|

Date of fiscal year end:

|

10/31

|

|

Date of reporting period:

|

4/30/2012

|

|

ITEM 1.

|

REPORT TO STOCKHOLDERS

|

|

APRIL 30, 2012

Semiannual Report

to Shareholders

|

|

DWS Latin America Equity Fund

|

|

|

4 Performance Summary

7 Portfolio Summary

9 Investment Portfolio

13 Statement of Assets and Liabilities

15 Statement of Operations

16 Statement of Changes in Net Assets

17 Financial Highlights

21 Notes to Financial Statements

29 Information About Your Fund's Expenses

31 Summary of Management Fee Evaluation by Independent Fee Consultant

35 Account Management Resources

37 Privacy Statement

|

|

Average Annual Total Returns as of 4/30/12

|

|||||

|

Unadjusted for Sales Charge

|

6-Month‡

|

1-Year

|

3-Year

|

5-Year

|

10-Year

|

|

Class A

|

3.08%

|

-13.71%

|

16.27%

|

1.09%

|

14.54%

|

|

Class B

|

2.72%

|

-14.36%

|

15.36%

|

0.30%

|

13.61%

|

|

Class C

|

2.70%

|

-14.36%

|

15.34%

|

0.28%

|

13.63%

|

|

MSCI EM Latin America Index+

|

2.06%

|

-12.26%

|

19.04%

|

6.32%

|

19.08%

|

|

Adjusted for the Maximum Sales Charge

|

|||||

|

Class A (max 5.75% load)

|

-2.85%

|

-18.67%

|

14.00%

|

-0.10%

|

13.87%

|

|

Class B (max 4.00% CDSC)

|

-1.00%

|

-16.68%

|

14.85%

|

0.17%

|

13.61%

|

|

Class C (max 1.00% CDSC)

|

1.77%

|

-14.36%

|

15.34%

|

0.28%

|

13.63%

|

|

MSCI EM Latin America Index+

|

2.06%

|

-12.26%

|

19.04%

|

6.32%

|

19.08%

|

|

No Sales Charges

|

|||||

|

Class S

|

3.24%

|

-13.46%

|

16.63%

|

1.40%

|

14.85%

|

|

MSCI EM Latin America Index+

|

2.06%

|

-12.26%

|

19.04%

|

6.32%

|

19.08%

|

|

Average Annual Total Returns as of 3/31/12 (most recent calendar quarter end)

|

||||

|

Unadjusted for Sales Charge

|

1-Year

|

3-Year

|

5-Year

|

10-Year

|

|

Class A

|

-11.11%

|

23.03%

|

2.70%

|

14.73%

|

|

Class B

|

-11.81%

|

22.02%

|

1.89%

|

13.79%

|

|

Class C

|

-11.78%

|

22.02%

|

1.87%

|

13.81%

|

|

MSCI EM Latin America Index+

|

-8.35%

|

27.22%

|

8.29%

|

19.38%

|

|

Adjusted for the Maximum Sales Charge

|

||||

|

Class A (max 5.75% load)

|

-16.22%

|

20.62%

|

1.49%

|

14.05%

|

|

Class B (max 4.00% CDSC)

|

-14.20%

|

21.57%

|

1.76%

|

13.79%

|

|

Class C (max 1.00% CDSC)

|

-11.78%

|

22.02%

|

1.87%

|

13.81%

|

|

MSCI EM Latin America Index+

|

-8.35%

|

27.22%

|

8.29%

|

19.38%

|

|

No Sales Charges

|

||||

|

Class S

|

-10.87%

|

23.41%

|

3.01%

|

15.04%

|

|

MSCI EM Latin America Index+

|

-8.35%

|

27.22%

|

8.29%

|

19.38%

|

|

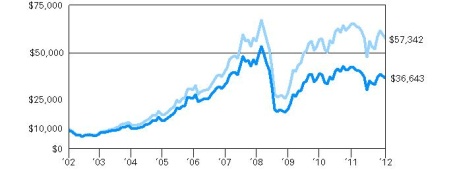

Growth of an Assumed $10,000 Investment (Adjusted for Maximum Sales Charge)

|

|

|

|

Yearly periods ended April 30

|

|

Net Asset Value and Distribution Information

|

||||||||||||||||

|

Class A

|

Class B

|

Class C

|

Class S

|

|||||||||||||

|

Net Asset Value:

4/30/12

|

$ | 41.02 | $ | 39.73 | $ | 39.72 | $ | 40.94 | ||||||||

|

10/31/11

|

$ | 43.85 | $ | 42.72 | $ | 42.71 | $ | 43.86 | ||||||||

|

Distribution Information:

Six Months as of 4/30/12:

Income Dividends

|

$ | .02 | $ | — | $ | — | $ | .16 | ||||||||

|

Capital Gain Distributions

|

$ | 3.83 | $ | 3.83 | $ | 3.83 | $ | 3.83 | ||||||||

|

Morningstar Rankings — Latin American Stock Funds Category as of 4/30/12

|

||||

|

Period

|

Rank

|

Number of Fund Classes Tracked

|

Percentile Ranking (%)

|

|

|

Class A

1-Year

|

21

|

of

|

43

|

48

|

|

3-Year

|

16

|

of

|

19

|

83

|

|

5-Year

|

13

|

of

|

17

|

75

|

|

10-Year

|

9

|

of

|

12

|

73

|

|

Class B

1-Year

|

24

|

of

|

43

|

55

|

|

3-Year

|

18

|

of

|

19

|

94

|

|

5-Year

|

15

|

of

|

17

|

87

|

|

10-Year

|

12

|

of

|

12

|

100

|

|

Class C

1-Year

|

25

|

of

|

43

|

57

|

|

3-Year

|

19

|

of

|

19

|

100

|

|

5-Year

|

16

|

of

|

17

|

93

|

|

10-Year

|

11

|

of

|

12

|

91

|

|

Class S

1-Year

|

19

|

of

|

43

|

43

|

|

3-Year

|

15

|

of

|

19

|

78

|

|

5-Year

|

12

|

of

|

17

|

69

|

|

10-Year

|

8

|

of

|

12

|

64

|

|

Ten Largest Equity Holdings at April 30, 2012 (51.2% of Net Assets)

|

Country

|

Percent

|

|

1. Gerdau SA

Produces and manufactures steel

|

Brazil

|

9.3%

|

|

2. Petroleo Brasileiro SA

Explores for and produces oil and natural gas

|

Brazil

|

5.5%

|

|

3. Ecopetrol SA

An integrated oil company

|

Brazil

|

5.4%

|

|

4. Wal-Mart de Mexico SAB de CV

Retailer of food, clothing and other merchandise

|

Mexico

|

5.3%

|

|

5. Companhia de Bebidas das Americas

Produces beer, soft drinks, teas, mineral water and sports drinks

|

Brazil

|

5.1%

|

|

6. Cia. Hering

Active in brand management, manufacturing and retail in the fashion industry

|

Brazil

|

4.5%

|

|

7. Banco Bradesco SA

Provider of banking services

|

Brazil

|

4.5%

|

|

8. Fomento Economico Mexicano SAB de CV

Produces, distributes and markets non-alcoholic beverages and owns and operates convenience stores

|

Mexico

|

4.2%

|

|

9. Companhia Brasileira de Distribuicao Grupo Pao de Acucar

Operator in the food and non-food retail businesses

|

Brazil

|

3.9%

|

|

10. America Movil SAB de CV

Provider of wireless communication services

|

Mexico

|

3.5%

|

|

Portfolio holdings and characteristics are subject to change.

|

||

|

Shares

|

Value ($)

|

|||||||

|

Equity Securities 98.5%

|

||||||||

|

Argentina 0.0%

|

||||||||

|

Nortel Inversora SA "A"(ADR) 144A (Preferred)* (Cost $82,865)

|

12,721 | 75,690 | ||||||

|

Bermuda 1.1%

|

||||||||

|

BTG Pactual Participations Ltd. (Units) (a)* (Cost $6,924,522)

|

417,100 | 6,693,644 | ||||||

|

Brazil 59.4%

|

||||||||

|

Arezzo Industria e Comercio SA

|

112,130 | 1,764,761 | ||||||

|

Banco Bradesco SA (ADR) (Preferred) (b)

|

1,661,000 | 26,625,830 | ||||||

|

BR Malls Participacoes SA

|

775,950 | 9,639,586 | ||||||

|

Bradespar SA (Preferred)

|

167,000 | 3,057,629 | ||||||

|

Braskem SA "A" (Preferred)

|

52 | 366 | ||||||

|

BRF-Brasil Foods SA

|

1,035,700 | 18,935,627 | ||||||

|

CCR SA

|

1,583,850 | 12,297,553 | ||||||

|

CETIP SA — Mercados Organizados

|

350,000 | 5,392,807 | ||||||

|

Cia. Hering

|

1,082,250 | 26,855,402 | ||||||

|

Cielo SA

|

450,360 | 13,514,462 | ||||||

|

Companhia Brasileira de Distribuicao Grupo Pao de Acucar "A" (Preferred)

|

496,450 | 23,049,511 | ||||||

|

Companhia Brasileira de Distribuicao Grupo Pao de Acucar, (Rights) Expiration Date 5/31/2012*

|

3,582 | 5,337 | ||||||

|

Companhia de Bebidas das Americas (ADR) (Preferred) (b)

|

727,550 | 30,542,549 | ||||||

|

Companhia Energetica de Minas Gerais (ADR) (Preferred) (b)

|

284,000 | 7,006,280 | ||||||

|

Ecorodovias Infraestrutura e Logistica SA

|

456,000 | 3,803,688 | ||||||

|

Gerdau SA (ADR) (b)

|

4,428,500 | 41,583,615 | ||||||

|

Gerdau SA (Preferred)

|

1,485,700 | 13,967,287 | ||||||

|

Itau Unibanco Holding SA (ADR) (Preferred)

|

994,800 | 15,608,412 | ||||||

|

Itausa — Investimentos Itau SA (Preferred)

|

1,843,270 | 8,761,129 | ||||||

|

Itausa — Investimentos Itau SA, (Rights) Expiration Date 5/31/2012*

|

22,367 | 6,571 | ||||||

|

Localiza Rent a Car SA

|

321,450 | 5,489,178 | ||||||

|

Lojas Americanas SA (Preferred)

|

509,150 | 4,786,595 | ||||||

|

Marcopolo SA (Preferred)

|

1,250,150 | 6,722,471 | ||||||

|

Metalurgica Gerdau SA (Preferred)

|

203,000 | 2,476,064 | ||||||

|

Multiplan Empreendimentos Imobiliarios SA

|

247,800 | 5,850,012 | ||||||

|

OdontoPrev SA

|

1,929,000 | 10,291,913 | ||||||

|

Petroleo Brasileiro SA

|

985,300 | 11,573,521 | ||||||

|

Petroleo Brasileiro SA (ADR) (b)

|

180,400 | 3,997,664 | ||||||

|

Petroleo Brasileiro SA (Preferred)

|

1,533,150 | 17,123,922 | ||||||

|

Raia Drogasil SA

|

1,016,500 | 10,953,445 | ||||||

|

Redecard SA

|

543,100 | 9,145,928 | ||||||

|

TOTVS SA

|

214,750 | 4,185,380 | ||||||

|

(Cost $297,002,171)

|

355,014,495 | |||||||

|

Chile 6.4%

|

||||||||

|

Banco de Chile

|

33,000,000 | 5,204,082 | ||||||

|

Banco de Credito e Inversiones

|

49,000 | 3,525,152 | ||||||

|

Cencosud SA

|

985,400 | 6,276,821 | ||||||

|

Empresas Copec SA

|

467,300 | 7,571,589 | ||||||

|

S.A.C.I. Falabella

|

950,000 | 9,321,789 | ||||||

|

Sociedad Quimica y Minera de Chile SA "B" (Preferred)

|

106,000 | 6,205,731 | ||||||

|

(Cost $34,240,467)

|

38,105,164 | |||||||

|

Colombia 7.2%

|

||||||||

|

Bancolombia SA (ADR)

|

155,200 | 10,527,216 | ||||||

|

Ecopetrol SA (ADR) (b)

|

503,300 | 32,563,510 | ||||||

|

(Cost $32,502,776)

|

43,090,726 | |||||||

|

Mexico 22.3%

|

||||||||

|

Alfa SAB "A"

|

566,200 | 8,100,090 | ||||||

|

Alpek SAB de CV*

|

2,647,900 | 5,858,496 | ||||||

|

America Movil SAB de CV "L"

|

2,658,100 | 3,548,636 | ||||||

|

America Movil SAB de CV "L" (ADR) (b)

|

664,000 | 17,695,600 | ||||||

|

Coca-Cola Femsa SAB de CV "L"*

|

834,000 | 8,852,241 | ||||||

|

Fomento Economico Mexicano SAB de CV (ADR) (Units) (b)

|

74,000 | 6,013,240 | ||||||

|

Fomento Economico Mexicano SAB de CV (Units)

|

2,370,000 | 19,247,909 | ||||||

|

Grupo Financiero Banorte SAB de CV "O"

|

1,133,300 | 5,465,544 | ||||||

|

Grupo Mexico SAB de CV "B"

|

2,597,085 | 8,005,018 | ||||||

|

Grupo Modelo SAB de CV "C"

|

1,591,500 | 11,246,594 | ||||||

|

Industrias Penoles SAB de CV

|

121,000 | 5,669,168 | ||||||

|

Minera Frisco SAB de CV "A1"*

|

445,000 | 1,926,086 | ||||||

|

OHL Mexico SAB de CV*

|

714 | 1,129 | ||||||

|

Wal-Mart de Mexico SAB de CV "V"

|

11,089,000 | 31,710,950 | ||||||

|

(Cost $84,752,538)

|

133,340,701 | |||||||

|

Peru 2.1%

|

||||||||

|

Credicorp Ltd. (b) (Cost $6,800,978)

|

96,100 | 12,580,451 | ||||||

|

United States 0.0%

|

||||||||

|

Southern Copper Corp. (b) (Cost $36,203)

|

1,568 | 51,556 | ||||||

|

Total Equity Securities (Cost $462,342,520)

|

588,952,427 | |||||||

|

Units

|

Value ($)

|

|||||||

|

Other Investments 0.1%

|

||||||||

|

Brazil

|

||||||||

|

TOTVS SA (Debenture Unit), 3.5%, 8/19/2019 (c) (Cost $836,592)

|

766 | 442,319 | ||||||

|

Shares

|

Value ($)

|

|||||||

|

Securities Lending Collateral 20.5%

|

||||||||

|

Daily Assets Fund Institutional, 0.24% (d) (e) (Cost $122,248,913)

|

122,248,913 | 122,248,913 | ||||||

|

Cash Equivalents 0.0%

|

||||||||

|

Central Cash Management Fund, 0.12% (d) (Cost $297,391)

|

297,391 | 297,391 | ||||||

|

% of Net Assets

|

Value ($)

|

|||||||

|

Total Investment Portfolio (Cost $585,725,416)+

|

119.1 | 711,941,050 | ||||||

|

Other Assets and Liabilities, Net

|

(19.1 | ) | (114,335,685 | ) | ||||

|

Net Assets

|

100.0 | 597,605,365 | ||||||

|

Schedule of Restricted Securities

|

Acquisition Date

|

Cost ($)

|

Value ($)

|

Value as % of Net Assets

|

|||||||||

|

TOTVS SA (Debenture Unit)

|

September 2008

|

836,592 | 442,319 | 0.07 | |||||||||

|

Assets

|

Level 1

|

Level 2

|

Level 3

|

Total

|

||||||||||||

|

Equity Securities

|

||||||||||||||||

|

Argentina

|

$ | — | $ | — | $ | 75,690 | $ | 75,690 | ||||||||

|

Bermuda

|

6,693,644 | — | — | 6,693,644 | ||||||||||||

|

Brazil

|

355,014,495 | — | — | 355,014,495 | ||||||||||||

|

Chile

|

38,105,164 | — | — | 38,105,164 | ||||||||||||

|

Colombia

|

43,090,726 | — | — | 43,090,726 | ||||||||||||

|

Mexico

|

133,340,701 | — | — | 133,340,701 | ||||||||||||

|

Peru

|

12,580,451 | — | — | 12,580,451 | ||||||||||||

|

United States

|

51,556 | — | — | 51,556 | ||||||||||||

|

Other Investments

|

— | — | 442,319 | 442,319 | ||||||||||||

|

Short-Term Investments (f)

|

122,546,304 | — | — | 122,546,304 | ||||||||||||

|

Total

|

$ | 711,423,041 | $ | — | $ | 518,009 | $ | 711,941,050 | ||||||||

|

Equity Securities

|

Other Investments

|

Total

|

||||||||||

|

Balance as of October 31, 2011

|

$ | 75,690 | $ | 423,705 | $ | 499,395 | ||||||

|

Realized gain (loss)

|

— | — | — | |||||||||

|

Change in unrealized appreciation (depreciation)

|

0 | 18,614 | 18,614 | |||||||||

|

Amortization premium/discount

|

— | — | — | |||||||||

|

Purchases

|

— | — | — | |||||||||

|

Sales

|

— | — | — | |||||||||

|

Transfers into Level 3

|

— | — | — | |||||||||

|

Transfers (out) of Level 3

|

— | — | — | |||||||||

|

Balance as of April 30, 2012

|

$ | 75,690 | $ | 442,319 | $ | 518,009 | ||||||

|

Net change in unrealized appreciation (depreciation) from investments still held as of April 30, 2012

|

$ | 0 | $ | 18,614 | $ | 18,614 | ||||||

|

as of April 30, 2012 (Unaudited)

|

||||

|

Assets

|

||||

|

Investments:

Investments in non-affiliated securities, at value (cost $463,179,112) — including $119,357,965 of securities loaned

|

$ | 589,394,746 | ||

|

Investment in Daily Assets Fund Institutional (cost $122,248,913)*

|

122,248,913 | |||

|

Investment in Central Cash Management Fund (cost $297,391)

|

297,391 | |||

|

Total investments in securities, at value (cost $585,725,416)

|

711,941,050 | |||

|

Foreign currency, at value (cost $2,222,140)

|

2,221,643 | |||

|

Receivable for investments sold

|

11,058,620 | |||

|

Receivable for Fund shares sold

|

25,810 | |||

|

Dividends receivable

|

3,916,529 | |||

|

Interest receivable

|

51,130 | |||

|

Other assets

|

39,728 | |||

|

Total assets

|

729,254,510 | |||

|

Liabilities

|

||||

|

Payable upon return of securities loaned

|

122,248,913 | |||

|

Payable for investments purchased

|

7,883,992 | |||

|

Payable for Fund shares redeemed

|

626,487 | |||

|

Accrued management fee

|

567,042 | |||

|

Accrued Directors' fees

|

2,650 | |||

|

Other accrued expenses and payables

|

320,061 | |||

|

Total liabilities

|

131,649,145 | |||

|

Net assets, at value

|

$ | 597,605,365 | ||

|

Net Assets Consist of

|

||||

|

Undistributed net investment income

|

1,668,438 | |||

|

Net unrealized appreciation (depreciation) on:

Investments

|

126,215,634 | |||

|

Foreign currency

|

(114,035 | ) | ||

|

Accumulated net realized gain (loss)

|

75,523,281 | |||

|

Paid-in capital

|

394,312,047 | |||

|

Net assets, at value

|

$ | 597,605,365 | ||

|

Statement of Assets and Liabilities as of April 30, 2012 (Unaudited) (continued)

|

||||

|

Net Asset Value

|

||||

|

Class A

Net Asset Value and redemption price(a) per share ($31,698,454 ÷ 772,767 shares of capital stock outstanding, $.01 par value, 50,000,000 shares authorized)

|

$ | 41.02 | ||

|

Maximum offering price per share (100 ÷ 94.25 of $41.02)

|

$ | 43.52 | ||

|

Class B

Net Asset Value, offering and redemption price(a) (subject to contingent deferred sales charge) per share ($2,093,008 ÷ 52,679 shares of capital stock outstanding, $.01 par value, 50,000,000 shares authorized)

|

$ | 39.73 | ||

|

Class C

Net Asset Value, offering and redemption price(a) (subject to contingent deferred sales charge) per share ($6,273,136 ÷ 157,941 shares of capital stock outstanding, $.01 par value, 20,000,000 shares authorized)

|

$ | 39.72 | ||

|

Class S

Net Asset Value, offering and redemption price(a) per share ($557,540,767 ÷ 13,617,135 shares of capital stock outstanding, $.01 par value, 100,000,000 shares authorized)

|

$ | 40.94 | ||

|

for the six months ended April 30, 2012 (Unaudited)

|

||||

|

Investment Income

|

||||

|

Income:

Dividends (net of foreign taxes withheld of $659,927)

|

$ | 10,255,064 | ||

|

Interest (net of foreign taxes withheld of $7,295)

|

43,181 | |||

|

Income distributions — Central Cash Management Fund

|

6,771 | |||

|

Securities lending income, including income from Daily Assets Fund Institutional, net of borrower rebates

|

166,644 | |||

|

Total income

|

10,471,660 | |||

|

Expenses:

Management fee

|

3,411,236 | |||

|

Administration fee

|

301,627 | |||

|

Services to shareholders

|

399,607 | |||

|

Distribution and service fees

|

88,851 | |||

|

Custodian fee

|

144,499 | |||

|

Professional fees

|

58,415 | |||

|

Reports to shareholders

|

32,048 | |||

|

Registration fees

|

28,440 | |||

|

Directors' fees and expenses

|

11,475 | |||

|

Other

|

30,520 | |||

|

Total expenses before expense reductions

|

4,506,718 | |||

|

Expense reductions

|

(19,957 | ) | ||

|

Total expenses after expense reductions

|

4,486,761 | |||

|

Net investment income (loss)

|

5,984,899 | |||

|

Realized and Unrealized Gain (Loss)

|

||||

|

Net realized gain (loss) from:

Investments (net of foreign taxes of $619)

|

80,074,612 | |||

|

Foreign currency

|

(394,893 | ) | ||

| 79,679,719 | ||||

|

Change in net unrealized appreciation (depreciation) on:

Investments

|

(68,023,484 | ) | ||

|

Foreign currency

|

(68,948 | ) | ||

| (68,092,432 | ) | |||

|

Net gain (loss)

|

11,587,287 | |||

|

Net increase (decrease) in net assets resulting from operations

|

$ | 17,572,186 | ||

|

Increase (Decrease) in Net Assets

|

Six Months Ended April 30, 2012 (Unaudited)

|

Year Ended October 31, 2011

|

||||||

|

Operations:

Net investment income (loss)

|

$ | 5,984,899 | $ | 11,917,121 | ||||

|

Net realized gain (loss)

|

79,679,719 | 58,978,596 | ||||||

|

Change in net unrealized appreciation (depreciation)

|

(68,092,432 | ) | (176,324,410 | ) | ||||

|

Net increase (decrease) in net assets resulting from operations

|

17,572,186 | (105,428,693 | ) | |||||

|

Distributions to shareholders from:

Net investment income:

Class A

|

(18,123 | ) | (1,377,753 | ) | ||||

|

Class B

|

— | (99,890 | ) | |||||

|

Class C

|

— | (186,114 | ) | |||||

|

Class S

|

(1,982,118 | ) | (20,319,045 | ) | ||||

|

Net realized gains:

Class A

|

(2,833,873 | ) | (2,363,049 | ) | ||||

|

Class B

|

(263,171 | ) | (259,296 | ) | ||||

|

Class C

|

(620,972 | ) | (483,331 | ) | ||||

|

Class S

|

(48,169,502 | ) | (31,071,818 | ) | ||||

|

Total distributions

|

(53,887,759 | ) | (56,160,296 | ) | ||||

|

Fund share transactions:

Proceeds from shares sold

|

36,703,503 | 57,985,486 | ||||||

|

Reinvestment of distributions

|

50,989,708 | 52,994,755 | ||||||

|

Payments for shares redeemed

|

(64,483,773 | ) | (152,661,600 | ) | ||||

|

Redemption fees

|

33,582 | 37,652 | ||||||

|

Net increase (decrease) in net assets from Fund share transactions

|

23,243,020 | (41,643,707 | ) | |||||

|

Increase (decrease) in net assets

|

(13,072,553 | ) | (203,232,696 | ) | ||||

|

Net assets at beginning of period

|

610,677,918 | 813,910,614 | ||||||

|

Net assets at end of period (including undistributed net investment income and distributions in excess of net investment income of $1,668,438 and $2,316,220, respectively)

|

$ | 597,605,365 | $ | 610,677,918 | ||||

|

Years Ended October 31,

|

|||||||||||||||||||||||||

|

Class A

|

|

Six Months Ended 4/30/12 (Unaudited)

|

2011

|

2010

|

2009

|

2008

|

2007

|

||||||||||||||||||

|

Selected Per Share Data

|

|||||||||||||||||||||||||

|

Net asset value, beginning of period

|

$ | 43.85 | $ | 54.97 | $ | 47.75 | $ | 31.89 | $ | 87.06 | $ | 57.68 | |||||||||||||

|

Income (loss) from investment operations:

Net investment income (loss)a

|

.36 | .69 | .42 | .44 | .21 | .28 | |||||||||||||||||||

|

Net realized and unrealized gain (loss)

|

.66 | (8.07 | ) | 8.09 | 19.11 | (43.52 | ) | 36.24 | |||||||||||||||||

|

Total from investment operations

|

1.02 | (7.38 | ) | 8.51 | 19.55 | (43.31 | ) | 36.52 | |||||||||||||||||

|

Less distributions from:

Net investment income

|

(.02 | ) | (1.38 | ) | (1.29 | ) | (.26 | ) | (.26 | ) | (.27 | ) | |||||||||||||

|

Net realized gains

|

(3.83 | ) | (2.36 | ) | — | (3.43 | ) | (11.61 | ) | (6.87 | ) | ||||||||||||||

|

Total distributions

|

(3.85 | ) | (3.74 | ) | (1.29 | ) | (3.69 | ) | (11.87 | ) | (7.14 | ) | |||||||||||||

|

Redemption fees

|

.00 | *** | .00 | *** | .00 | *** | .00 | *** | .01 | .00 | *** | ||||||||||||||

|

Net asset value, end of period

|

$ | 41.02 | $ | 43.85 | $ | 54.97 | $ | 47.75 | $ | 31.89 | $ | 87.06 | |||||||||||||

|

Total Return (%)b

|

3.08 | c** | (14.44 | ) | 18.05 | 70.81 | (57.20 | ) | 70.34 | ||||||||||||||||

|

Ratios to Average Net Assets and Supplemental Data

|

|||||||||||||||||||||||||

|

Net assets, end of period ($ millions)

|

32 | 35 | 58 | 59 | 37 | 120 | |||||||||||||||||||

|

Ratio of expenses before expense reductions (%)

|

1.79 | * | 1.73 | 1.76 | 1.82 | 1.70 | 1.68 | ||||||||||||||||||

|

Ratio of expenses after expense reductions (%)

|

1.71 | * | 1.73 | 1.76 | 1.82 | 1.70 | 1.68 | ||||||||||||||||||

|

Ratio of net investment income (%)

|

1.74 | * | 1.38 | .84 | 1.27 | .32 | .44 | ||||||||||||||||||

|

Portfolio turnover rate (%)

|

70 | ** | 35 | 37 | 95 | 37 | 62 | ||||||||||||||||||

|

a Based on average shares outstanding during the period.

b Total return does not reflect the effect of any sales charges.

c Total return would have been lower had certain expenses not been reduced.

* Annualized

** Not annualized

*** Amount is less than $.005.

|

|||||||||||||||||||||||||

|

Years Ended October 31,

|

|||||||||||||||||||||||||

|

Class B

|

|

Six Months Ended 4/30/12 (Unaudited)

|

2011

|

2010

|

2009

|

2008

|

2007

|

||||||||||||||||||

|

Selected Per Share Data

|

|||||||||||||||||||||||||

|

Net asset value, beginning of period

|

$ | 42.72 | $ | 53.60 | $ | 46.52 | $ | 31.14 | $ | 85.63 | $ | 56.99 | |||||||||||||

|

Income (loss) from investment operations:

Net investment income (loss)a

|

.17 | .28 | .05 | .16 | (.30 | ) | (.20 | ) | |||||||||||||||||

|

Net realized and unrealized gain (loss)

|

.67 | (7.89 | ) | 7.85 | 18.65 | (42.59 | ) | 35.71 | |||||||||||||||||

|

Total from investment operations

|

.84 | (7.61 | ) | 7.90 | 18.81 | (42.89 | ) | 35.51 | |||||||||||||||||

|

Less distributions from:

Net investment income

|

— | (.91 | ) | (.82 | ) | — | — | — | |||||||||||||||||

|

Net realized gains

|

(3.83 | ) | (2.36 | ) | — | (3.43 | ) | (11.61 | ) | (6.87 | ) | ||||||||||||||

|

Total distributions

|

(3.83 | ) | (3.27 | ) | (.82 | ) | (3.43 | ) | (11.61 | ) | (6.87 | ) | |||||||||||||

|

Redemption fees

|

.00 | *** | .00 | *** | .00 | *** | .00 | *** | .01 | .00 | *** | ||||||||||||||

|

Net asset value, end of period

|

$ | 39.73 | $ | 42.72 | $ | 53.60 | $ | 46.52 | $ | 31.14 | $ | 85.63 | |||||||||||||

|

Total Return (%)b

|

2.72 | c** | (15.12 | )c | 17.11 | 69.31 | (57.55 | ) | 69.01 | ||||||||||||||||

|

Ratios to Average Net Assets and Supplemental Data

|

|||||||||||||||||||||||||

|

Net assets, end of period ($ millions)

|

2 | 3 | 6 | 6 | 4 | 14 | |||||||||||||||||||

|

Ratio of expenses before expense reductions (%)

|

2.66 | * | 2.53 | 2.55 | 2.72 | 2.50 | 2.47 | ||||||||||||||||||

|

Ratio of expenses after expense reductions (%)

|

2.46 | * | 2.52 | 2.55 | 2.72 | 2.50 | 2.47 | ||||||||||||||||||

|

Ratio of net investment income (loss) (%)

|

.83 | * | .58 | .05 | .38 | (.48 | ) | (.35 | ) | ||||||||||||||||

|

Portfolio turnover rate (%)

|

70 | ** | 35 | 37 | 95 | 37 | 62 | ||||||||||||||||||

|

a Based on average shares outstanding during the period.

b Total return does not reflect the effect of any sales charges.

c Total return would have been lower had certain expenses not been reduced.

* Annualized

** Not annualized

*** Amount is less than $.005.

|

|||||||||||||||||||||||||

|

Years Ended October 31,

|

|||||||||||||||||||||||||

|

Class C

|

|

Six Months Ended 4/30/12 (Unaudited)

|

2011

|

2010

|

2009

|

2008

|

2007

|

||||||||||||||||||

|

Selected Per Share Data

|

|||||||||||||||||||||||||

|

Net asset value, beginning of period

|

$ | 42.71 | $ | 53.58 | $ | 46.46 | $ | 31.12 | $ | 85.56 | $ | 56.96 | |||||||||||||

|

Income (loss) from investment operations:

Net investment income (loss)a

|

.20 | .28 | .05 | .15 | (.30 | ) | (.23 | ) | |||||||||||||||||

|

Net realized and unrealized gain (loss)

|

.64 | (7.88 | ) | 7.84 | 18.62 | (42.54 | ) | 35.70 | |||||||||||||||||

|

Total from investment operations

|

.84 | (7.60 | ) | 7.89 | 18.77 | (42.84 | ) | 35.47 | |||||||||||||||||

|

Less distributions from:

Net investment income

|

— | (.91 | ) | (.77 | ) | — | — | — | |||||||||||||||||

|

Net realized gains

|

(3.83 | ) | (2.36 | ) | — | (3.43 | ) | (11.61 | ) | (6.87 | ) | ||||||||||||||

|

Total distributions

|

(3.83 | ) | (3.27 | ) | (.77 | ) | (3.43 | ) | (11.61 | ) | (6.87 | ) | |||||||||||||

|

Redemption fees

|

.00 | *** | .00 | *** | .00 | *** | .00 | *** | .01 | .00 | *** | ||||||||||||||

|

Net asset value, end of period

|

$ | 39.72 | $ | 42.71 | $ | 53.58 | $ | 46.46 | $ | 31.12 | $ | 85.56 | |||||||||||||

|

Total Return (%)b

|

2.70 | c** | (15.12 | )c | 17.12 | 69.27 | (57.55 | ) | 68.97 | ||||||||||||||||

|

Ratios to Average Net Assets and Supplemental Data

|

|||||||||||||||||||||||||

|

Net assets, end of period ($ millions)

|

6 | 7 | 11 | 12 | 9 | 29 | |||||||||||||||||||

|

Ratio of expenses before expense reductions (%)

|

2.57 | * | 2.53 | 2.56 | 2.75 | 2.49 | 2.48 | ||||||||||||||||||

|

Ratio of expenses after expense reductions (%)

|

2.46 | * | 2.53 | 2.56 | 2.75 | 2.49 | 2.48 | ||||||||||||||||||

|

Ratio of net investment income (loss) (%)

|

.98 | * | .57 | .04 | .34 | (.47 | ) | (.36 | ) | ||||||||||||||||

|

Portfolio turnover rate (%)

|

70 | ** | 35 | 37 | 95 | 37 | 62 | ||||||||||||||||||

|

a Based on average shares outstanding during the period.

b Total return does not reflect the effect of any sales charges.

c Total return would have been lower had certain expenses not been reduced.

* Annualized

** Not annualized

*** Amount is less than $.005.

|

|||||||||||||||||||||||||

|

Years Ended October 31,

|

|||||||||||||||||||||||||

|

Class S

|

|

Six Months Ended 4/30/12 (Unaudited)

|

2011

|

2010

|

2009

|

2008

|

2007

|

||||||||||||||||||

|

Selected Per Share Data

|

|||||||||||||||||||||||||

|

Net asset value, beginning of period

|

$ | 43.86 | $ | 55.00 | $ | 47.89 | $ | 32.03 | $ | 87.36 | $ | 57.90 | |||||||||||||

|

Income (loss) from investment operations:

Net investment income (loss)a

|

.42 | .84 | .58 | .56 | .39 | .44 | |||||||||||||||||||

|

Net realized and unrealized gain (loss)

|

.65 | (8.08 | ) | 8.12 | 19.14 | (43.66 | ) | 36.34 | |||||||||||||||||

|

Total from investment operations

|

1.07 | (7.24 | ) | 8.70 | 19.70 | (43.27 | ) | 36.78 | |||||||||||||||||

|

Less distributions from:

Net investment income

|

(.16 | ) | (1.54 | ) | (1.59 | ) | (.41 | ) | (.45 | ) | (.45 | ) | |||||||||||||

|

Net realized gains

|

(3.83 | ) | (2.36 | ) | — | (3.43 | ) | (11.61 | ) | (6.87 | ) | ||||||||||||||

|

Total distributions

|

(3.99 | ) | (3.90 | ) | (1.59 | ) | (3.84 | ) | (12.06 | ) | (7.32 | ) | |||||||||||||

|

Redemption fees

|

.00 | *** | .00 | *** | .00 | *** | .00 | *** | .00 | *** | .00 | *** | |||||||||||||

|

Net asset value, end of period

|

$ | 40.94 | $ | 43.86 | $ | 55.00 | $ | 47.89 | $ | 32.03 | $ | 87.36 | |||||||||||||

|

Total Return (%)

|

3.24 | ** | (14.19 | ) | 18.45 | 71.37 | (57.08 | ) | 70.72 | ||||||||||||||||

|

Ratios to Average Net Assets and Supplemental Data

|

|||||||||||||||||||||||||

|

Net assets, end of period ($ millions)

|

558 | 565 | 738 | 697 | 433 | 1,137 | |||||||||||||||||||

|

Ratio of expenses (%)

|

1.46 | * | 1.42 | 1.43 | 1.47 | 1.44 | 1.45 | ||||||||||||||||||

|

Ratio of net investment income (%)

|

2.02 | * | 1.71 | 1.16 | 1.62 | .58 | .67 | ||||||||||||||||||

|

Portfolio turnover rate (%)

|

70 | ** | 35 | 37 | 95 | 37 | 62 | ||||||||||||||||||

|

a Based on average shares outstanding during the period.

* Annualized

** Not annualized

*** Amount is less than $.005.

|

|||||||||||||||||||||||||

|

First $400 million of the Fund's average daily net assets

|

1.165 | % | ||

|

Next $400 million of such net assets

|

1.065 | % | ||

|

Over $800 million of such net assets

|

.965 | % |

|

Class A

|

1.71%

|

|

Class B

|

2.46%

|

|

Class C

|

2.46%

|

|

Services to Shareholders

|

Total Aggregated

|

Waived

|

Unpaid at April 30, 2012

|

|||||||||

|

Class A

|

$ | 15,463 | $ | 13,711 | $ | 1,752 | ||||||

|

Class B

|

1,661 | 1,661 | — | |||||||||

|

Class C

|

2,442 | 2,442 | — | |||||||||

|

Class S

|

189,680 | — | 65,198 | |||||||||

| $ | 209,246 | $ | 17,814 | $ | 66,950 | |||||||

|

Distribution Fee

|

Total Aggregated

|

Unpaid at April 30, 2012

|

||||||

|

Class B

|

$ | 10,091 | $ | 1,358 | ||||

|

Class C

|

24,991 | 3,930 | ||||||

| $ | 35,082 | $ | 5,288 | |||||

|

Service Fee

|

Total Aggregated

|

Waived

|

Unpaid at April 30, 2012

|

Annualized Effective Rate

|

||||||||||||

|

Class A

|

$ | 42,128 | $ | — | $ | 12,587 | .25 | % | ||||||||

|

Class B

|

3,337 | 964 | 923 | .18 | % | |||||||||||

|

Class C

|

8,304 | 1,179 | 2,520 | .21 | % | |||||||||||

| $ | 53,769 | $ | 2,143 | $ | 16,030 | |||||||||||

|

Six Months Ended April 30, 2012

|

Year Ended October 31, 2011

|

|||||||||||||||

|

Shares

|

Dollars

|

Shares

|

Dollars

|

|||||||||||||

|

Shares sold

|

||||||||||||||||

|

Class A

|

173,706 | $ | 7,265,522 | 249,101 | $ | 12,355,425 | ||||||||||

|

Class B

|

103 | 4,164 | 2,441 | 125,781 | ||||||||||||

|

Class C

|

6,681 | 268,999 | 21,685 | 1,050,889 | ||||||||||||

|

Class S

|

693,964 | 29,164,818 | 888,932 | 44,453,391 | ||||||||||||

| $ | 36,703,503 | $ | 57,985,486 | |||||||||||||

|

Shares issued to shareholders in reinvestment of distributions

|

||||||||||||||||

|

Class A

|

70,465 | $ | 2,666,394 | 64,734 | $ | 3,340,285 | ||||||||||

|

Class B

|

6,686 | 245,654 | 6,758 | 342,032 | ||||||||||||

|

Class C

|

15,587 | 572,504 | 12,182 | 616,267 | ||||||||||||

|

Class S

|

1,259,082 | 47,505,156 | 945,920 | 48,696,171 | ||||||||||||

| $ | 50,989,708 | $ | 52,994,755 | |||||||||||||

|

Shares redeemed

|

||||||||||||||||

|

Class A

|

(270,561 | ) | $ | (11,187,979 | ) | (576,632 | ) | $ | (28,905,583 | ) | ||||||

|

Class B

|

(32,424 | ) | (1,307,202 | ) | (43,598 | ) | (2,045,248 | ) | ||||||||

|

Class C

|

(34,361 | ) | (1,368,529 | ) | (72,039 | ) | (3,484,390 | ) | ||||||||

|

Class S

|

(1,217,866 | ) | (50,620,063 | ) | (2,377,411 | ) | (118,226,379 | ) | ||||||||

| $ | (64,483,773 | ) | $ | (152,661,600 | ) | |||||||||||

|

Redemption fees

|

$ | 33,582 | $ | 37,652 | ||||||||||||

|

Net increase (decrease)

|

||||||||||||||||

|

Class A

|

(26,390 | ) | $ | (1,223,799 | ) | (262,797 | ) | $ | (13,175,255 | ) | ||||||

|

Class B

|

(25,635 | ) | (1,057,384 | ) | (34,399 | ) | (1,577,435 | ) | ||||||||

|

Class C

|

(12,093 | ) | (527,026 | ) | (38,172 | ) | (1,817,230 | ) | ||||||||

|

Class S

|

735,180 | 26,051,229 | (542,559 | ) | (25,073,787 | ) | ||||||||||

| $ | 23,243,020 | $ | (41,643,707 | ) | ||||||||||||

|

Expenses and Value of a $1,000 Investment for the six months ended April 30, 2012 (Unaudited)

|

||||||||||||||||

|

Actual Fund Return

|

Class A

|

Class B

|

Class C

|

Class S

|

||||||||||||

|

Beginning Account Value 11/1/11

|

$ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | ||||||||

|

Ending Account Value 4/30/12

|

$ | 1,030.80 | $ | 1,027.20 | $ | 1,027.00 | $ | 1,032.40 | ||||||||

|

Expenses Paid per $1,000*

|

$ | 8.63 | $ | 12.40 | $ | 12.40 | $ | 7.38 | ||||||||

|

Hypothetical 5% Fund Return

|

Class A

|

Class B

|

Class C

|

Class S

|

||||||||||||

|

Beginning Account Value 11/1/11

|

$ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | ||||||||

|

Ending Account Value 4/30/12

|

$ | 1,016.36 | $ | 1,012.63 | $ | 1,012.63 | $ | 1,017.60 | ||||||||

|

Expenses Paid per $1,000*

|

$ | 8.57 | $ | 12.31 | $ | 12.31 | $ | 7.32 | ||||||||

|

Annualized Expense Ratios

|

Class A

|

Class B

|

Class C

|

Class S

|

|

DWS Latin America Equity Fund

|

1.71%

|

2.46%

|

2.46%

|

1.46%

|

|

For More Information

|

The automated telephone system allows you to access personalized account information and obtain information on other DWS funds using either your voice or your telephone keypad. Certain account types within Classes A, B, C and S also have the ability to purchase, exchange or redeem shares using this system.

For more information, contact your financial advisor. You may also access our automated telephone system or speak with a DWS Investments representative by calling the appropriate number below:

For shareholders of Classes A, B and C:

(800) 621-1048

For shareholders of Class S:

(800) 728-3337

|

|

|

Web Site

|

www.dws-investments.com

View your account transactions and balances, trade shares, monitor your asset allocation, and change your address, 24 hours a day.

Obtain prospectuses and applications, blank forms, interactive worksheets, news about DWS funds, subscription to fund updates by e-mail, retirement planning information, and more.

|

|

|

Written Correspondence

|

DWS Investments

PO Box 219151

Kansas City, MO 64121-9151

|

|

|

Proxy Voting

|

The fund's policies and procedures for voting proxies for portfolio securities and information about how the fund voted proxies related to its portfolio securities during the 12-month period ended June 30 are available on our Web site — www.dws-investments.com (click on "proxy voting"at the bottom of the page) — or on the SEC's Web site — www.sec.gov. To obtain a written copy of the fund's policies and procedures without charge, upon request, call us toll free at (800) 621-1048.

|

|

|

Portfolio Holdings

|

Following the fund's fiscal first and third quarter-end, a complete portfolio holdings listing is filed with the SEC on Form N-Q. This form will be available on the SEC's Web site at www.sec.gov, and it also may be reviewed and copied at the SEC's Public Reference Room in Washington, D.C. Information on the operation of the SEC's Public Reference Room may be obtained by calling (800) SEC-0330. The fund's portfolio holdings are also posted on www.dws-investments.com from time to time. Please see the fund's current prospectus for more information.

|

|

|

Principal Underwriter

|

If you have questions, comments or complaints, contact:

DWS Investments Distributors, Inc.

222 South Riverside Plaza

Chicago, IL 60606-5808

(800) 621-1148

|

|

|

Investment Management

|

Deutsche Investment Management Americas Inc. ("DIMA" or the "Advisor"), which is part of Deutsche Asset Management, is the investment advisor for the fund. DIMA and its predecessors have more than 80 years of experience managing mutual funds and DIMA provides a full range of investment advisory services to both institutional and retail clients.

DIMA is an indirect, wholly owned subsidiary of Deutsche Bank AG. Deutsche Bank AG is a major global banking institution engaged in a wide variety of financial services, including investment management, retail, private and commercial banking, investment banking and insurance.

DWS Investments is the retail brand name in the U.S. for the asset management activities of Deutsche Bank AG and DIMA. As such, DWS is committed to delivering the investing expertise, insight and resources of this global investment platform to American investors.

|

|

|

Class A

|

Class B

|

Class C

|

Class S

|

||

|

Nasdaq Symbol

|

SLANX

|

SLAOX

|

SLAPX

|

SLAFX

|

|

|

CUSIP Number

|

23337R 775

|

23337R 767

|

23337R 759

|

23337R 726

|

|

|

Fund Number

|

474

|

674

|

774

|

2074

|

|

FACTS

|

What Does DWS Investments Do With Your Personal Information?

|

|

|

Why?

|

Financial companies choose how they share your personal information. Federal law gives consumers the right to limit some but not all sharing. Federal law also requires us to tell you how we collect, share and protect your personal information. Please read this notice carefully to understand what we do.

|

|

|

What?

|

The types of personal information we collect and share can include:

• Social Security number

• Account balances

• Purchase and transaction history

• Bank account information

• Contact information such as mailing address, e-mail address and telephone number

|

|

|

How?

|

All financial companies need to share customers' personal information to run their everyday business. In the section below, we list the reasons financial companies can share their customers' personal information, the reasons DWS Investments chooses to share and whether you can limit this sharing.

|

|

Reasons we can share your personal information

|

Does DWS Investments share?

|

Can you limit this sharing?

|

|

For our everyday business purposes — such as to process your transactions, maintain your account(s), respond to court orders or legal investigations

|

Yes

|

No

|

|

For our marketing purposes — to offer our products and services to you

|

Yes

|

No

|

|

For joint marketing with other financial companies

|

No

|

We do not share

|

|

For our affiliates' everyday business purposes — information about your transactions and experiences

|

No

|

We do not share

|

|

For our affiliates' everyday business purposes — information about your creditworthiness

|

No

|

We do not share

|

|

For non-affiliates to market to you

|

No

|

We do not share

|

|

Questions?

|

Call (800) 621-1048 or e-mail us at dws-investments.info@dws.com

|

|

Who we are

|

||

|

Who is providing this notice?

|

DWS Investments Distributors, Inc.; Deutsche Investment Management Americas Inc.; DeAM Investor Services, Inc.; DWS Trust Company; the DWS Funds

|

|

|

What we do

|

||

|

How does DWS Investments protect my personal information?

|

To protect your personal information from unauthorized access and use, we use security measures that comply with federal law. These measures include computer safeguards and secured files and buildings.

|

|

|

How does DWS Investments collect my personal information?

|

We collect your personal information, for example. When you:

• open an account

• give us your contact information

• provide bank account information for ACH or wire transactions

• tell us where to send money

• seek advice about your investments

|

|

|

Why can't I limit all sharing?

|

Federal law gives you the right to limit only

• sharing for affiliates' everyday business purposes — information about your creditworthiness

• affiliates from using your information to market to you

• sharing for nonaffiliates to market to you

State laws and individual companies may give you additional rights to limit sharing.

|

|

|

Definitions

|

||

|

Affiliates

|

Companies related by common ownership or control. They can be financial or non-financial companies. Our affiliates include financial companies with the DWS or Deutsche Bank ("DB") name, such as DB AG Frankfurt and DB Alex Brown.

|

|

|

Non-affiliates

|

Companies not related by common ownership or control. They can be financial and non-financial companies.

Non-affiliates we share with include account service providers, service quality monitoring services, mailing service providers and verification services to help in the fight against money laundering and fraud.

|

|

|

Joint marketing

|

A formal agreement between non-affiliated financial companies that together market financial products or services to you. DWS Investments does not jointly market.

|

|

|

Rev. 09/2011

|

||

|

ITEM 2.

|

CODE OF ETHICS

|

|

|

Not applicable.

|

||

|

ITEM 3.

|

AUDIT COMMITTEE FINANCIAL EXPERT

|

|

|

Not applicable

|

||

|

ITEM 4.

|

PRINCIPAL ACCOUNTANT FEES AND SERVICES

|

|

|

Not applicable

|

||

|

ITEM 5.

|

AUDIT COMMITTEE OF LISTED REGISTRANTS

|

|

|

Not applicable

|

||

|

ITEM 6.

|

SCHEDULE OF INVESTMENTS

|

|

|

Not applicable

|

||

|

ITEM 7.

|

DISCLOSURE OF PROXY VOTING POLICIES AND PROCEDURES FOR CLOSED-END MANAGEMENT INVESTMENT COMPANIES

|

|

|

Not applicable

|

||

|

ITEM 8.

|

PORTFOLIO MANAGERS OF CLOSED-END MANAGEMENT INVESTMENT COMPANIES

|

|

|

Not applicable

|

||

|

ITEM 9.

|

PURCHASES OF EQUITY SECURITIES BY CLOSED-END MANAGEMENT INVESTMENT COMPANY AND AFFILIATED PURCHASERS

|

|

|

Not applicable

|

||

|

ITEM 10.

|

SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

|

|

|

There were no material changes to the procedures by which shareholders may recommend nominees to the Fund’s Board. The primary function of the Nominating and Governance Committee is to identify and recommend individuals for membership on the Board and oversee the administration of the Board Governance Guidelines. Shareholders may recommend candidates for Board positions by forwarding their correspondence by U.S. mail or courier service to Paul K. Freeman, Independent Chairman, DWS Funds, P.O. Box 101833, Denver, CO 80250-1833.

|

||

|

ITEM 11.

|

CONTROLS AND PROCEDURES

|

|

|

(a)

|

The Chief Executive and Financial Officers concluded that the Registrant’s Disclosure Controls and Procedures are effective based on the evaluation of the Disclosure Controls and Procedures as of a date within 90 days of the filing date of this report.

|

|

|

(b)

|

There have been no changes in the registrant’s internal control over financial reporting that occurred during the second fiscal quarter of the period covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant’s internal controls over financial reporting.

|

|

|

ITEM 12.

|

EXHIBITS

|

|

|

(a)(1)

|

Certification pursuant to Rule 30a-2(a) under the Investment Company Act of 1940 (17 CFR 270.30a-2(a)) is filed and attached hereto as Exhibit 99.CERT.

|

|

|

(b)

|

Certification pursuant to Rule 30a-2(b) under the Investment Company Act of 1940 (17 CFR 270.30a-2(b)) is furnished and attached hereto as Exhibit 99.906CERT.

|

|

|

Registrant:

|

DWS Latin America Equity Fund, a series of DWS International Fund, Inc.

|

|

By:

|

/s/W. Douglas Beck

W. Douglas Beck

President

|

|

Date:

|

June 27, 2012

|

|

By:

|

/s/W. Douglas Beck

W. Douglas Beck

President

|

|

Date:

|

June 27, 2012

|

|

By:

|

/s/Paul Schubert

Paul Schubert

Chief Financial Officer and Treasurer

|

|

Date:

|

June 27, 2012

|