EXHIBIT 99.1

Elliott Management Corp.

40 West 57th Street

New York, New York 10019

------

Tel. (212) 974-6000

Fax: (212) 974-2092

June 11, 2015

The Board of Directors

Citrix Systems, Inc.

851 West Cypress Creek Road

Fort Lauderdale, FL 33309

Attn: Thomas Bogan, Chairman

Attn: Mark Templeton, CEO

Dear Thomas, Mark and Members of the Board:

I am writing to you on behalf of Elliott Associates, L.P. and Elliott International, L.P. (together, “Elliott” or “we”), which together own 7.1% of the common stock and equivalents of Citrix Systems, Inc. (NASDAQ: CTXS) (the “Company” or, “Citrix”), making us one of your largest stockholders.

We believe that Citrix can achieve a stock price of $90 – $100+ per share by the end of 2016. This outcome – which represents an increase in stockholder value of approximately 50% – is achievable because Citrix has leading technology franchises in attractive markets but has struggled operationally for years. As a result, today Citrix’s operations and product portfolio represent an opportunity for improvement of uniquely significant magnitude.

The purpose of today’s letter is to a) introduce ourselves, b) preview some of the extensive work we have done to validate the $90 – $100+ per share opportunity, and c) respectfully request a meeting with the Company’s board of directors (the “Board”) to share our detailed thoughts about how to improve Citrix for the benefit of stockholders, employees and customers.

Today’s letter is being made public primarily because Elliott has become a 13D filer. We want to be clear about our intentions and avoid undue speculation.

To be clear, we approach this opportunity with tremendous respect for the work Mark and the entire Citrix team have done to achieve technological leadership, particularly in the high-quality markets in which Citrix participates. Without their vision, the enormous opportunity outlined below would not exist today.

About Elliott

Elliott is an investment firm founded in 1977 that today manages more than $26 billion of capital for both institutional and individual investors. We are a multi-strategy firm active in debt, equities, commodities, currencies and various other asset classes across a range of industries. Investing in the technology sector is one of our most active efforts at Elliott and one in which we have built a long track record.

Within the technology sector, we have made approximately three dozen active investments and have successfully identified value-creating opportunities at companies such as BMC, Informatica, Brocade, Riverbed, Juniper, Novell/Attachmate, Blue Coat and many others.

One key differentiating factor in Elliott’s active investments, especially in the technology sector, is our deep focus on operations. Our team includes experienced and proven C-level executives with technical and operational capabilities from software and technology companies. These executives evaluate operations, products and markets within our investments and work to develop strategies to streamline operations, grow revenue and create value. We also have long-lasting engagements with leading operations consulting firms, sales and marketing specialists, and technical consulting firms that we deploy on our investments. Finally, in addition to our public portfolio, we have significant investments in private technology companies, which provide important insights into operating best practices, market trends and general industry knowledge.

The Citrix Opportunity

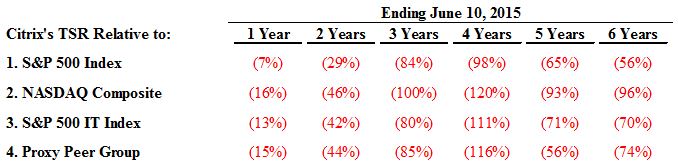

Citrix has great products in strong markets. However, Citrix has struggled operationally and has consequently missed a profound value creation opportunity to capitalize on these products and markets. Despite Citrix’s strong products, the Company’s stock price performance tells the story of deep underperformance across every relevant benchmark, including its closest peers, over every time period during the last six years:

Over the years, Citrix has recognized that operational changes are needed and that its product portfolio requires rationalization. In 2010, Citrix made promises of “efficiency” and “focus” with the goal of achieving margin targets and rationalizing the portfolio. Unfortunately, these promises were followed by a period of nearly 400 basis points of margin contraction and an expansion into several non-core product categories.

In early 2014, Citrix again made a series of promises to address the operational and share price underperformance. Despite the fact that these promises were nearly identical to the promises made in 2010, many investors and analysts hoped that this time Citrix was finally going to remedy the serious deficiencies in its cost structure. However, operating expenses have continued to outpace revenue growth, and both profit margins and profit dollars have declined over the last 12 months.

2

It is perhaps because Citrix’s promises have uniformly been followed by increased costs and greater product breadth that the research community maintains a skeptical approach to Citrix and continues to call for organizational change, as the quotes below illustrate:

|

|

·

|

“We maintain our Buy rating, although we stress that significant changes are needed to help drive value for shareholders, which would include rationalizing business lines as well as further cost reductions” – Goldman Sachs, April 2015

|

|

|

·

|

“We have found that it takes the same time, if not longer, to explain the businesses that Citrix is in as to explain Microsoft. We believe divestitures would help clarify the business for investors, which would help the stock price” – Sanford Bernstein, April 2015

|

|

|

·

|

“The Company’s execution has been terribly poor for more than 2 years, and we believe management will be compelled to make more organizational changes going forward – beyond those already announced” – Credit Suisse, April 2015

|

This is just a small sampling of commentary, but it provides a highly accurate picture of analyst sentiment toward Citrix and is consistent with other well-respected software analysts. Furthermore, based on numerous conversations with your stockholder base, we believe these quotes are representative of stockholder sentiment as well. Unfulfilled announcements of expense rebalancing and incremental, recurring restructurings are damaging to companies and destabilizing to their employees and customer relationships. In Citrix’s case, these announcements have also impaired the Company’s credibility with stockholders. We believe that Citrix today has a far superior opportunity to make serious and lasting changes and to create sustainable value for stockholders.

New Citrix Operating Plan

Today, Elliott is formally requesting a meeting with the Board to share the details of an operational plan that we believe will create tremendous value for stockholders. What we call the “New Citrix” Operating Plan (the “New Citrix Plan”) was developed through exhaustive research and with the help of a full team of operating partners with proven experience turning around software companies. That team includes the following:

|

|

·

|

Senior Software Executives: We have assembled a team of senior software executives to evaluate Citrix and the opportunity for value creation. These are C-level software executives who have assisted us in understanding the operating and strategic possibilities at Citrix and who have helped diagnose issues at, and develop solutions for, other software and technology companies in which we have invested.

|

3

|

|

·

|

Top-Tier Consulting Firm: We retained a leading consulting firm to aid in our in-depth diligence on Citrix’s products and markets, conducting a survey of more than 400 customers and channel partners, enabling us to better understand the competitive landscape from a customer’s perspective and identify key factors in purchase decisions.

|

|

|

·

|

Sales and Marketing Specialist Firm: We engaged with a leading salesforce consulting firm to analyze Citrix’s go-to-market strategy and its efficiency. We evaluated Citrix’s salesforce organization structure, typical deal team composition, channel ecosystem and compensation methodology to determine what steps are needed to conform Citrix’s go-to-market strategy to the industry’s best practices.

|

|

|

·

|

Operations Consultant: We worked with a major operations consulting firm to conduct a “deep-dive” on Citrix’s operations in product development, professional services and various support and corporate functions, which provided important insight into Citrix’s geographic footprint, utilization of its international workforce and efficiency of its product development organization.

|

|

|

·

|

IT Specialists and Data Center Engineers: We worked with highly experienced technical experts with deep knowledge of Citrix’s product portfolio to better understand how it evolved, including understanding perspectives on product roadmaps, critical features / functionality and how these products integrate into broader IT solutions.

|

|

|

·

|

Investment Banking Firms: We engaged with two leading investment banks to ensure our understanding of capital return options, as well as strategic options for the GoTo and NetScaler divisions.

|

The New Citrix Plan is based upon two driving principles: the need for i) fundamental change and ii) effective oversight. The key components for fundamental change are as follows:

|

|

1)

|

Implementation of Operational Best Practices: Citrix’s cost structure is the result of years of layered complexity and expenses. The structure has become highly inefficient in terms of actual cost and is also ineffective at generating revenue growth. We have identified numerous opportunities throughout the organization for significant improvement, which we believe will result in both superior revenue performance and a more efficient use of resources. In total, our New Citrix operating model target for operating expense is a range of 54.5% – 55.0% of revenue by 2017 relative to 63% over the last 12 months. Our team has identified the major areas for improvement as follows:

|

|

|

·

|

Sales & Marketing: Citrix’s sales & marketing organization is operating well below industry benchmarks on efficiency and effectiveness, with the weakest metrics among its peers. This is primarily the result of a highly cumbersome and ineffective go-to-market strategy. Critical operational metrics, including the ratios of management positions to quota-carrying reps and sales engineers to field reps, remain out of line with industry best practices. This inefficiency has led to weak productivity per sales FTE and is exacerbated by poor alignment between performance and compensation. In addition, Citrix’s channel strategy is stretched across too many channel partners, with important channel-enablement resources being directed to sub-scale partners. We are confident all of these issues are fixable through a full realignment to implement best practices in the areas of deal team composition, sales management span of control, channel management and compensation structure.

|

4

|

|

·

|

Research & Development: Citrix’s product development effort needs a full operational review with strong cross-functional participation. The recent product-release issues in both XenApp and XenDesktop, marred by critical feature gaps from prior versions, had a deep impact on execution over the last several years and demonstrated a disconnect between customer requirements and development roadmaps. In addition, Citrix’s recent history of funding speculative R&D initiatives without clear route-to-market or tangible competitive advantage must be reevaluated immediately. These speculative or non-core projects need to be scaled back or eliminated and resources reallocated to the product categories where Citrix has the greatest likelihood of success. Return-on-investment project tracking with a focus on risk-adjusted returns needs to be implemented and strictly followed.

|

|

|

·

|

Product Portfolio: Citrix’s product portfolio is too broad for its scale and contains far too many underperforming product lines that consume valuable resources, have low or negative (i.e., loss-making) return profiles, and serve as distractions. For example, we believe CloudBridge, CloudPlatform and ByteMobile are non-core, are underperforming and are distractions to the management team. We believe these businesses, particularly ByteMobile, should be sold or realigned.

|

|

|

2)

|

Evaluation of High-Value Non-Core Assets: Citrix possesses high-value, strategic assets that we believe can be separated from the core Workspace Services segment: the GoTo franchise and NetScaler. Such separations would not only be meaningfully accretive to value but also would enable Citrix management to focus on improving the Company’s core operational execution.

|

|

|

·

|

Spin or Sale of the GoTo Franchise: While we recognize the broad notion of empowering a mobile workforce, this business’s go-to-market strategy, product development roadmap and end-market are absolutely distinct from the core of Citrix. GoTo is an attractive business with scale in its market, and we have confidence that it can realize significant value through several alternative transaction structures, including a sale or a spin. We also further believe that core Citrix’s management can create significantly more value for stockholders by focusing on operational execution rather than attempting to oversee the GoTo franchise.

|

|

|

·

|

Exploration of Strategic Alternatives for NetScaler: We are not explicitly advocating for a sale of NetScaler, but we believe the sale option should be seriously explored to assess potential strategic buyer interest and valuation, which we believe may be robust. NetScaler is an excellent business, and its ADC technology is an industry-leader; however, we believe Citrix has overly relied on the virtualization cross-sell, resulting in significant under-penetration in non-virtualization use-cases and within the telco vertical. We believe other strategic owners can accelerate NetScaler’s growth through greater scale and unique customer relationships. It is critical for the Board to consider whether Citrix is the parent company best positioned to maximize NetScaler’s value.

|

5

|

|

3)

|

Capital Allocation: If effectively executed, the New Citrix Plan will result in tremendous value creation over the next several years. As a result, Citrix’s stock is deeply undervalued today. Furthermore, Citrix’s balance sheet is being under-utilized given its strong cash flow profile, even at today’s level of inefficiency. At a more appropriate 1.5x – 2.0x target net leverage ratio, Citrix would have $4.5 – $5.3 billion of buyback capacity through 2017 while maintaining an investment grade rating. Debt financing remains at historically attractive levels, and we believe Citrix should take advantage of this opportunity to repurchase 56 – 61 million shares from now through 2017.

|

|

|

4)

|

Management: Over the past two years, Citrix has suffered a wave of senior-level management departures, which have introduced uncertainty and instability into the organization. In several cases (e.g., Sumit Dhawan and Bob Schultz), these valuable managers have left to join Citrix’s direct competitors. Citrix requires stable and confident leadership of its business units and, under the New Citrix Plan, will also require proven operational skillsets to drive fundamental change. Elliott is looking forward to working with Citrix to address its ability to retain and recruit top talent.

|

This high-level summary is a brief overview of the details supporting the New Citrix Plan. Though significant in magnitude, changes of this kind are relatively common in the software sector. Nonetheless, a key differentiator, and the second tenet of the New Citrix Plan, is effective oversight. A strong and capable Board that oversees and holds management accountable is critical. We look forward to discussing our recommendations regarding proper oversight of the New Citrix Plan’s execution.

6

By implementing the New Citrix Plan and providing the oversight necessary to ensure its execution, we believe Citrix can achieve a stock price of $90 – $100+ per share by the end of 2016, excluding the impact of separating NetScaler and GoTo. We believe there is potentially significant upside from these price targets if Citrix executes on the separation of these high-value strategic assets. The table below details Elliott’s model scenarios supporting our stock price targets.

|

Elliott Base Case

|

Elliott Upside Case

|

|

|

‘14A – ‘17E Revenue CAGR 1

|

4.0%

|

5.5%

|

|

2017E Operating Expense % of Revenue

|

55.0%

|

54.5%

|

|

2017E Operating Margin

|

30.0%

|

30.5%

|

|

2017E Leverage (Net Debt / EBITDA) 2

|

1.5x

|

2.0x

|

|

2017E EPS 3

|

$6.20

|

$6.70

|

|

NTM P/E Multiple 4

|

14.5x

|

15.5x

|

|

2016 Price Target 5

|

$90.00

|

$103.75

|

|

% Gain to Unaffected Price 6

|

41%

|

63%

|

As this table demonstrates, reasonable revenue growth and P/E multiple assumptions can achieve tremendous results under the New Citrix Plan. Moreover, the vast majority of the value creation of approximately $26 in the Base Case is driven by operational improvements, as margin expansion drives approximately $207 per share of value increase and improved capital allocation drives approximately $6 per share of value increase.

1 Elliott estimates, based on Company filings and Wall Street estimates. Analysis performed as of June 10, 2015

2 Share repurchase plan assumes a mix of accelerated share repurchases and recurring quarterly buybacks between 2015 and 2017 to target the stated net leverage levels. Share repurchases are assumed to be funded by available US cash ($250 million minimum US cash balance) and the issuance of US debt financing at a 4.5% annual rate. Incremental interest expense from new debt issuance netted against US taxable income at the US statutory rate of 35%. Share repurchases executed at a price per share implied by similar valuation multiples as the assumptions above. The Elliott Base Case and Elliott Upside Case assume an average share repurchase price per share of $80.25 and $87.75, respectively, for the 2015-2017 repurchase plan (round to the nearest $0.25 per share)

5 Price targets round to the nearest $0.25. The impact of the convertible note conversion at $90 per share assumed to be mitigated by the existing note hedge

6 Unaffected price assumed to be $63.80 as of April 10, 2015, which was the day following Citrix’s Q1 2015 earnings preannouncement and when significant speculation of potential activist interest in Citrix’s stock began

7 Elliott estimates, based on a constant unlevered valuation multiple and assumes Citrix’s status quo share repurchase plan of approximately $400 million per year

7

Next Steps

As is always the case, we look forward to a collaborative and positive dialogue with Citrix’s Board and management. To that end, we respectfully request a meeting in the next few weeks with the full Board during which we can share a detailed presentation of the New Citrix Plan and discuss what we believe are the necessary steps for its implementation. It is our sincere hope that we can work together to implement the New Citrix Plan, which we are confident will create real and lasting value for your stockholders.

Elliott hopes that the Board also sees the need for fundamental change and oversight and will therefore be excited to embrace this opportunity. We would be remiss if we failed to note that, to date and as recently as last month, the Company has repeatedly resisted public calls for real change from the broader investment community. We hope that the Company can move on from that position and work together with us to realize the profound opportunity to create value that is undeniably before us. Elliott is prepared to push for change directly, but the far better course is for Citrix to embrace this offer of cooperation and for us to proceed collaboratively, and quickly, together.

Thank you very much for your time and consideration. I look forward to our meeting.

Best regards,

Jesse Cohn

Senior Portfolio Manager

8