s

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

(Mark One)

|

☒ |

ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended September 30, 2019.

|

☐ |

TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 001-38042

ARROWHEAD PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

|

Delaware |

|

46-0408024 |

|

(State of incorporation) |

|

(I.R.S. Employer Identification No.) |

177 E. Colorado Blvd, Suite 700

Pasadena, California 91105

(626) 304-3400

(Address and telephone number of principal executive offices)

Securities registered under Section 12(b) of the Exchange Act:

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

|

Common Stock, $0.001 par value |

ARWR |

The Nasdaq Global Select Market |

Securities registered pursuant to Section 12(g) of the Exchange Act: None

Indicate by a check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by a check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ☒ |

|

Accelerated filer ☐ |

|

Non-accelerated filer ☐ |

|

Smaller Reporting Company ☐ |

|

Emerging growth company ☐ |

|

|

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of issuer’s voting and non-voting outstanding Common Stock held by non-affiliates was approximately $1.7 billion based upon the closing stock price of issuer’s Common Stock on March 31, 2019. Shares of common stock held by each officer and director and by each person who is known to own 10% or more of the outstanding Common Stock have been excluded in that such persons may be deemed to be affiliates of the Company. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of November 20, 2019, 95,708,027 shares of the issuer’s Common Stock were issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Definitive Proxy Statement to be filed for Arrowhead Pharmaceuticals Inc.’s 2020 Annual Meeting of Stockholders are incorporated by reference into Part III hereof.

|

|

|

|

|

|

|

|

|

|

||

|

ITEM 1. |

|

|

1 |

|

|

ITEM 1A. |

|

|

25 |

|

|

ITEM 1B. |

|

|

38 |

|

|

ITEM 2. |

|

|

38 |

|

|

ITEM 3. |

|

|

38 |

|

|

ITEM 4. |

|

|

38 |

|

|

|

|

|

||

|

PART II |

|

|

|

|

|

|

|

|

||

|

ITEM 5. |

|

|

39 |

|

|

ITEM 6. |

|

|

41 |

|

|

ITEM 7. |

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

|

42 |

|

ITEM 7A. |

|

|

52 |

|

|

ITEM 8. |

|

|

52 |

|

|

ITEM 9. |

|

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE |

|

52 |

|

ITEM 9A. |

|

|

52 |

|

|

ITEM 9B. |

|

|

53 |

|

|

|

|

|

||

|

PART III |

|

|

|

|

|

|

|

|

||

|

ITEM 10. |

|

|

53 |

|

|

ITEM 11. |

|

|

53 |

|

|

ITEM 12. |

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDERS |

|

53 |

|

ITEM 13. |

|

CERTAIN RELATIONSHIPS, RELATED TRANSACTIONS AND DIRECTORS INDEPENDENCE |

|

53 |

|

ITEM 14. |

|

|

53 |

|

|

|

|

|

||

|

PART IV |

|

|

|

|

|

|

|

|

||

|

ITEM 15. |

|

|

53 |

|

|

|

|

|||

|

|

56 |

|||

|

|

|

|||

|

|

F-1 |

|||

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, and we intend that such forward-looking statements be subject to the safe harbors created thereby. For this purpose, any statements contained in this Annual Report on Form 10-K except for historical information may be deemed to be forward-looking statements. Without limiting the generality of the foregoing, words such as “may,” “will,” “expect,” “believe,” “anticipate,” “intend,” “could,” “estimate,” or “continue” or the negative or other variations thereof or comparable terminology are intended to identify forward-looking statements. In addition, any statements that refer to projections of our future financial performance, trends in our businesses, or other characterizations of future events or circumstances are forward-looking statements.

The forward-looking statements included herein are based on current expectations of our management based on available information and involve a number of risks and uncertainties, all of which are difficult or impossible to predict accurately and many of which are beyond our control. As such, our actual results may differ significantly from those expressed in any forward-looking statements. Factors that may cause or contribute to such differences include, but are not limited to, those discussed in more detail in Item 1 (Business) and Item 1A (Risk Factors) of Part I and Item 7 (Management’s Discussion and Analysis of Financial Condition and Results of Operations) of Part II of this Annual Report on Form 10-K. Readers should carefully review these risks, as well as the additional risks described in other documents we file from time to time with the Securities and Exchange Commission. In light of the significant risks and uncertainties inherent in the forward-looking information included herein, the inclusion of such information should not be regarded as a representation by us or any other person that such results will be achieved, and readers are cautioned not to place undue reliance on such forward-looking information. Except as may be required by law, we disclaim any intent to revise the forward-looking statements contained herein to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

Unless otherwise noted, (1) the term “Arrowhead” refers to Arrowhead Pharmaceuticals, Inc., a Delaware corporation and its Subsidiaries, (2) the terms “Company,” “we,” “us,” and “our,” refer to the ongoing business operations of Arrowhead and its Subsidiaries, whether conducted through Arrowhead or a subsidiary of Arrowhead, (3) the term “Subsidiaries” refers collectively to Arrowhead Madison Inc. (“Arrowhead Madison”), Arrowhead Australia Pty Ltd (“Arrowhead Australia”) and Ablaris Therapeutics, Inc. (“Ablaris”), (4) the term “Common Stock” refers to Arrowhead’s Common Stock, (5) the term “Preferred Stock” refers to Arrowhead’s Preferred Stock and (6) the term “Stockholder(s)” refers to the holders of Arrowhead Common Stock.

ITEM 1.BUSINESS

Description of Business

Arrowhead develops medicines that treat intractable diseases by silencing the genes that cause them. Using a broad portfolio of RNA chemistries and efficient modes of delivery, Arrowhead therapies trigger the RNA interference mechanism to induce rapid, deep and durable knockdown of target genes. RNA interference, or RNAi, is a mechanism present in living cells that inhibits the expression of a specific gene, thereby affecting the production of a specific protein. Deemed to be one of the most important recent discoveries in life science with the potential to transform medicine, the discoverers of RNAi were awarded a Nobel Prize in 2006 for their work. Arrowhead’s RNAi-based therapeutics leverage this natural pathway of gene silencing.

Pipeline Overview

Arrowhead is focused on developing innovative drugs for diseases with a genetic basis, typically characterized by the overproduction of one or more proteins that are involved with disease. The depth and versatility of our RNAi technologies enables us to potentially address conditions in virtually any therapeutic area and pursue disease targets that are not otherwise addressable by small molecules and biologics. Arrowhead is leading the field in bringing the promise of RNAi to address diseases outside of the liver, and our pipeline now includes disease targets in the liver, lung, and solid tumors.

1

ARO-AAT is the company’s second generation subcutaneously administered RNAi therapeutic being developed as a treatment for liver disease associated with alpha-1 antitrypsin deficiency (AATD), which is a rare genetic disorder that severely damages the liver and lungs of affected individuals. ARO-AAT is designed to reduce production of the mutant Z-AAT protein by silencing the AAT gene in order to prevent accumulation of Z-AAT in the liver, allow clearance of the accumulated Z-AAT protein, prevent repeated cycles of cellular damage, and possibly prevent or even reverse the progression of liver fibrosis.

Arrowhead is currently investigating ARO-AAT in two clinical studies:

|

|

1. |

SEQUOIA (AROAAT2001), which is a potentially pivotal multi-center, multi-dose, placebo-controlled, adaptive Phase 2/3 study to evaluate the safety, efficacy and tolerability of ARO-AAT, administered subcutaneously to patients with alpha-1 antitrypsin deficiency. |

|

|

2. |

AROAAT2002, which is a pilot open-label, multi-dose, Phase 2 study to assess changes in a novel histological activity scale in response to ARO-AAT over time in patients with alpha-1 antitrypsin deficiency associated liver disease. |

Initial results from AROAAT1001, a randomized, double-blind, placebo controlled single-ascending dose and multiple-ascending dose Phase 1 study to evaluate the safety, tolerability, pharmacokinetics, and effect of subcutaneous doses of ARO-AAT on serum alpha-1 antitrypsin levels in healthy adult volunteers, were presented in November 2018 at The Liver Meeting®. In the AROAAT1001 study, 45 normal healthy volunteers received a single dose of ARO-AAT (n=16), three monthly doses of ARO-AAT (n=12), or placebo (n=17). Key data presented include the following:

|

|

• |

ARO-AAT at single and multiple doses produced robust and consistent reductions in serum AAT levels |

|

|

• |

Single-doses of 200 mg and 300 mg resulted in greater than 91% serum AAT reduction with 3 of 4 subjects having concentrations below the level of quantitation (BLQ) |

|

|

• |

In 200 mg and 300 mg single-dose cohorts, an average serum AAT reduction of greater than 90% was sustained for 6 weeks |

|

|

• |

In the multiple-dose cohorts of 200 and 300 mg, for subjects receiving all 3 doses, an average of greater than 90% reduction in serum AAT was sustained for longer than 14 weeks |

|

|

• |

The maximum NADIR reduction is 94% |

•Monthly serum AAT follow up is ongoing with 9 of 10 subjects at BLQ in the multiple-dose cohorts, including 100% of subjects from the 300 mg cohort

•Duration of response indicates that quarterly or less frequent dosing appears feasible

•ARO-AAT has been well-tolerated at all doses tested (up to 300 mg) given three times every 28 days

|

|

• |

The most common adverse events were upper respiratory tract infection (39%) and headache (32%) |

Goal of ARO-AAT Treatment

The goal of ARO-AAT treatment is prevention and potential reversal of Z-AAT accumulation-related liver injury and fibrosis. Reduction of inflammatory Z-AAT protein, which has been clearly defined as the cause of progressive liver disease in AATD patients, is important as it is expected to halt the progression of liver disease and allow fibrotic tissue repair.

Alpha-1 Antitrypsin Deficiency (AATD)

AATD is a genetic disorder associated with liver disease in children and adults, and pulmonary disease in adults. AAT is a circulating glycoprotein protease inhibitor that is primarily synthesized and secreted by liver hepatocytes. Its physiologic function is the inhibition of neutrophil proteases to protect healthy tissues during inflammation and prevent tissue damage. The most common disease variant, the Z mutant, has a single amino acid substitution that results in improper folding of the protein. The mutant protein cannot be effectively secreted and accumulates in globules in the hepatocytes. This triggers continuous hepatocyte injury, leading to fibrosis, cirrhosis, and increased risk of hepatocellular carcinoma.

Current Treatments

Individuals with the homozygous PiZZ genotype have severe deficiency of functional AAT leading to pulmonary disease and hepatocyte injury and liver disease. Lung disease in this patient population is frequently treated with AAT augmentation therapy. However, augmentation therapy does nothing to treat liver disease, and there is no specific therapy for hepatic manifestations. There is a significant unmet need as liver transplant, with its attendant morbidity and mortality, is currently the only available cure.

2

Study Name: Study of ARO-AAT in Normal Adult Volunteers

A Phase 1 Single and Multiple Dose-Escalating Study to Evaluate the Safety, Tolerability, Pharmacokinetics and Effect of ARO-AAT on Serum Alpha-1 Antitrypsin Levels in Normal Adult Volunteers

ClinicalTrials.gov Identifier: NCT03362242

Study Name: Assessment of Changes in a Novel Histological Activity Scale in Response to ARO-AAT

A Pilot Open Label, Multi-dose, Phase 2 Study to Assess Changes in a Novel Histological Activity Scale in Response to ARO-AAT in Patients With Alpha-1 Antitrypsin Deficiency Associated Liver Disease (AATD)

ClinicalTrials.gov Identifier: NCT03946449

Study Name: Safety, Tolerability and Effect on Liver Histologic Parameters of ARO-AAT (SEQUOIA)

A Placebo-Controlled, Multi-dose, Phase 2/3 Study to Determine the Safety, Tolerability and Effect on Liver Histologic Parameters in Response to ARO-AAT in Patients With Alpha-1 Antitrypsin Deficiency (AATD)

ClinicalTrials.gov Identifier: NCT03945292

ARO-APOC3

ARO-APOC3 is designed to reduce production of Apolipoprotein C-III (apoC-III), a component of triglyceride rich lipoproteins (TRLs) including VLDL and chylomicrons and a key regulator of triglyceride metabolism. We believe that knocking down the hepatic production of apoC-III may result in reduced VLDL synthesis and assembly, enhanced breakdown of TRLs, and better clearance of VLDL and chylomicron remnants. Arrowhead is currently investigating ARO-APOC3 in a Phase 1 clinical trial.

Initial topline results from the Phase1 study (AROAPOC31001) were presented at The 2019 Global Summit on Cardiology and Heart Diseases. The data demonstrated that ARO-APOC3 reduced plasma apoC-III and reduced triglycerides without drug-related serious or severe adverse events. A single dose of 100 mg of ARO-APOC3 in healthy volunteers achieved mean maximal reductions of plasma triglycerides of 63% and apoC-III protein of 94%. In November 2019, we presented additional data at the American Heart Association meeting. The data demonstrated in 40 subjects (24 active, 16 placebo) dose dependent reduction in serum APOC3, including a mean maximum reduction from baseline in serum APOC3 levels which ranged from 72% (10 mg dose) to 94% (100 mg dose). A reduction in serum APOC3 levels was maintained through the end of the study with week 16 mean reductions of 70% (25 mg dose) to 91% (100 mg dose). Mean maximum reduction from baseline in serum triglycerides ranged from 53% (77 mg/dL) (10 mg dose) to 64% (92 mg/dL) (100 mg dose). Mean maximum reduction from baseline in serum VLDL-C ranged from 53% (16 mg/dL) (10 mg dose) to 68% (19 mg/dL) (50 mg dose). Reduction in serum triglycerides and VLDL-C was maintained through the end of study, with week 16 mean reductions of 41%-55% for triglycerides and 42-53% for VLDL-C . Mean maximum reduction from baseline in serum LDL-C ranged from 12% (19 mg/dL) (25 mg dose) to 25% (35 mg/dL) (10 mg dose). A dose dependent increase in serum HDL-C was seen with a mean maximum increase from baseline in serum HDL-C ranging from 30% (13 mg/dL) 10 mg dose to 69% (32 mg/dL) 100 mg dose. Serum HDL-C increases were maintained through the end of study, with week 16 mean increases of 28% (12 mg/dL) (10 mg dose) to 52% (22 mg/dL) (100 mg dose). No serious or severe adverse events were reported. There was one adverse event of moderate transit ALT elevation (peak of 210 U/L on Day 22) in a subject receiving ARO-APOC3 who had elevated ALT at baseline (65 U/L). The ALT in that subject returned to baseline by Day 85 (61 U/L). There were eight local injection site reactions reported, more commonly at higher doses, all of which were rated mild.

Hypertriglyceridemia

Elevated triglyceride levels are an independent risk factor for cardiovascular disease. Severely elevated triglycerides (often over 2,000 mg/dL) in patients with familial chylomicronemia syndrome (FCS), a rare genetic disorder, can result in potentially fatal acute pancreatitis.

3

Study Name: Study of ARO-APOC3 in Healthy Volunteers, Hypertriglyceridemic Patients and Patients With Familial Chylomicronemia Syndrome (FCS)

A Phase 1 Single and Multiple Dose-Escalating Study to Evaluate the Safety, Tolerability, Pharmacokinetics and Pharmacodynamic Effects of ARO-APOC3 in Adult Healthy Volunteers as Well as in Severely Hypertriglyceridemic Patients and Patients With Familial Chylomicronemia Syndrome

ClinicalTrials.gov Identifier: NCT03783377

ARO-ANG3

ARO-ANG3 is designed to reduce production of angiopoietin-like protein 3 (ANGPTL3), a liver synthesized inhibitor of lipoprotein lipase and endothelial lipase. ANGPTL3 inhibition has been shown to lower serum LDL, serum and liver triglyceride and has genetic validation as a novel target for cardiovascular disease. Arrowhead is currently investigating ARO-ANG3 in a Phase 1 clinical trial.

Initial topline results from the Phase1 study (AROANG1001) were presented at the 2019 Global Summit on Cardiology and Heart Diseases. The data demonstrated that ARO-ANG3 reduced plasma ANGPTL3 and reduced triglycerides without drug-related serious or severe adverse events. A single dose of 200 mg of ARO-ANG3 in healthy volunteers demonstrated mean maximal reductions of plasma triglycerides of 66% and ANGPTL3 protein of 79%. In November 2019, we presented additional data at the American Heart Association meeting. The data demonstrated dose dependent reduction in serum ANGPTL3. The mean reduction from baseline in ANGPTL3 ranged from 55% (50 ng/mL) (35 mg) to 83% (63 ng/mL) 300 mg, and reduction in ANGPTL3 were maintained through the end of the study, with week 16 mean reductions of 43% (42 ng/mL) (35 mg) to 75% (57 ng/mL) (300 mg). Dose dependent reduction in triglycerides and VLDL-C were also observed. Mean maximum triglyceride reduction from baseline ranged from 31% (38 mg/dL) (35 mg) to 66% (167 mg/dL) (200 mg. Mean maximum VLDL-C reduction from baseline ranged from 30% (8 mg/dL) (35 mg) to 65% (33 mg/dL) (200 mg). The reduction in triglyceride and VLDL-C maintained through end of study in 200 mg and 300 mg cohorts, with week 16 mean reductions of 47% to 53% for triglycerides, and 49% to 51% for VLDL-C. Mean maximum HDL-C were reduction ranged from 8% (4 mg/dL) (35 mg) to 26% (12 mg/dL) (300 mg) and there were HDL-C mean reductions at week 16 of up to 16% ((7mg/dL) (200 mg). The mean maximum LDL-C reduction ranged from 9% (16 mg/dL) (200 mg) to 30% (48 mg/dL) (300 mg) and LDL-C mean reductions at week 16 were up to 28% (46 mg/dL) (100 mg) after a single dose. The mean maximum reduction in LDL-C with a single dose of 200 mg was blunted by two subjects in the cohort with increasing LDL-C post-dose. Multiple dose healthy volunteer data at a 200 mg dose demonstrated similar reductions to 100 mg and 300 mg doses of 33%-46% reduction in LDL-C from baseline two weeks after a second dose. There were no drug related severe or serious adverse events. Two adverse events of mild transient elevations in ALT occurred, one on active drug and one on placebo. ALT elevation in one subject on ARO-ANG3 was confounded by concomitant ingestion of an herbal supplement with known liver toxicity. In that subject, the peak ALT was 192 U/L at day 99, and within normal limits by study day 113. One patient had a mild local injection site reaction.

Dyslipidemia and Hypertriglyceridemia

Dyslipidemia and hypertriglyceridemia are risk factors for atherosclerotic coronary heart disease and cardiovascular events.

Study Name: Study of ARO-ANG3 in Healthy Volunteers and in Dyslipidemic Patients

A Phase 1 Single and Multiple Dose Study to Evaluate the Safety, Tolerability, Pharmacokinetics and Pharmacodynamic Effects of ARO-ANG3 in Adult Healthy Volunteers and in Dyslipidemic Patients

ClinicalTrials.gov Identifier: NCT03747224

ARO-HSD

ARO-HSD is designed to reduce production of HSD17B13, a hydroxysteroid dehydrogenase involved in the metabolism of hormones, fatty acids and bile acids. Published human genetic data indicate that a loss of function mutation in HSD17B13 provides strong protection against nonalcoholic steatohepatitis (NASH) cirrhosis and alcoholic hepatitis and cirrhosis. Improvements in NASH and fibrosis were seen with HSD17B13 knockdown in the CDAA diet mouse model, a commonly used NASH model. Arrowhead expects to file a clinical trial application (CTA) before calendar year end 2019.

ARO-ENaC

4

ARO-ENaC is designed to reduce production of the epithelial sodium channel alpha subunit (αENaC) in the airways of the lung. In cystic fibrosis patients, increased ENaC activity contributes to airway dehydration and reduced mucociliary transport. Arrowhead expects to file a CTA in the first half of calendar year 2020.

Cystic Fibrosis

Cystic fibrosis (CF) is a rare disease caused by a genetic mutation that leads to mucus buildup in the lungs and pancreas. In CF lung disease, patients can have difficulty breathing and experience frequent and persistent lung infections.

ARO-HIF2

ARO-HIF2 is being developed for the treatment of clear cell renal cell carcinoma (ccRCC). ARO-HIF2 is designed to inhibit the production of HIF-2α, which has been linked to tumor progression and metastasis in ccRCC. Arrowhead believes it is an attractive target for intervention because over 90% of ccRCC tumors express a mutant form of the Von Hippel-Landau protein that is unable to degrade HIF-2α, leading to its accumulation during tumor hypoxia and promoting tumor growth. Arrowhead expects to file a CTA before calendar year end 2019.

Renal Cell Carcinoma

Renal Cell Carcinoma is a type of kidney cancer that originates in the cells that line the small tubes that filter waste material from the blood. RCC is the most common type of kidney cancer accounting for more than 90% of cases with approximately 50,000 diagnoses in the U.S. each year. Unfortunately, patients with advanced stages of RCC have a 5-year survival rate of only 12-25%. Surgical resection is the mainstay of current treatment while chemotherapy and radiation have not been successful at prolonging survival. The treatment options for patients with metastatic disease are extremely limited.

Partnered Programs

Janssen Pharmaceuticals, Inc.

Arrowhead entered into a license agreement in October 2018 with Janssen Pharmaceuticals, Inc. (“Janssen”), part of the Janssen Pharmaceutical Companies of Johnson & Johnson, to develop and commercialize ARO-HBV. In addition, Arrowhead entered into a research collaboration and option agreement with Janssen to potentially collaborate for up to three additional RNAi therapeutics against new targets to be selected by Janssen.

Under the terms of the license agreement, Arrowhead received $175 million as an upfront payment. Separately, Johnson & Johnson Innovation – JJDC, Inc. (JJDC) made a $75 million equity investment in Arrowhead at a price of $23.00 per share of Arrowhead common stock.

Arrowhead is eligible to receive up to approximately $1.6 billion in milestone payments for the license agreement. Arrowhead is also eligible to receive approximately $1.9 billion in option and milestone payments for the collaboration and option agreement related to up to three additional targets. Arrowhead is further eligible to receive tiered royalties up to mid teens under the license agreement and up to low teens under the collaboration and option agreement on product sales. During the year ended September 30, 2019, Arrowhead received two $25 million developmental milestone payments from Janssen.

JNJ-3989 (formerly ARO-HBV)

JNJ-3989, formerly ARO-HBV, is being developed in collaboration with Janssen to be a potentially curative therapy for patients with chronic hepatitis B infection, when used in combination with other therapeutic modalities. JNJ-3989 is a sub-cutaneous, RNAi therapy candidate which is designed to silence all HBV gene products and intervenes upstream of the reverse transcription process where current standard-of-care nucleotide and nucleoside analogues act. The company believes this, especially the elimination of hepatitis B surface antigen (HBsAg), may allow the body’s natural immune defenses to clear the virus and potentially lead to a functional cure. JNJ-3989 (ARO-HBV) is being investigated in multiple Phase 2 clinical trials being conducted by Janssen.

5

Study Name: Study of ARO-HBV in Normal Adult Volunteers and Patients With Hepatitis B Virus (HBV)

A Phase 1/2a Single Dose-Escalating Study to Evaluate the Safety, Tolerability and Pharmacokinetic Effects of ARO-HBV in Normal Adult Volunteers and Multiple Escalating Doses Evaluating Safety, Tolerability and Pharmacodynamic Effects in HBV Patients

ClinicalTrials.gov Identifier: NCT03365947

Study Name: A Study of JNJ-73763989 in Healthy Japanese Adult Participants

A Double-blind, Placebo-controlled, Randomized, Parallel, Single Dose Study to Investigate Pharmacokinetics, Safety, and Tolerability of JNJ-73763989 in Healthy Japanese Adult Participants

ClinicalTrials.gov Identifier: NCT04002752

Study Name: A Study of Different Combination Regimens Including JNJ-73763989 and/or JNJ-56136379 for the Treatment of Chronic Hepatitis B Virus Infection (REEF-1)

A Phase 2b, Multicenter, Double-blind, Active-controlled, Randomized Study to Investigate the Efficacy and Safety of Different Combination Regimens Including JNJ-73763989 and/or JNJ-56136379 for the Treatment of Chronic Hepatitis B Virus Infection

ClinicalTrials.gov Identifier: NCT03982186

Study Name: A Study of JNJ 73763989+JNJ 56136379+Nucleos(t)Ide Analog (NA) Regimen Compared to NA Alone in e Antigen Negative Virologically Suppressed Participants With Chronic Hepatitis B Virus Infection

A Randomized, Double Blind, Placebo-controlled Phase 2b Study to Evaluate Efficacy, Pharmacokinetics, and Safety of 48-week Study Intervention With JNJ 73763989+JNJ 56136379+Nucleos(t)Ide Analog (NA) Regimen Compared to NA Alone in e Antigen Negative Virologically Suppressed Participants With Chronic Hepatitis B Virus Infection

ClinicalTrials.gov Identifier: NCT04129554

ARO-JNJ1

ARO-JNJ1 is being developed against an undisclosed liver-expressed target as part of Arrowhead’s Research Collaboration and Option Agreement with Janssen.

Amgen Inc.

Amgen Inc. (“Amgen”) acquired a worldwide, exclusive license in September 2016 to develop and commercialize ARO-LPA (now referred to as AMG 890). Under the terms of the agreements taken together for AMG 890 (ARO-LPA) and ARO-AMG1, the Company received $35 million in upfront payments, $21.5 million in the form of an equity investment by Amgen in the Company’s Common Stock, and the Company was eligible to receive up to $617 million in option payments and development, regulatory and sales milestone payments. The Company remains eligible to receive up to $420 million in development, regulatory and sales milestone payments under the AMG-890 (ARO-LPA) agreement. The Company is further eligible to receive up to low double-digit royalties for sales of products under the AMG-890 (ARO-LPA) agreement.

AMG 890 (formerly ARO-LPA)

AMG 890 (ARO-LPA) is designed to reduce production of apolipoprotein A, a key component of lipoprotein(a), which has been genetically linked with increased risk of cardiovascular diseases, independent of cholesterol and LDL levels. Amgen started a Phase 1 clinical study of AMG 890 (ARO-LPA) designed to assess its safety in volunteers and patients with elevated levels of lipoprotein(a) in August 2018. The initiation of this Phase 1 clinical study triggered a $10 million milestone payment from Amgen to Arrowhead in 2018. Amgen expects to initiate a Phase 2 clinical study in the first half of calendar year 2020.

ARO-AMG1

In August 2018, Arrowhead delivered to Amgen a candidate that met or exceeded the activity and safety requirements stipulated in the ARO-AMG1 collaboration agreement. The option period expired on August 7, 2019, and Amgen advised Arrowhead that it did not intend to exercise its option.

6

RNA Interference & the Benefits of RNAi Therapeutics

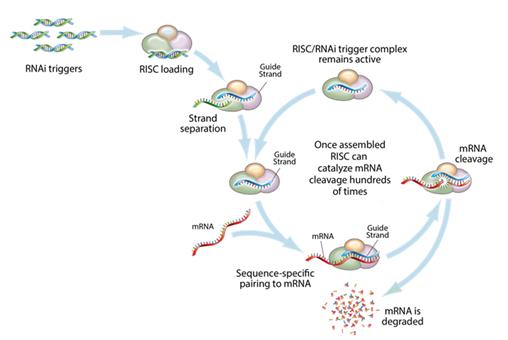

RNAi is a mechanism present in living cells that inhibits the expression of a specific gene, thereby affecting the production of a specific protein. Deemed to be one of the most important recent discoveries in life science with the potential to transform medicine, the discoverers of RNAi were awarded a Nobel Prize in 2006 for their work. RNAi-based therapeutics may leverage this natural pathway of gene silencing to target and shut down specific disease-causing genes.

Small molecule and antibody drugs have proven effective at inhibiting certain cell surface, intracellular, and extracellular targets. However, other drug targets have proven difficult to inhibit with traditional drug-based and biologic therapeutics. Developing effective drugs for these targets would have the potential to address large underserved markets for the treatment of many diseases. Using the ability to specifically silence any gene, RNAi therapeutics may be able to address previously “undruggable” targets, unlocking the market potential of such targets.

7

This figure depicts the mechanism by which gene silencing occurs. Double stranded RNAi triggers are introduced into a cell and get loaded into the RNA-induced silencing complex, (RISC). The strands are then separated, leaving an active RISC/RNAi trigger complex. This complex can then pair with and degrade the complementary messenger RNAs (mRNA) and stop the production of the target proteins. RNAi is a catalytic process, so each RNAi trigger can degrade mRNA hundreds of times, which results in a relatively long duration of effect for RNAi therapeutics.

Key Advantages of RNAi as a Therapeutic Modality

|

|

• |

Silences the expression of disease associated genes; |

|

|

• |

Potential to address any target in the transcriptome including previously "undruggable" targets; |

|

|

• |

Rapid lead identification; |

|

|

• |

High specificity; |

|

|

• |

Opportunity to use multiple RNA sequences in one drug product for synergistic silencing of related targets; and |

|

|

• |

RNAi therapeutics are uniquely suited for personalized medicine through target and cell specific delivery and gene knockdown. |

Targeted RNAi Molecule (TRiMTM) Platform

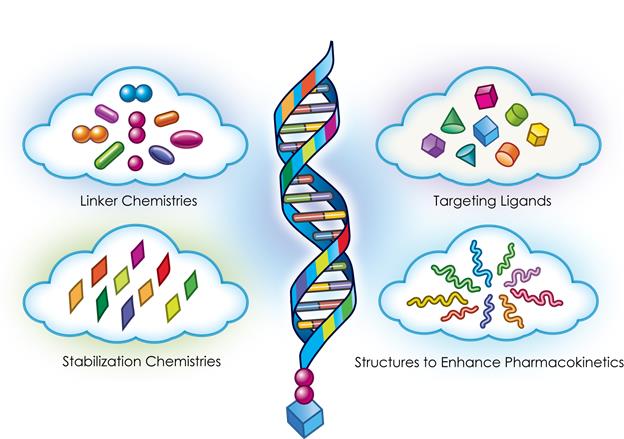

Arrowhead’s Targeted RNAi Molecule (TRiMTM) platform utilizes ligand-mediated delivery and is designed to enable tissue-specific targeting while being structurally simple. Targeting has been core to Arrowhead’s development philosophy and the TRiMTM platform builds on more than a decade of work on actively targeted drug delivery vehicles. Arrowhead scientists have discovered ways to progressively “TRiM” away extraneous features and chemistries and retain optimal pharmacologic activity.

The TRiMTM platform comprises a highly potent RNA trigger identified using Arrowhead’s proprietary trigger selection rules and algorithms with the following components optimized, as needed, for each drug candidate: a high affinity targeting ligand; various linker and chemistries; structures that enhance pharmacokinetics; and highly potent RNAi triggers with sequence specific stabilization chemistries.

Therapeutics developed with the TRiMTM platform offer several advantages: simplified manufacturing and reduced costs; multiple routes of administration; and potential for improved safety because there are less metabolites from smaller molecules, thereby reducing the risk of intracellular buildup. At Arrowhead, we also believe that for RNAi to reach its true potential, it must target organs outside the liver. Arrowhead is leading this expansion with the TRiMTM platform, which has shown the potential to reach multiple tissues, including liver, lung, tumor, muscle and others.

8

RNA Chemistries

The structure and chemistries of the oligonucleotide molecules used to trigger the RNAi mechanism can be tailored for optimal activity. Arrowhead’s broad portfolio of RNA trigger structures and chemistries, including some proprietary structures, enable the company to optimize each drug candidate on a target-by-target basis and utilize the combination of structure and chemical modifications that yield the most potent RNAi trigger.

As a component of the TRiMTM platform, Arrowhead’s design philosophy for RNA chemical modifications is to start with a structurally simple molecule and add only selective modification and stabilization chemistries as necessary to achieve the desired level of target knockdown and duration of effect. The conceptual framework for the stabilization strategy starts with a more sophisticated RNAi trigger screening and selection process that identifies potent sequences rapidly in locations that others may miss.

Intellectual Property and Key Agreements

The Company controls approximately 383 issued patents (including 239 directed to RNAi trigger molecules; 30 directed to targeting groups or targeting compounds; and 7 for hydrodynamic gene delivery), including European validations, and approximately 397 currently pending patent applications worldwide from 49 different patent families. The Company’s patent applications have been filed throughout the world, including, in the United States, Argentina, ARIPO (Africa Regional Intellectual Property Organization), Australia, Brazil, Canada, Chile, China, Eurasian Patent Organization, Europe, GCC (Gulf Cooperation Council), Hong Kong, Israel, India, Indonesia, Iraq, Jordan, Japan, Republic of Korea, Lebanon, Mexico, New Zealand, OAPI (African Intellectual Property Organization), Peru, Philippines, Russian Federation, Saudi Arabia, Singapore, Thailand, Taiwan, Uruguay, Venezuela, Vietnam, and South Africa.

RNAi Triggers

The Company owns issued patents or has filed patent applications directed to RNAi trigger molecules, which serve as the foundation of Arrowhead’s TRiMTM platform, and are targeted to reduce expression of various gene targets, including the following:

9

|

Patent Group |

Estimated Year(s) of Expiration* |

|

RNAi Triggers Gene Target |

|

|

HBV |

2032, 2036, 2037 |

|

AAT |

2035, 2038 |

|

LPA |

2036 |

|

Factor 12 |

2036, 2038 |

|

HIF2α |

2034, 2036 |

|

RRM2 |

2031 |

|

APOC3 |

2035, 2038 |

|

ANGPTL3 |

2038 |

|

α-ENaC |

2028, 2038 |

|

β-ENaC |

2031 |

|

β-Catenin |

2033 |

|

Cx43 |

2029 |

|

HCV |

2023 |

|

HIF1A |

2026 |

|

HRH1 |

2027 |

|

HSF1 |

2030, 2032 |

|

FRP-1 |

2026 |

|

KRAS |

2033 |

|

PDtype4 |

2026 |

|

PI4Kinase |

2028 |

|

SYK |

2027 |

|

TNF-α |

2027, 2028 |

*Assuming issuance of any pending patent applications.

Delivery Technologies

The delivery technology-related patents and patent applications, which include components used in Arrowhead’s TRiMTM platform, have been filed and/or issued in various jurisdictions worldwide including the United States, Argentina, Australia, Brazil, Canada, China, Eurasian Patent Organization, Europe (including validations in France, Germany, Italy, Spain, Switzerland, United Kingdom), GCC (Gulf Cooperation Council), Israel, India, Japan, Lebanon, Mexico, New Zealand, Philippines, Russia, South Korea, Singapore, Taiwan, Uruguay, and South Africa. The Company also controls a number of patents directed to hydrodynamic nucleic acid delivery, which issued in the United States, Australia and Europe (validated in Austria, Belgium, Switzerland, Germany, Denmark, Spain, Finland, France, the United Kingdom, Hungary, Ireland, Italy, Netherlands and Sweden). The approximate year of expiration for each of these various groups of patents are set forth below:

10

|

Patent Group |

Estimated Year(s) of Expiration* |

|

Targeting ligands and other RNAi delivery technologies |

|

|

Targeting groups (Galactose derivative trimer-PK) |

2031 |

|

Targeting groups (αvβ3 integrin) |

2034, 2039, 2039 |

|

Targeting groups (αvβ6 integrin) |

2037, 2038 |

|

Targeting groups (Galactose derivative ligands) |

2037, 2037 |

|

RNAi agent design (5′-phosphate mimic) |

2037 |

|

Physiologically labile linkers |

2036 |

|

Biologically cleavable linkers |

2036 |

|

Trialkyne linkers |

2039 |

|

Transferrin targeting |

2028 |

|

LDLR targeting |

2028 |

|

Peptide targeting (CPP-Arg) |

2028 |

|

Peptide targeting (YM3-10H) |

2032 |

|

|

|

|

Hydrodynamic delivery |

|

|

Second iteration |

2020 |

|

Third iteration |

2024 |

*Assuming issuance of any pending patent applications.

The RNAi and drug delivery patent landscapes are complex and rapidly evolving. As such, we may need to obtain additional patent licenses prior to commercialization of our candidates. You should review the factors identified in “Risk Factors” in Part I, Item 1A of this Annual Report on Form 10-K.

Non-Exclusively Licensed Patent Rights obtained from Roche

On October 21, 2011, Arrowhead acquired the RNAi therapeutics business of Hoffmann-La Roche, Inc. and F. Hoffmann-La Roche Ltd. (collectively, “Roche”). The acquisition provided us with two primary sources of value:

|

|

• |

Broad freedom to operate with respect to key patents directed to the primary RNAi-trigger formats: canonical, UNA, meroduplex, and dicer substrate structures; and |

|

|

• |

A large team of scientists experienced in RNAi and oligonucleotide delivery. |

Pursuant to this acquisition, Roche assigned to Arrowhead its entire rights under certain licenses including: the License and Collaboration Agreement between Roche and Alnylam Pharmaceuticals, Inc. (“Alnylam”) dated July 8, 2007 (the “Alnylam License”); the Non-Exclusive Patent License Agreement between Roche and MDRNA, Inc. dated February 12, 2009 (“MDRNA License”); and the Non-Exclusive License Agreement between Roche and City of Hope dated September 19, 2011 (the “COH License”) (Collectively the “RNAi Licenses”). The RNAi Licenses have provided the Company with non-exclusive, worldwide, perpetual, irrevocable, royalty-bearing rights and the right to sublicense a broad portfolio of intellectual property relating to the discovery, development, manufacture, characterization, and use of therapeutic products that function through the mechanism of RNA interference for specified targets.

The RNAi Licenses include licenses to patents related to modifications of double-stranded oligonucleotides, including modifications to the base, sugar, or internucleoside linkage, nucleotide mimetics, and end modifications, which do not abolish the RNAi activity of the double-stranded oligonucleotides. Also included are patents relating to modified double-stranded oligonucleotides, such as meroduplexes described in U.S. Patent No. 9,074,205 assigned to Marina Biotech (f/k/a MDRNA, Inc.), as well as U.S. Patent Nos. 8,314,227, 9,051,570, and 9,303,260 related to unlocked nucleotide analogs (UNA). The UNA patents were assigned by Marina Biotech to Arcturus Therapeutics, Inc., but remain part of the MDRNA License. The RNAi Licenses further include patents related to dicer substrates and uses of the double-stranded oligonucleotides that function through the mechanism of RNA interference, such as described in City of Hope‘s U.S. Patent Nos. 8,084,599, 8,658,356, 8,691,786, 8,796,444, 8,809,515, and 9,518,262.

2012 License to Alnylam

In consideration for licenses obtained from Alnylam to certain RNAi intellectual property, in January 2012 we granted Alnylam a worldwide non-exclusive, sublicensable royalty-bearing license under our broad and target-specific DPC intellectual property rights

11

to research, develop and commercialize RNAi-based products against a single undisclosed target in combination with DPC technology. Under the license to Alnylam, Alnylam may be obligated to pay us development and sales milestone payments of up to the low double-digit millions of dollars for each licensed product that progresses through clinical trials, receives marketing approval and is the subject of a first commercial sale. Additionally, Alnylam may be obligated to pay us low single-digit percentage royalties on sales of such products.

Acquisition of Assets from Novartis

On March 3, 2015, the Company entered into an Asset Purchase and Exclusive License Agreement (the “RNAi Purchase Agreement”) with Novartis pursuant to which the Company acquired Novartis’ RNAi assets and rights thereunder. Pursuant to the RNAi Purchase Agreement, the Company acquired or was granted a license to certain patents and patent applications owned or controlled by Novartis related to RNAi therapeutics, was assigned Novartis’s rights under a license from Alnylam (the “Alnylam-Novartis License”) and acquired a license to certain additional Novartis assets (the “Licensed Novartis Assets”). The patents acquired from Novartis include multiple patent families covering delivery technologies and RNAi-trigger design rules and modifications. The Licensed Novartis Assets include an exclusive, worldwide right and license, solely in the RNAi field, with the right to grant sublicenses through multiple tiers under or with respect to certain patent rights and know how relating to delivery technologies and RNAi-trigger design rules and modifications. Under the assigned Alnylam-Novartis License, the Company acquired a worldwide, royalty-bearing, exclusive license with limited sublicensing rights to existing and future Alnylam intellectual property (including intellectual property that came under Alnylam’s control on or before March 31, 2016), excluding intellectual property concerning delivery technology, to research, develop and commercialize 30 undisclosed gene targets.

We see the Roche and Novartis acquisitions as a powerful combination of intellectual property, R&D infrastructure, and RNAi experts. This foundation and substantial progress made by Arrowhead scientists over the last several years enable us to develop what we think are optimal RNAi therapeutics.

Cardiovascular Collaboration and License Agreements with Amgen

On September 28, 2016, the Company entered into two Collaboration and License agreements and a Common Stock Purchase Agreement with Amgen. Under the First Collaboration and License Agreement, Amgen received an option to a worldwide, exclusive license to ARO-AMG1, an RNAi therapy for an undisclosed genetically validated cardiovascular target. Under the Second Collaboration and License, Amgen received a worldwide, exclusive license to Arrowhead’s novel, RNAi AMG-980 (ARO-LPA) program. The AMG-890 (ARO-LPA) RNAi molecules are designed to reduce elevated lipoprotein(a), which is a genetically validated, independent risk factor for atherosclerotic cardiovascular disease. In both agreements, Amgen is wholly responsible for clinical development and commercialization. Under the terms of the agreements taken together, the Company has received $35 million in upfront payments, $21.5 million in the form of an equity investment by Amgen in the Company’s Common Stock. The Company was eligible to receive up to $617 million in option payments and development, regulatory and sales milestone payments. In August 2018, the Company received a $10 million milestone payment from Amgen following the administration of the first dose of AMG 890 (ARO-LPA) in a phase 1 clinical study. The Company remains eligible to receive up to $420 million in development, regulatory and sales milestone payments under the AMG-890 (ARO-LPA) agreement. The Company is further eligible to receive up to low double-digit royalties for sales of products under the AMG 890 (ARO-LPA) agreement.

In August 2018, Arrowhead delivered to Amgen a candidate that met or exceeded the activity and safety requirements stipulated in the ARO-AMG1 collaboration agreement. The option period expired on August 7, 2019, and Amgen advised Arrowhead that it did not intend to exercise its option.

License and Research Collaboration Agreements with Janssen Pharmaceuticals, Inc.

On October 3, 2018, the Company entered into a License Agreement (“Janssen License Agreement”) and a Research Collaboration and Option Agreement (“Janssen Collaboration Agreement”) with Janssen Pharmaceuticals, Inc. (“Janssen”), part of the Janssen Pharmaceutical Companies of Johnson & Johnson. The Company also entered into a Stock Purchase Agreement (“JJDC Stock Purchase Agreement”) with Johnson & Johnson Innovation-JJDC, Inc. (“JJDC”), a New Jersey corporation.

Under the Janssen License Agreement, Janssen will receive a worldwide, exclusive license to the Company’s JNJ-3989 (ARO-HBV) program, the Company’s third-generation subcutaneously administered RNAi therapeutic candidate being developed as a potentially curative therapy for patients with chronic hepatitis B virus infection. Beyond the Company’s ongoing Phase 1 / 2 study of JNJ-3989 (ARO-HBV) (which will remain the responsibility of the Company), Janssen will be wholly responsible for clinical development and commercialization.

12

Under the Janssen Collaboration Agreement, Janssen will be able to select up to three new targets against which the Company will develop clinical candidates. These candidates are subject to certain restrictions and will not include candidates in the Company’s current pipeline. The Company will perform discovery, optimization and preclinical development on selected targets, entirely funded by Janssen, sufficient to allow the filing of a U.S. Investigational New Drug application or equivalent, at which time Janssen will have the option to take an exclusive license to the Company’s intellectual property rights covering that compound. If the option is exercised, Janssen will be wholly responsible for clinical development and commercialization of each optioned compound.

Under the terms of the agreements taken together, the Company has received (i) $175 million as an upfront payment, (ii) $75 million in the form of an equity investment by JJDC in the Company’s common stock at a price of $23.00 per share, and may receive (iii) up to $1.6 billion in development and sales milestones payments for the Janssen License Agreement, and (iv) up to $1.9 billion in development and sales milestone payments for the three additional targets covered under the Janssen Collaboration Agreement. The Company is further eligible to receive tiered royalties up to mid teens under the Janssen License agreement and up to low teens under the Janssen Collaboration Agreement on product sales. During the year ended September 30, 2019, the Company received two $25 million developmental milestones from Janssen.

Research and Development Facility

Arrowhead’s research and development operations are primarily located in Madison, Wisconsin. Substantially all of the Company’s assets are located either in this facility or in our corporate headquarters in Pasadena. A summary of our research and development resources in Madison is provided below:

|

|

• |

93 R&D personnel as of September 30, 2019; |

|

|

• |

State-of-the-art laboratories consisting of 74,000 total sq. ft.; |

|

|

• |

Complete small animal facility; |

|

|

• |

Primate colony housed at the Wisconsin National Primate Research Center, an affiliate of the University of Wisconsin; |

|

|

• |

In-house histopathology capabilities; |

|

|

• |

Animal models for cardio metabolic, viral, lung, and oncologic diseases; |

|

|

• |

Animal efficacy and safety assessment; |

|

|

• |

In-house drug manufacturing capabilities to produce first-in-human GMP (phase appropriate) material; |

|

|

• |

Polymer, peptide, oligonucleotide and small molecule synthesis and analytics capabilities (HPLC, NMR, MS, etc.); |

|

|

• |

Polymer, peptide and oligonucleotide PK, biodistribution, clearance methodologies; and |

|

|

• |

Conventional and confocal microscopy, flow cytometry, Luminex platform, qRT-PCR, clinical chemistry analytics. |

Research and Development Expenses

Research and development (R&D) expenses consist of costs incurred in discovering, developing and testing our clinical and preclinical candidates and platform technologies. R&D expenses also include costs related to clinical trials, including costs of contract research organizations to recruit patients and manage clinical trials. Other costs associated with clinical trials include manufacturing of clinical supplies, as well as good laboratory practice (“GLP”) toxicology studies necessary to support clinical trials, both of which are currently outsourced to cGMP-compliant manufacturers and GLP-compliant laboratories. Total research and development expense for fiscal 2019, 2018 and 2017 was $81.0 million, $53.0 million and $50.9 million, respectively.

At September 30, 2019, we employed 109 employees in an R&D function, primarily working from our facility in Madison, Wisconsin. These employees are engaged in various areas of research on Arrowhead candidate and platform development including synthesis and analytics, PK/biodistribution, formulation, CMC and analytics, tumor and extra-hepatic targeting, bioassays, live animal research, toxicology/histopathology, clinical and regulatory operations, and other areas. Salaries and payroll-related expenses and stock compensation for our R&D activities were $19.0 million, $15.1 million, and $14.6 million in fiscal 2019, 2018 and 2017, respectively. Costs related to the manufacture of clinical supplies, GLP toxicology studies and clinical trial costs were $47.1 million, $23.6 million, and $22.2 million in fiscal 2019, 2018, and 2017, respectively. Facility-related costs, primarily rental costs for our leased laboratory in Madison, Wisconsin were $2.6 million, $2.3 million, and $2.3 million in fiscal 2019, 2018, and 2017, respectively. Depreciation and amortization expenses primarily for our lab equipment and leasehold improvements in our leased laboratory in Madison, Wisconsin were $4.4 million, $4.7 million and $4.7 million in fiscal 2019, 2018 and 2017, respectively. Licensing, royalties and milestones expenses were $0, $0, and $0 million in fiscal 2019, 2018 and 2017, respectively. These expenses are primarily related to milestone payments, which can vary from period to period depending on the nature of our various license agreements, and the timing of reaching various development milestones requiring payment. Other research and development expenses

13

were $7.9 million, $7.3 million, and $7.2 million in fiscal 2019, 2018 and 2017, respectively. These expenses primarily relate to laboratory supply costs and animal-related costs for in-vivo studies.

Government Regulation

Government authorities in the United States, at the federal, state, and local levels, and in other countries and jurisdictions, including the European Union, extensively regulate, among other things, the research, development, testing, product approval, manufacture, quality control, manufacturing changes, packaging, storage, recordkeeping, labeling, promotion, advertising, sales, distribution, marketing, and import and export of drugs and biologic products. All of our foreseeable product candidates are expected to be regulated as drugs. The processes for obtaining regulatory approval in the U.S. and in foreign countries and jurisdictions, along with compliance with applicable statutes and regulations and other regulatory authorities both pre- and post-commercialization, are a significant factor in the production and marketing of our products and our R&D activities and require the expenditure of substantial time and financial resources.

Review and Approval of Drugs in the United States

In the U.S., the FDA and other government entities regulate drugs under the Federal Food, Drug, and Cosmetic Act (the “FDCA”), the Public Health Service Act, and the regulations promulgated under those statutes, as well as other federal and state statutes and regulations. Failure to comply with applicable legal and regulatory requirements in the U.S. at any time during the product development process, approval process, or after approval, may subject us to a variety of administrative or judicial sanctions, such as a delay in approving or refusal by the FDA to approve pending applications, withdrawal of approvals, delay or suspension of clinical trials, issuance of warning letters and other types of regulatory letters, product recalls, product seizures, total or partial suspension of production or distribution, injunctions, fines, civil monetary penalties, refusals of or debarment from government contracts, exclusion from the federal healthcare programs, restitution, disgorgement of profits, civil or criminal investigations by the FDA, U.S. Department of Justice, State Attorneys General, and/or other agencies, False Claims Act suits and/or other litigation, and/or criminal prosecutions.

An applicant seeking approval to market and distribute a new drug in the U.S. must typically undertake the following:

(1) completion of pre-clinical laboratory tests, animal studies, and formulation studies in compliance with the FDA’s GLP regulations;

(2) submission to the FDA of an Investigational New Drug Application (“IND”) for human clinical testing, which must become effective without FDA objection before human clinical trials may begin;

(3) approval by an independent institutional review board (“IRB”), representing each clinical site before each clinical trial may be initiated;

(4) performance of adequate and well-controlled human clinical trials in accordance with the FDA’s current good clinical practice (“cGCP”) regulations, to establish the safety and effectiveness of the proposed drug product for each indication for which approval is sought;

(5) preparation and submission to the FDA of a New Drug Application (“NDA”);

(6) satisfactory review of the NDA by an FDA advisory committee, where appropriate or if applicable,

(7) satisfactory completion of one or more FDA inspections of the manufacturing facility or facilities at which the drug product, and the active pharmaceutical ingredient or ingredients thereof, are produced to assess compliance with current good manufacturing practice (“cGMP”) regulations and to assure that the facilities, methods, and controls are adequate to ensure the product’s identity, strength, quality, and purity;

(8) payment of user fees, as applicable, and securing FDA approval of the NDA; and

(9) compliance with any post-approval requirements, such as any Risk Evaluation and Mitigation Strategies (“REMS”) or post-approval studies required by the FDA.

Preclinical Studies and an IND

Preclinical studies can include in vitro and animal studies to assess the potential for adverse events and, in some cases, to establish a rationale for therapeutic use. The conduct of preclinical studies is subject to federal regulations and requirements, including

14

GLP regulations. Other studies include laboratory evaluation of the purity, stability and physical form of the manufactured drug substance or active pharmaceutical ingredient and the physical properties, stability and reproducibility of the formulated drug or drug product. An IND sponsor must submit the results of the preclinical tests, together with manufacturing information, analytical data, any available clinical data or literature and plans for clinical studies, among other things, to the FDA as part of an IND. Some preclinical testing, such as longer-term toxicity testing, animal tests of reproductive adverse events and carcinogenicity, may continue after the IND is submitted. An IND automatically becomes effective 30 days after receipt by the FDA, unless before that time the FDA raises concerns or questions related to a proposed clinical trial and places the trial on clinical hold. In such a case, the IND sponsor and the FDA must resolve any outstanding concerns before the clinical trial can begin. As a result, submission of an IND may not result in the FDA allowing clinical trials to commence.

Following commencement of a clinical trial under an IND, the FDA may place a clinical hold on that trial. A clinical hold is an order issued by the FDA to the sponsor to delay a proposed clinical investigation or to suspend an ongoing investigation. A partial clinical hold is a delay or suspension of only part of the clinical work requested under the IND. For example, a specific protocol or part of a protocol is not allowed to proceed, while other protocols may do so. No more than 30 days after imposition of a clinical hold or partial clinical hold, the FDA will provide the sponsor a written explanation of the basis for the hold. Following issuance of a clinical hold or partial clinical hold, an investigation may only resume after the FDA has notified the sponsor that the investigation may proceed. The FDA will base that determination on information provided by the sponsor correcting the deficiencies previously cited or otherwise satisfying the FDA that the investigation can proceed.

Human Clinical Studies in Support of an NDA

Clinical trials involve the administration of the investigational product to human subjects under the supervision of qualified investigators in accordance with cGCP requirements, which include, among other things, the requirement that all research subjects provide their informed consent in writing before their participation in any clinical trial. Clinical trials are conducted under written study protocols detailing, among other things, the objectives of the study, the parameters to be used in monitoring safety and the effectiveness criteria to be evaluated. A protocol for each clinical trial and any subsequent protocol amendments must be submitted to the FDA as part of the IND. In addition, an IRB representing each institution participating in the clinical trial must review and approve the plan for any clinical trial before it commences at that institution, and the IRB must conduct continuing review and reapprove the study at least annually. The IRB must review and approve, among other things, the study protocol and informed consent information to be provided to study subjects. An IRB must operate in compliance with FDA regulations. Information about certain clinical trials must be submitted within specific timeframes to the NIH for public dissemination on its ClinicalTrials.gov website.

Human clinical trials are typically conducted in three sequential phases, which may overlap or be combined:

Phase 1: The product candidate is initially introduced into healthy human subjects or patients with the target disease or condition and tested for safety, dosage tolerance, absorption, metabolism, distribution, excretion and, if possible, to gain an early indication of its effectiveness.

Phase 2: The product candidate is administered to a limited patient population to identify possible adverse effects and safety risks, to preliminarily evaluate the efficacy of the product for specific targeted diseases and to determine dosage tolerance and optimal dosage.

Phase 3: The product candidate is administered to an expanded patient population, generally at geographically dispersed clinical trial sites, in well-controlled clinical trials to generate enough data to statistically evaluate the efficacy and safety of the product for approval, to establish the overall risk-benefit profile of the product, and to provide adequate information for the labeling of the product.

Progress reports detailing the results of the clinical trials must be submitted at least annually to the FDA and more frequently if serious adverse events occur. Phase 1, Phase 2, and Phase 3 clinical trials may not be completed successfully within any specified period, or at all. Furthermore, the FDA or the sponsor may suspend or terminate a clinical trial at any time on various grounds, including a finding that the research subjects are being exposed to an unacceptable health risk. Similarly, an IRB can suspend or terminate approval of a clinical trial at its institution, or an institution it represents, if the clinical trial is not being conducted in accordance with the IRB’s requirements or if the drug has been associated with unexpected serious harm to patients. The FDA will typically inspect one or more clinical sites in late-stage clinical trials to assure compliance with cGCP and the integrity of the clinical data submitted.

Submission of an NDA to the FDA

Assuming successful completion of required clinical testing and other requirements, the results of the preclinical and clinical studies, together with detailed information relating to the product’s chemistry, manufacture, controls and proposed labeling, among other things, are submitted to the FDA as part of an NDA requesting approval to market the drug product for one or more indications.

15

Under federal law, the submission of most NDAs is additionally subject to an application user fee, currently $2.9 million for applications requiring clinical data, and the sponsor of an approved NDA is also subject to an annual program fee, currently $325,000. These fees are typically increased annually.

Under certain circumstances, the FDA will waive the application fee for the first human drug application that a small business, defined as a company with less than 500 employees, including employees of affiliates, submits for review. An affiliate is defined as a business entity that has a relationship with a second business entity if one business entity controls, or has the power to control, the other business entity, or a third-party controls, or has the power to control, both entities. In addition, an application to market a prescription drug product that has received orphan designation is not subject to a prescription drug user fee unless the application includes an indication for other than the rare disease or condition for which the drug was designated.

The FDA conducts a preliminary review of an NDA within 60 days of its receipt and informs the sponsor by the 74th day after the FDA’s receipt of the submission to determine whether the application is sufficiently complete to permit substantive review. The FDA may request additional information rather than accept an NDA for filing. In this event, the application must be resubmitted with the additional information. The resubmitted application is also subject to review before the FDA accepts it for filing. Once the submission is accepted for filing, the FDA begins an in-depth substantive review. The FDA has agreed to specified performance goals in the review process of NDAs. Most such applications are meant to be reviewed within ten months from the date of filing, and most applications for “priority review” products are meant to be reviewed within six months of filing. The review process may be extended by the FDA for three additional months to consider new information or clarification provided by the applicant to address an outstanding deficiency identified by the FDA following the original submission.

Before approving an NDA, the FDA typically will inspect the facility or facilities where the product is manufactured. The FDA will not approve an application unless it determines that the manufacturing processes and facilities are in compliance with cGMP requirements and adequate to assure consistent production of the product within required specifications. Additionally, before approving an NDA, the FDA will typically inspect one or more clinical sites to assure compliance with cGCP.

The FDA also may require submission of a REMS plan to mitigate any identified or suspected serious risks. The REMS plan could include medication guides, physician communication plans, assessment plans, and elements to assure safe use, such as restricted distribution methods, patient registries, or other risk minimization tools.

The FDA is required to refer an application for a novel drug to an advisory committee or explain why such referral was not made. Typically, an advisory committee is a panel of independent experts, including clinicians and other scientific experts, that reviews, evaluates and provides a recommendation as to whether the application should be approved and under what conditions. The FDA is not bound by the recommendations of an advisory committee, but it considers such recommendations carefully when making decisions.

The FDA’s Decision on an NDA

On the basis of the FDA’s evaluation of the NDA and accompanying information, including the results of the inspection of the manufacturing facilities, the FDA may issue an approval letter or a complete response letter. An approval letter authorizes commercial marketing of the product with specific prescribing information for specific indications. A complete response letter generally outlines the deficiencies in the submission and may require substantial additional testing or information in order for the FDA to reconsider the application. If and when those deficiencies have been addressed to the FDA’s satisfaction in a resubmission of the NDA, the FDA will issue an approval letter. The FDA has committed to reviewing such resubmissions in two or six months depending on the type of information included. Even with submission of this additional information, the FDA ultimately may decide that the application does not satisfy the regulatory criteria for approval.

If the FDA approves a product, it may limit the approved indications for use for the product, require that contraindications, warnings or precautions be included in the product labeling, require that post-approval studies be conducted to further assess the drug’s safety after approval, require testing and surveillance programs to monitor the product after commercialization, or impose other conditions, including distribution restrictions or other risk management mechanisms, including REMS, which can materially affect the potential market and profitability of the product. After approval, the FDA may seek to prevent or limit further marketing of a product based on the results of post-market studies or surveillance programs. Some types of changes to the approved product, such as adding new indications, manufacturing changes and additional labeling claims, are subject to further testing requirements and FDA review and approval.

The product may also be subject to official lot release, meaning that the manufacturer is required to perform certain tests on each lot of the product before it is released for distribution. If the product is subject to official lot release, the manufacturer must submit samples of each lot, together with a release protocol showing a summary of the history of manufacture of the lot and the results of all of the manufacturer’s tests performed on the lot, to the FDA. The FDA may in addition perform certain confirmatory tests on lots of

16

some products before releasing the lots for distribution. Finally, the FDA will conduct laboratory research related to the safety and effectiveness of drug products.

Under the Orphan Drug Act, the FDA may grant orphan drug designation to a drug intended to treat a rare disease or condition, which is generally a disease or condition that affects fewer than 200,000 individuals in the United States, or more than 200,000 individuals in the U.S. and for which there is no reasonable expectation that the cost of developing and making available in the U.S. a drug for this type of disease or condition will be recovered from sales in the U.S. for that drug. Orphan drug designation entitles the applicant to incentives such as grant funding towards clinical study costs, tax advantages, and waivers of FDA user fees. Orphan drug designation must be requested before submitting an NDA, and both the drug and the disease or condition must meet certain criteria specified in the Orphan Drug Act and FDA’s implementing regulations at 21 C.F.R. Part 316. The granting of an orphan drug designation does not alter the standard regulatory requirements and process for obtaining marketing approval. Safety and effectiveness of a drug must be established through adequate and well-controlled studies.

After the FDA grants orphan drug designation, the identity of the therapeutic agent and its potential orphan use are disclosed publicly by the FDA. If a product that has orphan drug designation subsequently receives the first FDA approval for the disease for which it has such designation, the product is entitled to orphan product exclusivity, which means that the FDA may not approve any other application to market the same drug for the same indication, except in very limited circumstances, for seven years. Orphan drug exclusivity does not prevent the FDA from approving a different drug for the same disease or condition, or the same drug for a different disease or condition.

Expedited Review and Accelerated Approval Programs

A sponsor may seek approval of its product candidate under programs designed to accelerate the FDA’s review and approval of NDAs. For example, Fast Track Designation may be granted to a drug intended for treatment of a serious or life-threatening disease or condition and data demonstrate its potential to address unmet medical needs for the disease or condition. The key benefits of Fast Track Designation are the eligibility for priority review, rolling review (submission of portions of an application before the complete marketing application is submitted), and accelerated approval, if relevant criteria are met. The FDA may grant the NDA a priority review designation, which sets the target date for FDA action on the application at six months after the FDA accepts the application for filing. Priority review is granted where there is evidence that the proposed product would be a significant improvement in the safety or effectiveness of the treatment, diagnosis, or prevention of a serious condition. Priority review designation does not change the scientific/medical standard for approval or the quality of evidence necessary to support approval.

The FDA may approve an NDA under the accelerated approval program if the drug treats a serious condition, provides a meaningful advantage over available therapies, and demonstrates an effect on either (1) a surrogate endpoint that is reasonably likely to predict clinical benefit, or (2) on a clinical endpoint that can be measured earlier than irreversible morbidity or mortality, that is reasonably likely to predict an effect on irreversible morbidity or mortality or other clinical benefit, taking into account the severity, rarity, or prevalence of the condition and the availability or lack of alternative treatments. Post-marketing studies or completion of ongoing studies after marketing approval are generally required to verify the drug’s clinical benefit in relationship to the surrogate endpoint or ultimate outcome in relationship to the clinical benefit.

In addition, the Food and Drug Administration Safety and Innovation Act of 2012, or FDASIA, established the Breakthrough Therapy designation. A sponsor may seek FDA designation of its product candidate as a breakthrough therapy if the drug is intended, alone or in combination with one or more other drugs, to treat a serious or life-threatening disease or condition and preliminary clinical evidence indicates that the drug may demonstrate substantial improvement over existing therapies on one or more clinically significant endpoints, such as substantial treatment effects observed early in clinical development. If a drug is designated as breakthrough therapy, FDA will provide more intensive guidance on the drug development program and expedite its review.

Post-Approval Requirements

Drugs manufactured or distributed pursuant to FDA approvals are subject to pervasive and continuing regulation by the FDA, including, among other things, requirements relating to recordkeeping, periodic reporting, product sampling and distribution, advertising and promotion and reporting of adverse experiences with the product. After approval, most changes to the approved product, such as adding new indications or other labeling claims, are subject to prior FDA review and approval. There also are continuing, annual user fee requirements for any marketed products and the establishments at which such products are manufactured, as well as new application fees for supplemental applications with clinical data.

In addition, drug manufacturers and other entities involved in the manufacture and distribution of approved drugs are required to register their establishments with the FDA and state agencies and are subject to periodic unannounced inspections by the FDA and these state agencies for compliance with cGMP requirements. Changes to the manufacturing process are strictly regulated and often require prior FDA approval before being implemented. FDA regulations also require investigation and correction of any deviations

17

from cGMP and impose reporting and documentation requirements upon the sponsor and any third-party manufacturers that the sponsor may decide to use. Accordingly, manufacturers must continue to expend time, money, and effort in the area of production and quality control to maintain cGMP compliance.

Once an approval is granted, the FDA may withdraw the approval if compliance with regulatory requirements and standards is not maintained or if problems occur after the product reaches the market. Later discovery of previously unknown problems with a product, including adverse events or problems with manufacturing processes of unanticipated severity or frequency, or failure to comply with regulatory requirements, may result in revisions to the approved labeling to add new safety information; imposition of post-market studies or clinical trials to assess new safety risks; or imposition of distribution or other restrictions under a REMS program. Other potential consequences include, among other things:

|

|

• |

restrictions on the marketing or manufacturing of the product, complete withdrawal of the product from the market or product recalls; |

|

|

• |

fines, warning letters or holds on post-approval clinical trials; |

|

|

• |

refusal of the FDA to approve pending NDAs or supplements to approved NDAs, or suspension or revocation of product license approvals; |

|

|

• |

product seizure or detention, or refusal to permit the import or export of products; or |

|

|

• |

injunctions or the imposition of civil or criminal penalties. |