therefore, may underperform funds that do not consider ESG factors.

Operational and technology

risk. Cyber-attacks, disruptions, or failures that affect the fund’s service providers or counterparties, issuers of securities held by the fund, or other market participants may adversely

affect the fund and its shareholders, including by causing losses for the fund or impairing fund operations.

Past Performance

How a fund's returns vary from

year to year can give an idea of its risk; so can comparing fund performance to overall market performance (as measured by an appropriate market index). Past performance may not indicate future results. All

performance figures below assume that dividends and distributions were reinvested. For more recent performance figures, go to dws.com (the Web site does not form a part of this prospectus) or call the telephone number

included in this prospectus.

Class T had not commenced

investment operations as of the date of this prospectus. The performance figures for Class T shares are based on the historical performance of the fund’s Institutional Class shares adjusted to reflect the higher

expenses and applicable sales charges of Class T. Institutional Class shares are offered in a separate prospectus. The Class Inception date is the date that Class T shares became effective with the SEC.

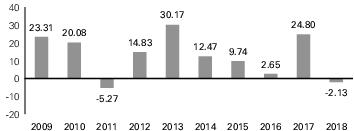

CALENDAR YEAR TOTAL RETURNS

(%) (Class T)

These year-by-year returns do not

include sales charges, if any, and would be lower if they did. Returns for other classes were different and are not shown here.

| 3 | DWS Large Cap Focus Growth Fund |

Summary

Prospectus December 1, 2019

| Returns | Period ending | |

| Best Quarter | 17.06% | March 31, 2012 |

| Worst Quarter | -17.02% | December 31, 2018 |

| Year-to-Date | 27.38% | September 30, 2019 |

Average Annual Total

Returns

(For periods ended 12/31/2018 expressed as a %)

(For periods ended 12/31/2018 expressed as a %)

After-tax returns reflect the

historical highest individual federal income tax rates, but do not reflect any state or local taxes. Your actual after-tax returns may be different. After-tax returns are not relevant to shares held in an IRA, 401(k)

or other tax-advantaged investment plan.

| Class Inception | 1 Year | 5 Years | 10 Years | |

| Class T before tax | 3/16/2017 | -4.57 | 8.57 | 12.21 |

| After tax on distributions | -5.84 | 6.01 | 10.83 | |

| After tax on distributions and sale of fund shares | -2.86 | 6.08 | 9.87 | |

| Russell 1000 Growth Index (reflects no deduction for fees, expenses or taxes) | -1.51 | 10.40 | 15.29 |

Management

Investment Advisor

DWS Investment Management

Americas, Inc.

Portfolio Manager(s)

Sebastian P. Werner, PhD,

Director. Portfolio Manager of the fund. Began managing the fund in 2016.

Purchase and Sale of Fund

Shares

Minimum Initial

Investment ($)

| Non-IRA | IRAs | UGMAs/ UTMAs | Automatic Investment Plans | |

| T | 1,000 | 500 | 1,000 | 500 |

For participants in all group retirement plans there

is no minimum initial investment and no minimum additional investment for Class T. The minimum additional investment in all other instances is $50.

To Place Orders

| New Accounts | DWS PO Box 219356 Kansas City, MO 64121-9356 | |

| Additional Investments | DWS PO Box 219154 Kansas City, MO 64121-9154 | |

| Exchanges and Redemptions | DWS PO Box 219557 Kansas City, MO 64121-9557 | |

| Expedited Mail | DWS 210 West 10th Street Kansas City, MO 64105-1614 | |

| Web Site | dws.com | |

| Telephone | (800) 728-3337, M – F 8 a.m. – 7 p.m. ET | |

| TDD Line | (800) 972-3006, M – F 8 a.m. – 7 p.m. ET | |

The fund is generally open on

days when the New York Stock Exchange is open for regular trading. Initial investments must be sent by mail. You can make additional investments or sell shares of the fund on any business day by visiting our Web site,

by mail, or by telephone; however you may have to elect certain privileges on your initial account application. If you are working with a financial representative, contact your financial representative for assistance

with buying or selling fund shares. A financial representative separately may impose its own policies and procedures for buying and selling fund shares.

Class T shares are closed to new

purchases, except in connection with the reinvestment of dividends or other distributions where Class T shares have been issued.

Tax Information

The fund's distributions are

generally taxable to you as ordinary income or capital gains, except when your investment is in an IRA, 401(k), or other tax-advantaged investment plan. Any withdrawals you make from such tax- advantaged investment

plans, however, may be taxable to you.

Payments to Broker-Dealers

and

Other Financial Intermediaries

Other Financial Intermediaries

If you purchase shares of the

fund through a broker-dealer or other financial intermediary (such as a bank), the fund, the Advisor, and/or the Advisor’s affiliates may pay the intermediary for the sale of fund shares and related services.

These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the fund over another investment. Ask your salesperson or visit your financial

intermediary’s Web site for more information.

| 4 | DWS Large Cap Focus Growth Fund |

Summary Prospectus December 1, 2019 DLCFGF-T-SUM