| QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Delaware |

||

| (State or other jurisdiction of incorporation or organization) |

(IRS Employer Identification No.) |

| th Floor |

||

(Address of principal executive offices) |

(Zip Code) |

| ☒ | Accelerated filer | ☐ | ||||

Non-accelerated filer |

☐ | Smaller reporting company | ||||

| Emerging growth company | ||||||

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered | ||

The |

| • | the ultimate duration of the COVID-19 pandemic and its short-term and long-term impact on our business and the global economy; |

| • | anticipated trends, conditions and investor sentiment in the global markets and exchange traded products, or ETPs; |

| • | anticipated levels of inflows into and outflows out of our ETPs; |

| • | our ability to deliver favorable rates of return to investors; |

| • | competition in our business; |

| • | our ability to develop new products and services; |

| • | our ability to maintain current vendors or find new vendors to provide services to us at favorable costs; |

| • | our ability to successfully operate and expand our business in non-U.S. markets; and |

| • | the effect of laws and regulations that apply to our business. |

ITEM 1. |

FINANCIAL STATEMENTS |

September 30, 2020 |

December 31, 2019 |

|||||||

(Unaudited) |

||||||||

| Assets |

||||||||

| Current assets: |

||||||||

| Cash and cash equivalents |

$ | $ | ||||||

| Securities owned, at fair value (including $ |

||||||||

| Accounts receivable (including $ |

||||||||

| Income taxes receivable |

— | |||||||

| Prepaid expenses |

||||||||

| Other current assets |

||||||||

| |

|

|

|

|||||

| Total current assets |

||||||||

| Fixed assets, net |

||||||||

| Notes receivable, net |

— | |||||||

| Indemnification receivable (Note 22) |

||||||||

| Securities held-to-maturity |

||||||||

| Deferred tax assets, net |

||||||||

| Investments (Note 9) |

||||||||

| Right of use assets – operating leases (Note 15) |

||||||||

| Goodwill (Note 24) |

||||||||

| Intangible assets (Note 24) |

||||||||

| Other noncurrent assets |

||||||||

| |

|

|

|

|||||

| Total assets |

$ | $ | ||||||

| |

|

|

|

|||||

| Liabilities and stockholders’ equity |

||||||||

| Liabilities |

||||||||

| Current liabilities: |

||||||||

| Fund management and administration payable |

$ | $ | ||||||

| Compensation and benefits payable |

||||||||

| Deferred consideration – gold payments (Note 11) |

||||||||

| Securities sold, but not yet purchased, at fair value |

— | |||||||

| Operating lease liabilities (Note 15) |

||||||||

| Income taxes payable |

— | |||||||

| Accounts payable and other liabilities |

||||||||

| |

|

|

|

|||||

| Total current liabilities |

||||||||

| Convertible notes (Note 13) |

— | |||||||

| Debt (Note 12) |

— | |||||||

| Deferred consideration – gold payments (Note 11) |

||||||||

| Operating lease liabilities (Note 15) |

||||||||

| Other noncurrent liabilities (Note 22) |

||||||||

| |

|

|

|

|||||

| Total liabilities |

||||||||

| Preferred stock – Series A Non-Voting Convertible, par value $outstanding; redemption value of $ respectively) (Note 14) |

||||||||

| |

|

|

|

|||||

| Contingencies (Note ) |

||||||||

| Stockholders’ equity |

||||||||

| Preferred stock, par value $ |

||||||||

| Common stock, par value $ |

||||||||

| Additional paid-in capital |

||||||||

| Accumulated other comprehensive income |

||||||||

| Accumulated deficit |

( |

) | ( |

) | ||||

| |

|

|

|

|||||

| Total stockholders’ equity |

||||||||

| |

|

|

|

|||||

| Total liabilities and stockholders’ equity |

$ | $ | ||||||

| |

|

|

|

|||||

Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||||||

2020 |

2019 |

2020 |

2019 |

|||||||||||||

| Operating Revenues: |

||||||||||||||||

| Advisory fees |

$ | $ | $ | $ | ||||||||||||

| Other income |

||||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total revenues |

||||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Operating Expenses: |

||||||||||||||||

| Compensation and benefits |

||||||||||||||||

| Fund management and administration |

||||||||||||||||

| Marketing and advertising |

||||||||||||||||

| Sales and business development |

||||||||||||||||

| Contractual gold payments (Note 11) |

||||||||||||||||

| Professional and consulting fees |

||||||||||||||||

| Occupancy, communications and equipment |

||||||||||||||||

| Depreciation and amortization |

||||||||||||||||

| Third-party distribution fees |

||||||||||||||||

| Acquisition and disposition-related costs |

— | |||||||||||||||

| Other |

||||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total operating expenses |

||||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Operating income |

||||||||||||||||

| Other Income/(Expenses): |

||||||||||||||||

| Interest expense |

( |

) | ( |

) | ( |

) | ( |

) | ||||||||

| Loss on revaluation of deferred consideration – gold payments (Note 11) |

( |

) | ( |

) | ( |

) | ( |

) | ||||||||

| Interest income |

||||||||||||||||

| Impairments (Note 26) |

( |

) | — | ( |

) | ( |

) | |||||||||

| Loss on extinguishment of debt (Note 12) |

— | — | ( |

) | — | |||||||||||

| Other gains and losses, net |

( |

) | ||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Income/(loss) before income taxes |

( |

) | ||||||||||||||

| Income tax expense/(benefit) |

( |

) | ||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Net (loss)/income |

$ | ( |

) | $ | $ | ( |

) | $ | ||||||||

| |

|

|

|

|

|

|

|

|||||||||

| (Loss)/earnings per share—basic |

$ | ( |

) | $ | $ | ( |

) | $ | ||||||||

| |

|

|

|

|

|

|

|

|||||||||

| (Loss)/earnings per share—diluted |

$ | ( |

) | $ | $ | ( |

) | $ | ||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Weighted-average common shares—basic |

||||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Weighted-average common shares—diluted |

||||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Cash dividends declared per common share |

$ | $ | $ | $ | ||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||||||

2020 |

2019 |

2020 |

2019 |

|||||||||||||

| Net (loss)/income |

$ | ( |

) | $ | $ | ( |

) | $ | ||||||||

| Other comprehensive income/(loss) |

||||||||||||||||

| Reclassification of foreign currency translation adjustment to other gains and losses, net, upon the sale of WisdomTree Asset Management Canada Inc. (“WTAMC” or “Canadian ETF business”) (Note 25) |

— | — | ( |

) | — | |||||||||||

| Reclassification of foreign currency translation adjustment to other gains and losses, net, upon the liquidation of WisdomTree Japan Inc. (Note 25) |

— | ( |

) | — | ( |

) | ||||||||||

| Foreign currency translation adjustment |

( |

) | ( |

) | ( |

) | ||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Other comprehensive income/(loss) |

( |

) | ( |

) | ( |

) | ||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Comprehensive income/(loss) |

$ | $ | $ | ( |

) | $ | ||||||||||

| |

|

|

|

|

|

|

|

|||||||||

For the Three Months Ended September 30, 2020 |

||||||||||||||||||||||||

Common Stock |

Additional Paid-In Capital |

Accumulated Other Comprehensive Income |

Accumulated Deficit |

Total |

||||||||||||||||||||

Shares Issued |

Par Value |

|||||||||||||||||||||||

| Balance—July 1, 2020 |

$ | $ | $ | $ | ( |

) | $ | |||||||||||||||||

| Restricted stock issued and vesting of restricted stock units, net |

( |

) | — | — | — | |||||||||||||||||||

| Shares repurchased |

( |

) | ( |

) | ( |

) | — | — | ( |

) | ||||||||||||||

| Stock-based compensation |

— |

— | — | — | ||||||||||||||||||||

| Allocation of equity component related to convertible notes, net of issuance costs of $ |

— |

— | — | — | ||||||||||||||||||||

| Other comprehensive income |

— |

— | — | — | ||||||||||||||||||||

| Dividends |

— |

— | ( |

) | — | — | ( |

) | ||||||||||||||||

| Net loss |

— |

— | — | — | ( |

) | ( |

) | ||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Balance—September 30, 2020 |

$ | $ | $ | $ | ( |

) | $ | |||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

For the Three Months Ended September 30, 2019 |

||||||||||||||||||||||||

Common Stock |

Additional Paid-In Capital |

Accumulated Other Comprehensive Income |

Accumulated Deficit |

Total |

||||||||||||||||||||

Shares Issued |

Par Value |

|||||||||||||||||||||||

| Balance—July 1, 2019 |

$ | $ | $ | $ | ( |

) | $ | |||||||||||||||||

| Restricted stock issued and vesting of restricted stock units, net |

( |

) | ( |

) | — | — | — | |||||||||||||||||

| Shares repurchased |

( |

) | — | ( |

) | — | — | ( |

) | |||||||||||||||

| Exercise of stock options, net |

— | — | — | |||||||||||||||||||||

| Stock-based compensation |

— | — | — | — | ||||||||||||||||||||

| Other comprehensive loss |

— | — | — | ( |

) | — | ( |

) | ||||||||||||||||

| Dividends |

— | — | — | — | ( |

) | ( |

) | ||||||||||||||||

| Net income |

— | — | — | — | ||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Balance—September 30, 2019 |

$ | $ | $ | $ | ( |

) | $ | |||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

For the Nine Months Ended September 30, 2020 |

||||||||||||||||||||||||

Common Stock |

Additional Paid-In Capital |

Accumulated Other Comprehensive Income |

Accumulated Deficit |

Total |

||||||||||||||||||||

Shares Issued |

Par Value |

|||||||||||||||||||||||

| Balance—January 1, 2020 |

$ | $ | $ | $ | ( |

) | $ | |||||||||||||||||

| Restricted stock issued and vesting of restricted stock units, net |

( |

) | — | — | — | |||||||||||||||||||

| Shares repurchased |

( |

) | ( |

) | ( |

) | — | — | ( |

) | ||||||||||||||

| Exercise of stock options, net |

— | — | — | |||||||||||||||||||||

| Stock-based compensation |

— |

— | — | — | ||||||||||||||||||||

| Allocation of equity component related to convertible notes, net of issuance costs of $ |

— |

— | — | — | ||||||||||||||||||||

| Other comprehensive loss |

— |

— | — | ( |

) | — | ( |

) | ||||||||||||||||

| Dividends |

— |

— | ( |

) | — | — | ( |

) | ||||||||||||||||

| Net loss |

— |

— | — | — | ( |

) | ( |

) | ||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Balance—September 30, 2020 |

$ | $ | $ | $ | ( |

) | $ | |||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

For the Nine Months Ended September 30, 2019 |

||||||||||||||||||||||||

Common Stock |

Additional Paid-In Capital |

Accumulated Other Comprehensive Income |

Accumulated Deficit |

Total |

||||||||||||||||||||

Shares Issued |

Par Value |

|||||||||||||||||||||||

| Balance—January 1, 2019 |

$ | $ | $ | $ | ( |

) | $ | |||||||||||||||||

| Restricted stock issued and vesting of restricted stock units, net |

( |

) | — | — | — | |||||||||||||||||||

| Shares repurchased |

( |

) | ( |

) | ( |

) | — | — | ( |

) | ||||||||||||||

| Exercise of stock options, net |

— | — | — | |||||||||||||||||||||

| Stock-based compensation |

— | — | — | — | ||||||||||||||||||||

| Other comprehensive loss |

— | — | — | ( |

) | — | ( |

) | ||||||||||||||||

| Dividends |

— | — | — | — | ( |

) | ( |

) | ||||||||||||||||

| Net income |

— | — | — | — | ||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Balance—September 30, 2019 |

$ | $ | $ | $ | ( |

) | $ | |||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Nine Months Ended September 30, |

||||||||

2020 |

2019 |

|||||||

| Cash flows from operating activities: |

||||||||

| Net (loss)/income |

$ | ( |

) | $ | ||||

| Adjustments to reconcile net (loss)/income to net cash provided by operating activities: |

||||||||

| Advisory fees received in gold and other precious metals |

( |

) | ( |

) | ||||

| Loss on revaluation of deferred consideration – gold payments (Note 11) |

||||||||

| Impairments |

||||||||

| Contractual gold payments (Note 11) |

||||||||

| Stock-based compensation |

||||||||

| Gain on sale – Canadian ETF business |

( |

) | — | |||||

| Loss on extinguishment of debt |

— | |||||||

| Amortization of right of use asset |

||||||||

| Amortization of issuance costs – former credit facility |

||||||||

| Deferred income taxes |

( |

) | ||||||

| Amortization of issuance costs – convertible notes |

— | |||||||

| Depreciation and amortization |

||||||||

| Paid-in-kind |

— | ( |

) | |||||

| Other |

( |

) | ( |

) | ||||

| Changes in operating assets and liabilities: |

||||||||

| Securities owned, at fair value |

( |

) | ||||||

| Accounts receivable |

||||||||

| Income taxes receivable/payable |

( |

) | ||||||

| Prepaid expenses |

( |

) | ( |

) | ||||

| Gold and other precious metals |

||||||||

| Other assets |

( |

) | ( |

) | ||||

| Fund management and administration payable |

( |

) | ||||||

| Compensation and benefits payable |

( |

) | ||||||

| Securities sold, but not yet purchased, at fair value |

( |

) | ( |

) | ||||

| Operating lease liabilities |

( |

) | ( |

) | ||||

| Accounts payable and other liabilities |

||||||||

| |

|

|

|

|||||

| Net cash provided by operating activities |

||||||||

| |

|

|

|

|||||

| Cash flows from investing activities: |

||||||||

| Purchase of fixed assets |

( |

) | ( |

) | ||||

| Funding of notes receivable |

— | ( |

) | |||||

| Proceeds from held-to-maturity |

||||||||

| Proceeds from the sale of the Company’s financial interests in AdvisorEngine Inc. |

— | |||||||

| Proceeds from sale of Canadian ETF business, net |

— | |||||||

| |

|

|

|

|||||

| Net cash provided by investing activities |

||||||||

| |

|

|

|

|||||

| Cash flows from financing activities: |

||||||||

| Repayment of long-term debt |

( |

) | ( |

) | ||||

| Shares repurchased |

( |

) | ( |

) | ||||

| Dividends paid |

( |

) | ( |

) | ||||

| Convertible notes issuance costs |

( |

) | — | |||||

| Proceeds from the issuance of convertible notes (Note 13) |

— | |||||||

| Proceeds from exercise of stock options |

||||||||

| |

|

|

|

|||||

| Net cash used in financing activities |

( |

) | ( |

) | ||||

| |

|

|

|

|||||

| Decrease in cash flow due to changes in foreign exchange rate |

( |

) | ( |

) | ||||

| |

|

|

|

|||||

| (Decrease)/increase in cash and cash equivalents |

( |

) | ||||||

| Cash and cash equivalents—beginning of period |

||||||||

| |

|

|

|

|||||

| Cash and cash equivalents—end of period |

$ | $ | ||||||

| |

|

|

|

|||||

| Supplemental disclosure of cash flow information: |

||||||||

| Cash paid for taxes |

$ | $ | ||||||

| |

|

|

|

|||||

| Cash paid for interest |

$ | $ | ||||||

| |

|

|

|

|||||

| • | WisdomTree Asset Management, Inc. non-consolidated third party, is a Delaware statutory trust registered with the SEC as an open-end management investment company. The Company has licensed to WTT the use of certain of its own indexes on an exclusive basis for the WisdomTree ETFs in the U.S. |

| • | WisdomTree Management Jersey Limited seven issuers (the “ManJer Issuers”) in respect of the ETPs issued and listed by the ManJer Issuers covering commodity, currency, cryptocurrency and leveraged-and-inverse |

| • | WisdomTree Multi Asset Management Limited non-consolidated third party, is a public limited company domiciled in Ireland. |

| • | WisdomTree Management Limited non-consolidated third party, is a public limited company domiciled in Ireland. |

| • | WisdomTree UK Limited |

| • | WisdomTree Europe Limited |

| • | WisdomTree Ireland Limited |

| • | WisdomTree Commodity Services, LLC |

| Equipment |

| |

| Furniture and fixtures |

| Level 2 – | Quoted prices for similar instruments in active markets; quoted prices for identical or similar instruments in markets that are not active; and model-derived valuations whose inputs are observable or whose significant value drivers are observable. |

| Level 3 – | Instruments whose significant drivers are unobservable. |

September 30, 2020 |

||||||||||||||||

Total |

Level 1 |

Level 2 |

Level 3 |

|||||||||||||

| Assets: |

||||||||||||||||

| Recurring fair value measurements: |

||||||||||||||||

| Cash equivalents |

$ | $ | $ | — | $ | — | ||||||||||

| Securities owned, at fair value |

— | |||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total |

$ | $ | $ | $ | — | |||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Liabilities: |

||||||||||||||||

| Recurring fair value measurements: |

||||||||||||||||

| Deferred consideration (Note 11) |

$ | $ | — | $ | — | $ | ||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Non-recurring fair value measurements |

||||||||||||||||

| Convertible notes (1) |

$ | $ | — | $ | $ | — | ||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| (1) | Fair value determined on August 13, 2020 (Note 13) |

December 31, 2019 |

||||||||||||||||

Total |

Level 1 |

Level 2 |

Level 3 |

|||||||||||||

| Assets: |

||||||||||||||||

| Recurring fair value measurements: |

||||||||||||||||

| Cash equivalents |

$ | $ | $ | — | $ | — | ||||||||||

| Securities owned, at fair value |

|

— | — | |||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total |

$ | |

$ | $ | — | $ | — | |||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Non-recurring fair value measurements: |

||||||||||||||||

| AdvisorEngine Inc. – Financial interests (1) |

$ | |

— | — | $ | |

||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Liabilities: |

||||||||||||||||

| Recurring fair value measurements: |

||||||||||||||||

| Deferred consideration (Note 11) |

$ | $ | — | $ | — | $ | ||||||||||

| Securities sold, but not yet purchased |

— | — | ||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total |

$ | $ | $ | — | $ | |||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| (1) | Fair value determined on December 31, 2019 (Note 7). |

Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||||||

2020 |

2019 |

2020 |

2019 |

|||||||||||||

| Deferred consideration (Note 11) |

||||||||||||||||

| Beginning balance |

$ | $ | $ | $ | ||||||||||||

| Net realized losses (1) |

||||||||||||||||

| Net unrealized losses/(gains) (2) |

||||||||||||||||

| Settlements |

( |

) | ( |

) | ( |

) | ( |

) | ||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Ending balance |

$ | $ | $ | $ | ||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| (1) | Recorded as contractual gold payments expense on the Company’s Consolidated Statements of Operations. |

| (2) | Recorded as loss on revaluation of deferred consideration – gold payments on the Company’s Consolidated Statements of Operations. |

September 30, 2020 |

December 31, 2019 |

|||||||

| Securities Owned |

||||||||

| Trading securities |

$ | $ | ||||||

| |

|

|

|

|||||

| Securities Sold, but not yet Purchased |

||||||||

| Trading securities |

$ | — | $ | |||||

| |

|

|

|

|||||

September 30, 2020 |

December 31, 2019 |

|||||||

| Debt instruments: Pass-through GSEs (amortized cost) |

$ | $ | ||||||

| |

|

|

|

|||||

September 30, 2020 |

December 31, 2019 |

|||||||

| Cost/amortized cost |

$ | $ | ||||||

| Gross unrealized gains |

||||||||

| Gross unrealized losses |

( |

) | ( |

) | ||||

| |

|

|

|

|||||

| Fair value |

$ | $ | ||||||

| |

|

|

|

|||||

September 30, 2020 |

December 31, 2019 |

|||||||

| Due within one year |

$ | — | $ | — | ||||

| Due one year through five years |

— | |||||||

| Due five years through ten years |

— | |||||||

| Due over ten years |

||||||||

| |

|

|

|

|||||

| Total |

$ | $ | ||||||

| |

|

|

|

|||||

| Unobservable Inputs (Initial Recognition – May 4, 2020 ) | ||

| Forecasted revenue simulated forward as a percentage of the pre-defined revenue targets |

||

| Revenue volatility |

||

September 30, 2020 |

December 31, 2019 |

|||||||||||||||

Amortized Cost, plus Accrued Interest |

Net Carrying Value |

Amortized Cost, plus Accrued Interest |

Net Carrying Value |

|||||||||||||

| Unsecured convertible note |

$ | $ | — | $ | $ | |||||||||||

| Unsecured non-convertible note |

— | |||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Subtotal—Notes receivable |

||||||||||||||||

| Preferred stock |

— | |||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total |

$ | $ | (1) |

$ | $ | (1) | ||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| (1) | Net of an impairment of $ its financial interests in AdvisorEngine. These gains were included in other gains and losses, net on the Consolidated Statements of Operations. |

September 30, 2020 |

December 31, 2019 |

|||||||

| Securrency – Preferred stock |

$ | $ | ||||||

| Thesys Group, Inc. (“Thesys”) |

— | |||||||

| |

|

|

|

|||||

| Total |

$ | $ | ||||||

| |

|

|

|

|||||

September 30, 2020 |

December 31, 2019 |

|||||||

| Equipment |

$ | $ | ||||||

| Furniture and fixtures |

||||||||

| Leasehold improvements |

||||||||

| Less: accumulated depreciation and amortization |

( |

) | ( |

) | ||||

| |

|

|

|

|||||

| Total |

$ | $ | ||||||

| |

|

|

|

|||||

September 30, 2020 |

December 31, 2019 |

|||||||

| Forward-looking gold price (low) – per ounce |

$ | $ | ||||||

| Forward-looking gold price (high) – per ounce |

$ | $ | ||||||

| Forward-looking gold price (weighted average) – per ounce |

$ | $ | ||||||

| Discount rate |

% | % | ||||||

| Perpetual growth rate |

% | % | ||||||

Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||||||

2020 |

2019 |

2020 |

2019 |

|||||||||||||

| Contractual gold payments |

$ | $ | $ | $ | ||||||||||||

| Contractual gold payments – gold ounces paid |

||||||||||||||||

| Loss on revaluation of deferred consideration – gold payments (1) |

$ | ( |

) | $ | ( |

) | $ | ( |

) | $ | ( |

) | ||||

| (1) | Losses arise due to increases in the forward-looking price of gold and the magnitude of any gain or loss is highly correlated to the magnitude of the change in the forward-looking price of gold. |

September 30, 2020 |

December 31, 2019 |

|||||||||||||||

Term Loan |

Revolver |

Term Loan |

Revolver |

|||||||||||||

| Amount borrowed |

$ | $ | — | $ | $ | — | ||||||||||

| Amounts repaid |

( |

) (1) |

— | ( |

) | — | ||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Amounts outstanding |

— | — | — | |||||||||||||

| Unamortized issuance costs |

— | — | ( |

) | ||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Carrying amount |

$ | — | $ | — | $ | $ | ||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Effective interest rate |

% | /a | % | /a | ||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| (1) | Includes $ |

| • | Maturity date |

| • | Interest rate of 4.25% |

| • | Conversion price of $5.92 |

| • | Conversion |

| • | Cash settlement of principal amount |

• |

Redemption price of $7 70 th scheduled trading day immediately preceding the maturity date, if the last reported sale price of the Company’s common stock has been at least |

| • | Limited investor put rights |

| • | Conversion rate increase in certain customary circumstances |

| • | Seniority and Security Non-Voting Convertible Preferred Stock (Note 14). |

Total |

Additional Notes |

Existing Notes |

||||||||||

| Principal amount |

$ | $ | $ | |||||||||

| Plus: premium on Additional Notes |

— | |||||||||||

| |

|

|

|

|

|

|||||||

| Gross proceeds |

||||||||||||

| Less: Unamortized debt discount and issuance costs (1) |

( |

) | ( |

) | ( |

) | ||||||

| |

|

|

|

|

|

|||||||

| Carrying amount |

$ | $ | $ | |||||||||

| |

|

|

|

|

|

|||||||

| Effective interest rate (2) |

% | % | % | |||||||||

| |

|

|

|

|

|

|||||||

(1) |

The debt discount arose from the bifurcation of the conversion option. The unamortized debt discount and issuance costs is reported net of the unamortized premium on the Additional Notes. |

(2) |

Includes amortization of the discount arising from the bifurcation of the conversion option, amortization of the issuance costs allocated to the Convertible Notes and amortization of the premium associated with the Additional Notes. |

September 30, 2020 |

December 31, 2019 |

|||||||

| Issuance of Preferred Shares |

$ | $ | ||||||

| Less: Issuance costs |

( |

) | ( |

) | ||||

| |

|

|

|

|||||

| Preferred Shares – carrying value |

$ | $ | ||||||

| |

|

|

|

|||||

Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||||||

2020 |

2019 |

2020 |

2019 |

|||||||||||||

| Lease cost: |

||||||||||||||||

| Operating lease cost |

$ | $ | $ | $ | ||||||||||||

| Short-term lease cost |

||||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total lease cost |

$ | $ | $ | $ | ||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Other information: |

||||||||||||||||

| Cash paid for amounts included in the measurement of operating liabilities (operating leases) |

$ | $ | $ | $ | ||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Right-of-use |

n/a | n/a | n/a | n/a | ||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Weighted-average remaining lease term (in years) – operating leases |

||||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Weighted-average discount rate – operating leases |

% | % | % | % | ||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Remainder of 2020 |

$ | |||

| 2021 |

||||

| 2022 |

||||

| 2023 |

||||

| 2024 |

||||

| 2025 and thereafter |

||||

| |

|

|||

| Total future minimum lease payments (undiscounted) |

$ | |||

| |

|

| Amounts recognized in the Company’s Consolidated Balance Sheet |

||||

| Lease liability – short term |

$ | |||

| Lease liability – long term |

||||

| |

|

|||

| Subtotal |

||||

| Difference between undiscounted and discounted cash flows |

||||

| |

|

|||

| Total future minimum lease payments (undiscounted) |

$ | |||

| |

|

September 30, 2020 |

December 31, 2019 |

|||||||

| Carrying Amount – Assets (Securrency) |

||||||||

| Preferred stock (Note 9) |

$ | $ | ||||||

| |

|

|

|

|||||

| Carrying Amount – Assets (AdvisorEngine) |

||||||||

| Unsecured convertible notes receivable |

$ | — | $ | |||||

| Unsecured non-convertible note receivable |

— | |||||||

| Preferred stock |

— | — | ||||||

| |

|

|

|

|||||

| Total carrying amount (Note 7) |

$ | — | $ | |||||

| |

|

|

|

|||||

| Total carrying amount – Assets |

$ |

$ | ||||||

| |

|

|

|

|||||

| Maximum exposure to loss |

$ | $ | ||||||

| |

|

|

|

|||||

Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||||||

2020 |

2019 |

2020 |

2019 |

|||||||||||||

| Revenues from contracts with customers: |

||||||||||||||||

| Advisory fees |

$ | $ | $ | $ | ||||||||||||

| Other |

||||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total operating revenues |

$ | $ | $ | $ | ||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||||||

2020 |

2019 |

2020 |

2019 |

|||||||||||||

| Revenues from contracts with customers: |

||||||||||||||||

| United States |

$ | $ | $ | $ | ||||||||||||

| Jersey |

||||||||||||||||

| Ireland |

||||||||||||||||

| Canada (Note 25) |

— | |||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total operating revenues |

$ | $ | $ | $ | ||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

September 30, 2020 |

December 31, 2019 |

|||||||

| Receivable from WTT |

$ | $ | ||||||

| Receivable from ManJer Issuers |

||||||||

| Receivable from WMAI and WTI |

||||||||

| Receivable from WTAMC (Note 25) |

— | |||||||

| Receivable from WTCS |

||||||||

| |

|

|

|

|||||

| Total |

$ | $ | ||||||

| |

|

|

|

|||||

Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||||||

2020 |

2019 |

2020 |

2019 |

|||||||||||||

| Advisory services provided to WTT |

$ | $ | $ | $ | ||||||||||||

| Advisory services provided to ManJer Issuers |

||||||||||||||||

| Advisory services provided to WMAI and WTI |

||||||||||||||||

| Advisory services provided to WTAMC (Note 25) |

— | |||||||||||||||

| Advisory services provided to WTCS |

||||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total |

$ | $ | $ | $ | ||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Stock options: | Generally issued for terms of | |||

| RSAs/RSUs: | Awards are valued based on the Company’s stock price on grant date and generally vest ratably over three years. | |||

| PRSUs: | These awards cliff vest three years from the grant date and contain a market condition whereby the number of PRSUs ultimately vesting is tied to how the Company’s total shareholder return (“TSR”) compares to a peer group of other publicly traded asset managers over the three-year period. A Monte Carlo simulation is used to value these awards. | |||

| • | If the relative TSR is below the 25 th percentile, then |

| • | If the relative TSR is at the 25 th percentile, then |

| • | If the relative TSR is above the 25 th percentile, then linear scaling is applied such that the percent of the target number of PRSUs vesting is th percentile and capped at th percentile. |

September 30, 2020 |

||||||||

Unrecognized Stock- Based Compensation |

Average Remaining Vesting Period (Years) |

|||||||

| Employees and directors |

$ | |||||||

Stock Options |

RSAs |

RSUs |

PRSUs |

|||||||||||||

| Balance at July 1, 2020 |

||||||||||||||||

| Granted |

— | — | — | |||||||||||||

| Exercised/vested |

— | ( |

) | — | — | |||||||||||

| Forfeitures |

— | ( |

) | — | ( |

) | ||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Balance at September 30, 2020 |

||||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

Three Months September 30, |

Nine Months Ended September 30, |

|||||||||||||||

Basic (Loss)/Earnings per Share |

2020 |

2019 |

2020 |

2019 |

||||||||||||

Net (loss)/income |

$ | ( |

) | $ | $ | ( |

) | $ | ||||||||

Less: Income distributed to participating securities |

( |

) | ( |

) | ( |

) | ( |

) | ||||||||

Less: Undistributed income allocable to participating securities |

— | — | — | ( |

) | |||||||||||

Net (loss)/income available to common stockholders – Basic EPS |

$ | ( |

) | $ | $ | ( |

) | $ | ||||||||

Weighted average common shares (in thousands) |

||||||||||||||||

Basic (loss)/earnings per share |

$ | ( |

) | $ | $ | ( |

) | $ | ||||||||

Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||||||

Diluted (Loss)/Earnings per Share |

2020 |

2019 |

2020 |

2019 |

||||||||||||

Net (loss)/income available to common stockholders |

$ | ( |

) | $ | $ | ( |

) | $ | ||||||||

Add back: Undistributed income allocable to participating securities |

— | — | — | |||||||||||||

Less: Reallocation of undistributed income allocable to participating securities considered potentially dilutive |

— | — | — | ( |

) | |||||||||||

Net (loss)/income available to common stockholders – Diluted EPS |

$ | ( |

) | $ | $ | ( |

) | $ | ||||||||

Weighted Average Diluted Shares (in thousands) : |

||||||||||||||||

Weighted average common shares |

||||||||||||||||

Dilutive effect of common stock equivalents, excluding participating securities |

— | — | ||||||||||||||

Weighted average diluted shares, excluding participating securities (in thousands) |

||||||||||||||||

Diluted (loss)/earnings per share |

$ | ( |

) | $ | $ | ( |

) | $ | ||||||||

Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||||||

Reconciliation of Weighted Average Diluted Shares (in thousands) |

2020 |

2019 |

2020 |

2019 |

||||||||||||

Weighted average diluted shares as disclosed on the consolidated statements of operations |

(1) |

(1) |

||||||||||||||

Less: Participating securities |

||||||||||||||||

Weighted average shares of common stock issuable upon conversion of the Preferred Shares (Note 14) |

— | ( |

) | — | ( |

) | ||||||||||

Potentially dilutive restricted stock awards |

— | ( |

) | — | ( |

) | ||||||||||

Weighted average diluted shares used to calculate diluted (loss)/earnings per share as disclosed in the table above |

||||||||||||||||

| (1) | Excludes non-participating common stock equivalents for the three and nine months ended September 30, 2020 as the Company reported a net loss for the period. |

September 30, 2020 |

December 31, 2019 |

|||||||

Deferred tax assets: |

||||||||

Capital losses |

$ | $ | ||||||

Operating lease liabilities |

||||||||

Interest carryforwards |

||||||||

NOLs – International |

||||||||

Accrued expenses |

||||||||

Stock-based compensation |

||||||||

Goodwill and intangible assets |

||||||||

NOLs – U.S. |

||||||||

Outside basis differences |

||||||||

Other |

||||||||

Deferred tax assets |

||||||||

Deferred tax liabilities: |

||||||||

Right of use assets – operating leases |

||||||||

Fixed assets and prepaid assets |

||||||||

Allocated equity component of convertible note |

— | |||||||

Unrealized gains |

— | |||||||

Deferred tax liabilities |

||||||||

Total deferred tax assets less deferred tax liabilities |

||||||||

Less: valuation allowance |

( |

) | ( |

) | ||||

Deferred tax assets, net |

$ | $ | ||||||

Total |

Unrecognized Tax Benefits |

Interest and Penalties |

||||||||||

Balance on January 1, 2020 |

$ | $ | $ | |||||||||

Decrease—Lapse of statute of limitations(1) |

( |

) | ( |

) | ( |

) | ||||||

Increases |

— | |||||||||||

Foreign currency translation (2) |

( |

) | ( |

) | ( |

) | ||||||

Balance at March 31, 2020 |

$ | $ | $ | |||||||||

Increases |

— | |||||||||||

Foreign currency translation (2) |

( |

) | ( |

) | ( |

) | ||||||

Balance at June 30, 2020 |

$ | $ | $ | |||||||||

Increases |

— | |||||||||||

Foreign currency translation (2) |

||||||||||||

Balance at September 30, 2020 |

$ | $ | $ | |||||||||

| (1) | Recorded as an income tax benefit of $ September 30, 2019, an income tax benefit of $ |

| (2) | The gross unrecognized tax benefits were accrued in British pounds. |

Total |

||||

| Balance at January 1, 2020 |

$ | |||

| |

|

|||

| Changes |

— | |||

| |

|

|||

| Balance at September 30, 2020 |

$ | |||

| |

|

|||

Advisory Agreements (ETFS) |

Advisory Agreements (Questrade AUM) |

Total |

||||||||||

| Balance at January 1, 2020 |

$ | $ | $ | |||||||||

| Decreases (1) |

— | ( |

) | ( |

) | |||||||

| Foreign currency translation |

— | ( |

) | ( |

) | |||||||

| |

|

|

|

|

|

|||||||

| Balance at September 30, 2020 |

$ | $ | — | $ | ||||||||

| |

|

|

|

|

|

|||||||

| (1) | Derecognized upon the sale of the Company’s Canadian ETF business (Note 25). |

Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||||||

2020 |

2019 |

2020 |

2019 |

|||||||||||||

| WTAMC |

$ | — | $ | $ | $ | |||||||||||

| WisdomTree Japan Inc. (“WTJ”) (1) |

— | — | ||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total |

$ | — | $ | $ | $ | |||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| |

|

|

|

|

|

|

|

|||||||||

| (1) | WTJ also recognized an impairment expense of $ |

Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||||||

2020 |

2019 |

2020 |

2019 |

|||||||||||||

| AdvisorEngine – Financial Interests (Note 7) |

$ | — | $ | — | $ | $ | — | |||||||||

| Thesys – Series Y Preferred (Note 9) |

— | — | ||||||||||||||

| WTJ (Note 25) |

— | — | — | |||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total |

$ | $ | — | $ | $ | |||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| |

|

|

|

|

|

|

|

|||||||||

ITEM 2. |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

| • | Revenues |

| • | Operating Expenses |

| • | Other Income/(Expenses) |

| • | Net (loss)/income |

Three Months Ended |

Nine Months Ended |

|||||||||||||||||||

September 30, 2020 |

June 30, 2020 |

September 30, 2019 |

September 30, 2020 |

September 30, 2019 |

||||||||||||||||

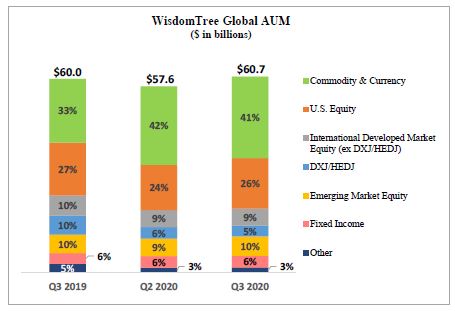

| GLOBAL ETPs (in millions) |

||||||||||||||||||||

| Beginning of period assets |

$ | 57,647 | $ | 50,323 | $ | 60,389 | $ | 63,615 | $ | 54,094 | ||||||||||

| Assets sold |

— | — | — | (778 | ) | — | ||||||||||||||

| Inflows/(outflows) |

(468 | ) | 126 | (698 | ) | (878 | ) | 206 | ||||||||||||

| Market appreciation/(depreciation) |

|

3,560 |

|

|

7,494 |

|

|

471 |

|

|

(904 |

) |

|

5,949 |

| |||||

| Fund closures |

(46 | ) | (296 | ) | (181 | ) | (362 | ) | (268 | ) | ||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| End of period assets |

$ | 60,693 | $ | 57,647 | $ | 59,981 | $ | 60,693 | $ | 59,981 | ||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Average assets during the period |

$ | 61,194 | $ | 55,689 | $ | 60,306 | $ | 58,901 | $ | 58,855 | ||||||||||

| Average ETF advisory fee during the period |

0.42 | % | 0.41 | % | 0.44 | % | 0.42 | % | 0.45 | % | ||||||||||

| Number of ETFs – end of the period |

305 | 311 | 348 | 305 | 348 | |||||||||||||||

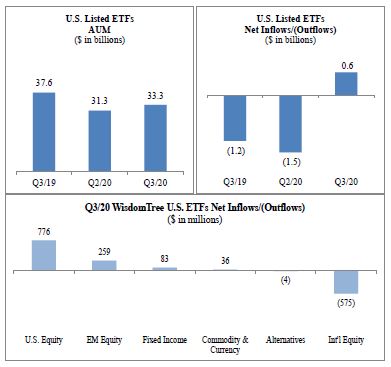

| U.S. LISTED ETFs (in millions) |

||||||||||||||||||||

| Beginning of period assets |

$ | 31,344 | $ | 28,893 | $ | 39,220 | $ | 40,600 | $ | 35,486 | ||||||||||

| Inflows/(outflows) |

575 | (1,474 | ) | (1,198 | ) | (2,172 | ) | (1,217 | ) | |||||||||||

| Market appreciation/(depreciation) |

1,373 | 4,039 | (430 | ) | (5,012 | ) | 3,410 | |||||||||||||

| Fund closures |

— | (114 | ) | — | (124 | ) | (87 | ) | ||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| End of period assets |

$ | 33,292 | $ | 31,344 | $ | 37,592 | $ | 33,292 | $ | 37,592 | ||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Average assets during the period |

$ | 32,962 | $ | 30,607 | $ | 37,857 | $ | 33,502 | $ | 38,288 | ||||||||||

| Average ETF advisory fee during the period |

0.41 | % | 0.41 | % | 0.44 | % | 0.42 | % | 0.45 | % | ||||||||||

| Number of ETFs – end of the period |

67 | 67 | 80 | 67 | 80 | |||||||||||||||

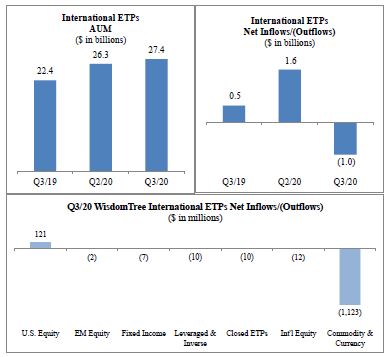

| INTERNATIONAL LISTED ETPs (in millions) |

||||||||||||||||||||

| Beginning of period assets |

$ | 26,303 | $ | 21,430 | $ | 21,169 | $ | 23,015 | $ | 18,608 | ||||||||||

| Assets sold |

— | — | — | (778 | ) | — | ||||||||||||||

| Inflows/(outflows) |

(1,043 | ) | 1,600 | 500 | 1,294 | 1,423 | ||||||||||||||

| Market appreciation/(depreciation) |

2,187 | 3,455 | 901 | 4,108 | 2,539 | |||||||||||||||

| Fund closures |

(46 | ) | (182 | ) | (181 | ) | (238 | ) | (181 | ) | ||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| End of period assets |

$ | 27,401 | $ | 26,303 | $ | 22,389 | $ | 27,401 | $ | 22,389 | ||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Average assets during the period |

$ | 28,232 | $ | 25,082 | $ | 22,449 | $ | 25,399 | $ | 20,567 | ||||||||||

| Average ETP advisory fee during the period |

0.42 | % | 0.41 | % | 0.44 | % | 0.41 | % | 0.45 | % | ||||||||||

| Number of ETPs—end of period |

238 | 244 | 268 | 238 | 268 | |||||||||||||||

| PRODUCT CATEGORIES (in millions) |

||||||||||||||||||||

| Commodity & Currency |

||||||||||||||||||||

| Beginning of period assets |

$ | 24,260 | $ | 19,823 | $ | 18,204 | $ | 20,074 | $ | 15,976 | ||||||||||

| Inflows/(outflows) |

(1,087 | ) | 1,316 | 511 | 821 | 1,354 | ||||||||||||||

| Market appreciation/(depreciation) |

2,036 | 3,121 | 998 | 4,314 | 2,383 | |||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| End of period assets |

$ | 25,209 | $ | 24,260 | $ | 19,713 | $ | 25,209 | $ | 19,713 | ||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Average assets during the period |

$ | 25,959 | $ | 23,037 | $ | 19,558 | $ | 23,134 | $ | 17,643 | ||||||||||

| U.S. Equity |

||||||||||||||||||||

| Beginning of period assets |

$ | 13,997 | $ | 12,151 | $ | 15,889 | $ | 17,732 | $ | 13,211 | ||||||||||

| Inflows/(outflows) |

897 | (241 | ) | 239 | 371 | 986 | ||||||||||||||

| Market appreciation/(depreciation) |

718 | 2,087 | 153 | (2,491 | ) | 2,084 | ||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| End of period assets |

$ | 15,612 | $ | 13,997 | $ | 16,281 | $ | 15,612 | $ | 16,281 | ||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Average assets during the period |

$ | 15,139 | $ | 13,302 | $ | 15,872 | $ | 14,817 | $ | 15,453 | ||||||||||

| International Developed Market Equity |

||||||||||||||||||||

| Beginning of period assets |

$ | 8,821 | $ | 8,632 | $ | 13,313 | $ | 13,011 | $ | 14,232 | ||||||||||

| Inflows/(outflows) |

(587 | ) | (965 | ) | (1,009 | ) | (2,649 | ) | (3,318 | ) | ||||||||||

| Market appreciation/(depreciation) |

369 | 1,154 | (135 | ) | (1,759 | ) | 1,255 | |||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| End of period assets |

$ | 8,603 | $ | 8,821 | $ | 12,169 | $ | 8,603 | $ | 12,169 | ||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Average assets during the period |

$ | 8,819 | $ | 8,760 | $ | 12,379 | $ | 9,675 | $ | 13,390 | ||||||||||

Three Months Ended |

Nine Months Ended |

|||||||||||||||||||

September 30, 2020 |

June 30, 2020 |

September 30, 2019 |

September 30, 2020 |

September 30, 2019 |

||||||||||||||||

| Emerging Market Equity |

||||||||||||||||||||

| Beginning of period assets |

$ | 5,413 | $ | 4,600 | $ | 5,966 | $ | 6,400 | $ | 5,201 | ||||||||||

| Inflows/(outflows) |

257 | (25 | ) | 176 | 301 | 423 | ||||||||||||||

| Market appreciation/(depreciation) |

309 | 838 | (443 | ) | (722 | ) | 75 | |||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| End of period assets |

$ | 5,979 | $ | 5,413 | $ | 5,699 | $ | 5,979 | $ | 5,699 | ||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Average assets during the period |

$ | 5,913 | $ | 5,129 | $ | 5,729 | $ | 5,654 | $ | 5,604 | ||||||||||

| Fixed Income |

||||||||||||||||||||

| Beginning of period assets |

$ | 3,530 | $ | 3,527 | $ | 3,946 | $ | 3,585 | $ | 2,244 | ||||||||||

| Inflows/(outflows) |

76 | (53 | ) | (594 | ) | 44 | 1,062 | |||||||||||||

| Market appreciation/(depreciation) |

24 | 56 | (15 | ) | 1 | 31 | ||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| End of period assets |

$ | 3,630 | $ | 3,530 | $ | 3,337 | $ | 3,630 | $ | 3,337 | ||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Average assets during the period |

$ | 3,605 | $ | 3,523 | $ | 3,731 | $ | 3,594 | $ | 3,570 | ||||||||||

| Leveraged & Inverse |

||||||||||||||||||||

| Beginning of period assets |

$ | 1,349 | $ | 882 | $ | 989 | $ | 995 | $ | 964 | ||||||||||

| Inflows/(outflows) |

(10 | ) | 312 | 12 | 314 | 78 | ||||||||||||||

| Market appreciation/(depreciation) |

92 | 155 | 1 | 122 | (40 | ) | ||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| End of period assets |

$ | 1,431 | $ | 1,349 | $ | 1,002 | $ | 1,431 | $ | 1,002 | ||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Average assets during the period |

$ | 1,481 | $ | 1,163 | $ | 1,019 | $ | 1,218 | $ | 1,039 | ||||||||||

| Alternatives |

||||||||||||||||||||

| Beginning of period assets |

$ | 225 | $ | 244 | $ | 434 | $ | 358 | $ | 508 | ||||||||||

| Inflows/(outflows) |

(4 | ) | (29 | ) | (17 | ) | (99 | ) | (101 | ) | ||||||||||

| Market appreciation/(depreciation) |

8 | 10 | 1 | (30 | ) | 11 | ||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| End of period assets |

$ | 229 | $ | 225 | $ | 418 | $ | 229 | $ | 418 | ||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Average assets during the period |

$ | 226 | $ | 226 | $ | 428 | $ | 260 | $ | 455 | ||||||||||

| Closed ETPs |

||||||||||||||||||||

| Beginning of period assets |

$ | 52 | $ | 464 | $ | 1,648 | $ | 1,460 | $ | 1,758 | ||||||||||

| Assets sold |

— | — | — | (778 | ) | — | ||||||||||||||

| Inflows/(outflows) |

(10 | ) | (189 | ) | (16 | ) | 19 | (278 | ) | |||||||||||

| Market appreciation/(depreciation) |

4 | 73 | (89 | ) | (339 | ) | 150 | |||||||||||||

| Fund closures |

(46 | ) | (296 | ) | (181 | ) | (362 | ) | (268 | ) | ||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| End of period assets |

$ | — | $ | 52 | $ | 1,362 | $ | — | $ | 1,362 | ||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Average assets during the period |

$ | 52 | $ | 549 | $ | 1,590 | $ | 549 | $ | 1,701 | ||||||||||

| Headcount: |

211 | 214 | 212 | 211 | 212 | |||||||||||||||

Three Months Ended September 30, |

Change |

Percent Change |

||||||||||||||

2020 |

2019 |

|||||||||||||||

| Global AUM (in millions) |

||||||||||||||||

| Average global AUM |

$ | 61,194 | $ | 60,306 | $ | 888 | 1.5 | % | ||||||||

| |

|

|

|

|

|

|||||||||||

| Operating Revenues (in thousands) |

||||||||||||||||

| Advisory fees |

$ | 63,919 | $ | 67,006 | $ | (3,087 | ) | (4.6 | %) | |||||||

| Other income |

721 | 712 | 9 | 1.3 | % | |||||||||||

| |

|

|

|

|

|

|||||||||||

| Total revenues |

$ | 64,640 | $ | 67,718 | $ | (3,078 | ) | (4.5 | %) | |||||||

| |

|

|

|

|

|

|||||||||||

Three Months Ended September 30, |

Change |

Percent Change |

||||||||||||||

(in thousands) |

2020 |

2019 |

||||||||||||||

| Compensation and benefits |

$ | 19,098 | $ | 18,880 | $ | 218 | 1.2 | % | ||||||||

| Fund management and administration |

15,219 | 15,110 | 109 | 0.7 | % | |||||||||||

| Marketing and advertising |

2,996 | 3,022 | (26 | ) | (0.9 | %) | ||||||||||

| Sales and business development |

2,386 | 4,354 | (1,968 | ) | (45.2 | %) | ||||||||||

| Contractual gold payments |

4,539 | 3,502 | 1,037 | 29.6 | % | |||||||||||

| Professional and consulting fees |

950 | 1,259 | (309 | ) | (24.5 | %) | ||||||||||

| Occupancy, communications and equipment |

1,611 | 1,549 | 62 | 4.0 | % | |||||||||||

| Depreciation and amortization |

253 | 259 | (6 | ) | (2.3 | %) | ||||||||||

| Third-party distribution fees |

1,233 | 1,503 | (270 | ) | (18.0 | %) | ||||||||||

| Acquisition and disposition-related costs |

— | 190 | (190 | ) | n/a | |||||||||||

| Other |

1,611 | 1,959 | (348 | ) | (17.8 | %) | ||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total operating expenses |

$ | 49,896 | $ | 51,587 | $ | (1,691 | ) | (3.3 | %) | |||||||

| |

|

|

|

|

|

|

|

|||||||||

Three Months Ended September 30, |

||||||||

| As a Percent of Revenues: |

2020 |

2019 |

||||||

| Compensation and benefits |

29.6 | % | 27.9 | % | ||||

| Fund management and administration |

23.5 | % | 22.3 | % | ||||

| Marketing and advertising |

4.6 | % | 4.5 | % | ||||

| Sales and business development |

3.7 | % | 6.5 | % | ||||

| Contractual gold payments |

7.0 | % | 5.2 | % | ||||

| Professional and consulting fees |

1.5 | % | 1.9 | % | ||||

| Occupancy, communications and equipment |

2.5 | % | 2.2 | % | ||||

Three Months Ended September 30, |

||||||||

| As a Percent of Revenues: |

2020 |

2019 |

||||||

| Depreciation and amortization |

0.4 | % | 0.4 | % | ||||

| Third-party distribution fees |

1.9 | % | 2.2 | % | ||||

| Acquisition and disposition-related costs |

— | 0.2 | % | |||||

| Other |

2.5 | % | 2.9 | % | ||||

| |

|

|

|

|||||

| Total expenses |

77.2 | % | 76.2 | % | ||||

| |

|

|

|

|||||

Three Months Ended September 30, |

Change |

Percent Change |

||||||||||||||

(in thousands) |

2020 |

2019 |

||||||||||||||

| Interest expense |

$ | (2,511 | ) | $ | (2,832 | ) | $ | 321 | (11.3 | %) | ||||||

| Loss on revaluation of deferred consideration – gold payments |

(8,870 | ) | (6,306 | ) | (2,564 | ) | 40.7 | % | ||||||||

| Interest income |

111 | 799 | (688 | ) | (86.1 | %) | ||||||||||

| Impairments |

(3,080 | ) | — | (3,080 | ) | n/a | ||||||||||

| Other gains, net |

744 | 843 | (99 | ) | (11.7 | %) | ||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total other income/(expenses) |

$ | (13,606 | ) | $ | (7,496 | ) | $ | (6,110 | ) | 81.5 | % | |||||

| |

|

|

|

|

|

|

|

|||||||||

Three Months Ended September 30, |

||||||||

| As a Percent of Revenues: |

2020 |

2019 |

||||||

| Interest expense |

(3.9 | %) | (4.2 | %) | ||||

| Loss on revaluation of deferred consideration – gold payments |

(13.7 | %) | (9.3 | %) | ||||

| Interest income |

0.2 | % | 1.1 | % | ||||

| Impairments |

(4.8 | %) | n/a | |||||

| Other gains, net |

1.2 | % | 1.2 | % | ||||

| |

|

|

|

|||||

| Total other income/(expenses) |

(21.0 | %) | (11.2 | %) | ||||

| |

|

|

|

|||||

Nine Months Ended September 30, |

Change |

Percent Change |

||||||||||||||

2020 |

2019 |

|||||||||||||||

| Global AUM (in millions) |

||||||||||||||||

| Average global AUM |

$ | 58,901 | $ | 58,855 | $ | 46 | 0.0 | % | ||||||||

| |

|

|

|

|

|

|||||||||||

| Operating Revenues (in thousands) |

||||||||||||||||

| Advisory fees |

$ | 184,077 | $ | 197,473 | $ | (13,396 | ) | (6.8 | %) | |||||||

| Other income |

2,563 | 2,023 | 540 | 26.7 | % | |||||||||||

| |

|

|

|

|

|

|||||||||||

| Total revenues |

$ | 186,640 | $ | 199,496 | $ | (12,856 | ) | (6.4 | %) | |||||||

| |

|

|

|

|

|

|||||||||||

Nine Months Ended September 30, |

Change |

Percent Change |

||||||||||||||

(in thousands) |

2020 |

2019 |

||||||||||||||

| Compensation and benefits |

$ | 53,848 | $ | 61,481 | $ | (7,633 | ) | (12.4 | %) | |||||||

| Fund management and administration |

44,165 | 45,852 | (1,687 | ) | (3.7 | %) | ||||||||||

| Marketing and advertising |

7,413 | 8,612 | (1,199 | ) | (13.9 | %) | ||||||||||

| Sales and business development |

7,984 | 12,947 | (4,963 | ) | (38.3 | %) | ||||||||||

| Contractual gold payments |

12,362 | 9,710 | 2,652 | 27.3 | % | |||||||||||

| Professional and consulting fees |

3,580 | 4,037 | (457 | ) | (11.3 | %) | ||||||||||

| Occupancy, communications and equipment |

4,805 | 4,715 | 90 | 1.9 | % | |||||||||||

| Depreciation and amortization |

760 | 792 | (32 | ) | (4.0 | %) | ||||||||||

| Third-party distribution fees |

3,928 | 5,822 | (1,894 | ) | (32.5 | %) | ||||||||||

| Acquisition and disposition-related costs |

416 | 536 | (120 | ) | (22.4 | %) | ||||||||||

| Other |

5,204 | 6,267 | (1,063 | ) | (17.0 | %) | ||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total expenses |

$ | 144,465 | $ | 160,771 | $ | (16,306 | ) | (10.1 | %) | |||||||

| |

|

|

|

|

|

|

|

|||||||||

Nine Months Ended September 30, |

||||||||

| As a Percent of Revenues: |

2020 |

2019 |

||||||

| Compensation and benefits |

28.8 | % | 30.8 | % | ||||

| Fund management and administration |

23.7 | % | 23.0 | % | ||||

| Marketing and advertising |

4.0 | % | 4.3 | % | ||||

Nine Months Ended September 30, |

||||||||

| As a Percent of Revenues: |

2020 |

2019 |

||||||

| Sales and business development |

4.3 | % | 6.5 | % | ||||

| Contractual gold payments |

6.6 | % | 4.9 | % | ||||

| Professional and consulting fees |

1.9 | % | 2.0 | % | ||||

| Occupancy, communications and equipment |

2.6 | % | 2.4 | % | ||||

| Depreciation and amortization |

0.4 | % | 0.4 | % | ||||

| Third-party distribution fees |

2.1 | % | 2.9 | % | ||||

| Acquisition and disposition-related costs |

0.2 | % | 0.3 | % | ||||

| Other |

2.8 | % | 3.1 | % | ||||

| |

|

|

|

|||||

| Total expenses |

77.4 | % | 80.6 | % | ||||

| |

|

|

|

|||||

Nine Months Ended September 30, |

Change |

Percent Change |

||||||||||||||

(in thousands) |

2020 |

2019 |

||||||||||||||

| Interest expense |

$ | (6,974 | ) | $ | (8,634 | ) | $ | 1,660 | (19.2 | %) | ||||||

| Loss on revaluation of deferred consideration – gold payments |

(34,436 | ) | (5,939 | ) | (28,497 | ) | 479.8 | % | ||||||||

| Interest income |

393 | 2,396 | (2,003 | ) | (83.6 | %) | ||||||||||

| Impairments |

(22,752 | ) | (572 | ) | (22,180 | ) | 3,877.6 | % | ||||||||

| Loss on extinguishment of debt |

(2,387 | ) | — | (2,387 | ) | n/a | ||||||||||

| Other gains and losses, net |

56 | (3,500 | ) | 3,556 | n/a | |||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total other income/(expenses) |

$ | (66,100 | ) | $ | (16,249 | ) | $ | (49,851 | ) | 306.8 | % | |||||

| |

|

|

|

|

|

|

|

|||||||||

Nine Months Ended September 30, |

||||||||

| As a Percent of Revenues: |

2020 |

2019 |

||||||

| Interest expense |

(3.7 | %) | (4.3 | %) | ||||

| Loss on revaluation of deferred consideration – gold payments |

(18.4 | %) | (3.0 | %) | ||||

| Interest income |

0.2 | % | 1.2 | % | ||||

| Impairments |

(12.2 | %) | (0.3 | %) | ||||

| Loss on extinguishment of debt |

(1.3 | %) | n/a | |||||

| Other gains and losses, net |

0.0 | % | (1.7 | %) | ||||

| |

|

|

|

|||||

| Total other income/(expenses) |

(35.4 | %) | (8.1 | %) | ||||

| |

|

|

|

|||||

| • | Adjusted net income and adjusted diluted earnings per share. non-GAAP financial measurements in order to report our results exclusive of items that are non-recurring or not core to our operating business. We believe presenting these non-GAAP financial measures provides investors with a consistent way to analyze our performance. These non-GAAP financial measures exclude the following: |

| ➣ | Unrealized gains or losses on the revaluation of deferred consideration |

| ➣ | Tax shortfalls and windfalls upon vesting and exercise of stock-based compensation awards |

| ➣ | Interest expense from the amortization of discount arising from the bifurcation of the conversion option embedded in the convertible notes non-GAAP financial measurements as it is non-cash and distorts our actual cost of borrowing. In addition, in August 2020, the FASB issued Accounting Standards Update 2020-06, Debt – Debt with Conversion and Other Options, Cash Conversion |

| ➣ | Other items |

Three Months Ended |

Nine Months Ended |

|||||||||||||||

| Adjusted Net Income and Diluted Earnings per Share: |

Sept. 30, 2020 |

Sept. 30, 2019 |

Sept. 30, 2020 |

Sept. 30, 2019 |

||||||||||||

| Net (loss)/income, as reported |

$ | (270 | ) | $ | 4,152 | $ | (22,158 | ) | $ | 15,455 | ||||||

| Add back: Loss on revaluation of deferred consideration |

8,870 | 6,306 | 34,436 | 5,939 | ||||||||||||

| Add back: Impairments, net of income taxes |

2,326 | — | 21,998 | 572 | ||||||||||||

| Deduct: Gain recognized upon sale of Canadian ETF business |

— | — | (2,877 | ) | — | |||||||||||

| Deduct: Release of a deferred tax asset valuation allowance recognized on interest carryforwards arising from debt previously outstanding in the United Kingdom |

— | — | (2,842 | ) | — | |||||||||||

| Add back: Loss on extinguishment of debt, net of income taxes |

— | — | 1,910 | — | ||||||||||||

| Deduct: Gain arising from an adjustment to the estimated fair value of consideration received from the exit of investment in AdvisorEngine |

(225 | ) | — | (1,093 | ) | — | ||||||||||

| Add back: Interest expense from the amortization of discount arising from the bifurcation of the conversion option embedded in the convertible notes, net of income taxes |

286 | — | 328 | — | ||||||||||||

| Add back: Tax shortfalls upon vesting and exercise of stock-based compensation awards |

50 | 30 | 670 | 1,077 | ||||||||||||

| Add back: Acquisition and disposition-related costs, net of income taxes |

— | 154 | 383 | 434 | ||||||||||||

| Add back: Severance expense, net of income taxes |

— | — | — | 2,715 | ||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Adjusted net income |

$ | 11,037 | $ | 10,642 | $ | 30,755 | $ | 26,192 | ||||||||

| Deduct: Income distributed to participating securities |

(556 | ) | (539 | ) | (1,663 | ) | (1,622 | ) | ||||||||

| Deduct: Undistributed income allocable to participating securities |

(687 | ) | (584 | ) | (1,701 | ) | (1,149 | ) | ||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Adjusted net income available to common stockholders |

$ | 9,794 | $ | 9,519 | $ | 27,391 | $ | 23,421 | ||||||||

| Weighted average diluted shares, excluding participating securities (in thousands) (See Note 21 to our Consolidated Financial Statements) |

145,569 | 152,032 | 149,891 | 151,954 | ||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Adjusted earnings per share—diluted |

$ | 0.07 | $ | 0.06 | $ | 0.18 | $ | 0.15 | ||||||||

| |

|

|

|

|

|

|

|

|||||||||

September 30, 2020 |

December 31, 2019 |

|||||||

| Balance Sheet Data (in thousands) : |

||||||||

| Cash and cash equivalents |

$ | 63,561 | $ | 74,972 | ||||

| Securities owned, at fair value |

32,574 | 17,319 | ||||||

| Accounts receivable |

26,163 | 26,838 | ||||||

| Securities held-to-maturity |

501 | 16,863 | ||||||

| |

|

|

|

|||||

| Total: Liquid assets |

122,799 | 135,992 | ||||||

| Less: Total current liabilities |

(67,017 | ) | (79,041 | ) | ||||

| Less: Regulatory capital requirement – certain international subsidiaries |

(10,644 | ) | (12,312 | ) | ||||

| |

|

|

|

|||||

| Subtotal |

45,138 | 44,639 | ||||||

| Plus: Revolving credit facility – available capacity |

— | (1) |

27,908 | |||||

| |

|

|

|

|||||

| Total: Available liquidity |

$ | 45,138 | $ | 72,547 | ||||

| |

|

|

|

|||||

| (1) Terminated on June 16, 2020. |

||||||||

Nine Months Ended September 30, |

||||||||

2020 |

2019 |

|||||||

| Cash Flow Data (in thousands) : |

||||||||

| Operating cash flows |

$ | 15,568 | $ | 43,081 | ||||

| Investing cash flows |

28,515 | 498 | ||||||

| Financing cash flows |

(55,107 | ) | (32,403 | ) | ||||

| Foreign exchange rate effect |

(387 | ) | (385 | ) | ||||

| |

|

|

|

|||||

| (Decrease)/increase in cash and cash equivalents |

$ | (11,411 | ) | $ | 10,791 | |||

| |

|

|

|

|||||

| • | Maturity date |

| • | Interest rate of 4.25% |

| • | Conversion price of $5.92 |

| • | Conversion |

| • | Cash settlement of principal amount |

| • | Redemption price of $7 70 th scheduled trading day immediately preceding the maturity date, if the last reported sale price of our common stock has been at least 130% of the conversion price then in effect for at least 20 trading days, including the trading day immediately preceding the date on which we provide notice of redemption, during any 30 consecutive trading day period ending on, and including, the trading day immediately preceding the date on which we provides notice of redemption, at a redemption price equal to 100% of the principal amount of the notes to be redeemed, plus accrued and unpaid interest to, but excluding the redemption date. No sinking fund is provided for the Convertible Notes. |

| • | Limited investor put rights |

| • | Conversion rate increase in certain customary circumstances |

| • | Seniority and Security Non-Voting Convertible Preferred Stock (See Note 14 to our Consolidated Financial Statements). |

Total |

Payments Due by Period |

|||||||||||||||||||

(in thousands) |

||||||||||||||||||||

Less than 1 year |

1 to 3 years |

3 to 5 years |

More than 5 years |

|||||||||||||||||

| Convertible Notes (1) |

$ | 175,000 | $ | — | $ | 175,000 | $ | — | $ | — | ||||||||||

| Deferred consideration – gold payments (2) |

207,748 | 17,202 | 30,658 | 25,815 | 134,073 | |||||||||||||||

| Operating leases |

27,422 | 3,124 | 5,916 | 6,137 | 12,245 | |||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Total |

$ | 410,170 | $ | 20,326 | $ | 211,574 | $ | 31,952 | $ | 146,318 | ||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| (1) | Conditional conversions or a requirement to repurchase the convertible notes upon the occurrence of a fundamental change may accelerate payment (See Note 13 to our Consolidated Financial Statements). |

| (2) | Paid from advisory fee income generated by any Company-sponsored financial product backed by physical gold with no recourse back to us for any unpaid amounts that exceed advisory fees earned (See Note 11 to our Consolidated Financial Statements). |

Total Number of Shares Purchased |

Average Price Paid Per Share |

Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs (1) |

Approximate Dollar Value of Shares that May Yet Be Purchased Under the Plans or Programs |

|||||||||||||

| Period |

(in thousands) |

|||||||||||||||

| July 1, 2020 to July 31, 2020 |

24,875 | $ | 3.57 | 24,875 | ||||||||||||

| August 1, 2020 to August 31, 2020 |

1,041,386 | $ | 4.27 | 1,041,386 | ||||||||||||

| September 1, 2020 to September 30, 2020 |

— | $ | — | — | ||||||||||||

| |

|

|

|

|||||||||||||

| Total |

1,066,261 | $ | 4.25 | 1,066,261 | $ | 52,410 | ||||||||||

| |

|

|

|

|

|

|||||||||||

| (1) | On April 24, 2019, our Board of Directors extended the term of our share repurchase program for three years through April 27, 2022. During the three months ended September 30, 2020, we repurchased 1,066,261 shares of our common stock under this program for an aggregate cost of approximately $4.5 million. As of September 30, 2020, $52.4 million remained under this program for future repurchases. |

ITEM 6. |

EXHIBITS |

| Exhibit No. |

Description | |

| 101.PRE (1) | Inline XBRL Taxonomy Extension Presentation Linkbase Document | |

| 104 (1) | Cover Page Interactive Data File (formatted as inline XBRL with applicable taxonomy extension information contained in Exhibits 101.*) | |