Exhibit 13

Pictured on front cover: Brian Miller, ProVia; Robbie Keim, Keim Lumber; Judy Delaney, Goodwill Industries of Wayne and Holmes Counties

2013 Report to Shareholders | CSB Bancorp, Inc. 3

LETTER TO SHAREHOLDERS

FELLOW SHAREHOLDERS:

CSB continues to focus on providing excellent service to our customers, developing our employees, supporting our communities and increasing value for our shareholders.

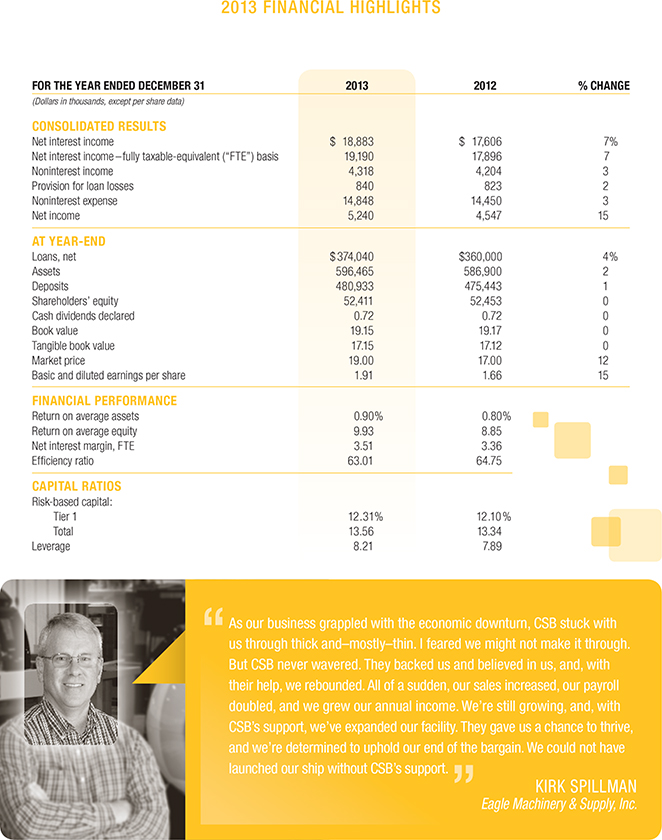

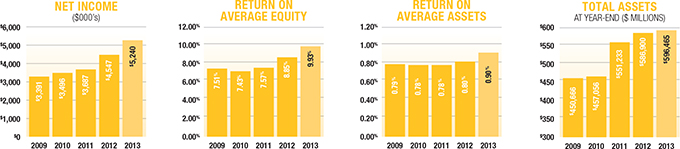

2013 results were encouraging and continued the Company’s growth and forward performance momentum. Net income increased to $5.2 million, eclipsing last year’s record high, while average total assets climbed to $581 million, the seventh consecutive year of record size for the Company.

Return on average shareholders’ equity amounted to 9.93% and return on average assets equaled 0.90%. Both of these numbers, while respectable, leave considerable room for improvement. We are intent on continuing the upward trend.

Credit quality within the Company’s loan and investment portfolios remained solid during 2013. Net charge-offs totaled 0.09% of average loans for the second year in a row. Loans more than 30 days past due or on nonaccrual amounted to 1.26% of year-end balances. The Company has no significant concentrations within its commercial loan portfolio. At year-end, commercial real estate loans, both owner and non-owner occupied, comprised 34% of total loans, followed by commercial and industrial loans at 31% and residential loans at 29%. Construction and land development, and consumer installment loans, comprised the remainder of loan balances.

Average deposit balances increased for the seventh year in a row and reached a fifth consecutive record high. Our capital levels exceed all regulatory requirements.

CSB also continued to pay a strong dividend, with an average yield of 3.75% over the course of the year. Our annual dividend yield has amounted to at least 3.75% for each of the past seven years based on average published daily closing stock prices. Total return on CSB stock during 2013 amounted to 15.9% when including dividends with stock price appreciation.

GROWTH PLANS

We remain committed to steadily growing the Company. Growth provides scale to increase cash flow for needed investments in infrastructure and personnel, generates capital to move forward when opportunities arise and creates a venue for the continued professional development of staff.

We evaluate growth opportunities within the context of prudent risk management and their fit with our strategic plan. We believe our current market area offers considerable growth potential. Growing our existing customer relationships, attracting new customers and serving each customer very well is the daily focus of every CSB employee.

We are also open to select expansion opportunities. Over the past seven years, the Company has acquired one bank, opened two new branches and purchased two additional branches. We continue to evaluate similar opportunities through the lens of what makes good business sense.

THE BANKING ENVIRONMENT

In our view, the new normal for banking includes interest margins that are lower than historic average, pervasive regulatory guidance, disruptive innovation by less-regulated entities, and a general preference among many customers for digital services. The contributing factors to this outlook are myriad and some are complex, but a few are unmistakably noteworthy.

The plodding economic recovery and sustained low interest rate environment continues to tamp down fundamental momentum for banking, as well as many other industries. However, there are clear signs of slow and steady improvement in the housing market, employment, household financial conditions and consumer spending, both nationally and in our local markets. The banking industry also has been regaining its health from a safety and soundness perspective and making progress toward more normalized earnings.

Congress’ inability to meaningfully address our nation’s most vexing fiscal problems portends more significant difficulties down the road. The gridlock is currently having a negative impact on the nation’s gross domestic product and may ultimately have adverse implications for individuals, corporations and communities alike. We do not anticipate that any significant economic legislation will be signed into law during the coming mid-term election year.

Resource intensive regulatory initiatives, technology initiatives, emerging payment system alternatives and threats to data integrity are increasing rapidly and adding to the challenging banking environment. These developments will be present for some time to come and the pace of change is not likely to slow in the foreseeable future.

4 2013 Report to Shareholders | CSB Bancorp, Inc.

LETTER TO SHAREHOLDERS

Many of the above factors are creating, individually or in concert with other factors, uncertainties for banks. These uncertainties are piling on top of existing incursions by nonbanks into traditional banking services such as lending and deposit-like services. Fundamentally, the overall challenge for banks will be to remain relevant in some of the aspects of the monetary system that have historically been the domain of the banking industry.

We are not waiting for more stable conditions to emerge. We are developing the capabilities and talent required for thriving in an environment of continuous change and innovation. We will continue keeping a sharp eye on costs and designing efficiencies. This will allow us to maximize the use of funds and talent for needed priorities. We are aligning our efforts in further development of delivery channels and organizing our teams in a manner that promotes agile response to opportunities at hand. We are investing for the future, positioning the Company for tomorrow’s requirements and opportunities as we grow and prepare for further growth.

INFRASTRUCTURE

In last year’s report, we outlined an ambitious list of technology upgrades and projects we were undertaking to further enhance our ability to serve customers effectively and efficiently. We are happy to report that we successfully completed deployment of a company-wide mortgage loan origination system, company-wide automated phone system, core computer processing system and an excellent mobile banking application. In addition, we’ve made considerable progress with our multi-year electronic document management initiative and are presently completing projects to upgrade all ATMs, install a company-wide commercial loan origination process and enhance debit card transaction capabilities. All of these initiatives are aimed squarely at supporting our commitment to provide excellent products and services safely, effectively and efficiently to our customers.

2013 Report to Shareholders | CSB Bancorp, Inc. 5

6 2013 Report to Shareholders | CSB Bancorp, Inc.

2013 Report to Shareholders | CSB Bancorp, Inc. 7

2013 FINANCIAL REVIEW

INTRODUCTION

CSB Bancorp, Inc. (the “Company” or “CSB”) was incorporated under the laws of the State of Ohio in 1991 and is a registered bank holding company. The Company’s wholly-owned subsidiaries are The Commercial and Savings Bank (the “Bank”) and CSB Investment Services, LLC, inactive. The Bank is chartered under the laws of the State of Ohio and was organized in 1879. The Bank is a member of the Federal Reserve System, with deposits insured by the Federal Deposit Insurance Corporation, and its primary regulators are the Ohio Division of Financial Institutions and the Federal Reserve Board.

The Company, through the Bank, provides retail and commercial banking services to its customers including checking and savings accounts, time deposits, cash management, safe deposit facilities, personal loans, commercial loans, real estate mortgage loans, installment loans, IRAs, night depository facilities and trust and brokerage services. Its customers are located primarily in Holmes, Tuscarawas, Wayne, Stark and portions of surrounding counties in Ohio.

The Company’s market area has historically exhibited relatively stable economic conditions; however, economic activity declined in the latter half of 2008 and the subsequent recovery continues at a slow pace. Unemployment levels in Holmes County have generally been among the lowest in the State of Ohio, while the balance of the Company’s market area reported unemployment levels below the state average for 2013 and 2012. Residential real estate property values have also returned to close to more normalized valuations. Household debt peaked in 2007 and has fallen as consumers were leery of taking on new loans; however, spending on durable goods, such as autos has begun to return to within the normal range. The Federal Reserve Bank of Cleveland has reported that a lot of Ohio’s growth activity in industrial production is coming from oil and shale. The Company’s market is adjacent to areas of primary shale activity.

FORWARD-LOOKING STATEMENTS

Certain statements contained in Management’s Discussion and Analysis of Financial Condition and Results of Operations are not related to historical results, but are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements involve a number of risks and uncertainties. Any forward-looking statements made by the Company herein and in future reports and statements are not guarantees of future performance, and actual results may differ materially from those in forward-looking statements because of various risk factors as discussed in this annual report and the Company’s Annual Report on Form 10-K. The Company does not undertake, and specifically disclaims, any obligation to publicly release the result of any revisions to any forward-looking statements to reflect the occurrence of unanticipated events or circumstances after the date of such statements.

8 2013 Report to Shareholders | CSB Bancorp, Inc.

2013 FINANCIAL REVIEW

SELECTED FINANCIAL DATA

The following table sets forth certain selected consolidated financial information:

| (Dollars in thousands) |

2013 | 2012 | 2011 | 2010 | 2009 | |||||||||||||||

| Statements of income: |

||||||||||||||||||||

| Total interest income |

$ | 21,138 | $ | 20,584 | $ | 20,018 | $ | 20,390 | $ | 22,105 | ||||||||||

| Total interest expense |

2,255 | 2,978 | 3,678 | 4,820 | 6,340 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net interest income |

18,883 | 17,606 | 16,340 | 15,570 | 15,765 | |||||||||||||||

| Provision for loan losses |

840 | 823 | 950 | 1,235 | 1,337 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net interest income after provision for loan losses |

18,043 | 16,783 | 15,390 | 14,335 | 14,428 | |||||||||||||||

| Noninterest income |

4,318 | 4,204 | 3,508 | 3,275 | 3,243 | |||||||||||||||

| Noninterest expense |

14,848 | 14,450 | 13,609 | 12,546 | 12,746 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income before income taxes |

7,513 | 6,537 | 5,289 | 5,064 | 4,925 | |||||||||||||||

| Income tax provision |

2,273 | 1,990 | 1,602 | 1,568 | 1,534 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income |

$ | 5,240 | $ | 4,547 | $ | 3,687 | $ | 3,496 | $ | 3,391 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Per share of common stock: |

||||||||||||||||||||

| Basic income per share |

$ | 1.91 | $ | 1.66 | $ | 1.35 | $ | 1.28 | $ | 1.24 | ||||||||||

| Diluted income per share |

1.91 | 1.66 | 1.35 | 1.28 | 1.24 | |||||||||||||||

| Dividends |

0.72 | 0.72 | 0.72 | 0.72 | 0.72 | |||||||||||||||

| Book value |

19.15 | 19.17 | 18.07 | 17.24 | 16.76 | |||||||||||||||

| Average basic common shares outstanding |

2,736,473 | 2,734,889 | 2,734,799 | 2,734,799 | 2,734,799 | |||||||||||||||

| Average diluted common shares outstanding |

2,738,477 | 2,735,141 | 2,734,838 | 2,734,799 | 2,734,799 | |||||||||||||||

| Year-end balances: |

||||||||||||||||||||

| Loans, net |

$ | 374,040 | $ | 360,000 | $ | 320,100 | $ | 311,616 | $ | 309,423 | ||||||||||

| Securities |

151,535 | 134,754 | 128,489 | 80,667 | 80,621 | |||||||||||||||

| Total assets |

596,465 | 586,900 | 551,233 | 457,056 | 450,666 | |||||||||||||||

| Deposits |

480,933 | 475,443 | 443,553 | 353,491 | 329,486 | |||||||||||||||

| Borrowings |

61,130 | 56,664 | 56,234 | 54,927 | 73,774 | |||||||||||||||

| Shareholders’ equity |

52,411 | 52,453 | 49,429 | 47,154 | 45,822 | |||||||||||||||

| Average balances: |

||||||||||||||||||||

| Loans, net |

$ | 369,889 | $ | 338,441 | $ | 314,670 | $ | 309,121 | $ | 313,726 | ||||||||||

| Securities |

138,976 | 132,567 | 93,851 | 77,967 | 75,597 | |||||||||||||||

| Total assets |

581,150 | 564,875 | 471,329 | 445,649 | 427,613 | |||||||||||||||

| Deposits |

468,395 | 453,526 | 367,865 | 334,073 | 304,902 | |||||||||||||||

| Borrowings |

57,882 | 57,735 | 52,717 | 62,951 | 75,734 | |||||||||||||||

| Shareholders’ equity |

52,787 | 51,384 | 48,674 | 47,081 | 45,184 | |||||||||||||||

| Select ratios: |

||||||||||||||||||||

| Net interest margin, tax equivalent basis |

3.51 | % | 3.36 | % | 3.71 | % | 3.73 | % | 3.93 | % | ||||||||||

| Return on average total assets |

0.90 | 0.80 | 0.78 | 0.78 | 0.79 | |||||||||||||||

| Return on average shareholders’ equity |

9.93 | 8.85 | 7.57 | 7.43 | 7.51 | |||||||||||||||

| Average shareholders’ equity as a percent of average total assets |

9.08 | 9.10 | 10.33 | 10.56 | 10.57 | |||||||||||||||

| Net loan charge-offs as a percent of average loans |

0.09 | 0.09 | 0.28 | 0.40 | 0.21 | |||||||||||||||

| Allowance for loan losses as a percent of loans at year-end |

1.34 | 1.26 | 1.26 | 1.28 | 1.29 | |||||||||||||||

| Shareholders’ equity as a percent of total year-end assets |

8.79 | 8.94 | 8.97 | 10.32 | 10.17 | |||||||||||||||

| Dividend payout ratio |

37.60 | 43.30 | 53.40 | 56.32 | 58.06 | |||||||||||||||

2013 Report to Shareholders | CSB Bancorp, Inc. 9

2013 FINANCIAL REVIEW

RESULTS OF OPERATIONS

Net Income

CSB’s 2013 net income was $5.2 million compared to $4.5 million for 2012, representing an increase of 15%. Basic and diluted earnings per share were $1.91, also up 15% from the prior year. The increased net income improved the return on average assets to 0.90% in 2013 from 0.80% in 2012 and return on average equity rose to 9.93% in 2013 from 8.85% in 2012.

Net income for 2012 was $4.5 million while basic and diluted earnings per share were $1.66, as compared to $3.7 million or $1.35 per share, for the year ended December 31, 2011. Net income increased 23% during 2012 as compared to 2011, due primarily to a $1.3 million increase in total net interest income and a $696 thousand increase in noninterest income. Partially offsetting the higher revenue were increases in noninterest expenses and federal income taxes. Return on average assets was 0.80% in 2012 compared to 0.78% in 2011, and return on average shareholders’ equity was 8.85% in 2012 as compared to 7.57% in 2011.

Net Interest Income

| (Dollars in thousands) |

2013 | 2012 | 2011 | |||||||||

| Net interest income |

$ | 18,883 | $ | 17,606 | $ | 16,340 | ||||||

| Taxable equivalent1 |

307 | 290 | 256 | |||||||||

|

|

|

|

|

|

|

|||||||

| Net interest income, fully taxable equivalent |

$ | 19,190 | $ | 17,896 | $ | 16,596 | ||||||

|

|

|

|

|

|

|

|||||||

| Net interest yield |

3.46 | % | 3.31 | % | 3.65 | % | ||||||

| Taxable equivalent adjustment1 |

0.05 | 0.05 | 0.06 | |||||||||

|

|

|

|

|

|

|

|||||||

| Net interest yield-taxable equivalent |

3.51 | % | 3.36 | % | 3.71 | % | ||||||

|

|

|

|

|

|

|

|||||||

| 1 | Taxable equivalent adjustments have been computed assuming a 34% tax rate. |

Net interest income is the largest source of the Company’s revenue and consists of the difference between interest income generated on earning assets and interest expense incurred on liabilities (deposits and short-term and long-term borrowings). Volumes, interest rates and composition of interest-earning assets and interest-bearing liabilities affect net interest income.

Net interest income increased $1.3 million or 7% in 2013 compared to 2012, partially due to a 3% increase in average earning assets, and a favorable mix trend of increased average loan balances and decreased cash balances. Additionally, the net interest margin increased to 3.51%, from 3.36% last year. The margin improvement was primarily due to lower funding costs resulting from a 3% increase in total average deposits, with average balance increases in lower cost demand, savings and maturing time deposits repricing at lower rates. Accretion of purchase accounting adjustments for loans, time deposits and borrowings acquired also improved the net interest margin by 5 basis points during 2013 and 2 basis points in 2012.

Interest income increased $554 thousand or 3% in 2013 compared to 2012 due to the $32 million increase in average loan balances, partially offset by lower yields. Rates decreased on all significant earning asset categories from reduced rates on new and repriced assets due to lending competition and the lower interest rate environment. Repricing of loans and lower rates to quality borrowers caused a decline in loan yields of 26 basis points in 2013 as compared to 2012. The increase in average loan volume helped mitigate the low interest rate environment. In 2013, average loan balances to average gross earning assets rose to 69%, compared to 64% in 2012. Securities yields continued to decline in 2013 with new and reinvestment cash flows being deployed at lower rates.

Interest income increased $566 thousand in 2012 as compared to 2011. The increase was primarily due to an increase of $85 million in average earning assets. The interest rate yield on average assets declined 61 basis points during 2012 as compared to 2011.

Interest expense decreased $723 thousand or 24% in 2013 as compared to 2012 due to decreases in the cost of all categories of interest bearing liabilities and a continued shift in the liability mix towards less expensive non-interest bearing demand deposits and savings accounts. Total average time deposits continue to decline with an emphasis on growing customers with multiple banking relationships, as opposed to single service time deposit customers.

Interest expense decreased $700 thousand, or 19%, for 2012 as compared to 2011, due to continued declines in average rates paid for interest bearing liabilities, from 1.05% in 2011 to 0.71% in 2012. Interest expense on deposits declined $541 thousand, even though average interest-bearing deposit balances increased by $65 million, or 22% in 2012 as compared to 2011. Interest expense on borrowed funds decreased by $159 thousand due to principal reductions and maturities of Federal Home Loan Bank (“FHLB”) advances, and lower interest rates remaining on outstanding borrowings.

10 2013 Report to Shareholders | CSB Bancorp, Inc.

2013 FINANCIAL REVIEW

The following table provides detailed analysis of changes in average balances, yield and net interest income:

| AVERAGE BALANCE SHEETS AND NET INTEREST | ||||||||||||||||||||||||||||||||||||

| MARGIN ANALYSIS | ||||||||||||||||||||||||||||||||||||

| 2013 | 2012 | 2011 | ||||||||||||||||||||||||||||||||||

| Average | Average | Average | Average | Average | Average | |||||||||||||||||||||||||||||||

| (Dollars in thousands) |

Balance1 | Interest | Rate2 | Balance1 | Interest | Rate2 | Balance1 | Interest | Rate2 | |||||||||||||||||||||||||||

| Interest-earning assets |

||||||||||||||||||||||||||||||||||||

| Federal funds sold |

$ | 188 | $ | 0 | 0.16 | % | $ | 148 | $ | 0 | 0.12 | % | $ | 92 | $ | 0 | 0.04 | % | ||||||||||||||||||

| Interest-earning deposits |

32,127 | 90 | 0.28 | 56,422 | 147 | 0.26 | 34,205 | 82 | 0.24 | |||||||||||||||||||||||||||

| Securities: |

||||||||||||||||||||||||||||||||||||

| Taxable |

122,314 | 2,572 | 2.10 | 118,867 | 2,672 | 2.25 | 81,341 | 2,538 | 3.12 | |||||||||||||||||||||||||||

| Tax exempt |

16,662 | 513 | 3.08 | 13,700 | 486 | 3.55 | 12,510 | 421 | 3.37 | |||||||||||||||||||||||||||

|

Loans3 |

374,821 | 17,963 | 4.79 | 342,868 | 17,279 | 5.05 | 318,781 | 16,977 | 5.33 | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| Total interest-earning assets |

546,112 | 21,138 | 3.87 | % | 532,005 | 20,584 | 3.87 | % | 446,929 | 20,018 | 4.48 | % | ||||||||||||||||||||||||

| Noninterest-earning assets |

||||||||||||||||||||||||||||||||||||

| Cash and due from banks |

12,911 | 12,399 | 11,094 | |||||||||||||||||||||||||||||||||

| Bank premises and equipment, net |

9,222 | 8,630 | 8,040 | |||||||||||||||||||||||||||||||||

| Other assets |

17,837 | 16,268 | 9,377 | |||||||||||||||||||||||||||||||||

| Allowance for loan losses |

(4,932 | ) | (4,427 | ) | (4,111 | ) | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

| Total assets |

$ | 581,150 | $ | 564,875 | $ | 471,329 | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

| Interest-bearing liabilities |

||||||||||||||||||||||||||||||||||||

| Demand deposits |

$ | 70,648 | 42 | 0.06 | % | $ | 63,346 | 50 | 0.08 | % | $ | 53,896 | 44 | 0.08 | % | |||||||||||||||||||||

| Savings deposits |

141,638 | 144 | 0.10 | 135,035 | 230 | 0.17 | 91,232 | 228 | 0.25 | |||||||||||||||||||||||||||

| Time deposits |

149,340 | 1,534 | 1.03 | 163,997 | 2,043 | 1.25 | 152,194 | 2,592 | 1.70 | |||||||||||||||||||||||||||

| Borrowed funds |

57,882 | 535 | 0.92 | 57,735 | 655 | 1.13 | 52,717 | 814 | 1.54 | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| Total interest-bearing liabilities |

419,508 | 2,255 | 0.54 | % | 420,113 | 2,978 | 0.71 | % | 350,039 | 3,678 | 1.05 | % | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| Noninterest-bearing liabilities and shareholders’ equity |

||||||||||||||||||||||||||||||||||||

| Demand deposits |

106,769 | 91,148 | 70,543 | |||||||||||||||||||||||||||||||||

| Other liabilities |

2,086 | 2,230 | 2,073 | |||||||||||||||||||||||||||||||||

| Shareholders’ equity |

52,787 | 51,384 | 48,674 | |||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

| Total liabilities and equity |

$ | 581,150 | $ | 564,875 | $ | 471,329 | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

| Net interest income |

$ | 18,883 | $ | 17,606 | $ | 16,340 | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

| Net interest margin |

3.46 | % | 3.31 | % | 3.65 | % | ||||||||||||||||||||||||||||||

| Net interest spread |

3.33 | % | 3.16 | % | 3.43 | % | ||||||||||||||||||||||||||||||

| 1 | Average balances have been computed on an average daily basis. |

| 2 | Average rates have been computed based on the amortized cost of the corresponding asset or liability. |

| 3 | Average loan balances include nonaccrual loans. |

2013 Report to Shareholders | CSB Bancorp, Inc. 11

2013 FINANCIAL REVIEW

The following table compares the impact of changes in average rates and changes in average volumes on net interest income:

| RATE/VOLUME ANALYSIS OF CHANGES | ||||||||||||||||||||||||

| IN INCOME AND EXPENSE1 | ||||||||||||||||||||||||

| 2013 v. 2012 | 2012 v. 2011 | |||||||||||||||||||||||

| Net Increase | Net Increase | |||||||||||||||||||||||

| (Dollars in thousands) |

(Decrease) | Volume | Rate | (Decrease) | Volume | Rate | ||||||||||||||||||

| Increase (decrease) in interest income: |

||||||||||||||||||||||||

| Interest-earning deposits |

$ | (57 | ) | $ | (68 | ) | $ | 11 | $ | 65 | $ | 58 | $ | 7 | ||||||||||

| Securities: |

||||||||||||||||||||||||

| Taxable |

(100 | ) | 72 | (172 | ) | 134 | 845 | (711 | ) | |||||||||||||||

| Tax exempt |

27 | 91 | (64 | ) | 65 | 42 | 23 | |||||||||||||||||

| Loans |

684 | 1,531 | (847 | ) | 302 | 1,216 | (914 | ) | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total interest income change |

554 | 1,626 | (1,072 | ) | 566 | 2,161 | (1,595 | ) | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Increase (decrease) in interest expense: |

||||||||||||||||||||||||

| Demand deposits |

(8 | ) | 4 | (12 | ) | 6 | 8 | (2 | ) | |||||||||||||||

| Savings deposits |

(86 | ) | 7 | (93 | ) | 2 | 75 | (73 | ) | |||||||||||||||

| Time deposits |

(509 | ) | (151 | ) | (358 | ) | (549 | ) | 147 | (696 | ) | |||||||||||||

| Other borrowed funds |

(120 | ) | 1 | (121 | ) | (159 | ) | 57 | (216 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total interest expense change |

(723 | ) | (139 | ) | (584 | ) | (700 | ) | 287 | (987 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net interest income |

$ | 1,277 | $ | 1,765 | $ | (488 | ) | $ | 1,266 | $ | 1,874 | $ | (608 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| 1 | Changes attributable to both volume and rate, which cannot be segregated, have been allocated based on the absolute value of the change due to volume and the change due to rate. |

Provision For Loan Losses

The provision for loan losses is determined by management as the amount required to bring the allowance for loan losses to a level considered appropriate to absorb probable future net charge-offs inherent in the loan portfolio as of period end. The provision for loan losses was $840 thousand in 2013, $823 thousand for 2012 and $950 thousand for 2011. Lower provision expense in 2013 and 2012 reflects improving economic conditions which have led to a decrease in charge-offs and nonperforming loans. See “Financial Condition – Allowance for Loan Losses” below for additional discussion and information relative to the provision for loan losses.

Noninterest Income

| YEAR ENDED DECEMBER 31 | ||||||||||||||||||||||||||||

| Change from 2012 | Change from 2011 | |||||||||||||||||||||||||||

| (Dollars in thousands) |

2013 | Amount | % | 2012 | Amount | % | 2011 | |||||||||||||||||||||

| Service charges on deposit accounts |

$ | 1,349 | $ | 44 | 3.4 | % | $ | 1,305 | $ | 171 | 15.1 | % | $ | 1,134 | ||||||||||||||

| Trust services |

826 | 155 | 23.1 | 671 | (6 | ) | (0.9 | ) | 677 | |||||||||||||||||||

| Debit card interchange fees |

779 | (18 | ) | (2.3 | ) | 797 | 166 | 26.3 | 631 | |||||||||||||||||||

| Securities gains |

159 | 159 | 100.0 | — | (237 | ) | (100.0 | ) | 237 | |||||||||||||||||||

| Gain on sale of loans, including MSR’s |

347 | (244 | ) | (41.3 | ) | 591 | 372 | 169.9 | 219 | |||||||||||||||||||

| Other |

858 | 18 | 2.1 | 840 | 230 | 37.7 | 610 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total noninterest income |

$ | 4,318 | $ | 114 | 2.7 | % | $ | 4,204 | $ | 696 | 19.8 | % | $ | 3,508 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

12 2013 Report to Shareholders | CSB Bancorp, Inc.

2013 FINANCIAL REVIEW

Noninterest income increased $114 thousand, or 3% in 2013 compared to the same period in 2012. Trust and brokerage fees increased 23% as assets under management increased from overall market improvements and customer development initiatives. The average market value of trust assets under management in 2013 was $86 million as compared to $76 million in 2012. Brokerage fees increased $86 thousand in 2013 as customers returned to stock and annuity investments to increase their returns. Service charges on deposits which are primarily customer overdraft fees, increased 3% in 2013 due to growth in deposits. Net gains on sales of mortgage loans including mortgage servicing rights (“MSR’s”) decreased 41% due to a significant slowdown in mortgage refinance activity during 2013. The Bank originated and sold $12 million in mortgage loans in 2013 as compared to the sale of $20 million of loans in 2012. With historical low interest rates during the first half of 2013, available-for-sale securities with gains of $159 thousand were sold as net loan demand increased.

Noninterest income increased $696 thousand, or 20% for 2012 as compared to 2011. Service charges on deposits increased $171 thousand and debit card interchange fees increased $166 thousand in 2012 as compared to 2011, reflecting the increase in accounts following the fourth quarter 2011 Wooster branch acquisition. Trust services income decreased in 2012 as brokerage fees declined $36 thousand, or 20%, and trust revenue increased $30 thousand, or 6%. The average market value of trust assets under management during 2012 and 2011 was $76 million and $68 million, respectively. Gain on sale of loans increased in 2012 from 2011 due to volume increases in 1-4 family residential mortgages sold into the secondary market, reflecting a consumer refinancing wave due to historically low mortgage rates. There were no securities sold in 2012. Other income increased $230 thousand in 2012 over 2011 primarily from increases in cash surrender value of bank-owned life insurance of $124 thousand following an additional $5 million purchase of bank-owned life insurance during first quarter 2012, an increase of $28 thousand in all other credit card fee income and an increase of $10 thousand in noncustomer ATM usage fees in 2012 over 2011.

Noninterest Expenses

| YEAR ENDED DECEMBER 31 |

||||||||||||||||||||||||||||

| Change from 2012 | Change from 2011 | |||||||||||||||||||||||||||

| (Dollars in thousands) |

2013 | Amount | % | 2012 | Amount | % | 2011 | |||||||||||||||||||||

| Salaries and employee benefits |

$ | 8,261 | $ | 301 | 3.8 | % | $ | 7,960 | $ | 501 | 6.7 | % | $ | 7,459 | ||||||||||||||

| Occupancy expense |

1,026 | 1 | 0.1 | 1,025 | 135 | 15.2 | 890 | |||||||||||||||||||||

| Equipment expense |

719 | 101 | 16.3 | 618 | 94 | 17.9 | 524 | |||||||||||||||||||||

| Professional and director fees |

628 | (186 | ) | (22.9 | ) | 814 | 101 | 14.2 | 713 | |||||||||||||||||||

| Franchise tax expense |

581 | 39 | 7.2 | 542 | (8 | ) | (1.5 | ) | 550 | |||||||||||||||||||

| Marketing and public relations |

395 | 3 | 0.8 | 392 | 72 | 22.5 | 320 | |||||||||||||||||||||

| Software expense |

530 | 139 | 35.5 | 391 | 18 | 4.8 | 373 | |||||||||||||||||||||

| Debit card expense |

268 | (36 | ) | (11.8 | ) | 304 | 51 | 20.2 | 253 | |||||||||||||||||||

| Amortization of intangible assets |

135 | (5 | ) | (3.6 | ) | 140 | 62 | 79.5 | 78 | |||||||||||||||||||

| FDIC insurance |

359 | 31 | 9.5 | 328 | (24 | ) | (6.8 | ) | 352 | |||||||||||||||||||

| Branch acquisition expense |

— | (8 | ) | (100.0 | ) | 8 | (329 | ) | (97.6 | ) | 337 | |||||||||||||||||

| Other real estate expenses |

9 | (24 | ) | N.M. | 33 | 58 | N.M. | (25 | ) | |||||||||||||||||||

| Other |

1,937 | 42 | 2.2 | 1,895 | 110 | 6.2 | 1,785 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total noninterest expenses |

$ | 14,848 | $ | 398 | 2.8 | % | $ | 14,450 | $ | 841 | 6.2 | % | $ | 13,609 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

N.M., not a meaningful value

Noninterest expense increased $398 thousand, or 3% in 2013 as compared to 2012. Salaries and employee benefits increased $301 thousand due to annual adjustments to compensation of $211 thousand and benefit increases of $90 thousand due to higher payroll taxes and retirement benefits. Software expense rose $139 thousand in 2013 due to the acquisition of new core processing and loan documentation software. Equipment expense increased $101 thousand in 2013 as compared to 2012 with the acquisition of a new core processor, new telephone system and new ATMs in the branch network. Franchise tax expense increased $39 thousand in 2013 to $581 thousand but is expected to decrease to under $450 thousand in 2014 with the new Ohio Financial Institutions Tax.

Noninterest expense increased $841 thousand, or 6% in 2012 as compared to 2011. Salaries and employee benefits increased $449 thousand due to a full year increase in personnel costs of the acquired branches and annual adjustments to compensation with employee benefits expense increasing $52 thousand from increased health insurance and retirement benefit costs. Occupancy expense increased $135 thousand and equipment expense increased $94 thousand as both expenses reflected the increase in the number of branches for a full year in

2013 Report to Shareholders | CSB Bancorp, Inc. 13

2013 FINANCIAL REVIEW

2012 as compared to 2011. Professional and director fees increased $101 thousand reflecting employment search fees for the Chief Operating Officer and commercial lending positions as well as fees spent to review the Company’s computer operating system. FDIC deposit insurance expense decreased $24 thousand in 2012 as compared to 2011 due to a prior year change in the calculation which resulted in a decreased rate for a full year in 2012 as compared to a partial year in 2011. Other expenses increased $110 thousand primarily due to the cost of running a larger institution.

Income Taxes

The provision for income taxes amounted to $2.3 million in 2013, $2.0 million in 2012 and $1.6 million in 2011, an effective rate of 30.3% in 2013, 30.4% in 2012 and 30.3% in 2011. The decrease in the effective tax rate during 2013 as compared to 2012 is due primarily to increased tax exempt income on securities and loans.

FINANCIAL CONDITION

Total assets of the Company were $597 million at December 31, 2013, compared to $587 million at December 31, 2012, representing an increase of $10 million, or 2%. Net loans increased $14 million, or 4%, while investment securities increased $17 million, or 13% and interest-earning deposits with other banks decreased $19 million. Deposits increased $6 million, or 1%, while other borrowings from the FHLB decreased by $213 thousand, or 2%.

Securities

Total investment securities increased $17 million, or 13% to $152 million at year-end 2013. CSB’s portfolio is primarily comprised of agency mortgage-backed securities, other government agencies’ debt, and obligations of state and political subdivisions. Restricted securities consist primarily of FHLB stock. During 2013, increases occurred in government agency debt, mortgage-backed securities, and corporate bonds.

The Company has no exposure to government-sponsored enterprise preferred stocks, collateralized debt obligations or trust preferred securities. The Company’s municipal bond portfolio consists of both taxable and tax-exempt general obligation and revenue bonds. As of December 31, 2013, $13.7 million, or 83%, held an S&P or Moody’s investment grade rating and $2.8 million or 17% were non-rated. The municipal portfolio includes a broad spectrum of counties, towns, universities and school districts in Ohio. Total gross unrealized security losses within the portfolio were 1.5% of total available-for-sale securities at December 31, 2013, reflecting interest rate fluctuations, not credit downgrades.

During the third quarter 2013, the Company reclassified $39 million of U.S. Agency and U.S. Agency collateralized mortgage-backed obligations from available-for-sale to held-to-maturity. The Company considers the held-to-maturity classification to be more appropriate in a rising interest rate environment as other comprehensive income is no longer negatively impacted by the decline in value on specific bonds. The Company has the ability and the intent to hold the longer-term Agency debt securities and the mortgage-backed securities to maturity. On the date of transfer, the $1.9 million gross unrealized loss became a discount to the carrying value of the bonds while the net of tax unrealized loss remained in shareholders’ equity in other comprehensive income. The effect on interest income of the accretion of the discount on the bonds is basically offset by the amortization of the other comprehensive loss over the life of the bonds.

One of the primary functions of the securities portfolio is to provide a source of liquidity and it is structured such that maturities and cash flows satisfy the Company’s liquidity needs and asset/liability management requirements.

Loans

Total loans increased $15 million, or 4% during 2013. Volume increases were recognized in commercial and commercial real estate loans of $23 million, or 10%, and residential real estate loans of $1 million, or 1%. Construction loans saw a decline of $10 million, or 42% as projects were completed and converted to permanent financing. During 2012 the Company added two seasoned commercial lenders in its newly expanded markets and combined with low interest rates and business expansion, increases in commercial and commercial real estate loans continued in 2013.

As investment spreads tightened in the mortgage-backed securities market, the Company developed marketing campaigns for fifteen year, lower fee, fixed-rate, owner occupied loans which drove the $1 million increase in residential real estate loans. Attractive interest rates in the secondary market continued to drive consumer demand for longer-term 1-4 family fixed rate residential mortgages during 2013 and the Company sold $12 million of originated mortgages into the secondary market as compared to $20 million in 2012. This demand for low fixed-rate mortgages included some refinancing of the Company’s in-house mortgage portfolio. Demand for home equity loans flattened in 2013, with balances decreasing $107 thousand. Installment lending improved slightly with consumer loans increasing 3% on a year over year basis to $6.7 million at December 31, 2013.

14 2013 Report to Shareholders | CSB Bancorp, Inc.

2013 FINANCIAL REVIEW

Management anticipates the Company’s local service areas will continue to exhibit modest economic growth in line with the past three years. Commercial and commercial real estate loans comprise approximately 65% and 61% of the total loan portfolio at year-end 2013 and 2012. Residential real estate loans decreased from 30% to approximately 29% between December 31, 2012 and December 31, 2013. Construction and land development loans decreased from 6% to 4% of the total portfolio between 2012 and 2013. The Company is well within the respective regulatory guidelines for investment in construction development and investment property loans that are not owner occupied.

Most of the Company’s lending activity is with customers primarily located within Holmes, Tuscarawas, Wayne and Stark Counties in Ohio. Credit concentrations, including commitments, as determined using North American Industry Classification Codes (NAICS), to the four largest industries compared to total loans at December 31, 2013 included $27 million, or 7% of total loans to lessors of non-residential buildings or dwellings; $19 million, or 5% of total loans to lessors of residential real estate; $17 million, or 4.5% of total loans to logging, sawmills and timber tract operations and $14 million, or 4% of total loans to borrowers in the hotel, motel and lodging business. These loans are generally secured by real property and equipment, and repayment is expected from operational cash flow. Credit evaluation is based on an evaluation of cash flow coverage of principal and interest payments and the adequacy of the collateral received.

Nonperforming Assets, Impaired Loans and Loans Past Due 90 Days or More

Nonperforming assets consist of nonaccrual loans, loans past due 90 days and still accruing and other real estate acquired through or in lieu of foreclosure. Other impaired loans include certain loans that are internally classified as substandard or doubtful. Loans are placed on nonaccrual status when they become past due 90 days or more, or when mortgage loans are past due as to principal and interest 120 days or more, unless they are both well secured and in the process of collection.

NONPERFORMING ASSETS

| DECEMBER 31 | ||||||||

| (Dollars in thousands) |

2013 | 2012 | ||||||

| Nonaccrual loans: |

||||||||

| Commercial |

$ | 84 | $ | 483 | ||||

| Commercial real estate |

1,108 | 1,745 | ||||||

| Residential real estate |

1,042 | 805 | ||||||

| Construction & land development |

— | 173 | ||||||

| Loans past due 90 days and still accruing: |

||||||||

| Commercial |

— | — | ||||||

| Commercial real estate |

40 | — | ||||||

| Residential real estate |

46 | 131 | ||||||

| Construction & land development |

950 | — | ||||||

| Total nonperforming loans |

3,270 | 3,337 | ||||||

| Other real estate owned |

— | 25 | ||||||

| Total nonperforming assets |

$ | 3,270 | $ | 3,362 | ||||

| Nonperforming assets as a percentage of loans plus other real estate |

0.86 | % | 0.92 | % | ||||

Allowance for Loan Losses

The allowance for loan losses is maintained at a level considered adequate to cover loan losses that are currently anticipated based on past loss experience, general economic conditions, changes in mix and size of the loan portfolio, information about specific borrower situations and other factors and estimates which are subject to change over time. Management periodically reviews selected large loans, delinquent and other problem loans and selected other loans. Collectability of these loans is evaluated by considering the current financial position and performance of the borrower, estimated market value of the collateral, the Company’s collateral position in relationship to other creditors, guarantees and other potential sources of repayment. Management forms judgments, which are in part subjective, as to the probability of loss and the amount of loss on these loans as well as other loans taken together. The Company’s Allowance for Loan Losses Policy includes, among other items, provisions for classified loans and a provision for the remainder of the portfolio based on historical data, including past charge-offs.

2013 Report to Shareholders | CSB Bancorp, Inc. 15

2013 FINANCIAL REVIEW

ALLOWANCE FOR LOAN LOSSES

| FOR THE YEAR ENDED | ||||||||

| (Dollars in thousands) |

2013 | 2012 | ||||||

| Beginning balance of allowance for loan losses |

$ | 4,580 | $ | 4,082 | ||||

| Provision for loan losses |

840 | 823 | ||||||

| Charge-offs: |

||||||||

| Commercial |

149 | 29 | ||||||

| Commercial real estate |

108 | 283 | ||||||

| Residential real estate & home equity |

82 | 106 | ||||||

| Construction & land development |

— | — | ||||||

| Consumer |

48 | 39 | ||||||

| Deposit accounts |

35 | 50 | ||||||

| Credit cards |

6 | — | ||||||

| Total charge-offs |

428 | 507 | ||||||

| Recoveries: |

||||||||

| Commercial |

15 | 16 | ||||||

| Commercial real estate |

— | — | ||||||

| Residential real estate & home equity |

18 | 102 | ||||||

| Construction & land development |

— | — | ||||||

| Consumer |

50 | 44 | ||||||

| Deposit accounts |

10 | 20 | ||||||

| Credit cards |

— | — | ||||||

| Total recoveries |

93 | 182 | ||||||

| Net charge-offs |

335 | 325 | ||||||

| Ending balance of allowance for loan losses |

$ | 5,085 | $ | 4,580 | ||||

| Net charge-offs as a percentage of average total loans |

0.09 | % | 0.09 | % | ||||

| Allowance for loan losses as a percentage of total loans |

1.34 | 1.26 | ||||||

| Allowance for loan losses to total nonperforming loans |

1.56 | x | 1.37 | x | ||||

| Components of the allowance for loan losses: |

||||||||

| General reserves |

$ | 4,301 | $ | 3,801 | ||||

| Specific reserve allocations |

784 | 779 | ||||||

| Total allowance for loan losses |

$ | 5,085 | $ | 4,580 | ||||

The allowance for loan losses totaled $5.1 million, or 1.34%, of total loans at year-end 2013 as compared to $4.6 million, or 1.26% of total loans at year-end 2012. Net charge-offs for 2013 totaled $335 thousand as compared to net charge-offs of $325 thousand in 2012.

The Company maintains an internal watch list on which it places loans where management’s analysis of the borrower’s operating results and financial condition indicates that the borrower’s cash flows are inadequate to meet its debt service requirements and loans where there exists an increased risk that such a shortfall may occur. Nonperforming loans, which consist of loans past due 90 days or more and nonaccrual loans aggregated $3.3 million, or 0.9% of loans at year-end 2013 as compared to $3.3 million, or 0.9% of loans at year-end 2012. Impaired loans were $10.7 million at year-end 2013 as compared to $10.2 million at year-end 2012. Impaired loans as a percentage of total loans remained stable from 2012 to 2013 and reflect economic stabilization in the Company’s market area with decreasing unemployment levels. Management has assigned loss allocations to absorb the estimated losses on these impaired loans, and these allocations are included in the total allowance for loan losses balance.

16 2013 Report to Shareholders | CSB Bancorp, Inc.

2013 FINANCIAL REVIEW

Other Assets

Net premises and equipment increased $215 thousand to $8.7 million at year-end 2013 primarily as the purchase of equipment and furniture in 2013 exceeded depreciation expense. There was no other real estate owned at December 31, 2013 compared to $25 thousand owned at December 31, 2012. Bank-owned life insurance of $1 million was purchased on the life of a senior management member during 2013. At December 31, 2013 the Company recognized a net deferred tax asset of $1.2 million as compared to a net deferred tax liability of $476 thousand at December 31, 2012. The change in the Company’s net deferred tax position resulted primarily from the increase in the net deferred asset related to the unrealized loss on securities available-for-sale.

Deposits

The Company’s deposits are obtained primarily from individuals and businesses located in its market area. For deposits, the Company must compete with products offered by other financial institutions as well as alternative investment options. Demand and savings deposits increased for the year ended 2013, due to focused retail and business banking strategies to obtain more account relationships as well as customers reflecting their preference for shorter maturities.

| December 31 | Change from 2012 | |||||||||||||||

| (Dollars in thousands) |

2013 | 2012 | Amount | % | ||||||||||||

| Noninterest-bearing demand |

$ | 120,325 | $ | 104,147 | $ | 16,178 | 15.5 | % | ||||||||

| Interest-bearing demand |

76,327 | 74,429 | 1,898 | 2.6 | ||||||||||||

| Traditional savings |

76,630 | 67,957 | 8,673 | 12.8 | ||||||||||||

| Money market savings |

73,307 | 70,837 | 2,470 | 3.5 | ||||||||||||

| Time deposits in excess of $100,000 |

42,562 | 54,163 | (11,601 | ) | (21.4 | ) | ||||||||||

| Other time deposits |

91,782 | 103,910 | (12,128) | (11.7) | ||||||||||||

| Total deposits |

$ | 480,933 | $ | 475,443 | $ | 5,490 | 1.2 | % | ||||||||

Other Funding Sources

The Company obtains additional funds through securities sold under repurchase agreements, overnight borrowings from the FHLB or other financial institutions and advances from the FHLB. Short-term borrowings, which consist of securities sold under repurchase agreements, increased $5 million; while other borrowings, which consist of FHLB advances, decreased $213 thousand due to required principal repayments during 2013.

CAPITAL RESOURCES

Total shareholders’ equity decreased to $52.4 million at December 31, 2013 as compared to $52.5 million at December 31, 2012. This decrease was primarily due to $3.3 million other comprehensive loss and the payment of $2.0 million cash dividends which were offset by $5.2 million of net income in 2013. The Board of Directors approved a Stock Repurchase Program on July 7, 2005 that would allow the repurchase of up to 10% of the Company’s then-outstanding common shares. Repurchased shares are to be held as treasury stock and would be available for general corporate purposes. At December 31, 2013, approximately forty-one thousand shares could still be repurchased under the current authorized program. No shares were repurchased in 2013 or 2012.

`Banking regulations have established minimum capital ratios for banks and bank holding companies. Therefore, the Company and the Bank must meet a risk-based capital requirement, which defines two tiers of capital and compares each to the Company’s “risk-weighted assets.” The Company’s assets and certain off-balance-sheet items, such as loan commitments, are each assigned a risk factor such that assets with potentially higher credit risk will require more capital support than assets with lower risk. These regulations require the Company to have a minimum total risk-based capital ratio of 8%, at least half of which must be Tier 1 capital. The Company’s Tier 1 capital is its shareholders’ equity before any unrealized gain or loss on securities available-for-sale, while total risk-based capital includes Tier 1 capital and a limited amount of the allowance for loan losses. In addition, a bank or bank holding company’s leverage ratio (which for the Company equals its shareholders’ equity before any unrealized gain or loss on securities available-for-sale, divided by average assets) must be maintained at a minimum of 4%. The Company and Bank’s actual and required capital amounts are disclosed in Note 12 to the consolidated financial statements.

2013 Report to Shareholders | CSB Bancorp, Inc. 17

2013 FINANCIAL REVIEW

Dividends paid by the Bank to CSB are the primary source of funds available to the Company for payment of dividends to shareholders and for other working capital needs. The payment of dividends by the Bank to the Company is subject to restrictions by regulatory authorities, which generally limit dividends to current year net income and the prior two years net retained earnings, as defined by regulation. In addition, dividend payments generally cannot reduce regulatory capital levels below the minimum regulatory guidelines discussed above.

In July 2013, the Federal Reserve adopted final rules effective generally on January 1, 2015 to implement the Basel III and regulatory capital changes required by the Dodd-Frank Act. These changes will apply to the Company and the Bank. Among other things, the rules include new minimum risk-based and leverage capital requirements for all banking organizations and removal of references to credit ratings. A new capital conservation buffer of 2.5% of risk-weighted assets is being phased-in over a transition period ending December 31, 2018. Failure to maintain the required ratios will restrict or prohibit dividends, share repurchases and discretionary bonuses. Management is evaluating the new rules and their effects on the Company and the Bank, but Management believes the Company and the Bank will remain “well-capitalized” under the new rules.

LIQUIDITY

| December 31 | Change | |||||||||||

| (Dollars in millions) |

2013 | 2012 | from 2012 | |||||||||

| Cash and cash equivalents |

$ | 43 | $ | 67 | $ | (24 | ) | |||||

| Unused lines of credit |

42 | 41 | 1 | |||||||||

| Unpledged securities at fair market value |

42 | 59 | $ | (17 | ) | |||||||

|

|

|

|

|

|

|

|||||||

| $ | 127 | $ | 167 | (40 | ) | |||||||

|

|

|

|

|

|

|

|||||||

| Net deposits and short-term liabilities |

$ | 473 | $ | 444 | $ | 29 | ||||||

|

|

|

|

|

|

|

|||||||

| Liquidity ratio |

26.9 | % | 37.6 | % | ||||||||

| Minimum board approved liquidity ratio |

20.0 | % | 20.0 | % | ||||||||

Liquidity refers to the Company’s ability to generate sufficient cash to fund current loan demand, meet deposit withdrawals, pay operating expenses and meet other obligations. The Company’s liquidity ratio declined in 2013 as a result of continuing to deploy cash received in the Wooster branch acquisition in fourth quarter 2011 into loans and investments. Liquidity is monitored by CSB’s Asset Liability Committee. The Company was within all Board-approved limits at December 31, 2013 and 2012. Additional sources of liquidity include net income, loan repayments, and adjustments of interest rates to attract deposit accounts.

As summarized in the consolidated statements of cash flows, the most significant investing activities for the Company in 2013 included net loan originations of $15 million and the maturities and repayments of securities totaling $37 million, offset by $64 million in securities purchases and the $1 million purchase of bank-owned life insurance. The Company’s financing activities included a $6 million increase in deposits, a $5 million increase in securities sold under agreements to repurchase and a $213 thousand net repayment of FHLB advances.

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

The most significant market risk to which the Company is exposed is interest rate risk. The business of the Company and the composition of its balance sheet consist of investments in interest-earning assets (primarily loans and securities), which are funded by interest-bearing liabilities (deposits and borrowings). These financial instruments have varying levels of sensitivity to changes in the market rates of interest, resulting in market risk. None of the Company’s financial instruments are held for trading purposes.

The Board of Directors establishes policies and operating limits with respect to interest rate risk. The Company manages interest rate risk regularly through its Asset Liability Committee. The Committee meets on a monthly basis and reviews various asset and liability management information including, but not limited to, the Company’s liquidity position, projected sources and uses of funds, interest rate risk position and economic conditions.

Interest rate risk is monitored primarily through the use of an earnings simulation model. The model is highly dependent on various assumptions, which change regularly as the balance sheet and market interest rates change. The earnings simulation model projects changes in net interest income resulting from the effect of changes in interest rates. The analysis is performed quarterly over a twenty-four month horizon. The analysis includes two balance sheet models, one based on a static balance sheet and one on a dynamic balance sheet with projected growth in assets and liabilities. This analysis is performed by estimating the expected cash flows of the Company’s financial instruments using interest rates in effect at year-end 2013 and 2012. Interest rate risk policy limits are tested by measuring the anticipated change in net interest income

18 2013 Report to Shareholders | CSB Bancorp, Inc.

2013 FINANCIAL REVIEW

over a two year period. The tests assume a quarterly ramped 100, 200, 300 and 400 basis point increase and a 100 basis point decrease in 2013 in market interest rates as compared to a stable rate environment or base model. The following table reflects the change to interest income for the first twelve month period of the twenty-four month horizon.

Net Interest Income at Risk

| December 31, 2013 | ||||||||||||||||||||

| Net | ||||||||||||||||||||

| Change In | Interest | Dollar | Board | |||||||||||||||||

| Interest Rates | Income | Change | Percentage | Policy | ||||||||||||||||

| (Basis Points) |

(Dollars in thousands) | Change | Limits | |||||||||||||||||

| + 400 | $ | 20,812 | $ | 962 | 4.8 | % | ±25 | % | ||||||||||||

| + 300 | 20,507 | 657 | 3.3 | ±15 | ||||||||||||||||

| + 200 | 20,217 | 367 | 1.8 | ±10 | ||||||||||||||||

| + 100 | 19,966 | 116 | 0.6 | ±5 | ||||||||||||||||

| 0 | 19,850 | — | — | |||||||||||||||||

| – 100 | 19,644 | (206 | ) | (1.0 | ) | ±5 | ||||||||||||||

| December 31, 2012 | ||||||||||||||||||||

| + 400 | $ | 19,420 | $ | 1,762 | 10.0 | % | ±25 | % | ||||||||||||

| + 300 | 18,982 | 1,324 | 7.5 | ±15 | ||||||||||||||||

| + 200 | 18,507 | 849 | 4.8 | ±10 | ||||||||||||||||

| + 100 | 18,053 | 395 | 2.2 | ±5 | ||||||||||||||||

| 0 | 17,658 | — | — | |||||||||||||||||

| – 100 | 17,483 | (175 | ) | (1.0 | ) | ±5 | ||||||||||||||

Management reviews Net Interest Income at Risk with the Board on a periodic basis. The Company was within all Board-approved limits at December 31, 2013 and 2012.

Economic Value of Equity at Risk

| December 31, 2013 | ||||||||||||

| Change In Interest Rates (Basis Points) |

Percentage Change |

Board Policy Limits |

||||||||||

| + 400 | 9.8 | % | ±35 | % | ||||||||

| + 300 | 8.8 | ±30 | ||||||||||

| + 200 | 7.4 | ±20 | ||||||||||

| + 100 | 4.7 | ±15 | ||||||||||

| – 100 | (7.6 | ) | ±15 | |||||||||

| December 31, 2012 | ||||||||||||

| + 400 | 19.0 | % | ±35 | % | ||||||||

| + 300 | 17.4 | ±30 | ||||||||||

| + 200 | 14.8 | ±20 | ||||||||||

| + 100 | 9.5 | ±15 | ||||||||||

2013 Report to Shareholders | CSB Bancorp, Inc. 19

2013 FINANCIAL REVIEW

The economic value of equity is calculated by subjecting the period-end balance sheet to changes in interest rates and measuring the impact of the changes on the values of the assets and liabilities. Hypothetical changes in interest rates are then applied to the financial instruments, and the cash flows and fair values are again estimated using these hypothetical rates. For the net interest income estimates, the hypothetical rates are applied to the financial instruments based on the assumed cash flows.

Management periodically measures and reviews the Economic Value of Equity at Risk with the Board. At December 31, 2013, the market value of equity as a percent of base in a 400 basis point rising rate environment indicates an increase of 9.8%, as compared to an increase of 19.0% as of December 31, 2012. The Company added the review of a -100 basis change in interest rates during 2013 as rates had risen at December 31, 2013 in comparison with 2012. The Company was within all Board-approved limits at December 31, 2013 and 2012.

SIGNIFICANT ASSUMPTIONS AND OTHER CONSIDERATIONS

The above analysis is based on numerous assumptions, including relative levels of market interest rates, loan prepayments and reactions of depositors to changes in interest rates, and should not be relied upon as being indicative of actual results. Further, the analysis does not necessarily contemplate all actions the Company may undertake in response to changes in interest rates.

U.S. Treasury securities, obligations of U.S. Government corporations and agencies and obligations of states and political subdivisions will generally repay at their stated maturity, or if callable prior to their final maturity date. Mortgage-backed security payments increase when interest rates are low and decrease when interest rates rise. Many of the Company’s loans permit the borrower to prepay the principal balance prior to maturity without penalty. The likelihood of prepayment depends on a number of factors, including current interest rate and interest rate index (if any) on the loan, the financial ability of the borrower to refinance, the economic benefit to be obtained from refinancing, availability of refinancing at attractive terms, as well as economic and other factors in specific geographic areas which affect the sales and price levels of residential and commercial property. In a changing interest rate environment, prepayments may increase or decrease on fixed and adjustable rate loans depending on the current relative levels and expectations of future short-term and long-term interest rates. Prepayments on adjustable rate loans generally increase when long-term interest rates fall or are at historically low levels relative to short-term interest rates, thus making fixed rate loans more desirable. While savings and checking deposits generally may be withdrawn upon the customer’s request without prior notice, a continuing relationship with customers resulting in future deposits and withdrawals is generally predictable, resulting in a dependable and uninterrupted source of funds. Time deposits generally have early withdrawal penalties, which discourage customer withdrawal prior to maturity. Short-term borrowings have fixed maturities. Certain advances from the FHLB carry prepayment penalties and are expected to be repaid in accordance with their contractual terms.

FAIR VALUE MEASUREMENTS

The Company discloses the estimated fair value of its financial instruments at December 31, 2013 and 2012 in Note 15 to the consolidated financial statements.

OFF-BALANCE SHEET ARRANGEMENTS, CONTRACTUAL OBLIGATIONS, AND CONTINGENT LIABILITIES AND COMMITMENTS

The following table summarizes the Company’s loan commitments, including letters of credit, as of December 31, 2013:

| Amount of Commitment to Expire Per Period | ||||||||||||||||||||

| (Dollars in thousands) Type of Commitment |

Total Amount |

Less than 1 year |

1 to 3 Years |

3 to 5 Years |

Over 5 Years |

|||||||||||||||

| Commercial lines-of-credit |

$ | 68,029 | $ | 62,438 | $ | 209 | $ | 2,081 | $ | 3,301 | ||||||||||

| Real estate lines-of-credit |

35,880 | 2,936 | 5,510 | 4,947 | 22,487 | |||||||||||||||

| Consumer lines-of-credit |

842 | 842 | — | — | — | |||||||||||||||

| Credit cards lines-of-credit |

3,493 | 3,493 | — | — | — | |||||||||||||||

| Overdraft privilege |

6,523 | 6,523 | — | — | — | |||||||||||||||

| Commercial real estate loan commitments |

4,804 | 4,804 | — | — | — | |||||||||||||||

| Letters of credit |

679 | 679 | — | — | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total commitments |

$ | 120,250 | $ | 81,715 | $ | 5,719 | $ | 7,028 | $ | 25,788 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

20 2013 Report to Shareholders | CSB Bancorp, Inc.

2013 FINANCIAL REVIEW

As indicated in Note 10 to the consolidated financial statements, the Company had $120 million in total loan commitments at the end of 2013, with $77 million of that amount expiring within one year. All lines-of-credit represent either fee-paid or legally binding loan commitments for the loan categories noted. Letters of credit are also included in the amounts noted in the table since the Company requires that each letter of credit be supported by a loan agreement. The commercial and consumer lines represent both unsecured and secured obligations. The real estate lines are secured by mortgages on residential and nonresidential property. It is anticipated that a significant portion of these lines will expire without being drawn upon.

The following table summarizes the Company’s other contractual obligations, exclusive of interest, as of December 31, 2013:

| Payment Due by period | ||||||||||||||||||||

| (Dollars in thousands) Contractual Obligations |

Total Amount |

Less than 1 year |

1 to 3 Years |

3 to 5 Years |

Over 5 Years |

|||||||||||||||

| Total time deposits |

$ | 134,344 | $ | 75,051 | $ | 44,073 | $ | 15,173 | $ | 47 | ||||||||||

| Short-term borrowings |

48,671 | 48,671 | — | — | — | |||||||||||||||

| Other borrowings |

12,459 | 2,190 | 266 | 10,003 | — | |||||||||||||||

| Operating leases |

797 | 299 | 466 | 32 | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total obligations |

$ | 196,271 | $ | 126,211 | $ | 44,805 | $ | 25,208 | $ | 47 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

The other borrowings noted in the preceding table represent borrowings from the FHLB of Cincinnati. The notes require payment of interest on a monthly basis with principal due in monthly installments or at maturity, depending upon the issue. The obligations bear stated fixed interest rates and stipulate a prepayment penalty if the note’s interest rate exceeds the current market rate for similar borrowings at the time of repayment. As the notes mature, the Company evaluates the liquidity and interest rate circumstances, at that time, to determine whether to pay off or renew the note. The evaluation process typically includes the strength of current and projected customer loan demand, the Company’s federal funds sold or purchased position, projected cash flows from maturing investment securities, the current and projected market interest rate environment, local and national economic conditions and customer demand for the Company’s deposit product offerings.

CRITICAL ACCOUNTING POLICIES

The Company’s consolidated financial statements are prepared in accordance with U.S. generally accepted accounting principles and follow general practices within the commercial banking industry. Application of these principles requires management to make estimates, assumptions and judgments that affect the amounts reported in the financial statements. These estimates, assumptions, and judgments are based upon the information available as of the date of the financial statements.

The most significant accounting policies followed by the Company are presented in the Summary of Significant Accounting Policies. These policies, along with the other disclosures presented in the Notes to Consolidated Financial Statements and the 2013 Financial Review, provide information about how significant assets and liabilities are valued in the financial statements and how those values are determined. Management has identified the allowance for loan losses and the fair value of financial instruments as the accounting areas that require the most subjective and complex estimates, assumptions and judgments and, as such, could be the most subject to revision as new information becomes available.

Securities are evaluated periodically to determine whether a decline in their value is other-than-temporary. Management utilizes criteria such as the magnitude and duration of the decline, in addition to the reasons underlying the decline, to determine whether the loss in value is other-than-temporary. The term “other-than-temporary” is not intended to indicate that the decline is permanent, but indicates that the prospect for a near-term recovery of value is not necessarily favorable, or that there is a lack of evidence to support a realizable value equal to or greater than the carrying value of the investment. Once a decline in value is determined to be other-than-temporary, the value of the security is reduced and a corresponding charge to earnings is recognized.

As previously noted in the section entitled Allowance for Loan Losses, management performs analysis to assess the adequacy of its allowance for loan losses. This analysis encompasses a variety of factors including the potential loss exposure for individually reviewed loans, the historical loss experience, the volume of nonperforming loans (i.e., loans in nonaccrual status or past due 90 days or more), the volume of loans past due, any significant changes in lending or loan review staff, an evaluation of current and future local and national economic conditions, any significant changes in the volume or mix of loans within each category, a review of the significant concentrations of credit and any legal, competitive or regulatory concerns.

2013 Report to Shareholders | CSB Bancorp, Inc. 21

2013 FINANCIAL REVIEW

CSB accounts for business combinations using the acquisition method of accounting. Goodwill and intangible assets with indefinite useful lives are not amortized. Intangible assets with finite useful lives, consisting of core deposit intangibles, are amortized using accelerated methods over their estimated weighted-average useful lives, approximating ten years. Additional information is presented in Note 5, Core Deposit Intangible Asset.

IMPACT OF INFLATION AND CHANGING PRICES

The consolidated financial statements and related data presented herein have been prepared in accordance with U.S. generally accepted accounting principles, requiring measurement of financial position and results of operations primarily in terms of historical dollars without considering changes in the relative purchasing power of money over time due to inflation. Unlike most industrial companies, most assets and liabilities of the Company are monetary in nature. Therefore, interest rates have a more significant impact on the Company’s performance than the effects of general levels of inflation. Interest rates do not necessarily move in the same direction or in the same magnitude as prices of goods and services. The liquidity, maturity structure and quality of the Company’s assets and liabilities are critical to maintenance of acceptable performance levels.

COMMON STOCK AND SHAREHOLDER INFORMATION

Common shares of the Company are not traded on an established market. Shares are traded on the over-the-counter-bulletin-board through broker/dealers under the symbol “CSBB” and through private transactions. The table below represents the range of high and low prices paid for transactions known to the Company. Management does not have knowledge of prices paid on all transactions. Because of the lack of an established market, these prices may not reflect the prices at which stock would trade in an active market. These quotations reflect interdealer prices, without mark-up, markdown or commission and may not represent actual transactions. The table specifies cash dividends declared by the Company to its shareholders during 2013 and 2012. No assurances can be given that future dividends will be declared, or if declared, what the amount of any such dividends will be. Additional information concerning restrictions over the payment of dividends is included in Note 12 of the consolidated financial statements.

| Dividends | ||||||||||||||||

| Declared | Dividends | |||||||||||||||

| Quarter Ended |

High | Low | Per Share | Declared | ||||||||||||

| March 31, 2013 |

$ | 19.20 | $ | 17.00 | $ | 0.18 | $ | 492,594 | ||||||||

| June 30, 2013 |

20.85 | 19.00 | 0.18 | 492,594 | ||||||||||||

| September 30, 2013 |

20.80 | 18.60 | 0.18 | 492,594 | ||||||||||||

| December 31, 2013 |

19.60 | 18.62 | 0.18 | 492,594 | ||||||||||||

| March 31, 2012 |

$ | 20.00 | $ | 16.00 | $ | 0.18 | $ | 492,264 | ||||||||

| June 30, 2012 |

20.50 | 17.50 | 0.18 | 492,264 | ||||||||||||

| September 30, 2012 |

20.49 | 17.75 | 0.18 | 492,264 | ||||||||||||

| December 31, 2012 |

18.65 | 16.84 | 0.18 | 492,374 | ||||||||||||

As of December 31, 2013, the Company had 1,300 known shareholders of record and 2,736,634 outstanding shares of common stock.

22 2013 Report to Shareholders | CSB Bancorp, Inc.

REPORT ON MANAGEMENT’S ASSESSMENT OF

INTERNAL CONTROL OVER FINANCIAL REPORTING

The management of CSB Bancorp, Inc. is responsible for establishing and maintaining adequate internal control over financial reporting. Management has designed our internal control over financial reporting to provide reasonable assurance that our published financial statements are fairly presented, in all material respects, in conformity with U.S. generally accepted accounting principles.

Management is required by paragraph (c) of Rule 13a-15 of the Securities Exchange Act of 1934, as amended, to assess the effectiveness of our internal control over financial reporting as of each year-end. In making this assessment, management used the Internal Control-Integrated Framework issued in July 1994 by the Committee of Sponsoring Organizations of the Treadway Commission (COSO).

Management conducted the required assessment of the effectiveness of our internal control over financial reporting as of December 31, 2013. Based upon this assessment, management believes that our internal control over financial reporting is effective as of December 31, 2013.

This annual report does not include an attestation report of the Company’s registered public accounting firm regarding internal control over financial reporting. Management’s report was not subject to attestation by the Company’s registered public accounting firm pursuant to the rules of the Securities and Exchange Commission that permit the Company to provide only management’s report in this annual report.

|

| |

| Eddie L. Steiner | Paula J. Meiler | |

| President, | Senior Vice President, | |

| Chief Executive Officer | Chief Financial Officer | |

2013 Report to Shareholders | CSB Bancorp, Inc. 23

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM REPORT

Board of Directors and Shareholders

CSB Bancorp, Inc.

We have audited the accompanying consolidated balance sheets of CSB Bancorp, Inc. and subsidiaries as of December 31, 2013 and 2012, and the related consolidated statements of income, comprehensive income, changes in shareholders’ equity, and cash flows for each of the three years in the period ended December 31, 2013. These consolidated financial statements are the responsibility of CSB Bancorp, Inc.’s management. Our responsibility is to express an opinion on these consolidated financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement. CSB Bancorp, Inc. is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of CSB Bancorp, Inc.’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of CSB Bancorp, Inc. and subsidiaries as of December 31, 2013 and 2012, and the consolidated results of their operations and their cash flows for each of the years then ended, in conformity with U.S. generally accepted accounting principles.

Wexford, Pennsylvania

March 6, 2014

24 2013 Report to Shareholders | CSB Bancorp, Inc.

CONSOLIDATED BALANCE SHEETS

December 31, 2013 and 2012

| (Dollars in thousands) |

2013 | 2012 | ||||||

| ASSETS |

||||||||

| Cash and cash equivalents |

||||||||

| Cash and due from banks |

$ | 15,777 | $ | 21,485 | ||||

| Interest-earning deposits in other banks |

26,822 | 45,393 | ||||||

|

|

|

|

|

|||||

| Total cash and cash equivalents |

42,599 | 66,878 | ||||||

|

|

|

|

|

|||||

| Securities |

||||||||