UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM N-CSRS

Investment Company Act file number: 811-00043

DWS Investment Trust

(Exact Name of Registrant as Specified in Charter)

345 Park Avenue

New York, NY 10154-0004

(Address of Principal Executive Offices) (Zip Code)

Registrant’s Telephone Number, including Area Code: (212) 250-3220

Paul Schubert

60 Wall Street

New York, NY 10005

(Name and Address of Agent for Service)

|

Date of fiscal year end:

|

7/31

|

|

Date of reporting period:

|

1/31/2014

|

|

ITEM 1.

|

REPORT TO STOCKHOLDERS

|

January 31, 2014

Semiannual Report

to Shareholders

DWS Large Cap Focus Growth Fund

Contents

|

3 Letter to Shareholders

4 Performance Summary

7 Portfolio Management Team

8 Portfolio Summary

10 Investment Portfolio

14 Statement of Assets and Liabilities

16 Statement of Operations

17 Statement of Changes in Net Assets

18 Financial Highlights

23 Notes to Financial Statements

33 Information About Your Fund's Expenses

35 Advisory Agreement Board Considerations and Fee Evaluation

40 Account Management Resources

42 Privacy Statement

|

This report must be preceded or accompanied by a prospectus. To obtain a summary prospectus, if available, or prospectus for any of our funds, refer to the Account Management Resources information provided in the back of this booklet. We advise you to consider the fund's objectives, risks, charges and expenses carefully before investing. The summary prospectus and prospectus contain this and other important information about the fund. Please read the prospectus carefully before you invest.

The fund may lend securities to approved institutions. Stocks may decline in value. See the prospectus for details.

Deutsche Asset & Wealth Management represents the asset management and wealth management activities conducted by Deutsche Bank AG or any of its subsidiaries, including the Advisor and DWS Investments Distributors, Inc.

NOT FDIC/NCUA INSURED NO BANK GUARANTEE MAY LOSE VALUE NOT A DEPOSIT NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Dear Shareholder:

Having recently joined Deutsche Asset & Wealth Management as president of the DWS funds and head of Fund Administration, I'd like to take this opportunity to introduce myself. I come with 20 years of experience in asset management and the mutual fund industry. My job is to work closely with your fund board to ensure optimal oversight of the DWS funds' management and operations. I look forward to serving in this role on your behalf.

As for the economy, experts seem to agree that both the U.S. and global economies are recovering. Interest rates, while destined to rise to a level more in line with historical "normal" at some point, will likely remain relatively low for the foreseeable future. The stock markets continue to demonstrate strength as housing rebounds, American manufacturing strengthens, the U.S. budget deficit improves and unemployment continues to move lower. However, uncertainty persists regarding the pace of the recovery, the eventual tapering of government bond purchases, the potential for further political gridlock around the fiscal impasse and lingering effects of the financial crisis. All this uncertainty may well contribute to volatility in both the bond and stock markets.

It may help to remember that market fluctuations are not unusual. However, significant market swings may also reflect behavior that is driven more by investor emotion than any fundamental factors relating to the securities in question. If volatility is making you nervous, it may be time to review your investments. A trusted financial advisor can help you determine if a strategy change is appropriate and identify risk management strategies that serve your specific goals and situation.

Best regards,

Brian Binder

President, DWS Funds

|

Class A

|

6-Month‡

|

1-Year

|

5-Year

|

10-Year

|

|

Average Annual Total Returns as of 1/31/14

|

||||

|

Unadjusted for Sales Charge

|

11.14%

|

22.58%

|

15.94%

|

6.10%

|

|

Adjusted for the Maximum Sales Charge (max 5.75% load)

|

4.75%

|

15.53%

|

14.57%

|

5.47%

|

|

Russell 1000® Growth Index†

|

10.15%

|

24.35%

|

20.88%

|

7.30%

|

|

Average Annual Total Returns as of 12/31/13 (most recent calendar quarter end)

|

||||

|

Unadjusted for Sales Charge

|

30.14%

|

15.82%

|

6.56%

|

|

|

Adjusted for the Maximum Sales Charge (max 5.75% load)

|

22.66%

|

14.46%

|

5.94%

|

|

|

Russell 1000® Growth Index†

|

33.48%

|

20.39%

|

7.83%

|

|

|

Class B

|

6-Month‡

|

1-Year

|

5-Year

|

10-Year

|

|

Average Annual Total Returns as of 1/31/14

|

||||

|

Unadjusted for Sales Charge

|

10.75%

|

21.68%

|

15.03%

|

5.28%

|

|

Adjusted for the Maximum Sales Charge (max 4.00% CDSC)

|

6.75%

|

18.68%

|

14.92%

|

5.28%

|

|

Russell 1000® Growth Index†

|

10.15%

|

24.35%

|

20.88%

|

7.30%

|

|

Average Annual Total Returns as of 12/31/13 (most recent calendar quarter end)

|

||||

|

Unadjusted for Sales Charge

|

29.17%

|

14.91%

|

5.75%

|

|

|

Adjusted for the Maximum Sales Charge (max 4.00% CDSC)

|

26.17%

|

14.80%

|

5.75%

|

|

|

Russell 1000® Growth Index†

|

33.48%

|

20.39%

|

7.83%

|

|

|

Class C

|

6-Month‡

|

1-Year

|

5-Year

|

10-Year

|

|

Average Annual Total Returns as of 1/31/14

|

||||

|

Unadjusted for Sales Charge

|

10.75%

|

21.68%

|

15.09%

|

5.31%

|

|

Adjusted for the Maximum Sales Charge (max 1.00% CDSC)

|

9.75%

|

21.68%

|

15.09%

|

5.31%

|

|

Russell 1000® Growth Index†

|

10.15%

|

24.35%

|

20.88%

|

7.30%

|

|

Average Annual Total Returns as of 12/31/13 (most recent calendar quarter end)

|

||||

|

Unadjusted for Sales Charge

|

29.17%

|

14.98%

|

5.77%

|

|

|

Adjusted for the Maximum Sales Charge (max 1.00% CDSC)

|

29.17%

|

14.98%

|

5.77%

|

|

|

Russell 1000® Growth Index†

|

33.48%

|

20.39%

|

7.83%

|

|

|

Class S

|

6-Month‡

|

1-Year

|

5-Year

|

10-Year

|

|

Average Annual Total Returns as of 1/31/14

|

||||

|

No Sales Charges

|

11.30%

|

22.89%

|

16.20%

|

6.35%

|

|

Russell 1000® Growth Index†

|

10.15%

|

24.35%

|

20.88%

|

7.30%

|

|

Average Annual Total Returns as of 12/31/13 (most recent calendar quarter end)

|

||||

|

No Sales Charges

|

30.44%

|

16.08%

|

6.82%

|

|

|

Russell 1000® Growth Index†

|

33.48%

|

20.39%

|

7.83%

|

|

|

Institutional Class

|

6-Month‡

|

1-Year

|

5-Year

|

10-Year

|

|

Average Annual Total Returns as of 1/31/14

|

||||

|

No Sales Charges

|

11.39%

|

22.99%

|

16.36%

|

6.53%

|

|

Russell 1000® Growth Index†

|

10.15%

|

24.35%

|

20.88%

|

7.30%

|

|

Average Annual Total Returns as of 12/31/13 (most recent calendar quarter end)

|

||||

|

No Sales Charges

|

30.49%

|

16.25%

|

7.00%

|

|

|

Russell 1000® Growth Index†

|

33.48%

|

20.39%

|

7.83%

|

|

Performance in the Average Annual Total Returns table above and the Growth of an Assumed $10,000 Investment line graph that follows is historical and does not guarantee future results. Investment return and principal fluctuate, so your shares may be worth more or less when redeemed. Current performance may differ from performance data shown. Please visit dws-investments.com for the Fund's most recent month-end performance. Fund performance includes reinvestment of all distributions. Unadjusted returns do not reflect sales charges and would have been lower if they had.

The gross expense ratios of the Fund, as stated in the fee table of the prospectus dated December 1, 2013 are 1.26%, 2.14%, 1.99%, 1.02% and 0.96% for Class A, Class B, Class C, Class S and Institutional Class shares, respectively, and may differ from the expense ratios disclosed in the Financial Highlights tables in this report.

Index returns do not reflect any fees or expenses and it is not possible to invest directly into an index.

Performance figures do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemptions of fund shares.

|

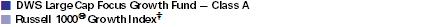

Growth of an Assumed $10,000 Investment (Adjusted for Maximum Sales Charge)

|

|

|

|

Yearly periods ended January 31

|

The Fund's growth of an assumed $10,000 investment is adjusted for the maximum sales charge of 5.75%. This results in a net initial investment of $9,425.

The growth of $10,000 is cumulative.

Performance of other share classes will vary based on the sales charges and the fee structure of those classes.

† The Russell 1000 Growth Index is an unmanaged index that consists of those stocks in the Russell 1000 Index that have higher price-to-book ratios and higher forecasted growth values. Russell 1000® Index is an unmanaged price-only index of the 1,000 largest capitalized companies that are domiciled in the U.S. and whose common stocks are traded.

‡ Total returns shown for periods less than one year are not annualized.

|

Class A

|

Class B

|

Class C

|

Class S

|

Institutional Class

|

||||||||||||||||

|

Net Asset Value

|

||||||||||||||||||||

|

1/31/14

|

$ | 40.15 | $ | 36.82 | $ | 36.95 | $ | 41.06 | $ | 41.43 | ||||||||||

|

7/31/13

|

$ | 36.55 | $ | 33.39 | $ | 33.52 | $ | 37.43 | $ | 37.74 | ||||||||||

|

Distribution Information as of 1/31/14

|

||||||||||||||||||||

|

Income Dividends, Six Months

|

$ | .47 | $ | .16 | $ | .16 | $ | .59 | $ | .60 | ||||||||||

Owen Fitzpatrick, CFA, Managing Director

Lead Manager of the fund. Began managing the fund in 2009.

— Joined Deutsche Asset & Wealth Management in 1995.

— Prior to his current role as Head of US Equity, he was Managing Director of Deutsche Bank Private Wealth Management, head of US Equity Strategy, manager of the US large cap core, value and growth portfolios, member of the US Investment Committee and head of the Equity Strategy Group.

— Previous experience includes over 21 years of experience in trust and investment management. Prior to joining Deutsche Bank, he managed an equity income fund, trust and advisory relationships for Princeton Bank & Trust Company, where he was also responsible for research coverage of the consumer cyclical sector. Previously, he served as a portfolio manager at Manufacturer's Hanover Trust Company.

— BA and MBA, Fordham University.

Brendan O'Neill, CFA, Director

Portfolio Manager of the fund. Began managing the fund in 2007.

— Joined Deutsche Asset & Wealth Management in 2000.

— Equity Research Analyst covering the financial services sector from 2001–2009.

— Previously served as a member of the Large Cap Core Equity team.

— BA, Queens College, CUNY; MS, Zicklin School of Business, Baruch College.

Thomas M. Hynes, Jr., CFA, Director

Portfolio Manager of the fund. Began managing the fund in 2010.

— Joined Deutsche Asset & Wealth Management in 1995, served in DB Private Wealth Management from 1995–2004; served as US equity portfolio manager at Citigroup Asset Management from 2004–2007; rejoined Deutsche Asset Management in 2007.

— Portfolio manager for US Large Cap Equity: New York.

— BS, Fordham University.

The views expressed reflect those of the portfolio management team only through the end of the period of the report as stated on the cover. The management team's views are subject to change at any time based on market and other conditions and should not be construed as a recommendation. Past performance is no guarantee of future results. Current and future portfolio holdings are subject to risk.

|

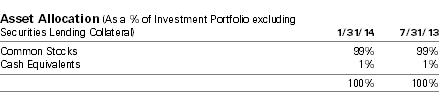

Ten Largest Equity Holdings at January 31, 2014 (41.6% of Net Assets)

|

|

|

1. Google, Inc.

Provides a Web-based search engine for the Internet

|

8.7%

|

|

2. NIKE, Inc.

Designs, develops and markets athletic footwear, apparel, equipment and accessory products

|

4.9%

|

|

3. Visa, Inc.

Operates a retail electronic payments network and manages global financial services

|

4.8%

|

|

4. Comcast Corp.

Developer, manager and operator of hybrid fiber-coaxial broadband cable communications networks

|

4.6%

|

|

5. Gilead Sciences, Inc.

Developer of nucleotide pharmaceuticals

|

4.0%

|

|

6. Parker Hannifin Corp.

Manufacturer of fluid control components

|

3.1%

|

|

7. Express Scripts Holding Co.

Operator of Web-based pharmaceutical distribution store

|

3.0%

|

|

8. Whole Foods Market, Inc.

Operator of natural food supermarket chain

|

2.9%

|

|

9. Las Vegas Sands Corp.

Owns and operates hotels in Las Vegas

|

2.8%

|

|

10. Accenture PLC

Provides management and technology consulting services and solutions

|

2.8%

|

|

Portfolio holdings and characteristics are subject to change.

|

|

|

Shares

|

Value ($)

|

|||||||

|

Common Stocks 99.5%

|

||||||||

|

Consumer Discretionary 19.9%

|

||||||||

|

Hotels, Restaurants & Leisure 5.3%

|

||||||||

|

Las Vegas Sands Corp.

|

75,121 | 5,748,259 | ||||||

|

Starwood Hotels & Resorts Worldwide, Inc.

|

70,965 | 5,301,795 | ||||||

| 11,050,054 | ||||||||

|

Media 4.6%

|

||||||||

|

Comcast Corp. "A"

|

174,009 | 9,474,790 | ||||||

|

Specialty Retail 5.0%

|

||||||||

|

Dick's Sporting Goods, Inc. (a)

|

92,009 | 4,830,473 | ||||||

|

L Brands, Inc. (a)

|

105,772 | 5,538,222 | ||||||

| 10,368,695 | ||||||||

|

Textiles, Apparel & Luxury Goods 5.0%

|

||||||||

|

NIKE, Inc. "B"

|

140,733 | 10,252,399 | ||||||

|

Consumer Staples 9.6%

|

||||||||

|

Food & Staples Retailing 5.6%

|

||||||||

|

Costco Wholesale Corp.

|

50,191 | 5,639,461 | ||||||

|

Whole Foods Market, Inc.

|

115,647 | 6,043,712 | ||||||

| 11,683,173 | ||||||||

|

Food Products 4.0%

|

||||||||

|

Hillshire Brands Co.

|

88,553 | 3,154,258 | ||||||

|

Mondelez International, Inc. "A"

|

153,190 | 5,016,972 | ||||||

| 8,171,230 | ||||||||

|

Energy 4.2%

|

||||||||

|

Energy Equipment & Services 2.5%

|

||||||||

|

Halliburton Co.

|

108,309 | 5,308,224 | ||||||

|

Oil, Gas & Consumable Fuels 1.7%

|

||||||||

|

Pioneer Natural Resources Co.

|

20,398 | 3,453,789 | ||||||

|

Financials 5.2%

|

||||||||

|

Capital Markets 3.7%

|

||||||||

|

Affiliated Managers Group, Inc.*

|

23,162 | 4,614,797 | ||||||

|

Charles Schwab Corp.

|

119,192 | 2,958,345 | ||||||

| 7,573,142 | ||||||||

|

Consumer Finance 1.5%

|

||||||||

|

Discover Financial Services

|

58,732 | 3,150,972 | ||||||

|

Health Care 16.2%

|

||||||||

|

Biotechnology 8.1%

|

||||||||

|

Celgene Corp.*

|

37,589 | 5,710,897 | ||||||

|

Gilead Sciences, Inc.*

|

101,954 | 8,222,590 | ||||||

|

Medivation, Inc.*

|

35,787 | 2,848,645 | ||||||

| 16,782,132 | ||||||||

|

Health Care Equipment & Supplies 1.1%

|

||||||||

|

CareFusion Corp.*

|

56,301 | 2,295,392 | ||||||

|

Health Care Providers & Services 5.3%

|

||||||||

|

Express Scripts Holding Co.*

|

84,340 | 6,299,355 | ||||||

|

McKesson Corp.

|

26,781 | 4,670,874 | ||||||

| 10,970,229 | ||||||||

|

Life Sciences Tools & Services 1.7%

|

||||||||

|

Thermo Fisher Scientific, Inc. (a)

|

31,064 | 3,576,709 | ||||||

|

Industrials 12.2%

|

||||||||

|

Electrical Equipment 4.8%

|

||||||||

|

AMETEK, Inc.

|

110,172 | 5,444,701 | ||||||

|

Roper Industries, Inc. (a)

|

33,076 | 4,539,350 | ||||||

| 9,984,051 | ||||||||

|

Machinery 5.0%

|

||||||||

|

Dover Corp.

|

46,471 | 4,022,530 | ||||||

|

Parker Hannifin Corp.

|

56,092 | 6,359,150 | ||||||

| 10,381,680 | ||||||||

|

Road & Rail 2.4%

|

||||||||

|

Norfolk Southern Corp.

|

52,180 | 4,831,346 | ||||||

|

Information Technology 26.7%

|

||||||||

|

Computers & Peripherals 0.9%

|

||||||||

|

Stratasys Ltd.*

|

15,581 | 1,878,445 | ||||||

|

Internet Software & Services 10.6%

|

||||||||

|

Google, Inc. "A"*

|

15,318 | 18,090,099 | ||||||

|

LinkedIn Corp. "A"*

|

18,026 | 3,879,375 | ||||||

| 21,969,474 | ||||||||

|

IT Services 7.6%

|

||||||||

|

Accenture PLC "A"

|

71,646 | 5,723,082 | ||||||

|

Visa, Inc. "A"

|

46,248 | 9,963,207 | ||||||

| 15,686,289 | ||||||||

|

Software 7.6%

|

||||||||

|

Citrix Systems, Inc.*

|

70,782 | 3,827,183 | ||||||

|

FireEye, Inc.* (a)

|

24,794 | 1,809,714 | ||||||

|

Fortinet, Inc.*

|

98,193 | 2,081,692 | ||||||

|

Intuit, Inc.

|

52,711 | 3,861,081 | ||||||

|

VMware, Inc. "A"* (a)

|

46,197 | 4,164,197 | ||||||

| 15,743,867 | ||||||||

|

Materials 4.4%

|

||||||||

|

Chemicals

|

||||||||

|

Ecolab, Inc.

|

49,652 | 4,992,012 | ||||||

|

LyondellBasell Industries NV "A"

|

51,663 | 4,068,978 | ||||||

| 9,060,990 | ||||||||

|

Telecommunication Services 0.8%

|

||||||||

|

Wireless Telecommunication Services

|

||||||||

|

Crown Castle International Corp.*

|

25,153 | 1,784,857 | ||||||

|

Utilities 0.3%

|

||||||||

|

Water Utilities

|

||||||||

|

American Water Works Co., Inc.

|

14,669 | 624,459 | ||||||

|

Total Common Stocks (Cost $157,540,857)

|

206,056,388 | |||||||

|

Securities Lending Collateral 7.9%

|

||||||||

|

Daily Assets Fund Institutional, 0.08% (b) (c) (Cost $16,405,823)

|

16,405,823 | 16,405,823 | ||||||

|

Cash Equivalents 0.7%

|

||||||||

|

Central Cash Management Fund, 0.04% (b) (Cost $1,382,001)

|

1,382,001 | 1,382,001 | ||||||

|

% of Net Assets

|

Value ($)

|

|||||||

|

Total Investment Portfolio (Cost $175,328,681)†

|

108.1 | 223,844,212 | ||||||

|

Other Assets and Liabilities, Net

|

(8.1 | ) | (16,703,095 | ) | ||||

|

Net Assets

|

100.0 | 207,141,117 | ||||||

* Non-income producing security.

† The cost for federal income tax purposes was $175,816,542. At January 31, 2014, net unrealized appreciation for all securities based on tax cost was $48,027,670. This consisted of aggregate gross unrealized appreciation for all securities in which there was an excess of value over tax cost of $51,048,915 and aggregate gross unrealized depreciation for all securities in which there was an excess of tax cost over value of $3,021,245.

(a) All or a portion of these securities were on loan. In addition, "Other Assets and Liabilities, Net" may include pending sales that are also on loan. The value of securities loaned at January 31, 2014 amounted to $16,039,187, which is 7.7% of net assets.

(b) Affiliated fund managed by Deutsche Investment Management Americas Inc. The rate shown is the annualized seven-day yield at period end.

(c) Represents collateral held in connection with securities lending. Income earned by the Fund is net of borrower rebates.

Fair Value Measurements

Various inputs are used in determining the value of the Fund's investments. These inputs are summarized in three broad levels. Level 1 includes quoted prices in active markets for identical securities. Level 2 includes other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds and credit risk). Level 3 includes significant unobservable inputs (including the Fund's own assumptions in determining the fair value of investments). The level assigned to the securities valuations may not be an indication of the risk or liquidity associated with investing in those securities.

The following is a summary of the inputs used as of January 31, 2014 in valuing the Fund's investments. For information on the Fund's policy regarding the valuation of investments, please refer to the Security Valuation section of Note A in the accompanying Notes to Financial Statements.

|

Assets

|

Level 1

|

Level 2

|

Level 3

|

Total

|

||||||||||||

|

Common Stocks (d)

|

$ | 206,056,388 | $ | — | $ | — | $ | 206,056,388 | ||||||||

|

Short-Term Investments (d)

|

17,787,824 | — | — | 17,787,824 | ||||||||||||

|

Total

|

$ | 223,844,212 | $ | — | $ | — | $ | 223,844,212 | ||||||||

There have been no transfers between fair value measurement levels during the period ended January 31, 2014.

(d) See Investment Portfolio for additional detailed categorizations.

The accompanying notes are an integral part of the financial statements.

|

as of January 31, 2014 (Unaudited)

|

||||

|

Assets

|

||||

|

Investments:

Investments in non-affiliated securities, at value (cost $157,540,857) — including $16,039,187 of securities loaned

|

$ | 206,056,388 | ||

|

Investment in Daily Assets Fund Institutional (cost $16,405,823)*

|

16,405,823 | |||

|

Investment in Central Cash Management Fund (cost $1,382,001)

|

1,382,001 | |||

|

Total investments in securities, at value (cost $175,328,681)

|

223,844,212 | |||

|

Receivable for Fund shares sold

|

116,456 | |||

|

Dividends receivable

|

4,370 | |||

|

Interest receivable

|

511 | |||

|

Other assets

|

41,523 | |||

|

Total assets

|

224,007,072 | |||

|

Liabilities

|

||||

|

Payable upon return of securities loaned

|

16,405,823 | |||

|

Payable for Fund shares redeemed

|

166,071 | |||

|

Accrued management fee

|

109,425 | |||

|

Accrued Trustees' fees

|

2,662 | |||

|

Other accrued expenses and payables

|

181,974 | |||

|

Total liabilities

|

16,865,955 | |||

|

Net assets, at value

|

$ | 207,141,117 | ||

|

Net Assets Consist of

|

||||

|

Distirbutions in excess of net investment income

|

(26,254 | ) | ||

|

Net unrealized appreciation (depreciation) on investments

|

48,515,531 | |||

|

Accumulated net realized gain (loss)

|

11,731,648 | |||

|

Paid-in capital

|

146,920,192 | |||

|

Net assets, at value

|

$ | 207,141,117 | ||

* Represents collateral on securities loaned.

The accompanying notes are an integral part of the financial statements.

|

Statement of Assets and Liabilities as of January 31, 2014 (Unaudited) (continued)

|

||||

|

Net Asset Value

|

||||

|

Class A

Net Asset Value and redemption price per share ($23,447,258 ÷ 584,064 outstanding shares of beneficial interest, $.01 par value, unlimited number of shares authorized)

|

$ | 40.15 | ||

|

Maximum offering price per share (100 ÷ 94.25 of $40.15)

|

$ | 42.60 | ||

|

Class B

Net Asset Value, offering and redemption price (subject to contingent deferred sales charge) per share ($276,513 ÷ 7,510 outstanding shares of beneficial interest, $.01 par value, unlimited number of shares authorized)

|

$ | 36.82 | ||

|

Class C

Net Asset Value, offering and redemption price (subject to contingent deferred sales charge) per share ($4,458,340 ÷ 120,647 outstanding shares of beneficial interest, $.01 par value, unlimited number of shares authorized)

|

$ | 36.95 | ||

|

Class S

Net Asset Value, offering and redemption price per share ($174,366,261 ÷ 4,246,481 outstanding shares of beneficial interest, $.01 par value, unlimited number of shares authorized)

|

$ | 41.06 | ||

|

Institutional Class

Net Asset Value, offering and redemption price per share ($4,592,745 ÷ 110,865 outstanding shares of beneficial interest, $.01 par value, unlimited number of shares authorized)

|

$ | 41.43 | ||

The accompanying notes are an integral part of the financial statements.

|

for the six months ended January 31, 2014 (Unaudited)

|

||||

|

Investment Income

|

||||

|

Income:

Dividends

|

$ | 1,052,813 | ||

|

Income distributions — Central Cash Management Fund

|

458 | |||

|

Securities lending income, including income from Daily Assets Fund Institutional, net of borrower rebates

|

2,963 | |||

|

Total income

|

1,056,234 | |||

|

Expenses:

Management fee

|

655,937 | |||

|

Administration fee

|

106,656 | |||

|

Services to shareholders

|

204,523 | |||

|

Distribution and service fees

|

51,909 | |||

|

Custodian fee

|

5,700 | |||

|

Professional fees

|

39,520 | |||

|

Reports to shareholders

|

22,400 | |||

|

Registration fees

|

24,784 | |||

|

Trustees' fees and expenses

|

4,348 | |||

|

Other

|

5,329 | |||

|

Total expenses before expense reductions

|

1,121,106 | |||

|

Expense reductions

|

(46,249 | ) | ||

|

Total expenses after expense reductions

|

1,074,857 | |||

|

Net investment income (loss)

|

(18,623 | ) | ||

|

Realized and Unrealized Gain (Loss)

|

||||

|

Net realized gain (loss) from investments

|

14,227,418 | |||

|

Change in net unrealized appreciation (depreciation) on investments

|

8,390,526 | |||

|

Net gain (loss)

|

22,617,944 | |||

|

Net increase (decrease) in net assets resulting from operations

|

$ | 22,599,321 | ||

The accompanying notes are an integral part of the financial statements.

|

Increase (Decrease) in Net Assets

|

Six Months Ended January 31, 2014 (Unaudited)

|

Year Ended July 31, 2013

|

||||||

|

Operations:

Net investment income (loss)

|

$ | (18,623 | ) | $ | 2,924,613 | |||

|

Operations:

Net investment income (loss)

|

$ | (18,623 | ) | $ | 2,924,613 | |||

|

Net realized gain (loss)

|

14,227,418 | 9,295,364 | ||||||

|

Change in net unrealized appreciation (depreciation)

|

8,390,526 | 20,029,112 | ||||||

|

Net increase (decrease) in net assets resulting from operations

|

22,599,321 | 32,249,089 | ||||||

|

Distributions to shareholders from:

Net investment income:

Class A

|

(276,035 | ) | (12,100 | ) | ||||

|

Class B

|

(1,170 | ) | — | |||||

|

Class C

|

(20,047 | ) | — | |||||

|

Class S

|

(2,561,975 | ) | (445,212 | ) | ||||

|

Institutional Class

|

(68,981 | ) | (54,528 | ) | ||||

|

Total distributions

|

(2,928,208 | ) | (511,840 | ) | ||||

|

Fund share transactions:

Proceeds from shares sold

|

6,306,539 | 14,005,112 | ||||||

|

Reinvestment of distributions

|

2,801,365 | 489,870 | ||||||

|

Payments for shares redeemed

|

(34,390,873 | ) | (43,680,469 | ) | ||||

|

Net increase (decrease) in net assets from Fund share transactions

|

(25,282,969 | ) | (29,185,487 | ) | ||||

|

Increase (decrease) in net assets

|

(5,611,856 | ) | 2,551,762 | |||||

|

Net assets at beginning of period

|

212,752,973 | 210,201,211 | ||||||

|

Net assets at end of period (including distributions in excess of net investment income of $26,254 and undistributed net investment income of $2,920,577, respectively)

|

$ | 207,141,117 | $ | 212,752,973 | ||||

The accompanying notes are an integral part of the financial statements.

|

Years Ended July 31,

|

||||||||||||||||||||||||

|

Class A

|

Six Months Ended 1/31/14 (Unaudited)

|

2013

|

2012

|

2011

|

2010

|

2009

|

||||||||||||||||||

|

Selected Per Share Data

|

||||||||||||||||||||||||

|

Net asset value, beginning of period

|

$ | 36.55 | $ | 31.36 | $ | 29.99 | $ | 24.62 | $ | 22.42 | $ | 27.91 | ||||||||||||

|

Income (loss) from investment operations:

Net investment income (loss)a

|

(.04 | ) | .41 | .02 | (.04 | ) | (.04 | ) | .06 | |||||||||||||||

|

Net realized and unrealized gain (loss)

|

4.11 | 4.80 | 1.35 | 5.41 | 2.30 | (5.55 | ) | |||||||||||||||||

|

Total from investment operations

|

4.07 | 5.21 | 1.37 | 5.37 | 2.26 | (5.49 | ) | |||||||||||||||||

|

Less distributions from:

Net investment income

|

(.47 | ) | (.02 | ) | — | — | (.06 | ) | — | |||||||||||||||

|

Net asset value, end of period

|

$ | 40.15 | $ | 36.55 | $ | 31.36 | $ | 29.99 | $ | 24.62 | $ | 22.42 | ||||||||||||

|

Total Return (%)b

|

11.14 | c** | 16.61 | c | 4.57 | 21.81 | 10.07 | (19.67 | ) | |||||||||||||||

|

Ratios to Average Net Assets and Supplemental Data

|

||||||||||||||||||||||||

|

Net assets, end of period ($ millions)

|

23 | 22 | 23 | 21 | 30 | 31 | ||||||||||||||||||

|

Ratio of expenses before expense reductions (%)

|

1.25 | * | 1.26 | 1.26 | 1.25 | 1.33 | 1.34 | |||||||||||||||||

|

Ratio of expenses after expense reductions (%)

|

1.21 | * | 1.21 | 1.26 | 1.25 | 1.33 | 1.34 | |||||||||||||||||

|

Ratio of net investment income (loss) (%)

|

(.23 | )* | 1.23 | .06 | (.18 | ) | (.18 | ) | .24 | |||||||||||||||

|

Portfolio turnover rate (%)

|

43 | ** | 67 | 74 | 209 | 213 | 62 | |||||||||||||||||

|

a Based on average shares outstanding during the period.

b Total return does not reflect the effect of any sales charges.

c Total return would have been lower had certain expenses not been reduced.

* Annualized

** Not annualized

|

||||||||||||||||||||||||

|

Years Ended July 31,

|

||||||||||||||||||||||||

|

Class B

|

Six Months Ended 1/31/14 (Unaudited)

|

2013

|

2012

|

2011

|

2010

|

2009

|

||||||||||||||||||

|

Selected Per Share Data

|

||||||||||||||||||||||||

|

Net asset value, beginning of period

|

$ | 33.39 | $ | 28.85 | $ | 27.82 | $ | 23.03 | $ | 21.09 | $ | 26.45 | ||||||||||||

|

Income (loss) from investment operations:

Net investment income (loss)a

|

(.17 | ) | .16 | (.19 | ) | (.25 | ) | (.21 | ) | (.08 | ) | |||||||||||||

|

Net realized and unrealized gain (loss)

|

3.76 | 4.38 | 1.22 | 5.04 | 2.15 | (5.28 | ) | |||||||||||||||||

|

Total from investment operations

|

3.59 | 4.54 | 1.03 | 4.79 | 1.94 | (5.36 | ) | |||||||||||||||||

|

Less distributions from:

Net investment income

|

(.16 | ) | — | — | — | — | — | |||||||||||||||||

|

Net asset value, end of period

|

$ | 36.82 | $ | 33.39 | $ | 28.85 | $ | 27.82 | $ | 23.03 | $ | 21.09 | ||||||||||||

|

Total Return (%)b,c

|

10.75 | ** | 15.74 | 3.70 | 20.80 | 9.20 | (20.26 | ) | ||||||||||||||||

|

Ratios to Average Net Assets and Supplemental Data

|

||||||||||||||||||||||||

|

Net assets, end of period ($ millions)

|

.3 | .3 | .4 | 1 | 1 | 2 | ||||||||||||||||||

|

Ratio of expenses before expense reductions (%)

|

2.14 | * | 2.14 | 2.13 | 2.12 | 2.19 | 2.24 | |||||||||||||||||

|

Ratio of expenses after expense reductions (%)

|

1.96 | * | 1.97 | 2.07 | 2.10 | 2.15 | 2.10 | |||||||||||||||||

|

Ratio of net investment income (loss) (%)

|

(.98 | )* | .51 | (.70 | ) | (1.03 | ) | (1.01 | ) | (.52 | ) | |||||||||||||

|

Portfolio turnover rate (%)

|

43 | ** | 67 | 74 | 209 | 213 | 62 | |||||||||||||||||

|

a Based on average shares outstanding during the period.

b Total return does not reflect the effect of any sales charges.

c Total return would have been lower had certain expenses not been reduced.

* Annualized

** Not annualized

|

||||||||||||||||||||||||

|

Years Ended July 31,

|

||||||||||||||||||||||||

|

Class C

|

Six Months Ended 1/31/14 (Unaudited)

|

2013

|

2012

|

2011

|

2010

|

2009

|

||||||||||||||||||

|

Selected Per Share Data

|

||||||||||||||||||||||||

|

Net asset value, beginning of period

|

$ | 33.52 | $ | 28.96 | $ | 27.89 | $ | 23.08 | $ | 21.11 | $ | 26.48 | ||||||||||||

|

Income (loss) from investment operations:

Net investment income (loss)a

|

(.17 | ) | .12 | (.19 | ) | (.23 | ) | (.19 | ) | (.07 | ) | |||||||||||||

|

Net realized and unrealized gain (loss)

|

3.76 | 4.44 | 1.26 | 5.04 | 2.16 | (5.30 | ) | |||||||||||||||||

|

Total from investment operations

|

3.59 | 4.56 | 1.07 | 4.81 | 1.97 | (5.37 | ) | |||||||||||||||||

|

Less distributions from:

Net investment income

|

(.16 | ) | — | — | — | — | — | |||||||||||||||||

|

Net asset value, end of period

|

$ | 36.95 | $ | 33.52 | $ | 28.96 | $ | 27.89 | $ | 23.08 | $ | 21.11 | ||||||||||||

|

Total Return (%)b

|

10.75 | c** | 15.75 | c | 3.84 | 20.84 | 9.33 | c | (20.28 | )c | ||||||||||||||

|

Ratios to Average Net Assets and Supplemental Data

|

||||||||||||||||||||||||

|

Net assets, end of period ($ millions)

|

4 | 4 | 3 | 3 | 3 | 3 | ||||||||||||||||||

|

Ratio of expenses before expense reductions (%)

|

1.98 | * | 1.99 | 2.00 | 1.99 | 2.07 | 2.15 | |||||||||||||||||

|

Ratio of expenses after expense reductions (%)

|

1.96 | * | 1.96 | 2.00 | 1.99 | 2.07 | 2.09 | |||||||||||||||||

|

Ratio of net investment income (loss) (%)

|

(.97 | )* | .40 | (.69 | ) | (.93 | ) | (.92 | ) | (.51 | ) | |||||||||||||

|

Portfolio turnover rate (%)

|

43 | ** | 67 | 74 | 209 | 213 | 62 | |||||||||||||||||

|

a Based on average shares outstanding during the period.

b Total return does not reflect the effect of any sales charges.

c Total return would have been lower had certain expenses not been reduced.

* Annualized

** Not annualized

|

||||||||||||||||||||||||

|

Years Ended July 31,

|

||||||||||||||||||||||||

|

Class S

|

Six Months Ended 1/31/14 (Unaudited)

|

2013

|

2012

|

2011

|

2010

|

2009

|

||||||||||||||||||

|

Selected Per Share Data

|

||||||||||||||||||||||||

|

Net asset value, beginning of period

|

$ | 37.43 | $ | 32.11 | $ | 30.64 | $ | 25.10 | $ | 22.84 | $ | 28.43 | ||||||||||||

|

Income (loss) from investment operations:

Net investment income (loss)a

|

.01 | .50 | .09 | .01 | .01 | .09 | ||||||||||||||||||

|

Net realized and unrealized gain (loss)

|

4.21 | 4.91 | 1.38 | 5.53 | 2.35 | (5.65 | ) | |||||||||||||||||

|

Total from investment operations

|

4.22 | 5.41 | 1.47 | 5.54 | 2.36 | (5.56 | ) | |||||||||||||||||

|

Less distributions from:

Net investment income

|

(.59 | ) | (.09 | ) | — | — | (.10 | ) | (.03 | ) | ||||||||||||||

|

Net asset value, end of period

|

$ | 41.06 | $ | 37.43 | $ | 32.11 | $ | 30.64 | $ | 25.10 | $ | 22.84 | ||||||||||||

|

Total Return (%)

|

11.30 | b** | 16.89 | b | 4.80 | 22.07 | 10.34 | (19.54 | ) | |||||||||||||||

|

Ratios to Average Net Assets and Supplemental Data

|

||||||||||||||||||||||||

|

Net assets, end of period ($ millions)

|

174 | 170 | 167 | 175 | 166 | 159 | ||||||||||||||||||

|

Ratio of expenses before expense reductions (%)

|

1.00 | * | 1.02 | 1.04 | 1.02 | 1.11 | 1.16 | |||||||||||||||||

|

Ratio of expenses after expense reductions (%)

|

.96 | * | .96 | 1.04 | 1.02 | 1.11 | 1.16 | |||||||||||||||||

|

Ratio of net investment income (loss) (%)

|

.03 | * | 1.45 | .28 | .05 | .04 | .42 | |||||||||||||||||

|

Portfolio turnover rate (%)

|

43 | ** | 67 | 74 | 209 | 213 | 62 | |||||||||||||||||

|

a Based on average shares outstanding during the period.

b Total return would have been lower had certain expenses not been reduced.

* Annualized

** Not annualized

|

||||||||||||||||||||||||

|

Years Ended July 31,

|

||||||||||||||||||||||||

|

Institutional Class

|

Six Months Ended 1/31/14 (Unaudited)

|

2013

|

2012

|

2011

|

2010

|

2009

|

||||||||||||||||||

|

Selected Per Share Data

|

||||||||||||||||||||||||

|

Net asset value, beginning of period

|

$ | 37.74 | $ | 32.40 | $ | 30.89 | $ | 25.26 | $ | 22.99 | $ | 28.62 | ||||||||||||

|

Income (loss) from investment operations:

Net investment incomea

|

.03 | .50 | .11 | .04 | .07 | .15 | ||||||||||||||||||

|

Net realized and unrealized gain (loss)

|

4.26 | 4.96 | 1.40 | 5.59 | 2.37 | (5.70 | ) | |||||||||||||||||

|

Total from investment operations

|

4.29 | 5.46 | 1.51 | 5.63 | 2.44 | (5.55 | ) | |||||||||||||||||

|

Less distributions from:

Net investment income

|

(.60 | ) | (.12 | ) | (.00 | )*** | — | (.17 | ) | (.08 | ) | |||||||||||||

|

Net asset value, end of period

|

$ | 41.43 | $ | 37.74 | $ | 32.40 | $ | 30.89 | $ | 25.26 | $ | 22.99 | ||||||||||||

|

Total Return (%)

|

11.39 | b** | 16.90 | b | 4.89 | 22.29 | 10.62 | (19.34 | ) | |||||||||||||||

|

Ratios to Average Net Assets and Supplemental Data

|

||||||||||||||||||||||||

|

Net assets, end of period ($ millions)

|

5 | 16 | 17 | 17 | 4 | 12 | ||||||||||||||||||

|

Ratio of expenses before expense reductions (%)

|

.96 | * | .96 | .96 | .90 | .87 | .89 | |||||||||||||||||

|

Ratio of expenses after expense reductions (%)

|

.90 | * | .95 | .96 | .90 | .87 | .89 | |||||||||||||||||

|

Ratio of net investment income (loss) (%)

|

.14 | * | 1.46 | .36 | .17 | .27 | .69 | |||||||||||||||||

|

Portfolio turnover rate (%)

|

43 | ** | 67 | 74 | 209 | 213 | 62 | |||||||||||||||||

|

a Based on average shares outstanding during the period.

b Total return would have been lower had certain expenses not been reduced.

* Annualized

** Not annualized

*** Amount is less than $.005.

|

||||||||||||||||||||||||

A. Organization and Significant Accounting Policies

DWS Large Cap Focus Growth Fund (the "Fund") is a diversified series of DWS Investment Trust (the "Trust"), which is registered under the Investment Company Act of 1940, as amended (the "1940 Act"), as an open-end management investment company organized as a Massachusetts business trust.

The Fund offers multiple classes of shares which provide investors with different purchase options. Class A shares are offered to investors subject to an initial sales charge. Class B shares of the Fund are closed to new purchases, except exchanges or the reinvestment of dividends or other distributions. Class B shares were offered to investors without an initial sales charge and are subject to higher ongoing expenses than Class A shares and a contingent deferred sales charge payable upon certain redemptions. Class B shares automatically convert to Class A shares six years after issuance. Class C shares are offered to investors without an initial sales charge but are subject to higher ongoing expenses than Class A shares and a contingent deferred sales charge payable upon certain redemptions within one year of purchase. Class C shares do not automatically convert into another class. Institutional Class shares are generally available only to qualified institutions, are not subject to initial or contingent deferred sales charges and generally have lower ongoing expenses than other classes. Class S shares are not subject to initial or contingent deferred sales charges and are only available to a limited group of investors.

Investment income, realized and unrealized gains and losses, and certain fund-level expenses and expense reductions, if any, are borne pro rata on the basis of relative net assets by the holders of all classes of shares except that each class bears certain expenses unique to that class such as distribution and service fees, services to shareholders and certain other class-specific expenses. Differences in class-level expenses may result in payment of different per share dividends by class. All shares of the Fund have equal rights with respect to voting subject to class-specific arrangements.

The Fund's financial statements are prepared in accordance with accounting principles generally accepted in the United States of America which require the use of management estimates. Actual results could differ from those estimates. The policies described below are followed consistently by the Fund in the preparation of its financial statements.

Security Valuation. Investments are stated at value determined as of the close of regular trading on the New York Stock Exchange on each day the exchange is open for trading.

Various inputs are used in determining the value of the Fund's investments. These inputs are summarized in three broad levels. Level 1 includes quoted prices in active markets for identical securities. Level 2 includes other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds and credit risk). Level 3 includes significant unobservable inputs (including the Fund's own assumptions in determining the fair value of investments). The level assigned to the securities valuations may not be an indication of the risk or liquidity associated with investing in those securities.

Equity securities are valued at the most recent sale price or official closing price reported on the exchange (U.S. or foreign) or over-the-counter market on which they trade. Securities for which no sales are reported are valued at the calculated mean between the most recent bid and asked quotations on the relevant market or, if a mean cannot be determined, at the most recent bid quotation. Equity securities are generally categorized as Level 1.

Investments in open-end investment companies are valued at their net asset value each business day and are categorized as Level 1.

Securities and other assets for which market quotations are not readily available or for which the above valuation procedures are deemed not to reflect fair value are valued in a manner that is intended to reflect their fair value as determined in accordance with procedures approved by the Board and are generally categorized as Level 3. In accordance with the Fund's valuation procedures, factors used in determining value may include, but are not limited to, the type of the security; the size of the holding; the initial cost of the security; the existence of any contractual restrictions on the security's disposition; the price and extent of public trading in similar securities of the issuer or of comparable companies; quotations or evaluated prices from broker-dealers and/or pricing services; information obtained from the issuer, analysts, and/or the appropriate stock exchange (for exchange-traded securities); an analysis of the company's or issuer's financial statements; an evaluation of the forces that influence the issuer and the market(s) in which the security is purchased and sold; and with respect to debt securities, the maturity, coupon, creditworthiness, currency denomination and the movement of the market in which the security is normally traded. The value determined under these procedures may differ from published values for the same securities.

Disclosure about the classification of fair value measurements is included in a table following the Fund's Investment Portfolio.

Securities Lending. Brown Brothers Harriman & Co., as lending agent, lends securities of the Fund to certain financial institutions under the terms of the Security Lending Agreement. The Fund retains benefits of owning the securities it has loaned and continues to receive interest and dividends generated by the securities and to participate in any changes in their market value. The Fund requires the borrowers of the securities to maintain collateral with the Fund consisting of either cash or liquid, unencumbered assets having a value at least equal to the value of the securities loaned. When the collateral falls below specified amounts, the lending agent will use its best effort to obtain additional collateral on the next business day to meet required amounts under the security lending agreement. The Fund may invest the cash collateral into a joint trading account in an affiliated money market fund pursuant to Exemptive Orders issued by the SEC. The Fund receives compensation for lending its securities either in the form of fees or by earning interest on invested cash collateral net of borrower rebates and fees paid to a lending agent. Either the Fund or the borrower may terminate the loan. There may be risks of delay and costs in recovery of securities or even loss of rights in the collateral should the borrower of the securities fail financially. If the Fund is not able to recover securities lent, the Fund may sell the collateral and purchase a replacement investment in the market, incurring the risk that the value of the replacement security is greater than the value of the collateral. The Fund is also subject to all investment risks associated with the reinvestment of any cash collateral received, including, but not limited to, interest rate, credit and liquidity risk associated with such investments.

As of January 31, 2014, the Fund had securities on loan. The value of the related collateral exceeded the value of the securities loaned at period end.

Federal Income Taxes. The Fund's policy is to comply with the requirements of the Internal Revenue Code, as amended, which are applicable to regulated investment companies, and to distribute all of its taxable income to its shareholders.

Under the Regulated Investment Company Modernization Act of 2010, net capital losses incurred post-enactment may be carried forward indefinitely, and their character is retained as short-term and/or long-term. Previously, net capital losses were carried forward for eight years and treated as short-term losses. As a transition rule, the Act requires that post-enactment net capital losses be used before pre-enactment net capital losses.

At July 31, 2013, the Fund had a net tax basis capital loss carryforward of approximately $2,008,000, including $438,000 of pre-enactment losses, which may be applied against any realized net taxable capital gains of each succeeding year until fully utilized or July 31, 2017, the expiration date, whichever occurs first; and $1,570,000 of short-term post-enactment losses, which may be applied against realized net taxable capital gains indefinitely.

The Fund has reviewed the tax positions for the open tax years as of July 31, 2013 and has determined that no provision for income tax is required in the Fund's financial statements. The Fund's federal tax returns for the prior three fiscal years remain open subject to examination by the Internal Revenue Service.

Distribution of Income and Gains. Distributions from net investment income of the Fund, if any, are declared and distributed to shareholders annually. Net realized gains from investment transactions, in excess of available capital loss carryforwards, would be taxable to the Fund if not distributed and, therefore, will be distributed to shareholders at least annually. The Fund may also make additional distributions for tax purposes if necessary.

The timing and characterization of certain income and capital gain distributions are determined annually in accordance with federal tax regulations which may differ from accounting principles generally accepted in the United States of America. These differences primarily relate to net investment losses incurred by the Fund and certain securities sold at a loss. As a result, net investment income (loss) and net realized gain (loss) on investment transactions for a reporting period may differ significantly from distributions during such period. Accordingly, the Fund may periodically make reclassifications among certain of its capital accounts without impacting the net asset value of the Fund.

The tax character of current year distributions will be determined at the end of the current fiscal year.

Expenses. Expenses of the Trust arising in connection with a specific fund are allocated to that fund. Other Trust expenses which cannot be directly attributed to a fund are apportioned among the funds in the Trust based upon the relative net assets or other appropriate measures.

Contingencies. In the normal course of business, the Fund may enter into contracts with service providers that contain general indemnification clauses. The Fund's maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet been made. However, based on experience, the Fund expects the risk of loss to be remote.

Other. Investment transactions are accounted for on a trade date plus one basis for daily net asset value calculations. However, for financial reporting purposes, investment transactions are reported on trade date. Interest income is recorded on the accrual basis. Dividend income is recorded on the ex-dividend date net of foreign withholding taxes. Realized gains and losses from investment transactions are recorded on an identified cost basis. Proceeds from litigation payments, if any, are included in net realized gain (loss) from investments.

B. Purchases and Sales of Securities

During the six months ended January 31, 2014, purchases and sales of investment securities (excluding short-term investments) aggregated $90,470,810 and $117,347,013, respectively.

C. Related Parties

Management Agreement. Under the Investment Management Agreement with Deutsche Investment Management Americas Inc. ("DIMA" or the "Advisor"), an indirect, wholly owned subsidiary of Deutsche Bank AG, the Advisor directs the investments of the Fund in accordance with its investment objectives, policies and restrictions. The Advisor determines the securities, instruments and other contracts relating to investments to be purchased, sold or entered into by the Fund.

Under the Investment Management Agreement with the Advisor, the Fund pays a monthly management fee based on the Fund's average daily net assets computed and accrued daily and payable monthly, at the following annual rates:

|

First $1.5 billion of the Fund's average daily net assets

|

.615 | % | ||

|

Next $500 million of such net assets

|

.565 | % | ||

|

Over $2.0 billion of such net assets

|

.515 | % |

Accordingly, for the six months ended January 31, 2014, the fee pursuant to the Investment Management Agreement was equivalent to an annualized effective rate (exclusive of any applicable waivers/reimbursements) of 0.615% of the Fund's average daily net assets.

For the period from August 1, 2013 through November 30, 2013, the Advisor had contractually agreed to waive its fees and/or reimburse certain operating expenses of the Fund to the extent necessary to maintain the operating expenses (excluding certain expenses such as extraordinary expenses, taxes, brokerage and interest) of each class as follows:

|

Class A

|

1.20%

|

|

Class B

|

1.95%

|

|

Class C

|

1.95%

|

|

Class S

|

.95%

|

|

Institutional Class

|

.95%

|

Effective December 1, 2013 through November 30, 2014, the Advisor has contractually agreed to waive its fees and/or reimburse certain operating expenses of the Fund to the extent necessary to maintain the operating expenses (excluding certain expenses such as extraordinary expenses, taxes, brokerage and interest) of each class as follows:

|

Class A

|

1.23%

|

|

Class B

|

1.98%

|

|

Class C

|

1.98%

|

|

Class S

|

.98%

|

|

Institutional Class

|

.98%

|

For the six months ended January 31, 2014, fees waived and/or expenses reimbursed for each class are as follows:

|

Class A

|

$ | 4,691 | ||

|

Class B

|

255 | |||

|

Class C

|

365 | |||

|

Class S

|

38,204 | |||

|

Institutional Class

|

2,734 | |||

| $ | 46,249 |

Administration Fee. Pursuant to an Administrative Services Agreement, DIMA provides most administrative services to the Fund. For all services provided under the Administrative Services Agreement, the Fund pays the Advisor an annual fee ("Administration Fee") of 0.10% of the Fund's average daily net assets, computed and accrued daily and payable monthly. For the six months ended January 31, 2014, the Administration Fee was $106,656, of which $18,052 is unpaid.

Service Provider Fees. DWS Investments Service Company ("DISC"), an affiliate of the Advisor, is the transfer agent, dividend-paying agent and shareholder service agent for the Fund. Pursuant to a sub-transfer agency agreement between DISC and DST Systems, Inc. ("DST"), DISC has delegated certain transfer agent, dividend-paying agent and shareholder service agent functions to DST. DISC compensates DST out of the shareholder servicing fee it receives from the Fund. For the six months ended January 31, 2014, the amounts charged to the Fund by DISC were as follows:

|

Services to Shareholders

|

Total Aggregated

|

Unpaid at January 31, 2014

|

||||||

|

Class A

|

$ | 14,000 | $ | 10,325 | ||||

|

Class B

|

329 | 329 | ||||||

|

Class C

|

1,718 | 1,074 | ||||||

|

Class S

|

136,500 | 96,733 | ||||||

|

Institutional Class

|

4,514 | 2,276 | ||||||

| $ | 157,061 | $ | 110,737 | |||||

Distribution and Service Fees. Under the Fund's Class B and Class C 12b-1 Plans, DWS Investments Distributors, Inc. ("DIDI"), an affiliate of the Advisor, receives a fee ("Distribution Fee") of 0.75% of average daily net assets of each of Class B and C shares. In accordance with the Fund's Underwriting and Distribution Services Agreement, DIDI enters into related selling group agreements with various firms at various rates for sales of Class B and C shares, respectively. For the six months ended January 31, 2014, the Distribution Fee was as follows:

|

Distribution Fee

|

Total Aggregated

|

Unpaid at January 31, 2014

|

||||||

|

Class B

|

$ | 1,044 | $ | 180 | ||||

|

Class C

|

16,926 | 2,936 | ||||||

| $ | 17,970 | $ | 3,116 | |||||

In addition, DIDI provides information and administrative services for a fee ("Service Fee") to Class A, B and C shareholders at an annual rate of up to 0.25% of average daily net assets for each such class. DIDI in turn has various agreements with financial services firms that provide these services and pays these fees based upon the assets of shareholder accounts the firms service. For the six months ended January 31, 2014, the Service Fee was as follows:

|

Service Fee

|

Total Aggregated

|

Unpaid at January 31, 2014

|

Annualized Effective Rate

|

|||||||||

|

Class A

|

$ | 27,958 | $ | 15,157 | .24 | % | ||||||

|

Class B

|

347 | 177 | .25 | % | ||||||||

|

Class C

|

5,634 | 2,909 | .25 | % | ||||||||

| $ | 33,939 | $ | 18,243 | |||||||||

Underwriting Agreement and Contingent Deferred Sales Charge. DIDI is the principal underwriter for the Fund. Underwriting commissions paid in connection with the distribution of Class A shares for the six months ended January 31, 2014 aggregated $1,751.

In addition, DIDI receives any contingent deferred sales charge ("CDSC") from Class B share redemptions occurring within six years of purchase and Class C share redemptions occurring within one year of purchase. There is no such charge upon redemption of any share appreciation or reinvested dividends. The CDSC is based on declining rates, ranging from 4% to 1% for Class B and 1% for Class C, of the value of the shares redeemed. For the six months ended January 31, 2014, the CDSC for Class C shares aggregated $1,096. A deferred sales charge of up to 1% is assessed on certain redemptions of Class A shares. For the six months ended January 31, 2014, DIDI received $61 for Class A shares.

Typesetting and Filing Service Fees. Under an agreement with DIMA, DIMA is compensated for providing typesetting and certain regulatory filing services to the Fund. For the six months ended January 31, 2014, the amount charged to the Fund by DIMA included in the Statement of Operations under "reports to shareholders" aggregated $9,108, of which $2,975 is unpaid.

Trustees' Fees and Expenses. The Fund paid retainer fees to each Trustee not affiliated with the Advisor, plus specified amounts to the Board Chairperson and Vice Chairperson and to each committee Chairperson.

Affiliated Cash Management Vehicles. The Fund may invest uninvested cash balances in Central Cash Management Fund and DWS Variable NAV Money Fund, affiliated money market funds which are managed by the Advisor. Each affiliated money market fund seeks to provide a high level of current income consistent with liquidity and the preservation of capital. Each affiliated money market fund is managed in accordance with Rule 2a-7 under the Investment Company Act of 1940, which governs the quality, maturity, diversity and liquidity of instruments in which a money market fund may invest. Central Cash Management Fund seeks to maintain a stable net asset value, and DWS Variable NAV Money Fund maintains a floating net asset value. The Fund indirectly bears its proportionate share of the expenses of each affiliated money market fund in which it invests. Central Cash Management Fund does not pay the Advisor an investment management fee. To the extent that DWS Variable NAV Money Fund pays an investment management fee to the Advisor, the Advisor will waive an amount of the investment management fee payable to the Advisor by the Fund equal to the amount of the investment management fee payable on the Fund's assets invested in DWS Variable NAV Money Fund.

D. Line of Credit

The Fund and other affiliated funds (the "Participants") share in a $375 million revolving credit facility provided by a syndication of banks. The Fund may borrow for temporary or emergency purposes, including the meeting of redemption requests that otherwise might require the untimely disposition of securities. The Participants are charged an annual commitment fee which is allocated based on net assets, among each of the Participants. Interest is calculated at a rate per annum equal to the sum of the Federal Funds Rate plus 1.25 percent plus if LIBOR exceeds the Federal Funds Rate the amount of such excess. The Fund may borrow up to a maximum of 33 percent of its net assets under the agreement. The Fund had no outstanding loans at January 31, 2014.

E. Share Transactions

The following table summarizes share and dollar activity in the Fund:

|

Six Months Ended January 31, 2014

|

Year Ended July 31, 2013

|

|||||||||||||||

|

Shares

|

Dollars

|

Shares

|

Dollars

|

|||||||||||||

|

Shares sold

|

||||||||||||||||

|

Class A

|

41,368 | $ | 1,601,445 | 121,392 | $ | 4,077,331 | ||||||||||

|

Class B

|

283 | 9,669 | 893 | 28,648 | ||||||||||||

|

Class C

|

8,884 | 317,969 | 35,547 | 1,098,673 | ||||||||||||

|

Class S

|

100,357 | 4,017,069 | 207,065 | 7,096,964 | ||||||||||||

|

Institutional Class

|

9,107 | 360,387 | 49,232 | 1,703,496 | ||||||||||||

| $ | 6,306,539 | $ | 14,005,112 | |||||||||||||

|

Shares issued to shareholders in reinvestment of distributions

|

||||||||||||||||

|

Class A

|

6,836 | $ | 268,983 | 366 | $ | 11,715 | ||||||||||

|

Class B

|

31 | 1,126 | — | — | ||||||||||||

|

Class C

|

459 | 16,648 | — | — | ||||||||||||

|

Class S

|

60,912 | 2,450,505 | 12,979 | 424,543 | ||||||||||||

|

Institutional Class

|

1,580 | 64,103 | 1,626 | 53,612 | ||||||||||||

| $ | 2,801,365 | $ | 489,870 | |||||||||||||

|

Shares redeemed

|

||||||||||||||||

|

Class A

|

(74,646 | ) | $ | (2,872,254 | ) | (246,558 | ) | $ | (8,184,033 | ) | ||||||

|

Class B

|

(1,510 | ) | (51,583 | ) | (6,907 | ) | (211,752 | ) | ||||||||

|

Class C

|

(18,855 | ) | (674,055 | ) | (24,317 | ) | (747,040 | ) | ||||||||

|

Class S

|

(453,140 | ) | (18,293,065 | ) | (872,205 | ) | (29,682,617 | ) | ||||||||

|

Institutional Class

|

(321,544 | ) | (12,499,916 | ) | (141,722 | ) | (4,855,027 | ) | ||||||||

| $ | (34,390,873 | ) | $ | (43,680,469 | ) | |||||||||||

|

Net increase (decrease)

|

||||||||||||||||

|

Class A

|

(26,442 | ) | $ | (1,001,826 | ) | (124,800 | ) | $ | (4,094,987 | ) | ||||||

|

Class B

|

(1,196 | ) | (40,788 | ) | (6,014 | ) | (183,104 | ) | ||||||||

|

Class C

|

(9,512 | ) | (339,438 | ) | 11,230 | 351,633 | ||||||||||

|

Class S

|

(291,871 | ) | (11,825,491 | ) | (652,161 | ) | (22,161,110 | ) | ||||||||

|

Institutional Class

|

(310,857 | ) | (12,075,426 | ) | (90,864 | ) | (3,097,919 | ) | ||||||||

| $ | (25,282,969 | ) | $ | (29,185,487 | ) | |||||||||||

As an investor of the Fund, you incur two types of costs: ongoing expenses and transaction costs. Ongoing expenses include management fees, distribution and service (12b-1) fees and other Fund expenses. Examples of transaction costs include sales charges (loads) and account maintenance fees, which are not shown in this section. The following tables are intended to help you understand your ongoing expenses (in dollars) of investing in the Fund and to help you compare these expenses with the ongoing expenses of investing in other mutual funds. In the most recent six-month period, the Fund limited these expenses; had it not done so, expenses would have been higher. The example in the table is based on an investment of $1,000 invested at the beginning of the six-month period and held for the entire period (August 1, 2013 to January 31, 2014).

The tables illustrate your Fund's expenses in two ways:

—Actual Fund Return. This helps you estimate the actual dollar amount of ongoing expenses (but not transaction costs) paid on a $1,000 investment in the Fund using the Fund's actual return during the period. To estimate the expenses you paid over the period, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the "Expenses Paid per $1,000" line under the share class you hold.

— Hypothetical 5% Fund Return. This helps you to compare your Fund's ongoing expenses (but not transaction costs) with those of other mutual funds using the Fund's actual expense ratio and a hypothetical rate of return of 5% per year before expenses. Examples using a 5% hypothetical fund return may be found in the shareholder reports of other mutual funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

Please note that the expenses shown in these tables are meant to highlight your ongoing expenses only and do not reflect any transaction costs. The "Expenses Paid per $1,000" line of the tables is useful in comparing ongoing expenses only and will not help you determine the relative total expense of owning different funds. Subject to certain exceptions, an account maintenance fee of $20.00 assessed once per calendar year for Classes A, B, C and S shares may apply for accounts with balances less than $10,000. This fee is not included in these tables. If it was, the estimate of expenses paid for Classes A, B, C and S shares during the period would be higher, and account value during the period would be lower, by this amount.

|

Expenses and Value of a $1,000 Investment for the six months ended January 31, 2014 (Unaudited)

|

||||||||||||||||||||

|

Actual Fund Return

|

Class A

|

Class B

|

Class C

|

Class S

|

Institutional Class

|

|||||||||||||||

|

Beginning Account Value 8/1/13

|

$ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | ||||||||||

|

Ending Account Value 1/31/14

|

$ | 1,111.40 | $ | 1,107.50 | $ | 1,107.50 | $ | 1,113.00 | $ | 1,113.90 | ||||||||||

|

Expenses Paid per $1,000*

|

$ | 6.44 | $ | 10.41 | $ | 10.41 | $ | 5.11 | $ | 4.80 | ||||||||||

|

Hypothetical 5% Fund Return

|

Class A

|

Class B

|

Class C

|

Class S

|

Institutional Class

|

|||||||||||||||

|

Beginning Account Value 8/1/13

|

$ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | ||||||||||

|

Ending Account Value 1/31/14

|

$ | 1,019.11 | $ | 1,015.32 | $ | 1,015.32 | $ | 1,020.37 | $ | 1,020.67 | ||||||||||

|

Expenses Paid per $1,000*

|

$ | 6.16 | $ | 9.96 | $ | 9.96 | $ | 4.89 | $ | 4.58 | ||||||||||

* Expenses are equal to the Fund's annualized expense ratio for each share class, multiplied by the average account value over the period, multiplied by 184 (the number of days in the most recent six-month period), then divided by 365.

|

Annualized Expense Ratios

|

Class A

|

Class B

|

Class C

|

Class S

|

Institutional Class

|

|

DWS Large Cap Focus Growth Fund

|

1.21%

|

1.96%

|

1.96%

|

.96%

|

.90%

|

For more information, please refer to the Fund's prospectuses.

For an analysis of the fees associated with an investment in the Fund or similar funds, please refer to http://apps.finra.org/fundanalyzer/1/fa.aspx.

The Board of Trustees approved the renewal of DWS Large Cap Focus Growth Fund's investment management agreement (the "Agreement") with Deutsche Investment Management Americas Inc. ("DIMA") in September 2013.

In terms of the process that the Board followed prior to approving the Agreement, shareholders should know that:

— In September 2013, all of the Fund's Trustees were independent of DIMA and its affiliates.

— The Trustees met frequently during the past year to discuss fund matters and dedicated a substantial amount of time to contract review matters. Over the course of several months, the Board's Contract Committee, in coordination with the Board's Equity Oversight Committee, reviewed comprehensive materials received from DIMA, independent third parties and independent counsel. These materials included an analysis of the Fund's performance, fees and expenses, and profitability compiled by a fee consultant retained by the Fund's Independent Trustees (the "Fee Consultant"). The Board also received extensive information throughout the year regarding performance of the Fund.

— The Independent Trustees regularly meet privately with their independent counsel to discuss contract review and other matters. In addition, the Independent Trustees were also advised by the Fee Consultant in the course of their review of the Fund's contractual arrangements and considered a comprehensive report prepared by the Fee Consultant in connection with their deliberations.

— In connection with reviewing the Agreement, the Board also reviewed the terms of the Fund's Rule 12b-1 plan, distribution agreement, administrative services agreement, transfer agency agreement and other material service agreements.

— Based on its evaluation of the information provided, the Contract Committee presented its findings and recommendations to the Board. The Board then reviewed the Contract Committee's findings and recommendations.

In connection with the contract review process, the Contract Committee and the Board considered the factors discussed below, among others. The Board also considered that DIMA and its predecessors have managed the Fund since its inception, and the Board believes that a long-term relationship with a capable, conscientious advisor is in the best interests of the Fund. The Board considered, generally, that shareholders chose to invest or remain invested in the Fund knowing that DIMA managed the Fund, and that the Agreement was approved by the Fund's shareholders. DIMA is part of Deutsche Bank AG, a major global banking institution that is engaged in a wide range of financial services. The Board believes that there are advantages to being part of a global asset management business that offers a wide range of investing expertise and resources, including hundreds of portfolio managers and analysts with research capabilities in many countries throughout the world.

As part of the contract review process, the Board carefully considered the fees and expenses of each DWS fund overseen by the Board in light of the fund's performance. In many cases, this led to a negotiation with DIMA of lower expense caps as part of the 2012 and 2013 contract review processes than had previously been in place. As part of these negotiations, the Board indicated that it would consider relaxing these new lower caps in future years following sustained improvements in performance, among other considerations.

In June 2012, Deutsche Bank AG ("DB"), DIMA's parent company, announced that DB would combine its Asset Management (of which DIMA was a part) and Wealth Management divisions. DB has advised the Independent Trustees that the U.S. asset management business is a critical and integral part of DB, and that it has, and will continue to, reinvest a significant portion of the substantial savings it expects to realize by combining its Asset Management and Wealth Management divisions into the new Asset and Wealth Management ("AWM") division, including ongoing enhancements to its investment capabilities. DB also has confirmed its commitment to maintaining strong legal and compliance groups within the AWM division.

While shareholders may focus primarily on fund performance and fees, the Fund's Board considers these and many other factors, including the quality and integrity of DIMA's personnel and such other issues as back-office operations, fund valuations, and compliance policies and procedures.