AMG Funds II

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED

SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-06431

AMG Funds II

(Exact

name of registrant as specified in charter)

600 Steamboat

Road, Suite 300, Greenwich, Connecticut 06830

(Address of principal executive offices) (Zip code)

AMG Funds LLC

600

Steamboat Road, Suite 300, Greenwich, Connecticut 06830

(Name and address of agent for service)

Registrant’s telephone number, including area code: (203) 299-3500

Date of fiscal year end: DECEMBER 31

Date of reporting period: JANUARY 1, 2016 – DECEMBER 31, 2016

(Annual Shareholder Report)

Item 1. Reports to Shareholders

|

|

|

|

|

|

|

|

|

ANNUAL REPORT |

AMG Funds

December 31, 2016

AMG GW&K Enhanced Core Bond Fund

Class N: MFDAX | Class S: MFDSX | Class C:

MFDCX

Class I: MFDYX

AMG GW&K

Municipal Bond Fund

Class N: GWMTX | Class S:

GWMSX | Class I: GWMIX

AMG GW&K Municipal Enhanced Yield Fund

Class N: GWMNX | Class S: GWMRX | Class I:

GWMEX

AMG GW&K Small Cap Core Fund

Class

N: GWETX | Class S: GWESX | Class I: GWEIX

AMG GW&K Small Cap Growth Fund

Class I: GWGIX

|

|

|

| www.amgfunds.com | |

|

AR020-1216 |

AMG Funds

Annual Report—December 31, 2016

|

|

|

|

|

| TABLE OF CONTENTS |

|

PAGE |

|

| LETTER TO SHAREHOLDERS |

|

|

2 |

|

|

|

| ABOUT YOUR FUND’S EXPENSES |

|

|

3 |

|

|

|

| PORTFOLIO MANAGER’S COMMENTS, FUND SNAPSHOTS, AND SCHEDULES OF PORTFOLIO

INVESTMENTS |

|

|

|

|

| AMG GW&K Enhanced Core Bond Fund |

|

|

5 |

|

| AMG GW&K Municipal Bond Fund |

|

|

11 |

|

| AMG GW&K Municipal Enhanced Yield Fund |

|

|

20 |

|

| AMG GW&K Small Cap Core Fund |

|

|

27 |

|

| AMG GW&K Small Cap Growth Fund |

|

|

33 |

|

|

|

| NOTES TO SCHEDULES OF PORTFOLIO INVESTMENTS |

|

|

39 |

|

|

|

| FINANCIAL STATEMENTS |

|

|

|

|

|

|

| Statement of Assets and Liabilities

Balance sheets, net asset value (NAV) per share computations and cumulative undistributed amounts |

|

|

42 |

|

|

|

| Statement of Operations |

|

|

44 |

|

| Detail of sources of income, expenses, and realized and unrealized gains (losses) during the

fiscal year |

|

|

|

|

|

|

| Statements of Changes in Net Assets |

|

|

45 |

|

| Detail of changes in assets for the past two fiscal years |

|

|

|

|

|

|

| Financial Highlights |

|

|

47 |

|

| Historical net asset values per share, distributions, total returns, income and expense ratios,

turnover ratios and net assets |

|

|

|

|

|

|

| Notes to Financial Highlights |

|

|

56 |

|

|

|

| Notes to Financial Statements |

|

|

57 |

|

| Accounting and distribution policies, details of agreements and transactions with Fund

management and affiliates, and descriptions of certain investment risks |

|

|

|

|

|

|

| REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING

FIRM |

|

|

67 |

|

|

|

| TRUSTEES AND OFFICERS |

|

|

68 |

|

Nothing contained herein is to be considered an offer, sale or solicitation of an offer to buy shares of any series of the AMG

Fund family of mutual funds. Such offering is made only by prospectus, which includes details as to offering price and other material information.

|

|

|

|

|

|

|

|

|

Letter to Shareholders |

DEAR

SHAREHOLDER:

While the year got off to a rocky start, overall U.S. equity investors enjoyed strong positive returns for 2016.

The S&P 500 Index, a widely-followed barometer of the U.S. equity market, returned 12.0% during the prior twelve months. Small cap investors were also rewarded with a return of 21.3% for the small cap Russell 2000® Index.

After the market’s initial stumble, investors had to balance a number of noteworthy

events, including the U.K.’s planned exit from the European Union (“Brexit”), a contentious U.S. presidential election and the U.S. Federal Reserve’s second rate increase of 25 basis points to 0.50%-0.75%. Following the surprise

election of Donald Trump as the 45th President of the United States, investors witnessed a rally in pro-cyclical sectors as the new administration’s plans for tax reform and increased fiscal spending drove anticipation of stronger future

economic growth. Along with higher equity prices, long-term interest rates rose and the U.S. Dollar strengthened. Commodity prices collapsed, but then rebounded on indications of an increase in U.S. infrastructure spending and a small uptick in

China’s third-quarter Gross Domestic Product (GDP). Oil prices also experienced volatility as they continued their fall from 2015, bottoming in February and subsequently recovering more than 100%. This recovery lent some much needed support to

the beleaguered energy industry, which ended the year with the highest returns of any sector in the S&P 500 Index. In total, all sectors but the health care sector were positive for 2016; however, there was significant dispersion in performance

across sectors. Energy, telecommunication services and financials returned 27%, 23% and 21%, respectively, while companies within the consumer staples, real estate and health care sectors returned 5%, 4% and (3)%, respectively. Internationally,

stocks lagged their U.S. counterparts, returning 4.5%, as measured by the MSCI ACWI ex USA (in U.S. Dollar terms).

The Bloomberg Barclays U.S.

Aggregate Bond Index, a broad U.S. bond market benchmark, returned 2.7% for the year ended December 31, 2016. Over the course of the year, interest rates and credit spreads gyrated at times, putting pressure on bond prices. While stocks

finished strong, bond prices were less fortunate, as rising interest rates caused yields to rise and bond prices to fall. The 10-year U.S. Treasury note’s yield started the year at 2.24%, bottomed at 1.37% in July, and ended the year much

higher at 2.45%. High yield, on the other hand, was very strong, as investor risk appetite improved and spreads tightened 470 basis points. The Bloomberg Barclays U.S. Corporate High Yield Bond Index ended the year with a healthy 17.1% return.

We are excited to announce as of October 1, 2016, the AMG Funds family of mutual funds fully integrated the former Aston Funds. AMG Funds and Aston Funds

shareholders will now have access to the differentiated solutions of AMG Funds, which represents a single point of access to one of the largest line-ups of boutique managers and products in the world.

AMG Funds appreciates the privilege of providing investment tools to you and your clients. Our foremost goal at

AMG Funds is to provide investment solutions that help our shareholders successfully reach their long-term investment goals. By partnering with AMG’s affiliated investment boutiques, AMG Funds provides access to a distinctive array of

actively-managed return-oriented investment strategies. Additionally, we oversee and distribute a number of complementary open-architecture mutual funds subadvised by unaffiliated investment managers. We thank you for your continued confidence and

investment in AMG Funds. You can rest assured that under all market conditions our team is focused on delivering excellent investment management services for your benefit.

Respectfully,

Jeffery Cerutti

President

AMG Funds

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average Annual Total Returns |

|

Periods ended December 31, 2016 |

|

| Stocks: |

|

|

|

1 Year |

|

|

3 Years |

|

|

5 Years |

|

| Large Caps |

|

(S&P 500 Index) |

|

|

11.96 |

% |

|

|

8.87 |

% |

|

|

14.66 |

% |

| Small Caps |

|

(Russell 2000® Index) |

|

|

21.31 |

% |

|

|

6.74 |

% |

|

|

14.46 |

% |

| International |

|

(MSCI All Country World ex-USA Index) |

|

|

4.50 |

% |

|

|

(1.78 |

)% |

|

|

5.00 |

% |

| Bonds: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Investment Grade |

|

(Bloomberg Barclays U.S. Aggregate Bond Index) |

|

|

2.65 |

% |

|

|

3.03 |

% |

|

|

2.23 |

% |

| High Yield |

|

(Bloomberg Barclays U.S. Corporate High Yield Index) |

|

|

17.13 |

% |

|

|

4.66 |

% |

|

|

7.36 |

% |

| Tax-exempt |

|

(Bloomberg Barclays Municipal Bond Index) |

|

|

0.25 |

% |

|

|

4.14 |

% |

|

|

3.28 |

% |

| Treasury Bills |

|

(BofA Merrill Lynch 6 month U.S. Treasury Bill) |

|

|

0.67 |

% |

|

|

0.34 |

% |

|

|

0.27 |

% |

About Your Fund’s Expenses

As a shareholder of a Fund, you may incur two types of costs: (1) transaction costs, which may include

sales charges (loads) on purchase payments; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing

costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on $1,000 invested at the beginning of the period and held for the entire period as indicated

below.

ACTUAL EXPENSES

The first line of the

following table provides information about the actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your

account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on

your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The second line of the following table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense

ratio and an assumed annual rate of return of 5% before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the

period. You may use this information to compare the ongoing costs of investing in the Fund and other funds by comparing this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales

charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Six Months Ended December 31, 2016 |

|

Expense

Ratio for

the Period |

|

|

Beginning

Account Value

07/01/16 |

|

|

Ending

Account Value

12/31/16 |

|

|

Expenses

Paid During

the Period* |

|

| AMG GW&K Enhanced Core Bond Fund |

|

| Class N |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Based on Actual Fund Return |

|

|

0.84 |

% |

|

$ |

1,000 |

|

|

$ |

980 |

|

|

$ |

4.18 |

|

| Hypothetical (5% return before expenses) |

|

|

0.84 |

% |

|

$ |

1,000 |

|

|

$ |

1,021 |

|

|

$ |

4.27 |

|

| Class S |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Based on Actual Fund Return |

|

|

0.69 |

% |

|

$ |

1,000 |

|

|

$ |

980 |

|

|

$ |

3.43 |

|

| Hypothetical (5% return before expenses) |

|

|

0.69 |

% |

|

$ |

1,000 |

|

|

$ |

1,022 |

|

|

$ |

3.51 |

|

| Class C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Based on Actual Fund Return |

|

|

1.59 |

% |

|

$ |

1,000 |

|

|

$ |

976 |

|

|

$ |

7.90 |

|

| Hypothetical (5% return before expenses) |

|

|

1.59 |

% |

|

$ |

1,000 |

|

|

$ |

1,017 |

|

|

$ |

8.06 |

|

| Class I |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Based on Actual Fund Return |

|

|

0.59 |

% |

|

$ |

1,000 |

|

|

$ |

982 |

|

|

$ |

2.94 |

|

| Hypothetical (5% return before expenses) |

|

|

0.59 |

% |

|

$ |

1,000 |

|

|

$ |

1,022 |

|

|

$ |

3.00 |

|

| AMG GW&K Municipal Bond Fund |

|

| Class N |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Based on Actual Fund Return |

|

|

0.65 |

% |

|

$ |

1,000 |

|

|

$ |

955 |

|

|

$ |

3.19 |

|

| Hypothetical (5% return before expenses) |

|

|

0.65 |

% |

|

$ |

1,000 |

|

|

$ |

1,022 |

|

|

$ |

3.30 |

|

| Class S |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Based on Actual Fund Return |

|

|

0.49 |

% |

|

$ |

1,000 |

|

|

$ |

957 |

|

|

$ |

2.41 |

|

| Hypothetical (5% return before expenses) |

|

|

0.49 |

% |

|

$ |

1,000 |

|

|

$ |

1,023 |

|

|

$ |

2.49 |

|

| Class I |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Based on Actual Fund Return |

|

|

0.34 |

% |

|

$ |

1,000 |

|

|

$ |

957 |

|

|

$ |

1.67 |

|

| Hypothetical (5% return before expenses) |

|

|

0.34 |

% |

|

$ |

1,000 |

|

|

$ |

1,023 |

|

|

$ |

1.73 |

|

| AMG GW&K Municipal Enhanced Yield Fund |

|

| Class N |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Based on Actual Fund Return |

|

|

1.14 |

% |

|

$ |

1,000 |

|

|

$ |

927 |

|

|

$ |

5.52 |

|

| Hypothetical (5% return before expenses) |

|

|

1.14 |

% |

|

$ |

1,000 |

|

|

$ |

1,019 |

|

|

$ |

5.79 |

|

| Class S |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Based on Actual Fund Return |

|

|

0.74 |

% |

|

$ |

1,000 |

|

|

$ |

929 |

|

|

$ |

3.59 |

|

| Hypothetical (5% return before expenses) |

|

|

0.74 |

% |

|

$ |

1,000 |

|

|

$ |

1,021 |

|

|

$ |

3.76 |

|

| Class I |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Based on Actual Fund Return |

|

|

0.64 |

% |

|

$ |

1,000 |

|

|

$ |

930 |

|

|

$ |

3.11 |

|

| Hypothetical (5% return before expenses) |

|

|

0.64 |

% |

|

$ |

1,000 |

|

|

$ |

1,022 |

|

|

$ |

3.25 |

|

| AMG GW&K Small Cap Core Fund |

|

| Class N |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Based on Actual Fund Return |

|

|

1.34 |

% |

|

$ |

1,000 |

|

|

$ |

1,105 |

|

|

$ |

7.09 |

|

| Hypothetical (5% return before expenses) |

|

|

1.34 |

% |

|

$ |

1,000 |

|

|

$ |

1,018 |

|

|

$ |

6.80 |

|

| Class S |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Based on Actual Fund Return |

|

|

1.09 |

% |

|

$ |

1,000 |

|

|

$ |

1,107 |

|

|

$ |

5.77 |

|

| Hypothetical (5% return before expenses) |

|

|

1.09 |

% |

|

$ |

1,000 |

|

|

$ |

1,020 |

|

|

$ |

5.53 |

|

| Class I |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Based on Actual Fund Return |

|

|

0.95 |

% |

|

$ |

1,000 |

|

|

$ |

1,108 |

|

|

$ |

5.03 |

|

| Hypothetical (5% return before expenses) |

|

|

0.95 |

% |

|

$ |

1,000 |

|

|

$ |

1,020 |

|

|

$ |

4.82 |

|

About Your Fund’s Expenses

(continued)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Six Months Ended December 31, 2016 |

|

Expense

Ratio for

the Period |

|

|

Beginning

Account Value

07/01/16 |

|

|

Ending

Account Value

12/31/16 |

|

|

Expenses

Paid During

the Period* |

|

| AMG GW&K Small Cap Growth Fund |

|

| Class I |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Based on Actual Fund Return |

|

|

0.95 |

% |

|

$ |

1,000 |

|

|

$ |

1,102 |

|

|

$ |

5.02 |

|

| Hypothetical (5% return before expenses) |

|

|

0.95 |

% |

|

$ |

1,000 |

|

|

$ |

1,020 |

|

|

$ |

4.82 |

|

| * |

Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period,multiplied by the number of days in the most recent fiscal half-year (184), then divided by 366.

|

4

AMG GW&K Enhanced Core Bond Fund

Portfolio Manager’s Comments (unaudited)

THE YEAR IN REVIEW

AMG GW&K Enhanced Core Bond Fund (Class N)1 (the “Fund”) returned 3.2% for the year ended

December 31, 2016, compared to the return of 2.7% for the Bloomberg Barclays U.S. Aggregate Bond Index (the “Index”).

BACKGROUND

Fixed-income markets experienced a stark departure from the status quo in the fourth quarter. The unexpected outcome of the U.S. election, OPEC’s

decision to cut crude production and hawkish commentary from the U.S. Federal Reserve (the Fed) prompted a major reappraisal of the narrative that dominated trading through the first three quarters of the year. All at once, long-held assumptions

about growth, inflation, taxes and regulation were called into question and investors responded by sending interest rates sharply higher. Notably, this dramatic move simply brought rates back to approximately where they began the year, suggesting

more of a return to normal than an outright panic.

MARKET

The taxable bond market saw its worst quarterly performance in more than 35 years, with the Index posting a return of (3.0%) in the fourth quarter of

2016. Treasuries led the way, losing (3.8%) as yields bounced sharply from near-record lows to their highest levels in more than two years. Yields at the front end of the curve rose in response to signals from the Fed that it could accelerate

the pace of rate hikes in 2017, sending two-year yields up 43 basis points to a seven-year high. Meanwhile, intermediate and long rates increased in response to post-election expectations of aggressive fiscal stimulus, with the 30-year rising 75

basis points. This resulted in a significant steepening of the yield curve, as the two-year/30-year spread widened 32 basis points and reversed most of its year-to-date flattening.

Investment-grade corporates declined (2.8%), outperforming Treasuries due to 15 basis points of spread tightening. The same appetite for risk that pushed

equity indices to record levels drove strong performance in credit as well. BBB-rated bonds fared the best, tightening 21 basis points, as investor focus shifted toward the more industrial and cyclical corners of the market. High-yield corporate

bonds also benefited from investor

optimism, reaching their tightest level in more than two years and posting the only positive return in the

taxable market (1.8%). Here too, the lower end of the quality spectrum outperformed, as CCCs returned 4.7% on the back of strong returns from the energy (5.8%) and basic materials (2.88%) sectors. Mortgage-backed securities were a relative

outperformer as well (2.0%), owing, in large part, to their shorter duration and ongoing technical support from Fed reinvestments. Government-related bonds (3.1%) performed in line with the broader market.

PERFORMANCE ATTRIBUTION

The moderate yield curve

steepening throughout the year was a minimal detractor to performance, as the Fund was just slightly longer in duration than the benchmark. Any detraction to performance from the yield curve, however, was mitigated by our overweight allocation to

spread product. Investment-grade corporates and taxable municipals were strong contributors to the allocation effect, while our out-of-benchmark allocation to high-yield corporates earned us performance at the security-selection level.

OUTLOOK

Looking ahead, 2017 promises to resolve much of

the uncertainty that has arisen in the closing months of 2016. The policy specifics of the Trump administration’s planned fiscal stimulus are likely to emerge early in the year, with significant implications for economic growth, corporate

profits and inflation. Proposed changes to trade agreements, tax policy and government regulation should also have meaningful economic impact. At the same time, much of this anticipated benefit could be mitigated by an accelerated pace of Fed rate

hikes. Higher costs of financing and a stronger U.S. Dollar could offset the intended advantages of lower taxes, looser regulation and increased government spending. Given these somewhat countervailing forces, we expect moves in intermediate

and long maturities to be subdued. The Fund is positioned with duration slightly longer than the benchmark due to our overweight to intermediate maturities rather than a particular preference for the long end. We believe this part of the curve

offers the most attractive potential returns, due to the carry and roll available for the assumed interest-rate exposure.

Positive economic data and strong corporate earnings have driven demand for corporate credit and brought spreads

to their tightest level in two years. The commodity price decline that caused a selloff earlier in the year reversed sharply in recent months, driving outsized returns in many of the worst-performing sectors over the last two years. Additionally,

expectations of a more relaxed regulatory environment helped drive performance in the financial sector. The default rate in the high-yield market was 5.1% in 2016, though removing energy and natural resources issuers brings that down to 2.4%.2

Despite the high degree of uncertainty heading into 2017, we believe corporate credit is likely to

outperform under most scenarios. Credit fundamentals remain sound, earnings growth is steady and corporations have ready access to capital. Furthermore, the global search for yield continues to favor high-quality corporate bonds, suggesting the

potential for further spread compression, as well as limited room for widening in the event of a selloff. That said, we continue to avoid lower-quality industrials and commodity-linked sectors where sentiment is prone to rapid reversals. Our view

toward the high-yield market is neutral because we believe solid credit fundamentals are being fairly priced at current spread levels. We believe the outlook for the mortgage market remains favorable, given the protection it offers against higher

rates at the front end. The sector should also benefit from positive technical dynamics provided by the Fed’s ongoing asset purchases.

| 1 |

Prior to October 1, 2016, the Fund’s Class N shares were known as Investor Shares. |

This commentary reflects the viewpoints of the portfolio manager, GW&K

Investment Management, LLC as of December 31, 2016, and is not intended as a forecast or guarantee of future results, and is subject to change without notice.

AMG GW&K Enhanced Core Bond Fund

Portfolio Manager’s Comments (continued)

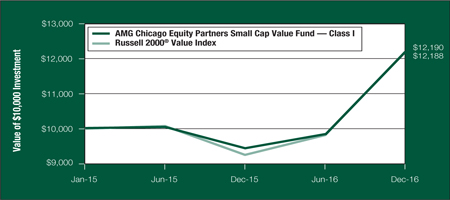

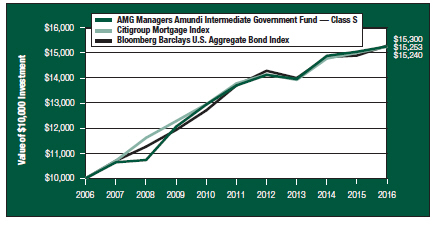

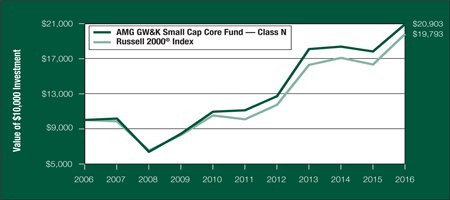

CUMULATIVE TOTAL RETURN PERFORMANCE

AMG GW&K Enhanced Core Bond Fund’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all distributions

were reinvested. The graph compares a hypothetical $10,000 investment made in the AMG GW&K Enhanced Core Bond Fund Class N (formally Investor Class) shares on December 31, 2006, with a $10,000 investment made in the Bloomberg Barclays U.S.

Aggregate Bond Index for the same time period. The graph and table do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of shares. The listed returns for the Fund are net of expenses and the returns

for the index exclude expenses. Total returns for the Fund would have been lower had certain expenses not been reduced.

The table below shows the average annual total returns for the AMG GW&K Enhanced Core Bond Fund and the Bloomberg

Barclays U.S. Aggregate Bond Index for the same time periods ended December 31, 2016.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average Annual Total Returns1 |

|

One

Year |

|

|

Five

Years |

|

|

Ten

Years |

|

|

Since

Inception |

|

|

Inception

Date |

|

| AMG GW&K Enhanced Core Bond Fund 2,3,4,5,6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Class N7 |

|

|

3.15 |

% |

|

|

2.94 |

% |

|

|

4.46 |

% |

|

|

5.50 |

% |

|

|

01/02/97 |

|

| Class S7 |

|

|

3.31 |

% |

|

|

— |

|

|

|

— |

|

|

|

1.54 |

% |

|

|

11/30/12 |

|

| Class C7,8 |

|

|

2.40 |

% |

|

|

2.16 |

% |

|

|

3.67 |

% |

|

|

4.67 |

% |

|

|

03/05/98 |

|

| Class I7 |

|

|

3.41 |

% |

|

|

3.19 |

% |

|

|

4.72 |

% |

|

|

5.89 |

% |

|

|

01/02/97 |

|

| Bloomberg Barclays U.S. Aggregate Bond

Index9 |

|

|

2.65 |

% |

|

|

2.23 |

% |

|

|

4.34 |

% |

|

|

5.31 |

% |

|

|

01/02/97 |

† |

The performance data shown represents past performance. Past performance is not a guarantee of future results. Current performance may be lower or higher

than the performance data quoted. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Investors should carefully consider the Fund’s

investment objectives, risks, charges and expenses before investing. For performance information through the most recent month end, current net asset values per share for the Fund and other information, please call (800) 835-3879 or visit our

website at www.amgfunds.com for a free prospectus. Read it carefully before investing or sending money.

Funds are distributed by AMG Distributors, Inc.,

member FINRA/SIPC.

| † |

Date reflects the inception date of the Fund, not the index.

|

| 1 |

Total return equals income yield plus share price change and assumes reinvestment of all dividends and capital gain distributions. Returns are net of fees and may reflect offsets of Fund expenses as described in the

prospectus. No adjustment has been made for taxes payable by shareholders on their reinvested dividends and capital gain distributions. Returns for periods greater than one year are annualized. The listed returns on the Fund are net of expenses and

based on the published NAV as of December 31, 2016. All returns are in U.S. dollars ($). |

| 2 |

From time to time, the Fund’s advisor has waived its fees and/or absorbed Fund expenses, which has resulted in higher returns. |

| 3 |

The Fund is subject to the risks associated with investments in debt securities, such as default risk and fluctuations in the perception of the debtor’s ability to pay its creditors. Changing interest rates may

adversely affect the value of an investment. An increase in interest rates typically causes the value of bonds and other fixed income securities to fall. |

| 4 |

To the extent that the Fund invests in asset-backed or mortgage-backed securities, its exposure to prepayment and extension risks may be greater than investments in other fixed income securities. |

| 5 |

High-yield bonds (also known as “junk bonds”) may be subject to greater levels of interest rate, credit, and liquidity risk than investments in higher rated securities. These securities are considered

predominantly speculative with respect to the issuer’s continuing ability to make principal and interest payments. The issuers of the Fund’s holdings may be involved in bankruptcy proceedings, reorganizations, or financial restructurings,

and are not as strong financially as higher-rated issuers. |

| 6 |

Investments in international securities are subject to certain risks of overseas investing including currency fluctuations and changes in political and economic conditions, which could result in significant market

fluctuations. These risks are magnified in emerging markets. |

| 7 |

Effective October 1, 2016, the Investor Class, Service Class and Institutional Class were renamed Class N, Class S and Class I, respectively. |

| 8 |

Closed to new investments. |

| 9 |

The Bloomberg Barclays U.S. Aggregate Bond Index is an index of the U.S. investment-grade fixed-rate bond market, including both government and corporate bonds. Effective August 24, 2016, the Barclays indices were

renamed Bloomberg Barclays indices. Unlike the Fund, the Bloomberg Barclays U.S. Aggregate Bond Index is unmanaged, is not available for investment and does not incur expenses. |

Not FDIC insured, nor bank guaranteed. May lose value.

6

AMG GW&K Enhanced Core Bond Fund

Fund Snapshots (unaudited)

December 31, 2016

PORTFOLIO BREAKDOWN

|

|

|

|

|

| Sector |

|

AMG GW&K Enhanced

Core Bond Fund* |

|

| U.S. Government and Agency Obligations |

|

|

36.0 |

% |

| Industrials |

|

|

35.0 |

% |

| Financials |

|

|

16.2 |

% |

| Municipal Bonds |

|

|

6.7 |

% |

| Other Assets and Liabilities |

|

|

6.1 |

% |

| * |

As a percentage of net assets. |

|

|

|

|

|

| Rating |

|

AMG GW&K Enhanced

Core Bond Fund** |

|

| U.S. Government and Agency Obligations |

|

|

38.3 |

% |

| Aaa |

|

|

1.0 |

% |

| Aa |

|

|

8.6 |

% |

| A |

|

|

7.0 |

% |

| Baa |

|

|

32.0 |

% |

| Ba |

|

|

12.1 |

% |

| B |

|

|

1.0 |

% |

| ** |

As a percentage of market value of fixed-income securities.

|

TOP TEN HOLDINGS

|

|

|

|

|

| Security Name |

|

% of

Net Assets |

|

| FNMA, 4.000%, 10/01/43*** |

|

|

3.6 |

% |

| United States Treasury Bond, 6.250%, 08/15/23*** |

|

|

2.9 |

|

| United States Treasury Notes, 2.000%, 11/30/22*** |

|

|

2.9 |

|

| FNMA, 4.500%, 04/01/41*** |

|

|

2.5 |

|

| FNMA, 4.500%, 05/01/39*** |

|

|

2.1 |

|

| Citigroup, Inc., 2.050%, 12/07/18 |

|

|

2.0 |

|

| California State General Obligation, School Improvements, 7.550%, 04/01/39*** |

|

|

1.9 |

|

| FHLMC Gold Pool, 5.000%, 10/01/36*** |

|

|

1.7 |

|

| FNMA, 3.500%, 02/01/46 |

|

|

1.7 |

|

| Weyerhaeuser Co., 8.500%, 01/15/25 |

|

|

1.6 |

|

|

|

|

|

|

| Top Ten as a Group |

|

|

22.9 |

% |

|

|

|

|

|

| *** |

Top Ten Holdings as of June 30, 2016. |

Credit quality ratings shown above reflect

the highest rating assigned by either Standard & Poor’s (“S&P”) or Moody’s Investors Service, Inc. (“Moody’s”). These rating agencies are independent, nationally recognized statistical rating

organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated

investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change.

Because a fund’s strategy may result in

multiple investments in particular sectors of the economy, its performance may depend on the performance of those sectors and may fluctuate more widely than investments diversified across more sectors. For additional information on these and other

risk considerations, please see the Fund’s prospectus.

Any sectors, industries, or securities discussed should not be perceived as investment

recommendations. Mention of a specific security should not be considered a recommendation to buy or solicitation to sell that security. Specific securities mentioned in this report may have been sold from the Fund’s portfolio of investments by

the time you receive this report.

7

AMG GW&K Enhanced Core Bond Fund

Schedule of Portfolio Investments

December 31, 2016

|

|

|

|

|

|

|

|

|

| |

|

Principal Amount |

|

|

Value |

|

| Corporate Bonds and Notes—51.2% |

|

|

|

|

|

|

|

|

| Financials—16.2% |

|

|

|

|

|

|

|

|

| Ally Financial, Inc., |

|

|

|

|

|

|

|

|

| 5.125%, 09/30/241 |

|

$ |

499,000 |

|

|

$ |

508,980 |

|

| 8.000%, 03/15/20 |

|

|

650,000 |

|

|

|

737,750 |

|

| American Tower Corp., 4.400%, 02/15/26 |

|

|

1,097,000 |

|

|

|

1,123,021 |

|

| Bank of America Corp., MTN, 3.875%, 08/01/25 |

|

|

1,654,000 |

|

|

|

1,684,892 |

|

| Citigroup, Inc., 2.050%, 12/07/18 |

|

|

2,301,000 |

|

|

|

2,301,822 |

|

| Crown Castle International Corp., 5.250%, 01/15/23 |

|

|

1,030,000 |

|

|

|

1,112,400 |

|

| The Goldman Sachs Group, Inc., 6.125%, 02/15/33 |

|

|

946,000 |

|

|

|

1,146,448 |

|

| Host Hotels & Resorts, L.P., Series C, 4.750%, 03/01/23 |

|

|

1,077,000 |

|

|

|

1,123,209 |

|

| International Lease Finance Corp., 8.250%, 12/15/20 |

|

|

1,124,000 |

|

|

|

1,312,270 |

|

| JPMorgan Chase & Co., Series S, 6.750%, 01/29/491,2,3 |

|

|

1,050,000 |

|

|

|

1,132,688 |

|

| Morgan Stanley, GMTN, 5.500%, 07/28/21 |

|

|

997,000 |

|

|

|

1,105,936 |

|

| National Rural Utilities Cooperative Finance Corp., MTN, 3.250%, 11/01/25 |

|

|

1,088,000 |

|

|

|

1,104,652 |

|

| Northern Trust Corp., Series D, 4.600%,

12/29/492,3 |

|

|

1,113,000 |

|

|

|

1,061,524 |

|

| Wells Fargo & Co., Series U, 5.875%,

12/29/492,3 |

|

|

1,069,000 |

|

|

|

1,123,679 |

|

| Weyerhaeuser Co., 8.500%, 01/15/25 |

|

|

1,413,000 |

|

|

|

1,829,860 |

|

| Total Financials |

|

|

|

|

|

|

18,409,131 |

|

| Industrials—35.0% |

|

|

|

|

|

|

|

|

| American Airlines Group, Inc., 6.125%, 06/01/18 |

|

|

616,000 |

|

|

|

644,490 |

|

| Automatic Data Processing, Inc., 3.375%, 09/15/25 |

|

|

1,586,000 |

|

|

|

1,628,099 |

|

| Ball Corp., 5.250%, 07/01/25 |

|

|

1,116,000 |

|

|

|

1,170,405 |

|

| Burlington Northern Santa Fe LLC, 6.150%, 05/01/37 |

|

|

1,342,000 |

|

|

|

1,717,251 |

|

| CCO Holdings LLC / CCO Holdings Capital Corp., |

|

|

|

|

|

|

|

|

| 5.125%, 02/15/23 |

|

|

1,130,000 |

|

|

|

1,163,900 |

|

| 5.750%, 01/15/24 |

|

|

25,000 |

|

|

|

26,187 |

|

| CDW LLC / CDW Finance Corp., 5.500%, 12/01/24 |

|

|

1,126,000 |

|

|

|

1,156,965 |

|

| Cedar Fair LP / Canada’s Wonderland Co. / Magnum Management Corp., 5.375%, 06/01/24 |

|

|

1,084,000 |

|

|

|

1,121,940 |

|

| Comcast Corp., 7.050%, 03/15/33 |

|

|

835,000 |

|

|

|

1,122,762 |

|

| CSX Corp., 2.600%, 11/01/26 |

|

|

1,203,000 |

|

|

|

1,128,554 |

|

| CVS Health Corp., 5.125%, 07/20/45 |

|

|

956,000 |

|

|

|

1,069,555 |

|

| General Motors Co., 6.250%, 10/02/43 |

|

|

1,039,000 |

|

|

|

1,152,501 |

|

| Georgia-Pacific LLC, 8.000%, 01/15/24 |

|

|

876,000 |

|

|

|

1,119,659 |

|

| The Goodyear Tire & Rubber Co., 5.000%, 05/31/26 |

|

|

1,135,000 |

|

|

|

1,132,662 |

|

| Hanesbrands, Inc., 4.625%, 05/15/24 (a) |

|

|

925,000 |

|

|

|

901,875 |

|

| HCA, Inc., 5.000%, 03/15/24 |

|

|

1,429,000 |

|

|

|

1,473,656 |

|

| International Paper Co., 3.000%, 02/15/27 |

|

|

1,183,000 |

|

|

|

1,118,487 |

|

| Lennar Corp., 4.750%, 11/15/22 |

|

|

1,157,000 |

|

|

|

1,191,710 |

|

| Masco Corp., Series, 4.375%, 04/01/26 |

|

|

1,143,000 |

|

|

|

1,160,145 |

|

The accompanying notes are an integral part of these financial statements.

8

AMG GW&K Enhanced Core Bond Fund

Schedule of Portfolio Investments (continued)

|

|

|

|

|

|

|

|

|

| |

|

Principal Amount |

|

|

Value |

|

| Industrials—35.0% (continued) |

|

|

|

|

|

|

|

|

| McDonald’s Corp., MTN, 3.700%, 01/30/26 |

|

$ |

1,072,000 |

|

|

$ |

1,093,445 |

|

| Microsoft Corp., 3.750%, 02/12/45 |

|

|

1,146,000 |

|

|

|

1,077,389 |

|

| Molson Coors Brewing Co., 3.000%, 07/15/26 |

|

|

1,159,000 |

|

|

|

1,097,856 |

|

| Newell Brands, Inc., 3.850%, 04/01/23 |

|

|

1,632,000 |

|

|

|

1,695,173 |

|

| Omnicom Group, Inc., 3.600%, 04/15/26 |

|

|

1,111,000 |

|

|

|

1,101,675 |

|

| Owens Corning, 4.200%, 12/15/22 |

|

|

1,100,000 |

|

|

|

1,143,831 |

|

| Reynolds Group Issuer, Inc., 5.125%, 07/15/23 (a) |

|

|

1,000,000 |

|

|

|

1,022,500 |

|

| Sirius XM Radio, Inc., 5.375%, 07/15/26 (a) |

|

|

1,000,000 |

|

|

|

980,000 |

|

| Southwest Airlines Co., 3.000%, 11/15/26 |

|

|

1,325,000 |

|

|

|

1,251,512 |

|

| Steel Dynamics, Inc., 5.000%, 12/15/26

(a)1 |

|

|

1,000,000 |

|

|

|

998,750 |

|

| T-Mobile USA, Inc., 6.500%, 01/15/26 |

|

|

1,080,000 |

|

|

|

1,170,450 |

|

| Tyson Foods, Inc., 4.875%, 08/15/34 |

|

|

1,047,000 |

|

|

|

1,070,029 |

|

| Under Armour, Inc., 3.250%, 06/15/26 |

|

|

1,155,000 |

|

|

|

1,092,997 |

|

| Verizon Communications, Inc., 4.400%, 11/01/34 |

|

|

1,105,000 |

|

|

|

1,093,958 |

|

| Vulcan Materials Co., 4.500%, 04/01/25 |

|

|

803,000 |

|

|

|

843,150 |

|

| Walgreens Boots Alliance, Inc., 3.100%, 06/01/23 |

|

|

1,680,000 |

|

|

|

1,671,304 |

|

| Total Industrials |

|

|

|

|

|

|

39,604,822 |

|

| Total Corporate Bonds and Notes (cost $58,455,468) |

|

|

|

|

|

|

58,013,953 |

|

| Municipal Bonds—6.7% |

|

|

|

|

|

|

|

|

| California State General Obligation, School Improvements, 7.550%, 04/01/39 |

|

|

1,445,000 |

|

|

|

2,139,539 |

|

| JobsOhio Beverage System, Series B, 3.985%, 01/01/29 |

|

|

1,190,000 |

|

|

|

1,260,127 |

|

| Los Angeles Unified School District, School Improvements, 5.750%, 07/01/34 |

|

|

1,100,000 |

|

|

|

1,359,622 |

|

| Los Angeles Unified School District, School Improvements, 6.758%, 07/01/34 |

|

|

345,000 |

|

|

|

463,335 |

|

| Metropolitan Transportation Authority Revenue, Transit Improvements, 6.668%, 11/15/39 |

|

|

965,000 |

|

|

|

1,280,690 |

|

| New Jersey Economic Development Authority, Pension Funding, Series A, 7.425%, 02/15/29 (National

Insured)4 |

|

|

923,000 |

|

|

|

1,100,484 |

|

| Total Municipal Bonds (cost $7,545,046) |

|

|

|

|

|

|

7,603,797 |

|

| U.S. Government and Agency Obligations—36.0% |

|

|

|

|

|

|

|

|

| Federal Home Loan Mortgage Corporation—3.4% |

|

|

|

|

|

|

|

|

| FHLMC Gold Pool, |

|

|

|

|

|

|

|

|

| 4.500%, 09/01/26 to 10/01/39 |

|

|

1,189,328 |

|

|

|

1,266,860 |

|

| 5.000%, 06/01/26 to 10/01/36 |

|

|

2,342,567 |

|

|

|

2,537,774 |

|

| Total Federal Home Loan Mortgage Corporation |

|

|

|

|

|

|

3,804,634 |

|

| Federal National Mortgage Association—26.8% |

|

|

|

|

|

|

|

|

| FNMA, |

|

|

|

|

|

|

|

|

| 3.500%, 11/01/42 to 03/01/46 |

|

|

5,456,389 |

|

|

|

5,615,437 |

|

| 4.000%, 09/01/25 to 10/01/44 |

|

|

11,265,569 |

|

|

|

11,909,323 |

|

| 4.500%, 05/01/39 to 09/01/42 |

|

|

7,136,407 |

|

|

|

7,716,337 |

|

| 5.000%, 08/01/35 |

|

|

846,347 |

|

|

|

925,085 |

|

| 5.500%, 05/01/25 to 04/01/40 |

|

|

2,089,350 |

|

|

|

2,308,696 |

|

The accompanying notes are an integral part of these financial statements.

9

AMG GW&K Enhanced Core Bond Fund

Schedule of Portfolio Investments (continued)

|

|

|

|

|

|

|

|

|

| |

|

Principal Amount |

|

|

Value |

|

| Federal National Mortgage Association—26.8% (continued) |

|

|

|

|

|

|

|

|

| FNMA, |

|

|

|

|

|

|

|

|

| 6.000%, 02/01/23 to 10/01/39 |

|

$ |

1,698,589 |

|

|

$ |

1,920,573 |

|

| Total Federal National Mortgage Association |

|

|

|

|

|

|

30,395,451 |

|

| U.S. Treasury Obligations—5.8% |

|

|

|

|

|

|

|

|

| United States Treasury Bonds, 6.250%, 08/15/23 |

|

|

2,639,000 |

|

|

|

3,300,091 |

|

| United States Treasury Notes, 2.000%, 11/30/22 |

|

|

3,316,000 |

|

|

|

3,294,174 |

|

| Total U.S. Treasury Obligations |

|

|

|

|

|

|

6,594,265 |

|

| Total U.S. Government and Agency Obligations (cost $41,190,830) |

|

|

|

|

|

|

40,794,350 |

|

| Short-Term Investments—6.3% |

|

|

|

|

|

|

|

|

| Repurchase

Agreements—1.7%5 |

|

|

|

|

|

|

|

|

| Daiwa Capital Markets America, dated 12/30/16, due 01/03/17, 0.520% total to be received

$1,000,058 (collateralized by various U.S. Government Agency Obligations, 0.000% - 6.500%, 03/02/17 - 02/01/49, totaling $1,020,000) |

|

|

1,000,000 |

|

|

|

1,000,000 |

|

| Nomura Securities International, Inc., dated 12/30/16, due 01/03/17, 0.500% total to be received

$888,968 (collateralized by various U.S. Government Agency Obligations, 0.000% - 9.500%, 01/15/17 - 08/20/66, totaling $906,697) |

|

|

888,919 |

|

|

|

888,919 |

|

| Total Repurchase Agreements |

|

|

|

|

|

|

1,888,919 |

|

| |

|

Shares |

|

|

|

|

| Other Investment

Companies—4.6%6 |

|

|

|

|

|

|

|

|

| Dreyfus Government Cash Management Fund, Institutional Class Shares, 0.45% |

|

|

5,203,078 |

|

|

|

5,203,078 |

|

| Total Short-Term Investments (cost $7,091,997) |

|

|

|

|

|

|

7,091,997 |

|

| Total Investments—100.2% (cost $114,283,341) |

|

|

|

|

|

|

113,504,097 |

|

| Other Assets, less Liabilities—(0.2)% |

|

|

|

|

|

|

(238,251 |

) |

| Net Assets—100.0% |

|

|

|

|

|

$ |

113,265,846 |

|

The accompanying notes are an integral part of these financial statements.

10

AMG GW&K Municipal Bond Fund

Portfolio Manager’s Comments (unaudited)

THE YEAR IN REVIEW

For the year ended December 31, 2016, the AMG GW&K Municipal Bond Fund (Class S)1 (the

“Fund”) returned (0.8%), underperforming its benchmark, the Bloomberg Barclays 10-Year Municipal Bond Index (the “Index”), which returned (0.1%).

MARKET

Municipal bonds suffered their worst quarter of

performance since 1994, essentially wiping out all their gains from the previous nine months. Ten-year tax-exempt yields soared 80 basis points over the quarter to finish the year at 2.31%, 100 basis points above their summer lows2. The results of the November election caught the markets by surprise and shifted sentiment dramatically. The Republican sweep brushed away long-held assumptions of sluggish growth amid continued

Washington gridlock and the market seemed to immediately price in the successful passage of steep tax cuts, heavy infrastructure spending and more business-friendly regulation. Oil prices rose to cyclical highs and stock markets set a series of new

record levels. Inflation expectations moved sharply higher and the yield on the 10-year U.S. Treasury note hit a two-year high of 2.64%2. In December, after the unemployment rate declined to

its lowest reading since 2007, the U.S. Federal Reserve finally raised rates and signaled a marginally faster pace of tightening for 2017, giving the economy an important vote of confidence. Treasuries rallied back in the final two weeks of December

to close the year at 2.45% as the equity rally ran out of steam.

Municipals followed the path of Treasuries over the quarter but exhibited greater volatility. The post-election

selloff was far more acute as retail investors reacted poorly to their first losses in years. Mutual funds, which had just seen 54 consecutive weeks of inflows, were suddenly inundated with redemption requests. During the week ended

November 16, investors withdrew $3.1 billion, the most in over three years. The outflows continued into year-end at a pace of nearly $2 billion a week3. Prior to the election, dealer

inventories were sagging under the weight of three successive months of record issuance. Instead of absorbing bonds, they were adding to the selling pressure in an effort to shed exposure to a falling market. As issuance slowed in mid-November, a

lack of price transparency emerged, forcing prices to adjust with little guidance. Municipal bonds underperformed significantly. The 10-year municipal bond/Treasury ratio, which began November at 95%, peaked at 107%, similar to the panic selling

experience back in 2013’s Taper Tantrum2. Ultimately, however, municipal bonds cheapened enough to entice crossover buyers to step in with other value-seeking investors to support the market,

and municipals rallied back hard to end the year on firmer footing. After peaking at 2.58%, its highest level since January 2014, the yield on the 10-year municipal bond fell 30 basis points in four trading days and eventually closed the year at

2.31%, nearly 40 basis points higher than where it began in January.

Heading into 2017, it appears like the municipal bond market has essentially

stabilized. Ratios

versus Treasuries begin the year near more normal levels as the demand side recognized the value offered by November’s dislocation. But uncertainty still looms in the coming year. Few

details have emerged on potential tax reform and infrastructure spending, leaving the market to speculate on possible outcomes. Long dormant fears of inflation have shown signs of resurfacing, adding to investor caution. Extreme proposals regarding

the municipal bond tax-exemption will undoubtedly get voiced from one corner or another, but we do not expect a major overhaul to the primary funding vehicle of the nation’s infrastructure for the last 100+ years. We also don’t expect a

supply boom anytime soon. The Trump Administration’s infrastructure plan appears to be based on harnessing private versus public investment, and the rise in interest rates has already slowed the biggest source of issuance this year: refunding

deals. Average expectations for issuance are in the $380 billion range, a 15% drop-off from 2016’s record-breaking year4. While the market is in a much more attractive position for investors

heading into 2017, with rates higher and relative value ratios still historically cheap, we could be in for a volatile stretch. Of course, volatility suits our style of active management and we look forward to seeking to take advantage of market

fluctuations in 2017.

The Fund underperformed the Bloomberg Barclays 10-Year Municipal Bond Index in 2016. Our overweight to shorter maturities (5-7

years) was a negative. A lower yield relative to the Index due to our higher quality was also a performance detractor. On the positive side, a duration extension trade post-election aided performance as rates subsequently declined.

11

AMG GW&K Municipal Bond Fund

Portfolio Manager’s Comments (continued)

FUND PORTFOLIO

The post-election selloff sent yields to three-year highs and pushed the market to oversold conditions with municipal bond/Treasury ratios exceeding 100%

across the curve. We reacted to this opportunity as we always do — by buying aggressively, extending duration and locking in higher rates. We focused our purchases on the 10-15-year part of the curve where we executed trades at average yields

of 3.0%, or 5.3% on a taxable-equivalent basis. The proceeds for the trade came from five-year maturities, an area of the curve in high demand because it had performed well on a relative basis. We picked up approximately 140 basis points in yield

between the buy and the sell and also positioned for better curve and credit roll down.

We never claim to know the direction of rates ahead of time, but when they move meaningfully in one direction or

the other, we shift our allocation along the curve. As rates have declined over the past few years to a historic low in July, we incrementally moved our duration in and increased our allocation to maturities shorter than the benchmark. This not only

provided us with greater protection from rising rates, but also equipped us with more flexibility to push out duration if the opportunity arose. As such, when rates shot up post-election, we knew exactly what our response should be: buy into the

selloff. And, if rates rise again, we will extend duration further. We have seen, time and again, how this approach has maximized returns over the long run.

| 1 |

Prior to October 1, 2016, the Fund’s Class S shares were known as Service Shares. |

| 3 |

Bloomberg and Lipper U.S. Fund Flows |

This commentary reflects the viewpoints of the portfolio manager, GW&K Investment

Management, LLC as of December 31, 2016, and is not intended as a forecast or guarantee of future results, and is subject to change without notice.

12

AMG GW&K Municipal Bond Fund

Portfolio Manager’s Comments (continued)

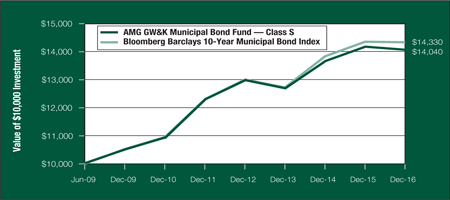

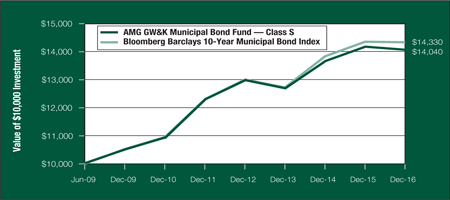

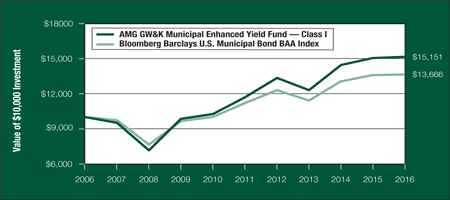

CUMULATIVE TOTAL RETURN PERFORMANCE

AMG GW&K Municipal Bond Fund’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all dividends and

distributions were reinvested. The graph compares a hypothetical $10,000 investment made in AMG GW&K Municipal Bond Fund Class S (formally Service Class) on June 30, 2009, to a $10,000 investment made in the Bloomberg Barclays 10-Year

Municipal Bond Index for the same time period. The graph and table do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of shares. The listed returns for the Fund are net of expenses and the returns

for the index exclude expenses. Total returns would have been lower had certain expenses not been reduced.

The table below shows the average annual total returns for the AMG GW&K Municipal Bond Fund and the Bloomberg Barclays

10-Year Municipal Bond Index for the same time periods ended December 31, 2016.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average Annual Total Returns1 |

|

One

Year |

|

|

Five

Years |

|

|

Since

Inception |

|

|

Inception

Date |

|

| AMG GW&K Municipal Bond Fund

2,3,4,5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Class N6 |

|

|

(1.05 |

)% |

|

|

2.42 |

% |

|

|

4.35 |

% |

|

|

6/30/09 |

|

| Class S6 |

|

|

(0.77 |

)% |

|

|

2.71 |

% |

|

|

4.63 |

% |

|

|

6/30/09 |

|

| Class I6 |

|

|

(0.70 |

)% |

|

|

2.88 |

% |

|

|

4.86 |

% |

|

|

6/30/09 |

|

| Bloomberg Barclays 10-Year Municipal Bond

Index7 |

|

|

(0.12 |

)% |

|

|

3.10 |

% |

|

|

4.91 |

% |

|

|

6/30/09 |

† |

The performance data shown represents past performance. Past performance is not a guarantee of future results. Current performance may be lower or higher

than the performance data quoted. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Investors should carefully consider the Fund’s

investment objectives, risks, charges and expenses before investing. For performance information through the most recent month end, current net asset values per share for the Fund and other information, please call (800) 835-3879 or visit our

website at www.amgfunds.com for a free prospectus. Read it carefully before investing or sending money.

Funds are distributed by AMG Distributors, Inc.,

member FINRA/SIPC.

| † |

Date reflects the inception date of the Fund, not the index.

|

| 1 |

Total return equals income yield plus share price change and assumes reinvestment of all dividends and capital gain distributions. Returns are net of fees and may

reflect offsets of Fund expenses as described in the prospectus. No adjustment has been made for taxes payable by shareholders on their reinvested dividends and capital gain distributions. Returns for periods greater than one year are annualized.

The listed returns on the Fund are net of expenses and based on the published NAV as of December 31, 2016. All returns are in U.S. dollars ($). |

| 2 |

From time to time, the Fund’s advisor has waived its fees and/or absorbed Fund expenses, which has resulted in higher returns. |

| 3 |

The Fund is subject to the risks associated with investments in debt securities, such as default risk and fluctuations in the perception of the debtor’s ability

to pay its creditors. Changing interest rates may adversely affect the value of an investment. An increase in interest rates typically causes the value of bonds and other fixed income securities to fall. |

| 4 |

Factors unique to the municipal bond market may negatively affect the value in municipal bonds. |

| 5 |

Investment income may be subject to certain state and local taxes, and depending on your tax status, the federal alternative minimum tax. Capital gains are not exempt

from federal income tax. |

| 6 |

Effective October 1, 2016, the Investor class, Service class and Institutional Class were renamed Class N, Class S and Class I, respectively. |

| 7 |

The Bloomberg Barclays 10-Year Municipal Bond Index is the 10 Year (8-12) component of the Municipal Bond index. It is a rulesbased,market-value-weighted index

engineered for the tax-exempt bond market. The Index tracks general obligation bonds, revenue bonds, insured bonds, and prerefunded bonds rated Baa3/BBB- or higher by at least two of the ratings agencies: Moody’s, S&P, Fitch. Effective

August 24, 2016, the Barclays indices were renamed Bloomberg Barclays indices. Unlike the Fund, the Bloomberg Barclays 10-Year Municipal Bond Index is unmanaged, is not available for investment and does not incur expenses. |

Not FDIC insured, nor bank guaranteed. May lose value.

13

AMG GW&K Municipal Bond Fund

Fund Snapshots (unaudited)

December 31, 2016

PORTFOLIO BREAKDOWN

|

|

|

|

|

| Sector |

|

AMG GW&K Municipal

Bond Fund* |

|

| General Obligation |

|

|

33.8 |

% |

| Transportation |

|

|

18.9 |

% |

| Utilities |

|

|

16.9 |

% |

| Public Services |

|

|

9.5 |

% |

| Education |

|

|

7.1 |

% |

| Healthcare |

|

|

6.7 |

% |

| Certificate of Participation |

|

|

1.3 |

% |

| Industrial Development |

|

|

1.3 |

% |

| Tax |

|

|

1.2 |

% |

| Other |

|

|

0.9 |

% |

| Other Assets & Liabilities |

|

|

2.4 |

% |

| * |

As a percentage of net assets. |

|

|

|

|

|

| Rating |

|

AMG GW&K Municipal

Bond Fund** |

|

| Aaa |

|

|

34.2 |

% |

| Aa |

|

|

55.2 |

% |

| A |

|

|

9.3 |

% |

| Baa |

|

|

1.3 |

% |

| ** |

As a percentage of market value of fixed-income securities.

|

TOP TEN HOLDINGS

|

|

|

|

|

| Security Name |

|

% of

Net Assets |

|

| Maryland State, General Obligation, University and College Improvements, Series B, 5.000%,

08/01/23*** |

|

|

2.5 |

% |

| Arizona Water Infrastructure Finance Authority,Water Quality Revenue, Series A, 5.000%,

10/01/26*** |

|

|

1.9 |

|

| Commonwealth of Virginia, Series B, 5.000%, 06/01/22*** |

|

|

1.6 |

|

| State of Michigan, 5.000%, 03/15/27 |

|

|

1.6 |

|

| State of Washington, Water Utility Improvements Revenue, Series C, 5.000%, 08/01/25*** |

|

|

1.5 |

|

| Illinois State Finance Authority Revenue, Clean Water Initiative Revenue, 5.000%,

07/01/27 |

|

|

1.4 |

|

| New York City General Obligation, Series I, 5.000%, 08/01/24*** |

|

|

1.4 |

|

| Texas Transportation Commission Fund, Series A, 5.000%, 04/01/27*** |

|

|

1.4 |

|

| Missouri Highway & Transportation Commission, Fuel Sales Tax Revenue, Series A, 5.000%,

05/01/22*** |

|

|

1.3 |

|

| Missouri Highway & Transportation Commission, Fuel Sales Tax Revenue, Series B, 5.000%,

05/01/23 |

|

|

1.3 |

|

|

|

|

|

|

| Top Ten as a Group |

|

|

15.9 |

% |

|

|

|

|

|

| *** |

Top Ten Holdings as of June 30, 2016. |

Credit quality ratings shown above reflect

the highest rating assigned by either Standard & Poor’s (“S&P”) or Moody’s Investors Service, Inc. (“Moody’s”). These rating agencies are independent, nationally recognized statistical rating

organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated

investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change.

Because a fund’s strategy may result in

multiple investments in particular sectors of the economy, its performance may depend on the performance of those sectors and may fluctuate more widely than investments diversified across more sectors. For additional information on these and other

risk considerations, please see the Fund’s prospectus.

Any sectors, industries, or securities discussed should not be perceived as investment

recommendations. Mention of a specific security should not be considered a recommendation to buy or solicitation to sell that security. Specific securities mentioned in this report may have been sold from the Fund’s portfolio of investments by

the time you receive this report.

14

AMG GW&K Municipal Bond Fund

Schedule of Portfolio Investments

December 31, 2016

|

|

|

|

|

|

|

|

|

| |

|

Principal Amount |

|

|

Value |

|

| Municipal Bonds—99.2% |

|

|

|

|

|

|

|

|

| Arizona—4.0% |

|

|

|

|

|

|

|

|

| Arizona School Facilities Board COPS, Series A, 5.000%, 09/01/21 |

|

$ |

5,100,000 |

|

|

$ |

5,779,218 |

|

| Arizona Transportation Board, Subordinated Highway Revenue, Series 2013 A, 5.000%,

07/01/22 |

|

|

4,355,000 |

|

|

|

5,021,184 |

|

| Arizona Water Infrastructure Finance Authority, Water Quality Revenue, Series A, 5.000%,

10/01/26 |

|

|

15,000,000 |

|

|

|

17,949,600 |

|

| City of Phoenix Civic Improvement Corp., Water Utility Improvements, Series A, 5.000%,

07/01/21 |

|

|

4,110,000 |

|

|

|

4,464,323 |

|

| Phoenix Civic Improvement Corp., Water Utility Improvements, Series A, 5.000%, 07/01/22 |

|

|

3,650,000 |

|

|

|

3,964,666 |

|

| Total Arizona |

|

|

|

|

|

|

37,178,991 |

|

| California—4.9% |

|

|

|

|

|

|

|

|

| California State Tax Exempt General Obligation, 5.000%, 03/01/24 |

|

|

5,000,000 |

|

|

|

5,911,200 |

|

| California State University, Series A, 5.000%, 11/01/29 |

|

|

4,525,000 |

|

|

|

5,278,594 |

|

| State of California, 5.000%, 09/01/22 |

|

|

6,040,000 |

|

|

|

6,986,770 |

|

| State of California, 5.000%, 09/01/25 |

|

|

10,000,000 |

|

|

|

12,029,500 |

|

| State of California, 5.000%, 09/01/29 |

|

|

5,010,000 |

|

|

|

5,964,706 |

|

| State of California, Series C, 5.000%, 09/01/26 |

|

|

7,700,000 |

|

|

|

9,196,264 |

|

| Total California |

|

|

|

|

|

|

45,367,034 |

|

| Colorado—1.5% |

|

|

|

|

|

|

|

|

| City & County of Denver CO. Airport System Revenue, Series A, 5.000%, 11/15/23 |

|

|

6,000,000 |

|

|

|

6,997,800 |

|

| Regional Transportation District County COPS, Series A, 5.000%, 06/01/24 |

|

|

6,000,000 |

|

|

|

6,810,420 |

|

| Total Colorado |

|

|

|

|

|

|

13,808,220 |

|

| Connecticut—0.7% |

|

|

|

|

|

|

|

|

| State of Connecticut Special Tax Revenue, Transit Infrastructure, 5.000%, 08/01/24 |

|

|

5,340,000 |

|

|

|

6,207,697 |

|

| District of Columbia—2.6% |

|

|

|

|

|

|

|

|

| District of Columbia Water & Sewer Authority Public Utility Revenue, Sub Lien, Series C,

5.000%, 10/01/21 |

|

|

5,100,000 |

|

|

|

5,813,082 |

|

| District of Columbia Water & Sewer Authority Public Utility Revenue, Sub Lien, Series C,

5.000%, 10/01/24 |

|

|

5,475,000 |

|

|

|

6,348,317 |

|

| District of Columbia, Series A, 5.000%, 06/01/24 |

|

|

5,000,000 |

|

|

|

5,936,800 |

|

| District of Columbia, Series A, 5.000%, 06/01/30 |

|

|

5,010,000 |

|

|

|

5,947,622 |

|

| Total District of Columbia |

|

|

|

|

|

|

24,045,821 |

|

| Florida—3.8% |

|

|

|

|

|

|

|

|

| Florida State Board of Education, Series D, 5.000%, 06/01/24 |

|

|

6,565,000 |

|

|

|

7,406,239 |

|

| Orange County Health Facilities Authority, Series A, 5.000%, 10/01/31 |

|

|

4,165,000 |

|

|

|

4,658,386 |

|

| State of Florida, Capital Outlay, Series B, 5.000%, 06/01/27 |

|

|

9,145,000 |

|

|

|

10,783,235 |

|

| State of Florida, Department of Transportation, Fuel Sales Tax Revenue, Series B, 5.000%,

07/01/26 |

|

|

5,780,000 |

|

|

|

6,574,172 |

|

| Tampa Bay Water, 5.500%, 10/01/22 (National

Insured)4 |

|

|

4,775,000 |

|

|

|

5,685,258 |

|

| Total Florida |

|

|

|

|

|

|

35,107,290 |

|

| Georgia—3.3% |

|

|

|

|

|

|

|

|

| Atlanta Water & Wastewater Revenue, 5.000%, 11/01/25 |

|

|

5,100,000 |

|

|

|

6,107,505 |

|

| Georgia State University & College Improvements, Series A, 5.000%, 02/01/26 |

|

|

5,520,000 |

|

|

|

6,639,235 |

|

| Georgia State University & College Improvements, Series A, 5.000%, 07/01/27 |

|

|

5,450,000 |

|

|

|

6,314,370 |

|

The accompanying notes are an integral part of these financial statements.

15

AMG GW&K Municipal Bond Fund

Schedule of Portfolio Investments (continued)

|

|

|

|

|

|

|

|

|

| |

|

Principal Amount |

|

|

Value |

|

| Georgia—3.3% (continued) |

|

|

|

|

|

|

|

|

| Georgia State University & College Improvements, Series A—Tranche 2, 5.000%,

07/01/24 |

|

$ |

5,000,000 |

|

|

$ |

5,829,800 |

|

| State of Georgia, Series C, 5.000%, 09/01/23 |

|

|

5,000,000 |

|

|

|

5,865,400 |

|

| Total Georgia |

|

|

|

|

|

|

30,756,310 |

|

| Idaho—0.7% |

|

|

|

|

|

|

|

|

| Idaho Housing & Finance Association, 5.000%, 07/15/23 |

|

|

5,770,000 |

|

|

|

6,671,389 |

|

| Illinois—4.8% |

|

|

|

|

|

|

|

|