| Label |

Element |

Value |

| Risk/Return: |

rr_RiskReturnAbstract |

|

| Registrant Name |

dei_EntityRegistrantName |

DEUTSCHE INTERNATIONAL FUND, INC.

|

| Prospectus Date |

rr_ProspectusDate |

Dec. 01, 2016

|

| Deutsche Emerging Markets Frontier Fund |

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

| Objective [Heading] |

rr_ObjectiveHeading |

Investment Objective

|

| Objective, Primary [Text Block] |

rr_ObjectivePrimaryTextBlock |

The fund seeks capital appreciation.

|

| Expense [Heading] |

rr_ExpenseHeading |

Fees and Expenses of the Fund

|

| Expense Narrative [Text Block] |

rr_ExpenseNarrativeTextBlock |

These are the fees and expenses you may pay when you buy and hold shares. You may qualify for sales charge discounts if you and your immediate family invest, or agree to invest in the future, at least $50,000 in Deutsche funds. More information about these and other discounts is available from your financial professional and in Choosing a Share Class (p. 14) and Purchase and Redemption of Shares in the fund's Statement of Additional Information (SAI) (p. II-16).

|

| Shareholder Fees Caption [Text] |

rr_ShareholderFeesCaption |

SHAREHOLDER FEES (paid directly from your investment)

|

| Operating Expenses Caption [Text] |

rr_OperatingExpensesCaption |

ANNUAL FUND OPERATING EXPENSES

(expenses that you pay each year as a % of the value of your investment)

|

| Fee Waiver or Reimbursement over Assets, Date of Termination |

rr_FeeWaiverOrReimbursementOverAssetsDateOfTermination |

November 30, 2017

|

| Portfolio Turnover [Heading] |

rr_PortfolioTurnoverHeading |

PORTFOLIO TURNOVER

|

| Portfolio Turnover [Text Block] |

rr_PortfolioTurnoverTextBlock |

The fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover may indicate higher transaction costs and may mean higher taxes if you are investing in a taxable account. These costs are not reflected in annual fund operating expenses or in the expense example, and can affect the fund's performance. Portfolio turnover rate for fiscal year 2016: 47%.

|

| Portfolio Turnover, Rate |

rr_PortfolioTurnoverRate |

47.00%

|

| Expense Footnotes [Text Block] |

rr_ExpenseFootnotesTextBlock |

The Advisor has contractually agreed through November 30, 2017 to waive its fees and/or reimburse fund expenses to the extent necessary to maintain the fund's total annual operating expenses (excluding extraordinary expenses, taxes, brokerage and interest expense, and acquired funds fees and expenses) at ratios no higher than 2.25%, 3.00%, 2.00% and 2.10% for Class A, Class C, Institutional Class and Class S, respectively. The agreement may only be terminated with the consent of the fund's Board.

|

| Expense Breakpoint Discounts [Text] |

rr_ExpenseBreakpointDiscounts |

You may qualify for sales charge discounts if you and your immediate family invest, or agree to invest in the future, at least $50,000 in Deutsche funds.

|

| Expense Breakpoint, Minimum Investment Required [Amount] |

rr_ExpenseBreakpointMinimumInvestmentRequiredAmount |

$ 50,000

|

| Expense Example [Heading] |

rr_ExpenseExampleHeading |

EXAMPLE

|

| Expense Example Narrative [Text Block] |

rr_ExpenseExampleNarrativeTextBlock |

This Example is intended to help you compare the cost of investing in the fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the fund's operating expenses (including one year of capped expenses in each period) remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

| Expense Example, No Redemption Narrative [Text Block] |

rr_ExpenseExampleNoRedemptionNarrativeTextBlock |

You would pay the following expenses if you did not redeem your shares:

|

| Strategy [Heading] |

rr_StrategyHeading |

Principal Investment Strategy

|

| Strategy Narrative [Text Block] |

rr_StrategyNarrativeTextBlock |

Main investments. Under normal circumstances, the fund invests at least 80% of its net assets, plus the amount of any borrowings for investment purposes, in securities of issuers that are listed on an exchange in a frontier market or small emerging market country; are organized under the laws of, or have principal offices in, frontier market or small emerging market countries; or have significant exposure to such countries' economies. In general, frontier market and small emerging market countries are sub-sets of those countries or markets (i) currently classified as low- to middle-income economies by the World Bank; (ii) currently considered to be developing by the International Finance Corporation, the United Nations or the countries' authorities; or (iii) with a stock market capitalization of less than 3% of the MSCI World Index. The fund currently considers "frontier market or small emerging market countries" to include all of the countries in the MSCI Frontier Emerging Markets Index as well as the following countries: Chile, Czech Republic, Greece, Hungary, Indonesia, Malaysia, Poland, Qatar, Saudi Arabia, Thailand, Turkey, and the United Arab Emirates. The fund may add or remove countries from those it considers to be frontier market or small emerging market countries based on portfolio management's evaluation of whether those countries satisfy the fund's criteria for frontier market and small emerging market countries. Frontier market and small emerging market countries are generally at an earlier stage of economic, political, or financial development than traditional emerging market countries and generally have smaller economies and less developed capital markets, even by emerging market standards. Compared to frontier markets, small emerging markets are usually expected to provide somewhat higher levels of openness, investability, and efficiency of operational framework. Some characteristics of small emerging markets may resemble, however, those of frontier markets. For example, small emerging markets typically have few global companies and are less likely to be widely owned and researched, resulting in lower correlation with larger markets. Frontier and small emerging market countries are typically located in the Asia-Pacific region, Central and Eastern Europe, the Middle East, Central and South America, and Africa. The fund considers an issuer to have significant exposure to frontier market or small emerging market country economies if the issuer (i) has at least 50% of its assets in one or more frontier market or small emerging market countries; or (ii) derives at least 50% of its revenues or profits from goods produced or sold, investments made, or services provided in one or more frontier market or small emerging market countries. An investment in a derivative or other synthetic instrument will be counted toward the fund's 80% investment policy described above if, in the judgment of portfolio management, it has economic characteristics similar to a direct investment in an issuer that is tied economically to a frontier market or small emerging market country. The fund normally invests primarily in common stocks, but may also invest in preferred stocks or convertible securities. In addition, the fund may invest a portion of its assets in other types of securities, including debt securities of any quality, maturity or duration, short term securities, warrants, and other similar securities. The fund may invest in companies of any size and may invest significantly in small or micro-cap companies. The fund may also invest significantly in participation or participatory notes to gain exposure to certain frontier market or small emerging market countries that do not permit or restrict direct investment or as a substitute for direct investment. Participation notes are a type of equity linked derivative, which are structured as debt obligations and are issued or backed by banks and broker-dealers. They are designed to replicate equity market exposure in foreign markets where direct investment is either impossible or difficult due to local investment restrictions.

Management Process. Portfolio management uses a four step management process. In the first step, portfolio management assesses the general outlook for frontier market and small emerging market securities at a macroeconomic level. The key drivers of this outlook are growth, valuation, and market sentiment. This process is then applied at individual country and sector levels to determine country and sector weightings. In the second step, portfolio management performs a bottom-up fundamental analysis of the companies in the designated countries and sectors (i.e., an analysis of the salient attributes of the various individual companies), resulting in recommended securities for the designated countries and sectors and corresponding target prices for those securities. Salient company attributes that portfolio management may consider include attractiveness of valuation relative to earnings, sustainability of business model, the presence of clearly identifiable catalysts, such as a specific corporate event, and positive share price momentum. In the third step, portfolio management constructs the fund's portfolio, weighting individual securities based on management's assessments and setting individual country and sector market exposure based on management's outlook. In the fourth and final step, portfolio management actively monitors the fund's portfolio, including an ongoing assessment of the portfolio's risks. Portfolio management will typically sell a security if it no longer represents good value relative to fundamentals and/or if it lacks positive catalysts.

Derivatives. In addition to participation notes, portfolio management generally may use futures contracts, which are a type of derivative (a contract whose value is based on, for example, indices, currencies or securities) as a substitute for direct investment in a particular asset class or to keep cash on hand to meet shareholder redemptions. Portfolio management may also generally use forward currency contracts to hedge the fund's exposure to changes in foreign currency exchange rates on its foreign currency denominated portfolio holdings or to facilitate transactions in foreign currency denominated securities. Lastly, the fund may also use other types of derivatives, including stock options and total return swaps (i) for hedging purposes; (ii) for risk management; (iii) for non-hedging purposes to seek to enhance potential gains; or (iv) as a substitute for direct investment in a particular asset class or to keep cash on hand to meet shareholder redemptions.

|

| Risk [Heading] |

rr_RiskHeading |

Main Risks

|

| Risk Narrative [Text Block] |

rr_RiskNarrativeTextBlock |

There are several risk factors that could hurt the fund's performance, cause you to lose money or cause the fund's performance to trail that of other investments. The fund may not achieve its investment objective, and is not intended to be a complete investment program. An investment in the fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency.

Stock market risk. The fund is affected by how the stock market performs. When stock prices fall, you should expect the value of your investment to fall as well.

Foreign investment risk. The fund faces the risks inherent in foreign investing. Adverse political, economic or social developments could undermine the value of the fund's investments or prevent the fund from realizing the full value of its investments. Financial reporting standards for companies based in foreign markets differ from those in the US. Additionally, foreign securities markets generally are smaller and less liquid than US markets. To the extent that the fund invests in non-US dollar denominated foreign securities, changes in currency exchange rates may affect the US dollar value of foreign securities or the income or gain received on these securities.

Emerging markets risk. Foreign investment risks are greater in emerging markets than in developed markets. Investments in emerging markets are often considered speculative.

Frontier market risk. Frontier market countries generally have smaller, less diverse economies and even less developed capital markets and legal, regulatory, and political systems than traditional emerging markets. As a result, the risks of investing in emerging market countries are magnified in frontier market countries. Frontier market risks include the potential for extreme price volatility and illiquidity – economic or political instability may cause larger price changes in frontier market securities than in securities of issuers located in more developed markets. The risks of investing in frontier market countries may also be magnified by: government ownership or control of parts of the private sector and of certain companies; trade barriers, exchange controls, managed adjustments in relative currency values, impaired or limited access to issuer information and other protectionist measures imposed or negotiated by the countries with which frontier market countries trade; and the relatively new and unsettled securities laws in many frontier market countries. The actions of a relatively few major investors in these markets are more likely to result in significant changes in local stock prices and the value of fund shares. The risk also exists that an emergency situation may arise in one or more frontier market countries as a result of which trading of securities may cease or may be substantially curtailed and prices for investments in such markets may not be readily available. All of these factors can make investing in frontier markets riskier than investing in more developed emerging markets or other foreign markets.

Regional focus risk. Focusing investments in a single country or few countries, or regions, involves increased currency, political, regulatory and other risks. Market swings in such a targeted country, countries or regions are likely to have a greater effect on fund performance than they would in a more geographically diversified fund.

Currency risk. Changes in currency exchange rates may affect the value of the fund's investments and the fund's share price. To the extent the fund seeks to hedge part or all of its foreign currency exposure, the fund may not be successful in hedging against currency changes. The fund's US dollar share price may go down if the value of the local currency of the non−US markets in which the fund invests depreciates against the US dollar. This is true even if the local currency value of securities in the fund's holdings goes up. Furthermore, the fund's use of forward currency contracts may eliminate some or all of the benefit of an increase in the value of a foreign currency versus the US dollar. The value of the US dollar measured against other currencies is influenced by a variety of factors. These factors include: interest rates, national debt levels and trade deficits, changes in balances of payments and trade, domestic and foreign interest and inflation rates, global or regional political, economic or financial events, monetary policies of governments, actual or potential government intervention, global energy prices, political instability and government monetary policies and the buying or selling of currency by a country's government.

Liquidity risk. In certain situations, it may be difficult or impossible to sell an investment and/or the fund may sell certain investments at a price or time that is not advantageous in order to meet redemption requests or other cash needs. Unusual market conditions, such as an unusually high volume of redemptions or other similar conditions could increase liquidity risk for the fund.

Pricing risk. If market conditions make it difficult to value some investments, the fund may value these investments using more subjective methods, such as fair value pricing. In such cases, the value determined for an investment could be different from the value realized upon such investment's sale. As a result, you could pay more than the market value when buying fund shares or receive less than the market value when selling fund shares.

Micro-cap company risk. Micro-cap stocks involve substantially greater risks of loss and price fluctuations because micro-cap companies' earnings and revenues tend to be less predictable (and some companies may be experiencing significant losses). Micro-cap stocks tend to be less liquid than stocks of companies with larger market capitalizations. Micro-cap companies may be newly formed or in the early stages of development, with limited product lines, markets or financial resources and may lack management depth. In addition, there may be less public information available about these companies. The shares of micro-cap companies tend to trade less frequently than those of larger, more established companies, which generally increases liquidity risk and pricing risk for these securities. There may be a substantial period before the fund realizes a gain, if any, on an investment in a micro-cap company.

Small company risk. Small company stocks tend to be more volatile than medium-sized or large company stocks. Because stock analysts are less likely to follow small companies, less information about them is available to investors. Industry-wide reversals may have a greater impact on small companies, since they may lack the financial resources of larger companies. Small company stocks are typically less liquid than large company stocks.

Medium-sized company risk. Medium-sized company stocks tend to be more volatile than large company stocks. Because stock analysts are less likely to follow medium-sized companies, less information about them is available to investors. Industry-wide reversals may have a greater impact on medium-sized companies, since they lack the financial resources of larger companies. Medium-sized company stocks are typically less liquid than large company stocks.

Derivatives risk. Risks associated with derivatives may include the risk that the derivative is not well correlated with the security, index or currency to which it relates; the risk that derivatives may result in losses or missed opportunities; the risk that the fund will be unable to sell the derivative because of an illiquid secondary market; the risk that a counterparty is unwilling or unable to meet its obligation; and the risk that the derivative transaction could expose the fund to the effects of leverage, which could increase the fund's exposure to the market and magnify potential losses.

Security selection risk. The securities in the fund's portfolio may decline in value. Portfolio management could be wrong in its analysis of industries, companies, economic trends, the relative attractiveness of different securities or other matters.

Counterparty risk. A financial institution or other counterparty with whom the fund does business, or that underwrites, distributes or guarantees any investments or contracts that the fund owns or is otherwise exposed to, may decline in financial health and become unable to honor its commitments. This could cause losses for the fund or could delay the return or delivery of collateral or other assets to the fund.

Growth investing risk. As a category, growth stocks may underperform value stocks (and the stock market as a whole) over any period of time. Because the prices of growth stocks are based largely on the expectation of future earnings, growth stock prices can decline rapidly and significantly in reaction to negative news about such factors as earnings, the economy, political developments, or other news.

Dividend-paying stock risk. As a category, dividend-paying stocks may underperform non-dividend paying stocks (and the stock market as a whole) over any period of time. In addition, issuers of dividend-paying stocks may have discretion to defer or stop paying dividends for a stated period of time. If the dividend-paying stocks held by the fund reduce or stop paying dividends, the fund's ability to generate income may be adversely affected.

Credit risk. The fund's performance could be hurt if an issuer of a debt security suffers an adverse change in financial condition that results in the issuer not making timely payments of interest or principal, a security downgrade or an inability to meet a financial obligation. Credit risk is greater for lower-rated securities. Because the issuers of high-yield debt securities or junk bonds (debt securities rated below the fourth highest credit rating category) may be in uncertain financial health, the prices of their debt securities can be more vulnerable to bad economic news, or even the expectation of bad news, than investment-grade debt securities. Credit risk for high-yield securities is greater than for higher-rated securities.

Interest rate risk. When interest rates rise, prices of debt securities generally decline. The fund may be subject to a greater risk of rising interest rates due to the current period of historically low rates. The longer the duration of the fund's debt securities, the more sensitive the fund will be to interest rate changes. (As a general rule, a 1% rise in interest rates means a 1% fall in value for every year of duration.)

Prepayment and extension risk. When interest rates fall, issuers of high interest debt obligations may pay off the debts earlier than expected (prepayment risk), and the fund may have to reinvest the proceeds at lower yields. When interest rates rise, issuers of lower interest debt obligations may pay off the debts later than expected (extension risk), thus keeping the fund's assets tied up in lower interest debt obligations. Ultimately, any unexpected behavior in interest rates could increase the volatility of the fund's share price and yield and could hurt fund performance. Prepayments could also create capital gains tax liability in some instances.

Operational and technology risk. Cyber-attacks, disruptions, or failures that affect the fund's service providers or counterparties, issuers of securities held by the fund, or other market participants may adversely affect the fund and its shareholders, including by causing losses for the fund or impairing fund operations.

|

| Risk Lose Money [Text] |

rr_RiskLoseMoney |

There are several risk factors that could hurt the fund's performance, cause you to lose money or cause the fund's performance to trail that of other investments.

|

| Risk Not Insured Depository Institution [Text] |

rr_RiskNotInsuredDepositoryInstitution |

An investment in the fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency.

|

| Bar Chart and Performance Table [Heading] |

rr_BarChartAndPerformanceTableHeading |

Past Performance

|

| Performance Narrative [Text Block] |

rr_PerformanceNarrativeTextBlock |

How a fund's returns vary from year to year can give an idea of its risk; so can comparing fund performance to overall market performance (as measured by an appropriate market index).

Past performance may not indicate future results. All performance figures below assume that dividends and distributions were reinvested. For more recent performance figures, go to deutschefunds.com (the Web site does not form a part of this prospectus) or call the phone number included in this prospectus.

|

| Performance Information Illustrates Variability of Returns [Text] |

rr_PerformanceInformationIllustratesVariabilityOfReturns |

How a fund's returns vary from year to year can give an idea of its risk; so can comparing fund performance to overall market performance (as measured by an appropriate market index).

|

| Performance Availability Website Address [Text] |

rr_PerformanceAvailabilityWebSiteAddress |

deutschefunds.com

|

| Performance Past Does Not Indicate Future [Text] |

rr_PerformancePastDoesNotIndicateFuture |

Past performance may not indicate future results.

|

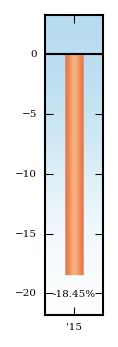

| Bar Chart [Heading] |

rr_BarChartHeading |

CALENDAR YEAR TOTAL RETURNS (%) (Class A)

|

| Bar Chart Narrative [Text Block] |

rr_BarChartNarrativeTextBlock |

These year-by-year returns do not include sales charges, if any, and would be lower if they did. Returns for other classes were different and are not shown here.

|

| Bar Chart Does Not Reflect Sales Loads [Text] |

rr_BarChartDoesNotReflectSalesLoads |

These year-by-year returns do not include sales charges, if any, and would be lower if they did.

|

| Bar Chart Closing [Text Block] |

rr_BarChartClosingTextBlock |

|

Returns |

Period ending |

| Best Quarter |

-0.40% |

December 31, 2015 |

| Worst Quarter |

-14.14% |

September 30, 2015 |

| Year-to-Date |

10.30% |

September 30, 2016 |

|

| Performance Table Heading |

rr_PerformanceTableHeading |

Average Annual Total Returns

(For periods ended 12/31/2015 expressed as a %)

|

| Performance Table Uses Highest Federal Rate |

rr_PerformanceTableUsesHighestFederalRate |

After-tax returns (which are shown only for Class A and would be different for other classes) reflect the historical highest individual federal income tax rates, but do not reflect any state or local taxes.

|

| Performance Table Not Relevant to Tax Deferred |

rr_PerformanceTableNotRelevantToTaxDeferred |

After-tax returns are not relevant to shares held in an IRA, 401(k) or other tax-advantaged investment plan.

|

| Performance Table One Class of after Tax Shown [Text] |

rr_PerformanceTableOneClassOfAfterTaxShown |

After-tax returns (which are shown only for Class A and would be different for other classes)

|

| Performance Table Narrative |

rr_PerformanceTableNarrativeTextBlock |

After-tax returns (which are shown only for Class A and would be different for other classes) reflect the historical highest individual federal income tax rates, but do not reflect any state or local taxes. Your actual after-tax returns may be different. After-tax returns are not relevant to shares held in an IRA, 401(k) or other tax-advantaged investment plan.

|

| Deutsche Emerging Markets Frontier Fund | Class A |

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

| Maximum sales charge (load) imposed on purchases, as % of offering price |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

5.75%

|

| Maximum deferred sales charge (load), as % of redemption proceeds |

rr_MaximumDeferredSalesChargeOverOther |

none

|

| Redemption/exchange fee on shares owned less than 15 days, as % of redemption proceeds |

rr_RedemptionFeeOverRedemption |

2.00%

|

| Account Maintenance Fee (annually, for fund account balances below $10,000 and subject to certain exceptions) |

rr_MaximumAccountFee |

$ 20

|

| Management fee |

rr_ManagementFeesOverAssets |

1.40%

|

| Distribution/service (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

0.25%

|

| Other expenses |

rr_OtherExpensesOverAssets |

6.17%

|

| Acquired funds fees and expenses |

rr_AcquiredFundFeesAndExpensesOverAssets |

0.06%

|

| Total annual fund operating expenses |

rr_ExpensesOverAssets |

7.88%

|

| Fee waiver/expense reimbursement |

rr_FeeWaiverOrReimbursementOverAssets |

5.57%

|

| Total annual fund operating expenses after fee waiver/expense reimbursement |

rr_NetExpensesOverAssets |

2.31%

|

| 1 Year |

rr_ExpenseExampleYear01 |

$ 796

|

| 3 Years |

rr_ExpenseExampleYear03 |

2,277

|

| 5 Years |

rr_ExpenseExampleYear05 |

3,675

|

| 10 Years |

rr_ExpenseExampleYear10 |

6,832

|

| 1 Year |

rr_ExpenseExampleNoRedemptionYear01 |

796

|

| 3 Years |

rr_ExpenseExampleNoRedemptionYear03 |

2,277

|

| 5 Years |

rr_ExpenseExampleNoRedemptionYear05 |

3,675

|

| 10 Years |

rr_ExpenseExampleNoRedemptionYear10 |

$ 6,832

|

| 2015 |

rr_AnnualReturn2015 |

(18.45%)

|

| Year to Date Return, Label |

rr_YearToDateReturnLabel |

Year-to-Date

|

| Bar Chart, Year to Date Return, Date |

rr_BarChartYearToDateReturnDate |

Sep. 30, 2016

|

| Bar Chart, Year to Date Return |

rr_BarChartYearToDateReturn |

10.30%

|

| Highest Quarterly Return, Label |

rr_HighestQuarterlyReturnLabel |

Best Quarter

|

| Highest Quarterly Return, Date |

rr_BarChartHighestQuarterlyReturnDate |

Dec. 31, 2015

|

| Highest Quarterly Return |

rr_BarChartHighestQuarterlyReturn |

(0.40%)

|

| Lowest Quarterly Return, Label |

rr_LowestQuarterlyReturnLabel |

Worst Quarter

|

| Lowest Quarterly Return, Date |

rr_BarChartLowestQuarterlyReturnDate |

Sep. 30, 2015

|

| Lowest Quarterly Return |

rr_BarChartLowestQuarterlyReturn |

(14.14%)

|

| Deutsche Emerging Markets Frontier Fund | Class C |

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

| Maximum sales charge (load) imposed on purchases, as % of offering price |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

| Maximum deferred sales charge (load), as % of redemption proceeds |

rr_MaximumDeferredSalesChargeOverOther |

1.00%

|

| Redemption/exchange fee on shares owned less than 15 days, as % of redemption proceeds |

rr_RedemptionFeeOverRedemption |

2.00%

|

| Account Maintenance Fee (annually, for fund account balances below $10,000 and subject to certain exceptions) |

rr_MaximumAccountFee |

$ 20

|

| Management fee |

rr_ManagementFeesOverAssets |

1.40%

|

| Distribution/service (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

0.97%

|

| Other expenses |

rr_OtherExpensesOverAssets |

6.36%

|

| Acquired funds fees and expenses |

rr_AcquiredFundFeesAndExpensesOverAssets |

0.06%

|

| Total annual fund operating expenses |

rr_ExpensesOverAssets |

8.79%

|

| Fee waiver/expense reimbursement |

rr_FeeWaiverOrReimbursementOverAssets |

5.73%

|

| Total annual fund operating expenses after fee waiver/expense reimbursement |

rr_NetExpensesOverAssets |

3.06%

|

| 1 Year |

rr_ExpenseExampleYear01 |

$ 409

|

| 3 Years |

rr_ExpenseExampleYear03 |

2,034

|

| 5 Years |

rr_ExpenseExampleYear05 |

3,630

|

| 10 Years |

rr_ExpenseExampleYear10 |

7,121

|

| 1 Year |

rr_ExpenseExampleNoRedemptionYear01 |

309

|

| 3 Years |

rr_ExpenseExampleNoRedemptionYear03 |

2,034

|

| 5 Years |

rr_ExpenseExampleNoRedemptionYear05 |

3,630

|

| 10 Years |

rr_ExpenseExampleNoRedemptionYear10 |

$ 7,121

|

| Deutsche Emerging Markets Frontier Fund | INST Class |

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

| Maximum sales charge (load) imposed on purchases, as % of offering price |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

| Maximum deferred sales charge (load), as % of redemption proceeds |

rr_MaximumDeferredSalesChargeOverOther |

none

|

| Redemption/exchange fee on shares owned less than 15 days, as % of redemption proceeds |

rr_RedemptionFeeOverRedemption |

2.00%

|

| Account Maintenance Fee (annually, for fund account balances below $10,000 and subject to certain exceptions) |

rr_MaximumAccountFee |

none

|

| Management fee |

rr_ManagementFeesOverAssets |

1.40%

|

| Distribution/service (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

none

|

| Other expenses |

rr_OtherExpensesOverAssets |

6.08%

|

| Acquired funds fees and expenses |

rr_AcquiredFundFeesAndExpensesOverAssets |

0.06%

|

| Total annual fund operating expenses |

rr_ExpensesOverAssets |

7.54%

|

| Fee waiver/expense reimbursement |

rr_FeeWaiverOrReimbursementOverAssets |

5.48%

|

| Total annual fund operating expenses after fee waiver/expense reimbursement |

rr_NetExpensesOverAssets |

2.06%

|

| 1 Year |

rr_ExpenseExampleYear01 |

$ 209

|

| 3 Years |

rr_ExpenseExampleYear03 |

1,722

|

| 5 Years |

rr_ExpenseExampleYear05 |

3,159

|

| 10 Years |

rr_ExpenseExampleYear10 |

6,445

|

| 1 Year |

rr_ExpenseExampleNoRedemptionYear01 |

209

|

| 3 Years |

rr_ExpenseExampleNoRedemptionYear03 |

1,722

|

| 5 Years |

rr_ExpenseExampleNoRedemptionYear05 |

3,159

|

| 10 Years |

rr_ExpenseExampleNoRedemptionYear10 |

$ 6,445

|

| Deutsche Emerging Markets Frontier Fund | Class S |

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

| Maximum sales charge (load) imposed on purchases, as % of offering price |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

| Maximum deferred sales charge (load), as % of redemption proceeds |

rr_MaximumDeferredSalesChargeOverOther |

none

|

| Redemption/exchange fee on shares owned less than 15 days, as % of redemption proceeds |

rr_RedemptionFeeOverRedemption |

2.00%

|

| Account Maintenance Fee (annually, for fund account balances below $10,000 and subject to certain exceptions) |

rr_MaximumAccountFee |

$ 20

|

| Management fee |

rr_ManagementFeesOverAssets |

1.40%

|

| Distribution/service (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

none

|

| Other expenses |

rr_OtherExpensesOverAssets |

6.19%

|

| Acquired funds fees and expenses |

rr_AcquiredFundFeesAndExpensesOverAssets |

0.06%

|

| Total annual fund operating expenses |

rr_ExpensesOverAssets |

7.65%

|

| Fee waiver/expense reimbursement |

rr_FeeWaiverOrReimbursementOverAssets |

5.49%

|

| Total annual fund operating expenses after fee waiver/expense reimbursement |

rr_NetExpensesOverAssets |

2.16%

|

| 1 Year |

rr_ExpenseExampleYear01 |

$ 219

|

| 3 Years |

rr_ExpenseExampleYear03 |

1,751

|

| 5 Years |

rr_ExpenseExampleYear05 |

3,203

|

| 10 Years |

rr_ExpenseExampleYear10 |

6,509

|

| 1 Year |

rr_ExpenseExampleNoRedemptionYear01 |

219

|

| 3 Years |

rr_ExpenseExampleNoRedemptionYear03 |

1,751

|

| 5 Years |

rr_ExpenseExampleNoRedemptionYear05 |

3,203

|

| 10 Years |

rr_ExpenseExampleNoRedemptionYear10 |

$ 6,509

|

| Deutsche Emerging Markets Frontier Fund | before tax | Class A |

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

(23.14%)

|

| Since Inception |

rr_AverageAnnualReturnSinceInception |

(24.86%)

|

| Class Inception |

rr_AverageAnnualReturnInceptionDate |

Sep. 23, 2014

|

| Deutsche Emerging Markets Frontier Fund | before tax | Class C |

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

(19.14%)

|

| Since Inception |

rr_AverageAnnualReturnSinceInception |

(21.86%)

|

| Class Inception |

rr_AverageAnnualReturnInceptionDate |

Sep. 23, 2014

|

| Deutsche Emerging Markets Frontier Fund | before tax | INST Class |

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

(18.21%)

|

| Since Inception |

rr_AverageAnnualReturnSinceInception |

(21.02%)

|

| Class Inception |

rr_AverageAnnualReturnInceptionDate |

Sep. 23, 2014

|

| Deutsche Emerging Markets Frontier Fund | before tax | Class S |

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

(18.32%)

|

| Since Inception |

rr_AverageAnnualReturnSinceInception |

(21.10%)

|

| Class Inception |

rr_AverageAnnualReturnInceptionDate |

Sep. 23, 2014

|

| Deutsche Emerging Markets Frontier Fund | After tax on distributions | Class A |

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

(23.14%)

|

| Since Inception |

rr_AverageAnnualReturnSinceInception |

(24.86%)

|

| Deutsche Emerging Markets Frontier Fund | After tax on distributions and sale of fund shares | Class A |

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

(13.10%)

|

| Since Inception |

rr_AverageAnnualReturnSinceInception |

(18.76%)

|

| Deutsche Emerging Markets Frontier Fund | MSCI Frontier Emerging Markets Index (reflects no deduction for fees or expenses) |

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

(18.30%)

|

| Since Inception |

rr_AverageAnnualReturnSinceInception |

(22.54%)

|