ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

(State or other jurisdiction of incorporation or organization) |

(IRS Employer Identification No.) | |

th Floor |

||

(Address of principal executive offices ) |

(Zip Code) | |

Title of each class: |

Trading Symbol(s) |

Name of each exchange on which registered: | ||

Large accelerated filer |

☐ |

☒ | ||||

Non-accelerated filer |

☐ |

Smaller reporting company |

||||

Emerging growth company |

||||||

Page |

||||

| 3 | ||||

| 3 | ||||

| 22 | ||||

| 34 | ||||

| 34 | ||||

| 34 | ||||

| 34 | ||||

| 34 | ||||

| 34 | ||||

| 36 | ||||

| 37 | ||||

| 64 | ||||

| 65 | ||||

| 65 | ||||

| 65 | ||||

| 66 | ||||

| 66 | ||||

| 66 | ||||

| 66 | ||||

| 67 | ||||

| 67 | ||||

| 67 | ||||

| 67 | ||||

| 67 | ||||

| 67 | ||||

| • | the ultimate duration of the COVID-19 pandemic and its short-term and long-term impact on our business and the global economy; |

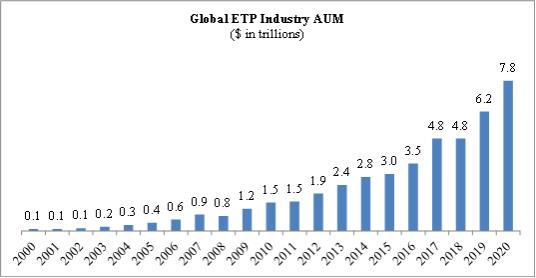

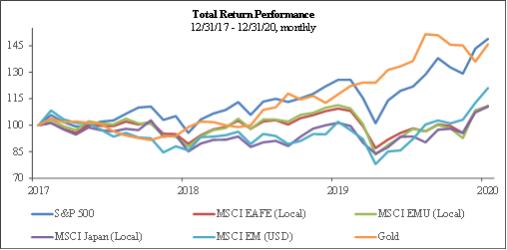

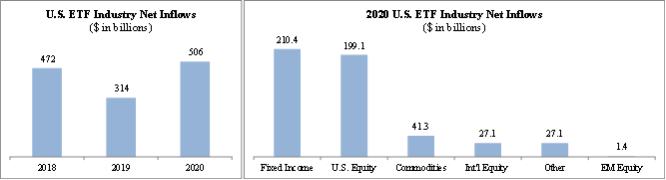

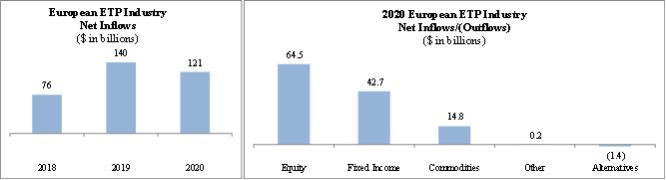

| • | anticipated trends, conditions and investor sentiment in the global markets and exchange-traded products, or ETPs; |

| • | anticipated levels of inflows into and outflows out of our ETPs; |

| • | our ability to deliver favorable rates of return to investors; |

| • | competition in our business; |

| • | our ability to develop new products and services; |

| • | our ability to maintain current vendors or find new vendors to provide services to us at favorable costs; |

| • | our ability to successfully operate and expand our business in non-U.S. markets; and |

| • | the effect of laws and regulations that apply to our business. |

ITEM 1. |

BUSINESS |

| • | Revenues |

| • | Expenses |

| • | Other Income/(Expenses) |

| • | Net (loss)/income |

GLOBAL RANKING |

||||||

| Rank |

ETP Sponsor |

AUM (in billions) |

||||

| 1 |

iShares |

$ | 2,703 | |||

| 2 |

Vanguard | $ | 1,621 | |||

| 3 |

State Street |

$ | 919 | |||

| 4 |

Invesco |

$ | 349 | |||

| 5 |

Nomura Group |

$ | 237 | |||

| 6 |

Charles Schwab |

$ | 199 | |||

| 7 |

Xtrackers |

$ | 161 | |||

| 8 |

First Trust |

$ | 112 | |||

| 9 |

Nikko |

$ | 109 | |||

| 10 |

Daiwa |

$ | 105 | |||

| 11 |

Lyxor |

$ | 95 | |||

| 12 |

UBS |

$ | 83 | |||

| 13 |

Amundi |

$ | 78 | |||

| 14 |

WisdomTree |

$ | 67 | |||

| • | Transparency |

| • | Intraday trading, hedging strategies and complex orders |

| • | Tax efficiency “in-kind” redemptions in which low-cost securities are transferred out of the ETF in exchange for fund shares in a non-taxable transaction. By using this process, ETFs can avoid the transaction fees and tax impact incurred by mutual funds that sell securities to generate cash to pay out redemptions. |

| • | Uniform pricing 12b-1 fees. In many cases, ETFs offer lower expense ratios than comparable mutual funds. |

| • | Low cost index investing . |

| • | Improved access to specific asset classes |

| • | Asset allocation |

| • | Protective hedging |

| • | Income generation |

| • | Speculative investing |

| • | Arbitrage |

| • | Diversification |

| • | Education and greater investor awareness |

| • | Move to fee-based models“fee-based” approach, where an overall fee is charged based on the value of AUM. This fee-based approach lends itself to the advisor selecting lower-fee financial products, and in our opinion, better aligns advisers with the interests of their clients. Since ETFs generally charge lower fees than mutual funds, we believe this model shift will benefit the ETF industry. |

| • | Innovative product offerings leveraged-and-inverse |

| • | Changing demographics fee-based models, and their ability to provide access to more diverse market sectors, improve multi-asset class allocation, and be used for different investment strategies, including income generation. Overall, we believe ETFs are well-suited to meet the needs of this large and important group of investors. In addition, since many younger investors and financial advisors have demonstrated a preference for the ETF structure over traditional product structures, we believe that wealth transfers from one generation to another will also have a positive effect on ETF industry growth. |

| • | International markets. |

| • | Well-positioned in large and growing markets . |

| • | Strong performance 4- or 5-star by Morningstar. |

| • | Differentiated product set, powered by innovation and performance leveraged-and-inverse, |

| • | the first gold and oil ETPs via our acquisition of ETFS; |

| • | the first emerging markets small-cap equity ETF; |

| • | the first actively managed currency ETF; |

| • | the first ETF to provide investors with access to the Additional Tier 1 Contingent Convertible, or CoCo, bond market; |

| • | one of the first international local currency denominated fixed income ETFs; |

| • | the first managed futures strategy ETF; |

| • | the first currency hedged international equity ETFs in the U.S.; |

| • | the first 90/60 balanced ETF; |

| • | the first multifactor ETFs incorporating dynamic currency hedging as a factor; and |

| • | the first smart beta corporate bond suite. |

| • | Extensive marketing, research and sales efforts |

| • | Efficient business model with lower risk profile |

| • | Strong, seasoned and creative management team |

| • | Launch innovative new products that diversify our product offerings and revenues first-to-market |

| • | target 20 new global product launches with a focus on core, tactical, thematic and ESG exposures in 2021 to complement our crypto ETP offering in Europe, our cloud, artificial intelligence, battery and recent global cybersecurity launch as well as our leading ESG offering; |

| • | to be a leader in the ESG space. We currently rank third in the U.S. in this category by ESG assets under management, and our multifactor and ex-state-owned suites, together comprising six funds and $5 billion in AUM in total, each represent differentiated performance-oriented investment strategies. Recently, we further enhanced our ex-state-owned suite by adding environmental and social screens ensuring they will appear in more third-party ESG classifications and be more visible to ESG oriented investors. In Europe, the same broad ESG screen has been applied to our core UCITS equity funds to meet increasing local demand for such considerations and traditional exposures; |

| • | to establish ourselves as a leader in digital assets. This includes leveraging our European experience to offer exchange-traded bitcoin exposures beyond Europe. We are also seeking to have a regulated gold token in the market as we are committed to competing for the future of gold, which we believe is both digital and global. We also plan to pursue “tokenized” or digital versions of certain WisdomTree strategies on the blockchain covering other core building block asset classes, including treasuries. |

| • | Foster deeper relationships through technology-enabled and research-driven solutions . |

| • | access to over 30 model portfolios, which are currently available on a number of platforms, including TD Ameritrade, Merrill Lynch, Envestnet, 55ip and others. Our model portfolios are a natural extension of our research capabilities and provide advisors access to an open-architecture approach, a tenured team and a firm dedicated to innovation and value creation. As part of this initiative, we launched two of our model portfolios in collaboration with Professor Jeremy Siegel; |

| • | portfolio construction services such as our award-winning Digital Portfolio Developer, an enhanced portfolio construction tool that assists financial advisors in analyzing an existing investment portfolio by examining the data and providing alternative portfolio approaches to consider in seeking to improve outcomes based on different measures; |

| • | wealth investment research and ETF education, such as a recent first of its kind study we conducted on the practice management and adoption of third-party model portfolios, the results of which revealed investors view model portfolios as a more sophisticated approach to asset allocation, yet adoption remains low; and |

| • | practice management resources, including access to thought leaders in retirement planning, leadership and behavioral finance. |

| • | Deepen relationships with distribution platforms . |

| • | LPL Financial. |

| • | BNY Mellon/Pershing. ® ETF no-transaction-fee |

| • | Swissquote |

| • | Ally Invest. |

| • | Cetera. no-transaction fee product platform of Cetera Financial Group, the second largest independent financial advisor network in the nation. This allows for Cetera’s network of independent broker-dealers to access our diverse line-up of ETF products with no transaction fees. |

| • | Leverage data intelligence to serve and expand investor base and improve sales and marketing effectiveness . |

| • | Selectively pursue acquisitions or other strategic transactions. |

| • | Targeted advertising. ETF-specific web sites, such as www.seekingalpha.com and www.etfdatabase.com using targeted dynamic and personalized ad messaging. We recently introduced Connected TV (CTV) advertising that leverages the same targeted segments of users who use CTV devices. |

| • | Media relations. |

| • | Database Messaging Strategy on-demand research presentations, ETP-specific or educational events and presentations and market commentary from our senior investment strategy adviser, Professor Jeremy Siegel. Additionally, we communicate to our retail database about new product launches and provide ETF education. |

| • | Social media |

| • | Sales support |

| • | The Investment Advisers Act of 1940 (Investment Advisers Act) |

| • | The Investment Company Act of 1940 (ICA) 6c-11, or the ETF Rule, including, among others, requirements relating to operations, fees charged, sales, accounting, recordkeeping, disclosure, transparency and governance. In addition, the SEC has recently finalized new rules and/or rule amendments related to valuation, fund of fund investing, derivatives and marketing/advertising, which will be implemented in 2021-2022, and the SEC is expected to continue to propose, new and/or revised provisions under the ICA that will impact current and future ETF operations and/or investments. |

| • | Broker-Dealer Regulations |

| • | Internal Revenue Code |

| • | U.S. Commodity Futures Trading Commission (CFTC) and National Futures Association (NFA) |

| • | Exchange Listing Requirements . |

| • | FINRA Rules . so-called leveraged ETFs in the U.S., which may include within their holdings derivative instruments such as options, futures or swaps to obtain leveraged exposures, FINRA guidance, the recently issued derivatives rules by the SEC and/or other future rules or regulations may influence how member firms effect sales of certain WisdomTree U.S. listed ETFs, such as our currency ETFs, or how such ETFs operate, which also use some forms of derivatives, including forward currency contracts and swaps, our international hedged equity ETFs, which use currency forwards, and our rising rates bond ETFs and alternative strategy ETFs, which use futures or options. |

| • | The Companies (Jersey) Law 1991 . |

| • | The Foreign Account Tax Compliance Act, or FATCA non-financial foreign entities report on the foreign assets held by their U.S. account holders or be subject to withholding on withholdable payments. The HIRE Act also contained legislation requiring U.S. persons to report, depending on the value, their foreign financial accounts and foreign assets. ETCs benefit from the so called “listing exemption” and Jersey local authorities have determined that for companies which can benefit from such exemption the filing of a nil report is optional. |

| • | The Common Reporting Standards, or CRS |

| • | The Collective Investment Funds (Jersey) Law 1988 |

| • | The Prospectus Regulation |

| • | Regulation (EU) No 648/2012 of the European Parliament and of the Council of 4 July 2012 on OTC derivatives, central counterparties and trade repositories, known as the European Market Infrastructure Regulation (“EMIR”) over-the-counter, EU-based financial counterparties (defined as those authorized under MiFID, CRR, AIFMD, UCITS or insurance regulations) or those non-financial entities that have a rolling three-month notional exposure above a certain amount (between €1 and €3 billion, depending on asset class), which means that the ManJer Issuers are not directly subject to these obligations, but could indirectly be subject to them by virtue of their interaction with EU-based financial counterparties. In terms of reporting obligations, being non-EU entities, the ManJer Issuers are only indirectly subject to such obligations when they interact with their EU-based financial counter-parties. Each ManJer Issuer has adhered to the 2013 EMIR Portfolio Reconciliation, Dispute Resolution and Disclosure Protocol published by the International Swaps and Derivatives Association, Inc. |

| • | Regulation (EU) No 596/2014 of the European Parliament and of the Council on market abuse (the “Regulation”) and Directive 2014/57/EU of the European Parliament and of the Council on criminal sanctions for market abuse (the “Directive” and, together with the Regulation, “MAD”) |

| • | Regulation (EU) 2016/1011 of the European Parliament and of the Council of 8 June 2016 on indices used as benchmarks in financial instruments and financial contracts or to measure the performance of investment funds and amending Directives 2008/48/EC and 2014/17/EU and Regulation (EU) No 596/2014 (“BMR”) non-EU entities and as a result, BMR application is very limited, although in some circumstances a few residual obligations could be deemed to be applicable because the ETCs are marketed across Europe. |

| • | Regulation (EU) No 1286/2014 of the European Parliament and of the Council of 26 November 2014 on key information documents for packaged retail and insurance-based investment products (“PRIIPS”) |

| • | MIFID II |

| • | Regulation (EU) 2015/2365 of the European Parliament and of the Council of 25 November 2015 on transparency of securities financing transactions and of reuse and amending Regulation (EU) No 648/2012. (“SFTR”) re-hypothecation are transferred to an account in the name of the other counterparty. Since the ManJer Issuers are based in non-EU jurisdictions, obligations are only indirectly applicable to them, but a certain level of interaction with EU counterparties is required to comply with some of these requirements. |

| • | The Control of Borrowing (Jersey) Order 1958 . |

| • | The Companies (General Provisions) (Jersey) Order 2002 |

| • | European Communities (Undertakings for Collective Investment in Transferable Securities) Regulations 2011 (as amended) (“UCITS Regulations”). |

| • | Central Bank (Supervision and Enforcement) Act 2013 (Section 48(1)) (Undertakings for Collective Investment in Transferable Securities) Regulations 2019 (“Central Bank UCITS Regulations”). |

| • | Central Bank Guidance. |

| • | The Irish Collective Asset-Management Vehicle Act 2015 (“ICAV Act”). sub-funds means there cannot be, as a matter of Irish law, cross-contamination of liability as between sub-funds so that the insolvency of one sub-fund affects another sub-fund. |

| • | EMIR inter alia sub-funds, which are subject to EMIR. WTI has adhered to the 2013 EMIR Portfolio Reconciliation, Dispute Resolution and Disclosure Protocol published by the International Swaps and Derivatives Association, Inc. The Central Bank has been designated as the competent authority for EMIR. |

| • | BMR non-EU administrators of benchmarks are required to satisfy a number of requirements to enable the benchmarks they provide to be used in the EU. To ensure investor protection, the BMR provides equivalence, recognition and endorsement conditions under which third country benchmarks may be used by supervised entities in the EU. Since we control the provision of benchmarks, we are required to comply with applicable obligations within the timeframes set out under the BMR. |

| • | The Companies Act |

| • | The Prospectus Regulation |

| • | EMIR |

| • | BMR |

| • | MAD |

ITEM 1A. |

RISK FACTORS |

| • | continuing to retain, motivate and manage our existing employees and/or attract and integrate new employees; |

| • | developing, implementing and improving our operational, financial, accounting, reporting and other internal systems and controls on a timely basis; and |

| • | maintaining and developing our various support functions including human resources, information technology, legal and corporate communications. |

| • | Products issued by the ManJer Issuers (except WisdomTree Issuer X Limited) are backed by physical metal and are subject to risks associated with the custody of metal, including the risk that access to the physically backed metal held in the vaults or secure warehouses of a custodian or sub-custodian could be restricted by natural events, such as an earthquake, or human actions, such as a terrorist attack, the risk that such physically backed metal in its custody could be lost, stolen or damaged, and the risk that our recovery of any losses from a custodian, sub-custodian or insurer may be inadequate. |

| • | Products issued by WisdomTree Issuer X Limited are backed by digital currencies and are subject to risks associated with the custody of digital assets, including the risk that the digital currency itself or the relevant blockchain infrastructure could be threatened by hacks, other malicious actions, breakdown or disturbance of the infrastructure and loss of the digital keys. |

| • | Products issued by WMAI, certain WisdomTree UCITS ETFs and certain products issued by the ManJer Issuers are backed by swap, derivative or similar arrangements are subject to risks associated with the creditworthiness of their counterparties, including the risk that a counterparty will not settle a transaction in accordance with its terms and conditions because of a dispute over the terms of the relevant arrangement (whether or not bona fide) or because of a credit, liquidity, regulatory, tax or operational problem. Any deterioration of the credit or downgrade in the credit rating of a counterparty, or the custodian holding the collateral, could cause the associated products to trade at a discount to the value of the underlying assets. |

| • | Counterparty risk |

| • | Default |

| • | losses for investors and the potentially limited ability to recover losses; |

| • | a compulsory redemption or other termination of the relevant products which may be earlier and at a different price to that which investors may receive had their investment not been redeemed or otherwise terminated; |

| • | the associated products trading at a discount to the value of the underlying assets; |

| • | the imposition of temporary restrictions on creation and redemption activity in the primary market in accordance with applicable product documentation. Such actions may impact the operation and liquidity of these products in the secondary market on exchange and the products may trade at a discount or premium; and/or |

| • | increased operational risks or transaction costs, which may negatively affect the investment performance of the relevant products and have a material adverse effect on our business and operations. |

| • | pay third-party infringement claims; |

| • | discontinue selling the particular funds subject to infringement claims; |

| • | discontinue using the processes subject to infringement claims; |

| • | develop other intellectual property or products not subject to infringement claims, which could be time-consuming and costly or may not be possible; or |

| • | license the intellectual property from the third party claiming infringement, which license may not be available on commercially reasonable terms. |

| • | the ultimate duration of the COVID-19 pandemic and its short-term and long-term impact on our business and the global economy; |

| • | decreases in our AUM; |

| • | variations in our quarterly operating results; |

| • | differences between our actual financial operating results and those expected by investors and analysts; |

| • | publication of research reports about us or the investment management industry; |

| • | changes in expectations concerning our future financial performance and the future performance of the ETP industry and the asset management industry in general, including financial estimates and recommendations by securities analysts; |

| • | our strategic moves and those of our competitors, such as acquisitions or consolidations; |

| • | changes in the regulatory framework of the ETP industry and the asset management industry in general and regulatory action, including action by the SEC to lessen the regulatory requirements or shorten the process under the Investment Company Act to become an ETP sponsor; |

| • | the level of demand for our stock, including the amount of short interest in our stock; |

| • | changes in general economic or market conditions; and |

| • | realization of any other of the risks described elsewhere in this section. |

| • | a classified Board of Directors; |

| • | limitations on the removal of directors; |

| • | advance notice requirements for stockholder proposals and nominations; |

| • | the inability of stockholders to act by written consent or to call special meetings; |

| • | the ability of our Board of Directors to make, alter or repeal our by-laws; and |

| • | the authority of our Board of Directors to issue preferred stock with such terms as our Board of Directors may determine. |

Total Number of Shares Purchased |

Average Price Paid Per Share |

Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs |

Approximate Dollar Value of Shares that May Yet Be Purchased Under the Plans or Programs |

|||||||||||||

| Period |

(in thousands) |

|||||||||||||||

| October 1, 2020 to October 31, 2020 |

— | $ | — | — | ||||||||||||

| November 1, 2020 to November 30, 2020 |

— | $ | — | — | ||||||||||||

| December 1, 2020 to December 31, 2020 |

44,351 | $ | 4.93 | 44,351 | ||||||||||||

| |

|

|

|

|||||||||||||

| Total |

44,351 | $ | 4.93 | 44,351 | $ | 52,191 | ||||||||||

| |

|

|

|

|

|

|||||||||||

2020 |

2019 |

2018 |

2017 |

2016 |

||||||||||||||||

| (in thousands, except per share data) | ||||||||||||||||||||

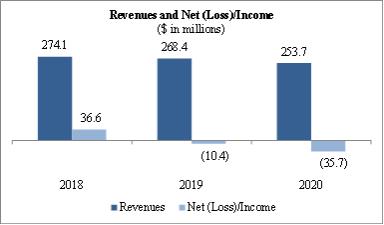

| Consolidated Statements of Operations Data: |

||||||||||||||||||||

| Operating Revenues: |

||||||||||||||||||||

| Advisory fees |

$ | 250,182 | $ | 265,652 | $ | 271,104 | $ | 226,692 | $ | 218,217 | ||||||||||

| Other income |

3,517 | 2,751 | 3,012 | 1,603 | 703 | |||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Total revenues |

253,699 | 268,403 | 274,116 | 228,295 | 218,920 | |||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Operating Expenses: |

||||||||||||||||||||

| Compensation and benefits |

74,675 | 80,761 | 74,515 | 81,493 | 63,263 | |||||||||||||||

| Fund management and administration |

60,515 | 61,502 | 56,686 | 42,144 | 41,083 | |||||||||||||||

| Marketing and advertising |

11,128 | 12,163 | 13,884 | 14,402 | 15,643 | |||||||||||||||

| Sales and business development |

10,579 | 18,276 | 17,153 | 13,811 | 12,537 | |||||||||||||||

| Contractual gold payments |

16,811 | 13,226 | 8,512 | — | — | |||||||||||||||

| Professional and consulting fees |

4,902 | 5,641 | 7,984 | 5,254 | 6,692 | |||||||||||||||

| Occupancy, communications and equipment |

6,427 | 6,302 | 6,203 | 5,415 | 5,211 | |||||||||||||||

| Depreciation and amortization |

1,021 | 1,045 | 1,301 | 1,395 | 1,305 | |||||||||||||||

| Third-party distribution fees |

5,219 | 6,968 | 6,611 | 3,393 | 2,827 | |||||||||||||||

| Acquisition and disposition-related costs |

416 | 902 | 11,454 | 4,832 | — | |||||||||||||||

| Other |

6,924 | 8,083 | 8,534 | 7,068 | 6,909 | |||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Total operating expenses |

198,617 | 214,869 | 212,837 | 179,207 | 155,470 | |||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Operating income |

55,082 | 53,534 | 61,279 | 49,088 | 63,450 | |||||||||||||||

| Other Income/(Expenses) |

||||||||||||||||||||

| Interest expense |

(9,668 | ) | (11,240 | ) | (7,962 | ) | — | — | ||||||||||||

| (Loss)/gain on revaluation of deferred consideration – gold payments |

(56,821 | ) | (11,293 | ) | 12,220 | — | — | |||||||||||||

| Interest income |

744 | 3,332 | 3,093 | 2,861 | 1,111 | |||||||||||||||

| Settlement gain |

— | — | — | 6,909 | — | |||||||||||||||

| Impairments |

(22,752 | ) | (30,710 | ) | (17,386 | ) | — | (1,676 | ) | |||||||||||

| Loss on extinguishment of debt |

(2,387 | ) | — | — | — | — | ||||||||||||||

| Acquisition payment |

— | — | — | — | (6,738 | ) | ||||||||||||||

| Other gains and losses, net |

580 | (3,502 | ) | (205 | ) | (666 | ) | (585 | ) | |||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| (Loss)/income before taxes |

(35,222 | ) | 121 | 51,039 | 58,192 | 55,562 | ||||||||||||||

| Income tax expense |

433 | 10,546 | 14,406 | 30,993 | 29,407 | |||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Net (loss)/income |

$ | (35,655 | ) | $ | (10,425 | ) | $ | 36,633 | $ | 27,199 | $ | 26,155 | ||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| (Loss)/earnings per share—diluted(1) |

$ | (0.25 | ) | $ | (0.08 | ) | $ | 0.23 | $ | 0.20 | $ | 0.19 | ||||||||

| Weighted average common shares—diluted(1) |

148,682 | 151,823 | 158,415 | 136,003 | 135,539 | |||||||||||||||

| Cash dividends declared per common share |

$ | 0.12 | $ | 0.12 | $ | 0.12 | $ | 0.32 | $ | 0.32 | ||||||||||

(1) |

See Note 23 to our Consolidated Financial Statements |

2020 |

2019 |

2018 |

2017 |

2016 |

||||||||||||||||

| Consolidated Balance Sheet Data: |

||||||||||||||||||||

| Cash and cash equivalents |

$ | 73,425 | $ | 74,972 | $ | 77,784 | $ | 54,193 | $ | 92,722 | ||||||||||

| Total assets |

$ | 896,692 | $ | 935,207 | $ | 937,518 | $ | 254,985 | $ | 249,767 | ||||||||||

| Convertible Notes and Debt |

$ | 166,646 | $ | 175,956 | $ | 194,592 | $ | — | $ | — | ||||||||||

| Deferred consideration – gold payments (total) |

$ | 230,137 | $ | 173,024 | $ | 161,540 | $ | — | $ | — | ||||||||||

| Total liabilities |

$ | 497,858 | $ | 465,226 | $ | 446,614 | $ | 62,034 | $ | 48,423 | ||||||||||

| Preferred stock – Series A Non-Voting Convertible |

$ | 132,569 | $ | 132,569 | $ | 132,569 | $ | — | $ | — | ||||||||||

| Stockholders’ equity |

$ | 266,265 | $ | 337,412 | $ | 358,335 | $ | 192,951 | $ | 201,344 | ||||||||||

| • | With the integration of ESG criteria in our ex-state-owned family of products, we are now the third largest ESG U.S. listed ETF issuer. |

| • | In December 2020, we announced the reorganization of the WisdomTree Enhanced Commodity Strategy Fund – previously the WisdomTree Continuing Commodity Index Fund (GCC) – with an updated approach to broad-based commodity investing. |

| • | In October 2020, we were named “Best International Equity ETF Issuer ($1BN+)” by the ETF Express U.S. Awards 2020, which recognizes excellence among ETF issuers and service providers across a wide range of categories. |

| • | In October 2020, we announced a collaboration with 55ip, a financial technology company, to deliver WisdomTree model portfolios utilizing 55ip’s automated tax-smart technology. |

| • | In September 2020, we won two awards at the AJ Bell Fund & Investment Trust Awards 2020 for WisdomTree Physical Gold (PHAU) and WisdomTree Cloud Computing UCITS ETF (WCLD). |

| • | In July 2020, we secured additional third-party relationships for our model portfolios, including Carson Group, Riskalzye, Kwanti, ETF Logic and Orion. |

| • | In June 2020, we entered into a new distribution agreement in Italy for our model portfolios with The Intermonte Eye, a digital service providing products to its network of private banks. |

| • | In March 2020, we were awarded “Best European Commodity ETF Provider” at the ETF Express 2020 European Awards. |

| • | In February 2020, we completed sale of our Canadian ETF business to CI Financial Corp. |

| • | In February 2020, in collaboration with Professor Jeremy Siegel, we launched two Siegel-WisdomTree model portfolios – The Siegel-WisdomTree Global Equity Model and the Siegel-WisdomTree Longevity Model. |

| • | We launched 4 new International listed ETPs. |

| • | In connection with our capital management strategy, we issued $175.0 million of convertible senior notes due 2023, repaid our debt previously outstanding and returned approximately $51.3 million to our stockholders through stock repurchases and our ongoing quarterly cash dividend. |

| Commodity & Currency: | 38bps | Leveraged & Inverse: | 89bps | |||

| International Equity: | 53bps | Fixed Income: | 19bps | |||

| U.S. Equity: | 33bps | Alternatives: | 55bps | |||

| Emerging Market Equity: | 49bps |

| • | portfolio management of our ETPs (sub-advisory); |

| • | fund accounting and administration; |

| • | custodial and storage services; |

| • | market making; |

| • | transfer agency; |

| • | accounting and tax services; |

| • | printing and mailing of stockholder materials; |

| • | index calculation; |

| • | indicative values; |

| • | distribution fees; |

| • | legal and compliance services; |

| • | exchange listing fees; |

| • | trustee fees and expenses; |

| • | preparation of regulatory reports and filings; |

| • | insurance; |

| • | certain local income taxes; and |

| • | other administrative services. |

| • | advertising and product promotion campaigns that are initiated to promote our existing and new ETPs as well as brand awareness; |

| • | development and maintenance of our website; and |

| • | creation and preparation of marketing materials. |

| • | travel and entertainment or conference related expenses for our sales force; |

| • | market data services for our research team; |

| • | sales related software tools; |

| • | voluntary payment of certain costs associated with the creation or redemption of ETF shares, as we may elect from time to time; and |

| • | legal and other advisory fees associated with the development of new funds or business initiatives. |

Years Ended December 31, |

||||||||||||

2020 |

2019 |

2018 |

||||||||||

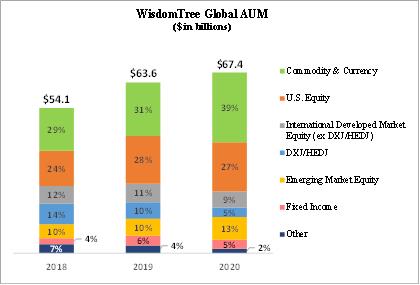

| GLOBAL ETPs (in millions) |

||||||||||||

| Beginning of period assets |

$ | 63,615 | $ | 54,094 | $ | 48,936 | ||||||

| Assets acquired/(sold) |

(778 | ) | — | 17,641 | ||||||||

| Inflows/(outflows) |

(6 | ) | 596 | (4,432 | ) | |||||||

| Market appreciation/(depreciation) |

5,020 | 9,196 | (8,006 | ) | ||||||||

| Fund closures |

(459 | ) | (271 | ) | (45 | ) | ||||||

| |

|

|

|

|

|

|||||||

| End of period assets |

$ | 67,392 | $ | 63,615 | $ | 54,094 | ||||||

| |

|

|

|

|

|

|||||||

| Average assets during the period |

$ | 61,158 | $ | 59,712 | $ | 56,397 | ||||||

| Average advisory fee during the period |

0.41 | % | 0.45 | % | 0.48 | % | ||||||

| Number of ETPs – end of the period |

309 | 367 | 537 | |||||||||

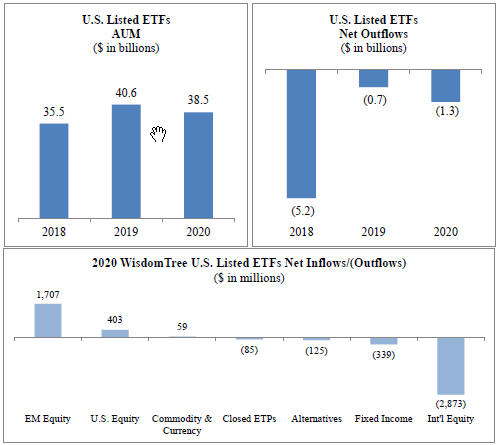

| U.S. LISTED ETFs (in millions) |

||||||||||||

| Beginning of period assets |

$ | 40,600 | $ | 35,486 | $ | 46,827 | ||||||

| Inflows/(outflows) |

(1,253 | ) | (654 | ) | (5,169 | ) | ||||||

| Market appreciation/(depreciation) |

(609 | ) | 5,858 | (6,127 | ) | |||||||

| Fund closures |

(221 | ) | (90 | ) | (45 | ) | ||||||

| |

|

|

|

|

|

|||||||

| End of period assets |

$ | 38,517 | $ | 40,600 | $ | 35,486 | ||||||

| |

|

|

|

|

|

|||||||

| Average assets during the period |

$ | 34,304 | $ | 38,577 | $ | 42,241 | ||||||

| Average advisory fee during the period |

0.41 | % | 0.44 | % | 0.48 | % | ||||||

| Number of ETPs—end of period |

67 | 80 | 85 | |||||||||

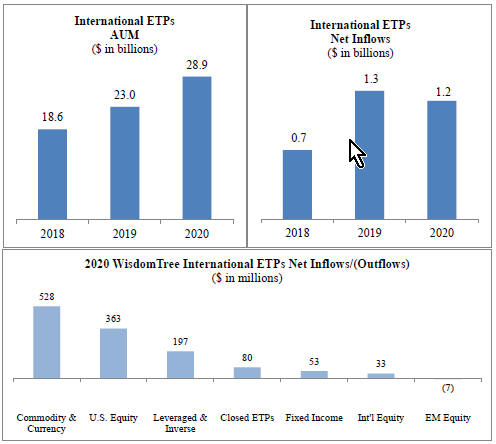

| INTERNATIONAL LISTED ETPs (in millions) |

||||||||||||

| Beginning of period assets |

$ | 23,015 | $ | 18,608 | $ | 2,109 | ||||||

| Assets acquired/(sold) |

(778 | ) | — | 17,641 | ||||||||

| Inflows/(outflows) |

1,247 | 1,250 | 737 | |||||||||

| Market appreciation/(depreciation) |

5,629 | 3,338 | (1,879 | ) | ||||||||

| Fund closures |

(238 | ) | (181 | ) | — | |||||||

| |

|

|

|

|

|

|||||||

| End of period assets |

$ | 28,875 | $ | 23,015 | $ | 18,608 | ||||||

| |

|

|

|

|

|

|||||||

| Average assets during the period |

$ | 26,854 | $ | 21,135 | $ | 14,156 | ||||||

| Average advisory fee during the period |

0.40 | % | 0.45 | % | 0.48 | % | ||||||

| Number of ETPs—end of period |

242 | 287 | 452 | |||||||||

| PRODUCT CATEGORIES (in millions) |

||||||||||||

| Commodity & Currency |

||||||||||||

| Beginning of period assets |

$ | 19,947 | $ | 15,830 | $ | 278 | ||||||

| Assets acquired |

— | — | 16,778 | |||||||||

| Inflows/(outflows) |

587 | 1,147 | 484 | |||||||||

| Market appreciation/(depreciation) |

5,513 | 2,970 | (1,710 | ) | ||||||||

| |

|

|

|

|

|

|||||||

| End of period assets |

$ | 26,047 | $ | 19,947 | $ | 15,830 | ||||||

| |

|

|

|

|

|

|||||||

| Average assets during the period |

$ | 23,807 | $ | 18,085 | $ | 11,334 | ||||||

| U.S. Equity |

||||||||||||

| Beginning of period assets |

$ | 17,732 | $ | 13,211 | $ | 14,135 | ||||||

| Inflows/(outflows) |

766 | 1,445 | 859 | |||||||||

| Market appreciation/(depreciation) |

(131 | ) | 3,076 | (1,783 | ) | |||||||

| |

|

|

|

|

|

|||||||

| End of period assets |

$ | 18,367 | $ | 17,732 | $ | 13,211 | ||||||

| |

|

|

|

|

|

|||||||

| Average assets during the period |

$ | 15,380 | $ | 15,846 | $ | 14,223 | ||||||

| International Developed Equity |

||||||||||||

| Beginning of period assets |

$ | 13,011 | $ | 14,232 | $ | 25,495 | ||||||

| Inflows/(outflows) |

(2,840 | ) | (3,452 | ) | (7,903 | ) | ||||||

| Market appreciation/(depreciation) |

(757 | ) | 2,231 | (3,360 | ) | |||||||

| |

|

|

|

|

|

|||||||

| End of period assets |

$ | 9,414 | $ | 13,011 | $ | 14,232 | ||||||

| |

|

|

|

|

|

|||||||

| Average assets during the period |

$ | 9,499 | $ | 13,187 | $ | 20,352 | ||||||

Years Ended December 31, |

||||||||||||

2020 |

2019 |

2018 |

||||||||||

| Emerging Market Equity |

||||||||||||

| Beginning of period assets |

$ | 6,400 | $ | 5,202 | $ | 5,798 | ||||||

| Inflows/(outflows) |

1,700 | 618 | 311 | |||||||||

| Market appreciation/(depreciation) |

439 | 580 | (907 | ) | ||||||||

| |

|

|

|

|

|

|||||||

| End of period assets |

$ | 8,539 | $ | 6,400 | $ | 5,202 | ||||||

| |

|

|

|

|

|

|||||||

| Average assets during the period |

$ | 6,056 | $ | 5,703 | $ | 5,673 | ||||||

| Fixed Income |

||||||||||||

| Beginning of period assets |

$ | 3,585 | $ | 2,245 | $ | 703 | ||||||

| Inflows/(outflows) |

(286 | ) | 1,280 | 1,607 | ||||||||

| Market appreciation/(depreciation) |

25 | 60 | (65 | ) | ||||||||

| |

|

|

|

|

|

|||||||

| End of period assets |

$ | 3,324 | $ | 3,585 | $ | 2,245 | ||||||

| |

|

|

|

|

|

|||||||

| Average assets during the period |

$ | 3,563 | $ | 3,572 | $ | 1,267 | ||||||

| Leveraged & Inverse |

||||||||||||

| Beginning of period assets |

$ | 1,138 | $ | 1,059 | $ | 897 | ||||||

| Assets acquired |

— | — | 863 | |||||||||

| Inflows/(outflows) |

197 | 55 | (214 | ) | ||||||||

| Market appreciation/(depreciation) |

152 | 24 | (487 | ) | ||||||||

| |

|

|

|

|

|

|||||||

| End of period assets |

$ | 1,487 | $ | 1,138 | $ | 1,059 | ||||||

| |

|

|

|

|

|

|||||||

| Average assets during the period |

$ | 1,361 | $ | 1,174 | $ | 1,164 | ||||||

| Alternatives |

||||||||||||

| Beginning of period assets |

$ | 358 | $ | 508 | $ | 473 | ||||||

| Inflows/(outflows) |

(125 | ) | (162 | ) | 76 | |||||||

| Market appreciation/(depreciation) |

(19 | ) | 12 | (41 | ) | |||||||

| |

|

|

|

|

|

|||||||

| End of period assets |

$ | 214 | $ | 358 | $ | 508 | ||||||

| |

|

|

|

|

|

|||||||

| Average assets during the period |

$ | 251 | $ | 440 | $ | 408 | ||||||

| Closed ETPs |

||||||||||||

| Beginning of period assets |

$ | 1,444 | $ | 1,807 | $ | 1,157 | ||||||

| Assets sold |

(778 | ) | — | — | ||||||||

| Inflows/(outflows) |

(5 | ) | (335 | ) | 348 | |||||||

| Market appreciation/(depreciation) |

(202 | ) | 243 | 347 | ||||||||

| Fund closures |

(459 | ) | (271 | ) | (45 | ) | ||||||

| |

|

|

|

|

|

|||||||

| End of period assets |

$ | — | $ | 1,444 | $ | 1,807 | ||||||

| |

|

|

|

|

|

|||||||

| Average assets during the period |

$ | 1,241 | $ | 1,705 | $ | 1,976 | ||||||

| Headcount |

217 | 208 | 228 | |||||||||

Year Ended December 31, |

Change |

Percent Change |

||||||||||||||

2020 |

2019 |

|||||||||||||||

| Global AUM (in millions) |

||||||||||||||||

| Average global AUM |

$ | 61,158 | $ | 59,712 | $ | 1,446 | 2.4 | % | ||||||||

| |

|

|

|

|

|

|||||||||||

| Operating Revenues (in thousands) |

||||||||||||||||

| Advisory fees |

$ | 250,182 | $ | 265,652 | $ | (15,470 | ) | (5.8 | %) | |||||||

| Other income |

3,517 | 2,751 | 766 | 27.8 | % | |||||||||||

| |

|

|

|

|

|

|||||||||||

| Total revenues |

$ | 253,699 | $ | 268,403 | $ | (14,704 | ) | (5.5 | %) | |||||||

| |

|

|

|

|

|

|||||||||||

| (in thousands) |

Year Ended December 31, |

Change |

Percent Change |

|||||||||||||

2020 |

2019 |

|||||||||||||||

| Compensation and benefits |

$ | 74,675 | $ | 80,761 | $ | (6,086 | ) | (7.5 | %) | |||||||

| Fund management and administration |

60,515 | 61,502 | (987 | ) | (1.6 | %) | ||||||||||

| Marketing and advertising |

11,128 | 12,163 | (1,035 | ) | (8.5 | %) | ||||||||||

| Sales and business development |

10,579 | 18,276 | (7,697 | ) | (42.1 | %) | ||||||||||

| Contractual gold payments |

16,811 | 13,226 | 3,585 | 27.1 | % | |||||||||||

| Professional and consulting fees |

4,902 | 5,641 | (739 | ) | (13.1 | %) | ||||||||||

| Occupancy, communications and equipment |

6,427 | 6,302 | 125 | 2.0 | % | |||||||||||

| Depreciation and amortization |

1,021 | 1,045 | (24 | ) | (2.3 | %) | ||||||||||

| Third-party distribution fees |

5,219 | 6,968 | (1,749 | ) | (25.1 | %) | ||||||||||

| Acquisition and disposition-related costs |

416 | 902 | (486 | ) | (53.9 | %) | ||||||||||

| Other |

6,924 | 8,083 | (1,159 | ) | (14.3 | %) | ||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total operating expenses |

$ | 198,617 | $ | 214,869 | $ | (16,252 | ) | (7.6 | %) | |||||||

| |

|

|

|

|

|

|

|

|||||||||

| As a Percent of Revenues: |

Year Ended December 31, |

|||||||

2020 |

2019 |

|||||||

| Compensation and benefits |

29.4 | % | 30.1 | % | ||||

| Fund management and administration |

23.9 | % | 22.9 | % | ||||

| Marketing and advertising |

4.4 | % | 4.6 | % | ||||

| Sales and business development |

4.2 | % | 6.8 | % | ||||

| As a Percent of Revenues: |

Year Ended December 31, |

|||||||

2020 |

2019 |

|||||||

| Contractual gold payments |

6.6 | % | 4.9 | % | ||||

| Professional and consulting fees |

1.9 | % | 2.1 | % | ||||

| Occupancy, communications and equipment |

2.5 | % | 2.4 | % | ||||

| Depreciation and amortization |

0.4 | % | 0.4 | % | ||||

| Third-party distribution fees |

2.1 | % | 2.6 | % | ||||

| Acquisition and disposition-related costs |

0.2 | % | 0.3 | % | ||||

| Other |

2.7 | % | 3.0 | % | ||||

| |

|

|

|

|||||

| Total operating expenses |

78.3 | % | 80.1 | % | ||||

| |

|

|

|

|||||

Year Ended December 31, |

Change |

Percent Change |

||||||||||||||

| (in thousands) |

2020 |

2019 |

||||||||||||||

| Interest expense |

$ | (9,668 | ) | $ | (11,240 | ) | $ | 1,572 | (14.0 | %) | ||||||

| Loss on revaluation of deferred consideration |

(56,821 | ) | (11,293 | ) | (45,528 | ) | 403.2 | % | ||||||||

| Interest income |

744 | 3,332 | (2,588 | ) | (77.7 | %) | ||||||||||

| Impairments |

(22,752 | ) | (30,710 | ) | 7,958 | (25.9 | %) | |||||||||

| Loss on extinguishment of debt |

(2,387 | ) | — | (2,387 | ) | n/a | ||||||||||

| Other gains and losses, net |

580 | (3,502 | ) | 4,082 | n/a | |||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total other expenses, net |

$ | (90,304 | ) | $ | (53,413 | ) | $ | (36,891 | ) | 69.1 | % | |||||

| |

|

|

|

|

|

|

|

|||||||||

Year Ended December 31, |

||||||||

| As a Percent of Revenues: |

2020 |

2019 |

||||||

| Interest expense |

(3.8 | %) | (4.2 | %) | ||||

| Loss on revaluation of deferred consideration |

(22.4 | %) | (4.2 | %) | ||||

| Interest income |

0.3 | % | 1.2 | % | ||||

| Impairments |

(9.0 | %) | (11.4 | %) | ||||

| Loss on extinguishment of debt |

(0.9 | %) | — | |||||

| Other gains and losses, net |

0.2 | % | (1.3 | %) | ||||

| |

|

|

|

|||||

| Total other expenses, net |

(35.6 | %) | (19.9 | %) | ||||

| |

|

|

|

|||||

Year Ended December 31, |

Change |

Percent Change |

||||||||||||||

2019 |

2018 |

|||||||||||||||

| Global AUM (in millions) |

||||||||||||||||

| Average global AUM |

$ | 59,712 | $ | 56,397 | $ | 3,315 | 5.9 | % | ||||||||

| |

|

|

|

|

|

|||||||||||

| Operating Revenues (in thousands) |

||||||||||||||||

| Advisory fees |

$ | 265,652 | $ | 271,104 | $ | (5,452 | ) | (2.0 | %) | |||||||

| Other income |

2,751 | 3,012 | (261 | ) | (8.7 | %) | ||||||||||

| |

|

|

|

|

|

|||||||||||

| Total revenues |

$ | 268,403 | $ | 274,116 | $ | (5,713 | ) | (2.1 | %) | |||||||

| |

|

|

|

|

|

|||||||||||

| (in thousands) |

Year Ended December 31, |

Change |

Percent Change |

|||||||||||||

2019 |

2018 |

|||||||||||||||

| Compensation and benefits |

$ | 80,761 | $ | 74,515 | $ | 6,246 | 8.4 | % | ||||||||

| Fund management and administration |

61,502 | 56,686 | 4,816 | 8.5 | % | |||||||||||

| Marketing and advertising |

12,163 | 13,884 | (1,721 | ) | (12.4 | %) | ||||||||||

| Sales and business development |

18,276 | 17,153 | 1,123 | 6.5 | % | |||||||||||

| Contractual gold payments |

13,226 | 8,512 | 4,714 | 55.4 | % | |||||||||||

| Professional and consulting fees |

5,641 | 7,984 | (2,343 | ) | (29.3 | %) | ||||||||||

| Occupancy, communications and equipment |

6,302 | 6,203 | 99 | 1.6 | % | |||||||||||

| Depreciation and amortization |

1,045 | 1,301 | (256 | ) | (19.7 | %) | ||||||||||

| Third-party distribution fees |

6,968 | 6,611 | 357 | 5.4 | % | |||||||||||

| Acquisition and disposition-related costs |

902 | 11,454 | (10,552 | ) | (92.1 | %) | ||||||||||

| Other |

8,083 | 8,534 | (451 | ) | (5.3 | %) | ||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total operating expenses |

$ | 214,869 | $ | 212,837 | $ | 2,032 | 1.0 | % | ||||||||

| |

|

|

|

|

|

|

|

|||||||||

| As a Percent of Revenues: |

Year Ended December 31, |

|||||||

2019 |

2018 |

|||||||

| Compensation and benefits |

30.1 | % | 27.2 | % | ||||

| Fund management and administration |

22.9 | % | 20.7 | % | ||||

| Marketing and advertising |

4.6 | % | 5.1 | % | ||||

| Sales and business development |

6.8 | % | 6.2 | % | ||||

| Contractual gold payments |

4.9 | % | 3.1 | % | ||||

| Professional and consulting fees |

2.1 | % | 2.9 | % | ||||

| Occupancy, communications and equipment |

2.4 | % | 2.3 | % | ||||

| Depreciation and amortization |

0.4 | % | 0.4 | % | ||||

| Third-party distribution fees |

2.6 | % | 2.4 | % | ||||

| Acquisition and disposition-related costs |

0.3 | % | 4.2 | % | ||||

| Other |

3.0 | % | 3.1 | % | ||||

| |

|

|

|

|||||

| Total operating expenses |

80.1 | % | 77.6 | % | ||||

| |

|

|

|

|||||

Year Ended December 31, |

Change |

Percent Change |

||||||||||||||

| (in thousands) |

2019 |

2018 |

||||||||||||||

| Interest expense |

$ | (11,240 | ) | $ | (7,962 | ) | $ | (3,278 | ) | 41.2 | % | |||||

| (Loss)/gain on revaluation of deferred consideration |

(11,293 | ) | 12,220 | (23,513 | ) | n/a | ||||||||||

| Interest income |

3,332 | 3,093 | 239 | 7.7 | % | |||||||||||

| Impairments |

(30,710 | ) | (17,386 | ) | (13,324 | ) | 76.6 | % | ||||||||

| Other losses, net |

(3,502 | ) | (205 | ) | (3,297 | ) | 1,608.3 | % | ||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total other expenses, net |

$ | (53,413 | ) | $ | (10,240 | ) | $ | (43,173 | ) | 421.6 | % | |||||

| |

|

|

|

|

|

|

|

|||||||||

Year Ended December 31, |

||||||||

| As a Percent of Revenues: |

2019 |

2018 |

||||||

| Interest expense |

(4.2 | %) | (2.9 | %) | ||||

| (Loss)/gain on revaluation of deferred consideration |

(4.2 | %) | 4.5 | % | ||||

| Interest income |

1.2 | % | 1.1 | % | ||||

| Impairments |

(11.4 | %) | (6.3 | %) | ||||

| Other losses, net |

(1.3 | %) | (0.1 | %) | ||||

| |

|

|

|

|||||

| Total other expenses, net |

(19.9 | %) | (3.7 | %) | ||||

| |

|

|

|

|||||

(in thousands, except per share amounts) |

Q4/20 |

Q3/20 |

Q2/20 |

Q1/20 |

Q4/19 |

Q3/19 |

Q2/19 |

Q1/19 |

||||||||||||||||||||||||

| Operating Revenues: |

||||||||||||||||||||||||||||||||

| Advisory fees |

$ | 66,105 | $ | 63,919 | $ | 57,208 | $ | 62,950 | $ | 68,179 | $ | 67,006 | $ | 65,627 | $ | 64,840 | ||||||||||||||||

| Other income |

954 | 721 | 918 | 924 | 728 | 712 | 666 | 645 | ||||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total revenues |

67,059 | 64,640 | 58,126 | 63,874 | 68,907 | 67,718 | 66,293 | 65,485 | ||||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Operating Expenses: |

||||||||||||||||||||||||||||||||

| Compensation and benefits |

20,827 | 19,098 | 17,455 | 17,295 | 19,280 | 18,880 | 21,300 | 21,301 | ||||||||||||||||||||||||

| Fund management and administration |

16,350 | 15,219 | 14,461 | 14,485 | 15,650 | 15,110 | 15,576 | 15,166 | ||||||||||||||||||||||||

| Marketing and advertising |

3,715 | 2,996 | 1,949 | 2,468 | 3,551 | 3,022 | 2,910 | 2,680 | ||||||||||||||||||||||||

| Sales and business development |

2,595 | 2,386 | 2,181 | 3,417 | 5,329 | 4,354 | 4,171 | 4,422 | ||||||||||||||||||||||||

| Contractual gold payments |

4,449 | 4,539 | 4,063 | 3,760 | 3,516 | 3,502 | 3,110 | 3,098 | ||||||||||||||||||||||||

| Professional and consulting fees |

1,322 | 950 | 1,357 | 1,273 | 1,604 | 1,259 | 1,296 | 1,482 | ||||||||||||||||||||||||

| Occupancy, communications and equipment |

1,622 | 1,611 | 1,643 | 1,551 | 1,587 | 1,549 | 1,548 | 1,618 | ||||||||||||||||||||||||

| Depreciation and amortization |

261 | 253 | 251 | 256 | 253 | 259 | 264 | 269 | ||||||||||||||||||||||||

| Third-party distribution fees |

1,291 | 1,233 | 1,340 | 1,355 | 1,146 | 1,503 | 1,919 | 2,400 | ||||||||||||||||||||||||

| Acquisition and disposition-related costs |

— | — | 33 | 383 | 366 | 190 | 33 | 313 | ||||||||||||||||||||||||

| Other |

1,720 | 1,611 | 1,596 | 1,997 | 1,816 | 1,959 | 2,255 | 2,053 | ||||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total operating expenses |

54,152 | 49,896 | 46,329 | 48,240 | 54,098 | 51,587 | 54,382 | 54,802 | ||||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Operating income |

12,907 | 14,744 | 11,797 | 15,634 | 14,809 | 16,131 | 11,911 | 10,683 | ||||||||||||||||||||||||

| Other Income/(Expenses): |

||||||||||||||||||||||||||||||||

| Interest expense |

(2,694 | ) | (2,511 | ) | (2,044 | ) | (2,419 | ) | (2,606 | ) | (2,832 | ) | (2,910 | ) | (2,892 | ) | ||||||||||||||||

| (Loss)/gain on revaluation of deferred consideration |

(22,385 | ) | (8,870 | ) | (23,358 | ) | (2,208 | ) | (5,354 | ) | (6,306 | ) | (4,037 | ) | 4,404 | |||||||||||||||||

| Interest income |

351 | 111 | 119 | 163 | 936 | 799 | 818 | 779 | ||||||||||||||||||||||||

| Impairments |

— | (3,080 | ) | — | (19,672 | ) | (30,138 | ) | — | — | (572 | ) | ||||||||||||||||||||

| Loss on extinguishment of debt |

— | — | (2,387 | ) | — | — | — | — | — | |||||||||||||||||||||||

| Other gains and losses, net |

524 | 744 | 1,819 | (2,507 | ) | (2 | ) | 843 | 284 | (4,627 | ) | |||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| (Loss)/income before income taxes |

(11,297 | ) | 1,138 | (14,054 | ) | (11,009 | ) | (22,355 | ) | 8,635 | 6,066 | 7,775 | ||||||||||||||||||||

| Income tax expense/(benefit) |

2,200 | 1,408 | (804 | ) | (2,371 | ) | 3,525 | 4,483 | 3,587 | (1,049 | ) | |||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Net (loss)/income |

($ | 13,497 | ) | $ | (270) | ($ | 13,250 | ) | ($ | 8,638 | ) | ($ | 25,880 | ) | $ | 4,152 | $ | 2,479 | $ | 8,824 | ||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| (Loss)/earnings per share - basic |

($ | 0.10 | ) | ($ | 0.01 | ) | ($ | 0.09 | ) | ($ | 0.06 | ) | ($ | 0.17 | ) | $ | 0.02 | $ | 0.01 | $ | 0.05 | |||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| (Loss)/earnings per share - diluted |

($ | 0.10 | ) | ($ | 0.01 | ) | ($ | 0.09 | ) | ($ | 0.06 | ) | ($ | 0.17 | ) | $ | 0.02 | $ | 0.01 | $ | 0.05 | |||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Dividends per common share |

$ | 0.03 | $ | 0.03 | $ | 0.03 | $ | 0.03 | $ | 0.03 | $ | 0.03 | $ | 0.03 | $ | 0.03 | ||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

Q4/20 |

Q3/20 |

Q2/20 |

Q1/20 |

Q4/19 |

Q3/19 |

Q2/19 |

Q1/19 |

|||||||||||||||||||||||||

| Percent of Revenues |

||||||||||||||||||||||||||||||||

| Operating Revenues |

||||||||||||||||||||||||||||||||

| Advisory fees |

98.6 | % | 98.9 | % | 98.4 | % | 98.6 | % | 98.9 | % | 98.9 | % | 99.0 | % | 99.0 | % | ||||||||||||||||

| Other income |

1.4 | % | 1.1 | % | 1.6 | % | 1.4 | % | 1.1 | % | 1.1 | % | 1.0 | % | 1.0 | % | ||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total revenues |

100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | ||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Operating Expenses |

||||||||||||||||||||||||||||||||

| Compensation and benefits |

31.1 | % | 29.6 | % | 30.0 | % | 27.1 | % | 28.0 | % | 27.9 | % | 32.1 | % | 32.5 | % | ||||||||||||||||

| Fund management and administration |

24.4 | % | 23.5 | % | 24.9 | % | 22.7 | % | 22.7 | % | 22.3 | % | 23.5 | % | 23.2 | % | ||||||||||||||||

| Marketing and advertising |

5.5 | % | 4.6 | % | 3.3 | % | 3.9 | % | 5.2 | % | 4.5 | % | 4.4 | % | 4.1 | % | ||||||||||||||||

| Sales and business development |

3.9 | % | 3.7 | % | 3.8 | % | 5.3 | % | 7.7 | % | 6.5 | % | 6.3 | % | 6.8 | % | ||||||||||||||||

| Contractual gold payments |

6.6 | % | 7.0 | % | 7.0 | % | 5.9 | % | 5.1 | % | 5.2 | % | 4.7 | % | 4.7 | % | ||||||||||||||||

| Professional and consulting fees |

2.0 | % | 1.5 | % | 2.3 | % | 2.0 | % | 2.3 | % | 1.9 | % | 1.9 | % | 2.3 | % | ||||||||||||||||

| Occupancy, communications and equipment |

2.4 | % | 2.5 | % | 2.8 | % | 2.4 | % | 2.3 | % | 2.2 | % | 2.3 | % | 2.4 | % | ||||||||||||||||

| Depreciation and amortization |

0.4 | % | 0.4 | % | 0.4 | % | 0.4 | % | 0.4 | % | 0.4 | % | 0.4 | % | 0.4 | % | ||||||||||||||||

| Third-party distribution fees |

1.9 | % | 1.9 | % | 2.3 | % | 2.1 | % | 1.7 | % | 2.2 | % | 2.9 | % | 3.7 | % | ||||||||||||||||

| Acquisition and disposition-related costs |

n/a | n/a | 0.1 | % | 0.6 | % | 0.5 | % | 0.2 | % | 0.1 | % | 0.5 | % | ||||||||||||||||||

| Other |

2.6 | % | 2.5 | % | 2.8 | % | 3.1 | % | 2.6 | % | 2.9 | % | 3.4 | % | 3.1 | % | ||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total operating expenses |

80.8 | % | 77.2 | % | 79.7 | % | 75.5 | % | 78.5 | % | 76.2 | % | 82.0 | % | 83.7 | % | ||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Operating income |

19.2 | % | 22.8 | % | 20.3 | % | 24.5 | % | 21.5 | % | 23.8 | % | 18.0 | % | 16.3 | % | ||||||||||||||||

| Other Income/(Expenses) |

||||||||||||||||||||||||||||||||

| Interest expense |

(4.0 | %) | (3.9 | %) | (3.5 | %) | (3.8 | %) | (3.8 | %) | (4.2 | %) | (4.4 | %) | (4.4 | %) | ||||||||||||||||

| (Loss)/gain on revaluation of deferred consideration |

(33.3 | %) | (13.7 | %) | (40.2 | %) | (3.5 | %) | (7.8 | %) | (9.3 | %) | (6.1 | %) | 6.7 | % | ||||||||||||||||

| Interest income |

0.5 | % | 0.2 | % | 0.2 | % | 0.2 | % | 1.4 | % | 1.2 | % | 1.2 | % | 1.2 | % | ||||||||||||||||

| Impairments |

n/a | (4.8 | %) | n/a | (30.7 | %) | (43.7 | %) | n/a | n/a | (0.9 | %) | ||||||||||||||||||||

| Loss on extinguishment of debt |

n/a | n/a | (4.1 | %) | n/a | n/a | n/a | n/a | n/a | |||||||||||||||||||||||

| Other gains and losses, net |

0.8 | % | 1.2 | % | 3.1 | % | (3.9 | %) | 0.0 | % | 1.2 | % | 0.4 | % | (7.0 | %) | ||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| (Loss)/income before income taxes |

(16.8 | %) | 1.8 | % | (24.2 | %) | (17.2 | %) | (32.4 | %) | 12.7 | % | 9.1 | % | 11.9 | % | ||||||||||||||||

| Income tax expense/(benefit) |

3.3 | % | 2.2 | % | (1.4 | %) | (3.7 | %) | 5.1 | % | 6.6 | % | 5.4 | % | (1.6 | %) | ||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Net (loss)/income |

(20.1 | %) | (0.4 | %) | (22.8 | %) | (13.5 | %) | (37.5 | %) | 6.1 | % | 3.7 | % | 13.5 | % | ||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

Q4/20 |

Q3/20 |

Q2/20 |

Q1/20 |

Q4/19 |

Q3/19 |

Q2/19 |

Q1/19 |

|||||||||||||||||||||||||

| Operating Statistics |

||||||||||||||||||||||||||||||||

| GLOBAL ETPs (in millions) |

||||||||||||||||||||||||||||||||

| Beginning of period assets |

$ | 60,710 | $ | 57,666 | $ | 50,347 | $ | 63,615 | $ | 59,981 | $ | 60,389 | $ | 59,112 | $ | 54,094 | ||||||||||||||||

| Assets sold |

— | — | — | (778 | ) | — | — | — | — | |||||||||||||||||||||||

| Inflows/(outflows) |

881 | (477 | ) | 126 | (536 | ) | 390 | (698 | ) | 343 | 561 | |||||||||||||||||||||

| Market appreciation/(depreciation) |

5,898 | 3,567 | 7,489 | (11,934 | ) | 3,247 | 471 | 934 | 4,544 | |||||||||||||||||||||||

| Fund closures |

(97 | ) | (46 | ) | (296 | ) | (20 | ) | (3 | ) | (181 | ) | — | (87 | ) | |||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| End of period assets |

$ | 67,392 | $ | 60,710 | $ | 57,666 | $ | 50,347 | $ | 63,615 | $ | 59,981 | $ | 60,389 | $ | 59,112 | ||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Average assets during the period |

$ | 64,125 | $ | 61,216 | $ | 55,708 | $ | 60,189 | $ | 61,858 | $ | 60,306 | $ | 58,575 | $ | 57,683 | ||||||||||||||||

| Average advisory fee during the period |

0.41 | % | 0.42 | % | 0.41 | % | 0.42 | % | 0.44 | % | 0.44 | % | 0.45 | % | 0.46 | % | ||||||||||||||||

| Number of ETPs – end of the period |

309 | 305 | 311 | 331 | 349 | 348 | 536 | 534 | ||||||||||||||||||||||||

| U.S. LISTED ETFs (in millions) |

||||||||||||||||||||||||||||||||

| Beginning of period assets |

$ | 33,310 | $ | 31,362 | $ | 28,920 | $ | 40,600 | $ | 37,592 | $ | 39,220 | $ | 39,366 | $ | 35,486 | ||||||||||||||||

| Inflows/(outflows) |

919 | 575 | (1,474 | ) | (1,273 | ) | 563 | (1,198 | ) | (166 | ) | 147 | ||||||||||||||||||||

| Market appreciation/(depreciation) |

4,385 | 1,373 | 4,030 | (10,397 | ) | 2,448 | (430 | ) | 20 | 3,820 | ||||||||||||||||||||||

| Fund closures |

(97 | ) | — | (114 | ) | (10 | ) | (3 | ) | — | — | (87 | ) | |||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| End of period assets |

$ | 38,517 | $ | 33,310 | $ | 31,362 | $ | 28,920 | $ | 40,600 | $ | 37,592 | $ | 39,220 | $ | 39,366 | ||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Average assets during the period |

$ | 36,002 | $ | 32,984 | $ | 30,626 | $ | 36,940 | 39,094 | $ | 37,857 | $ | 38,945 | $ | 38,061 | |||||||||||||||||

| Average advisory fee during the period |

0.40 | % | 0.41 | % | 0.41 | % | 0.43 | % | 0.44 | % | 0.44 | % | 0.44 | % | 0.45 | % | ||||||||||||||||

| Number of ETFs – end of the period |

67 | 67 | 67 | 77 | 80 | 80 | 79 | 77 | ||||||||||||||||||||||||

| INTERNATIONAL LISTED ETPs (in millions) |

||||||||||||||||||||||||||||||||

| Beginning of period assets |

$ | 27,400 | $ | 26,304 | $ | 21,427 | $ | 23,015 | $ | 22,389 | $ | 21,169 | $ | 19,746 | $ | 18,608 | ||||||||||||||||

| Assets sold |

— | — | — | (778 | ) | — | — | — | — | |||||||||||||||||||||||

| Inflows/(outflows) |

(38 | ) | (1,052 | ) | 1,600 | 737 | (173 | ) | 500 | 509 | 414 | |||||||||||||||||||||

| Market appreciation/(depreciation) |

1,513 | 2,194 | 3,459 | (1,537 | ) | 799 | 901 | 914 | 724 | |||||||||||||||||||||||

| Fund closures |

— | (46 | ) | (182 | ) | (10 | ) | — | (181 | ) | — | — | ||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| End of period assets |

$ | 28,875 | $ | 27,400 | $ | 26,304 | $ | 21,427 | $ | 23,015 | $ | 22,389 | $ | 21,169 | $ | 19,746 | ||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Average assets during the period |

$ | 28,123 | $ | 28,232 | $ | 25,082 | $ | 23,249 | $ | 22,764 | $ | 22,449 | $ | 19,630 | $ | 19,622 | ||||||||||||||||

| Average advisory fee during the period |

0.42 | % | 0.42 | % | 0.41 | % | 0.40 | % | 0.44 | % | 0.44 | % | 0.46 | % | 0.47 | % | ||||||||||||||||

| Number of ETPs – end of the period |

242 | 238 | 244 | 254 | 269 | 268 | 457 | 457 | ||||||||||||||||||||||||

| PRODUCT CATEGORIES |

||||||||||||||||||||||||||||||||

| Commodity & Currency |

||||||||||||||||||||||||||||||||

| Beginning of period assets |

$ | 25,122 | $ | 24,191 | $ | 19,748 | $ | 19,947 | $ | 19,599 | $ | 18,075 | $ | 16,545 | $ | 15,830 | ||||||||||||||||

| Inflows/(outflows) |

(254 | ) | (1,106 | ) | 1,325 | 622 | (250 | ) | 524 | 624 | 249 | |||||||||||||||||||||

| Market appreciation/(depreciation) |

1,179 | 2,037 | 3,118 | (821 | ) | 598 | 1,000 | 906 | 466 | |||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| End of period assets |

$ | 26,047 | $ | 25,122 | $ | 24,191 | $ | 19,748 | $ | 19,947 | $ | 19,599 | $ | 18,075 | $ | 16,545 | ||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Average assets during the period |

$ | 25,676 | $ | 25,878 | $ | 22,964 | $ | 20,302 | $ | 19,770 | $ | 19,438 | $ | 16,508 | $ | 16,568 | ||||||||||||||||

| U.S. Equity |

||||||||||||||||||||||||||||||||

| Beginning of period assets |

$ | 15,612 | $ | 13,997 | $ | 12,151 | $ | 17,732 | $ | 16,281 | $ | 15,889 | $ | 15,747 | $ | 13,211 | ||||||||||||||||

| Inflows/(outflows) |

395 | 897 | (241 | ) | (285 | ) | 460 | 239 | 107 | 639 | ||||||||||||||||||||||

| Market appreciation/(depreciation) |

2,360 | 718 | 2,087 | (5,296 | ) | 991 | 153 | 35 | 1,897 | |||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| End of period assets |

$ | 18,367 | $ | 15,612 | $ | 13,997 | $ | 12,151 | $ | 17,732 | $ | 16,281 | $ | 15,889 | $ | 15,747 | ||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Average assets during the period |

$ | 17,050 | $ | 15,141 | $ | 13,302 | $ | 16,011 | $ | 16,969 | $ | 15,872 | $ | 15,677 | $ | 14,810 | ||||||||||||||||

| International Developed Market Equity |

||||||||||||||||||||||||||||||||

| Beginning of period assets |

$ | 8,621 | $ | 8,839 | $ | 8,659 | $ | 13,011 | $ | 12,169 | $ | 13,313 | $ | 14,056 | $ | 14,232 | ||||||||||||||||

| Inflows/(outflows) |

(191 | ) | (587 | ) | (965 | ) | (1,097 | ) | (135 | ) | (1,009 | ) | (733 | ) | (1,575 | ) | ||||||||||||||||

| Market appreciation/(depreciation) |

984 | 369 | 1,145 | (3,255 | ) | 977 | (135 | ) | (10 | ) | 1,399 | |||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| End of period assets |

$ | 9,414 | $ | 8,621 | $ | 8,839 | $ | 8,659 | $ | 13,011 | $ | 12,169 | $ | 13,313 | $ | 14,056 | ||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Average assets during the period |

$ | 8,930 | $ | 8,835 | $ | 8,779 | $ | 11,453 | $ | 12,607 | $ | 12,379 | $ | 13,593 | $ | 14,197 | ||||||||||||||||

| Emerging Market Equity |

||||||||||||||||||||||||||||||||

| Beginning of period assets |

$ | 5,979 | $ | 5,413 | $ | 4,600 | $ | 6,400 | $ | 5,699 | $ | 5,966 | $ | 5,626 | $ | 5,202 | ||||||||||||||||

| Inflows/(outflows) |

1,399 | 257 | (25 | ) | 69 | 195 | 176 | 346 | (99 | ) | ||||||||||||||||||||||

| Market appreciation/(depreciation) |

1,161 | 309 | 838 | (1,869 | ) | 506 | (443 | ) | (6 | ) | 523 | |||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| End of period assets |

$ | 8,539 | $ | 5,979 | $ | 5,413 | $ | 4,600 | $ | 6,400 | $ | 5,699 | $ | 5,966 | $ | 5,626 | ||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Average assets during the period |

$ | 7,249 | $ | 5,917 | $ | 5,129 | $ | 5,919 | $ | 5,991 | $ | 5,729 | $ | 5,674 | $ | 5,411 | ||||||||||||||||

Q4/20 |

Q3/20 |

Q2/20 |

Q1/20 |

Q4/19 |

Q3/19 |

Q2/19 |

Q1/19 |

|||||||||||||||||||||||||

| Fixed Income |

||||||||||||||||||||||||||||||||

| Beginning of period assets |

$ | 3,630 | $ | 3,530 | $ | 3,527 | $ | 3,585 | $ | 3,337 | $ | 3,946 | $ | 3,692 | $ | 2,245 | ||||||||||||||||

| Inflows/(outflows) |

(330 | ) | 76 | (53 | ) | 21 | 218 | (594 | ) | 235 | 1,421 | |||||||||||||||||||||

| Market appreciation/(depreciation) |

24 | 24 | 56 | (79 | ) | 30 | (15 | ) | 19 | 26 | ||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| End of period assets |

$ | 3,324 | $ | 3,630 | $ | 3,530 | $ | 3,527 | $ | 3,585 | $ | 3,337 | $ | 3,946 | $ | 3,692 | ||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Average assets during the period |

$ | 3,472 | $ | 3,605 | $ | 3,523 | $ | 3,653 | $ | 3,540 | $ | 3,731 | $ | 3,796 | $ | 3,184 | ||||||||||||||||

| Leveraged & Inverse |

||||||||||||||||||||||||||||||||

| Beginning of period assets |

$ | 1,430 | $ | 1,350 | $ | 896 | $ | 1,138 | $ | 1,121 | $ | 1,125 | $ | 1,204 | $ | 1,059 | ||||||||||||||||

| Inflows/(outflows) |

(118 | ) | (9 | ) | 312 | 12 | (22 | ) | 12 | (55 | ) | 120 | ||||||||||||||||||||

| Market appreciation/(depreciation) |

175 | 89 | 142 | (254 | ) | 39 | (16 | ) | (24 | ) | 25 | |||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| End of period assets |

$ | 1,487 | $ | 1,430 | $ | 1,350 | $ | 896 | $ | 1,138 | $ | 1,121 | $ | 1,125 | $ | 1,204 | ||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Average assets during the period |

$ | 1,436 | $ | 1,482 | $ | 1,169 | $ | 1,147 | $ | 1,178 | $ | 1,146 | $ | 1,179 | $ | 1,190 | ||||||||||||||||

| Alternatives |

||||||||||||||||||||||||||||||||

| Beginning of period assets |

$ | 229 | $ | 225 | $ | 244 | $ | 358 | $ | 418 | $ | 433 | $ | 472 | $ | 508 | ||||||||||||||||

| Inflows/(outflows) |

(26 | ) | (4 | ) | (29 | ) | (66 | ) | (61 | ) | (17 | ) | (38 | ) | (46 | ) | ||||||||||||||||

| Market appreciation/(depreciation) |

11 | 8 | 10 | (48 | ) | 1 | 2 | (1 | ) | 10 | ||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| End of period assets |

$ | 214 | $ | 229 | $ | 225 | $ | 244 | $ | 358 | $ | 418 | $ | 433 | $ | 472 | ||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Average assets during the period |

$ | 224 | $ | 226 | $ | 226 | $ | 328 | $ | 398 | $ | 428 | $ | 463 | $ | 472 | ||||||||||||||||

| Closed ETPs |

||||||||||||||||||||||||||||||||

| Beginning of period assets |

$ | 87 | $ | 121 | $ | 522 | $ | 1,444 | $ | 1,357 | $ | 1,642 | $ | 1,770 | $ | 1,807 | ||||||||||||||||

| Assets sold |

— | — | — | (778 | ) | — | — | — | — | |||||||||||||||||||||||

| Inflows/(outflows) |

6 | (1 | ) | (198 | ) | 188 | (15 | ) | (29 | ) | (143 | ) | (148 | ) | ||||||||||||||||||

| Market appreciation/(depreciation) |

4 | 13 | 93 | (312 | ) | 105 | (75 | ) | 15 | 198 | ||||||||||||||||||||||

| Fund closures |

(97 | ) | (46 | ) | (296 | ) | (20 | ) | (3 | ) | (181 | ) | — | (87 | ) | |||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| End of period assets |

$ | — | $ | 87 | $ | 121 | $ | 522 | $ | 1,444 | $ | 1,357 | $ | 1,642 | $ | 1,770 | ||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Average assets during the period |

$ | 88 | $ | 132 | $ | 616 | $ | 1,376 | $ | 1,405 | $ | 1,583 | $ | 1,685 | $ | 1,851 | ||||||||||||||||

| Headcount |

217 | 211 | 214 | 210 | 208 | 212 | 214 | 216 | ||||||||||||||||||||||||

| Note: Previously issued statistics may be restated due to fund closures and trade adjustments Source: WisdomTree |

|

|||||||||||||||||||||||||||||||

| • | Adjusted net income and adjusted diluted earnings per share. non-GAAP financial measurements in order to report our results exclusive of items that are non-recurring or not core to our operating business. We believe presenting these non-GAAP financial measures provides investors with a consistent way to analyze our performance. These non-GAAP financial measures exclude the following: |

| • | Unrealized gains or losses on the revaluation of deferred consideration |

| • | Tax shortfalls and windfalls upon vesting and exercise of stock-based compensation awards |

| • | Interest expense from the amortization of discount arising from the bifurcation of the conversion option embedded in the convertible notes non-GAAP financial measurements as it is non-cash and distorts our actual cost of borrowing. In addition, in August 2020, the FASB issued Accounting Standards Update 2020-06, Debt – Debt with Conversion and Other Options, Cash Conversion |

| • | Other items |

Years Ended |

||||||||||||

| Adjusted Net Income and Diluted Earnings per Share: |

Dec. 31, 2020 |

Dec. 31, 2019 |

Dec. 31, 2018 |

|||||||||

| Net (loss)/income, as reported |

$ | (35,655 | ) | $ | (10,425 | ) | $ | 36,633 | ||||

| Add back/(deduct): Loss/(gain) on revaluation of deferred consideration |

56,821 | 11,293 | (12,220 | ) | ||||||||

| Add back: Impairments, net of income taxes |

21,998 | 30,710 | 14,048 | |||||||||

| Deduct: Gain recognized upon sale of Canadian ETF business |

(2,877 | ) | — | — | ||||||||

| Deduct: Release of a deferred tax asset valuation allowance recognized on interest carryforwards arising from debt previously outstanding in the United Kingdom |

(2,615 | ) | — | — | ||||||||

| Add back: Loss on extinguishment of debt, net of income taxes |

1,910 | |||||||||||

| Deduct: Gain arising from an adjustment to the estimated fair value of consideration received from the exit of investment in AdvisorEngine |

(1,093 | ) | — | — | ||||||||

| Add back: Interest expense from the amortization of discount arising from the bifurcation of the conversion option embedded in the convertible notes, net of income taxes |

642 | — | — | |||||||||

| Add back/(deduct): Tax shortfalls/(windfalls) upon vesting and exercise of stock-based compensation awards |