MANAGEMENT INFORMATION CIRCULAR

SOLICITATION OF PROXIES BY MANAGEMENT

This Management Information Circular (the “Circular”) is furnished in connection with the solicitation by the management of Intertape Polymer Group Inc. (the “Corporation”) of proxies to be used at the Annual Meeting of shareholders (the “Meeting”) of the Corporation to be held at the time and place and for the purposes set forth in the Notice of Meeting and all adjournments thereof. Except as otherwise stated, the information contained herein is given as of April 15, 2012 and all dollar amounts in this Circular are in U.S. dollars. The solicitation will be made primarily by mail. However, officers and employees of the Corporation may also solicit proxies by telephone, telecopier, e-mail or in person. The total cost of solicitation of proxies will be borne by the Corporation.

APPOINTMENT AND REVOCATION OF PROXIES

The persons named in the enclosed form of proxy are directors and officers of the Corporation. Each shareholder is entitled to appoint a person, who need not be a shareholder, to represent him, her or it at the Meeting other than those whose names are printed on the accompanying form of proxy by inserting such other person’s name in the blank space provided in the form of proxy and signing the form of proxy or by completing and signing another proper form of proxy. To be valid, the duly-completed form of proxy must be deposited at the offices of Canadian Stock Transfer Company (CST) as administrative agent for CIBC Mellon Trust Company (CIBC Mellon), B1 Level, 320 Bay Street, Toronto, Ontario M5H 4A6 before the commencement of the Meeting or at any adjournment thereof, or with the Chairman of the Meeting before the commencement of the Meeting or any adjournment thereof. The instrument appointing a proxy holder must be executed by the shareholder or by his attorney authorized in writing or, if the shareholder is a corporate body, by its authorized officer or officers.

A shareholder who has given a proxy may revoke it, as to any motion on which a vote has not already been cast pursuant to the authority conferred by it, by an instrument in writing executed by the shareholder or by the shareholder’s attorney authorized in writing or, if the shareholder is a corporation, under its corporate seal or by an officer or attorney thereof duly authorized. The revocation of a proxy, in order to be acted upon, must be deposited with Canadian Stock Transfer Company (CST) as administrative agent for CIBC Mellon Trust Company (CIBC Mellon), B1 Level, 320 Bay Street, Toronto, Ontario M5H 4A6 prior to 5:00 p.m. on May 15, 2012 or with the Chairman of the Meeting before the commencement of the Meeting or any adjournment thereof, or in any other manner permitted by law.

REGISTERED SHAREHOLDERS

There are four ways that registered shareholder can vote their common shares. A shareholder is a registered shareholder if their name appears on their share certificate. A registered shareholder may (i) vote in person at the Meeting, (ii) complete and sign the enclosed form of proxy and appoint one of the named persons or another person the shareholder chooses to represent them and to vote their shares at the Meeting and mail it, (iii) vote electronically on the Internet, or (iv) vote by telephone. The shareholder should make sure that the person they appoint is aware that he or she is appointed and attends the Meeting. Completing, signing and returning the form of proxy does not preclude the shareholder from attending the Meeting in person. If the shareholder does not wish to attend the Meeting or does not wish to vote in person, the shareholder’s proxy will be voted or be withheld from voting, in accordance with their instructions specified on their proxy, on any ballot that may be called at the Meeting. If the shareholder is a corporation or other legal entity, the form of proxy must be signed by an officer or attorney authorized by such corporation or other legal entity.

To vote by telephone, a registered shareholder should call 1-866-206-5104. To vote electronically, a registered shareholder must go to the following Internet site: www.proxypush.ca/ITP and enter their personalized 12-digit e-voting control number printed on their form of proxy and follow the instructions on the screen.

If a registered shareholder wishes to attend the Meeting and wishes to vote its shares in person at the Meeting, it is not necessary for the registered shareholder to complete or return the form of proxy. A registered shareholder vote will be taken and counted at the Meeting. A registered shareholder should register with the transfer agent, CIBC Mellon Trust Company, upon arrival at the Meeting.

2

EXERCISE OF DISCRETION BY PROXIES

In the absence of any direction to the contrary, shares represented by properly-executed proxies in favour of the persons designated in the enclosed form of proxy will be voted FOR the: (i) election of directors; and (ii) appointment of auditors, as stated under such headings in this Circular. Instructions with respect to voting will be respected by the persons designated in the enclosed form of proxy. With respect to amendments or variations to matters identified in the Notice of Meeting and with respect to other matters that may properly come before the Meeting, such shares will be voted by the persons so designated in their discretion. At the time of printing this Circular, management of the Corporation knows of no such amendments, variations or other matters.

NON-REGISTERED SHAREHOLDERS

Only registered shareholders or the persons they appoint as their proxies are permitted to vote at the Meeting. However, in many cases, shares beneficially owned by a non-registered shareholder (a “Non-Registered Holder”) are registered either: (i) in the name of an intermediary (an “Intermediary”) that the Non-Registered Holder deals with in respect of the common shares (such as securities dealers or brokers, banks, trust companies, and trustees or administrators of self-administered RRSPs, RRIFs, RESPs, TFSAs and similar plans); or (ii) in the name of a clearing agency of which the Intermediary is a participant. In accordance with National Instrument 54-101 of the Canadian Securities Administrators, entitled “Communication with Beneficial Owners of Securities of a Reporting Issuer”, the Corporation has distributed copies of the Notice of Meeting and this Circular (collectively, the “Meeting Materials”) to the clearing agencies and Intermediaries for distribution to Non-Registered Holders. Intermediaries are required to forward the Meeting Materials to Non-Registered Holders unless a Non-Registered Holder has waived the right to receive them. Intermediaries often use service companies to forward meeting materials to Non-Registered Holders. Generally, Non-Registered Holders who have not waived the right to receive the Meeting Materials will either:

| (a) |

typically, be provided with a computerized form (often called a “voting instruction form”) which is not signed by the Intermediary and which, when properly completed and signed by the Non-Registered Holder and returned to the Intermediary or its service company, will constitute voting instructions which the Intermediary must follow. In order for the applicable computerized form to validly constitute a voting instruction form, the Non-Registered Holder must properly complete and sign the form and submit it to the Intermediary or its service company in accordance with the instructions of the Intermediary or service company. In certain cases, the Non-Registered Holder may provide such voting instructions to the Intermediary or its service company through the Internet or through a toll-free telephone number; or |

| (b) |

less commonly, be given a proxy form which has already been signed by the Intermediary (typically by a facsimile, stamped signature), which is restricted to the number of shares beneficially owned by the Non-Registered Holder but which is otherwise not completed. In this case, the Non-Registered Holder who wishes to submit a proxy should properly complete the proxy form and submit it to Canadian Stock Transfer Company (CST) as administrative agent for CIBC Mellon Trust Company (CIBC Mellon), B1 Level, 320 Bay Street, Toronto, Ontario M5H 4A6. |

In either case, the purpose of these procedures is to permit Non-Registered Holders to direct the voting of the common shares which they beneficially own.

Should a Non-Registered Holder who receives a voting instruction form wish to vote at the Meeting in person (or have another person attend and vote on behalf of the Non-Registered Holder), the Non-Registered Holder should print his, her or its own name, or that of such other person, on the voting instruction form and return it to the Intermediary or its service company. Should a Non-Registered Holder who receives a proxy form wish to vote at the Meeting in person (or have another person attend and vote on behalf of the Non-Registered Holder), the Non-Registered Holder should strike out the names of the persons set out in the proxy form and insert the name of the Non-Registered Holder or such other person in the blank space provided and submit it to Canadian Stock Transfer Company (CST) as administrative agent for CIBC Mellon Trust Company (CIBC Mellon) at the address above.

In all cases, Non-Registered Holders should carefully follow the instructions of their Intermediary, including those regarding when, where and by what means the voting instruction form or proxy form must be delivered.

A Non-Registered Holder may revoke voting instructions which have been given to an Intermediary at any time by written notice to the Intermediary.

3

VOTING SHARES

As at April 15, 2012, there were 58,961,050 common shares of the Corporation issued and outstanding. Each common share entitles the holder thereof to one vote. The Corporation has fixed April 16, 2012 as the record date (the “Record Date”) for the purpose of determining shareholders entitled to receive notice of the Meeting. Pursuant to the Canada Business Corporations Act (“CBCA”), the Corporation is required to prepare, no later than ten days after the Record Date, an alphabetical list of shareholders entitled to vote as of the Record Date that shows the number of common shares held by each shareholder. A shareholder whose name appears on the list referred to above is entitled to vote the common shares shown opposite his, her or its name at the Meeting. The list of shareholders is available for inspection during usual business hours at the registered office of the Corporation, 1250 René-Lévesque Blvd. West, Suite 2500, Montreal, Québec H3Y 4Y1 and at the Meeting.

PRINCIPAL SHAREHOLDERS

As at April 15, 2012, to the knowledge of the directors and executive officers of the Corporation, the following are the only persons who beneficially own, or exercise control or direction over, directly or indirectly, more than 10% of the issued and outstanding common shares of the Corporation:

| Name |

Number of shares held | Percentage | ||

| Letko, Brosseau & Associates Inc.(1) |

13,411,823 | 22.75 | ||

| Wells Fargo & Company(2) |

11,756,371 | 19.94 | ||

| (1) |

Based on a report filed February 6, 2012 reflecting ownership as of December 31, 2011 by Letko, Brosseau & Associates Inc. pursuant to National Instrument 62-103. |

| (2) |

Based on a report filed January 25, 2012 reflecting ownership as of December 31, 2011 by Wells Fargo & Company with the United States Securities and Exchange Commission. |

ELECTION OF DIRECTORS

The Board currently consists of eight directors. The persons named in the enclosed form of proxy intend to vote for the election of the eight nominees whose names are set out below. Each director will hold office until the next annual meeting of shareholders or until the election of his successor, unless he resigns or his office becomes vacant by removal, death or other cause.

The following table sets out the name of each of the persons proposed to be nominated for election as director, all other positions and offices with the Corporation now held by such person, his province or state, and country of residence and principal occupation, the date on which such person became a director of the Corporation, and the number of common shares of the Corporation that such person has advised are beneficially owned or over which control or direction is exercised, directly or indirectly, by such person as at the date indicated below.

| Name, province or state and country of residence and position with the Corporation |

Principal occupation |

Director since |

Number of common shares beneficially owned or over which control or direction is exercised as at April 15, 2012(1) | |||

| Eric E. Baker (2)(3) Ontario, Canada Chairman of the Board of Directors |

Managing Partner Miralta Capital L.P. President Altacap Investors Inc. (private equity manager) |

June 28, 2007(4) | 2,878,689 | |||

| Robert M. Beil(3)(5) Arizona, U.S.A. Director |

Retired |

September 5, 2007 | 30,000 | |||

| George J. Bunze(3)(6) Québec, Canada Director |

Vice-Chairman and Director Kruger Inc. (manufacturer of paper, tissue, wood products, energy (hydro/wind) and wine and spirits products) |

June 28, 2007 | 25,250 | |||

4

| Name, province or state and country of residence and position with the Corporation |

Principal occupation |

Director since |

Number of common shares beneficially owned or over which control or direction is exercised as at April 15, 2012(1) | |||

| Robert J. Foster(6) Ontario, Canada Lead Director |

CEO and President Capital Canada Limited (investment banking firm) |

June 8, 2010 | 35,000 | |||

| James Pantelidis Ontario, Canada |

Corporate Director |

— | 1,000 | |||

| Jorge N. Quintas(5)(7) Porto, Portugal Director |

President Nelson Quintas SGPS, SA (manufacturer of electrical and telecommunication cables) |

June 29, 2009 | 1,833,468 | |||

| Gregory A. Yull Florida, U.S.A. Director, Chief Executive Officer and President of the Corporation |

Chief Executive Officer and President of the Corporation |

August 2, 2010 | 190,374 | |||

| Melbourne F. Yull(2) Florida, U.S.A. Director |

President Sammana Group, Inc. |

June 28, 2007(8) | 2,505,109 | |||

| (1) |

This information was provided to the Corporation by the respective directors. |

| (2) |

Member of the Executive Committee. |

| (3) |

Member of the Nominating & Governance Committee. |

| (4) |

Mr. Baker was also a director of the Corporation from its incorporation on December 22, 1989 to July 4, 2000 and, prior thereto, a director of a predecessor company from 1984. |

| (5) |

Member of the Compensation Committee. |

| (6) |

Member of the Audit Committee. |

| (7) |

Mr. Quintas was also a director of the Corporation from May 2005 to June 2006. |

| (8) |

Mr. Yull was also a director of the Corporation from its incorporation on December 22, 1989 to June 14, 2006 and, prior thereto, a director of a predecessor company from 1981. |

Mr. Pantelidis has over 30 years of experience in the petroleum industry. Mr. Pantelidis is Chairman of the Board of Parkland Fuel Corporation and has served as a director of Parkland Fuel Corporation since 1999. Mr. Pantelidis is Chairman and Director of EnerCare Inc. since 2002 (member of the Audit, Governance and Compensation, and Investment Committees). He also serves on the Board of each of RONA Inc. (Chairman of the Human Resources and Compensation Committee and member of the Development Committee); Industrial Alliance Insurance and Financial Services Inc. (Chairman of the Investment Committee and member of Human Resources and Compensation Committee). From 2002 to 2006, Mr. Pantelidis was on the board of FisherCast Global Corporation and served as Chairman and Chief Executive Officer from 2004 to 2006. From 2002 to 2004, Mr. Pantelidis was President of J.P. & Associates, a strategic consulting group. Between 1999 and 2001, Mr. Pantelidis served as Chairman and Chief Executive Officer for the Bata International Organization. Mr. Pantelidis has a Bachelor of Science degree and a Master of Business Administration degree, both from McGill University.

To the knowledge of the Corporation, none of the foregoing nominees for election as director of the Corporation:

| (a) |

is, or within the last ten years has been, a director, chief executive officer or chief financial officer of any company that: |

| (i) |

was subject to a cease trade order, an order similar to a cease trade order, or an order that denied the relevant company access to any exemption under applicable securities legislation, and which in all cases was in effect for a period of more than 30 consecutive days (an “Order”), which Order was issued while the proposed director was acting in the capacity as director, chief executive officer or chief financial officer of such company; or |

| (ii) |

was subject to an Order that was issued after the proposed director ceased to be a director, chief executive officer or chief financial officer and which resulted from an event that occurred while that |

5

| person was acting in the capacity as director, chief executive officer or chief financial officer of such company; or |

| (b) |

is, or within the last ten years has been, a director or executive officer of any company that, while the proposed director was acting in that capacity, or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets, except for: George J. Bunze, who is Vice-Chairman and Director of Kruger Inc., and served as Vice-Chairman of Global Tissue LLC, a Delaware limited liability company acquired in 1999 by an indirect partially-owned subsidiary of Kruger Inc., and which commenced bankruptcy proceedings in 2000 before the U.S. Bankruptcy Court in Delaware; Eric E. Baker, a former director of AldeaVision Solutions Inc., a company whose shares were listed on the TSX Venture Exchange and which in 2007 filed court proceedings before the Superior Court of Québec for protection under the Companies’ Creditors Arrangement Act (Canada); and James Pantelidis, who made a private investment in Tattoo Footwear Inc. and joined the board of that company in 2003. In the 12 month period following the sale of his shares and departure from the board of Tattoo Footwear Inc., the company went into receivership; or |

| (c) |

has, within the last ten years, become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or become subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold his assets. |

None of the foregoing nominees for election as director of the Corporation has been subject to:

| (a) |

any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority or has entered into a settlement agreement with a securities regulatory authority; or |

| (b) |

any other penalties or sanctions imposed by a court or regulatory body that would likely be considered important to a reasonable security holder in deciding whether to vote for a proposed director. |

DIRECTORS’ AND OFFICERS’ INSURANCE

The Corporation maintains directors’ and officers’ liability insurance covering liability, including defense costs, of directors and officers of the Corporation incurred as a result of acting in such capacity, provided that they acted honestly and in good faith with a view to the best interests of the Corporation. The current limit of the insurance is $25 million. An annual premium of $85,000 was paid by the Corporation in the last-completed financial year with respect to the period from December 2010 to December 2011. Claims payable to the Corporation are subject to retention or a deductible of up to $100,000 per occurrence.

COMPENSATION OF EXECUTIVE OFFICERS AND DIRECTORS

Compensation Discussion and Analysis

This discussion describes the Corporation’s compensation program for each person who acted as Chief Executive Officer (“CEO”) and Chief Financial Officer (“CFO”) and the three most highly-compensated executive officers (or three most highly-compensated individuals acting in a similar capacity), other than the CEO and CFO, whose total compensation was more than $150,000 in the Corporation’s last financial year (each a “Named Executive Officer” or “NEO” and collectively, the “Named Executive Officers”). This section addresses the Corporation’s philosophy and objectives and provides a review of the process that the Compensation Committee follows in deciding how to compensate the Named Executive Officers. This section also provides discussion and analysis of the Compensation Committee’s specific decisions regarding the compensation of the Named Executive Officers for the financial year ended December 31, 2011.

Compensation Committee

The Compensation Committee of the Board of Directors (the “Compensation Committee”) is composed of three directors, namely Robert M. Beil (Chairman), Torsten A. Schermer and Jorge N. Quintas, none of whom is or has been at any previous time an employee of the Corporation or any of its subsidiaries, and all of whom are considered independent within the meaning of National Instrument 52 - 110—Audit Committee. The Committee reviews annually the performance of the executives and ensures that it understands compensation trends and that the programs in place are adequate. When circumstances warrant it, the Committee may make recommendations that deviate from current policies. The Board of Directors is of the view that the Compensation Committee collectively has the knowledge, experience and background to fulfill its mandate, and that each of the members of the Compensation Committee has direct experience relevant to his responsibilities regarding executive compensation. Each of the members of the Compensation Committee is an experienced senior executive. In particular, Messrs. Schermer and

6

Quintas are presidents of their respective firms and Mr. Beil has extensive experience with the design and implementation of executive compensation packages. These collective skills and extensive experience enable the Compensation Committee to make decisions on the suitability of the Corporation’s compensation policies and practices.

Compensation Program Philosophy

The Corporation’s executive compensation philosophy and program objectives are directed primarily by two guiding principles. First, the program is intended to provide competitive levels of compensation, at expected levels of performance, in order to attract, motivate and retain talented executives. Second, the program is intended to create an alignment of interest between the Corporation’s executives and shareholders so that a significant portion of each executive’s compensation is linked to maximizing shareholder value. In support of this philosophy, the executive compensation program is designed to reward performance that is directly relevant to the Corporation’s short-term and long-term success. The Corporation attempts to provide both short-term and long-term incentive compensation that varies based on corporate and individual performance.

Three primary components comprise the Corporation’s compensation program. They are basic salary, annual incentive bonuses based on performance, and long-term stock options granted pursuant to the Corporation’s Executive Stock Option Plan (“ESOP”). Each element of compensation fulfills a different role in attracting, retaining and motivating qualified executives and employees with the expertise and skills required in the business of the Corporation, who can effectively contribute to its long-term success and objectives. The following discussion describes the Corporation’s executive compensation program by component of compensation and discusses how each component relates to the Corporation’s overall executive compensation objective. In establishing the executive compensation program, the Corporation believes that:

| (a) |

base salaries provide an immediate cash incentive for the Corporation’s Named Executive Officers and should be at levels competitive with peer companies that compete with the Corporation for business opportunities and executive talent; |

| (b) |

annual incentive bonuses encourage and reward performance over the financial year compared to predefined goals and objectives and reflect progress toward company-wide performance objectives and personal objectives; and |

| (c) |

stock options ensure that the Named Executive Officers are motivated to achieve long-term growth of the Corporation and continuing increases in shareholder value, and provide capital accumulation linked directly to the Corporation’s performance. |

The Corporation places equal emphasis on base salary and stock options as short-term and long-term incentives, respectively. Annual incentive bonuses are related to performance and may form a greater or lesser part of the entire compensation package in any given year.

Purpose

The Corporation’s executive compensation program has been designed to accomplish the following long-term objectives:

| (a) |

create a proper balance between building shareholder wealth and competitive executive compensation while maintaining good corporate governance; |

| (b) |

produce long-term, positive results for the Corporation’s shareholders; |

| (c) |

align executive compensation with corporate performance and appropriate peer-group comparisons; and |

| (d) |

provide market-competitive compensation and benefits that will enable the Corporation to recruit, retain and motivate the executive talent necessary to be successful. |

Compensation Process

The Compensation Committee administers the Corporation’s compensation program in accordance with the mandate set out in the Compensation Committee’s charter, which has been adopted by the Board of Directors of the Corporation (the “Board”). Part of the mandate is to evaluate and recommend to the Board compensation policies and programs for the Corporation’s directors, executive officers and senior management, including option grants under the ESOP described below. The Compensation Committee has the authority to retain compensation consultants to assist in the evaluation of director, chief executive officer and

7

senior executive compensation. In 2011, the Corporation retained the services of Hay Group, Inc. for advice relating to the competitiveness and appropriateness of the compensation programs of the Corporation for the President and Chief Executive Officer and members of senior management, as the case may be. Hay Group, Inc. is in the midst of finalizing its external benchmarking study. The services to be provided by Hay Group, Inc may include, but are not limited to, advice on base salaries, short term, medium term and long term incentive programs, pension plans, social benefits, awards and provisions regarding employment and change of control. In connection with these services, Hay Group, Inc. may review the Corporation’s compensation policies (including choosing the companies forming part of the comparative groups, positioning regarding compensation and performance, performance measures, etc.), the design of the programs and the levels of compensation compared to market and may make observations and recommendations regarding amendments where appropriate.

The CEO makes recommendations to the Compensation Committee as to the compensation of the Corporation’s executive officers, other than himself. The Compensation Committee makes recommendations to the Board of Directors as to the compensation of the CEO and the other Named Executive Officers for approval, in accordance with the same criteria upon which the compensation of all other executive officers is based.

The Compensation Committee annually reviews the compensation levels for the executive officers and certain members of senior management. The Compensation Committee makes recommendations to the Board of Directors as to the compensation of the CEO and the other Named Executive Officers for approval, in accordance with the same criteria upon which the compensation of all other executive officers is based. For the fiscal year ended December 31, 2011, the Compensation Committee reviewed information it received from the CEO. It used this information to determine and approve such changes to the general compensation levels that it considered appropriate. In addition, on the recommendation of the CEO, the Compensation Committee approved and recommended to the Board discretionary stock option awards for executive officers and senior management. In arriving at its decisions, the Compensation Committee reviewed industry comparisons for similar-sized companies and for other companies in the packaging materials sector. For the fiscal year ended December 31, 2011, the comparative group was comprised of the following companies: AEP Industries, Aptargroup, Boise Inc., Enpro Industries, Exopak Holding Corporation, Myers Industries, Packaging Corporation of America and Tredegar Corporation. As of the date hereof, the Corporation has no plan to make any significant change to its compensation policies and practices in the next financial year.

Although the Compensation Committee may rely on information and advice obtained from consultants, all decisions with respect to executive compensation are made by the Board of Directors upon recommendation of the Compensation Committee and may reflect factors and considerations that differ from information and recommendations provided by such consultants, such as merit and the need to retain high-performing executives. Accordingly, the Board of Directors may exercise discretion either to award compensation absent attainment of the relevant performance goal or similar condition or to reduce or increase the size of any award or payout to one or more Named Executive Officer.

Base Salaries

The base salaries of the Named Executive Officers are reviewed annually to ensure that they take into account the following factors: market and economic conditions; levels of responsibility and accountability of each Named Executive Officer; skill and competencies of each Named Executive Officer; retention considerations; and level of demonstrated performance.

Variable Cash Incentive Awards – Bonuses

The Compensation Committee’s philosophy with respect to executive officer bonuses is to align the payments of bonuses with the performance of the Corporation, based on predefined goals and objectives established by the Compensation Committee and management. As a result of the fiscal 2011 performance of the Corporation, the Compensation Committee recommended the payment of bonuses to the Named Executive Officers for the fiscal year ended December 31, 2011.

Each of the Named Executive Officers received a performance bonus for 2011. Bonuses paid depend on the level of achievement of financial objectives of the Corporation. The Corporation attributes to each executive, depending on his or her hierarchic level, a bonus target level set as a percentage of his or her salary, representing the amount which will be paid if all objectives are achieved according to the targets set. Actual bonuses may vary between zero and twice the target bonus, based on the level of achievement of the predetermined objectives set out at the beginning of the fiscal year. The objectives and weight attached thereto are re-evaluated on an annual basis by the Compensation Committee and communicated to the relevant individuals.

For the fiscal year ended December 31, 2011, the bonuses were based on the Corporation achieving certain target amounts for:

| (i) |

Adjusted EBITDA, which the Corporation defines as net earnings (loss) before (i) income taxes (recovery); (ii) interest and other (income) expense; (iii) refinancing expense, net of amortization; (iv) amortization of debt |

8

| issue expenses; (v) amortization of intangible assets and deferred charges; (vi) depreciation of property, plant and equipment; (vii) manufacturing facility closures, restructuring and other charges; (viii) impairment of goodwill; (ix) impairment of long lived assets and other assets; (x) write down on assets classified as asset held for sale; and (xi) other items as disclosed. Interest expense is defined as the total interest expense incurred net of any interest income earned during the year; and |

| (ii) |

“cash flows from operations after changes in working capital”. |

The Board of Directors elected to use Adjusted EBITDA instead of EBITDA (which the Corporation defines as net earnings (loss) before (i) income taxes (recovery); (ii) financial expenses, net of amortization; (iii) refinancing expense, net of amortization; (iv) amortization of other intangibles and capitalized software costs; and (v) depreciation) in determining bonuses for 2011 inasmuch as certain expenses and charges incurred by the Corporation during the year (i.e., manufacturing facility closure costs) were in the long term interest of the Corporation and that such amounts should not impact the ability of the Named Executive Officers to achieve the performance bonus targets.

The target amount for Adjusted EBITDA for 2011 was set at $59,900,000 (the “EBITDA Target”) and the target amount for cash flows from operations after changes in working capital was $37,200,000 (the “Cash flows Target”). The Corporation’s EBITDA for 2011 was $59,296,000 which was 99% of the EBITDA Target. The utilization of Adjusted EBITDA had the effect of increasing the bonus payable to the Named Executive Officers other than Mr. Yull and Mr. Pitz.

The following table presents the target incentive compensation as a percentage of salary, the indicators used in 2011 to measure the Corporation’s performance for purposes of the short term incentive compensation program and their relative weight.

| Gregory A. Yull |

Bernard J. Pitz |

Jim Bob Carpenter |

Shawn Nelson |

Douglas R. Nalette | ||||||||

|

| ||||||||||||

| Incentive compensation as a percentage of salary |

Minimum Target Maximum |

0% 100% 100% |

0% 100% 100% |

0% 50% 100% |

0% 50% 100% |

0% 50% 100% | ||||||

|

| ||||||||||||

| Relative weight of financial indicators |

||||||||||||

| Adjusted EBITDA |

50% | 50% | 50% | 100% | 100% | |||||||

| Cash flows from operations after changes in working capital |

50% | 50% | 50% | — | — | |||||||

|

| ||||||||||||

| Total |

100% | 100% | 100% | 100% | 100% | |||||||

|

| ||||||||||||

The bonus is calculated using, for each objective, the following formula and is equal to the sum of all results:

|

Annual salary X number of applicable months |

X | Target bonus percentage | X | Weight of financial indicator | ||||

| 12 months |

The Named Executive Officers other than Messrs. Yull and Pitz were also eligible for an additional bonus calculated using an Adjusted EBITDA target amount of $72,000,000 (the “Reach EBITDA Target”). This additional bonus is calculated using the following formula:

|

Actual Adjusted EBITDA – EBITDA Target |

X | Maximum bonus amount- | ||

| Reach EBITDA Target – EBITDA Target |

Target bonus amount |

The following table presents the objectives for 2011 approved by the Board of Directors and the results achieved by the Corporation:

9

| Target | Result | Evaluation of | ||||||||

|

| ||||||||||

| EBITDA |

$ | 59,900,000 | $ | 59,296,000 | 98.99% | |||||

| Adjusted EBITDA |

$ | 59,900,000 | $ | 63,144,000 | 105.42% | |||||

| Cash flows from operations after changes in working capital |

$ | 37,200,000 | $ | 48,752,000 | 131.05% | |||||

| Reach EBITDA Target |

$ | 72,000,000 | $ | 63,144,000 | 87.70% | |||||

Named Executive Officers were also eligible for prorated bonus amounts if between 90% and 100% of the target objectives were achieved by the Corporation.

The following table presents, for each target objective, the bonus amount earned by the Named Executive Officer for 2011.

| Gregory A. Yull | Bernard J. Pitz | Jim Bob Carpenter | Shawn Nelson | Douglas R. Nalette | ||||||

|

| ||||||||||

| EBITDA Target |

$237,500 | $185,400 | $77,575 | $152,500 | $145,000 | |||||

| Cash flows Target |

$237,500 | $185,400 | $77,575 | — | — | |||||

| Reach Target |

— | — | $41,596 | $40,885 | $38,874 | |||||

|

| ||||||||||

| Total |

$475,000 | $370,800 | $196,746 | $193,385 | $183,874 | |||||

|

| ||||||||||

Stock Option Plan

The Corporation provides long-term incentive compensation to its Named Executive Officers through the ESOP. The ESOP is described in detail below under the heading “Securities Authorized for Issuance under Equity Compensation Plan – Executive Stock Option Plan”. The Compensation Committee recommends the granting of stock options from time to time based on its assessment of the appropriateness of doing so in light of the long-term strategic objectives of the Corporation, its current stage of development, the need to retain or attract particular key personnel, the number of stock options already outstanding and overall market conditions. The Compensation Committee views the granting of stock options as a means of promoting the success of the Corporation and higher returns to its shareholders. As such, the Compensation Committee does not grant stock options in excessively dilutive numbers or at exercise prices not reflective of the Corporation’s underlying value. For the fiscal year ended December 31, 2011, the Compensation Committee recommended the granting of stock options to the Named Executive Officers in respect of an aggregate of 575,000 common shares.

Group Benefits/Perquisites

The Compensation Committee believes that the perquisites for Named Executive Officers should be limited in scope and value and commensurate with perquisites offered by peer group companies. The perquisites, including property or other personal benefits provided to an Named Executive Officer that are not generally available to all employees in the year ended December 31, 2011 did not exceed in any case the lesser of $50,000 or 10% of the Named Executive Officer’s total salary.

Assessment of Risk Associated with the Corporation’s Compensation Policies and Practices

The Compensation Committee has assessed the Corporation’s compensation plans and programs for its executive officers to ensure alignment with the Corporation’s business plan and to evaluate the potential risks associated with those plans and programs. The Compensation Committee has concluded that the compensation policies and practices do not create any risks that are reasonably likely to have a material adverse effect on the Corporation.

The Compensation Committee considers the risks associated with executive compensation and corporate incentive plans when designing and reviewing such plans and programs.

NEO or directors are not permitted to purchase financial instruments (such as prepaid variable forward contracts, equity swaps, collars, or units of exchange funds) that are designed to hedge or offset a decrease in market value of equity securities granted as compensation or held, directly or indirectly, by the NEO or director.

Executive Compensation-Related Fees

“Executive Compensation-Related Fees” consist of fees for professional services billed by each consultant or advisor, or any of its affiliates, that are related to determining compensation for any of the Corporation’s directors and executive officers. In the fiscal year ended December 31, 2011, the Corporation paid to Hay Group, Inc. Executive Compensation-Related Fees amounting to $20,121 (nil for the fiscal year ended December 31, 2010).

10

Performance Graph

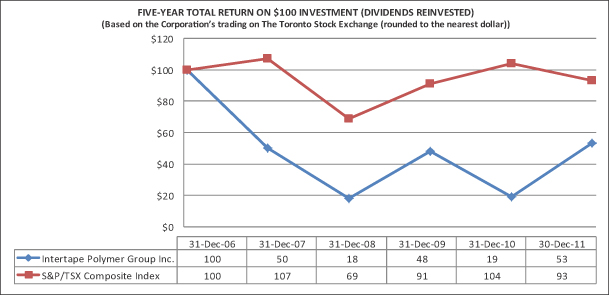

The following graph compares the cumulative five-year total return provided to shareholders on the Corporation’s common shares relative to the cumulative total returns of the S&P/TSX Composite Index. An investment of $100 (with reinvestment of all dividends) is assumed to have been made in the Corporation’s common shares and in the Index on December 31, 2006 and their relative performance is tracked through December 31, 2011.

During the period from 2006 through 2011, the Corporation’s share price underperformed in comparison to the S&P/TSX Composite Index. The aggregate annual compensation of the Named Executive Officers increased in 2007, decreased in 2008 and 2009 and increased in 2010 and 2011.

Variable cash incentive awards based on the Corporation’s financial performance occurred in 2005 based on 2004 financial performance and peaked in 2007 in connection with the Corporation’s financial performance for 2006. In 2008, there was a variable cash incentive award based on the financial performance of the Tapes and Films Division in 2007. There was no variable cash incentive award in 2009 based on the financial performance of the Corporation in 2008. In 2010, there was a variable cash incentive award based on the financial performance of the Tapes and Films Division in 2009. In 2011, there was a variable cash incentive award based on the financial performance of the Corporation (Divisions have been eliminated).

In 2007 and 2008, retention bonuses were paid to Named Executive Officers in connection with the strategic alternatives process and the subsequent voting down by the shareholders of the proposed sale of the Corporation and the related changes in the composition of the Board of Directors.

The Compensation Committee does not establish compensation or incentive levels based solely on the market value of the common shares of the Corporation. The Compensation Committee believes that there are a variety of factors that have an impact on the market value of the Corporation’s common shares that are not reflective of the underlying performance of the Named Executive Officers including the general market volatility.

Summary of the Compensation of the Named Executive Officers

Between the resignation of the Interim CEO on June 28, 2007 and June 8, 2010, the Corporation did not have a CEO. Eric E. Baker and Melbourne F. Yull have served, respectively, as the Chairman of the Board of Directors and Executive Director of the Corporation between June 28, 2007 and June 8, 2010, the date on which Gregory A. Yull was appointed CEO. The compensation paid to companies with which Messrs. Baker and Yull are respectively associated is set out in the “Advisory Services Agreements”, section below.

The following table provides information for the financial years ended December 31, 2011, 2010 and 2009 regarding compensation paid to or earned by the Named Executive Officers.

11

Summary Compensation Table

|

Name and Principal Occupation |

Year |

Salary ($) |

Share- Based Awards ($) |

Option- Based- Awards(1) ($) |

Non-Equity Incentive Plan Compensation ($) |

Pension Value ($) |

All other

Compensation(2) ($) |

Total Compensation | ||||||||||

| Annual Incentive Plans |

Long-Term Incentive Plans |

|||||||||||||||||

| Gregory A. Yull(3) CEO & President |

2011 2010 2009 |

464,711 418,317 350,202 |

— — — |

332,500 398,440 — |

475,000 — — |

— — — |

9,605(4)

— — |

18,732(5) — — |

1,300,548 816,757 350,202 | |||||||||

| Bernard J. Pitz(6) Chief Financial Officer |

2011 2010 2009 |

368,141 360,000 55,385 |

— — — |

110,000 — 193,350 |

370,800 49,315(7) — |

— — — |

9,605(4)

— — |

1,894(8) 353,113(9) — |

860,440 762,428 248,735 | |||||||||

| Victor DiTommaso(10) Chief Financial Officer |

2011 2010 2009 |

— — 220,480 |

— — — |

— — — |

— — — |

— — — |

— — — |

— 279,900(11) — |

— 279,900 220,480 | |||||||||

| Jim Bob Carpenter Sr. Vice President ECP and Procurement |

2011 2010 2009 |

310,300 306,123 282,254 |

— — — |

27,500 45,707 — |

196,746 — — |

— — — |

9,605(4)

— — |

2,947(8) — — |

547,098 351,830 282,254 | |||||||||

| Shawn Nelson Senior Vice- President Industrial Business Unit(12) |

2011 2010 2009 |

297,616 271,298 250,144 |

— — — |

55,000 45,707 — |

193,385 — 55,000(13) |

— — — |

9,605(4)

— — |

978(8) — — |

556,584 317,005 305,144 | |||||||||

| Douglas R. Nalette Senior Vice President Operations(12) |

2011 2010 2009 |

281,385 251,567 231,952 |

— — — |

55,000 45,707 — |

183,874 — 55,000(13) |

— — — |

4,168(4)

— — |

2,638(8) — — |

527,065 297,274 286,952 | |||||||||

| (1) |

Value of awards granted on June 27, 2011 to Bernard J. Pitz, Jim Bob Carpenter, Shawn Nelson and Douglas R. Nalette using the Black-Scholes method, a commonly-used method, using the following assumptions: estimated volatility assumption of 65.87%, estimated dividend yield of 0%, interest rate of 2.48%, and option term of six years. The value of awards granted on June 7, 2011 to Greg Yull was determined using the Black-Scholes method and the following assumptions: estimated volatility assumption of 65.81%, estimated dividend yield of 0%, interest rate of 2.45% and option term of ten years. |

| (2) |

The value of perquisites received by each of the Named Executive Officers, including property or other personal benefits provided to the Named Executive Officers that are not generally available to all employees, were not in the aggregate greater than the lesser of $50,000 or 10% of the Named Executive Officer’s total salary for the financial year. |

| (3) |

Prior to June 8, 2010, Mr. Yull was President, Distribution Products (Tapes & Films). |

| (4) |

Represents the Corporation’s contribution to its defined contribution pension plan, which qualifies as a deferred salary arrangement under section 401(k) of the United States Internal Revenue Code. |

| (5) |

Includes an amount of $10,899 with respect to a company leased vehicle per the terms of Mr. Yull’s employment agreement with the Corporation, an amount of $6,250 tax gross-up paid by the Corporation to Gregory A. Yull with respect to the company leased vehicle, and Group Term Life Insurance. |

| (6) |

Mr. Pitz was appointed CFO of the Corporation effective on November 12, 2009. |

| (7) |

The annual incentive paid to Mr. Pitz was based on a pro rata bonus for 2009 pursuant to the terms of his employment agreement. |

| (8) |

Group Term Life Insurance. |

| (9) |

This amount represents the tax gross-up paid by the Corporation to Bernard J. Pitz with respect to the reimbursement of the loss on the sale of his home and relocation costs (these costs amounted to $660,990). |

| (10) |

Mr. DiTommaso resigned from the position of Chief Financial Officer of the Corporation effective on November 12, 2009. |

| (11) |

Mr. DiTommaso resigned from the position of Chief Financial Officer of the Corporation effective November 12, 2009. This amount represents a severance payment. |

| (12) |

Officer of Intertape Polymer Corp., a wholly owned subsidiary of the Corporation. |

| (13) |

This amount was paid to Mr. Nelson and Mr. Nalette in 2010 but earned on the basis of the Tapes & Film Division attaining specific performance goals in fiscal 2009. |

Incentive Plan Awards—Outstanding Share-Based Awards and Option-Based Awards

The following table sets out the details of all outstanding stock options granted to the Named Executive Officers at December 31, 2011, the end of the most recently completed financial year of the Corporation.

12

| Option-Based Awards | Share-Based Awards | |||||||||||||||||||

| Name | Number

of (#) |

Option Exercise Price ($) |

Option Expiration Date |

Value

of ($) |

Number of (#) |

Market or Payout Value of Share-based awards that have not Vested(2) ($) |

Market

or Payout Value of Vested Share-based awards not paid out or distributed ($) | |||||||||||||

| Gregory A. Yull |

|

50,000 20,000 35,000 442,073 350,000 350,000 |

|

|

9.85 9.85 7.50 3.37 1.90 1.55 |

|

|

03/28/2012 03/28/2012 05/29/2012 09/17/2013 08/05/2020 06/07/2021 |

|

— — — — 493,500 616,000 |

— | — | — | |||||||

| Bernard J. Pitz |

|

182,927 100,000 |

|

|

3.37 1.80 |

|

|

11/12/2015 06/27/2017 |

|

— 151,000 |

— | — | — | |||||||

| Jim Bob Carpenter |

|

20,000 15,000 2,907 100,000 35,000 25,000 |

|

|

9.85 7.50 3.37 3.37 2.19 1.80 |

|

|

03/28/2012 05/29/2012 09/17/2013 08/26/2014 06/10/2016 06/27/2017 |

|

— — — — 39,200 37,750 |

— | — | — | |||||||

| Shawn Nelson |

|

17,500 15,000 152,439 35,000 50,000 |

|

|

9.85 8.46 3.37 2.19 1.80 |

|

|

03/28/2012 05/09/2012 09/17/2013 06/10/2016 06/27/2017 |

|

— — — 39,200 75,500 |

— | — | — | |||||||

| Douglas R. Nalette |

|

13,000 15,000 147,352 35,000 50,000 |

|

|

9.85 8.46 3.37 2.19 1.80 |

|

|

03/28/2012 05/09/2012 09/17/2013 06/10/2016 06/27/2017 |

|

— — — 39,200 75,500 |

— | — | — | |||||||

| (1) |

This column contains the aggregate value of in-the-money unexercised options as at December 31, 2011, calculated based on the difference between the closing price of the common shares on the TSX underlying the stock options as at December 31, 2011 (being $3.31) and the exercise price of the stock options. Actual gains, if any, on exercise will depend on the value of the common shares on the date of exercise. There is no guarantee that gains will be realized. |

| (2) |

Calculated based on the closing price of the common shares on the TSX underlying the performance shares as at December 30, 2011 (being $3.31). |

Incentive Plan Awards – Value Vested or Earned During the Year

The following table sets out, for each Named Executive Officer, the value of option-based awards and share-based awards which vested during the year ended December 31, 2011 and the value of non-equity incentive plan compensation earned during the year ended December 31, 2011.

| Name

|

Option-Based Awards –Value

|

Share-Based Awards –Value

|

Non-Equity Incentive Plan Compensation –

| |||

| Gregory A. Yull

|

$31,500 | nil | nil | |||

| Bernard J. Pitz

|

nil | nil | nil | |||

| Jim Bob Carpenter

|

nil | nil | nil | |||

| Shawn Nelson

|

nil | nil | nil | |||

| Douglas R. Nalette

|

nil | nil | nil |

| (1) |

The value is calculated as if the stock options were exercised on the vesting date of each relevant grant. The value is equal to the excess of the closing price of the common shares underlying the options on the vesting date over the exercise price on the vesting date. |

13

For a description of the terms and conditions of the ESOP, see below under the heading “Securities Authorized for Issuance under Equity Compensation Plans – Executive Stock Option Plan.”

Termination and Change of Control Benefits

The following agreements between the Corporation and members of senior management were in effect at the end of the Corporation’s most recently-completed financial year.

The Corporation entered into “change of control” agreements as of January 2001 with each of Messrs. Jim Bob Carpenter (Sr. Vice-President, Global Sourcing), Burgess Hildreth (Sr. Vice-President, Administration), Shawn Nelson (Sr. Vice-President Sales), as of October 28, 2004 with Douglas R. Nalette (Sr. Vice-President Operations), and as of November 17, 2009 with Bernard J. Pitz (Chief Financial Officer). These agreements provide that if, within a period of six months after a change of control of the Corporation: (a) the executive voluntarily terminates his employment with the Corporation; or (b) the Corporation terminates the executive’s employment without cause, such executive will be entitled to, subject to the restrictions of Section 409A of the Internal Revenue Code of 1986, in deferred compensation, a lump sum in the case of his resignation or an indemnity in lieu of notice in a lump sum in the case of his termination, equal to 12 to 24 months of such executive’s remuneration at the effective date of such resignation or termination, depending on his seniority.

Furthermore, these agreements also provide that if during the term of the executive’s employment a bona fide offer is made to all shareholders of the Corporation which, if accepted, would result in a change of control of the Corporation, then, subject to any applicable law, all of the executive’s options which have not yet become vested and exercisable shall become vested and exercisable immediately. Upon expiry of such bona fide offer, if it does not result in a change of control of the Corporation, all of the executive’s unexercised options which were not vested prior to such offer, shall immediately revert to their unvested status and to their former provisions with respect to the time of their vesting.

On August 2, 2010, the Corporation entered into an Executive Employment Agreement with Gregory A. Yull. Pursuant to the terms of the Agreement, Mr. Yull shall receive an annual base salary of $450,000, increased to $475,000 commencing June 1, 2011 and $500,000 commencing on June 1, 2012. Mr. Yull shall also be entitled to a performance bonus for each fiscal year ranging from zero to 100% of his then current annual base salary based on the achievement of specific goals that are mutually agreed to between Mr. Yull and the Board. For 2011, Mr. Yull’s bonus was based on the Corporation’s achieving certain target amounts for adjusted EBITDA and cash flows from operations after changes in working capital as set forth above in the Section entitled “Compensation Of Executive Officers And Directors - Compensation Discussion And Analysis - Variable Cash Incentive Awards – Bonuses”. During the first three years of Mr. Yull’s employment, commencing June 8, 2010, Mr. Yull shall be granted 350,000 stock options annually in accordance with the ESOP and thereafter at the discretion of the Board. The options to be granted during each of the first three years shall become exercisable in annual increments of 25% on each of the first four anniversaries of the grant date. Such options shall expire on the tenth anniversary of the grant date, subject to the early expiry provisions of the ESOP. The exercise price of such options shall be equal to the closing market price on the last trading day prior to the date of such grant. Fifty percent (50%) of the shares acquired by Mr. Yull pursuant to the exercise of the options granted under the Executive Employment Agreement must be retained by Mr. Yull and not sold or disposed of for a period of three years following the date when the option was exercised. Further, pursuant to the Agreement, Mr. Yull shall receive a reasonable car allowance or leased vehicle, be entitled to participate in all employee benefit programs established by the Corporation, and be reimbursed for his annual dues for the Laurel Oak Golf and Country Club and the Restigouche Club.

Provided Mr. Yull has served under the Agreement a minimum of five years, upon termination of his employment for any reason other than for cause, he shall receive a defined benefit supplementary pension annually for life equal to the lesser of (i) $600,000 if he separates from service at age 65 or older, $570,000 at age 64, $540,000 at age 63, $510,000 at age 62, $480,000 at age 61, or $450,000 at age 60, and (ii) two percent of the average of his total cash compensation (base salary and performance bonus) for the highest five years of his employment during the prior ten years as of the time of separation, multiplied by his years of service with the Corporation.

In the event of Mr. Yull’s death, his surviving spouse would receive 50% of the annual supplement pension benefit within ninety days of his death and continuing annually during her lifetime. In the event the Corporation terminates Mr. Yull’s employment for any reason other than cause, or Mr. Yull terminates his employment for Good Reason as defined in the Agreement, Mr. Yull shall be entitled to severance pay in an amount equal to two times the sum of his base salary and the average performance bonus paid to Mr. Yull in the last two fiscal years ending on the date prior to his date of termination. Subject to the restrictions of Section 409A of the Internal Revenue Code of 1986, such amount shall be paid 65% in a lump sum and the balance in eight equal quarterly installments. In addition, all unvested options that would otherwise vest during the 24 months following the date of termination shall be immediately vested and remain exercisable for a period of twelve months. Lastly, the retirement benefits set forth above shall vest.

14

In the event that Mr. Yull’s employment is terminated as a result of his Permanent Disability, as defined in the Agreement, or death, he shall be entitled to receive (i) accrued and unpaid base salary earned up to the date of termination, (ii) a pro-rated performance bonus that he would have received in respect of the fiscal year in which the termination occurred, (iii) vacation pay earned up to the date of termination, and (iv) provided the date of termination is on or after the fifth year anniversary of the Agreement, the retirement benefits set forth above shall vest. In addition, all unvested stock options held by Mr. Yull shall immediately vest and remain exercisable for a period of nine months following the date of termination for Permanent Disability or death.

In the event that Mr. Yull’s employment is terminated by the Corporation without cause or for Good Reason within two years of a Change of Control, as defined in the Agreement, then he shall be entitled to receive (i) accrued and unpaid base salary earned up to the date of termination, (ii) a pro-rated performance bonus that he would have received in respect of the fiscal year in which the termination occurred, based upon the average performance bonus paid to Mr. Yull in the last two fiscal years, (iii) vacation pay earned up to the date of termination, and (iv) severance pay in an amount equal to three times the sum of his base salary and the average performance bonus paid in the last two fiscal years immediately preceding the date of termination. In addition, all unvested stock options held by Mr. Yull shall immediately vest and remain exercisable for a period of 36 months following the date of termination, and the retirement benefits set forth above shall vest. Mr. Yull shall also be entitled to participate, at his cost, in the benefits under the Corporation’s medical and dental benefit program until such time as he reaches the age of eligibility for coverage under Medicare. Lastly, disability and life insurance benefits shall be provided for the benefit of Mr. Yull pursuant to any benefit plans and programs then provided by the Corporation generally to its executives and continue for a period of 36 months following the date of termination.

Mr. Yull has also agreed to a customary non-compete for two years from the date of termination.

On October 30, 2009, the Corporation entered into an employment letter agreement with Bernard J. Pitz. Pursuant to the terms of the letter agreement, Mr. Pitz receives an annual base salary of $360,000. Mr. Pitz is also entitled to a bonus ranging from zero to 100% of his then current annual base salary based on the achievement of specific goals that are mutually agreed to between Mr. Pitz and the Board. For 2011, Mr. Pitz’ bonus was based on the Corporation’s achieving certain target amounts for adjusted EBITDA and cash flows from operations after changes in working capital as set forth above in the Section entitled “Compensation Of Executive Officers And Directors - Compensation Discussion And Analysis - Variable Cash Incentive Awards – Bonuses”. Further, Mr. Pitz was awarded 182,927 options with a grant price of $3.37. In addition, the Corporation agreed to cover Mr. Pitz’ relocation costs.

On November 17, 2009, the Corporation entered into a second letter agreement with Mr. Pitz. Pursuant to the terms of the letter agreement, in the event the Corporation terminates Mr. Pitz’ employment for any reason other than Cause as defined in the letter agreement, or Mr. Pitz terminates his employment for Good Reason as defined in the letter agreement, Mr. Pitz shall be entitled to severance pay in an amount equal to 12 times his highest total base monthly salary received in any one month during the twelve months prior to Mr. Pitz’ last day of employment, provided that if Mr. Pitz’ termination of employment occurs within twelve months of the appointment of a Chief Executive Officer of the Corporation other than Gregory A. Yull, then the severance payment due to Mr. Pitz shall be equal to 24 times Mr. Pitz’ highest monthly salary. Subject to the restrictions of Section 409A of the Internal Revenue Code of 1986 (“Section 409A”), such amount shall be paid in either 12 or 24 equal monthly instalments as applicable (“Severance Period”). In the event there is a Section 409A Change in Control within 6 months prior to Mr. Pitz’ termination of employment or during the Severance Period, the remainder of the unpaid severance payments shall be accelerated and paid in a single lump sum within 10 days after the 409A Change in Control occurs, subject to Section 409A. In the event there is an occurrence of Good Reason and Mr. Pitz does not terminate his employment within 60 days of the occurrence, he shall be deemed to have waived such Good Reason. If Mr. Pitz’ employment is terminated for Cause, or he resigns without Good Reason, or retires, then Mr. Pitz will not be eligible for severance pay. Mr. Pitz shall also be entitled to participate in the benefits under the Corporation’s medical, dental, vision, life insurance and accidental death and dismemberment coverage, subject to the then current cost sharing features of the plans. In the event Mr. Pitz obtains other employment during the first twelve months of severance payments, the Corporation’s obligation to pay such severance shall cease. In the event Mr. Pitz obtains employment after twelve months but during the remainder of the Severance Period, the severance payments shall be reduced by the amount of compensation paid to Mr. Pitz by his subsequent employer.

15

On July 19, 2010, the Corporation entered into a letter agreement with Mr. Jim Bob Carpenter. Pursuant to the terms of the letter agreement, in the event the Corporation terminates Mr. Carpenter’s employment for any reason other than Cause as defined in the letter agreement, or Mr. Carpenter terminates his employment for Good Reason as defined in the letter agreement, Mr. Carpenter shall be entitled to severance pay in an amount equal to 24 times his highest total base monthly salary received in any one month during the twelve months prior to Mr. Carpenter’s last day of employment. Subject to the restrictions of Section 409A of the Internal Revenue Code of 1986 (“Section 409A”), such amount shall be paid in 24 equal monthly instalments (“Severance Period”). In the event there is a Section 409A Change in Control within 6 months prior to Mr. Carpenter’s termination of employment or during the Severance Period, the remainder of the unpaid severance payments shall be accelerated and paid in a single lump sum within 10 days after the 409A Change in Control occurs, subject to Section 409A. In the event there is an occurrence of Good Reason and Mr. Carpenter does not terminate his employment within 60 days of the occurrence, he shall be deemed to have waived such Good Reason. If Mr. Carpenter’s employment is terminated for Cause, or he resigns without Good Reason, or retires, then Mr. Carpenter will not be eligible for severance pay. Mr. Carpenter shall also be entitled to participate in the benefits under the Corporation’s medical, dental, vision, life insurance and accidental death and dismemberment coverage, subject to the then current cost sharing features of the plans. In the event Mr. Carpenter obtains other employment during the Severance Period, the Corporation’s obligation to pay such severance shall cease.

Director Compensation

Compensation of directors is established in order to allow the Corporation to attract and retain highly qualified and devoted directors with a varied and relevant experience, taking into account the numerous segments of activities which the Corporation exploits, and to align the interests of the directors with those of the shareholders.

Directors receive annual fees and additional compensation which varies depending on their attendance to meetings of the Board or of its committees. Compensation is paid semi-annually.

The following table presents the different components of the compensation the directors may be entitled to receive, with the exception of Gregory A. Yull, who does not receive any compensation for serving as director as he is an executive of the Corporation.

| Type of Compensation

|

Amount

|

|||

| Annual Amount |

||||

| Annual retainer fee |

$30,000 | |||

| Chair of the Board of Directors (includes the annual retainer fee) |

$90,000 | |||

| Chair of the Audit Committee |

$10,000 | |||

| Member of the Audit Committee |

$5,000 | |||

| Chair of the Compensation Committee and of the Nominating & Corporate Governance Committee |

$5,000 | |||

| Member of the Compensation Committee and of the Nominating & Corporate Governance Committee |

$2,000 | |||

| Chair of the Executive Committee |

$5,000 | |||

| Member of the Executive Committee |

$2,000 | |||

| Other Compensation |

||||

| Attendance fee for each meeting of the Board of Directors and committees |

|

$1,000 ($500 by telephone)

|

| |

The Corporation does not have a retirement plan for directors who are not employees of the Corporation.

If an independent director who is not an employee of the Corporation or of one of its subsidiaries is asked to provide additional services to the Corporation as director beyond the customary responsibilities of a director, such director may receive additional compensation determined by the Nominating and Corporate Governance Committee.

16

Summary of Director Compensation

The Corporation paid its directors an aggregate of $314,500 for their services as directors in respect of the fiscal year ended December 31, 2011. The following table presents the details of the compensation paid to the directors of the Corporation for the fiscal year ended December 31, 2011 (except for Mr. Gregory A. Yull who is a Named Executive Officer).

| Director

|

Fees earned

|

Share-based awards ($)

|

Option-based ($)

|

Non-equity

|

Pension value(2)

|

All other

|

Total

|

|||||||||||||||

| Eric E. Baker(3) |

49,500 | — | 19,000 | — | — | — | 68,500 | |||||||||||||||

| Robert M. Beil |

40,500 | — | 19,000 | — | — | — | 59,500 | |||||||||||||||

| George J. Bunze |

50,500 | — | 19,000 | — | — | — | 69,500 | |||||||||||||||

| Robert J. Foster |

45,500 | — | 19,000 | — | — | — | 64,500 | |||||||||||||||

| Jorge N. Quintas |

36,000 | — | 19,000 | — | — | — | 55,000 | |||||||||||||||

| Torsten A. Schermer |

48,000 | — | 19,000 | — | — | — | 67,000 | |||||||||||||||

| Gregory A. Yull |

— | — | — | — | — | — | — | |||||||||||||||

| Melbourne F. Yull

|

|

44,500

|

|

|

—

|

|

|

19,000

|

|

—

|

—

|

—

|

|

63,500

|

| |||||||

| (1) |

Value of awards granted on June 7, 2011 using the Black-Scholes method, a commonly-used method, using the following assumptions: estimated volatility assumption of 65.81%, estimated dividend yield of 0%, interest rate of 2.45%, and option term of six years. |

| (2) |

The Corporation does not have a retirement plan for directors who are not employees of the Corporation. |

| (3) |

Prior to July 1, 2011, Mr. Baker’s services as Chairman of the Board were provided pursuant to an Advisory Services Agreement that expired on June 30, 2011 and which provided for monthly compensation in the amount of CDN$25,000 (see below “Advisory Services Agreement”). Accordingly, Mr. Baker received half of the annual fee for serving as Chair of the Board of Directors. |

The following table presents the fees paid to each director as such for the fiscal year ended December 31, 2011

|

Directors

|

Annual ($)

|

Compensation as ($)

|

Compensation as ($)

|

Attendance fees for ($)

|

Total ($)

|

|||||||||||||||

| Eric E. Baker(1) |

45,000 | 1,000 | — | 3,500 | 49,500 | |||||||||||||||

| Robert M. Beil |

30,000 | — | 5,000 | 5,500 | 40,500 | |||||||||||||||

| George J. Bunze |

30,000 | — | 10,000 | 10,500 | 50,500 | |||||||||||||||

| Robert J. Foster |

30,000 | 5,000 | — | 10,500 | 45,500 | |||||||||||||||

| Jorge N. Quintas |

30,000 | 2,000 | — | 4,000 | 36,000 | |||||||||||||||

| Torsten A. Schermer |

30,000 | 7,000 | — | 11,000 | 48,000 | |||||||||||||||

| Gregory A. Yull |

— | — | — | — | — | |||||||||||||||

| Melbourne F. Yull

|

|

30,000

|

|

|

—

|

|

|

5,000

|

|

|

9,500

|

|

|

44,500

|

| |||||

| (1) |

Prior to July 1, 2011, Mr. Baker’s services as Chairman of the Board were provided pursuant to a Services Agreement that expired on June 30, 2011 and which provided for monthly compensation in the amount of CDN$25,000 (see below “Advisory Services Agreement”). Accordingly, Mr. Baker received half of the yearly fee for serving as a director. |

17

Outstanding Director Incentive Plan Awards for the Fiscal Year Ended December 31, 2011

The following table presents for each director all outstanding awards at the end of the fiscal year ended December 31, 2011 (except for Mr. Gregory A. Yull who is an Named Executive Officer, see the heading “Compensation of Executive Officers Analysis—Summary Compensation for Executive Officers—Incentive Plan Awards—Outstanding Share-Based Awards and Option-Based Awards”).

| Option-Based Awards

|

Share-Based Awards

|

|||||||||||||||||||||||||||

| Name

|

Number

of (#)

|

Option Exercise Price ($)

|

Option

|

Value

of ($)

|

Number of (#)

|

Market or ($)

|

Market or ($)

|

|||||||||||||||||||||

| Eric E. Baker |

|

50,000 20,000

|

|

|

2.19 1.55

|

|

|

06/10/2016 06/07/2017

|

|

|

56,000 35,200

|

|

— |

|

—

|

|

|

—

|

| |||||||||

| Robert M. Beil |

|

30,000 10,000 10,000 20,000

|

|

|

3.24 0.55 2.19 1.55

|

|

|

09/05/2013 04/01/2015 06/10/2016 06/07/2017

|

|

|

2,100 27,600 11,200 35,200

|

|

— | — | — | |||||||||||||

| George J. Bunze |

|

30,000 10,000 10,000 20,000

|

|

|

3.24 0.55 2.19 1.55

|

|

|

09/05/2013 04/01/2015 06/10/2016 06/07/2017

|

|

|

2,100 27,600 11,200 35,200

|

|

— | — | — | |||||||||||||

| Robert J. Foster |

|

30,000 20,000

|

|

|

2.19 1.55

|

|

|

06/10/2016 06/07/2017

|

|

|

33,600 35,200

|

|

— | — | — | |||||||||||||

| Jorge N. Quintas |

|

30,000 10,000 20,000

|

|

|

1.84 2.19 1.55

|

|

|

11/13/2015 06/10/2016 06/07/2017

|

|

|

44,100 11,200 35,200

|

|

— | — | — | |||||||||||||

| Torsten A. Schermer |

|

30,000 10,000 10,000 20,000

|

|

|

3.24 0.55 2.19 1.55

|

|

|

09/05/2013 04/01/2015 06/10/2016 06/07/2017

|

|

|

2,100 27,600 11,200 35,200

|

|

— | — | — | |||||||||||||

| Melbourne F. Yull |

|

110,000 50,000 20,000

|

|

|

9.85 2.19 1.55

|

|

|

03/28/2012 06/10/2016 06/07/2017

|

|

|

— 56,000 35,200

|

|

— | — | — | |||||||||||||

| (1) |

This column contains the aggregate value of in-the-money unexercised options as at December 31, 2011, calculated based on the difference between the closing price of the common shares on the TSX underlying the stock options as at December 31, 2011 (being $3.31) and the exercise price of the stock options. Actual gains, if any, on exercise will depend on the value of the common shares on the date of exercise. There is no guarantee that gains will be realized. |

| (2) |

Calculated based on the closing price of the common shares on the TSX underlying the performance shares as at December 31, 2011 (being $3.31). |

Each Director is required to own a minimum of USD$20,000.00 of the Corporation’s common shares, such amount to be measured based on the original purchase price of such shares. Each Director is in compliance with this requirement.

Advisory Services Agreements

In 2010, the Corporation entered into a service agreement with a company controlled by the current Chairman of the Board of Directors. This agreement required the provision of support services that included the duties of Chairman of the Board and qualified as a related party transaction in the normal course of operations. The Chairman of the Board support services agreement was effective from January 1, 2010 through June 30, 2011 and provided for monthly compensation in the amount of CDN$25,000. These amounts were in lieu of the fees otherwise paid to Directors for their services.

18

Pension and Post-Retirement Benefit Plans

The following table sets out the entitlements of each of Melbourne F. Yull and Gregory A. Yull under the defined benefit plans that provide for payments or benefits at, following, or in connection with retirement (all figures were calculated using the accounting methods and assumptions disclosed in Note 17 to the Consolidated Financial Statements of the Corporation for the fiscal year ended December 31, 2011).

| Name | Number of Years Credited Service |

Annual Benefits ($) |

Opening ($) |

Compensatory ($) |

Non- Compensatory ($) |

Closing ($) |

||||||||||||||||||||

| At Year |

At Age 65 |

|||||||||||||||||||||||||

| Melbourne F. Yull |

25 | 260,935 | N/A | 2,940,644 | (260,935) | 392,414 | 3,072,123 | |||||||||||||||||||

| Gregory A. Yull |

22 | 224,955 | 600,000 | 1,263,159 | — | 584,438 | 1,847,597 | |||||||||||||||||||

Melbourne F. Yull was Chairman of the Board of Directors and Chief Executive Officer of the Corporation from January 11, 1995 to June 14, 2006. Prior thereto, Mr. Yull was the President and a director of the Corporation or a predecessor thereof, from 1981. The former employment agreement entered into between the Corporation and Mr. Yull provides that Mr. Yull receives from the Corporation a defined benefit supplementary pension annually for life in an amount equal to 2% of the average of Mr. Yull’s annual gross salary for the final five years of his employment with the Corporation, multiplied by his years of service with the Corporation to retirement. Accordingly, Mr. Yull receives a pension from the Corporation in an amount of $260,935 per year.

Gregory A. Yull is President, Chief Executive Officer and a director of the Corporation. The employment agreement entered into between the Corporation and Gregory A. Yull provides that he will receive from the Corporation a defined benefit supplementary pension annually for life in an amount equal to the lesser of (i) $450,00 if he separates from service to the Corporation at age 60 up to a maximum amount of $600,000 at age 65 increasing rateably for each additional year of service past age 60, and (ii) 2% of the average of his total cash compensation (base salary and performance bonus) for the highest five years of his employment during the prior ten years as of the time of separation of his employment with the Corporation, multiplied by his years of service with the Corporation. As of December 31, 2011, Mr. Yull’s accumulated benefit was an amount of $224,955 per year.