Table of Contents

As filed with the Securities and Exchange Commission on July 29, 2013

Registration No. 333-190046

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

to

FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Education Management LLC

Education Management Finance Corp.

(Exact name of registrant as specified in its charter)

SEE TABLE OF ADDITIONAL REGISTRANTS

| Delaware | 8200 | 20-4506022 | ||

| (State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) |

20-4887689 (I.R.S. Employer Identification Number) |

c/o Education Management Corporation

210 Sixth Avenue, 33rd Floor

Pittsburgh, PA, 15222

(412) 562-0900

(Address, including zip code, and telephone number, including area code, of registrants’ principal executive offices)

J. Devitt Kramer, Esq.

Senior Vice President, General Counsel and Secretary

210 Sixth Avenue, 33rd Floor

Pittsburgh, PA, 15222

(412) 562-0900

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With a copy to:

Richard A. Fenyes, Esq.

Simpson Thacher & Bartlett LLP

425 Lexington Avenue

New York, New York 10017-3954

(212) 455-2000

Approximate date of commencement of proposed exchange offer:

As soon as practicable after this Registration Statement is declared effective.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | x | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issue Tender Offer) ¨

Exchange Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) ¨

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of Each Class of Securities to be Registered |

Amount to be Registered |

Proposed Maximum Offering Price Per Note |

Proposed Maximum Aggregate Offering Price(1) |

Amount of Registration Fee | ||||

| Senior Cash Pay/PIK Notes due 2018(2) |

$226,499,638 |

100% | $226,499,638 |

$30,894.56 | ||||

| Guarantees of Senior Cash Pay/PIK Notes due 2018(3) |

N/A(4) | (4) | (4) | (4) | ||||

|

| ||||||||

|

| ||||||||

| (1) | Estimated solely for the purpose of calculating the registration fee under Rule 457(f) of the Securities Act of 1933, as amended. |

| (2) | Includes $23,455,215 principal amount of such notes that represents the maximum amount of notes that may be issued as payment-in-kind interest under the terms of the notes through maturity. |

| (3) | See inside facing page for additional registrant guarantors. |

| (4) | Pursuant to Rule 457(n) under the Securities Act, no separate filing fee is required for the guarantees. |

The Registrants hereby amend this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrants shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

Table of Additional Registrants

| Exact Name of Registrant Guarantor as Specified in its Charter |

State or Other Jurisdiction of Incorporation or Organization |

I.R.S. Employer Identification Number |

Address, Including Zip Code | |||

| AICA-IE Restaurant, Inc. |

California | 26-2961312 | 210 Sixth Avenue 33rd Floor Pittsburgh, PA, 15222 (412) 562-0900 | |||

| AID Restaurant, Inc. |

Texas | 01-0691168 | 8080 Park Lane Suite 100 Dallas, Texas 75231 214-692-8080 | |||

| AIH Restaurant, Inc. |

Texas | 76-0431417 | 1900 Yorktown Houston, Texas 77056 713-623-2040 | |||

| AIIN Restaurant LLC |

Indiana | 26-2701617 | 210 Sixth Avenue 33rd Floor Pittsburgh, PA, 15222 (412) 562-0900 | |||

| AIIM Restaurant, Inc. |

Minnesota | 41-1977654 | 15 S. 9th St. LaSalle Building Minneapolis, Minnesota 55409 612-332-3361 | |||

| AIT Restaurant, Inc. |

Florida | 20-8315057 | 210 Sixth Avenue 33rd Floor Pittsburgh, PA, 15222 (412) 562-0900 | |||

| AITN Restaurant, Inc. |

Tennessee | 26-2240577 | 210 Sixth Avenue 33rd Floor Pittsburgh, PA, 15222 (412) 562-0900 | |||

| Argosy University Family Center, Inc. |

Minnesota | 16-1665500 | 310 East 38th St. Minneapolis, MN 55409 612-827-5981 | |||

| The Connecting Link, Inc. |

Georgia | 58-1987235 | 5126 Ralston St. Ventura, CA 93003 805-654-0739 | |||

| EDMC Marketing and Advertising, Inc. |

Georgia | 58-1591601 | 210 Sixth Avenue 33rd Floor Pittsburgh, PA, 15222 (412) 562-0900 | |||

| Education Management Corporation |

Pennsylvania | 25-1119571 | 210 Sixth Avenue 33rd Floor Pittsburgh, PA, 15222 (412) 562-0900 | |||

| Higher Education Services, Inc. |

Georgia | 58-1983881 | 709 Mall Avenue Savannah, GA 31406 803-799-9082 | |||

| MCM University Plaza, Inc. |

Illinois | 36-4118464 | 210 Sixth Avenue 33rd Floor Pittsburgh, PA, 15222 (412) 562-0900 |

Table of Contents

The information in this prospectus is not complete and may be changed. We may not complete the exchange offer and issue these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell securities and it is not soliciting an offer to buy these securities in any state where the offer is not permitted.

SUBJECT TO COMPLETION, DATED JULY 29, 2013

PRELIMINARY PROSPECTUS

Education Management LLC

Education Management Finance Corp.

Offer to Exchange (the “exchange offer”)

$203,044,423 aggregate principal amount of their Senior Cash Pay/PIK Notes due 2018 (the “exchange notes”), which have been registered under the Securities Act of 1933, as amended (the “Securities Act”), for any and all of their outstanding unregistered Senior Cash Pay/PIK Notes due 2018 (the “outstanding notes”).

We are conducting the exchange offer in order to provide you with an opportunity to exchange your unregistered notes for freely tradable notes that have been registered under the Securities Act.

The exchange offer

| • | We will exchange all outstanding notes that are validly tendered and not validly withdrawn for an equal principal amount of exchange notes that are freely tradable. |

| • | You may withdraw tenders of outstanding notes at any time prior to the expiration date of the exchange offer. |

| • | The exchange offer expires at 12:00 a.m. midnight, New York City time, on , 2013, unless extended. We do not currently intend to extend the expiration date. |

| • | The exchange of the outstanding notes for the exchange notes in the exchange offer will not be a taxable event for United States federal income tax purposes. |

| • | The terms of the exchange notes to be issued in the exchange offer are substantially identical to the outstanding notes, except that the exchange notes will be freely tradable. |

Results of the exchange offer

| • | The exchange notes, plus up to an additional $23,455,215 of exchange notes that may be issued as payment-in-kind interest under the terms of the notes through maturity, may be sold in the over-the-counter market, in negotiated transactions or through a combination of such methods. We do not plan to list the exchange notes on a national market. |

All untendered outstanding notes will continue to be subject to the restrictions on transfer set forth in the outstanding notes and in the indenture. In general, the outstanding notes may not be offered or sold, unless registered under the Securities Act, except pursuant to an exemption from, or in a transaction not subject to, the Securities Act and applicable state securities laws. Other than in connection with the exchange offer, we do not currently anticipate that we will register the outstanding notes under the Securities Act.

See “Risk Factors” beginning on page 15 for a discussion of certain risks that you should consider before participating in the exchange offer.

Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of the exchange notes to be distributed in the exchange offer or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2013.

Table of Contents

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with different information. The prospectus may be used only for the purposes for which it has been published and no person has been authorized to give any information not contained herein. If you receive any other information, you should not rely on it. We are not making an offer of these securities in any state where the offer is not permitted.

| Page | ||||

| 1 | ||||

| 15 | ||||

| 21 | ||||

| 22 | ||||

| 23 | ||||

| 24 | ||||

| 34 | ||||

| 86 | ||||

| 91 | ||||

| 93 | ||||

| 93 | ||||

| 93 | ||||

| 94 | ||||

i

Table of Contents

MARKET, RANKING AND OTHER INDUSTRY DATA

Some of the industry and market data contained in this prospectus are based on independent industry publications or other publicly available information, while other information is based on internal company sources. Although we believe that these independent sources and our internal data are reliable as of their respective dates, the information contained in them has not been independently verified, and we cannot assure you as to the accuracy or completeness of this information. As a result, you should be aware that the market industry data contained in this prospectus, and beliefs and estimates based on such data, may not be reliable. We obtained information relating to the U.S. post-secondary education market from the National Center for Education Statistics, which is the primary federal entity for collecting and analyzing data related to education, the College Board, the U.S. Census Bureau and the U.S. Department of Labor-Bureau of Labor Statistics.

TRADEMARKS

We have proprietary rights to a number of trademarks used in this prospectus which are important to our business, including Argosy University and Brown Mackie College, as well as the names of certain of our schools. We have omitted the “®” and “™” trademark designations for such trademarks in this prospectus. Nevertheless, all rights to such trademarks named in this prospectus are reserved.

FORWARD-LOOKING STATEMENTS

Certain of the matters that we discuss in this prospectus may constitute forward-looking statements. These statements, which are based on information currently available to management, typically contain words such as “anticipates,” “believes,” “estimates,” “expects,” “intends,” “may,” “will,” “should,” “seeks,” “approximately” or “plans” or similar words and concern our strategy, plans or intentions. However, the absence of these or similar words does not mean that any particular statement is not forward-looking. All of the statements that we make relating to estimated and projected earnings, margins, costs, expenditures, cash flows, growth rates and financial results are forward looking statements. In addition, from time to time, we make forward-looking public statements concerning our expected future operations and performance and other developments. These and any other forward-looking statements involve estimates, assumptions, known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements to differ materially and unpredictably from any future results, performance or achievements expressed or implied by such forward-looking statements. We derive many of our forward-looking statements from our operating budgets and forecasts, which are based upon many detailed assumptions, and we caution that it is very difficult to predict the impact of known factors, and impossible to anticipate all factors, that could affect our actual results.

Some of the factors that we believe could affect our results and that could cause actual results to differ materially from our expectations include, but are not limited to: the timing and magnitude of student enrollment and changes in student mix, including the relative proportions of on-ground and online students enrolled in our programs; changes in average registered credits taken by students; our ability to maintain eligibility to participate in Title IV programs; other changes in our students’ ability to access federal and state financial aid, as well as private loans from third-party lenders; any difficulties we may face in opening new schools, growing our online academic programs and otherwise implementing our growth strategy; increased or unanticipated legal and regulatory costs; the results of program reviews and audits; changes in accreditation standards; the implementation of new operating procedures for our fully online programs; the implementation of program initiatives in response to, or as a result of further developments in, the litigation concerning the U.S. Department of Education’s new gainful employment regulation; adjustments to our programmatic offerings to comply with the 90/10 rule; our high degree of leverage and our ability to generate sufficient cash to service all of our debt obligations and other liquidity needs; other market and credit risks associated with the post-secondary education

ii

Table of Contents

industry, adverse media coverage of the industry and overall condition of the industry; changes in the overall U.S. or global economy; disruptions or other changes in access to the credit and equity markets in the United States and worldwide; and the effects of war, terrorism, natural disasters or other catastrophic events.

The foregoing review of factors should not be construed as exhaustive. For a more detailed discussion of certain risk factors affecting the Company’s risk profile, see the section entitled “Risk Factors” included elsewhere in this prospectus. We expressly disclaim any current intention to update any forward-looking statements contained in this prospectus.

iii

Table of Contents

This summary highlights selected information in this prospectus and may not contain all of the information that is important to you. You should carefully read this entire prospectus, including the information set forth under the heading “Risk Factors” and the financial statements incorporated by reference into this prospectus, before making an investment decision. Unless the context otherwise requires, references in this prospectus to “we,” “our,” “us,” “the Company” and “EDMC” refer to Education Management Corporation and its consolidated subsidiaries. References to our fiscal year refer to the twelve month period ended June 30 of the year referenced.

Our Business

We are among the largest providers of post-secondary education in North America, with approximately 132,000 enrolled students as of October 2012. We offer academic programs to our students through campus-based and online instruction, or through a combination of both. We are committed to offering quality academic programs and strive to improve the learning experience for our students. We target a large and diverse market, as our educational institutions offer students the opportunity to earn undergraduate and graduate degrees, including doctoral degrees, and certain specialized non-degree diplomas in a broad range of disciplines. These disciplines include media arts, health sciences, design, psychology and behavioral sciences, culinary, business, fashion, legal, education and information technology. Each of our schools located in the United States is licensed or permitted to offer post-secondary programs in the state in which it is located, accredited by a national or regional accreditation agency and certified by the U.S. Department of Education, enabling students to access federal student loans, grants and other forms of public and private financial aid. Our academic programs are designed with an emphasis on applied content and are taught primarily by faculty members who, in addition to having appropriate academic credentials, offer practical and relevant professional experience in their respective fields. We had net revenues of $2.76 billion in fiscal 2012.

Our schools comprise a national education platform that is designed to address the needs of a broad market, taking into consideration various factors that influence demand, such as programmatic and degree interest, employment opportunities, requirements for credentials in certain professions, demographics, tuition pricing points and economic conditions. We believe that our schools collectively enable us to provide access to a high quality education for potential students, at a variety of degree levels and across a wide range of disciplines.

During our more than 40-year operating history, we have expanded the reach of our education systems and currently operate 110 primary locations across 32 U.S. states and in Canada. In addition, we have offered online programs since 2000, enabling our students to pursue degrees fully online or through a flexible combination of both online and campus-based education. We strive to maintain a culture of compliance within our organization with the numerous regulations that govern our business and operations.

Each of our 110 schools provides student-centered education. Our schools are organized and managed to capitalize on our four recognized brands and align them with specific targeted markets based on field of study, employment opportunity, type of degree offering and student demographics. Our operations are organized into four corresponding reportable segments:

| • | The Art Institutes. The Art Institutes focus on applied arts in creative professions such as graphic design, culinary arts, media arts and animation, interior design, web site development, digital filmmaking and video production, fashion design and marketing and game art and design. The Art Institutes offer Associate’s, Bachelor’s and Master’s degree programs, as well as selective non-degree diploma programs. Students pursue their degrees through local campuses, fully online programs through The Art Institute of Pittsburgh, Online Division and blended formats, which combine campus- |

1

Table of Contents

| based and online education. As of March 31, 2013, there were 51 Art Institutes campuses in 25 U.S. states and in Canada. As of October 2012, students enrolled at The Art Institutes represented approximately 54% of our total enrollments. |

| • | Argosy University. Argosy University offers academic programs in psychology and behavioral sciences, business, education and health sciences disciplines. Argosy University offers Doctoral, Master’s and undergraduate degrees through local campuses, fully online programs and blended formats. Argosy University’s academic programs focus on graduate students seeking advanced credentials as a prerequisite to initial licensing, career advancement and/or structured pay increases. As of March 31, 2013, there were 20 Argosy University campuses in 13 U.S. states. As of October 2012, students enrolled at Argosy University represented approximately 19% of our total enrollments. This segment includes Western State College of Law, which offers Juris Doctor degrees, and the Ventura Group, which provides courses and materials for post-graduate licensure examinations in the human services fields and continuing education courses for K-12 educators. |

| • | Brown Mackie Colleges. Brown Mackie Colleges offer flexible Associate’s and non-degree diploma programs that enable students to develop skills for entry-level positions in high demand vocational specialties and Bachelor’s degree programs that assist students to advance within the workplace. Brown Mackie Colleges offer programs in growing fields such as medical assisting, criminal justice, nursing, business, legal support and information technology. As of March 31, 2013, there were 28 Brown Mackie College campuses in 15 U.S. states. As of October 2012, students enrolled at Brown Mackie Colleges represented approximately 13% of our total enrollments. |

| • | South University. South University offers academic programs in health sciences and business disciplines, including business administration, criminal justice, nursing, information technology, psychology, pharmacy and physician assisting. South University offers Doctoral, Master’s, Bachelor’s and Associate’s degrees through local campuses, fully online programs and blended formats. As of March 31, 2013, there were 11 South University campuses in nine U.S. states. As of October 2012, students enrolled at South University represented approximately 14% of our total enrollments. |

The net revenues for fiscal years 2012, 2011 and 2010 for each of our reportable segments were as follows (in thousands):

| For the Fiscal Year Ended June 30, | ||||||||||||

| 2012 | 2011 | 2010 | ||||||||||

| Net revenues: |

||||||||||||

| The Art Institute |

$ | 1,738,542 | $ | 1,791,176 | $ | 1,597,072 | ||||||

| Argosy University |

397,458 | 431,097 | 344,382 | |||||||||

| Brown Mackie Colleges |

314,801 | 348,140 | 301,850 | |||||||||

| South University |

310,166 | 317,216 | 265,217 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total EDMC |

$ | 2,760,967 | $ | 2,887,629 | $ | 2,508,521 | ||||||

|

|

|

|

|

|

|

|||||||

Industry Overview

The U.S. Department of Education estimates that the U.S. public and private post-secondary education market for degree-granting institutions was a $490 billion industry in 2010 (the most recent year for which such data is available), representing approximately 21.0 million students enrolled at over 4,600 institutions. According to the National Center of Education Statistics, traditional students, who typically are recent high school graduates under 25 years of age and are pursuing their first higher education degree, represent approximately 61% of the national student population. The remaining 39% of the student population is comprised of non-traditional students, who are largely working adults pursuing further education in their current field or are preparing for a new career.

2

Table of Contents

Although recently the industry as a whole has been challenged by state and federal regulatory pressures, negative media coverage, widespread enrollment declines and the overall negative impact of the current political and economic climate, there remain a number of factors that we believe should contribute to long-term demand for post-secondary education. The shift toward a services-based economy increases the demand for higher levels of education. Georgetown University’s Center on Education and the Workforce published a research study titled “Help Wanted—Projections of Jobs and Education Requirements through 2018”, based upon the U.S. Department of Labor—Bureau of Labor Statistics occupational employment projections. According to the study, jobs requiring an Associate’s or higher level degree are expected to grow by 28% to approximately 79 million jobs in 2018, while jobs requiring some or no college are expected to decrease by 3%. Of the jobs in 2018 requiring higher education, approximately 45% are in occupation groups in which we provide education—business, healthcare, education, food preparation, legal, and arts, design and media. Additionally, economic incentives are favorable for post-secondary graduates. According to the U.S. Department of Labor—Bureau of Labor Statistics, in 2011 the median weekly earnings for individuals aged 25 years and older with a Bachelor’s degree was approximately 65% higher than for high school graduates of the same age with no college experience, and the average unemployment rate in 2011 for persons aged 25 years and older with a Bachelor’s degree was nearly half that of those without college experience. See “Risk Factors—Risks Related to Our Highly Regulated Industry” elsewhere in this prospectus.

The post-secondary education industry is highly fragmented, with no one provider controlling a significant share of the market. Students choose among providers based on programs and degrees offered, program flexibility and convenience, quality of instruction, graduate employment rates, reputation and recruiting effectiveness. This multi-faceted market fragmentation results in significant differentiation among various education providers, limited direct competition and minimal overlap between proprietary providers. The main competitors of proprietary, post-secondary education providers are local public and private two-year junior and community colleges, traditional public and private undergraduate and graduate colleges and, to a lesser degree, other proprietary providers.

Although competition exists, proprietary educators serve a segment of the market for post-secondary education that we believe has not been fully addressed by traditional public and private universities. Non-profit public and private institutions can face limited financial capability to expand their offerings in response to growth or changes in the demand for education, due to a combination of state funding challenges, significant expenditures required for research and the professor tenure system. Certain private institutions also may control enrollments to preserve the perceived prestige and exclusivity of their degree offerings. In contrast, proprietary providers of post-secondary education offer potential students the greater flexibility and convenience of their schools’ programmatic offerings and learning structure, an emphasis on applied content and an ability to consistently introduce new campuses and academic programs. At the same time, the share of the post-secondary education market that has been captured by proprietary providers remains relatively small. As a result, we believe that in spite of recent regulatory changes and other challenges facing the industry, proprietary, post-secondary education providers continue to have significant opportunities to address the demand for post-secondary education.

Our Competitive Strengths

We believe that the following strengths differentiate our business:

Commitment to offering quality academic programs and to student and graduate success. We are committed to offering quality academic programs, and we strive to improve the learning experience for our students. We are dedicated to recruiting and retaining quality faculty and instructors with relevant industry experience and appropriate academic credentials. Our program advisory boards help us to reassess and update our educational offerings on a regular basis in order to ensure the relevance of our curriculum and to design new academic programs with the goal of enabling students to either enter or advance in their chosen fields. We seek

3

Table of Contents

to identify emerging industry trends in order to understand the evolving educational needs of our students and graduates. We are able to rapidly develop new academic programs and to tailor our existing proprietary content for courses across our degree programs. In addition, we frequently introduce existing academic programs to additional locations in our national platform of schools. During fiscal 2012, we developed ten new academic programs and introduced over 250 new academic programs to locations that had not previously offered such programs. Additionally, our staff of trained, dedicated career services specialists maintain strong relationships with employers in an effort to improve our graduate employment rates for our students in their chosen fields.

Recognized brands aligned with specific fields of study and degree offerings. We offer academic programs primarily through four education systems. We have devoted significant resources to establishing, and continue to invest in developing, the brand identity for each education system. Through The Art Institutes, Argosy University, Brown Mackie Colleges and South University education systems, we have the ability to align our academic program offerings to address the unique needs of specific student groups. Our marketing strategy is designed to develop brand awareness among practitioners and likely prospects in particular fields of study. We believe that this comprehensive brand building approach in each specific market also enables us to gain economies of scale with respect to student acquisition and retention costs, assisting in the recruitment and retention of quality faculty and staff members.

Diverse program offerings and broad degree capabilities. Our breadth of programmatic and degree offerings enables us to appeal to a diverse range of potential students. We currently offer academic programs in the following areas: media arts, health sciences, design, psychology and behavioral sciences, culinary, business, fashion, legal, education and information technology. Approximately 61% of our students as of October 2012 were enrolled in Doctorate, Master’s and Bachelor’s degree programs, which are typically multi-year programs that contribute to the overall stability of our student population. We monitor and adjust our education offerings based on, among other factors, changes in demand for new programs, degrees, schedules and delivery methods.

National platform of schools and integrated online learning platform. The combination of our national platform of schools and integrated online learning platform provides students at three of our education systems with flexible curriculum delivery options and academic programs taught on campus, online and in blended formats. This flexibility enables our academic programs to appeal to both traditional students and working adults who may seek convenience due to scheduling, geographical or other constraints.

Our campuses are located primarily in large metropolitan areas, and we focus our marketing efforts on demand for post-secondary education primarily within a 100-mile radius of the campus. Throughout our history, we have invested in our campuses in order to provide attractive and efficient learning environments. Our schools offer many amenities found in traditional colleges, including libraries, bookstores and laboratories, as well as the industry-specific equipment necessary for the various programs that we offer. Additionally, we continue to believe that attractive locations are available to open additional campuses. In evaluating potential new locations, we focus our efforts on markets that we believe offer the most attractive projected growth and return on capital, and we rigorously analyze employment statistics and demographic data in order to align or new schools with the specific educational needs of the targeted market. During fiscal 2012, we opened four new locations, and we currently anticipate opening one new location during calendar 2013.

Strong management team with a focus on long-term performance. Our school presidents and senior operating executives have substantial experience in the sector and are instrumental in directing investments to enhance the student experience and build infrastructure.

4

Table of Contents

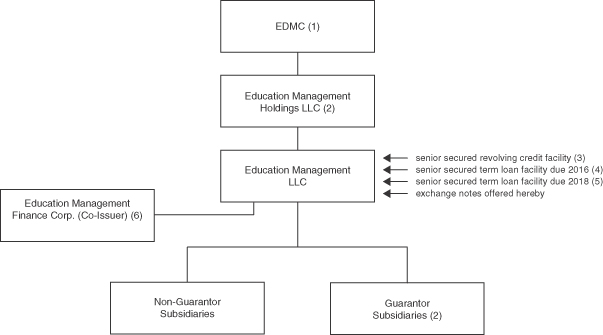

Corporate Structure

The following chart shows a summary of our capital structure as of March 31, 2013.

| (1) | Education Management Corporation will guarantee the exchange notes. This guarantee is being provided solely for the purpose of allowing the Issuers (as defined herein) to satisfy their reporting obligations under the indenture that governs the exchange notes by furnishing financial information relating to Education Management Corporation instead of the Issuers and, accordingly, you should not assign any value to such guarantee. |

| (2) | The obligations under our senior secured credit facilities are guaranteed by Education Management Holdings LLC and all of Education Management LLC’s existing direct and indirect domestic subsidiaries, other than any subsidiary that directly owns or operates a school or any inactive subsidiary that has less than $100,000 of assets. The exchange notes will be fully and unconditionally guaranteed by Education Management Corporation and all of our existing direct and indirect domestic restricted subsidiaries, other than any subsidiary that directly owns or operates a school or has been formed for such purpose and has no material assets. |

| (3) | As of March 31, 2013, no borrowings were outstanding under our senior secured revolving credit facility (excluding $353.0 million of outstanding letters of credit). |

| (4) | As of March 31, 2013, $738.5 million was outstanding under our senior secured term loan facility due June 1, 2016. |

| (5) | As of March 31, 2013, $343.2 million (net of discount of $3.1 million) was outstanding under our senior secured term loan facility due March 30, 2018. |

| (6) | Education Management Finance Corp. has only nominal assets, does not currently conduct any operations and acts as co-issuer of the exchange notes. |

Education Management Corporation is a Pennsylvania corporation founded in 1962. Education Management LLC was organized under Delaware law on March 15, 2006. Education Management Finance Corp. was incorporated under Delaware law on May 2, 2006. Our headquarters are located at 210 Sixth Avenue, 33rd Floor, Pittsburgh, Pennsylvania 15222. Our telephone number is (412) 562-0900. Our website is accessible through www.edmc.com. Information on, or accessible through, this website is not a part of, and is not incorporated into, this prospectus.

5

Table of Contents

The Exchange Offer

$203,044,423 aggregate principal amount of outstanding Senior Cash Notes/PIK Notes due 2018 were issued in a private offering on March 5, 2013. The term “notes” refers collectively to the outstanding notes and the exchange notes.

| General |

In connection with the private offering, Education Management LLC (“EM LCC”) and Education Management Finance Corp. (“EMFC”, and together with EM LLC, the “Issuers”) and the guarantors of the outstanding notes entered into a registration rights agreement with Goldman, Sachs & Co., Merrill Lynch, Pierce, Fenner & Smith Incorporated and Barclays Capital Inc. (the “Dealer Managers”) in which they agreed, among other things, to deliver this prospectus to you and to complete the exchange offer within 240 days after the date of original issuance of the outstanding notes. You are entitled to exchange in the exchange offer your outstanding notes for the exchange notes which are identical in all material respects to the outstanding notes except: |

| • | the exchange notes have been registered under the Securities Act; |

| • | the exchange notes are not entitled to any registration rights which are applicable to the outstanding notes under the registration rights agreement; and |

| • | the liquidated damages provisions of the registration rights agreements are no longer applicable. |

| The Exchange Offer |

EMFC and EM LLC are offering to exchange $203,044,423 aggregate principal amount of their exchange notes which have been registered under the Securities Act for any and all of the outstanding notes. |

| You may only exchange outstanding notes in denominations of $2,000 and integral multiples of $1 excess thereof; provided that any unexchanged outstanding notes must be in a minimum principal amount of $2,000 and integral multiples of $1 in excess thereof. |

| Resale |

Based on an interpretation by the staff of the SEC set forth in no-action letters issued to third parties, we believe that the exchange notes issued pursuant to the exchange offer in exchange for outstanding notes may be offered for resale, resold and otherwise transferred by you (unless you are our “affiliate” within the meaning of Rule 405 under the Securities Act) without compliance with the registration and prospectus delivery provisions of the Securities Act; provided that: |

| • | you are acquiring the exchange notes in the ordinary course of your business; and |

| • | you have not engaged in, do not intend to engage in, and have no arrangement or understanding with any person to participate in, a distribution of the exchange notes. |

6

Table of Contents

| If you are a broker-dealer and receive exchange notes for your own account in exchange for outstanding notes that you acquired as a result of market-making activities or other trading activities, you must acknowledge that you will deliver this prospectus in connection with any resale of the exchange notes. See “Plan of Distribution.” |

| Any holder of outstanding notes who: |

| • | is our affiliate; |

| • | does not acquire exchange notes in the ordinary course of its business; or |

| • | tenders its outstanding notes in the exchange offer with the intention to participate, or for the purpose of participating, in a distribution of exchange notes cannot rely on the position of the staff of the SEC enunciated in Morgan Stanley & Co. Incorporated (available June 5, 1991) and Exxon Capital Holdings Corporation (available May 13, 1988), as interpreted in the SEC’s letter to Shearman & Sterling, dated available July 2, 1993, or similar no-action letters and, in the absence of an exemption therefrom, must comply with the registration and prospectus delivery requirements of the Securities Act in connection with any resale of the exchange notes. |

| Expiration Date |

The exchange offer will expire at 12:00 a.m. midnight, New York City time, on , 2013, unless extended by EMFC and EM LLC. EMFC and EM LLC do not currently intend to extend the expiration date. |

| Withdrawal |

You may withdraw the tender of your outstanding notes at any time prior to the expiration of the exchange offer. EMFC and EM LLC will return to you any of your outstanding notes that are not accepted for any reason for exchange, without expense to you, promptly after the expiration or termination of the exchange offer. |

| Conditions to the Exchange Offer |

Each exchange offer is subject to customary conditions, which EMFC and EM LLC may waive. See “The Exchange Offer—Conditions to the Exchange Offer.” |

| Procedures for Tendering Outstanding Notes |

If you wish to participate in the exchange offer, you must complete, sign and date the accompanying letter of transmittal, or a facsimile of such letter of transmittal, according to the instructions contained in this prospectus and the letter of transmittal. You must then mail or otherwise deliver the letter of transmittal, or a facsimile of such letter of transmittal, together with the outstanding notes and any other required documents, to the exchange agent at the address set forth on the cover page of the letter of transmittal. |

| If you hold outstanding notes through The Depository Trust Company (“DTC”) and wish to participate in the exchange offer, you must comply with the Automated Tender Offer Program procedures of |

7

Table of Contents

| DTC by which you will agree to be bound by the letter of transmittal. By signing, or agreeing to be bound by, the letter of transmittal, you will represent to us that, among other things: |

| • | you are not our “affiliate” within the meaning of Rule 405 under the Securities Act; |

| • | you do not have an arrangement or understanding with any person or entity to participate in the distribution of the exchange notes; |

| • | you are acquiring the exchange notes in the ordinary course of your business; and |

| • | if you are a broker-dealer that will receive exchange notes for your own account in exchange for outstanding notes that were acquired as a result of market-making activities, that you will deliver a prospectus, as required by law, in connection with any resale of such exchange notes. |

| Special Procedures for Beneficial Owners |

If you are a beneficial owner of outstanding notes that are registered in the name of a broker, dealer, commercial bank, trust company or other nominee, and you wish to tender those outstanding notes in the exchange offer, you should contact the registered holder promptly and instruct the registered holder to tender those outstanding notes on your behalf. If you wish to tender on your own behalf, you must, prior to completing and executing the letter of transmittal and delivering your outstanding notes, either make appropriate arrangements to register ownership of the outstanding notes in your name or obtain a properly completed bond power from the registered holder. The transfer of registered ownership may take considerable time and may not be able to be completed prior to the expiration date. |

| Guaranteed Delivery Procedures |

If you wish to tender your outstanding notes and your outstanding notes are not immediately available or you cannot deliver your outstanding notes, the letter of transmittal or any other required documents, or you cannot comply with the procedures under DTC’s Automated Tender Offer Program for transfer of book-entry interests, prior to the expiration date, you must tender your outstanding notes according to the guaranteed delivery procedures set forth in this prospectus under “The Exchange Offer—Guaranteed Delivery Procedures.” |

| Effect on Holders of Outstanding Notes |

As a result of the making of, and upon acceptance for exchange of, all validly tendered outstanding notes pursuant to the terms of the exchange offer, EMFC and EM LLC and the guarantors of the notes will have fulfilled a covenant under the registration rights agreement. Accordingly, there will be no increase in the interest rate on the outstanding notes under the circumstances described in the registration rights agreement. If you do not tender your outstanding notes in the exchange offer, you will continue to be entitled to all the rights and limitations applicable to the outstanding notes as set forth |

8

Table of Contents

| in the indenture; however, EMFC and EM LLC and the guarantors of the notes will not have any further obligation to you to provide for the exchange and registration of the outstanding notes under the registration rights agreement. To the extent that the outstanding notes are tendered and accepted in the exchange offer, the trading market for the outstanding notes that are not so tendered and accepted could be adversely affected. |

| Consequences of Failure to Exchange |

All untendered outstanding notes will continue to be subject to the restrictions on transfer set forth in the outstanding notes and in the indenture. In general, the outstanding notes may not be offered or sold, unless registered under the Securities Act, except pursuant to an exemption from, or in a transaction not subject to, the Securities Act and applicable state securities laws. Other than in connection with the exchange offer, EMFC and EM LLC and the guarantors of the notes do not currently anticipate that they will register the outstanding notes under the Securities Act. |

| Certain U.S. Federal Income Tax Consequences |

The exchange of outstanding notes for exchange notes in the exchange offer will not be a taxable event to holders for U.S. federal income tax purposes. See “Certain U.S. Federal Income Tax Consequences.” |

| Use of Proceeds |

We will not receive any cash proceeds from the issuance of the exchange notes in the exchange offer. |

| Exchange Agent |

The Bank of New York Mellon Trust Company, N.A. is the exchange agent for the exchange offer. The addresses and telephone numbers of the exchange agent are set forth under “The Exchange Offer—Exchange Agent.” |

9

Table of Contents

The Exchange Notes

The summary below describes the principal terms of the exchange notes. Certain of the terms and conditions described below are subject to important limitations and exceptions. The “Description of Notes” section of this prospectus contains a more detailed description of the terms and conditions of the notes. The exchange notes will have terms identical in all material respects to the corresponding outstanding notes, except that the exchange notes will not contain terms with respect to transfer restrictions, registration rights and additional interest for failure to observe certain obligations in the registration rights agreement.

| Issuers |

Education Management LLC and Education Management Finance Corp., a wholly-owned subsidiary of Education Management LLC, will jointly and severally issue the exchange notes. Education Management Finance Corp. has only nominal assets, does not currently conduct any operations and was formed solely to act as a co-issuer of notes issued by Education Management LLC. |

| Securities Offered |

$203,044,423 aggregate principal amount of exchange notes. |

| Maturity Date |

July 1, 2018. |

| Interest Rate |

15% per annum will be payable in cash. For any interest period after March 30, 2014 up to and including July 1, 2018, interest in addition to the cash interest shall be paid by increasing the principal amount of the outstanding exchange notes or by issuing additional exchange notes (rounded up to the nearest $1) (“PIK Interest”). PIK Interest on the exchange notes will accrue at a rate of (i) 1.0% per annum for the period from March 30, 2014 through and including March 30, 2015, (ii) 2.0% per annum for the period from March 30, 2015 through and including March 30, 2016, (iii) 3.0% per annum for the period from March 30, 2016 through and including March 30, 2017 and (iv) 4.0% per annum for the period from March 30, 2017 through and including July 1, 2018. |

| Interest Payment Dates |

March 30 and September 30, beginning on September 30, 2013. Interest on the exchange notes accrued from the issue date of the outstanding notes. |

| Ranking |

The exchange notes will be our senior unsecured obligations and will: |

| • | rank senior in right of payment to our future debt and other obligations that are, by their terms, expressly subordinated in right of payment to the exchange notes; |

| • | rank equally in right of payment to all of our existing and future senior debt and other obligations that are not, by their terms, expressly subordinated in right of payment to the exchange notes; and |

| • | be effectively subordinated in right of payment to all of our existing and future secured debt (including obligations under our senior secured credit facilities), to the extent of the value of the assets securing such debt, and be structurally subordinated to all obligations of each of our subsidiaries that is not a guarantor of the exchange notes. |

10

Table of Contents

| Similarly, the guarantees of the exchange notes will be senior unsecured obligations of the guarantors and will: |

| • | rank senior in right of payment to all of the applicable guarantor’s future debt and other obligations that are, by their terms, expressly subordinated in right of payment to the exchange notes; |

| • | rank equally in right of payment to all of the applicable guarantor’s existing and future senior debt and other obligations that are not, by their terms, expressly subordinated in right of payment to the exchange notes; and |

| • | be effectively subordinated in right of payment to all of the applicable guarantor’s existing and future secured debt (including such guarantor’s guarantee under our senior secured credit facilities), to the extent of the value of the assets securing such debt, and be structurally subordinated to all obligations of any subsidiary of a guarantor if that subsidiary is not also a guarantor of the exchange notes. |

| Guarantees |

The exchange notes will be fully and unconditionally guaranteed by Education Management Corporation and all of Education Management LLC’s existing direct and indirect domestic restricted subsidiaries, other than any subsidiary that directly owns or operates a school or has been formed for such purpose and has no material assets, and will also be guaranteed by certain future restricted subsidiaries that guarantee other debt. The guarantee by Education Management Corporation is being provided as a holding company guarantee solely for the purpose of allowing the Issuers to satisfy their reporting obligation under the indenture that will govern the exchange notes by furnishing financial information relating to Education Management Corporation and, accordingly, you should not assign any value to this guarantee. |

| Our guarantor subsidiaries accounted for less than 1% of our net revenue and our total EBITDA for the twelve months ended March 31, 2013, and less than 1% of our total assets and our total liabilities as of March 31, 2013. |

| Since our non-guarantor subsidiaries are our primary source of revenue, the guarantors will have limited ability to make payments in respect of the exchange notes if the Issuers are unable to satisfy their payment obligations. As a result, the guarantees will be of limited value. |

| Optional Redemption |

Prior to March 30, 2014, we will have the option to redeem some or all of the exchange notes for cash at a redemption price equal to 100% of their principal amount plus an applicable make-whole premium (as described in “Description of Notes-Optional Redemption”) plus accrued and unpaid interest to the redemption date. Beginning on March 30, 2014, we may redeem some or all of the exchange notes at the redemption prices listed under “Description of Notes-Optional Redemption” plus accrued interest on the exchange notes to the date of redemption. |

| See “Description of Notes-Optional Redemption.” |

11

Table of Contents

| Optional Redemption After Certain Equity Offerings |

At any time (which may be more than once) before March 30, 2014, we may choose to redeem up to 35% of the exchange notes at a redemption price equal to 115% of the face amount thereof with proceeds that we raise in one or more equity offerings, as long as at least 65% of the aggregate principal amount of the exchange notes issued remain outstanding afterwards. |

| See “Description of Notes-Optional Redemption.” |

| Mandatory Principal Redemption |

If the exchange notes would otherwise constitute “applicable high yield discount obligations” within the meaning of Section 163(i)(1) of the Internal Revenue Code of 1986, as amended (the “Code”), at the end of the first “accrual period” (as defined in Section 1272(a)(5) of the Code) ending after the fifth anniversary of the outstanding notes’ issuance (the “AHYDO redemption date”), we will be required to redeem for cash a portion of each exchange note then outstanding equal to the “Mandatory Principal Redemption Amount” (each such redemption, a “Mandatory Principal Redemption”). The redemption price for the portion of each exchange note redeemed pursuant to any Mandatory Principal Redemption will be 100% of the principal amount of such portion plus any accrued interest thereon on the date of redemption. “Mandatory Principal Redemption Amount” means, as of the AHYDO redemption date, the portion of an exchange note required to be redeemed to prevent such exchange note from being treated as an “applicable high yield discount obligation” within the meaning of Section 163(i)(1) of the Code. No partial redemption or repurchase of the exchange notes prior to the AHYDO redemption date pursuant to any other provision of the indenture governing the exchange notes will alter our obligation to make any Mandatory Principal Redemption with respect to any exchange notes that remain outstanding on the AHYDO redemption date. |

| Change of Control |

Upon the occurrence of a change of control, you will have the right, as holders of the exchange notes, to require us to repurchase some or all of the exchange notes at 101% of their face amount, plus accrued and unpaid interest to the repurchase date. See “Description of Notes-Repurchase at the Option of Holders-Change of Control.” |

| We may not be able to pay you the required price for exchange notes you present to us at the time of a change of control, because: |

| • | we may not have enough funds at that time; or |

| • | terms of our senior debt, including our senior secured credit facilities, may prevent us from making such payment. |

| Your right to require us to repurchase the exchange notes upon the occurrence of a change of control will be suspended during any time that the exchange notes have investment grade ratings from both Moody’s Investors Service, Inc. and Standard & Poor’s. |

12

Table of Contents

| Restrictive Covenants |

The indenture governing the exchange notes contains covenants limiting our ability and the ability of our restricted subsidiaries to: |

| • | incur additional debt or issue certain preferred shares; |

| • | pay dividends on or make distributions in respect of our capital stock or make other restricted payments; |

| • | make certain investments; |

| • | sell certain assets; |

| • | create liens on certain assets to secure debt; |

| • | consolidate, merge, sell or otherwise dispose of all or substantially all of our assets; |

| • | enter into certain transactions with our affiliates; and |

| • | designate our subsidiaries as unrestricted subsidiaries. |

| These covenants are subject to a number of important limitations and exceptions. See “Description of Notes.” At all times when the exchange notes have investment grade ratings from both Moody’s Investors Service, Inc. and Standard & Poor’s these covenants will be superseded. However, they will be reinstated if the exchange notes cease to have an investment grade rating. |

| Form and Denomination |

The exchange notes will be issued in denominations of $2,000 and integral multiples of $1.00 in excess thereof. We will issue the exchange notes in the form of one or more global notes in definitive, fully registered, book-entry form. The global notes will be deposited with or on behalf of DTC. PIK Interest on the exchange notes will be made in denominations of $1.00 and integral multiples of $1.00 in excess thereof. |

| Public Market |

The exchange notes will be freely transferrable but will be new securities for which there will not initially be a market. Accordingly, we cannot assure you that a liquid market for the exchange notes will develop. See “Risk Factors—Risks Related to the Exchange Offer—Your ability to transfer the exchange notes may be limited by the absence of an active trading market, and there is no assurance that any active trading market will be maintained for the exchange notes.” |

You should carefully consider all the information in the prospectus prior to exchanging your outstanding notes. In particular, we urge you to carefully consider the factors set forth under the “Risk Factors” section.

13

Table of Contents

RATIO OF EARNINGS TO FIXED CHARGES

The following table sets forth the historical ratio of earnings to fixed charges for EM LLC for the periods presented:

| Nine months ended March 31 |

Year ended June 30 | |||||||||||||||||||||||

| 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | |||||||||||||||||||

| Ratio of earnings to fixed charges (a) |

(1.0)x | (9.2)x | 3.3x | 2.6x | 1.9x | 1.6x | ||||||||||||||||||

| (a) | For the purpose of computing the ratio of earnings to fixed charges, “earnings” consist of consolidated pretax income (loss) from continuing operations before adjustment for minority interests in consolidated subsidiaries and income (loss) of equity investees, plus (1) amortization of capitalized interest, (2) distributed income of equity investees and (3) fixed charges described below, excluding interest capitalized. “Fixed charges” consist of (1) interest expensed, (2) capitalized interest, (3) amortization of debt issuance costs and (4) the portion of rent expense estimated to represent interest. |

14

Table of Contents

Before deciding to participate in the Exchange Offer, you should carefully consider the risks and uncertainties described below, as well as other information contained in this prospectus. If any of the following risks actually occur, our business, financial condition, operating results or cash flow could be materially and adversely affected. Additional risks and uncertainties not presently known to us or not believed by us to be material may also negatively impact us.

Risks Related to the Exchange Offer

There may be adverse consequences if you do not exchange your outstanding notes.

If you do not exchange your outstanding notes for exchange notes in the exchange offer, you will continue to be subject to restrictions on transfer of your outstanding notes as set forth in the offering circular distributed in connection with the private offering of the outstanding notes. In general, the outstanding notes may not be offered or sold unless they are registered or exempt from registration under the Securities Act and applicable state securities laws. Except as required by the registration rights agreement, we do not intend to register resales of the outstanding notes under the Securities Act. You should refer to “Prospectus Summary—The Exchange Offer” and “The Exchange Offer” for information about how to tender your outstanding notes.

The tender of outstanding notes under the exchange offer will reduce the outstanding amount of the outstanding notes, which may have an adverse effect upon, and increase the volatility of, the market price of the outstanding notes not exchanged in the exchange offer due to a reduction in liquidity.

Certain persons who participate in the exchange offer must deliver a prospectus in connection with resales of the exchange notes.

Based on interpretations of the staff of the SEC contained in Exxon Capital Holdings Corp., SEC no-action letter (April 13, 1988), Morgan Stanley & Co. Inc., SEC no-action letter (June 5, 1991) and Shearman & Sterling, SEC no-action letter (July 2, 1983), we believe that you may offer for resale, resell or otherwise transfer the exchange notes without compliance with the registration and prospectus delivery requirements of the Securities Act. However, in some instances described in this prospectus under “Plan of Distribution,” certain holders of exchange notes will remain obligated to comply with the registration and prospectus delivery requirements of the Securities Act to transfer the exchange notes. If such a holder transfers any exchange notes without delivering a prospectus meeting the requirements of the Securities Act or without an applicable exemption from registration under the Securities Act, such a holder may incur liability under the Securities Act. We do not and will not assume, or indemnify such a holder against, this liability.

Risks Related to the Notes

Despite our current leverage, we may still be able to incur substantially more debt. This could further exacerbate the risks that we and our subsidiaries face.

We and our subsidiaries may be able to incur substantial additional indebtedness in the future. If we incur any additional indebtedness that ranks equally with the exchange notes, the holders of that additional debt will be entitled to share ratably with the holders of the exchange notes in any proceeds distributed in connection with any insolvency, liquidation, reorganization, dissolution or other winding-up of us. This may have the effect of reducing the amount of proceeds paid to you. If new debt is added to our current debt levels, the related risks that we and our subsidiaries now face could intensify. In addition, under the exchange notes, beginning after March 30, 2014, we will pay additional interest on the exchange notes by increasing the principal amount of the exchange notes, which will increase our debt by the amount of any such PIK Interest.

15

Table of Contents

Your right to receive payments on the exchange notes is effectively junior to those lenders who have a security interest in our assets.

Our obligations under the exchange notes and our guarantors’ obligations under their guarantees of the exchange notes are unsecured, but our obligations under our senior secured credit facilities and each guarantor’s obligations under their respective guarantees of the senior secured credit facilities are secured by a security interest in substantially all of the domestic tangible and intangible assets of us and the guarantors, including the stock of most of our and the guarantors’ direct wholly-owned U.S. subsidiaries, and a portion of the stock of certain of our non-U.S. subsidiaries. If we are declared bankrupt or insolvent, or if we default under our senior secured credit agreement, the lenders could declare all of the funds borrowed thereunder, together with accrued interest, immediately due and payable. If we were unable to repay such indebtedness, the lenders could foreclose on the pledged assets to the exclusion of holders of the exchange notes, even if an event of default exists under the indenture governing the exchange notes at such time. Furthermore, if the lenders foreclose and sell the pledged equity interests in any subsidiary guarantor under the exchange notes, then that guarantor will be released from its guarantee of the exchange notes automatically and immediately upon such sale. In any such event, because the exchange notes will not be secured by any of our assets or the equity interests in subsidiary guarantors, it is possible that there would be no assets remaining from which your claims could be satisfied or, if any assets remained, they might be insufficient to satisfy your claims fully. See “Description of Other Indebtedness.”

As of March 31, 2013, we had $1,081.6 million (net of discount) of senior secured indebtedness, all of which was indebtedness under our credit facilities. We had $175.3 million of borrowing capacity under our senior secured revolving credit facility, excluding $353.0 million in letters of credit. We were required to post a letter of credit of $348.6 million as of March 31, 2013 in favor of the U.S. Department of Education due to our failure to meet certain regulatory financial ratios after giving effect to the acquisition of the company by our principal shareholders, which are private equity funds affiliated with Providence Equity Partners, Goldman Sachs Capital Partners and Leeds Equity Partners, which we refer to collectively as the “Sponsors,” and related financing transactions which took place on June 1, 2006. In December 2012, the U.S. Department of Education decreased the required letter of credit from $414.5 million at September 30, 2012 to $348.6 million, which equals 15% of total aid received by students attending our institutions pursuant to Title IV (“Title IV”) of the Higher Education Act of 1965, as amended (“HEA”) during the fiscal year ended June 30, 2012. Subsequent to the U.S. Department of Education’s notification, we reduced the letter of credit to $388.1 million during the quarter ended December 31, 2012 and then to $348.6 million in January 2013. The indenture governing the exchange notes permits us and our restricted subsidiaries to incur additional indebtedness in the future, including senior secured indebtedness.

Claims of noteholders will be structurally subordinate to claims of creditors of all of our non-U.S. subsidiaries and some of our U.S. subsidiaries because they will not guarantee the exchange notes.

The exchange notes will be fully and unconditionally guaranteed by all of our existing direct and indirect domestic restricted subsidiaries, other than any subsidiary that directly owns or operates a school or has been formed for such purpose and has no material assets. The exchange notes will not be guaranteed by any of our non-U.S. subsidiaries or future subsidiaries, unless they guarantee other debt. Accordingly, claims of holders of the exchange notes will be structurally subordinate to the claims of creditors of these non-guarantor subsidiaries, including trade creditors. All obligations of our non-guarantor subsidiaries will have to be satisfied before any of the assets of such subsidiaries would be available for distribution, upon a liquidation or otherwise, to us or a guarantor of the exchange notes.

Our guarantor subsidiaries accounted for less than 1% of our net revenue and our total EBITDA for the twelve months ended March 31, 2013, and less than 1% of our total assets and our total liabilities as of March 31, 2013.

Since our non-guarantor subsidiaries are our primary source of revenue, the guarantors will have limited ability to make payments in respect of the exchange notes if the Issuers are unable to satisfy their payment obligations. As a result, the guarantees will be of limited value.

16

Table of Contents

If we default on our obligations to pay our indebtedness, we may not be able to make payments on the exchange notes.

Any default under the agreements governing our indebtedness, including a default under the senior secured credit agreement, that is not waived by the required lenders, and the remedies sought by the holders of such indebtedness, could prevent us from paying principal, premium, if any, and interest on the exchange notes and substantially decrease the market value of the exchange notes. If we are unable to generate sufficient cash flow and are otherwise unable to obtain funds necessary to meet required payments of principal, premium, if any, and interest on our indebtedness, or if we otherwise fail to comply with the various covenants, including financial and operating covenants, in the instruments governing our indebtedness (including covenants in our senior secured credit facilities and the indenture governing the exchange notes), we could be in default under the terms of the agreements governing such indebtedness, including our senior secured credit agreement and the indenture governing the exchange notes. In the event of such default, the holders of such indebtedness could elect to declare all the funds borrowed thereunder to be due and payable, together with accrued and unpaid interest, the lenders under our senior secured credit facilities could elect to terminate their commitments thereunder, cease making further loans and institute foreclosure proceedings against our assets, and we could be forced into bankruptcy or liquidation. If our operating performance declines, we may in the future need to obtain waivers from the required lenders under our senior secured credit facilities to avoid being in default. If we breach our covenants under our senior secured credit facilities and seek a waiver, we may not be able to obtain a waiver from the required lenders. If this occurs, we would be in default under our senior secured credit agreement, the lenders could exercise their rights, as described above, and we could be forced into bankruptcy or liquidation.

We may not be able to repurchase the exchange notes upon a change of control.

Upon the occurrence of specific kinds of change of control events, we will be required to offer to repurchase all outstanding exchange notes at 101% of their principal amount plus accrued and unpaid interest. The source of funds for any such purchase of the exchange notes will be our available cash or cash generated from our subsidiaries’ operations or other sources, including borrowings, sales of assets or sales of equity. We may not be able to repurchase the exchange notes upon a change of control because we may not have sufficient financial resources to purchase all of the exchange notes that are tendered upon a change of control. Our failure to repurchase the exchange notes upon a change of control would cause a default under the indenture governing the exchange notes and a cross-default under the senior secured credit agreement. The senior secured credit agreement also provides that a change of control will be a default that permits lenders to accelerate the maturity of borrowings thereunder. Any of our future debt agreements may contain similar provisions.

In addition, the change of control provisions in the indenture that will govern the exchange notes offered hereby may not protect you from certain important corporate events, such as a leveraged recapitalization (which would increase the level of our indebtedness), reorganization, restructuring, merger or other similar transaction. Such a transaction may not involve a change in voting power or beneficial ownership or, even if it does, may not involve a change that constitutes a “Change of Control” as defined in such indenture that would trigger our obligation to repurchase the exchange notes. If an event occurs that does not constitute a “Change of Control” as defined in such indenture, we will not be required to make an offer to repurchase the exchange notes and you may be required to continue to hold your exchange notes despite the event.

The lenders under the senior secured credit facilities will have the discretion to release the guarantors under the senior secured credit agreement in a variety of circumstances, which will cause those guarantors to be released from their guarantees of the exchange notes.

While any obligations under the senior secured credit facilities remain outstanding, any guarantee of the exchange notes may be released without action by, or consent of, any holder of the exchange notes or the trustee under the indenture governing the exchange notes, at the discretion of lenders under the senior secured credit facilities, if the related guarantor is no longer a guarantor of obligations under the senior secured credit facilities or any other indebtedness. See “Description of Notes.” The lenders under the senior secured credit facilities will

17

Table of Contents

have the discretion to release the guarantees under the senior secured credit facilities in a variety of circumstances. You will not have a claim as a creditor against any subsidiary that is no longer a guarantor of the exchange notes, and the indebtedness and other liabilities, including trade payables, whether secured or unsecured, of those subsidiaries will effectively be senior to claims of noteholders.

Federal and state fraudulent transfer laws may permit a court to void the exchange notes and related guarantees, and, if that occurs, you may not receive any payments on the exchange notes.

Federal and state fraudulent transfer and conveyance statutes may apply to the issuance of the exchange notes and the incurrence of the related guarantees. Under federal bankruptcy law and comparable provisions of state fraudulent transfer or conveyance laws, which may vary from state to state, the exchange notes or related guarantees could be voided as a fraudulent transfer or conveyance if (1) we or any of the guarantors, as applicable, issued the exchange notes or incurred the related guarantees with the intent of hindering, delaying or defrauding creditors or (2) we or any of the guarantors, as applicable, received less than reasonably equivalent value or fair consideration in return for either issuing the exchange notes or incurring the related guarantees and, in the case of (2) only, one of the following is also true at the time thereof:

| • | we or any of the guarantors, as applicable, were insolvent or rendered insolvent by reason of the issuance of the exchange notes or the incurrence of the related guarantees; |

| • | the issuance of the exchange notes or the incurrence of the related guarantees left us or any of the guarantors, as applicable, with an unreasonably small amount of capital to carry on the business; |

| • | we or any of the guarantors intended to, or believed that we or such guarantor would, incur debts beyond our or such guarantor’s ability to pay as they mature; or |

| • | we or any of the guarantors was a defendant in an action for money damages, or had a judgment for money damages docketed against us or such guarantor if, in either case, after final judgment, the judgment is unsatisfied. |

If a court were to find that the issuance of the exchange notes or the incurrence of the related guarantees was a fraudulent transfer or conveyance, the court could void the payment obligations under the exchange notes or such related guarantees or further subordinate the exchange notes or such related guarantees to presently existing and future indebtedness of ours or of the related guarantor, or require the holders of the exchange notes to repay any amounts received with respect to such related guarantees. In the event of a finding that a fraudulent transfer or conveyance occurred, you may not receive any repayment on the exchange notes. Further, the voidance of the exchange notes could result in an event of default with respect to our and our subsidiaries’ other debt that could result in acceleration of such debt.

As a general matter, value is given for a transfer or an obligation if, in exchange for the transfer or obligation, property is transferred or an antecedent debt is secured or satisfied. A debtor may not be considered to have received value in connection with a debt offering if the debtor uses the proceeds of that offering to make a dividend payment or otherwise retire or redeem equity securities issued by the debtor or to refinance debt that was incurred for such purposes.

We cannot be certain as to the standards a court would use to determine whether or not we or the guarantors were solvent at the relevant time or, regardless of the standard that a court uses, that the issuance of the related guarantees would not be further subordinated to our or any of our guarantors’ other debt. Generally, however, an entity would be considered solvent if, at the time it incurred indebtedness:

| • | the sum of its debts, including contingent liabilities, was greater than the fair saleable value of all its assets; |

| • | the present fair saleable value of its assets was less than the amount that would be required to pay its probable liability on its existing debts, including contingent liabilities, as they become absolute and mature; or |

| • | it could not pay its debts as they become due. |

18

Table of Contents

Our obligations under the exchange notes will be guaranteed by certain of our existing domestic restricted subsidiaries, and the guarantees may also be subject to review under various laws for the protection of creditors. It is possible that creditors of the guarantors may challenge the guarantees as a fraudulent transfer or conveyance. The analysis set forth above would generally apply, except that the guarantees could also be subject to the claim that, since the guarantees were incurred for our benefit, and only indirectly for the benefit of the guarantors, the obligations of the guarantors thereunder were incurred for less than reasonably equivalent value or fair consideration. A court could void a guarantor’s obligation under its guarantee, subordinate the guarantee to the other indebtedness of a guarantor, direct that holders of the exchange notes return any amounts paid under a guarantee to the relevant guarantor or to a fund for the benefit of its creditors, or take other action detrimental to the holders of the exchange notes. In addition, the liability of each guarantor under the indenture is limited to the amount that will result in its guarantee not constituting a fraudulent conveyance or improper corporate distribution, and there can be no assurance as to what standard a court would apply in making a determination as to what would be the maximum liability of each guarantor.

We are dependent upon dividends from our subsidiaries to meet our debt service obligations.