UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

(Mark One)

|

x |

ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended September 30, 2013.

|

¨ |

TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 000-21898

ARROWHEAD RESEARCH CORPORATION

(Exact name of registrant as specified in its charter)

|

Delaware |

|

46-0408024 |

|

(State of incorporation) |

|

(I.R.S. Employer Identification No.) |

225 S. Lake Avenue, Suite 1050

Pasadena, California 91101

(626) 304-3400

(Address and telephone number of principal executive offices)

Securities registered under Section 12(b) of the Exchange Act:

|

Title of each class |

|

Name of each exchange on which registered |

|

Common Stock, $0.001 par value |

|

The NASDAQ Capital Market |

Securities registered pursuant to Section 12(g) of the Exchange Act:

None

Indicate by a check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by a check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ¨ |

|

Accelerated filer ¨ |

|

Non-accelerated filer ¨ |

|

Smaller Reporting Company x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of issuer’s outstanding Common Stock held by non-affiliates was approximately $38 million based upon the bid price of issuer’s Common Stock on March 31, 2013. Shares of common stock held by each officer and director and by each person who is known to own 10% or more of the outstanding Common Stock have been excluded in that such persons may be deemed to be affiliates of the Company. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of December 16, 2013, 38,700,363 shares of the issuer’s Common Stock were outstanding.

TABLE OF CONTENTS

|

PART I |

|

|

|

|

|

|

|

| ||

|

ITEM 1. |

|

|

1 | |

|

ITEM 1A. |

|

|

23 | |

|

ITEM 1B. |

|

|

33 | |

|

ITEM 2. |

|

|

33 | |

|

ITEM 3. |

|

|

33 | |

|

ITEM 4. |

|

|

33 | |

|

|

|

| ||

|

PART II |

|

|

|

|

|

|

|

| ||

|

ITEM 5. |

|

|

34 | |

|

ITEM 6. |

|

|

34 | |

|

ITEM 7. |

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

|

35 |

|

ITEM 7A. |

|

|

42 | |

|

ITEM 8. |

|

|

42 | |

|

ITEM 9. |

|

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE |

|

42 |

|

ITEM 9A. |

|

|

43 | |

|

ITEM 9B. |

|

|

43 | |

|

|

|

| ||

|

PART III |

|

|

|

|

|

|

|

| ||

|

ITEM 10. |

|

|

44 | |

|

ITEM 11. |

|

|

44 | |

|

ITEM 12. |

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS |

|

44 |

|

ITEM 13. |

|

CERTAIN RELATIONSHIPS, RELATED TRANSACTIONS AND DIRECTORS INDEPENDENCE |

|

44 |

|

ITEM 14. |

|

|

44 | |

|

|

|

| ||

|

PART IV |

|

|

|

|

|

|

|

| ||

|

ITEM 15. |

|

|

44 | |

|

|

| |||

|

|

F-1 | |||

|

|

| |||

|

|

F-2 | |||

i

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, and we intend that such forward-looking statements be subject to the safe harbors created thereby. For this purpose, any statements contained in this Annual Report on Form 10-K except for historical information may be deemed to be forward-looking statements. Without limiting the generality of the foregoing, words such as “may,” “will,” “expect,” “believe,” “anticipate,” “intend,” “could,” “estimate,” or “continue” or the negative or other variations thereof or comparable terminology are intended to identify forward-looking statements. In addition, any statements that refer to projections of our future financial performance, trends in our businesses, or other characterizations of future events or circumstances are forward-looking statements.

The forward-looking statements included herein are based on current expectations of our management based on available information and involve a number of risks and uncertainties, all of which are difficult or impossible to predict accurately and many of which are beyond our control. As such, our actual results may differ significantly from those expressed in any forward-looking statements. Factors that may cause or contribute to such differences include, but are not limited to, those discussed in more detail in Item 1 (Business) and Item 1A (Risk Factors) of Part I and Item 7 (Management’s Discussion and Analysis of Financial Condition and Results of Operations) of Part II of this Annual Report on Form 10-K. Readers should carefully review these risks, as well as the additional risks described in other documents we file from time to time with the Securities and Exchange Commission. In light of the significant risks and uncertainties inherent in the forward-looking information included herein, the inclusion of such information should not be regarded as a representation by us or any other person that such results will be achieved, and readers are cautioned not to place undue reliance on such forward-looking information. Except as may be required by law, we disclaim any intent to revise the forward-looking statements contained herein to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

ii

PART I

Description of Business

OVERVIEW

Arrowhead Research Corporation is a biopharmaceutical company developing targeted RNAi therapeutics. The Company is leveraging its proprietary drug delivery technologies to develop drugs based on the RNA interference mechanism that efficiently silences disease-causing genes. These platforms have yielded several drug candidates under internal and partnered development. Arrowhead technologies also enable partners to create peptide-drug conjugates that specifically home to cell types of interest while sparing off-target tissues. Arrowhead’s pipeline includes clinical programs in chronic hepatitis B virus and partner-based programs in obesity and oncology.

Lead Product Candidate

| · |

ARC-520 is an RNAi-based therapeutic designed to treat chronic hepatitis B virus (HBV) infection. It is the first drug candidate from Arrowhead’s Dynamic Polyconjugate® siRNA delivery platform. It is designed to treat chronic HBV infection by reducing the expression and release of new viral particles and key viral proteins with the goal of achieving a functional cure. The Company completed its planned enrollment in a Phase 1 clinical trial in 2013 and expects to begin a Phase 2a trial in the first half of 2014 and a Phase 2b trial in the second half of 2014. |

Platform Technologies

| · |

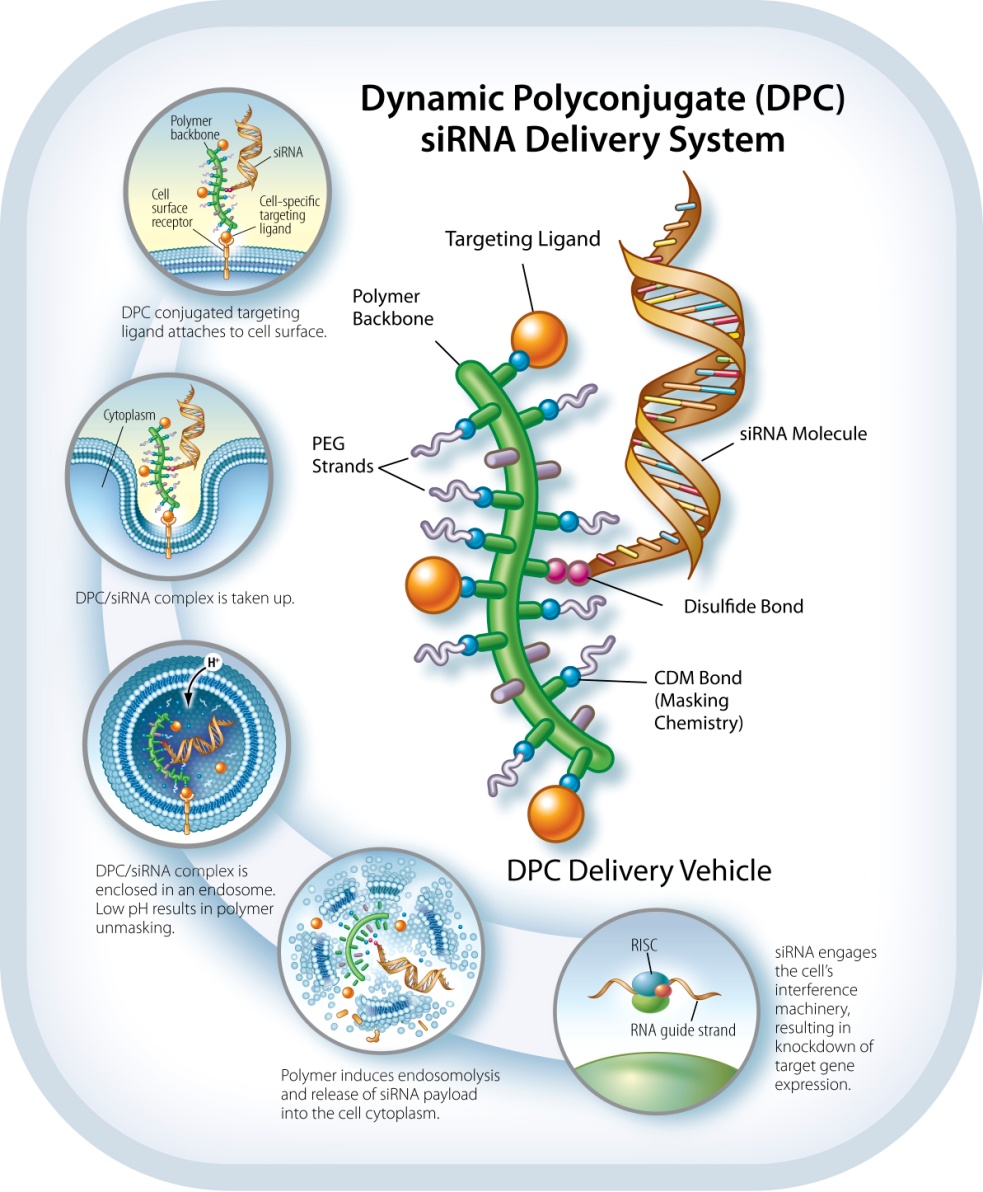

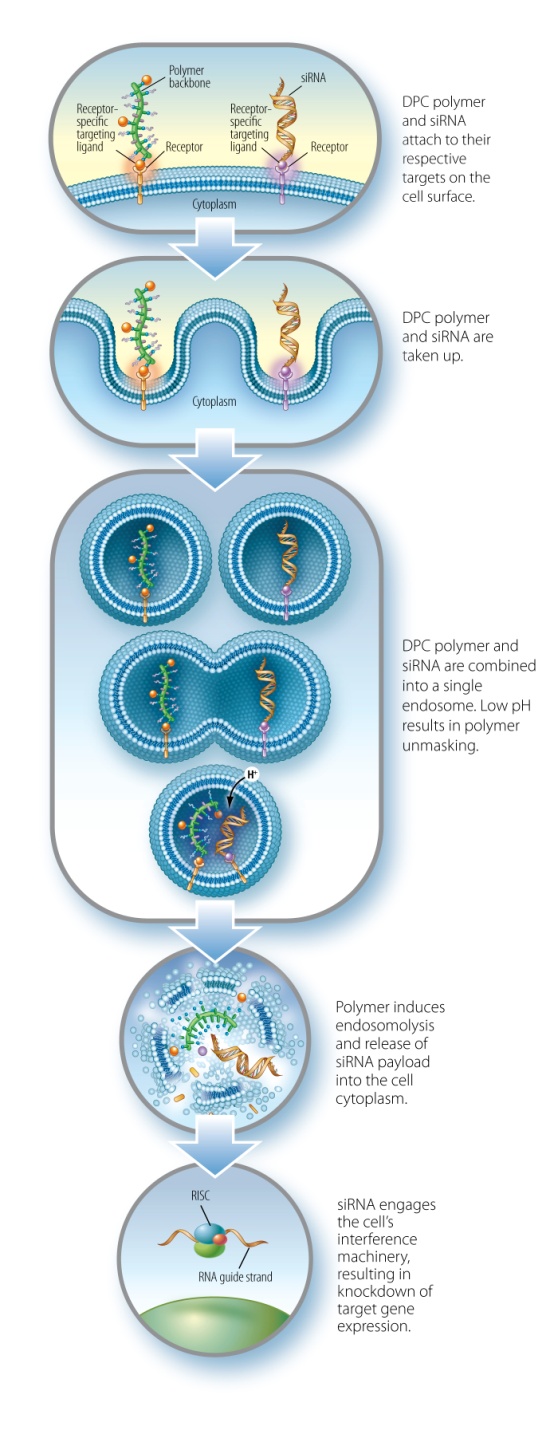

The Dynamic Polyconjugate (DPC®) platform is a small RNA delivery system that may be targeted to address multiple organ systems and cell types. It is a modular system that may be optimized on a target-by-target basis and has been demonstrated to promote multi-log gene knockdown, induce efficient endosomal escape, and has a favorable safety profile using a variety of siRNA molecules. |

| · |

Arrowhead’s Homing Peptides platform is a vast, proprietary library of short peptides that have demonstrated rapid and specific internalization into a wide variety of cell types. This library is being mined for the potential targeting of RNAi therapeutics using the DPC delivery system as well as to enable partners to target traditional small molecule or peptide drugs. |

Pipeline Development Strategy

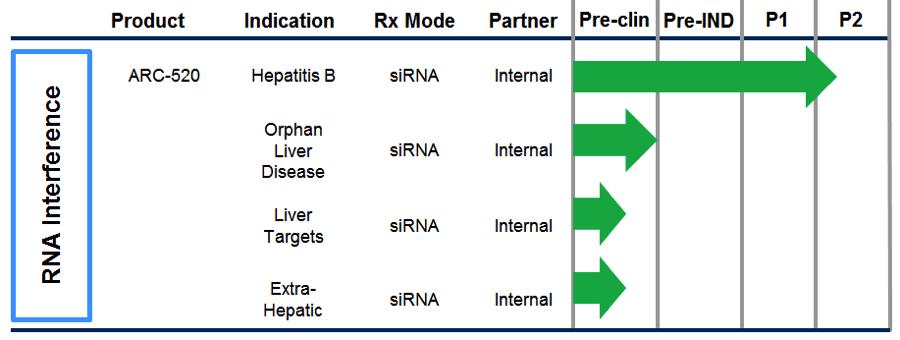

Arrowhead’s internal drug pipeline is intended to drive value directly through the clinical development of novel therapeutics and to provide proof of concept for our platform technologies. Our core areas of focus for expanding our internal pipeline of RNAi therapeutics are: (1) develop intravenous (“IV”) administered liver-targeted candidates; (2) develop subcutaneously administered liver-targeted candidates; and (3) explore extra-hepatic targets, including oncology.

We actively seek collaboration and licensing agreements with leading biopharmaceutical companies to augment their pipelines through the application of our technologies and to advance the development and commercialization of our own technology platforms and drug candidates. Partnerships are intended to provide access to external expertise and capital to complement our internal development and create commercialization opportunities in areas outside of our core focus.

1

Recent Events

Arrowhead made significant progress on product and platform development during fiscal 2013 and focused our resources on advancing targeted RNAi therapeutics based on the DPC delivery system. The following are highlights of this progress:

| · |

Published data showing first ever cholesterol-siRNA mediated gene knockdown in primates using a novel DPC co-injection strategy; |

| · |

Strengthened our balance sheet and expanded our institutional shareholder base with equity financings totaling $107.5 million in gross proceeds since the period ended September 30, 2012; |

| · |

Signed a collaboration and license agreement with Shire AG providing them access to the Homing Peptide technology to develop peptide-targeted therapeutics for a rare disease target; |

| · |

Strategically focused internal resources on expanding our pipeline of DPC-enabled RNAi therapeutics, while terminating development of the RONDEL delivery platform and its clinical candidate, CALAA-01; |

| · |

Published preclinical data showing that a single injection of ARC-520 induces multi-log reductions of viral RNA, proteins, and viral DNA; |

| · |

Expanded patent protection of ARC-520 and DPC platform extending through 2032; |

| · |

Presented data on ARC-520 at the Annual Meeting of the American Association for the Study of Liver Diseases (AASLD) demonstrating reduction of key HBV antigens and DNA, and evidence of immune reactivation in a chimpanzee with chronic HBV infection; |

| · |

Completed planned enrollment in a Phase 1 clinical trial indicating ARC-520 is generally safe and well-tolerated at all six dose levels studied, enabling the company to proceed with its plans to initiate a Phase 2a clinical trial; |

| · |

Submitted for ethics and regulatory permission to initiate a Phase 2a pilot efficacy clinical trial in chronic HBV patients; and |

| · |

Advanced our preclinical pipeline of RNAi therapeutics to include a lead program against an orphan liver disease. |

Acquisition of Roche RNAi business

The last few years have brought substantial change to Arrowhead’s research and development (R&D) capabilities and strategy. We have transitioned from being a nanotechnology holding company in multiple industries to a focused biotech model. We are now a unified RNAi therapeutics company, developing novel drugs that silence disease causing genes based on our broad RNAi and peptide technology platforms.

The most significant step in this transition was our 2011 acquisition of Roche’s RNAi therapeutics business, which included the Dynamic Polyconjugate, or DPC, delivery system that we use in our hepatitis B drug candidate, ARC-520. Roche built this business unit in a manner that only a large pharmaceutical company is capable of: backed by expansive capital resources, they systematically acquired technologies, licensed expansive IP, attracted leading scientists, developed new technologies internally, and built state-of-the-art facilities. At a time when the markets were questioning whether RNAi could become a viable therapeutic modality, we saw great promise in the technology broadly and the quality of what Roche built specifically. The acquisition provided us with three primary sources of value:

|

(1) |

Broad freedom to operate within three siRNA formats, canonical, meroduplex, and dicer substrate siRNA structures; |

|

(2) |

Best-in-class small RNA delivery system, the targetable DPC platform; and |

|

(3) |

A state-of-the-art R&D facility in Madison, Wisconsin, including a large team of scientists experienced in RNAi and siRNA delivery. |

2

We see this as a powerful combination of intellectual property, R&D infrastructure, and RNAi delivery experts. It provided us with the tools we needed to build an independent and broad RNAi company. We believe we are the only company with access to all three siRNA structures and this enables us to optimize the RNAi trigger on a target-by-target basis. Our DPC delivery system enables us to deliver siRNA efficiently to hepatocytes and non-hepatic tissues in a highly specific manner. Our R&D team and facility enable rapid innovation and drive to the clinic, as evidenced by the speed at which we have advanced the ARC-520 program. As we look at the RNAi space, we do not see any company with as powerful and complete a combination of assets and capabilities as ours.

We have made great strides since the acquisition. We brought ARC-520 into the clinic, completed a Phase 1 trial, and we are in the process of initiating a Phase 2 trial. Additionally, we have made important advances in the DPC delivery technology. This includes new generations of DPCs capable of inducing deep and durable gene knockdown with various constructs designed for both IV and subcutaneous administration. A key to DPC’s potency, and one of its differentiating qualities, is a polymer backbone designed to induce efficient endosomal escape. This allows more of the siRNA to get into the cytosol where it can engage the cell’s RNAi machinery. We have also taken advantage of our DPC’s targetable nature and have made substantial progress toward extra-hepatic delivery.

Delivering outside the liver is important for maximizing the value of DPCs and to continue to differentiate Arrowhead from its competitors. Toward those ends, we have active programs to identify and evaluate targeting ligands that may be used with DPCs. As part of this initiative, in April 2012 we acquired Alvos Therapeutics, a privately held company that licensed a large platform of proprietary human-derived homing peptides from MD Anderson Cancer Center. This library contains peptides discovered through screening in human patients, and we are actively determining whether we could use these peptides to target DPCs.

We have focused our resources behind the DPC platform and our focus is entirely on advancing ARC-520 through the clinic and developing additional DPC-enabled RNAi therapeutics. Additionally, Arrowhead now has the infrastructure, expertise, IP portfolio, and management that we believe is necessary to attract and support a broad range of partnerships and research collaborations with large biopharma companies from discovery stage through clinical trials.

Pipeline Overview

Our internal preclinical and clinical development programs are designed to create value directly through our proprietary candidates. These programs also drive value to the technology platforms as proof of concept for the power of the programs to enable innovative new therapies.

3

Internal Clinical Program

ARC-520 – Hepatitis B Virus Infection

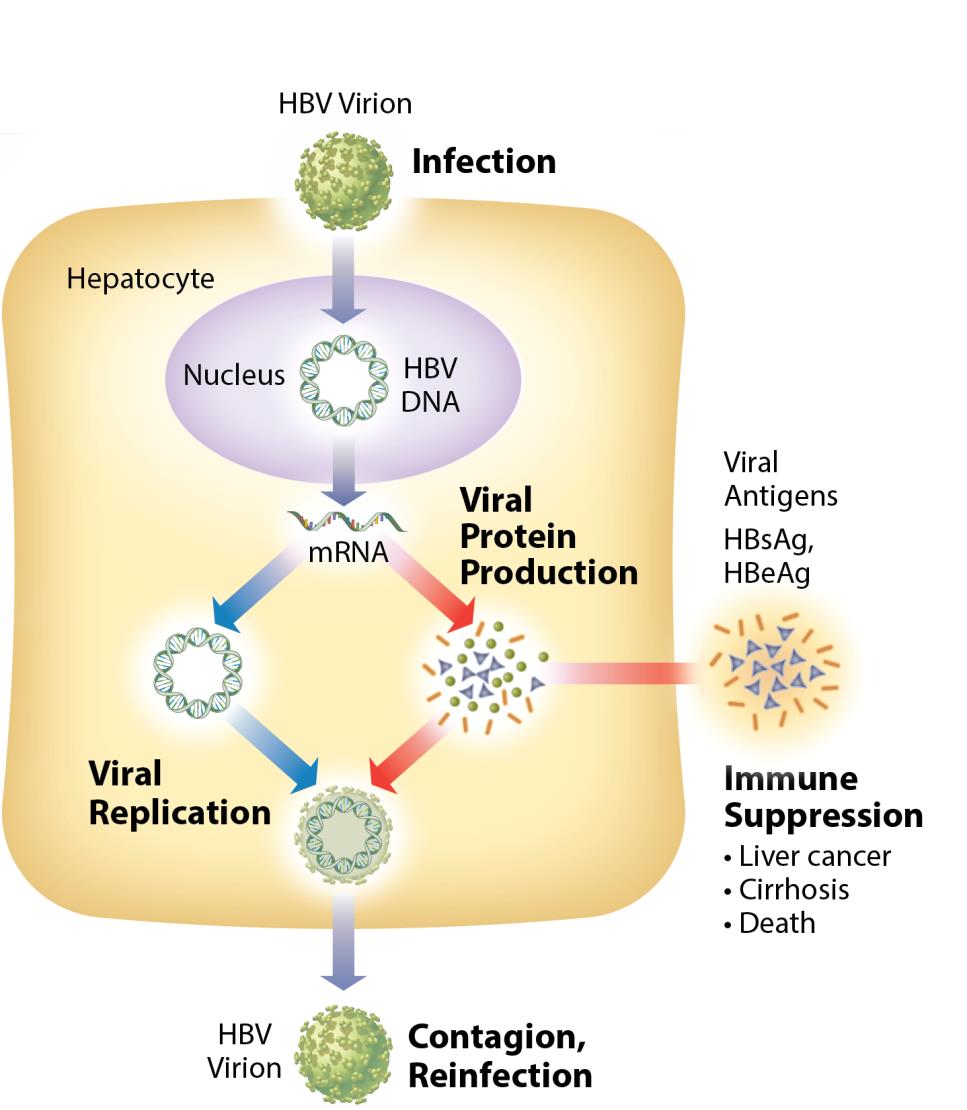

According to the World Health Organization, 360 million people worldwide are chronically infected with hepatitis B virus, of which 500,000 to 1,000,000 people die each year from HBV related liver disease. Chronic HBV infection is defined by the presence of hepatitis B surface antigen (HBsAg) for more than 6 months. In the immune tolerant phase of chronic infection, which can last for many years, the infected person typically produces very high levels of viral DNA and viral antigens. However, the infection is not cytotoxic and the carrier may have no symptoms of illness. Over time, the ongoing production of viral antigens causes inflammation and necrosis, leading to elevation of liver enzymes such as alanine and aspartate transaminases, hepatitis, fibrosis, and liver cancer (HCC). If untreated, as many as 25% to 40% of chronic carriers develop cirrhosis or HCC. Antiviral therapy is generally prescribed when liver enzymes become elevated.

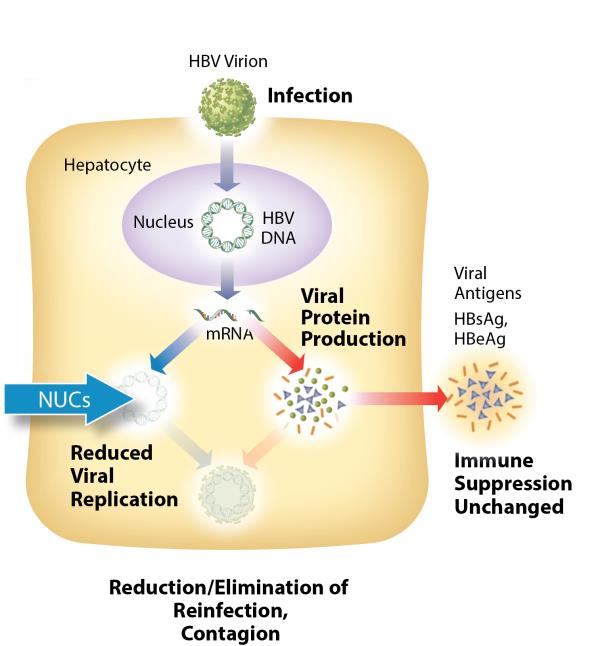

The current standard of care for treatment of chronic HBV infection is a daily oral dose of nucleotide/nucleoside analogs (NUCs) or a regimen of interferon injections 2 to 7 times weekly for approximately one year. NUCs are generally well-tolerated, but patients may need lifetime treatment because viral replication often rebounds upon cessation of treatment. Interferon therapeutics can result in a functional cure in 10-20% of some patient types, but treatment is often associated with significant side effects, including severe flu-like symptoms, marrow suppression, and autoimmune disorders.

We see the need for a next generation HBV treatment with fewer side effects, that eliminates the need for interferon based treatment, has a finite treatment period and an attractive dosing regimen, and one that can be used at earlier stages of disease. We believe a novel therapeutic approach that can effectively treat or provide a functional cure (development of patient antibodies against HBsAg) has the potential to take significant market share and may expand the available market to include patients that are currently untreated.

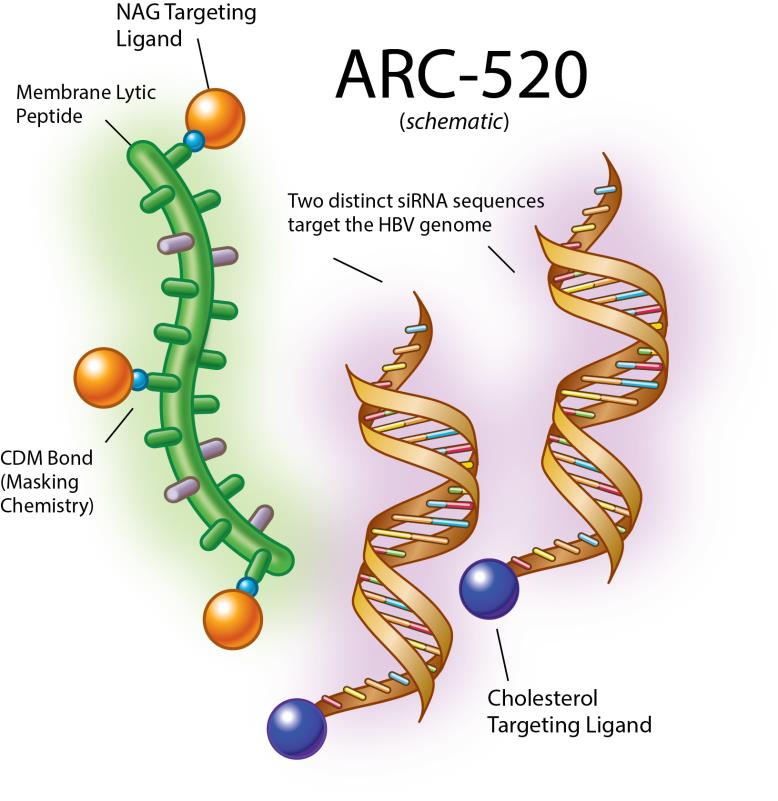

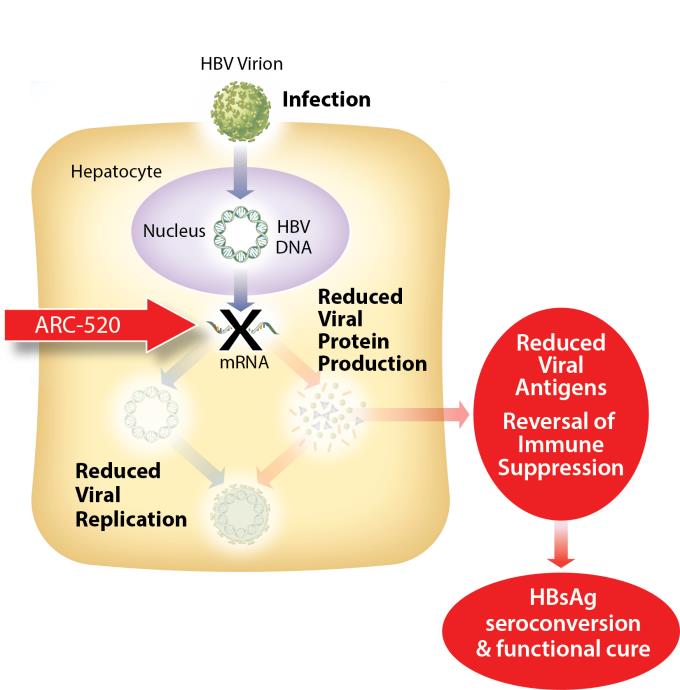

ARC-520 is an siRNA therapeutic intended for delivery to the active site of infection using our proprietary Dynamic Polyconjugate (DPC) technology. ARC-520 consists of two siRNA duplexes, each conjugated to a cholesterol derivative to enhance liver delivery and cellular uptake. We have designed ARC-520 to be co-administered with an active excipient, a masked, hepatocyte targeted polymeric amine. Once the siRNAs and the active excipient are taken up by the hepatocytes, the polymeric amines are unmasked in the endosome and disrupt the endosomal membrane, releasing the siRNA to the cytoplasm where it can engage the RNAi machinery of the cell.

The siRNAs in ARC-520 are designed to target multiple components of HBV production including the pregenomic RNA that would be reverse transcribed to generate the viral DNA. The siRNAs intervene at the mRNA level, upstream of where NUCs act, and target the mRNAs that produce HBsAg proteins, the viral polymerase, the core protein that forms the capsid, the pre-genomic RNA and the HBeAg. NUCs are effective at reducing production of viral particles, but are ineffective at controlling production of viral antigens and other HBV gene products. A reduction of viral antigens is considered necessary to effective therapy because their presence is thought to be a major contributor to repression of the immune system and the persistence of liver disease secondary to HBV infection.

4

Chronic HBV Untreated:

ARC-520 Versus NUC Intervention:

5

Efficacy data in mouse models of HBV infection show that ARC-520 is capable of reducing HBsAg by greater than 3 log (99.9%), HBV DNA by approximately 3 logs, and HBeAg to the limit of detection. Pharmacologic effects persist for approximately one month after a single dose of ARC-520. Safety data in rodents and non-human primates indicate an acceptable safety margin.

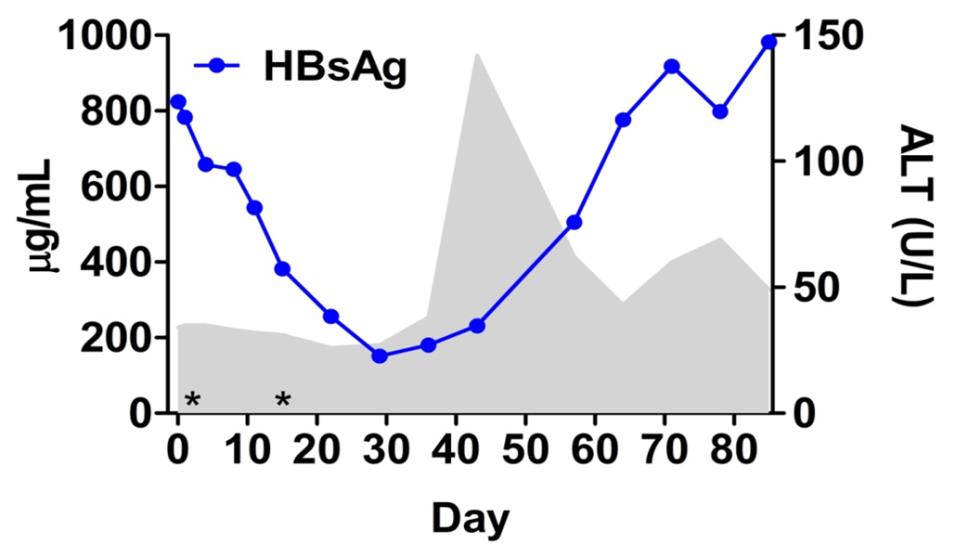

Additional preclinical data in a chimpanzee chronically infected with HBV demonstrate that intravenous administration of two doses (2 mg/kg on day 1, and 3 mg/kg on day 15) of ARC-520, resulted in substantial and sustained reductions in HBV DNA, HBeAg, and HBsAg, which did not return to baseline until study day 43, 43, and 71, respectively. In addition, an increase in serum alanine transaminase (ALT) occurred 4 weeks after the second dose, coincident with the nadir of circulating HBsAg. This is suggestive of a therapeutic immunological flare, which is thought to be part of a cascade that under chronic therapy may lead to HBsAg seroconversion and functional cure. Observed increases in key chemokine/cytokine mRNAs are also consistent with a T-cell mediated immunological event.

Arrowhead completed its planned enrollment in a Phase 1 trial in the fall of 2013. The study was designed to characterize the safety profile of ARC-520 across a range of doses and evaluate pharmacokinetics. It was a single-center, randomized, double-blind, placebo-controlled, single dose-escalation, first-in-human study of ARC-520 administered intravenously to healthy adult volunteers. All subjects received either placebo or ARC-520 in doses ranging from 0.01 mg/kg to 2 mg/kg. The study was planned to enroll 36 subjects in six cohorts of six subjects each, with 2 subjects receiving placebo and 4 receiving ARC-520. The study successfully enrolled all 36 subjects (24 received ARC-520, 12 placebo) at a single center in Melbourne, Australia. All subjects received their full, assigned dose and there were no discontinuations for adverse events or otherwise.

Based on pre-clinical studies, including GLP toxicology, it is expected that if any clinically significant or dose-limiting toxicities were to occur, they would be observed within the first 24-48 hours after administration, and would be apparent in elevations in blood chemistries. The anticipated organs of interest for potential toxicity and the resultant chemistries are liver (ALT), kidney (creatinine, urea), and muscle (CK, AST, LDH, Troponin I). In the Phase 1 study, laboratory results have not indicated any organ toxicity involving the liver, kidney, or muscle in any subject.

There have been no serious or severe adverse events reported in any subject. Overall, adverse events have been consistent with those typically seen in normal volunteer studies, including in placebo subjects. The most common events reported were upper respiratory infection, (which were not unexpected as the trial was enrolled during the Australian winter), and headache. The only other event reported in more than one subject was mild lightheadedness. Neither occurrence was accompanied by any changes in vital signs, laboratories or physical examinations. Adverse events appear to have been randomly scattered across all six dosing groups with no apparent dose-related increases in occurrence rate or severity with the possible exception of mild lightheadedness. Both subjects with mild lightheadedness were in the 2 mg/kg group. Laboratory abnormalities have occurred sporadically across groups and time points pre- and post-dosing. None of these indicate any organ toxicity and the frequency and severity do not appear to be dose-related.

In the first half of 2014, Arrowhead plans to conduct a Phase 2a multicenter, randomized, double-blind, placebo-controlled, dose-escalation study to determine the depth and duration of hepatitis B surface antigen (HBsAg) reduction after a single intravenous dose of ARC-520 in combination with entecavir in patients with chronic HBV infection. The Company has conducted combination studies in mouse models of HBV, and ARC-520 appears to have at least additive and possibly a synergistic effect with entecavir. We also believe that a patient population with adequately controlled viral load, but uncontrolled antigenemia may provide us with a clear signal of ARC-520’s activity.

6

Chronic dose GLP-toxicology studies are underway to support a Phase 2b study planned to begin in the second half of 2014. That study is planned to have clinical sites in the US, Western Europe, Asia, and potentially other regions.

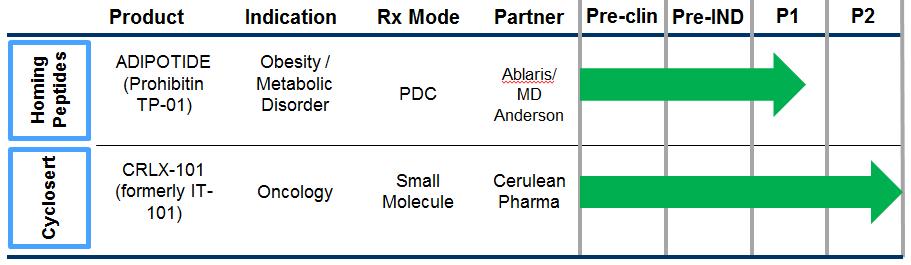

Partner-based Pipeline

Adipotide – Obesity and Metabolic Disorder

Adipotide has been developed by our majority-owned subsidiary, Ablaris Therapeutics, Inc. (“Ablaris”). Arrowhead owns 64% of the fully diluted shares of Ablaris. Adipotide is based on the Homing Peptide™ library developed at MD Anderson Cancer Center, the licensor, which is also funding and managing a Phase 1 clinical trial. Patient recruiting is on-going, and though internal resources are not being expended on this program, the Company continues to monitor its progress to determine whether it can be an attractive licensing candidate.

An Investigational New Drug Application (IND) for Adipotide was filed with the FDA, and patient enrollment began in 2012 as part of a Phase 1 clinical trial to test the safety of the compound in human patients. Our collaborator, MD Anderson Cancer Center in Houston, plans to enroll up to 39 obese prostate cancer patients in the Phase 1 study and has agreed to bear all direct costs of this trial. Up to five dose levels of the drug candidate will be tested in the trial. Three participants will be enrolled at each dose level, with the first group of participants receiving the lowest dose level by injection under the skin once per day for 28 days and each new group receiving a higher dose than the group before it, if no intolerable side effects are seen. This will continue until the highest tolerable dose is found or the study terminates.

Cyclosert and CRLX-101 (formerly IT-101)

The linear cyclodextrin-based drug delivery platform, Cyclosert, was designed for the delivery of small molecule drugs. In December 2008, we completed a Phase 1 trial with IT-101, a conjugate of the linear cyclodextrin polymer and Camptothecin, a potent anti-cancer drug, with a positive safety profile and indications of efficacy.

In June 2009, we entered into a transaction with Cerulean Pharmaceuticals, Inc., a privately held Boston, Massachusetts based company. Cerulean licensed rights to further research and commercialize IT-101 (now known as “CRLX-101”), and the Cyclosert platform for all products except for nucleic acids, tubulysin, cytolysin and second-generation epothilones. In connection with the transaction, we assigned certain patents to Cerulean and Cerulean granted back to us rights necessary to research and commercialize the excluded products.

7

We received an initial payment of $2.4 million, and may receive development and sales milestones, and royalty payments if CRLX-101 or other products based on the Cyclosert platform are successfully developed. Should Cerulean sublicense CRLX-101 to a third party, we are entitled to receive a percentage of any sublicensing income at rates between 10% and 40%, depending on the stage of the drug’s development at the time of sublicensing.

Cerulean has multiple active Phase 2 trials ongoing to study CRLX-101 in several cancer types, including: metastatic stomach, gastroesophageal, esophageal, small cell lung, ovarian, tubal, peritoneal, and renal cell.

Alnylam Pharmaceuticals

In January 2012, Arrowhead granted Alnylam Pharmaceuticals, Inc., (“Alnylam”) a license to utilize the Dynamic Polyconjugate delivery technology for a single RNAi therapeutic product. Alnylam is collaborating with Arrowhead to develop this technology for an undisclosed target in its "Alnylam 5x15" pipeline, which is focused on genetically defined targets and diseases. Alnylam has not publically disclosed what progress, if any, it may have made with respect to this target. Arrowhead is eligible to receive milestone payments up to $18.1 million and royalties on sales from Alnylam.

Shire

In December 2012, Arrowhead signed a research collaboration and license agreement with Shire AG to develop and commercialize targeted peptide-drug conjugates (PDCs) utilizing Arrowhead’s human-derived Homing Peptide platform and Shire’s therapeutic payloads. Arrowhead may receive research funding and could be eligible for development, regulatory, and commercialization milestone payments of up to $32.8 million for each development candidate, plus additional milestone payments for a second indication, and royalties on worldwide sales.

Preclinical Programs

In addition to our clinical candidates and our partner-based programs, we are actively engaged in the discovery and development of additional pre-clinical stage products. Our lead preclinical program is a DPC-enabled RNAi therapeutic targeting an undisclosed orphan liver disease.

We have additional discovery and preclinical programs for intravenous and subcutaneous administered therapeutics targeting the liver,as well as programs targeting extra-hepatic tissues. We focus on disease targets that are well suited for intervention with targeted RNAi therapeutics using our DPC delivery platform. These may include liver disease, oncology, and other therapeutic areas.

RNAi Program

In October 2011, Arrowhead acquired Roche’s RNAi business, including its RNA therapeutic assets, related intellectual property and research facility in Madison, Wisconsin. We believe that these assets position Arrowhead as one of the most advanced and broadest RNAi therapeutics companies in the world. Arrowhead possesses the following siRNA assets:

| · |

Non-exclusive license from Alnylam to use canonical siRNAs in oncology, respiratory diseases, metabolic diseases and certain liver diseases. This includes a sub-license from Isis Pharmaceuticals granting Arrowhead a license for siRNA chemical modifications for these specific disease areas. |

| · |

Non-exclusive license from City of Hope Comprehensive Cancer Center to Dicer substrate and Meroduplex siRNAs. The Dicer technology may provide advantages over canonical siRNAs in certain circumstances. In addition, different siRNA formats may trigger RNAi more or less efficiently on a target-by-target basis. |

| · |

Patent estate covering the Dynamic Polyconjugate siRNA delivery system. |

| · |

Access to certain patents on targeting siRNA drugs with antibodies and small molecules. |

8

| · |

State-of-the-art laboratory facilities in Madison, Wisconsin, managed by long-term leaders in oligonucleotide therapeutics and delivery, including a small animal research facility and an offsite primate colony. |

| · |

Intellectual property covering Roche’s internally developed liposomal nanoparticle drug delivery technology. |

We believe this represents one of the broadest siRNA drug technology and delivery portfolios in the field.

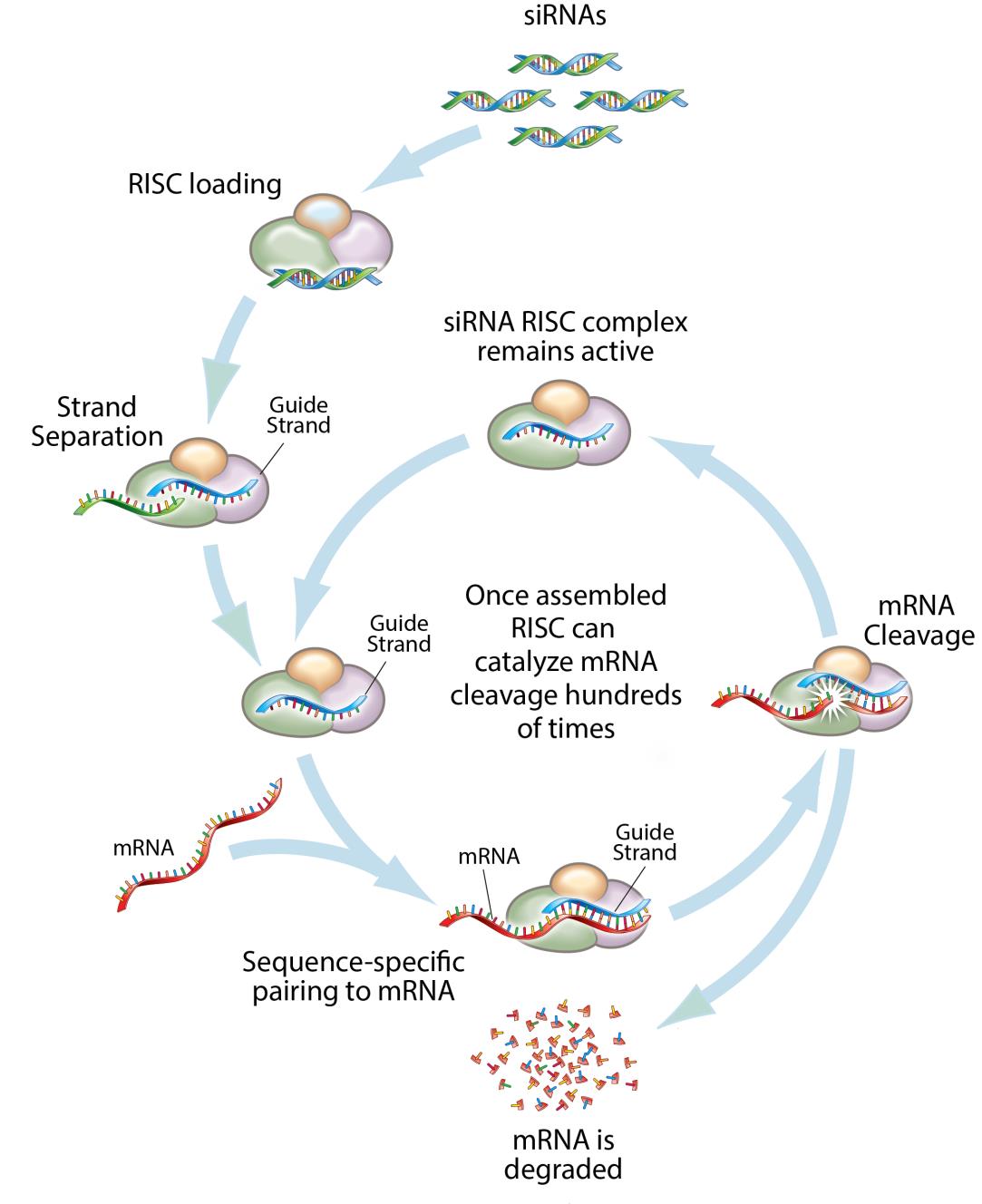

RNA Interference & the Benefits of siRNA Therapeutics

RNA interference (RNAi) is a mechanism present in living cells that inhibits the expression of a specific gene, thereby affecting the production of a specific protein. Deemed to be one of the most important recent discoveries in life science with the potential to transform medicine, the discoverers of RNAi were awarded a Nobel Prize in 2006 for their work. Mediated by small interfering RNAs (siRNA), RNAi-based therapeutics can leverage this natural pathway of gene silencing to potentially target and shut down specific disease causing genes.

Small molecule and antibody drugs have proven effective at inhibiting certain cell surface, intracellular, and extracellular targets. However, certain drug targets such as intranuclear genes and some proteins have proven difficult to inhibit with traditional drug-based and biologic therapeutics. Developing effective drugs for these targets would have the potential to address large underserved markets for the treatment of many diseases. Using the ability to specifically silence any gene, RNAi therapeutics may be able to address previously “undruggable” targets, unlocking the market potential of such targets.

9

Mechanism of RNA interference:

Advantages of RNAi as a Therapeutic Modality

| · |

Silences the expression of disease causing genes; |

| · |

Potential to address any target in the transcriptome including previously "undruggable" targets; |

| · |

Rapid lead identification; |

| · |

High specificity; |

| · |

Opportunity to use multiple RNA sequences in one drug product for synergistic silencing of related targets; and |

| · |

siRNAs are uniquely suited for personalized medicine through target and cell specific delivery and gene knockdown. |

Addressing the siRNA Delivery Challenge

To date, the primary challenge to the development of siRNA therapeutics has been delivering the fragile, often immunogenic and otherwise rapidly cleared siRNA molecules, into the cytoplasm of the cell, where RNAi activity occurs. This hurdle has prevented siRNA therapeutics from reaching full potential. Many companies have attempted to overcome the delivery challenge. Most early systems involved cholesterol conjugates or liposomes. However, development in humans has been limited due to toxicity and immunogenicity of these approaches when studied in clinical trials.

10

To address the delivery challenge, Arrowhead has a leading team of researchers with extensive siRNA therapeutic know-how and an advanced delivery system. The DPC system is modular and may be optimized on a target-by-target basis. Importantly, it also may be targeted to address a variety of tissues, including those outside of the liver.

The Dynamic Polyconjugate siRNA Delivery System

The DPC delivery system represents an innovative solution to the siRNA delivery problem, specifically designed to overcome barriers to systemic administration of siRNA. Developed by our scientists in Madison, Wisconsin, the inspiration for DPC technology came from the physical characteristics of viruses, nature’s own nanoparticles for nucleic acid delivery. Viruses are efficient at finding their target cells and delivering their nucleic acid payload to the proper cellular compartment. Key features of viruses are their small size, their overall negative surface charge, their specificity for particular cell types based on receptors unique to that cell, and their ability to disassemble and release their nucleic acid cargo to the proper cell compartment in response to cellular triggers. All of these features are incorporated into DPC technology.

DPCs are small nanoparticles, 5-20 nanometers (nm) in size, with an amphipathic polymer backbone. Arrowhead has a library of polymers that may be employed with the system, enabling optimization based on factors such as preferred mode of administration, pharmacokinetics, and target tissue. Shielding agents such as polyethylene glycol and targeting ligands may be reversibly attached to the polymer backbone. In some constructs, the siRNA payload is attached to the DPC, while in other constructs, the siRNA circulates attached to a different carrier. When attached, the DPC construct protects the siRNA payload while allowing the polymer to circulate in the blood without creating undue toxicity. The targeting ligand guides it to the cell of interest where, together with the siRNA, it is taken up into a membrane-enclosed cellular compartment known as an endosome. The polymer is selected for its ability to disrupt the endosomal membrane, which allows the siRNA to be released into the cytoplasm. There, it engages the cell’s RNAi machinery, ultimately resulting in knockdown of target gene expression. This lytic chemistry of the DPC polymeric backbone is modified, or “masked”, using proprietary chemistry. Masking of the polymer’s lytic chemistry accomplishes two interrelated objectives that are critical to in vivo siRNA delivery:

| · |

Reduction of toxicity by controlling when the membrane lytic property of the polymer is activated. |

| · |

Inhibition of non-specific interactions with blood components and non-targeted cell types. |

11

Single Molecule DPCs:

12

DPCs using Co-injection Strategy

Arrowhead has developed multiple forms of the prototypical DPC delivery system. Our ARC-520 clinical candidate utilizes a formulation where the siRNA is conjugated to cholesterol and is not attached to the DPC. Pre-clinical studies have shown co-injection of liver-targeted DPC polymer together with siRNA conjugated to a lipophilic moiety, such as cholesterol, results in a >500-fold increase in the potency when compared to the siRNA-cholesterol alone. This formulation retains the potent endosomal escape capabilities of Arrowhead's DPC platform, simplifies drug manufacturing, and creates new targeting opportunities.

DPCs for Subcutaneous Administration

A DPC formulation for subcutaneous administration has also been developed using Arrowhead’s latest proprietary polymer masking technology. Using DPCs to deliver siRNA, high-level target gene knockdown is observed at low siRNA doses with limited toxicity in rodents and non-human primates. Arrowhead studies have shown knockdown of 99% in monkeys after a single injection of 1 mg/kg, >90% at 0.5 mg/kg, and 80% in mice at 0.05 mg/kg, which represents greater knockdown at lower doses than reported results of other clinical candidates. PK and biodistribution studies indicate that the new masking technology is highly stable, allowing for maximal bioavailability and long circulation times. Arrowhead is developing this formulation for use in multiple therapeutic areas where chronic dosing may be required.

13

Homing Peptide Program

In April 2012, Arrowhead acquired Alvos Therapeutics, Inc. (“Alvos”). Alvos licensed a discovery platform and large library of proprietary human-derived Homing Peptides from the MD Anderson Cancer Center. This discovery platform is designed to identify targeting agents, such as peptides, that selectively accumulate in primary and metastatic tumors, associated vasculature, and to 30 normal tissue types. Such targeting agents are of interest for drug development because they hold the promise of shepherding drugs into specific cells while sparing others. This new platform was acquired because it fit well into our existing business. One of the key advantages of our DPC delivery systems is its ability to be targeted. With a vast proprietary targeting library of our own, we believe that we can enhance the value of our RNAi programs and differentiate our capabilities from those of our competitors.

In addition, we believe that the homing peptide sequences can be applied to non-RNA therapeutics almost as a by-product of our work targeting RNAi drugs and present attractive value to potential partners. The platform has the potential to allow partners to:

| · |

Develop therapeutic agents that hunt down and destroy known tumors, as well as distant unidentified metastases; |

| · |

Convert cancer therapeutics that generally interact with most cells in the body to “smart” drugs that accumulate primarily at tumor sites and affect cancer cells preferentially, thereby improving the toxicity and side effects of currently used cancer drugs; and |

| · |

Selectively target non-cancer therapeutics to virtually any tissue type in the body where they can have the desired pharmacologic effect. |

This platform is potentially powerful in the specificity of the large number of unique targeting sequences and in their origin from human screening. In addition, because of the human-based identification process, there is lower risk that animal model data will not translate. Our proprietary library of 42,000 unique targeting sequences can be used with our own delivery platforms, as well as with small molecule drugs. This platform has achieved clinical proof of concept in targeting metastatic prostate cancer with the first sequence tested in humans.

Importantly, the method used identifies peptides that are rapidly internalized into cells. These peptide-receptor pairs hold the promise of shuttling therapeutic payloads preferentially and directly into those cells. The ability to target and deliver cytotoxins would address some of the problems with current cancer therapeutics by limiting side effects and increasing efficacy.

In order to discover receptors and peptide sequences that target them, a technique called in vivo phage display is employed. Over the past several years, phage display screening has been conducted at MD Anderson Cancer Center in end-stage cancer patients with primary and metastatic tumors under rigorous ethical standards. To our knowledge, they are the only group in the world that is generating this type of human-derived data. Direct screening in human cancer patients has the potential to eliminate some of the uncertainty that has plagued current discovery methods with animal models. This strategy sought to map the human vasculature into “zip codes” and has discovered a large number of novel receptors that are expressed only on the cell surface of tumor sites and nowhere else. The library can be increased further through continuing work with MD Anderson to screen additional patients.

Arrowhead is working to apply this technology to targeting our proprietary siRNA delivery vehicles. Our DPC delivery platform is highly attractive in part because it has been shown to be well tolerated, effective, capable of delivering RNAs to multiple organ systems, and it is targetable. The Homing Peptide library provides our targeted RNAi therapeutic program with a powerful new source of flexibility. The library is also valuable to enable partners, through license and collaboration deals, to create a new class of therapeutics, Peptide-Drug Conjugates, or PDCs. By linking the Homing Peptides to traditional small molecule drugs, potential partners may be able to transform a therapeutic that interacts with most cells in the body into one that interacts preferentially with the cell of choice. We believe that this transition from untargeted to targeted drugs is a paradigm shift for cancer therapeutics and that our new library puts us at the forefront of this transformation. We do not currently intend to build our own pipeline of PDCs, but do intend to work with partners to apply our targeting sequences to their drugs. We believe that this specific targeting will enable partners to make existing generics safer and more effective and help make their proprietary drugs better. Given the large number of approved APIs for oncology and the thousands of Homing Peptide sequences that we now have, there are many potential combinations of targeting sequence and drug molecules.

14

PDCs share the promise of the original class of guided therapeutics, antibody-drug conjugates or ADCs, in that they could increase efficacy and decrease toxicity relative to current standard of care oncology products. Benefits of PDCs as a class are as follows:

| · |

They are potentially faster, cheaper, and simpler to make than ADCs, making them attractive development projects for biopharmaceutical companies; |

| · |

Their targets are expressed on a high percentage of multiple tumor types, giving them a larger potential commercial market than genetically targeted agents that are efficacious in only a small subset of patient populations; and |

| · |

The use of Homing Peptides that were discovered in human cancer patients as the targeting moieties for PDCs potentially increases clinical probability of success. |

We believe this unique mix of benefits will be attractive to potential partners in the biopharmaceutical industry. This technology has the potential to facilitate the rapid development of multiple new product candidates, each of which could meet a critical unmet medical need. In addition, screening in man has broad applicability in other therapeutic areas of interest to the biopharmaceutical industry.

Intellectual Property

The Company controls approximately 51 issued patents (14 for DPCs; 9 for hydrodynamic gene delivery; 26 for Homing Peptides; and 2 from Calando), including European validations, and 29 patent applications (13 for DPCs; 8 for Homing Peptides; and 8 from Calando). The pending applications have been filed throughout the world, including, in the United States, Argentina, Australia, Brazil, Canada, Chile, China, Europe, the Arab States of the Gulf, Israel, India, Japan, Republic of Korea, Mexico, Peru, Philippines, Russian Federation, Singapore, Thailand, Taiwan and Venezuela.

siRNAs

The Company owns patents directed to siRNAs targeted to reduce expression of hepatitis B viral proteins as well the RRM2 gene. Calando owns a U.S. issued patent (in addition to a patent in Singapore) directed to siRNAs targeted to reduce expression of endothelial PAS domain protein 1 (EPAS1). Calando has also licensed patents from Alnylam relevant to siRNA therapeutics for its products.

|

Patent Group |

Estimated Year of Expiration |

|

siRNAs | |

|

Patent directed to HIF-2 alpha (EPAS1) siRNAs |

2030 |

|

Patent directed to HBV siRNAs |

2032 |

|

Patent directed to RRM2 siRNAs |

2031 |

15

DPCs

The DPC related patents have issued in the United States, Australia, Canada, Europe (France, Germany, Italy, Spain, Switzerland, United Kingdom), India, Japan, Mexico, New Zealand, Philippines, Russia, South Korea, Singapore, and South Africa. The Company also controls a number of patents directed to hydrodynamic nucleic acid delivery, which issued in the United States, Australia and Europe (validated in Austria, Belgium, Switzerland, Germany, Denmark, Spain, Finland, France, the United Kingdom, Hungary, Ireland, Italy, Netherlands and Sweden). The approximate year of expiration for each of these various groups of patents are set forth below:

|

Patent Group |

Estimated Year of Expiration |

|

Dynamic Polyconjugates® (DPC®) | |

|

Membrane Active Polymers |

2027 |

|

Membrane Active Polymers – Additional Iterations |

2024 |

|

Copolymer Systems |

2024 |

|

Polynucleotide-Polymer Composition |

2024 |

|

Polynucleotide-Polymer Composition – Additional Iterations |

2031 |

|

Polyampholyte Delivery |

2017 |

|

pH Labile Molecules |

2020 |

|

Endosomolytic Polymers |

2020 |

|

Hydrodynamic delivery | |

|

First iterations |

2015 |

|

Second iteration |

2020 |

|

Third iteration |

2024 |

The RNAi and nanoparticle drug delivery patent landscapes are complex and rapidly evolving. As such, we may need to obtain additional patent licenses prior to commercialization of our candidates. You should review the factors identified in “Risk Factors” in Part I, Item 1A of this Annual Report on Form 10-K.

Homing Peptides

We also control patents related to our Homing Peptide platforms, related to Adipotide, our drug candidate for the treatment for obesity and related metabolic disorders. Approximately five of these patents are United States patents and the remaining patents are validated in Belgium, Switzerland, Germany, Spain, France, the United Kingdom, Ireland, Greece, Italy, Netherlands, Portugal, Sweden and Turkey.

|

Patent Group |

Estimated Year of Expiration |

|

Adipotide® | |

|

Targeting moieties and conjugates |

2021 |

|

Targeted Pharmaceutical Compositions |

2021 |

|

Homing Peptides | |

|

EphA5 Targeting Peptides |

2027 |

|

IL-11R Targeting Peptides |

2022 |

16

Non-Exclusively Licensed Patents

Hoffmann-La Roche, Inc. and F. Hoffmann-La Roche Ltd. (“Roche”) and the Company entered into a Stock and Asset Purchase Agreement on October 21, 2011 in which Roche assigned to Arrowhead its entire rights under certain licenses for example: the License and Collaboration Agreement between Roche and Alnylam Pharmaceuticals, Inc. (“Alnylam”) dated July 8, 2007 (the “Alnylam License”); the Non-Exclusive Patent License Agreement between Roche and MDRNA, Inc. dated February 12, 2009 (“MDRNA License”); and the Non-Exclusive License Agreement between Roche and City of Hope dated September 19, 2011 (the “COH License”) (Collectively the “RNAi Licenses”). The RNAi Licenses provide the Company with non-exclusive, worldwide, perpetual, irrevocable, royalty-bearing rights and the right to sublicense a broad portfolio of intellectual property relating to the discovery, development, manufacture, characterization, and use of therapeutic products that function through the mechanism of RNA interference for specified targets.

Core Patents relating to RNAi

The RNAi Licenses include patents relating to the general structure, architecture, and design of double-stranded oligonucleotide molecules, which engage RNA interference mechanisms in a cell. These rights include the “Tuschl II” patents, including issued U.S. Patent Nos. 7,056,704; 7,078,196; 7,078,196; 8,329,463; 8,362,231; 8,372,968; and 8,445,327; “Tuschl I” patents, including U.S. Patent Nos. 8,394,628 and 8,420,391; and allowed “Tuschl I” patent application, U.S. Publication No. 2011024446; “City of Hope” patents, including U.S. Patent No. 8,084,599; and “Kreutzer-Limmer” patents assigned to Alnylam, including U.S. Patent Nos. 7,829,693; 8,101,594; 8,119,608; 8,202,980; and 8,168,776.

Thomas Tuschl is the first named inventor on “Tuschl I” and “Tuschl II.” “Tuschl I” refers to the patents arising from the patent application entitled “The Uses of 21-23 Sequence-Specific Mediators of Double-Stranded RNA Interference as a Tool to Study Gene Function and as a Gene-Specific Therapeutic.” “Tuschl II” patents refer to the patents and patent applications arising from the patent application entitled “RNA Interference Mediating Small RNA Molecules.” “City of Hope” is the first named assignee of certain core siRNA patents. The second named assignee of these patents is Integrated DNA Technologies, Inc. Kreutzer-Limmer patents refer to the Alnylam patents and patent applications, relating to core siRNA IP, which includes inventors, Roland Kreutzer and Stefan Limmer.

Chemical modifications of double-stranded oligonucleotides

The RNAi Licenses also include patents related to modifications of double-stranded oligonucleotides, including modifications to the base, sugar, or internucleoside linkage, nucleotide mimetics, and end modifications, which do not abolish the RNAi activity of the double-stranded oligonucleotides. Also included are patents relating to modified double-stranded oligonucleotides, such as meroduplexes described in in U.S. Publication No. 20100209487 assigned to Marina Biotech (f/k/a MDRNA, Inc.), and microRNAs described in U.S. Patent Nos. 7,582,744; 7,674,778, and 7,772,387 assigned Alnylam. The RNAi Licenses also include rights from INEX/Tekmira relating to lipid-nucleic acid particles, and oligonucleotide modifications to improve pharmacokinetic activity including resistance to degradation, increased stability, and more specific targeting of cells from Alnylam and ISIS Pharmaceuticals, Inc.

Manufacturing techniques for the double-stranded oligonucleotide molecules or chemical modifications

The RNAi Licenses also include patents relating to the synthesis and manufacture of double-stranded oligonucleotide molecules for use in RNA interference, as well as chemical modifications of such molecules, as described above. These include methods of synthesizing the double-stranded oligonucleotide molecules such as in the core “Tuschl I” allowed U.S. Application No. 12/897,749, the core “Tuschl II” U.S. Patent Nos. 7,056,704; 7,078,196; and 8,445,327; and Alnylam’s U.S. Patent Nos. 8,168,776, as well as methods of making chemical modifications of the double-stranded oligonucleotides such as described in Alnylam’s U.S. Patent No. 7,723,509 and INEX’s U.S. Patent Nos. 5,976,567; 6,858,224; and 8,484,282. Patent applications are currently pending that further cover manufacturing techniques for double-stranded oligonucleotide molecules or chemical modifications.

Uses and Applications of Double-Stranded Oligonucleotide Molecules or Chemical modifications

The RNAi Licenses also include patents related to uses of the double-stranded oligonucleotides that function through the mechanism of RNA interference. These include for example, the core “Tuschl I” U.S. Patent No. 8,394,628 and “Tuschl II” U.S. Patent No. 8,329,463; Alnylam’s U.S. Patent Nos. 7,763,590; 8,101,594, and 8,119,608, and City of Hope‘s U.S. Patent No. 8,084,599. Other more specific uses have been acquired and patent applications are currently pending that cover additional end uses and applications of double-stranded oligonucleotides functioning through RNA interference.

17

License Agreements

Cerulean License

The linear cyclodextrin-based drug delivery platform, Cyclosert, was designed for the delivery of small molecule drugs. In December 2008, we completed a Phase 1 trial with IT-101, a conjugate of Calando’s linear cyclodextrin polymer and Camptothecin, a potent anti-cancer drug, with a positive safety profile and indications of efficacy.

On June 23, 2009, we entered into a transaction with Cerulean related to Cyclosert and IT-101 (the “Cerulean Transaction”). In the Cerulean Transaction, we granted Cerulean an irrevocable, perpetual, royalty bearing worldwide license with the right to sublicense, under certain patent rights and know-how in the field of human diseases solely in order to: (a) conduct research and development on the Linear Cyclodextrin System, including making improvements thereto, in order to research and commercialize our clinical asset IT-101 (now known as “CRLX-101”), as well as certain other products in which no therapeutic agent is specifically defined (the “Cerulean Products”); (b) research, develop, make, have made, use, market, offer to sell, distribute, sell and import CRLX-101 and Cerulean Products; and (c) use, copy, modify and distribute certain know-how for those purposes. In the Cerulean Transaction, we retained all rights with respect to products in which a therapeutic agent is a (i) tubulysin, (ii) cytolysin, (iii) second generation epothilone or (iv) nucleic acid (hereinafter “Calando Products”).

The Cerulean Transaction also involved the sale and assignment by us of certain patents directed to Cyclosert and CRLX-101 (the “Cerulean Assigned Patents”) to Cerulean. Cerulean then granted back to us an exclusive, irrevocable, perpetual, royalty free, worldwide license, with the right to grant sublicenses, under the Cerulean Assigned Patents solely to the extent necessary to research and commercialize products in which each therapeutic agent is a cytolysin, tubulysin, second generation epothilone or any nucleic acid.

The Cerulean Transaction resulted in an initial payment to Calando of $2.4 million. Cerulean is obligated to pay development milestone payments of up to $2.75 million if CRLX-101 progresses through clinical trials and receives marketing approval. If approved, we are also entitled to receive up to an additional $30 million in sales milestone payments, plus single digit royalties on net sales. Should Cerulean sublicense CRLX-101 to a third party, we are entitled to receive a percentage of any sublicensing income at rates between 10% and 40%, depending on the stage of the drug’s development at the time of sublicensing.

Cerulean is obligated to further pay development milestone payments of up to $3 million for each Cerulean Product that progresses through clinical trials and receives marketing approval. If Cerulean Products are approved, we are entitled to receive up to an additional $15 million in sales milestone payments, plus single digit royalties on net sales. Should Cerulean sublicense a Cerulean Product to a third party, we are entitled to receive a percentage of any sublicensing income at a rate in the tens.

The terms of the agreements of the Cerulean Transactions are tied to the expiration of certain controlled patent rights and Cerulean Assigned Patents. Cerulean may terminate the agreements on thirty (30) days’ notice and unless there is a drug safety concern, would be obligated to re-assign the CRLX-101 IND back to us and provide us with an exclusive license thereto under the Cerulean Assigned Patents.

On August 5, 2013, Calando terminated and Cerulean assumed all of Calando’s rights in a license from the California Institute of Technology (“Caltech”) under intellectual property related to linear cyclodextrin-based drug delivery technology (the “Caltech License”). Notwithstanding the termination of Calando’s rights under the Caltech License (including those to the retained Calando Products), Cerulean remains contractually obligated to make all of the aforementioned milestone, sublicensing and royalty payments to Calando.

Calando is no longer responsible for the costs associated with prosecution of the patents of the Caltech License. However, Cerulean may offset any costs it incurs prosecuting the Caltech License-associated patents from payments that are due to Calando.

18

University of Texas MD Anderson Cancer Center License

In December 2010, we obtained an exclusive worldwide license from at the University of Texas MD Anderson Cancer Center in Houston, Texas (“UTMDACC”) related to Adipotide technology (the “UTMDACC License”). The UTMDACC License granted us a royalty-bearing, exclusive right (with the right to sublicense) under certain UTMDACC patents to develop and commercialize certain products in the fields of: 1) therapeutics, diagnostics and research services that both (i) incorporate peptides that specifically target adipose tissue, and (ii) are used to treat, diagnose or research solely either (a) obesity, overweight and/or (b) metabolic conditions related to, caused by and/or associated with obesity and overweight, e.g., diabetes; and 2) cancer therapies, diagnostics and research products associated with a specific targeting moiety. We also have rights to certain improvements to the technology.

In consideration for the license, we paid UTMDACC an upfront fee of $2 million and are obligated to pay annual fees initially equal to $50,000 increasing up to a maximum of $100,000, with such annual fees creditable against milestone payments.

We may be obligated to pay development milestone payments of up to $8.3 million for each UTMDCC licensed product that progresses through clinical trials and receives U.S. marketing approval. Additional EU and Japanese approval milestone payments are in the low single digit million dollar range. If a commercial drug is developed and approved, royalty payments on net sales of UTMDACC licensed products are in the low single digit range. Should we sublicense or partner a UTMDACC licensed product, UTMDACC would receive partnering fee percentages in the range of single digits to the twenties, depending on the stage of development of the partnered UTMDACC licensed product.

The term of the UTMDACC License is linked to the last to expire patents licensed therein or 15 years if a licensed product contains only licensed know-how. We are obligated to actively and effectively attempt to commercialize the UTMDACC Technology and submit to UTMDACC a Phase 2 clinical trial protocol within two years of obtaining an approved IND. We are also obligated to commence a Phase 2 clinical trial within four years and a Phase 3 clinical trial within seven years of approval of an IND. However, we may obtain yearly extensions of time upon the payment of an increasing fee in the range of tens of thousands of dollars up to several hundred thousand dollars. We also have diligence obligations with respect to any UTMDACC Improvements later added to the license.

Research and Development Facility

Arrowhead operates a research and development facility in Madison, Wisconsin. This facility was built and equipped by Roche and was part of our acquisition of their RNA therapeutics business. Since the acquisition in 2011, we have integrated all research and development operations into that facility. A summary of the facility is provided below:

| · |

Approximately 40 scientists; |

| · |

State-of-the-art laboratories: 24,000 total sq. ft. of lab space; |

| · |

Complete small animal facility; |

| · |

Primate colony housed at the Wisconsin National Primate Research Center, an affiliate of the University of Wisconsin; |

| · |

In-house histopathology capabilities; |

| · |

Animals models for metabolic, viral, and oncologic diseases; |

| · |

Animal efficacy and safety assessment; |

| · |

Polymer, siRNA, and small molecule synthesis and analytics capabilities (HPLC, NMR, MS, etc.); |

| · |

Polymer and siRNA PK, biodistribution, clearance methodologies; and |

| · |

Confocal microscopy, flow cytometry, Luminex platform, clinical chemistry analytics. |

Research and Development Expenses

Research and development expenses consist of costs incurred in discovering, developing and testing our clinical candidates and platform technologies. R&D expenses also include costs related to clinical trials, including costs of Contract Research Organizations to recruit patients and manage clinical trials. Other costs associated with clinical trials include manufacturing of clinical supplies, as well as GLP toxicology studies necessary to support clinical trials, both of which are outsourced to cGMP-compliant manufactures and GLP-compliant laboratories. Total research and development expense for fiscal 2013 was $12.3 million, an increase from $8.7 million in 2012.

19

We employ approximately 40 employees in an R&D function, primarily working from our facility in Madison, Wisconsin. These employees are engaged in various areas of research on Arrowhead candidate and platform development including synthesis and analytics, PK/biodistribution, formulation, CMC and analytics, tumor and extra-hepatic targeting, bioassays, live animal research, toxicology/histopathology, clinical and regulatory operations, and other areas. Salaries and payroll-related expenses for our R&D activities were $3.6 million during fiscal 2013 and $3.3 million in fiscal 2012. Laboratory supplies including animal-related costs for in-vivo studies were $1.4 million and $1.1 million in fiscal 2013 and 2012, respectively.

Costs related to manufacture of clinical supplies, GLP toxicology studies and other outsourced lab studies, as well as clinical trial costs were $5.8 million and $2.6 million in fiscal 2013 and 2012 respectively.

Facility-related costs, primarily rental costs for our leased laboratory in Madison, Wisconsin were $0.7 million and $0.8 million in fiscal 2013 and 2012, respectively. Other research and development expenses were $0.8 million and $0.9 million in fiscal 2013 and 2012, respectively. These expenses are primarily related to consulting fees, technology license fees and sponsored research.

Government Regulation

Governmental authorities in the U.S. and other countries extensively regulate the research, development, testing, manufacture, labeling, promotion, advertising, distribution and marketing, among other things, of drugs and biologic products. All of our foreseeable product candidates are expected to be regulated as drug products.

In the U.S., the FDA regulates drug products under the Federal Food, Drug and Cosmetic Act (the “FDCA”), and other laws within the Public Health Service Act. Failure to comply with applicable U.S. requirements, both before and after approval, may lead to administrative and judicial sanctions, such as a delay in approving or refusal by the FDA to approve pending applications, warning letters, product recalls, product seizures, total or partial suspension of production or distribution, injunctions, and/or criminal prosecutions. Before drug products are marketed they must be approved by the FDA. The steps required before a novel drug product is approved by the FDA include: (1) pre-clinical laboratory, animal, and formulation tests; (2) submission to the FDA of an Investigational New Drug Application (“IND”) for human clinical testing, which must become effective before human clinical trials may begin; (3) adequate and well-controlled clinical trials to establish the safety and effectiveness of the product for each indication for which approval is sought; (4) submission to the FDA of a New Drug Application (“NDA”); (5) satisfactory completion of a FDA inspection of the manufacturing facility or facilities at which the drug product is produced to assess compliance with cGMP; and FDA review and finally (6) approval of an NDA.

Pre-clinical tests include laboratory evaluations of product chemistry, toxicity and formulation, as well as animal studies. The results of the pre-clinical tests, together with manufacturing information and analytical data, are submitted to the FDA as part of an IND, which must become effective before human clinical trials may begin. An IND will automatically become effective 30 days after receipt by the FDA, unless before that time the FDA raises concerns or questions, such as the conduct of the trials as outlined in the IND. In such a case, the IND sponsor and the FDA must resolve any outstanding FDA concerns or questions before clinical trials can proceed. There can be no assurance that submission of an IND will result in FDA authorization to commence clinical trials. Once an IND is in effect, each clinical trial to be conducted under the IND must be submitted to the FDA, which may or may not allow the trial to proceed.

Clinical trials involve the administration of the investigational drug to human subjects under the supervision of qualified physician-investigators and healthcare personnel. Clinical trials are typically conducted in three defined phases, but the phases may overlap or be combined. Phase 1 usually involves the initial administration of the investigational drug or biologic product to healthy individuals to evaluate its safety, dosage tolerance and pharmacodynamics. Phase 2 usually involves trials in a limited patient population, with the disease or condition for which the test material is being developed, to evaluate dosage tolerance and appropriate dosage; identify possible adverse side effects and safety risks; and preliminarily evaluate the effectiveness of the drug or biologic for specific indications. Phase 3 trials usually further evaluate effectiveness and test further for safety by administering the drug or biologic candidate in its final form in an expanded patient population. Our product development partners, the FDA, or we may suspend clinical trials at any time on various grounds, including any situation where we believe that patients are being exposed to an unacceptable health risk or are obtaining no medical benefit from the test material.

20

Assuming successful completion of the required clinical testing, the results of the pre-clinical trials and the clinical trials, together with other detailed information, including information on the manufacture and composition of the product, are submitted to the FDA in the form of an NDA requesting approval to market the product for one or more indications. Before approving an application, the FDA will usually inspect the facilities where the product is manufactured, and will not approve the product unless cGMP compliance is satisfactory. If the FDA determines the NDA is not acceptable, the FDA may outline the deficiencies in the NDA and often will request additional information. If the FDA approves the NDA, certain changes to the approved product, such as adding new indications, manufacturing changes or additional labeling claims are subject to further FDA review and approval. The testing and approval process requires substantial time, effort and financial resources, and approval on a timely basis, if at all, cannot be guaranteed.

Under the Orphan Drug Act, the FDA may grant orphan drug designation to a drug intended to treat a rare disease or condition, which is generally a disease or condition that affects fewer than 200,000 individuals in the United States, or more than 200,000 individuals in the U.S. and for which there is no reasonable expectation that the cost of developing and making available in the U.S. a drug for this type of disease or condition will be recovered from sales in the U.S. for that drug. Orphan drug designation must be requested before submitting an NDA. After the FDA grants orphan drug designation, the identity of the therapeutic agent and its potential orphan use are disclosed publicly by the FDA. If a product that has orphan drug designation subsequently receives the first FDA approval for the disease for which it has such designation, the product is entitled to orphan product exclusivity, which means that the FDA may not approve any other application to market the same drug for the same indication, except in very limited circumstances, for seven years.

In addition, regardless of the type of approval, we and our partners are required to comply with a number of FDA requirements both before and after approval. For example, drug makers are required to report certain adverse reactions and production problems, if any, to the FDA, and to comply with certain requirements concerning advertising and promotion for our products. In addition, quality control and manufacturing procedures must continue to conform to cGMP after approval, and the FDA periodically inspects manufacturing facilities to assess compliance with cGMP. Accordingly, manufacturers must continue to expend time, money and effort in all areas of regulatory compliance, including production and quality control to comply with cGMP. In addition, discovery of problems, such as safety problems, may result in changes in labeling or restrictions on a product manufacturer or NDA holder, including removal of the product from the market.

Corporate Information

Unless otherwise noted, (1) the term “Arrowhead” refers to Arrowhead Research Corporation, a Delaware corporation, (2) the terms the “Company,” “we,” “us,” and “our,” refer to the ongoing business operations of Arrowhead and its Subsidiaries, whether conducted through Arrowhead or a subsidiary of Arrowhead, (3) the term “Subsidiaries” refers collectively to Arrowhead Madison Inc. (“Madison”), Calando Pharmaceuticals, Inc. (“Calando”), Ablaris Therapeutics, Inc. (“Ablaris”), and Tego Biosciences Corporation (“Tego”), as well as our former subsidiary, Unidym, Inc. (“Unidym”), which was divested in January 2011, and Alvos Therapeutics, Inc. (“Alvos”) and Agonn Systems, Inc. (“Agonn”),which were merged into Arrowhead during 2013. (4) the term “Minority Investments” refers collectively to Nanotope, Inc. (“Nanotope”), which was dissolved during 2013, and Leonardo Biosystems, Inc. (“Leonardo”) in which the company holds a less than majority ownership position, (5) the term “Common Stock” refers to Arrowhead’s Common Stock, (6) the term “Preferred Stock” refers to Arrowhead’s Preferred Stock and the term “Stockholder(s)” refers to the holders of Arrowhead Common Stock. All Arrowhead share and per share data have been adjusted to reflect a one for ten reverse stock split effected on November 17, 2011.

Arrowhead was originally incorporated in South Dakota in 1989, and was reincorporated in Delaware in 2000. The Company’s principal executive offices are located at 225 South Lake Avenue, Suite 1050, Pasadena, California 91101, and its telephone number is (626) 304-3400. We operate a 24,000 square foot research and development facility in Madison, Wisconsin. As of September 30, 2013, Arrowhead had 54 full-time employees.

21

Other Business Interests

Leonardo Biosystems, Inc.

Leonardo is a drug delivery company that employs a novel multi-stage drug delivery mechanism aimed at dramatically increasing targeting efficiency of pharmaceuticals. Arrowhead has an approximately 3% ownership interest in Leonardo. Leonardo’s silicon micro-particulate technology involves transporting a therapeutic agent past multiple biological barriers using multiple carriers, each optimized for a specific barrier. Leonardo’s proprietary primary vehicles are designed to preferentially accumulate at tumor vasculature. Secondary carriers are then released from the primary carriers that are designed to accumulate around tumor cells and release their therapeutic payloads. Pre-clinical testing in animal disease models suggests that Leonardo’s platform enables significantly increased targeting of tumors and also provides sustained release of cancer therapies. Further development of Leonardo’s technology is dependent on cash resources available to Leonardo.

Unidym, Inc.

In January 2011, Arrowhead sold Unidym, Inc. to Wisepower Co., Ltd., a publicly traded, Seoul, Korea-based electronics company (KOSDAQ: 040670). Unidym was a majority-owned subsidiary that developed nanotechnology-enabled materials to be used in the manufacturing of certain electronics components. Upfront consideration consisted of stock and convertible bonds originally valued at $5,000,000. Additional cash earn-out payments of up to $140 million are possible based on cumulative sales and licensing milestones, and up to 40% of licensing revenue.

22

You should carefully consider the risks discussed below and all of the other information contained in this report in evaluating us and an investment in our securities. If any of the following risks and uncertainties should occur, they could have a material adverse effect on our business, financial condition or results of operations. In that case, the trading price of our Common Stock could decline. Additionally, we note that we are a development stage company and we have accrued net losses annually since inception. We urge you to consider our likelihood of success and prospects in light of the risks, expenses and difficulties frequently encountered by entities at similar stages of development.

Risks Related to Our Company

Drug development is time consuming, expensive and risky.

We are focused on technology related to new and improved pharmaceutical candidates. Product candidates that appear promising in the early phases of development, such as in animal and early human clinical trials, often fail to reach the market for a number of reasons, such as:

|

— |

Clinical trial results may be unacceptable, even though preclinical trial results were promising; |

|

— |

Inefficacy and/or harmful side effects in humans or animals; |

|

— |

The necessary regulatory bodies, such as the U.S. Food and Drug Administration, may not approve our potential product for the intended use; and |

|

— |

Manufacturing and distribution may be uneconomical. |

For example, the positive pre-clinical results for ARC-520 in animals may not be replicated in human clinical studies or it may be found to be unsafe in humans. Additionally, clinical trial results are frequently susceptible to varying interpretations by scientists, medical personnel, regulatory personnel, statisticians and others, which often delays, limits, or prevents further clinical development or regulatory approvals of potential products. Clinical trials can take many years to complete, including the process of study design, clinical site selection and the enrollment of patients. As a result, we can experience significant delays in completing clinical studies, which can increase the cost of developing a drug candidate. If our drug candidates are not successful in human clinical trials, we may be forced to curtail or abandon certain development programs. If we experience significant delays in commencing or completing our clinical studies, we could suffer from significant cost overruns, which could negatively affect our capital resources and our ability to complete these studies.

There are substantial risks inherent in attempting to commercialize new drugs, and, as a result, we may not be able to successfully develop products for commercial use.