SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2016

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________ to ____________

Commission file number 33-42125

Chugach Electric Association, Inc.

(Exact name of registrant as specified in its charter)

|

Alaska |

92-0014224 |

|

|

(State or other jurisdiction of |

(I.R.S. Employer |

|

|

incorporation or organization) |

Identification No.) |

|

|

|

||

|

5601 Electron Dr., Anchorage, Alaska |

99518 |

|

|

(Address of principal executive offices) |

(Zip Code) |

|

|

|

||

|

Registrant’s telephone number, including area code |

(907) 563-7494 |

|

|

|

||

|

Securities registered pursuant to Section 12(b) of the Act: |

||

|

Title of each class |

Name of each exchange on which registered |

|

|

N/A |

N/A |

|

|

|

||

|

Securities registered pursuant to Section 12(g) of the Act: |

||

|

N/A |

||

|

(Title of class) |

||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

☐ Yes ☒ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

☒ Yes ☐ No

Indicate by check mark whether registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

☐ Yes ☒ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

☒ Yes ☐ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Registration S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

Accelerated filer |

|||

|

Non-accelerated filer |

Smaller reporting company |

|||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

☐Yes ☒ No

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter. N/A

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the last practicable date. NONE

CHUGACH ELECTRIC ASSOCIATION, INC.

2016 Form 10-K Annual Report

Table of Contents

|

Page |

|||||

|

|

Item 1. |

2 |

|||

|

|

Item 1A. |

8 |

|||

|

|

Item 1B. |

14 |

|||

|

|

Item 2. |

14 |

|||

|

|

Item 3. |

22 |

|||

|

|

Item 4. |

22 |

|||

|

|

Item 5. |

23 |

|||

|

|

Item 6. |

23 |

|||

|

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

24 |

||

|

|

Item 7A. |

40 |

|||

|

|

Item 8. |

41 |

|||

|

|

Item 9. |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

85 |

||

|

|

Item 9A. |

85 |

|||

|

|

Item 9B. |

86 |

|||

|

|

Item 10. |

86 |

|||

|

|

Item 11. |

90 |

|||

|

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

96 |

||

|

|

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

96 |

||

|

|

Item 14. |

97 |

|||

|

|

Item 15. |

98 |

|||

|

|

110 |

||||

1

CAUTION REGARDING FORWARD-LOOKING STATEMENTS

Statements in this report that do not relate to historical facts, including statements relating to future plans, events or performance, are forward-looking statements that involve risks and uncertainties. Actual results, events or performance may differ materially. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date of this report and the accuracy of which is subject to inherent uncertainty. Chugach Electric Association, Inc. (Chugach) undertakes no obligation to publicly release any revisions to these forward-looking statements to reflect events or circumstances that may occur after the date of this report or the effect of those events or circumstances on any of the forward-looking statements contained in this report, except as required by law.

General

Chugach was organized as an Alaska electric cooperative in 1948. Cooperatives are business organizations that are owned by their members. As not-for-profit organizations (Internal Revenue Code 501(c)(12)), cooperatives are structured to provide services to their members at cost, in part by eliminating the need to produce profits or a return on equity other than for reasonable reserves and margins. Today, cooperatives in general operate throughout the United States in such diverse areas as utilities, agriculture, irrigation, insurance and credit. All cooperatives are based upon similar principles and legal foundations. Because members’ equity is not considered an investment, a cooperative’s objectives and policies are oriented to serving member interests, rather than maximizing return on investment.

Chugach makes its current and periodic reports available, free of charge, on its website at www.chugachelectric.com as soon as practicable after filing with the Securities and Exchange Commission (SEC). The information on Chugach’s website is not a part of this Annual Report on Form 10-K. Chugach’s website also provides a link to the SEC’s website at http://www.sec.gov.

Chugach is one of the largest electric utilities in Alaska. We are engaged in the generation, transmission and distribution of electricity in the Anchorage and upper Kenai Peninsula areas. Chugach is on an interconnected regional electrical system referred to as the Alaska Railbelt, a 400-mile-long area stretching from the coastline of the southern Kenai Peninsula to the interior of the state, including Alaska’s largest cities, Anchorage and Fairbanks. Neither Chugach nor any other electric utility in Alaska’s Railbelt has any connection to the electric grid of the continental United States or Canada. Our principal executive offices are located at 5601 Electron Drive, Anchorage, Alaska 99518. Our telephone number is (907) 563-7494.

Chugach is a rural electric cooperative that is exempt from federal income taxation as an organization described in Section 501(c)(12) of the Internal Revenue Code (Code). Chugach’s hydroelectric project is licensed by the Federal Energy Regulatory Commission (FERC). As such, Chugach is subject to FERC reporting requirements and our accounting records conform to the Uniform System of Accounts as prescribed by FERC. In lieu of state and local ad valorem, income and excise taxes, Alaska electric cooperatives must pay a gross revenue tax to the State of Alaska at the rate of $0.0005 per kilowatt-hour (kWh) of electricity sold in the retail market during the preceding year. This tax is collected monthly and remitted annually. In addition, we currently collect a regulatory cost charge (RCC) of $0.000675 per kWh of retail electricity sold. The RCC is

2

assessed to fund the operations of the Regulatory Commission of Alaska (RCA) and is collected monthly and remitted to the State of Alaska quarterly. We also collect sales tax on retail electricity sold to consumers in Whittier, seasonally (April through September), and in the Kenai Peninsula Borough, monthly. This tax is remitted to the City of Whittier monthly and to the Kenai Peninsula Borough quarterly. These taxes are a direct pass-through to consumer bills and therefore do not impact our margins.

We had 288 employees as of March 3, 2017. Approximately 70% of our employees are members of the International Brotherhood of Electrical Workers (IBEW). Chugach has three Collective Bargaining Unit Agreements (CBA) with the IBEW. We also have an agreement with the Hotel Employees and Restaurant Employees (HERE). All three IBEW CBA have been renewed through June 30, 2021. The three CBA provide for wage and pension contribution increases in all years and include health and welfare premium cost sharing provisions. The HERE contract was renewed through June 30, 2021, and provides for wage, pension contribution, and health and welfare contribution increases in all years. We believe our relationship with our employees is good.

Our members are the consumers of the electricity sold by us. As of December 31, 2016, we had one wholesale customer, 68,215 retail members, and 83,855 service locations, including idle services. No individual retail customer accounts for more than ten percent of our revenue. Our customers’ requirements for capacity and energy generally peak in fall and winter as home heating and lighting needs rise and then decline in the spring and summer as the weather becomes milder and daylight hours increase.

We supply power to the City of Seward (Seward) as a wholesale customer, and provided most of the power requirements of Matanuska Electric Association, Inc. (MEA) through the expiration of their contract on April 30, 2015. Through March 31, 2015, we sold economy (non-firm) energy to Golden Valley Electric Association, Inc. (GVEA), which used that energy to serve its own load.

Our customers are billed on a monthly basis per a tariffed rate for electrical power consumed during the preceding period. Billing rates are approved by the RCA, see “Item 1 – Business – Rate Regulation and Rates.” Base rates (derived on the basis of historic cost of service including margins) are established to generate revenues in excess of current period costs in any year and such excess is designated on our Consolidated Statements of Operations and Changes in Equities and Margins as “assignable margins.” Retained assignable margins are designated on our balance sheet as “patronage capital” that is assigned to each member on the basis of patronage. Patronage capital is held for the account of the members without interest and returned when the Chugach Board of Directors deems it appropriate to do so.

In 2016, we had 531.2 megawatts (MW) of installed generating capacity (rated capacity) provided by 16 generating units at our five owned power plants: Beluga Power Plant, International Station Power Plant (historically known as “IGT”), Cooper Lake Hydroelectric Project, Southcentral Power Project (SPP), in which we own a 70% interest, and Eklutna Hydroelectric Project, in which we own a 30% interest. Of the 531.2 MW of installed generating capacity, approximately 87% was fueled by natural gas. The rest of our owned generating resources were hydroelectric facilities. In 2016, 77% of Chugach’s power, including purchased power, was generated from gas. Of that gas-fired generation, 88% took place at SPP and 9% took place at Beluga. The SPP furnishes up to 200.2 MW of capacity; Chugach owns 70% of this plant’s output and Anchorage Municipal Light & Power (ML&P) owns the remaining 30%. The Bradley Lake Hydroelectric Project, which is not owned by Chugach, provides up to 27.4 MW, as currently operated, for our retail customers and up

3

to 0.9 MW for our remaining wholesale customer. For more information concerning Bradley Lake, see “Item 2 – Properties – Other Property – Bradley Lake.” In addition, we purchase up to 17.6 MW from Fire Island Wind, LLC (FIW), annually. We operate 1,719 miles of distribution line and 434 miles of transmission line, which includes Chugach’s share of the Eklutna transmission line. For the year ended December 31, 2016, we sold 1.2 billion kWh of electrical power.

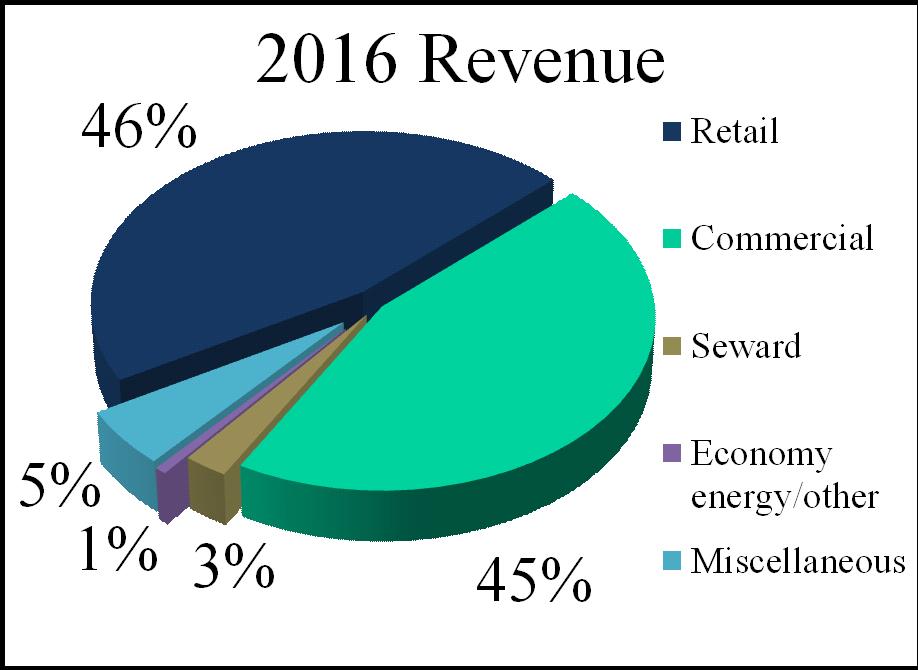

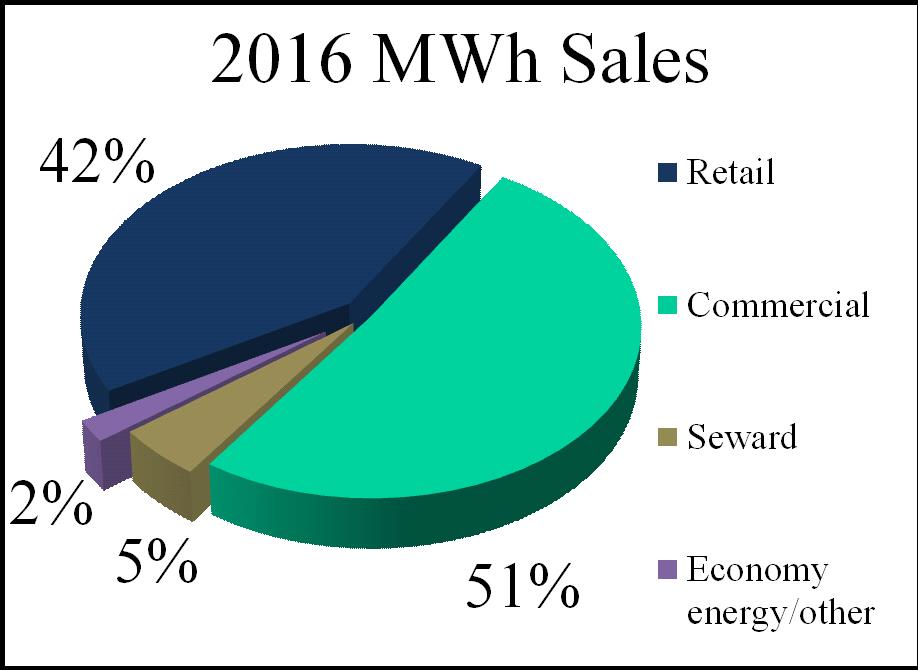

Customer Revenue from Sales

|

|

|

|

Economy energy/other includes sales to GVEA, MEA and ML&P.

Retail Service Territory

Our retail service area covers most of Anchorage, excluding downtown Anchorage, as well as remote mountain areas and villages. The service area ranges from the northern Kenai Peninsula westward to Tyonek, including Fire Island, and eastward to Whittier.

Retail Customers

As of December 31, 2016, we had 68,215 members receiving power from 83,855 services, including idle services (some members are served by more than one service). Our customers are a mix of urban and suburban. The urban nature of our customer base means that we have a relatively high customer density per line mile. Higher customer density means that fixed costs can be spread over a greater number of customers. As a result of lower average costs attributable to each customer, we benefit from a greater stability in revenue, as compared to a less dense distribution system in which each individual customer would have a more significant impact on operating results. For the past five years no retail customer accounted for more than ten percent of our revenues. The revenue contributed by retail customers for the years ended December 31, 2016, 2015 and 2014 is discussed in “Item 7 – Management’s Discussion and Analysis of Financial Condition and Results of Operations – Year ended December 31, 2016, compared to the year ended December 31, 2015, and the year ended December 31, 2015, compared to the year ended December 31, 2014 – Revenues.”

Wholesale Customers

We are the principal supplier of power to Seward under a wholesale power contract. We were the principal supplier of power to MEA through April 30, 2015. Our wholesale power contracts, including the fuel and purchased power components, contributed $4.9 million, $30.9 million, and $75.5 million in revenues for the years ended December 31, 2016, 2015 and 2014, respectively.

4

MEA

We had a power sales contract with MEA, which was in effect through December 31, 2014. In 2004, pursuant to terms of this contract, MEA communicated to Chugach that MEA did not desire to renew, extend or modify the agreement. MEA indicated it would follow the path its membership most favored and move forward with plans to build its own generation plant.

On August 12, 2014, MEA notified Chugach that their newly constructed power plant, the Eklutna Generation Station (EGS), would not be completed by January 1, 2015. On September 30, 2014, Chugach entered into an Interim Power Sales Agreement to provide MEA with all demand and energy requirements on a firm basis based on existing tariff rates for a minimum one quarter period beginning on January 1, 2015, and ending on March 31, 2015.

On December 22, 2014, Chugach entered into a Dispatch Services Agreement with MEA to provide electric and natural gas dispatch services for EGS, electric dispatch services for MEA’s share of the Bradley Lake Hydroelectric Project and electric dispatch coordination services for MEA’s share of the Eklutna Hydroelectric Project effective on or about April 1, 2015. The Dispatch Services Agreement was in effect through March 31, 2016.

On March 31, 2015, Chugach entered into a Memorandum of Understanding (MOU) with MEA to extend the Interim Power Sales Agreement for one month while MEA continued to prepare its EGS and supervisory control and data acquisition (SCADA) system for commercial operation. This MOU also delayed the implementation of the Dispatch Services Agreement to May 1, 2015. The Interim Power Sales Agreement with MEA expired on April 30, 2015. Wholesale power sales to MEA represented approximately 0%, 17%, and 33% of Chugach’s total energy sales for the years ended December 31, 2016, 2015, and 2014, respectively.

In an agreement reached in May of 2014 with MEA, capital credits retired to MEA are classified as patronage capital payable on Chugach’s Balance Sheet. MEA’s patronage capital payable was $4.1 million and $3.2 million at December 31, 2016, and 2015, respectively.

Seward

We currently provide nearly all the power needs of the City of Seward. Sales to Seward represented approximately 5%, 4%, and 3% of Chugach’s total energy sales for the years ended December 31, 2016, 2015, and 2014, respectively. We entered into the 2006 Agreement for the Sale and Purchase of Electric Power and Energy between Chugach Electric Association, Inc. and the City of Seward (2006 Agreement), effective June 1, 2006. The 2006 Agreement contains an evergreen clause providing for an automatic five-year extension unless written notice is provided at least one year prior to the expiration date. Neither Chugach nor Seward provided written notice to terminate as both utilities desired to extend the term of the agreement.

On June 2, 2016, Chugach submitted an updated listing of its special contracts to reflect the extension of the expiration date of the 2006 Agreement from December 31, 2016, to December 31, 2021. On July 18, 2016, the RCA approved the filing.

5

The 2006 Agreement is an interruptible, all-requirements/no generation capacity reserves contract. It has many of the attributes of firm service, especially in the requirement that so long as Chugach has sufficient power available, it must meet Seward’s needs for power. However, service is interruptible because Chugach is under no obligation to supply or plan for generation capacity reserves to supply Seward and there is no limit on the number of times or hours per year that the supply can be interrupted. Counterbalancing this is the requirement that Chugach must provide power to Seward if Chugach has the power available after first meeting its obligations to its retail customers for whom Chugach has an obligation to provide reserves. The price under the 2006 Agreement reflects the reduced level of service because no costs of generation in excess of that needed to meet the system peak is assigned to Seward.

Economy Customers

Periodically, Chugach sells available generation, in excess of its own needs, to other electric utilities. Sales are made under the terms and conditions of Chugach’s economy energy sales tariff. The price includes the cost of fuel, variable operations and maintenance expense, wheeling charges and a margin.

From 1989 through March 31, 2015, we sold, under contract, economy (non-firm) energy to GVEA, which used that energy to serve its own loads. During 2016, we continued to make non-firm, economy energy sales to GVEA on an as needed basis. Non-firm sales to GVEA were 25,000 MWh, 96,259 MWh and 358,988 MWh for 2016, 2015, and 2014, respectively.

Rate Regulation and Rates

The RCA regulates our rates. We seek changes in our base rates by submitting Simplified Rate Filings (SRF) or through general rate cases filed with the RCA on an as-needed basis. Chugach’s base rates, whether set under a general rate case or a SRF, are established to allow the continued recovery of our specific costs of providing electric service. In each rate filing, rates are set at levels to recover all of our specific allowable costs and those rates are then collected from our retail and wholesale customers.

Alaska Statute 42.05.175 requires the RCA to issue a final order no later than 15 months after a complete tariff filing is made for a tariff filing that changes a utility’s revenue requirement or rate design. It is within the RCA’s authority to authorize, after a notice period, rate changes on an interim, refundable basis. In addition, the RCA has been willing to open limited reviews of matters to resolve specific issues from which expeditious decisions can often be rendered.

The RCA has exclusive regulatory control of our retail and wholesale rates, subject to appeal to the Alaska courts. The regulatory environment in Alaska requires cooperatives to use a debt service coverage approach to ratemaking. Times Interest Earned Ratio (TIER) is designed to ensure Chugach maintains a coverage ratio that allows Chugach to remain in compliance with its debt covenants. Under Alaska law, financial covenants of an Alaskan electric cooperative contained in a debt instrument will be valid and enforceable, and rates set by the RCA must be adequate to meet those covenants. Under Alaska law, a cooperative utility that is negotiating to enter into a mortgage or other debt instrument that provides for a TIER greater than the ratio the RCA most recently approved for that cooperative must submit the mortgage or debt instrument to the RCA before the instrument takes effect. The rate covenants contained in the instruments governing our outstanding long-term indebtedness do not impose any greater TIER requirement than those previously approved by the RCA.

6

We expect to continue to recover changes in our fuel and purchased power expenses through routine quarterly filings with the RCA, see “Item 7 – Management’s Discussion and Analysis of Financial Condition and Results of Operations - Results of Operations – Overview – Rate Regulation and Rates – Fuel and Purchased Power Recovery.”

The Second Amended and Restated Indenture of Trust (the Indenture), which became effective January 20, 2011, governs all of our outstanding bonds and requires us to set rates expected to yield margins for interest equal to at least 1.10 times total interest expense. The Second Amended and Restated Master Loan Agreement with CoBank, ACB (CoBank) which became effective June 30, 2016, also requires Chugach to establish and collect rates reasonably expected to yield margins for interest equal to at least 1.10 times total interest expense. The Credit Agreement with National Rural Utilities Cooperative Finance Corporation (NRUCFC), KeyBank National Association, Bank of America, N.A., and CoBank, which governs the unsecured credit facility Chugach may use to meet its obligations under its commercial paper program, also requires Chugach to maintain a minimum margins for interest of at least 1.10 times interest charges for each fiscal year.

For the years ended December 31, 2016, 2015 and 2014, our Margins for Interest/Interest (MFI/I) was 1.27, 1.29, and 1.28, respectively. For the same periods, our TIER was 1.27, 1.30, and 1.29, respectively.

Our Service Areas and Local Economy

Our service areas and the service area of our wholesale customer reside within the Alaska Railbelt region of Alaska which is linked by the Alaska Railroad.

Anchorage is located in the Southcentral region of Alaska and is the trade, service, medical and financial center for most of Alaska and serves as a major center for many state governmental functions. Other significant contributing factors to the Anchorage economy include a large federal government and military presence, tourism, medical, financial and educational facilities, air and rail transportation facilities and headquarters support for the petroleum, mining and other basic industries located elsewhere in the state.

Seward is a city located at the head of Resurrection Bay on the Kenai Peninsula. Seward, which is approximately 127 miles south of Anchorage, is a major fisheries port and also serves as the ocean terminus of the Alaska Railroad. Seward’s other major industry is tourism.

Sales Forecasts

The following table sets forth our projected sales forecasts for the next five years:

|

|

||||||||||

|

Sales (MWh) |

2017 |

2018 |

2019 |

2020 |

2021 |

|||||

|

Retail |

1,093,147 | 1,082,901 | 1,072,072 | 1,061,351 | 1,064,005 | |||||

|

Wholesale |

58,259 | 58,889 | 58,300 | 57,717 | 57,861 | |||||

|

Total |

1,151,406 | 1,141,790 | 1,130,372 | 1,119,068 | 1,121,866 |

Energy sales are expected to slightly decline due to slow economic growth and progress in energy efficiency and conservation from 2017 to 2020. These projections are based on assumptions that management believes to be reasonable as of the date the projections were made. The occurrence of a significant change in any of the assumptions could affect a change in the projected sales forecast.

7

Chugach’s consolidated financial results will be impacted by weather, the economy of our service territory, fuel availability and prices, and the decisions of regulatory agencies. Our creditworthiness will be affected by national and international monetary trends, general market conditions and the expectations of the investment community, all of which are largely beyond our control. In addition, the following statements highlight risk factors that, in the view of management, may significantly affect our consolidated financial condition, results of operations and cash flows. This discussion is not exhaustive. You may view risks differently than we do, or there may be other risks and uncertainties which you consider important which are not discussed. These risks, whether discussed below or those unknown, could negatively affect our business operations and financial condition. The statements below must be read together with factors discussed elsewhere in this document and in our other filings with the SEC.

Financing

On June 13, 2016, Chugach replaced the $100 million unsecured Credit Agreement, amended and extended on June 29, 2012, and due to expire on November 17, 2016. The new Credit Agreement is a $150 million senior unsecured credit facility under which Chugach may borrow funds necessary for general corporate purposes, to issue standby letters of credit or to pay amounts due under short-term promissory notes (commercial paper) issued by Chugach, in the event of a disruption in the commercial paper markets. The new Credit Agreement is due to expire on June 13, 2021.

On June 30, 2016, Chugach entered into the Second Amended and Restated Master Loan Agreement with respect to a $45.6 million term loan with CoBank, ACB, due April 30, 2031. This agreement was entered into for the purpose of repaying outstanding commercial paper used to finance Chugach’s investment in the Beluga River Unit. The term loan bears an interest rate of 2.58% per annum. Interest and principal is paid quarterly and commenced on July 20, 2016.

On July 13, 2016, Chugach used commercial paper to pay down the outstanding balance on its 2011 CoBank Note. Chugach is expected to continue to issue commercial paper in 2017, as needed. For additional information concerning our Commercial Paper Program, see “Item 8 – Financial Statements and Supplementary Data – Note 11 – Debt – Commercial Paper.”

No assurance can be given that Chugach will be able to continue to access the commercial paper market. If Chugach were unable to access that market, the Credit Agreement would effectively replace Chugach’s commercial paper program. Global financial markets and economic conditions have been volatile due to a variety of factors. As a result, the cost of raising money in the debt capital markets could increase while the availability of funds from those markets could diminish.

Credit Ratings

Changes in our credit ratings could affect our ability to access capital. We maintain a rating from Standard & Poor's Rating Services (S&P) and Fitch Ratings (Fitch) of "A-" (Stable) and "A" (Stable), respectively. S&P and Moody's currently rate our commercial paper at "A-1" and "P-2", respectively. If these agencies were to downgrade our ratings, particularly below investment grade, our commercial paper rates could increase immediately and we may be required to pay higher interest rates on financings which we need to undertake in the future. Additionally our potential pool of investors and funding sources could decrease.

8

War, acts and threats of terrorism, sabotage, cyber security breach, natural disaster, and other significant events could adversely affect our operations

We cannot predict the impact that any future terrorist attacks, sabotage, or natural disaster may have on the energy industry in general, or on our business in particular. Any such event may affect our operations in unpredictable ways, such as changes in insurance markets. Furthermore, electric generation, transmission and distribution facilities could be direct targets of, or indirect casualties of, an act of terror, sabotage, or cyber security breach. Chugach has not experienced any disruptions or significant costs associated with intentional attacks or unauthorized access to any of our systems. While Chugach has numerous programs in place to safeguard our operating systems and the personal information of our customers and employees, the physical or cyber security compromise of our facilities could adversely affect our ability to manage our facilities effectively.

Pension Plans

We participate in the Alaska Electrical Pension Fund (AEPF). The AEPF is a multiemployer pension plan to which we make fixed, per employee contributions through our collective bargaining agreement with the IBEW, which covers our IBEW-represented workforce. We do not have control over the AEPF. Chugach receives information concerning its funding status annually. There is no contingent liability at this time. If a funding shortfall in the AEPF exists, we may incur a contingent withdrawal liability.

We also participate in the National Rural Electric Cooperative Association (NRECA) Retirement Security Plan (RS Plan), a multi-employer defined benefit master pension plan maintained and administered by the NRECA for the benefit of its members and their employees. All employees not covered by a union agreement become participants in the RS Plan. We do not have control over the RS Plan. The RS Plan updates contribution rates on an annual basis to maintain the health of the plan under the plans rules allowed by the Employee Retirement Income Security Act (ERISA). The RS Plan’s funding status is governed by plan rules as provided by ERISA. Chugach receives information concerning its funding status biannually. The RS Plan is not subject to the Pension Protection Act of 2006 under a permanent exemption from Congress as of December 16, 2014.

On December 14, 2016 the Chugach Board of Directors approved a prepayment of $7.9 million to the NRECA Retirement Security plan. Using the low interest rate environment, this prepayment will mitigate the impact of future contribution increases and will lower annual budgetary impacts of current contributions over an eleven year term.

Equipment Failures and Other External Factors

The generation and transmission of electricity requires the use of expensive and complex equipment. While we have maintenance programs for existing equipment, along with a contractual service plan in place for SPP, generating plants are subject to unplanned outages because of equipment failure or environmental disasters. In the event of unplanned outages, we must acquire power, which is not otherwise available from the fleet of Chugach generators, from other sources at unpredictable costs in order to supply our customers and comply with our contractual agreements. The fuel and purchased power rate adjustment process allows Chugach to recover current purchased power costs and to recover under-recoveries or refund over-recoveries with a three-month lag. If Chugach were to materially under-recover purchased power costs due to an unplanned outage, we would normally seek an increase in the rate adjustment to recover those costs at the time of the next

9

quarterly fuel and purchased power rate adjustment filing. As a result, cash flows may be impacted due to the lag in payments for purchased power costs and the corresponding collection of those costs from customers. To the extent the regulatory process does not provide for the timely recovery of purchased power costs, Chugach could experience a material negative impact on its cash flows. Chugach has line of credit and commercial paper borrowing capacity to mitigate this risk.

Fuel Supply

In 2016, 77% of our power was generated from natural gas. Our primary sources of natural gas in 2016 were Hilcorp ConocPhillips, ML&P, and Chugach’s 10% share of the Beluga River Unit. Chugach currently has gas contracts in place to fill up to 100% of Chugach’s needs through March 31, 2023. Chugach also has agreements with Cook Inlet Energy (CIE), AIX Energy, LLC, and ML&P which provide a structure to purchase supplemental gas, adding diversity in Chugach’s sources of natural gas to meet system load requirements.

On April 21, 2016, the RCA approved the acquisition of the Beluga River Unit effective January 1, 2016, as discussed in “Item 8 - Financial Statements and Supplementary Data – Note 5 – Regulatory Matters – Beluga River Unit and Note 15 – Beluga River Unit.” The acquisition complements existing gas supplies and is expected to provide greater fuel diversity at an effective annual cost that is $2 million to $3 million less than alternative sources of gas in the Cook Inlet region.

The acquisition is expected to provide gas to meet Chugach’s on-going generation requirements over an approximate 18-year period. Gas associated with the acquisition is expected to provide about 15% of Chugach’s gas requirements through 2033, although actual gas quantities produced are expected to vary on a year-by-year basis.

The State of Alaska’s Department of Natural Resources (DNR) published a study in September of 2015, “Updated Engineering Evaluation of Remaining Cook Inlet Gas Reserves,” to provide an estimate of Cook Inlet’s gas supply. The study estimated there are 1,183 Bcf of proved and probable reserves remaining in Cook Inlet’s legacy fields. This is higher than the 2009 DNR study estimate of 1,142 Bcf. Effectively, Cook Inlet gas supply has slightly increased from 2009. The 2015 DNR estimate does not include reserves from a large gas field under development by Furie Operating Alaska, LLC (Furie) and another considered for development by BlueCrest Energy, Inc. Furie has constructed an offshore gas production platform and has achieved production. The platform and other production facilities are designed for up to 200 million cubic feet (MMcf) per day. Other gas producers are actively developing gas supplies in the Cook Inlet. Chugach is encouraged with these developments but continues to explore other alternatives to diversify its portfolio.

The Alaska Gasline Development Corporation (AGDC) is investigating a project to deliver North Slope gas to Southcentral Alaska for export. AGDC expects to complete the FERC license application and assess gas markets by mid-2018. The gas pipeline is expected to include off-take points to allow for the opportunity for future in-state deliveries of natural gas. If the project moves forward, the pipeline is expected to be completed in the mid 2020’s.

10

Cook Inlet Natural Gas Storage Alaska (CINGSA) began service April 1, 2012. The facility ensures local utilities, including Chugach, have gas available to meet deliverability requirements during peak periods and store gas during low demand periods. The RCA approved inception rates and a tariff for the CINGSA facility on January 31, 2011, and a Firm Storage Service (FSS) Agreement between the seller and Chugach in July of 2011. Injections into the facility began in 2012. Chugach's share of the capacity was 1.7 Bcf in 2016. Chugach is entitled to withdraw gas at a rate of up to 35 million cubic feet (MMcf) per day.

Recovery of Fuel and Purchased Power Costs

The RCA approved inclusion of all fuel and transportation costs related to our current contracts in the calculation of Chugach’s fuel and purchased power adjustment process which will ensure, in advance, that costs incurred under the contracts can be recovered from Chugach’s customers. The fuel and purchased power adjustment process collects under-recoveries and refunds over-recoveries from prior periods with minimal regulatory lag. Chugach's fuel and purchased power adjustment process includes quarterly filings with the RCA, which set the rates on projected costs, sales and system operations for the quarter. Any under- or over-recovery of costs is incorporated into the following quarterly filing. Chugach over-recovered $3.8 million and $5.1 million at December 31, 2016, and 2015, respectively. To the extent the regulated fuel and purchased power adjustment process does not provide for the timely recovery of costs, Chugach could experience a material negative impact on its cash flows. Chugach has line of credit and commercial paper borrowing capacity to mitigate this risk.

Regulatory

Chugach’s billing rates are approved by the RCA. Chugach filed its June 2014 General Rate Case on February 13, 2015, to reflect revenue and cost changes resulting from the April 30, 2015, expiration of the 2015 Interim Power Sales Agreement between MEA and Chugach. Chugach requested a system base rate increase of approximately $21.3 million on total base rate revenues. The RCA issued Order U-15-081(1) on April 30, 2015, suspending the filing and granting Chugach’s request for interim and refundable rate increases effective May 1, 2015. On May 2, 2016, the RCA issued Order U-15-081(8) accepting a stipulation between Chugach and the Attorney General (AG). On May 20, 2016, Chugach submitted updated revenue requirement, cost of service and tariffs reflecting the results of the stipulation, with proposed final rates effective July 5, 2016, which were subsequently approved by the RCA.

On June 27, 2016, the RCA issued Order U-15-081(11) resolving the outstanding issues related to transmission and ancillary services. On July 15, 2016, Chugach submitted updated tariff sheets and supporting exhibits for the calculation of transmission and ancillary service rates. On August 23, 2016, the RCA approved final rates contained in Chugach’s July 15, 2016, compliance filing. A final order closing the docket was issued on October 6, 2016. See “Item 8 – Financial Statements and Supplementary Data – Note 5 – Regulatory Matters – June 2014 Test Year General Rate Case.”

On July 1, 2016, Chugach returned to the SRF process filing its first energy and demand rate adjustment, with rates effective August 15, 2016. This filing was subsequently approved by the RCA on August 12, 2016. Chugach submitted its June 2016 and September 2016 test year SRFs with the RCA on August 29, 2016, and December 1, 2016, respectively, as informational filings with no changes to the demand and energy rates. See “Item 8 - Financial Statements and Supplementary Data – Note 5 – Regulatory Matters – Simplified Rate Filings.”

11

To the extent the RCA does not allow for the recovery of our costs associated with our current or anticipated rate cases, Chugach could experience a material negative impact on its results of operations, financial position and cash flows.

Accounting Standards or Practices

We cannot predict the impact that future changes in accounting standards or practices may have on public companies in general, the energy industry or our operations specifically. New accounting standards could be issued that could change the way we record revenues, expenses, assets and liabilities. These changes in accounting standards could adversely affect our reported earnings or could increase reported liabilities.

Green House Gas Regulations, Carbon Emission and Climate Change

Uncertainty remains regarding the impacts of potential regulations regarding greenhouse gases (GHG), carbon emissions, and climate change on Chugach’s operations. The United States Environmental Protection Agency (EPA) is moving forward with regulations that seek to limit carbon emissions in the United States. Power plants are the single largest source of carbon emissions in the United States. On August 3, 2015, the EPA released the final 111(d) regulation aimed at reducing emissions of carbon dioxide (CO2) from existing power plants. Alaska is not bound by the 111(d) regulation, however Alaska may be required to comply at some future date. On February 9, 2016 the U.S. Supreme Court issued a stay on the proposed EPA 111(d) regulations until the DC Circuit decides the case, or until the disposition of a petition to the Supreme Court on the issue. On September 27, 2016, the US Court of Appeals for the District of Columbia Circuit heard oral arguments challenging the legality of the Clean Power Plan. The court is expected to issue a decision in the near future. The EPA 111(d) regulation, in its current form, is not expected to have a material effect on Chugach’s financial condition, results of operations, or cash flows.

Additional costs related to a GHG tax or cap and trade program, if enacted by Congress, or other regulatory action, could affect the relative cost of the energy Chugach produces. While Chugach cannot predict the implementation of any additional new law or regulation, or the limitations thereof, it is possible that new laws or regulations could increase capital and operating costs. Chugach has obtained or applied for all Clean Air Act permits currently required for the operation of generating facilities.

Other Environmental Regulations

Since January 1, 2007, transformer manufacturers have been required to meet the United States Department of Energy (DOE) efficiency levels as defined by the Energy Act of 2005 (Energy Act) for all “Distribution Transformers.” As of January 1, 2016, the specific efficiency levels are increasing from the original “TP1” levels to the new “DOE-2016” levels. All new transformers are DOE-2016 compliant. At this time a small increase in capital costs is anticipated along with a reduction in energy losses.

Chugach is currently required to comply with numerous federal, state and local laws and regulations relating to the protection of the environment. While we believe Chugach has obtained all material environmental-related approvals currently required to own and operate our facilities, Chugach may incur significant additional costs because of compliance with these requirements in addition to costs related to any costs of compliance with laws or regulations relating to GHG or carbon emissions. Failure to comply with environmental laws and regulations could have a material effect on

12

Chugach, including potential civil or criminal liability and the imposition of fines or expenditures of funds to bring our facilities into compliance. Delay in obtaining, or failure to obtain and maintain in effect any environmental approvals, or the delay or failure to satisfy any applicable environmental regulatory requirements related to the operation of our existing facilities could result in significant additional costs to Chugach and a material adverse impact to Chugach’s results of operations, financial condition, and cash flows.

Aging Plant

Many of our facilities were constructed over 30 years ago and, as a result, may require significant capital expenditures to maintain efficiency and reliability. As plant equipment ages, the potential for operational issues such as unscheduled outages increases which could negatively impact our cost of electric service. With the addition of the SPP generating facility which began operation in 2013, we are able to significantly reduce the reliance on some of the older facilities. The older units are used for peaking, and, in the future, may be primarily used as a reserve. Mitigating the aging risk is Chugach’s experienced work force, extensive maintenance program, and predictive maintenance measures. Also mitigating the risk of significant unanticipated capital expenditures associated with generation maintenance is a long-term service agreement smoothing major maintenance costs for our largest power producer, SPP. Additionally, we are working to establish the Power Pooling and Joint Dispatch Agreement which will allow us to buy power from other utilities if it is more efficient and economical than generating it on our own.

Distributed Generation

Distributed generation technologies, such as combined heat and power, solar cells, micro turbines, fuel cells, batteries, and wind turbines currently exist or are in development. Significant technological advancements or positive perceptions regarding the environmentally friendly benefits of self-generation and distributed energy technologies could lead to the adoption of these technologies by our members. Increased adoption of these technologies could reduce demand for electricity and the pool of customers from whom we recover fixed costs. This could have a negative impact on our business, financial condition, or cost of electric service.

Constraints on Transmission

We currently experience occasional constraints on our transmission system and those of other utilities used to transmit energy from our remote generators to loads due to periodic maintenance activities, equipment failures and other system conditions. We manage these constraints using alternative generation dispatch and energy purchasing patterns. The long-term solution for reducing transmission constraints can include purchasing additional wheeling service from other utilities, or construction of additional transmission lines which would require significant capital expenditures.

Construction of new transmission lines presents numerous challenges. Environmental and state and local permitting processes can result in significant inefficiencies and delays in construction. These issues are unavoidable and are addressed through long-term planning. We typically begin planning new transmission at least 10 years in advance of the need and foster and participate in regional and interregional transmission planning and cost allocation discussions with neighboring transmission providers. In the event that we are unable to complete construction of planned transmission expansion, we must rely on purchases of electric power, which could put increased pressure on electric rates.

13

Counterparties

We rely on other entities in the production of power and supply of fuel and therefore, we are exposed to the risk that these counterparties may default in performance of their obligations to us. As a 70% owner in SPP, a 30% owner in the Eklutna Hydroelectric Project, and a 10% owner in the Beluga River Unit (BRU), we rely upon the other owners to fulfill their contractual and financial obligations. Additionally we rely on numerous other entities with whom we have purchased power agreements. Failure of our counterparties to perform their obligations could increase the cost of electric service we provide to our members as we, for example, may be forced to enter into alternative contractual arrangements or purchase energy or natural gas at prices that may exceed the prices previously agreed upon with the defaulting counterparty.

Legal Proceedings

Chugach has certain litigation matters and pending claims that arise in the ordinary course of business as discussed under “Item 3 – Legal Proceedings.” We cannot predict the outcome of any current or future legal proceedings. Our business, financial condition, and results of operations could be materially adversely affected by unfavorable resolution or adverse results of legal matters.

These factors, as well as weather, interest rates and economic conditions are largely beyond our control, but may have a material adverse effect on our earnings, cash flows and financial position.

Item 1B – Unresolved Staff Comments

None

General

As of December 31, 2016, we had 531.2 MW of installed capacity consisting of 16 generating units at five power plants. These included 332.0 MW of operating capacity at the Beluga facility on the west side of Cook Inlet; 140.1 MW at SPP in Anchorage, which we jointly own with ML&P; 28.2 MW at IGT in Anchorage; and 19.2 MW at the Cooper Lake facility, which is on the Kenai Peninsula. We also own rights to 11.7 MW of capacity from the two Eklutna Hydroelectric Project generating units that we jointly own with MEA and ML&P.

In addition to our own generation, we purchased power from the 120 MW Bradley Lake Hydroelectric Project, which is owned by the Alaska Energy Authority (AEA), operated by Homer Electric Association, Inc. (HEA) and dispatched by Chugach, and MEA’s newly constructed 171 MW EGS, which is also dispatched by Chugach. In 2016, we also purchased power from FIW.

The Beluga, IGT and SPP facilities are all fueled by natural gas. We own our offices and headquarters, located adjacent to IGT and SPP in Anchorage. We also lease warehouse space for some generation, transmission and distribution inventory (including a small amount of office space).

14

Generation Assets

We own the land and improvements comprising our generating facilities at Beluga, IGT and SPP. Our principal generation assets are in two plants, Beluga and SPP. With SPP in operation, the Beluga units are used for peaking, ad, in the future, may be primarily used as reserve. While the Beluga turbine-generators have been in service for many years, they have been maintained in good working order with scheduled inspections and periodic upgrades. All Beluga units have been inspected annually with combustion and hot gas path parts replaced according to their condition or as recommended by the manufacturer. Units 6 and 7, the largest Beluga units, are approaching their recommended major inspection intervals based on fired hours. Units 3 and 5 are most often run for peak demand and are being considered for major parts replacements and generator inspections over the next three years.

On February 1, 2013, SPP began commercial operation, contributing 200.2 MW of capacity provided by 4 generating units. Chugach owns 70% of this plant and ML&P owns the remaining 30%. Each owner takes a proportionate share of power from SPP. Our principal generation units at SPP are Units 10, 11, 12, and 13. Since the units have been in commercial operation, SPP units have received preventative maintenance inspections consistent with original equipment manufacturer (OEM) recommendations through 2016. The gas turbine generators of Units 11, 12, and 13 receive two internal combustion system inspections each and one full package inspection annually. In 2016, Unit 11 gas turbine was replaced with a spare gas turbine. The removed gas turbine was prepared for another full cycle of operation by the OEM and Chugach technicians under our Contractual Service Agreement. The turbine was then staged at the power plant awaiting the next engine rotation. All three steam-generating boilers were internally inspected as well as hydrotested in accordance with OEM recommendations.

The Cooper Lake Hydroelectric Project is partially located on federal lands. Chugach owns, operates and maintains the Cooper Lake project pursuant to a 50-year license granted to us by FERC in August of 2007. As part of the relicensing process, there was a negotiated Relicensing Settlement Agreement (RSA) entered into in August of 2005. A requirement of the RSA required Chugach to establish a flow regime in Cooper Creek below the Cooper Lake Dam. This project included a Stetson Creek Diversion (Dam), Pipeline (Conveyance System) and Cooper Lake Outlet Works. The project was designed to replace colder water flowing into the Cooper Creek drainage from Stetson Creek with warmer Cooper Lake water. Project construction was completed in July 2015.

The two generating units at Cooper Lake, Units 1 and 2, have a combined capacity of 19.2 MW. Both units were taken out of service for annual maintenance in October 2015 and August 2016.

The Eklutna Hydroelectric Project is located on federal land pursuant to a United States Bureau of Land Management right-of-way grant issued in October of 1997. The facility is jointly owned, operated and maintained by Chugach, MEA, and ML&P with ownership shares of 30%, 17%, and 53%, respectively. Chugach owns rights to 11.7 MW of capacity from the two Eklutna Hydroelectric Project generating units.

15

The following matrix depicts nomenclature, run hours for 2016, percentages of contribution and other historical information for all Chugach generation units.

|

|

||||||||||||

|

Facility |

Commercial Operation Date |

Nomenclature |

Rating |

Run |

Percent of Total Run Hours |

Percent of Time Available |

||||||

|

Beluga Power Plant (2) |

||||||||||||

|

1 |

1968 |

GE Frame 5 |

19.6 | 219.2 | 0.44 | 96.7 | ||||||

|

2 |

1968 |

GE Frame 5 |

19.6 | 575.9 | 1.16 | 96.1 | ||||||

|

3 |

1973 |

GE Frame 7 |

64.8 | 1,793.6 | 3.61 | 92.5 | ||||||

|

5 |

1975 |

GE Frame 7 |

68.7 | 1,492.7 | 3.00 | 90.4 | ||||||

|

6 |

1976 |

GE 11DM-EV |

79.2 | 42.8 | 0.09 | 72.8 | ||||||

|

7 |

1978 |

GE 11DM-EV |

80.1 | 76.2 | 0.15 | 90.4 | ||||||

|

|

332.0 | |||||||||||

|

Cooper Lake Hydroelectric Project |

||||||||||||

|

1 |

1960 |

BBC MV 230/10 |

9.6 | 4,843.0 | 9.74 | 98.6 | ||||||

|

2 |

1960 |

BBC MV 230/10 |

9.6 | 6,682.0 | 13.43 | 98.6 | ||||||

|

|

19.2 | |||||||||||

|

IGT Power Plant (7) |

||||||||||||

|

1 |

1964 |

GE Frame 5 |

14.1 | 9.1 | 0.02 | 57.6 | ||||||

|

2 |

1965 |

GE Frame 5 |

14.1 | 8.2 | 0.02 | 91.8 | ||||||

|

|

28.2 | |||||||||||

|

Southcentral Power Project |

||||||||||||

|

10 |

2013 |

Mitsubishi SC1F-29.5 (6) |

40.2 |

(5) |

8,776.0 | 17.64 | 95.7 | |||||

|

11 |

2013 |

GE LM6000 PF |

33.3 |

(5) |

8,194.0 | 16.47 | 93.1 | |||||

|

12 |

2013 |

GE LM6000 PF |

33.3 |

(5) |

8,438.0 | 16.96 | 93.1 | |||||

|

13 |

2013 |

GE LM6000 PF |

33.3 |

(5) |

8,593.0 | 17.27 | 95.3 | |||||

|

|

140.1 | |||||||||||

|

Eklutna Hydroelectric Project |

||||||||||||

|

1 |

1955 |

Newport News |

5.8 |

(3) |

N/A |

(4) |

94.4 | |||||

|

2 |

1955 |

Oerlikon custom |

5.9 |

(3) |

N/A |

(4) |

94.1 | |||||

|

|

11.7 | |||||||||||

|

System Total |

531.2 | 49,743.7 | 100.00 | |||||||||

|

|

||||||||||||

|

(1) Capacity rating in MW at 30 degrees Fahrenheit. |

||||||||||||

|

(2) Beluga Unit 4 was retired during 1994. Beluga Unit 8 was retired in April of 2015. |

||||||||||||

|

(3) The Eklutna Hydroelectric Project is jointly owned by Chugach, MEA and ML&P. The capacity shown is our 30% share of the plant's output under normal operating conditions. The actual nameplate rating on each unit is 23.5 MW. |

||||||||||||

|

(4) Run hours are not recorded by Chugach for the Eklutna Hydroelectric Project as it is maintained by a committee of three owners. |

||||||||||||

|

(5) The Southcentral Power Project is jointly owned by Chugach and ML&P. The capacity shown is our 70% share of the plant's output under normal operating conditions. The actual nameplate rating for the project is 200.2 MW. |

||||||||||||

|

(6) Steam-turbine powered generator with heat provided by exhaust from natural gas fueled Units 11, 12 and 13 and additional heat from supplemental duct firing in the once through steam generators associated with the respective gas turbines (combined-cycle). |

||||||||||||

|

(7) IGT Unit 3 was retired in August of 2015. |

||||||||||||

|

Note: GE = General Electric, BBC = Brown Boveri Corporation |

||||||||||||

16

Transmission and Distribution Assets

As of December 31, 2016, our transmission and distribution assets included 42 substations and 434 miles of transmission lines, which included Chugach’s share of the Eklutna transmission line, 896 miles of overhead distribution lines and 823 miles of underground distribution line. We own the land on which 24 of our substations are located and a portion of the right-of-way connecting our Beluga plant to Anchorage. As part of our 1997 acquisition of 30% of the Eklutna Hydroelectric Project, we also acquired a partial interest in two substations and additional transmission facilities.

Most of Chugach’s generation sites and many of its substation sites are on Chugach-owned lands. The rights for the sites not on Chugach-owned lands are as follows: the Postmark and Point Woronzof Substations, and the East Terminal Site (N/S runway) are under rights from the State Department of Transportation and Public Facilities/Ted Stevens Anchorage International Airport; the East Terminal Site (6 mile) is under rights from Joint Base Elmendorf-Richardson; the West Terminal Site is under rights from the Matanuska-Susitna Borough; the University Substation is on State land under rights from the Federal Bureau of Land Management; the Hope and Daves Creek Substations are under rights from the State; the Portage Substation is under rights from the Alaska Railroad Corporation (ARRC); the Summit Lake Substation is on State land under rights from the United States Forest Service; the Dowling and Raspberry Substations are on Municipality of Anchorage land under rights from the State; and, the Indian Substation is under rights by FERC License, until a permit is issued by Chugach State Park. The Cooper Lake Power Plant, Quartz Creek Substation, and the 69kV transmission line between them are operated under a FERC License. Most of Chugach’s transmission, sub-transmission and distribution lines are either on public lands under rights from the federal, state, municipal, borough or ARRC, or on private lands via easements.

Title

On January 20, 2011, Chugach and the indenture trustee entered into the Indenture, granting a lien on substantially all of Chugach’s assets to secure Chugach’s long-term debt. Assets that are generally not subject to the lien of the Indenture include cash (other than cash deposited with the indenture trustee); instruments and securities; patents, trademarks, licenses and other intellectual property; vehicles and other movable equipment; inventory and consumable materials and supplies; office furniture, equipment and supplies; computer equipment and software; office leases; other leasehold interests for an original term of less than five years; contracts (other than power sales agreements with members having an original term exceeding three years, certain contracts specifically identified in the Indenture, and other contracts relating to the ownership, operation or maintenance of generation, transmission or distribution facilities); non-assignable permits, licenses and other contract rights; timber and minerals separated from land; electricity, gas, steam, water and other products generated, produced or purchased; other property in which a security interest cannot legally be perfected by the filing of a Uniform Commercial Code financing statement, and certain parcels of real property specifically excepted from the lien of the Indenture. The lien of the Indenture may be subject to various permitted encumbrances that include matters existing on the date of the Indenture or the date on which property is later acquired; reservations in United States patents; non-delinquent or contested taxes, assessments and contractors’ liens; and various leases, rights-of-way, easements, covenants, conditions, restrictions, reservations, licenses and permits that do not materially impair Chugach’s use of the mortgaged property in the conduct of Chugach’s business.

17

Many of Chugach’s properties are burdened by easements, plat restrictions, mineral reservation, water rights and similar title exceptions common to the area or customarily reserved in conveyances from federal or state governmental entities, and by additional minor title encumbrances and defects. We do not believe that any of these title defects will materially impair the use of our properties in the operation of our business.

Under the Alaska Electric and Telephone Cooperative Act, we possess the power of eminent domain for the purpose and in the manner provided by Alaska condemnation laws for acquiring private property for public use.

Other Property

Bradley Lake

We are a participant in the Bradley Lake Hydroelectric Project, which is a 120 MW rated capacity hydroelectric facility near Homer on the southern end of the Kenai Peninsula that was placed into service in September 1991. The project is nominally scheduled below 90 MW to minimize losses and ensure system stability. We have a 30.4% (27.4 MW as currently operated) share in the Bradley Lake project’s output, and currently take Seward’s share which we net bill to them, for a total of 31.4% of the project’s capacity. We are obligated to pay 30.4% of the annual project costs regardless of project output.

The project was financed and built by AEA through grants from the State of Alaska and the issuance of $166.0 million principal amount of revenue bonds supported by power sales agreements with six electric utilities that share the output from the facility (ML&P, HEA and MEA (through Alaska Electric Generation & Transmission Cooperative, Inc. (AEG&T) and Alaska Electric and Energy Cooperative, Inc. (AEEC)), GVEA, Seward and us). The participating utilities have entered into take-or-pay power sales agreements under which AEA has sold percentage shares of the project capacity and the utilities have agreed to pay a like-percentage of annual costs of the project (including ownership, operation and maintenance costs, debt-service costs and amounts required to maintain established reserves). By contract, we also provide transmission and related services to all of the participants in the Bradley Lake project.

The term of our Bradley Lake power sales agreement is 50 years from the date of commercial operation of the facility (September of 1991) or when the revenue bond principal is repaid, whichever is the longer. The agreement may be renewed for successive forty-year periods or for the useful life of the project, whichever is shorter. We believe that so long as this project produces power taken by us for our use that this expense will be recoverable through the fuel and purchased power adjustment process. The share of Bradley Lake indebtedness for which we are responsible is approximately $19.0 million. Upon the default of a participant, and subject to certain other conditions, AEA is entitled to increase each participant’s share of costs and output pro rata, to the extent necessary to compensate for the failure of the defaulting participant to pay its share, provided that no participant’s percentage share is increased by more than 25%. Upon default, Chugach could be faced with annual expenditures of approximately $6.0 million as a result of Chugach’s Bradley Lake take-or-pay obligations.

The State of Alaska provided an initial grant for work on a project to divert water from Battle Creek into Bradley Lake. The project is being managed by the Alaska Energy Authority. Diverting a portion of Battle Creek into Bradley Lake is currently estimated to increase annual energy output by 37,000 MWh. Chugach would be entitled to 30.4% of the additional energy produced.

18

Eklutna

Along with two other utilities, Chugach purchased the Eklutna Hydroelectric Project from the Federal Government in 1997. Ownership was transferred from the DOE’s Alaska Power Administration jointly to Chugach (30%), MEA (17%) and ML&P (53%). Through April 30, 2015, the power MEA purchased from the Eklutna Hydroelectric Project was pooled with Chugach’s purchases and sold back to MEA to be used to meet MEA’s overall power requirements.

Beluga River Unit (BRU)

On April 22, 2016, Chugach commenced receiving gas from the BRU as a Working Interest Owner (WIO) of the gas production field. Chugach acquired a 10% working interest in the Beluga River Unit by jointly purchasing, in partnership with ML&P, ConocoPhillips’ 1/3 Working Interest Ownership of the BRU. From April 22, 2016 Chugach received 1.2 Bcf from the BRU field at the field’s delivery meter as a WIO. Of that gas volume received Chugach allocated gas deliveries of 380 MMcf to the COP/APC (ENSTAR) contract (average price of $7.27 per Mcf), 608 MMcf to the COP/Chugach contract (average price of $2.214 per Mcf), and retained 219 MMcf for Chugach native use in thermal generation, which had a calculated transfer price of $5.88 per Mcf.

Fuel Supply

In 2016, 77% of our power was generated from natural gas. Total gas purchased and produced in 2016 was approximately 8.8 Bcf. All of the production came from Cook Inlet, Alaska. The contract with Hilcorp provided 54%, with ConocoPhillips (assigned to Chugach and ML&P in 2016) provided 40% and the balance from Chugach’s 10% share of the Beluga River Unit gas field, with minor purchases from AIX and CIE. Of the 8.8 Bcf of gas purchased and produced, 0.4 Bcf was sold to ENSTAR as part of an existing ConocoPhillips-ENSTAR gas contract that was assumed with Chugach’s share of the BRU acquisition. The gas contract with ConocoPhillips began providing gas in 2010 and expired December 31, 2016. On April 22, 2016, 70% of the Chugach-ConocoPhillips contract was assigned to ML&P. The current gas contract with Hilcorp began providing gas in 2011 and will expire March 31, 2023. The BRU and Hilcorp, together, fill 100% of Chugach’s firm needs through March 31, 2023. Gas to provide economy energy sales to GVEA was supplied by a gas supply arrangement with Hilcorp through March of 2015.

ConocoPhillips and ML&P

Chugach entered into a contract with ConocoPhillips in 2009, which started providing gas January 1, 2010, and expired December 31, 2016. This contract was assumed by Chugach and ML&P as part of the BRU acquisition, on the basis of ownership share. As such, Chugach paid ML&P for 70% of gas purchased under this contract.

The gas supplied by ConocoPhillips/ML&P under the contract was separated into two volume tranches for pricing purposes. “Firm Fixed Quantity” gas met a portion of Chugach’s base load requirements, while “Firm Variable Quantity” gas met peaking needs. After December 31, 2013, all of the gas purchased under the contract was firm fixed since firm variable gas was not provided by the contract. The ConocoPhillips/ML&P contract during 2016 had a fixed volume delivery of 18,000 thousand cubic feet (Mcf) per day at the Firm Fixed Quantity price.

19

Pricing for firm fixed gas was based on the average of five Lower 48 natural gas production areas. The contract price was calculated on a quarterly basis as the trailing average of the simple daily average of the Platts Gas Daily midpoint prices for each “flow day” in these market areas during the last quarter.

Hilcorp

Chugach entered into a contract with Hilcorp to provide gas beginning January 1, 2015, through March 31, 2018. In September 2014, the RCA approved an amendment to extend through March 31, 2019, then another amendment in September 2015 to extend through March 31, 2023. The total amount of gas under contract is currently estimated to be 60 Bcf. Pricing for the 2016 term of the Hilcorp contract was set at $7.42 per Mcf.

Chugach entered into a Gas Sales and Purchase Agreement with Hilcorp for the purchase of gas. This agreement was intended for Chugach to produce economy energy for GVEA. GVEA reimbursed Chugach for the cost of gas related to economy energy sales.

Cook Inlet Energy, LLC

Chugach entered into a Gas Sale and Purchase Agreement (GSPA) with CIE in 2013, to supply gas from April 1, 2014, through March 31, 2018, with an option to extend for an additional five years by mutual agreement during the term of the GSPA. In an extension letter agreement dated February 17, 2017, both parties agreed to extend the term of the agreement until March 31, 2023. The GSPA with CIE provides Chugach with an opportunity to diversify its gas supply portfolio, and minimize its current dependence on the gas agreements in place with two vendors. The gas that may be purchased under the GSPA with CIE is not required, however it introduces a new pricing mechanism.

The GSPA identifies and defines two types of gas purchases. Base Gas is defined by the volume of gas purchased on a firm or interruptible basis at an agreed delivery rate. Pricing for base gas purchases ranges from $6.12 to $7.31 per Mcf. Swing Gas is gas sold to Chugach at a delivery rate in excess of the applicable Base Gas agreed delivery rate. Pricing for swing gas purchases ranges from $7.65 to $9.14 per Mcf.

AIX Energy, LLC

Chugach entered into a contract with AIX Energy, LLC (AIX) in 2014, to supply gas from March 1, 2015, through February 29, 2016. This agreement caps the price of gas at $6.24 per Mcf and the total volume at 300,000 Mcf. In anticipation of this agreement’s expiration, Chugach entered into another gas sale and purchase agreement with AIX in November of 2015, to provide gas beginning April 1, 2016, through March 31, 2023, with the option to extend to March 31, 2029. The AIX agreements provide flexibility in both the purchase price and volumes and allow Chugach to further diversify its gas supply portfolio, with no minimum purchase requirements.

Municipality of Anchorage, dba Municipal Light and Power

Chugach entered into a contract with Municipality of Anchorage, DBA Municipal Light and Power (ML&P) in 2016, to supply gas from June 6, 2016, through March 31, 2017. This agreement caps the price of gas at $5.75 per Mcf and the total volume at 500,000 Mcf. The ML&P agreement provides Chugach the ability to further diversify its gas supply portfolio, with no minimum purchase requirements.

20

Natural Gas Transportation Contracts

The terms of the ConocoPhillips/ML&P and Hilcorp agreements require Chugach to transport gas. Chugach took over the transportation obligation for natural gas shipments for gas supplied under its contracts on October 1, 2010. The following information summarizes the transportation obligations for Chugach:

ENSTAR (Alaska Pipeline Company)

ENSTAR Natural Gas Company (ENSTAR) has a tariff to transport our gas purchased from gas suppliers on a firm basis to our IGT Power Plant and SPP.

Chugach and ENSTAR entered into a Firm Transportation Service Agreement on May 21, 2012, to provide for the transportation of gas to SPP. The agreement commenced on August 1, 2012, and remains in effect until canceled upon a 12-month written notice by either party. The agreement sets a contracted peak demand of 36,300 Mcf per day.

Harvest Alaska, LLC Pipeline System

Marathon Oil Company sold its share of its subsidiary pipeline company Marathon Pipe Line Company as part of a Cook Inlet asset divestiture effective February 1, 2013, to Hilcorp. Hilcorp now operates four major gas pipelines through Harvest Alaska, LLC, in the Cook Inlet basin, including the Kenai-Nikiski Pipeline (KNPL), the Beluga Pipeline (BPL), the Cook Inlet Gas Gathering System (CIGGS) and the Kenai-Kachemak Pipeline (KKPL). Chugach has entered into tariff agreements to ship gas on the KNPL, BPL and CIGGS. Effective August 1, 2013, Chugach entered into a special contract with KNPL for Firm Service capacity over the Kenai Pipeline Junction (KPL) compressor of 35,000 Mcf per month for the movement of gas to its Beluga power plant at a firm capacity rate of $2.13 per Mcf. This agreement ended effective October 31, 2014.

On November 1, 2014, the RCA approved consolidation of these four pipelines into a single pipeline, the KBPL. Chugach has entered into tariff agreements to ship gas on the KBPL.

Environmental Matters

Chugach’s operations are subject to certain federal, state and local environmental laws and regulations, which seek to limit air, water and other pollution and regulate hazardous or toxic waste disposal. While we monitor these laws and regulations to ensure compliance, they frequently change and often become more restrictive. When this occurs, the costs of our compliance generally increase.

We include costs associated with environmental compliance in both our operating and capital budgets. We accrue for costs associated with environmental remediation obligations when those costs are probable and reasonably estimable. We do not anticipate that environmental related expenditures will have a material effect on our results of operations or financial condition. We cannot, however, predict the nature, extent or cost of new laws or regulations relating to environmental matters.

21

Since January 1, 2007, transformer manufacturers have been required to meet the DOE efficiency levels as defined by the Energy Act for all “Distribution Transformers.” As of January 1, 2016, the specific efficiency levels are increasing from the original “TP1” levels to the new “DOE-2016” levels. All new transformers are DOE-2016 compliant. At this time a small increase in capital costs is anticipated along with a reduction in energy losses.

The Clean Air Act and EPA regulations under the Clean Air Act establish ambient air quality standards and limit the emission of many air pollutants. New Clean Air Act regulations impacting electric utilities may result from future events or new regulatory programs. On August 3, 2015, the EPA released the final 111(d) regulation language aimed at reducing emissions of CO2 from existing power plants that provide electricity for utility customers. In the final rule, the EPA took the approach of making the individual states responsible for the development and implementation of plans to reduce the rate of CO2 emissions from the power sector. The EPA has initially applied the final rule to 47 of the contiguous states. At this time Alaska, Hawaii, Vermont, Washington D.C. and two U.S. territories are not bound by the regulation. Alaska may be required to comply at some future date. On February 9, 2016 the U.S. Supreme Court issued a stay on the proposed EPA 111(d) regulations until the DC Circuit decides the case, or until the disposition of a petition to the Supreme Court on the issue. On September 27, 2016, the US Court of Appeals for the District of Columbia Circuit heard oral arguments challenging the legality of the Clean Power Plan. The court is expected to issue a decision in the near future. The EPA 111(d) regulation, in its current form, is not expected to have a material effect on Chugach’s financial condition, results of operations, or cash flows. While Chugach cannot predict the implementation of any additional new law or regulation, or the limitations thereof, it is possible that new laws or regulations could increase capital and operating costs. Chugach has obtained or applied for all Clean Air Act permits currently required for the operation of generating facilities.

Chugach is subject to numerous other environmental statutes including the Clean Water Act, the Resource Conservation and Recovery Act, the Toxic Substances Control Act, the Endangered Species Act, and the Comprehensive Environmental Response, Compensation and Liability Act and to the regulations implementing these statutes. Chugach does not believe that compliance with these statutes and regulations to date has had a material impact on its financial condition, results of operation or cash flows. However, the implementation of any additional new law or regulation, or the limitations thereof, or changes in or new interpretations of laws or regulations could result in significant additional capital or operating expenses. Chugach monitors proposed new regulations and existing regulation changes through industry associations and professional organizations.

Chugach has certain litigation matters and pending claims that arise in the ordinary course of Chugach’s business. In the opinion of management, none of these other matters, individually, or in the aggregate, is or are likely to have a material adverse effect on Chugach’s results of operations, financial condition or cash flows.

Item 4 – Mine Safety Disclosures

Not Applicable

22

PART II

Item 5 – Market for Registrant's Common Equity, Related Stockholder Matters

and Issuer Purchases of Equity Securities

Not Applicable

Item 6 – Selected Financial Data

The following table presents selected historical information relating to financial condition and results of operations for the years ended December 31:

|

|

||||||||||||||

|

Balance Sheet Data |

2016 |

2015 |

2014 |

2013 |

2012 |

|||||||||

|

Electric plant, net: |

||||||||||||||

|

In service |

$ |

696,415,738 |

$ |

659,275,066 |

$ |

657,899,592 |

$ |

670,476,634 |

$ |

442,515,434 | ||||

|

Construction work in progress |

18,455,940 | 15,601,374 | 21,567,341 | 28,674,163 | 263,459,794 | |||||||||

|

Electric plant, net |

714,871,678 | 674,876,440 | 679,466,933 | 699,150,797 | 705,975,228 | |||||||||

|

Other assets |

121,284,452 | 110,437,674 | 126,244,688 | 139,033,241 | 156,626,138 | |||||||||

|

Total assets |

$ |