Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-06431

AMG Funds II

(Exact name of registrant as specified in charter)

800 Connecticut Avenue, Norwalk, Connecticut 06854

(Address of principal executive offices) (Zip code)

AMG Funds LLC

800 Connecticut Avenue, Norwalk, Connecticut 06854

(Name and address of agent for service)

Registrant’s telephone number, including area code: (203) 299-3500

Date of fiscal year end: DECEMBER 31

Date of reporting period: JANUARY 1, 2014 – DECEMBER 31, 2014

(Annual Shareholder Report)

Table of Contents

| Item 1. | Reports to Shareholders |

Table of Contents

|

ANNUAL REPORT |

AMG Funds

December 31, 2014

AMG Chicago Equity Partners Balanced Fund

Investor Class: MBEAX | Service Class: MBESX | Institutional Class: MBEYX

AMG Managers High Yield Fund

Investor Class: MHHAX | Institutional Class: MHHYX |

AMG Managers Intermediate Duration Government Fund: MGIDX

AMG Managers Short Duration Government Fund: MGSDX

| www.amgfunds.com |

AR002-1214 |

Table of Contents

Table of Contents

AMG Funds

Annual Report—December 31, 2014

| PAGE | ||||

| 2 | ||||

| 3 | ||||

| PORTFOLIO MANAGER’S COMMENTS, FUND SNAPSHOTS, AND SCHEDULES OF PORTFOLIO INVESTMENTS |

||||

| 4 | ||||

| 15 | ||||

| 34 | ||||

| 41 | ||||

| 52 | ||||

| FINANCIAL STATEMENTS |

||||

| 59 | ||||

| Balance sheets, net asset value (NAV) per share computations and cumulative undistributed amounts |

||||

| 62 | ||||

| Detail of sources of income, expenses, and realized and unrealized gains (losses) during the year |

||||

| 63 | ||||

| Detail of changes in assets for the past two years |

||||

| 64 | ||||

| Detail of changes in assets for the past two years |

||||

| 65 | ||||

| Historical net asset values per share, distributions, total returns, income and expense ratios, turnover ratios and net assets |

||||

| 70 | ||||

| Accounting and distribution policies, details of agreements and transactions with Fund management and affiliates, and descriptions of certain investment risks |

||||

| 79 | ||||

| 80 | ||||

Nothing contained herein is to be considered an offer, sale or solicitation of an offer to buy shares of any series of the AMG Fund Family of mutual funds. Such offering is made only by Prospectus, which includes details as to offering price and other material information.

Table of Contents

|

Letter to Shareholders |

2

Table of Contents

3

Table of Contents

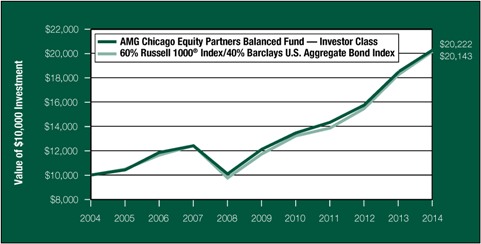

AMG Chicago Equity Partners Balanced Fund

Portfolio Manager’s Comments

| 4 |

Table of Contents

AMG Chicago Equity Partners Balanced Fund

Portfolio Manager’s Comments (continued)

5

Table of Contents

AMG Chicago Equity Partners Balanced Fund

Fund Snapshots (unaudited)

December 31, 2014

Because a fund’s strategy may result in multiple investments in particular sectors of the economy, its performance may depend on the performance of those sectors and may fluctuate more widely than investments diversified across more sectors. For additional information on these and other risk considerations, please see the Fund’s prospectus.

Any sectors, industries, or securities discussed should not be perceived as investment recommendations. Mention of a specific security should not be considered a recommendation to buy or solicitation to sell that security. Specific securities mentioned in this report may have been sold from the Fund’s portfolio of investments by the time you receive this report.

6

Table of Contents

AMG Chicago Equity Partners Balanced Fund

Schedule of Portfolio Investments

December 31, 2014

| The accompanying notes are an integral part of these financial statements.

7 |

Table of Contents

AMG Chicago Equity Partners Balanced Fund

Schedule of Portfolio Investments (continued)

The accompanying notes are an integral part of these financial statements.

8

Table of Contents

AMG Chicago Equity Partners Balanced Fund

Schedule of Portfolio Investments (continued)

The accompanying notes are an integral part of these financial statements.

9

Table of Contents

AMG Chicago Equity Partners Balanced Fund

Schedule of Portfolio Investments (continued)

The accompanying notes are an integral part of these financial statements.

10

Table of Contents

AMG Chicago Equity Partners Balanced Fund

Schedule of Portfolio Investments (continued)

The accompanying notes are an integral part of these financial statements.

11

Table of Contents

AMG Chicago Equity Partners Balanced Fund

Schedule of Portfolio Investments (continued)

The accompanying notes are an integral part of these financial statements.

12

Table of Contents

AMG Chicago Equity Partners Balanced Fund

Schedule of Portfolio Investments (continued)

The accompanying notes are an integral part of these financial statements.

13

Table of Contents

AMG Chicago Equity Partners Balanced Fund

Schedule of Portfolio Investments (continued)

The accompanying notes are an integral part of these financial statements.

14

Table of Contents

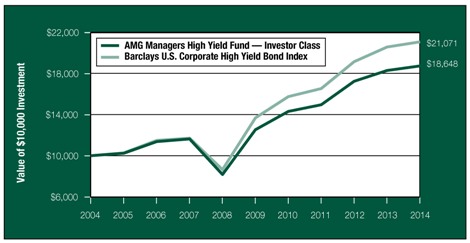

Portfolio Manager’s Comments

15

Table of Contents

AMG Managers High Yield Fund

Portfolio Manager’s Comments (continued)

16

Table of Contents

AMG Managers High Yield Fund

Fund Snapshots (unaudited)

December 31, 2014

Credit quality ratings shown above reflect the highest rating assigned by either Standard & Poor’s (“S&P”) or Moody’s Investors Service, Inc. (“Moody’s”). These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change.

Because a fund’s strategy may result in multiple investments in particular sectors of the economy, its performance may depend on the performance of those sectors and may fluctuate more widely than investments diversified across more sectors. For additional information on these and other risk considerations, please see the Fund’s prospectus.

Any sectors, industries, or securities discussed should not be perceived as investment recommendations. Mention of a specific security should not be considered a recommendation to buy or solicitation to sell that security. Specific securities mentioned in this report may have been sold from the Fund’s portfolio of investments by the time you receive this report.

17

Table of Contents

AMG Managers High Yield Fund

Schedule of Portfolio Investments

December 31, 2014

| . | Principal Amount | Value | ||||||

| Floating Rate Senior Loan Interests - 5.6%4 |

||||||||

| Academy, LTD., Initial Term Loan, |

||||||||

| 3.167%, 08/03/18 (01/23/15) |

$ | 33,841 | $ | 33,450 | ||||

| 4.500%, 08/03/18 (01/30/15) |

65,398 | 64,641 | ||||||

| Accellent, Inc., Initial Term Loan (First Lien), 4.500%, 03/12/21 (03/12/15) |

99,250 | 97,017 | ||||||

| Alliance Laundry Systems LLC, Term Loan (First Lien), 4.250%, 12/10/18 (01/05/15) |

96,404 | 95,561 | ||||||

| American Energy - Marcelus, LLC, Initial Loan (First Lien), 5.250%, 08/04/20 (02/04/15) |

65,000 | 57,525 | ||||||

| Bway Intermediate Company, Inc., Initial Term Loan, |

||||||||

| 5.500%, 08/14/20 (02/26/15) |

62,011 | 61,759 | ||||||

| 6.750%, 08/14/20 (04/08/15) |

2,664 | 2,653 | ||||||

| CD&R Millennium Holdco. 6 S.A.R.L. (Mauser Holdings), Initial Dollar Term Loan (First Lien), 4.500%, 07/31/21 (01/30/15) |

64,838 | 64,027 | ||||||

| CD&R Millennium Holdco. 6 S.A.R.L. (Mauser Holdings), Initial Term Loan (Second Lien), 8.250%, 07/31/22 (01/30/15) |

70,000 | 68,250 | ||||||

| Charter Communications Operating LLC (AKA CCO Holdings), Term G Loan, 4.250%, 08/21/21 (01/15/15) |

170,000 | 171,074 | ||||||

| Clear Channel Communications, Inc., Term Loan D, 6.919%, 01/30/19 (01/30/15) |

34,927 | 32,995 | ||||||

| Diamond Foods, Loan, 4.250%, 08/20/18 (01/30/15) |

99,499 | 98,794 | ||||||

| Evergreen Skills LUX S.A R.L., Initial Term Loan (First Lien), 5.750%, 04/28/21 (01/28/15) |

99,750 | 98,104 | ||||||

| Evergreen Skills LUX S.A R.L., Initial Term Loan (Second Lien), 9.250%, 04/28/22 (01/28/15) |

100,000 | 94,750 | ||||||

| Grifols Worldwide Operations Limited, U.S. Tranche B Term Loan, 3.169%, 02/27/21 (01/30/15) |

99,250 | 98,059 | ||||||

| The Hillman Group, Inc., Initial Term Loan, 4.500%, 06/30/21 (03/31/15) |

99,500 | 98,505 | ||||||

| Integra Telecom Holdings, Inc., Term Loan, 5.250%, 02/22/19 (01/30/15) |

127,725 | 125,011 | ||||||

| Interline Brands, 1st Lien Term Loan, 4.000%, 03/17/21 (03/17/15) |

79,599 | 76,912 | ||||||

| Neiman Marcus Group, Inc.., Other Term Loan, |

||||||||

| 4.250%, 10/25/20 (03/06/15) |

198,496 | 194,719 | ||||||

| 4.250%, 10/25/20 (01/30/15) |

501 | 492 | ||||||

| New Albertsons, Inc., Term B Loan, 4.750%, 06/27/21 (03/23/15) |

99,750 | 98,472 | ||||||

| Ortho-Clinical Diagnostics Holdings Luxembourg S.A.R.L., Initial Term Loan, 4.750%, 06/30/21 (03/27/15) |

99,499 | 98,069 | ||||||

| Steinway Musical Instruments, Inc., 1st Lien Term Loan, 4.750%, 09/19/19 (01/30/15) |

99,497 | 99,249 | ||||||

| Varsity Brands, Term Loan B, 5.000%, 12/10/21 (03/10/15)5 |

95,000 | 94,881 | ||||||

| Vertaforce, Inc., 2nd Lien Term Loan, 9.750%, 10/29/17 (03/30/15) |

45,000 | 45,262 | ||||||

| Wilton Brands LLC (FKA Wilton Brands Inc.), Tranche B Loan, |

||||||||

| 7.500%, 08/30/18 (02/27/15)5 |

73,955 | 69,641 | ||||||

| 7.500%, 08/30/18 (01/30/15)5 |

1,056 | 995 | ||||||

| Total Floating Rate Senior Loan Interests |

2,140,867 | |||||||

The accompanying notes are an integral part of these financial statements.

18

Table of Contents

AMG Managers High Yield Fund

Schedule of Portfolio Investments (continued)

| Principal Amount | Value | |||||||

| Corporate Bonds and Notes - 90.6% |

||||||||

| Financials - 5.6% |

||||||||

| Ally Financial, Inc., |

||||||||

| 2.911%, 07/18/16 (01/20/15)4 |

$ | 40,000 | $ | 39,824 | ||||

| 3.500%, 01/27/19 |

75,000 | 74,287 | ||||||

| 4.750%, 09/10/18 |

40,000 | 41,500 | ||||||

| 6.250%, 12/01/17 |

145,000 | 156,962 | ||||||

| 7.500%, 09/15/20 |

108,000 | 126,900 | ||||||

| Bank of America Corp., Series K, 8.000%, 07/29/496 |

145,000 | 156,419 | ||||||

| Chinos Intermediate Holdings A, Inc., (7.500% Cash or 8.500% PIK), 7.750%, |

45,000 | 39,937 | ||||||

| CIT Group, Inc., |

||||||||

| 3.875%, 02/19/19 |

100,000 | 100,000 | ||||||

| 5.250%, 03/15/18 |

110,000 | 114,950 | ||||||

| 5.500%, 02/15/19 (a) |

80,000 | 84,650 | ||||||

| Cogent Communications Finance, Inc., 5.625%, 04/15/21 (a) |

85,000 | 83,512 | ||||||

| Corrections Corp. of America, |

||||||||

| 4.125%, 04/01/20 |

90,000 | 87,975 | ||||||

| 4.625%, 05/01/23 |

130,000 | 125,775 | ||||||

| General Motors Financial Co., Inc., |

||||||||

| 3.250%, 05/15/18 |

15,000 | 15,056 | ||||||

| 4.250%, 05/15/23 |

30,000 | 30,672 | ||||||

| International Lease Finance Corp., |

||||||||

| 4.625%, 04/15/21 |

60,000 | 61,163 | ||||||

| 5.875%, 04/01/19 |

285,000 | 307,800 | ||||||

| 6.250%, 05/15/19 |

130,000 | 142,350 | ||||||

| Realogy Group LLC, 7.625%, 01/15/20 (a) |

65,000 | 69,875 | ||||||

| Realogy Group LLC / Realogy Co-Issuer Corp., 5.250%, 12/01/21 (a) |

20,000 | 19,525 | ||||||

| Serta Simmons Holdings LLC, 8.125%, 10/01/20 (a) |

195,000 | 207,188 | ||||||

| Vanguard Natural Resources LLC/VNR Finance Corp., 7.875%, 04/01/20 |

50,000 | 43,388 | ||||||

| Total Financials |

2,129,708 | |||||||

| Industrials - 83.8% |

||||||||

| 1011778 BC ULC / New Red Finance, Inc., 6.000%, 04/01/22 (a) |

40,000 | 41,200 | ||||||

| 21st Century Oncology, Inc., |

||||||||

| 8.875%, 01/15/17 |

60,000 | 60,750 | ||||||

| 9.875%, 04/15/17 |

55,000 | 51,425 | ||||||

| Academy, Ltd. / Academy Finance Corp., 9.250%, 08/01/19 (a) |

60,000 | 63,300 | ||||||

The accompanying notes are an integral part of these financial statements.

19

Table of Contents

AMG Managers High Yield Fund

Schedule of Portfolio Investments (continued)

| Principal Amount | Value | |||||||

| Industrials - 83.8% (continued) |

||||||||

| Access Midstream Partners, L.P. / ACMP Finance Corp., |

||||||||

| 4.875%, 05/15/23 |

$ | 40,000 | $ | 40,800 | ||||

| 5.875%, 04/15/21 |

20,000 | 20,950 | ||||||

| 6.125%, 07/15/22 |

60,000 | 64,050 | ||||||

| ACCO Brands Corp., 6.750%, 04/30/20 |

120,000 | 126,180 | ||||||

| ACI Worldwide, Inc., 6.375%, 08/15/20 (a) |

50,000 | 52,437 | ||||||

| The ADT Corp., |

||||||||

| 3.500%, 07/15/22 |

75,000 | 64,125 | ||||||

| 6.250%, 10/15/211 |

85,000 | 87,550 | ||||||

| AECOM Technology Corp., |

||||||||

| 5.750%, 10/15/22 (a) |

20,000 | 20,500 | ||||||

| 5.875%, 10/15/24 (a) |

25,000 | 25,625 | ||||||

| Aircastle, Ltd., |

||||||||

| 4.625%, 12/15/18 |

40,000 | 40,300 | ||||||

| 7.625%, 04/15/20 |

70,000 | 77,875 | ||||||

| Alcatel-Lucent USA, Inc., 8.875%, 01/01/20 (a) |

200,000 | 218,500 | ||||||

| Alere, Inc., 6.500%, 06/15/20 |

20,000 | 20,250 | ||||||

| Allegion US Holding Co., Inc., 5.750%, 10/01/21 |

30,000 | 31,875 | ||||||

| Alliant Techsystems, Inc., 5.250%, 10/01/21 (a) |

60,000 | 60,750 | ||||||

| Allison Transmission, Inc., 7.125%, 05/15/19 (a) |

125,000 | 131,406 | ||||||

| Altice, S.A., 7.750%, 05/15/22 (a) |

200,000 | 200,875 | ||||||

| AMC Entertainment, Inc., 9.750%, 12/01/20 |

120,000 | 131,100 | ||||||

| American Axle & Manufacturing, Inc., |

||||||||

| 6.250%, 03/15/21 |

25,000 | 26,375 | ||||||

| 7.750%, 11/15/19 |

60,000 | 67,500 | ||||||

| American Energy-Permian Basin LLC / AEPB Finance Corp., |

||||||||

| 7.125%, 11/01/20 (a)1 |

20,000 | 14,900 | ||||||

| 7.375%, 11/01/21 (a)1 |

40,000 | 29,600 | ||||||

| Amkor Technology, Inc., |

||||||||

| 6.375%, 10/01/22 |

110,000 | 106,700 | ||||||

| 6.625%, 06/01/21 |

55,000 | 54,725 | ||||||

| Anixter, Inc., 5.625%, 05/01/19 |

35,000 | 37,100 | ||||||

| Antero Resources Corp., 5.125%, 12/01/22 (a) |

15,000 | 14,212 | ||||||

| Antero Resources Finance Corp., |

||||||||

| 5.375%, 11/01/21 |

40,000 | 38,850 | ||||||

| 6.000%, 12/01/20 |

15,000 | 15,037 | ||||||

| Apex Tool Group LLC, 7.000%, 02/01/21 (a) |

15,000 | 12,900 | ||||||

The accompanying notes are an integral part of these financial statements.

20

Table of Contents

AMG Managers High Yield Fund

Schedule of Portfolio Investments (continued)

| Principal Amount | Value | |||||||

| Industrials - 83.8% (continued) |

||||||||

| Arch Coal, Inc., |

||||||||

| 7.000%, 06/15/19 |

$ | 35,000 | $ | 10,675 | ||||

| 7.250%, 06/15/21 |

95,000 | 28,144 | ||||||

| 8.000%, 01/15/19 (a)1 |

20,000 | 11,200 | ||||||

| Ardagh Packaging Finance PLC, 9.125%, 10/15/20 (a) |

200,000 | 214,000 | ||||||

| Armored Autogroup, Inc., 9.250%, 11/01/18 |

90,000 | 90,000 | ||||||

| Ashland, Inc., 4.750%, 08/15/22 (b) |

195,000 | 195,975 | ||||||

| Ashtead Capital, Inc., 6.500%, 07/15/22 (a) |

35,000 | 37,362 | ||||||

| Aspect Software, Inc., 10.625%, 05/15/17 |

80,000 | 76,000 | ||||||

| Associated Materials LLC / AMH New Finance, Inc., 9.125%, 11/01/17 |

40,000 | 33,200 | ||||||

| Atwood Oceanics, Inc., 6.500%, 02/01/20 |

100,000 | 92,000 | ||||||

| Audatex North America, Inc., 6.000%, 06/15/21 (a) |

165,000 | 170,775 | ||||||

| Avaya, Inc., 7.000%, 04/01/19 (a) |

115,000 | 112,700 | ||||||

| Avis Budget Car Rental LLC / Avis Budget Finance, Inc., |

||||||||

| 4.875%, 11/15/17 |

5,000 | 5,175 | ||||||

| 5.125%, 06/01/22 (a) |

10,000 | 10,125 | ||||||

| 5.500%, 04/01/23 (a) |

110,000 | 112,750 | ||||||

| B&G Foods, Inc., 4.625%, 06/01/21 |

55,000 | 53,892 | ||||||

| Belden, Inc., 5.500%, 09/01/22 (a) |

85,000 | 84,787 | ||||||

| Berry Petroleum Co., 6.375%, 09/15/22 |

40,000 | 30,600 | ||||||

| Big Heart Pet Brands, 7.625%, 02/15/19 |

186,000 | 183,210 | ||||||

| Biomet, Inc., 6.500%, 08/01/20 |

230,000 | 246,675 | ||||||

| Blackboard, Inc., 7.750%, 11/15/19 (a) |

95,000 | 95,712 | ||||||

| Blue Racer Midstream LLC / Blue Racer Finance Corp., 6.125%, 11/15/22 (a) |

40,000 | 38,700 | ||||||

| Bombardier, Inc., |

||||||||

| 6.125%, 01/15/23 (a)1 |

85,000 | 86,912 | ||||||

| 7.750%, 03/15/20 (a) |

40,000 | 43,600 | ||||||

| BreitBurn Energy Partners, L.P. / BreitBurn Finance Corp., |

||||||||

| 7.875%, 04/15/22 |

40,000 | 31,100 | ||||||

| 8.625%, 10/15/20 |

70,000 | 60,550 | ||||||

| Building Materials Corp. of America, 6.750%, 05/01/21 (a) |

65,000 | 68,900 | ||||||

| Bumble Bee Holding, Inc., 9.000%, 12/15/17 (a) |

110,000 | 115,665 | ||||||

| Caesars Entertainment Operating Co., Inc., |

||||||||

| 8.500%, 02/15/201 |

125,000 | 95,000 | ||||||

| 9.000%, 02/15/201 |

380,000 | 283,100 | ||||||

| 10.000%, 12/15/189 |

57,000 | 9,120 | ||||||

| 11.250%, 06/01/17 |

115,000 | 84,870 | ||||||

| California Resources Corp., 6.000%, 11/15/24 (a)1 |

95,000 | 80,750 | ||||||

| Case New Holland Industrial, Inc., 7.875%, 12/01/17 |

35,000 | 38,675 | ||||||

The accompanying notes are an integral part of these financial statements.

21

Table of Contents

AMG Managers High Yield Fund

Schedule of Portfolio Investments (continued)

| Principal Amount | Value | |||||||

| Industrials - 83.8% (continued) |

||||||||

| CBS Outdoor Americas Capital LLC / CBS Outdoor Americas Capital Corp., |

||||||||

| 5.250%, 02/15/22 (a)1 |

$ | 20,000 | $ | 20,200 | ||||

| 5.875%, 03/15/25 (a)1 |

20,000 | 20,200 | ||||||

| CCO Holdings LLC / CCO Holdings Capital Corp., |

||||||||

| 5.250%, 03/15/21 |

180,000 | 182,025 | ||||||

| 6.625%, 01/31/22 |

30,000 | 31,987 | ||||||

| 7.375%, 06/01/20 |

75,000 | 79,687 | ||||||

| CCOH Safari LLC, |

||||||||

| 5.500%, 12/01/22 |

50,000 | 50,875 | ||||||

| 5.750%, 12/01/24 |

65,000 | 65,894 | ||||||

| CDW LLC / CDW Finance Corp., 8.500%, 04/01/19 |

21,000 | 22,234 | ||||||

| Central Garden and Pet Co., 8.250%, 03/01/181 |

160,000 | 162,000 | ||||||

| CenturyLink, Inc., |

||||||||

| Series T, 5.800%, 03/15/22 |

145,000 | 151,162 | ||||||

| Series W, 6.750%, 12/01/231 |

130,000 | 142,837 | ||||||

| Cequel Communications Holdings I LLC / Cequel Capital Corp., 5.125%, 12/15/21 (a) |

50,000 | 48,750 | ||||||

| CEVA Group PLC, 7.000%, 03/01/21 (a)1 |

75,000 | 72,750 | ||||||

| Chesapeake Energy Corp., |

||||||||

| 4.875%, 04/15/221 |

50,000 | 48,875 | ||||||

| 6.125%, 02/15/21 |

25,000 | 26,375 | ||||||

| 6.625%, 08/15/20 |

100,000 | 106,750 | ||||||

| 6.875%, 11/15/20 |

15,000 | 16,200 | ||||||

| Chiquita Brands International, Inc. / Chiquita Brands LLC, 7.875%, 02/01/21 |

96,000 | 103,560 | ||||||

| Chrysler Group LLC / CG Co-Issuer, Inc., 8.250%, 06/15/21 |

400,000 | 445,000 | ||||||

| Cinemark USA, Inc., |

||||||||

| 4.875%, 06/01/23 |

25,000 | 23,750 | ||||||

| 7.375%, 06/15/21 |

115,000 | 123,050 | ||||||

| Claire’s Stores, Inc., |

||||||||

| 8.875%, 03/15/19 |

70,000 | 57,050 | ||||||

| 9.000%, 03/15/19 (a) |

145,000 | 143,550 | ||||||

| Clean Harbors, Inc., 5.250%, 08/01/20 |

110,000 | 111,100 | ||||||

| Clear Channel Worldwide Holdings, Inc., |

||||||||

| 6.500%, 11/15/22 |

85,000 | 86,912 | ||||||

| Series A, 7.625%, 03/15/20 |

5,000 | 5,212 | ||||||

| Series B, 6.500%, 11/15/22 |

295,000 | 305,325 | ||||||

| Series B, 7.625%, 03/15/20 |

155,000 | 163,912 | ||||||

| CNH Industrial Capital LLC, 3.625%, 04/15/18 |

50,000 | 49,500 | ||||||

| Cogent Communications Holdings, Inc., 8.375%, 02/15/18 (a) |

55,000 | 57,750 | ||||||

The accompanying notes are an integral part of these financial statements.

22

Table of Contents

AMG Managers High Yield Fund

Schedule of Portfolio Investments (continued)

| Principal Amount | Value | |||||||

| Industrials - 83.8% (continued) |

||||||||

| CommScope, Inc., |

||||||||

| 5.000%, 06/15/21 (a) |

$ | 10,000 | $ | 9,900 | ||||

| 5.500%, 06/15/24 (a) |

10,000 | 9,900 | ||||||

| Compressco Partners L.P. / Compressco Finance, Inc., 7.250%, 08/15/22 (a) |

20,000 | 17,400 | ||||||

| CONSOL Energy, Inc., 5.875%, 04/15/22 (a) |

40,000 | 37,400 | ||||||

| Crown Castle International Corp., 5.250%, 01/15/23 |

80,000 | 82,000 | ||||||

| Dana Holding Corp., |

||||||||

| 5.375%, 09/15/21 |

35,000 | 36,137 | ||||||

| 5.500%, 12/15/24 |

55,000 | 55,825 | ||||||

| 6.000%, 09/15/23 |

40,000 | 42,000 | ||||||

| 6.750%, 02/15/21 |

45,000 | 47,812 | ||||||

| DaVita HealthCare Partners, Inc., 6.625%, 11/01/20 |

38,000 | 40,019 | ||||||

| Denali Borrower LLC / Denali Finance Corp., 5.625%, 10/15/20 (a) |

100,000 | 104,300 | ||||||

| Denbury Resources, Inc., |

||||||||

| 4.625%, 07/15/23 |

55,000 | 47,987 | ||||||

| 5.500%, 05/01/22 |

95,000 | 87,400 | ||||||

| DISH DBS Corp., |

||||||||

| 5.125%, 05/01/20 |

40,000 | 40,400 | ||||||

| 5.875%, 07/15/22 |

170,000 | 174,675 | ||||||

| 5.875%, 11/15/24 (a) |

65,000 | 65,487 | ||||||

| 6.750%, 06/01/21 |

305,000 | 328,637 | ||||||

| 7.875%, 09/01/19 |

65,000 | 73,937 | ||||||

| DJO Finance LLC / DJO Finance Corp., |

||||||||

| 7.750%, 04/15/18 |

135,000 | 131,625 | ||||||

| 8.750%, 03/15/18 |

45,000 | 47,025 | ||||||

| 9.875%, 04/15/18 |

20,000 | 20,400 | ||||||

| DreamWorks Animation SKG, Inc., 6.875%, 08/15/20 (a) |

35,000 | 36,050 | ||||||

| Eagle Midco, Inc., 9.000%, 06/15/18 (a) |

30,000 | 30,825 | ||||||

| Entegris, Inc., 6.000%, 04/01/22 (a) |

25,000 | 25,437 | ||||||

| EP Energy LLC / Everest Acquisition Finance, Inc., |

||||||||

| 7.750%, 09/01/22 |

85,000 | 79,900 | ||||||

| 9.375%, 05/01/201 |

200,000 | 203,000 | ||||||

| Epicor Software Corp., 8.625%, 05/01/19 |

100,000 | 105,500 | ||||||

| Equinix, Inc., |

||||||||

| 5.375%, 01/01/22 |

25,000 | 25,360 | ||||||

| 5.750%, 01/01/25 |

20,000 | 20,275 | ||||||

| EV Energy Partners, L.P. / EV Energy Finance Corp., 8.000%, 04/15/19 |

125,000 | 106,875 | ||||||

| FGI Operating Co. LLC / FGI Finance, Inc., 7.875%, 05/01/20 |

110,000 | 99,550 | ||||||

The accompanying notes are an integral part of these financial statements.

23

Table of Contents

AMG Managers High Yield Fund

Schedule of Portfolio Investments (continued)

| Principal Amount | Value | |||||||

| Industrials - 83.8% (continued) |

||||||||

| First Data Corp., |

||||||||

| 6.750%, 11/01/20 (a) |

$ | 37,000 | $ | 39,590 | ||||

| 7.375%, 06/15/19 (a) |

85,000 | 89,675 | ||||||

| 8.250%, 01/15/21 (a) |

180,000 | 193,500 | ||||||

| 8.875%, 08/15/20 (a) |

165,000 | 177,375 | ||||||

| 12.625%, 01/15/21 |

155,000 | 184,450 | ||||||

| First Data Corp., (8.750% Cash or 10.000% PIK), 8.750%, 01/15/22 (a)7 |

290,000 | 313,200 | ||||||

| FMG Resources August 2006 Pty, Ltd., |

||||||||

| 6.875%, 02/01/18 (a)1 |

20,000 | 18,200 | ||||||

| 8.250%, 11/01/19 (a)1 |

155,000 | 141,631 | ||||||

| Frontier Communications Corp., |

||||||||

| 6.250%, 09/15/211 |

20,000 | 20,150 | ||||||

| 6.875%, 01/15/25 |

35,000 | 35,087 | ||||||

| 7.125%, 01/15/23 |

10,000 | 10,225 | ||||||

| Gannett Co., Inc., |

||||||||

| 4.875%, 09/15/21 (a) |

15,000 | 14,925 | ||||||

| 5.500%, 09/15/24 (a) |

15,000 | 15,075 | ||||||

| Gardner Denver, Inc., 6.875%, 08/15/21 (a)1 |

30,000 | 28,950 | ||||||

| GCI, Inc., |

||||||||

| 6.750%, 06/01/21 |

90,000 | 88,706 | ||||||

| 8.625%, 11/15/19 |

95,000 | 99,987 | ||||||

| GenCorp, Inc., 7.125%, 03/15/21 |

125,000 | 131,537 | ||||||

| General Cable Corp., 5.750%, 10/01/22 (b) |

90,000 | 66,150 | ||||||

| General Motors Co., 4.875%, 10/02/23 |

185,000 | 198,875 | ||||||

| The Geo Group, Inc., |

||||||||

| 5.875%, 01/15/22 |

60,000 | 61,800 | ||||||

| 6.625%, 02/15/21 |

100,000 | 105,250 | ||||||

| The Goodyear Tire & Rubber Co., |

||||||||

| 6.500%, 03/01/21 |

40,000 | 42,600 | ||||||

| 8.250%, 08/15/20 |

80,000 | 85,200 | ||||||

| 8.750%, 08/15/20 |

65,000 | 75,562 | ||||||

| Great Lakes Dredge & Dock Corp., 7.375%, 02/01/19 |

120,000 | 123,000 | ||||||

| Gymboree Corp., 9.125%, 12/01/18 |

80,000 | 31,200 | ||||||

| H&E Equipment Services, Inc., 7.000%, 09/01/22 |

40,000 | 41,350 | ||||||

| Halcon Resources Corp., |

||||||||

| 8.875%, 05/15/211 |

160,000 | 121,200 | ||||||

| 9.250%, 02/15/22 |

25,000 | 18,562 | ||||||

| 9.750%, 07/15/20 |

15,000 | 11,325 | ||||||

| Hanesbrands, Inc., 6.375%, 12/15/20 |

50,000 | 53,250 | ||||||

The accompanying notes are an integral part of these financial statements.

24

Table of Contents

AMG Managers High Yield Fund

Schedule of Portfolio Investments (continued)

| Principal Amount | Value | |||||||

| Industrials - 83.8% (continued) |

||||||||

| HCA Holdings, Inc., |

||||||||

| 6.250%, 02/15/21 |

$ | 30,000 | $ | 32,025 | ||||

| 7.750%, 05/15/21 |

320,000 | 341,600 | ||||||

| HCA, Inc., |

||||||||

| 5.250%, 04/15/25 |

65,000 | 68,006 | ||||||

| 6.500%, 02/15/20 |

25,000 | 28,075 | ||||||

| 7.500%, 02/15/22 |

535,000 | 612,575 | ||||||

| HD Supply, Inc., |

||||||||

| 5.250%, 12/15/21 (a) |

70,000 | 71,400 | ||||||

| 11.000%, 04/15/20 |

45,000 | 51,525 | ||||||

| 11.500%, 07/15/20 |

70,000 | 80,500 | ||||||

| HealthSouth Corp., |

||||||||

| 5.750%, 11/01/24 |

25,000 | 26,125 | ||||||

| 7.750%, 09/15/22 |

42,000 | 44,730 | ||||||

| Hearthside Group Holdings LLC / Hearthside Finance Co., 6.500%, 05/01/22 (a) |

5,000 | 4,900 | ||||||

| The Hertz Corp., |

||||||||

| 5.875%, 10/15/20 |

80,000 | 81,000 | ||||||

| 6.250%, 10/15/22 |

75,000 | 76,125 | ||||||

| 7.375%, 01/15/211 |

40,000 | 42,200 | ||||||

| 7.500%, 10/15/18 |

55,000 | 57,200 | ||||||

| Hexion US Finance Corp., 6.625%, 04/15/20 |

215,000 | 211,775 | ||||||

| Hexion US Finance Corp. / Hexion Nova Scotia Finance ULC, |

||||||||

| 8.875%, 02/01/18 |

80,000 | 71,400 | ||||||

| 9.000%, 11/15/20 |

40,000 | 29,000 | ||||||

| Hiland Partners, L.P. / Hiland Partners Finance Corp., 7.250%, 10/01/20 (a) |

55,000 | 52,525 | ||||||

| The Hillman Group, Inc., 6.375%, 07/15/22 (a) |

50,000 | 48,250 | ||||||

| Hilton Worldwide Finance LLC / Hilton Worldwide Finance Corp., 5.625%, 10/15/21 |

40,000 | 42,000 | ||||||

| HJ Heinz Co., 4.250%, 10/15/20 |

60,000 | 60,750 | ||||||

| Hologic, Inc., 6.250%, 08/01/20 |

115,000 | 120,175 | ||||||

| Hughes Satellite Systems Corp., 6.500%, 06/15/19 |

60,000 | 64,650 | ||||||

| Huntington Ingalls Industries, Inc., 5.000%, 12/15/21 (a) |

35,000 | 35,656 | ||||||

| Huntsman International LLC, |

||||||||

| 4.875%, 11/15/20 |

165,000 | 164,588 | ||||||

| 8.625%, 03/15/21 |

25,000 | 26,938 | ||||||

| iHeartCommunications, Inc., 9.000%, 03/01/21 |

115,000 | 113,131 | ||||||

| IMS Health, Inc., 6.000%, 11/01/20 (a) |

75,000 | 77,437 | ||||||

| Ineos Finance PLC, |

||||||||

| 7.500%, 05/01/20 (a) |

70,000 | 73,762 | ||||||

| 8.375%, 02/15/19 (a) |

200,000 | 213,250 | ||||||

| Infinity Acquisition LLC / Infinity Acquisition Finance Corp., 7.250%, 08/01/22 (a) |

40,000 | 36,400 | ||||||

The accompanying notes are an integral part of these financial statements.

25

Table of Contents

AMG Managers High Yield Fund

Schedule of Portfolio Investments (continued)

| Principal Amount | Value | |||||||

| Industrials - 83.8% (continued) |

||||||||

| Infor Software Parent LLC / Infor Software Parent, Inc., (7.125% Cash or 7.875% PIK), 7.125%, 05/01/21 (a)1,7 |

$ | 115,000 | $ | 113,275 | ||||

| Infor US, Inc., |

||||||||

| 9.375%, 04/01/19 |

85,000 | 91,269 | ||||||

| 11.500%, 07/15/18 |

65,000 | 71,175 | ||||||

| Intelsat Jackson Holdings SA, |

||||||||

| 5.500%, 08/01/23 |

45,000 | 44,894 | ||||||

| 6.625%, 12/15/221 |

55,000 | 56,788 | ||||||

| 7.250%, 10/15/20 |

355,000 | 375,856 | ||||||

| 7.500%, 04/01/21 |

120,000 | 128,850 | ||||||

| Intelsat Luxembourg, S.A., 7.750%, 06/01/21 |

110,000 | 110,688 | ||||||

| Interline Brands, Inc., (10.000% Cash or 10.750% PIK), 10.000%, 11/15/187 |

15,000 | 15,750 | ||||||

| inVentiv Health, Inc., |

||||||||

| 9.000%, 01/15/18 (a) |

75,000 | 76,875 | ||||||

| 11.000%, 08/15/18 (a), (b) |

35,000 | 30,593 | ||||||

| inVentiv Health, Inc., (10.000% Cash or 12.000% PIK), 10.000%, 08/15/18 (a)7 |

45,000 | 42,525 | ||||||

| Iron Mountain, Inc., 6.000%, 08/15/23 |

70,000 | 73,150 | ||||||

| Isle of Capri Casinos, Inc., 5.875%, 03/15/21 |

45,000 | 45,900 | ||||||

| J.C. Penney Corp., Inc., |

||||||||

| 5.750%, 02/15/181 |

35,000 | 30,625 | ||||||

| 6.375%, 10/15/36 |

60,000 | 39,450 | ||||||

| Jack Cooper Holdings Corp., 9.250%, 06/01/20 (a) |

80,000 | 83,600 | ||||||

| Jarden Corp., 6.125%, 11/15/22 |

90,000 | 94,275 | ||||||

| JCH Parent, Inc., (10.500% Cash or 11.250% PIK), 10.500%, 03/15/19 (a)7 |

30,000 | 27,900 | ||||||

| Kindred Escrow Corp. II, |

||||||||

| 8.000%, 01/15/20 (a) |

70,000 | 74,725 | ||||||

| 8.750%, 01/15/23 (a)1 |

15,000 | 16,219 | ||||||

| Kinetic Concepts, Inc. / KCI USA, Inc., 10.500%, 11/01/18 (b) |

150,000 | 163,500 | ||||||

| KLX, Inc., 5.875%, 12/01/22 (a) |

70,000 | 70,875 | ||||||

| Kodiak Oil & Gas Corp., |

||||||||

| 5.500%, 01/15/21 |

10,000 | 10,075 | ||||||

| 5.500%, 02/01/22 |

10,000 | 10,075 | ||||||

| 8.125%, 12/01/191 |

90,000 | 92,025 | ||||||

| Kratos Defense & Security Solutions, Inc., 7.000%, 05/15/19 |

90,000 | 76,950 | ||||||

| L Brands, Inc., 6.625%, 04/01/21 |

120,000 | 135,600 | ||||||

| Laredo Petroleum, Inc., |

||||||||

| 5.625%, 01/15/22 |

35,000 | 30,800 | ||||||

| 7.375%, 05/01/22 |

40,000 | 37,600 | ||||||

The accompanying notes are an integral part of these financial statements.

26

Table of Contents

AMG Managers High Yield Fund

Schedule of Portfolio Investments (continued)

| Principal Amount | Value | |||||||

| Industrials - 83.8% (continued) |

||||||||

| Legacy Reserves L.P. / Legacy Reserves Finance Corp., |

||||||||

| 6.625%, 12/01/21 (a)1 |

$ | 40,000 | $ | 33,000 | ||||

| 8.000%, 12/01/20 |

70,000 | 58,450 | ||||||

| Level 3 Communications, Inc., 5.750%, 12/01/22 (a) |

60,000 | 60,675 | ||||||

| Level 3 Financing, Inc., |

||||||||

| 8.125%, 07/01/19 |

80,000 | 85,400 | ||||||

| 8.625%, 07/15/20 |

65,000 | 70,444 | ||||||

| Lightstream Resources, Ltd., 8.625%, 02/01/20 (a) |

30,000 | 21,150 | ||||||

| Linn Energy LLC / Linn Energy Finance Corp., |

||||||||

| 6.250%, 11/01/19 (b) |

50,000 | 42,750 | ||||||

| 7.750%, 02/01/21 |

145,000 | 122,888 | ||||||

| Linn Energy LLC/Linn Energy Finance Corp., 8.625%, 04/15/20 |

10,000 | 8,750 | ||||||

| LSB Industries, Inc., 7.750%, 08/01/19 |

85,000 | 88,825 | ||||||

| Magnachip Semiconductor Corp., 6.625%, 07/15/21 |

105,000 | 95,813 | ||||||

| The Manitowoc Co., Inc., 8.500%, 11/01/20 |

100,000 | 108,500 | ||||||

| Marina District Finance Co., Inc., 9.875%, 08/15/18 |

125,000 | 131,406 | ||||||

| MarkWest Energy Partners, L.P. / MarkWest Energy Finance Corp., |

||||||||

| 5.500%, 02/15/23 |

85,000 | 86,488 | ||||||

| 6.500%, 08/15/211 |

25,000 | 25,875 | ||||||

| McGraw-Hill Global Education Holdings LLC / McGraw-Hill Global Education Finance, 9.750%, 04/01/21 (b) |

55,000 | 61,050 | ||||||

| MEG Energy Corp., |

||||||||

| 6.375%, 01/30/23 (a) |

80,000 | 71,800 | ||||||

| 6.500%, 03/15/21 (a) |

40,000 | 36,700 | ||||||

| 7.000%, 03/31/24 (a) |

90,000 | 81,900 | ||||||

| Memorial Production Partners, L.P. / Memorial Production Finance Corp., |

||||||||

| 6.875%, 08/01/22 (a) |

50,000 | 38,250 | ||||||

| 7.625%, 05/01/21 |

80,000 | 64,400 | ||||||

| MGM Resorts International, |

||||||||

| 5.250%, 03/31/201 |

280,000 | 278,600 | ||||||

| 6.000%, 03/15/23 |

100,000 | 101,000 | ||||||

| 6.750%, 10/01/20 |

125,000 | 131,563 | ||||||

| 7.750%, 03/15/22 |

90,000 | 99,900 | ||||||

| 8.625%, 02/01/19 |

5,000 | 5,694 | ||||||

| Michaels FinCo Holdings LLC / Michaels FinCo, Inc., (7.500% Cash or 8.250% PIK), 7.500%, 08/01/18 (a)7 |

6,000 | 6,135 | ||||||

| Michaels Stores, Inc., 5.875%, 12/15/20 (a) |

25,000 | 25,375 | ||||||

| Micron Technology, Inc., 5.875%, 02/15/22 (a) |

60,000 | 63,150 | ||||||

| Midstates Petroleum Co., Inc. / Midstates Petroleum Co. LLC, |

||||||||

| 9.250%, 06/01/21 |

40,000 | 20,400 | ||||||

| 10.750%, 10/01/20 |

45,000 | 24,300 | ||||||

| Neiman Marcus Group, Ltd., Inc., 8.000%, 10/15/21 (a) |

40,000 | 42,500 | ||||||

The accompanying notes are an integral part of these financial statements.

27

Table of Contents

AMG Managers High Yield Fund

Schedule of Portfolio Investments (continued)

| Principal Amount | Value | |||||||

| Industrials - 83.8% (continued) |

||||||||

| Neiman Marcus Group, Ltd., Inc. (8.750% Cash or 9.500% PIK), 8.750%, 10/15/21 (a)7 |

$ | 65,000 | $ | 69,225 | ||||

| Nexeo Solutions LLC / Nexeo Solutions Finance Corp., 8.375%, 03/01/18 |

75,000 | 73,125 | ||||||

| Nexstar Broadcasting, Inc., 6.875%, 11/15/20 |

120,000 | 125,100 | ||||||

| The Nielsen Co. Luxembourg SARL, 5.500%, 10/01/21 (a) |

50,000 | 51,250 | ||||||

| Nielsen Finance LLC / Nielsen Finance Co., 5.000%, 04/15/22 (a) |

70,000 | 70,700 | ||||||

| Noranda Aluminum Acquisition Corp., 11.000%, 06/01/19 |

35,000 | 34,563 | ||||||

| Novelis, Inc., 8.375%, 12/15/17 |

65,000 | 67,519 | ||||||

| Numericable Group, S.A., 6.000%, 05/15/22 (a) |

200,000 | 201,350 | ||||||

| NXP, B.V. / NXP Funding LLC, 5.750%, 02/15/21 (a) |

200,000 | 211,000 | ||||||

| Oasis Petroleum, Inc., 6.875%, 03/15/221 |

70,000 | 64,050 | ||||||

| Omnicare, Inc., |

||||||||

| 4.750%, 12/01/22 |

10,000 | 10,175 | ||||||

| 5.000%, 12/01/24 |

5,000 | 5,150 | ||||||

| Oshkosh Corp., |

||||||||

| 5.375%, 03/01/221 |

5,000 | 5,125 | ||||||

| 8.500%, 03/01/20 |

35,000 | 36,838 | ||||||

| Packaging Dynamics Corp., 8.750%, 02/01/16 (a) |

42,000 | 42,210 | ||||||

| PAETEC Holding Corp., 9.875%, 12/01/18 |

85,000 | 89,548 | ||||||

| Party City Holdings, Inc., 8.875%, 08/01/20 |

130,000 | 139,425 | ||||||

| PC Nextco Holdings LLC / PC Nextco Finance, Inc., 8.750%, 08/15/19 |

30,000 | 30,300 | ||||||

| Peabody Energy Corp., |

||||||||

| 6.250%, 11/15/211 |

85,000 | 72,994 | ||||||

| 6.500%, 09/15/201 |

15,000 | 13,088 | ||||||

| Petco Animal Supplies, Inc., 9.250%, 12/01/18 (a) |

110,000 | 115,500 | ||||||

| Polymer Group, Inc., 7.750%, 02/01/19 |

103,000 | 107,249 | ||||||

| PolyOne Corp., 7.375%, 09/15/20 |

70,000 | 74,725 | ||||||

| Post Holdings, Inc., |

||||||||

| 6.000%, 12/15/22 (a) |

25,000 | 23,531 | ||||||

| 6.750%, 12/01/21 (a) |

50,000 | 48,625 | ||||||

| 7.375%, 02/15/22 |

150,000 | 150,375 | ||||||

| Quebecor Media, Inc., 5.750%, 01/15/23 |

180,000 | 184,950 | ||||||

| Quebecor World, Escrow, 6.500%, 08/01/279 |

165,000 | 722 | ||||||

| Qwest Capital Funding, Inc., 7.750%, 02/15/31 |

65,000 | 66,300 | ||||||

| Radio Systems Corp., 8.375%, 11/01/19 (a) |

85,000 | 91,375 | ||||||

| Rain CII Carbon LLC / CII Carbon Corp., 8.000%, 12/01/18 (a) |

30,000 | 30,450 | ||||||

| Regal Entertainment Group, 5.750%, 03/15/22 |

40,000 | 38,400 | ||||||

The accompanying notes are an integral part of these financial statements.

28

Table of Contents

AMG Managers High Yield Fund

Schedule of Portfolio Investments (continued)

| Principal Amount | Value | |||||||

| Industrials - 83.8% (continued) |

||||||||

| Regency Energy Partners, L.P. / Regency Energy Finance Corp., |

||||||||

| 5.000%, 10/01/22 |

$ | 35,000 | $ | 33,250 | ||||

| 5.500%, 04/15/23 |

45,000 | 43,650 | ||||||

| 5.750%, 09/01/20 |

5,000 | 5,038 | ||||||

| 5.875%, 03/01/22 |

20,000 | 20,050 | ||||||

| Reichhold Holdings International B.V., 12.000%, 02/27/158 |

75,000 | 72,750 | ||||||

| Reichhold Industries, Inc., (9.000% Cash or 11.000% PIK), 9.000%, 05/08/17 (a)8,9 |

151,046 | 86,851 | ||||||

| Reichhold, Inc., 12.000%, 02/27/158 |

35,000 | 33,950 | ||||||

| Rentech Nitrogen Partners, L.P. / Rentech Nitrogen Finance Corp., 6.500%, 04/15/21 (a) |

60,000 | 53,700 | ||||||

| Reynolds Group Issuer, Inc. / Reynolds Group Issuer LLC / Reynolds Group Issuer Lu, |

||||||||

| 5.750%, 10/15/20 |

145,000 | 149,350 | ||||||

| 9.000%, 04/15/19 |

230,000 | 239,200 | ||||||

| 9.875%, 08/15/19 |

325,000 | 346,125 | ||||||

| RHP Hotel Properties, L.P. / RHP Finance Corp., 5.000%, 04/15/21 |

135,000 | 135,000 | ||||||

| Rite Aid Corp., 9.250%, 03/15/20 |

35,000 | 38,281 | ||||||

| RKI Exploration & Production LLC / RKI Finance Corp., 8.500%, 08/01/21 (a) |

55,000 | 44,688 | ||||||

| RSI Home Products, Inc., 6.875%, 03/01/18 (a) |

65,000 | 68,250 | ||||||

| RSP Permian, Inc., 6.625%, 10/01/22 (a) |

15,000 | 14,025 | ||||||

| Sabine Pass Liquefaction LLC, |

||||||||

| 5.750%, 05/15/24 |

100,000 | 98,625 | ||||||

| 6.250%, 03/15/22 |

100,000 | 101,875 | ||||||

| Sabre GLBL, Inc., 8.500%, 05/15/19 (a) |

114,000 | 122,408 | ||||||

| Sally Holdings LLC / Sally Capital, Inc., |

||||||||

| 5.500%, 11/01/23 |

20,000 | 20,950 | ||||||

| 5.750%, 06/01/22 |

35,000 | 36,838 | ||||||

| 6.875%, 11/15/19 |

75,000 | 80,063 | ||||||

| Sanchez Energy Corp., 6.125%, 01/15/23 (a) |

45,000 | 37,913 | ||||||

| SandRidge Energy, Inc., |

||||||||

| 7.500%, 03/15/21 |

70,000 | 45,150 | ||||||

| 8.125%, 10/15/22 |

95,000 | 60,325 | ||||||

| SBA Telecommunications, Inc., 5.750%, 07/15/20 |

45,000 | 46,026 | ||||||

| The Scotts Miracle-Gro Co., 6.625%, 12/15/20 |

60,000 | 63,450 | ||||||

| Sealed Air Corp., |

||||||||

| 6.500%, 12/01/20 (a) |

30,000 | 33,000 | ||||||

| 8.375%, 09/15/21 (a)1 |

95,000 | 106,638 | ||||||

| Sensata Technologies BV, |

||||||||

| 5.625%, 11/01/24 (a) |

15,000 | 15,591 | ||||||

| 6.500%, 05/15/19 (a) |

25,000 | 26,063 | ||||||

The accompanying notes are an integral part of these financial statements.

29

Table of Contents

AMG Managers High Yield Fund

Schedule of Portfolio Investments (continued)

| Principal Amount | Value | |||||||

| Industrials - 83.8% (continued) |

||||||||

| Service Corp. International, |

||||||||

| 7.000%, 06/15/17 |

$ | 60,000 | $ | 64,800 | ||||

| 7.500%, 04/01/27 |

115,000 | 129,950 | ||||||

| Service Corp. International/US, 5.375%, 05/15/24 |

40,000 | 41,000 | ||||||

| The ServiceMaster Co., |

||||||||

| 7.000%, 08/15/20 |

43,000 | 44,720 | ||||||

| 8.000%, 02/15/20 |

20,000 | 21,150 | ||||||

| Sinclair Television Group, Inc., |

||||||||

| 5.375%, 04/01/21 |

85,000 | 84,788 | ||||||

| 6.125%, 10/01/22 |

40,000 | 40,900 | ||||||

| Sirius XM Radio, Inc., |

||||||||

| 4.250%, 05/15/20 (a) |

75,000 | 74,063 | ||||||

| 4.625%, 05/15/23 (a) |

10,000 | 9,400 | ||||||

| 5.750%, 08/01/21 (a)1 |

95,000 | 97,613 | ||||||

| 6.000%, 07/15/24 (a) |

30,000 | 30,825 | ||||||

| SM Energy Co., 6.125%, 11/15/22 (a) |

20,000 | 18,850 | ||||||

| Spectrum Brands, Inc., |

||||||||

| 6.375%, 11/15/20 |

35,000 | 36,663 | ||||||

| 6.625%, 11/15/22 |

25,000 | 26,563 | ||||||

| 6.750%, 03/15/20 |

110,000 | 115,225 | ||||||

| Sprint Capital Corp., |

||||||||

| 6.875%, 11/15/28 |

10,000 | 8,850 | ||||||

| 8.750%, 03/15/32 |

395,000 | 384,138 | ||||||

| Sprint Communications, Inc., 9.000%, 11/15/18 (a) |

100,000 | 113,990 | ||||||

| Sprint Corp., |

||||||||

| 7.250%, 09/15/21 |

80,000 | 79,700 | ||||||

| 7.875%, 09/15/23 |

455,000 | 451,451 | ||||||

| SunGard Data Systems, Inc., |

||||||||

| 6.625%, 11/01/19 |

55,000 | 55,825 | ||||||

| 7.375%, 11/15/18 |

37,000 | 38,526 | ||||||

| 7.625%, 11/15/20 |

30,000 | 31,950 | ||||||

| Targa Resources Partners LP / Targa Resources Partners Finance Corp., 4.125%, |

20,000 | 19,350 | ||||||

| Tekni-Plex, Inc., 9.750%, 06/01/19 (a) |

10,000 | 10,900 | ||||||

| Telecom Italia S.P.A., 5.303%, 05/30/24 (a) |

200,000 | 203,250 | ||||||

| Tempur Sealy International, Inc., 6.875%, 12/15/20 |

45,000 | 48,038 | ||||||

| Tenet Healthcare Corp., |

||||||||

| 4.750%, 06/01/20 |

100,000 | 102,000 | ||||||

| 6.000%, 10/01/20 |

150,000 | 161,450 | ||||||

| 8.000%, 08/01/20 |

205,000 | 216,788 | ||||||

| 8.125%, 04/01/22 |

155,000 | 173,600 | ||||||

The accompanying notes are an integral part of these financial statements.

30

Table of Contents

AMG Managers High Yield Fund

Schedule of Portfolio Investments (continued)

| Principal Amount | Value | |||||||

| Industrials - 83.8% (continued) |

||||||||

| Terex Corp., |

||||||||

| 6.000%, 05/15/21 |

$ | 120,000 | $ | 123,000 | ||||

| 6.500%, 04/01/20 |

60,000 | 62,400 | ||||||

| Tesoro Logistics L.P. / Tesoro Logistics Finance Corp., |

||||||||

| 5.500%, 10/15/19 (a) |

20,000 | 19,900 | ||||||

| 5.875%, 10/01/20 |

93,000 | 93,698 | ||||||

| 6.125%, 10/15/21 |

45,000 | 45,113 | ||||||

| 6.250%, 10/15/22 (a) |

20,000 | 20,050 | ||||||

| Time, Inc., 5.750%, 04/15/22 (a) |

80,000 | 77,600 | ||||||

| T-Mobile USA, Inc., |

||||||||

| 6.633%, 04/28/21 |

45,000 | 46,350 | ||||||

| 6.731%, 04/28/22 |

210,000 | 217,088 | ||||||

| Trinidad Drilling, Ltd., 7.875%, 01/15/19 (a) |

90,000 | 84,150 | ||||||

| Trinseo Materials Operating SCA / Trinseo Materials Finance, Inc., 8.750%, 02/01/19 |

92,000 | 93,725 | ||||||

| Triumph Group, Inc., 4.875%, 04/01/21 |

80,000 | 79,400 | ||||||

| UCI International, Inc., 8.625%, 02/15/19 |

110,000 | 105,600 | ||||||

| Ultra Petroleum Corp., 6.125%, 10/01/24 (a)1 |

50,000 | 43,250 | ||||||

| United Rentals North America, Inc., |

||||||||

| 7.375%, 05/15/20 |

50,000 | 54,250 | ||||||

| 7.625%, 04/15/22 |

100,000 | 110,450 | ||||||

| 8.250%, 02/01/21 |

195,000 | 213,525 | ||||||

| United States Cellular Corp., 6.700%, 12/15/33 |

40,000 | 39,489 | ||||||

| United Surgical Partners International, Inc., 9.000%, 04/01/20 |

100,000 | 107,875 | ||||||

| UPCB Finance III, Ltd., 6.625%, 07/01/20 (a) |

150,000 | 157,875 | ||||||

| UPCB Finance VI, Ltd., 6.875%, 01/15/22 (a) |

150,000 | 163,875 | ||||||

| Vail Resorts, Inc., 6.500%, 05/01/19 |

80,000 | 82,950 | ||||||

| Valeant Pharmaceuticals International, |

||||||||

| 6.750%, 08/15/21 (a) |

100,000 | 104,875 | ||||||

| 7.000%, 10/01/20 (a) |

55,000 | 58,300 | ||||||

| 7.250%, 07/15/22 (a) |

180,000 | 192,600 | ||||||

| 7.500%, 07/15/21 (a) |

280,000 | 303,450 | ||||||

| Videotron, Ltd., 5.000%, 07/15/22 |

20,000 | 20,450 | ||||||

| Virgin Media Secured Finance PLC, 5.375%, 04/15/21 (a) |

200,000 | 207,500 | ||||||

| Vulcan Materials Co., 7.500%, 06/15/21 |

65,000 | 76,050 | ||||||

| Watco Cos. LLC / Watco Finance Corp., 6.375%, 04/01/23 (a) |

55,000 | 54,725 | ||||||

| Whiting Petroleum Corp., 5.750%, 03/15/21 |

210,000 | 195,300 | ||||||

The accompanying notes are an integral part of these financial statements.

31

Table of Contents

AMG Managers High Yield Fund

Schedule of Portfolio Investments (continued)

| Principal Amount | Value | |||||||

| Industrials - 83.8% (continued) |

||||||||

| Windstream Corp., |

||||||||

| 7.500%, 04/01/23 |

$ | 130,000 | $ | 130,000 | ||||

| 7.750%, 10/01/21 |

120,000 | 123,000 | ||||||

| WMG Acquisition Corp., |

||||||||

| 5.625%, 04/15/22 (a) |

20,000 | 19,450 | ||||||

| 6.000%, 01/15/21 (a) |

56,000 | 56,280 | ||||||

| WPX Energy, Inc., 5.250%, 09/15/24 |

25,000 | 23,375 | ||||||

| WR Grace & Co., |

||||||||

| 5.125%, 10/01/21 (a) |

20,000 | 20,550 | ||||||

| 5.625%, 10/01/24 (a) |

10,000 | 10,462 | ||||||

| Zayo Group LLC / Zayo Capital, Inc., 8.125%, 01/01/20 |

50,000 | 53,187 | ||||||

| Zebra Technologies Corp., 7.250%, 10/15/22 (a) |

130,000 | 136,825 | ||||||

| Total Industrials |

31,689,722 | |||||||

| Utilities - 1.2% |

||||||||

| The AES Corp., |

||||||||

| 3.234%, 06/01/19 (03/01/15)4 |

35,000 | 34,212 | ||||||

| 4.875%, 05/15/23 |

25,000 | 24,937 | ||||||

| 7.375%, 07/01/21 |

125,000 | 141,875 | ||||||

| 8.000%, 06/01/20 |

15,000 | 17,212 | ||||||

| Dynegy Finance I, Inc. / Dynegy Finance II, Inc., |

||||||||

| 7.375%, 11/01/22 (a) |

80,000 | 81,500 | ||||||

| 7.625%, 11/01/24 (a) |

40,000 | 40,850 | ||||||

| NRG Energy, Inc., |

||||||||

| 6.250%, 07/15/22 |

40,000 | 41,100 | ||||||

| 7.875%, 05/15/21 |

45,000 | 48,713 | ||||||

| 8.250%, 09/01/20 |

30,000 | 32,175 | ||||||

| Total Utilities |

462,574 | |||||||

| Total Corporate Bonds and Notes |

34,282,004 | |||||||

| Short-Term Investments - 8.5% |

||||||||

| Repurchase Agreements - 5.5%2 |

||||||||

| Cantor Fitzgerald Securities, Inc., dated 12/31/14 due 01/02/15, 0.090%, total to be received $1,000,005 (collateralized by various U.S. Government Agency Obligations, 0.000% - 10.500%, 01/01/15 - 11/20/64, totaling $1,020,000) |

1,000,000 | 1,000,000 | ||||||

| Daiwa Capital Markets America, dated 12/31/14, due 01/02/15, 0.120%, total to be received $64,987 (collateralized by various U.S. Government Agency Obligations, 0.000% - 6.500%, 06/01/17 - 03/01/48, totaling $66,287) |

64,987 | 64,987 | ||||||

| Nomura Securities International, Inc., dated 12/31/14, due 01/02/15, 0.080%, total to be received $1,000,004 (collateralized by various U.S. Government Agency Obligations, 0.000% - 8.875%, 01/07/15 -11/20/64 totaling $1,020,000) |

1,000,000 | 1,000,000 | ||||||

| Total Repurchase Agreements |

2,064,987 | |||||||

The accompanying notes are an integral part of these financial statements.

32

Table of Contents

AMG Managers High Yield Fund

Schedule of Portfolio Investments (continued)

| Shares | Value | |||||||

| Other Investment Companies - 3.0%3 |

||||||||

| Dreyfus Institutional Cash Advantage Fund, Institutional Class Shares, 0.06%10 |

1,138,985 | $ | 1,138,985 | |||||

| Total Short-Term Investments |

3,203,972 | |||||||

| Total Investments - 104.7% |

39,626,843 | |||||||

| Other Assets, less Liabilities - (4.7)% |

(1,786,878 | ) | ||||||

| Net Assets - 100.0% |

$ | 37,839,965 | ||||||

The accompanying notes are an integral part of these financial statements.

33

Table of Contents

AMG Managers Intermediate Duration Government Fund

Portfolio Manager’s Comments

34

Table of Contents

AMG Managers Intermediate Duration Government Fund

Portfolio Manager’s Comments (continued)

35

Table of Contents

AMG Managers Intermediate Duration Government Fund

Fund Snapshots (unaudited)

December 31, 2014

Credit quality ratings shown above reflect the highest rating assigned by either Standard & Poor’s (“S&P”) or Moody’s Investors Service, Inc. (“Moody’s”). These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change.

Because a fund’s strategy may result in multiple investments in particular sectors of the economy, its performance may depend on the performance of those sectors and may fluctuate more widely than investments diversified across more sectors. For additional information on these and other risk considerations, please see the Fund’s prospectus.

Any sectors, industries, or securities discussed should not be perceived as investment recommendations. Mention of a specific security should not be considered a recommendation to buy or solicitation to sell that security. Specific securities mentioned in this report may have been sold from the Fund’s portfolio of investments by the time you receive this report.

36

Table of Contents

AMG Managers Intermediate Duration Government Fund

Schedule of Portfolio Investments

December 31, 2014

| Principal Amount | Value | |||||||

| Mortgage-Backed Securities - 2.7% |

||||||||

| American Home Mortgage Assets Trust, Series 2005-1, Class 1A1, 2.446%, 11/25/35 (02/25/15)4 |

$ | 86,407 | $ | 75,807 | ||||

| American Home Mortgage Investment Trust, |

||||||||

| Series 2004-1, Class 4A, 2.332%, 04/25/44 (02/25/15)4 |

130,135 | 123,170 | ||||||

| Series 2005-1, Class 5A1, 2.326%, 06/25/45 (02/25/15)4 |

54,130 | 53,536 | ||||||

| Series 2005-1, Class 6A, 2.326%, 06/25/45 (02/25/15)4 |

995,602 | 969,884 | ||||||

| Bank of America Commercial Mortgage Trust, Series 2006-6, Class A2, 5.309%, 10/10/45 |

127,222 | 127,268 | ||||||

| Bank of America Funding Corp., Series 2004-B, Class 1A2, 2.669%, 12/20/34 (02/20/15)4 |

125,727 | 105,182 | ||||||

| Bear Stearns Alt-A Trust, Series 2005-3, Class 2A3, 2.638%, 04/25/35 (02/25/15)4 |

124,493 | 108,181 | ||||||

| Countrywide Home Loan Mortgage Pass Through Trust, |

||||||||

| Series 2005-HYB2, Class 1A4, 2.744%, 05/20/35 (02/20/15)4 |

98,897 | 92,509 | ||||||

| Series 2005-HYB8, Class 1A1, 2.470%, 12/20/35 (02/20/15)4 |

108,559 | 88,904 | ||||||

| Countrywide Home Loan reperforming loan REMIC Trust, Series 2004-R2, Class 1AF1, 0.590%, 11/25/34 (01/25/15) (a)4,8 |

141,623 | 124,450 | ||||||

| GSMPS Mortgage Loan Trust, Series 2005-RP2, Class 1AF, 0.520%, 03/25/35 (01/25/15) (a)4,8 |

192,739 | 168,480 | ||||||

| GSR Mortgage Loan Trust, Series 2004-5, Class 1A3, 1.890%, 05/25/34 (02/25/15)4 |

40,738 | 37,479 | ||||||

| Harborview Mortgage Loan Trust, Series 2004-7, Class 2A2, 2.258%, 11/19/34 (02/19/15)4 |

75,274 | 69,871 | ||||||

| JPMorgan Chase Commercial Mortgage Securities Trust, Series 2006-LDP7, Class A3B, 5.865%, 04/15/456 |

589,945 | 588,969 | ||||||

| Master Alternative Loans Trust, Series 2005-2, Class 2A1, 6.000%, 01/25/3510 |

600,888 | 620,752 | ||||||

| Morgan Stanley Mortgage Loan Trust, Series 2005-4, Class 2A1, 5.913%, 08/25/356 |

902,362 | 892,148 | ||||||

| Structured Asset Securities Corp., Series 2005-RF1, Class A, 0.520%, 03/25/35 (01/25/15) (a)4,8 |

232,108 | 194,744 | ||||||

| Wells Fargo Mortgage Backed Securities Trust, Series 2007-16, Class 1A1, 6.000%, 12/28/37 |

282,262 | 291,074 | ||||||

| Total Mortgage-Backed Securities (cost $4,934,614) |

4,732,408 | |||||||

| U.S. Government and Agency Obligations - 109.0% |

||||||||

| Federal Home Loan Mortgage Corporation - 41.3% |

||||||||

| FHLMC, |

||||||||

| 2.349%, 11/01/33 (03/15/15)4,10 |

983,383 | 1,048,936 | ||||||

| 2.470%, 01/01/36 (03/15/15)4,10 |

2,136,299 | 2,286,263 | ||||||

| 2.797%, 02/01/37 (03/15/15)4 |

68,810 | 73,895 | ||||||

| FHLMC Gold Pool, |

||||||||

| 3.500%, 04/01/32 to 01/01/4410 |

13,167,001 | 13,755,932 | ||||||

| 3.500%, TBA 30yr,5,11 |

4,900,000 | 5,082,601 | ||||||

| 4.000%, 05/01/24 to 09/01/4210 |

5,293,323 | 5,656,926 | ||||||

| 4.000%, TBA 30yr,5,11 |

24,400,000 | 25,964,190 | ||||||

| 4.500%, 02/01/20 to 09/01/4110 |

3,977,357 | 4,308,048 | ||||||

| 5.000%, 05/01/18 to 07/01/4110 |

5,846,599 | 6,434,939 | ||||||

| 5.500%, 11/01/17 to 01/01/4010 |

4,280,240 | 4,781,370 | ||||||

| 6.000%, 09/01/17 to 01/01/2410 |

1,185,744 | 1,297,553 | ||||||

| 7.000%, 07/01/19 |

134,601 | 143,539 | ||||||

| 7.500%, 07/01/3410 |

1,004,953 | 1,176,262 | ||||||

| Total Federal Home Loan Mortgage Corporation |

72,010,454 | |||||||

The accompanying notes are an integral part of these financial statements.

37

Table of Contents

AMG Managers Intermediate Duration Government Fund

Schedule of Portfolio Investments (continued)

| Principal Amount | Value | |||||||

| Federal National Mortgage Association - 52.4% |

||||||||

| FNMA, |

||||||||

| 1.975%, 06/01/34 (02/25/15)4,10 |

$ | 783,573 | $ | 830,807 | ||||

| 2.150%, 08/01/34 (02/25/15)4 |

317,594 | 337,689 | ||||||

| 3.000%, 05/01/43 to 06/01/43 |

2,678,687 | 2,713,474 | ||||||

| 3.000%, TBA 15yr,5,11 |

6,300,000 | 6,548,309 | ||||||

| 3.500%, 05/01/42 to 04/01/4310 |

1,715,342 | 1,794,673 | ||||||

| 3.500%, TBA 30yr,5,11 |

22,800,000 | 23,712,510 | ||||||

| 4.000%, 01/01/26 to 11/01/4410 |

4,935,825 | 5,277,425 | ||||||

| 4.000%, TBA 30yr,5,11 |

11,600,000 | 12,358,817 | ||||||

| 4.500%, 04/01/25 to 04/01/4210 |

10,739,616 | 11,679,332 | ||||||

| 4.500%, TBA 30yr,5,11 |

13,300,000 | 14,436,735 | ||||||

| 4.750%, 07/01/34 to 09/01/34 |

369,656 | 407,185 | ||||||

| 5.000%, 06/01/18 to 06/01/41 |

1,560,720 | 1,720,005 | ||||||

| 5.500%, 03/01/17 to 08/01/4110 |

3,655,109 | 4,078,222 | ||||||

| 6.000%, 08/01/17 to 06/01/3910 |

2,764,815 | 3,048,772 | ||||||

| 6.500%, 11/01/28 to 07/01/32 |

227,520 | 249,489 | ||||||

| 7.000%, 11/01/2210 |

651,532 | 714,235 | ||||||

| FNMA REMICS, |

||||||||

| Series 1994-55, Class H, 7.000%, 03/25/2410 |

715,298 | 789,810 | ||||||

| Series 2005-13, Class AF, 0.570%, 03/25/35 (01/25/15)4,10 |

393,480 | 396,965 | ||||||

| FNMA Whole Loan, Series 2003-W4, Class 4A, 7.017%, 10/25/426 |

84,954 | 97,249 | ||||||

| Total Federal National Mortgage Association |

91,191,703 | |||||||

| Government National Mortgage Association - 14.0% |

||||||||

| GNMA, |

||||||||

| 2.000%, 05/20/21 (02/20/15)4 |

16,690 | 17,363 | ||||||

| 3.000%, 03/20/16 to 08/20/18 (02/20/15)4 |

101,317 | 104,195 | ||||||

| 3.500%, 08/15/43 |

1,172,475 | 1,241,617 | ||||||

| 3.500%, TBA 30yr,5,11 |

1,000,000 | 1,049,687 | ||||||

| 4.000%, 06/20/43 to 11/15/445,10 |

2,344,298 | 2,538,757 | ||||||

| 4.000%, TBA 30yr,5,11 |

8,900,000 | 9,542,364 | ||||||

| 4.500%, 06/15/39 to 05/15/4110 |

993,090 | 1,094,392 | ||||||

| 5.000%, 09/15/39 to 10/20/4110 |

5,816,187 | 6,469,180 | ||||||

| 5.500%, 10/15/39 to 11/15/3910 |

2,015,787 | 2,270,291 | ||||||

| 7.500%, 09/15/28 to 11/15/31 |

22,495 | 23,552 | ||||||

| Total Government National Mortgage Association |

24,351,398 | |||||||

| Interest Only Strips - 1.3% |

||||||||

| FHLMC, |

||||||||

| Series 212, Class IO, 6.000%, 05/01/318 |

1,779 | 392 | ||||||

| Series 233, Class 5, 4.500%, 09/15/35 |

120,360 | 19,566 | ||||||

The accompanying notes are an integral part of these financial statements.

38

Table of Contents

AMG Managers Intermediate Duration Government Fund

Schedule of Portfolio Investments (continued)

| Principal Amount | Value | |||||||

| Interest Only Strips - 1.3% (continued) |

||||||||

| FHLMC REMICS, |

||||||||

| Series 2380, Class SI, 7.739%, 06/15/31 (01/15/15)4,8 |

$ | 14,798 | $ | 3,343 | ||||

| Series 2922, Class SE, 6.589%, 02/15/35 (01/15/15)4 |

134,672 | 26,494 | ||||||

| Series 2934, Class HI, 5.000%, 02/15/20 |

70,094 | 6,183 | ||||||

| Series 2934, Class KI, 5.000%, 02/15/20 |

54,795 | 4,638 | ||||||

| Series 2965, Class SA, 5.889%, 05/15/32 (01/15/15)4 |

292,019 | 46,879 | ||||||

| Series 2967, Class JI, 5.000%, 04/15/20 |

126,562 | 10,978 | ||||||

| Series 2980, Class SL, 6.539%, 11/15/34 (01/15/15)4 |

178,788 | 43,403 | ||||||

| Series 3031, Class BI, 6.529%, 08/15/35 (01/15/15)4 |

339,793 | 60,909 | ||||||

| Series 3065, Class DI, 6.459%, 04/15/35 (01/15/15)4 |

300,240 | 50,082 | ||||||

| Series 3114, Class GI, 6.439%, 02/15/36 (01/15/15)4 |

248,443 | 46,782 | ||||||

| Series 3308, Class S, 7.039%, 03/15/32 (01/15/15)4 |

286,411 | 55,631 | ||||||

| Series 3424, Class XI, 6.409%, 05/15/36 (01/15/15)4 |

281,810 | 43,689 | ||||||

| Series 3489, Class SD, 7.639%, 06/15/32 (01/15/15)4 |

162,182 | 34,133 | ||||||

| Series 3606, Class SN, 6.089%, 12/15/39 (01/15/15)4 |

385,193 | 60,720 | ||||||

| Series 3685, Class EI, 5.000%, 03/15/19 |

410,359 | 23,162 | ||||||

| Series 3731, Class IO, 5.000%, 07/15/19 |

191,449 | 11,542 | ||||||

| Series 3882, Class AI, 5.000%, 06/15/26 |

276,741 | 20,866 | ||||||

| FNMA, |

||||||||

| Series 215, Class 2, 7.000%, 04/25/238 |

90,113 | 18,131 | ||||||

| Series 222, Class 2, 7.000%, 06/25/238 |

8,774 | 1,762 | ||||||

| Series 343, Class 2, 4.500%, 10/25/33 |

84,450 | 14,999 | ||||||

| Series 343, Class 21, 4.000%, 09/25/18 |

111,745 | 6,057 | ||||||

| Series 343, Class 22, 4.000%, 11/25/18 |

60,246 | 3,264 | ||||||

| Series 351, Class 3, 5.000%, 04/25/34 |

97,336 | 18,460 | ||||||

| Series 351, Class 4, 5.000%, 04/25/34 |

57,346 | 10,733 | ||||||

| Series 351, Class 5, 5.000%, 04/25/34 |

48,423 | 9,063 | ||||||

| Series 365, Class 4, 5.000%, 04/25/36 |

131,484 | 23,663 | ||||||

| FNMA REMICS, |

||||||||

| Series 2003-73, Class SM, 6.431%, 04/25/18 (01/25/15)4 |

82,341 | 2,702 | ||||||

| Series 2004-49, Class SQ, 6.881%, 07/25/34 (01/25/15)4 |

113,169 | 22,113 | ||||||

| Series 2004-51, Class SX, 6.951%, 07/25/34 (01/25/15)4 |

163,566 | 33,588 | ||||||

| Series 2004-64, Class SW, 6.881%, 08/25/34 (01/25/15)4 |

475,378 | 97,378 | ||||||

| Series 2005-12, Class SC, 6.581%, 03/25/35 (01/25/15)4 |

184,608 | 30,192 | ||||||

| Series 2005-45, Class SR, 6.551%, 06/25/35 (01/25/15)4 |

386,344 | 77,021 | ||||||

| Series 2005-65, Class KI, 6.831%, 08/25/35 (01/25/15)4,10 |

883,782 | 175,280 | ||||||

| Series 2005-89, Class S, 6.531%, 10/25/35 (01/25/15)4 |

887,294 | 169,815 | ||||||

| Series 2006-3, Class SA, 5.981%, 03/25/36 (01/25/15)4 |

187,781 | 33,588 | ||||||

| Series 2007-75, Class JI, 6.376%, 08/25/37 (01/25/15)4 |

193,834 | 30,888 | ||||||

| Series 2008-86, Class IO, 4.500%, 03/25/23 |

361,851 | 21,077 | ||||||

The accompanying notes are an integral part of these financial statements.

39

Table of Contents

AMG Managers Intermediate Duration Government Fund

Schedule of Portfolio Investments (continued)

| Principal Amount | Value | |||||||

| Interest Only Strips - 1.3% (continued) |

||||||||

| FNMA REMICS, |

||||||||

| Series 2010-37, Class GI, 5.000%, 04/25/25 |

$ | 461,714 | $ | 23,654 | ||||

| Series 2010-65, Class IO, 5.000%, 09/25/20 |

519,450 | 38,417 | ||||||

| Series 2010-121, Class IO, 5.000%, 10/25/25 |

197,121 | 13,722 | ||||||

| Series 2011-69, Class AI, 5.000%, 05/25/18 |

537,036 | 29,572 | ||||||

| Series 2011-88, Class WI, 3.500%, 09/25/26 |

457,823 | 57,062 | ||||||

| Series 2011-124, Class IC, 3.500%, 09/25/21 |

435,319 | 32,463 | ||||||

| Series 2012-126, Class SJ, 4.831%, 11/25/42 (01/25/15)4 |

827,179 | 129,053 | ||||||

| GNMA, |

||||||||

| Series 2011-32, Class KS, 11.778%, 06/16/34 (01/16/15)4 |

353,207 | 74,448 | ||||||

| Series 2011-94, Class IS, 6.539%, 06/16/36 (01/16/15)4 |

300,178 | 48,407 | ||||||

| Series 2011-157, Class SG, 6.435%, 12/20/41 (01/20/15)4 |

1,135,754 | 263,150 | ||||||

| Series 2011-167, Class IO, 5.000%, 12/16/20 |

415,672 | 27,810 | ||||||

| Series 2012-34, Class KS, 5.889%, 03/16/42 (01/16/15)4 |

462,911 | 101,722 | ||||||

| Series 2012-69, Class QI, 4.000%, 03/16/41 |

340,151 | 60,330 | ||||||

| Series 2012-103, Class IB, 3.500%, 04/20/40 |

296,533 | 42,078 | ||||||

| Total Interest Only Strips |

2,311,054 | |||||||

| Total U.S. Government and Agency Obligations (cost $186,488,076) |

189,864,609 | |||||||

| Short-Term Investments - 45.4% |

||||||||

| U.S. Treasury Bills - 0.1% |

||||||||

| U.S. Treasury Bill, 0.04%, 04/02/1512,13 |

90,000 | 89,991 | ||||||

| Shares | ||||||||

| Other Investment Companies - 45.3%3 |

||||||||

| Dreyfus Institutional Cash Advantage Fund, Institutional Class Shares, 0.06%10 |

58,876,539 | 58,876,539 | ||||||

| JPMorgan Liquid Assets Money Market Fund, Capital Shares, 0.07%10 |

20,009,126 | 20,009,126 | ||||||

| Total Other Investment Companies |

78,885,665 | |||||||

| Total Short-Term Investments |

78,975,656 | |||||||

| Total Investments - 157.1% |

273,572,673 | |||||||

| Other Assets, less Liabilities - (57.1)% |

(99,435,051 | ) | ||||||

| Net Assets - 100.0% |

$ | 174,137,622 | ||||||

The accompanying notes are an integral part of these financial statements.

40

Table of Contents

AMG Managers Short Duration Government Fund

Portfolio Manager’s Comments

41

Table of Contents

AMG Managers Short Duration Government Fund

Portfolio Manager’s Comments (continued)

42

Table of Contents

AMG Managers Short Duration Government Fund

Fund Snapshots (unaudited)

December 31, 2014

Credit quality ratings shown above reflect the highest rating assigned by either Standard & Poor’s (“S&P”) or Moody’s Investors Service, Inc. (“Moody’s”). These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change.

Because a fund’s strategy may result in multiple investments in particular sectors of the economy, its performance may depend on the performance of those sectors and may fluctuate more widely than investments diversified across more sectors. For additional information on these and other risk considerations, please see the Fund’s prospectus.

Any sectors, industries, or securities discussed should not be perceived as investment recommendations. Mention of a specific security should not be considered a recommendation to buy or solicitation to sell that security. Specific securities mentioned in this report may have been sold from the Fund’s portfolio of investments by the time you receive this report.

43

Table of Contents

AMG Managers Short Duration Government Fund

Schedule of Portfolio Investments

December 31, 2014

| Principal Amount | Value | |||||||

| Asset-Backed Securities - 9.6% |

||||||||

| AmeriCredit Automobile Receivables Trust, |

||||||||

| Series 2011-1, Class D, 4.260%, 02/08/17 |

$ | 3,420,000 | $ | 3,464,556 | ||||

| Series 2011-2, Class D, 4.000%, 05/08/17 |

3,900,000 | 3,959,682 | ||||||

| Series 2011-3, Class D, 4.040%, 07/10/17 |

4,095,000 | 4,168,575 | ||||||

| Series 2012-1, Class C, 2.670%, 01/08/18 |

400,000 | 404,894 | ||||||

| Chase Issuance Trust, |

||||||||

| Series 2013-A9, Class A, 0.581%, 11/16/20 (01/15/15)4 |

11,724,000 | 11,746,791 | ||||||

| Series 2014-A5, Class A5, 0.531%, 04/15/21 (01/15/15)4 |

1,284,000 | 1,279,746 | ||||||

| Citibank Credit Card Issuance Trust, |

||||||||

| Series 2013-A12, Class A12, 0.462%, 11/07/18 (02/09/15)4 |

4,000,000 | 3,995,688 | ||||||

| Series 2013-A7, Class A7, 0.596%, 09/10/20 (02/10/15)4 |

1,121,000 | 1,120,751 | ||||||

| Discover Card Execution Note Trust, |

||||||||

| Series 2014-A1, Class A1, 0.591%, 07/15/21 (01/15/15)4 |

1,080,000 | 1,082,337 | ||||||

| Series 2014-A2, Class A2, 0.432%, 08/15/19 (02/17/15)4 |

1,500,000 | 1,496,544 | ||||||

| Santander Drive Auto Receivables Trust, Series 2011-1, Class D, 4.010%, 02/15/17 |

4,161,000 | 4,230,426 | ||||||

| Structured Asset Investment Loan Trust, Series 2004-BNC2, Class A5, 1.250%, 12/25/34 (01/26/15)4 |

87,913 | 87,393 | ||||||

| Total Asset-Backed Securities (cost $37,113,624) |

37,037,383 | |||||||

| Mortgage-Backed Securities - 4.2% |

||||||||

| Bank of America Commercial Mortgage Trust, Series 2006-6, Class A2, 5.309%, 10/10/45 |

28,050 | 28,060 | ||||||

| Bank of America Merrill Lynch Commercial Mortgage, Inc., Series 2005-6, Class A4, 5.152%, 09/10/476 |

2,536,753 | 2,589,081 | ||||||

| Bear Stearns Commercial Mortgage Securities Trust, |

||||||||

| Series 2004-PWR4, Class A3, 5.468%, 06/11/416 |

105,652 | 105,628 | ||||||

| Series 2005-PWR7, Class A3, 5.116%, 02/11/416 |

507,952 | 507,962 | ||||||

| Series 2006-T22, Class A4, 5.575%, 04/12/386 |

1,667,451 | 1,729,199 | ||||||

| CD Commercial Mortgage Trust, Series 2005-CD1, Class A4, 5.226%, 07/15/446 |

561,550 | 570,623 | ||||||

| Citigroup Commercial Mortgage Trust, Series 2005-C3, Class A4, 4.860%, 05/15/43 |

22,673 | 22,649 | ||||||

| Commercial Mortgage Trust, Series 2005-C6, Class A5A, 5.116%, 06/10/446 |

518,069 | 523,593 | ||||||

| Countrywide Home Loan Mortgage Pass Through Trust, Series 2004-25, Class 2A4, 0.670%, 02/25/35 (01/26/15)4,8 |

544,104 | 216,898 | ||||||

| GS Mortgage Securities Corp. II, Series 2005-GG4, Class A4A, 4.751%, 07/10/39 |

1,693,102 | 1,694,736 | ||||||

| LB-UBS Commercial Mortgage Trust, Series 2005-C5, Class A4, 4.954%, 09/15/30 |

1,208,142 | 1,214,171 | ||||||

| Merrill Lynch Mortgage Investors Trust, Series 1998-C1, Class A3, 6.720%, 11/15/266 |

837,738 | 873,961 | ||||||

| Merrill Lynch Mortgage Trust, Series 2005-MKB2, Class A4, 5.204%, 09/12/426 |

919,680 | 919,387 | ||||||

| Morgan Stanley Capital I Trust, Series 2006-HQ8, Class A4, 5.412%, 03/12/446 |

1,691,049 | 1,733,494 | ||||||

| Wachovia Bank Commercial Mortgage Trust, |

||||||||

| Series 2005-C20, Class A7, 5.118%, 07/15/426 |

1,696,377 | 1,710,473 | ||||||

| Series 2005-C22, Class A4, 5.269%, 12/15/446 |

1,358,667 | 1,387,674 | ||||||

| WaMu Mortgage Pass Through Certificates, Series 2005-AR2, Class 2A3, 0.520%, 01/25/45 (01/25/15)4 |

456,617 | 420,453 | ||||||

| Total Mortgage-Backed Securities (cost $17,247,155) |

16,248,042 | |||||||

The accompanying notes are an integral part of these financial statements.

44

Table of Contents

AMG Managers Short Duration Government Fund

Schedule of Portfolio Investments (continued)

| Principal Amount | Value | |||||||

| U.S. Government and Agency Obligations - 74.7% |

||||||||

| Federal Home Loan Mortgage Corporation - 28.5% |

||||||||

| FHLMC, |

||||||||

| 1.875%, 09/01/35 (03/15/15)4 |

$ | 2,010,680 | $ | 2,113,130 | ||||

| 2.125%, 11/01/33 (03/15/15)4 |

962,618 | 1,017,550 | ||||||

| 2.344%, 10/01/33 (03/15/15)4 |

1,303,108 | 1,385,058 | ||||||

| 2.350%, 10/01/33 to 11/01/33 (03/15/15)4 |

3,148,408 | 3,353,038 | ||||||

| 2.355%, 12/01/33 (03/15/15)4 |

1,815,043 | 1,937,005 | ||||||

| 2.357%, 07/01/34 (03/15/15)4 |

288,727 | 308,375 | ||||||

| 2.365%, 09/01/33 (03/15/15)4 |

2,350,410 | 2,511,346 | ||||||

| 2.375%, 12/01/32 to 05/01/34 (03/15/15)4 |

6,253,627 | 6,665,160 | ||||||

| 2.392%, 10/01/28 (03/15/15)4 |

46,267 | 48,824 | ||||||

| 2.554%, 02/01/23 (03/15/15)4 |

290,108 | 308,816 | ||||||

| 2.621%, 06/01/35 (03/15/15)4 |

712,745 | 766,015 | ||||||

| 2.797%, 02/01/37 (03/15/15)4 |

821,784 | 882,510 | ||||||

| FHLMC Gold Pool, |

||||||||

| 4.000%, 05/01/24 to 11/01/26 |

8,778,009 | 9,379,349 | ||||||

| 4.500%, 05/01/19 to 07/01/26 |

5,777,093 | 6,159,309 | ||||||

| 5.000%, 09/01/17 to 04/01/23 |

8,463,756 | 8,974,655 | ||||||

| 5.500%, 05/01/17 to 08/01/40 |

23,657,393 | 26,147,164 | ||||||

| 6.000%, 06/01/16 to 01/01/24 |

7,068,581 | 7,682,502 | ||||||

| 6.500%, 03/01/18 to 10/01/23 |

510,931 | 548,916 | ||||||

| 7.000%, 06/01/17 to 07/01/19 |

239,031 | 250,892 | ||||||

| 7.500%, 04/01/15 to 03/01/33 |

371,141 | 435,147 | ||||||

| FHLMC REMICS, |

||||||||

| Series 2091, Class PG, 6.000%, 11/15/28 |

246,075 | 270,715 | ||||||

| Series 2132, Class PE, 6.000%, 03/15/29 |

406,485 | 445,854 | ||||||

| Series 2427, Class LW, 6.000%, 03/15/17 |

575,379 | 597,310 | ||||||

| Series 2429, Class HB, 6.500%, 12/15/23 |

622,021 | 701,690 | ||||||

| Series 2541, Class ED, 5.000%, 12/15/17 |

2,247,936 | 2,351,923 | ||||||

| Series 2554, Class HA, 4.500%, 04/15/32 |

56,712 | 56,752 | ||||||

| Series 2627, Class BM, 4.500%, 06/15/18 |

170,576 | 177,907 | ||||||

| Series 2631, Class PD, 4.500%, 06/15/18 |

57,861 | 60,601 | ||||||

| Series 2645, Class BY, 4.500%, 07/15/18 |

1,956,307 | 2,040,176 | ||||||

| Series 2682, Class LC, 4.500%, 07/15/32 |

821,729 | 847,036 | ||||||

| Series 2683, Class JB, 4.000%, 09/15/18 |

302,829 | 314,649 | ||||||

| Series 2709, Class PE, 5.000%, 12/15/22 |

327,503 | 332,367 | ||||||

| Series 2763, Class JD, 3.500%, 10/15/18 |

146,825 | 148,239 | ||||||

| Series 2786, Class BC, 4.000%, 04/15/19 |

200,283 | 209,681 | ||||||

| Series 2809, Class UC, 4.000%, 06/15/19 |

213,346 | 221,869 | ||||||

The accompanying notes are an integral part of these financial statements.

45

Table of Contents

AMG Managers Short Duration Government Fund

Schedule of Portfolio Investments (continued)

| Principal Amount | Value | |||||||

| Federal Home Loan Mortgage Corporation - 28.5% (continued) |

||||||||

| FHLMC REMICS, |

||||||||

| Series 2877, Class PA, 5.500%, 07/15/33 |

$ | 192,581 | $ | 204,265 | ||||

| Series 2882, Class UM, 4.500%, 08/15/19 |

616,603 | 624,043 | ||||||

| Series 2935, Class LM, 4.500%, 02/15/35 |

656,865 | 684,711 | ||||||

| Series 3000, Class PB, 3.900%, 01/15/23 |

21,933 | 22,048 | ||||||

| Series 3013, Class GA, 5.000%, 06/15/34 |

428,192 | 435,566 | ||||||

| Series 3033, Class CI, 5.500%, 01/15/35 |

377,406 | 398,032 | ||||||

| Series 3117, Class PL, 5.000%, 08/15/34 |

309,847 | 312,691 | ||||||

| Series 3535, Class CA, 4.000%, 05/15/24 |

192,586 | 200,353 | ||||||

| Series 3609, Class LA, 4.000%, 12/15/24 |

631,308 | 660,259 | ||||||

| Series 3632, Class AG, 4.000%, 06/15/38 |

350,032 | 366,772 | ||||||

| Series 3640, Class JA, 1.500%, 03/15/15 |

47,280 | 47,276 | ||||||

| Series 3653, Class JK, 5.000%, 11/15/38 |

329,115 | 351,983 | ||||||

| Series 3659, Class EJ, 3.000%, 06/15/18 |

4,327,648 | 4,434,212 | ||||||

| Series 3683, Class AD, 2.250%, 06/15/20 |

954,289 | 963,888 | ||||||

| Series 3756, Class DA, 1.200%, 11/15/18 |

762,798 | 764,832 | ||||||