Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-Q

(Mark One)

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2015

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

Commission File Number 001-10932

WisdomTree Investments, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 13-3487784 | |

| (State or other jurisdiction of incorporation or organization) |

(IRS Employer Identification No.) | |

| 245 Park Avenue, 35th Floor New York, New York |

10167 | |

| (Address of principal executive officers) | (Zip Code) | |

212-801-2080

(Registrant’s Telephone Number, Including Area Code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). x Yes ¨ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | x | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of October 31, 2015, there were 138,371,775 shares of the registrant’s Common Stock, $0.01 par value per share, outstanding (voting shares).

Table of Contents

WISDOMTREE INVESTMENTS, INC.

Form 10-Q

For the Quarterly Period Ended September 30, 2015

2

Table of Contents

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q contains forward-looking statements that are based on our management’s beliefs and assumptions and on information currently available to our management. Although we believe that the expectations reflected in these forward-looking statements are reasonable, these statements relate to future events or our future financial performance, and involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” “continue” or the negative of these terms or other comparable terminology. These statements are only predictions. You should not place undue reliance on forward-looking statements because they involve known and unknown risks, uncertainties and other factors, which are, in some cases, beyond our control and which could materially affect results. Factors that may cause actual results to differ materially from current expectations include, among other things, those listed in the section entitled “Risk Factors” included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2014. If one or more of these or other risks or uncertainties occur, or if our underlying assumptions prove to be incorrect, actual events or results may vary significantly from those implied or projected by the forward-looking statements. No forward-looking statement is a guarantee of future performance. You should read this Report and the documents that we reference in this Report and have filed with the Securities and Exchange Commission (“SEC”) as exhibits to this Report, completely and with the understanding that our actual future results may be materially different from any future results expressed or implied by these forward-looking statements.

In particular, forward-looking statements in this Report may include statements about:

| • | anticipated trends, conditions and investor sentiment in the global markets and exchange traded products, or ETPs, which include exchange traded funds, or ETFs; |

| • | anticipated levels of inflows into and outflows out of our ETPs; |

| • | our ability to deliver favorable rates of return to investors; |

| • | our ability to develop new products and services; |

| • | our ability to maintain current vendors or find new vendors to provide services to us at favorable costs; |

| • | our ability to successfully expand our business into non-U.S. markets; |

| • | timing of payment of our cash income taxes; |

| • | competition in our business; and |

| • | the effect of laws and regulations that apply to our business. |

The forward-looking statements in this Report represent our views as of the date of this Report. We anticipate that subsequent events and developments may cause our views to change. However, while we may elect to update these forward-looking statements at some point in the future, we have no current intention of doing so except to the extent required by applicable law. Therefore, these forward-looking statements do not represent our views as of any date other than the date of this Report.

3

Table of Contents

| ITEM 1. | FINANCIAL STATEMENTS |

WisdomTree Investments, Inc. and Subsidiaries

Consolidated Balance Sheets

(In Thousands, Except Per Share Amounts)

| September 30, 2015 |

December 31, 2014 |

|||||||

| (Unaudited) | ||||||||

| Assets |

||||||||

| Current assets: |

||||||||

| Cash and cash equivalents |

$ | 211,992 | $ | 165,284 | ||||

| Accounts receivable |

25,514 | 18,176 | ||||||

| Deferred tax asset, net |

10,297 | 3,872 | ||||||

| Other current assets |

2,958 | 1,708 | ||||||

|

|

|

|

|

|||||

| Total current assets |

250,761 | 189,040 | ||||||

| Fixed assets, net |

11,279 | 10,356 | ||||||

| Investments |

23,651 | 13,990 | ||||||

| Deferred tax asset, net |

4,326 | 5,618 | ||||||

| Goodwill |

1,676 | 1,676 | ||||||

| Other noncurrent assets |

723 | 71 | ||||||

|

|

|

|

|

|||||

| Total assets |

$ | 292,416 | $ | 220,751 | ||||

|

|

|

|

|

|||||

| Liabilities and stockholders’ equity |

||||||||

| Liabilities: |

||||||||

| Current liabilities: |

||||||||

| Fund management and administration payable |

$ | 11,245 | $ | 9,983 | ||||

| Compensation and benefits payable |

21,875 | 14,333 | ||||||

| Accounts payable and other liabilities |

6,420 | 5,115 | ||||||

|

|

|

|

|

|||||

| Total current liabilities |

39,540 | 29,431 | ||||||

| Other noncurrent liabilities: |

||||||||

| Acquisition payable |

2,449 | 1,757 | ||||||

| Deferred rent payable |

5,213 | 5,278 | ||||||

|

|

|

|

|

|||||

| Total liabilities |

47,202 | 36,466 | ||||||

|

|

|

|

|

|||||

| Stockholders’ equity: |

||||||||

| Preferred stock, par value $0.01; 2,000 shares authorized |

— | — | ||||||

| Common stock, par value $0.01; 250,000 shares authorized; issued: 138,398 and 134,959; outstanding: 136,727 and 133,445 |

1,384 | 1,350 | ||||||

| Additional paid-in capital |

243,410 | 209,216 | ||||||

| Accumulated other comprehensive loss |

(7 | ) | (53 | ) | ||||

| Retained earnings/(accumulated deficit) |

427 | (26,228 | ) | |||||

|

|

|

|

|

|||||

| Total stockholders’ equity |

245,214 | 184,285 | ||||||

|

|

|

|

|

|||||

| Total liabilities and stockholders’ equity |

$ | 292,416 | $ | 220,751 | ||||

|

|

|

|

|

|||||

The accompanying notes are an integral part of these consolidated financial statements.

4

Table of Contents

WisdomTree Investments, Inc. and Subsidiaries

Consolidated Statements of Operations

(In Thousands, Except Per Share Amounts)

(Unaudited)

| Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||||||

| 2015 | 2014 | 2015 | 2014 | |||||||||||||

| Revenues: |

||||||||||||||||

| Advisory fees |

$ | 80,520 | $ | 46,942 | $ | 221,709 | $ | 133,489 | ||||||||

| Other income |

233 | 172 | 744 | 673 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total revenues |

80,753 | 47,114 | 222,453 | 134,162 | ||||||||||||

| Expenses: |

||||||||||||||||

| Compensation and benefits |

19,407 | 9,990 | 57,677 | 26,896 | ||||||||||||

| Fund management and administration |

10,519 | 8,465 | 31,895 | 25,451 | ||||||||||||

| Marketing and advertising |

3,573 | 3,341 | 10,277 | 8,645 | ||||||||||||

| Sales and business development |

2,438 | 1,279 | 6,414 | 4,307 | ||||||||||||

| Professional and consulting fees |

1,570 | 1,383 | 4,637 | 5,018 | ||||||||||||

| Occupancy, communications and equipment |

1,183 | 882 | 3,044 | 2,635 | ||||||||||||

| Depreciation and amortization |

253 | 207 | 696 | 600 | ||||||||||||

| Third party sharing arrangements |

485 | 187 | 1,265 | 312 | ||||||||||||

| Acquisition contingent payment |

172 | — | 693 | — | ||||||||||||

| Other |

1,620 | 1,123 | 4,364 | 3,429 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total expenses |

41,220 | 26,857 | 120,962 | 77,293 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income before taxes |

39,533 | 20,257 | 101,491 | 56,869 | ||||||||||||

| Income tax expense |

16,245 | 9,634 | 41,969 | 5,440 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income |

$ | 23,288 | $ | 10,623 | $ | 59,522 | $ | 51,429 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income per share - basic |

$ | 0.17 | $ | 0.08 | $ | 0.44 | $ | 0.39 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income per share - diluted |

$ | 0.17 | $ | 0.08 | $ | 0.43 | $ | 0.37 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Weighted-average common shares - basic |

136,582 | 131,778 | 135,527 | 131,418 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Weighted-average common shares - diluted |

138,181 | 138,346 | 137,833 | 138,476 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Cash dividends declared per common share |

$ | 0.08 | $ | — | $ | 0.24 | $ | — | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

The accompanying notes are an integral part of these consolidated financial statements

5

Table of Contents

WisdomTree Investments, Inc. and Subsidiaries

Consolidated Statements of Comprehensive Income

(In Thousands)

(Unaudited)

| Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||||||

| 2015 | 2014 | 2015 | 2014 | |||||||||||||

| Comprehensive income |

||||||||||||||||

| Net income |

$ | 23,288 | $ | 10,623 | $ | 59,522 | $ | 51,429 | ||||||||

| Other comprehensive income/(loss) |

||||||||||||||||

| Foreign currency translation adjustment |

168 | (9 | ) | 46 | (9 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Comprehensive income |

$ | 23,456 | $ | 10,614 | $ | 59,568 | $ | 51,420 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

The accompanying notes are an integral part of these consolidated financial statements

6

Table of Contents

WisdomTree Investments, Inc. and Subsidiaries

Consolidated Statements of Cash Flows

(In Thousands)

(Unaudited)

| Nine Months Ended September 30, |

||||||||

| 2015 | 2014 | |||||||

| Cash flows from operating activities: |

||||||||

| Net income |

$ | 59,522 | $ | 51,429 | ||||

| Non-cash items included in net income: |

||||||||

| Income tax expense |

40,573 | 5,396 | ||||||

| Depreciation and amortization |

696 | 600 | ||||||

| Stock-based compensation |

7,878 | 6,122 | ||||||

| Deferred rent |

(26 | ) | 1,620 | |||||

| Accretion to interest income and other |

9 | (76 | ) | |||||

| Changes in operating assets and liabilities: |

||||||||

| Accounts receivable |

(7,253 | ) | 2,049 | |||||

| Other assets |

(1,892 | ) | (811 | ) | ||||

| Deferred acquisition contingent payment |

693 | — | ||||||

| Fund management and administration payable |

1,216 | (1,579 | ) | |||||

| Compensation and benefits payable |

7,402 | (7,510 | ) | |||||

| Accounts payable and other liabilities |

1,330 | (590 | ) | |||||

|

|

|

|

|

|||||

| Net cash provided by operating activities |

110,148 | 56,650 | ||||||

| Cash flows from investing activities: |

||||||||

| Purchase of fixed assets |

(1,606 | ) | (4,580 | ) | ||||

| Purchase of investments |

(11,353 | ) | (1,384 | ) | ||||

| Cash acquired on acquisition |

— | 1,349 | ||||||

| Proceeds from the redemption of investments |

1,681 | 868 | ||||||

|

|

|

|

|

|||||

| Net cash used in investing activities |

(11,278 | ) | (3,747 | ) | ||||

| Cash flows from financing activities: |

||||||||

| Dividends paid |

(32,867 | ) | — | |||||

| Shares repurchased |

(23,689 | ) | (6,259 | ) | ||||

| Proceeds from exercise of stock options |

4,471 | 341 | ||||||

|

|

|

|

|

|||||

| Net cash used in financing activities |

(52,085 | ) | (5,918 | ) | ||||

|

|

|

|

|

|||||

| Decrease in cash flows due to changes in foreign exchange rate |

(77 | ) | (14 | ) | ||||

|

|

|

|

|

|||||

| Net increase in cash and cash equivalents |

46,708 | 46,971 | ||||||

| Cash and cash equivalents - beginning of period |

165,284 | 104,316 | ||||||

|

|

|

|

|

|||||

| Cash and cash equivalents - end of period |

$ | 211,992 | $ | 151,287 | ||||

|

|

|

|

|

|||||

| Supplemental disclosure of cash flow information: |

||||||||

| Cash paid for taxes |

$ | 551 | $ | 66 | ||||

|

|

|

|

|

|||||

The accompanying notes are an integral part of these consolidated financial statements

7

Table of Contents

WisdomTree Investments, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

(In Thousands, Except Share and Per Share Amounts)

1. Organization and Description of Business

WisdomTree Investments, Inc., through its global subsidiaries (collectively, “WisdomTree” or the “Company”), is an ETP sponsor and asset manager headquartered in New York. WisdomTree offers ETPs covering equity, fixed income, currency, alternative and commodity asset classes. The Company has the following operating subsidiaries:

| • | WisdomTree Asset Management, Inc. (“WTAM”) is a New York based investment adviser registered with the SEC providing investment advisory and other management services to WisdomTree Trust (“WTT”) and WisdomTree exchange traded funds (“ETFs”). |

| • | Boost Management Limited (“BML” or “Boost”) is a Jersey based investment manager providing investment and other management services to Boost Issuer PLC (“BI”) and Boost ETPs. |

| • | WisdomTree Europe Limited (“WisdomTree Europe”) is a U.K. based company registered with the Financial Conduct Authority providing management and other services to BML and WisdomTree Management Limited. |

| • | WisdomTree Management Limited (“WTML”) is an Ireland based investment manager providing investment and other management services to WisdomTree Issuer plc (“WTI”) and WisdomTree UCITS ETFs. |

| • | WisdomTree Japan K. K. (“WTJ”) is a Japan based company that is currently applying for requisite regulatory business registrations to offer WisdomTree ETPs in Japan. |

The WisdomTree ETFs are issued in the U.S. by WTT. WTT, a non-consolidated third party, is a Delaware statutory trust registered with the SEC as an open-end management investment company. The Company has licensed to WTT the use of certain of its own indexes on an exclusive basis for the WisdomTree ETFs in the U.S. The Boost ETPs are issued by BI. BI, a non-consolidated third party, is a public limited company organized in Ireland. The WisdomTree UCITS ETFs are issued by WTI. WTI, a non-consolidated third party, is a public limited company organized in Ireland.

The Board of Trustees and Board of Directors of WTT, BI and WTI, respectively, are separate from the Board of Directors of the Company. The Trustees and Directors of WTT, BI and WTI respectively, are primarily responsible for overseeing the management and affairs of the WisdomTree ETFs, Boost ETPs and the WisdomTree UCITS ETFs for the benefit of the WisdomTree ETF, Boost ETP and the WisdomTree UCITS ETF shareholders, respectively, and have contracted with the Company to provide for general management and administration services. The Company, in turn, has contracted with third parties to provide the majority of these administration services. In addition, certain officers of the Company provide general management services for WTT, BI and WTI.

2. Significant Accounting Policies

Basis of Presentation

These consolidated financial statements have been prepared in conformity with U.S. generally accepted accounting principles (“GAAP”) and in the opinion of management reflect all adjustments, consisting of only normal recurring adjustments, necessary for a fair statement of financial condition, results of operations, and cash flows for the periods presented. The consolidated financial statements include the accounts of the Company’s wholly owned subsidiaries.

All intercompany accounts and transactions have been eliminated in consolidation. Certain accounts in the prior years’ consolidated financial statements have been reclassified to conform to the current year’s consolidated financial statements presentation. These reclassifications had no effect on the previously reported operating results.

Foreign Currency Translation

Assets and liabilities of subsidiaries whose functional currency is not the U.S. dollar are translated based on the end of period exchange rates from local currency to U.S. dollars. Results of operations are translated at the average exchange rates in effect during the period.

Use of Estimates

The preparation of the Company’s consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities as of the balance sheet dates and the reported amounts of revenues and expenses for the periods presented. Actual results could differ materially from those estimates.

8

Table of Contents

Revenue Recognition

The Company earns investment advisory fees from ETPs, as well as licensing fees from third parties. ETP advisory fees are based on a percentage of the ETPs’ average daily net assets and recognized over the period the related service is provided. Licensing fees are based on a percentage of the average monthly net assets and recognized over the period the related service is provided.

Depreciation and Amortization

Depreciation is provided for using the straight-line method over the estimated useful lives of the related assets as follows:

| Equipment |

5 years | |||

| Furniture and fixtures |

15 years |

Leasehold improvements are amortized over the term of their respective leases or service lives of the improvements, whichever is shorter. Fixed assets are stated at cost less accumulated depreciation and amortization.

Marketing and Advertising

Advertising costs, including media advertising and production costs, are expensed when incurred.

Cash and Cash Equivalents

The Company considers all highly liquid investments with an original maturity of 90 days or less at the time of purchase to be classified as cash equivalents. Cash and cash equivalents are held primarily with one large financial institution.

Accounts Receivable and Allowance for Doubtful Accounts

Accounts receivable are customer and other obligations due under normal trade terms. An allowance for doubtful accounts is not provided since, in the opinion of management, all accounts receivable recorded are deemed collectible.

Impairment of Long-Lived Assets

On a periodic basis, the Company performs a review for the impairment of long-lived assets when events or changes in circumstances indicate that the estimated undiscounted future cash flows expected to be generated by the assets are less than their carrying amounts or when other events occur which may indicate that the carrying amount of an asset may not be recoverable.

Earnings per Share

Basic earnings per share is computed by dividing net income available to common stockholders by the weighted-average number of common shares outstanding for the period. Diluted earnings per share reflects the reduction in earnings per share assuming options or other contracts to issue common stock were exercised or converted into common stock.

Investments

The Company accounts for all of its investments as held-to-maturity, which are recorded at amortized cost. For held-to-maturity investments, the Company has the intent and ability to hold investments to maturity and it is not more-likely-than-not that the Company will be required to sell the investments before recovery of their amortized cost bases, which may be maturity.

On a periodic basis, the Company reviews its portfolio of investments for impairment. If a decline in fair value is deemed to be other-than-temporary, the security is written down to its fair value through earnings.

Goodwill

Goodwill is the excess of the fair value of the purchase price over the fair values of the identifiable net assets at the acquisition date. The Company tests its goodwill for impairment at least annually. An impairment loss is triggered if the estimated fair value of the operating reporting unit is less than the estimated net book value. Such loss is calculated as the difference between the estimated fair value of goodwill and its carrying value.

Stock-Based Awards

Accounting for stock-based compensation requires the measurement and recognition of compensation expense for all equity awards based on estimated fair values. Stock-based compensation is measured based on the grant-date fair value of the award and is amortized over the relevant service period.

9

Table of Contents

Income Taxes

The Company accounts for income taxes using the liability method, which requires the determination of deferred tax assets and liabilities based on the differences between the financial and tax basis of assets and liabilities using the enacted tax rates in effect for the year in which differences are expected to reverse. Deferred tax assets are adjusted by a valuation allowance if, based on the weight of available evidence, it is more-likely-than-not that some portion or all of the deferred tax assets will not be realized.

In order to recognize and measure any unrecognized tax benefits, management evaluates and determines whether any of its tax positions are more-likely-than-not to be sustained upon examination, including resolution of any related appeals or litigation processes, based on the technical merits of the position. Once it is determined that a position meets this recognition threshold, the position is measured to determine the amount of benefit to be recognized in the consolidated financial statements. The Company records interest expense and penalties related to tax expenses as income tax expense.

Related Party Transactions

The Company’s revenues are derived primarily from investment advisory agreements with WTT and WisdomTree ETFs. Under these agreements, the Company has licensed to WTT the use of certain of its own indexes on an exclusive basis for the WisdomTree ETFs in the U.S. The Trustees are primarily responsible for overseeing the management and affairs of the WisdomTree ETFs and the Trust for the benefit of the WisdomTree ETF shareholders and WTT has contracted with the Company to provide for general management and administration of WTT and the WisdomTree ETFs. The Company is also responsible for certain expenses of WTT, including the cost of transfer agency, custody, fund administration and accounting, legal, audit, and other non-distribution services, excluding extraordinary expenses, taxes and certain other expenses. In exchange, the Company receives fees based on a percentage of the ETF average daily net assets. The advisory agreements may be terminated by WTT upon notice. Certain officers of the Company also provide general management oversight of WTT; however, these officers have no material decision making responsibilities and primarily implement the decisions of the Trustees. At September 30, 2015 and December 31, 2014, the balance of accounts receivable from WTT was approximately $23,917 and $17,288, respectively, which is included as a component of accounts receivable on the Company’s Consolidated Balance Sheets. Revenue from advisory services provided to WTT for the three months ended September 30, 2015 and 2014 was approximately $79,242 and $46,660, respectively, and for the nine months ended September 30, 2015 and 2014 was approximately $218,997 and $133,022, respectively.

At September 30, 2015 and December 31, 2014, the balance of accounts receivable from BI and WTI was approximately $824 and $157, respectively, which is included as a component of accounts receivable on the Company’s Consolidated Balance Sheets. Revenue from advisory fee services provided to BI and WTI for the three months ended September 30, 2015 and 2014 was approximately $1,278 and $282, respectively, and for the nine months ended September 30, 2015 and 2014 was approximately $2,712 and $467, respectively.

Third-Party Sharing Arrangements

The Company pays a percentage of its advisory fee revenue based on incremental growth in AUM, subject to caps or minimums, to marketing agents to sell WisdomTree ETFs and for including WisdomTree ETFs on third party customer platforms.

Segment, Geographic and Customer Information

The Company operates as a single business segment as an ETP sponsor and asset manager providing investment advisory services. Substantially all of the Company’s revenues, pretax income and assets are derived or located in the U.S. The Company maintains operations in Europe through its acquisition of Boost, now known as WisdomTree Europe (Note 11).

Recently Issued Accounting Pronouncements

In February 2015, the FASB issued Accounting Standards Update 2015-02 (ASU 2015-02) Amendments to the Consolidation Analysis, which amends the consolidation guidance in ASC 810. The standard eliminates the deferral of FAS 167, per ASC 810-10-65-2(a), which has allowed certain investment funds to follow the previous consolidation guidance in FIN 46 (R). The standard changes whether (1) fees paid to a decision maker or service provider represent a variable interest, (2) a limited partnership or similar entity has the characteristics of a variable interest entity (“VIE”) and (3) a reporting entity is the primary beneficiary of a VIE. The effective date of the standard will be for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2015 for public companies, and early adoption is permitted. The Company is currently assessing the potential impact of the adoption of this guidance on its consolidated financial statements.

In May 2014, the FASB issued Accounting Standards Update 2014-09 (ASU 2014-09) Revenue from Contracts with Customers, which is a new comprehensive revenue recognition standard on the financial reporting requirements for revenue from contracts entered into with customers. In July 2015, the FASB deferred this ASU’s effective date by one year, to interim and annual periods beginning after December 15, 2017. The deferral allows early adoption at the original effective date. The Company is currently assessing the potential impact of the adoption of this guidance on its consolidated financial statements.

10

Table of Contents

Business Combinations

The Company includes the results of operations of the businesses that it acquires from the respective dates of acquisition. The fair values of the purchase price of the acquisitions are allocated to the assets acquired and liabilities assumed based on their estimated fair values. The excess of the fair value of purchase price over the fair values of these identifiable assets and liabilities is recorded as goodwill.

Subsequent Events

The Company has evaluated subsequent events after the date of the consolidated financial statements to consider whether or not the impact of such events needed to be reflected or disclosed in the consolidated financial statements. Such evaluation was performed through the issuance date of the consolidated financial statements.

3. Investments and Fair Value Measurements

The following table is a summary of the Company’s investments:

| September 30, 2015 | December 31, 2014 | |||||||

| Held-to- Maturity |

Held-to- Maturity |

|||||||

| Federal agency debt instruments |

$ | 23,651 | $ | 13,990 | ||||

|

|

|

|

|

|||||

The following table summarizes unrealized gains, losses and fair value of investments:

| September 30, 2015 | December 31, 2014 | |||||||

| Held-to- Maturity |

Held-to- Maturity |

|||||||

| Cost/amortized cost |

$ | 23,651 | $ | 13,990 | ||||

| Gross unrealized gains |

124 | 112 | ||||||

| Gross unrealized losses |

(353 | ) | (386 | ) | ||||

|

|

|

|

|

|||||

| Fair value |

$ | 23,422 | $ | 13,716 | ||||

|

|

|

|

|

|||||

The following table sets forth the maturity profile of investments; however these investments may be called prior to maturity date:

| September 30, 2015 | December 31, 2014 | |||||||

| Held-to- Maturity |

Held-to- Maturity |

|||||||

| Due within one year |

$ | — | $ | — | ||||

| Due one year through five years |

11,373 | 1,409 | ||||||

| Due five years through ten years |

1,115 | 350 | ||||||

| Due over ten years |

11,163 | 12,231 | ||||||

|

|

|

|

|

|||||

| Total |

$ | 23,651 | $ | 13,990 | ||||

|

|

|

|

|

|||||

Fair Value Measurement

Under the accounting for fair value measurements and disclosures, fair value is defined as the price that would be received to sell an asset or paid to transfer a liability, or the exit price, in an orderly transaction between market participants at the measurement date. The accounting guidance establishes a hierarchy of valuation techniques based on whether the inputs to those valuation techniques are observable or unobservable. Observable inputs reflect market data obtained from independent sources, while unobservable inputs reflect the Company’s market assumptions.

These three types of inputs create the following fair value hierarchy:

Level 1—Quoted prices for identical instruments in active markets.

Level 2—Quoted prices for similar instruments in active markets; quoted prices for identical or similar instruments in markets that are not active; and model-derived valuations whose inputs are observable or whose significant value drivers are observable.

Level 3—Instruments whose significant value drivers are unobservable.

11

Table of Contents

This hierarchy requires the use of observable market data when available. The Company’s held-to-maturity securities are categorized as Level 1.

The majority of the Company’s acquisition payable of $2,449 is measured at fair value and is categorized as Level 3. Fair value is determined based on a predefined formula which includes observable and unobservable inputs and is subject in part to a minimum payout. Inputs to the predefined formula include the contractual minimum payment obligation, European AUM, the Company’s enterprise value over global AUM, and profitability of the European business (Note 11). During the three and nine months ended September 30, 2015, the Company recorded an acquisition contingent payment expense of $172 and $693, respectively, which represents the expense accrual for expected payments due to the former Boost shareholders primarily driven by increased AUM from the Company’s European business.

Some of the Company’s financial instruments are not measured at fair value on a recurring basis but are recorded at amounts that approximate fair value due to their liquid or short-term nature.

4. Fixed Assets

The following table summarizes fixed assets:

| September 30, 2015 | December 31, 2014 | |||||||

| Equipment |

$ | 1,292 | $ | 913 | ||||

| Furniture and fixtures |

2,024 | 1,620 | ||||||

| Leasehold improvements |

9,631 | 8,795 | ||||||

| Less accumulated depreciation and amortization |

(1,668 | ) | (972 | ) | ||||

|

|

|

|

|

|||||

| Total |

$ | 11,279 | $ | 10,356 | ||||

|

|

|

|

|

|||||

5. Commitments and Contingencies

Contractual Obligations

The Company has entered into obligations under operating leases with initial non-cancelable terms in excess of one year for office space, telephone and data services. Expenses recorded under these agreements for the three months ended September 30, 2015 and 2014 were approximately $906 and $778, and for the nine months ended September 30, 2015 and 2014 were approximately $2,529 and $2,372.

Future minimum lease payments with respect to non-cancelable operating leases at September 30, 2015 are approximately as follows:

| Remainder of 2015 |

$ | 1,002 | ||

| 2016 |

3,785 | |||

| 2017 |

3,483 | |||

| 2018 and thereafter |

33,065 | |||

|

|

|

|||

| Total |

$ | 41,335 | ||

|

|

|

The Company’s prior U.S. office lease expired in January 2014. In August 2013, the Company entered into a new 16 year lease agreement. Pursuant to the new lease agreement, the Company received lease incentives which include a deferred rent period and a leasehold improvement allowance equal to $3,223. At that time, the Company recorded a receivable of $3,223 due from the lessor of its new office space related to its leasehold improvement allowance. The balance at September 30, 2015 and December 31, 2014 was $509, which was included in accounts receivable on the Company’s Consolidated Balance Sheets.

In May 2015, the Company entered into a new three-year lease agreement for office space in Japan. Pursuant to the new lease agreement, the Company received a lease incentive of a deferred rent period equal to ¥10,440, or $85.

In July 2015, the Company entered into a new five-year lease agreement for office space in the U.K. Pursuant to the new lease agreement, the Company received a lease incentive of a deferred rent period equal to £26, or $41.

Letter of Credit

The Company collateralized its U.S. office lease through a standby letter of credit totaling $1,384. The collateral is included in investments on the Company’s Consolidated Balance Sheets.

12

Table of Contents

Contingencies

The Company is subject to various routine reviews and inspections by regulatory authorities as well as legal proceedings arising in the ordinary course of business. The Company is not currently party to any litigation or other legal proceedings that are expected to have a material impact on its business, financial position or results of operations.

6. Stock-Based Awards

The Company grants equity awards to employees and directors. Options are issued for terms of ten years and vest between two to four years. Options are issued with an exercise price equal to the fair value of the Company on the date of grant. The Company estimated the fair value for options using the Black-Scholes option pricing model. All restricted stock and option awards require future service as a condition of vesting with certain awards subject to acceleration under certain conditions. Restricted stock awards generally vest over three years.

A summary of options and restricted stock activity is as follows:

| Options | Weighted Average Exercise Price of Options |

Restricted Stock Awards |

||||||||||

| Balance at January 1, 2015 |

5,330,070 | $ | 1.61 | 1,513,939 | ||||||||

| Granted |

— | $ | — | 886,413 | ||||||||

| Exercised/vested |

(3,742,258 | ) | $ | 1.19 | (703,917 | ) | ||||||

| Forfeitures |

— | $ | — | (25,578 | ) | |||||||

|

|

|

|

|

|

|

|||||||

| Balance at September 30, 2015 |

1,587,812 | $ | 2.58 | 1,670,857 | ||||||||

|

|

|

|

|

|

|

|||||||

A summary of stock-based compensation expense is as follows:

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||

| 2015 | 2014 | 2015 | 2014 | |||||||||||

| $ | 2,926 | $ | 2,077 | $ | 7,878 | $ | 6,122 | |||||||

|

|

|

|

|

|

|

|

|

|||||||

A summary of unrecognized stock-based compensation expense and average remaining vesting period is as follows:

| September 30, 2015 | ||||||||

| Unrecognized Stock-Based Compensation |

Average Remaining Vesting Period |

|||||||

| Employees and directors option awards |

$ | 152 | 1.12 | |||||

| Employees and directors restricted stock awards |

$ | 20,001 | 1.83 | |||||

7. Employee Benefit Plans

The Company has a 401(k) savings plan covering all eligible employees in which the Company can make discretionary contributions from its profits.

A summary of the Company made discretionary contributions is as follows:

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||

| 2015 | 2014 | 2015 | 2014 | |||||||||||

| $ | 168 | $ | 113 | $ | 665 | $ | 506 | |||||||

|

|

|

|

|

|

|

|

|

|||||||

13

Table of Contents

8. Earnings Per Share

The following is a reconciliation of the basic and diluted earnings per share computation:

| Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||||||

| 2015 | 2014 | 2015 | 2014 | |||||||||||||

| (shares in thousands) | (shares in thousands) | |||||||||||||||

| Net income |

$ | 23,288 | $ | 10,623 | $ | 59,522 | $ | 51,429 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Shares of common stock and common stock equivalents: |

||||||||||||||||

| Weighted averages shares used in basic computation |

136,582 | 131,778 | 135,527 | 131,418 | ||||||||||||

| Dilutive effect of stock options and unvested restricted stock |

1,599 | 6,568 | 2,306 | 7,058 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Weighted averages shares used in dilutive computation |

138,181 | 138,346 | 137,833 | 138,476 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Basic earnings per share |

$ | 0.17 | $ | 0.08 | $ | 0.44 | $ | 0.39 | ||||||||

| Dilutive earnings per share |

$ | 0.17 | $ | 0.08 | $ | 0.43 | $ | 0.37 | ||||||||

Diluted earnings per share reflects the reduction in earnings per share assuming options or other contracts to issue common stock were exercised or converted into common stock under the treasury stock method. The dilutive effect of options to purchase shares of common stock and restricted shares were included in the diluted earnings per share in the three and nine months ended September 30, 2015, and 2014, respectively. 243 and 624 restricted shares were determined to be anti-dilutive and were not included in the calculation of diluted earnings per share for the three months ended September 30, 2015 and 2014, respectively. 836 and 1,197 restricted shares were determined to be anti-dilutive and were not included in the calculation of diluted earnings per share for the nine months ended September 30, 2015 and 2014, respectively.

9. Income Taxes

Net operating losses – U.S.

The Company has generated net operating losses in the U.S. (“NOLs”). The following table summarizes the activity for NOLs for the nine months ended September 30, 2015:

| December 31, 2014 |

$ | (109,839 | ) | |

| 2014 Return to provision adjustment |

3,906 | |||

| U.S. GAAP pretax income |

106,321 | |||

| State income taxes |

(1,357 | ) | ||

| Income tax differences: |

||||

| Temporary |

14,137 | |||

| Permanent |

(73,922 | ) | ||

|

|

|

|||

| September 30, 2015 |

$ | (60,754 | ) | |

|

|

|

During the first quarter of 2014, management determined that although realization is not assured, it believed that it is more likely than not that its gross deferred tax asset would be realized. Therefore, it released the valuation allowance previously recorded, resulting in an income tax benefit of $13,725 on the Company’s Consolidated Statements of Operations and Comprehensive Income in the three months ended March 31, 2014 and a corresponding deferred tax asset on the Company’s Consolidated Balance Sheets at March 31, 2014. The balance of the deferred tax asset at September 30, 2015 and December 31, 2014 was $14,623 and $9,490, respectively.

At September 30, 2015 and December 31, 2014, $52,547 and $101,108 of the NOLs were generated from stock-based compensation amounts recognized for tax purposes at the time options are exercised (at the intrinsic value) or restricted stock is vested (at fair value of the share price) in excess of amounts previously expensed at the date of grant for U.S. GAAP purposes. These amounts cannot be recognized as a deferred tax asset under U.S. GAAP. In addition, $3,487 of the NOLs are deemed worthless. Therefore, at September 30, 2015, the Company has no recognized deferred tax assets related to these NOLs.

During the three and nine months ended September 30, 2015, the Company recognized tax expense of $16,245 and $41,969. During the nine months ended September 30, 2015, the Company’s deferred tax asset increased by $5,133 and the Company recorded a credit to additional paid-in capital of $45,706 for the amount of NOLs from stock-based compensation utilized to reduce taxes payable during the period. In addition, during the three and nine months ended September 30, 2015, the Company recorded $852 and $1,357 of state income taxes.

14

Table of Contents

During the three and nine months ended September 30, 2014, the Company recognized a tax expense of $9,634 and $5,440. During the nine months ended September 30, 2014, the Company utilized $5,472 of its deferred tax asset and recorded a credit to additional paid-in capital of $13,649 for the amount of NOLs from stock-based compensation utilized to reduce taxes payable during the period.

In the third quarter of 2014, the Company completed a state tax study which resulted in a reduction of its current baseline operating tax rate in the U.S. from 45% to approximately 38%. The Company reduced the carrying value of its deferred tax asset which had previously been recorded using the higher rate.

A summary of the components of the gross and tax affected deferred tax asset as of September 30, 2015 is as follows:

| Stock-based compensation |

$ | 10,303 | ||

| Deferred rent liability |

5,509 | |||

| NOLs |

4,720 | |||

| Accrued expenses |

30,180 | |||

| Incentive compensation |

(7,996 | ) | ||

| Fixed assets |

(5,119 | ) | ||

| Other |

218 | |||

|

|

|

|||

| Total deferred components |

37,815 | |||

| Income tax rate |

38.67 | % | ||

|

|

|

|||

| Tax affected |

$ | 14,623 | ||

|

|

|

Net operating losses – Non-U.S.

The Company’s foreign subsidiaries generated net operating losses outside the U.S. The following table summarizes the activity for NOLs for the nine months ended September 30, 2015:

| December 31, 2014 |

$ | (4,061 | ) | |

| Foreign subsidiaries loss |

(4,912 | ) | ||

|

|

|

|||

| September 30, 2015 |

$ | (8,973 | ) | |

|

|

|

At September 30, 2015 and December 31, 2014, a deferred tax asset related to these NOLs has been fully offset by a valuation allowance of $1,814 and $816, respectively.

10. Shares Repurchased

On October 29, 2014, the Company’s Board of Directors authorized a three-year share repurchase program of up to $100 million. During the three months ended September 30, 2015, the Company repurchased 330 shares of its common stock under this program for an aggregate cost of $8,424. During the nine months ended September 30, 2015, the Company repurchased 1,165 shares of its common stock under this program for an aggregate cost of $23,689. Of these shares, 278 were repurchased to offset tax withholding obligations that occur upon vesting and release of restricted shares for an aggregate cost of $4,842, and 887 shares were repurchased in the open market to offset new shares issued in connection with employee equity grants for an aggregate cost of $18,847. $76,311 remains under this program for future purchases.

During three and nine months ended September 30, 2014, the Company repurchased 80 and 392 shares of its common stock to offset tax withholding obligations that occur upon vesting and release of restricted shares for an aggregate cost of $834 and $6,259.

11. Acquisition and Goodwill

On April 15, 2014, the Company completed its acquisition of Boost, a U.K. and Jersey based ETP sponsor, now known as WisdomTree Europe, as part of the Company’s strategy to expand internationally. Under the terms of the agreement, the Company owns 75% of WisdomTree Europe and the former Boost shareholders own 25%. The Company will acquire the remaining 25% ownership interest on or about March 31, 2018 using a predefined formula based on the 180-day average of European AUM at December 31, 2017 and will be tied to the Company’s enterprise value over the 180-day average of global AUM at December 31, 2017, and affected by profitability of the European business. No consideration was transferred on the acquisition date. The ultimate payout will be made in cash over the two years subsequent to December 31, 2017.

15

Table of Contents

Two shareholders of Boost, who owned 88% of Boost prior to the acquisition, became co-CEOs of WisdomTree Europe and are guaranteed a minimum payment of $1,757 for their interest if they terminate their employment without good reason or they are terminated for cause prior to December 31, 2017. The Company determined that this minimum payment represents consideration transferred and was recognized and measured at acquisition-date fair value to determine the purchase price. Any future payments made to the co-CEOs in excess of the minimum payments is accounted for separately from the business combination as acquisition contingent payment on the Company’s Consolidated Statements of Operations and Comprehensive Income and represents compensation for post-acquisition services. The obligation to mandatorily redeem the remaining 12% minority shareholders’ interest in Boost is measured at the fair value of the amount of cash that would be paid under the conditions specified in the agreement. Any change in the carrying amount of the liability will be recognized as an expense.

During the three and nine months ended September 30, 2015, the Company incurred $136 and $252 of compensation expense and $36 and $441 of interest expense, which represents contingent consideration due to the co-CEOs and non-employee shareholders, respectively. These amounts have both been recorded in acquisition contingent payment on the Company’s Consolidated Statements of Operations and Comprehensive Income.

Because the Company is required to redeem the shares from the former Boost shareholders on or about March 31, 2018 using a predefined formula, under U.S. GAAP, the Company does not reflect the 25% interest held by the former Boost shareholders in WisdomTree Europe as non-controlling interest.

The Company recorded goodwill of $1,676 in connection with this acquisition. Goodwill represents the excess value of the purchase price over the $81 fair value of the net assets acquired, consisting primarily of accounts receivable, accounts payable and fixed assets. While the Company paid no consideration up front to the former Boost shareholders, under the terms of the acquisition agreement, $1,757 was deemed to represent the purchase price. Goodwill is not expected to be tax deductible.

The following table summarizes the goodwill activity for the nine months ended September 30, 2015:

| Balance at January 1, 2015 |

$ | 1,676 | ||

| Goodwill acquired during the period |

— | |||

|

|

|

|||

| Balance at September 30, 2015 |

$ | 1,676 | ||

|

|

|

12. Subsequent Event

On October 29, 2015, the Company entered into an agreement to acquire GreenHaven Commodity Services, LLC, the managing owner of the GreenHaven Continuous Commodity Index Fund (NYSE Arca: GCC), and GreenHaven Coal Services, LLC, the sponsor of the GreenHaven Coal Fund (NYSE Arca: TONS), from GreenHaven, LLC and GreenHaven Group LLC, respectively, for approximately $12,000 in cash. The transaction is subject to approval by the GreenHaven Continuous Commodity Index Fund shareholders and customary closing conditions, and is expected to close in the fourth quarter of 2015. The Company will retain GreenHaven Advisors, LLC as the sub-advisor to the funds to conduct portfolio management services.

16

Table of Contents

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis of our financial condition and results of operations should be read together with our consolidated financial statements and the related notes and the other financial information included elsewhere in this Report. In addition to historical consolidated financial information, the following discussion contains forward-looking statements that reflect our plans, estimates and beliefs. Our actual results could differ materially from those discussed in the forward-looking statements. Factors that could cause or contribute to these differences include those discussed below. For a more complete description of the risks noted above and other risks that could cause our actual results to materially differ from our current expectations, please see Item 1A “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2014. We assume no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, unless required by law.

Executive Summary

Introduction

We were the seventh largest ETP sponsor in the world based on assets under management (“AUM”), with AUM of $53.7 billion globally as of September 30, 2015. An ETP is a pooled investment vehicle that holds a basket of securities, financial instruments or other assets and generally seeks to track (index-based) or outperform (actively managed) the performance of a broad or specific equity, fixed income or alternatives market segment, commodity or currency (or an inverse or multiple thereof). ETPs are listed on an exchange with their shares traded in the secondary market at market prices, generally at approximately the same price as the net asset value of their underlying components. ETP is an umbrella term that includes ETFs, exchange-traded notes and exchange-traded commodities.

Through our operating subsidiaries, we provide investment advisory and other management services to the WisdomTree ETFs, WisdomTree UCITS ETFs and Boost ETPs, collectively offering ETPs covering equity, fixed income, currency, alternatives and commodity asset classes. In exchange for providing these services, we receive advisory fee revenues based on a percentage of the ETPs’ average daily AUM. Our expenses are predominantly related to selling, operating and marketing our ETPs. We have contracted with third parties to provide certain operational services for the ETPs. We distribute our ETPs through all major channels within the asset management industry, including brokerage firms, registered investment advisers, institutional investors, private wealth managers and discount brokers primarily through our sales force. Our sales efforts are not directed towards the retail segment but rather are directed towards financial or investment advisers that act as intermediaries between the end-client and us.

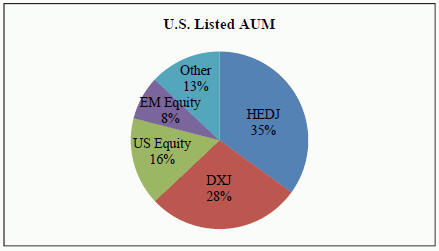

$53.0 billion of our AUM are from our U.S. listed WisdomTree ETFs. As of September 30, 2015, we were the fifth largest sponsor of ETFs in the United States based on AUM. As the pie chart below reflects, 63% of our U.S. AUM is concentrated in European and Japanese equity exposures which hedge the Euro (trading under the symbol HEDJ) or Yen (trading under the symbol DXJ) against the U.S. dollar. The weakening of the U.S. dollar against the Euro or Yen or negative sentiment towards these two markets may have an adverse effect on our results.

17

Table of Contents

Market Environment

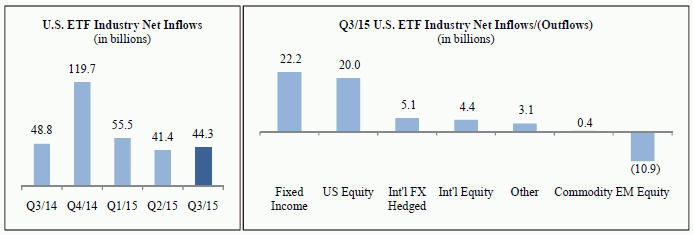

The following charts reflect the U.S. ETF industry net flows in total and net inflows/(outflows) by broad category:

Source: Investment Company Institute, WisdomTree

As the charts above reflect, industry flows for the third quarter of 2015 were $44.3 billion, which was slightly higher than the second quarter of 2015 but also down slightly from the third quarter of 2014. Fixed Income ETFs gathered the majority of the flows followed by U.S. equities, predominantly ETFs tracking the S&P 500 index.

Industry Developments

In September 2015, the SEC proposed new requirements on portfolio liquidity, risk monitoring and board oversight for open-end mutual funds and ETFs. We believe the structural benefits of ETFs, including daily transparency of holdings, intraday trading and the utilization of the “in-kind” creation/redemption mechanism, particularly when combined with the underlying methodologies and strategies we employ, will allow us to comply with these proposals if enacted in current form. Though we may put forward specific recommendations in connection with the SEC’s request for public comment, either directly or through industry channels, we are generally supportive of greater transparency and liquidity in financial markets.

On Monday, August 24, 2015, the U.S. equity market experienced exceptional volatility and many U.S-listed equities and ETFs had a brief period of abnormal trading. Extreme imbalances in orders at the start of the trading day created wide dislocations among many single stock and ETF prices for approximately 45 minutes. Some commentators have claimed the events of August 24 exposed a flaw in ETFs. We believe, however, that these events reflect certain structural issues concerning the broader U.S. equity market that are not specifically related to ETFs, including the structure of “circuit breaker” rules and the interplay of differences between such rules among various equity exchanges. We are supportive of the continued examination of the market structure issues that impacted and potentially prolonged the disruption in individual securities and ETFs and would be supportive of changes that would improve such structures.

Our Operating and Financial Results

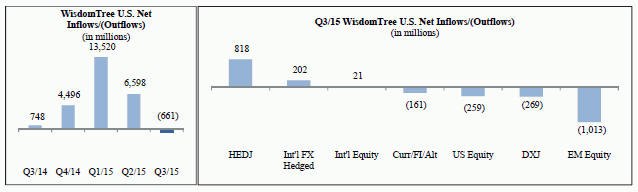

The following charts reflect the net flows into and from our U.S. listed ETFs:

18

Table of Contents

In the third quarter of 2015, we experienced $661 million of net outflows primarily due to outflows in our emerging market equity ETFs. As the industry charts reflect, emerging market equities were out of favor and experienced outflows industry wide. Our European hedged equity ETF, HEDJ, had $818 million of net inflows and our Japanese hedged equity ETF, DXJ, had $269 million of net outflows. Our U.S. listed AUM declined from $61.3 billion as of June 30, 2015 to $53.0 billion as of September 30, 2015 primarily due to $7.6 billion of negative market movement, particularly in our Japan and emerging market exposures.

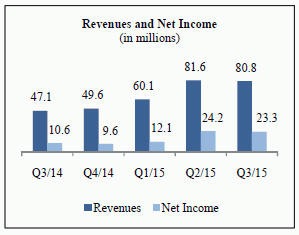

Despite these challenges, we generated solid financial results as reflected in the below chart:

| • | Revenues – We recorded revenues of $80.8 million in the third quarter of 2015, an increase of 71.4% from $47.1 million in the third quarter of last year primarily due to higher average AUM from new inflows. |

| • | Expenses – Total expenses increased 53.5% compared to the third quarter of last year primarily due to higher incentive compensation due to our record setting inflow levels and increased headcount to support our growth. |

| • | Net income – Net income was $23.3 million in the third quarter of 2015, an increase of 119.2% from $10.6 million in the third quarter of last year. |

Other Important Developments

On October 29, 2015, we entered into an agreement to acquire GreenHaven Commodity Services, LLC, the managing owner of the GreenHaven Continuous Commodity Index Fund (NYSE Arca: GCC), and GreenHaven Coal Services, LLC, the sponsor of the GreenHaven Coal Fund (NYSE Arca: TONS), from GreenHaven, LLC and GreenHaven Group LLC, respectively, for $11.75 million in cash. GCC has $247.0 million in assets under management and TONS has $1.0 million in assets under management, as of October 28, 2015. The transaction is subject to approval by the GreenHaven Continuous Commodity Index Fund shareholders and customary closing conditions, and is expected to close in the fourth quarter of 2015. We intend to enter the U.S. commodities ETF space through this transaction. We will retain GreenHaven Advisors, LLC as the sub-advisor to the funds to conduct portfolio management services.

Non-GAAP Financial Measurements

Gross margin is a non-GAAP financial measurement which we believe provides useful and meaningful information as it is a financial measurement management reviews when evaluating the Company’s operating results. We define gross margin as total revenues less fund management and administration expenses and third-party sharing arrangements. We believe this financial measurement provides investors with a consistent way to analyze the amount we retain after paying third party service providers to operate our ETPs and third party marketing agents whose fees are associated with our AUM level. The following table reflects the calculation of our gross margin and gross margin percentage:

| Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||||||

| (in thousands) | 2015 | 2014 | 2015 | 2014 | ||||||||||||

| GAAP total revenue |

$ | 80,753 | $ | 47,114 | $ | 222,453 | $ | 134,162 | ||||||||

| Fund management and administration |

(10,519 | ) | (8,465 | ) | (31,895 | ) | (25,451 | ) | ||||||||

| Third-party sharing arrangements |

(485 | ) | (187 | ) | (1,265 | ) | (312 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Gross margin |

$ | 69,749 | $ | 38,462 | $ | 189,293 | $ | 108,399 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Gross margin percentage |

86.4 | % | 81.6 | % | 85.1 | % | 80.8 | % | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

19

Table of Contents

Key Operating Statistics

The following table presents key operating statistics that serve as indicators for the performance of our business:

| Three Months Ended | Nine Months Ended | |||||||||||||||||||

| September 30, | June 30, | September 30, | September 30, | |||||||||||||||||

| 2015 | 2015 | 2014 | 2015 | 2014 | ||||||||||||||||

| U.S. Listed ETFs |

||||||||||||||||||||

| Total ETFs (in millions) |

||||||||||||||||||||

| Beginning of period assets |

$ | 61,299 | $ | 55,758 | $ | 35,500 | $ | 39,281 | $ | 34,884 | ||||||||||

| Inflows/(outflows) |

(661 | ) | 6,598 | 748 | 19,457 | 580 | ||||||||||||||

| Market appreciation/(depreciation) |

(7,591 | ) | (1,057 | ) | (425 | ) | (5,691 | ) | 359 | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| End of period assets |

$ | 53,047 | $ | 61,299 | $ | 35,823 | $ | 53,047 | $ | 35,823 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Average assets during the period |

$ | 59,572 | $ | 61,153 | $ | 35,554 | $ | 55,705 | $ | 34,518 | ||||||||||

| ETF Industry and Market Share (in billions) |

||||||||||||||||||||

| ETF industry net inflows |

$ | 44.3 | $ | 41.4 | $ | 48.8 | $ | 141.2 | $ | 121.0 | ||||||||||

| WisdomTree market share of industry inflows |

n/a | 15.9 | % | 1.5 | % | 13.8 | % | 0.5 | % | |||||||||||

| International Hedged Equity ETFs (in millions) |

||||||||||||||||||||

| Beginning of period assets |

$ | 39,222 | $ | 33,925 | $ | 12,557 | $ | 17,760 | $ | 13,348 | ||||||||||

| Inflows |

751 | 6,083 | 799 | 20,274 | 285 | |||||||||||||||

| Market appreciation/(depreciation) |

(5,365 | ) | (786 | ) | 615 | (3,426 | ) | 338 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| End of period assets |

$ | 34,608 | $ | 39,222 | $ | 13,971 | $ | 34,608 | $ | 13,971 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Average assets during the period |

$ | 39,061 | $ | 38,548 | $ | 12,654 | $ | 34,056 | $ | 12,631 | ||||||||||

| U.S. Equity ETFs (in millions) |

||||||||||||||||||||

| Beginning of period assets |

$ | 9,245 | $ | 9,748 | $ | 8,052 | $ | 9,390 | $ | 7,181 | ||||||||||

| Inflows/(outflows) |

(259 | ) | (320 | ) | 84 | (285 | ) | 494 | ||||||||||||

| Market appreciation/(depreciation) |

(739 | ) | (183 | ) | (197 | ) | (858 | ) | 264 | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| End of period assets |

$ | 8,247 | $ | 9,245 | $ | 7,939 | $ | 8,247 | $ | 7,939 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Average assets during the period |

$ | 8,876 | $ | 9,664 | $ | 8,067 | $ | 9,436 | $ | 7,655 | ||||||||||

| International Developed Equity ETFs (in millions) |

||||||||||||||||||||

| Beginning of period assets |

$ | 4,829 | $ | 4,323 | $ | 5,340 | $ | 3,988 | $ | 3,864 | ||||||||||

| Inflows/(outflows) |

21 | 497 | (452 | ) | 706 | 878 | ||||||||||||||

| Market appreciation/(depreciation) |

(456 | ) | 9 | (394 | ) | (300 | ) | (248 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| End of period assets |

$ | 4,394 | $ | 4,829 | $ | 4,494 | $ | 4,394 | $ | 4,494 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Average assets during the period |

$ | 4,714 | $ | 4,790 | $ | 5,016 | $ | 4,538 | $ | 4,833 | ||||||||||

| Emerging Markets Equity ETFs (in millions) |

||||||||||||||||||||

| Beginning of period assets |

$ | 6,244 | $ | 6,068 | $ | 7,606 | $ | 6,187 | $ | 7,448 | ||||||||||

| Inflows/(outflows) |

(1,013 | ) | 250 | 270 | (928 | ) | 26 | |||||||||||||

| Market appreciation/(depreciation) |

(943 | ) | (74 | ) | (381 | ) | (971 | ) | 21 | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| End of period assets |

$ | 4,288 | $ | 6,244 | $ | 7,495 | $ | 4,288 | $ | 7,495 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Average assets during the period |

$ | 5,253 | $ | 6,336 | $ | 7,878 | $ | 5,912 | $ | 7,247 | ||||||||||

| Fixed Income ETFs (in millions) |

||||||||||||||||||||

| Beginning of period assets |

$ | 956 | $ | 904 | $ | 1,376 | $ | 1,152 | $ | 1,906 | ||||||||||

| Inflows/(outflows) |

(85 | ) | 67 | 69 | (228 | ) | (515 | ) | ||||||||||||

| Market depreciation |

(77 | ) | (15 | ) | (66 | ) | (130 | ) | (12 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| End of period assets |

$ | 794 | $ | 956 | $ | 1,379 | $ | 794 | $ | 1,379 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Average assets during the period |

$ | 884 | $ | 929 | $ | 1,385 | $ | 944 | $ | 1,522 | ||||||||||

| Currency ETFs (in millions) |

||||||||||||||||||||

| Beginning of period assets |

$ | 573 | $ | 565 | $ | 406 | $ | 599 | $ | 979 | ||||||||||

| Inflows/(outflows) |

(63 | ) | 7 | (35 | ) | (100 | ) | (605 | ) | |||||||||||

| Market appreciation/(depreciation) |

(5 | ) | 1 | (9 | ) | 6 | (12 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| End of period assets |

$ | 505 | $ | 573 | $ | 362 | $ | 505 | $ | 362 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Average assets during the period |

$ | 562 | $ | 651 | $ | 380 | $ | 595 | $ | 468 | ||||||||||

20

Table of Contents

| Three Months Ended | Nine Months Ended | |||||||||||||||||||

| September 30, | June 30, | September 30, | September 30, | |||||||||||||||||

| 2015 | 2015 | 2014 | 2015 | 2014 | ||||||||||||||||

| Alternative Strategy ETFs (in millions) |

||||||||||||||||||||

| Beginning of period assets |

$ | 230 | $ | 225 | $ | 163 | $ | 205 | $ | 158 | ||||||||||

| Inflows/(outflows) |

(13 | ) | 14 | 13 | 18 | 17 | ||||||||||||||

| Market appreciation/(depreciation) |

(6 | ) | (9 | ) | 7 | (12 | ) | 8 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| End of period assets |

$ | 211 | $ | 230 | $ | 183 | $ | 211 | $ | 183 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Average assets during the period |

$ | 222 | $ | 235 | $ | 174 | $ | 224 | $ | 162 | ||||||||||

| Average ETF assets during the period |

||||||||||||||||||||

| International hedged equity ETFs |

66 | % | 63 | % | 36 | % | 61 | % | 37 | % | ||||||||||

| U.S. equity ETFs |

15 | % | 16 | % | 23 | % | 17 | % | 22 | % | ||||||||||

| Emerging markets equity ETFs |

9 | % | 10 | % | 22 | % | 11 | % | 21 | % | ||||||||||

| International developed equity ETFs |

8 | % | 8 | % | 14 | % | 8 | % | 14 | % | ||||||||||

| Fixed income ETFs |

1 | % | 2 | % | 4 | % | 2 | % | 4 | % | ||||||||||

| Currency ETFs |

1 | % | 1 | % | 1 | % | 1 | % | 1 | % | ||||||||||

| Alternative strategy ETFs |

0 | % | 0 | % | 0 | % | 0 | % | 1 | % | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total |

100 | % | 100 | % | 100 | % | 100 | % | 100 | % | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Average ETF advisory fee during the period |

||||||||||||||||||||

| Alternative strategy ETFs |

0.95 | % | 0.95 | % | 0.94 | % | 0.95 | % | 0.94 | % | ||||||||||

| Emerging markets equity ETFs |

0.72 | % | 0.71 | % | 0.68 | % | 0.71 | % | 0.67 | % | ||||||||||

| International developed equity ETFs |

0.56 | % | 0.56 | % | 0.56 | % | 0.56 | % | 0.56 | % | ||||||||||

| International hedged equity ETFs |

0.54 | % | 0.54 | % | 0.50 | % | 0.54 | % | 0.50 | % | ||||||||||

| Fixed income ETFs |

0.51 | % | 0.52 | % | 0.55 | % | 0.52 | % | 0.55 | % | ||||||||||

| Currency ETFs |

0.50 | % | 0.50 | % | 0.49 | % | 0.50 | % | 0.49 | % | ||||||||||

| U.S. equity ETFs |

0.35 | % | 0.35 | % | 0.35 | % | 0.35 | % | 0.35 | % | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Blended total |

0.53 | % | 0.53 | % | 0.52 | % | 0.53 | % | 0.52 | % | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Number of ETFs—end of the period |

||||||||||||||||||||

| International developed equity ETFs |

18 | 18 | 17 | 18 | 17 | |||||||||||||||

| International hedged equity ETFs |

17 | 16 | 12 | 17 | 12 | |||||||||||||||

| U.S. equity ETFs |

15 | 13 | 13 | 15 | 13 | |||||||||||||||

| Fixed income ETFs |

13 | 12 | 12 | 13 | 12 | |||||||||||||||

| Emerging markets equity ETFs |

8 | 8 | 7 | 8 | 7 | |||||||||||||||

| Currency ETFs |

6 | 6 | 6 | 6 | 6 | |||||||||||||||

| Alternative strategy ETFs |

2 | 2 | 2 | 2 | 2 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total |

79 | 75 | 69 | 79 | 69 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| European Listed ETPs |

||||||||||||||||||||

| Total ETPs (in thousands) |

||||||||||||||||||||

| Beginning of period assets*** |

$ | 384,089 | $ | 288,801 | $ | 113,244 | $ | 165,018 | $ | 96,817 | ||||||||||

| Inflows |

191,044 | 50,331 | 19,224 | 386,757 | 36,882 | |||||||||||||||

| Market appreciation/(depreciation) |

(143,874 | ) | 44,957 | (9,258 | ) | (120,516 | ) | (10,489 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| End of period assets |

$ | 431,259 | $ | 384,089 | $ | 123,210 | $ | 431,259 | $ | 123,210 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Average ETP advisory fee during the period |

0.83 | % | 0.82 | % | 0.79 | % | 0.83 | % | 0.80 | % | ||||||||||

| Number of ETPs – end of period |

62 | 57 | 42 | 62 | 42 | |||||||||||||||

| Total UCITS ETFS (in thousands) |

||||||||||||||||||||

| Beginning of period assets**** |

$ | 228,588 | $ | 45,846 | — | $ | 16,179 | — | ||||||||||||

| Inflows |

67,770 | 144,234 | — | 240,855 | — | |||||||||||||||

| Market appreciation/(depreciation) |

(31,906 | ) | 38,508 | — | 7,418 | — | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| End of period assets |

$ | 264,452 | $ | 228,588 | — | $ | 264,452 | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Average ETP advisory fee during the period |

0.45 | % | 0.44 | % | — | 0.44 | % | — | ||||||||||||

| Number of ETPs – end of period |

12 | 10 | — | 12 | — | |||||||||||||||

| U.S. headcount |

128 | 117 | 97 | 128 | 97 | |||||||||||||||

| Non-U.S. headcount |

34 | 29 | 20 | 34 | 20 | |||||||||||||||

Note: Previously issued statistics may be restated due to trade adjustments.

Source: Investment Company Institute, Bloomberg, WisdomTree

| *** | European listed ETPs acquired April 15, 2014 |

| **** | UCITS first launched October 24, 2014 |

21

Table of Contents

Three Months Ended September 30, 2015 Compared to September 30, 2014

Revenues

| Three Months Ended September 30, |

Change | Percent Change |

||||||||||||||

| 2015 | 2014 | |||||||||||||||

| U.S. listed-Average assets under management (in millions) |

$ | 59,572 | $ | 35,554 | $ | 24,018 | 67.6 | % | ||||||||

| U.S. listed-Average ETF advisory fee |

0.53 | % | 0.52 | % | 0.01 | |||||||||||

| Advisory fees (in thousands) |

$ | 80,520 | $ | 46,942 | $ | 33,578 | 71.5 | % | ||||||||

| Other income (in thousands) |

233 | 172 | 61 | 35.5 | % | |||||||||||

|

|

|

|

|

|

|

|||||||||||

| Total revenues (in thousands) |

$ | 80,753 | $ | 47,114 | $ | 33,639 | 71.4 | % | ||||||||

|

|

|

|

|

|

|

|||||||||||

Advisory fees

Advisory fees revenue increased 71.5% from $46.9 million in the three months ended September 30, 2014 to $80.5 million in the comparable period in 2015. This increase was primarily due to higher average AUM from our net inflow levels and higher average fee capture. Our average advisory fee for our U.S. listed ETFs was 0.53% as compared to 0.52% for the same period last year due to net inflows into our higher priced ETFs, primarily HEDJ. Included in the third quarter of 2015 and 2014 was $1.3 million and $0.3 million, respectively, in advisory fees revenue from our European listed ETPs.

Other income

Other income increased 35.5% from $0.17 million in the three months ended September 30, 2014 to $0.23 million in the comparable period in 2015. This increase was due primarily to higher interest income due to increasing cash balances.

Expenses

| Three Months Ended September 30, |

Change | Percent Change |

||||||||||||||

| (in thousands) | 2015 | 2014 | ||||||||||||||

| Compensation and benefits |

$ | 19,407 | $ | 9,990 | $ | 9,417 | 94.3 | % | ||||||||

| Fund management and administration |

10,519 | 8,465 | 2,054 | 24.3 | % | |||||||||||

| Marketing and advertising |

3,573 | 3,341 | 232 | 6.9 | % | |||||||||||

| Sales and business development |

2,438 | 1,279 | 1,159 | 90.6 | % | |||||||||||

| Professional and consulting fees |

1,570 | 1,383 | 187 | 13.5 | % | |||||||||||

| Occupancy, communications and equipment |

1,183 | 882 | 301 | 34.1 | % | |||||||||||

| Depreciation and amortization |

253 | 207 | 46 | 22.2 | % | |||||||||||

| Third-party sharing arrangements |

485 | 187 | 298 | 159.4 | % | |||||||||||

| Acquisition contingent payment |

172 | — | 172 | n/a | ||||||||||||

| Other |

1,620 | 1,123 | 497 | 44.3 | % | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total expenses |

$ | 41,220 | $ | 26,857 | $ | 14,363 | 53.5 | % | ||||||||

|

|

|