UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM N-CSRS

Investment Company Act file number: 811-00642

DWS International Fund, Inc.

(Exact Name of Registrant as Specified in Charter)

345 Park Avenue

New York, NY 10154-0004

(Address of Principal Executive Offices) (Zip Code)

Registrant’s Telephone Number, including Area Code: (212) 250-3220

Paul Schubert

60 Wall Street

New York, NY 10005

(Name and Address of Agent for Service)

|

Date of fiscal year end:

|

10/31

|

|

Date of reporting period:

|

4/30/2012

|

|

ITEM 1.

|

REPORT TO STOCKHOLDERS

|

|

APRIL 30, 2012

Semiannual Report

to Shareholders

|

|

DWS Diversified International Equity Fund

|

|

Contents

|

4 Performance Summary

7 Portfolio Summary

9 Investment Portfolio

23 Statement of Assets and Liabilities

25 Statement of Operations

26 Statement of Changes in Net Assets

27 Financial Highlights

33 Notes to Financial Statements

43 Information About Your Fund's Expenses

45 Summary of Management Fee Evaluation by Independent Fee Consultant

49 Account Management Resources

51 Privacy Statement

|

This report must be preceded or accompanied by a prospectus. To obtain a summary prospectus, if available, or prospectus for any of our funds, refer to the Account Management Resources information provided in the back of this booklet. We advise you to consider the fund's objectives, risks, charges and expenses carefully before investing. The summary prospectus and prospectus contain this and other important information about the fund. Please read the prospectus carefully before you invest.

Investing in derivatives entails special risks relating to liquidity, leverage and credit that may reduce returns and/or increase volatility. Investing in foreign securities, particularly those of emerging markets, presents certain risks, such as currency fluctuations, political and economic changes, and market risks. The fund may lend securities to approved institutions. Stocks may decline in value. See the prospectus for details.

DWS Investments is part of Deutsche Bank's Asset Management division and, within the U.S., represents the retail asset management activities of Deutsche Bank AG, Deutsche Bank Trust Company Americas, Deutsche Investment Management Americas Inc. and DWS Trust Company.

NOT FDIC/NCUA INSURED NO BANK GUARANTEE MAY LOSE VALUE NOT A DEPOSIT NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

|

Average Annual Total Returns as of 4/30/12

|

|||||

|

Unadjusted for Sales Charge

|

6-Month‡

|

1-Year

|

3-Year

|

5-Year

|

10-Year

|

|

Class A

|

2.89%

|

-13.87%

|

12.21%

|

-5.86%

|

3.80%

|

|

Class B

|

2.43%

|

-14.58%

|

11.39%

|

-6.58%

|

3.01%

|

|

Class C

|

2.60%

|

-14.57%

|

11.32%

|

-6.57%

|

3.00%

|

|

MSCI EAFE Index+

|

2.44%

|

-12.82%

|

11.78%

|

-4.72%

|

5.42%

|

|

Adjusted for the Maximum Sales Charge

|

|||||

|

Class A (max 5.75% load)

|

-3.03%

|

-18.83%

|

10.02%

|

-6.97%

|

3.19%

|

|

Class B (max 4.00% CDSC)

|

-1.57%

|

-17.10%

|

10.85%

|

-6.72%

|

3.01%

|

|

Class C (max 1.00% CDSC)

|

1.60%

|

-14.57%

|

11.32%

|

-6.57%

|

3.00%

|

|

MSCI EAFE Index+

|

2.44%

|

-12.82%

|

11.78%

|

-4.72%

|

5.42%

|

|

No Sales Charges

|

|||||

|

Class R

|

2.88%

|

-13.96%

|

12.06%

|

-5.94%

|

3.61%

|

|

Class S

|

3.02%

|

-13.63%

|

12.51%

|

-5.57%

|

4.01%

|

|

Institutional Class

|

3.10%

|

-13.64%

|

12.62%

|

-5.47%

|

4.15%

|

|

MSCI EAFE Index+

|

2.44%

|

-12.82%

|

11.78%

|

-4.72%

|

5.42%

|

‡ Total returns shown for periods less than one year are not annualized.

|

Average Annual Total Returns as of 3/31/12 (most recent calendar quarter end)

|

||||

|

Unadjusted for Sales Charge

|

1-Year

|

3-Year

|

5-Year

|

10-Year

|

|

Class A

|

-7.36%

|

16.08%

|

-4.68%

|

4.15%

|

|

Class B

|

-8.13%

|

15.21%

|

-5.39%

|

3.35%

|

|

Class C

|

-7.99%

|

15.22%

|

-5.39%

|

3.35%

|

|

MSCI EAFE Index+

|

-5.77%

|

17.13%

|

-3.51%

|

5.65%

|

|

Adjusted for the Maximum Sales Charge

|

||||

|

Class A (max 5.75% load)

|

-12.69%

|

13.81%

|

-5.80%

|

3.53%

|

|

Class B (max 4.00% CDSC)

|

-10.85%

|

14.71%

|

-5.53%

|

3.35%

|

|

Class C (max 1.00% CDSC)

|

-7.99%

|

15.22%

|

-5.39%

|

3.35%

|

|

MSCI EAFE Index+

|

-5.77%

|

17.13%

|

-3.51%

|

5.65%

|

|

No Sales Charges

|

||||

|

Class R

|

-7.65%

|

15.89%

|

-4.77%

|

3.95%

|

|

Class S

|

-7.14%

|

16.36%

|

-4.38%

|

4.35%

|

|

Institutional Class

|

-7.04%

|

16.61%

|

-4.26%

|

4.50%

|

|

MSCI EAFE Index+

|

-5.77%

|

17.13%

|

-3.51%

|

5.65%

|

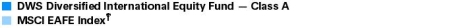

Performance in the Average Annual Total Returns table(s) above and the Growth of an Assumed $10,000 Investment line graph that follows is historical and does not guarantee future results. Investment return and principal fluctuate, so your shares may be worth more or less when redeemed. Current performance may differ from performance data shown. Please visit www.dws-investments.com for the Fund's most recent month-end performance. Fund performance includes reinvestment of all distributions. Unadjusted returns do not reflect sales charges and would have been lower if they had.

The gross expense ratios of the Fund, as stated in the fee table of the prospectus dated February 1, 2012 are 1.73%, 2.52%, 2.48%, 1.98%, 1.50% and 1.29% for Class A, Class B, Class C, Class R, Class S and Institutional Class shares, respectively, and may differ from the expense ratios disclosed in the Financial Highlights tables in this report.

The Fund may charge a 2% fee for redemptions of shares held less than 15 days.

Index returns do not reflect any fees or expenses and it is not possible to invest directly into an index.

Performance figures do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Returns shown for Class R shares prior to their inception on July 1, 2003 and for Class S shares prior to their inception on February 28, 2005 are derived from the historical performance of Institutional Class shares of the predecessor Fund's original share class during such periods and have been adjusted to reflect the different total annual operating expenses of each specific class. Any difference in expenses will affect performance.

|

Growth of an Assumed $10,000 Investment (Adjusted for Maximum Sales Charge)

|

|

|

|

Yearly periods ended April 30

|

The Fund's growth of an assumed $10,000 investment is adjusted for the maximum sales charge of 5.75%. This results in a net initial investment of $9,425.

The growth of $10,000 is cumulative.

Performance of other share classes will vary based on the sales charges and the fee structure of those classes.

+ MSCI EAFE Index (Europe, Australia, Far East) tracks the performance of stocks in select developed markets outside of the United States. The index is calculated using closing local market prices and translates into U.S. dollars using the London close foreign exchange rates.

|

Net Asset Value and Distribution Information

|

||||||||||||||||||||||||

|

Class A

|

Class B

|

Class C

|

Class R

|

Class S

|

Institutional Class

|

|||||||||||||||||||

|

Net Asset Value:

4/30/12

|

$ | 6.78 | $ | 6.55 | $ | 6.55 | $ | 6.60 | $ | 6.58 | $ | 6.58 | ||||||||||||

|

10/31/11

|

$ | 6.73 | $ | 6.48 | $ | 6.47 | $ | 6.54 | $ | 6.54 | $ | 6.55 | ||||||||||||

|

Distribution Information:

Six Months as of 4/30/12:

Income Dividends

|

$ | .13 | $ | .08 | $ | .08 | $ | .12 | $ | .15 | $ | .16 | ||||||||||||

|

Morningstar Rankings — Foreign Large Blend Funds Category as of 4/30/12

|

||||

|

Period

|

Rank

|

Number of Fund Classes Tracked

|

Percentile Ranking (%)

|

|

|

Class A

1-Year

|

537

|

of

|

798

|

67

|

|

3-Year

|

391

|

of

|

722

|

54

|

|

5-Year

|

456

|

of

|

560

|

81

|

|

10-Year

|

234

|

of

|

312

|

75

|

|

Class B

1-Year

|

628

|

of

|

798

|

78

|

|

3-Year

|

498

|

of

|

722

|

69

|

|

5-Year

|

490

|

of

|

560

|

87

|

|

10-Year

|

269

|

of

|

312

|

86

|

|

Class C

1-Year

|

626

|

of

|

798

|

78

|

|

3-Year

|

505

|

of

|

722

|

70

|

|

5-Year

|

489

|

of

|

560

|

87

|

|

10-Year

|

270

|

of

|

312

|

86

|

|

Class R

1-Year

|

552

|

of

|

798

|

69

|

|

3-Year

|

419

|

of

|

722

|

58

|

|

5-Year

|

460

|

of

|

560

|

82

|

|

Class S

1-Year

|

494

|

of

|

798

|

62

|

|

3-Year

|

342

|

of

|

722

|

47

|

|

5-Year

|

433

|

of

|

560

|

77

|

|

Institutional Class

1-Year

|

497

|

of

|

798

|

62

|

|

3-Year

|

334

|

of

|

722

|

46

|

|

5-Year

|

426

|

of

|

560

|

76

|

|

10-Year

|

212

|

of

|

312

|

68

|

Source: Morningstar, Inc. Rankings are historical and do not guarantee future results. Rankings are based on total return unadjusted for sales charges with distributions reinvested. If sales charges had been included, rankings might have been less favorable.

|

Ten Largest Common Stocks at April 30, 2012 (13.3% of Net Assets)

|

Country

|

Percent

|

|

1. Swisscom AG

Operates in public telecommunications networks and application services

|

Switzerland

|

1.7%

|

|

2. ASML Holding NV

Developer of photolithography projection systems

|

Netherlands

|

1.7%

|

|

3. Nestle SA

A multinational company that markets a wide range of food products

|

Switzerland

|

1.6%

|

|

4. Sanofi

Manufactures prescription pharmaceuticals

|

France

|

1.5%

|

|

5. CRH PLC

Manufactures building materials

|

Ireland

|

1.4%

|

|

6. Valeant Pharmaceuticals International, Inc.

Develops drugs for unmet medical needs

|

Canada

|

1.4%

|

|

7. Novo Nordisk AS

Develops, produces and markets pharmaceutical products

|

Denmark

|

1.2%

|

|

8. GlaxoSmithKline PLC

Develops, manufactures and markets vaccines and medicines

|

United Kingdom

|

1.0%

|

|

9. UPM-Kummene Oyj

Manufactures forest products

|

Finland

|

0.9%

|

|

10. Telecom Italia SpA

Offers fixed-line and mobile telephone and data transmission services

|

Italy

|

0.9%

|

|

Portfolio holdings and characteristics are subject to change.

|

||

|

Shares

|

Value ($)

|

|||||||

|

Common Stocks 87.1%

|

||||||||

|

Australia 3.8%

|

||||||||

|

AGL Energy Ltd.

|

18,040 | 281,053 | ||||||

|

APA Group

|

12,159 | 65,746 | ||||||

|

Asciano Ltd.

|

12,022 | 58,905 | ||||||

|

Australia & New Zealand Banking Group Ltd.

|

3,616 | 89,736 | ||||||

|

BHP Billiton Ltd.

|

4,759 | 176,663 | ||||||

|

Brambles Ltd.

|

13,753 | 103,453 | ||||||

|

Cochlear Ltd.

|

514 | 35,045 | ||||||

|

Commonwealth Bank of Australia

|

1,944 | 104,931 | ||||||

|

Crown Ltd.

|

11,044 | 104,618 | ||||||

|

CSL Ltd.

|

5,205 | 198,364 | ||||||

|

Echo Entertainment Group Ltd.

|

8,537 | 39,845 | ||||||

|

Fairfax Media Ltd.

|

50,627 | 36,313 | ||||||

|

Leighton Holdings Ltd.

|

1,931 | 41,202 | ||||||

|

National Australia Bank Ltd.

|

3,004 | 78,694 | ||||||

|

Newcrest Mining Ltd.

|

1,515 | 41,461 | ||||||

|

Origin Energy Ltd.

|

7,150 | 98,434 | ||||||

|

QBE Insurance Group Ltd.

|

1,905 | 27,390 | ||||||

|

QR National Ltd.

|

17,104 | 64,794 | ||||||

|

Rio Tinto Ltd.

|

870 | 60,050 | ||||||

|

Santos Ltd.

|

6,285 | 91,737 | ||||||

|

Sonic Healthcare Ltd.

|

4,722 | 61,888 | ||||||

|

SP Ausnet

|

57,595 | 66,267 | ||||||

|

TABCORP Holdings Ltd.

|

15,831 | 47,318 | ||||||

|

Tatts Group Ltd.

|

37,226 | 99,683 | ||||||

|

Telstra Corp., Ltd.

|

72,082 | 265,690 | ||||||

|

Toll Holdings Ltd.

|

8,188 | 49,948 | ||||||

|

Transurban Group (Units)

|

11,448 | 69,822 | ||||||

|

Wesfarmers Ltd.

|

3,273 | 102,922 | ||||||

|

Westfield Group (REIT) (Units)

|

5,187 | 49,749 | ||||||

|

Westpac Banking Corp.

|

3,187 | 75,414 | ||||||

|

Woodside Petroleum Ltd.

|

4,096 | 148,844 | ||||||

|

Woolworths Ltd.

|

3,723 | 100,457 | ||||||

|

WorleyParsons Ltd.

|

1,661 | 48,869 | ||||||

|

(Cost $2,086,643)

|

2,985,305 | |||||||

|

Austria 0.4%

|

||||||||

|

Erste Group Bank AG (a)

|

5,613 | 129,166 | ||||||

|

Immofinanz AG*

|

22,979 | 80,780 | ||||||

|

Raiffeisen Bank International AG (a)

|

1,343 | 44,576 | ||||||

|

Vienna Insurance Group AG Wiener Versicherung Gruppe

|

1,439 | 58,654 | ||||||

|

(Cost $273,635)

|

313,176 | |||||||

|

Belgium 1.1%

|

||||||||

|

Ageas (a)

|

55,815 | 101,489 | ||||||

|

Anheuser-Busch InBev NV (a)

|

3,672 | 265,230 | ||||||

|

Delhaize Group

|

688 | 33,504 | ||||||

|

Groupe Bruxelles Lambert SA (a)

|

1,396 | 96,831 | ||||||

|

KBC Groep NV (a)

|

4,115 | 79,708 | ||||||

|

Solvay SA (a)

|

1,280 | 156,053 | ||||||

|

Umicore SA (a)

|

2,459 | 133,495 | ||||||

|

(Cost $660,830)

|

866,310 | |||||||

|

Bermuda 0.1%

|

||||||||

|

Seadrill Ltd. (a) (Cost $28,856)

|

2,757 | 106,756 | ||||||

|

Canada 11.8%

|

||||||||

|

Alimentation Couche-Tard, Inc. "B"

|

3,800 | 164,833 | ||||||

|

Bank of Montreal (a)

|

1,400 | 83,148 | ||||||

|

Bank of Nova Scotia (a)

|

2,600 | 144,232 | ||||||

|

Barrick Gold Corp.

|

1,700 | 68,767 | ||||||

|

BCE, Inc. (a)

|

7,100 | 287,637 | ||||||

|

Bell Aliant, Inc.

|

4,000 | 105,927 | ||||||

|

Bombardier, Inc. "B"

|

21,700 | 91,822 | ||||||

|

Brookfield Asset Management, Inc. "A" (a)

|

1,600 | 52,801 | ||||||

|

CAE, Inc. (a)

|

3,800 | 41,545 | ||||||

|

Canadian Imperial Bank of Commerce (a)

|

1,000 | 75,447 | ||||||

|

Canadian National Railway Co. (a)

|

6,000 | 512,021 | ||||||

|

Canadian Natural Resources Ltd.

|

1,400 | 48,639 | ||||||

|

Canadian Pacific Railway Ltd. (a)

|

2,300 | 177,998 | ||||||

|

Canadian Tire Corp., Ltd. "A" (a)

|

1,800 | 125,891 | ||||||

|

Canadian Utilities Ltd. "A"

|

5,600 | 394,497 | ||||||

|

Cenovus Energy, Inc.

|

1,200 | 43,549 | ||||||

|

CGI Group, Inc. "A"*

|

17,900 | 401,724 | ||||||

|

Empire Co., Ltd. "A"

|

900 | 52,970 | ||||||

|

EnCana Corp. (a)

|

1,700 | 35,606 | ||||||

|

Finning International, Inc. (a)

|

2,700 | 75,436 | ||||||

|

First Quantum Minerals Ltd. (a)

|

1,000 | 20,772 | ||||||

|

Fortis, Inc. (a)

|

12,200 | 423,113 | ||||||

|

George Weston Ltd.

|

1,500 | 95,860 | ||||||

|

Gildan Activewear, Inc. (a)

|

2,700 | 77,760 | ||||||

|

Goldcorp, Inc. (a)

|

1,400 | 53,613 | ||||||

|

Imperial Oil Ltd. (a)

|

700 | 32,589 | ||||||

|

Loblaw Companies Ltd. (a)

|

3,100 | 104,657 | ||||||

|

Magna International, Inc. "A" (a)

|

4,968 | 217,710 | ||||||

|

Manulife Financial Corp. (a)

|

5,000 | 68,381 | ||||||

|

Metro, Inc. "A" (a)

|

2,900 | 159,994 | ||||||

|

National Bank of Canada (a)

|

500 | 39,024 | ||||||

|

Open Text Corp.*

|

4,600 | 257,881 | ||||||

|

Potash Corp. of Saskatchewan, Inc. (a)

|

1,502 | 63,839 | ||||||

|

Research In Motion Ltd.*

|

37,200 | 532,101 | ||||||

|

Ritchie Bros. Auctioneers, Inc. (a)

|

1,700 | 35,967 | ||||||

|

Rogers Communications, Inc. "B" (a)

|

10,600 | 395,629 | ||||||

|

Royal Bank of Canada (a)

|

3,500 | 202,273 | ||||||

|

Saputo, Inc. (a)

|

3,600 | 168,256 | ||||||

|

Shaw Communications, Inc. "B" (a)

|

8,400 | 173,127 | ||||||

|

Shoppers Drug Mart Corp. (a)

|

5,500 | 236,959 | ||||||

|

Silver Wheaton Corp. (a)

|

900 | 27,478 | ||||||

|

SNC-Lavalin Group, Inc. (a)

|

2,300 | 86,473 | ||||||

|

Sun Life Financial, Inc. (a)

|

1,800 | 44,132 | ||||||

|

Suncor Energy, Inc.

|

2,432 | 80,332 | ||||||

|

Talisman Energy, Inc. (a)

|

1,600 | 20,926 | ||||||

|

Teck Resources Ltd. "B"

|

1,400 | 52,239 | ||||||

|

Telus Corp.

|

2,100 | 126,083 | ||||||

|

Telus Corp. (Non-Voting Shares) (a)

|

4,200 | 246,469 | ||||||

|

Thomson Reuters Corp. (b)

|

1,660 | 49,501 | ||||||

|

Thomson Reuters Corp. (a) (b)

|

6,300 | 188,263 | ||||||

|

Tim Hortons, Inc.

|

3,900 | 225,113 | ||||||

|

Toronto-Dominion Bank (a)

|

2,300 | 194,389 | ||||||

|

TransAlta Corp. (a)

|

13,500 | 223,850 | ||||||

|

Valeant Pharmaceuticals International, Inc.*

|

19,000 | 1,056,891 | ||||||

|

Viterra, Inc.

|

10,900 | 175,552 | ||||||

|

Yamana Gold, Inc.

|

1,700 | 24,936 | ||||||

|

(Cost $8,658,200)

|

9,166,622 | |||||||

|

Denmark 2.8%

|

||||||||

|

A P Moller-Maersk AS "A"

|

8 | 59,615 | ||||||

|

A P Moller-Maersk AS "B"

|

16 | 125,153 | ||||||

|

Carlsberg AS "B"

|

6,167 | 531,701 | ||||||

|

Coloplast AS "B"

|

217 | 40,156 | ||||||

|

Danske Bank AS*

|

20,132 | 326,876 | ||||||

|

DSV AS

|

2,944 | 67,051 | ||||||

|

Novo Nordisk AS "B"

|

6,250 | 920,150 | ||||||

|

Tryg AS

|

1,039 | 57,957 | ||||||

|

Vestas Wind Systems AS* (a)

|

2,490 | 21,983 | ||||||

|

(Cost $1,611,662)

|

2,150,642 | |||||||

|

Finland 3.0%

|

||||||||

|

Fortum Oyj (a)

|

13,126 | 282,224 | ||||||

|

Kone Oyj "B" (a)

|

2,231 | 138,093 | ||||||

|

Metso Corp. (a)

|

1,888 | 80,993 | ||||||

|

Nokia Oyj (a)

|

57,500 | 208,020 | ||||||

|

Pohjola Bank PLC

|

5,629 | 60,535 | ||||||

|

Sampo Oyj "A"

|

10,874 | 289,225 | ||||||

|

Stora Enso Oyj "R" (a)

|

60,396 | 412,699 | ||||||

|

UPM-Kymmene Oyj

|

56,432 | 724,030 | ||||||

|

Wartsila Oyj

|

2,523 | 102,065 | ||||||

|

(Cost $2,393,132)

|

2,297,884 | |||||||

|

France 6.5%

|

||||||||

|

Air Liquide SA (a)

|

1,579 | 203,254 | ||||||

|

Alcatel-Lucent* (a)

|

23,601 | 36,394 | ||||||

|

AtoS

|

863 | 55,522 | ||||||

|

AXA SA* (a)

|

5,702 | 80,718 | ||||||

|

BNP Paribas SA

|

2,608 | 104,714 | ||||||

|

Bouygues SA (a)

|

860 | 23,403 | ||||||

|

Cap Gemini

|

1,646 | 64,283 | ||||||

|

Carrefour SA (a)

|

4,963 | 99,725 | ||||||

|

Casino Guichard-Perrachon SA*

|

810 | 79,563 | ||||||

|

Cie Generale des Etablissements Michelin "B"

|

519 | 38,724 | ||||||

|

Compagnie de Saint-Gobain

|

834 | 35,004 | ||||||

|

DANONE SA (a)

|

4,943 | 347,848 | ||||||

|

Dassault Systemes SA

|

1,104 | 107,178 | ||||||

|

Electricite de France

|

2,373 | 50,232 | ||||||

|

Essilor International SA

|

3,008 | 264,862 | ||||||

|

France Telecom SA (a)

|

26,535 | 365,339 | ||||||

|

GDF Suez (a)

|

17,043 | 392,052 | ||||||

|

Iliad SA

|

569 | 73,222 | ||||||

|

L'Oreal SA (a)

|

1,980 | 238,117 | ||||||

|

Lafarge SA

|

1,293 | 50,541 | ||||||

|

LVMH Moet Hennessy Louis Vuitton SA

|

489 | 81,046 | ||||||

|

Neopost SA (a)

|

656 | 37,730 | ||||||

|

Pernod Ricard SA

|

1,835 | 190,506 | ||||||

|

Sanofi

|

15,172 | 1,158,402 | ||||||

|

Schneider Electric SA*

|

982 | 60,348 | ||||||

|

Societe Generale

|

1,772 | 41,873 | ||||||

|

Suez Environnement Co.

|

2,266 | 31,941 | ||||||

|

Total SA

|

6,490 | 310,752 | ||||||

|

Unibail-Rodamco SE (REIT) (a)

|

350 | 65,405 | ||||||

|

Veolia Environnement

|

4,939 | 72,084 | ||||||

|

Vinci SA

|

548 | 25,437 | ||||||

|

Vivendi (a)

|

15,691 | 290,209 | ||||||

|

(Cost $4,829,386)

|

5,076,428 | |||||||

|

Germany 6.1%

|

||||||||

|

Adidas AG

|

1,555 | 129,721 | ||||||

|

Allianz SE (Registered)

|

1,635 | 182,200 | ||||||

|

BASF SE (a)

|

1,815 | 149,527 | ||||||

|

Bayer AG (Registered) (a)

|

7,290 | 513,506 | ||||||

|

Bayerische Motoren Werke (BMW) AG

|

2,610 | 248,133 | ||||||

|

Beiersdorf AG (a)

|

2,832 | 198,885 | ||||||

|

Commerzbank AG*

|

10,367 | 22,463 | ||||||

|

Continental AG (a)

|

708 | 68,622 | ||||||

|

Daimler AG (Registered)

|

7,634 | 422,148 | ||||||

|

Deutsche Boerse AG

|

774 | 48,597 | ||||||

|

Deutsche Post AG (Registered)

|

2,891 | 53,980 | ||||||

|

Deutsche Telekom AG (Registered)

|

58,948 | 664,651 | ||||||

|

E.ON AG (a)

|

9,867 | 223,640 | ||||||

|

Fresenius Medical Care AG & Co. KGaA

|

1,398 | 99,236 | ||||||

|

Fresenius SE & Co. KGaA

|

721 | 71,969 | ||||||

|

GEA Group AG (a)

|

1,705 | 56,268 | ||||||

|

Henkel AG & Co. KGaA

|

3,838 | 234,893 | ||||||

|

Infineon Technologies AG (a)

|

6,361 | 63,352 | ||||||

|

K+S AG (Registered)

|

460 | 22,992 | ||||||

|

Kabel Deutschland Holding AG*

|

612 | 38,564 | ||||||

|

Linde AG (a)

|

386 | 66,070 | ||||||

|

Merck KGaA

|

516 | 56,686 | ||||||

|

Metro AG

|

3,665 | 118,254 | ||||||

|

Muenchener Rueckversicherungs-Gesellschaft AG (Registered) (a)

|

782 | 113,540 | ||||||

|

RWE AG

|

2,504 | 107,652 | ||||||

|

SAP AG

|

6,658 | 441,479 | ||||||

|

Siemens AG (Registered)

|

1,714 | 158,821 | ||||||

|

Suedzucker AG (a)

|

2,367 | 72,059 | ||||||

|

ThyssenKrupp AG

|

816 | 19,338 | ||||||

|

Volkswagen AG

|

256 | 43,702 | ||||||

|

(Cost $3,962,199)

|

4,710,948 | |||||||

|

Greece 0.3%

|

||||||||

|

National Bank of Greece SA* (Cost $489,637)

|

105,639 | 235,416 | ||||||

|

Hong Kong 2.2%

|

||||||||

|

AIA Group Ltd.

|

23,000 | 81,570 | ||||||

|

Cathay Pacific Airways Ltd.

|

26,000 | 43,978 | ||||||

|

Cheung Kong (Holdings) Ltd.

|

4,000 | 53,081 | ||||||

|

Cheung Kong Infrastructure Holdings Ltd. (a)

|

8,000 | 47,346 | ||||||

|

CLP Holdings Ltd.

|

22,500 | 192,517 | ||||||

|

Galaxy Entertainment Group Ltd.* (a)

|

12,000 | 37,383 | ||||||

|

Hang Lung Properties Ltd.

|

19,000 | 70,148 | ||||||

|

Hang Seng Bank Ltd. (a)

|

3,800 | 52,056 | ||||||

|

Hong Kong & China Gas Co., Ltd.

|

49,529 | 126,516 | ||||||

|

Hong Kong Exchanges & Clearing Ltd. (a)

|

4,200 | 66,852 | ||||||

|

Hutchison Whampoa Ltd.

|

33,000 | 316,154 | ||||||

|

Li & Fung Ltd. (a)

|

46,000 | 97,997 | ||||||

|

MTR Corp., Ltd.

|

22,500 | 79,872 | ||||||

|

Noble Group Ltd. (a)

|

40,181 | 38,075 | ||||||

|

NWS Holdings Ltd.

|

23,500 | 35,430 | ||||||

|

Power Assets Holdings Ltd.

|

16,000 | 119,707 | ||||||

|

Shangri-La Asia Ltd. (a)

|

20,000 | 42,420 | ||||||

|

SJM Holdings Ltd.

|

16,000 | 35,116 | ||||||

|

Sun Hung Kai Properties Ltd. (a)

|

6,000 | 72,067 | ||||||

|

Wharf Holdings Ltd.

|

10,000 | 59,387 | ||||||

|

Yue Yuen Industrial (Holdings) Ltd. (a)

|

11,500 | 38,340 | ||||||

|

(Cost $1,281,988)

|

1,706,012 | |||||||

|

Ireland 1.4%

|

||||||||

|

CRH PLC (b)

|

28,278 | 573,756 | ||||||

|

CRH PLC (b)

|

24,053 | 485,682 | ||||||

|

Experian PLC

|

3,613 | 57,003 | ||||||

|

(Cost $1,019,877)

|

1,116,441 | |||||||

|

Italy 3.2%

|

||||||||

|

Assicurazioni Generali SpA

|

7,431 | 101,195 | ||||||

|

Atlantia SpA

|

6,394 | 96,919 | ||||||

|

Banco Popolare Societa Cooperativa

|

11,884 | 17,642 | ||||||

|

Enel Green Power SpA

|

17,769 | 28,684 | ||||||

|

Enel SpA

|

98,141 | 322,259 | ||||||

|

Eni SpA

|

11,740 | 261,155 | ||||||

|

Fiat Industrial SpA (a)

|

16,293 | 184,874 | ||||||

|

Fiat SpA* (a)

|

19,161 | 92,536 | ||||||

|

Finmeccanica SpA

|

7,953 | 34,179 | ||||||

|

Intesa Sanpaolo (a)

|

46,043 | 69,627 | ||||||

|

Luxottica Group SpA

|

3,194 | 113,925 | ||||||

|

Mediaset SpA

|

17,879 | 42,554 | ||||||

|

Pirelli & C. SpA

|

6,895 | 83,899 | ||||||

|

Prysmian SpA

|

3,756 | 61,172 | ||||||

|

Saipem SpA

|

1,417 | 70,154 | ||||||

|

Snam SpA

|

23,139 | 110,049 | ||||||

|

Telecom Italia SpA*

|

395,262 | 449,314 | ||||||

|

Telecom Italia SpA (RSP)*

|

249,211 | 232,176 | ||||||

|

Terna — Rete Elettrica Nationale SpA

|

17,328 | 64,425 | ||||||

|

UBI Banca — Unione di Banche Italiane ScpA

|

5,181 | 19,226 | ||||||

|

UniCredit SpA

|

15,006 | 59,679 | ||||||

|

(Cost $2,952,889)

|

2,515,643 | |||||||

|

Japan 12.2%

|

||||||||

|

AEON Co., Ltd. (a)

|

5,700 | 74,351 | ||||||

|

Ajinomoto Co., Inc. (a)

|

7,000 | 90,224 | ||||||

|

Alfresa Holdings Corp.

|

900 | 41,623 | ||||||

|

Asahi Group Holdings Ltd. (a)

|

3,700 | 83,224 | ||||||

|

Asahi Kasei Corp.

|

6,000 | 37,247 | ||||||

|

Astellas Pharma, Inc.

|

4,300 | 173,953 | ||||||

|

Bridgestone Corp.

|

2,200 | 52,085 | ||||||

|

Canon, Inc.

|

1,850 | 83,765 | ||||||

|

Central Japan Railway Co.

|

4 | 33,172 | ||||||

|

Chubu Electric Power Co., Inc.

|

11,400 | 186,204 | ||||||

|

Chugai Pharmaceutical Co., Ltd. (a)

|

2,100 | 37,989 | ||||||

|

Chugoku Electric Power Co., Inc. (a)

|

4,700 | 80,551 | ||||||

|

Dai-ichi Life Insurance Co., Ltd.

|

38 | 47,493 | ||||||

|

Daiichi Sankyo Co., Ltd. (a)

|

6,800 | 116,463 | ||||||

|

Denso Corp.

|

2,300 | 74,363 | ||||||

|

East Japan Railway Co.

|

398 | 24,735 | ||||||

|

Eisai Co., Ltd. (a)

|

3,100 | 121,437 | ||||||

|

Electric Power Development Co., Ltd.

|

2,500 | 69,110 | ||||||

|

FamilyMart Co., Ltd.

|

800 | 35,582 | ||||||

|

FANUC Corp.

|

300 | 50,954 | ||||||

|

FUJIFILM Holdings Corp.

|

2,100 | 44,536 | ||||||

|

Hisamitsu Pharmaceutical Co., Inc. (a)

|

600 | 26,636 | ||||||

|

Hitachi Ltd.

|

9,000 | 57,333 | ||||||

|

Hokkaido Electric Power Co., Inc.

|

4,200 | 58,986 | ||||||

|

Hokuriku Electric Power Co.

|

3,800 | 64,869 | ||||||

|

Honda Motor Co., Ltd.

|

5,000 | 180,013 | ||||||

|

HOYA Corp.

|

2,000 | 45,991 | ||||||

|

Idemitsu Kosan Co., Ltd.

|

400 | 36,781 | ||||||

|

INPEX Corp. (a)

|

23 | 153,139 | ||||||

|

Japan Real Estate Investment Corp. (REIT)

|

6 | 53,070 | ||||||

|

Japan Tobacco, Inc.

|

49 | 270,572 | ||||||

|

JFE Holdings, Inc.

|

2,200 | 41,079 | ||||||

|

JX Holdings, Inc.

|

24,690 | 140,470 | ||||||

|

Kansai Electric Power Co., Inc.

|

12,800 | 185,828 | ||||||

|

Kao Corp.

|

5,300 | 141,966 | ||||||

|

KDDI Corp.

|

45 | 294,394 | ||||||

|

Keyence Corp.

|

110 | 25,926 | ||||||

|

Kirin Holdings Co., Ltd.

|

9,000 | 114,580 | ||||||

|

Komatsu Ltd.

|

1,300 | 37,594 | ||||||

|

Kyocera Corp.

|

500 | 48,755 | ||||||

|

Kyowa Hakko Kirin Co., Ltd. (a)

|

3,000 | 31,538 | ||||||

|

Kyushu Electric Power Co., Inc.

|

6,300 | 83,404 | ||||||

|

Lawson, Inc. (a)

|

700 | 46,275 | ||||||

|

Medipal Holdings Corp.

|

3,700 | 46,717 | ||||||

|

MEIJI Holdings Co., Ltd.

|

800 | 35,562 | ||||||

|

Miraca Holdings, Inc.

|

1,200 | 47,150 | ||||||

|

Mitsubishi Chemical Holdings Corp.

|

6,000 | 31,511 | ||||||

|

Mitsubishi Corp.

|

2,200 | 47,551 | ||||||

|

Mitsubishi Electric Corp.

|

3,000 | 26,362 | ||||||

|

Mitsubishi Estate Co., Ltd.

|

6,000 | 105,903 | ||||||

|

Mitsubishi Tanabe Pharma Corp.

|

2,600 | 36,051 | ||||||

|

Mitsubishi UFJ Financial Group, Inc.

|

50,900 | 244,091 | ||||||

|

Mitsui & Co., Ltd.

|

3,000 | 46,683 | ||||||

|

Mitsui Fudosan Co., Ltd.

|

5,000 | 91,390 | ||||||

|

Mitsui O.S.K Lines Ltd.

|

5,000 | 19,292 | ||||||

|

Mizuho Financial Group, Inc.

|

80,600 | 126,999 | ||||||

|

MS&AD Insurance Group Holdings, Inc.

|

3,100 | 57,022 | ||||||

|

Murata Manufacturing Co., Ltd.

|

500 | 28,533 | ||||||

|

Nintendo Co., Ltd. (a)

|

200 | 27,095 | ||||||

|

Nippon Building Fund, Inc. (REIT)

|

5 | 47,605 | ||||||

|

Nippon Meat Packers, Inc. (a)

|

4,000 | 51,074 | ||||||

|

Nippon Steel Corp. (a)

|

20,000 | 49,815 | ||||||

|

Nippon Telegraph & Telephone Corp.

|

6,805 | 307,920 | ||||||

|

Nissan Motor Co., Ltd. (a)

|

7,400 | 76,679 | ||||||

|

Nisshin Seifun Group, Inc.

|

3,500 | 42,667 | ||||||

|

Nissin Foods Holdings Co., Ltd. (a)

|

1,200 | 45,070 | ||||||

|

Nitto Denko Corp.

|

700 | 28,752 | ||||||

|

NKSJ Holdings, Inc.

|

2,500 | 51,281 | ||||||

|

Nomura Holdings, Inc.

|

16,700 | 68,128 | ||||||

|

Nomura Real Estate Office Fund, Inc. (REIT)

|

11 | 63,809 | ||||||

|

NTT DoCoMo, Inc.

|

236 | 401,530 | ||||||

|

Olympus Corp.*

|

2,200 | 34,741 | ||||||

|

Ono Pharmaceutical Co., Ltd.

|

800 | 45,173 | ||||||

|

ORIX Corp. (a)

|

510 | 48,573 | ||||||

|

Osaka Gas Co., Ltd.

|

34,000 | 137,251 | ||||||

|

Otsuka Holdings KK

|

3,200 | 96,543 | ||||||

|

Panasonic Corp. (a)

|

4,700 | 36,706 | ||||||

|

Santen Pharmaceutical Co., Ltd. (a)

|

900 | 37,469 | ||||||

|

Seven & I Holdings Co., Ltd.

|

8,400 | 253,805 | ||||||

|

Sharp Corp. (a)

|

3,000 | 19,352 | ||||||

|

Shikoku Electric Power Co., Inc. (a)

|

2,900 | 74,755 | ||||||

|

Shin-Etsu Chemical Co., Ltd.

|

1,500 | 86,484 | ||||||

|

Shionogi & Co., Ltd.

|

3,300 | 42,960 | ||||||

|

Shiseido Co., Ltd. (a)

|

4,200 | 73,469 | ||||||

|

Softbank Corp. (a)

|

13,400 | 399,747 | ||||||

|

Sony Corp.

|

2,100 | 34,041 | ||||||

|

Sumitomo Chemical Co., Ltd.

|

10,000 | 41,037 | ||||||

|

Sumitomo Corp.

|

3,800 | 53,830 | ||||||

|

Sumitomo Electric Industries Ltd.

|

3,000 | 40,513 | ||||||

|

Sumitomo Mitsui Financial Group, Inc.

|

6,100 | 195,675 | ||||||

|

Sumitomo Mitsui Trust Holdings, Inc.

|

17,000 | 49,765 | ||||||

|

Sumitomo Realty & Development Co., Ltd.

|

2,000 | 47,618 | ||||||

|

Suzuken Co., Ltd.

|

1,500 | 45,249 | ||||||

|

Taisho Pharmaceutical Holdings Co., Ltd.

|

400 | 31,980 | ||||||

|

Takeda Pharmaceutical Co., Ltd.

|

8,200 | 357,835 | ||||||

|

Terumo Corp. (a)

|

1,800 | 82,239 | ||||||

|

Toho Gas Co., Ltd. (a)

|

9,000 | 54,206 | ||||||

|

Tohoku Electric Power Co., Inc.*

|

6,900 | 72,263 | ||||||

|

Tokio Marine Holdings, Inc.

|

3,600 | 91,854 | ||||||

|

Tokyo Electric Power Co., Inc.* (a)

|

27,000 | 67,318 | ||||||

|

Tokyo Gas Co., Ltd.

|

39,000 | 188,044 | ||||||

|

TonenGeneral Sekiyu KK

|

4,000 | 37,459 | ||||||

|

Toray Industries, Inc.

|

6,000 | 46,076 | ||||||

|

Toshiba Corp.

|

8,000 | 32,707 | ||||||

|

Toyo Suisan Kaisha Ltd.

|

2,000 | 51,248 | ||||||

|

Toyota Motor Corp.

|

8,200 | 334,918 | ||||||

|

Tsumura & Co.

|

1,500 | 39,979 | ||||||

|

Unicharm Corp. (a)

|

1,100 | 61,460 | ||||||

|

Yakult Honsha Co., Ltd. (a)

|

900 | 33,121 | ||||||

|

Yamazaki Baking Co., Ltd.

|

3,000 | 44,482 | ||||||

|

(Cost $9,147,035)

|

9,472,447 | |||||||

|

Luxembourg 0.3%

|

||||||||

|

ArcelorMittal

|

4,368 | 75,782 | ||||||

|

Millicom International Cellular SA (SDR) (a)

|

1,219 | 129,603 | ||||||

|

Tenaris SA

|

2,054 | 40,181 | ||||||

|

(Cost $185,445)

|

245,566 | |||||||

|

Macau 0.2%

|

||||||||

|

Sands China Ltd. (a)

|

22,000 | 86,232 | ||||||

|

Wynn Macau Ltd. (a)

|

12,800 | 40,850 | ||||||

|

(Cost $50,497)

|

127,082 | |||||||

|

Netherlands 6.2%

|

||||||||

|

AEGON NV*

|

14,094 | 65,061 | ||||||

|

Akzo Nobel NV (a)

|

2,840 | 152,325 | ||||||

|

ASML Holding NV (a)

|

25,561 | 1,301,144 | ||||||

|

Fugro NV (CVA)

|

3,474 | 253,805 | ||||||

|

Heineken Holding NV (a)

|

1,385 | 64,161 | ||||||

|

Heineken NV (a)

|

2,540 | 138,989 | ||||||

|

ING Groep NV (CVA)*

|

26,780 | 188,748 | ||||||

|

Koninklijke (Royal) KPN NV (a)

|

65,057 | 584,059 | ||||||

|

Koninklijke Ahold NV

|

11,609 | 147,262 | ||||||

|

Koninklijke DSM NV

|

1,968 | 112,953 | ||||||

|

Koninklijke Philips Electronics NV*

|

7,199 | 142,981 | ||||||

|

Randstad Holding NV

|

1,101 | 38,143 | ||||||

|

Reed Elsevier NV (a)

|

39,261 | 462,953 | ||||||

|

Royal Dutch Shell PLC "A"

|

2,485 | 88,679 | ||||||

|

Royal Dutch Shell PLC "B"

|

1,993 | 72,857 | ||||||

|

SBM Offshore NV

|

8,684 | 157,608 | ||||||

|

TNT Express NV

|

3,072 | 37,253 | ||||||

|

Unilever NV (CVA)

|

15,603 | 534,375 | ||||||

|

Wolters Kluwer NV (a)

|

16,429 | 283,644 | ||||||

|

(Cost $4,285,195)

|

4,827,000 | |||||||

|

Norway 1.8%

|

||||||||

|

Aker Solutions ASA

|

2,106 | 35,890 | ||||||

|

DnB ASA (a)

|

18,966 | 204,658 | ||||||

|

Norsk Hydro ASA (a)

|

23,788 | 115,830 | ||||||

|

Statoil ASA

|

8,658 | 231,882 | ||||||

|

Telenor ASA

|

28,874 | 530,595 | ||||||

|

Yara International ASA

|

5,246 | 257,944 | ||||||

|

(Cost $746,173)

|

1,376,799 | |||||||

|

Portugal 0.7%

|

||||||||

|

EDP — Energias de Portugal SA (Cost $653,767)

|

194,437 | 556,126 | ||||||

|

Singapore 3.0%

|

||||||||

|

CapitaLand Ltd. (a)

|

20,000 | 47,260 | ||||||

|

ComfortDelGro Corp., Ltd.

|

30,000 | 37,056 | ||||||

|

DBS Group Holdings Ltd.

|

14,000 | 157,646 | ||||||

|

Fraser & Neave Ltd.

|

9,000 | 51,153 | ||||||

|

Genting Singapore PLC* (a)

|

186,000 | 259,108 | ||||||

|

Golden Agri-Resources Ltd.

|

173,000 | 102,411 | ||||||

|

Hutchison Port Holdings Trust (Units)

|

51,000 | 38,383 | ||||||

|

Jardine Cycle & Carriage Ltd. (a)

|

3,000 | 113,942 | ||||||

|

Keppel Corp., Ltd. (a)

|

19,800 | 176,205 | ||||||

|

Olam International Ltd. (a)

|

34,000 | 62,018 | ||||||

|

Oversea-Chinese Banking Corp., Ltd.

|

21,000 | 151,579 | ||||||

|

SembCorp Marine Ltd.

|

12,000 | 49,239 | ||||||

|

Singapore Airlines Ltd.

|

8,000 | 69,021 | ||||||

|

Singapore Exchange Ltd.

|

9,000 | 48,555 | ||||||

|

Singapore Press Holdings Ltd.

|

43,000 | 137,860 | ||||||

|

Singapore Technologies Engineering Ltd.

|

26,000 | 63,126 | ||||||

|

Singapore Telecommunications Ltd.

|

175,000 | 440,498 | ||||||

|

StarHub Ltd.

|

16,000 | 41,195 | ||||||

|

United Overseas Bank Ltd.

|

7,000 | 108,558 | ||||||

|

Wilmar International Ltd. (a)

|

42,000 | 164,779 | ||||||

|

(Cost $1,590,992)

|

2,319,592 | |||||||

|

Spain 2.9%

|

||||||||

|

Abertis Infraestructuras SA

|

6,291 | 97,363 | ||||||

|

Acciona SA

|

387 | 23,787 | ||||||

|

ACS, Actividades de Construccion y Servicios SA (a)

|

2,323 | 42,629 | ||||||

|

Banco Bilbao Vizcaya Argentaria SA

|

10,748 | 72,614 | ||||||

|

Banco Santander SA

|

20,621 | 128,924 | ||||||

|

EDP Renovaveis SA*

|

23,285 | 99,205 | ||||||

|

Enagas SA

|

3,019 | 53,067 | ||||||

|

Ferrovial SA (a)

|

6,672 | 74,341 | ||||||

|

Gas Natural SDG SA

|

6,527 | 90,849 | ||||||

|

Iberdrola SA

|

62,932 | 293,107 | ||||||

|

Industria de Diseno Textil SA (a)

|

3,291 | 297,013 | ||||||

|

Red Electrica Corporacion SA

|

1,971 | 85,772 | ||||||

|

Repsol YPF SA

|

13,212 | 253,553 | ||||||

|

Telefonica SA

|

39,117 | 570,848 | ||||||

|

Zardoya Otis SA (a)

|

3,165 | 38,756 | ||||||

|

(Cost $2,570,607)

|

2,221,828 | |||||||

|

Sweden 2.7%

|

||||||||

|

Assa Abloy AB "B"

|

1,597 | 46,597 | ||||||

|

Atlas Copco AB "A" (a)

|

2,382 | 56,720 | ||||||

|

Atlas Copco AB "B"

|

1,896 | 39,812 | ||||||

|

Boliden AB (a)

|

5,502 | 88,402 | ||||||

|

Electrolux AB "B" (a)

|

2,224 | 49,698 | ||||||

|

Hennes & Mauritz AB "B"* (a)

|

6,564 | 225,582 | ||||||

|

Hexagon AB "B"

|

1,516 | 30,811 | ||||||

|

Holmen AB "B"

|

1,457 | 38,729 | ||||||

|

Husqvarna AB "B" (a)

|

5,434 | 31,275 | ||||||

|

Modern Times Group "B"

|

534 | 25,974 | ||||||

|

Nordea Bank AB

|

8,547 | 75,725 | ||||||

|

Sandvik AB (a)

|

3,558 | 56,337 | ||||||

|

Scania AB "B"

|

1,671 | 34,167 | ||||||

|

Skandinaviska Enskilda Banken AB "A"

|

7,816 | 52,733 | ||||||

|

Skanska AB "B"

|

2,292 | 37,350 | ||||||

|

SKF AB "B"

|

1,471 | 34,917 | ||||||

|

SSAB AB "A" (a)

|

3,185 | 32,479 | ||||||

|

Svenska Cellulosa AB "B"

|

10,968 | 173,795 | ||||||

|

Svenska Handelsbanken AB "A"

|

2,305 | 74,725 | ||||||

|

Swedbank AB "A"

|

4,740 | 78,470 | ||||||

|

Tele2 AB "B" (a)

|

4,894 | 93,244 | ||||||

|

Telefonaktiebolaget LM Ericsson "B"* (a)

|

42,957 | 425,083 | ||||||

|

TeliaSonera AB (a)

|

31,497 | 210,940 | ||||||

|

Volvo AB "B"

|

4,497 | 62,298 | ||||||

|

(Cost $1,548,237)

|

2,075,863 | |||||||

|

Switzerland 7.1%

|

||||||||

|

ABB Ltd. (Registered)* (a)

|

7,555 | 137,597 | ||||||

|

Actelion Ltd. (Registered)*

|

838 | 35,462 | ||||||

|

Adecco SA (Registered)*

|

796 | 38,736 | ||||||

|

Aryzta AG*

|

834 | 42,001 | ||||||

|

Compagnie Financiere Richemont SA "A"

|

3,393 | 209,805 | ||||||

|

Credit Suisse Group AG (Registered)*

|

2,351 | 55,128 | ||||||

|

Geberit AG (Registered)* (a)

|

225 | 47,571 | ||||||

|

Givaudan SA (Registered)*

|

57 | 55,347 | ||||||

|

Holcim Ltd. (Registered)*

|

1,511 | 94,094 | ||||||

|

Lindt & Spruengli AG (Registered)

|

1 | 39,174 | ||||||

|

Nestle SA (Registered)

|

21,023 | 1,287,956 | ||||||

|

Novartis AG (Registered)

|

11,413 | 629,240 | ||||||

|

Roche Holding AG (Genusschein)

|

3,521 | 643,322 | ||||||

|

SGS SA (Registered)

|

34 | 65,641 | ||||||

|

Sika AG

|

17 | 36,027 | ||||||

|

Sonova Holding AG (Registered)*

|

361 | 39,861 | ||||||

|

STMicroelectronics NV

|

7,559 | 42,828 | ||||||

|

Swatch Group AG (Bearer)

|

222 | 102,437 | ||||||

|

Swatch Group AG (Registered)

|

466 | 37,186 | ||||||

|

Swiss Re AG.* (a)

|

1,017 | 63,781 | ||||||

|

Swisscom AG (Registered) (a)

|

3,593 | 1,338,418 | ||||||

|

Syngenta AG (Registered) (a)

|

493 | 172,644 | ||||||

|

UBS AG (Registered)*

|

6,006 | 74,910 | ||||||

|

Wolseley PLC

|

1,358 | 51,615 | ||||||

|

Xstrata PLC

|

3,542 | 67,746 | ||||||

|

Zurich Financial Services AG*

|

437 | 106,930 | ||||||

|

(Cost $3,537,631)

|

5,515,457 | |||||||

|

United Kingdom 7.3%

|

||||||||

|

Anglo American PLC

|

2,015 | 77,493 | ||||||

|

ARM Holdings PLC

|

36,952 | 312,975 | ||||||

|

AstraZeneca PLC (a)

|

9,012 | 395,108 | ||||||

|

BAE Systems PLC

|

12,780 | 61,194 | ||||||

|

Barclays PLC

|

14,664 | 52,099 | ||||||

|

BG Group PLC (a)

|

2,693 | 63,424 | ||||||

|

BHP Billiton PLC

|

3,343 | 107,499 | ||||||

|

BP PLC

|

14,248 | 102,991 | ||||||

|

British American Tobacco PLC (a)

|

4,305 | 221,043 | ||||||

|

British Sky Broadcasting Group PLC

|

3,759 | 41,345 | ||||||

|

BT Group PLC

|

36,288 | 124,079 | ||||||

|

Capita PLC

|

2,985 | 32,126 | ||||||

|

Centrica PLC

|

42,065 | 209,571 | ||||||

|

Compass Group PLC

|

6,032 | 63,056 | ||||||

|

Diageo PLC

|

4,451 | 112,061 | ||||||

|

GlaxoSmithKline PLC (a)

|

35,498 | 821,073 | ||||||

|

HSBC Holdings PLC

|

15,258 | 137,758 | ||||||

|

Imperial Tobacco Group PLC

|

1,958 | 78,316 | ||||||

|

Inmarsat PLC

|

4,081 | 29,131 | ||||||

|

International Consolidated Airlines Group SA* (a)

|

15,394 | 44,188 | ||||||

|

International Power PLC

|

12,345 | 83,558 | ||||||

|

Kingfisher PLC (a)

|

10,702 | 50,472 | ||||||

|

Marks & Spencer Group PLC (a)

|

7,264 | 42,068 | ||||||

|

National Grid PLC

|

29,545 | 318,990 | ||||||

|

Next PLC

|

569 | 27,055 | ||||||

|

Pearson PLC (a)

|

2,403 | 45,252 | ||||||

|

Reckitt Benckiser Group PLC

|

1,270 | 73,948 | ||||||

|

Reed Elsevier PLC

|

3,160 | 26,135 | ||||||

|

Rio Tinto PLC

|

2,110 | 117,629 | ||||||

|

Rolls-Royce Holdings PLC

|

4,528 | 60,494 | ||||||

|

Rolls-Royce Holdings PLC "C" (Entitlement Shares)*

|

479,968 | 779 | ||||||

|

SABMiller PLC

|

2,186 | 91,851 | ||||||

|

Severn Trent PLC

|

3,041 | 83,421 | ||||||

|

Shire PLC (a)

|

3,702 | 120,725 | ||||||

|

Smith & Nephew PLC

|

8,325 | 81,961 | ||||||

|

Smiths Group PLC

|

1,780 | 30,918 | ||||||

|

SSE PLC

|

8,522 | 182,751 | ||||||

|

Standard Chartered PLC

|

2,621 | 64,089 | ||||||

|

Subsea 7 SA*

|

1,487 | 38,668 | ||||||

|

Tesco PLC

|

15,950 | 82,129 | ||||||

|

The Sage Group PLC

|

35,098 | 162,879 | ||||||

|

Unilever PLC

|

1,703 | 58,105 | ||||||

|

United Utilities Group PLC

|

7,244 | 72,726 | ||||||

|

Vodafone Group PLC

|

207,236 | 574,861 | ||||||

|

William Morrison Supermarkets PLC

|

5,755 | 26,216 | ||||||

|

WPP PLC

|

5,735 | 77,601 | ||||||

|

(Cost $4,013,417)

|

5,681,811 | |||||||

|

Total Common Stocks (Cost $58,577,930)

|

67,667,154 | |||||||

|

Preferred Stocks 0.9%

|

||||||||

|

Germany 0.9%

|

||||||||

|

Bayerische Motoren Werke (BMW) AG

|

702 | 43,678 | ||||||

|

Henkel AG & Co. KGaA

|

5,019 | 373,363 | ||||||

|

Porsche Automobil Holding SE

|

1,239 | 75,636 | ||||||

|

Volkswagen AG (a)

|

1,131 | 214,324 | ||||||

|

Total Preferred Stocks (Cost $412,908)

|

707,001 | |||||||

|

Exchange-Traded Funds 9.9%

|

||||||||

|

iShares MSCI Emerging Markets Index Fund (a)

|

91,300 | 3,852,860 | ||||||

|

Vanguard MSCI Emerging Markets Fund

|

89,950 | 3,825,574 | ||||||

|

Total Exchange-Traded Funds (Cost $6,751,140)

|

7,678,434 | |||||||

|

Securities Lending Collateral 33.7%

|

||||||||

|

Daily Assets Fund Institutional, 0.24% (c) (d) (Cost $26,200,937)

|

26,200,937 | 26,200,937 | ||||||

|

Cash Equivalents 1.0%

|

||||||||

|

Central Cash Management Fund, 0.12% (c) (Cost $775,797)

|

775,797 | 775,797 | ||||||

|

% of Net Assets

|

Value ($)

|

|||||||

|

Total Investment Portfolio (Cost $92,718,712)+

|

132.6 | 103,029,323 | ||||||

|

Other Assets and Liabilities, Net

|

(32.6 | ) | (25,314,267 | ) | ||||

|

Net Assets

|

100.0 | 77,715,056 | ||||||

* Non-income producing security.

+ The cost for federal income tax purposes was $93,251,359. At April 30, 2012, net unrealized appreciation for all securities based on tax cost was $9,777,964. This consisted of aggregate gross unrealized appreciation for all securities in which there was an excess of value over tax cost of $15,819,233 and aggregate gross unrealized depreciation for all securities in which there was an excess of tax cost over value of $6,041,269.

(a) All or a portion of these securities were on loan (see Notes to Financial Statements). The value of all securities loaned at April 30, 2012 amounted to $24,889,071, which is 32.0% of net assets.

(b) Securities with the same description are the same corporate entity but trade on different stock exchanges.

(c) Affiliated fund managed by Deutsche Investment Management Americas Inc. The rate shown is the annualized seven-day yield at period end.

(d) Represents collateral held in connection with securities lending. Income earned by the Fund is net of borrower rebates.

CVA: Certificaten Van Aandelen

MSCI: Morgan Stanley Capital International

REIT: Real Estate Investment Trust

RSP: Risparmio (Convertible Savings Shares)

SDR: Swedish Depositary Receipt

At April 30, 2012, open futures contracts purchased were as follows:

|

Futures

|

Currency

|

Expiration Date

|

Contracts

|

Notional Value ($)

|

Unrealized Appreciation/

Depreciation ($)

|

|||||||||

|

ASX SPI 200 Index

|

AUD

|

6/21/2012

|

1 | 114,536 | 4,191 | |||||||||

|

Euro Stoxx 50 Index

|

EUR

|

6/15/2012

|

36 | 1,076,486 | (97,183 | ) | ||||||||

|

FTSE 100 Index

|

GBP

|

6/15/2012

|

1 | 92,749 | (2,502 | ) | ||||||||

|

Nikkei 225 Index

|

USD

|

6/7/2012

|

5 | 236,875 | (7,270 | ) | ||||||||

|

S&P TSE 60 Index

|

CAD

|

6/14/2012

|

1 | 141,398 | (449 | ) | ||||||||

|

Total net unrealized depreciation

|

(103,213 | ) | ||||||||||||

|

Currency Abbreviations

|

|

AUD Australian Dollar

CAD Canadian Dollar

EUR Euro

GBP British Pound

USD United States Dollar

|

For information on the Fund's policy and additional disclosures regarding futures contracts, please refer to the Derivatives Section of Note B in the accompanying Notes to Financial Statements.

Fair Value Measurements

Various inputs are used in determining the value of the Fund's investments. These inputs are summarized in three broad levels. Level 1 includes quoted prices in active markets for identical securities. Level 2 includes other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds and credit risk). Level 3 includes significant unobservable inputs (including the Fund's own assumptions in determining the fair value of investments). The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used as of April 30, 2012 in valuing the Fund's investments. For information on the Fund's policy regarding the valuation of investments, please refer to the Security Valuation section of Note A in the accompanying Notes to Financial Statements.

|

Assets

|

Level 1

|

Level 2

|

Level 3

|

Total

|

||||||||||||

|

Common Stock and/or Other Equity Investments (e)

|

||||||||||||||||

|

Australia

|

$ | — | $ | 2,985,305 | $ | — | $ | 2,985,305 | ||||||||

|

Austria

|

— | 313,176 | — | 313,176 | ||||||||||||

|

Belgium

|

— | 866,310 | — | 866,310 | ||||||||||||

|

Bermuda

|

— | 106,756 | — | 106,756 | ||||||||||||

|

Canada

|

9,117,121 | 49,501 | — | 9,166,622 | ||||||||||||

|

Denmark

|

— | 2,150,642 | — | 2,150,642 | ||||||||||||

|

Finland

|

— | 2,297,884 | — | 2,297,884 | ||||||||||||

|

France

|

— | 5,076,428 | — | 5,076,428 | ||||||||||||

|

Germany

|

— | 5,417,949 | — | 5,417,949 | ||||||||||||

|

Greece

|

— | 235,416 | — | 235,416 | ||||||||||||

|

Hong Kong

|

— | 1,706,012 | — | 1,706,012 | ||||||||||||

|

Ireland

|

— | 1,116,441 | — | 1,116,441 | ||||||||||||

|

Italy

|

— | 2,515,643 | — | 2,515,643 | ||||||||||||

|

Japan

|

— | 9,472,447 | — | 9,472,447 | ||||||||||||

|

Luxembourg

|

— | 245,566 | — | 245,566 | ||||||||||||

|

Macau

|

— | 127,082 | — | 127,082 | ||||||||||||

|

Netherlands

|

— | 4,827,000 | — | 4,827,000 | ||||||||||||

|

Norway

|

— | 1,376,799 | — | 1,376,799 | ||||||||||||

|

Portugal

|

— | 556,126 | — | 556,126 | ||||||||||||

|

Singapore

|

— | 2,319,592 | — | 2,319,592 | ||||||||||||

|

Spain

|

— | 2,221,828 | — | 2,221,828 | ||||||||||||

|

Sweden

|

— | 2,075,863 | — | 2,075,863 | ||||||||||||

|

Switzerland

|

— | 5,515,457 | — | 5,515,457 | ||||||||||||

|

United Kingdom

|

— | 5,681,032 | 779 | 5,681,811 | ||||||||||||

|

Exchange-Traded Funds

|

7,678,434 | — | — | 7,678,434 | ||||||||||||

|

Short-Term Investments (e)

|

26,976,734 | — | — | 26,976,734 | ||||||||||||

|

Derivatives (f)

|

4,191 | — | — | 4,191 | ||||||||||||

|

Total

|

$ | 43,776,480 | $ | 59,256,255 | $ | 779 | $ | 103,033,514 | ||||||||

|

Liabilities

|

||||||||||||||||

|

Derivatives (f)

|

$ | (107,404 | ) | $ | — | $ | — | $ | (107,404 | ) | ||||||

|

Total

|

$ | (107,404 | ) | $ | — | $ | — | $ | (107,404 | ) | ||||||

There have been no transfers between Level 1 and Level 2 fair value measurements during the period ended April 30, 2012.

(e) See Investment Portfolio for additional detailed categorizations.

(f) Derivatives include unrealized appreciation (depreciation) on futures contracts.

Level 3 Reconciliation

The following is a reconciliation of the Fund's Level 3 investments for which significant unobservable inputs were used in determining value:

|

Entitlement Shares

|

||||

|

United Kingdom

|

||||

|

Balance as of October 31, 2011

|

$ | 875 | ||

|

Realized gain (loss)

|

— | |||

|

Change in unrealized appreciation (depreciation)

|

(1 | ) | ||

|

Amortization premium/discount

|

— | |||

|

Purchase

|

775 | |||

|

(Sales)

|

(870 | ) | ||

|

Transfers into Level 3

|

— | |||

|

Transfers (out) of Level 3

|

— | |||

|

Balance as of April 30, 2012

|

$ | 779 | ||

|

Net change in unrealized appreciation (depreciation) from investments still held as of April 30, 2012

|

$ | 4 | ||

Transfers between price levels are recognized at the beginning of the reporting period.

The accompanying notes are an integral part of the financial statements.

|

as of April 30, 2012 (Unaudited)

|

||||

|

Assets

|

||||

|

Investments:

Investments in non-affiliated securities, at value (cost $65,741,978) — including $24,889,071 of securities loaned

|

$ | 76,052,589 | ||

|

Investment in Daily Assets Fund Institutional (cost $26,200,937)*

|

26,200,937 | |||

|

Investment in Central Cash Management Fund (cost $775,797)

|

775,797 | |||

|

Total investments in securities, at value (cost $92,718,712)

|

103,029,323 | |||

|

Foreign currency, at value (cost $550,160)

|

590,912 | |||

|

Deposits with broker for futures contracts

|

230,808 | |||

|

Receivable for Fund shares sold

|

39,946 | |||

|

Dividends receivable

|

338,843 | |||

|

Interest receivable

|

9,188 | |||

|

Foreign taxes recoverable

|

78,579 | |||

|

Other assets

|

44,488 | |||

|

Total assets

|

104,362,087 | |||

|

Liabilities

|

||||

|

Payable upon return of securities loaned

|

26,200,937 | |||

|

Payable for investments purchased

|

779 | |||

|

Payable for Fund shares redeemed

|

139,549 | |||

|

Payable for variation margin on futures contracts

|

103,213 | |||

|

Accrued management fee

|

44,615 | |||

|

Accrued Directors' fee

|

1,602 | |||

|

Other accrued expenses and payables

|

156,336 | |||

|

Total liabilities

|

26,647,031 | |||

|

Net assets, at value

|

$ | 77,715,056 | ||

|

Net Assets Consist of

|

||||

|

Undistributed net investment income

|

576,458 | |||

|

Net unrealized appreciation (depreciation) on:

Investments

|

10,310,611 | |||

|

Futures

|

(103,213 | ) | ||

|

Foreign currency

|

45,826 | |||

|

Accumulated net realized gain (loss)

|

(70,692,476 | ) | ||

|

Paid-in capital

|

137,577,850 | |||

|

Net assets, at value

|

$ | 77,715,056 | ||

* Represents collateral on securities loaned.

The accompanying notes are an integral part of the financial statements.

|

Statement of Assets and Liabilities as of April 30, 2012 (Unaudited) (continued)

|

||||

|

Net Asset Value

|

||||

|

Class A

Net Asset Value and redemption price(a) per share ($24,316,838 ÷ 3,586,634 shares of capital stock outstanding, $.01 par value, $50,000,000 shares authorized)

|

$ | 6.78 | ||

|

Maximum offering price per share (100 ÷ 94.25 of $6.78)

|

$ | 7.19 | ||

|

Class B

Net Asset Value, offering and redemption price(a) (subject to contingent deferred sales charge) per share ($551,655 ÷ 84,179 shares of capital stock outstanding, $.01 par value, $50,000,000 shares authorized)

|

$ | 6.55 | ||

|

Class C

Net Asset Value, offering and redemption price(a) (subject to contingent deferred sales charge) per share ($3,742,448 ÷ 571,221 shares of capital stock outstanding, $.01 par value, $50,000,000 shares authorized)

|

$ | 6.55 | ||

|

Class R

Net Asset Value, offering and redemption price(a) (subject to contingent deferred sales charge) per share ($1,930,775 ÷ 292,759 shares of capital stock outstanding, $.01 par value, $50,000,000 shares authorized)

|

$ | 6.60 | ||

|

Class S

Net Asset Value, offering and redemption price(a) per share ($14,136,781÷ 2,148,388 shares of capital stock outstanding, $.01 par value, $50,000,000 shares authorized)

|

$ | 6.58 | ||

|

Institutional Class

Net Asset Value, offering and redemption price(a) per share ($33,036,559 ÷ 5,017,557 shares of capital stock outstanding, $.01 par value, $50,000,000 shares authorized)

|

$ | 6.58 | ||

(a) Redemption price per share for shares held less than 15 days is equal to net asset value less a 2% redemption fee.

The accompanying notes are an integral part of the financial statements.

|

for the six months ended April 30, 2012 (Unaudited)

|

||||

|

Investment Income

|

||||

|

Income:

Dividends (net of foreign taxes withheld of $140,812)

|

$ | 1,309,079 | ||

|

Interest

|

661 | |||

|

Income distributions — Central Cash Management Fund

|

1,141 | |||

|

Securities lending income, including income from Daily Assets Fund Institutional, net of borrower rebates

|

80,297 | |||

|

Total income

|

1,391,178 | |||

|

Expenses:

Management fee

|

265,600 | |||

|

Administration fee

|

37,943 | |||

|

Services to shareholders

|

75,125 | |||

|

Distribution and service fees

|

56,778 | |||

|

Custodian fee

|

34,494 | |||

|

Professional fees

|

43,711 | |||

|

Reports to shareholders

|

22,930 | |||

|

Registration fees

|

37,652 | |||

|

Directors' fees and expenses

|

3,004 | |||

|

Other

|

22,099 | |||

|

Total expenses before expense reductions

|

599,336 | |||

|

Expense reductions

|

(39,181 | ) | ||

|

Total expenses after expense reductions

|

560,155 | |||

|

Net investment income (loss)

|

831,023 | |||

|

Realized and Unrealized Gain (Loss)

|

||||

|

Net realized gain (loss) from:

Investments (net of foreign taxes of $219)

|

456,496 | |||

|

Futures

|

443,203 | |||

|

Foreign currency

|

(41,762 | ) | ||

| 857,937 | ||||

|

Change in net unrealized appreciation (depreciation) on:

Investments

|

797,236 | |||

|

Futures

|

(427,214 | ) | ||

|

Foreign currency

|

43,190 | |||

| 413,212 | ||||

|

Net gain (loss)

|

1,271,149 | |||

|

Net increase (decrease) in net assets resulting from operations

|

$ | 2,102,172 | ||

The accompanying notes are an integral part of the financial statements.

|

Increase (Decrease) in Net Assets

|

Six Months Ended April 30, 2012 (Unaudited)

|

Year Ended October 31, 2011

|

||||||

|

Operations:

Net investment income (loss)

|

$ | 831,023 | $ | 1,680,258 | ||||

|

Net realized gain (loss)

|

857,937 | 14,401,954 | ||||||

|

Change in net unrealized appreciation (depreciation)

|

413,212 | (20,230,944 | ) | |||||

|

Net increase (decrease) in net assets resulting from operations

|

2,102,172 | (4,148,732 | ) | |||||

|

Distributions to shareholders from:

Net investment income:

Class A

|

(533,655 | ) | (817,108 | ) | ||||

|

Class B

|

(9,110 | ) | (25,388 | ) | ||||

|

Class C

|

(48,345 | ) | (82,724 | ) | ||||

|

Class R

|

(35,940 | ) | (39,567 | ) | ||||

|

Class S

|

(317,565 | ) | (403,907 | ) | ||||

|

Institutional Class

|

(720,175 | ) | (1,195,266 | ) | ||||

|

Total distributions

|

(1,664,790 | ) | (2,563,960 | ) | ||||

|

Fund share transactions:

Proceeds from shares sold

|

10,497,112 | 14,918,361 | ||||||

|

Reinvestment of distributions

|

1,620,668 | 2,497,810 | ||||||

|

Payments for shares redeemed

|

(12,794,520 | ) | (46,841,646 | ) | ||||

|

Redemption fees

|

21 | 385 | ||||||

|

Net increase (decrease) in net assets from Fund share transactions

|

(676,719 | ) | (29,425,090 | ) | ||||

|

Increase (decrease) in net assets

|

(239,337 | ) | (36,137,782 | ) | ||||

|

Net assets at beginning of period

|

77,954,393 | 114,092,175 | ||||||

|

Net assets at end of period (including undistributed net investment income of $576,458 and $1,410,225, respectively)

|

$ | 77,715,056 | $ | 77,954,393 | ||||

The accompanying notes are an integral part of the financial statements.

|

Years Ended October 31,

|

||||||||||||||||||||||||

|

Class A

|

Six Months Ended 4/30/12 (Unaudited)

|

2011

|

2010

|

2009

|

2008

|

2007

|

||||||||||||||||||

|

Selected Per Share Data

|

||||||||||||||||||||||||

|

Net asset value, beginning of period

|

$ | 6.73 | $ | 7.36 | $ | 6.56 | $ | 5.66 | $ | 14.53 | $ | 13.15 | ||||||||||||

|

Income (loss) from investment operations:

Net investment income (loss)a

|

.07 | .12 | .08 | .08 | .22 | b | .14 | |||||||||||||||||

|

Net realized and unrealized gain (loss)

|

.11 | (.58 | ) | .79 | 1.04 | (6.18 | ) | 3.47 | ||||||||||||||||

|

Total from investment operations

|

.18 | (.46 | ) | .87 | 1.12 | (5.96 | ) | 3.61 | ||||||||||||||||

|

Less distributions from:

Net investment income

|

(.13 | ) | (.17 | ) | (.09 | ) | (.22 | ) | (.07 | ) | (.44 | ) | ||||||||||||

|

Net realized gains

|

— | — | — | — | (2.84 | ) | (1.79 | ) | ||||||||||||||||

|

Total distributions

|

(.13 | ) | (.17 | ) | (.09 | ) | (.22 | ) | (2.91 | ) | (2.23 | ) | ||||||||||||

|

Increase from regulatory settlements

|

— | — | .02 | f | — | — | — | |||||||||||||||||

|

Redemption fees

|

.00 | *** | .00 | *** | .00 | *** | .00 | *** | .00 | *** | .00 | *** | ||||||||||||

|

Net asset value, end of period

|

$ | 6.78 | $ | 6.73 | $ | 7.36 | $ | 6.56 | $ | 5.66 | $ | 14.53 | ||||||||||||

|

Total Return (%)c,d

|

2.89 | ** | (6.44 | ) | 13.65 | 20.98 | (50.51 | )e | 31.76 | |||||||||||||||

|

Ratios to Average Net Assets and Supplemental Data

|

||||||||||||||||||||||||

|

Net assets, end of period ($ millions)

|

24 | 28 | 37 | 47 | 46 | 101 | ||||||||||||||||||

|

Ratio of expenses before expense reductions (%)

|

1.76 | * | 1.69 | 1.61 | 1.62 | 1.55 | 1.45 | |||||||||||||||||

|

Ratio of expenses after expense reductions (%)

|

1.59 | * | 1.68 | 1.60 | 1.41 | 1.38 | 1.36 | |||||||||||||||||

|

Ratio of net investment income (%)

|

2.07 | * | 1.66 | 1.31 | 1.53 | 2.22 | b | 1.08 | ||||||||||||||||

|

Portfolio turnover rate (%)

|

6 | ** | 25 | 28 | 152 | 154 | 119 | |||||||||||||||||

|

a Based on average shares outstanding during the period.

b Net investment income per share and the ratio of net investment income include non-recurring dividend income amounting to $0.12 per share and 1.27% of average daily net assets for the year ended October 31, 2008.

c Total return does not reflect the effect of any sales charges.

d Total return would have been lower had certain expenses not been reduced.

e Includes a reimbursement from the Advisor to reimburse the effect of losses incurred as a result of certain operation errors during the period. Excluding this reimbursement, total return would have been (50.68)%.

f Includes a non-recurring payment from the Advisor, which amounted to $0.013 per share, recorded as a result of the Advisor's settlement with the SEC and NY Attorney General in connection with certain trading arrangements. The Fund also received $0.01 per share of non-affiliated regulatory settlements. Excluding these non-recurring payments, total return would have been 0.35% lower.

* Annualized ** Not annualized *** Amount is less than $.005.

|

||||||||||||||||||||||||

|

Years Ended October 31,

|

||||||||||||||||||||||||

|

Class B

|

Six Months Ended 4/30/12 (Unaudited)

|

2011

|

2010

|

2009

|

2008

|

2007

|

||||||||||||||||||

|

Selected Per Share Data

|

||||||||||||||||||||||||

|

Net asset value, beginning of period

|

$ | 6.48 | $ | 7.08 | $ | 6.31 | $ | 5.44 | $ | 14.10 | $ | 12.80 | ||||||||||||

|