0000877860DEF 14Afalse00008778602023-01-012023-12-31iso4217:USD00008778602022-01-012022-12-3100008778602021-01-012021-12-3100008778602020-01-012020-12-310000877860nhi:StockAwardsAdjustmentsMemberecd:PeoMember2023-01-012023-12-310000877860nhi:EquityAwardAdjustmentsMemberecd:PeoMember2023-01-012023-12-310000877860nhi:StockAwardsAdjustmentsMemberecd:NonPeoNeoMember2023-01-012023-12-310000877860nhi:EquityAwardAdjustmentsMemberecd:NonPeoNeoMember2023-01-012023-12-310000877860nhi:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:PeoMember2023-01-012023-12-310000877860nhi:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:PeoMember2023-01-012023-12-310000877860nhi:EquityAwardsGrantedDuringTheYearVestedMemberecd:PeoMember2023-01-012023-12-310000877860ecd:PeoMembernhi:EquityAwardsGrantedInPriorYearsVestedMember2023-01-012023-12-310000877860nhi:EquityAwardsThatFailedToMeetVestingConditionsMemberecd:PeoMember2023-01-012023-12-310000877860nhi:EquityAwardsValueOfDividendsAndOtherEarningsPaidAdjustmentMemberecd:PeoMember2023-01-012023-12-310000877860nhi:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:NonPeoNeoMember2023-01-012023-12-310000877860ecd:NonPeoNeoMembernhi:EquityAwardsGrantedInPriorYearsUnvestedMember2023-01-012023-12-310000877860nhi:EquityAwardsGrantedDuringTheYearVestedMemberecd:NonPeoNeoMember2023-01-012023-12-310000877860ecd:NonPeoNeoMembernhi:EquityAwardsGrantedInPriorYearsVestedMember2023-01-012023-12-310000877860nhi:EquityAwardsThatFailedToMeetVestingConditionsMemberecd:NonPeoNeoMember2023-01-012023-12-310000877860ecd:NonPeoNeoMembernhi:EquityAwardsValueOfDividendsAndOtherEarningsPaidAdjustmentMember2023-01-012023-12-31000087786012023-01-012023-12-31000087786022023-01-012023-12-31000087786032023-01-012023-12-31000087786042023-01-012023-12-31000087786052023-01-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant [ x ]

Filed by a Party other than the Registrant [ ]

Check the appropriate box: | | | | | | | | | | | | | | |

[ ] | Preliminary Proxy Statement |

[ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

[ x ] | Definitive Proxy Statement |

[ ] | Definitive Additional Materials |

[ ] | Soliciting Material Pursuant to §240.14a-12 |

| | | | |

National Health Investors, Inc. |

(Name of Registrant as Specified in its Charter) |

| | | | |

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

| | | | |

Payment of Filing Fee (Check the appropriate box): |

[ x ] | No fee required. |

[ ] | Fee paid previously with preliminary materials. |

[ ] | Fee computed on table in exhibit required by Item 25 (b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | | | |

| | |

| | | | |

| | |

| | | | |

| | |

| | | | |

| | |

| | | | |

| | | | |

| |

| |

| | |

| | | | |

| | |

| | | | |

| | |

| | | | |

| | |

| | | | |

Letter from our President and CEO

Dear Fellow Stockholders –

On behalf of our Board of Directors and everyone at NHI, I want to thank you for your continued investment and confidence in the Company as we have transitioned NHI through our portfolio optimization and are now in position to reignite growth through organic and external growth initiatives.

The strategic decisions made in 2020 - 2022 to optimize our portfolio continued to resonate in 2023 through improved performance throughout the Company. Specifically, NHI increased the EBITDARM coverage ratios across all asset classes; granted fewer tenant rent concessions; accelerated and received deferral repayments throughout the year; and improved occupancy and operating margins in the Senior Housing Operating Portfolio (“SHOP”).

NHI’s financial position continues to be a pillar of strength and positions NHI well to deploy capital for accretive transactions in 2024 and beyond. NHI invested approximately $74 million in 2023 at a weighted average yield of 8.3% without the need to raise equity capital and while maintaining leverage at a prudent 4.5 times net debt-to-adjusted EBITDA. At these leverage levels, NHI is one of the lowest levered healthcare REITs and ranks in the top quartile for low leverage among all REIT asset classes nationally. We believe that this creates a significant strategic advantage as the supply of capital is shrinking just as demand is increasing.

The Board has recently approved several new initiatives for reviewing and improving our Environmental, Social and Governance (“ESG”) policies. We recently formed a new ESG Committee that includes direct Board involvement together with Management which will report to the Nominating & Corporate Governance Committee. We have engaged external consultants to lay the foundation for Climate and Environmental sustainability reporting. We are reviewing all our governance policies with the assistance of outside advisors. With the appointment of Tracy Colden as Chairman of Nominating & Corporate Governance Committee, we are confident we will be improving our overall ESG performance and reporting over the coming year.

We accomplished a great deal in 2023 and concluded the year on a strong note with both third and fourth quarter results exceeding our own internal expectations as well as analyst consensus estimates. We attribute this outperformance to the factors just described and believe this momentum has carried into 2024 and positions NHI to return to growth.

There are multiple factors driving our optimism in the near- and long-term prospects for NHI. Our multipronged organic growth opportunity in both the leased portfolio and SHOP is as strong as ever; the investment and lending environments are very favorable for well-capitalized, low levered capital providers like NHI; and the industry supply-demand balance is beginning to lean in our favor due to a lack of new construction. To conclude, NHI is poised to capitalize on several opportunities in what we expect to be several years of exceptional growth.

We are pleased to present the 2024 NHI Proxy and invite you to join our Annual Stockholder Meeting either virtually or in person on May 22, 2024. We appreciate your support and investment in NHI and we look forward to updating you regularly on our progress.

Best,

Eric Mendelsohn

President and Chief Executive Officer

222 Robert Rose Drive

Murfreesboro, TN 37129

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Our Stockholders:

We cordially invite you to attend the 2024 Annual Meeting of Stockholders of National Health Investors, Inc. (“NHI” or the “Company”). The annual meeting will be held both virtually at www.virtualshareholdermeeting.com/NHI2024 and in person at The View at Fountains, 1500 Medical Center Parkway, Suite 1D, Murfreesboro, Tennessee 37129 on Wednesday, May 22, 2024, at 1:00 pm CDT, for the following purposes:

(1) To re-elect three directors, D. Eric Mendelsohn, Charlotte A. Swafford and Robert T. Webb, each of whom are current directors of the Company;

(2) To approve, on an advisory basis, the compensation paid to our named executive officers;

(3) To ratify the Audit Committee’s selection of BDO USA, P.C. as our independent registered public accounting firm for the fiscal year ending December 31, 2024; and

(4) To transact such other business as may properly come before the meeting or any continuance or postponement of it.

Stockholders of record as of the close of business on March 28, 2024 are entitled to vote at the annual meeting and any postponement or continuance thereof. Please see page 40 for additional information regarding accessing the meeting and how to vote your shares. You do not need to attend the meeting in order to vote your shares.

Your vote is important. Please vote your proxy promptly to ensure your shares are properly represented, even if you plan to attend the annual meeting. You can vote by Internet, by telephone, or by requesting a printed copy of the proxy materials and using the enclosed proxy card.

We appreciate your continued confidence in our Company and look forward to you joining us on May 22, 2024. As always, we encourage you to vote your shares prior to the annual meeting.

By order of the Board of Directors,

/s/ Susan Sidwell

Corporate Secretary

Murfreesboro, Tennessee

April 4, 2024

REVIEW THE PROXY STATEMENT AND VOTE IN ONE OF FOUR WAYS:

| | | | | | | | | | | | | | |

| VIA THE INTERNET IN ADVANCE Visit www.proxyvote.com | | | BY MAIL Sign, date, and return the enclosed proxy card or voting instruction form.

|

| BY TELEPHONE Call the telephone number on your proxy card or voting instruction form.

| | | AT THE MEETING Attend the annual meeting. See page 40 for additional details on how to attend.

|

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be held on May 22, 2024: This Notice of Annual Meeting of Stockholders, the proxy statement, and the 2023 Annual Report to Stockholder are available at www.proxyvote.com. |

Table of Contents

| | | | | |

| Page |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Committees of the Board | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Proxy Statement

PROXY SUMMARY

This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all of the information you should consider. Please carefully read the entire proxy statement before voting.

Meeting Details

The accompanying proxy is solicited by the Board of Directors (the “Board”) of National Health Investors, Inc. (“NHI” or the “Company”) to be voted at the 2024 Annual Meeting of Stockholders (the “Meeting”) to be held on Wednesday, May 22, 2024, commencing at 1:00 p.m. CDT and at any continuance or postponement of the Meeting. The Meeting will be held both virtually and in person (a “hybrid meeting”). Stockholders and guests desiring to attend the Meeting in person, can attend at The View at Fountains, 1500 Medical Center Parkway, Suite 1D, Murfreesboro, Tennessee 37129. Stockholders desiring to attend virtually can log in to www.virtualshareholdermeeting.com/NHI2024. Stockholders attending virtually will have two options: You can join as a “Stockholder” or you can join as a “Guest.” If you join as a “Stockholder,” you must enter the 16-digit control number found on your proxy card or the notice of Internet availability of proxy materials (the “Notice”) you received. Once properly admitted to the Meeting, as “Stockholders”, all stockholders of record as of March 28, 2024 (the “Record Date”) will be able to submit questions and vote their shares by following the instructions that will be available on the virtual meeting platform. An individual interested in attending the Meeting virtually who does not have a control number or who is not a stockholder may attend the Meeting as a guest but will not have the option to ask questions or participate in the vote. Technical support will be available on the virtual meeting platform at www.virtualshareholdermeeting.com/NHI2024 beginning at 12:30 CDT on May 22, 2024. The technical support offered through this service is designed to address difficulty related to the virtual meeting platform. It is recommended that you contact your broker should you be unable to locate your control number. It is anticipated that this proxy statement and the form of proxy card solicited on behalf of our Board will be filed with the Securities and Exchange Commission (“SEC”) and an accompanying Notice mailed to our stockholders beginning on April 4, 2024. In this document, the words “we”, “our”, “ours”, and “us” refer to National Health Investors, Inc.

Voting Matters and Board Recommendations

| | | | | | | | | | | | | | |

| | | Board Vote | See |

| Voting Matter | Voting Standard | Recommendation | Page |

| Proposal 1 | Election of Directors | Majority of votes cast | For Each Nominee | |

| Proposal 2 | Advisory Vote on Executive Compensation | Majority of votes cast | For | |

| Proposal 3 | Ratification of Independent Registered Public Accounting Firm | Majority of votes cast | For | |

Corporate Sustainability

We believe that integrating environmental, social and governance, or ESG, initiatives into our strategic business objectives will contribute to our long-term success. Through our sustainability efforts, we seek to incentivize positive change and create value for our stakeholders. See “Corporate Sustainability” beginning on page 15 for more details of our corporate sustainability efforts.

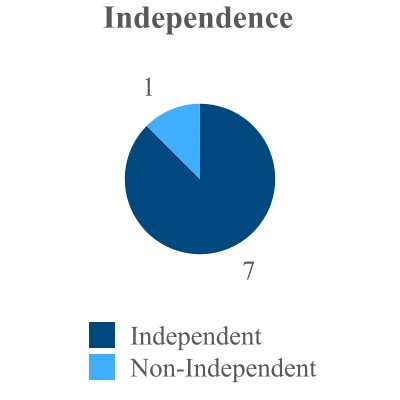

Our Directors

NHI is currently managed by an eight-person Board. A director may be removed from office for cause only. Three of the directors are standing for re-election at the Meeting in accordance with the Company’s bylaws (as amended and/or restated to date, the “Bylaws”). The Board believes that each of the director nominees is qualified to serve as a director of NHI and possesses the qualities and skills described in the section of the proxy statement captioned “Proposal 1 - Election of Directors,” beginning on page 3.

| | | | | | | | | | | | | | |

Name | Age | Director Since | Position | Expiration of term |

| Nominees | | | | |

D. Eric Mendelsohn | 62 | 2021 | Director, President & Chief Executive Officer | 2024 |

| Charlotte A. Swafford | 76 | 2020 | Director | 2024 |

Robert T. Webb | 79 | 1991 | Director | 2024 |

| Continuing Directors | | | | |

| Robert G. Adams | 77 | 2020 | Director | 2025 |

James R. Jobe | 62 | 2013 | Director | 2025 |

| W. Andrew Adams | 78 | 1991 | Chairperson of the Board | 2026 |

Tracy M. J. Colden | 62 | 2022 | Director | 2026 |

| Robert A. McCabe, Jr. | 73 | 2001 | Director | 2026 |

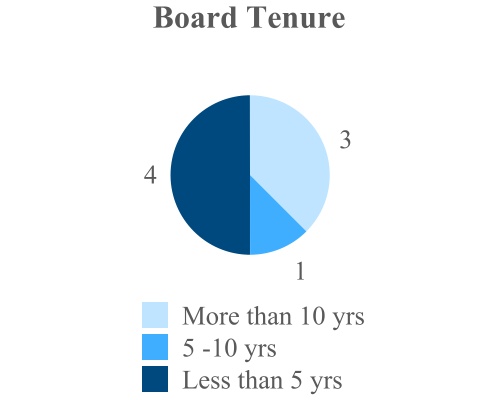

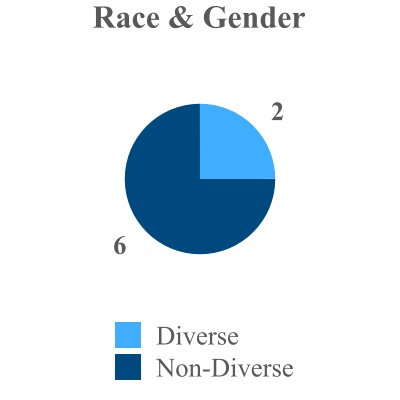

The following matrix provides information regarding the members of our Board, including demographic information for, and certain qualifications and experience possessed by, the members of our Board, which our Board believes are relevant to our business and industry and provide a range of viewpoints that are invaluable for our Board’s discussions and decision-making processes. In addition, each of our current directors, other than Mr. Mendelsohn, is considered independent by our Board based on the independence standards of the New York Stock Exchange (the “NYSE”). The matrix does not encompass all of the qualifications, experiences or attributes of the members of our Board, and the fact that a particular qualification, experience or attribute is not listed does not mean that a director does not possess it. In addition, the absence of a particular qualification, experience or attribute with respect to any of the members of our Board does not mean the director in question is unable to contribute to the decision-making process in that area. The type and degree of qualification and experience listed below may vary among the members of the Board.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Skills and Experience | W. A. Adams | Colden | McCabe | R. Adams | Jobe | Swafford | Webb | Mendelsohn |

| Public Company Board Experience | x | x | x | x | x | | | |

| C-Suite Leadership | x | | x | x | | | | x |

| Financial Literacy/Accounting | x | x | x | x | x | x | x | x |

| Healthcare | x | | | x | | x | | x |

| Risk Management/Strategic Planning | x | x | x | x | x | x | x | x |

| Corporate Governance/Legal | | x | | | | | | x |

Background | | | | | | | | |

| Gender | Male | Female | Male | Male | Male | Female | Male | Male |

| Race/Ethnicity | White | African/American | White | White | White | White | White | White |

| Age | 78 | 62 | 73 | 77 | 62 | 76 | 79 | 62 |

| Tenure (years) | 32 | 2 | 23 | 4 | 10 | 4 | 32 | 3 |

We Invest in Relationships, not Just Properties

Incorporated in 1991, we are a real estate investment trust (“REIT”) specializing in sale-leaseback, joint-venture, and mortgage and mezzanine financing of need-driven and discretionary senior housing and medical investments. Our portfolio consists of independent, assisted and memory care communities, entrance-fee communities, skilled nursing facilities, and a specialty hospital.

PROPOSAL 1- ELECTION OF DIRECTORS

Pursuant to the Company’s Articles of Incorporation, the directors have been divided into three classes. Each class is elected for a three-year term and only one group is up for election each year. The Company’s Articles of Incorporation and Bylaws provide that the number of directors to be elected by the stockholders shall be at least three and not more than nine, as established by the Board from time to time. In May 2022, the Board expanded the Board from seven to eight members. On February 16, 2024, the Board’s Nominating and Corporate Governance Committee recommended, and the full Board nominated, Mr. Mendelsohn, Ms. Swafford and Mr. Webb for re-election to the Board for a three-year term or until their successors are duly elected and qualified. Our director nominees were assessed and chosen in accordance with our Nominating and Corporate Governance Committee’s charter. Our Bylaws require that directors be elected by a majority of the votes cast with respect to their election at the Meeting. If your proxy does not specifically instruct the proxy holder to vote against the election of Mr. Mendelsohn, Ms. Swafford and/or Mr. Webb, your proxy holder intends to vote for the election of Mr. Mendelsohn, Ms. Swafford and/or Mr. Webb to hold office as a director for the term described above or until their successor has been duly elected and qualified.

Each nominee has indicated that he or she will serve if elected. We do not anticipate that any nominee will be unable or unwilling to stand for re-election, but if that happens, your proxy may be voted for another person nominated by the Board or the Board may reduce the number of directors to be elected. If elected at the Meeting, the nominees will hold office until the 2027 Annual Meeting of Stockholders and until their successors have been elected and qualified.

Our Director Nominees

| | | | | |

| D. Eric Mendelsohn |

| Age 62 |

| Director since 2021 |

| Committees: |

| None |

|

|

|

| Background |

| Mr. Mendelsohn joined NHI in January 2015 as Executive Vice President of Corporate Finance. He was named interim Chief Executive Officer (“CEO”) in August 2015 and CEO and President in October 2015. Mr. Mendelsohn became a director in February 2021. He has over 20 years of healthcare real estate and financing experience. Previously, Mr. Mendelsohn was with Emeritus Senior Living for nine years, most recently as a senior vice president of corporate development where he was responsible for the financing and acquisition of assisted living properties, home health care companies, administration of joint venture relationships and executing corporate finance strategies. Prior to Emeritus, Mr. Mendelsohn was with the University of Washington as a transaction officer where he worked on the development, acquisition and financing of research, clinic and medical properties. Prior to that, Mr. Mendelsohn was a practicing transactional attorney, representing lenders and landlords. Mr. Mendelsohn has a Bachelor of Science degree from American University in International Relations, a Juris Doctor degree from Pepperdine University, and a Masters (LLM) in Banking and Finance from Boston University. Mr. Mendelsohn is a member of the Florida and Washington State Bar Associations. |

| |

| Qualifications |

| |

| Mr. Mendelsohn is the only management member of the Board and as such the Board concluded that his perspective is important in developing the strategic and operation direction of the Company and thus Mr. Mendelsohn should serve as a director of the Company based on his role as CEO and his executive experience in the senior care industry. |

| | | | | | | | |

| | Charlotte A. Swafford |

| Age 76 |

| Director since 2020 |

| Committees: |

| Compensation Committee |

| Audit Committee |

| Nominating & Corporate Governance Committee |

| |

| |

| Background | |

| | |

| Ms. Swafford joined the Board in May 2020. She served as senior vice president and treasurer of National HealthCare Corporation (“NHC”) from 1985 until her retirement on December 31, 2016. She joined NHC in 1973 and served as staff accountant, accounting manager and assistant treasurer. NHC served as the Company's Investment Advisor from 1991 through October 2004, and as a result, Ms. Swafford served as Treasurer of the Company during that period. She has not provided any services to the Company (other than as a director) since October 2004. Ms. Swafford has a Bachelor of Science degree from Tennessee Technological University. |

|

|

|

|

|

| Qualifications | |

| | | | | | | | |

| | |

| The Board concluded that Ms. Swafford should serve as a director of the Company based on her extensive healthcare, accounting and financial background. |

| | | | | | | | |

| | Robert T. Webb |

| Age 79 |

| Director since 1991 |

| Committees: |

| Compensation Committee (Chairperson) |

| Audit Committee |

| Nominating & Corporate Governance Committee |

| |

| |

| Background | |

| | |

| Mr. Webb has served as a director of the Company since its inception in 1991. Mr. Webb is the owner of commercial buildings in the Middle Tennessee area and is a subdivision developer. Additionally, Mr. Webb is the vice president and treasurer of Webb’s Refreshments, Inc., which has been in operation serving the Middle Tennessee area since 1976. Mr. Webb served as president of Webb’s Refreshments until that position was assumed by his son in 2010. He attended David Lipscomb College and received a Bachelor of Arts in business marketing from Middle Tennessee State University in 1969. |

|

|

|

|

|

| Qualifications | |

| | |

| The Board concluded Mr. Webb should serve as a director of the Company based on his extensive real estate business experience, his leadership qualities and his independence from the Company. |

The Board Recommends a Vote “For” the Election of Mr. Mendelsohn, Ms. Swafford and Mr. Webb as Provided In Proposal 1.

Our Continuing Directors

| | | | | |

| |

| Robert G. Adams |

| Age 77 |

| Director since 2020 |

| Committees: |

| Compensation Committee |

| Nominating & Corporate Governance Committee |

Other Current Public Directorship: National HealthCare Corporation

|

| Background | |

| | | | | |

| Mr. R. Adams joined NHI as a director in May 2020. He was with NHC for 45 years. He became chairperson of the board of NHC on January 1, 2009 and served as chief executive officer of NHC from November 1, 2004 until his retirement on December 31, 2016. Mr. R. Adams remains non-executive chairman of the NHC board. He has extensive long-term healthcare experience, including serving NHC as a healthcare center administrator and regional vice president. NHC served as the Company's Investment Advisor from 1991 through October 2004 and as a result, Mr. R. Adams served as Vice President of the Company during that period. He has not provided any services to the Company (other than as a director) since October 2004. He also served on the board of National Health Realty, Inc. (“NHR”), a publicly-traded REIT from December 1997 through October 2007. Mr. R. Adams has a Bachelor of Science degree from Middle Tennessee State University. He is the brother of W. Andrew Adams, the Chairperson of the Board. |

| Qualifications | |

| |

| The Board concluded Mr. R. Adams should serve as a director of the Company because he provides a valuable perspective regarding the long-term healthcare industry and brings his NHC experience in all aspects of the Board’s deliberations. |

| |

| James R. Jobe |

| Age 62 |

| Director since 2013 |

| Committees: |

| Audit Committee |

| Compensation Committee |

| Nominating & Corporate Governance Committee (Chairperson) |

|

|

Background

Mr. Jobe joined NHI as a director in April, 2013. Mr. Jobe is a partner in the accounting firm of Jobe, Hastings & Associates, CPA’s, established in 1984 in Murfreesboro, Tennessee. In that capacity, he has provided accounting and consulting services in the healthcare and long-term care industries for over 30 years. Mr. Jobe previously served as an independent director of NHR, until its merger with NHC in 2007. He received his Bachelor of Business Administration in Accounting from Middle Tennessee State University in 1984 and became a certified public accountant in 1986.

Qualifications

The Board concluded that Mr. Jobe should serve as a director of the Company based on his public company director experience, his accounting experience within the long-term care industry, and his independence from the Company. |

| | | | | |

| W. Andrew Adams |

| Chairperson of the Board |

| Age 78 |

| Director since 1991 |

| Committees: None |

| Other Current Public Directorships: National HealthCare Corporation |

|

|

Background

Mr. W. A. Adams has been our Chairperson of the Board since our inception in 1991. Mr. W. A. Adams served as both President and Chief Executive Officer (“CEO”) of the Company from our inception until his retirement as President in February 2009 and as CEO in March 2011. Mr. W. A. Adams was president and chief executive officer of NHC until he resigned those positions in 2004. He remains on NHC’s board of directors and served as chairman of the board of NHC until 2008. Mr. W. A. Adams served as president of National Health Realty, Inc. (“NHR”), a publicly-traded REIT from 1997 until November 2004 and served as chairman of the board of NHR until its merger with NHC in 2007. Effective January 16, 2017, Mr. W. A. Adams was appointed to the Governing Board of Middle Tennessee State University. Mr. W. A. Adams has previously served on the boards of Assisted Living Concepts, SunTrust Bank, David Lipscomb University and the Boy Scouts of America. He received his Bachelor of Science and Master of Business Administration degrees from Middle Tennessee State University. He is the brother of director Robert G. Adams.

Qualifications

The Board concluded Mr. W.A. Adams should serve as a director of the Company based on his prior role as CEO of the Company, extensive experience in the healthcare and REIT industries and his thorough understanding of the Company. |

| | | | | |

| Tracy M. J. Colden |

| Age 62 |

| Director since 2022 |

| Committees: |

| Nominating & Corporate Governance Committee |

|

|

|

|

Background

Ms. Colden was added as a director of the Company in June 2022. Ms Colden has served as general counsel, executive vice president and corporate secretary with Playa Hotels & Resorts N. V. (NASDAQ: PLYA) since January 2020. Ms. Colden has more than 30 years of experience in the hospitality and lodging industry. Ms. Colden has previously served as general counsel, executive vice president and corporate secretary for Highland Hospitality Corporation and Crestline Capital Corporation. Prior to joining Crestline Capital, Ms. Colden was an assistant general counsel at Host Marriott Corporation (now Host Hotels & Resorts, Inc.) and was previously in the private practice of law. Ms. Colden received her Bachelor of Business Administration from the University of Michigan and a Juris Doctor from the University of Virginia School of Law. Ms. Colden is a certified public accountant (inactive) and is a member of the District of Columbia, Florida and Michigan (emeritus status) bars.

Qualifications

The Board concluded that Ms. Colden should serve as a director of the Company based on her public company experience, legal background, diversity and independence from the Company. |

| | | | | |

| Robert A. McCabe |

| Age 73 |

| Director since 2001 |

| Committees: |

| Audit Committee (Chairperson) |

| Nominating & Corporate Governance Committee |

| Compensation Committee |

| Other Current Public Directorship: Pinnacle Financial Partners |

|

Background

Mr. McCabe has served as a director of the Company since 2001. Mr. McCabe has been chairperson of Pinnacle Financial Partners (“Pinnacle”) in Nashville, Tennessee since August 2000. He began his banking career with the former Park National Bank of Knoxville, Tennessee (“PNB”) and held numerous executive positions with PNB and its successor, First American National Bank. In 1994, Mr. McCabe was appointed vice chairman of First American Corporation. In March 1999, he was appointed by First American to manage all banking and non-banking operations, a position he held until First American’s merger with AmSouth Bancorporation in October 1999. Mr. McCabe previously served as chairman of the Nashville Chamber of Commerce and chairman of Nashville Electric Service, a municipal electric distribution company. Mr. McCabe was a director of Diversicare Healthcare Services, Inc. until it was sold in November 2021. He was also a director of Goldleaf Financial Solutions, Inc. until its sale in 2009 and a director of SSC Services of Knoxville, Tennessee until 2010. Mr. McCabe has been active in various civic organizations within his community, including Leadership Knoxville and Leadership Nashville. He is a member of the World Presidents’ Organization and the Chief Executives Organization, and served as the past chairman of the board of trustees of The Ensworth School and Cheekwood Botanical Gardens and Museum of Art. He is also the past chairman of the Middle Tennessee Boy Scout Council, the Nashville Symphony and the Nashville Downtown Partnership. Mr. McCabe received his Master of Business Administration degree from the University of Tennessee and completed the Advanced Management Program of Harvard Business School. |

| |

| Qualifications | |

| |

| The Board concluded Mr. McCabe should serve as a director of the Company because of his extensive leadership experience, his understanding of finance, accounting and the banking industry, and his independence from the Company. |

CORPORATE GOVERNANCE

The Board’s Leadership Structure

Mr. W. A. Adams has served as our Chairperson of the Board since the Company was founded in 1991. Mr. Mendelsohn was named CEO in August 2015 and joined the Board in February 2021. During 2023, our Board was comprised of Mr. W. A. Adams as Chairperson of the Board, Mr. Mendelsohn as CEO and director and six other independent directors.

We believe that this leadership structure is effective for the Company. Our Chairperson of the Board is charged with presiding over all meetings of the Board and our stockholders and providing advice and counsel to the CEO and our Company’s other officers regarding our business and operations. Further, our CEO and Chairperson of the Board have an excellent working relationship. With over 30 years of experience with NHI as its founder and Chairperson of the Board, Mr. W. A. Adams is well positioned to provide our CEO with guidance, advice and counsel regarding our Company’s business, operations and strategy. We believe that having Mr. W. A. Adams as Chairperson of the Board allows us to continue to draw upon his extensive knowledge of the REIT and healthcare industries.

The Board’s Oversight of Risk

Our full Board regularly engages in discussions of risk management and receives reports on risk management from members of management. Each of our Board committees also considers the risk within its areas of responsibility. Each of the independent committee chairpersons leads the Board in its role of risk oversight with respect to such committee’s area of responsibility. Thus, the Audit Committee leads the risk management oversight with respect to the Company’s financial statements and cyber-security, the Compensation Committee with respect to the Company’s compensation policies and the Nominating and Corporate Governance Committee with respect to corporate governance. Each of the committees will continue to lead risk oversight with respect to such committee’s area of responsibility and the Chairperson of the Board will add additional risk oversight with respect to the Company as a whole. We believe this structure provides effective oversight of the risk management function.

Board and Committee Meetings

The Board held four meetings during 2023 and acted by three written consents. Each director attended at least 75% of the total number of meetings of the Board and each committee on which such director served in 2023. The Company strongly urges, but does not require, directors to attend the annual meeting of stockholders. All directors as of the meeting date were in attendance at the 2023 annual meeting of stockholders.

Director Independence

The Board has determined that no director, other than Mr. Mendelsohn, had a material relationship with the Company during 2023 or the preceding three years. Accordingly, Mr. R. Adams, Mr. W. A. Adams, Ms. Colden, Mr. Jobe, Mr. McCabe, Ms. Swafford and Mr. Webb were “independent” directors based on an affirmative determination by our Board in accordance with the listing standards of the NYSE, the SEC and our Bylaws. Mr. W.A. Adams has not been an officer of the Company since February 2011 and based on the SEC rules, the NYSE rules and the Bylaws, the Board has determined that he is an independent director. Mr. Mendelsohn is the CEO of the Company and is thus not an independent director. Our Corporate Governance Guidelines provide that our independent directors meet in executive session without management present at least annually and generally each quarter. During the Board meetings, there are regularly scheduled executive sessions of the independent directors with no members of management present. Mr. W. A. Adams, as Chairperson of the Board, leads the executive sessions.

Committees of the Board

The Board has three standing independent committees with separate chairpersons, the Audit Committee, the Nominating and Corporate Governance Committee, and the Compensation Committee. The charters of each committee are provided on our website at www.nhireit.com. During 2023, each committee was comprised solely of independent directors. Each committee is submitting a report in this proxy statement. Each committee adopted its respective charter, which provides

that such committee elect a chairperson. The committee meetings serve as the vehicle for addressing matters within each committee’s purview at a detailed level.

Audit Committee

The Audit Committee is comprised of four members consisting of Mr. McCabe as the Chairperson, Mr. Jobe, Ms. Swafford and Mr. Webb. During 2023, the Audit Committee met four times and acted by one written consent. The Board has determined that the Chairperson of the Audit Committee, Mr. McCabe, meets the SEC’s definition of “audit committee financial expert” and all four members of the Audit Committee are “financially literate” as required by the NYSE rules. The Board has determined that all of the members of the Audit Committee are independent, as independence for audit committee members is defined under the NYSE listing standards and under the independence standards set forth in Rule 10A-3 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). We maintain an internal audit function as required by the NYSE rules to provide management and the Audit Committee with ongoing assessment of our risk management processes and system of internal control over financial reporting. Since 2006, we have outsourced this internal audit function to Rodefer Moss & Co., a Tennessee regional accounting firm with significant experience in providing audit and non-audit related services to its SEC clients. The primary functions of the Audit Committee are to assist the Board in fulfilling its oversight responsibilities with respect to: (a) the Company’s systems of internal control regarding finance, accounting, legal compliance and ethical behavior; (b) the Company’s auditing, accounting and financial reporting processes; (c) the Company’s financial statements and other financial information provided by the Company to its stockholders, the public and others; (d) the Company’s compliance with legal and regulatory requirements; and (e) the performance of the Company’s internal audit function and independent registered public accounting firm. The Audit Committee has the sole authority and responsibility to select, evaluate, and, where appropriate, replace the independent registered public accounting firm or nominate the independent registered public accounting firm for stockholder approval. The Audit Committee approves all audit engagement fees and terms of all non-audit engagements with the independent registered public accounting firm.

Nominating and Corporate Governance Committee

During 2023, the Nominating and Corporate Governance Committee was comprised of six members consisting of Mr. Jobe as the Chairperson, Mr. R. Adams, Ms. Colden, Mr. McCabe, Ms. Swafford and Mr. Webb, all of whom are independent directors. The Nominating and Corporate Governance Committee met two times during 2023 and acted by one written consent. The Nominating and Corporate Governance Committee’s responsibilities include providing assistance to the Board in identifying and recommending candidates qualified to serve as directors of the Company, reviewing the composition of the Board, developing, reviewing and recommending governance policies and principles for the Company and reviewing periodically the performance of the Board.

The process we follow with respect to director nominations is to identify qualified individuals for Board membership and recommend them to the full Board for consideration. In determining whether to recommend a candidate for the Board of Directors’ consideration, the Nominating and Corporate Governance Committee looks at diversity of experience and capabilities, with greater weight given to qualifications like an understanding of the healthcare industry, real estate, finance and accounting. The minimum and principal qualification of a director is the ability to act successfully on the stockholders’ behalf. The Nominating and Corporate Governance Committee then evaluates each nominee and does an internal rank ordering. Existing Board members are automatically considered for a term renewal. All potential candidates, whether initially recommended from management, other Board members or stockholders of the Company are considered in the same manner. If the appropriate biographical information is provided on a timely basis, we will evaluate stockholder recommended candidates by following substantially the same process, and applying the same criteria, as we follow for candidates submitted by others. Nominations by stockholders should be sent to National Health Investors, Inc., Attn: Nominating and Corporate Governance Committee, 222 Robert Rose Drive, Murfreesboro, Tennessee 37129.

Mr. Jobe has notified the Company that he intends to resign his position as the Chairperson of the Nominating and Corporate Governance Committee effective as of the day of the Meeting, however he will remain a member of the Committee. The Nominating and Corporate Governance Committee has recommended to the Board that Ms. Colden should be named as the Chairperson of the Committee, effective upon Mr. Jobe’s resignation. The Board has approved this recommendation.

Compensation Committee

The Compensation Committee is comprised of five members consisting of Mr. Webb as the Chairperson, Mr. R. Adams, Mr. Jobe, Mr. McCabe and Ms. Swafford, all of whom are independent directors. The Compensation Committee met seven times during 2023 and acted by one written consent. The purpose of the Compensation Committee is to discharge the responsibilities of the Board relating to the compensation of our executive officers and directors and to review and approve

senior officers’ compensation. This includes reviewing the alignment of executive compensation and benefit programs, policies and practices with Company values and strategy and the creation of value for stockholders and overseeing management’s review of the Company’s compensation programs, policies and practices to determine whether they encourage excessive risk-taking or otherwise create risks that are reasonably likely to have a material adverse effect on the Company. The Compensation Committee also oversees and reviews executive compensation programs, benefits, policies and practices with a view to attract, motivate and retain qualified executive officers and other key employees of the Company and make recommendations to the Board with respect to compensation, incentive compensation plans and equity-based plans for directors and officers of the Company. The Compensation Committee reviews and approves corporate goals and objectives relevant to compensation of the CEO, evaluates the performance of the CEO in light of those goals and objectives, and determines the compensation of the CEO based on this evaluation. In determining the long-term incentive component of CEO compensation, the Compensation Committee considers the Company’s performance and relative stockholder return, the value of similar incentive awards to chief executive officers at comparable companies, and the awards given to the CEO in past years. In evaluating and determining the CEO’s compensation, the Compensation Committee considers the results of the most recent stockholder advisory vote on executive compensation.

Corporate Governance Policies

The Board has adopted the NHI Code of Business Conduct and Ethics (“NHI Code”) and the NHI Corporate Governance Guidelines which, are available on our website at www.nhireit.com. Our website also contains information about the NHI EthicsPoint program, and this proxy statement contains a description of our EthicsPoint program under the caption “Stockholder Communications.” The contents of the website are not incorporated into this proxy statement.

The NHI Code was adopted to: (a) promote honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest; (b) promote compliance with applicable governmental laws, rules and regulations; (c) promote the protection of Company assets, including corporate opportunities and confidential information; (d) promote full, fair, accurate, timely and understandable disclosure in reports and documents that the Company files with, or submits to, the SEC and in other public communications made by the Company; (e) promote fair dealing practices; (f) deter wrongdoing; and (g) ensure accountability for adherence to the NHI Code.

The Company has adopted policies and procedures designed to prohibit unlawful trading, hedging transactions and related practices. Specifically, the Company’s employees, officers and directors are prohibited from trading in the Company’s securities while in possession of material non-public information and are also subject to routine and non-routine blackout periods during which times trading in our securities is not permitted. The Board has also adopted a policy that prohibits employees, officers, and directors, or any of their designees, from purchasing financial instruments (including prepaid variable forward contracts, equity swaps, collars, and exchange funds), or otherwise engaging in transactions that hedge or offset, or are designed to hedge or offset, any decrease in the market value of our equity securities. In addition, we have a policy that requires the pre-approval by our Chief Financial Officer before any employee, executive officer and Board member may pledge our common stock as collateral for a loan or for a margin account.

DIRECTOR COMPENSATION

During 2023, the independent directors received compensation for their Board service including an annual retainer of $75,000 and a $7,500 per meeting fee. Each committee chairperson received an annual retainer of $5,000 and the Audit Committee Chairperson received a $2,500 meeting fee. In 2023, each director received a fully vested option to purchase 10,000 shares of Company stock based on the closing price of NHI’s shares on February 24, 2023, the third business day following the Company’s annual earnings release. Additionally, the Company reimburses all directors for travel expenses incurred in connection with their duties as directors of the Company. Our option grants only have value if the Company’s stock price increases. We believe our director compensation package is reasonable.

2023 Director Compensation

| | | | | | | | | | | | | | | | | | | | | | | |

Name | Fees Earned or Paid in Cash ($) | Stock Awards ($) | Option Awards (1)($) | Non-Equity Incentive Plan Comp.($) | Change in Pension Value and Nonqualified Deferred Comp. Earnings | All Other Comp. ($) | Total ($) |

W. Andrew Adams | 105,000 | — | 70,860 | — | — | — | 175,860 |

Robert T. Webb | 110,000 | — | 70,860 | — | — | — | 180,860 |

Robert A. McCabe, Jr. | 120,000 | — | 70,860 | — | — | — | 190,860 |

| Tracy M.J. Colden | 105,000 | | 70,860 | — | — | — | 175,860 |

James R. Jobe | 110,000 | — | 70,860 | — | — | — | 180,860 |

Charlotte Swafford | 105,000 | — | 70,860 | — | — | — | 175,860 |

Robert G. Adams | 105,000 | — | 70,860 | — | — | — | 175,860 |

(1) This represents the amount of stock compensation expense recorded by the Company in 2023 for the annual grant of options to purchase 10,000 shares to each independent director on the third day following the Company’s annual earnings release. The exercise price of the options is the closing price of our common stock on the NYSE on the day the options are granted. The options vest immediately upon grant. At year-end, the aggregate number of outstanding option awards held by each independent director was as follows: Mr. W. A. Adams, 110,000; Mr. R. Adams, 60,000; Ms. Colden 35,000; Mr. Jobe, 85,000; Mr. McCabe, 85,000; Ms. Swafford, 60,000; and Mr. Webb, 110,000.

COMMITTEE REPORTS

Report of the Nominating and Corporate Governance Committee

In determining whether to recommend a candidate for the Board of Directors’ consideration, the Nominating and Corporate Governance Committee looks at diversity of experience and capabilities, with greater weight given to qualifications like an understanding of the healthcare industry, real estate, finance and accounting. The minimum and principal qualification of a director is the ability to act successfully on the stockholders’ behalf. The Nominating and Corporate Governance Committee then evaluates each nominee and does an internal rank ordering. Existing Board members are automatically considered for a term renewal. The Nominating and Corporate Governance Committee believes that the collective diversity of experience and qualifications of the directors should provide a variety of understanding and abilities that will allow the Board to fulfill its responsibilities. On February 16, 2024, the Nominating and Corporate Governance Committee nominated Mr. Mendelsohn, Ms. Swafford and Mr. Webb for re-election to the Board at the Meeting. Our nominees were assessed and chosen in accordance with the Nominating and Corporate Governance Committee’s charter.

This report is hereby submitted by the NHI Nominating and Corporate Governance Committee.

James R. Jobe, Chairperson

Robert G. Adams

Tracy M.J. Colden

Robert A. McCabe, Jr.

Charlotte A. Swafford

Robert T. Webb

This report of the Nominating and Corporate Governance Committee shall not be deemed incorporated by reference by any general statement incorporating by reference this proxy statement into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except to the extent that we specifically incorporate this information by reference, and shall not otherwise be deemed filed under these acts.

Report of the Audit Committee

The Audit Committee (a) reviewed and discussed with management and BDO USA, P.C. (“BDO”) the quarterly and annual financial statements and disclosures of the Company contained in Form 10-Q and Form 10-K, respectively, (b) reviewed internal operating reports with management, and (c) made detailed inquiries of the Company’s internal auditor and independent auditor as part of the Audit Committee’s review of the Company’s internal control over financial reporting. During Audit

Committee meetings, the members meet in executive session individually with the CEO, the Chief Financial Officer, the Chief Accounting Officer, the internal auditor and BDO, whenever the Audit Committee deems it appropriate. The Audit Committee has discussed with BDO the matters required by the standards of the Public Company Accounting Oversight Board (“PCAOB”) and as required by the SEC. In addition, the Audit Committee has received from and discussed with BDO the written disclosures and letter from BDO required by the applicable requirements of the PCAOB regarding BDO’s communications with the Audit Committee concerning independence and concluded that BDO remains independent from management and the Company.

In reliance on the reviews and discussions referred to above, the responsibilities outlined in the Restated Audit Committee Charter and legal requirements applicable for 2023, the Audit Committee recommended to the Board, and the Board approved, that the audited consolidated financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023.

This report is hereby submitted by the NHI Audit Committee.

Robert A. McCabe, Jr., Chairperson

James R. Jobe

Charlotte A. Swafford

Robert T. Webb

This report of the Audit Committee shall not be deemed incorporated by reference by any general statement incorporating by reference this proxy statement into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except to the extent that we specifically incorporate this information by reference, and shall not otherwise be deemed filed under these acts.

Report of the Compensation Committee

The Compensation Committee has reviewed and discussed the Compensation Discussion and Analysis required by Item 402(b) of Regulation S-K with management, and based on such review and discussions, the Compensation Committee recommended to the Board that the Compensation Discussion and Analysis be included in this proxy statement and incorporated by reference into the Company’s Annual Report on Form 10-K for the year ended December 31, 2023.

This report is hereby submitted by the NHI Compensation Committee.

Robert T. Webb, Chairperson

Robert G. Adams

James R. Jobe

Robert A. McCabe, Jr.

Charlotte A. Swafford

This report of the Compensation Committee shall not be deemed incorporated by reference by any general statement incorporating by reference this proxy statement into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except to the extent that we specifically incorporate this information by reference, and shall not otherwise be deemed filed under these acts.

EXECUTIVE OFFICERS

Officers serve at the pleasure of the Board for a term of one year. The following table gives information about our executive officers.

| | | | | |

| D. Eric Mendelsohn |

| Age: 62 |

| Position: President and CEO |

|

|

| Background |

| Biographical information on Mr. Mendelsohn is included above under “Proposal 1 - Election of Directors.” |

|

| | | | | |

| Kristin S. Gaines |

| Age 52 |

| Senior Vice President and Chief Transaction Officer |

|

| Background |

| Ms. Gaines joined NHI in 1998 as a Credit Analyst, she was named Chief Credit Officer in February 2010 and appointed NHI’s Senior Vice President and, Chief Transaction Officer in February 2023. During her tenure with NHI, Ms. Gaines has had a progressive career in the areas of real estate, finance and operations. Her experience has resulted in a breadth of expertise in underwriting, asset management and real estate transactions. Ms. Gaines holds a Master of Business Administration and a Bachelor of Business Administration in Accounting from Middle Tennessee State University and earned a Master of Legal Studies with a concentration in Dispute Resolution from Washington University in St. Louis in 2023. |

|

|

|

|

|

| | | | | |

| Kevin C. Pascoe |

| Age 44 |

| Executive Vice President of Investments and Chief Investment Officer |

|

| Background |

| Mr. Pascoe joined NHI in June 2010 as Vice President of Asset Management. He was named Executive Vice President of Investments in January 2015 and was named Chief Investment Officer in February 2017. Mr. Pascoe oversees NHI’s business development, asset management and relationship management with existing tenants and conducts operational due diligence on NHI’s new investment opportunities. He has over 15 years of healthcare real estate background including his experience with General Electric - Healthcare Financial Services (“GE HFS”) (2006 – 2010) where he most recently served as a vice president. With GE HFS, he moved up through the organization while working on various assignments including relationship management, deal restructuring, and special assets. He also was awarded an assignment in the GE Capital Global Risk Rotation Program. Mr. Pascoe holds a Master of Business Administration and a Bachelor of Business Administration in Economics from Middle Tennessee State University. |

|

|

|

|

|

|

|

|

|

| | | | | |

| John L. Spaid |

| Age 64 |

| Executive Vice President of Finance, Chief Financial Officer and Treasurer |

|

| Background |

| Mr. Spaid was named Chief Financial Officer in November 2019 and Treasurer in February 2023. He joined NHI in March 2016 as Executive Vice President of Finance. He oversees the Company’s banking relationships, financial transactions, accounting functions and SEC reporting. Mr. Spaid has over 40 years of experience in real estate, finance and senior housing. From November 2015 until joining NHI, Mr. Spaid provided consulting services to NHI, which services included acquisition underwriting analyses and Board presentations. Previously, Mr. Spaid was with Emeritus Senior Living as their senior vice president of financial planning and analysis where he led corporate and operational financial analysis and support teams. His responsibilities included forecasting, investor presentation, annual budget, debt and lease obligation underwriting, M&A processes, financial modeling, due diligence, board presentations and employee development from 2012 to 2014. Mr. Spaid was a member of the Sarbanes-Oxley compliance committee at Emeritus. Prior to Emeritus, Mr. Spaid was an independent financial consultant, who provided mergers & acquisition, work-out, and private equity consulting services from 2010 to 2011. He also served as the chief financial officer of a regional assisted living and memory care provider in Redmond, Washington from 2008 to 2009. Mr. Spaid has a Bachelor of Business Administration degree with honors from the University of Texas and a Masters of Business Administration with High Distinction from the University of Michigan. |

|

|

|

|

|

|

|

|

|

|

|

|

|

| | | | | |

| David L. Travis |

| Age 49 |

| Senior Vice President and Chief Accounting Officer |

|

| Background |

| Mr. Travis was named Senior Vice President and Chief Accounting Officer in May 2020. Mr. Travis has over 25 years of accounting and financial reporting experience, including over 15 years as a chief accounting officer for publicly traded healthcare REITs. Prior to joining NHI, Mr. Travis was the chief accounting officer with MedEquities Realty Trust from August 2014 through the completion of its merger with Omega Healthcare Investors (NYSE:OHI) in 2019. He was previously senior vice president and chief accounting officer of Healthcare Realty Trust (NYSE:HR) from December 2006 until July 2014. Before joining Healthcare Realty Trust, Mr. Travis was an auditor at Ernst & Young LLP from 1996-2006. Mr. Travis earned his Bachelor of Business Administration summa cum laude in accounting from the University of Memphis and is a certified public accountant. |

|

|

|

|

|

|

|

CORPORATE SUSTAINABILITY

We believe that integrating environmental, social and governance, or ESG, initiatives into our strategic business objectives will contribute to our long-term success. We have established a management ESG committee comprised of our Chief Financial Officer, Vice President, Finance and Investor Relations and Vice President, HR/Benefits and Compliance. This committee is tasked with overseeing our strategies regarding the Company’s social impact and environmental sustainability. Our ESG Committee was established with the goal of increasing our accountability, sharpening our focus, and maximizing our efforts with respect to the environmental, social and governance impact on our clients, employees and properties. In addition, the ESG Committee will help to measure our progress on our ESG initiatives and priorities, adding an element of accountability, which should also increase our effectiveness. The ESG Committee will meet at least quarterly with the chairperson of the Nominating and Corporate Governance Committee of the Board. Through our sustainability efforts, we seek to incentivize positive change and create value for our stakeholders. Below are some more details of our corporate sustainability efforts:

Environmental

•We provide our triple net lease operators capital improvement allowances for the redevelopment, expansions and renovations at our properties which may include energy efficient improvements like LED lighting and low emission carpeting, recycled materials and solar power;

•We provide our development partners with capital to build new state-of-the-art properties with energy efficient components and design features;

•We obtain Phase I environmental and Phase II reports if warranted as part of our due diligence procedures when acquiring properties and attempt to avoid buying real estate with known environmental contamination;

•Our document retention practices strive to reduce paper usage and encourage electronic file sharing;

•We strive for efficiency and sustainability in our corporate headquarters, participate in a recycling program, and encourage our employees to reduce, reuse and recycle waste;

Social

•We employ individuals who possess a broad range of experiences, background and skills, and we believe that to continue to deliver long-term value to our stockholders, we must provide and maintain a work environment that attracts, develops, and retains top talent and affords our employees an engaging work experience that allows for career development and opportunities. Along with a competitive compensation program including incentive bonuses and a stock incentive plan, NHI provides a 401(k) plan with a safe harbor contribution, employer sponsored health insurance coverage and tuition reimbursement;

•We actively support charitable organizations within our community that promote health education and social well-being. During 2023, we donated approximately $45,000 to external charitable organizations that provide support services to the communities that sustain our residents, operating partners and employees, such as the ALZ foundation, our employee match program and other fundraising efforts which leverage our professional relationships with banks, law firms, and other key vendors;

•We support efforts to cure diseases that afflict our residents and loved ones by sponsoring and participating in local community events such as the Walk to End Alzheimer’s;

•We encourage our employees to support our local community by matching voluntary contributions through our company-wide charity program;

•We support the Granger Cobb Institute with a continuing endowment to further educate students in pursuit of careers in senior housing;

•We support the Community Foundation of Middle Tennessee with a continuing endowment to support local charities; one of our corporate officers serves on the board of this foundation as well;

Governance

•We elected our first female director to the Board in 2020;

•We engaged a search firm to help the Board identify an additional diverse member which resulted in the appointment of our first African-American and our second female director to the Board in 2022;

•NHI’s workforce by gender is 52% female and 48% male;

•We have designed our executive compensation to be aligned with stockholders by rewarding executives for growth in Normalized FAD and dividend growth, conservative dividend payout ratios, prudent balance sheet management, accretive investment growth and total shareholder return;

•We have adopted an insider trading policy designed to prohibit unlawful trading, hedging transactions and related practices; and

•We have adopted a Clawback Policy to recoup incentive compensation in the event the Company is required to restate its financial statements.

COMPENSATION DISCUSSION AND ANALYSIS

This Compensation Discussion and Analysis describes the material elements of the Company’s named executive officer compensation program and analyzes the compensation decisions made for our named executive officers included in the Summary Compensation Table below.

2023 Highlights(1)

Our operating and financial performance highlights achieved in 2023 include:

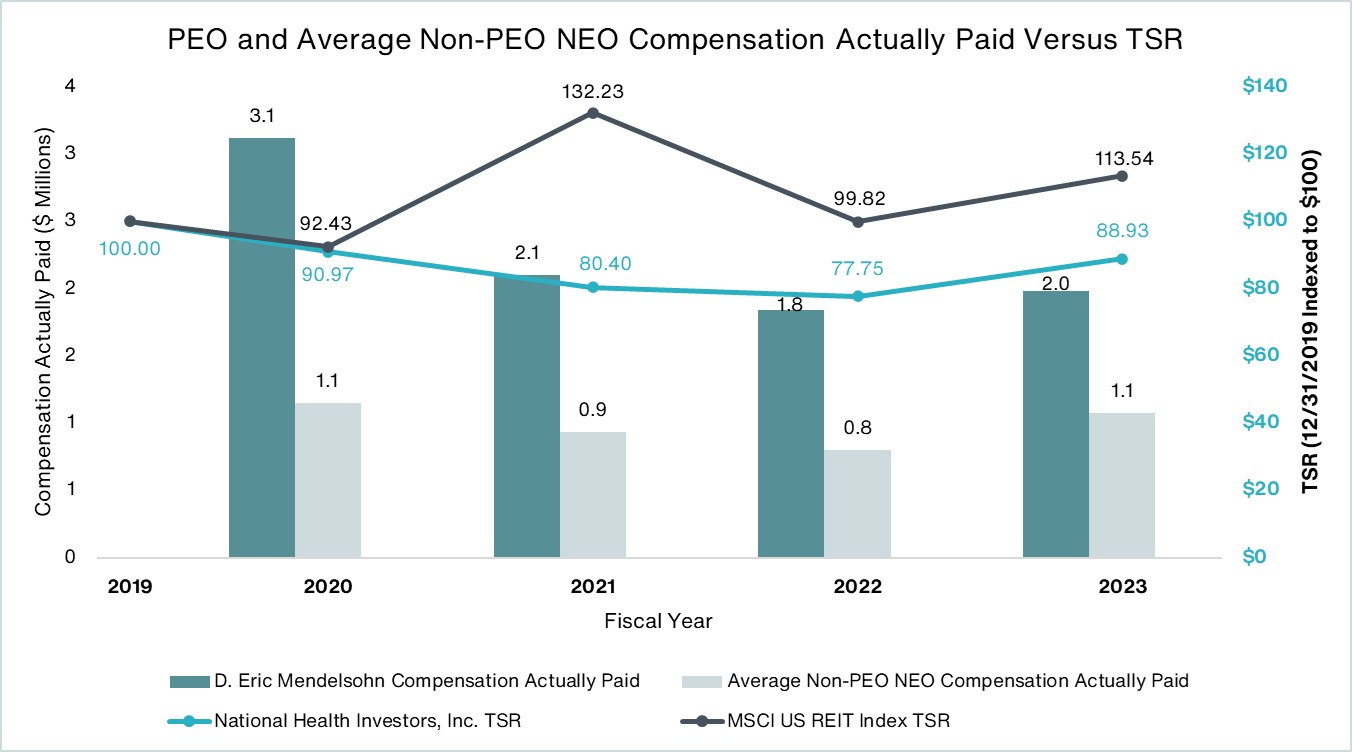

•Net income attributable to common stockholders per diluted common share for the twelve months ended December 31, 2023 was $3.13 compared to $1.48 during the same period in the prior year.

•Funds from operations (“FFO”) per diluted common or the twelve months ended December 31, 2023 was $4.39 compared to $3.55 during the same period in the prior year.

•Normalized FFO per diluted common share for the twelve months ended December 31, 2023 was $4.33 compared to $4.30 during the same period in the prior year.

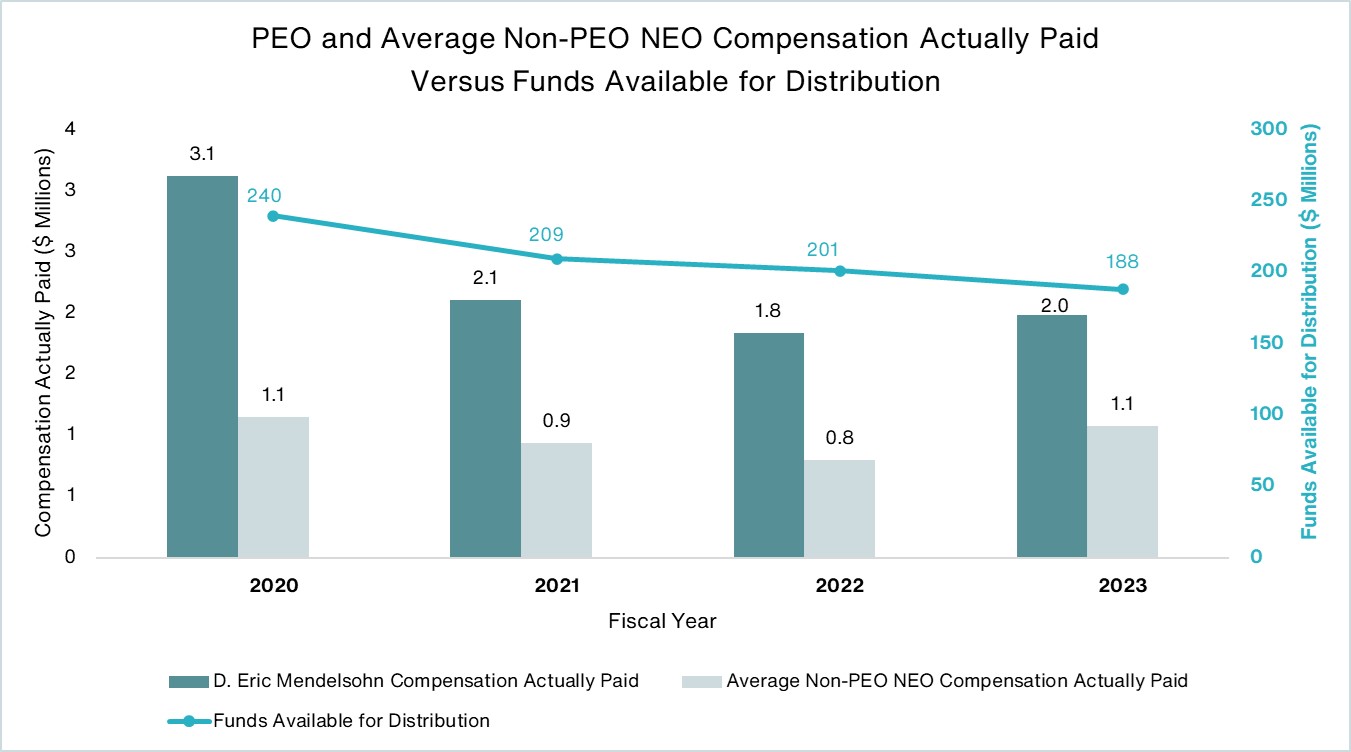

•Normalized funds available for distribution (“FAD”) for the twelve months ended December 31, 2023 was $187.8 million compared to $201.0 million during the same period in the prior year.

•Net income attributable to common stockholders, FFO, Normalized FFO and Normalized FAD for the twelve months ended December 31, 2023 included approximately $5.7 million in the repayment of previously deferred rent and related interest.

•Net operating income (“NOI”) from the Senior Housing Operating Portfolio (“SHOP”) segment, comprised of revenues from resident fees and related services less operating expenses, totaled $9.2 million for the year ended December 31, 2023 compared to $7.6 million for the period from inception of the SHOP segment on April 1, 2022 through December 31, 2022.

•On June 16, 2023, we closed on a $200 million two year term loan, with one year option to extend.

• Made approximately $74 million in investments during the year ended December 31, 2023 at an average initial yield of 8.3%.

• During the year ended December 31, 2023 we retired approximately $415 million in debt using proceeds from the new term loan and revolver.

•For the year ended December 31, 2023, we sold 12 properties with a net book value of approximately $45.1 million for net proceeds of approximately $59.1 million, as part of our portfolio optimization plan.

(1) See Appendix A for a reconciliation of FFO, Normalized FFO, Normalized FAD and NOI to net income computed in accordance with accounting principles generally accepted in the United States (“GAAP”).

Objectives

The objectives of our compensation programs are to actively motivate and retain qualified senior officers and other key employees who are responsible for our Company’s success. The compensation program is designed to reward our officers for the Company’s performance as a whole and for each officer’s individual effort in achieving the Company’s goals. Our compensation program includes the elements of (a) a base salary that is reflective of job responsibilities, expertise and market demands, (b) an annual incentive bonus award to reward individual effort in achieving the Company’s goals, and (c) share-based compensation, which we have historically paid in the form of stock options, to align the financial interests of our senior officers with those of our stockholders. In 2023, the Compensation Committee also granted shares of restricted stock. The Compensation Committee has not engaged a compensation consultant to date.

Base Salary

Our Chief Executive Officer is the only executive officer that has an employment agreement, which is described on page 28 of this proxy statement. Base salaries are reviewed and adjusted by the Compensation Committee on an annual basis. The Compensation Committee seeks to ensure that base salaries are established at levels that reflect the responsibilities and duties of our executives and are competitive with amounts paid to executives of other healthcare REITs, although our base salaries tend to be below those of our peer group companies. In determining an individual executive’s actual base salary, the Compensation Committee considers other factors, which may include the executive’s past performance, relative importance, future poten

tial, and contributions to our past success. In February 2023, the Compensation Committee noted its decision to significantly reduce the number of options granted to the named executive officers as discussed below under “2023 Equity Awards” and decided to increase base salaries in connection with that reduction. The Compensation Committee also concluded that the salaries for the Chief Executive Officer, Chief Financial Officer and Chief Accounting Officer were substantially less than the salaries of persons in similar positions with other healthcare REITs and significantly increased those salaries. The following table summarizes salary approved by the Compensation Committee for 2023:

| | | | | | | | | | | |

| Named Executive Officer | 2023 Base Salary | 2022 Base Salary | Year over Year Increase |

| D. Eric Mendelsohn | $500,000 | $417,730 | 19.7% |

| Kristin S. Gaines | $206,000 | $200,788 | 2.6% |

| Kevin C. Pascoe | $242,265 | $235,208 | 3.0% |

| John L. Spaid | $400,000 | $315,000 | 27.0% |

| David L. Travis | $300,000 | $275,000 | 9.1% |

Incentive Awards

Annual incentive awards are designed to focus management attention on key operational goals for the current fiscal year and are paid in cash. The key operational goals are a combination of each executive’s area of responsibility and the overall financial performance by the Company. In approving annual incentive awards, the Compensation Committee considers, among other factors, the Company’s revenue growth and profitability, the development and expansion of its business, the executive’s work during the year, past compensation, perceived contribution to the Company, level of responsibility, and any notable individual achievements or failings in the year in question. Those executives in a position to have a more significant impact on the financial performance of the Company are eligible to receive substantially larger bonuses than executives who are not in such a position.

As part of the annual incentive awards, the Compensation Committee originally adopted a Cash Performance Incentive Plan (“Prior Incentive Plan”) in 2009, which for 2022 was driven 50% by the Company’s Normalized FAD and 50% by the Company’s recurring dividend growth. Under the Prior Incentive Plan, for 2022 the named executive officers were entitled to an award based on Normalized FAD growth provided that the Company’s Normalized FAD increased at least 5% over the previous year’s Normalized FAD and an award based on dividend growth provided the Company’s recurring dividend increased at least 5% over the previous year’s recurring dividend.

Equity Awards

Long-term equity awards are granted to align the executives’ financial interests with those of our stockholders. We believe that long-term compensation should motivate and reward the creation and preservation of long-term stockholder value through both price increases and dividends. Long-term equity awards typically vest over three to five years and are subject to forfeiture if the executive leaves the Company prior to vesting. The Company has historically relied solely on stock options for equity awards to all employees, including the named executive officers. Such grants provide our executive officers the opportunity to purchase shares of NHI common stock at some future date at the fair market value of the stock on the date of the stock option grant. Stock option grants are designed to provide long-term (up to ten years) incentives linked directly to the price of our common stock. Stock options add value to the recipient only when stockholders benefit from stock price appreciation.

2023 Incentive Plan

The Compensation Committee considered that the Prior Incentive Plan did not provide much of an incentive for the named executive officers given the difficulties encountered by the industry over the past three years. The Prior Incentive Plan operated in a way that the named executive officers either received the full target bonus payout amount for each element or received no incentive bonus if the target was not met. The Compensation Committee also recognized that under the Prior Incentive Plan, it was highly unlikely that any of the named executive officers would be able to meet the incentive goals for 2023. In addition, the Company’s new SHOP segment requires different management skills and provides different goals than under the Prior Incentive Plan for 2022.

As a result, the Compensation Committee redesigned the Prior Incentive Plan by adopting the 2023 Incentive Plans (the “2023 Incentive Plans”) to replace the Prior Incentive Plan. Under the 2023 Incentive Plans, each named executive officer

has an individual plan with specific goals aligned with the individual officer’s area of responsibility. Under the 2023 Incentive Plans, the Compensation Committee established a target payout amount based on budgeted outcomes, but provided for additional amounts if performance exceeds expectations. The 2023 Incentive Plans also provides for reduced amounts if certain goals are not accomplished. Thus the 2023 Incentive Plans are not all-or-nothing plans like the Prior Incentive Plan.

Mr. Mendelsohn’s 2023 Incentive Plan which provided incentive compensation, linked to Company performance and investor returns, was based on the following categories and provided that the incentive compensation will be paid in cash, or with respect to Items (5) and (6) may be paid in cash or restricted stock, at Mr. Mendelsohn’s election:

•Normalized FAD/Dividend increases. This category is similar to the Prior Incentive Plan for 2022, but provides for modified Normalized FAD/dividend increase goals which grants tiered levels of incentive compensation based on the increase in Normalized FAD above $4.38 and the increase in the annual dividend above $3.60.

•Normalized FAD payout ratio. This category provides for different incentive compensation levels for a Normalized FAD payout ratio at or below 80% or at or below 85%

•New investments. This category provides for incentive compensation based on the average annual return on new investments.

•SHOP revenue goals. This category provides for incentive compensation based on certain percentage increases in SHOP revenue.

•Net debt to Adjusted EBITDA. This category provides incentive compensation for a net debt to Adjusted EBITDA ratio of 4.5 times or less.

•Collection of deferrals. This category provides incentive compensation based on the collection of deferrals previously granted by the Company to certain of its tenants.

The Compensation Committee considered the Normalized FAD increases, Normalized FAD payout ratio, New investment yield, SHOP revenue increases and deferral collections as the most meaningful performance measures. Normalized FAD, as calculated by us, is net income (computed in accordance with GAAP) with adjustments to exclude various items, as described below. Adjustments related to real estate activities include gains (or losses) from sales of real estate property, impairments of real estate, real estate depreciation and amortization, and the results of unconsolidated partnerships and joint ventures, if any. Other adjustments are made for certain items which, due to their infrequent or unpredictable nature, may create some difficulty in comparing results across periods, and may include, but are not limited to, impairment of non-real estate assets, gains and losses attributable to the acquisition and disposition of assets and liabilities, and recoveries of previous write-downs. Adjusted EBITDA, as calculated by us, is earnings before interest, taxes, depreciation and amortization, including amounts in discontinued operations, excluding real estate asset impairments and gains on dispositions.

GAAP requires a lessor to recognize contractual lease payments into income on a straight-line basis over the expected term of the lease. This straight-line adjustment has the effect of reporting lease income that is significantly more or less than the contractual cash flows received pursuant to the terms of the lease agreement. GAAP also requires any discount or premium related to indebtedness and debt issuance costs to be amortized as non-cash adjustments to earnings. The Company adjusts Normalized FAD for these non-cash items as well as for the net change in the allowance for expected credit losses, non-cash stock-based compensation, senior housing portfolio capital expenditures, and for certain non-cash items related to equity method investments such as straight-line lease expense and amortization of purchase accounting adjustments. Normalized FAD is an important supplemental measure of liquidity for a REIT as a useful indicator of the ability to distribute dividends to stockholders.

Normalized FAD payout ratio and net debt to Adjusted EBITDA are non-GAAP measures that we use to measure our performance. Normalized FAD payout ratio is our Normalized FAD divided by our distributions to common stockholders, expressed as a percentage. Net debt is our total debt less cash and cash equivalents and we divide that by Adjusted EBITDA, to calculate our net debt to Adjusted EBITDA. See Appendix A for additional information on Normalized FAD, Adjusted EBITDA and net debt to Adjusted EBITDA ratio.

Any incentive bonus paid in restricted stock would vest one-third on the date of grant and one-third on each of the first and second anniversary of the date of grant. Under the 2023 Incentive Plan for Mr. Mendelsohn, the target payout amount was $845,000.

The other named executive officers had similar individual plans as outlined in the following table:

| | | | | | | | | | | |

| Named Executive Officer | Categories | Target Payout amount |

| Kristin S. Gaines | •Normalized FAD growth (1) | •Number of closed transactions | $355,000 |

•Conversion to SharePoint | •Timing of converting LOI to PSA(3) | |

•TSR goals(2) | | |

| Kevin C. Pascoe | •Normalized FAD growth | •Collection of deferrals | $450,000 |

| •SHOP revenue increase | •TSR goals | |

| •New investments | | |

| John L. Spaid | •Normalized FAD/Dividend growth | •Capital structure and liquidity | $400,000 |

| •Normalized FAD guidance accuracy | •TSR goals | |

| •Credit ratings | •Net debt to Adjusted EBITDA | |

| David L. Travis | •Normalized FAD/Dividend growth | •Timely filing of financial statements | $225,000 |

| •TSR goals | •No restatement/adjustments | |

| •Shorten closing schedule | | |

(1) For the other named executive officers, the growth in Normalized FAD was based on growth above $4.26.

(2) TSR was based on the Company’s total stockholder return (“TSR”) for 2023 and compared to six peers, consisting of LTC Properties, Inc.; Sabra Health Care REIT, Inc.; Welltower, Inc.; Ventas, Inc.; CareTrust REIT, Inc.; and Omega Healthcare Investors, Inc.

(3) This is based on the number of days involved in moving a potential transaction from the signed letter of intent stage to the signed purchase agreement.

Based on the above described 2023 Incentive Plans, the following amounts were earned by each of the named executive officers:

| | | | | |

| Named Executive Officer | Amount Earned Under 2023 Incentive Plans |

| D. Eric Mendelsohn | $ 875,044 |

| Kristin S. Gaines | $ 271,333 |

| Kevin C. Pascoe | $ 450,000 |

| John L. Spaid | $ 345,728 |

| David L. Travis | $ 201,171 |