UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark one)

| x | ANNUAL REPORT PURSUANT TO SECTIONS 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2013

OR

| ¨ | TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File No. 0-21714

CSB BANCORP, INC.

(Exact name of registrant as specified in its charter)

| Ohio | 34-1687530 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

| 91 North Clay Street, Millersburg, Ohio | 44654 | |

| (Address of principal executive offices) | (Zip code) |

Registrant’s telephone number, including area code (330) 674-9015

Securities registered under Section 12(b) of the Act: None

Securities registered under Section 12(g) of the Act:

Common Shares, $6.25 par value

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨ Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months. x Yes ¨ No

Indicate by check mark if disclosure of delinquent filers in response to Item 405 of Regulation S-K is not contained herein and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check One):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ | Smaller reporting company | x | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ¨ Yes x No

At June 30, 2013, the aggregate market value of the voting common equity held by non-affiliates of the registrant, based on a share price of $19.25 per common share (such price being the last trade price on such date) was $48.1 million.

At March 25, 2014, there were outstanding 2,736,634 of the registrant’s common shares, $6.25 par value.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of CSB Bancorp Inc.’s 2013 Annual Report to Shareholders are incorporated by reference into Parts I and II of this Form 10-K.

Portions of CSB Bancorp Inc.’s Proxy Statement dated March 25, 2014 are incorporated by reference in Part III of this Form 10-K.

PART I

ITEM 1. BUSINESS.

General

CSB Bancorp, Inc. (“CSB”), is a registered financial holding company under the Bank Holding Company Act of 1956, as amended, and was incorporated under the laws of the State of Ohio in 1991. The Commercial and Savings Bank of Millersburg, Ohio (the “Bank”), an Ohio banking corporation chartered in 1879, is a wholly-owned subsidiary of the Company. The Bank is a member of the Federal Reserve System, and its deposits are insured up to the maximum amount provided by law by the Federal Deposit Insurance Corporation (“FDIC”). The primary regulators of the Bank are the Federal Reserve Board and the Ohio Division of Financial Institutions. In this Annual Report on Form 10-K sometimes CSB and the Bank are collectively referred to as the “Company.”

Cautionary Statement Regarding Forward-Looking Information

Certain statements contained in this Annual Report on Form 10-K, which are not statements of historical fact, constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as “anticipate”, “estimates”, “may”, “feels”, “expects”, “believes”, “plans”, “will”, “would”, “should”, “could” and similar expressions are intended to identify these forward-looking statements but are not the exclusive means of identifying such statements. Examples of forward-looking statements include: (i) projections of income or expense, earnings per share, the payment or non-payment of dividends, capital structure and other financial items; (ii) statements of plans and objectives of the Company and of its management or Board of Directors, including those relating to products or services; (iii) statements of future economic performance; and (iv) statements of assumptions underlying such statements. Forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially. Factors that could cause or contribute to such differences include, without limitation, risks and uncertainties detailed from time to time in the Company’s filings with the SEC, including without limitation the risk factors disclosed in Item 1A of this Annual Report on Form 10-K.

Other factors not currently anticipated may also materially and adversely affect on the Company’s business, financial condition, results of operations or cash flows. There can be no assurance that future results will meet expectations. While the Company believes that the forward-looking statements in this Annual Report on Form 10-K are reasonable, the reader should not place undue reliance on any forward-looking statement. In addition, these statements speak only as of the date made. The Company does not undertake, and expressly disclaims, any obligation to update or alter any statements whether as a result of new information, future events or otherwise, except as may be required by applicable law.

The Private Securities Litigation Reform Act of 1995 provides a “safe harbor” for forward-looking statements to encourage companies to provide prospective information so long as those statements are identified as forward-looking and are accompanied by meaningful cautionary statements identifying important factors that could cause actual results to differ materially from those discussed in the forward-looking statements. The Company desires to take advantage of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995.

Business Overview and Lending Activities

CSB operates primarily through the Bank and its other subsidiaries, providing a wide range of banking, trust, financial and brokerage services to corporate, institutional and individual customers throughout northeast Ohio. The Bank provides retail and commercial banking services to its customers, including checking and savings accounts, time deposits, IRAs, safe deposit facilities, personal loans, commercial loans, real estate mortgage loans, installment loans, night depository facilities, brokerage and trust services.

The Bank provides residential real estate, commercial real estate, commercial and consumer loans to customers located primarily in Holmes, Tuscarawas, Wayne, Stark and portions of surrounding counties in Ohio. The Bank’s market area has historically exhibited relatively stable economic conditions; however, a pronounced slowdown in economic activity occurred during the latter half of 2008 and the subsequent recovery continues at a slow pace. Unemployment levels in Holmes County have generally been among the lowest in the State of Ohio, while the balance of the Bank’s market area reported unemployment levels below the state average in 2013 and 2012. Residential real estate values have also returned to close to more normalized valuations. Household debt peaked in

2

2007 and has fallen as consumers were leery of taking on new loans; however, spending on durable goods, such as autos has begun to return to within the normal range. The Federal Reserve Bank of Cleveland has reported that a lot of Ohio’s growth activity in industrial production is coming from oil and shale. The Company’s market is adjacent to areas of primary shale activity.

Certain risks are involved in providing loans, including, but not limited to, the borrowers’ ability and willingness to repay the debt. Before the Bank extends a new loan or renews an existing loan to a customer, these risks are assessed through a review of the borrower’s past and current credit history, the collateral being used to secure the transaction, the borrower’s character, and other factors. For all commercial loan relationships greater than $275,000, the Bank’s internal credit department performs an annual risk rating review. In addition to this review, an independent outside loan review firm is engaged to review all watch list and adversely classified credits, all commercial loan relationships greater than $750,000, a sample of commercial loan relationships less than $750,000, loans within an industry concentration and a sample of consumer/mortgage loans. In addition, any loan identified as a problem credit by management and/or the external loan review consultants is assigned to the Bank’s “loan watch list,” and is subject to ongoing review by the Bank’s credit department and the assigned loan officer to ensure appropriate action is taken when deterioration has occurred.

Commercial loan rates are variable as well as fixed, and include operating lines of credit and term loans made to small businesses, primarily based on their ability to repay the loan from the cash flow of the business. Business assets such as equipment, accounts receivable and inventory typically secure such loans. When the borrower is not an individual, the Bank generally obtains the personal guarantee of the business owner. As compared to consumer lending, which includes single-family residences, personal installment loans and automobile loans, commercial lending entails significant additional risks. These loans typically involve larger loan balances, are generally dependent on the cash flow of the business and thus may be subject to a greater extent to adverse conditions in the general economy or in a specific industry. Management reviews the borrower’s cash flows when deciding whether to grant the credit in order to evaluate whether estimated future cash flows will be adequate to service principal and interest of the new obligation in addition to existing obligations.

Commercial real estate loans are primarily secured by borrower-occupied business real estate and are dependent on the ability of the related business to generate adequate cash flow to service the debt. Commercial real estate loans are generally originated with a loan-to-value ratio of 80% or less. Commercial construction loans are secured by commercial real estate and in most cases the Bank also provides the permanent financing. The Bank monitors advances and the maximum loan to value ratio is typically limited to the lesser of 90% of cost or 80% of appraisal. Management performs much of the same analysis when deciding whether to grant a commercial real estate loan as when deciding whether to grant a commercial loan.

Residential real estate loans carry both fixed and variable rates and are secured by the borrower’s residence. Such loans are made based on the borrower’s ability to make repayment from employment and other income. Management assesses the borrower’s ability and willingness to repay the debt through review of credit history and ratings, verification of employment and other income, review of debt-to-income ratios and other measures of repayment ability. The Bank generally makes these loans in amounts of 80% or less of the value of the collateral or up to 95% of collateral value with private mortgage insurance. An appraisal from a qualified real estate appraiser or an evaluation primarily based on tax value is obtained for substantially all loans secured by real estate. Residential construction loans are secured by residential real estate that generally will be occupied by the borrower upon completion. The Bank usually makes the permanent loan at the end of the construction phase. Generally, construction loans are made in amounts of 80% or less of the value of the collateral.

Home equity lines of credit are made to individuals and are secured by second or first mortgages on the borrower’s residence. Loans are based on similar credit and appraisal criteria used for residential real estate loans; however, loans up to 100% of the value of the property may be approved for borrowers with excellent credit histories. These loans typically bear interest at variable rates and require certain minimum monthly payments.

Installment loans to individuals include unsecured loans and loans secured by automobiles and other consumer assets. Consumer loans for the purchase of new automobiles generally do not exceed 100% of the purchase price of the automobile. Loans for used automobiles generally do not exceed average wholesale or trade-in values as stipulated in a recent auto-industry used-car price guide. Overdraft protection loans are unsecured personal lines of credit to individuals who have demonstrated good credit character with reasonably assured sources of income and satisfactory credit histories. Consumer loans generally involve more risk than residential mortgage loans because of the type and nature of collateral and, in certain types of consumer loans, absence of collateral. Since these loans are generally repaid from ordinary income of the individual or family unit, repayment may be adversely affected by job loss, divorce, ill health or by a general decline in economic conditions. The Bank assesses the borrower’s ability and willingness to make repayment through a review of credit history, credit ratings, debt-to-income ratios and other measures of repayment ability.

3

While CSB’s chief decision-makers monitor the revenue streams of the various financial products and services, operations are managed and financial performance is evaluated on a Company-wide basis. Accordingly, all of the Company’s banking operations are considered by management to be aggregated in one reportable operating segment. For a discussion of CSB’s financial performance for the fiscal year ended December 31, 2013, see the Consolidated Financial Statements and Notes to the Consolidated Financial Statements found in Item 8 of this Annual Report on Form 10-K.

Employees

At December 31, 2013, the Company had 177 employees, 136 of which were employed on a full-time basis. CSB has no separate employees not also employed by the Bank. No employees are covered by collective bargaining agreements. Employees are provided benefit programs, some of which are contributory. Management considers its employee relations to be good.

Competition

The Bank operates in a highly competitive industry due, in part, to Ohio law permitting statewide branching by banks, savings and loan associations and credit unions. Ohio and federal law also permits nationwide interstate banking. In its primary market area of Holmes, Tuscarawas, Wayne, Stark and surrounding Ohio counties, the Bank competes for new deposit dollars and loans with several other commercial banks, including both large regional banks and smaller community banks, as well as savings and loan associations, credit unions, finance companies, insurance companies, brokerage firms and investment companies. The Bank believes its presence in the Holmes, Tuscarawas, Wayne and Stark County areas provides the Bank with a competitive advantage due to its ability to make loans and provide services to the local community.

Competition within the financial service industry continues to increase as a result of mergers between, and expansion of, financial service providers within and outside of the Bank’s primary market areas. In addition, the deregulation of the financial services industry (see the discussion of the Gramm-Leach-Bliley Act of 1999 (“GLBA”) in the section of this item captioned “Financial Modernization”) has allowed securities firms and insurance companies that have elected to become financial holding companies to acquire commercial banks and other financial institutions, which can create additional competitive pressure.

Investor Relations

The Company’s website address is www.csb1.com. The Company makes available its Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and all amendments to those reports, free of charge on its website as soon as reasonably practicable after such material is electronically filed with the Securities and Exchange Commission (the “SEC”). The Company also makes available through its website, other reports filed with the SEC under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), including its proxy statements and reports filed by officers and directors under Section 16(a) of the Exchange Act, as well as the Company’s Code of Ethics. The Company does not intend for information contained in its website to be incorporated by reference into this Annual Report on Form 10-K.

In addition, the Company’s filings with the SEC may be read and copied at the SEC’s Public Reference Room at 450 Fifth Street, NW, Washington DC 20549. Information on the operation of the Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330. These filings are also available on the SEC’s website at www.sec.gov free of charge as soon as reasonably practicable after the Company has filed the above referenced reports.

Supervision and Regulation of CSB and the Bank

CSB and the Bank are subject to extensive regulation by federal and state regulatory agencies. The regulation of financial holding companies and their subsidiaries by bank regulatory agencies is intended primarily for the protection of consumers, depositors, federal deposit insurance funds and the banking system as a whole and not for the protection of shareholders.

CSB is registered with the Federal Reserve Board (“FRB”) as a financial holding company under the Bank Holding Company Act, as amended (the “BHC Act”), and is subject to regulation, examination and supervision by the FRB under the BHC Act. CSB is also subject to the disclosure and regulatory requirements of the Securities Exchange Act of 1933, as amended, the Securities Exchange Act of 1934, as amended, and the regulations promulgated thereunder, as administered by the SEC.

The Bank, as an Ohio state-chartered bank and member of the Federal Reserve System, is subject to regulation, supervision, and examination by the Ohio Division of Financial Institutions and the FRB. Because the FDIC insures its deposits, the Bank is also subject to certain regulations of that federal agency. The FDIC is an independent federal agency which insures the deposits, up to prescribed statutory limits, of federally-insured banks and savings associations and safeguards the safety and soundness of the financial institution industry. The Bank’s deposits are insured up to applicable limits by the Deposit Insurance Fund of the FDIC and the Bank is subject to deposit insurance assessments to maintain the Deposit Insurance Fund.

4

The earnings, dividends and other aspects of the operations and activities of CSB and the Bank are affected by state and federal laws and regulations, and by policies of various regulatory authorities. These policies include, for example, statutory maximum lending rates, requirements on maintenance of reserves against deposits, domestic monetary policies of the FRB, United States fiscal and economic policies, international currency regulations and monetary policies, certain restrictions on relationships with many phases of the securities business and capital adequacy and liquidity restraints.

The following information describes selected federal and state statutory and regulatory provisions that have, or could have, a material impact on the Company’s business. This discussion is qualified in its entirety by reference to the full text of the particular statutory or regulatory provisions. These statutes and regulations are continually under review by the United States Congress and state legislatures and state and federal regulatory agencies. A change in statutes, regulations, or regulatory policies applicable to CSB and its subsidiaries could have a material effect on their respective businesses.

Dodd-Frank Wall Street Reform and Consumer Protection Act

Federal regulators continue to implement many provisions of the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”), which was signed into law by President Obama on July 21, 2010. The Dodd-Frank Act created many new restrictions and an expanded framework of regulatory oversight for financial institutions, including depository institutions. Currently, federal regulators are still in the process of drafting the implementing regulations for many portions of the Dodd-Frank Act. The Company is closely monitoring all relevant sections of the Dodd-Frank Act to ensure continued compliance with these regulatory requirements. The following discussion summarizes significant aspects of the Dodd-Frank Act that may affect the Company and the Bank:

| • | the Consumer Financial Protection Bureau has been established and empowered to exercise broad regulatory, supervisory and enforcement authority with respect to both new and existing consumer financial protection laws; |

| • | the deposit insurance assessment base for federal deposit insurance has been expanded from domestic deposits to average assets less average tangible equity; |

| • | the Dodd-Frank Act instructs appropriate federal banking agencies to make the capital requirements for banks and savings and loan holding companies and insured depository institutions countercyclical so that the amount of capital required to be maintained increases in times of economic expansion and decreases in times of economic contraction, consistent with safety and soundness; |

| • | the prohibition on the payment of interest on business demand deposits has been repealed, thereby permitting depository institutions to pay interest on business transaction and other accounts; |

| • | the Dodd-Frank Act permanently increases the $250,000 limit for FDIC deposit insurance; |

| • | financial holding companies, such as the Company, are required to be well-capitalized and well-managed and must continue to be both well-capitalized and well-managed in order to acquire banks located outside their home state; |

| • | the Dodd-Frank Act extended the application to most bank holding companies of the same leverage and risk-based capital requirements that apply to insured depository institutions, which, among other things, will disallow treatment of trust preferred securities as Tier 1 capital under certain circumstances; |

| • | new corporate governance requirements, which are generally applicable to most larger public companies, now require new compensation practices, including, but not limited to, providing shareholders the opportunity to cast a non-binding vote on executive compensation, to consider the independence of compensation advisors and new executive compensation disclosure requirements; |

| • | the Dodd-Frank Act amended the Electronic Fund Transfer Act to, among other things, give the FRB the authority to establish rules regarding interchange fees charged for electronic debit transactions by payment card issuers having assets over $10 billion and to enforce a new statutory requirement that such fees be reasonable and proportional to the actual cost of a transaction to the issuer; and |

| • | increases authority of the FRB to examine financial holding companies and their non-bank subsidiaries. |

Many aspects of the Dodd-Frank Act are still subject to rulemaking and will take effect over several years, making it difficult to anticipate the overall financial impact on the Company, its subsidiaries, their respective customers or the financial services industry more generally.

Regulation of Financial Holding Companies

As a bank holding company, which is also designated as a financial holding company under GLBA, CSB’s activities are subject to extensive regulation by the FRB. CSB is required to file reports with the FRB and provide such additional information as the FRB may require, and is subject to regular examination and inspection by the FRB.

5

The FRB has extensive enforcement authority over financial holding companies, including the ability to assess civil money penalties, issue cease and desist orders and require that a financial holding company divest subsidiaries (including subsidiary banks). The FRB may initiate enforcement actions for violations of laws and regulations, and for unsafe and unsound practices. Under FRB policies, a financial holding company is expected to act as a “source of strength” to its subsidiary banks and to commit resources to support those subsidiary banks. Under this policy, the FRB may require a financial holding company to contribute additional capital to an undercapitalized subsidiary bank.

The BHC Act requires the prior approval of the FRB in cases where a financial holding company proposes to acquire direct or indirect ownership or control of more than 5% of the voting shares of any bank that is not already majority-owned by it, acquire all or substantially all of the assets of another bank or another financial or bank holding company, or merge or consolidate with any other financial or bank holding company.

The FRB also regulates and provides limitations on transactions between affiliates of a bank holding company, loans to directors and officers of bank affiliates, securities transactions and liability for losses incurred by commonly controlled banks in certain circumstances.

Financial Modernization

Pursuant to GLBA, a bank holding company may become a financial holding company if each of its subsidiary banks is “well-capitalized” under regulatory “prompt corrective action” provisions, is “well-managed,” and has at least a “satisfactory” rating under the Community Reinvestment Act (“CRA”) by filing a declaration with the FRB that the bank holding company wishes to become a financial holding company. CSB has been a financial holding company since 2005. No prior regulatory approval is required for a financial holding company to acquire certain companies, other than banks and savings associations, that are financial in nature as determined by the FRB.

GLBA defines “financial in nature” to include securities underwriting, dealing and market making; sponsoring mutual funds and investment companies; insurance underwriting and agency activities; merchant banking activities; and activities that the FRB has determined to be closely related to banking. Bank subsidiaries of a financial holding company must continue to be well-capitalized and well-managed in order to continue to engage in activities that are financial in nature without regulatory actions or restrictions, which could include divestiture of the subsidiary or subsidiaries. In addition, a financial holding company or a bank subsidiary of a financial holding company may not acquire a company that is engaged in activities that are financial in nature unless each of the subsidiary banks of the financial holding company or bank has a CRA rating of satisfactory or better.

Regulatory Capital

The FRB has adopted risk-based capital guidelines for bank holding companies and state member banks. These capital guidelines are based on the “International Convergence of Capital Measurement and Capital Standards” (Basel I), published by the Basel Committee on Banking Supervision (the “Basel Committee”). The guidelines provide a systematic analytical framework, which makes regulatory capital requirements sensitive to differences in risk profiles among banking organizations, takes off-balance sheet exposures expressly into account in evaluating capital adequacy and minimizes disincentives to holding liquid, low-risk assets. Capital levels as measured by these standards are also used to categorize financial institutions for purposes of certain prompt corrective action regulatory provisions.

Under the guidelines, the minimum ratio of total capital to risk-weighted assets (including certain off-balance sheet items such as standby letters of credit) is 8%. At least half of the minimum total risk-based capital ratio (4%) must be composed of “Tier 1” risk-based capital, which consists of common shareholders’ equity, minority interests in certain equity accounts of consolidated subsidiaries and a limited amount of qualifying preferred stock and qualified trust preferred securities (although the Tier 1 capital treatment of trust preferred securities will be phased out under the Dodd-Frank Act in certain circumstances), less goodwill and certain other intangible assets, including the unrealized net gains and losses, after applicable taxes, on available-for-sale securities carried at fair value. The remainder of total risk-based capital (commonly known as “Tier 2” risk-based capital) may consist of certain amounts of hybrid capital instruments, mandatory convertible debt, subordinated debt, preferred stock not qualifying as Tier 1 capital, loan and lease loss allowance and net unrealized gains on certain available-for-sale equity securities, all subject to limitations established by the guidelines.

Under the guidelines, capital is compared to the relative risk related to the balance sheet. To derive the risk included in the balance sheet, one of four risk weights (0%, 20%, 50% and 100%) is applied to different balance sheet and off-balance sheet assets, primarily based on the relative credit risk of the counterparty. The capital amounts and classification are also subject to qualitative judgments by the regulators about components, risk weightings and other factors.

The FRB has also established minimum leverage ratio guidelines for bank holding companies. The FRB guidelines provide for a minimum ratio of Tier 1 capital to average assets (excluding the loan and lease loss allowance,

6

goodwill and certain other intangibles), or “leverage ratio,” of 3% for bank holding companies that meet certain criteria, including having the highest regulatory rating, and 4% for all other bank holding companies. The guidelines further provide that bank holding companies making acquisitions will be expected to maintain strong capital positions substantially above the minimum levels.

The FRB’s review of certain bank holding company transactions is affected by whether the applying bank holding company is “well-capitalized.” To be deemed “well-capitalized,” the bank holding company must have a Tier 1 risk-based capital ratio of at least 6%, a leverage ratio of at least 5% and a total risk-based capital ratio of at least 10%, and must not be subject to any written agreement, order, capital directive or prompt corrective action directive issued by the FRB to meet and maintain a specific capital level for any capital measure.

In December 2010, the Basel Committee on Banking Supervision, an international forum for cooperation on banking supervisory matters, announced the “Basel III” capital standards, which proposed new capital requirements for banking organizations. On July 2, 2013, the Federal Reserve Board adopted a final rule implementing a revised capital framework based in part on the Basel III capital standards and, on July 9, 2013, the Office of the Comptroller of the Currency also adopted a final rule and the FDIC adopted an interim final rule implementing a revised capital framework based in part on the Basel III capital standards. The rule will not begin to phase in until January 1, 2014 for larger institutions and January 1, 2015 for smaller, less complex banking organizations such as the Company. The rule will be fully phased in by January 1, 2019.

The implementation of the final rule will lead to higher capital requirements and more restrictive leverage and liquidity ratios than those currently in place. Specifically, the rule imposes the following minimum capital requirements on federally insured financial institutions: (1) a new minimum common equity tier 1 capital to risk-weighted assets ratio of 4.5%; (2) a leverage capital ratio of 4%; (3) a tier 1 risk-based capital ratio of 6%; and (4) a total risk-based capital ratio of 8%. Under the rule, common equity generally consists of common stock, retained earnings and limited amounts of minority interests in the form of common stock. In addition, in order to avoid limitations on capital distributions, such as dividend payments and certain bonus payments to executive officers, the rule requires insured financial institutions to hold a capital conservation buffer of common equity tier 1 capital above its minimum risk-based capital requirements. The capital conservation buffer will be phased in over time, becoming effective on January 1, 2019, and will consist of an additional amount of common equity equal to 2.5% of risk-weighted assets. The rule will also revise the regulatory agencies’ prompt corrective action framework by incorporating the new regulatory capital minimums and updating the definition of common equity. Until the rule is fully phased in, we cannot predict the ultimate impact it will have upon the financial condition or results of operations of the Company.

Prompt Corrective Action

The federal banking agencies have established a system of “prompt corrective action” to resolve certain of the problems of undercapitalized institutions. This system is based on five capital level categories for insured depository institutions: “well capitalized,” “adequately capitalized,” “undercapitalized,” “significantly undercapitalized” and “critically undercapitalized.”

The federal banking agencies may (or in some cases must) take certain supervisory actions depending upon a bank’s capital level. For example, the banking agencies must appoint a receiver or conservator for a bank within 90 days after it becomes “critically undercapitalized” unless the bank’s primary regulator determines, with the concurrence of the FDIC, that other action would better achieve regulatory purposes. Banking operations otherwise may be significantly affected depending on a bank’s capital category. For example, a bank that is not “well capitalized” generally is prohibited from accepting brokered deposits and offering interest rates on deposits higher than the prevailing rate in its market, and the holding company of any undercapitalized depository institution must guarantee, in part, specific aspects of the bank’s capital plan for the plan to be acceptable.

In order to be “well-capitalized,” a bank must have total risk-based capital of at least 10%, Tier 1 risk-based capital of at least 6% and a leverage ratio of at least 5%, and the bank must not be subject to any written agreement, order, capital directive or prompt corrective action directive to meet and maintain a specific capital level for any capital measure. As of December 31, 2013, the Bank meets the ratio requirements to be deemed “well-capitalized” according to the guidelines described above. See Note 12 of the Notes to Consolidated Financial Statements located on page 51 of CSB’s 2013 Annual Report, which is incorporated herein by reference.

Deposit Insurance

Substantially all of the deposits of the Bank are insured up to applicable limits by the Deposit Insurance Fund of the FDIC, and the Bank is assessed deposit insurance premiums to maintain the Deposit Insurance Fund. Insurance premiums for each insured institution are determined based upon the institution’s capital level and supervisory rating

7

provided to the FDIC by the institution’s primary federal regulator and other information deemed by the FDIC to be relevant to the risk posed to the Deposit Insurance Fund by the institution. The assessment rate is then applied to the amount of the institution’s deposits to determine the institution’s insurance premium.

The FDIC issued final rules effective April 2011 that changed the deposit insurance assessment base, as required by the Dodd-Frank Act. As adopted, the final rule changed the deposit insurance assessment base from domestic deposits to average assets less average tangible equity. The final rule also set a target size for the Deposit Insurance Fund at 2% of insured deposits and implements a lower assessment rate schedule when the fund reaches 1.15% and, in lieu of dividends, provides for a lower rate schedule when the reserve ratio reaches 2% and 2.5%. The final rule went into effect beginning with the second quarter of 2011. The change to the assessment base and assessment rates, as well as the Deposit Insurance Fund restoration time frame, has lowered the Company’s deposit insurance assessment.

As insurer, the FDIC is authorized to conduct examinations of, and to require reporting by, federally-insured institutions. It also may prohibit any federally-insured institution from engaging in any activity the FDIC determines by regulation or order to pose a serious threat to the Deposit Insurance Fund. The FDIC also has the authority to take enforcement actions against insured institutions. Insurance of deposits may be terminated by the FDIC upon a finding that the institution has engaged or is engaging in unsafe and unsound practices, is in an unsafe or unsound condition to continue operations or has violated any applicable law, regulation, rule, order or condition imposed by the FDIC or written agreement entered into with the FDIC. The management of the Bank does not know of any practice, condition or violation that might lead to termination of deposit insurance.

Fiscal and Monetary Policies

The business and earnings of CSB are affected significantly by the fiscal and monetary policies of the United States Government and its agencies. CSB is particularly affected by the policies of the FRB, which regulates the supply of money and credit in the United States. These policies are used in varying degrees and combinations to directly affect the availability of bank loans and deposits, as well as the interest rates charged on loans and paid on deposits.

The monetary policies of the FRB have had a significant effect on the operating results of financial institutions in the past and are expected to continue to have significant effects in the future. In view of the changing conditions in the economy, the money markets and the activities of monetary and fiscal authorities, the Company can make no definitive predictions as to future changes in interest rates, credit availability or deposit levels.

Limits on Dividends and Other Payments

There are various legal limitations on the extent to which subsidiary banks may finance or otherwise supply funds to their parent holding companies. Under applicable federal and state laws, subsidiary banks may not, subject to certain limited exceptions, make loans or extensions of credit to, or investments in the securities of, their bank holding companies. Subsidiary banks are also subject to collateral security requirements for any loan or extension of credit permitted by such exceptions.

Payments of dividends by the Bank are limited by applicable state and federal laws and regulations. The ability of CSB to obtain funds for the payment of dividends and for other cash requirements is largely dependent on the amount of dividends, which may be declared by the Bank. However, the FRB expects CSB to serve as a source of strength for the Bank and may require CSB to retain capital for further investment in the Bank, rather than pay dividends to CSB shareholders. Payment of dividends by the Bank may be restricted at any time at the discretion of its applicable regulatory authorities, if they deem such dividends to constitute an unsafe or unsound banking practice. These provisions could have the effect of limiting CSB’s ability to pay dividends on its common shares.

The FRB issued a policy statement that provides that insured banks and bank holding companies should generally only pay dividends out of current operating earnings. At December 31, 2013, approximately $7.5 million of the total shareholders’ equity of the Bank was available for payment to CSB without the prior approval of the applicable regulatory authorities. See Note 12 of the “Notes to Consolidated Financial Statements located on page 52 of CSB’s 2013 Annual Report.

Customer Privacy

Under the GLBA, federal banking agencies have adopted rules that limit the ability of banks and other financial institutions to disclose non-public information about consumers to nonaffiliated third parties. These limitations require distribution of privacy policies to consumers and, in some circumstances, allow consumers to prevent disclosure of certain personal information to nonaffiliated third parties.

USA Patriot Act

In response to the events of September 11, 2001, the United and Strengthening of America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act of 2001 (the “Patriot Act”) was signed into law in October, 2001. The Patriot Act gives the federal government powers to address terrorist threats through enhanced security

8

measures, expanded surveillance powers, increased information sharing and broadened anti-money laundering requirements. Title III of the Patriot Act takes measures intended to encourage information sharing among federal banking agencies and law enforcement officials. Further, certain provisions of Title III impose affirmative obligations on a broad range of financial institutions to, among other things, establish a program specifying procedures for obtaining identifying information from customers seeking to open new accounts and establish enhanced due diligence policies, procedures and controls designed to detect and report suspicious activity. The Bank has established policies and procedures that are believed to be compliant with the requirements of the Patriot Act.

Corporate Governance

The Sarbanes-Oxley Act of 2002 (“SOX”) was signed into law on July 30, 2002. SOX contains important requirements for public companies with regard to financial disclosure and corporate governance. In accordance with section 302(a) of SOX, written certifications by CSB’s Chief Executive Officer and Chief Financial Officer are required to certify that CSB’s quarterly and annual reports filed with the SEC do not contain any untrue statement of a material fact or fail to state a material fact. CSB has also implemented a program designed to comply with Section 404 of SOX, which includes identification of significant processes and accounts, documentation of the design of control effectiveness over process and entity-level controls and testing of the operating effectiveness of key controls. Pursuant to provisions of the Dodd-Frank Act which provide a permanent exemption for smaller companies which have a public float of less than $75 million, from the SOX attestation requirement by the external accountants on internal controls. CSB is exempt from the requirement for external accountant attestation on internal controls. Management’s assessment of internal controls over financial reporting is located on page 23 of the CSB 2013 Annual Report.

Effect of Environmental Regulation

Compliance with federal, state and local provisions regulating the discharge of materials into the environment, or otherwise relating to the protection of the environment, has not had a material effect upon the capital expenditures, earnings or competitive position of CSB or its subsidiaries. CSB believes the nature of the operations of its subsidiaries has little, if any, environmental impact. CSB, therefore, anticipates no material capital expenditures for environmental control facilities for its current fiscal year or for the foreseeable future.

CSB believes its primary exposure to environmental risk is through the lending activities of the Bank. In cases where management believes environmental risk potentially exists, the Bank mitigates environmental risk exposure by requiring environmental site assessments at the time of loan origination to confirm collateral quality as to commercial real estate parcels posing higher than normal potential for environmental impact, as determined by reference to present and past uses of the subject property and adjacent sites.

Executive and Incentive Compensation

In June 2010, the federal banking agencies issued joint interagency guidance on incentive compensation policies (the “Joint Guidance”) intended to ensure that the incentive compensation policies of banking organizations do not undermine the safety and soundness of such organizations by encouraging excessive risk-taking. This principles-based guidance, which covers all employees that have the ability to materially affect the risk profile of an organization, either individually or as part of a group, is based upon the key principles that a banking organization’s incentive compensation arrangements should: (i) provide incentives that do not encourage risk-taking beyond the organization’s ability to effectively identify and manage risks; (ii) be compatible with effective internal controls and risk management; and (iii) be supported by strong corporate governance, including active and effective oversight by the organization’s board of directors.

Pursuant to the Joint Guidance, the FRB will review as part of a regular, risk-focused examination process, the incentive compensation arrangements of financial institutions such as the Company. Such review will be tailored to each organization based on the scope and complexity of the organization’s activities and the prevalence of incentive compensation arrangements. The findings of the supervisory initiatives will be included in reports of examination and deficiencies will be incorporated into the institution’s supervisory ratings, which can affect the institution’s ability to make acquisitions and take other actions. Enforcement actions may be taken against an institution if its incentive compensation arrangements, or related risk-management control or governance processes, pose a risk to the organization’s safety and soundness and prompt and effective measures are not being taken to correct the deficiencies.

Future Legislation

Various and significant legislation affecting financial institutions and the financial industry is from time to time introduced by the U.S. Congress, as evidenced by the sweeping reforms in the Dodd-Frank Act adopted in 2010. Such legislation may continue to change banking statutes and the operating environment of CSB and its subsidiaries in substantial and unpredictable ways, and could significantly increase or decrease costs of doing business, limit or expand permissible activities or affect the competitive balance among financial institutions. With the enactment of the Dodd-Frank Act and the continuing implementation of final rules and regulations thereunder, the nature and extent of future legislative and regulatory changes affecting financial institutions remains very unpredictable.

9

Statistical Disclosures

The following schedules present, for the periods indicated, certain financial and statistical information of the Company as required under the SEC’s Industry Guide 3 “Statistical Disclosures by Bank Holding Companies,” or a specific reference as to the location of required disclosures in the Company’s 2013 Annual Report.

Distribution of Assets, Liabilities and Stockholders’ Equity; Interest Rates and Interest Differential

The information set forth under the heading “Average Balance Sheets and Net Interest Margin Analysis” located on page 11 of the Company’s 2013 Annual Report is incorporated by reference herein.

The information set forth under the heading “Rate/Volume Analysis of Changes in Income and Expense” located on page 12 of the Company’s 2013 Annual Report is incorporated by reference herein.

Investment Portfolio

The following is a schedule of the carrying value of securities at December 31:

| (Dollars in thousands) | ||||||||||||

| 2013 | 2012 | 2011 | ||||||||||

| Securities available-for-sale, at fair value |

||||||||||||

| U.S. Treasury security |

$ | 997 | $ | 100 | $ | 100 | ||||||

| U.S. Government agencies |

22,301 | 35,980 | 28,323 | |||||||||

| Mortgage-backed securities of government agencies |

54,300 | 68,695 | 75,628 | |||||||||

| Other mortgage-backed securities |

235 | 344 | 704 | |||||||||

| Asset-backed securities of government agencies |

2,775 | 2,823 | — | |||||||||

| State and political subdivisions |

16,447 | 16,883 | 14,880 | |||||||||

| Corporate bonds |

4,539 | 4,397 | 3,330 | |||||||||

| Equity securities |

128 | 69 | 61 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total |

$ | 101,722 | $ | 129,291 | $ | 123,026 | ||||||

|

|

|

|

|

|

|

|||||||

| Securities held-to-maturity, at fair value |

||||||||||||

| U.S. Government agencies |

$ | 18,358 | $ | — | $ | — | ||||||

| Mortgage-backed securities of government agencies |

24,285 | — | — | |||||||||

|

|

|

|

|

|

|

|||||||

| Total |

$ | 42,643 | $ | — | $ | — | ||||||

|

|

|

|

|

|

|

|||||||

10

The following is a schedule of maturities for each category of debt securities and the related weighted average yield of such securities as of December 31, 2013:

| One Year or Less | After One Year Through Five Years |

Maturing After Five Years Through Ten Years |

After Ten Years | Total | ||||||||||||||||||||||||||||||||||||

| Amortized | Amortized | Amortized | Amortized | Amortized | ||||||||||||||||||||||||||||||||||||

| (Dollars in thousands) | Cost | Yield | Cost | Yield | Cost | Yield | Cost | Yield | Cost | Yield | ||||||||||||||||||||||||||||||

| Available-for-sale: |

||||||||||||||||||||||||||||||||||||||||

| U.S. Treasury |

$ | — | — | % | $ | 1,005 | 0.71 | % | $ | — | — | % | $ | — | — | % | $ | 1,005 | 0.71 | % | ||||||||||||||||||||

| U.S. Government agencies |

— | — | 6,000 | 0.81 | 13,000 | 1.97 | 3,999 | 1.18 | 22,999 | 1.53 | ||||||||||||||||||||||||||||||

| Mortgage-backed securities of government agencies |

106 | 2.78 | 281 | 4.40 | 917 | 4.44 | 53,151 | 2.54 | 54,455 | 2.59 | ||||||||||||||||||||||||||||||

| Other mortgage-backed securities |

— | — | — | — | 230 | 5.34 | — | — | 230 | 5.34 | ||||||||||||||||||||||||||||||

| Asset-backed securities of government agencies |

— | — | — | — | — | — | 2,739 | 1.54 | 2,739 | 1.54 | ||||||||||||||||||||||||||||||

| State and political subdivisions |

749 | 5.35 | 6,143 | 4.28 | 7,733 | 4.23 | 1,594 | 5.31 | 16,219 | 4.41 | ||||||||||||||||||||||||||||||

| Corporate bonds |

3,925 | 2.16 | 575 | 1.04 | — | — | 4,500 | 2.02 | ||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Total |

$ | 855 | 5.03 | % | $ | 17,354 | 2.40 | % | $ | 22,455 | 2.86 | % | $ | 61,483 | 2.48 | % | 102,147 | 2.57 | % | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Held-to-maturity: |

||||||||||||||||||||||||||||||||||||||||

| U.S. Government agencies |

$ | — | — | % | $ | — | — | % | $ | 7,717 | 2.44 | % | $ | 11,469 | 2.14 | % | $ | 19,186 | 2.26 | % | ||||||||||||||||||||

| Mortgage-backed securities of government agencies |

— | — | — | — | — | — | 25,164 | 1.88 | 25,164 | 1.88 | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Total |

$ | — | — | % | $ | — | — | % | $ | 7,717 | 2.44 | % | $ | 36,633 | 1.96 | % | $ | 44,350 | 2.04 | % | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

The weighted average yields are calculated using amortized cost of investments and are based on coupon rates for securities purchased at par value, and on effective interest rates considering amortization or accretion if securities were purchased at a premium or discount. The weighted average yield on tax-exempt obligations is presented on a tax-equivalent basis based on the Company’s marginal federal income tax rate of 34%.

11

Loan Portfolio

Total loans on the balance sheet are comprised of the following classifications at December 31:

| (Dollars in thousands) | 2013 | 2012 | 2011 | 2010 | 2009 | |||||||||||||||

| Commercial |

$ | 117,478 | $ | 104,899 | $ | 89,828 | $ | 78,540 | $ | 69,351 | ||||||||||

| Commercial real estate |

129,828 | 119,192 | 106,332 | 104,829 | 107,794 | |||||||||||||||

| Residential real estate |

111,445 | 110,412 | 103,518 | 108,832 | 114,882 | |||||||||||||||

| Construction and land development |

13,444 | 23,358 | 18,061 | 16,515 | 13,761 | |||||||||||||||

| Consumer |

6,687 | 6,480 | 6,216 | 6,715 | 7,464 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total loans |

$ | 378,882 | $ | 364,341 | $ | 323,955 | $ | 315,431 | $ | 313,252 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

The following is a schedule of maturities of loans based on contract terms and assuming no amortization or prepayments, excluding residential real estate mortgage and installment loans, as of December 31, 2013:

| Maturing | ||||||||||||||||

| One Year or Less |

One Through Five Years |

After Five Years |

Total | |||||||||||||

| (Dollars in thousands) | ||||||||||||||||

| Commercial |

$ | 54,770 | $ | 26,739 | $ | 35,969 | $ | 117,478 | ||||||||

| Commercial real estate |

4,489 | 8,010 | 117,329 | 129,828 | ||||||||||||

| Construction and land development |

3,317 | 1,880 | 8,247 | 13,444 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

$ | 62,576 | $ | 36,629 | $ | 161,545 | $ | 260,750 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

The following is a schedule of fixed rate and variable rate commercial, commercial real estate and construction and land development loans due after one year from December 31, 2013.

| (Dollars in thousands) | Fixed Rate | Variable Rate | ||||||

| Total commercial, commercial real estate and construction and land development loans due after one year |

$ | 62,017 | $ | 136,157 | ||||

The following schedule summarizes nonaccrual, past due and restructured loans.

| (Dollars in thousand) | 2013 | 2012 | 2011 | 2010 | 2009 | |||||||||||||||

| Loans accounted for on a nonaccural basis |

$ | 2,234 | $ | 3,206 | $ | 2,908 | $ | 3,905 | $ | 3,786 | ||||||||||

| Accruing loans that are contractually past due 90 days or more as to interest or principal payments |

1,036 | 131 | 581 | 685 | 355 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Totals |

$ | 3,270 | $ | 3,337 | $ | 3,489 | $ | 4,590 | $ | 4,141 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

The policy for placing loans on nonaccrual status is to cease accruing interest on loans when management believes that collection of interest is doubtful, when commercial loans are past due as to principal and interest 90 days or more or when mortgage loans are past due as to principal and interest 120 days or more, except that in certain circumstances interest accruals are continued on loans deemed by management to be well-secured and in process of collection. In such cases, loans are individually evaluated in order to determine whether to continue income recognition after 90 days beyond the due date. When loans are placed on nonaccrual, any accrued interest is charged against interest income. Consumer loans are not placed on nonaccrual but are charged-off after 90 days past due.

12

Information regarding impaired loans at December 31 is as follows:

| (Dollars in thousands) | 2013 | 2012 | 2011 | |||||||||

| Loans acquired with credit impairment |

$ | — | $ | — | $ | — | ||||||

| Total recorded investment of impaired loans |

10,655 | 10,210 | 7,263 | |||||||||

| Less portion for which no allowance for loan loss is allocated |

907 | 1,975 | — | |||||||||

| Portion of impaired loan balance for which an allowance for loan losses is allocated |

9,748 | 8,235 | 7,263 | |||||||||

| Portion of allowance for loan losses allocated to the impaired loan balance at December 31 |

784 | 779 | 522 | |||||||||

For the year ended December 31, 2013, interest income recognized on impaired loans amounted to $388 thousand, while $472 thousand would have been recognized had the loans been performing under their contractual terms. For the year ended December 31, 2012, interest income recognized on impaired loans amounted to $337 thousand, while $517 thousand would have been recognized had the loans been performing under their contractual terms. For the year ended December 31, 2011, interest income recognized on impaired loans amounted to $169 thousand while $190 thousand would have been recognized had the loans been performing under their contractual terms.

Impaired loans are comprised of commercial and commercial real estate loans, and are carried at the present value of expected cash flows discounted at the loan’s effective interest rate or at fair value of the collateral if the loan is collateral dependent. A portion of the allowance for loan losses is allocated to impaired loans.

Smaller-balance homogeneous loans are evaluated for impairment in total. Such loans include residential first-mortgage loans secured by one to four-family residences, residential construction loans, automobile loans, home equity loans and second-mortgage loans. These consumer loans are included in nonaccrual and past due disclosures above as well as impaired loans when they become nonperforming. Commercial loans and mortgage loans secured by other properties are evaluated individually for impairment. When analysis of borrower operating results and financial condition indicates that underlying cash flows of the borrower’s business are not adequate to meet its debt service requirements, the loan is evaluated for impairment. Impaired loans or portions thereof, are charged-off when deemed uncollectible.

At December 31, 2013, no loans were identified that management had serious doubts about the borrowers’ ability to comply with present loan repayment terms that are not included in the tables set forth above. On a monthly basis, the Company internally classifies certain loans based on various factors. At December 31, 2013, these amounts, including impaired and nonperforming loans, amounted to $11.0 million of substandard loans and $0 doubtful loans.

As of December 31, 2013, there are no concentrations of loans greater than 10% of total loans that are not otherwise disclosed as a category of loans in the loan portfolio table set forth above.

13

Summary of Loan Loss Experience

The following schedule presents an analysis of the allowance for loan losses, average loan data and related ratios for the years ended December 31:

| (Dollars in thousands) | 2013 | 2012 | 2011 | 2010 | 2009 | |||||||||||||||

| LOANS |

||||||||||||||||||||

| Average loans outstanding during period |

$ | 374,821 | $ | 342,868 | $ | 318,781 | $ | 313,549 | $ | 317,254 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| ALLOWANCE FOR LOAN LOSSES |

||||||||||||||||||||

| Balance at beginning of period |

$ | 4,580 | $ | 4,082 | $ | 4,031 | $ | 4,060 | $ | 3,394 | ||||||||||

| Loans charged-off: |

||||||||||||||||||||

| Commercial |

(190 | ) | (29 | ) | (487 | ) | (479 | ) | (320 | ) | ||||||||||

| Commercial real estate |

(108 | ) | (283 | ) | (68 | ) | (187 | ) | (254 | ) | ||||||||||

| Residential real estate |

(82 | ) | (106 | ) | (297 | ) | (488 | ) | (177 | ) | ||||||||||

| Construction and land development |

— | — | (41 | ) | (143 | ) | — | |||||||||||||

| Consumer |

(48 | ) | (89 | ) | (121 | ) | (92 | ) | (134 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total loans charged-off |

(428 | ) | (507 | ) | (1,014 | ) | (1,389 | ) | (885 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Recoveries of loans previously charged-off: |

||||||||||||||||||||

| Commercial |

25 | 16 | 38 | 93 | 55 | |||||||||||||||

| Commercial real estate |

— | — | — | — | 86 | |||||||||||||||

| Residential real estate |

18 | 102 | 19 | — | — | |||||||||||||||

| Construction and land development |

— | — | — | — | — | |||||||||||||||

| Consumer |

50 | 64 | 58 | 32 | 73 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total loans recoveries |

93 | 182 | 115 | 125 | 214 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net loans charged-off |

(335 | ) | (325 | ) | (899 | ) | (1,264 | ) | (671 | ) | ||||||||||

| Provision charged to operating expense |

840 | 823 | 950 | 1,235 | 1,337 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Balance at end of period |

$ | 5,085 | $ | 4,580 | $ | 4,082 | $ | 4,031 | $ | 4,060 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Ratio of net charge-offs to average loans outstanding for period |

0.09 | % | 0.09 | % | 0.28 | % | 0.40 | % | 0.21 | % | ||||||||||

The allowance for loan losses balance and provision charged to expense are determined by management based on periodic reviews of the loan portfolio, past loan loss experience, economic conditions and various other circumstances subject to change over time. In making this judgment, management reviews selected large loans, as well as impaired loans, other delinquent, nonaccrual and problem loans and loans to industries experiencing economic difficulties. The collectability of these loans is evaluated after considering current operating results and financial position of the borrower, estimated market value of collateral, guarantees and the Company’s collateral position versus other creditors. Judgments, which are necessarily subjective, as to the probability of loss and amount of such loss are formed on these loans, as well as other loans taken together.

14

The following schedule is a breakdown of the allowance for loan losses allocated by type of loan and related ratios. While management’s periodic analysis of the adequacy of the allowance for loan losses may allocate portions of the allowance for specific problem-loan situations, the entire allowance is available for any loan charge-offs that occur.

| Allocation of the Allowance for Loan Losses | ||||||||||||||||||||||||||||||||||||||||

| (Dollars in thousands) | ||||||||||||||||||||||||||||||||||||||||

| Allowance Amount |

Percentage of Loans in Each Category to Total Loans |

Allowance Amount |

Percentage of Loans in Each Category to Total Loans |

Allowance Amount |

Percentage of Loans in Each Category to Total Loans |

Allowance Amount |

Percentage of Loans in Each Category to Total Loans |

Allowance Amount |

Percentage of Loans in Each Category to Total Loans |

|||||||||||||||||||||||||||||||

| December 31, 2013 | December 31, 2012 | December 31, 2011 | December 31, 2010 | December 31, 2009 | ||||||||||||||||||||||||||||||||||||

| Commercial |

$ | 1,219 | 31.00 | % | $ | 933 | 28.79 | % | $ | 1,024 | 27.73 | % | $ | 1,179 | 24.90 | % | $ | 1,031 | 22.14 | % | ||||||||||||||||||||

| Commercial real estate |

1,872 | 34.27 | 1,902 | 32.71 | 1,673 | 32.82 | 1,183 | 33.23 | 1,338 | 34.41 | ||||||||||||||||||||||||||||||

| Residential real estate |

1,205 | 29.41 | 1,096 | 30.30 | 894 | 31.95 | 1,057 | 34.50 | 1,140 | 36.68 | ||||||||||||||||||||||||||||||

| Construction & land development |

178 | 3.55 | 253 | 6.41 | 180 | 5.58 | 213 | 5.24 | 246 | 4.39 | ||||||||||||||||||||||||||||||

| Consumer |

91 | 1.77 | 76 | 1.79 | 78 | 1.92 | 80 | 2.13 | 77 | 2.38 | ||||||||||||||||||||||||||||||

| Unallocated |

520 | 320 | 233 | 319 | 228 | |||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Total |

$ | 5,085 | 100.00 | % | $ | 4,580 | 100.00 | % | $ | 4,082 | 100.00 | % | $ | 4,031 | 100.00 | % | $ | 4,060 | 100.00 | % | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

15

Deposits

The following is a schedule of average deposit amounts and average rates paid on each category for the periods indicated:

| Average Amounts Outstanding Year ended December 31, |

Average Rate Paid Year ended December 31, |

|||||||||||||||||||||||

| (Dollars in thousands) | 2013 | 2012 | 2011 | 2013 | 2012 | 2011 | ||||||||||||||||||

| Noninterest-bearing demand |

$ | 106,769 | $ | 91,148 | $ | 70,543 | N/A | N/A | N/A | |||||||||||||||

| Interest-bearing demand |

70,648 | 63,346 | 53,896 | 0.06 | % | 0.08 | % | 0.08 | % | |||||||||||||||

| Savings deposits |

141,638 | 135,035 | 91,232 | 0.10 | 0.17 | 0.25 | ||||||||||||||||||

| Time deposits |

149,340 | 163,997 | 152,194 | 1.03 | 1.25 | 1.70 | ||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||

| Total deposits |

$ | 468,395 | $ | 453,526 | $ | 367,865 | ||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||

The Bank does not have any material deposits by foreign depositors.

The following is a schedule of maturities of time certificates of deposit in amounts of $100,000 or more as of December 31, 2013:

| (Dollars in thousands) | ||||

| Three months or less |

$ | 8,021 | ||

| Over three through six months |

4,799 | |||

| Over six through twelve months |

11,483 | |||

| Over twelve months |

18,259 | |||

|

|

|

|||

| Total |

$ | 42,562 | ||

|

|

|

|||

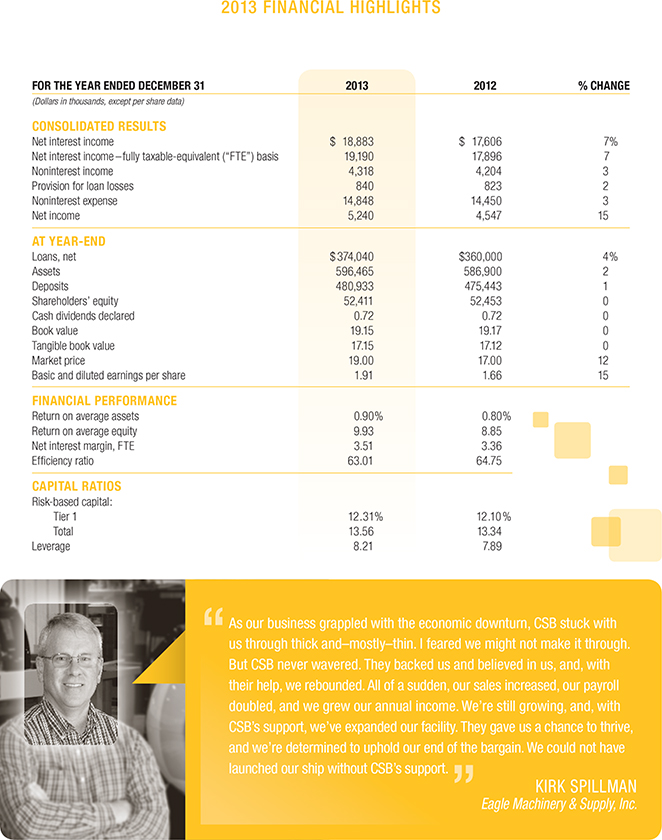

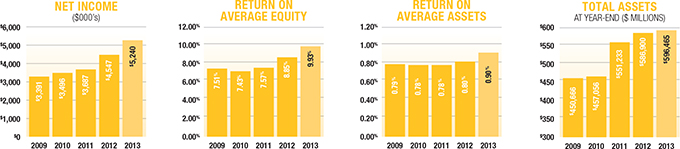

Return on Equity and Assets

| 2013 | 2012 | 2011 | ||||||||||

| Return on average assets |

0.90 | % | 0.80 | % | 0.78 | % | ||||||

| Return on average shareholders’ equity |

9.93 | 8.85 | 7.57 | |||||||||

| Dividend payout ratio |

37.60 | 43.30 | 53.40 | |||||||||

| Average shareholders’ equity to average assets |

9.08 | 9.10 | 10.33 | |||||||||

Short-Term Borrowings

Short-term borrowings consist of securities sold under agreements to repurchase, short-term advances through Federal Home Loan Bank and federal funds purchased. Securities sold under agreements to repurchase generally mature one (1) day from the transaction date. Federal funds purchased generally have overnight terms. Information concerning short-term borrowings is summarized as follows:

| (Dollars in thousands) | 2013 | 2012 | 2011 | |||||||||

| Securities sold under agreements to repurchase, federal funds purchased and short-term advances at period end |

$ | 48,671 | $ | 43,992 | $ | 37,073 | ||||||

| Weighted average interest rate at period end |

0.15 | % | 0.20 | % | 0.25 | % | ||||||

| Maximum outstanding at any month end during the year |

48,671 | 43,992 | 37,073 | |||||||||

| Average amount outstanding |

45,330 | 40,893 | 32,577 | |||||||||

| Weighted average rates during year |

0.15 | % | 0.22 | % | 0.43 | % | ||||||

16

ITEM 1A. RISK FACTORS.

Risks Related to the Company’s Business

The Company’s exposure to credit risk could adversely affect its earnings and financial condition.

Credit risk is the risk of losing principal and interest income because borrowers fail to repay loans. The Company’s earnings may be negatively impacted if it fails to manage credit risk, as the origination of loans is an integral part of the Company’s business. Factors which may affect the ability of borrowers to repay loans include a slowing of the local economy in which the Company operates, a downturn in one or more business sectors in which the Company’s customers operate or a rapid increase in interest rates. All of the Company’s loan portfolios, particularly commercial real estate loans, may continue to be affected by the sustained economic weakness of the Company’s north central Ohio market and the impact of higher unemployment rates. There has been a slow improvement in the housing market across the Company’s footprint, reflecting a bottom to prices and excess inventories of houses beginning to be sold. A return to further declines in home values and reduced levels of home sales in the Company’s market may have a negative effect on the Company’s business, financial condition or results of operation.

The Company’s allowance for loan losses may be insufficient.

The Company maintains an allowance for loan losses that it believes is a reasonable estimate of known and inherent losses within the loan portfolio. The Company makes various assumptions and judgments about the collectability of its loan portfolio, including the creditworthiness of its borrowers and the value of the real estate and other assets serving as collateral for the repayment of loans. Through a periodic review and consideration of the loan portfolio, management determines the amount of the allowance for loan losses by considering general market conditions, credit quality of the loan portfolio, the collateral supporting the loans and performance of customers relative to their financial obligations with us. The amount of future losses is susceptible to changes in economic, operating and other conditions, including changes in interest rates, which may be beyond the Company’s control, and these losses may exceed current estimates. The Company cannot fully predict the amount or timing of losses or whether the loss allowance will be adequate in the future. If the Company’s assumptions prove to be incorrect, the allowance for loan losses may not be sufficient to cover losses inherent in the Company’s loan portfolio, resulting in additions to the allowance. Excessive loan losses and significant additions to the Company’s allowance for loan losses could have a material adverse impact on the Company’s business, financial condition and results of operations. In addition, bank regulators periodically review the Company’s allowance for loan losses and may require the Company to increase its provision for loan losses or recognize further loan charge-offs. Any such increase in the Company’s allowance for loan losses or loan charge-offs as required by these regulatory authorities might have a material adverse effect on the Company’s business, financial condition or results of operations.

The Company has significant exposure to risks associated with commercial and commercial real estate loans.

As of December 31, 2013, approximately 65% of the Company’s loan portfolio consisted of commercial and commercial real estate loans. These loans are generally viewed as having more inherent risk of default than residential mortgage or consumer loans. The repayment of these loans often depends on the successful operation of a business. These loans are more likely to be adversely affected by weak conditions in the economy. Also, the commercial loan balance per borrower is typically larger than that for residential mortgage loans and consumer loans, indicating higher potential losses on an individual loan basis. The deterioration of one or a few of these loans could cause a significant increase in nonperforming loans and a reduction in interest income. An increase in nonperforming loans could result in an increase in the provision for loan losses and an increase in loan charge-offs, both of which could have a material adverse effect on the Company’s business, financial condition and results of operations.

A significant portion of the Company’s loan portfolio is secured by real property. During the ordinary course of business, the Company may foreclose on and take title to properties securing certain loans. In doing so, there is a risk that hazardous or toxic substances could be found on these properties. If hazardous or toxic substances are found, the Company may be liable for remediation costs, as well as for personal injury and property damage.

The Company is subject to liquidity risk.

The Company requires liquidity to meet its deposit and debt obligations as they come due. The Company’s access to funding sources in amounts adequate to finance its activities or on terms that are acceptable to it could be impaired by factors that affect it specifically or the financial services industry or economy generally. Factors that could reduce its access to liquidity sources include a downturn in the north central Ohio market, difficult credit markets or adverse regulatory actions. The Company’s access to deposits may also be affected by the liquidity needs of its depositors. In particular, a substantial majority of the Company’s liabilities are demand, savings, interest checking and money market deposits, which are payable on demand or upon several days’ notice, while by comparison, a substantial

17

portion of its assets are loans, which cannot be called or sold in the same time frame. Although the Company historically has been able to replace maturing deposits and advances as necessary, it might not be able to replace such funds in the future, especially if a large number of its depositors sought to withdraw their accounts, regardless of the reason. A failure to maintain adequate liquidity could have a material adverse effect on the Company’s business, financial condition or results of operations.

The Company’s business strategy includes planned growth. The Company’s financial condition and results of operations could be negatively affected if the Company fails to grow or fails to manage its growth effectively.

The Company’s ability to grow successfully will depend on a variety of factors, including the continued availability of desirable business opportunities, its ability to integrate acquisitions and manage growth and the Company’s ability to raise capital. While the Company believes it has the management resources and systems in place to successfully manage future growth, there can be no assurance that growth opportunities will be available.

Failure to manage the Company’s growth effectively could have a material adverse effect on its business, future prospects, financial condition or results of operations and could adversely affect the Company’s ability to successfully implement its business strategy.

The Company may need to raise capital in the future, but capital may not be available when needed or at acceptable terms.

Federal and state banking regulators require the Company and the Bank to maintain adequate levels of capital to support its operations. In addition, in the future the Company may need to raise additional capital to support its business or to finance acquisitions, if any, or the Company may otherwise elect to raise additional capital in anticipation of future growth opportunities. Many financial institutions have sought to raise considerable amounts of capital in recent years in response to deterioration in their results of operations and financial condition. Such overall market demand for capital may diminish the Company’s ability to raise additional capital if and when it is needed.

The Company’s ability to raise additional capital for CSB or the Bank’s needs will depend on conditions at that time in the capital markets, overall economic conditions, CSB’s financial performance and condition, and other factors, many of which are outside our control. There is no assurance that, if needed, CSB will be able to raise additional capital on favorable terms or at all. An inability to raise additional capital may have a material adverse effect on our ability to expand operations, and on our financial condition, results of operations and future prospects.

Strong competition within the market in which the Company operates could reduce its ability to attract and retain business.