formdef14a.htm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant T

Filed by a Party other than the Registrant o

Check the appropriate box:

|

o

|

Preliminary Proxy Statement

|

|

o

|

Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

T

|

Definitive Proxy Statement

|

|

o

|

Definitive Additional Materials

|

|

o

|

Soliciting Material Pursuant to §240.14a-12

|

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

o

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it is determined)

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

o

|

Fee paid previously with preliminary proxy materials.

|

|

o

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

|

|

|

(1)

|

Amount previously paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement no.:

|

DIRECT INSITE CORP.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

May 21, 2012

To our Stockholders:

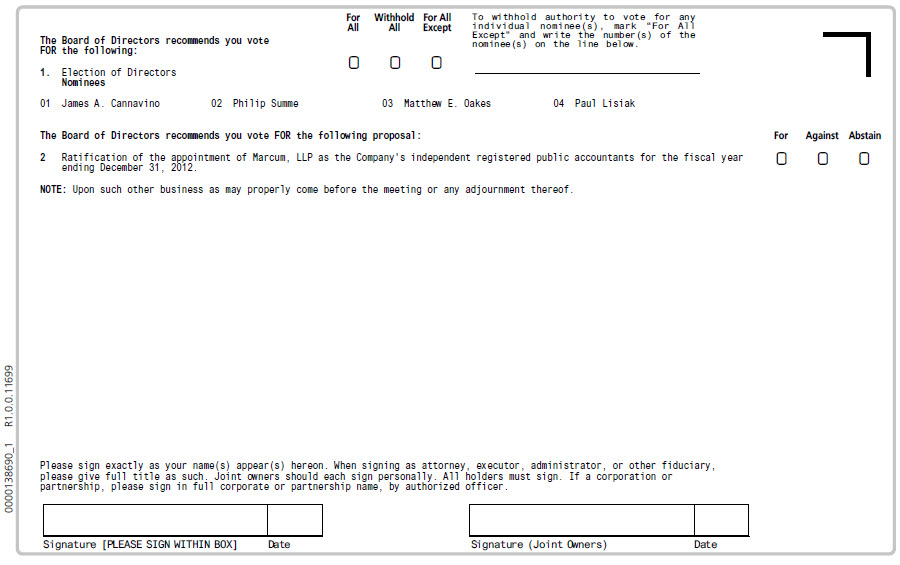

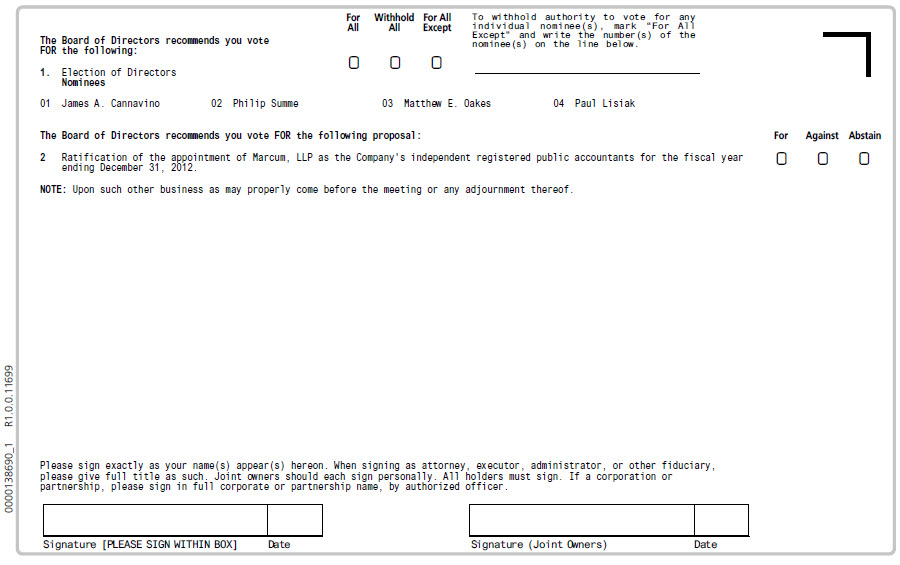

An annual meeting of stockholders will be held at the Doubletree by Hilton Sunrise - Sawgrass Mills, 13400 West Sunrise Blvd., Sunrise, FL 33323 on Monday, May 21, 2012, beginning at 9:00 a.m. EDT. At the meeting, you will be asked to vote on the following matters:

|

|

1.

|

Election of two directors in Class I to hold office until the 2015 Annual Meeting of Stockholders, one director in Class II to hold office until the 2014 Annual Meeting of Stockholders, and one director in Class III to hold office until the 2013 Annual Meeting of Stockholders.

|

|

|

2.

|

Ratification of the appointment of Marcum, LLP as our independent registered public accountants for the year ending December 31, 2012.

|

|

|

3.

|

Any other matters that properly come before the meeting.

|

The above matters are set forth in the proxy statement attached to this notice to which your attention is directed.

If you are a stockholder of record at the close of business on April 2, 2012, you are entitled to vote at the meeting or at any adjournment or postponement of the meeting. This notice and proxy statement is first being mailed to stockholders on or about April 11, 2012.

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to be held on May 21, 2012. The Proxy Statement and Annual Report on Form 10K are available at www.proxyvote.com for registered holders and for beneficial owners.

| |

By Order of the Board of Directors,

|

| |

|

| |

/s/ John J. Murabito |

|

| |

John J. Murabito

|

|

|

Chairman of the Board of Directors

|

|

Dated: April 11, 2012

|

|

|

Sunrise, Florida

|

|

WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING, YOU ARE URGED TO COMPLETE, SIGN, DATE AND RETURN THE ENCLOSED PROXY CARD IN THE ACCOMPANYING PRE-ADDRESSED POSTAGE-PAID ENVELOPE AS DESCRIBED ON THE ENCLOSED PROXY CARD. YOUR PROXY, GIVEN THROUGH THE RETURN OF THE ENCLOSED PROXY CARD, MAY BE REVOKED PRIOR TO ITS EXERCISE BY FILING WITH OUR CORPORATE SECRETARY PRIOR TO THE MEETING A WRITTEN NOTICE OF REVOCATION OR A DULY EXECUTED PROXY BEARING A LATER DATE, OR BY ATTENDING THE MEETING, FILING A WRITTEN NOTICE OF REVOCATION WITH THE SECRETARY OF THE MEETING AND VOTING IN PERSON.

DIRECT INSITE CORP.

13450 West Sunrise Boulevard

Suite 510

Sunrise, FL 33323

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

Monday, May 21, 2012

This proxy statement is being furnished to the holders of common stock, par value $0.0001, per share (the “common stock”) of Direct Insite Corp. (the “Company”) in connection with the solicitation by and on behalf of its board of directors (the “Board”) of proxies for use at the Annual Meeting of Stockholders. Our Annual Meeting of Stockholders will be held on Monday, May 21, 2012, at the Doubletree by Hilton Sunrise - Sawgrass Mills, 13400 West Sunrise Blvd., Sunrise, FL 33323 at 9:00 A.M. EDT. This proxy statement contains information about the matters to be considered at the meeting or any adjournments or postponements of the meeting. This notice and proxy statement is first being mailed to stockholders on or about April 11, 2012.

ABOUT THE MEETING

What is being considered at the meeting?

You will be voting on the following:

|

|

·

|

election of two Class I directors, one Class II director and one Class III director;

|

|

|

·

|

ratification of the appointment of our independent certified public accountants; and

|

|

|

·

|

any other matters that properly come before the meeting.

|

Who is entitled to vote at the meeting?

You may vote if you were a stockholder of record as of the close of business on April 2, 2012. Each share of stock is entitled to one vote.

How do I vote?

You can vote in two ways:

|

|

·

|

by attending the meeting in person; or

|

|

|

·

|

by completing, signing and returning the enclosed proxy card.

|

Can I change my mind after I vote?

Yes, you may change your mind at any time before the vote is taken at the meeting. You can do this by (1) signing another proxy with a later date and returning it to us prior to the meeting, (2) filing with our corporate secretary (Corporate Secretary, Direct Insite Corp., 13450 West Sunrise Boulevard, Suite 510, Sunrise, FL 33323) a written notice revoking your proxy, or (3) voting again at the meeting.

What if I return my proxy card but do not include voting instructions?

Proxies that are signed and returned but do not include voting instructions will be voted FOR the election of the nominees for director described herein, and FOR the ratification of our appointment of Marcum, LLP as our independent certified public accountants.

What does it mean if I receive more than one proxy card?

It means that you have multiple accounts with brokers and/or our transfer agent. Please vote all of these shares. We recommend that you contact your broker and/or our transfer agent to consolidate as many accounts as possible under the same name and address. Our transfer agent is Manhattan Transfer Registrar Company, (631) 928-7655.

Will my shares be voted if I do not provide my proxy?

If you hold your shares directly in your own name, they will not be voted if you do not provide a proxy. Your shares may be voted under certain circumstances if they are held in the name of a brokerage firm. Under current rules of the New York Stock Exchange to which its members are subject, brokerage firms holding shares of common stock in “street name” may vote, in their discretion, on behalf of their clients if such clients have not furnished voting instructions with respect to ratification of the selection of the Company’s independent registered public accounting firm, but not with respect to the election of directors or any of the other proposals. Such voted shares are counted for the purpose of establishing a quorum. A broker non-vote occurs when a broker cannot exercise discretionary voting power and has not received instructions from the beneficial owner.

How many votes must be present to hold the meeting?

Your shares are counted as present at the meeting if you attend the meeting and vote in person or if you properly return a proxy by mail. Proxies submitted that contain abstentions or broker non-votes will be deemed present at our meeting. In order for us to conduct our meeting, a majority of the combined voting power of our outstanding common stock as of the close of business on April 2, 2012, must be present at the meeting. This is referred to as a quorum. On April 2, 2012, there were 12,164,737 common shares outstanding and entitled to vote as a single class.

What vote is required to approve each item?

Directors are elected by a plurality of the votes cast. This means that the nominee for a slot with the most votes, or, if there are two or more nominees for a class, the two nominees with the most votes for a particular class, will be elected to fill the available slot(s) for that class. Shares that are not voted, either because you marked your proxy card to withhold authority to vote for one or more nominees or because they are broker non-votes, will have no impact on the election of directors.

The ratification of the appointment of Marcum, LLP as our independent registered public accounting firm requires the affirmative vote of a majority of the total votes cast on the proposal (whether in person or by proxy) by holders entitled to vote on the proposal, assuming a quorum is present at the meeting. An abstention will be counted as a vote against that proposal.

Our officers and directors beneficially own 53% of our voting power.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth the beneficial ownership of shares of voting stock of the Company, as of April 2, 2012 of (i) each person known by the Company to beneficially own 5% or more of the shares of outstanding common stock, based solely on filings with the Securities and Exchange Commission, (ii) each of the Company’s executive officers and directors and nominees for director and (iii) all of the Company’s executive officers and directors as a group. Except as otherwise indicated, all shares are beneficially owned, and the persons named as owners hold investment and voting power.

|

Name of Beneficial

Owner

(1)

|

|

Common Stock

Beneficially

Owned

(2)

|

|

|

Rights to Acquire

Beneficial Ownership

Through Exercise of

Options and Warrants

Within 60 Days

|

|

|

Total Beneficially

Owned as % of

Outstanding Shares

(3)

|

|

|

Metropolitan Venture Partners Corp.(4)

|

|

|

2,361,185 |

(5) |

|

|

-- |

|

|

|

19.4 |

% |

|

Lawrence D. Hite (6)

|

|

|

2,618,796 |

(7) |

|

|

-- |

|

|

|

21.6 |

% |

|

James Cannavino

|

|

|

2,371,787 |

|

|

|

50,000 |

|

|

|

19.9 |

% |

|

John J. Murabito

|

|

|

140,000 |

|

|

|

-- |

|

|

|

1.2 |

% |

|

Michael Levin

|

|

|

2,376,073 |

(8) |

|

|

-- |

|

|

|

19.6 |

% |

|

Thomas C. Lund

|

|

|

653,733 |

(9) |

|

|

-- |

|

|

|

5.4 |

% |

|

Philip Summe

|

|

|

15,000 |

|

|

|

-- |

|

|

|

* |

|

|

S.A.V.E. Partners III, LLC (10)

|

|

|

803,048 |

(11) |

|

|

-- |

|

|

|

6.6 |

% |

|

Matthew Oakes

|

|

|

487,145 |

|

|

|

22,500 |

|

|

|

4.2 |

% |

|

Paul Lisiak

|

|

|

2,361,185 |

(12) |

|

|

-- |

|

|

|

19.4 |

% |

|

Arnold Leap

|

|

|

331,331 |

|

|

|

-- |

|

|

|

2.7 |

% |

|

Sandra Wallace

|

|

|

20,000 |

|

|

|

-- |

|

|

|

* |

|

|

All Officers and Directors as a Group (9 persons)

|

|

|

4,836,932 |

|

|

|

72,500 |

|

|

|

53 |

% |

|

* = Less than 1%

|

|

|

|

|

|

|

|

|

|

|

|

|

Footnotes

|

(1)

|

Unless otherwise indicated, the address of each person named in the table is c/o Direct Insite Corp., 13450 West Sunrise Boulevard, Suite 510, Sunrise, FL 33323.

|

|

(2)

|

Except as otherwise indicated, each person listed in the table below has sole voting and investment power with respect to the shares indicated below.

|

|

(3)

|

Based upon 12,164,737 common shares outstanding as of April 2, 2012.

|

|

(4)

|

The address of Metropolitan Venture Partners II, L.P. is 70 East 55th Street, 15th Floor, New York, NY 10022.

|

|

(5)

|

Includes (i) 45,395 shares directly owned by Metropolitan Venture Partners Corp. (“Metropolitan Venture Partners”); and (ii) 2,315,790 shares directly owned by Metropolitan Venture Partners II, L.P. (“MVP II”). By reason of its position as the general partner of MVP II, Metropolitan Venture Partners (Advisors), L.P. (“MVP Advisors”) may be deemed to possess the shared power to vote and dispose of the shares of common stock beneficially owned by MVP II. By reason of its position as the general partner of MVP Advisors, Metropolitan Venture Partners may be deemed to possess the shared power to vote and dispose of the shares of common stock beneficially owned by MVP Advisors and MVP II. The business address for Metropolitan Venture Partners and MVP Advisors, L.P. is 70 East 55th Street, 15th Floor, New York, NY 10022.

|

|

(6)

|

The business address of Mr. Hite is 205 Lexington Avenue, New York, NY 10016.

|

|

(7)

|

Includes (i) 179,424 shares directly owned by Mr. Hite; (ii) 2,315,790 shares directly owned by MVP II; (iii) 45,395 shares directly owned by Metropolitan Venture Partners; and (iv) 78,187 shares directly owned by Tall Oaks Group LLC (“TOG”). By reason of his position of Chairman of Metropolitan Venture Partners and his ownership interest in Metropolitan Venture Partners, Mr. Hite may be deemed to possess the shared power to vote and dispose of the shares of common stock beneficially owned by the MVP entities. By reason of his positions as the Managing Member and majority stockholder of TOG, Mr. Hite may be deemed to possess the shared power to vote and dispose of the shares of common stock beneficially owned by TOG. The business address of TOG is 205 Lexington Avenue, 8th Floor, New York, NY 10016.

|

|

(8)

|

Includes (i) 14,888 shares directly owned by Mr. Levin, (ii) 2,315,790 shares directly owned by MVP II and (iii) 45,395 shares directly owned by Metropolitan Venture Partners. By reason of his position as a Managing Director of Metropolitan Venture Partners, Mr. Levin may be deemed to possess the shared power to vote and dispose of the shares of common stock beneficially owned by the MVP entities.

|

|

(9)

|

Includes (i) 589,733 shares owned by Mr. Lund’s wife and (ii) 24,000 shares held under Trust Agreement dated 9/16/94, Thomas C. Lund Trustee for the benefit of Thomas C. Lund, each of which Mr. Lund may be deemed to share voting and investment power.

|

|

(10)

|

The business address for S.A.V.E. Partners III, LLC is 500 West Putnam Avenue, Suite 400, Greenwich, CT 06830.

|

|

(11)

|

By reason of his position as a Managing Member of S.A.V.E. Partners III, LLC, Craig W. Thomas may be deemed to beneficially own the shares of common stock owned by S.A.V.E. Partners III, LLC.

|

|

(12)

|

Includes (i) 2,315,790 shares directly owned by MVP II and (ii) 45,395 shares directly owned by Metropolitan Venture Partners. By reason of his position as a Managing Director of Metropolitan Venture Partners, Mr. Lisiak may be deemed to possess the shared power to vote and dispose of the shares of common stock beneficially owned by the MVP entities.

|

COMPLIANCE WITH SECTION 16(a) OF THE SECURITIES EXCHANGE ACT

Section 16(a) of the Exchange Act requires our executive officers, directors and persons who own more than ten percent of a registered class of our equity securities (“Reporting Persons”) to file reports of ownership and changes in ownership on Forms 3, 4 and 5 with the SEC and the National Association of Securities Dealers, Inc. (the “NASD”). These Reporting Persons are required by SEC regulation to furnish us with copies of all Forms 3, 4 and 5 they file with the SEC and the NASD. Based solely on a review of copies of such reports furnished to the Company, and written representations that no reports were required, the Company believes that during the fiscal year ended December 31, 2011 its executive officers and directors complied in a timely manner with the Section 16(a) requirements, with the exception of a late Form 4 filing on June 9, 2011 by Thomas C. Lund and a late Form 4 filing on July 20, 2011 by Metropolitan Venture Partners II L.P., each of which was the result of administrative error.

PROPOSAL ONE

ELECTION OF DIRECTORS

Our by-laws provide for a Board consisting of not less than three nor more than seven directors. Our Board now consists of six directors. The Board has three classes of directors: Class I, whose term expires at the Annual Meeting; Class II, whose term will expire in 2013; and Class III, whose term will expire in 2014. The directors each intend to serve on the Board until his successor is duly elected and qualified. The Governance and Nominating Committee of the Board has nominated (i) James A. Cannavino and Philip Summe for election as Class I directors to serve until the 2015 Annual Meeting of Stockholders and until their respective successors are duly elected and qualified, (ii) Matthew E. Oakes for election as a Class II director to serve until the 2013 Annual Meeting of Stockholders and until his successor is duly elected and qualified and (iii) Paul Lisiak for election as a Class III director, in replacement of Michael Levin who has indicated that he will be resigning from the Board following the Annual Meeting, to serve until the 2014 Annual Meeting of Stockholders and until his successor is duly elected and qualified. Mr. Lisiak is being nominated pursuant to the exercise by Metropolitan Venture Partners, the Corporation’s largest outside stockholder, of its right to designate a Board representative.

Assuming a quorum is present, the nominee for a slot with the most votes, or, if there are two or more nominees for a class, the two nominees with the most votes for a particular class, will be elected to fill the available slot(s) for that class. Consequently, any shares not voted at the meeting, whether by abstention or otherwise, will have no effect on the election of directors. Shares represented by executed proxies in the form enclosed will be voted, unless otherwise indicated, for the election as directors of the nominees identified above unless any such nominee shall be unavailable, in which event such shares will be voted for a substitute nominee designated by the Board. The Board has no reason to believe that any of the nominees will be unavailable or, if elected, will decline to serve.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” ELECTION OF THE NOMINEES FOR DIRECTOR

Nominee Information

The following table sets forth information regarding the nominees for director:

|

Name

|

|

Age

|

|

Position

|

|

Director

Since

|

|

Class

|

|

James A. Cannavino(1)

|

|

67

|

|

Member of the Board of Directors and

former Chief Executive Officer

|

|

2000

|

|

I

|

| Philip Summe(1)(2) |

|

42 |

|

Member of the Board of Directors |

|

2011 |

|

I |

|

Matthew E. Oakes

|

|

49

|

|

President and Chief Executive Officer

|

|

|

|

II

|

|

Paul Lisiak

|

|

38

|

|

Founder and Managing Director of

Metropolitan Venture Partners

|

|

|

|

III

|

(1) Member of the Governance and Nominating Committee

(2) Member of the Audit Committee

Class I Directors – Terms Expiring at the 2015 Annual Meeting

James A. Cannavino has been a director since March 2000, served as Chairman of the Board from March 2000 to May 2011 and as Chief Executive Officer from December 2002 to May 2011. From September 1997 to April 2000 he was the non-executive Chairman of Softworks, Inc. (a then wholly-owned subsidiary of the Company), which went public and was later sold to EMC. Mr. Cannavino was also the Chief Executive Officer and Chairman of the Board of Directors of CyberSafe, Inc., a corporation specializing in network security, from April 1998 to July 2001. In August 1995, he was appointed as President and Chief Operating Officer of Perot Systems Corporation and in 1996 was elected to serve as Chief Executive Officer through July 1997. During his tenure at Perot he was responsible for all the day-to-day global operations of the company, as well as for strategy and organization. Prior to that, he served as a Senior Vice President at IBM, responsible for strategy and development. Mr. Cannavino held various positions at IBM for over thirty years beginning in 1963. Mr. Cannavino led IBM’s restructuring of its $7 billion PC business to form the IBM PC Company. He also served on the IBM Corporate Executive Committee and Worldwide Management Council, and on the Board of IBM’s integrated services and solutions company. Mr. Cannavino presently serves on the Boards of the National Center for Missing and Exploited Children, the International Center for Missing and Exploited Children, and Verio. He recently was Chairman of the Board of Marist College in Poughkeepsie, New York and continues to serve on the Board. Mr. Cannavino brings to our Board knowledge and experience regarding our history and operations and, generally, the computer software industry, finance and capital markets.

Philip Summe has been a director since May 2011. Mr. Summe is the Portfolio Manager of Crossfields Capital Management, a firm he founded in 2005 which invests in small-cap, deep-value companies. From 2002 to 2004, Mr. Summe was a General Partner for Gabriel Venture Partners (“Gabriel”). Gabriel is a $260 million venture capital fund focused on leading investments in technology companies. Gabriel has a deep operations-focused approach, where its representatives generally join the board of directors and actively partner with management teams. At Gabriel, Mr. Summe led and structured investments in LVL7 Systems, Inc. and Knowledge Management Solutions, Inc. He served as Chairman of the Board of LVL7 after initially investing in 2002. From 1998 to 2001, Mr. Summe was a Principal with J.P. Morgan Partners (formerly Chase Capital Partners) and Flatiron Partners where he led the software initiatives and served on numerous boards. Successful investments include Stamps.com, Starbelly, Interactive Search Holdings, and Arbinet. From 1996 to 1998, Mr. Summe was an investment banker with Deutsche Morgan Grenfell’s technology investment banking group, where he provided financing and M&A advice to companies. From 1991 to 1994, Mr. Summe was a Senior Consultant with Accenture and worked for Convergys Systems from 1989 to 1991. Mr. Summe received an MBA with Honors from the University of Chicago Graduate School of Business and a BS in Applied Physics with Honors from Xavier University. Mr. Summe brings to our Board experience investing in and growing small cap companies, as well as a background in technology finance. His experience of several years of soliciting views of stockholders on behalf of Owners Research Group also make him an effective voice for stockholder interests.

Class II Director – Term Expiring at the 2013 Annual Meeting

Matthew E. Oakes was appointed as the Company’s Chief Executive Officer on May 25, 2011 and has served as its President since March 2009. Prior thereto he held the position of Executive Vice President and Chief Operating Officer from August 2006, and Executive Vice President–Client Services from November of 2002. Prior to his joining the Company, Mr. Oakes served for three years as the Chief Operating Officer for Direct Media Networks a New York based e-commerce and technology company. He held executive positions in Westinghouse Communities Inc. including Managing Director of Operations. Mr. Oakes received a Juris Doctorate of Law from Nova Southeastern University and a Bachelors Degree in Business from Cornell University. Prior to attending Cornell University, he served with the United States Marine Corps in the Special Operations Group of the 3rd Marine Division and as a Marine Drill Instructor at the Marine Corps Recruit Depot, Paris Island, South Carolina. As President and Chief Executive Officer, Mr. Oakes brings to the Board an intimate knowledge of the Company’s business and a management perspective.

Class III Director – Term Expiring at the 2014 Annual Meeting

Paul Lisiak is a Managing Director of Metropolitan Venture Partners, a venture capital firm he co-founded in 1999. In his role, Mr. Lisiak negotiates and manages investments, as well as oversees the financial and operational management of the firm. Mr. Lisiak is also the Managing Partner of Metropolitan Equity Partners, which employs a special situation investment strategy with a particular focus on financial services. Prior thereto, he was a member of the Global High Yield team at Lazard Asset Management. Mr. Lisiak received a BA in Economics from the University of Pennsylvania. He currently serves as a board member of Capital Payments and Creditmax Holdings and is the chairman of Reed Energy. Mr. Lisiak brings to our Board experience in finance and management oversight, as well as the perspective of the Company’s largest outside stockholder, whom he represents.

Continuing Director Information

The following table sets forth information regarding our directors whose terms continue after the 2012 Annual Meeting. The terms for directors in Class II expire at the 2013 Annual Meeting, and the terms for directors in Class III expire at the 2014 Annual Meeting.

| Name |

|

Age |

|

Position |

|

Director

Since

|

| |

|

|

|

|

|

|

|

John J. Murabito(3)

|

|

56

|

|

Chairman of the Board

|

|

2011

|

|

Thomas C. Lund(2)(3)

|

|

68

|

|

Member of the Board of Directors

|

|

2011

|

|

Craig W. Thomas(1)(2)

|

|

37

|

|

Member of the Board of Directors

|

|

2011

|

(1) Member of the Audit Committee

(2) Member of the Compensation Committee

(3) Member of the Governance and Nominating Committee

Class II Directors – Terms Expiring at the 2013 Annual Meeting

John J. Murabito has been our Chairman of the Board since January 2012 and a director since May 2011. From November 2001 through February 2011, Mr. Murabito was Chief Executive Officer of Hapoalim Securities USA, Inc. and its predecessor companies, including Investec (US) Inc., an affiliate of the Investec Group, an international banking group. In his role as CEO of Investec (US) Inc., Mr. Murabito oversaw a firm with approximately 1,000 employees and $1 billion of assets. Mr. Murabito successfully restructured the company’s US operations, including the acquisition and disposition of businesses, to enhance stockholder value. In addition, as CEO of subsidiaries of publicly-traded companies in the UK, South Africa and Israel, he implemented structures to enhance corporate governance and controls. Mr. Murabito was a Managing Director in Information Technology at the National Securities Clearing Corporation and served as deputy CIO for this essential US securities industry clearing utility. Previously, Mr. Murabito was a general partner in the investment advisor Weiss Peck & Greer responsible for information technology and portfolio administration. Mr. Murabito spent ten years with the investment bank Dillon Read & Company, including as Chief Information Officer. Mr. Murabito earned an MBA from the Wharton School at the University of Pennsylvania. Mr. Murabito’s nearly thirty years of experience with investment banking and operations bring to the Board strong and effective knowledge of corporate governance, executive management and finance.

Thomas C. Lund has been a director since May 2011 and is the founder and Chief Executive Officer of Lund Capital Group, a private commercial real estate company that has holdings in various regions across the U.S. Prior to founding Lund Capital Group in 2000, Mr. Lund, in 1981, founded Customer Development Corporation (“CDC”), a company specializing in database management and marketing for financial institutions and other various companies around the world. Mr. Lund is widely known as a pioneer of database marketing. In 1987, CDC was honored by Inc. Magazine as the 8th fastest growing privately held company in the country. Mr. Lund, who is credited worldwide with many technical and creative innovations in the database marketing industry, also received the coveted “High-Tech Entrepreneur of the Year” award by Entrepreneur Magazine. Mr. Lund sold CDC in November 1998. In addition to Mr. Lund’s business interests, he and his wife are active philanthropists. Mr. Lund brings to the Board extensive experience in marketing and business growth, which is especially important as the Company seeks to expand its customer base.

Class III Directors – Term Expiring at the 2014 Annual Meeting

Craig W. Thomas has been a director since May 2011 and is a co-founder of Shareholder Advocates for Value Enhancement (S.A.V.E.) and a Managing Member of S.A.V.E. Partners III, LLC. He is also the founder of KC Trading Partners where he manages a portfolio of equity investments. Mr. Thomas served as Director of Research at S.A.C. Capital Advisors from 2007 to 2008 and was a Portfolio Manager at S.A.C. Capital Advisors from 2005 to 2007. Mr. Thomas was a Director at CR Intrinsic Investors, an affiliate of S.A.C. Capital Advisors, from 2004 to 2005, and he was a Research Analyst at S.A.C. Capital Advisors from 2003 to 2004. Prior to earning his MBA, Mr. Thomas was an Analyst at Goff Moore Strategic Partners and Rainwater, Inc. from 1999 to 2001 and an Associate at The Boston Consulting Group, Inc. from 1997 to 1999. Mr. Thomas is a former director of Laureate Education, Inc. and WCI Communities, Inc. Mr. Thomas earned his A.B. at Stanford University and earned his MBA from the Graduate School of Business at Stanford University. Mr. Thomas brings to the Board valuable experience in investment management, public company oversight and stockholder advocacy.

Family Relationships

Mr. Lund is the father-in-law of Mr. Oakes, the Company’s President and Chief Executive Officer.

Directors’ Compensation

As of May 25, 2011, directors’ compensation includes an annual fee of $10,000 cash, or stock at the director’s election, distributed quarterly in arrears with the number of shares determined by dividing $2,500 by the average closing price in the last five trading days of each respective quarter. At the beginning of a calendar year, directors additionally receive $10,000 in restricted stock vesting over two years, with the number of shares equal to $10,000 divided by the average closing price of the stock in the five prior trading days to year-end. Committee members each receive an additional annual fee of $7,500, dispensed quarterly in arrears in cash or stock at the director’s discretion. Committee chairs are paid $12,500 annually for their Committee work. For Committee fees elected to be received in stock, the number of shares is calculated at the average closing price in the last five trading days of each respective quarter. The Chairman of the Board receives total annual fees of $30,000 cash, or stock at his election, and $30,000 in restricted stock, under the same terms as the annual fees and stock grants as the directors above.

For the period January 1, 2011 to May 24, 2011 and for the fiscal year 2010, directors received an annual fee of $10,000 cash and a number of shares equal to $10,000 divided by the average closing price of the shares for the last five trading days in the prior calendar year. The directors also received meeting fees of $2,500 for each Board meeting attended; $1,500 for participation in a telephone meeting of the Board; an annual fee of $5,000 for membership on each Committee of the Board and $1,000 for each Committee meeting attended. The Chairperson of each Committee received an annual fee of $5,000 in addition to the membership fee.

In 2008 the Company adopted a deferred compensation plan for directors whereby the directors may elect to defer their compensation to a date following the termination of their service as a director. The Company also reimburses directors for reasonable expenses incurred in attending Board and Committee meetings.

The following table provides the compensation earned by our non-employee directors for the years ended December 31, 2011 and 2010. Mr. Cannavino’s directors’ fees earned during the period January 1, 2011 to May 24, 2011 and the year ended 2010 are included in the Summary Compensation Table provided below in this proxy statement.

|

Name

|

|

|

|

|

Fees

Earned

or Paid in Cash

($)

|

|

|

Stock Awards

($)

|

|

|

Option Awards

($)

|

|

|

Non-equity Incentive Plan Compensation

($)

|

|

|

Nonqualified Deferred Compensation Earnings

($)

|

|

|

All Other Compensation

($)

|

|

|

Total

($)

|

|

|

Michael Levin (1)

|

|

2011

2010

|

|

|

$

$

|

23,000

18,000

|

|

|

$

|

22,000

10,000

|

|

|

|

--

--

|

|

|

|

--

--

|

|

|

|

--

--

|

|

|

|

--

--

|

|

|

$

$

|

45,000

28,000

|

|

|

James A. Cannavino (2)

|

|

2011 |

|

|

$ |

11,000 |

|

|

$ |

-- |

|

|

|

-- |

|

|

|

-- |

|

|

|

-- |

|

|

|

-- |

|

|

$ |

11,000 |

|

|

Thomas C. Lund (3)

|

|

2011 |

|

|

$ |

11,000 |

|

|

$ |

6,000 |

|

|

|

-- |

|

|

|

-- |

|

|

|

-- |

|

|

|

-- |

|

|

$ |

17,000 |

|

|

John J. Murabito (4)

|

|

2011 |

|

|

$ |

23,000 |

|

|

$ |

6,000 |

|

|

|

-- |

|

|

|

-- |

|

|

|

-- |

|

|

|

-- |

|

|

$ |

29,000 |

|

|

Philip Summe (5)

|

|

2011 |

|

|

$ |

18,000 |

|

|

$ |

6,000 |

|

|

|

-- |

|

|

|

-- |

|

|

|

-- |

|

|

|

-- |

|

|

$ |

24,000 |

|

|

Craig W. Thomas (6)

|

|

2011 |

|

|

$ |

18,000 |

|

|

$ |

6,000 |

|

|

|

-- |

|

|

|

-- |

|

|

|

-- |

|

|

|

-- |

|

|

$ |

24,000 |

|

|

Dennis Murray (7)

|

|

2011

2010

|

|

|

$

|

17,000

46,000

|

|

|

$

|

4,000

10,000

|

|

|

|

--

--

|

|

|

|

--

--

|

|

|

|

--

--

|

|

|

|

--

--

|

|

|

$

$

|

21,000

56,000

|

|

|

Bernard Puckett (8)

|

|

2011

2010

|

|

|

$

|

20,000

46,000

|

|

|

$

$

|

4,000

10,000

|

|

|

|

--

--

|

|

|

|

--

--

|

|

|

|

--

--

|

|

|

|

--

--

|

|

|

$

$

|

24,000

56,000

|

|

|

Charles Mechem (9)

|

|

2011

2010

|

|

|

$

|

20,000

34,500

|

|

|

$

$

|

4,000

10,000

|

|

|

|

--

--

|

|

|

|

--

--

|

|

|

|

--

--

|

|

|

|

--

--

|

|

|

$

$

|

24,000

44,500

|

|

Footnotes

|

|

(1)

|

Mr. Levin was Chairman of the Board from May 25, 2011 to December 31, 2011. He has been the director designee of Metropolitan Venture Partners and as such, prior to January 1, 2011, all of his directors’ fees were assigned and paid to Metropolitan Venture Partners.

|

|

|

(2)

|

Mr. Cannavino was Chairman of the Board from January 1, 2010 to May 24, 2011. From May 25, 2011 to December 31, 2011 he was a member of the Governance and Nominating Committee.

|

|

|

(3)

|

Mr. Lund has been a director and member of the Compensation Committee since May 25, 2011.

|

|

|

(4)

|

Mr. Murabito has been a director and a member of the Compensation and Governance and Nominating Committees since May 25, 2011. He was also Chair of the Audit Committee through December 21, 2011. He has been Chairman of the Board since January 1, 2012.

|

|

|

(5)

|

Mr. Summe has been a director, Chair of the Governance and Nominating Committee and member of the Audit Committee since May 25, 2011.

|

|

|

(6)

|

Mr. Thomas has been a director, a member of the Audit Committee and a member of the Compensation Committee since May 25, 2011. He has been Chair of the Compensation Committee since May 31, 2011 and acting Chair of the Audit Committee since March 20, 2012.

|

|

|

(7)

|

Dr. Murray was a director, Chair of the Audit Committee and member of the Compensation Committee from January 1, 2010 to May 24, 2011.

|

|

|

(8)

|

Mr. Puckett was a director, Chair of the Compensation Committee and member of the Audit Committee from January 1, 2010 to May 24, 2011.

|

|

|

(9)

|

Mr. Mechem was a director from January 1, 2010 to May 24, 2011.

|

Board Meetings and Attendance

Our Board held eight meetings during our fiscal year ended December 31, 2011. A quorum of directors was present, either in person or telephonically, for all such meetings. Actions were also taken during the year by the unanimous written consent of the directors. During 2011, all directors attended at least 75% of the total number of meetings of the Board and the total number of meetings of all committees of the Board on which they served. All of the directors attended the 2011 Annual Meeting of Stockholders on May 25, 2011.

Director Independence

The Company’s common stock is not traded on any exchange, but the Company has chosen to observe the independence rules of the NASDAQ Stock Market pursuant to applicable rules of the Securities and Exchange Commission (“SEC”), on which all references to independence below are based. The Board has determined that each of the following nominees and directors are independent: Paul Lisiak, Thomas C. Lund, John J. Murabito, Philip Summe and Craig W. Thomas.

Audit Committee and Audit Committee Financial Expert

The Board has a standing Audit Committee. The Board has affirmatively determined that each director who serves on the Audit Committee is independent, as the term is defined by applicable SEC rules. From May 25, 2011 to December 31, 2011, the Audit Committee consisted of John J. Murabito (Chairman), Philip Summe and Craig W. Thomas. From January 1, 2010 to May 24, 2011, the Audit Committee consisted of Dr. Dennis J. Murray (Chairman), Charles Mechem and Bernard Puckett. The members of the Audit Committee have substantial experience in assessing the performance of companies, gained as members of the Company’s Board and Audit Committee, as well as by serving in various capacities in other companies or governmental agencies. As a result, they each have an understanding of financial statements. In addition, the Board determined that Mr. Thomas, who is currently serving as Acting Chairman of the Audit Committee, and Mr. Summe, each qualifies as an audit committee financial expert, as that term is defined in applicable regulations of the SEC.

The Audit Committee regularly meets with our independent registered public accounting firm outside the presence of management. The charter of the Audit Committee is available on the Company’s website, www.directinsite.com. The Audit Committee held seven meetings during 2011.

Compensation Committee

Our Compensation Committee annually establishes, subject to the approval of the Board of Directors and any applicable employment agreements, the salaries which will be paid to our executive officers during the coming year, and administers our stock-based benefit plans. From May 25, 2011 to December 31, 2011, the Compensation Committee consisted of Craig W. Thomas (Chairman), Thomas C. Lund and John J. Murabito. From January 1, 2010 to May 24, 2011, the Compensation Committee consisted of Bernard Puckett (Chairman), Charles Mechem and Dr. Dennis J. Murray. Each member of the Compensation Committee is a Director who is not employed by us or any of our affiliates, and is independent. The Compensation Committee held eleven meetings during 2011.

Governance and Nominating Committee

The Governance and Nominating Committee assists the Board in fulfilling its responsibilities relating to director nominations and corporate governance matters. The Committee’s primary responsibilities and duties are to (i) identify individuals qualified to become directors and recommend that the Board select such individuals for all directorships to be filled by the Board or by the stockholders; (ii) develop and recommend to the Board a set of corporate governance principles applicable to the Company; and (iii) otherwise take a leadership role in shaping the corporate governance of the Company. From May 25, 2011 to December 31, 2011 the Governance and Nominating Committee consisted of Philip Summe (Chairman), Michael Levin, James A. Cannavino and John J. Murabito. The Committee was formed on March 24, 2011 and from that date to May 24, 2011, the Committee consisted of Charles Mechem (Chairman) and Bernard Puckett. Each member of the Committee is a director who is not employed by us or any of our affiliates and is independent. The charter of the Governance and Nominating Committee is available on the Company’s website, www.directinsite.com. The Governance and Nominating Committee held two meetings during 2011.

Consideration of Director Nominees

The Company is of the view that the continuing service of qualified incumbents promotes stability and continuity in the board room, contributing to the Board’s ability to work as a collective body, while giving the Company the benefit of the familiarity and insight into the Company’s affairs that its directors have accumulated during their tenure. In considering candidates for election at annual meetings of stockholders, the Governance and Nominating Committee will first determine the incumbent directors whose terms expire at the upcoming meeting and who wish to continue their service on the Board. The Committee will evaluate the qualifications and performance of the incumbent directors that desire to continue their service. In particular, as to each such incumbent director, the Committee will: consider if the director continues to satisfy the minimum qualifications for director candidates adopted by the Committee and determine whether there exist any special, countervailing considerations against re-nomination of the director. If the Committee determines that an incumbent director consenting to re-nomination continues to be qualified and has satisfactorily performed his or her duties as director during the preceding term and there exist no reasons, including considerations relating to the composition and functional needs of the Board as a whole, why in the Committee’s view the incumbent should not be re-nominated, the Committee will, absent special circumstances, propose the incumbent director for re-election.

The Governance and Nominating Committee will identify and evaluate new candidates for election to the Board where there is no qualified and available incumbent, including for the purpose of filing vacancies arising by reason of the resignation, retirement, removal, death or disability of an incumbent director or a decision of the directors to expand the size of the Board.

The Governance and Nominating Committee will solicit recommendations for nominees from persons that the Nominating Committee believes are likely to be familiar with qualified candidates. These persons may include members of the Board, including members of the Committee, and management of the Company. The Committee may also determine to engage a professional search firm to assist in identifying qualified candidates; where such a search firm is engaged, the Committee shall set its fees and scope of engagement. The Committee will also, where appropriate, honor the contractual right of Metropolitan Venture Partners, the Company’s largest outside stockholder, to designate a Board representative.

In making its selection, the Committee will evaluate candidates proposed by stockholders under criteria similar to the evaluation of other candidates, except that the Committee may consider, as one of the factors in its evaluation of stockholder recommended nominees, the size and duration of the interest of the recommending stockholder or stockholder group in the equity of the Company. While the Committee has not established a minimum number of shares that a stockholder must own in order to present a nominating recommendation for consideration, or a minimum length of time during which the stockholder must own its shares, the Committee will take into account the size and duration of a recommending stockholder’s ownership interest in the Company and whether the recommending stockholder intends to continue holding its interest at least through the time of such annual meeting.

Board Leadership Structure

The current leadership structure of the Company provides for the separation of the roles of the Chief Executive Officer and the Chairman of the Board. The Company believes that this structure is most appropriate for the Company, since the two positions serve different functions. The Company’s Chairman provides leadership as Chairman of the Board and strategic oversight of the Company, and is particularly suited for this position, given his experience in executive management, finance and corporate governance. The Company’s Chief Executive Officer is responsible for the day-to-day supervision, management and control of the business and affairs of the Company. In support of the independent oversight of management, the non-management directors routinely meet and hold discussions without management present. The Board regularly reviews the Company’s leadership structure.

As part of its strategic function, the full Board is responsible for oversight of risk, and regularly addresses aspects of risk management with the Company’s executive officers. These include customer concentration, the efficacy of the Company’s sales and marketing programs and the reliability of its financial and accounting functions.

MANAGEMENT

The following sets forth certain information with respect to the Company’s executive officers (other than Matthew E. Oakes, for whom information is set forth above under the heading “Nominee Information”):

|

Name

|

|

Age

|

|

Position

|

|

Matthew E. Oakes

|

|

49

|

|

President and Chief Executive Officer

|

|

Arnold Leap

|

|

44

|

|

Executive Vice President Channel Sales and Chief Technology Officer

|

|

Sandra Wallace

|

|

52

|

|

Vice President Finance and Acting Chief Financial Officer, Secretary and Treasurer

|

|

Joan Foley

|

|

53

|

|

Vice President Sales

|

Arnold Leap has been the Company’s Executive Vice President and Chief Technology Officer since November 2000. Since January 2012, Mr. Leap has served in the additional role of EVP Channel Sales, prior to which he served as EVP Sales and Marketing. From March 1998 until November 2000 he held the position of Chief Information Officer. Mr. Leap originally was hired in February 1997 as the Company’s Director of Development and Engineering and held the position until March 1998. Prior to his joining Direct Insite, Mr. Leap was the MIS Manager/Director of AMP Circuits, Inc., and a subsidiary of AMP, Inc. from 1993 to February 1997. His responsibilities at AMP Circuits, Inc. included day-to-day information systems operation as well as the development and implementation of a consolidated ERP and financial system. Mr. Leap earned his Bachelors Degree from New York Institute of Technology with a major in Computer Science and a minor in Business Administration.

Sandra Wallace was appointed Vice President of Finance and Acting Chief Financial Officer in September 2011 and Secretary and Treasurer of the Company shortly thereafter. Prior to joining the Company, Ms. Wallace provided finance, accounting and technology management consulting services, including oversight of independent auditors and development of accounting and finance functions, for a variety of public and private companies from 2009 to September 2011. From 2008 to 2009, Ms. Wallace served as Senior Vice President, Finance, and later as Senior Vice President, Corporate Operations, for Purple Beverage Company, Inc., a publicly-traded beverage industry company. From 1999 to 2008, Ms. Wallace was Vice President and Chief Financial Officer of Robinette Homes Signature Series, Inc., a South Florida real estate developer. From 1997 to 1999, Ms. Wallace was Finance Director for Interim Services Inc., now SFN Group, Inc., and she served as Controller for Brooke Group Ltd., now Vector Group Ltd., from 1993 to 1997. Ms. Wallace spent the first seven years of her professional career with KPMG LLP. Ms. Wallace earned her Master of Science degree in Accounting from Oklahoma State University and Bachelor of Science degree in Business Administration from the University of Minnesota. She is a Certified Public Accountant and a member of the American Institute of Certified Public Accountants.

Joan Doyle Foley joined the Company as Vice President of Sales in January 2012. Prior to joining the Company Ms. Foley was an independent sales and strategy consultant for early stage application software companies from 2010 to December 2011. From 2009 to 2010 she held the position of Vice President of Worldwide Sales at Firstrain, Inc., a SaaS provider of an analytic application for gathering customer intelligence from the web. Ms. Foley was a founder, CEO and Vice President of Sales for APT Intelligence, a SaaS provider of an analytic application for the property management industry from 2006 to 2009. Prior thereto, Ms. Foley was Vice President of Sales at Valchemy, Inc. (subsequently acquired by IBM Global Services in 2006), a SaaS provider of an application for managing mergers and acquisitions, and Vice President of Sales at SuccessFactors, Inc. (acquired by SAP in 2012), a provider of SaaS human resource applications. She previously held sales and executive sales management positions with Hyperion Solutions, Oracle Corporation and IBM. Ms. Foley earned her Bachelor of Science degree in Engineering from Michigan State University.

Executive Compensation

The following table sets forth the annual and long-term compensation with respect to each person who served as the Company’s Principal Executive Officer (“PEO”), the Company’s two most highly compensated executive officers other than the PEO, and an additional individual who would have qualified as such but was not serving as an executive officer at the end of 2011, for the years ended December 31, 2011 and 2010.

Summary Compensation Table

|

Name and Principal

Position

|

|

Year

|

|

Salary

($)

|

|

|

Bonus

($)

|

|

|

Stock

Awards

($) (1)

|

|

|

Options

Awards

($) (1)

|

|

|

Non-Equity

Incentive

Plan

Compensation

($)

|

|

|

Nonqualified

Deferred

Compensation

Earnings ($)

|

|

|

All Other

Compensation

($) (2)

|

|

|

Total

($)

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Matthew E. Oakes

|

|

2011

|

|

$ |

218,750 |

|

|

$ |

50,000 |

|

|

$ |

-- |

|

|

$ |

15,525 |

(4) |

|

$ |

-- |

|

|

$ |

-- |

|

|

$ |

10,650 |

|

|

$ |

294,925 |

|

|

President and Chief Executive Officer (PEO) (3)

|

|

2010

|

|

$ |

186,000 |

|

|

$ |

-- |

|

|

$ |

97,875 |

|

|

$ |

-- |

|

|

$ |

-- |

|

|

$ |

-- |

|

|

$ |

10,829 |

|

|

$ |

294,704 |

|

|

Arnold Leap

|

|

2011

|

|

$ |

208,333 |

|

|

$ |

5,000 |

|

|

$ |

-- |

|

|

$ |

-- |

|

|

$ |

-- |

|

|

$ |

-- |

|

|

$ |

9,600 |

|

|

$ |

222,933 |

|

|

EVP Channel Sales and Chief Technology Officer

|

|

2010

|

|

$ |

198,000 |

|

|

$ |

25,000 |

|

|

$ |

97,875 |

|

|

$ |

-- |

|

|

$ |

-- |

|

|

$ |

-- |

|

|

$ |

11,526 |

|

|

$ |

332,401 |

|

|

Sandra Wallace

|

|

2011

|

|

$ |

44,923 |

|

|

$ |

4,000 |

|

|

$ |

-- |

|

|

$ |

-- |

|

|

$ |

-- |

|

|

$ |

-- |

|

|

$ |

-- |

|

|

$ |

48,923 |

|

|

Vice President Finance and Acting Chief Financial Officer (5)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

James A. Cannavino

|

|

2011

|

|

$ |

125,789 |

|

|

$ |

-- |

|

|

$ |

10,000 |

(7) |

|

$ |

-- |

|

|

$ |

-- |

|

|

$ |

-- |

|

|

$ |

689,088 |

|

|

$ |

824,877 |

|

|

Former Chief Executive Officer (6)

|

|

2010

|

|

$ |

340,740 |

|

|

$ |

-- |

|

|

$ |

270,000 |

|

|

$ |

-- |

|

|

$ |

-- |

|

|

$ |

-- |

|

|

$ |

227,524 |

|

|

$ |

838,264 |

|

|

Michael J. Beecher

|

|

2011

|

|

$ |

132,059 |

|

|

$ |

-- |

|

|

$ |

-- |

|

|

$ |

-- |

|

|

$ |

-- |

|

|

$ |

-- |

|

|

$ |

10,160 |

|

|

$ |

142,219 |

|

|

Former Chief Financial Officer (8)

|

|

2010

|

|

$ |

175,000 |

|

|

$ |

-- |

|

|

$ |

23,657 |

|

|

$ |

-- |

|

|

$ |

-- |

|

|

$ |

-- |

|

|

$ |

14,843 |

|

|

$ |

213,500 |

|

Footnotes

|

|

(1)

|

The assumptions used in determining the value of stock and option awards are included in Note 6 to the accompanying consolidated financial statements contained in the Company’s Annual Report on Form 10-K for the year ended December 31, 2011.

|

|

|

(2)

|

All Other Compensation includes the following for each of the executives:

|

In 2011, Mr. Oakes received a car allowance including insurance valued at $10,650, and in 2010 a car allowance including insurance of $9,600 and other reimbursable expenses of $1,229.

In 2011, Mr. Leap received a car allowance including insurance of $9,600 and in 2010 a car allowance including insurance of $9,600 and life insurance costs of $1,860.

In 2011, Mr. Cannavino received a severance payment of $620,400, medical expenses of $18,070, other reimbursable expenses of $45,000, auto reimbursements of $2,618 and Directors fees of $3,000. In 2010, Mr. Cannavino received a housing/office allowance of $120,000, medical expenses of $12,709, other reimbursable expenses of $55,000, leased cars including insurance valued at $11,772, and director's fees of $28,000.

In 2011, Mr. Beecher received a car allowance including insurance of $10,160, and in 2010 a car allowance including insurance of $9,600 and a living allowance of $5,200.

|

|

(3)

|

Mr. Oakes was appointed Chief Executive Officer on May 25, 2011.

|

|

|

(4)

|

On August 16, 2011, the Company granted Mr. Oakes options to purchase an aggregate of 22,500 shares of the Company’s common stock, 2,500 of such options vested on the date of the grant and the remaining 20,000 options vested in four equal installments on September 1, October 1, November 1 and December 1, 2011.

|

|

|

(5)

|

Ms. Wallace was appointed Vice President Finance and Acting Chief Financial Officer on September 21, 2011.

|

|

|

(6)

|

Mr. Cannavino elected to terminate his employment with the Company pursuant to the terms of his amended employment agreement on May 25, 2011.

|

|

|

(7)

|

On January 1, 2011, in connection with his service as a director, Mr. Cannavino was awarded a number of shares equal to $10,000 divided by the average closing price of the shares for the last five trading days in the prior calendar year.

|

|

|

(8)

|

Mr. Beecher resigned from his positions as Chief Financial Officer, Treasurer and Secretary effective September 15, 2011.

|

Employment Agreements

We have an employment agreement with Mr. Oakes, our Chief Executive Officer and President, for a two-year term effective January 1, 2012 through December 31, 2013. The agreement provides for a base salary of $22,917 per month, annual incentive bonuses based on the Company’s performance in achieving prescribed revenue and EBIT targets, and discretionary bonuses. The agreement further provides for the grant of options to purchase an aggregate of 360,000 shares of common stock of the Company at an exercise price of $1.15 per share, 90,000 of such options to vest on the twelve-month anniversary date of grant and the remaining options to vest in equal monthly installments beginning on the thirteen-month anniversary of the date of grant and concluding on the four-year anniversary of the date of grant. In addition, the Company has agreed to reimburse Mr. Oakes for up to $25,000 of expenses incurred in connection with his relocation to the Company’s headquarters in Sunrise, Florida. The agreement also provides for reimbursement of certain out-of-pocket expenses and certain severance benefits in the event of termination prior to the expiration date. For details relating to such severance benefits, please see “Potential Payments upon Termination or Change-in-Control” below.

On April 26, 2011, we entered into an employment agreement with Mr. Leap, formerly Executive Vice President of Sales and Marketing and Chief Technology Officer, for a two-year term commencing as of January 1, 2011 and ending on December 31, 2012, which was subsequently amended on January 9, 2012 to change Mr. Leap’s title and responsibilities to Executive Vice President of Channel Sales and Chief Technology Officer of the Company. The agreement provides for annual compensation of $80,000 for his position as Chief Technology Officer and $120,000 as Executive Vice President of Channel Sales, for a total of $200,000 as base salary, which is subject to such increases as the Company may determine, taking into consideration, among other things, the Company’s and Mr. Leap’s performance during the preceding year. Mr. Leap shall be eligible to receive an annual incentive bonus for his position as Chief Technology Officer, with a target bonus equal to 20% of the apportioned base salary of $80,000. Eighty percent of the annual bonus shall be based on the Company’s attainment of revenue growth and cash flow from operations as set forth in its annual commitment plan approved by the Board of Directors that will include a threshold opportunity of 50% of attainment and a maximum payout of 150% of attainment. Twenty percent of the annual bonus will be based on individual objectives as determined by the Compensation Committee of the Board. The Agreement further provides for reimbursement of certain expenses, and certain severance benefits in the event of termination prior to the expiration date of the Agreement. For details relating to such severance benefits, please see “Potential Payments upon Termination or Change-in-Control” below.

On January 1, 2011, the Company entered into a one-year consulting agreement with its former President ending on December 31, 2011. During the term of the agreement compensation was paid at a rate of $6,000 per month plus reimbursement of out-of-pocket expenses. Duties under the agreement included consultation with senior executives concerning the Company’s respective businesses and operations.

We had an agreement with our former Chief Executive Officer, James Cannavino, which had a two-year term effective January 1, 2011 through December 31, 2012 and was amended on April 26, 2011. Mr. Cannavino elected to terminate his employment the Company effective May 25, 2011. The agreement provided for a salary of $25,833 per month and an annual incentive bonus with a target equal to 70% of the base annual salary subject to achieving certain revenue growth and operating cash flow goals. The agreement further provided for reimbursement of certain medical and travel expenses and certain severance benefits in the event of termination prior to the expiration date, and in the event of termination on the expiration date, Mr. Cannavino was entitled to serve as a consultant to the Company for twelve months and receive monthly payments equal to the monthly base salary amount. On December 31, 2011, the Company entered into a Termination and Settlement Agreement with Mr. Cannavino, pursuant to which the Company, in full satisfaction of all obligations to Mr. Cannavino under the his employment agreement, paid to Mr. Cannavino a lump sum payment of $620,400. In addition, Mr. Cannavino agreed not to provide services to any competitor of the Company, solicit any customer of the Company to cease purchasing goods or services from the Company or solicit any employee of the Company, each through May 25, 2013. Mr. Cannavino and the Company also provided each other a full release of all claims under his employment agreement.

We had an agreement with our former Chief Financial Officer, Michael Beecher, which had a one year term effective January 1, 2011 through December 31, 2011, with an option to renew for an additional year to December 31, 2012. Mr. Beecher resigned from the Company on September 15, 2011. The agreement provided for a salary of $15,417 per month and an annual incentive bonus with a target equal to 20% of the base annual salary subject to achieving certain revenue growth and operating cash flow goals. The agreement further provided for use of an automobile and related expenses; reimbursement of certain medical and travel expenses; and certain severance benefits in the event of termination prior to the expiration date. For details relating to such severance benefits, please see “Potential Payments upon Termination or Change-in-Control” below.

Equity Compensation Plan Information

We maintain various stock plans under which options and shares are awarded at the discretion of our Board or its Compensation Committee. With respect to shares of common stock that may be issued under the plans as well as the shares underlying options awarded under the plans, the purchase price per share is fixed by the Board or the Compensation Committee, however it cannot be less than the fair market value of the common stock on the issuance or grant date, as applicable. The term of each option is generally five years and is determined at the time of the grant by the Board or the Compensation Committee. The participants in these plans are officers, directors, employees and consultants of the Company and its subsidiaries and affiliates.

The following information is provided about our current stock option plans:

|

Plan

|

|

Shares Originally Covered

|

|

Expiration Date for

Grants

|

|

Options

Granted

During 2011

|

|

|

Options

Outstanding at

December 31, 2011

|

|

|

2001 Stock Option/Stock Issuance Plan

|

|

|

330,000 |

|

May 31, 2011

|

|

|

-- |

|

|

|

-- |

|

|

2001-A Stock Option/Stock Issuance Plan

|

|

|

600,000 |

|

September 17, 2011

|

|

|

-- |

|

|

|

-- |

|

|

2002 Stock Option/Stock Issuance Plan

|

|

|

625,000 |

|

January 1, 2012

|

|

|

-- |

|

|

|

-- |

|

|

2002-A Stock Option/Stock Issuance Plan

|

|

|

875,000 |

|

January 1, 2012

|

|

|

-- |

|

|

|

-- |

|

|

2003 Stock Option/Stock Issuance Plan

|

|

|

725,000 |

|

April 1, 2013

|

|

|

-- |

|

|

|

-- |

|

|

2003-A Stock Option/Stock Issuance Plan

|

|

|

975,000 |

|

April 1, 2013

|

|

|

-- |

|

|

|

-- |

|

|

2003 Stock Option/Stock Issuance Plan

|

|

|

1,200,000 |

|

August 20, 2014

|

|

|

77,500 |

|

|

|

127,500 |

|

The terms of each of the plans are substantially the same. Options granted under the plans may be incentive stock options qualified under Section 422 of the Internal Revenue Code of 1986, as amended, or non-qualified stock options. The exercise price of options granted under the plans must equal at least the fair market value at the date of the grant. The exercise price for incentive stock options granted to employees who own 10% or more of our stock must equal at least 110% of the market value at the date of the grant. The nature and terms of the options to be granted are determined at the date of the grant by the Compensation Committee of the Board. Stock options granted under the 2001 Option/Stock Issuance and 2003 Stock Option/Stock Issuance Plans may not expire later than ten years from the date of grant, while options granted under the other plans may not expire later than five years from the date of grant. Stock options granted under the plan may become exercisable in one or more installments in the manner and at the time or times specified by the Committee.

The following table provides information concerning outstanding options, unvested stock and equity incentive plan awards for the named executives as of December 31, 2011:

| |

|

Option Awards

|

|

Stock Awards

|

|

|

Name

|

|

Number of

Securities

Underlying

Unexercised

Options -

Exercisable

|

|

|

Number of Securities Underlying Unexercised Options -Unexercisable

|

|

|

Equity

Incentive

Plan Awards:

Number of

Underlying

Unexercised

Unearned

Options

|

|

|

Option

Exercise

Price

|

|

Option Expiration

Date

|

|

Number of Shares or Units of Stock That Have Not Vested

|

|

|

Market Value

of Shares or

Units of Stock

That Have Not

Vested

|

|

|

Equity

Incentive Plan

Awards:

Number of

Unearned

Shares, Units

or Other Rights

That Have Not

Vested

|

|

|

Equity

Incentive Plan

Awards: Market

or Payout Value

of Unearned

Shares, Units or

Other Rights

That Have Not

Vested

|

|

|

James Cannavino

|

|

|

50,000 |

(1) |

|

|

-- |

|

|

|

-- |

|

|

$ |

1.50 |

|

3/25/2013

|

|

|

-- |

|

|

|

-- |

|

|

|

-- |

|

|

|

-- |

|

|

Matthew E. Oakes

|

|

|

22,500 |

(2) |

|

|

-- |

|

|

|

-- |

|

|

$ |

1.15 |

|

8/16/2016

|

|

|

-- |

|

|

|

-- |

|

|

|

-- |

|

|

|

-- |

|

(1) These options were fully vested on March 25, 2009

(2) These options were fully vested on December 31, 2011

Potential Payments upon Termination or Change-in-Control

Each of the employment agreements with Messrs. Oakes and Leap provide that upon termination by the Company without cause or by the executive for good reason, in each case as defined in the relevant agreement, the executive will be entitled to (i) his base salary through the date of termination, (ii) immediate vesting of all Company stock options, restricted stock and other outstanding equity awards, (iii) a lump sum cash payment equal to base salary at the date of termination times a payment factor of 1.3, (iv) a lump sum cash payment equal to the executive’s annual automobile costs and expenses and twelve months of COBRA coverage, (v) any unpaid annual bonus with respect to any completed fiscal year, and (vi) certain other accrued obligations, such as unreimbursed business expenses.

In the event of termination of an executive’s employment due to the executive’s death or disability, we have agreed to pay the executive, or his estate, his base salary through the date of termination, any unpaid annual bonus with respect to any completed fiscal year, certain other accrued obligations, and a pro rata bonus for the year of termination. In addition, all of the executive’s stock options, restricted stock and other outstanding equity based awards shall immediately vest upon termination of the executive’s employment due to the executive’s death or disability.

Mr. Leap’s severance benefits also include the payment of all past due commissions.

Mr. Beecher’s employment agreement provided that upon termination by the Company without cause or by Mr. Beecher for good reason, in each case as defined in his agreement, the executive was entitled to (i) his base salary through the date of termination, (ii) immediate vesting of all Company stock options, restricted stock and other outstanding equity awards, (iii) a lump sum cash payment equal to base salary at the date of termination times a payment factor of 1.3, (iv) a lump sum payment of the economic equivalent of medical coverage and the use of an automobile costs and expenses for a period of one year, (v) any unpaid annual bonus with respect to any completed fiscal year, and (vi) certain other accrued obligations, such as unreimbursed business expenses. Mr. Beecher resigned from the Company effective September 15, 2011 and received his base salary through such date, an automobile and medical insurance allowance and certain other accrued obligations in accordance with his employment agreement.

Mr. Cannavino’s employment agreement provided that upon termination of his employment Mr. Cannavino was entitled to certain severance benefits. Mr. Cannavino elected to terminate his employment the Company effective May 25, 2011 and was entitled to receive severance benefits under his employment agreement that included the payment of twice his annual base salary, the immediate vesting of all Company stock options, restricted stock and other outstanding equity based awards, and the payment of all accrued obligations, which obligations primarily consisted of unreimbursed business expenses through May 25, 2011. On December 31, 2011, the Company entered into a Termination and Settlement Agreement with Mr. Cannavino, the terms of which are described above under “Employment Agreements”.

The table below sets forth the payments and other benefits that would be provided to Messrs. Oakes and Leap upon termination of their employment by the Company without cause or by the executive for good reason or by death or disability. We have assumed a termination as of the end of the day on December 31, 2011 and used the closing price of our common stock on that date of $0.70 per share for purposes of the calculations for the table below:

Executive Severance Payments

|

Name

|

|

Cash Severance Payments

Upon Termination by

Executive for Good Reason