UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-06414

Name of Fund: BlackRock MuniYield Fund, Inc. (MYD)

Fund Address: 100 Bellevue Parkway, Wilmington, DE 19809

Name and address of agent for service: John M. Perlowski, Chief Executive Officer, BlackRock MuniYield Fund,

Inc., 55 East 52nd Street, New York, NY 10055

Registrant’s telephone number, including area code: (800) 882-0052, Option 4

Date of fiscal year end: 04/30/2021

Date of reporting period: 10/31/2020

Item 1 – Report to Stockholders

|

OCTOBER 31, 2020 |

| 2020 Semi-Annual Report (Unaudited) | ||

BlackRock MuniYield Fund, Inc. (MYD)

BlackRock MuniYield Quality Fund, Inc. (MQY)

BlackRock MuniYield Quality Fund II, Inc. (MQT)

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of each Fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from BlackRock or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

You may elect to receive all future reports in paper free of charge. If you hold accounts directly with BlackRock, you can call Computershare at (800) 699-1236 to request that you continue receiving paper copies of your shareholder reports. If you hold accounts through a financial intermediary, you can follow the instructions included with this disclosure, if applicable, or contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. Please note that not all financial intermediaries may offer this service. Your election to receive reports in paper will apply to all funds advised by BlackRock Advisors, LLC or its affiliates, or all funds held with your financial intermediary, as applicable.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive electronic delivery of shareholder reports and other communications by contacting your financial intermediary, if you hold accounts through a financial intermediary. Please note that not all financial intermediaries may offer this service.

| Not FDIC Insured • May Lose Value • No Bank Guarantee |

| 2 | THIS PAGE IS NOT PART OF YOUR FUND REPORT |

| Page | ||||

| 2 | ||||

| Semi-Annual Report: |

||||

| 4 | ||||

| 5 | ||||

| 6 | ||||

| Financial Statements: |

||||

| 15 | ||||

| 39 | ||||

| 40 | ||||

| 41 | ||||

| 43 | ||||

| 44 | ||||

| 47 | ||||

| 56 | ||||

| 60 | ||||

| 63 | ||||

| 3 |

Municipal Market Overview For the Reporting Period Ended October 31, 2020

Municipal Market Conditions

Municipal bonds posted positive total returns during the period amid increased volatility. Initial strong performance was driven by a favorable technical backdrop. However, as a result of the COVID-19 pandemic induced economic shutdown, the municipal market experienced volatility that was worse than during the height of the global financial crisis. Performance plummeted -10.87% during a two-week period in March, before rebounding on valuation-based buying. (For comparison, the -11.86% correction in 2008 spanned more than a month.) Strong performance returned alongside initial fiscal stimulus and the re-opening of the economy but later stalled amid U.S. election uncertainty and lack of additional federal aid.

| Similarly, strong technical support during most of the period temporarily waned as COVID-19 fears spurred risk-off sentiment and a streak of 60-consecutive weeks of inflows turned to record outflows. During the 12 months ended October 31, 2020, municipal bond funds experienced net inflows totaling $43 billion, drawn down by nearly $46 billion in outflows during the months of March and April (based on data from the Investment Company Institute). For the same 12-month period, new issuance was robust at $485 billion but slowed during the height of pandemic as market liquidity | S&P Municipal Bond Index | |

| Total Returns as of October 31, 2020 | ||

| 6 months: 4.87% | ||

| 12 months: 3.55% | ||

became constrained amid the flight to quality. Taxable municipal issuance was elevated as issuers increasingly advance refunded tax-exempt debt in the taxable municipal market for cost savings.

A Closer Look at Yields

|

|

From October 31, 2019 to October 31, 2020, yields on AAA-rated 30-year municipal bonds decreased by 35 basis points (“bps”) from 2.06% to 1.71%, while ten-year rates decreased by 56 bps from 1.49% to 0.93% and five-year rates decreased by 85 bps from 1.15% to 0.30% (as measured by Thomson Municipal Market Data). As a result, the municipal yield curve bull steepened over the 12-month period with the spread between two- and 30-year maturities steepening by 55 bps, lagging the 83 bps of steepening experienced in the U.S. Treasury curve. |

| During the same period, tax-exempt municipal bonds significantly underperformed U.S. Treasuries across the yield curve. As a result, relative valuations reset to more attractive levels and spurred increased participation from crossover investors. |

Financial Conditions of Municipal Issuers

The COVID-19 pandemic is an unprecedented shock to the system impacting nearly every sector in the municipal market. Fortunately, most states and municipalities were in excellent fiscal health before the crisis and the federal government provided an incredible amount of initial support. BlackRock expects ongoing stability in high-quality states as well as school districts and local governments given that property taxes have proven resilient. Essential public services such as power, water, and sewer remain protected segments. State housing authority bonds, flagship universities, and strong national and regional health systems have absorbed the impact of the economic shock. However, some segments are facing daunting financial challenges. Absent additional stimulus, issuers will make difficult choices such as drawing down reserves, raising user fees/taxes, slashing expenditures, and/or borrowing to meet financial obligations. Critical providers (safety net hospitals, mass transit systems, airports) with limited resources will require funding from the states and broader municipalities they serve. BlackRock anticipates that a small subset of the market, mainly non-rated stand-alone projects, will experience significant credit deterioration. Recent news of a potentially effective vaccine suggests that the onset of meaningful credit recovery from the COVID-19 pandemic could be months to a year away. However, the current coronavirus resurgence and its negative effects on economic activity could bring a number of defaults, primarily in non-rated credits, and the migration of the municipal market’s overall credit quality from AA- to a still-strong A+ rating. As a result, BlackRock advocates careful credit selection and anticipates increased credit dispersion as the market navigates near-term uncertainty.

The opinions expressed are those of BlackRock as of October 31, 2020 and are subject to change at any time due to changes in market or economic conditions. The comments should not be construed as a recommendation of any individual holdings or market sectors. Investing involves risk including loss of principal. Bond values fluctuate in price so the value of your investment can go down depending on market conditions. Fixed income risks include interest-rate and credit risk. Typically, when interest rates rise, there is a corresponding decline in bond values. Credit risk refers to the possibility that the bond issuer will not be able to make principal and interest payments. There may be less information on the financial condition of municipal issuers than for public corporations. The market for municipal bonds may be less liquid than for taxable bonds. Some investors may be subject to Alternative Minimum Tax (“AMT”). Capital gains distributions, if any, are taxable.

The S&P Municipal Bond Index, a broad, market value-weighted index, seeks to measure the performance of the U.S. municipal bond market. All bonds in the index are exempt from U.S. federal income taxes or subject to the AMT. Past performance is not an indication of future results. Index performance is shown for illustrative purposes only. It is not possible to invest directly in an index.

| 4 | 2020 BLACKROCK SEMI-ANNUAL REPORT TO SHAREHOLDERS |

The Benefits and Risks of Leveraging

The Funds may utilize leverage to seek to enhance the distribution rate on, and net asset value (“NAV”) of, their common shares (“Common Shares”). However, there is no guarantee that these objectives can be achieved in all interest rate environments.

In general, the concept of leveraging is based on the premise that the financing cost of leverage, which is based on short-term interest rates, is normally lower than the income earned by a Fund on its longer-term portfolio investments purchased with the proceeds from leverage. To the extent that the total assets of each Fund (including the assets obtained from leverage) are invested in higher-yielding portfolio investments, each Fund’s shareholders benefit from the incremental net income. The interest earned on securities purchased with the proceeds from leverage (after paying the leverage costs) is paid to shareholders in the form of dividends, and the value of these portfolio holdings (less the leverage liability) is reflected in the per share NAV.

To illustrate these concepts, assume a Fund’s Common Shares capitalization is $100 million and it utilizes leverage for an additional $30 million, creating a total value of $130 million available for investment in longer-term income securities. If prevailing short-term interest rates are 3% and longer-term interest rates are 6%, the yield curve has a strongly positive slope. In this case, a Fund’s financing costs on the $30 million of proceeds obtained from leverage are based on the lower short-term interest rates. At the same time, the securities purchased by a Fund with the proceeds from leverage earn income based on longer-term interest rates. In this case, a Fund’s financing cost of leverage is significantly lower than the income earned on a Fund’s longer-term investments acquired from such leverage proceeds, and therefore the holders of Common Shares (“Common Shareholders”) are the beneficiaries of the incremental net income.

However, in order to benefit Common Shareholders, the return on assets purchased with leverage proceeds must exceed the ongoing costs associated with the leverage. If interest and other costs of leverage exceed each Fund’s return on assets purchased with leverage proceeds, income to shareholders is lower than if the Fund had not used leverage. Furthermore, the value of each Fund’s portfolio investments generally varies inversely with the direction of long-term interest rates, although other factors can influence the value of portfolio investments. In contrast, the value of a Fund’s obligations under its respective leverage arrangement generally does not fluctuate in relation to interest rates. As a result, changes in interest rates can influence each Fund’s NAV positively or negatively. Changes in the future direction of interest rates are very difficult to predict accurately, and there is no assurance that each Fund’s intended leveraging strategy will be successful.

The use of leverage also generally causes greater changes in each Fund’s NAV, market price and dividend rates than comparable portfolios without leverage. In a declining market, leverage is likely to cause a greater decline in the NAV and market price of a Fund’s Common Shares than if the Fund were not leveraged. In addition, each Fund may be required to sell portfolio securities at inopportune times or at distressed values in order to comply with regulatory requirements applicable to the use of leverage or as required by the terms of leverage instruments, which may cause the Fund to incur losses. The use of leverage may limit a Fund’s ability to invest in certain types of securities or use certain types of hedging strategies. Each Fund incurs expenses in connection with the use of leverage, all of which are borne by Common Shareholders and may reduce income to the Common Shares. Moreover, to the extent the calculation of each Fund’s investment advisory fees includes assets purchased with the proceeds of leverage, the investment advisory fees payable to each Fund’s investment adviser will be higher than if the Funds did not use leverage.

To obtain leverage, each Fund has issued Variable Rate Demand Preferred Shares (“VRDP Shares”) or Variable Rate Muni Term Preferred Shares (“VMTP Shares”) (collectively, “Preferred Shares”) and/or leveraged its assets through the use of tender option bond trusts (“TOB Trusts”) as described in the Notes to Financial Statements.

Under the Investment Company Act of 1940, as amended (the “1940 Act”), each Fund is permitted to issue debt up to 33 1/3% of its total managed assets or equity securities (e.g., Preferred Shares) up to 50% of its total managed assets. A Fund may voluntarily elect to limit its leverage to less than the maximum amount permitted under the 1940 Act. In addition, a Fund may also be subject to certain asset coverage, leverage or portfolio composition requirements imposed by the Preferred Shares’ governing instruments or by agencies rating the Preferred Shares, which may be more stringent than those imposed by the 1940 Act.

If a Fund segregates or designates on its books and records cash or liquid assets having a value not less than the value of a Fund’s obligations under the TOB Trust (including accrued interest), then the TOB Trust is not considered a senior security and is not subject to the foregoing limitations and requirements imposed by the 1940 Act.

| THE BENEFITS AND RISKS OF LEVERAGING |

5 |

| Fund Summary as of October 31, 2020 | BlackRock MuniYield Fund, Inc. (MYD) |

Investment Objective

BlackRock MuniYield Fund, Inc.’s (MYD) (the “Fund”) investment objective is to provide shareholders with as high a level of current income exempt from U.S. federal income taxes as is consistent with its investment policies and prudent investment management. The Fund seeks to achieve its investment objective by investing at least 80% of its assets in municipal bonds exempt from U.S. federal income taxes (except that the interest may be subject to the U.S. federal alternative minimum tax). The Fund invests, under normal market conditions, at least 75% of its assets in municipal bonds rated investment grade, or deemed to be of comparable quality by the investment adviser, at the time of investment and invests primarily in long-term municipal bonds with a maturity of more than ten years at the time of investment. The Fund may invest directly in such securities or synthetically through the use of derivatives.

No assurance can be given that the Fund’s investment objective will be achieved.

Fund Information

| Symbol on New York Stock Exchange |

MYD | |

| Initial Offering Date |

November 29, 1991 | |

| Yield on Closing Market Price as of October 31, 2020 ($13.24)(a) |

5.08% | |

| Tax Equivalent Yield(b) |

8.58% | |

| Current Monthly Distribution per Common Share(c) |

$0.0560 | |

| Current Annualized Distribution per Common Share(c) |

$0.6720 | |

| Leverage as of October 31, 2020(d) |

37% |

| (a) | Yield on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. Past performance is not an indication of future results. |

| (b) | Tax equivalent yield assumes the maximum marginal U.S. federal tax rate of 40.8%, which includes the 3.8% Medicare tax. Actual tax rates will vary based on income, exemptions and deductions. Lower taxes will result in lower tax equivalent yields. |

| (c) | The distribution rate is not constant and is subject to change. |

| (d) | Represents VRDP Shares and TOB Trusts as a percentage of total managed assets, which is the total assets of the Fund, including any assets attributable to VRDP Shares and TOB Trusts, minus the sum of its accrued liabilities. Does not reflect derivatives or other instruments that may give rise to economic leverage. For a discussion of leveraging techniques utilized by the Fund, please see The Benefits and Risks of Leveraging. |

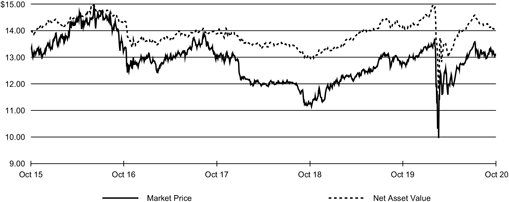

Market Price and Net Asset Value Per Share Summary

| 10/31/20 | 04/30/20 | Change | High | Low | ||||||||||||||||

| Market Price |

$ | 13.24 | $ | 12.29 | 7.73 | % | $ | 14.47 | $ | 12.21 | ||||||||||

| Net Asset Value |

14.52 | 13.38 | 8.52 | 15.11 | 13.38 | |||||||||||||||

Market Price and Net Asset Value History for the Past Five Years

| 6 | 2020 BLACKROCK SEMI-ANNUAL REPORT TO SHAREHOLDERS |

| Fund Summary as of October 31, 2020 (continued) | BlackRock MuniYield Fund, Inc. (MYD) |

Performance

Returns for the six months ended October 31, 2020 were as follows:

| Returns Based On | ||||||||

| Market Price | NAV | |||||||

| MYD(a)(b) |

10.40 | % | 11.20 | % | ||||

| Lipper General & Insured Municipal Debt Funds (Leveraged)(c) |

11.22 | 10.27 | ||||||

| (a) | All returns reflect reinvestment of dividends and/or distributions at actual reinvestment prices. Performance results reflect the Fund’s use of leverage. |

| (b) | The Fund’s discount to NAV widened during the period, which accounts for the difference between performance based on market price and performance based on NAV. |

| (c) | Average return. Returns reflect reinvestment of dividends and/or distributions at NAV on the ex-dividend date as calculated by Lipper. |

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles. Past performance is not an indication of future results.

More information about the Fund’s historical performance can be found in the “Closed End Funds” section of blackrock.com.

The following discussion relates to the Fund’s absolute performance based on NAV:

Municipal bonds delivered strong returns in the past six months. When the period began, municipal bonds were just beginning to recover from the broad-based sell-off caused by COVID-19 and governments’ efforts to mitigate the virus. The rally continued through the spring and summer, thanks to positive supply-and-demand trends, an improving economic outlook, and the Fed’s stated intent to maintain its near-zero interest rate policy indefinitely. Municipal bonds lost momentum late in the period due to elevated new-issue supply ahead of the election, as well as uncertainty surrounding the next phase of fiscal stimulus. Still, the broader market finished with a robust, double-digit return on the strength of its earlier gains.

The Fund’s positions in long-dated investment-grade bonds made the largest contribution to performance. At the sector level, positions in tax-backed, health care and transportation issues were key contributors. The Fund’s use of leverage also helped results by enhancing income and augmenting the effect of rising prices.

The Fund’s yield curve positioning detracted from performance, as did its positions in securities subject to early redemption by their issuers.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| FUND SUMMARY |

7 |

| Fund Summary as of October 31, 2020 (continued) | BlackRock MuniYield Fund, Inc. (MYD) |

Overview of the Fund’s Total Investments

| 8 | 2020 BLACKROCK SEMI-ANNUAL REPORT TO SHAREHOLDERS |

| Fund Summary as of October 31, 2020 | BlackRock MuniYield Quality Fund, Inc. (MQY) |

Investment Objective

BlackRock MuniYield Quality Fund, Inc.’s (MQY) (the “Fund”) investment objective is to provide shareholders with as high a level of current income exempt from U.S. federal income taxes as is consistent with its investment policies and prudent investment management. The Fund seeks to achieve its investment objective by investing at least 80% of its assets in municipal bonds exempt from U.S federal income taxes (except that the interest may be subject to the U.S. federal alternative minimum tax). The Fund invests in municipal bonds which are in the three highest quality rating categories (A or better), or which are deemed to be of comparable quality by the adviser, at the time of investment. The Fund invests primarily in long-term municipal bonds with maturities of more than ten years at the time of investment. The Fund may invest directly in such securities or synthetically through the use of derivatives.

On June 16, 2020, the Board of Directors or the Board of Trustees, as applicable, of BlackRock Maryland Municipal Bond Trust (BZM), BlackRock Massachusetts Tax-Exempt Trust (MHE), BlackRock MuniYield Arizona Fund, Inc. (MZA), BlackRock MuniYield Investment Fund (MYF), BlackRock MuniEnhanced Fund, Inc. (MEN) and the Board of Directors of MQY each approved the reorganizations of BZM, MHE, MZA, MYF and MEN into MQY. Subject to approvals by each Fund’s shareholders and the satisfaction of customary closing conditions, the reorganizations are expected to occur during the first quarter of 2021.

No assurance can be given that the Fund’s investment objective will be achieved.

Fund Information

| Symbol on New York Stock Exchange |

MQY | |

| Initial Offering Date |

June 26, 1992 | |

| Yield on Closing Market Price as of October 31, 2020 ($15.73)(a) |

4.81% | |

| Tax Equivalent Yield(b) |

8.13% | |

| Current Monthly Distribution per Common Share(c) |

$0.0630 | |

| Current Annualized Distribution per Common Share(c) |

$0.7560 | |

| Leverage as of October 31, 2020(d) |

38% |

| (a) | Yield on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. Past performance is not an indication of future results. |

| (b) | Tax equivalent yield assumes the maximum marginal U.S. federal tax rate of 40.8%, which includes the 3.8% Medicare tax. Actual tax rates will vary based on income, exemptions and deductions. Lower taxes will result in lower tax equivalent yields. |

| (c) | The distribution rate is not constant and is subject to change. |

| (d) | Represents VRDP Shares and TOB Trusts as a percentage of total managed assets, which is the total assets of the Fund, including any assets attributable to VRDP Shares and TOB Trusts, minus the sum of its accrued liabilities. Does not reflect derivatives or other instruments that may give rise to economic leverage. For a discussion of leveraging techniques utilized by the Fund, please see The Benefits and Risks of Leveraging. |

Market Price and Net Asset Value Per Share Summary

| 10/31/20 | 04/30/20 | Change | High | Low | ||||||||||||||||

| Market Price |

$ | 15.73 | $ | 13.88 | 13.33 | % | $ | 17.64 | $ | 13.85 | ||||||||||

| Net Asset Value |

16.04 | 14.79 | 8.45 | 16.65 | 14.79 | |||||||||||||||

Market Price and Net Asset Value History for the Past Five Years

| FUND SUMMARY |

9 |

| Fund Summary as of October 31, 2020 (continued) | BlackRock MuniYield Quality Fund, Inc. (MQY) |

Performance

Returns for the six months ended October 31, 2020 were as follows:

| Returns Based On | ||||||||

| Market Price | NAV | |||||||

| MQY(a)(b) |

15.90 | % | 10.91 | % | ||||

| Lipper General & Insured Municipal Debt Funds (Leveraged)(c) |

11.22 | 10.27 | ||||||

| (a) | All returns reflect reinvestment of dividends and/or distributions at actual reinvestment prices. Performance results reflect the Fund’s use of leverage. |

| (b) | The Fund’s discount to NAV narrowed during the period, which accounts for the difference between performance based on market price and performance based on NAV. |

| (c) | Average return. Returns reflect reinvestment of dividends and/or distributions at NAV on the ex-dividend date as calculated by Lipper. |

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles. Past performance is not an indication of future results.

More information about the Fund’s historical performance can be found in the “Closed End Funds” section of blackrock.com.

The following discussion relates to the Fund’s absolute performance based on NAV:

Municipal bonds delivered strong returns in the past six months. When the period began, municipal bonds were just beginning to recover from the broad-based sell-off caused by COVID-19 and governments’ efforts to mitigate the virus. The rally continued through the spring and summer, thanks to positive supply-and-demand trends, an improving economic outlook, and the Fed’s stated intent to maintain its near-zero interest rate policy indefinitely. Municipal bonds lost momentum late in the period due to elevated new-issue supply ahead of the election, as well as uncertainty surrounding the next phase of fiscal stimulus. Still, the broader market finished with a robust, double-digit return on the strength of its earlier gains.

The Fund’s strong return reflects the combination of income, falling yields, and a compression in yield spreads. (Prices and yields move in opposite directions; falling yield spreads indicate outperformance relative to U.S. Treasuries.) The sectors that benefited the most were generally those that experienced the largest downturns in the sell-off that occurred in the first quarter of 2020, including health care, transportation and corporate-backed securities. This trend also contributed to outperformance for lower-rated debt. The Fund’s holdings in high-yield bonds, including tobacco and Puerto Rico issues, were significant beneficiaries. The Fund’s use of leverage also aided results by augmenting income and amplifying the effect of rising prices.

Conversely, the Fund’s positions in shorter-dated issues—including pre-refunded securities—underperformed. Holdings in higher-quality bonds, while posting positive absolute returns, also lagged somewhat in the rally.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| 10 | 2020 BLACKROCK SEMI-ANNUAL REPORT TO SHAREHOLDERS |

| Fund Summary as of October 31, 2020 (continued) | BlackRock MuniYield Quality Fund, Inc. (MQY) |

Overview of the Fund’s Total Investments

| FUND SUMMARY |

11 |

| Fund Summary as of October 31, 2020 | BlackRock MuniYield Quality Fund II, Inc. (MQT) |

Investment Objective

BlackRock MuniYield Quality Fund II, Inc.’s (MQT) (the “Fund”) investment objective is to provide shareholders with as high a level of current income exempt from U.S federal income taxes as is consistent with its investment policies and prudent investment management. The Fund seeks to achieve its investment objective by investing at least 80% of its assets in municipal bonds exempt from U.S. federal income taxes (except that the interest may be subject to the U.S federal alternative minimum tax). The Fund invests in municipal bonds which are in the three highest quality rating categories (A or better), or are deemed to be of comparable quality by the investment adviser at the time of investment. The Fund invests primarily in long-term municipal bonds with maturities of more than ten years at the time of investment. The Fund may invest directly in such securities or synthetically through the use of derivatives.

No assurance can be given that the Fund’s investment objective will be achieved.

Fund Information

| Symbol on New York Stock Exchange |

MQT | |

| Initial Offering Date |

August 28, 1992 | |

| Yield on Closing Market Price as of October 31, 2020 ($13.04)(a) |

4.97% | |

| Tax Equivalent Yield(b) |

8.40% | |

| Current Monthly Distribution per Common Share(c) |

$0.0540 | |

| Current Annualized Distribution per Common Share(c) |

$0.6480 | |

| Leverage as of October 31, 2020(d) |

39% |

| (a) | Yield on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. Past performance is not an indication of future results. |

| (b) | Tax equivalent yield assumes the maximum marginal U.S. federal tax rate of 40.8%, which includes the 3.8% Medicare tax. Actual tax rates will vary based on income, exemptions and deductions. Lower taxes will result in lower tax equivalent yields. |

| (c) | The distribution rate is not constant and is subject to change. |

| (d) | Represents VMTP Shares and TOB Trusts as a percentage of total managed assets, which is the total assets of the Fund, including any assets attributable to VMTP Shares and TOB Trusts, minus the sum of its accrued liabilities. Does not reflect derivatives or other instruments that may give rise to economic leverage. For a discussion of leveraging techniques utilized by the Fund, please see The Benefits and Risks of Leveraging. |

Market Price and Net Asset Value Per Share Summary

| 10/31/20 | 04/30/20 | Change | High | Low | ||||||||||||||||

| Market Price |

$ | 13.04 | $ | 11.99 | 8.76 | % | $ | 13.58 | $ | 11.85 | ||||||||||

| Net Asset Value |

14.10 | 13.02 | 8.29 | 14.58 | 13.02 | |||||||||||||||

Market Price and Net Asset Value History for the Past Five Years

| 12 | 2020 BLACKROCK SEMI-ANNUAL REPORT TO SHAREHOLDERS |

| Fund Summary as of October 31, 2020 (continued) | BlackRock MuniYield Quality Fund II, Inc. (MQT) |

Performance

Returns for the six months ended October 31, 2020 were as follows:

| Returns Based On | ||||||||

| Market Price | NAV | |||||||

| MQT(a)(b) |

11.25 | % | 10.78 | % | ||||

| Lipper General & Insured Municipal Debt Funds (Leveraged)(c) |

11.22 | 10.27 | ||||||

| (a) | All returns reflect reinvestment of dividends and/or distributions at actual reinvestment prices. Performance results reflect the Fund’s use of leverage. |

| (b) | The Fund’s discount to NAV narrowed during the period, which accounts for the difference between performance based on market price and performance based on NAV. |

| (c) | Average return. Returns reflect reinvestment of dividends and/or distributions at NAV on the ex-dividend date as calculated by Lipper. |

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles. Past performance is not an indication of future results.

More information about the Fund’s historical performance can be found in the “Closed End Funds” section of blackrock.com.

The following discussion relates to the Fund’s absolute performance based on NAV:

Municipal bonds delivered strong returns in the past six months. When the period began, municipal bonds were just beginning to recover from the broad-based sell-off caused by COVID-19 and governments’ efforts to mitigate the virus. The rally continued through the spring and summer, thanks to positive supply-and-demand trends, an improving economic outlook, and the Fed’s stated intent to maintain its near-zero interest rate policy indefinitely. Municipal bonds lost momentum late in the period due to elevated new-issue supply ahead of the election, as well as uncertainty surrounding the next phase of fiscal stimulus. Still, the broader market finished with a robust, double-digit return on the strength of its earlier gains.

The Fund’s strong return reflects the combination of income, falling yields, and a compression in yield spreads. (Prices and yields move in opposite directions; falling yield spreads indicate outperformance relative to U.S. Treasuries.) The sectors that benefited the most were generally those that experienced the largest downturns in the sell-off that occurred in the first quarter of 2020, including health care, transportation and corporate-backed securities. This trend also contributed to outperformance for lower-rated debt. The Fund’s holdings in high-yield bonds, including tobacco and Puerto Rico issues, were significant beneficiaries. The Fund’s use of leverage also aided results by augmenting income and amplifying the effect of rising prices.

Conversely, the Fund’s positions in shorter-dated issues—including pre-refunded securities—underperformed. Holdings in higher-quality bonds, while posting positive absolute returns, also lagged somewhat in the rally.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| FUND SUMMARY |

13 |

| Fund Summary as of October 31, 2020 (continued) | BlackRock MuniYield Quality Fund II, Inc. (MQT) |

Overview of the Fund’s Total Investments

| 14 | 2020 BLACKROCK SEMI-ANNUAL REPORT TO SHAREHOLDERS |

| Schedule of Investments (unaudited) October 31, 2020 |

BlackRock MuniYield Fund, Inc. (MYD) (Percentages shown are based on Net Assets) |

| SCHEDULE OF INVESTMENTS |

15 |

| Schedule of Investments (unaudited) (continued) October 31, 2020 |

BlackRock MuniYield Fund, Inc. (MYD) (Percentages shown are based on Net Assets) |

| 16 | 2020 BLACKROCK SEMI-ANNUAL REPORT TO SHAREHOLDERS |

| Schedule of Investments (unaudited) (continued) October 31, 2020 |

BlackRock MuniYield Fund, Inc. (MYD) (Percentages shown are based on Net Assets) |

| SCHEDULE OF INVESTMENTS |

17 |

| Schedule of Investments (unaudited) (continued) October 31, 2020 |

BlackRock MuniYield Fund, Inc. (MYD) (Percentages shown are based on Net Assets) |

| 18 | 2020 BLACKROCK SEMI-ANNUAL REPORT TO SHAREHOLDERS |

| Schedule of Investments (unaudited) (continued) October 31, 2020 |

BlackRock MuniYield Fund, Inc. (MYD) (Percentages shown are based on Net Assets) |

| SCHEDULE OF INVESTMENTS |

19 |

| Schedule of Investments (unaudited) (continued) October 31, 2020 |

BlackRock MuniYield Fund, Inc. (MYD) (Percentages shown are based on Net Assets) |

| 20 | 2020 BLACKROCK SEMI-ANNUAL REPORT TO SHAREHOLDERS |

| Schedule of Investments (unaudited) (continued) October 31, 2020 |

BlackRock MuniYield Fund, Inc. (MYD) |

Affiliates

Investments in issuers considered to be affiliate(s) of the Fund during the six-months ended October 31, 2020 for purposes of Section 2(a)(3) of the 1940 Act, as amended, were as follows:

| Affiliated Issuer | Value at 04/30/20 |

Purchases at Cost |

Proceeds from Sales |

Net Realized Gain (Loss) |

Change in Unrealized Appreciation (Depreciation) |

Value at 10/31/20 |

Shares Held at 10/31/20 |

Income | Capital Gain Distributions from Underlying Funds |

|||||||||||||||||||||||||||

| BlackRock Liquidity Funds, MuniCash, Institutional Class |

$ | 20,527,420 | $ | — | $ | (19,724,177 | )(a) | $ | 8,724 | $ | (7,163 | ) | $ | 804,804 | 804,724 | $ | 1,020 | $ | — | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| (a) | Represents net amount purchased (sold). |

Fair Value Hierarchy as of Period End

Various inputs are used in determining the fair value of financial instruments. For description of the input levels and information about the Fund’s policy regarding valuation of financial instruments, refer to the Notes to Financial Statements.

The following table summarizes the Fund’s investments categorized in the disclosure hierarchy. The breakdown of the Fund’s investments into major categories is disclosed in the Schedule of Investments above.

| Level 1 | Level 2 | Level 3 | Total | |||||||||||||

| Assets |

| |||||||||||||||

| Investments |

| |||||||||||||||

| Long-Term Investments |

||||||||||||||||

| Municipal Bonds |

$ | — | $ | 828,967,516 | $ | — | $ | 828,967,516 | ||||||||

| Municipal Bonds Transferred to Tender Option Bond Trusts |

— | 245,331,701 | — | 245,331,701 | ||||||||||||

| Short-Term Securities |

||||||||||||||||

| Money Market Funds |

804,804 | — | — | 804,804 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| $ | 804,804 | $ | 1,074,299,217 | $ | — | $ | 1,075,104,021 | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

The Fund may hold assets and/or liabilities in which the fair value approximates the carrying amount for financial statement purposes. As of period end, such assets and/or liabilities are categorized within the disclosure hierarchy as follows:

| Level 1 | Level 2 | Level 3 | Total | |||||||||||||

| Liabilities |

| |||||||||||||||

| TOB Trust Certificates |

$ | — | $ | (146,335,743 | ) | $ | — | $ | (146,335,743 | ) | ||||||

| VRDP Shares at Liquidation Value |

— | (251,400,000 | ) | — | (251,400,000 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| $ | — | $ | (397,735,743 | ) | $ | — | $ | (397,735,743 | ) | |||||||

|

|

|

|

|

|

|

|

|

|||||||||

See notes to financial statements.

| SCHEDULE OF INVESTMENTS |

21 |

| Schedule of Investments (unaudited) October 31, 2020 |

BlackRock MuniYield Quality Fund, Inc. (MQY) (Percentages shown are based on Net Assets) |

| 22 | 2020 BLACKROCK SEMI-ANNUAL REPORT TO SHAREHOLDERS |

| Schedule of Investments (unaudited) (continued) October 31, 2020 |

BlackRock MuniYield Quality Fund, Inc. (MQY) (Percentages shown are based on Net Assets) |

| SCHEDULE OF INVESTMENTS |

23 |

| Schedule of Investments (unaudited) (continued) October 31, 2020 |

BlackRock MuniYield Quality Fund, Inc. (MQY) (Percentages shown are based on Net Assets) |

| 24 | 2020 BLACKROCK SEMI-ANNUAL REPORT TO SHAREHOLDERS |

| Schedule of Investments (unaudited) (continued) October 31, 2020 |

BlackRock MuniYield Quality Fund, Inc. (MQY) (Percentages shown are based on Net Assets) |

| SCHEDULE OF INVESTMENTS |

25 |

| Schedule of Investments (unaudited) (continued) October 31, 2020 |

BlackRock MuniYield Quality Fund, Inc. (MQY) (Percentages shown are based on Net Assets) |

| 26 | 2020 BLACKROCK SEMI-ANNUAL REPORT TO SHAREHOLDERS |

| Schedule of Investments (unaudited) (continued) October 31, 2020 |

BlackRock MuniYield Quality Fund, Inc. (MQY) (Percentages shown are based on Net Assets) |

| SCHEDULE OF INVESTMENTS |

27 |

| Schedule of Investments (unaudited) (continued) October 31, 2020 |

BlackRock MuniYield Quality Fund, Inc. (MQY) (Percentages shown are based on Net Assets) |

| 28 | 2020 BLACKROCK SEMI-ANNUAL REPORT TO SHAREHOLDERS |

| Schedule of Investments (unaudited) (continued) October 31, 2020 |

BlackRock MuniYield Quality Fund, Inc. (MQY) (Percentages shown are based on Net Assets) |

Affiliates

Investments in issuers considered to be affiliate(s) of the Fund during the six-months ended October 31, 2020 for purposes of Section 2(a)(3) of the 1940 Act, as amended, were as follows:

| Affiliated Issuer | Value at 04/30/20 |

Purchases at Cost |

Proceeds from Sales |

Net Realized Gain (Loss) |

Change in Unrealized Appreciation (Depreciation) |

Value at 10/31/20 |

Shares Held at 10/31/20 |

Income | Capital Gain Distributions from Underlying Funds |

|||||||||||||||||||||||||||

| BlackRock Liquidity Funds, MuniCash, Institutional Class |

$ | 649,910 | $ | 541,963 | (a) | $ | — | $ | (35 | ) | $ | — | $ | 1,191,838 | 1,191,719 | $ | 50 | $ | — | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| (a) | Represents net amount purchased (sold). |

| SCHEDULE OF INVESTMENTS |

29 |

| Schedule of Investments (unaudited) (continued) October 31, 2020 |

BlackRock MuniYield Quality Fund, Inc. (MQY) |

Fair Value Hierarchy as of Period End

Various inputs are used in determining the fair value of financial instruments. For description of the input levels and information about the Fund’s policy regarding valuation of financial instruments, refer to the Notes to Financial Statements.

The following table summarizes the Fund’s investments categorized in the disclosure hierarchy. The breakdown of the Fund’s investments into major categories is disclosed in the Schedule of Investments above.

| Level 1 | Level 2 | Level 3 | Total | |||||||||||||

| Assets |

| |||||||||||||||

| Investments |

| |||||||||||||||

| Long-Term Investments |

||||||||||||||||

| Municipal Bonds |

$ | — | $ | 564,341,728 | $ | — | $ | 564,341,728 | ||||||||

| Municipal Bonds Transferred to Tender Option Bond Trusts. |

— | 225,950,686 | — | 225,950,686 | ||||||||||||

| Short-Term Securities |

||||||||||||||||

| Money Market Funds |

1,191,838 | — | — | 1,191,838 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| $ | 1,191,838 | $ | 790,292,414 | $ | — | $ | 791,484,252 | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

The Fund may hold assets and/or liabilities in which the fair value approximates the carrying amount for financial statement purposes. As of period end, such assets and/or liabilities are categorized within the disclosure hierarchy as follows:

| Level 1 | Level 2 | Level 3 | Total | |||||||||||||

| Liabilities |

| |||||||||||||||

| TOB Trust Certificates. |

$ | — | $ | (126,879,803 | ) | $ | — | $ | (126,879,803 | ) | ||||||

| VRDP Shares at Liquidation Value |

— | (176,600,000 | ) | — | (176,600,000 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| $ | — | $ | (303,479,803 | ) | $ | — | $ | (303,479,803 | ) | |||||||

|

|

|

|

|

|

|

|

|

|||||||||

See notes to financial statements.

| 30 | 2020 BLACKROCK SEMI-ANNUAL REPORT TO SHAREHOLDERS |

| Schedule of Investments (unaudited) October 31, 2020 |

BlackRock MuniYield Quality Fund II, Inc. (MQT) (Percentages shown are based on Net Assets) |

| SCHEDULE OF INVESTMENTS |

31 |

| Schedule of Investments (unaudited) (continued) October 31, 2020 |

BlackRock MuniYield Quality Fund II, Inc. (MQT) (Percentages shown are based on Net Assets) |

| 32 | 2020 BLACKROCK SEMI-ANNUAL REPORT TO SHAREHOLDERS |

| Schedule of Investments (unaudited) (continued) October 31, 2020 |

BlackRock MuniYield Quality Fund II, Inc. (MQT) (Percentages shown are based on Net Assets) |

| SCHEDULE OF INVESTMENTS |

33 |

| Schedule of Investments (unaudited) (continued) October 31, 2020 |

BlackRock MuniYield Quality Fund II, Inc. (MQT) (Percentages shown are based on Net Assets) |

| 34 | 2020 BLACKROCK SEMI-ANNUAL REPORT TO SHAREHOLDERS |

| Schedule of Investments (unaudited) (continued) October 31, 2020 |

BlackRock MuniYield Quality Fund II, Inc. (MQT) (Percentages shown are based on Net Assets) |

| SCHEDULE OF INVESTMENTS |

35 |

| Schedule of Investments (unaudited) (continued) October 31, 2020 |

BlackRock MuniYield Quality Fund II, Inc. (MQT) (Percentages shown are based on Net Assets) |

| 36 | 2020 BLACKROCK SEMI-ANNUAL REPORT TO SHAREHOLDERS |

| Schedule of Investments (unaudited) (continued) October 31, 2020 |

BlackRock MuniYield Quality Fund II, Inc. (MQT) (Percentages shown are based on Net Assets) |

| SCHEDULE OF INVESTMENTS |

37 |

| Schedule of Investments (unaudited) (continued) October 31, 2020 |

BlackRock MuniYield Quality Fund II, Inc. (MQT) |

Affiliates

Investments in issuers considered to be affiliate(s) of the Fund during the six-months ended October 31, 2020 for purposes of Section 2(a)(3) of the 1940 Act, as amended, were as follows:

| Affiliated Issuer | Value at 04/30/20 |

Purchases at Cost |

Proceeds from Sales |

Net Realized Gain (Loss) |

Change in Unrealized Appreciation (Depreciation) |

Value at 10/31/20 |

Shares Held at 10/31/20 |

Income | Capital Gain Distributions from Underlying Funds |

|||||||||||||||||||||||||||

| BlackRock Liquidity Funds, MuniCash, Institutional Class |

$ | 443,146 | $ | 122,817 | (a) | $ | — | $ | (53 | ) | $ | — | $ | 565,910 | 565,853 | $ | 85 | $ | — | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

| (a) | Represents net amount purchased (sold). |

Fair Value Hierarchy as of Period End

Various inputs are used in determining the fair value of financial instruments. For description of the input levels and information about the Fund’s policy regarding valuation of financial instruments, refer to the Notes to Financial Statements.

The following table summarizes the Fund’s investments categorized in the disclosure hierarchy. The breakdown of the Fund’s investments into major categories is disclosed in the Schedule of Investments above.

| Level 1 | Level 2 | Level 3 | Total | |||||||||||||

| Assets |

||||||||||||||||

| Investments |

||||||||||||||||

| Long-Term Investments |

||||||||||||||||

| Municipal Bonds |

$ | — | $ | 365,120,295 | $ | — | $ | 365,120,295 | ||||||||

| Municipal Bonds Transferred to Tender Option Bond Trusts |

— | 148,394,665 | — | 148,394,665 | ||||||||||||

| Short-Term Securities |

||||||||||||||||

| Money Market Funds |

565,910 | — | — | 565,910 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| $ | 565,910 | $ | 513,514,960 | $ | — | $ | 514,080,870 | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

The Fund may hold assets and/or liabilities in which the fair value approximates the carrying amount for financial statement purposes. As of period end, such assets and/or liabilities are categorized within the disclosure hierarchy as follows:

| Level 1 | Level 2 | Level 3 | Total | |||||||||||||

| Liabilities |

||||||||||||||||

| TOB Trust Certificates |

$ | — | $ | (83,318,481 | ) | $ | — | $ | (83,318,481 | ) | ||||||

| VMTP Shares at Liquidation Value |

— | (116,500,000 | ) | — | (116,500,000 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| $ | — | $ | (199,818,481 | ) | $ | — | $ | (199,818,481 | ) | |||||||

|

|

|

|

|

|

|

|

|

|||||||||

See notes to financial statements.

| 38 | 2020 BLACKROCK SEMI-ANNUAL REPORT TO SHAREHOLDERS |

Statements of Assets and Liabilities (unaudited)

October 31, 2020

| MYD | MQY | MQT | ||||||||||

| ASSETS |

||||||||||||

| Investments at value — unaffiliated(a) |

$ | 1,074,299,217 | $ | 790,292,414 | $ | 513,514,960 | ||||||

| Investments at value — affiliated(b) |

804,804 | 1,191,838 | 565,910 | |||||||||

| Receivables: |

||||||||||||

| Investments sold |

14,229 | 350,475 | 228,087 | |||||||||

| Dividends — affiliated |

67 | 10 | 7 | |||||||||

| Interest — unaffiliated |

13,816,213 | 9,363,543 | 6,167,755 | |||||||||

| Prepaid expenses |

23,286 | 55,066 | 19,720 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total assets |

1,088,957,816 | 801,253,346 | 520,496,439 | |||||||||

|

|

|

|

|

|

|

|||||||

| ACCRUED LIABILITIES |

||||||||||||

| Bank overdraft |

445,225 | 328,027 | 211,653 | |||||||||

| Payables: |

||||||||||||

| Investments purchased |

6,174,526 | 1,883,607 | 869,616 | |||||||||

| Income dividend distributions — Common Shares |

2,627,503 | 1,935,725 | 1,218,132 | |||||||||

| Interest expense and fees |

70,094 | 71,580 | 48,581 | |||||||||

| Investment advisory fees |

457,519 | 339,036 | 220,256 | |||||||||

| Directors’ and Officer’s fees |

368,344 | 260,336 | 2,626 | |||||||||

| Other accrued expenses |

214,075 | 174,333 | 132,806 | |||||||||

| Reorganization costs |

— | 180,692 | — | |||||||||

|

|

|

|

|

|

|

|||||||

| Total accrued liabilities |

10,357,286 | 5,173,336 | 2,703,670 | |||||||||

|

|

|

|

|

|

|

|||||||

| OTHER LIABILITIES |

||||||||||||

| TOB Trust Certificates |

146,335,743 | 126,879,803 | 83,318,481 | |||||||||

| VRDP Shares, at liquidation value of $100,000 per share, net of deferred offering costs(c)(d)(e) |

251,072,134 | 176,389,597 | — | |||||||||

| VMTP Shares, at liquidation value of $100,000 per share(c)(d)(e) |

— | — | 116,500,000 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total other liabilities |

397,407,877 | 303,269,400 | 199,818,481 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total liabilities |

407,765,163 | 308,442,736 | 202,522,151 | |||||||||

|

|

|

|

|

|

|

|||||||

| NET ASSETS APPLICABLE TO COMMON SHAREHOLDERS |

$ | 681,192,653 | $ | 492,810,610 | $ | 317,974,288 | ||||||

|

|

|

|

|

|

|

|||||||

| NET ASSETS APPLICABLE TO COMMON SHAREHOLDERS CONSIST OF |

||||||||||||

| Paid-in capital(f)(g)(h) |

$ | 626,524,385 | $ | 430,784,211 | $ | 279,476,648 | ||||||

| Accumulated earnings |

54,668,268 | 62,026,399 | 38,497,640 | |||||||||

|

|

|

|

|

|

|

|||||||

| NET ASSETS APPLICABLE TO COMMON SHAREHOLDERS |

$ | 681,192,653 | $ | 492,810,610 | $ | 317,974,288 | ||||||

|

|

|

|

|

|

|

|||||||

| Net asset value per Common Share |

$ | 14.52 | $ | 16.04 | $ | 14.10 | ||||||

|

|

|

|

|

|

|

|||||||

| (a) Investments at cost — unaffiliated |

$ | 1,003,803,685 | $ | 719,035,651 | $ | 467,889,589 | ||||||

| (b) Investments at cost — affiliated |

$ | 804,588 | $ | 1,191,838 | $ | 565,910 | ||||||

| (c) Preferred Shares outstanding |

2,514 | 1,766 | 1,165 | |||||||||

| (d) Preferred Shares authorized |

16,234 | 11,766 | 7,565 | |||||||||

| (e) Par value per Preferred Share |

$ | 0.10 | $ | 0.10 | $ | 0.10 | ||||||

| (f) Common Shares outstanding |

46,919,695 | 30,725,788 | 22,558,009 | |||||||||

| (g) Common Shares authorized |

199,983,766 | 199,988,234 | 199,992,435 | |||||||||

| (h) Par value per Common Share |

$ | 0.10 | $ | 0.10 | $ | 0.10 | ||||||

See notes to financial statements.

| FINANCIAL STATEMENTS |

39 |

Statements of Operations (unaudited)

Six Months Ended October 31, 2020

| MYD | MQY | MQT | ||||||||||

| INVESTMENT INCOME |

||||||||||||

| Dividends — affiliated |

$ | 1,020 | $ | 50 | $ | 85 | ||||||

| Interest — unaffiliated |

21,458,536 | 15,351,218 | 9,758,033 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total investment income |

21,459,556 | 15,351,268 | 9,758,118 | |||||||||

|

|

|

|

|

|

|

|||||||

| EXPENSES |

||||||||||||

| Investment advisory |

2,715,063 | 2,011,918 | 1,301,487 | |||||||||

| Accounting services |

69,727 | 56,673 | 42,113 | |||||||||

| Professional |

54,801 | 55,116 | 42,513 | |||||||||

| Directors and Officer |

45,393 | 32,720 | 9,916 | |||||||||

| Transfer agent |

28,728 | 20,930 | 17,260 | |||||||||

| Rating agency |

24,809 | 24,809 | 24,809 | |||||||||

| Liquidity fees |

12,913 | 9,071 | — | |||||||||

| Remarketing fees on Preferred Shares |

12,673 | 8,903 | — | |||||||||

| Registration |

8,103 | 5,251 | 4,172 | |||||||||

| Custodian |

5,543 | 9,214 | 5,515 | |||||||||

| Printing and postage |

2,761 | 2,097 | 2,042 | |||||||||

| Reorganization |

— | 212,366 | — | |||||||||

| Miscellaneous |

7,688 | 7,431 | 5,942 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total expenses excluding interest expense, fees and amortization of offering costs |

2,988,202 | 2,456,499 | 1,455,769 | |||||||||

| Interest expense, fees and amortization of offering costs(a) |

1,775,174 | 1,372,355 | 929,759 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total expenses |

4,763,376 | 3,828,854 | 2,385,528 | |||||||||

| Less: |

||||||||||||

| Fees waived and/or reimbursed by the Manager |

(6,819 | ) | (31,915 | ) | (400 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Total expenses after fees waived and/or reimbursed |

4,756,557 | 3,796,939 | 2,385,128 | |||||||||

|

|

|

|

|

|

|

|||||||

| Net investment income |

16,702,999 | 11,554,329 | 7,372,990 | |||||||||

|

|

|

|

|

|

|

|||||||

| REALIZED AND UNREALIZED GAIN (LOSS) |

||||||||||||

| Net realized gain (loss) from: |

||||||||||||

| Investments — unaffiliated |

1,574,713 | 528,838 | 109,800 | |||||||||

| Investments — affiliated |

8,724 | (35 | ) | (53 | ) | |||||||

|

|

|

|

|

|

|

|||||||

| 1,583,437 | 528,803 | 109,747 | ||||||||||

|

|

|

|

|

|

|

|||||||

| Net change in unrealized appreciation (depreciation) on: |

||||||||||||

| Investments — unaffiliated |

50,880,483 | 37,165,703 | 23,540,586 | |||||||||

| Investments — affiliated |

(7,163 | ) | — | — | ||||||||

|

|

|

|

|

|

|

|||||||

| 50,873,320 | 37,165,703 | 23,540,586 | ||||||||||

|

|

|

|

|

|

|

|||||||

| Net realized and unrealized gain |

52,456,757 | 37,694,506 | 23,650,333 | |||||||||

|

|

|

|

|

|

|

|||||||

| NET INCREASE IN NET ASSETS APPLICABLE TO COMMON SHAREHOLDERS RESULTING FROM OPERATIONS |

$ | 69,159,756 | $ | 49,248,835 | $ | 31,023,323 | ||||||

|

|

|

|

|

|

|

|||||||

| (a) | Related to TOB Trusts, VMTP Shares and/or VRDP Shares. |

See notes to financial statements.

| 40 | 2020 BLACKROCK SEMI-ANNUAL REPORT TO SHAREHOLDERS |

Statements of Changes in Net Assets

| MYD | MQY | |||||||||||||||

| Six Months Ended 10/31/20 (unaudited) |

Year Ended 04/30/20 |

Six Months Ended 10/31/20 (unaudited) |

Year Ended 04/30/20 |

|||||||||||||

| INCREASE (DECREASE) IN NET ASSETS APPLICABLE TO COMMON SHAREHOLDERS |

||||||||||||||||

| OPERATIONS |

| |||||||||||||||

| Net investment income |

$ | 16,702,999 | $ | 31,095,198 | $ | 11,554,329 | $ | 20,433,261 | ||||||||

| Net realized gain (loss) |

1,583,437 | (10,046,492 | ) | 528,803 | (8,602,824 | ) | ||||||||||

| Net change in unrealized appreciation (depreciation) |

50,873,320 | (44,697,443 | ) | 37,165,703 | (19,002,399 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net increase (decrease) in net assets applicable to Common Shareholders resulting from operations |

69,159,756 | (23,648,737 | ) | 49,248,835 | (7,171,962 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| DISTRIBUTIONS TO COMMON SHAREHOLDERS(a) |

| |||||||||||||||

| Decrease in net assets resulting from distributions to Common Shareholders |

(15,765,017 | ) | (31,815,824 | ) | (10,934,788 | ) | (19,763,608 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| CAPITAL SHARE TRANSACTIONS |

| |||||||||||||||

| Reinvestment of common distributions |

— | 430,322 | 220,325 | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| NET ASSETS APPLICABLE TO COMMON SHAREHOLDERS |

| |||||||||||||||

| Total increase (decrease) in net assets applicable to Common Shareholders |

53,394,739 | (55,034,239 | ) | 38,534,372 | (26,935,570 | ) | ||||||||||

| Beginning of period |

627,797,914 | 682,832,153 | 454,276,238 | 481,211,808 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| End of period |

$ | 681,192,653 | $ | 627,797,914 | $ | 492,810,610 | $ | 454,276,238 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (a) | Distributions for annual periods determined in accordance with U.S. federal income tax regulations. |

See notes to financial statements.

| FINANCIAL STATEMENTS |

41 |

Statements of Changes in Net Assets (continued)

| MQT | ||||||||

| Six Months Ended 10/31/20 (unaudited) |

Year Ended 04/30/20 |

|||||||

| INCREASE (DECREASE) IN NET ASSETS APPLICABLE TO COMMON SHAREHOLDERS |

||||||||

| OPERATIONS |

| |||||||

| Net investment income |

$ | 7,372,990 | $ | 12,846,839 | ||||

| Net realized gain (loss) |

109,747 | (6,526,638 | ) | |||||

| Net change in unrealized appreciation (depreciation) |

23,540,586 | (11,166,868 | ) | |||||

|

|

|

|

|

|||||

| Net increase (decrease) in net assets applicable to Common Shareholders resulting from operations |

31,023,323 | (4,846,667 | ) | |||||

|

|

|

|

|

|||||

| DISTRIBUTIONS TO COMMON SHAREHOLDERS(a) |

| |||||||

| Decrease in net assets resulting from distributions to Common Shareholders |

(6,722,287 | ) | (12,091,093 | ) | ||||

|

|

|

|

|

|||||

| NET ASSETS APPLICABLE TO COMMON SHAREHOLDERS |

| |||||||

| Total increase (decrease) in net assets applicable to Common Shareholders |

24,301,036 | (16,937,760 | ) | |||||

| Beginning of period |

293,673,252 | 310,611,012 | ||||||

|

|

|

|

|

|||||

| End of period |

$ | 317,974,288 | $ | 293,673,252 | ||||

|

|

|

|

|

|||||

| (a) | Distributions for annual periods determined in accordance with U.S. federal income tax regulations. |

See notes to financial statements.

| 42 | 2020 BLACKROCK SEMI-ANNUAL REPORT TO SHAREHOLDERS |

Statements of Cash Flows (unaudited)

Six Months Ended October 31, 2020

| MYD | MQY | MQT | ||||||||||

| CASH PROVIDED BY (USED FOR) OPERATING ACTIVITIES |

||||||||||||

| Net increase in net assets resulting from operations |

$ | 69,159,756 | $ | 49,248,835 | $ | 31,023,323 | ||||||

| Adjustments to reconcile net increase in net assets resulting from operations to net cash provided by operating activities |

||||||||||||

| Proceeds from sales of long-term investments |

94,088,504 | 51,438,981 | 25,657,529 | |||||||||

| Purchases of long-term investments |

(114,587,179 | ) | (49,470,715 | ) | (26,789,046 | ) | ||||||

| Net proceeds from sales (purchases) of short-term securities |

19,724,177 | (541,963 | ) | (122,817 | ) | |||||||

| Amortization of premium and accretion of discount on investments and other fees |

1,201,050 | 332,416 | 250,744 | |||||||||

| Net realized gain on investments |

(1,583,437 | ) | (528,803 | ) | (109,747 | ) | ||||||

| Net unrealized appreciation on investments |

(50,873,320 | ) | (37,165,703 | ) | (23,540,586 | ) | ||||||

| (Increase) Decrease in Assets | ||||||||||||

| Receivables |

||||||||||||

| Dividends — affiliated |

(67 | ) | (10 | ) | 962 | |||||||

| Dividends — unaffiliated |

9,047 | 432 | — | |||||||||

| Interest — unaffiliated |

510,858 | (57,669 | ) | (93,203 | ) | |||||||

| Prepaid expenses |

(1,477 | ) | 1,645 | 4,076 | ||||||||

| Increase (Decrease) in Liabilities | ||||||||||||

| Payables |

||||||||||||

| Interest expense and fees |

(488,388 | ) | (477,420 | ) | (320,492 | ) | ||||||

| Investment advisory fees |

(418,433 | ) | (311,251 | ) | (201,582 | ) | ||||||

| Directors’ and Officer’s fees |

32,493 | 23,171 | 50 | |||||||||

| Other accrued expenses |

(12,500 | ) | (4,187 | ) | (8,382 | ) | ||||||

| Reorganization costs |

— | 180,692 | — | |||||||||

|

|

|

|

|

|

|

|||||||

| Net cash provided by operating activities |

16,761,084 | 12,668,451 | 5,750,829 | |||||||||

|

|

|

|

|

|

|

|||||||

| CASH PROVIDED BY (USED FOR) FINANCING ACTIVITIES |

||||||||||||

| Cash dividends paid to Common Shareholders |

(15,765,017 | ) | (10,406,487 | ) | (6,496,707 | ) | ||||||

| Repayments of TOB Trust Certificates |

(9,537,168 | ) | (5,115,477 | ) | (498,220 | ) | ||||||

| Repayments of Loan for TOB Trust Certificates |

(3,252,353 | ) | (2,375,000 | ) | (3,040,000 | ) | ||||||

| Proceeds from TOB Trust Certificates |

8,087,883 | 4,895,410 | 4,678,600 | |||||||||

| Proceeds from Loan for TOB Trust Certificates |

3,252,353 | — | — | |||||||||

| Increase (decrease) in bank overdraft |

445,225 | 328,027 | (394,502 | ) | ||||||||

| Amortization of deferred offering costs |

7,993 | 5,076 | — | |||||||||

|

|

|

|

|

|

|

|||||||

| Net cash used for financing activities |

(16,761,084 | ) | (12,668,451 | ) | (5,750,829 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| CASH |

||||||||||||

| Net increase in restricted and unrestricted cash |

— | — | — | |||||||||

| Restricted and unrestricted cash at beginning of period |

— | — | — | |||||||||

|

|

|

|

|

|

|

|||||||

| Restricted and unrestricted cash at end of period |

$ | — | $ | — | $ | — | ||||||

|

|

|

|

|

|

|

|||||||

| SUPPLEMENTAL DISCLOSURE OFCASH FLOW INFORMATION |

||||||||||||

| Cash paid during the period for interest expense |

$ | 2,255,569 | $ | 1,844,699 | $ | 1,250,251 | ||||||

|

|

|

|

|

|

|

|||||||

| NON-CASH FINANCING ACTIVITIES |

||||||||||||

| Capital shares issued in reinvestment of distributions paid to Common Shareholders |

$ | — | $ | 220,325 | $ | — | ||||||

|

|

|

|

|

|

|

|||||||

See notes to financial statements.

| FINANCIAL STATEMENTS |

43 |

(For a share outstanding throughout each period)

| MYD | ||||||||||||||||||||||||||||

| Six Months Ended (unaudited) |

Year Ended April 30, | |||||||||||||||||||||||||||

| 2020 | 2019 | 2018 | 2017 | 2016 | ||||||||||||||||||||||||

| Net asset value, beginning of period |

$ | 13.38 | $ | 14.56 | $ | 14.38 | $ | 14.71 | $ | 15.61 | $ | 15.29 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Net investment income(a) |

0.36 | 0.66 | 0.73 | 0.79 | 0.84 | 0.90 | ||||||||||||||||||||||

| Net realized and unrealized gain (loss) |

1.12 | (1.16 | ) | 0.17 | (0.30 | ) | (0.87 | ) | 0.35 | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Net increase (decrease) from investment operations |

1.48 | (0.50 | ) | 0.90 | 0.49 | (0.03 | ) | 1.25 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Distributions to Common Shareholders from net investment income(b) |

(0.34 | ) | (0.68 | ) | (0.72 | ) | (0.82 | ) | (0.87 | ) | (0.93 | ) | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Net asset value, end of period |

$ | 14.52 | $ | 13.38 | $ | 14.56 | $ | 14.38 | $ | 14.71 | $ | 15.61 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Market price, end of period |

$ | 13.24 | $ | 12.29 | $ | 14.15 | $ | 13.12 | $ | 14.75 | $ | 15.73 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total Return Applicable to Common Shareholders(c) |

||||||||||||||||||||||||||||

| Based on net asset value |

11.20 | %(d) | (3.66 | )% | 6.80 | % | 3.47 | % | (0.16 | )% | 8.81 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Based on market price |

10.40 | %(d) | (8.94 | )% | 13.76 | % | (5.85 | )% | (0.65 | )% | 12.36 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Ratios to Average Net Assets Applicable to Common Shareholders |

||||||||||||||||||||||||||||

| Total expenses |

1.39 | %(e) | 2.07 | %(f) | 2.27 | % | 2.00 | % | 1.75 | % | 1.39 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total expenses after fees waived and/or reimbursed |

1.39 | %(e) | 2.07 | %(f) | 2.27 | % | 2.00 | % | 1.75 | % | 1.39 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total expenses after fees waived and/or reimbursed and excluding interest expense, fees, and amortization of offering costs(g)(h) |

0.87 | %(e) | 0.85 | %(f) | 0.88 | % | 0.89 | % | 0.89 | % | 0.88 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Net investment income to Common Shareholders |

4.87 | %(e) | 4.49 | %(f) | 5.10 | % | 5.33 | % | 5.52 | % | 5.91 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Supplemental Data |

||||||||||||||||||||||||||||

| Net assets applicable to Common Shareholders, end of period (000) |

$ | 681,193 | $ | 627,798 | $ | 682,832 | $ | 674,077 | $ | 687,869 | $ | 728,621 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| VRDP Shares outstanding at $100,000 liquidation value, end of period (000) |

$ | 251,400 | $ | 251,400 | $ | 251,400 | $ | 251,400 | $ | 251,400 | $ | 251,400 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Asset coverage per VRDP Shares at $100,000 liquidation value, end of period |

$ | 370,960 | $ | 349,719 | $ | 371,612 | $ | 368,129 | $ | 373,615 | $ | 389,825 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Borrowings outstanding, end of period (000) |

$ | 146,336 | $ | 147,785 | $ | 136,925 | $ | 167,150 | $ | 168,316 | $ | 173,776 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Portfolio turnover rate |

8 | % | 19 | % | 17 | % | 9 | % | 10 | % | 9 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| (a) | Based on average Common Shares outstanding. |

| (b) | Distributions for annual periods determined in accordance with U.S. federal income tax regulations. |

| (c) | Total returns based on market price, which can be significantly greater or less than the net asset value, may result in substantially different returns. Where applicable, excludes the effects of any sales charges and assumes the reinvestment of distributions at actual reinvestment prices. |

| (d) | Aggregate total return. |

| (e) | Annualized. |

| (f) | Excludes expenses incurred indirectly as a result of investments in underlying funds of 0.01%. |

| (g) | Interest expense, fees and amortization of offering costs related to TOB Trusts and/or VRDP Shares. See Note 4 and Note 9 of the Notes to Financial Statements for details. |

| (h) | The total expense ratio after fees waived and/or reimbursed and excluding interest expense, fees, amortization of offering costs, liquidity and remarketing fees as follows: |

| Six Months Ended 10/31/20 |

Year Ended April 30, | |||||||||||||||||||||||||||||||||||||||||||||||

| 2020 | 2019 | 2018 | 2017 | 2016 | ||||||||||||||||||||||||||||||||||||||||||||

| Expense ratios |

0.87 | % | 0.85 | % | 0.88 | % | 0.88 | % | 0.89 | % | 0.88 | % | ||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

See notes to financial statements.

| 44 | 2020 BLACKROCK SEMI-ANNUAL REPORT TO SHAREHOLDERS |

Financial Highlights (continued)

(For a share outstanding throughout each period)

| MQY | ||||||||||||||||||||||||||||

| Six Months Ended (unaudited) |

Year Ended April 30, | |||||||||||||||||||||||||||

| 2020 | 2019 | 2018 | 2017 | 2016 | ||||||||||||||||||||||||

| Net asset value, beginning of period |

$ | 14.79 | $ | 15.67 | $ | 15.22 | $ | 15.56 | $ | 16.47 | $ | 16.12 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Net investment income(a) |

0.38 | 0.67 | 0.69 | 0.77 | 0.85 | 0.90 | ||||||||||||||||||||||

| Net realized and unrealized gain (loss) |

1.23 | (0.91 | ) | 0.47 | (0.29 | ) | (0.89 | ) | 0.40 | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Net increase (decrease) from investment operations |

1.61 | (0.24 | ) | 1.16 | 0.48 | (0.04 | ) | 1.30 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Distributions to Common Shareholders(b) | ||||||||||||||||||||||||||||

| From net investment income |

(0.36 | ) | (0.64 | ) | (0.69 | ) | (0.82 | ) | (0.87 | ) | (0.95 | ) | ||||||||||||||||

| From net realized gain |

— | — | (0.02 | ) | — | — | — | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total distributions to Common Shareholders |

(0.36 | ) | (0.64 | ) | (0.71 | ) | (0.82 | ) | (0.87 | ) | (0.95 | ) | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Net asset value, end of period |

$ | 16.04 | $ | 14.79 | $ | 15.67 | $ | 15.22 | $ | 15.56 | $ | 16.47 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Market price, end of period |

$ | 15.73 | $ | 13.88 | $ | 13.99 | $ | 13.83 | $ | 15.14 | $ | 16.56 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total Return Applicable to Common Shareholders(c) |

| |||||||||||||||||||||||||||

| Based on net asset value |

10.91 | %(d) | (1.44 | )% | 8.42 | % | 3.28 | % | (0.12 | )% | 8.61 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Based on market price |

15.90 | %(d) | 3.60 | % | 6.53 | % | (3.55 | )% | (3.34 | )% | 13.35 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Ratios to Average Net Assets Applicable to Common Shareholders |

| |||||||||||||||||||||||||||

| Total expenses |

1.55 | %(e)(f) | 2.20 | % | 2.48 | % | 2.05 | % | 1.74 | % | 1.47 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total expenses after fees waived and/or reimbursed |

1.53 | %(e)(f) | 2.20 | % | 2.48 | % | 2.05 | % | 1.74 | % | 1.47 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total expenses after fees waived and/or reimbursed and excluding interest expense, fees, and amortization of offering costs(g)(h) |

0.98 | %(e)(f) | 0.90 | % | 0.93 | % | 0.91 | % | 0.89 | % | 1.09 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Net investment income to Common Shareholders |

4.66 | %(f) | 4.15 | % | 4.55 | % | 4.91 | % | 5.28 | % | 5.62 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Supplemental Data |

| |||||||||||||||||||||||||||

| Net assets applicable to Common Shareholders, end of period (000) |

$ | 492,811 | $ | 454,276 | $ | 481,212 | $ | 467,334 | $ | 477,758 | $ | 505,367 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| VRDP Shares outstanding at $100,000 liquidation value, end of period (000) |

$ | 176,600 | $ | 176,600 | $ | 176,600 | $ | 176,600 | $ | 176,600 | $ | 176,600 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Asset coverage per VRDP Shares at $100,000 liquidation value, end of period |

$ | 379,055 | $ | 357,235 | $ | 372,487 | $ | 364,628 | $ | 370,531 | $ | 386,165 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Borrowings outstanding, end of period (000) |

$ | 126,880 | $ | 129,475 | $ | 134,198 | $ | 139,144 | $ | 119,144 | $ | 112,111 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Portfolio turnover rate |