Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For fiscal year ended December 31, 2016

or

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

Commission File Number 001-10932

WisdomTree Investments, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 13-3487784 | |

| (State or other jurisdiction of incorporation or organization) |

(IRS Employer Identification No.) | |

| 245 Park Avenue, 35th Floor New York, New York |

10167 | |

| (Address of principal executive offices) | (Zip Code) | |

212-801-2080

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class: |

Name of each exchange on which registered: | |

| Common Stock, $0.01 par value | The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☒ Yes ☐ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ☐ Yes ☒ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ☒ Yes ☐ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in 12b-2 of the Exchange Act.

| Large accelerated filer | ☒ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☐ (Do not check if a smaller reporting company) | Smaller reporting company | ☐ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

At June 30, 2016, the aggregate market value of the registrant’s Common Stock held by non-affiliates (computed by reference to the closing sale price of such shares on the NASDAQ Global Select Market on June 30, 2016) was $1,120,852,597. At February 17, 2017, there were 136,622,560 shares of the registrant’s Common Stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

The information required by Part III of this Report, to the extent not set forth herein, is incorporated herein by reference from the registrant’s definitive proxy statement relating to the Annual Meeting of Stockholders to be held in 2017, which definitive proxy statement shall be filed with the Securities and Exchange Commission within 120 days after the end of the fiscal year to which this Report relates.

Table of Contents

WISDOMTREE INVESTMENTS, INC.

Form 10-K

For the Fiscal Year Ended December 31, 2016

| Page | ||||||||

| 2 | ||||||||

| Item 1. |

Business | 2 | ||||||

| Item 1A. |

21 | |||||||

| Item 1B. |

34 | |||||||

| Item 2. |

34 | |||||||

| Item 3. |

34 | |||||||

| Item 4. |

34 | |||||||

| 35 | ||||||||

| Item 5. |

35 | |||||||

| Item 6. |

37 | |||||||

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

38 | ||||||

| Item 7A. |

66 | |||||||

| Item 8. |

66 | |||||||

| Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

66 | ||||||

| Item 9A. |

67 | |||||||

| Item 9B. |

67 | |||||||

| 68 | ||||||||

| Item 10. |

68 | |||||||

| Item 11. |

68 | |||||||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

68 | ||||||

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

68 | ||||||

| Item 14. |

68 | |||||||

| 69 | ||||||||

| Item 15. |

69 | |||||||

| Item 16. |

69 | |||||||

| 70 | ||||||||

i

Table of Contents

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K, or Report, contains forward-looking statements that are based on our management’s belief and assumptions and on information currently available to our management. Although we believe that the expectations reflected in these forward-looking statements are reasonable, these statements relate to future events or our future financial performance, and involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” “continue” or the negative of these terms or other comparable terminology. These statements are only predictions. You should not place undue reliance on forward-looking statements because they involve known and unknown risks, uncertainties and other factors, which are, in some cases, beyond our control and which could materially affect our results. Factors that may cause actual results to differ materially from current expectations include, among other things, those listed in the section entitled “Risk Factors” and elsewhere in this Report. If one or more of these risks or uncertainties occur, or if our underlying assumptions prove to be incorrect, actual events or results may vary significantly from those implied or projected by the forward-looking statements. No forward-looking statement is a guarantee of future performance. You should read this Report and the documents that we reference in this Report and have filed with the Securities and Exchange Commission, or the SEC, as exhibits to this Report, completely and with the understanding that our actual future results may be materially different from any future results expressed or implied by these forward-looking statements.

In particular, forward-looking statements in this Report include statements about:

| • | anticipated trends, conditions and investor sentiment in the global markets and exchange traded products, or ETPs, which include exchange traded funds, or ETFs; |

| • | anticipated levels of inflows into and outflows out of our ETPs; |

| • | our ability to deliver favorable rates of return to investors; |

| • | our ability to develop new products and services; |

| • | our ability to maintain current vendors or find new vendors to provide services to us at favorable costs; |

| • | our ability to successfully expand our business into non-U.S. markets; |

| • | competition in our business; and |

| • | the effect of laws and regulations that apply to our business. |

The forward-looking statements in this Report represent our views as of the date of this Report. We anticipate that subsequent events and developments may cause our views to change. However, while we may elect to update these forward-looking statements at some point in the future, we have no current intention of doing so except to the extent required by applicable law. Therefore, these forward-looking statements do not represent our views as of any date other than the date of this Report.

1

Table of Contents

| ITEM 1. | BUSINESS |

Our Company

We are the only publicly-traded asset management company that focuses exclusively on ETPs. We were the tenth largest ETP sponsor in the world based on assets under management, or AUM, with AUM of $41.3 billion globally as of December 31, 2016. An ETP is a pooled investment vehicle that holds a basket of securities, financial instruments or other assets and generally seeks to track (index-based) or outperform (actively managed) the performance of a broad or specific equity, fixed income or alternatives market segment, or a basket of or a single commodity or currency (or an inverse or multiple thereof). ETPs are listed on an exchange with their shares traded in the secondary market at market prices, generally at approximately the same price as the net asset value of their underlying components. ETP is an umbrella term that includes ETFs, exchange-traded notes and exchange-traded commodities.

Our U.S. listed ETFs make up the vast majority of our global AUM. As of December 31, 2016, we were the seventh largest ETF sponsor in the U.S. by AUM. Our family of ETFs includes funds that track our own indexes, funds that track third party indexes and actively managed funds. We distribute our ETFs through all major channels within the asset management industry, including brokerage firms, registered investment advisers and institutional investors.

We focus on creating ETFs for investors that offer thoughtful innovation, smart engineering and redefined investing. Most of our index-based funds employ a fundamentally weighted investment methodology, which weights securities on the basis of factors such as dividends or earnings, whereas most other ETF industry indexes use a capitalization weighted methodology. In June 2016, 19 of our U.S. listed ETFs established a 10-year track record, all of which employed a fundamentally weighted investment methodology and most of which outperformed their comparable benchmarks. We also offer actively managed ETFs, which are ETFs that are not based on a particular index but rather are actively managed with complete transparency into the ETF’s portfolio on a daily basis. Our broad regulatory exemptive relief enables us to use our own indexes for certain of our ETFs and actively manage other ETFs.

Business Segments

We operate as an ETP sponsor and asset manager providing investment advisory services in the U.S., Europe, Canada and Japan. These activities are reported in our U.S. Business and International Business segments, as follows:

| • | U.S. Business segment: Our U.S. business and Japan sales office, which primarily engages in selling our U.S. listed ETFs to Japanese institutions; and |

| • | International Business segment: Our European business which commenced in April 2014 in connection with our acquisition of U.K. based ETP sponsor Boost ETP, LLP (“Boost”) and our Canadian business which launched its first six ETFs in July 2016. |

2

Table of Contents

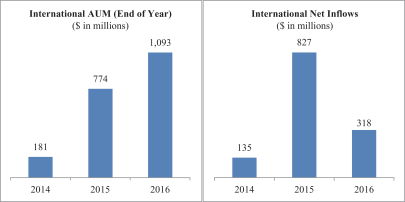

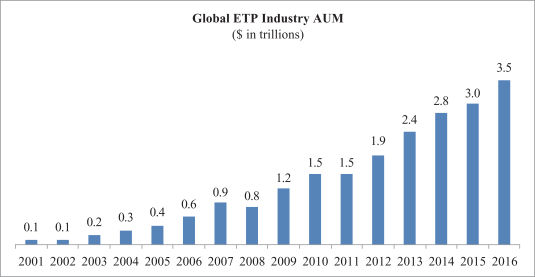

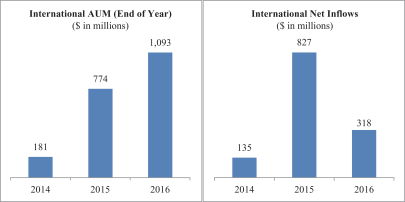

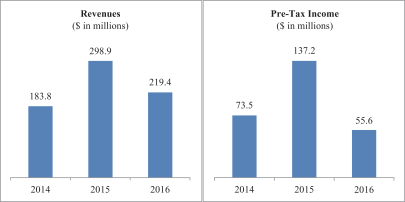

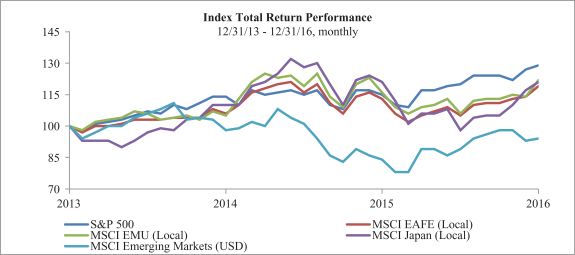

The following charts reflect key operating and financial metrics for our businesses:

U.S. Business Segment

International Business Segment

Consolidated Operating Results

3

Table of Contents

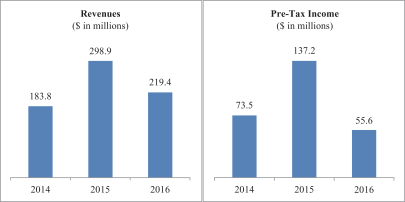

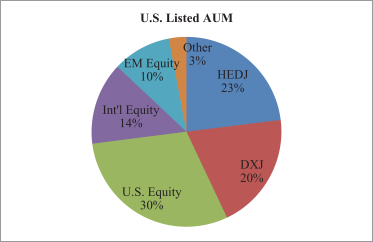

The following charts reflect the distribution and asset mix of our U.S. listed ETFs, which make up the vast majority of our global AUM as of December 31, 2016:

Approximately 43% of our AUM have been gathered in two of our U.S. listed ETFs – WisdomTree Europe Hedged Equity Fund (HEDJ) and WisdomTree Japan Hedged Equity Fund (DXJ) – which invest in European or Japanese equities, respectively, using our fundamentally weighted approach and, in addition, hedge exposure to the Euro or Yen. These two products also accounted for approximately 50% of our revenues in 2016.

Our Industry

An ETF is an investment fund that holds securities such as equities or bonds and/or other assets such as derivatives or commodities, and generally trades at approximately the same price as the net asset value of its underlying components over the course of the trading day. ETFs offer exposure to a wide variety of asset classes and investment themes, including domestic, international and global equities, and fixed income securities, as well as securities in specific industries and countries. There are also ETFs that track certain specific investments, such as commodities, real estate or currencies.

We believe ETPs, the vast majority of which are comprised of ETFs, have been one of the most innovative investment products to emerge in the last two decades in the asset management industry. As of December 31, 2016, there were approximately 2,000 ETPs in the U.S. with aggregate AUM of $2.5 trillion.

4

Table of Contents

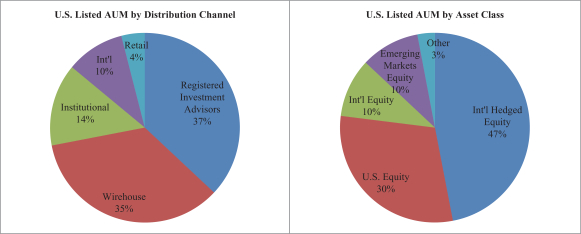

The chart below reflects the AUM of the global ETP industry since 2001:

Source: BlackRock

As of December 31, 2016, we were the seventh largest ETF sponsor in the U.S. and the tenth largest ETP sponsor in the world by AUM:

| Rank |

ETP Sponsor |

AUM (in billions) | ||||

| 1 |

iShares |

$ | 1,293 | |||

| 2 |

Vanguard |

$ | 647 | |||

| 3 |

State Street |

$ | 539 | |||

| 4 |

PowerShares |

$ | 116 | |||

| 5 |

Nomura |

$ | 82 | |||

| 6 |

Deutsche Bank |

$ | 73 | |||

| 7 |

Charles Schwab |

$ | 60 | |||

| 8 |

Lyxor/Soc Gen |

$ | 54 | |||

| 9 |

First Trust |

$ | 42 | |||

| 10 |

WisdomTree |

$ | 41 | |||

Source: BlackRock

ETFs have become more popular among a broad range of investors as they come to understand the benefits of ETFs and use them for a variety of purposes and strategies, including low cost index investing and asset allocation, access to specific asset classes, protective hedging, income generation, arbitrage opportunities and diversification.

While ETFs are similar to mutual funds in many respects, they have some important differences as well:

| • | Transparency. ETFs disclose the composition of their underlying portfolios on a daily basis, unlike mutual funds, which typically disclose their holdings every 90 days. |

| • | Intraday trading, hedging strategies and complex orders. Like stocks, ETFs can be bought and sold on exchanges throughout the trading day at market prices. ETFs update the indicative values of their |

5

Table of Contents

| underlying portfolios every 15 seconds. As publicly-traded securities, ETF shares can be purchased on margin and sold short, enabling the use of hedging strategies, and traded using limit orders, allowing investors to specify the price points at which they are willing to trade. |

| • | Tax efficiency. In the U.S., whenever a mutual fund or ETF realizes a capital gain that is not balanced by a realized loss, it must distribute the capital gain to its shareholders. These gains are taxable to all shareholders, even those who reinvest the gain distributions in additional shares of the fund. However, most ETFs typically redeem their shares through “in-kind” redemptions in which low-cost securities are transferred out of the ETF in exchange for fund shares in a non-taxable transaction. By using this process, ETFs avoid the transaction fees and tax impact incurred by mutual funds that sell securities to generate cash to pay out redemptions. |

| • | Uniform pricing. From a cost perspective, ETFs are one of the most equitable investment products on the market. Investors, regardless of their size, structure or sophistication, pay identical advisory fees. Unlike mutual funds, U.S. listed ETFs generally do not have different share classes or different expense structures for retail and institutional clients and ETFs typically are not sold with sales loads or 12b-1 fees. In many cases, ETFs offer lower expense ratios than comparable mutual funds. |

ETFs are used in various ways by a range of investors, from conservative to speculative uses including:

| • | Low cost index investing. ETFs provide exposure to a variety of broad-based indexes across equities, fixed income, commodities and other asset classes and strategies, and can be used as both long-term portfolio holdings or short term trading tools. ETFs offer an efficient and less costly method by which to gain exposure to indexes as compared to individual stock ownership. |

| • | Improved access to specific asset classes. Investors often use ETFs to gain access to specific market sectors or regions around the world by investing in an ETF that holds a portfolio of securities in that region or segment rather than buying individual securities. |

| • | Asset allocation. Investors seeking to invest in various asset classes to develop an asset allocation model in a cost-effective manner can do so easily with ETFs, which offer broad exposure to various asset classes in a single security. |

| • | Protective hedging. Investors seeking to protect their portfolios may use ETFs as a hedge against unexpected declines in prices of securities arising from market movements and changes in currency and interest rates. |

| • | Income generation. Investors seeking to obtain income from their portfolios may buy fixed income ETFs that typically distribute monthly income or dividend-paying ETFs that encompass a basket of dividend-paying stocks rather than buying individual stocks. |

| • | Speculative investing. Investors with a specific directional opinion about a market sector may choose to buy or sell (long or short) an ETF covering or leveraging that market sector. |

| • | Arbitrage. Sophisticated investors may use ETFs in order to exploit perceived value differences between the ETF and the value of the ETF’s underlying portfolio of securities. |

| • | Diversification. By definition, ETFs represent a basket of securities and each fund may contain hundreds or even thousands of different individual securities. The “instant diversification” of ETFs provides investors with broad exposure to an asset class, market sector or geography. |

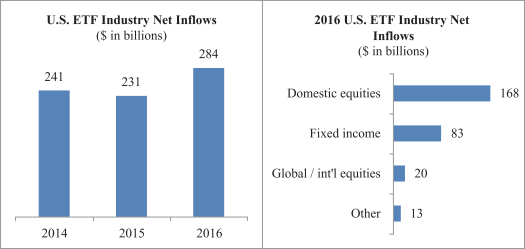

ETFs are one of the fastest growing sectors of the asset management industry. According to the Investment Company Institute, from January 1, 2014 through December 31, 2016, U.S. listed equity ETFs have generated positive inflows of approximately $550 billion while long-term equity mutual funds have experienced outflows of approximately $310 billion. U.S. listed ETF fixed income flows also have surpassed long-term fixed income mutual fund flows as fixed income ETFs have generated positive inflows of approximately $189 billion

6

Table of Contents

compared to $125 billion of inflows for long-term fixed income mutual funds during this same period. We believe this trend is due to the inherent benefits of ETFs, that is: transparency, liquidity and tax efficiency.

We believe our growth, and the growth of the ETF industry in general, will continue to be driven by the following factors:

| • | Education and greater investor awareness. Over the last several years, ETFs have been taking a greater share of inflows and AUM from mutual funds. We believe as a result of market downturns during the economic crisis, investors have become more aware of some of the deficiencies of mutual funds and other financial products. In particular, we believe investors are increasing their focus on important characteristics of their traditional investments—namely transparency, tradability, liquidity, tax efficiency and fees. Their attention and education focused on these important investment characteristics may be one of the drivers of the shift in inflows from traditional mutual funds to ETFs. We believe as investors become more aware and educated about ETFs and their benefits, ETFs will continue to take market share from traditional mutual funds and other financial products or structures such as hedge funds, separate accounts and individual stocks. |

| • | Move to fee-based models. Over the last several years, many financial advisers have changed the revenue model that they charge clients from one that is “transaction-based,” that is, based on commissions for trades or receiving sales loads, to a “fee-based” approach, where an overall fee is charged based on the value of AUM. This fee-based approach lends itself to the adviser selecting no-load, lower-fee financial products, and in our opinion, better aligns advisers with the interests of their clients. Since ETFs generally charge lower fees than mutual funds, we believe this model shift will benefit the ETF industry. As major brokerage firms and asset managers encourage their advisers to move towards fee-based models, we believe overall usage of ETFs likely will increase. |

| • | Innovative product offerings. Historically, ETFs tracked traditional equity indexes, but the volume of ETF growth has led to significant innovation and product development. As demand increased, the number of ETFs has also increased and today, ETFs are available for virtually every asset class including fixed income, commodities, alternative strategies, leveraged/inverse, real estate and currencies. We believe, though, that there remain substantial areas for ETF sponsors to continue to innovate, including alternative- and investment theme-based strategies, hard and soft commodities, and actively managed strategies. We believe the further expansion of ETFs will fuel further growth and investments from investors who typically access these products through hedge funds, separate accounts, stock investments or the futures and commodity markets. |

| • | New distribution channels. Online retail discount brokers now offer free trading and promotion of select ETFs. We believe the promotion of ETF trading by discount brokers and their marketing of ETFs to a wider retail channel will contribute to the future growth of ETFs. Increasingly, institutional investors such as pensions, endowments and even mutual funds are using ETFs as trading tools as well as core holdings. |

| • | Changing demographics. As the “baby boomer” generation continues to mature and retire, we expect that there will be a greater demand for a broad range of investment solutions, with a particular emphasis on income generation and principal protection, and that more of these investors will seek advice from professional financial advisers. We believe these financial advisers will migrate more of their clients’ portfolios to ETFs due to their lower fees, better fit within fee-based models, and their ability to (i) provide access to more diverse market sectors, (ii) improve multi-asset class allocation, and (iii) be used for different investment strategies, including income generation. Overall, we believe ETFs are well-suited to meet the needs of this large and important group of investors. In addition, since many younger investors and financial advisers have demonstrated a preference for the ETF structure over traditional product structures, we believe that wealth transfers from one generation to another will also have a positive effect on ETF industry growth. |

| • | International Markets. We believe the growth of ETFs is a global phenomenon. While the U.S. currently represents the vast majority of global ETF assets, Europe, Canada, Asia and Latin America |

7

Table of Contents

| are growing. Many of the same growth drivers powering the U.S. ETF industry are gradually taking hold in global markets. Additionally, there is an increasing trend of non-U.S. institutional investors investing in U.S.-listed ETFs. |

| • | Regulation. In April 2016, the Department of Labor, or DOL, published its final rule to address conflicts of interest in retirement advice, commonly referred to as the Fiduciary Rule. The Fiduciary Rule is scheduled to become effective in April 2017. However, in February 2017, President Trump issued a presidential memorandum instructing the DOL to conduct an economic and legal analysis of the rule’s potential impact. As a result, the DOL has formally proposed a 60-day delay to the effective date. Also in February 2017, a Texas district court upheld the rule. In response to the Fiduciary Rule, industry experts predict an acceleration in the shift from commission to fee-based advisory models. Already, we have seen several large asset management firms announce changes to their platforms and policies in response to the Fiduciary Rule which favor fee based account structures. Also, in response to the Fiduciary Rule, several fund sponsors have implemented further fee reductions which have occurred primarily in commoditized exposures based upon third party indexes. If the Fiduciary Rule is ultimately implemented, we believe that ETFs’ competitiveness generally will increase due to the inherent benefits of ETFs – transparency and liquidity; and while we are not immune to fee pressure, we believe our proprietary approach and self-indexing differentiates us from the competition. Even if the Fiduciary Rule is not implemented, we believe certain large firms nevertheless will move forward with changes that were developed to comply with the rule. |

Additionally, while the shift toward fee-based models continues to take hold in the U.S. market as described above, regulatory initiatives in international markets are accelerating this trend in new markets. We believe regulations that discourage a commission model and mandate transparency of fees are conducive for ETF growth.

Our Competitive Strengths

| • | Well-positioned in large and growing markets. We believe that ETFs are well positioned to grow significantly faster than the asset management industry as a whole, making our focus on ETFs a significant advantage versus other traditional asset management firms. At December 31, 2016, we were the seventh largest ETF sponsor in the U.S. by AUM. Within the ETF industry, being a first mover, or one of the first providers of ETFs in a particular asset class, can be a significant advantage. We believe that our early leadership in a number of asset classes positions us well to maintain a leadership position. |

| • | Strong performance. We create our own indexes, most of which weight companies in our equity ETFs by a measure of fundamental value and are rebalanced annually. By contrast, traditional indexes are market capitalization weighted and tend to track the momentum of the market. In addition, we also offer actively managed ETFs, as well as ETFs based on third party indexes. In evaluating the performance of our U.S. listed equity, fixed income and alternative ETFs against actively managed and index based mutual funds and ETFs, 95% of the $37.1 billion invested in our ETFs and 69% (52 of 75) of our ETFs covered by Morningstar outperformed their comparable Morningstar average since inception as of December 31, 2016. |

| • | Differentiated product set, powered by innovation. We have a broad and diverse product set. Our products span a variety of traditional and high growth asset classes, including equities, fixed income, currencies and alternatives, and include both passive and actively managed funds. Our innovations include launching the industry’s first emerging markets small-cap equity ETF, the first actively managed currency ETFs, one of the first international local currency denominated fixed income ETFs, the first managed futures strategy ETF, the first currency hedged international equity ETFs in the U.S. and the first smart beta corporate bond suite. |

8

Table of Contents

Our product development strategy comes from two competitive advantages:

| • | Self-indexing. The majority of our ETFs are based on proprietary WisdomTree indexes which we believe gives us several advantages. First, it minimizes our third party index licensing fees, which increases our profitability. Second, because we develop our own intellectual property, we are intimately familiar with our strategies and able to effectively communicate their value proposition in the market with research content and support. Third, it can enhance our speed to market and first mover advantage. Fourth, because these indexes are proprietary to WisdomTree, we may face similar competition, but we never face exact competition. Our competitors license similar third party indexes and need to compete on price to differentiate their offerings. |

| • | Broad regulatory relief. Our broad exemptive relief also allows us to bring unique products to markets, including actively managed funds. |

We believe that our expertise in product development combined with our self-indexing capabilities and regulatory exemptive relief provides a strategic advantage, enabling us to launch innovative ETFs that others may not be able to launch as quickly.

| • | Extensive marketing, research and sales efforts. We have invested significant resources to establish the WisdomTree brand through targeted television, print and online advertising, social media, as well as through our public relations efforts. The majority of our employees are dedicated to marketing, research and sales. Our sales professionals are the primary points of contact for financial advisers, independent advisory firms and institutional investors who use our ETFs. Their efforts are enhanced through value-added services provided by our research and marketing efforts. We have strong relationships with financial advisers at leading national brokerage firms, registered investment advisers and high net worth advisers. We believe that by strategically aligning these adviser relationships and marketing campaigns with targeted research and sales initiatives and products that align with market sentiment, we differentiate ourselves from our competitors. |

| • | Efficient business model with lower risk profile. We have invested heavily in the internal development of our core competencies with respect to product development, marketing, research and sales of ETFs. We outsource to third parties those services that are not our core competencies or may be resource or risk intensive, such as the portfolio management responsibilities and fund accounting operations of our ETFs. In addition, since we create our own indexes for most of our ETFs, we usually do not incur many licensing costs. |

| • | Strong, seasoned and creative management team. We have built a strong and dedicated senior leadership team. Most of our leadership team has significant ETF or financial services industry experience in fund operations, regulatory and compliance oversight, product development and management or marketing and communications. We believe our team, by developing an ETF sponsor from the ground up despite significant competitive, regulatory and operational barriers, has demonstrated an ability to innovate as well as recognize and respond to market opportunities and effectively execute our strategy. |

Our Growth Strategies

Our goal is to become one of the top five ETF sponsors in the world. We believe our continued execution will enable us to increase trading volumes and build longer performance track records, which should allow us to attract additional investors and, in turn, further grow our AUM. We will seek to increase our market share and build additional scale by continuing to implement the following growth strategies:

| • | Increase penetration within existing distribution channels and expand to new distribution channels. We believe there is an opportunity to increase our market share by further penetrating existing distribution channels, expanding into new distribution channels and by cross-selling additional WisdomTree ETFs. To achieve these objectives, we intend to continue our strategy of targeted advertising and direct marketing, coupled with our research-focused sales support initiatives, to enhance product awareness. |

9

Table of Contents

In addition, in November 2016, we made a $20.0 million strategic investment for a 36% fully diluted equity interest in AdvisorEngine, Inc., formerly known as Vanare, Inc., an end-to-end digital wealth management platform which enables individual customization of investment philosophies. We and AdvisorEngine also entered into a strategic agreement whereby our asset allocation models are made available through AdvisorEngine’s open architecture platform and we actively introduce the platform to our distribution network. AdvisorEngine offers an array of distinct product offerings that provide advisors with new client prospecting tools, online client onboarding, institutional grade analytics, trading, performance reporting and billing. Its technology is distinctive in that it provides these features from an advisor-centric point of view, allowing advisors to deepen their engagement with clients and demonstrate the value of the advisory relationship. We believe this investment will enable us to expand our relationships with advisors and actively participate in the digitization of the wealth management industry.

| • | Launch innovative new products that diversify our product offerings and revenues. We believe our track record has shown that we can create and sell innovative ETFs that meet market demand. In 2017, we intend to target the retirement sector by leveraging our existing intellectual property to offer collective investment funds under the WisdomTree Collective Investment Trust, or CIT. The CIT is exempt from registration with the SEC as a bank-maintained collective investment fund established for employee benefit trusts. We believe that continued launches of new products will strengthen our business by allowing us to realize new inflows, maintain and grow our AUM and generate revenues across different market cycles as particular investment strategies move in and out of favor. |

| • | Grow our international business. To date, our sales and marketing have been principally focused on the domestic U.S. market. However, we have taken steps to broaden our reach around the world. |

| • | Europe. In April 2014, we acquired a majority stake in our European business and accelerated the buyout of the remaining minority interest in May 2016. Through this platform, we currently have listed 16 WisdomTree branded UCITS ETFs, and for some have created additional currency-hedged share classes, on the London Stock Exchange, Borsa Italiana, Deutsche Börse and SIX Swiss Exchange, and we continue to manage and grow the Boost lineup ETPs under the Boost brand. |

| • | Latin America. We have cross-listed certain of our ETFs on the Mexican stock exchange, targeting institutional investors trading foreign securities in Mexico. We are also party to a marketing arrangement with the Compass Group to market WisdomTree ETFs in Latin America. |

| • | Australia, New Zealand and Israel. In 2014, we entered into a marketing arrangement with BetaShares to market our U.S. listed ETFs in Australia and New Zealand, and in 2015, we entered into a similar arrangement in Israel. |

| • | Japan. In February 2016, we began selling our U.S. listed ETFs to the institutional market through our sales office in Japan. Moreover, we made regulatory filings in Japan which permit 27 of our U.S. listed ETFs to be marketed to retail investors in Japan. In addition, key personnel from our Japan office travel globally to market our Japan themed ETFs to institutional investors outside of Japan. |

| • | Canada. In April 2016, we established an office in Toronto and in July 2016 began distributing a select range of locally listed ETFs. We currently have listed six WisdomTree branded Canadian ETFs. |

| • | China. In July 2016, we entered into a global product partnership with ICBC Credit Suisse Asset Management (International) Company Limited to launch, market and distribute ETFs that track the S&P China 500 Index. A Luxembourg UCITS ETF listed in Europe marked the first product in this collaboration. |

As ETFs are increasingly traded globally, we believe that international expansion of our marketing, communication and sales strategies will provide significant new growth avenues to participate in new regional markets as well as increasing cross-border investments by non U.S. institutional investors.

10

Table of Contents

| • | Selectively pursue acquisitions or partnerships. We may pursue acquisitions or enter into partnerships or other commercial arrangements that will enable us to strengthen our current business, expand and diversify our product offering, increase our AUM or enter into new markets. We believe entering into partnerships or pursuing acquisitions is a cost-effective means of growing our business and AUM. For example, in November 2016, we made a strategic investment in and entered into a strategic agreement with AdvisorEngine. In January 2016, we acquired the managing owner of the GreenHaven Continuous Commodity Index Fund, which has been renamed the WisdomTree Continuous Commodity Index Fund (NYSE Arca: GCC) to add commodities to our product set. In April 2014, we acquired a majority stake in our European business and accelerated the buyout of the remaining minority interest in May 2016. |

Regulatory Framework of the ETF Industry

Not all ETPs are ETFs. ETFs are a distinct type of security with features that are different than other ETPs. ETFs are open-end investment companies or unit investment trusts regulated in the U.S. by the Investment Company Act of 1940, or the Investment Company Act. This regulatory structure is designed to provide investor protection within a pooled investment product. For example, the Investment Company Act requires that at least 40% of the Trustees for each ETF must not be affiliated persons of the fund’s investment manager, or Independent Trustees. If the ETF seeks to rely on certain rules under the Investment Company Act, a majority of the Trustees for that ETF must be Independent Trustees. In addition, as discussed below, ETFs have received orders from the staff of the SEC which exempt them from certain provisions of the Investment Company Act; however, ETFs generally operate under regulations that prohibit affiliated transactions, are subject to standard pricing and valuation rules and have mandated compliance programs. ETPs can take a number of forms in addition to ETFs, including exchange traded notes, grantor trusts or limited partnerships. In the U.S. market, a key factor differentiating ETFs, grantor trusts and limited partnerships from exchange traded notes is that the former hold assets underlying the ETP. Exchange traded notes, on the other hand, are debt instruments issued by the exchange traded note sponsor. Also, each of these structures has implications for taxes, liquidity, tracking error and credit risk.

Because ETFs do not fit into the regulatory provisions governing mutual funds, ETF sponsors need to obtain “exemptive relief” from the SEC from certain provisions of the Investment Company Act in order to operate ETFs. This exemptive relief allows the ETF sponsor to bring to market the specific products or structures for which the relief was requested and obtained. Applying for exemptive relief can be costly and take several months to several years depending on the type of exemptive relief sought. See “Business—Regulation” below.

Our U.S. Listed Products

As of December 31, 2016, we offered a comprehensive family of 94 ETFs.

International Hedged Equity ETFs

In December 2009, we launched the U.S. industry’s first currency hedged equity ETFs and currently have 24 such ETFs in the market. These ETFs provide exposure to a specified international equity market while hedging the currency exposure of that market relative to the U.S. dollar. In 2016, we launched dynamic currency hedged ETFs, including the Dynamic Currency Hedged International Equity ETF (DDWM), which was the most successful ETF launched in the U.S. in 2016 based on total AUM. Our international hedged equity ETFs are sub-advised by Mellon Capital, a subsidiary of The Bank of New York Mellon Corporation, or BNY Mellon.

Equity ETFs

We offer equity ETFs that provide access to the securities of large, mid and small-cap companies located in the U.S., international developed markets and emerging markets, as well as particular market sectors and styles.

11

Table of Contents

Our equity ETFs track our own indexes, the majority of which are fundamentally weighted as opposed to market capitalization weighted indexes, which assign more weight to stocks with the highest market capitalizations. These fundamentally weighted indexes focus on securities of companies that pay regular cash dividends or on securities of companies that have generated positive cumulative earnings over a certain period. We believe weighting equity markets by dividends and income, rather than by market capitalization, can provide investors with better risk-adjusted returns over longer term periods in core equity exposures. In 2016, we experienced a record year of net inflows of $1.9 billion into our U.S. equity ETFs. Our equity ETFs are sub-advised by Mellon Capital.

Fixed Income ETFs

In 2010, we began launching international fixed income ETFs. Currently, these ETFs invest in emerging market countries, Asia Pacific ex-Japan countries or Australia and New Zealand. These ETFs are denominated in either local or U.S. currencies. We intend to launch additional fixed income bond funds and broaden our product offerings in this category. In December 2013, we launched a suite of rising rate bond ETFs based on leading fixed income benchmarks we license from third parties. In July 2015, we launched an ETF that seeks to track a yield-enhanced index of U.S. investment grade bonds and in 2016 we launched the industry’s first smart beta corporate bond suite. Our fixed income ETFs are sub-advised by either Mellon Capital, Western Asset Management, a subsidiary of Legg Mason, or Voya Investment Management, a subsidiary of Voya Financial Inc.

Currency ETFs

We launched the industry’s first currency ETFs in May 2008 using our regulatory exemption for actively managed funds. We offer currency ETFs that provide investors with exposure to developed and emerging markets currencies, including the Chinese Yuan and the Brazilian Real. In December 2013, we launched a U.S. Dollar Bullish Fund licensing a new Bloomberg index. Currency ETFs invest in U.S. money market securities, forward currency contracts and swaps and seek to achieve the total returns reflective of both money market rates in selected countries available to foreign investors and changes to the value of these currencies relative to the U.S. dollar. Our currency ETFs are sub-advised by Mellon Capital and Western Asset Management.

Alternative Strategy ETFs

In 2011, we launched the industry’s first managed futures strategy ETF and a global real return ETF. In 2015, we launched a dynamic long/short U.S. equity ETF and a dynamic bearish U.S. equity ETF. In 2016, we launched a collateralized put write strategy ETF on the S&P 500 index. We also intend to explore additional alternative strategy products in the future. Our managed futures strategy ETF and dynamic long/short and bearish U.S. equity ETFs are sub-advised by Mellon Capital and our global real return ETF is sub-advised by Western Asset Management.

Commodity ETFs

In January 2016, we acquired the managing owner of the GreenHaven Continuous Commodity Index Fund, which has been renamed the WisdomTree Continuous Commodity Index Fund (NYSE Arca: GCC).

Our International Listed Products

WisdomTree UCITS ETFs

In connection with our acquisition of our European business in April 2014 and its subsequent build out, we have launched 16 UCITS ETFs, and for some have created additional currency-hedged share classes, on the London Stock Exchange, Borsa Italiana, Deutsche Börse and SIX Swiss Exchange, providing exposure to large and small-cap U.S., European and emerging markets equities, as well as a diversified commodities strategy.

12

Table of Contents

Boost ETPs

As part of the acquisition of our European business in April 2014, we acquired Boost’s equity, commodity, fixed income and currency ETPs, which are listed in Europe. As of December 31, 2016, there were 68 ETPs on the European platform.

Canadian ETFs

In April 2016, we established an office in Toronto and in July 2016 began distributing a select range of locally listed ETFs. We currently have listed six WisdomTree branded Canadian ETFs.

Sales, Marketing and Research

We distribute our ETFs through all major channels within the asset management industry, including brokerage firms, registered investment advisers and institutional investors. Our primary sales efforts are not directed towards the retail segment but rather are directed towards the financial or investment adviser who acts as the intermediary between the end-client and us. We do not pay commissions nor do we offer 12b-1 fees to financial advisers to use or recommend the use of our ETFs.

We have developed an extensive network and relationships with financial advisers and we believe our ETFs and related research are well structured to meet their needs and those of their clients. Our sales professionals act in a consultative role to provide the financial adviser with value-added services. We seek to consistently grow our network of financial advisers and we opportunistically seek to introduce new products that best deliver our investment strategies to investors through these distribution channels. We have our own team of approximately 70 sales professionals globally as of December 31, 2016. We plan to incrementally add to our sales force and invest in sales-related resources over the course of 2017 to further penetrate existing sales channels, and to better service new emerging distribution channels.

In addition, we have agreements with third parties to serve as the external marketing agents for the WisdomTree ETFs in Latin America, Australia, New Zealand and Israel as well as with certain brokerage firms to allow certain of our ETFs to trade commission free on their brokerage platforms in exchange for a percentage of our advisory fee revenues from certain AUM. We believe these arrangements expand our distribution capabilities in a cost-effective manner and we may continue to enter into such arrangements in the future.

Our marketing efforts are focused on three objectives: generating new clients and inflows to our ETFs; retaining existing clients, with a focus on cross-selling additional WisdomTree ETFs; and building brand awareness. We pursue these objectives through a multi-faceted marketing strategy targeted at financial advisers. We utilize the following strategies:

| • | Targeted advertising. We create highly targeted multi-media advertising campaigns limited to established core financial media. For example, our television advertising runs exclusively on the cable networks CNBC, Fox Business and Bloomberg Television; online advertising runs on investing or ETF-specific web sites, such as www.seekingalpha.com and www.etfdatabase.com; and print advertising runs in core financial publications, including Barron’s, Pensions & Investments and Investor’s Business Daily. |

| • | Media relations. We have a full time public relations team who has established relationships with the major financial media outlets including: The Wall Street Journal, Barron’s, Financial Times, Bloomberg, Reuters, New York Times and USA Today. We utilize these relationships to help create awareness of the WisdomTree ETFs and the ETF industry in general. Several members of our management team and multiple members of our research team are frequent market commentators and conference panelists. |

13

Table of Contents

| • | Direct marketing. We have a database of financial advisers to which we regularly market through targeted and segmented communications, such as on-demand research presentations, ETF-specific or educational events and presentations, quarterly newsletters and market commentary from our senior investment strategy adviser, Professor Jeremy Siegel. |

| • | Social media. We have implemented a social media strategy that allows us to connect directly with financial advisers and investors by offering timely access to our research material and more general market commentary. Our social media strategy allows us to continue to enhance our brand reputation of expertise and thought leadership in the ETF industry. For example, we have established presence on LinkedIn, Twitter and YouTube, and our blog content is syndicated across multiple business-oriented websites. |

| • | Sales support. We create comprehensive materials to support our sales process including whitepapers, research reports, webinars, blogs, podcasts, videos and performance data for our ETFs. |

We will continue to evolve our marketing and communication efforts in response to changes in the ETF industry, market conditions and marketing trends.

Our research team has three core functions: index development and oversight, investment research and sales support. In its index development role, the research group is responsible for creating the investment methodologies and overseeing the maintenance of our indexes that the WisdomTree ETFs are designed to track. The team also provides a variety of investment research around these indexes and market segments. Our research is typically academic-type research to support our products, including white papers on the strategies underlying our indexes and ETFs, investment insights on current market trends, and types of investment strategies that drive long-term performance. We distribute our research through our sales professionals, online through our website and blog, targeted emails to financial advisers, or through financial media outlets. On some occasions, our research has been included in “op-ed” articles appearing in The Wall Street Journal. Shorter research notes are also developed to promote our ideas, which are distributed online through social media channels. Finally, the research team supports our sales professionals in meetings as market experts and through custom analysis on client portfolio holdings. In addition, we consult with our senior investment strategy adviser, Professor Jeremy Siegel, on product development ideas and market commentaries.

Product Development

We are focused on driving continued growth through innovative product development. Due to our broad based regulatory exemptive relief, proprietary index development capabilities and a strategic focus on product development at the senior management level, we have demonstrated an ability to launch innovative and differentiated ETFs. When developing new funds, we seek to introduce product that can be first to market, offer improvement in structure or strategy relative to an incumbent product or offer some other key distinction relative to an incumbent product. In short, we want to add choice in the market and seek to introduce thoughtful investment solutions by avoiding commoditized products. Lastly, when launching new products, we seek to expand and diversify our overall product line.

Competition

The asset management industry is highly competitive and we face substantial competition in virtually all aspects of our business. Factors affecting our business include fees for our products, investment performance, brand recognition, business reputation, quality of service and the continuity of our financial adviser relationships. We compete directly with other ETF sponsors and mutual fund companies and indirectly against other investment management firms, insurance companies, banks, brokerage firms and other financial institutions that offer products that have similar features and investment objectives to those offered by us. The vast majority of the firms we compete with are subsidiaries of large diversified financial companies and many others are much

14

Table of Contents

larger in terms of AUM, years in operations and revenues and, accordingly, have much larger sales organizations and budgets. In addition, these larger competitors may attract business through means that are not available to us, including retail bank offices, investment banking, insurance agencies and broker-dealers.

The ETF industry is becoming significantly more competitive. There has been increased price competition in not only commoditized product categories such as traditional, market capitalization weighted index exposures, but also in fundamental or other non-market cap weighted or factor-based exposures. In addition, existing players have broadened their suite of products to different strategies that are, in some cases, similar to ours. Lastly, large traditional asset managers are also launching ETFs, some with similar strategies to ours.

We do not know what effect, if any, the launch of these ETFs or price cuts may have on our business. Within the ETF industry, being a first mover, or one of the first providers of ETFs in a particular asset class, can be a significant advantage, as the first ETF in a category to attract scale in AUM and trading liquidity is generally viewed as the most attractive ETF. We believe that our early launch of ETFs in a number of asset classes or strategies, including fundamental weighting and currency hedging, positions us well to maintain our position as one of the leaders of the ETF industry. Additionally, we believe our affiliated indexing or “self-indexing” model enables us to launch proprietary products which do not have exact competition.

We believe our ability to successfully compete will depend largely on our competitive product structure and our ability to offer exposure to compelling investment strategies, develop distribution relationships, create new investment products, build trading volume, AUM and outperforming track records in existing funds, offer a diverse platform of investment choices, build upon our brand and attract and retain talented sales professionals and other employees.

U.S. Regulation

The investment management industry is subject to extensive regulation and virtually all aspects of our business are subject to various federal and state laws and regulations. These laws and regulations are primarily intended to protect investment advisory clients and shareholders of registered investment companies. These laws generally grant supervisory agencies broad administrative powers, including the power to limit or restrict the conduct of our business and to impose sanctions for failure to comply with these laws and regulations. Further, such laws and regulations may provide the basis for examination, inquiry, investigation, enforcement action and/or litigation that may also result in significant costs to us.

We are currently subject to the following laws and regulations, among others. The costs of complying with such laws and regulations have increased and will continue to contribute to the costs of doing business:

| • | The Investment Advisers Act of 1940 (Investment Advisers Act). The SEC is the federal agency generally responsible for administering the U.S. federal securities laws. One of our subsidiaries, WisdomTree Asset Management, Inc., or WTAM, is registered as an investment adviser under the Investment Advisers Act and, as such, is regulated by the SEC. The Investment Advisers Act requires registered investment advisers to comply with numerous and broad obligations, including, among others, recordkeeping requirements, operational procedures, registration and reporting and disclosure obligations. |

| • | The Investment Company Act of 1940 (ICA). Nearly all of our WisdomTree ETFs are registered with the SEC pursuant to the Investment Company Act. These WisdomTree ETFs must comply with the requirements of the Investment Company Act and other regulations related to publicly offering and listing shares, as well as conditions imposed in the exemptive orders received by the ETFs, including, among others, requirements relating to operations, fees charged, sales, accounting, recordkeeping, disclosure and governance. In addition, the SEC has proposed new and/or revised provisions under the ICA that may impact current and future ETF investments and/or operations. |

15

Table of Contents

| • | Broker-Dealer Regulations. Although we are not registered with the SEC as a broker-dealer under the Securities Exchange Act of 1934, as amended, or Exchange Act, nor are we a member firm of the Financial Industry Regulatory Authority, or FINRA, many of our employees, including all of our salespersons, are licensed with FINRA and are registered as associated persons of the distributor of the WisdomTree ETFs and, as such, are subject to the regulations of FINRA that relate to licensing, continuing education requirements and sales practices. FINRA also regulates the content of our marketing and sales material. |

| • | Internal Revenue Code. The WisdomTree Trust generally has obligations with respect to the qualification of the registered investment company for pass-through tax treatment under the Internal Revenue Code. |

| • | U.S. Commodity Futures Trading Commission (CFTC) and National Futures Association (NFA). In 2012, the CFTC adopted regulations that have required us to become a member of the NFA and register as a commodity pool operator for a select number of our ETFs. In addition, in January 2016, we acquired the ownership interest in two commodity pool operators (one of which has since been dissolved) to ETFs that are not registered under the ICA and are thereby subject to additional requirements imposed by the CFTC and NFA. Each commodity pool operator is required to comply with numerous CFTC and NFA requirements. |

| • | Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010. This comprehensive overhaul of the financial services regulatory environment requires federal agencies to implement numerous new rules, which, as they are adopted, may impose additional regulatory burdens and expenses on our business, and also may negatively impact WisdomTree ETFs. |

| • | Employee Retirement Income Security Act of 1974 (ERISA). As investment adviser to the CIT, WTAM will be subject to the fiduciary responsibility standards and prohibited transaction restrictions of ERISA and will be required to comply with certain requirements under ERISA to satisfy those standards and avoid liability. |

With respect to ETFs registered under the ICA, because such ETFs do not fit into the regulatory provisions governing mutual funds, ETF sponsors need to obtain from the SEC exemptive relief from certain provisions of the ICA in order to operate ETFs. This exemptive relief allows the ETF sponsor to bring products to market for the specific products or structures for which the relief was requested and obtained. Applying for exemptive relief can be costly and take several months to several years depending on the type of exemptive relief sought. In addition, each WisdomTree ETF is listed on a secondary market, (each, an Exchange) and any new WisdomTree ETF will seek listing on an Exchange. While the SEC has already approved rules for Exchanges to allow index-based ETFs and active ETFs to list that meet prescribed requirements (e.g., minimum number, market value and trading volume of securities in the new ETF’s benchmark index or in its portfolio, as applicable), these rules do not allow ETFs that do not meet the prescribed requirements without specific SEC approval. The SEC approval process has historically taken months to complete and, in some cases, years. The SEC may ultimately determine not to allow such potential new WisdomTree ETFs or may require strategy modifications prior to approval.

FINRA rules and guidance may affect how WisdomTree ETFs are sold by member firms. Although we currently do not offer so-called leveraged ETFs in the U.S., which may include within their holdings derivative instruments such as options, futures or swaps to obtain leveraged exposures, recent FINRA guidance on margin requirements and suitability determinations with respect to customers trading in leveraged ETFs may influence how member firms effect sales of certain WisdomTree ETFs, such as our currency ETFs, which also use some forms of derivatives, including forward currency contracts and swaps, our international hedged equity ETFs, which use currency forwards, and our rising rates bond ETFs and alternative strategy ETFs, which use futures or options. In September 2015, FINRA issued an investor alert to help investors better understand “smart beta” products, or products that are linked to and seek to track the performance of alternatively weighted indices.

16

Table of Contents

Finally, our common stock is traded on the NASDAQ Global Select Market and we are therefore also subject to its rules including corporate governance listing standards, as well as federal and state securities laws. In addition, the WisdomTree ETFs are listed on NYSE Arca, the NASDAQ Market and the BATS Exchange, and accordingly are subject to the listing requirements of those exchanges.

International Regulation

Our operations outside the U.S. are subject to the laws and regulations of various non-U.S. jurisdictions and non-U.S. regulatory agencies and bodies. As we have expanded our international presence, a number of our subsidiaries and international operations have become subject to regulatory systems, in various jurisdictions, comparable to those covering our operations in the U.S. Regulators in these non-U.S. jurisdictions may have broad authority with respect to the regulation of financial services including, among other things, the authority to grant or cancel required licenses or registrations.

Irish and European Regulation

In connection with our acquisition of Boost and the subsequent build out of our European business, we are subject to Irish and European regulation of our WisdomTree UCITS ETFs and Boost ETPs as follows:

WisdomTree UCITS ETFs

The investment management industry in Ireland is subject to both Irish domestic law and European Union law. The Central Bank of Ireland, or the Central Bank, is responsible for the authorization and supervision of collective investment schemes, or CIS, in Ireland. CIS’s are also commonly known as funds/schemes. There are two main categories of funds authorized by the Central Bank, UCITS (Undertaking for Collective Investment in Transferable Securities) and funds that are not UCITS. ETFs form part of the Irish and European regulatory frameworks that govern UCITS, with ETFs having been the subject of specific consideration at European level (which is then repeated and/or interpreted by the Central Bank in its UCITS Notices and Guidance Notes).

One of our subsidiaries, WisdomTree Management Limited, is an Ireland based management company providing investment and other management services to WisdomTree Issuer plc, or WTI, and WisdomTree UCITS ETFs. The WisdomTree UCITS ETFs are issued by WTI. WTI, a non-consolidated third party, is a public limited company organized in Ireland and is authorized as a UCITS by the Central Bank. All UCITS have their basis in EU legislation and once authorized in one European Economic Area, or EEA, Member State, may be marketed throughout the EU, without further authorization. This is described as an EU passport.

WTI is established and operated as a public limited company with segregated liability between its sub-funds. The sub-funds are segregated portfolios, each with their own investment objective and policies and assets. Each sub-fund has a separate authorization from the Central Bank, and each is authorized as an ETF. Each sub-fund tracks a different index. The index must comply with regulatory criteria that govern, among others, the eligibility and diversification of its constituents, and the availability of information on the index such as the frequency of calculation of the index, the index’s transparency, its methodology and frequency of calculation. Each sub-fund is listed on the Irish Stock Exchange and has shares admitted to trading on the London Stock Exchange and, typically, on various European stock exchanges and, accordingly, is subject to the listing requirements of those exchanges.

WTI is currently subject to the following legislation and regulatory requirements:

| • | European Communities (Undertakings for Collective Investment in Transferable Securities) Regulations 2011 (as amended) (UCITS Regulations). The UCITS Regulations, which transpose Council Directive 2009/65/EC, Commission Directive 2010/43/EC and Commission Directive 2010/44/EC into Irish law, are effective from July 1, 2011. UCITS established in Ireland are authorized under the UCITS Regulations. |

17

Table of Contents

| • | Central Bank (Supervision and Enforcement) Act 2013 (Section 48(1)) (Undertakings for Collective Investment in Transferable Securities) Regulations 2015 (Central Bank UCITS Regulations). The Central Bank UCITS Regulations were adopted in November 2015 and, together with the UCITS Regulations, any guidance notes produced by the Central Bank, and the Central Bank forms, they form the basis for all of the requirements that the Central Bank imposes on UCITS, UCITS management companies and depositaries of UCITS. |

| • | Central Bank Guidance Notes. The Central Bank has also produced Guidance Notes which provide direction on issues relating to the funds industry, certain of which set down conditions not contained in the Regulations with which UCITS must conform. |

| • | The Companies Acts 2014 (Companies Acts). WTI is incorporated as a public limited company under the Irish Companies Acts. Therefore, WTI is required to comply with various obligations under the Companies Acts such as, but not limited to, convening general meetings and keeping proper books and records. The segregation of liability between sub-funds means there cannot be, as a matter of Irish law, cross-contamination of liability as between sub-funds so that the insolvency of one sub-fund affects another sub-fund. |

| • | Regulation (EU) No 648/2012 of the European Parliament and of the Council of 4 July 2012 on OTC derivatives, central counterparties and trade repositories, known as the European Market Infrastructure Regulation (EMIR). EMIR, which became effective on August 16, 2012, provides for certain over-the-counter, or OTC, derivative contracts to be submitted to central clearing and imposes, inter alia, margin posting and other risk mitigation techniques, reporting and record keeping requirements. WTI uses OTC derivatives instruments to hedge the currency risk of some of its sub-funds, which are subject to EMIR. WTI has adhered to the 2013 EMIR Portfolio Reconciliation, Dispute Resolution and Disclosure Protocol published by the International Swaps and Derivatives Association, Inc. The Central Bank has been designated as the competent authority for EMIR. |

Boost ETPs

One of our subsidiaries, Boost Management Limited, is a Jersey based management company providing investment and other management services to Boost Issuer PLC, or BI, and Boost ETPs. The Boost ETPs are issued by BI. BI, a non-consolidated third party, is a public limited company organized in Ireland. It was established as a special purpose vehicle for the purposes of issuing collateralized exchange traded securities, or ETP Securities, under the Collateralized ETP Securities Programme described in its Base Prospectus. BI is not required to be licensed, registered or authorized under any current securities, commodities or banking laws of Ireland and operates without supervision by any authority in any jurisdiction.

The Central Bank, as competent authority under Directive 2003/71/EC (as amended by Directive 2010/73/EU), or the Prospectus Directive, has approved the Base Prospectus as meeting the requirements imposed under Irish and EU law pursuant to the Prospectus Directive. Such approval relates only to ETP Securities which are to be admitted to trading on a regulated market for the purpose of Directive 2004/39/EC of the European Parliament and of the Council on markets in financial instruments (MiFID) and/or which are to be offered to the public in any Member State of the European Economic Area.

The Central Bank has, at the request of BI, notified the approval of the Base Prospectus in accordance with Article 18 of the Prospectus Directive to the U.K. Listing Authority (the United Kingdom financial supervisory authority), the Commissione Nazionale per la Societá e la Borsa (the Italian financial supervisory authority), the Bundesanstalt für Finanzdienstleistungsaufsicht (the German Federal financial supervisory authority) and the Financial Market Authority of Austria, by providing them, inter alia, with certificates of approval attesting that this Base Prospectus has been drawn up in accordance with the Prospectus Directive. BI may request the Central Bank to provide competent authorities in other EEA Member States with such certificates whether for the purposes of making a public offer in such Member States or for admission to trading of all or any ETP Securities on a regulated market therein or both.

18

Table of Contents

BI is currently subject to the following legislation and regulatory requirements:

| • | The Companies Acts. BI is incorporated as a public limited liability company under the Companies Acts. Therefore, BI is required to comply with various obligations under the Companies Acts such as, but not limited to, convening general meetings and keep proper books and records. |

| • | The Prospectus Directive. The Base Prospectus has been drafted, and any offer of ETP Securities in any EEA Member State that has implemented the Prospectus Directive is made in compliance with the Prospectus Directive and any relevant implementing measure in such Member States. |

| • | EMIR. BI hedges its payment obligations in respect of the ETP Securities by entering into swap transactions with swap providers, which are subject to EMIR. The Central Bank has been designated as the competent authority for EMIR and, in order to assess compliance with EMIR, requests that BI submits annually an EMIR Regulatory Return. |

Japanese Regulation

In February 2016, our Tokyo, Japan-based subsidiary, WisdomTree Japan Inc., or WTJ, became registered as a Type 1 Financial Instruments Business with the Kanto Local Finance Bureau (a part of Japan’s Ministry of Finance under authority delegated by the Financial Services Agency of Japan, or FSA). WTJ also is a member of the Japan Securities Dealers Association and the Japan Investor Protection Fund, and is required to comply with the various rules and regulations of each, as applicable. Although WTJ does not currently sponsor any locally listed ETFs in the Japanese market, it assists in the marketing of our U.S. listed ETFs to investors in Japan and, as such, is subject to local regulation within the parameters of its Type 1 Financial Instruments Business registration.

WTJ is currently subject to the following legislation and regulatory requirements:

| • | The Companies Act. WTJ is incorporated as a “Kabushiki Kaisha”, or KK, under the Companies Act of Japan. KKs are similar to U.S. C corporations. WTJ is required to comply with various obligations under the Companies Act such as, but not limited to, convening general meetings, appointing a statutory auditor and maintaining proper books and records. |

| • | The Financial Instruments and Exchange Law. WTJ is subject to the Financial Instruments and Exchange Law, or FIEL, which is administered and enforced by the FSA. The FSA establishes standards for compliance, including capital adequacy and financial soundness requirements, customer protection requirements and conduct of business rules. The FSA is empowered to conduct administrative proceedings that can result in censure, fines, the issuance of cease and desist orders or the suspension or revocation of registrations and licenses granted under the FIEL. |

Canadian Regulation

Our Toronto, Canada based subsidiary, WisdomTree Asset Management Canada, Inc., or WTAMC, is registered as an investment fund manager and exempt market dealer (a restricted broker/dealer license for the exempt market) in certain Canadian jurisdictions where such registration is required. WTAMC’s registration as an investment fund manager enables it to act as fund manager to investment funds, including our Canadian ETFs, in Canada. WTAMC is a corporation incorporated under the Business Corporations Act (Ontario) and must comply with various obligations under that Act including with respect to the appointment of directors and officers, the conduct of meetings of directors and shareholders and the maintaining of books and records. As a registered investment fund manager and exempt market dealer, WTAMC is subject to the requirements of applicable securities laws including National Instrument 31-103 – Registration Requirements, Exemptions and Ongoing Registrant Obligations of the Canadian Securities Administrators, which prescribes registration requirements including proficiency requirements for certain individuals required to be registered on behalf of the firm, firm capital and reporting requirements, firm insurance coverage requirements and the requirement to establish and maintain policies and procedures to ensure compliance by the firm and individuals acting on its behalf with applicable securities legislation.

19

Table of Contents

Our Canadian ETFs are public investment funds whose units are listed on the Toronto Stock Exchange. Our Canadian ETFs are in continuous distribution of their units and have filed prospectuses with the Canadian Securities Administrators in order to offer their units, which are required to be renewed annually. Our Canadian ETFs are subject to National Instrument 81-102 – Investment Funds of the Canadian Securities Administrators, which sets out requirements relating to the investments and limitations on certain investment strategies that may be undertaken by public investment funds as well as requiring fund portfolio assets to be held by independent qualified financial institutions and prescribing that certain fundamental fund changes necessitate obtaining approval of unitholders. Our Canadian ETFs are also subject to National Instrument 81-106 – Investment Fund Continuous Disclosure, which mandates the preparation and filing of annual audited and semi-annual unaudited financial statements for each fund as well as management reports of fund performance for the same periods which are required to be sent to unitholders of the fund. In addition, each of our Canadian ETFs also must prepare quarterly portfolio disclosure and annually prepare and make available its proxy voting disclosure, which is a record of how the fund voted the various portfolio securities held by it. Finally, National Instrument 81-107 – Independent Review Committee for Investment Funds, requires public investment funds to have an independent review committee, or IRC, consisting of at least three members, each of whom must be independent of the fund manager, to review and approve or make a recommendation relating to conflict of interest matters referred to the IRC by the fund manager for consideration that may arise in the course of managing the operations of a fund.

Intellectual Property

We regard our name, WisdomTree, as material to our business and have registered WisdomTree® as a service mark with the U.S. Patent and Trademark Office and in various foreign jurisdictions.

Our index-based equity ETFs are based on our own indexes and we do not license them from, nor do we pay licensing fees to, third parties for these indexes. We do, however, license third party indexes for certain of our fixed income, currency and alternative ETFs.

On March 6, 2012, the U.S. Patent and Trademark Office issued to us our patent on Financial Instrument Selection and Weighting System and Method, which is embodied in our dividend weighted equity indexes. We also have two patent applications pending with the U.S. Patent and Trademark office that relate to the operation of our ETFs and our index methodology. There is no assurance that patents will be issued from these applications and we currently do not rely upon our recently issued or future patents for a competitive advantage.

Employees

As of December 31, 2016 we had 209 full-time employees, of which 163 were in our U.S. Business segment and 46 were in our International Business segment. None of our employees are covered by a collective bargaining agreement and we consider our relations with employees to be good.

Available Information

Company Website and Public Filings

Our website is located at www.wisdomtree.com, and our investor relations website is located at http://ir.wisdomtree.com. We make available, free of charge through our investor relations website, our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, and amendments to those reports, filed or furnished pursuant to Sections 13(a) or Section 15(d) of the Exchange Act as soon as reasonably practicable after they have been electronically filed with, or furnished to, the SEC. The public may read and copy any materials filed by us with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains a website that contains reports, proxy and information statements, and other information regarding the Company at www.sec.gov.

20

Table of Contents