UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM N-CSRS

Investment Company Act file number: 811-00043

Deutsche Investment Trust

(Exact Name of Registrant as Specified in Charter)

345 Park Avenue

New York, NY 10154-0004

(Address of Principal Executive Offices) (Zip Code)

Registrant’s Telephone Number, including Area Code: (212) 250-3220

Paul Schubert

345 Park Avenue

New York, NY 10154-0004

(Name and Address of Agent for Service)

| Date of fiscal year end: | 9/30 |

| Date of reporting period: | 3/31/2018 |

| ITEM 1. | REPORT TO STOCKHOLDERS |

Table of Contents

Table of Contents

This report must be preceded or accompanied by a prospectus. To obtain a summary prospectus, if available, or prospectus for any of our funds, refer to the Account Management Resources information provided in the back of this booklet. We advise you to consider the Fund’s objectives, risks, charges and expenses carefully before investing. The summary prospectus and prospectus contain this and other important information about the Fund. Please read the prospectus carefully before you invest.

The Fund may lend securities to approved institutions. Stocks may decline in value. Please read the prospectus for details.

The brand DWS represents DWS Group GmbH & Co. KGaA and any of its subsidiaries such as DWS Distributors, Inc. which offers investment products or Deutsche Investment Management Americas Inc. and RREEF America L.L.C. which offer advisory services.

NOT FDIC/NCUA INSURED NO BANK GUARANTEE MAY LOSE VALUE NOT A DEPOSIT NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

| 2 | Deutsche Capital Growth Fund |

Table of Contents

Dear Shareholder:

You may have noticed a new logo appearing on the cover of this report. As of March 23, 2018, Deutsche Asset Management has adopted its existing European brand, DWS, globally. As we have consolidated several businesses over the last several years, each of which has grown up relatively independently, the time has now come to be united under a single brand that reflects our global identity and the full breadth of capabilities we offer to our clients.

The DWS brand — Deutsche Gesellschaft für Wertpapiersparen — draws on our roots in the German market, going back over 60 years. It was established in Hamburg in 1956 with a singular objective: to assist private investors in building wealth and managing risk. We have been fulfilling that promise for generations. Today, the DWS name is synonymous with the values that we have continuously lived up to, and those that will remain central to our future success: Excellence, Entrepreneurship, Sustainability and Integrity. It is therefore a name that we are proud to adopt and build upon as our brand here in the Americas.

In connection with this change, our web site has recently been redesigned with a new address: dws.com. However, for your convenience, the deutschefunds.com address will remain live and automatically redirect you to our new site. Please visit us online to find the most current insights from our CIO, economists and investment specialists.

As always, thank you for your ongoing trust in us. We look forward to bringing you the very best in investment insight, strategies and solutions as we march forward gathering our unique qualities and capabilities under one roof, DWS.

Best regards,

|

Hepsen Uzcan

President, Deutsche Funds |

Assumptions, estimates and opinions contained in this document constitute our judgment as of the date of the document and are subject to change without notice. Any projections are based on a number of assumptions as to market conditions and there can be no guarantee that any projected results will be achieved. Past performance is not a guarantee of future results.

| Deutsche Capital Growth Fund | 3 |

Table of Contents

| Performance Summary | March 31, 2018 (Unaudited) |

| Class A | 6-Month‡ | 1-Year | 5-Year | 10-Year | ||||||||||||

| Average Annual Total Returns as of 3/31/18 | ||||||||||||||||

| Unadjusted for Sales Charge | 7.07% | 17.75% | 14.61% | 9.39% | ||||||||||||

| Adjusted for the Maximum Sales Charge (max 5.75% load) |

0.92% | 10.97% | 13.26% | 8.74% | ||||||||||||

| Russell 1000® Growth Index† | 9.39% | 21.25% | 15.53% | 11.34% | ||||||||||||

| Class C | 6-Month‡ |

1-Year | 5-Year | 10-Year | ||||||||||||

| Average Annual Total Returns as of 3/31/18 | ||||||||||||||||

| Unadjusted for Sales Charge | 6.62% | 16.71% | 13.67% | 8.52% | ||||||||||||

| Adjusted for the Maximum Sales Charge (max 1.00% CDSC) |

5.65% | 16.71% | 13.67% | 8.52% | ||||||||||||

| Russell 1000® Growth Index† | 9.39% | 21.25% | 15.53% | 11.34% | ||||||||||||

| Class R | 6-Month‡ | 1-Year | 5-Year | 10-Year | ||||||||||||

| Average Annual Total Returns as of 3/31/18 | ||||||||||||||||

| No Sales Charges | 6.84% | 17.25% | 14.15% | 9.02% | ||||||||||||

| Russell 1000® Growth Index† | 9.39% | 21.25% | 15.53% | 11.34% | ||||||||||||

| Class R6 | 6-Month‡ | 1-Year | Life of Class* |

|||||||||||||

| Average Annual Total Returns as of 3/31/18 | ||||||||||||||||

| No Sales Charges | 7.24% | 18.11% | 11.98% | |||||||||||||

| Russell 1000® Growth Index† | 9.39% | 21.25% | 10.23% | |||||||||||||

| Class S | 6-Month‡ | 1-Year | 5-Year | 10-Year | ||||||||||||

| Average Annual Total Returns as of 3/31/18 | ||||||||||||||||

| No Sales Charges | 7.20% | 18.03% | 14.90% | 9.67% | ||||||||||||

| Russell 1000® Growth Index† | 9.39% | 21.25% | 15.53% | 11.34% | ||||||||||||

| Institutional Class | 6-Month‡ | 1-Year | 5-Year | 10-Year | ||||||||||||

| Average Annual Total Returns as of 3/31/18 | ||||||||||||||||

| No Sales Charges | 7.20% | 17.99% | 14.91% | 9.72% | ||||||||||||

| Russell 1000® Growth Index† | 9.39% | 21.25% | 15.53% | 11.34% | ||||||||||||

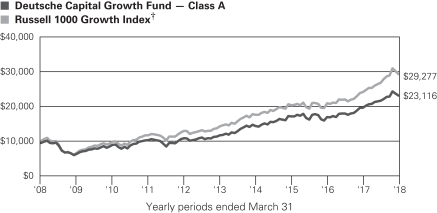

Performance in the Average Annual Total Returns table above and the Growth of an Assumed $10,000 Investment line graph that follows is historical and does not guarantee future results. Investment return and principal fluctuate, so your shares may be worth more or less when redeemed. Current performance may differ from performance data shown. Please visit dws.com for the Fund’s most

| 4 | Deutsche Capital Growth Fund |

Table of Contents

recent month-end performance. Fund performance includes reinvestment of all distributions. Unadjusted returns do not reflect sales charges and would have been lower if they had.

The gross expense ratios of the Fund, as stated in the fee table of the prospectus dated February 1, 2018 are 0.96%, 1.84%, 1.37%, 0.65%, 0.71% and 0.73% for Class A, Class C, Class R, Class R6, Class S and Institutional Class shares, respectively, and may differ from the expense ratios disclosed in the Financial Highlights tables in this report.

Index returns do not reflect any fees or expenses and it is not possible to invest directly into an index.

Performance figures do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Generally accepted accounting principles require adjustments to be made to the net assets of the Fund at period end for financial reporting purposes only, and as such, the total return based on the unadjusted net asset value per share may differ from the total return reported in the financial highlights.

| Growth of an Assumed $10,000 Investment (Adjusted for Maximum Sales Charge) |

The Fund’s growth of an assumed $10,000 investment is adjusted for the maximum sales charge of 5.75%. This results in a net initial investment of $9,425.

The growth of $10,000 is cumulative.

Performance of other share classes will vary based on the sales charges and the fee structure of those classes.

| * | Class R6 shares commenced operations on August 25, 2014. |

| † | The Russell 1000 Growth Index is an unmanaged index that consists of those stocks in the Russell 1000 Index that have higher price-to-book ratios and higher forecasted growth values. |

| ‡ | Total returns shown for periods less than one year are not annualized. |

| Deutsche Capital Growth Fund | 5 |

Table of Contents

| Class A | Class C | Class R | Class R6 | Class S | Institutional Class |

|||||||||||||||||||

| Net Asset Value | ||||||||||||||||||||||||

| 3/31/18 | $ | 77.89 | $ | 67.18 | $ | 76.81 | $ | 78.34 | $ | 78.66 | $ | 78.57 | ||||||||||||

| 9/30/17 | $ | 79.22 | $ | 69.19 | $ | 78.07 | $ | 79.77 | $ | 80.05 | $ | 79.95 | ||||||||||||

| Distribution Information as of 3/31/18 | ||||||||||||||||||||||||

| Income Dividends, Six Months | $ | .32 | $ | — | $ | — | $ | .58 | $ | .54 | $ | .52 | ||||||||||||

| Capital Gain Distributions, Six Months | $ | 6.52 | $ | 6.52 | $ | 6.52 | $ | 6.52 | $ | 6.52 | $ | 6.52 | ||||||||||||

| 6 | Deutsche Capital Growth Fund |

Table of Contents

Sebastian P. Werner, PhD, Director

Portfolio Manager of the fund. Began managing the fund in 2016.

| – | Joined DWS in 2008; previously, he served as a Research Assistant for the Endowed Chair of Asset Management at the European Business School, Oestrich -Winkel while earning his PhD. |

| – | Portfolio Manager for Global and US Growth Equities: New York. |

| – | MBA in International Management from the Thunderbird School of Global Management; Masters Degree (“Diplom-Kaufmann”) and PhD in Finance (“Dr.rer.pol.”) from the European Business School, Oestrich-Winkel. |

| Deutsche Capital Growth Fund | 7 |

Table of Contents

| Ten Largest Equity Holdings at March 31, 2018 (36.5% of Net Assets) | ||||||||

| 1. | Microsoft Corp. | 5.5 | % | |||||

| Develops, manufactures, licenses, sells and supports software products | ||||||||

| 2. | Apple, Inc. | 5.4 | % | |||||

| Designs, manufactures and markets personal computing and mobile communication devices |

||||||||

| 3. | Alphabet, Inc. | 4.8 | % | |||||

| Holding company with subsidiaries that provide Web-based search, maps, hardware products and various software applications |

||||||||

| 4. | Amazon.com, Inc. | 4.5 | % | |||||

| Online retailer offering a wide range of products |

||||||||

| 5. | Visa, Inc. | 3.6 | % | |||||

| Operates a retail electronic payments network and manages global financial services | ||||||||

| 6. | Becton, Dickinson & Co. | 2.8 | % | |||||

| Provider of medical supplies and devices | ||||||||

| 7. | Home Depot, Inc. | 2.7 | % | |||||

| Home improvement retailer that sells building materials and home improvements products |

||||||||

| 8. | Boeing Co. | 2.5 | % | |||||

| Manufacturer of jet aircrafts | ||||||||

| 9. | Thermo Fisher Scientific, Inc. | 2.4 | % | |||||

| Manufacturer of measurement instruments that monitor, collect, and analyze information for various industries | ||||||||

| 10. | Progressive Corp. | 2.3 | % | |||||

| Provider of property and casualty insurance | ||||||||

Portfolio holdings and characteristics are subject to change.

For more complete details about the fund’s investment portfolio, see page 9. A quarterly Fact Sheet is available on dws.com or upon request. Please see the Account Management Resources section on page 40 for contact information.

| 8 | Deutsche Capital Growth Fund |

Table of Contents

| Investment Portfolio | as of March 31, 2018 (Unaudited) |

| Shares | Value ($) | |||||||

| Common Stocks 99.6% | ||||||||

| Consumer Discretionary 18.6% | ||||||||

| Hotels, Restaurants & Leisure 2.6% |

||||||||

| Las Vegas Sands Corp. |

148,825 | 10,700,518 | ||||||

| McDonald’s Corp. |

177,403 | 27,742,281 | ||||||

|

|

|

|||||||

| 38,442,799 | ||||||||

| Internet & Direct Marketing Retail 5.8% |

||||||||

| Amazon.com, Inc.* |

46,390 | 67,142,103 | ||||||

| Booking Holdings, Inc.* |

9,188 | 19,114,623 | ||||||

|

|

|

|||||||

| 86,256,726 | ||||||||

| Media 4.8% |

||||||||

| Comcast Corp. “A” |

614,900 | 21,011,133 | ||||||

| Live Nation Entertainment, Inc.* |

169,388 | 7,138,010 | ||||||

| Time Warner, Inc. |

182,154 | 17,228,125 | ||||||

| Walt Disney Co. |

258,381 | 25,951,788 | ||||||

|

|

|

|||||||

| 71,329,056 | ||||||||

| Multiline Retail 1.0% |

||||||||

| Dollar General Corp. |

157,202 | 14,706,247 | ||||||

| Specialty Retail 3.7% |

||||||||

| Burlington Stores, Inc.* |

116,355 | 15,492,668 | ||||||

| Home Depot, Inc. |

222,500 | 39,658,400 | ||||||

|

|

|

|||||||

| 55,151,068 | ||||||||

| Textiles, Apparel & Luxury Goods 0.7% |

||||||||

| Carter’s, Inc. |

100,691 | 10,481,933 | ||||||

| Consumer Staples 4.1% | ||||||||

| Food & Staples Retailing 1.0% |

||||||||

| Costco Wholesale Corp. |

78,947 | 14,875,983 | ||||||

| Food Products 1.7% |

||||||||

| Mondelez International, Inc. “A” |

246,930 | 10,304,389 | ||||||

| Pinnacle Foods, Inc. |

279,426 | 15,116,947 | ||||||

|

|

|

|||||||

| 25,421,336 | ||||||||

| Personal Products 1.4% |

||||||||

| Estee Lauder Companies, Inc. “A” |

139,059 | 20,819,913 | ||||||

| Energy 0.8% | ||||||||

| Oil, Gas & Consumable Fuels |

||||||||

| Concho Resources, Inc.* |

81,752 | 12,289,778 | ||||||

| Financials 5.7% | ||||||||

| Banks 1.2% |

||||||||

| SVB Financial Group* |

71,889 | 17,254,079 | ||||||

The accompanying notes are an integral part of the financial statements.

| Deutsche Capital Growth Fund | 9 |

Table of Contents

| Shares | Value ($) | |||||||

| Capital Markets 2.2% |

||||||||

| Charles Schwab Corp. |

339,973 | 17,753,390 | ||||||

| Intercontinental Exchange, Inc. |

216,305 | 15,686,439 | ||||||

|

|

|

|||||||

| 33,439,829 | ||||||||

| Insurance 2.3% |

||||||||

| Progressive Corp. |

550,195 | 33,523,381 | ||||||

| Health Care 16.6% | ||||||||

| Biotechnology 4.6% |

||||||||

| Alexion Pharmaceuticals, Inc.* |

142,257 | 15,855,965 | ||||||

| Biogen, Inc.* |

39,434 | 10,797,818 | ||||||

| BioMarin Pharmaceutical, Inc.* |

96,160 | 7,795,691 | ||||||

| Celgene Corp.* |

264,047 | 23,555,633 | ||||||

| Shire PLC (ADR) |

69,714 | 10,414,575 | ||||||

|

|

|

|||||||

| 68,419,682 | ||||||||

| Health Care Equipment & Supplies 5.5% |

||||||||

| Becton, Dickinson & Co. |

190,823 | 41,351,344 | ||||||

| Danaher Corp. |

197,213 | 19,309,125 | ||||||

| Hologic, Inc.* |

352,241 | 13,159,724 | ||||||

| The Cooper Companies, Inc. |

32,048 | 7,332,903 | ||||||

|

|

|

|||||||

| 81,153,096 | ||||||||

| Health Care Providers & Services 1.1% |

||||||||

| Cigna Corp. |

98,784 | 16,570,028 | ||||||

| Life Sciences Tools & Services 2.5% |

||||||||

| Thermo Fisher Scientific, Inc. |

175,386 | 36,210,193 | ||||||

| Pharmaceuticals 2.9% |

||||||||

| Allergan PLC |

82,324 | 13,854,306 | ||||||

| Bristol-Myers Squibb Co. |

119,341 | 7,548,318 | ||||||

| Zoetis, Inc. |

258,771 | 21,609,966 | ||||||

|

|

|

|||||||

| 43,012,590 | ||||||||

| Industrials 10.4% | ||||||||

| Aerospace & Defense 3.4% |

||||||||

| Boeing Co. |

111,240 | 36,473,371 | ||||||

| TransDigm Group, Inc. |

45,613 | 14,000,454 | ||||||

|

|

|

|||||||

| 50,473,825 | ||||||||

| Electrical Equipment 2.0% |

||||||||

| Acuity Brands, Inc. |

35,214 | 4,901,437 | ||||||

| AMETEK, Inc. |

322,201 | 24,477,610 | ||||||

|

|

|

|||||||

| 29,379,047 | ||||||||

| Industrial Conglomerates 1.4% |

||||||||

| Roper Technologies, Inc. |

75,226 | 21,115,186 | ||||||

The accompanying notes are an integral part of the financial statements.

| 10 | Deutsche Capital Growth Fund |

Table of Contents

| Shares | Value ($) | |||||||

| Machinery 1.1% |

||||||||

| Parker-Hannifin Corp. |

95,530 | 16,338,496 | ||||||

| Professional Services 1.3% |

||||||||

| Verisk Analytics, Inc.* |

194,377 | 20,215,208 | ||||||

| Road & Rail 1.2% |

||||||||

| Norfolk Southern Corp. |

127,508 | 17,313,036 | ||||||

| Information Technology 37.4% | ||||||||

| Communications Equipment 0.6% |

||||||||

| Palo Alto Networks, Inc.* |

49,385 | 8,964,365 | ||||||

| Internet Software & Services 6.8% |

||||||||

| Alphabet, Inc. “A”* |

35,547 | 36,867,216 | ||||||

| Alphabet, Inc. “C”* |

32,735 | 33,775,646 | ||||||

| Facebook, Inc. “A”* |

192,483 | 30,756,858 | ||||||

|

|

|

|||||||

| 101,399,720 | ||||||||

| IT Services 7.3% |

||||||||

| Cognizant Technology Solutions Corp. “A” |

292,472 | 23,543,996 | ||||||

| Fidelity National Information Services, Inc. |

183,609 | 17,681,547 | ||||||

| Global Payments, Inc. |

131,578 | 14,673,578 | ||||||

| Visa, Inc. “A” |

441,118 | 52,766,535 | ||||||

|

|

|

|||||||

| 108,665,656 | ||||||||

| Semiconductors & Semiconductor Equipment 4.4% |

||||||||

| Analog Devices, Inc. |

166,022 | 15,129,585 | ||||||

| Broadcom Ltd. |

118,877 | 28,013,365 | ||||||

| NVIDIA Corp. |

92,651 | 21,457,045 | ||||||

|

|

|

|||||||

| 64,599,995 | ||||||||

| Software 12.9% |

||||||||

| Activision Blizzard, Inc. |

211,225 | 14,249,239 | ||||||

| Adobe Systems, Inc.* |

129,113 | 27,898,737 | ||||||

| Intuit, Inc. |

95,551 | 16,563,766 | ||||||

| Microsoft Corp. |

901,589 | 82,288,028 | ||||||

| Oracle Corp. |

354,711 | 16,228,028 | ||||||

| salesforce.com, Inc.* |

212,756 | 24,743,523 | ||||||

| ServiceNow, Inc.* |

51,151 | 8,462,933 | ||||||

|

|

|

|||||||

| 190,434,254 | ||||||||

| Technology Hardware, Storage & Peripherals 5.4% |

||||||||

| Apple, Inc. |

478,847 | 80,340,950 | ||||||

| Materials 1.6% | ||||||||

| Chemicals 0.9% |

||||||||

| Albemarle Corp. |

134,739 | 12,495,695 | ||||||

| Construction Materials 0.7% |

||||||||

| Vulcan Materials Co. |

94,176 | 10,752,074 | ||||||

The accompanying notes are an integral part of the financial statements.

| Deutsche Capital Growth Fund | 11 |

Table of Contents

| Shares | Value ($) | |||||||

| Real Estate 1.9% | ||||||||

| Equity Real Estate Investment Trusts (REITs) |

||||||||

| Digital Realty Trust, Inc. |

151,872 | 16,004,272 | ||||||

| Prologis, Inc. |

189,188 | 11,916,952 | ||||||

|

|

|

|||||||

| 27,921,224 | ||||||||

| Telecommunication Services 2.5% | ||||||||

| Diversified Telecommunication Services 1.1% |

||||||||

| Zayo Group Holdings, Inc.* |

454,684 | 15,532,006 | ||||||

| Wireless Telecommunication Services 1.4% |

||||||||

| T-Mobile U.S., Inc.* |

348,985 | 21,302,044 | ||||||

| Total Common Stocks (Cost $851,918,172) | 1,476,600,498 | |||||||

| Convertible Preferred Stock 0.0% | ||||||||

| Industrials |

||||||||

| Stericycle, Inc., Series A, 5.25% (Cost $479,700) |

4,797 | 217,016 | ||||||

| Cash Equivalents 0.5% | ||||||||

| Deutsche Central Cash Management Government Fund, 1.64% (a) (Cost $7,149,316) |

7,149,316 | 7,149,316 | ||||||

| % of Net Assets |

Value ($) | |||||||

| Total Investment Portfolio (Cost $859,547,188) | 100.1 | 1,483,966,830 | ||||||

| Other Assets and Liabilities, Net | (0.1 | ) | (1,400,629 | ) | ||||

|

|

||||||||

| Net Assets | 100.0 | 1,482,566,201 | ||||||

A summary of the Fund’s transactions with affiliated Underlying Deutsche Funds during the period ended March 31, 2018 are as follows:

| Value ($) at 9/30/2017 |

Purchases ($) |

Sales Proceeds ($) |

Net ($) |

Net Change in ($) |

Income ($) |

Capital Gain ($) |

Number of Shares at 3/31/2018 |

Value ($) at 3/31/2018 |

||||||||||||||||||||||||

| Securities Lending Collateral 0.9% | ||||||||||||||||||||||||||||||||

| Deutsche Government & Agency Securities Portfolio “Deutsche Government Cash Institutional Shares”, 0.93% (a) (b) |

| |||||||||||||||||||||||||||||||

| 12,678,750 | — | 12,678,750 | — | — | 2,519 | — | — | — | ||||||||||||||||||||||||

| Cash Equivalents 0.5% | ||||||||||||||||||||||||||||||||

| Deutsche Central Cash Management Government Fund, 1.64% (a) |

| |||||||||||||||||||||||||||||||

| 5,311,227 | 143,155,966 | 141,317,877 | — | — | 103,054 | — | 7,149,316 | 7,149,316 | ||||||||||||||||||||||||

| 17,989,977 | 143,155,966 | 153,996,627 | — | — | 105,573 | — | 7,149,316 | 7,149,316 | ||||||||||||||||||||||||

| * | Non-income producing security. |

| (a) | Affiliated fund managed by Deutsche Investment Management Americas Inc. The rate shown is the annualized seven-day yield at period end. |

The accompanying notes are an integral part of the financial statements.

| 12 | Deutsche Capital Growth Fund |

Table of Contents

| (b) | Represents collateral held in connection with securities lending. Income earned by the Fund is net of borrower rebates. Represents the net increase (purchase cost) or decrease (sales proceeds) in the amount invested for the period ended March 31, 2018. |

ADR: American Depositary Receipt

Fair Value Measurements

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in three broad levels. Level 1 includes quoted prices in active markets for identical securities. Level 2 includes other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds and credit risk). Level 3 includes significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments). The level assigned to the securities valuations may not be an indication of the risk or liquidity associated with investing in those securities.

The following is a summary of the inputs used as of March 31, 2018 in valuing the Fund’s investments. For information on the Fund’s policy regarding the valuation of investments, please refer to the Security Valuation section of Note A in the accompanying Notes to Financial Statements.

| Assets | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

| Common Stocks (c) | $ | 1,476,600,498 | $ | — | $ | — | $ | 1,476,600,498 | ||||||||

| Convertible Preferred Stocks | 217,016 | — | — | 217,016 | ||||||||||||

| Short-Term Investments | 7,149,316 | — | — | 7,149,316 | ||||||||||||

| Total | $ | 1,483,966,830 | $ | — | $ | — | $ | 1,483,966,830 | ||||||||

There have been no transfers between fair value measurement levels during the period ended March 31, 2018.

| (c) | See Investment Portfolio for additional detailed categorizations. |

The accompanying notes are an integral part of the financial statements.

| Deutsche Capital Growth Fund | 13 |

Table of Contents

Statement of Assets and Liabilities

| as of March 31, 2018 (Unaudited) | ||||

| Assets |

||||

| Investments in non-affiliated securities, at value (cost $852,397,872) |

$ | 1,476,817,514 | ||

| Investment in Deutsche Central Cash Management Government Fund (cost $7,149,316) |

7,149,316 | |||

| Cash |

12,204 | |||

| Receivable for Fund shares sold |

84,735 | |||

| Dividends receivable |

387,506 | |||

| Interest receivable |

13,171 | |||

| Other assets |

49,818 | |||

| Total assets |

1,484,514,264 | |||

| Liabilities |

||||

| Payable for Fund shares redeemed |

515,290 | |||

| Accrued management fee |

597,968 | |||

| Accrued Trustees’ fees |

9,602 | |||

| Other accrued expenses and payables |

825,203 | |||

| Total liabilities |

1,948,063 | |||

| Net assets, at value |

$ | 1,482,566,201 | ||

| Net Assets Consist of |

||||

| Undistributed net investment income |

2,288,455 | |||

| Net unrealized appreciation (depreciation) on investments |

624,419,642 | |||

| Accumulated net realized gain (loss) |

112,952,521 | |||

| Paid-in capital |

742,905,583 | |||

| Net assets, at value |

$ | 1,482,566,201 | ||

The accompanying notes are an integral part of the financial statements.

| 14 | Deutsche Capital Growth Fund |

Table of Contents

| Statement of Assets and Liabilities as of March 31, 2018 (Unaudited) (continued) |

| Net Asset Value | ||||

| Class A |

||||

| Net Asset Value and redemption price per share ($611,634,613 ÷ 7,852,791 shares of capital stock outstanding, |

$ | 77.89 | ||

| Maximum offering price per share (100 ÷ 94.25 of $77.89) | $ | 82.64 | ||

| Class C |

||||

| Net Asset Value offering and redemption price per share ($20,823,045 ÷ 309,936 shares of capital stock outstanding, |

$ | 67.18 | ||

| Class R |

||||

| Net Asset Value offering and redemption price per share ($8,404,310 ÷ 109,416 shares of capital stock outstanding, |

$ | 76.81 | ||

| Class R6 |

||||

| Net Asset Value offering and redemption price per share ($1,486,660 ÷ 18,978 shares of capital stock outstanding, |

$ | 78.34 | ||

| Class S |

||||

| Net Asset Value offering and redemption price per share ($779,528,826 ÷ 9,909,663 shares of capital stock outstanding, |

$ | 78.66 | ||

| Institutional Class |

||||

| Net Asset Value offering and redemption price per share ($60,688,747 ÷ 772,451 shares of capital stock outstanding, |

$ | 78.57 | ||

The accompanying notes are an integral part of the financial statements.

| Deutsche Capital Growth Fund | 15 |

Table of Contents

| for the six months ended March 31, 2018 (Unaudited) | ||||

| Investment Income | ||||

| Income: | ||||

| Dividends | $ | 8,461,118 | ||

| Income distributions — Deutsche Central Cash Management Government Fund | 103,054 | |||

| Securities lending income, net of borrower rebates | 2,519 | |||

| Total income | 8,566,691 | |||

| Expenses: | ||||

| Management fee | 3,495,511 | |||

| Administration fee | 754,694 | |||

| Services to shareholders | 867,547 | |||

| Distribution and service fees | 847,712 | |||

| Custodian fee | 7,484 | |||

| Professional fees | 61,350 | |||

| Reports to shareholders | 51,064 | |||

| Registration fees | 38,464 | |||

| Trustees’ fees and expenses | 45,388 | |||

| Other | 36,946 | |||

| Total expenses | 6,206,160 | |||

| Net investment income | 2,360,531 | |||

| Realized and Unrealized Gain (Loss) | ||||

| Net realized gain (loss) from investments | 114,205,145 | |||

| Change in net unrealized appreciation (depreciation) on investments | (12,564,039 | ) | ||

| Net gain (loss) | 101,641,106 | |||

| Net increase (decrease) in net assets resulting from operations | $ | 104,001,637 | ||

The accompanying notes are an integral part of the financial statements.

| 16 | Deutsche Capital Growth Fund |

Table of Contents

Statements of Changes in Net Assets

| Six Months Ended March 31, 2018 (Unaudited) |

Year Ended September 30, 2017 |

|||||||

| Increase (Decrease) in Net Assets | ||||||||

| Operations: | ||||||||

| Net investment income (loss) | $ | 2,360,531 | $ | 7,760,631 | ||||

| Net realized gain (loss) | 114,205,145 | 117,794,051 | ||||||

| Change in net unrealized appreciation (depreciation) | (12,564,039 | ) | 144,890,842 | |||||

| Net increase (decrease) in net assets resulting from operations | 104,001,637 | 270,445,524 | ||||||

| Distributions to shareholders from: | ||||||||

| Net investment income: | ||||||||

| Class A |

(2,401,394 | ) | (1,295,345 | ) | ||||

| Class R6 |

(5,788 | ) | (1,505 | ) | ||||

| Class S |

(5,019,935 | ) | (3,349,032 | ) | ||||

| Institutional Class |

(383,937 | ) | (1,038,670 | ) | ||||

| Net realized gains: | ||||||||

| Class A |

(48,863,677 | ) | (41,881,532 | ) | ||||

| Class C |

(2,033,354 | ) | (2,120,984 | ) | ||||

| Class R |

(681,237 | ) | (508,480 | ) | ||||

| Class R6 |

(64,624 | ) | (20,902 | ) | ||||

| Class S |

(61,149,449 | ) | (50,345,141 | ) | ||||

| Institutional Class |

(4,835,611 | ) | (15,259,142 | ) | ||||

| Total distributions | (125,439,006 | ) | (115,820,733 | ) | ||||

| Fund share transactions: | ||||||||

| Proceeds from shares sold | 33,373,236 | 109,382,603 | ||||||

| Reinvestment of distributions | 118,928,292 | 110,153,289 | ||||||

| Payments for shares redeemed | (115,586,343 | ) | (423,375,716 | ) | ||||

| Net increase (decrease) in net assets from Fund share transactions | 36,715,185 | (203,839,824 | ) | |||||

| Increase (decrease) in net assets | 15,277,816 | (49,215,033 | ) | |||||

| Net assets at beginning of period | 1,467,288,385 | 1,516,503,418 | ||||||

| Net assets at end of period (including undistributed net investment income of $2,288,455 and $7,738,978, respectively) | $ | 1,482,566,201 | $ | 1,467,288,385 | ||||

The accompanying notes are an integral part of the financial statements.

| Deutsche Capital Growth Fund | 17 |

Table of Contents

| Six Months Ended 3/31/18 |

Years Ended September 30, | |||||||||||||||||||||||||

| Class A | (Unaudited) | 2017 | 2016 | 2015 | 2014 | 2013 | ||||||||||||||||||||

| Selected Per Share Data | ||||||||||||||||||||||||||

| Net asset value, beginning of period | $ | 79.22 | $ | 71.34 | $ | 71.63 | $ | 79.28 | $ | 70.56 | $ | 60.83 | ||||||||||||||

| Income (loss) from investment operations: | ||||||||||||||||||||||||||

| Net investment income (loss)a |

.07 | .29 | .16 | .20 | .10 | .60 | ||||||||||||||||||||

| Net realized and unrealized gain (loss) |

5.44 | 13.10 | 7.46 | 3.29 | 13.31 | 9.63 | ||||||||||||||||||||

| Total from investment operations |

5.51 | 13.39 | 7.62 | 3.49 | 13.41 | 10.23 | ||||||||||||||||||||

| Less distributions from: | ||||||||||||||||||||||||||

| Net investment income |

(.32 | ) | (.17 | ) | (.19 | ) | (.10 | ) | (.21 | ) | (.50 | ) | ||||||||||||||

| Net realized gains |

(6.52 | ) | (5.34 | ) | (7.72 | ) | (11.04 | ) | (4.48 | ) | — | |||||||||||||||

| Total distributions |

(6.84 | ) | (5.51 | ) | (7.91 | ) | (11.14 | ) | (4.69 | ) | (.50 | ) | ||||||||||||||

| Net asset value, end of period | $ | 77.89 | $ | 79.22 | $ | 71.34 | $ | 71.63 | $ | 79.28 | $ | 70.56 | ||||||||||||||

| Total Return (%)b | 7.07 | ** | 20.13 | 11.13 | 4.78 | 19.65 | 16.97 | |||||||||||||||||||

| Ratios to Average Net Assets and Supplemental Data | ||||||||||||||||||||||||||

| Net assets, end of period ($ millions) | 612 | 607 | 573 | 579 | 604 | 569 | ||||||||||||||||||||

| Ratio of expenses (%) | .95 | * | .96 | .97 | .97 | .98 | 1.01 | |||||||||||||||||||

| Ratio of net investment income (loss) (%) | .19 | * | .40 | .24 | .27 | .14 | .94 | |||||||||||||||||||

| Portfolio turnover rate (%) | 14 | ** | 17 | 33 | 44 | 41 | 31 | |||||||||||||||||||

| a | Based on average shares outstanding during the period. |

| b | Total return does not reflect the effect of any sales charges. |

| * | Annualized |

| ** | Not annualized |

| 18 | Deutsche Capital Growth Fund |

Table of Contents

| Six Months Ended 3/31/18 |

Years Ended September 30, | |||||||||||||||||||||||||

| Class C | (Unaudited) | 2017 | 2016 | 2015 | 2014 | 2013 | ||||||||||||||||||||

| Selected Per Share Data | ||||||||||||||||||||||||||

| Net asset value, beginning of period | $ | 69.19 | $ | 63.34 | $ | 64.74 | $ | 73.12 | $ | 65.72 | $ | 56.65 | ||||||||||||||

| Income (loss) from investment operations: | ||||||||||||||||||||||||||

| Net investment income (loss)a |

(.22 | ) | (.31 | ) | (.36 | ) | (.37 | ) | (.46 | ) | .10 | |||||||||||||||

| Net realized and unrealized gain (loss) |

4.73 | 11.50 | 6.68 | 3.03 | 12.34 | 9.01 | ||||||||||||||||||||

| Total from investment operations |

4.51 | 11.19 | 6.32 | 2.66 | 11.88 | 9.11 | ||||||||||||||||||||

| Less distributions from: | ||||||||||||||||||||||||||

| Net investment income |

— | — | — | — | — | (.04 | ) | |||||||||||||||||||

| Net realized gains |

(6.52 | ) | (5.34 | ) | (7.72 | ) | (11.04 | ) | (4.48 | ) | — | |||||||||||||||

| Total distributions |

(6.52 | ) | (5.34 | ) | (7.72 | ) | (11.04 | ) | (4.48 | ) | (.04 | ) | ||||||||||||||

| Net asset value, end of period | $ | 67.18 | $ | 69.19 | $ | 63.34 | $ | 64.74 | $ | 73.12 | $ | 65.72 | ||||||||||||||

| Total Return (%)b | 6.62 | ** | 19.09 | 10.20 | 3.95 | 18.70 | 16.07 | |||||||||||||||||||

| Ratios to Average Net Assets and Supplemental Data | ||||||||||||||||||||||||||

| Net assets, end of period ($ millions) | 21 | 23 | 27 | 28 | 27 | 27 | ||||||||||||||||||||

| Ratio of expenses (%) | 1.77 | * | 1.84 | 1.79 | 1.78 | 1.78 | 1.79 | |||||||||||||||||||

| Ratio of net investment income (loss) (%) | (.64 | )* | (.48 | ) | (.58 | ) | (.53 | ) | (.66 | ) | .17 | |||||||||||||||

| Portfolio turnover rate (%) | 14 | ** | 17 | 33 | 44 | 41 | 31 | |||||||||||||||||||

| a | Based on average shares outstanding during the period. |

| b | Total return does not reflect the effect of any sales charges. |

| * | Annualized |

| ** | Not annualized |

| Deutsche Capital Growth Fund | 19 |

Table of Contents

| Six Months Ended 3/31/18 |

Years Ended September 30, | |||||||||||||||||||||||||

| Class R | (Unaudited) | 2017 | 2016 | 2015 | 2014 | 2013 | ||||||||||||||||||||

| Selected Per Share Data | ||||||||||||||||||||||||||

| Net asset value, beginning of period | $ | 78.07 | $ | 70.48 | $ | 70.94 | $ | 78.80 | $ | 70.24 | $ | 60.62 | ||||||||||||||

| Income (loss) from investment operations: | ||||||||||||||||||||||||||

| Net investment income (loss)a |

(.09 | ) | (.00 | )*** | (.11 | ) | (.10 | ) | (.20 | ) | .34 | |||||||||||||||

| Net realized and unrealized gain (loss) |

5.35 | 12.93 | 7.37 | 3.28 | 13.24 | 9.62 | ||||||||||||||||||||

| Total from investment operations |

5.26 | 12.93 | 7.26 | 3.18 | 13.04 | 9.96 | ||||||||||||||||||||

| Less distributions from: | ||||||||||||||||||||||||||

| Net investment income |

— | — | — | — | — | (.34 | ) | |||||||||||||||||||

| Net realized gains |

(6.52 | ) | (5.34 | ) | (7.72 | ) | (11.04 | ) | (4.48 | ) | — | |||||||||||||||

| Total distributions |

(6.52 | ) | (5.34 | ) | (7.72 | ) | (11.04 | ) | (4.48 | ) | (.34 | ) | ||||||||||||||

| Net asset value, end of period | $ | 76.81 | $ | 78.07 | $ | 70.48 | $ | 70.94 | $ | 78.80 | $ | 70.24 | ||||||||||||||

| Total Return (%) | 6.84 | ** | 19.66 | 10.67 | 4.35 | 19.18 | 16.54 | |||||||||||||||||||

| Ratios to Average Net Assets and Supplemental Data | ||||||||||||||||||||||||||

| Net assets, end of period ($ millions) | 8 | 9 | 7 | 7 | 7 | 7 | ||||||||||||||||||||

| Ratio of expenses (%) | 1.37 | * | 1.37 | 1.37 | 1.37 | 1.38 | 1.39 | |||||||||||||||||||

| Ratio of net investment income (loss) (%) | (.24 | )* | (.01 | ) | (.16 | ) | (.13 | ) | (.26 | ) | .54 | |||||||||||||||

| Portfolio turnover rate (%) | 14 | ** | 17 | 33 | 44 | 41 | 31 | |||||||||||||||||||

| a | Based on average shares outstanding during the period. |

| * | Annualized |

| ** | Not annualized |

| *** | Amount is less than $.005 |

| 20 | Deutsche Capital Growth Fund |

Table of Contents

| Six Months Ended 3/31/18 |

Years Ended September 30, |

Period Ended |

||||||||||||||||||||

| Class R6 | (Unaudited) | 2017 | 2016 | 2015 | 9/30/14a | |||||||||||||||||

| Selected Per Share Data | ||||||||||||||||||||||

| Net asset value, beginning of period | $ | 79.77 | $ | 71.80 | $ | 72.01 | $ | 79.89 | $ | 80.34 | ||||||||||||

| Income (loss) from investment operations: | ||||||||||||||||||||||

| Net investment income (loss)b |

.22 | .52 | .38 | .18 | .08 | |||||||||||||||||

| Net realized and unrealized gain (loss) |

5.45 | 13.17 | 7.48 | 3.40 | (.53 | ) | ||||||||||||||||

| Total from investment operations |

5.67 | 13.69 | 7.86 | 3.58 | (.45 | ) | ||||||||||||||||

| Less distributions from: | ||||||||||||||||||||||

| Net investment income |

(.58 | ) | (.38 | ) | (.35 | ) | (.42 | ) | — | |||||||||||||

| Net realized gains |

(6.52 | ) | (5.34 | ) | (7.72 | ) | (11.04 | ) | — | |||||||||||||

| Total distributions |

(7.10 | ) | (5.72 | ) | (8.07 | ) | (11.46 | ) | — | |||||||||||||

| Net asset value, end of period | $ | 78.34 | $ | 79.77 | $ | 71.80 | $ | 72.01 | $ | 79.89 | ||||||||||||

| Total Return (%) | 7.24 | ** | 20.51 | 11.44 | 4.85 | (.56 | )** | |||||||||||||||

| Ratios to Average Net Assets and Supplemental Data | ||||||||||||||||||||||

| Net assets, end of period ($ millions) | 1 | 1 | .3 | .01 | .01 | |||||||||||||||||

| Ratio of expenses (%) | .63 | * | .65 | .67 | .77 | .60 | * | |||||||||||||||

| Ratio of net investment income (loss) (%) | .55 | * | .70 | .54 | .25 | 1.02 | * | |||||||||||||||

| Portfolio turnover rate (%) | 14 | ** | 17 | 33 | 44 | 41 | c | |||||||||||||||

| a | For the period from August 25, 2014 (commencement of operations) to September 30, 2014. |

| b | Based on average shares outstanding during the period. |

| c | Represents the Fund’s portfolio turnover rate for the year ended September 30, 2014. |

| * | Annualized |

| ** | Not annualized |

| Deutsche Capital Growth Fund | 21 |

Table of Contents

| Six Months Ended 3/31/18 |

Years Ended September 30, | |||||||||||||||||||||||||

| Class S | (Unaudited) | 2017 | 2016 | 2015 | 2014 | 2013 | ||||||||||||||||||||

| Selected Per Share Data | ||||||||||||||||||||||||||

| Net asset value, beginning of period | $ | 80.05 | $ | 72.05 | $ | 72.29 | $ | 79.94 | $ | 71.12 | $ | 61.32 | ||||||||||||||

| Income (loss) from investment operations: | ||||||||||||||||||||||||||

| Net investment income (loss)a |

.18 | .48 | .35 | .41 | .30 | .77 | ||||||||||||||||||||

| Net realized and unrealized gain (loss) |

5.49 | 13.22 | 7.53 | 3.30 | 13.41 | 9.69 | ||||||||||||||||||||

| Total from investment operations |

5.67 | 13.70 | 7.88 | 3.71 | 13.71 | 10.46 | ||||||||||||||||||||

| Less distributions from: | ||||||||||||||||||||||||||

| Net investment income |

(.54 | ) | (.36 | ) | (.40 | ) | (.32 | ) | (.41 | ) | (.66 | ) | ||||||||||||||

| Net realized gains |

(6.52 | ) | (5.34 | ) | (7.72 | ) | (11.04 | ) | (4.48 | ) | — | |||||||||||||||

| Total distributions |

(7.06 | ) | (5.70 | ) | (8.12 | ) | (11.36 | ) | (4.89 | ) | (.66 | ) | ||||||||||||||

| Net asset value, end of period | $ | 78.66 | $ | 80.05 | $ | 72.05 | $ | 72.29 | $ | 79.94 | $ | 71.12 | ||||||||||||||

| Total Return (%) | 7.20 | ** | 20.43 | 11.42 | 5.04 | 19.97 | 17.29 | |||||||||||||||||||

| Ratios to Average Net Assets and Supplemental Data | ||||||||||||||||||||||||||

| Net assets, end of period ($ millions) | 780 | 771 | 697 | 693 | 716 | 649 | ||||||||||||||||||||

| Ratio of expenses (%) | .70 | * | .71 | .71 | .71 | .72 | .75 | |||||||||||||||||||

| Ratio of net investment income (loss) (%) | .44 | * | .65 | .49 | .53 | .40 | 1.20 | |||||||||||||||||||

| Portfolio turnover rate (%) | 14 | ** | 17 | 33 | 44 | 41 | 31 | |||||||||||||||||||

| a | Based on average shares outstanding during the period. |

| * | Annualized |

| ** | Not annualized |

| 22 | Deutsche Capital Growth Fund |

Table of Contents

| Six Months Ended 3/31/18 |

Years Ended September 30, | |||||||||||||||||||||||||

| Institutional Class | (Unaudited) | 2017 | 2016 | 2015 | 2014 | 2013 | ||||||||||||||||||||

| Selected Per Share Data | ||||||||||||||||||||||||||

| Net asset value, beginning of period | $ | 79.95 | $ | 71.99 | $ | 72.24 | $ | 79.89 | $ | 71.11 | $ | 61.32 | ||||||||||||||

| Income (loss) from investment operations: | ||||||||||||||||||||||||||

| Net investment income (loss)a |

.17 | .45 | .35 | .42 | .31 | .79 | ||||||||||||||||||||

| Net realized and unrealized gain (loss) |

5.49 | 13.21 | 7.53 | 3.29 | 13.40 | 9.70 | ||||||||||||||||||||

| Total from investment operations |

5.66 | 13.66 | 7.88 | 3.71 | 13.71 | 10.49 | ||||||||||||||||||||

| Less distributions from: | ||||||||||||||||||||||||||

| Net investment income |

(.52 | ) | (.36 | ) | (.41 | ) | (.32 | ) | (.45 | ) | (.70 | ) | ||||||||||||||

| Net realized gains |

(6.52 | ) | (5.34 | ) | (7.72 | ) | (11.04 | ) | (4.48 | ) | — | |||||||||||||||

| Total distributions |

(7.04 | ) | (5.70 | ) | (8.13 | ) | (11.36 | ) | (4.93 | ) | (.70 | ) | ||||||||||||||

| Net asset value, end of period | $ | 78.57 | $ | 79.95 | $ | 71.99 | $ | 72.24 | $ | 79.89 | $ | 71.11 | ||||||||||||||

| Total Return (%) | 7.20 | ** | 20.40 | 11.42 | 5.05 | 19.98 | 17.34 | |||||||||||||||||||

| Ratios to Average Net Assets and Supplemental Data | ||||||||||||||||||||||||||

| Net assets, end of period ($ millions) | 61 | 57 | 213 | 216 | 197 | 206 | ||||||||||||||||||||

| Ratio of expenses (%) | .71 | * | .73 | .70 | .70 | .71 | .70 | |||||||||||||||||||

| Ratio of net investment income (loss) (%) | .43 | * | .63 | .50 | .54 | .40 | 1.23 | |||||||||||||||||||

| Portfolio turnover rate (%) | 14 | ** | 17 | 33 | 44 | 41 | 31 | |||||||||||||||||||

| a | Based on average shares outstanding during the period. |

| * | Annualized |

| ** | Not annualized |

| Deutsche Capital Growth Fund | 23 |

Table of Contents

| Notes to Financial Statements | (Unaudited) |

A. Organization and Significant Accounting Policies

Deutsche Capital Growth Fund (the “Fund”) is a diversified series of Deutsche Investment Trust (the “Trust”), which is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company organized as a Massachusetts business trust.

The Fund offers multiple classes of shares which provide investors with different purchase options. Class A shares are subject to an initial sales charge. Class C shares are not subject to an initial sales charge but are subject to higher ongoing expenses than Class A shares and a contingent deferred sales charge payable upon certain redemptions within one year of purchase. Class C shares do not automatically convert into another class. Class R shares and Class R6 shares are not subject to initial or contingent deferred sales charges and are generally available only to certain retirement plans. Class S shares are not subject to initial or contingent deferred sales charges and are only available to a limited group of investors. Institutional Class shares are not subject to initial or contingent deferred sales charges and are generally available only to qualified institutions.

Investment income, realized and unrealized gains and losses, and certain fund-level expenses and expense reductions, if any, are borne pro rata on the basis of relative net assets by the holders of all classes of shares, except that each class bears certain expenses unique to that class such as distribution and service fees, services to shareholders and certain other class-specific expenses. Differences in class-level expenses may result in payment of different per share dividends by class. All shares of the Fund have equal rights with respect to voting subject to class-specific arrangements.

The Fund’s financial statements are prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) which require the use of management estimates. Actual results could differ from those estimates. The Fund qualifies as an investment company under Topic 946 of Accounting Standards Codification of U.S. GAAP. The policies described below are followed consistently by the Fund in the preparation of its financial statements.

Security Valuation. Investments are stated at value determined as of the close of regular trading on the New York Stock Exchange on each day the exchange is open for trading.

| 24 | Deutsche Capital Growth Fund |

Table of Contents

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in three broad levels. Level 1 includes quoted prices in active markets for identical securities. Level 2 includes other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds and credit risk). Level 3 includes significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments). The level assigned to the securities valuations may not be an indication of the risk or liquidity associated with investing in those securities.

Equity securities are valued at the most recent sale price or official closing price reported on the exchange (U.S. or foreign) or over-the-counter market on which they trade. Securities for which no sales are reported are valued at the calculated mean between the most recent bid and asked quotations on the relevant market or, if a mean cannot be determined, at the most recent bid quotation. Equity securities are generally categorized as Level 1.

Investments in open-end investment companies are valued at their net asset value each business day and are categorized as Level 1.

Securities and other assets for which market quotations are not readily available or for which the above valuation procedures are deemed not to reflect fair value are valued in a manner that is intended to reflect their fair value as determined in accordance with procedures approved by the Board and are generally categorized as Level 3. In accordance with the Fund’s valuation procedures, factors considered in determining value may include, but are not limited to, the type of the security; the size of the holding; the initial cost of the security; the existence of any contractual restrictions on the security’s disposition; the price and extent of public trading in similar securities of the issuer or of comparable companies; quotations or evaluated prices from broker-dealers and/or pricing services; information obtained from the issuer; analysts, and/or the appropriate stock exchange (for exchange-traded securities); an analysis of the company’s or issuer’s financial statements; an evaluation of the forces that influence the issuer and the market(s) in which the security is purchased and sold; and with respect to debt securities, the maturity, coupon, creditworthiness, currency denomination, and the movement of the market in which the security is normally traded. The value determined under these procedures may differ from published values for the same securities.

Disclosure about the classification of fair value measurements is included in a table following the Fund’s Investment Portfolio.

Securities Lending. Deutsche Bank AG as lending agent lends securities of the Fund to certain financial institutions under the terms of its

| Deutsche Capital Growth Fund | 25 |

Table of Contents

securities lending agreement. During the term of the loans, the Fund continues to receive interest and dividends generated by the securities and to participate in any changes in their market value. The Fund requires the borrowers of the securities to maintain collateral with the Fund consisting of either cash or liquid, unencumbered assets having a value at least equal to the value of the securities loaned. When the collateral falls below specified amounts, the lending agent will use its best effort to obtain additional collateral on the next business day to meet required amounts under the securities lending agreement. As of period end, any securities on loan were collateralized by cash. During the six months ended March 31, 2018, the Fund invested the cash collateral into a joint trading account in affiliated money market funds, including Deutsche Government & Agency Securities Portfolio, managed by Deutsche Investment Management Americas Inc. Deutsche Investment Management Americas Inc. receives a management/administration fee (0.14% annualized effective rate as of March 31, 2018) on the cash collateral invested in Deutsche Government & Agency Securities Portfolio. The Fund receives compensation for lending its securities either in the form of fees or by earning interest on invested cash collateral net of borrower rebates and fees paid to a lending agent. Either the Fund or the borrower may terminate the loan at any time, and the borrower, after notice, is required to return borrowed securities within a standard time period. There may be risks of delay and costs in recovery of securities or even loss of rights in the collateral should the borrower of the securities fail financially. If the Fund is not able to recover securities lent, the Fund may sell the collateral and purchase a replacement investment in the market, incurring the risk that the value of the replacement security is greater than the value of the collateral. The Fund is also subject to all investment risks associated with the reinvestment of any cash collateral received, including, but not limited to, interest rate, credit and liquidity risk associated with such investments.

As of March 31, 2018, the Fund had no securities on loan.

Federal Income Taxes. The Fund’s policy is to comply with the requirements of the Internal Revenue Code, as amended, which are applicable to regulated investment companies, and to distribute all of its taxable income to its shareholders.

At September 30, 2017, the aggregate cost of investments for federal income tax purposes was $846,041,905. The net unrealized appreciation for all investments based on tax cost was $635,869,994. This consisted of aggregate gross unrealized appreciation for all investments in which there was an excess of value over tax cost of $657,832,566 and aggregate gross unrealized depreciation for all investments in which there was an excess of tax cost over value of $21,962,572.

| 26 | Deutsche Capital Growth Fund |

Table of Contents

The Fund has reviewed the tax positions for the open tax years as of September 30, 2017 and has determined that no provision for income tax and/or uncertain tax positions is required in the Fund’s financial statements. The Fund’s federal tax returns for the prior three fiscal years remain open subject to examination by the Internal Revenue Service.

Distribution of Income and Gains. Distributions from net investment income of the Fund, if any, are declared and distributed to shareholders annually. Net realized gains from investment transactions, in excess of available capital loss carryforwards, would be taxable to the Fund if not distributed, and, therefore, will be distributed to shareholders at least annually. The Fund may also make additional distributions for tax purposes if necessary.

The timing and characterization of certain income and capital gain distributions are determined annually in accordance with federal tax regulations which may differ from accounting principles generally accepted in the United States of America. These differences primarily relate to certain securities sold at a loss. As a result, net investment income (loss) and net realized gain (loss) on investment transactions for a reporting period may differ significantly from distributions during such period. Accordingly, the Fund may periodically make reclassifications among certain of its capital accounts without impacting the net asset value of the Fund.

The tax character of current year distributions will be determined at the end of the current fiscal year.

Expenses. Expenses of the Trust arising in connection with a specific fund are allocated to that fund. Other Trust expenses which cannot be directly attributed to a fund are apportioned among the funds in the Trust based upon the relative net assets or other appropriate measures.

Contingencies. In the normal course of business, the Fund may enter into contracts with service providers that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet been made. However, based on experience, the Fund expects the risk of loss to be remote.

Other. Investment transactions are accounted for on a trade date plus one basis for daily net asset value calculations. However, for financial reporting purposes, investment transactions are reported on trade date. Interest income is recorded on the accrual basis. Dividend income is recorded on the ex-dividend date net of foreign withholding taxes. Realized gains and losses from investment transactions are recorded on an identified cost basis. Proceeds from litigation payments, if any, are included in net realized gain (loss) from investments.

| Deutsche Capital Growth Fund | 27 |

Table of Contents

B. Purchases and Sales of Securities

During the six months ended March 31, 2018, purchases and sales of investment securities (excluding short-term investments) aggregated $204,267,755 and $292,965,064, respectively.

C. Related Parties

Management Agreement. Under the Investment Management Agreement with Deutsche Investment Management Americas Inc. (“DIMA” or the “Advisor”), an indirect, wholly owned subsidiary of DWS Group Gmbh & Co. KGaA (“DWS Group”), the Advisor directs the investments of the Fund in accordance with its investment objectives, policies and restrictions. The Advisor determines the securities, instruments and other contracts relating to investments to be purchased, sold or entered into by the Fund.

Under the Investment Management Agreement with the Advisor, the Fund pays a monthly management fee based on the Fund’s average daily net assets, computed and accrued daily and payable monthly, at the following annual rates:

| First $250 million of the Fund’s average daily net assets | .495% | |||

| Next $750 million of such net assets | .465% | |||

| Next $1.5 billion of such net assets | .445% | |||

| Next $2.5 billion of such net assets | .425% | |||

| Next $2.5 billion of such net assets | .395% | |||

| Next $2.5 billion of such net assets | .375% | |||

| Next $2.5 billion of such net assets | .355% | |||

| Over $12.5 billion of such net assets | .335% |

Accordingly, for the six months ended March 31, 2018, the fee pursuant to the Investment Management Agreement was equivalent to an annualized rate (exclusive of any applicable waivers/reimbursements) of 0.46% of the Fund’s average daily net assets.

For the period from October 1, 2017 through September 30, 2018, the Advisor has contractually agreed to waive its fees and/or reimburse certain operating expenses of the Fund to the extent necessary to maintain the total annual operating expenses (excluding certain expenses such as extraordinary expenses, taxes, brokerage and interest) of each class as follows:

| Class A | 1.20% | |||

| Class C | 1.95% | |||

| Class R | 1.45% | |||

| Class R6 | .95% | |||

| Class S | .95% | |||

| Institutional Class | .95% |

| 28 | Deutsche Capital Growth Fund |

Table of Contents

Administration Fee. Pursuant to an Administrative Services Agreement, DIMA provides most administrative services to the Fund. For all services provided under the Administrative Services Agreement, the Fund pays the Advisor an annual fee (“Administration Fee”) of 0.10% of the Fund’s average daily net assets, computed and accrued daily and payable monthly. For the six months ended March 31, 2018, the Administration Fee was $754,694, of which $129,126 is unpaid.

Service Provider Fees. DWS Service Company (“DSC”), an affiliate of the Advisor, is the transfer agent, dividend-paying agent and shareholder service agent of the Fund. Pursuant to a sub-transfer agency agreement between DSC and DST Systems, Inc. (“DST”), DSC has delegated certain transfer agent, dividend-paying agent and shareholder service agent functions to DST. DSC compensates DST out of the shareholder servicing fee it receives from the Fund. For the six months ended March 31, 2018, the amounts charged to the Fund by DSC were as follows:

| Services to Shareholders | Total Aggregated |

Unpaid at March 31, 2018 |

||||||

| Class A | $ | 161,110 | $ | 69,026 | ||||

| Class C | 4,462 | 1,840 | ||||||

| Class R | 2,106 | 2,106 | ||||||

| Class R6 | 89 | — | ||||||

| Class S | 214,558 | 83,116 | ||||||

| Institutional Class | 3,642 | 3,642 | ||||||

| $ | 385,967 | $ | 159,730 | |||||

Distribution and Service Fees. Under the Fund’s Class C and R 12b-1 Plans, DWS Distributors, Inc. (“DDI”), an affiliate of the Advisor, receives a fee (“Distribution Fee”) of 0.75% of average daily net assets of Class C shares and 0.25% of the average daily net assets of Class R shares. In accordance with the Fund’s Underwriting and Distribution Service Agreement, DDI enters into related selling group agreements with various firms at various rates for sales of Class C and R shares. For the six months ended March 31, 2018, the Distribution Fee was as follows:

| Distribution Fee | Total Aggregated |

Unpaid at March 31, 2018 |

||||||

| Class C | $ | 83,365 | $ | 13,652 | ||||

| Class R | 10,703 | 1,829 | ||||||

| $ | 94,068 | $ | 15,481 | |||||

In addition, DDI provides information and administrative services for a fee (“Service Fee”) to Class A, C and R shareholders at an annual rate of up to 0.25% of average daily net assets for each such class. DDI in turn has

| Deutsche Capital Growth Fund | 29 |

Table of Contents

various agreements with financial services firms that provide these services and pays these fees based upon the assets of shareholder accounts the firms service. For the six months ended March 31, 2018, the Service Fee was as follows:

| Service Fee | Total Aggregated |

Unpaid at March 31, 2018 |

Annualized Rate |

|||||||||

| Class A | $ | 715,200 | $ | 235,786 | .23 | % | ||||||

| Class C | 27,763 | 8,616 | .25 | % | ||||||||

| Class R | 10,681 | 3,411 | .25 | % | ||||||||

| $ | 753,644 | $ | 247,813 | |||||||||

Underwriting Agreement and Contingent Deferred Sales Charge. DDI is the principal underwriter for the Fund. Underwriting commissions paid in connection with the distribution of Class A shares for the six months ended March 31, 2018 aggregated $32,111.

In addition, DDI receives any contingent deferred sales charge (“CDSC”) from Class C share redemptions occurring within one year of purchase. There is no such charge upon redemption of any share appreciation or reinvested dividends. The CDSC is 1% of the value of the shares redeemed for Class C. For the six months ended March 31, 2018, the CDSC for Class C shares aggregated $164. A deferred sales charge of up to 1% is assessed on certain redemptions of Class A shares. For the six months ended March 31, 2018, DDI received $1,110 for Class A shares.

Typesetting and Filing Service Fees. Under an agreement with DIMA, DIMA is compensated for providing certain pre-press and regulatory filing services to the Fund. For the six months ended March 31, 2018, the amount charged to the Fund by DIMA included in the Statement of Operations under “Reports to shareholders” aggregated $8,918, of which $8,620 is unpaid.

Trustees’ Fees and Expenses. The Fund paid retainer fees to each Trustee not affiliated with the Advisor, plus specified amounts to the Board Chairperson and Vice Chairperson and to each committee Chairperson.

Affiliated Cash Management Vehicles. The Fund may invest uninvested cash balances in Deutsche Central Cash Management Government Fund and Deutsche Variable NAV Money Fund, affiliated money market funds which are managed by the Advisor. Each affiliated money market fund is managed in accordance with Rule 2a-7 under the 1940 Act, which governs the quality, maturity, diversity and liquidity of instruments in which a money market fund may invest. Deutsche Central Cash Management Government Fund seeks to maintain a stable net asset value, and Deutsche Variable NAV Money Fund maintains a floating net asset value. The Fund indirectly bears its proportionate share of the

| 30 | Deutsche Capital Growth Fund |

Table of Contents

expenses of each affiliated money market fund in which it invests. Deutsche Central Cash Management Government Fund does not pay the Advisor an investment management fee. To the extent that Deutsche Variable NAV Money Fund pays an investment management fee to the Advisor, the Advisor will waive an amount of the investment management fee payable to the Advisor by the Fund equal to the amount of the investment management fee payable on the Fund’s assets invested in Deutsche Variable NAV Money Fund.

Security Lending Fees. Deutsche Bank AG serves as lending agent for the Fund. For the six months ended March 31, 2018, the Fund incurred lending agent fees to Deutsche Bank AG for the amount of $190.

D. Line of Credit

The Fund and other affiliated funds (the “Participants”) share in a $400 million revolving credit facility provided by a syndication of banks. The Fund may borrow for temporary or emergency purposes, including the meeting of redemption requests that otherwise might require the untimely disposition of securities. The Participants are charged an annual commitment fee, which is allocated based on net assets, among each of the Participants. Interest is calculated at a rate per annum equal to the sum of the Federal Funds Rate plus 1.25 percent plus if the one-month LIBOR exceeds the Federal Funds Rate, the amount of such excess. The Fund may borrow up to a maximum of 33 percent of its net assets under the agreement. The Fund had no outstanding loans at March 31, 2018.

E. Fund Share Transactions

The following table summarizes share and dollar activity in the Fund:

| Six Months Ended March 31, 2018 | Year Ended September 30, 2017 | |||||||||||||||||||||||||||||||

| Shares | Dollars | Shares | Dollars | |||||||||||||||||||||||||||||

| Shares sold | ||||||||||||||||||||||||||||||||

| Class A | 125,516 | $ | 10,031,224 | 384,904 | $ | 28,068,690 | ||||||||||||||||||||||||||

| Class C | 22,205 | 1,552,667 | 39,923 | 2,543,151 | ||||||||||||||||||||||||||||

| Class R | 8,061 | 629,274 | 78,666 | 5,669,439 | ||||||||||||||||||||||||||||

| Class R6 | 9,215 | 748,115 | 8,726 | 677,691 | ||||||||||||||||||||||||||||

| Class S | 154,504 | 12,413,925 | 615,162 | 44,963,192 | ||||||||||||||||||||||||||||

| Institutional Class | 99,297 | 7,998,031 | 381,515 | 27,460,440 | ||||||||||||||||||||||||||||

| $ | 33,373,236 | $ | 109,382,603 | |||||||||||||||||||||||||||||

| Deutsche Capital Growth Fund | 31 |

Table of Contents

| Six Months Ended March 31, 2018 | Year Ended September 30, 2017 | |||||||||||||||||||||||||||||||

| Shares | Dollars | Shares | Dollars | |||||||||||||||||||||||||||||

| Shares issued to shareholders in reinvestment of distributions | ||||||||||||||||||||||||||||||||

| Class A | 635,030 | $ | 48,827,472 | 611,258 | $ | 41,162,119 | ||||||||||||||||||||||||||

| Class C | 26,591 | 1,767,738 | 27,585 | 1,633,880 | ||||||||||||||||||||||||||||

| Class R | 6,823 | 518,008 | 7,353 | 489,490 | ||||||||||||||||||||||||||||

| Class R6 | 911 | 70,412 | 331 | 22,407 | ||||||||||||||||||||||||||||

| Class S | 812,622 | 63,059,425 | 754,183 | 51,216,597 | ||||||||||||||||||||||||||||

| Institutional Class | 60,455 | 4,685,237 | 230,377 | 15,628,796 | ||||||||||||||||||||||||||||

| $ | 118,928,292 | $ | 110,153,289 | |||||||||||||||||||||||||||||

| Shares redeemed | ||||||||||||||||||||||||||||||||

| Class A | (565,188 | ) | $ | (45,254,171 | ) | (1,369,352 | ) | $ | (98,837,168 | ) | ||||||||||||||||||||||

| Class C | (65,315 | ) | (4,553,337 | ) | (159,521 | ) | (10,131,044 | ) | ||||||||||||||||||||||||

| Class R | (16,712 | ) | (1,323,952 | ) | (67,154 | ) | (4,822,299 | ) | ||||||||||||||||||||||||

| Class R6 | (3,101 | ) | (253,664 | ) | (948 | ) | (73,174 | ) | ||||||||||||||||||||||||

| Class S | (691,900 | ) | (55,919,994 | ) | (1,407,764 | ) | (102,799,136 | ) | ||||||||||||||||||||||||

| Institutional Class | (102,229 | ) | (8,281,225 | ) | (2,861,718 | ) | (206,712,895 | ) | ||||||||||||||||||||||||

| $ | (115,586,343 | ) | $ | (423,375,716 | ) | |||||||||||||||||||||||||||

| Net increase (decrease) | ||||||||||||||||||||||||||||||||

| Class A | 195,358 | $ | 13,604,525 | (373,190 | ) | $ | (29,606,359 | ) | ||||||||||||||||||||||||

| Class C | (16,519 | ) | (1,232,932 | ) | (92,013 | ) | (5,954,013 | ) | ||||||||||||||||||||||||

| Class R | (1,828 | ) | (176,670 | ) | 18,865 | 1,336,630 | ||||||||||||||||||||||||||

| Class R6 | 7,025 | 564,863 | 8,109 | 626,923 | ||||||||||||||||||||||||||||

| Class S | 275,226 | 19,553,356 | (38,419 | ) | (6,619,346 | ) | ||||||||||||||||||||||||||

| Institutional Class | 57,523 | 4,402,043 | (2,249,826 | ) | (163,623,659 | ) | ||||||||||||||||||||||||||

| $ | 36,715,185 | $ | (203,839,824 | ) | ||||||||||||||||||||||||||||

F. Name Changes

In connection with adoption of the DWS brand, effective on or about July 2, 2018, Deutsche Investment Management Americas Inc., the Advisor, will be renamed to DWS Investment Management Americas, Inc. In addition, the “Deutsche Funds” will become known as the “DWS Funds.” As a result, Deutsche Capital Growth Fund will be renamed DWS Capital Growth Fund.

| 32 | Deutsche Capital Growth Fund |

Table of Contents

Information About Your Fund’s Expenses

As an investor of the Fund, you incur two types of costs: ongoing expenses and transaction costs. Ongoing expenses include management fees, distribution and service (12b-1) fees and other Fund expenses. Examples of transaction costs include sales charges (loads) and account maintenance fees, which are not shown in this section. The following table is intended to help you understand your ongoing expenses (in dollars) of investing in the Fund and to help you compare these expenses with the ongoing expenses of investing in other mutual funds. The example in the table is based on an investment of $1,000 invested at the beginning of the six-month period and held for the entire period (October 1, 2017 to March 31, 2018).

The tables illustrate your Fund’s expenses in two ways:

| – | Actual Fund Return. This helps you estimate the actual dollar amount of ongoing expenses (but not transaction costs) paid on a $1,000 investment in the Fund using the Fund’s actual return during the period. To estimate the expenses you paid over the period, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the “Expenses Paid per $1,000” line under the share class you hold. |

| – | Hypothetical 5% Fund Return. This helps you to compare your Fund’s ongoing expenses (but not transaction costs) with those of other mutual funds using the Fund’s actual expense ratio and a hypothetical rate of return of 5% per year before expenses. Examples using a 5% hypothetical fund return may be found in the shareholder reports of other mutual funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. |

Please note that the expenses shown in these tables are meant to highlight your ongoing expenses only and do not reflect any transaction costs. The “Expenses Paid per $1,000” line of the tables is useful in comparing ongoing expenses only and will not help you determine the relative total expense of owning different funds. Subject to certain exceptions, an account maintenance fee of $20.00 assessed once per calendar year for Classes A, C and S shares may apply for accounts with balances less than $10,000. This fee is not included in these tables. If it was, the estimate of expenses paid for Classes A, C and S shares during the period would be higher, and account value during the period would be lower, by this amount.

| Deutsche Capital Growth Fund | 33 |

Table of Contents

| Expenses and Value of a $1,000 Investment for the six months ended March 31, 2018 (Unaudited) |

||||||||||||||||||||||||

| Actual Fund Return | Class A | Class C | Class R | Class R6 | Class S | Institutional Class |

||||||||||||||||||

| Beginning Account Value 10/1/17 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | ||||||||||||

| Ending Account Value 3/31/18 | $ | 1,070.70 | $ | 1,066.20 | $ | 1,068.40 | $ | 1,072.40 | $ | 1,072.00 | $ | 1,072.00 | ||||||||||||

| Expenses Paid per $1,000* | $ | 4.90 | $ | 9.12 | $ | 7.06 | $ | 3.26 | $ | 3.62 | $ | 3.67 | ||||||||||||

| Hypothetical 5% Fund Return |

Class A | Class C | Class R | Class R6 | Class S | Institutional Class |

||||||||||||||||||

| Beginning Account Value 10/1/17 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | ||||||||||||

| Ending Account Value 3/31/18 | $ | 1,020.19 | $ | 1,016.11 | $ | 1,018.10 | $ | 1,021.79 | $ | 1,021.44 | $ | 1,021.39 | ||||||||||||

| Expenses Paid per $1,000* | $ | 4.78 | $ | 8.90 | $ | 6.89 | $ | 3.18 | $ | 3.53 | $ | 3.58 | ||||||||||||

| * | Expenses are equal to the Fund’s annualized expense ratio for each share class, multiplied by the average account value over the period, multiplied by 182 (the number of days in the most recent six-month period), then divided by 365. |

| Annualized Expense Ratios | Class A | Class C | Class R | Class R6 | Class S | Institutional Class |

||||||||||||||||||

| Deutsche Capital Growth Fund | .95 | % | 1.77 | % | 1.37 | % | .63 | % | .70 | % | .71 | % | ||||||||||||

For more information, please refer to the Fund’s prospectus.

For an analysis of the fees associated with an investment in the Fund or similar funds, please refer to http://apps.finra.org/fundanalyzer/1/fa.aspx.

| 34 | Deutsche Capital Growth Fund |

Table of Contents

Advisory Agreement Board Considerations and Fee Evaluation

The Board of Trustees (hereinafter referred to as the “Board” or “Trustees”) approved the renewal of Deutsche Capital Growth Fund’s (the “Fund”) investment management agreement (the “Agreement”) with Deutsche Investment Management Americas Inc. (“DIMA”) in September 2017.

In terms of the process that the Board followed prior to approving the Agreement, shareholders should know that:

| – | During the entire process, all of the Fund’s Trustees were independent of DIMA and its affiliates (the “Independent Trustees”). |

| – | The Board met frequently during the past year to discuss fund matters and dedicated a substantial amount of time to contract review matters. Over the course of several months, the Board’s Contract Committee reviewed extensive materials received from DIMA, independent third parties and independent counsel. These materials included an analysis of the Fund’s performance, fees and expenses, and profitability from a fee consultant retained by the Fund’s Independent Trustees (the “Fee Consultant”). Based on its evaluation of the information provided, the Contract Committee presented its findings and recommendations to the Board. The Board then reviewed the Contract Committee’s findings and recommendations. |

| – | The Board also received extensive information throughout the year regarding performance of the Fund. |

| – | The Independent Trustees regularly met privately with counsel to discuss contract review and other matters. In addition, the Independent Trustees were advised by the Fee Consultant in the course of their review of the Fund’s contractual arrangements and considered a comprehensive report prepared by the Fee Consultant in connection with their deliberations. |

In connection with reviewing the Agreement, the Board also reviewed the terms of the Fund’s Rule 12b-1 plan, distribution agreement, administrative services agreement, transfer agency agreement and other material service agreements.

In connection with the contract review process, the Contract Committee and the Board considered the factors discussed below, among others. The Board also considered that DIMA and its predecessors have managed the Fund since its inception, and the Board believes that a long-term relationship with a capable, conscientious advisor is in the best interests

| Deutsche Capital Growth Fund | 35 |

Table of Contents

of the Fund. The Board considered, generally, that shareholders chose to invest or remain invested in the Fund knowing that DIMA managed the Fund, and that the Agreement was approved by the Fund’s shareholders. DIMA is part of Deutsche Bank AG’s (“Deutsche Bank”) Asset Management (“Deutsche AM”) division. Deutsche AM is a global asset management business that offers a wide range of investing expertise and resources, including research capabilities in many countries throughout the world.

As part of the contract review process, the Board carefully considered the fees and expenses of each Deutsche fund overseen by the Board in light of the fund’s performance. In many cases, this led to the negotiation and implementation of expense caps. As part of these negotiations, the Board indicated that it would consider relaxing these caps in future years following sustained improvements in performance, among other considerations.

While shareholders may focus primarily on fund performance and fees, the Fund’s Board considers these and many other factors, including the quality and integrity of DIMA’s personnel and administrative support services provided by DIMA, such as back-office operations, fund valuations, and compliance policies and procedures.

Nature, Quality and Extent of Services. The Board considered the terms of the Agreement, including the scope of advisory services provided under the Agreement. The Board noted that, under the Agreement, DIMA provides portfolio management services to the Fund and that, pursuant to a separate administrative services agreement, DIMA provides administrative services to the Fund. The Board considered the experience and skills of senior management and investment personnel and the resources made available to such personnel. The Board reviewed the Fund’s performance over short-term and long-term periods and compared those returns to various agreed-upon performance measures, including market index(es) and a peer universe compiled using information supplied by Morningstar Direct (“Morningstar”), an independent fund data service. The Board also noted that it has put into place a process of identifying “Funds in Review” (e.g., funds performing poorly relative to a peer universe), and receives additional reporting from DIMA regarding such funds and, where appropriate, DIMA’s plans to address underperformance. The Board believes this process is an effective manner of identifying and addressing underperforming funds. Based on the information provided, the Board noted that, for the one-, three- and five-year periods ended December 31, 2016, the Fund’s performance (Class A shares) was in the 2nd quartile, 1st quartile and 1st quartile, respectively, of the applicable Morningstar universe (the 1st quartile being the best performers and the 4th quartile being the worst performers). The Board also observed that the Fund has underperformed its benchmark in the one-, three- and five-year periods ended December 31, 2016.

| 36 | Deutsche Capital Growth Fund |

Table of Contents