EX-99.2

Exhibit 99.2

TASEKO MINES LIMITED

Management’s Discussion and Analysis

This management discussion and analysis (“MD&A”) is intended to help the reader

understand Taseko Mines Limited (“Taseko”, “we”, “our” or the “Company”), our operations, financial performance, and current and future business environment. This MD&A is intended to supplement and

complement the consolidated financial statements and notes thereto, prepared in accordance with IAS 34 of International Financial Reporting Standards (“IFRS”) for the three months ended March 31, 2018 (the “Financial

Statements”). You are encouraged to review the Financial Statements in conjunction with your review of this MD&A and the Company’s other public filings, which are available on the Canadian Securities Administrators’ website at

www.sedar.com and on the EDGAR section of the United States Securities and Exchange Commission’s (“SEC”) website at www.sec.gov.

This MD&A is prepared as of May 1, 2018. All dollar figures stated herein are expressed in Canadian dollars, unless otherwise specified.

Cautionary Statement on Forward-Looking Information

This

discussion includes certain statements that may be deemed “forward-looking statements”. All statements in this discussion, other than statements of historical facts, that address future production, reserve potential, exploration drilling,

exploitation activities, and events or developments that the Company expects are forward-looking statements. Although we believe the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are

not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Factors that could cause actual results to differ materially from those in forward-looking statements include

market prices, exploitation and exploration successes, continued availability of capital and financing and general economic, market or business conditions. Investors are cautioned that any such statements are not guarantees of future performance and

actual results or developments may differ materially from those projected in the forward-looking statements. All of the forward-looking statements made in this MD&A are qualified by these cautionary statements. We disclaim any intention or

obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except to the extent required by applicable law. Further information concerning risks and uncertainties associated with

these forward-looking statements and our business may be found in the Company’s other public filings with the SEC and Canadian provincial securities regulatory authorities.

1

TASEKO MINES LIMITED

Management’s Discussion and Analysis

|

|

|

|

|

| CONTENTS |

|

|

|

| OVERVIEW |

|

|

3 |

|

|

|

| HIGHLIGHTS |

|

|

3 |

|

|

|

| REVIEW OF OPERATIONS |

|

|

5 |

|

|

|

| GIBRALTAR OUTLOOK |

|

|

6 |

|

|

|

| REVIEW OF PROJECTS |

|

|

7 |

|

|

|

| MARKET REVIEW |

|

|

7 |

|

|

|

| FINANCIAL PERFORMANCE |

|

|

8 |

|

|

|

| FINANCIAL CONDITION REVIEW |

|

|

12 |

|

|

|

| SUMMARY OF QUARTERLY RESULTS |

|

|

15 |

|

|

|

| CRITICAL ACCOUNTING POLICIES AND ESTIMATES |

|

|

15 |

|

|

|

| INTERNAL AND DISCLOSURE CONTROLS OVER FINANCIAL REPORTING |

|

|

16 |

|

|

|

| RELATED PARTY TRANSACTIONS |

|

|

16 |

|

|

|

| NON-GAAP PERFORMANCE MEASURES |

|

|

18 |

|

2

TASEKO MINES LIMITED

Management’s Discussion and Analysis

OVERVIEW

Taseko Mines Limited (“Taseko” or “Company”) is a mining company that seeks to create shareholder value by acquiring, developing,

and operating large tonnage mineral deposits which, under conservative forward metal price assumptions, are capable of supporting a mine for ten years or longer. The Company’s sole operating asset is the 75% owned Gibraltar Mine, a large copper

mine located in central British Columbia. The Gibraltar Mine is one of the largest copper mines in North America. Taseko also owns the Florence copper, Aley niobium, Harmony gold and New Prosperity gold-copper projects.

HIGHLIGHTS

|

|

|

|

|

|

|

|

|

|

|

|

|

| Financial Data |

|

Three months ended March 31, |

|

| (Cdn$ in thousands, except for per share amounts) |

|

2018 |

|

|

2017 |

|

|

Change |

|

|

|

|

|

| Revenues |

|

|

64,179 |

|

|

|

104,389 |

|

|

|

(40,210) |

|

|

|

|

|

| Earnings from mining operations before depletion and amortization* |

|

|

13,544 |

|

|

|

53,427 |

|

|

|

(39,883) |

|

|

|

|

|

| Earnings (loss) from mining operations |

|

|

(1,236) |

|

|

|

43,850 |

|

|

|

(45,086) |

|

|

|

|

|

| Net income (loss) |

|

|

(18,481) |

|

|

|

16,479 |

|

|

|

(34,960) |

|

|

|

|

|

| Per share - basic (“EPS”) |

|

|

(0.08) |

|

|

|

0.07 |

|

|

|

(0.15) |

|

|

|

|

|

| Adjusted net income (loss)* |

|

|

(10,999) |

|

|

|

15,254 |

|

|

|

(26,253) |

|

|

|

|

|

| Per share - basic (“adjusted EPS”)* |

|

|

(0.05) |

|

|

|

0.07 |

|

|

|

(0.12) |

|

|

|

|

|

| EBITDA* |

|

|

370 |

|

|

|

49,145 |

|

|

|

(48,775) |

|

|

|

|

|

| Adjusted EBITDA* |

|

|

7,537 |

|

|

|

47,934 |

|

|

|

(40,397) |

|

|

|

|

|

| Cash flows provided by operations

|

|

|

11,556 |

|

|

|

79,765 |

|

|

|

(68,209) |

|

| Operating Data (Gibraltar - 100% basis)

|

|

Three months ended March 31,

|

|

| |

|

2018 |

|

|

2017 |

|

|

Change |

|

|

|

|

|

| Tons mined (millions) |

|

|

26.7 |

|

|

|

21.8 |

|

|

|

4.9 |

|

|

|

|

|

| Tons milled (millions) |

|

|

7.5 |

|

|

|

7.3 |

|

|

|

0.2 |

|

|

|

|

|

| Production (million pounds Cu) |

|

|

22.9 |

|

|

|

41.3 |

|

|

|

(18.4) |

|

|

|

|

|

| Sales (million pounds Cu) |

|

|

22.8 |

|

|

|

40.8 |

|

|

|

(18.0) |

|

*Non-GAAP performance measure. See page 18 of this MD&A.

3

TASEKO MINES LIMITED

Management’s Discussion and Analysis

HIGHLIGHTS - CONTINUED

First Quarter Highlights

| |

• |

|

Earnings from mining operations before depletion and amortization* was $13.5 million; |

| |

• |

|

The increased use of stockpiled ore resulted in a non-cash inventory expense and

additional depletion and amortization which reduced earnings from mining operations by $5.2 million in the first quarter of 2018; |

| |

• |

|

Cash flow from operations was $11.6 million, a decrease from the same period in 2017 due to lower copper production

and sales volumes; |

| |

• |

|

In September 2017, the Company announced that it was moving forward with the construction of the Production Test

Facility (“PTF”) for the Florence Copper Project. The SX/EW plant and the associated wellfield, comprised of 24 production, monitoring, observation and point of compliance wells, will be built for approximately US$25 million.

Wellfield drilling was completed in early April and construction of the process plant progressed smoothly through the first quarter, with steel for the plant being erected at the end of the quarter. The project is

on-time and on budget with expenditures in the first quarter being approximately $14.3 million or US$10.8 million. The facility is expected to be operational by the end of the third quarter of 2018,

with first copper cathode being produced in December; |

| |

• |

|

Copper and molybdenum production in the first quarter was 22.9 million pounds and 0.4 million pounds,

respectively, a decrease from previous quarters as a result of the anticipated lower grade mine feed combined with the increased use of lower grade ore stockpiles, a consequence of the summer wildfires; |

| |

• |

|

Net loss was $18.5 million ($0.08 per share) and Adjusted net loss* was $11.0 million ($0.05 loss per share);

|

| |

• |

|

Site operating costs, net of by-product credits* were US$2.02 per pound produced and Total operating costs (C1)*

were US$2.33 per pound produced. Spending in the quarter remained at a similar level as the previous quarter but unit costs were impacted by the lower grades and production; |

| |

• |

|

Total sales (100% basis) for the quarter were 22.8 million pounds of copper and 0.4 million pounds of

molybdenum; and |

| |

• |

|

The Company’s cash balance at March 31, 2018 was $64 million, reduced from $80 million at the end of

2017 due in part to cash used for construction of the Florence Copper PTF. |

*Non-GAAP performance measure.

See page 18 of this MD&A

4

TASEKO MINES LIMITED

Management’s Discussion and Analysis

REVIEW OF OPERATIONS

Gibraltar Mine (75% Owned)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating data (100% basis) |

|

Q1 2018 |

|

|

Q4 2017 |

|

|

Q3 2017 |

|

|

Q2 2017 |

|

|

Q1 2017 |

|

| Tons mined (millions) |

|

|

26.7 |

|

|

|

26.9 |

|

|

|

23.3 |

|

|

|

21.1 |

|

|

|

21.8 |

|

|

|

|

|

|

|

| Tons milled (millions) |

|

|

7.5 |

|

|

|

7.9 |

|

|

|

7.2 |

|

|

|

7.5 |

|

|

|

7.3 |

|

|

|

|

|

|

|

| Strip ratio |

|

|

4.1 |

|

|

|

4.9 |

|

|

|

4.1 |

|

|

|

2.8 |

|

|

|

2.4 |

|

|

|

|

|

|

|

| Site operating cost per ton milled (CAD$)* |

|

|

$8.68 |

|

|

|

$7.68 |

|

|

|

$5.93 |

|

|

|

$7.67 |

|

|

|

$8.59 |

|

|

|

|

|

|

|

| Copper concentrate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Grade (%) |

|

|

0.201 |

|

|

|

0.209 |

|

|

|

0.284 |

|

|

|

0.309 |

|

|

|

0.328 |

|

|

|

|

|

|

|

| Recovery (%) |

|

|

75.7 |

|

|

|

77.5 |

|

|

|

86.1 |

|

|

|

85.2 |

|

|

|

85.9 |

|

|

|

|

|

|

|

| Production (million pounds Cu) |

|

|

22.9 |

|

|

|

25.5 |

|

|

|

35.1 |

|

|

|

39.4 |

|

|

|

41.3 |

|

|

|

|

|

|

|

| Sales (million pounds Cu) |

|

|

22.8 |

|

|

|

32.0 |

|

|

|

30.2 |

|

|

|

40.7 |

|

|

|

40.8 |

|

|

|

|

|

|

|

| Inventory (million pounds Cu) |

|

|

2.9 |

|

|

|

2.7 |

|

|

|

9.3 |

|

|

|

4.6 |

|

|

|

5.9 |

|

|

|

|

|

|

|

| Molybdenum concentrate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Production (thousand pounds Mo) |

|

|

443 |

|

|

|

537 |

|

|

|

445 |

|

|

|

789 |

|

|

|

866 |

|

|

|

|

|

|

|

| Sales (thousand pounds Mo) |

|

|

433 |

|

|

|

589 |

|

|

|

403 |

|

|

|

794 |

|

|

|

859 |

|

|

|

|

|

|

|

| Per unit data (US$ per pound produced)* |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Site operating costs* |

|

|

$2.25 |

|

|

|

$1.86 |

|

|

|

$0.97 |

|

|

|

$1.08 |

|

|

|

$1.15 |

|

|

|

|

|

|

|

| By-product credits* |

|

|

(0.23) |

|

|

|

(0.17) |

|

|

|

(0.09) |

|

|

|

(0.11) |

|

|

|

(0.15) |

|

|

|

|

|

|

|

| Site operating costs, net of by-product credits* |

|

|

$2.02 |

|

|

|

$1.69 |

|

|

|

$0.88 |

|

|

|

$0.97 |

|

|

|

$1.00 |

|

|

|

|

|

|

|

| Off-property costs |

|

|

0.31 |

|

|

|

0.42 |

|

|

|

0.30 |

|

|

|

0.34 |

|

|

|

0.33 |

|

|

|

|

|

|

|

| Total operating costs (C1)* |

|

|

$2.33 |

|

|

|

$2.11 |

|

|

|

$1.18 |

|

|

|

$1.31 |

|

|

|

$1.33 |

|

*Non-GAAP performance measure. See page 18 of this MD&A.

5

TASEKO MINES LIMITED

Management’s Discussion and Analysis

OPERATIONS ANALYSIS

First quarter results

First quarter copper production at

Gibraltar was 22.9 million pounds, lower than recent quarters as a result of reduced head grades and recoveries. Copper head grade at Gibraltar was 0.201% in the first quarter and the Company expects the head grade for the remainder of 2018 to

be in line with the average life of mine reserve grade of 0.26%. Although the lower head grade in the first quarter was expected in the mine plan, head grade was also affected by reduced waste stripping in the third quarter of 2017 due to the summer

wildfires in the Cariboo region and as a result more mill feed came from the stockpile than planned in the first quarter. The low head grades and some oxidation from stockpile ore also impacted copper recoveries which averaged 76% for the period.

A total of 26.7 million tons were mined during the quarter at a strip ratio of 4.1 to 1. Waste stripping costs of $14.7 million (75%

basis) were capitalized in the quarter related to the new pushback in the Granite pit. Approximately 2.5 million tons of ore were drawn from the ore stockpile in the first quarter.

Site operating cost per ton milled* was $8.68 in the first quarter of 2018, which is higher than the fourth quarter of 2017 primarily due to the

decreased capitalization of stripping costs and a decrease in the tons milled during the first quarter.

Site operating costs, net of by-product credits per pound produced* increased to US$2.02 in the first quarter of 2018 from US$1.69 in the fourth quarter of 2017. Total site spending in the first quarter remained at a similar level to the

previous quarter, but unit operating costs increased due to the lower copper production and lower capitalized stripping costs in the period. A total of 0.4 million pounds of molybdenum were sold resulting in

by-product credits per pound produced* of US$0.23 in the first quarter. The increase in molybdenum by-product credit was a result of higher molybdenum prices.

Off-property costs per pound produced* were US$0.31 for the first quarter of 2018 compared to US$0.34 for the

2017 year. The lower Off-property costs per pound produced* was primarily a result of lower treatment and refining costs charged on the Company’s copper concentrate sales.

Total operating costs (C1) per pound* increased to US$2.33, a 10% increase from the fourth quarter of 2017.

GIBRALTAR OUTLOOK

Looking

beyond the first quarter, with the transition into the new ore zone completed, copper grade will increase and we expect the average copper grade for the remainder of 2018 to be in line with Gibraltar’s average life of mine reserve grade of

0.26%.

Copper markets have shown continued strength with prices at US$3.07 per pound as of May 1, 2018. Molybdenum prices have also stayed

strong at US$12.40 per pound as of May 1, 2018.

The Company is pursuing an insurance claim related to the Cariboo region wildfires in July

2017. The amount of the insurance claim has not been finalized and is currently estimated to be in the range of $4 to $10 million on a 75% basis.

*Non-GAAP performance measure. See page 18 of this MD&A

6

TASEKO MINES LIMITED

Management’s Discussion and Analysis

REVIEW OF PROJECTS

Taseko’s strategy has been to grow the Company by leveraging cash flow from the Gibraltar Mine to assemble and develop a pipeline of projects. We

continue to believe this will generate the best, long-term returns for shareholders. Our development projects are located in British Columbia and Arizona and represent a diverse range of metals, including gold, copper, molybdenum and niobium. Our

project focus is currently on the development of the Florence Copper Project.

Florence Copper Project

In September 2017, the Company announced that it was moving forward with the construction of the Production Test Facility (“PTF”) for the

Florence Copper Project. The SX/EW Plant and the associated wellfield, comprised of 24 production, monitoring, observation and point of compliance wells, will be built for approximately US$25 million. Wellfield drilling was completed in early

April and construction of the process plant progressed smoothly through the first quarter, with steel for the plant being erected at the end of the quarter.

The project is on time and on budget with expenditures in the first quarter being approximately $14.3 million or US$10.8 million. The entire

facility, plant and wells are expected to be fully operational by the end of the third quarter of 2018.

Aley Niobium Project

In 2014, the Company filed an NI43-101 technical report for the Aley Niobium Project. Further engineering and

metallurgical test work has been completed since then which is expected to result in improved project economics. Environmental monitoring on the project continues and a number of product marketing initiatives are underway.

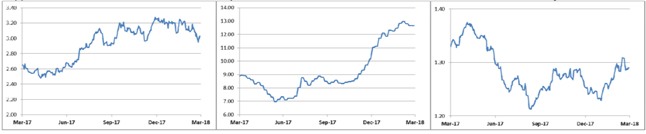

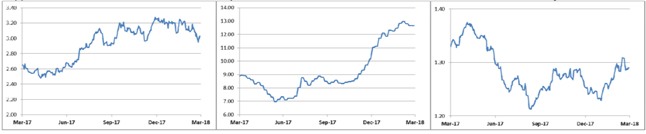

MARKET REVIEW

Copper

Molybdenum

Canadian/US Dollar Exchange

Prices (USD per pound for Commodities)

(Source Data: Bank of Canada, Platts Metals, and London Metals Exchange)

Global economic uncertainty has led to significant copper price volatility over short periods of time. The U.S. trade policies, Chinese economic demand,

copper supply disruptions, and interest rate expectations have all contributed to the recent price volatility.

Copper prices have been on an upward

trend over the last twelve months, with copper prices increasing by approximately 14% during the period. The average price of London Metals Exchange (“LME”) copper was US$3.16 per pound in the first quarter of 2018, which was comparable to

the fourth quarter of 2017 and is approximately 19% higher than the first quarter of 2017. Management believes that the market will continue to benefit from improving global copper demand and tight mine supply going forward.

The Company’s sales agreement specifies molybdenum pricing based on the published Platts Metals reports. The

7

TASEKO MINES LIMITED

Management’s Discussion and Analysis

average published molybdenum price was US$12.23 per pound in the first quarter of 2018, which was 40% higher than the fourth quarter of 2017. Molybdenum prices have continued to stay strong at

US$12.40 per pound as of May 1, 2018.

Approximately 80% of the Gibraltar Mine’s costs are Canadian dollar denominated and therefore,

fluctuations in the Canadian/US dollar exchange rate can have a significant effect on the Company’s operating results and unit production costs, which are reported in US dollars. The Canadian dollar weakened by approximately 3% during the first

quarter of 2018.

FINANCIAL PERFORMANCE

Earnings

The Company’s net loss was $18.5 million

($0.08 loss per share) for the three months ended March 31, 2018, compared to a net income of $16.5 million ($0.07 earnings per share) for the same period in 2017. The decrease in net income was primarily due to the loss from mining

operations and also unrealized foreign exchange losses on the Company’s US dollar denominated debt.

Earnings from mining operations before

depletion and amortization* was $13.5 million for the three months ended March 31, 2018, compared to earnings of $53.4 million for the same period in 2017. The decrease in earnings from mining operations before depletion and

amortization was a result of lower copper sales volumes and higher unit operating costs, however this was partially offset by higher realized copper and molybdenum prices.

Included in net income (loss) are a number of items that management believes require adjustment in order to better measure the underlying performance of

the business. The following items have been adjusted as management believes they are not indicative of a realized economic gain/loss or the underlying performance of the business in the period:

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended

March 31, |

|

|

|

|

| (Cdn$ in thousands) |

|

2018 |

|

|

2017 |

|

|

Change |

|

|

|

|

|

| Net income (loss) |

|

|

(18,481) |

|

|

|

16,479 |

|

|

|

(34,960) |

|

|

|

|

|

| Unrealized foreign exchange (gain) loss |

|

|

8,332 |

|

|

|

(2,677) |

|

|

|

11,009 |

|

|

|

|

|

| Unrealized (gain) loss on copper put options |

|

|

(1,165) |

|

|

|

52 |

|

|

|

(1,217) |

|

|

|

|

|

| Loss on copper call option |

|

|

- |

|

|

|

1,414 |

|

|

|

(1,414) |

|

|

|

|

|

| Estimated tax effect of adjustments |

|

|

315 |

|

|

|

(14) |

|

|

|

329 |

|

| |

|

|

|

| Adjusted net income (loss) * |

|

|

(10,999) |

|

|

|

15,254 |

|

|

|

(26,253) |

|

*Non-GAAP performance measure. See page 18 of this MD&A

In the three months ended March 31, 2018, the Canadian dollar weakened in comparison to the US dollar by 3% resulting in an unrealized foreign

exchange loss of $8.3 million. The unrealized foreign exchange losses were primarily driven by the translation of the Company’s US dollar denominated debt.

8

TASEKO MINES LIMITED

Management’s Discussion and Analysis

Revenues

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended

March 31, |

|

|

|

|

| (Cdn$ in thousands) |

|

2018 |

|

|

2017 |

|

|

Change |

|

|

|

|

|

| Copper in concentrate |

|

|

66,143 |

|

|

|

103,502 |

|

|

|

(37,359) |

|

|

|

|

|

| Molybdenum concentrate |

|

|

5,014 |

|

|

|

6,468 |

|

|

|

(1,454) |

|

|

|

|

|

| Silver |

|

|

940 |

|

|

|

767 |

|

|

|

173 |

|

|

|

|

|

| Price adjustments on settlement receivables |

|

|

(3,305) |

|

|

|

3,706 |

|

|

|

(7,011) |

|

|

|

|

|

| Total gross revenue |

|

|

68,792 |

|

|

|

114,443 |

|

|

|

(45,651) |

|

|

|

|

|

| Less: treatment and refining costs |

|

|

(4,613) |

|

|

|

(10,054) |

|

|

|

5,441 |

|

|

|

|

|

| Revenue |

|

|

64,179 |

|

|

|

104,389 |

|

|

|

(40,210) |

|

|

|

|

|

| (thousands of pounds, unless otherwise noted) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Copper in concentrate* |

|

|

16,484 |

|

|

|

29,504 |

|

|

|

(13,020) |

|

|

|

|

|

| Average realized copper price (US$ per pound) |

|

|

2.98 |

|

|

|

2.72 |

|

|

|

0.26 |

|

|

|

|

|

| Average LME copper price (US$ per pound) |

|

|

3.16 |

|

|

|

2.65 |

|

|

|

0.51 |

|

|

|

|

|

| Average exchange rate (US$/CAD) |

|

|

1.26 |

|

|

|

1.32 |

|

|

|

(0.06) |

|

* This amount includes a net smelter payable deduction of approximately 3.5% to derive net payable pounds of copper sold.

Copper revenues for the three months ended March 31, 2018 decreased by $44.1 million, compared to the same period in 2017, primarily due to a

decrease in copper sales volumes, partially offset by higher realized copper prices.

During the three months ended March 31, 2018, copper

revenues include $4.0 million of unfavorable adjustments to provisionally priced copper concentrate. The unfavourable provisional pricing adjustments equates to US$0.19 per pound decrease to the average realized copper price for the three

months ended March 31, 2018.

Molybdenum revenues for the three months ended March 31, 2018 was $5.7 million, a decrease of

$1.7 million compared to the same period in 2017. The decrease was due to lower production and sales volume of molybdenum, partially offset by higher molybdenum realized prices during the first quarter of 2018. During the three months ended

March 31, 2018, molybdenum revenues include $0.7 million of favorable adjustments to provisionally priced molybdenum concentrate

9

TASEKO MINES LIMITED

Management’s Discussion and Analysis

Cost of sales

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended

March 31, |

|

|

|

|

| (Cdn$ in thousands) |

|

2018 |

|

|

2017 |

|

|

Change |

|

|

|

|

|

| Site operating costs |

|

|

48,877 |

|

|

|

47,150 |

|

|

|

1,727 |

|

|

|

|

|

| Transportation costs |

|

|

2,829 |

|

|

|

5,217 |

|

|

|

(2,388) |

|

|

|

|

|

| Insurance recoverable |

|

|

(4,000) |

|

|

|

- |

|

|

|

(4,000) |

|

|

|

|

|

| Changes in inventories of finished goods |

|

|

(967) |

|

|

|

(233) |

|

|

|

(734) |

|

|

|

|

|

| Changes in inventories of ore stockpiles |

|

|

3,896 |

|

|

|

(1,172) |

|

|

|

5,068 |

|

|

|

|

|

| Production costs |

|

|

50,635 |

|

|

|

50,962 |

|

|

|

(327) |

|

|

|

|

|

| Depletion and amortization |

|

|

14,780 |

|

|

|

9,577 |

|

|

|

5,203 |

|

| |

|

|

|

| Cost of sales |

|

|

65,415 |

|

|

|

60,539 |

|

|

|

4,876 |

|

|

|

|

|

| Site operating costs per ton milled* |

|

|

$8.68 |

|

|

|

$8.59 |

|

|

|

$0.09 |

|

*Non-GAAP performance measure. See page 18 of this MD&A

Site operating costs for the three months ended March 31, 2018 was comparable to the same period in 2017. The total site operating costs excludes

costs that are allocated to capitalized stripping as a result of waste stripping in a new section of the Granite pit, in accordance with the mine plan. For the three months ended March 31, 2018, $14.7 million was allocated to capitalized

stripping, compared to $10.6 million for the same period in 2017.

The Company is pursuing an insurance claim related to the Cariboo region

wildfires in July 2017. The amount of the insurance claim has not been finalized and is currently estimated to be in the range of $4 to $10 million (75% basis). As at March 31, 2018, the Company has recorded an insurance recoverable of

$4 million.

Cost of sales was also impacted by changes in ore stockpile inventories. In the three months ended March 31, 2018, the ore

stockpiles were drawn down by 2.6 million tons resulting in a reduction in inventories (increase in cost of sales) of $3.9 million. In the first quarter of 2017, the ore stockpile inventory increased by $1.2 million (reduction in cost

of sales) due to an increase in the stockpiled tonnage.

Depletion and amortization for three months ended March 31, 2018 increased by

$5.2 million over the same period in 2017, and the difference is primarily due to changes in ore stockpile inventory and increased amortization of capitalized stripping costs in the period. In the first quarter of 2018 the reduction in

stockpile inventory resulted in additional depletion and amortization expense of $1.3 million.

Other operating (income) expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended

March 31, |

|

|

|

|

| (Cdn$ in thousands) |

|

2018 |

|

|

2017 |

|

|

Change |

|

|

|

|

|

| General and administrative |

|

|

4,751 |

|

|

|

5,170 |

|

|

|

(419) |

|

|

|

|

|

| Share-based compensation expense (recovery) |

|

|

(995) |

|

|

|

3,290 |

|

|

|

(4,285) |

|

|

|

|

|

| Exploration and evaluation |

|

|

845 |

|

|

|

475 |

|

|

|

370 |

|

|

|

|

|

| Realized loss on copper put options |

|

|

1,308 |

|

|

|

155 |

|

|

|

1,153 |

|

|

|

|

|

| Unrealized (gain) loss on copper put options |

|

|

(1,165) |

|

|

|

52 |

|

|

|

(1,217) |

|

|

|

|

|

| Loss on copper call option |

|

|

- |

|

|

|

1,414 |

|

|

|

(1,414) |

|

|

|

|

|

| Other income |

|

|

(331) |

|

|

|

(224) |

|

|

|

(107) |

|

| |

|

|

4,413 |

|

|

|

10,332 |

|

|

|

(5,919) |

|

10

TASEKO MINES LIMITED

Management’s Discussion and Analysis

General and administrative costs have decreased for the three months ended March 31, 2018 compared

to the same period in 2017, due primarily to a $0.5 million donation to a local hospital in the first quarter of 2017.

Share-based

compensation expense for the three months ended March 31, 2018 was a recovery of $1.0 million compared to an expense of $3.3 million in the same period in 2017. The share based compensation recovery for the first quarter was primarily

due to the revaluation of the liability for deferred share units resulting from a decrease in the Company’s share price.

Exploration and

evaluation costs for the three months ended March 31, 2018, represent costs associated with the New Prosperity and Aley projects.

During the

first quarter of 2018, the Company incurred a realized loss of $1.3 million from copper put options, which relates to copper put options that settled out-of-the-money. The unrealized gain of $1.2 million relates to the fair value adjustment of copper put options that will be settled during the second quarter of 2018.

Finance expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended

March 31, |

|

|

|

|

| (Cdn$ in thousands) |

|

2018 |

|

|

2017 |

|

|

Change |

|

|

|

|

|

| Interest expense |

|

|

7,810 |

|

|

|

7,486 |

|

|

|

324 |

|

|

|

|

|

| Finance expense – deferred revenue |

|

|

901 |

|

|

|

- |

|

|

|

901 |

|

|

|

|

|

| Accretion of PER |

|

|

600 |

|

|

|

548 |

|

|

|

52 |

|

|

|

|

|

| |

|

|

9,311 |

|

|

|

8,034 |

|

|

|

1,277 |

|

Interest expense for the three months ended March 31, 2018 increased by $0.3 million, compared to the same

period in 2017. The Company’s total interest costs are lower in the three months ended March 31, 2018 due to reduced long-term debt as a result of the June 2017 refinancing. However, interest expense is higher in the first quarter of 2018

because no interest was capitalized this quarter, whereas $1.3 million of interest was capitalized in the first quarter of 2017. Finance expense for the three months ended March 31, 2018 of $0.9 million represents the financing

component of the upfront deposit from the silver purchase and sale agreement.

Income tax

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Three months ended

March 31, |

|

|

|

|

|

| (Cdn$ in thousands) |

|

2018 |

|

|

2017 |

|

|

Change |

|

|

|

|

|

| Current income tax expense |

|

|

- |

|

|

|

648 |

|

|

|

(648) |

|

|

|

|

|

| Deferred income tax expense (recovery) |

|

|

(4,078) |

|

|

|

11,379 |

|

|

|

(15,457) |

|

|

|

|

|

| |

|

|

(4,078) |

|

|

|

12,027 |

|

|

|

(16,105) |

|

|

|

|

|

| Effective tax rate |

|

|

18.1% |

|

|

|

42.2% |

|

|

|

(24.1%) |

|

|

|

|

|

| Canadian statutory rate |

|

|

27.0% |

|

|

|

26.0% |

|

|

|

1.0% |

|

|

|

|

|

| B.C. Mineral tax rate |

|

|

9.6% |

|

|

|

9.6% |

|

|

|

- |

|

The income tax expense for the first quarter of 2018 decreased from the same quarter in 2017 due to lower earnings,

amongst other factors. There was no current income tax estimated for the quarter. For deferred

11

TASEKO MINES LIMITED

Management’s Discussion and Analysis

income tax, the recovery was mainly driven by an increase of temporary differences related to tax losses in the quarter due to lower earnings.

FINANCIAL CONDITION REVIEW

Balance sheet

review

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

As at March 31, |

|

|

As at December 31, |

|

|

|

|

| (Cdn$ in thousands) |

|

2018 |

|

|

2017 |

|

|

Change |

|

|

|

|

|

| Cash and cash equivalents |

|

|

64,232 |

|

|

|

80,231 |

|

|

|

(15,999) |

|

|

|

|

|

| Other current assets |

|

|

55,079 |

|

|

|

65,505 |

|

|

|

(10,426) |

|

|

|

|

|

| Property, plant and equipment |

|

|

819,734 |

|

|

|

797,265 |

|

|

|

22,469 |

|

|

|

|

|

| Other assets |

|

|

45,928 |

|

|

|

45,709 |

|

|

|

219 |

|

| |

|

|

|

| Total assets |

|

|

984,973 |

|

|

|

988,710 |

|

|

|

(3,737) |

|

|

|

|

|

| Current liabilities |

|

|

61,444 |

|

|

|

50,139 |

|

|

|

11,305 |

|

|

|

|

|

| Debt: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Senior secured notes |

|

|

311,334 |

|

|

|

302,085 |

|

|

|

9,249 |

|

|

|

|

|

| Capital leases and secured equipment loans |

|

|

23,913 |

|

|

|

27,133 |

|

|

|

(3,220) |

|

|

|

|

|

| Deferred revenue |

|

|

38,791 |

|

|

|

39,640 |

|

|

|

(849) |

|

|

|

|

|

| Other liabilities |

|

|

197,740 |

|

|

|

202,633 |

|

|

|

(4,893) |

|

| |

|

|

|

| Total liabilities |

|

|

633,222 |

|

|

|

621,630 |

|

|

|

11,592 |

|

|

|

|

|

| Equity |

|

|

351,751 |

|

|

|

367,080 |

|

|

|

(15,329) |

|

|

|

|

|

| Net debt (debt minus cash and equivalents) |

|

|

271,015 |

|

|

|

248,987 |

|

|

|

22,028 |

|

|

|

|

|

| Total common shares outstanding (millions) |

|

|

227.1 |

|

|

|

227.0 |

|

|

|

0.1 |

|

The Company’s asset base is comprised principally of non-current assets,

including property, plant and equipment, reflecting the capital intensive nature of the mining business. Other current assets include accounts receivable, other financial assets and inventories (supplies and production inventories), along with

prepaid expenses and deposits. Production inventories, accounts receivable and cash balances fluctuate in relation to shipping and cash settlement schedules.

Total long-term debt increased by $6.0 million for the three months ended March 31, 2018, due primarily to the foreign exchange losses on the

Company’s US dollar denominated debt, partially offset by the payments on the Company’s capital leases and equipment loans. The Company’s net debt has increased by $22.0 million for the three months ended March 31, 2018

primarily due to use of cash for the Florence PTF capital expenditures.

Deferred revenue relates to the US$33 million advance payment received

in March 2017 from Osisko Gold Royalties Ltd. (“Osisko”) for the sale of future silver production from the Gibraltar Mine.

Other

liabilities decreased by $4.9 million mainly due to the decrease in deferred tax liabilities and other financial liabilities, partially offset by an increase in the provision for environmental rehabilitation (“PER”). Other financial

liabilities decreased due the decrease in the fair value of deferred share units as at March 31, 2018.

The increase in the PER is driven by a

reduction in the discount rates. At March 31, 2018, the Bank of Canada long-term benchmark bond rate used as a proxy for long-term discount rates was 2.23% compared to 2.26% at December 31, 2017. Given the long time frame over which

environmental rehabilitation expenditures are

12

TASEKO MINES LIMITED

Management’s Discussion and Analysis

expected to be incurred (over 100 years), the carrying value of the provision is very sensitive to changes in discount rates.

As at May 1, 2018, there were 227,160,584 common shares outstanding. In addition, there were 10,814,900 stock options and 3,000,000 warrants

outstanding at May 1, 2018. More information on these instruments and the terms of their exercise is set out in Notes 13 and 15 of the March 31, 2018 unaudited condensed consolidated interim financial statements.

Liquidity, cash flow and capital resources

During the three

months ended March 31, 2018, the Company generated operating cash flow of $11.6 million and used $24.5 million for investing activities. Investing activities in the period included $6.6 million of cash payments for construction

of the PTF at Florence, $14.7 million for capitalized stripping costs, $1.2 million on other capital expenditures for Gibraltar, and $2.1 million on other project costs at the Florence and Aley projects.

Cash used for financing activities during the three months ended March 31, 2018 includes $3.2 million of payments for capital leases and

equipment loans.

During the three months ended March 31, 2017 the Company generated $64 million of positive cash flow from operating and

investing activities, as a result of strong operating results at the Gibraltar Mine and including $44 million of cash proceeds from the sale of a silver stream to Osisko.

At March 31, 2018, the Company had cash and equivalents of $64 million (December 31, 2017 - $80 million) and continues to maintain a strategy

of retaining a significant cash balance to reflect the volatile and capital intensive nature of the copper mining business. The Company continues to make monthly principal repayments for capital leases and equipment loans, however, there are no

principal payments required on the senior secured notes until the maturity date in June 2022.

Liquidity outlook

The Company has a pipeline of development stage projects, including the Florence Copper Project and Aley Niobium Project, and additional funding will be

required to advance these projects to production. To address these project funding requirements, the Company may seek to raise additional capital through debt or equity financings or asset sales (including royalties, sales of project interests, or

joint ventures). The senior secured notes (due in June 2022) allow for up to US$100 million of first lien secured debt to be issued, subject to the terms of the note indenture. The Company may also redeem or repurchase senior secured notes on

the market. From time to time, the Company evaluates these alternatives, based on a number of factors including the prevailing market prices of the senior secured notes, metal prices, liquidity requirements, covenant restrictions and other factors,

in order to determine the optimal mix of capital resources to address capital requirements, minimize the Company’s cost of capital, and maximize shareholder value.

Future changes in copper and molybdenum market prices could also impact the timing and amount of cash available for future investment in development

projects, debt obligations, and other uses of capital. To partially mitigate commodity price risks, copper put options are entered into for a portion of Gibraltar copper production (see section below “Hedging Strategy”).

13

TASEKO MINES LIMITED

Management’s Discussion and Analysis

Hedging strategy

The Company’s hedging strategy is to secure a minimum price for a portion of copper production using put options that are either purchased outright

or funded by the sale of call options that are significantly out of the money. The amount and duration of the hedge position is based on an assessment of business-specific risk elements combined with the copper pricing outlook. Copper price and

quantity exposure are reviewed at least quarterly to ensure that adequate revenue protection is in place. Hedge positions are typically extended adding incremental quarters at established put strike prices to provide the necessary price protection.

The Company’s hedging strategy is designed to mitigate short-term declines in copper price.

Considerations on the cost of the hedging program

include an assessment of Gibraltar’s estimated production costs, anticipated copper prices and the Company’s capital requirements during the relevant period. Subsequent to March 31, 2018, the Company spent $0.7 million to

purchase copper put options to mature during the third quarter of 2018. The following table shows the commodity contracts that were outstanding as at the date of this MD&A.

|

|

|

|

|

|

|

|

|

| |

|

Notional amount |

|

Strike price |

|

Term to maturity |

|

Original cost |

| At May 1, 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Copper put options |

|

10 million lbs |

|

US$2.80 per lb |

|

Q2 2018 |

|

$0.6 million |

|

|

|

|

|

| Copper put options |

|

15 million lbs |

|

US$2.80 per lb |

|

Q3 2018 |

|

$0.7 million |

Commitments and contingencies

Commitments

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Payments due |

|

|

|

|

|

|

|

| ($ in thousands) |

|

Remainder

of 2018 |

|

|

2019 |

|

|

2020 |

|

|

2021 |

|

|

2022 |

|

|

Thereafter |

|

|

Total |

|

|

|

|

|

|

|

|

|

| Debt 1: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Repayment of principal |

|

|

8,055 |

|

|

|

7,725 |

|

|

|

3,865 |

|

|

|

2,526 |

|

|

|

324,092 |

|

|

|

- |

|

|

|

346,263 |

|

|

|

|

|

|

|

|

|

| Interest |

|

|

28,914 |

|

|

|

28,747 |

|

|

|

28,450 |

|

|

|

28,334 |

|

|

|

5,120 |

|

|

|

- |

|

|

|

119,565 |

|

|

|

|

|

|

|

|

|

| PER 2 |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

109,515 |

|

|

|

109,515 |

|

|

|

|

|

|

|

|

|

| Operating leases |

|

|

1,698 |

|

|

|

1,283 |

|

|

|

858 |

|

|

|

96 |

|

|

|

|

|

|

|

- |

|

|

|

3,935 |

|

|

|

|

|

|

|

|

|

| Capital expenditures 3 |

|

|

4,953 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

4,953 |

|

|

|

|

|

|

|

|

|

| Other expenditures

4 |

|

|

5,222 |

|

|

|

1,171 |

|

|

|

611 |

|

|

|

321 |

|

|

|

240 |

|

|

|

- |

|

|

|

7,565 |

|

| |

1 |

As at March 31, 2018, debt is comprised of senior secured notes, capital leases and secured equipment loans.

|

| |

2 |

Provision for environmental rehabilitation amounts presented in the table represents the expected cost of environmental

rehabilitation for Gibraltar Mine without considering the effect of discount or inflation rates. |

| |

3 |

Capital expenditure commitments include only those items where the Company has entered into binding commitments.

|

| |

4 |

Other expenditure commitments include the purchase of goods and services and exploration activities.

|

The Company has guaranteed 100% of certain capital lease and equipment loans entered into by the Gibraltar joint venture in which

it holds a 75% interest. As a result, the Company has guaranteed the joint venture partner’s 25% share of this debt which amounted to $8.0 million as at March 31, 2018.

14

TASEKO MINES LIMITED

Management’s Discussion and Analysis

SUMMARY OF QUARTERLY RESULTS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

2018 |

|

|

2017 |

|

|

2016 |

|

(Cdn$ in thousands,

except per share amounts) |

|

Q1 |

|

|

Q4 |

|

|

Q3 |

|

|

Q2 |

|

|

Q1 |

|

|

Q4 |

|

|

Q3 |

|

|

Q2 |

|

|

|

|

|

|

|

|

|

|

| Revenues |

|

|

64,179 |

|

|

|

95,408 |

|

|

|

78,508 |

|

|

|

99,994 |

|

|

|

104,389 |

|

|

|

94,628 |

|

|

|

55,964 |

|

|

|

55,090 |

|

|

|

|

|

|

|

|

|

|

| Net income (loss) |

|

|

(18,481) |

|

|

|

(7,600) |

|

|

|

20,136 |

|

|

|

5,247 |

|

|

|

16,479 |

|

|

|

5,113 |

|

|

|

(15,610) |

|

|

|

(19,384) |

|

|

|

|

|

|

|

|

|

|

| Basic EPS |

|

|

(0.08) |

|

|

|

(0.03) |

|

|

|

0.09 |

|

|

|

0.02 |

|

|

|

0.07 |

|

|

|

0.02 |

|

|

|

(0.07) |

|

|

|

(0.09) |

|

|

|

|

|

|

|

|

|

|

| Adjusted net income (loss) * |

|

|

(10,999) |

|

|

|

(1,544) |

|

|

|

13,405 |

|

|

|

14,305 |

|

|

|

15,254 |

|

|

|

16,404 |

|

|

|

(10,423) |

|

|

|

(19,758) |

|

|

|

|

|

|

|

|

|

|

| Adjusted basic EPS * |

|

|

(0.05) |

|

|

|

(0.01) |

|

|

|

0.06 |

|

|

|

0.06 |

|

|

|

0.07 |

|

|

|

0.07 |

|

|

|

(0.05) |

|

|

|

(0.09) |

|

|

|

|

|

|

|

|

|

|

| EBITDA * |

|

|

370 |

|

|

|

22,350 |

|

|

|

48,457 |

|

|

|

43,805 |

|

|

|

49,145 |

|

|

|

32,312 |

|

|

|

4,064 |

|

|

|

(7,858) |

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA * |

|

|

7,537 |

|

|

|

28,639 |

|

|

|

42,356 |

|

|

|

42,820 |

|

|

|

47,934 |

|

|

|

44,477 |

|

|

|

9,285 |

|

|

|

(7,642) |

|

|

| (US$ per pound, except where indicated) |

|

| |

|

|

|

|

|

|

|

|

| Realized copper price * |

|

|

2.98 |

|

|

|

3.30 |

|

|

|

3.00 |

|

|

|

2.61 |

|

|

|

2.72 |

|

|

|

2.54 |

|

|

|

2.15 |

|

|

|

2.13 |

|

|

|

|

|

|

|

|

|

|

| Total operating costs * |

|

|

2.33 |

|

|

|

2.11 |

|

|

|

1.18 |

|

|

|

1.31 |

|

|

|

1.33 |

|

|

|

1.48 |

|

|

|

1.89 |

|

|

|

2.07 |

|

|

|

|

|

|

|

|

|

|

| Copper sales (million pounds) |

|

|

17.1 |

|

|

|

24.0 |

|

|

|

22.6 |

|

|

|

30.5 |

|

|

|

30.6 |

|

|

|

30.3 |

|

|

|

22.4 |

|

|

|

22.8 |

|

*Non-GAAP

performance measure. See page 18 of this MD&A

Financial results for the last eight quarters reflect: volatile copper and molybdenum prices and

foreign exchange rates that impact realized sale prices; and variability in the quarterly sales volumes due to copper grades and timing of shipments which impacts revenue recognition.

CRITICAL ACCOUNTING POLICIES AND ESTIMATES

The Company’s significant accounting policies are presented in Note 2.4 of the 2017 annual consolidated financial statements and Note 2 of the

March 31, 2018 unaudited condensed consolidated interim financial statements. The preparation of the financial statements in conformity with IFRS requires management to make judgments, estimates and assumptions that affect the application of

accounting policies and the reported amounts of assets, liabilities, income and expenses. Actual results may differ from these estimates. Estimates and underlying assumptions are reviewed on an ongoing basis. Revisions to accounting estimates are

recognized in the period in which the estimates are revised and in any future periods affected.

In the process of applying the Company’s

accounting policies, significant areas where judgment is required include the determination of a joint arrangement, recovery of other deferred tax assets, insurance recoverable, and deferred revenue and finance expense determination.

Other significant areas of estimation include reserve and resource estimation and asset valuations; ore stock piles and finished inventory quantities;

plant and equipment lives; tax provisions; provisions for environmental rehabilitation; valuation of financial instruments and derivatives; deferred stripping costs and share-based compensation. Key estimates and assumptions made by management with

respect to these areas have been disclosed in the notes to these consolidated financial statements as appropriate.

The accuracy of reserve and

resource estimates is a function of the quantity and quality of available data and the assumptions made and judgment used in the engineering and geological interpretation, and may be subject to revision based on various factors. Changes in reserve

and resource estimates may impact the carrying value of

15

TASEKO MINES LIMITED

Management’s Discussion and Analysis

property, plant and equipment; the calculation of depreciation expense; the capitalization of stripping costs incurred during production; and the timing of cash flows related to the provision for

environmental rehabilitation.

Changes in forecast prices of commodities, exchange rates, production costs and recovery rates may change the

economic status of reserves and resources. Forecast prices of commodities, exchange rates, production costs and recovery rates, and discount rates assumptions, either individually or collectively, may impact the carrying value of derivative

financial instruments, inventories, property, plant and equipment, and intangibles, as well as the measurement of impairment charges or reversals.

INTERNAL AND DISCLOSURE CONTROLS OVER FINANCIAL REPORTING

The Company’s management is responsible for

establishing and maintaining adequate internal control over financial reporting and disclosure controls and procedures.

The Company’s internal

control system over financial reporting is designed to provide reasonable assurance to management and the Board of Directors regarding the preparation and fair presentation of published financial statements. Internal control over financial reporting

includes those policies and procedures that:

| (1) |

pertain to the maintenance of records that in reasonable detail accurately and fairly reflect the transactions and

dispositions of the assets of the Company; |

| (2) |

provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements

in accordance with IFRS, and that receipts and expenditures of the Company are being made only in accordance with authorizations of management and directors of the Company; and |

| (3) |

provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of

the Company’s assets that could have a material effect on the financial statements. |

The Company’s internal control

system over disclosure controls and procedures is designed to provide reasonable assurance that material information relating to the Company is made known to management and disclosed to others and information required to be disclosed by the Company

in its annual filings, interim filings or other reports filed or submitted by us under securities legislation is recorded, processed, summarized and reported within the time periods specified in the securities legislation.

All internal control systems, no matter how well designed, have inherent limitations. Therefore, even those systems determined effective can provide

only reasonable assurance with respect to financial reporting and disclosure.

There have been no changes in our internal controls over financial

reporting and disclosure controls and procedures during the period ended March 31, 2018 that have materially affected, or are reasonably likely to materially affect, internal control over financial reporting and disclosure.

RELATED PARTY TRANSACTIONS

Key management

personnel

Key management personnel include the members of the Board of Directors and executive officers of the Company.

The Company contributes to a post-employment defined contribution pension plan on the behalf of certain key management personnel. This retirement

compensation arrangement (“RCA Trust”) was established to provide

16

TASEKO MINES LIMITED

Management’s Discussion and Analysis

benefits to certain executive officers on or after retirement in recognition of their long service. Upon retirement, the participant is entitled to the distribution of the accumulated value of

the contributions under the RCA Trust. Obligations for contributions to the defined contribution pension plan are recognized as compensation expense in the periods during which services are rendered by the executive officers.

Certain executive officers are entitled to termination and change in control benefits. In the event of termination without cause, other than a change in

control, these executive officers are entitled to an amount ranging from9-months’ to 18-months’ salary. In the event of a change in control, if a termination

without cause or a resignation occurs within 12 months following the change of control, these executive officers are entitled to receive, among other things, an amount ranging from 24-months’ to 32-months’ salary and accrued bonus, and all stock options held by these individuals will fully vest.

Executive officers and directors also participate in the Company’s share-based option program (refer to Note 16 of the unaudited condensed

consolidated interim financial statements).

Compensation for key management personnel (including all members of the Board of Directors and

executive officers) is as follows:

|

|

|

|

|

|

|

|

|

| |

|

Three months ended March 31, |

|

| (Cdn$ in thousands) |

|

2018 |

|

|

2017 |

|

| Salaries and benefits |

|

|

2,987 |

|

|

|

2,664 |

|

|

|

|

| Post-employment benefits |

|

|

373 |

|

|

|

373 |

|

|

|

|

| Share-based compensation |

|

|

(1,157) |

|

|

|

3,220 |

|

| |

|

|

2,203 |

|

|

|

6,257 |

|

Other related parties

Three

directors of the Company are also principals of Hunter Dickinson Services Inc. (“HDSI”), a private company. HDSI invoices the Company for their executive services (director fees) and for other services provided by HDSI. For the three month

period ended March 31, 2018, the Company incurred total costs of $0.4 million (Q1 2017: $0.4 million) in transactions with HDSI. Of these, $0.1 million (Q1 2017: $0.2 million) related to administrative, legal, exploration and tax

services, $0.2 million related to reimbursements of office rent costs (Q1 2017: $0.2 million), and $0.1 million (Q1 2017: $0.1 million) related to director fees for two Taseko directors who are also principals of HDSI.

Under the terms of the joint venture operating agreement, the Gibraltar Joint Venture pays the Company a management fee for services rendered by the

Company as operator of the Gibraltar Mine. In addition, the Company pays certain expenses on behalf of the Gibraltar Joint Venture and invoices the Joint Venture for these expenses.

17

TASEKO MINES LIMITED

Management’s Discussion and Analysis

NON-GAAP PERFORMANCE MEASURES

This document includes certain non-GAAP performance measures that do not have a standardized meaning prescribed

by IFRS. These measures may differ from those used by, and may not be comparable to such measures as reported by, other issuers. The Company believes that these measures are commonly used by certain investors, in conjunction with conventional IFRS

measures, to enhance their understanding of the Company’s performance. These measures have been derived from the Company’s financial statements and applied on a consistent basis. The following tables below provide a reconciliation of these

non-GAAP measures to the most directly comparable IFRS measure.

Total operating costs and site operating costs, net of by-product credits

Total costs of sales include all costs absorbed into inventory, as well as transportation

costs and insurance recoverable. Site operating costs is calculated by removing net changes in inventory, depletion and amortization, insurance recoverable, and transportation costs from cost of sales. Site operating costs, net of by-product credits is calculated by removing by-product credits from the site operating costs. Site operating costs, net of by-product

credits per pound are calculated by dividing the aggregate of the applicable costs by copper pounds produced. Total operating costs per pound is the sum of site operating costs, net of by-product credits and off-property costs divided by the copper pounds produced. By-product credits are calculated based on actual sales of molybdenum (net of treatment costs) and silver during the

period divided by the total pounds of copper produced during the period. These measures are calculated on a consistent basis for the periods presented.

|

|

|

|

|

|

|

|

|

| |

|

Three months ended March 31, |

|

| (Cdn$ in thousands, unless otherwise indicated) – 75% basis |

|

2018 |

|

|

2017 |

|

| Cost of sales |

|

|

65,415 |

|

|

|

60,539 |

|

| Less: |

|

|

|

|

|

|

|

|

| Depletion and amortization |

|

|

(14,780) |

|

|

|

(9,577) |

|

| Insurance recoverable |

|

|

4,000 |

|

|

|

- |

|

| Net change in inventories of finished goods |

|

|

967 |

|

|

|

233 |

|

| Net change in inventories of ore stockpiles |

|

|

(3,896) |

|

|

|

1,172 |

|

| Transportation costs |

|

|

(2,829) |

|

|

|

(5,217) |

|

| Site operating costs |

|

|

48,877 |

|

|

|

47,150 |

|

| Less by-product credits: |

|

|

|

|

|

|

|

|

| Molybdenum, net of treatment costs |

|

|

(5,009) |

|

|

|

(5,807) |

|

| Silver, excluding amortization of deferred revenue |

|

|

(92) |

|

|

|

(449) |

|

| Site operating costs, net of by-product credits |

|

|

43,776 |

|

|

|

40,894 |

|

| Total copper produced (thousand pounds) |

|

|

17,145 |

|

|

|

30,943 |

|

| Total costs per pound produced |

|

|

2.55 |

|

|

|

1.32 |

|

| Average exchange rate for the period (CAD/USD) |

|

|

1.26 |

|

|

|

1.32 |

|

| Site operating costs, net of

by-product credits (US$ per pound) |

|

|

2.02 |

|

|

|

1.00 |

|

| Site operating costs, net of by-product credits |

|

|

43,776 |

|

|

|

40,894 |

|

| Add off-property costs: |

|

|

|

|

|

|

|

|

| Treatment and refining costs of copper concentrate |

|

|

3,954 |

|

|

|

8,456 |

|

| Transportation costs |

|

|

2,829 |

|

|

|

5,217 |

|

| Total operating costs |

|

|

50,559 |

|

|

|

54,567 |

|

| Total operating costs (C1) (US$ per pound) |

|

|

2.33 |

|

|

|

1.33 |

|

18

TASEKO MINES LIMITED

Management’s Discussion and Analysis

Adjusted net income (loss)

Adjusted net income (loss) remove the effect of the following transactions from net income as reported under IFRS:

| |

• |

|

Unrealized foreign currency gains/losses; |

| |

• |

|

Unrealized gain/loss on copper put options; and |

| |

• |

|

Gain/loss on copper call option. |

Management believes these transactions do not reflect the underlying operating performance of our core mining business and are not necessarily indicative

of future operating results. Furthermore, unrealized gains/losses on derivative instruments, changes in the fair value of financial instruments, and unrealized foreign currency gains/losses are not necessarily reflective of the underlying operating

results for the reporting periods presented.

|

|

|

|

|

|

|

|

|

| |

|

Three months ended March 31, |

|

| ($ in thousands, except per share amounts) |

|

2018 |

|

|

2017 |

|

| Net income (loss) |

|

|

(18,481) |

|

|

|

16,479 |

|

|

|

|

| Unrealized foreign exchange (gain) loss |

|

|

8,332 |

|

|

|

(2,677) |

|

|

|

|

| Unrealized (gain) loss on copper put options |

|

|

(1,165) |

|

|

|

52 |

|

|

|

|

| Loss on copper call option |

|

|

- |

|

|

|

1,414 |

|

|

|

|

| Estimated tax effect of adjustments

|

|

|

315 |

|

|

|

(14) |

|

| Adjusted net income (loss) |

|

|

(10,999) |

|

|

|

15,254 |

|

| Adjusted EPS |

|

|

(0.05) |

|

|

|

0.07 |

|

EBITDA and adjusted EBITDA

EBITDA represents net income before interest, income taxes, and depreciation. EBITDA is presented because it is an important supplemental measure of our

performance and is frequently used by securities analysts, investors and other interested parties in the evaluation of companies in the industry, many of which present EBITDA when reporting their results. Issuers of “high yield” securities

also present EBITDA because investors, analysts and rating agencies consider it useful in measuring the ability of those issuers to meet debt service obligations. The Company believes EBITDA is an appropriate supplemental measure of debt service

capacity, because cash expenditures on interest are, by definition, available to pay interest, and tax expense is inversely correlated to interest expense because tax expense goes down as deductible interest expense goes up; depreciation is a non-cash charge.

Adjusted EBITDA is presented as a further supplemental measure of the Company’s performance