EX-99.4

Exhibit 99.4

OCTOBER 27, 2016

Management’s Discussion

and Analysis

INTRODUCTION

The Management’s

Discussion and Analysis (MD&A) provides a review of the significant developments that impacted Norbord’s performance during the period. The information in this section should be read in conjunction with the unaudited condensed consolidated

interim financial statements for the period ended September 24, 2016 and the audited annual financial statements and annual MD&A in the 2015 Annual Report.

In this MD&A, “Norbord” or the “Company” means Norbord Inc. and all of its consolidated subsidiaries and affiliates, unless the

context implies otherwise. “Brookfield” means Brookfield Asset Management Inc., or any of its consolidated subsidiaries and affiliates, which are related parties by virtue of a controlling equity interest in the Company.

Annual financial data provided has been prepared in accordance with International Financial Reporting Standards (IFRS) as issued by the International

Accounting Standards Board (the IASB) and interim financial data has been prepared in accordance with International Accounting Standard (IAS) 34, Interim Financial Reporting. Additional information on Norbord, including the Company’s

annual information form and other documents publicly filed by the Company, is available on the Company’s website at www.norbord.com, the System for Electronic Document Analysis and Retrieval (SEDAR) administered by the Canadian Securities

Administrators (the CSA) at www.sedar.com and on the Electronic Data Gathering, Analysis and Retrieval System (EDGAR) section of the US Securities and Exchange Commission (the SEC) website at www.sec.gov/edgar/searchedgar/companysearch.html. All

financial references in the MD&A are stated in US dollars, unless otherwise noted.

Some of the statements included or incorporated by reference in

this MD&A constitute forward-looking statements within the meaning of applicable securities legislation. Forward-looking statements are based on various assumptions and are subject to various risks. See the cautionary statement contained in the

Forward-Looking Statements section.

The Company has prepared this MD&A with reference to National Instrument 51-102 – Continuous Disclosure

Obligations of the CSA. The Company is an eligible issuer under the Multijurisdictional Disclosure System (MJDS) and complies with the US reporting requirements by filing its Canadian disclosure documents with the SEC. As a MJDS issuer, the

Company is permitted to prepare this MD&A in accordance with the disclosure requirements of Canada, whose requirements are different from those of the United States.

This MD&A provides financial and operating results for the three month and nine month periods ended September 24, 2016 and additional disclosure of

material information up to and including the date of issue, being October 27, 2016.

Adjusted EBITDA, Adjusted earnings (loss), Adjusted earnings

(loss) per share, cash provided by operating activities per share, operating working capital, total working capital, capital employed, return on capital employed (ROCE), return on equity (ROE), net debt for financial covenant purposes, tangible net

worth, net

Some of the statements included in this MD&A constitute forward-looking statements that are based on various assumptions and are subject to various risks.

See the cautionary statement contained in the Forward-Looking Statements section.

1

debt to capitalization, book basis, and net debt to capitalization, market basis, are non-IFRS financial measures described in the Non-IFRS Financial Measures section. Non-IFRS financial measures

do not have any standardized meaning prescribed by IFRS and are therefore unlikely to be comparable to similar measures presented by other companies. Where appropriate, a quantitative reconciliation of the non-IFRS financial measure to the most

directly comparable IFRS measure is also provided.

BUSINESS OVERVIEW & STRATEGY

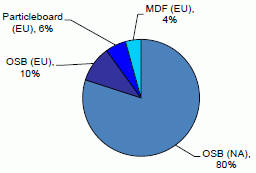

Norbord is a leading global manufacturer of wood-based panels with 17 plant locations in the United States (US), Canada and Europe. After the completion of the

merger with Ainsworth Lumber Co. Ltd. (Ainsworth) on March 31, 2015, Norbord became the largest global producer of oriented strand board (OSB) with annual capacity of 8 billion square feet (Bsf)

(3/8-inch basis). In North America, Norbord owns 13 OSB production facilities located in the Southern region of the US, Western Canada,

Quebec, Ontario and Minnesota. In Europe, the Company operates an OSB production facility, two particleboard mills and one medium density fibreboard (MDF) mill in the United Kingdom (UK) and one OSB production facility in Belgium and is the

UK’s largest panel producer. The Company reports its operations in two geographic segments, North America and Europe with approximately 80% of its panel production capacity in North America and 20% in Europe. Norbord’s business strategy is

focused entirely on the wood-based panels sector – in particular OSB – in North America, Europe and Asia.

OSB Accounts for 90% of Norbord’s Business

Production Capacity by Product

NA = North America

EU = Europe

Norbord’s financial goal is to

achieve top-quartile ROCE among North American forest products companies over the business cycle.

Protecting the balance sheet is an important element of

Norbord’s financing strategy. Management believes that its record of superior operational performance, disciplined capital allocation and prudent balance sheet management will enable it to access public and private capital markets (subject to

financial market conditions). At period-end, Norbord had unutilized liquidity of $420 million, comprising $74 million in cash, $221 million in unutilized revolving bank lines and $125 million undrawn under its accounts receivable securitization

program. The Company has $200 million senior secured notes that are due in February 2017, which the Company intends to permanently repay at maturity using cash on hand, cash generated from operations and if necessary, by drawing upon the accounts

receivable securitization program.

MERGER WITH AINSWORTH

On March 31, 2015, Norbord completed its merger with Ainsworth (the Merger). The Merger created the largest global OSB producer and brought together

Norbord’s manufacturing cost leadership with Ainsworth’s track record of innovation in product development. It also allows Norbord to better serve the Company’s North American customers as well as gain access to small but growing

Asian markets.

Some of the statements included in this MD&A constitute forward-looking statements that are based on various assumptions and are subject to various risks.

See the cautionary statement contained in the Forward-Looking Statements section.

2

As of the third quarter of 2016, Norbord has captured $45 million in cumulative (annual run rate) synergies from

the Merger, within 18 months of closing. Of this amount, $36 million has been realized within the past 18 months and the remaining $9 million is expected to be realized in future quarters from synergy initiatives already executed. These

synergies have resulted from reduced corporate overhead costs, optimization of sales and logistics, procurement savings, the sharing of operational best practices and implementing best practices related to operating working capital management such

as optimizing inventory levels and customer/supplier payment terms. Since the Merger, the Company has incurred one-time costs of $14 million to achieve these synergies, of which $7 million was incurred in 2015 and $7 million to-date in 2016. In

addition to these synergies, the Merger is enabling the Company to avoid significant capital cash outlays it would otherwise have had to incur. Norbord estimates this capital cost avoidance at $35 million, which includes utilizing formerly idle

assets throughout the Company. As the Merger synergies target has now been fully realized, the Company will continue to report progress on continuous improvement initiatives through the Margin Improvement Program (MIP).

QUEBEC MILL EXCHANGE

Subsequent to quarter-end, the

Company reached an agreement with Louisiana-Pacific Corporation (LP) to exchange OSB mills in the province of Quebec. Norbord will swap ownership of its mill in Val-d’Or for LP’s mill in Chambord. Production at both mills has been

curtailed for a number of years. The non-monetary asset exchange transaction is expected to close in November 2016. The Chambord mill has a stated capacity of 470 million square feet (3/8-inch basis) and the Val-d’Or mill has a stated capacity of 340 million square feet

(3/8-inch basis).

HIGH LEVEL FIRE

On May 4, 2016, a fire started in the wood yard of the High Level, Alberta mill. Production was halted immediately while the fire was brought

under control. The mill has an annual stated production capacity of 860 million square feet (3/8-inch basis) and has been ramping up

toward full production since resuming operations in late 2013. The fire destroyed a portion of the mill’s log inventory. The mill returned to production approximately three weeks later.

To date, the Company has recognized the following amounts:

|

|

|

|

|

| (US $ millions) |

|

|

|

| Write-off of log inventory destroyed by the fire |

|

$ |

(7 |

) |

| Costs of fighting and site restoration |

|

|

(6 |

) |

| Insurance recovery for the reimbursement of the lost log inventory, fire fighting costs and site

restoration |

|

|

12 |

|

|

|

|

|

|

| Costs related to High Level fire, net |

|

|

(1 |

) |

| Insurance recovery for business interruption |

|

|

2 |

|

|

|

|

|

|

| Net insurance claim recovery to-date |

|

$ |

1 |

|

|

|

|

|

|

At quarter-end, $8 million of insurance proceeds for property damage had been received and $6 million is included in accounts

receivable. Subsequent to quarter-end, a further installment of insurance proceeds of $3 million was received. The insurance claim is ongoing.

SUMMARY

North American OSB demand continues to improve, driven by a gradual rebound in new home construction and continued growth in repair and remodel and

industrial markets. Year-to-date US housing starts were up 4% compared to 2015, with single-family starts 9% higher. The North Central benchmark price averaged $301 per Msf (7/16-inch basis) for the quarter, up 14% against the previous quarter and up 48% against the same quarter last year. Norbord’s North American third quarter capacity utilization was in line with

the prior

Some of the statements included in this MD&A constitute forward-looking statements that are based on various assumptions and are subject to various risks.

See the cautionary statement contained in the Forward-Looking Statements section.

3

quarter and improved versus the same quarter last year, primarily due to fewer maintenance shutdown days and production curtailments.

Norbord’s European panel business continues to generate steady financial results despite the unexpected outcome of the “Brexit” referendum (UK

withdrawal from the European Union), as demand in the Company’s core markets in the UK and Germany remains strong. The European mills third quarter capacity utilization was lower than the prior quarter primarily due to lost production days

following a fatality at the Cowie, Scotland mill, but in line with the same quarter last year as improved productivity was offset by the lost production days.

Norbord generated operating income of $87 million in the third quarter of 2016, up from $67 million in the second quarter of 2016 and $8 million in the third

quarter of 2015. Year-to-date, Norbord generated operating income of $193 million, up from an operating loss of $2 million in the same period of 2015. Norbord recorded earnings of $55 million ($0.64 per basic and diluted share) in the third quarter

of 2016 versus earnings of $44 million ($0.51 per basic and diluted share) in the second quarter of 2016 and a loss of $9 million ($0.11 loss per basic and diluted share) in the third quarter of 2015. Year-to-date, Norbord recorded earnings of $122

million ($1.43 per basic share and $1.42 per diluted share), up from a loss of $69 million ($0.81 loss per basic and diluted share) in the same period of 2015.

Excluding the impact of non-recurring items (which includes costs related to the $315 million senior secured notes due 2017 of Ainsworth (Ainsworth Notes),

which were redeemed prior to maturity in the second quarter of 2015) and using a normalized Canadian statutory tax rate, Norbord recorded Adjusted earnings of $58 million ($0.68 per basic share and $0.67 per diluted share) in the third quarter of

2016 compared to Adjusted earnings of $42 million ($0.49 per basic and diluted share) in the second quarter of 2016 and an Adjusted loss of $4 million ($0.05 loss per basic and diluted share) in the third quarter of 2015. Year-to-date, Norbord

recorded Adjusted earnings of $120 million ($1.40 per basic share and $1.39 per diluted share) versus an Adjusted loss of $30 million ($0.35 loss per basic and diluted share) in the same period of 2015.

The following table reconciles Adjusted earnings (loss) to the most directly comparable IFRS measure:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (US $ millions) |

|

Q3

2016 |

|

|

Q2

2016 |

|

|

Q3

2015 |

|

|

9 mos

2016 |

|

|

9 mos

2015 |

|

| Earnings (loss) |

|

$ |

55 |

|

|

$ |

44 |

|

|

$ |

(9 |

) |

|

$ |

122 |

|

|

$ |

(69 |

) |

| Add: Merger transaction costs |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

8 |

|

| Add: Severance costs related to Merger |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

2 |

|

| Add: Other costs incurred to achieve Merger synergies |

|

|

4 |

|

|

|

2 |

|

|

|

— |

|

|

|

7 |

|

|

|

2 |

|

| Add: Costs related to High Level fire |

|

|

— |

|

|

|

1 |

|

|

|

— |

|

|

|

1 |

|

|

|

— |

|

| Add: Costs on early debt extinguishment |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

25 |

|

| Add: Foreign exchange loss on Ainsworth Notes |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

28 |

|

| Less: Gain on derivative financial instrument on Ainsworth Notes |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(4 |

) |

| Add: Reported income tax expense (recovery) |

|

|

19 |

|

|

|

10 |

|

|

|

3 |

|

|

|

32 |

|

|

|

(33 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted pre-tax earnings (loss) |

|

|

78 |

|

|

|

57 |

|

|

|

(6 |

) |

|

|

162 |

|

|

|

(41 |

) |

| Less: Income tax (expense) recovery at statutory

rate(1) |

|

|

(20 |

) |

|

|

(15 |

) |

|

|

2 |

|

|

|

(42 |

) |

|

|

11 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted earnings (loss) |

|

$ |

58 |

|

|

$ |

42 |

|

|

$ |

(4 |

) |

|

$ |

120 |

|

|

$ |

(30 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1) |

Represents Canadian combined federal and provincial statutory rate. |

Against the market and operating backdrop

described above, Norbord generated Adjusted EBITDA of $114 million in the third quarter of 2016 versus $94 million in the second quarter of 2016 and $30 million in the third quarter of 2015. Year-to-date, Norbord generated Adjusted EBITDA of $269

million versus $65 million in the same period of 2015. On the controllable side of the business, Norbord generated $10 million of MIP gains in the first nine months of 2016, measured relative to 2015 at constant prices and exchange rates, primarily

from lower raw material usages and higher productivity.

Some of the statements included in this MD&A constitute forward-looking statements that are based on various assumptions and are subject to various risks.

See the cautionary statement contained in the Forward-Looking Statements section.

4

The following table reconciles Adjusted EBITDA to the most directly comparable IFRS measure:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (US $ millions) |

|

Q3

2016 |

|

|

Q2

2016 |

|

|

Q3

2015 |

|

|

9 mos

2016 |

|

|

9 mos

2015 |

|

| Earnings (loss) |

|

$ |

55 |

|

|

$ |

44 |

|

|

$ |

(9 |

) |

|

$ |

122 |

|

|

$ |

(69 |

) |

| Add: Finance costs |

|

|

13 |

|

|

|

13 |

|

|

|

14 |

|

|

|

39 |

|

|

|

41 |

|

| Add: Depreciation and amortization |

|

|

23 |

|

|

|

24 |

|

|

|

22 |

|

|

|

68 |

|

|

|

65 |

|

| Add: Income tax expense (recovery) |

|

|

19 |

|

|

|

10 |

|

|

|

3 |

|

|

|

32 |

|

|

|

(33 |

) |

| Add: Merger transaction costs |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

8 |

|

| Add: Costs related to High Level fire |

|

|

— |

|

|

|

1 |

|

|

|

— |

|

|

|

1 |

|

|

|

— |

|

| Add: Severance costs related to Merger |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

2 |

|

| Add: Other costs incurred to achieve Merger synergies |

|

|

4 |

|

|

|

2 |

|

|

|

— |

|

|

|

7 |

|

|

|

2 |

|

| Add: Costs on early debt extinguishment |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

25 |

|

| Add: Foreign exchange loss on Ainsworth Notes |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

28 |

|

| Less: Gain on derivative financial instrument on Ainsworth Notes |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(4 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

|

$ |

114 |

|

|

$ |

94 |

|

|

$ |

30 |

|

|

$ |

269 |

|

|

$ |

65 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Home construction activity, particularly in the US, influences OSB demand and pricing. With 80% of the Company’s panel

capacity located in North America, fluctuations in North American OSB demand and prices significantly affect Norbord’s results. Year-to-date, approximately 55% of Norbord’s North American OSB sales volume went into the new home

construction sector. The remainder went into repair and remodelling, light commercial construction, industrial applications and export markets. Management believes this diversification provides opportunities to maximize profitability while limiting

the Company’s relative exposure to the new home construction segment during periods of soft housing activity. As the US housing market recovery progresses, management expects Norbord’s shipment volume to the new home construction sector

will continue to grow.

North America OSB demand is primarily driven by home construction activity. The long-term fundamentals that support North American

housing activity such as new household formations and replacement of housing stock are forecasted by US housing economists to be strong. Norbord’s European operations and Asian exports are exposed to different market dynamics relative to North

America and this has provided meaningful market and geographic diversification for the Company. Combined with Norbord’s strong financial liquidity and solid customer partnerships, the Company believes it is well positioned to benefit from the

continuing recovery in the US housing markets and growing demand in the its core European and Asian markets.

On the input cost side, fluctuations in raw

material input prices significantly impact operating costs. Wood fibre, resin, wax and energy account for approximately 65% of Norbord’s OSB cash production costs. The prices for these commodities are determined by economic and market

conditions. In the third quarter of 2016, resin prices were up slightly relative to the prior quarter but still lower than the same quarter last year. Resin used in the OSB manufacturing process is a petrochemical product, therefore its price is

expected to remain around these lower levels as long as global oil prices remain under pressure. Norbord will continue to pursue aggressive MIP initiatives to reduce raw material usages and improve productivity to offset potentially higher

uncontrollable costs.

Some of the statements included in this MD&A constitute forward-looking statements that are based on various assumptions and are subject to various risks.

See the cautionary statement contained in the Forward-Looking Statements section.

5

SUMMARY OF FINANCIAL AND OPERATING HIGHLIGHTS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (US $ millions, except per share information, unless otherwise

noted) |

|

Q3

2016 |

|

|

Q2

2016 |

|

|

Q3

2015 |

|

|

9 mos

2016 |

|

|

9 mos

2015 |

|

| KEY PERFORMANCE METRICS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Return on capital employed (ROCE)(1) |

|

|

32 |

% |

|

|

26 |

% |

|

|

8 |

% |

|

|

26 |

% |

|

|

6 |

% |

| Return on equity (ROE)(1) |

|

|

41 |

% |

|

|

31 |

% |

|

|

(3 |

)% |

|

|

29 |

% |

|

|

(7 |

)% |

| Cash provided by (used for) operating activities |

|

|

97 |

|

|

|

83 |

|

|

|

23 |

|

|

|

183 |

|

|

|

(32 |

) |

| Per Common Share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings (loss), basic(2) |

|

|

0.64 |

|

|

|

0.51 |

|

|

|

(0.11 |

) |

|

|

1.43 |

|

|

|

(0.81 |

) |

| Adjusted earnings (loss), basic

(1,3) |

|

|

0.68 |

|

|

|

0.49 |

|

|

|

(0.05 |

) |

|

|

1.40 |

|

|

|

(0.36 |

) |

| Cash provided by (used for) operating

activities(1) |

|

|

1.13 |

|

|

|

0.97 |

|

|

|

0.27 |

|

|

|

2.14 |

|

|

|

(0.38 |

) |

| Dividends declared(4) |

|

|

0.10 |

|

|

|

0.10 |

|

|

|

0.10 |

|

|

|

0.30 |

|

|

|

0.60 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| SALES AND EARNINGS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Sales |

|

|

453 |

|

|

|

447 |

|

|

|

378 |

|

|

|

1,284 |

|

|

|

1,094 |

|

| Operating income (loss) |

|

|

87 |

|

|

|

67 |

|

|

|

8 |

|

|

|

193 |

|

|

|

(2 |

) |

| Adjusted EBITDA(1) |

|

|

114 |

|

|

|

94 |

|

|

|

30 |

|

|

|

269 |

|

|

|

65 |

|

| Earnings (loss) |

|

|

55 |

|

|

|

44 |

|

|

|

(9 |

) |

|

|

122 |

|

|

|

(69 |

) |

| Adjusted earnings (loss)(1) |

|

|

58 |

|

|

|

42 |

|

|

|

(4 |

) |

|

|

120 |

|

|

|

(30 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

|

1,718 |

|

|

|

1,654 |

|

|

|

1,653 |

|

|

|

|

|

|

|

|

|

| Long-term debt(5) |

|

|

746 |

|

|

|

745 |

|

|

|

744 |

|

|

|

|

|

|

|

|

|

| Net debt for financial covenant

purposes(1) |

|

|

705 |

|

|

|

751 |

|

|

|

758 |

|

|

|

|

|

|

|

|

|

| Net debt to capitalization, market

basis(1) |

|

|

29 |

% |

|

|

31 |

% |

|

|

32 |

% |

|

|

|

|

|

|

|

|

| Net debt to capitalization, book

basis(1) |

|

|

45 |

% |

|

|

48 |

% |

|

|

51 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| KEY STATISTICS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Shipments (MMsf–3/8”) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| North America |

|

|

1,463 |

|

|

|

1,487 |

|

|

|

1,409 |

|

|

|

4,287 |

|

|

|

4,038 |

|

| Europe |

|

|

438 |

|

|

|

459 |

|

|

|

453 |

|

|

|

1,332 |

|

|

|

1,315 |

|

| Indicative Average OSB Price |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| North Central ($/Msf–7/16”) |

|

|

301 |

|

|

|

264 |

|

|

|

204 |

|

|

|

264 |

|

|

|

197 |

|

| South East ($/Msf–7/16”) |

|

|

256 |

|

|

|

245 |

|

|

|

176 |

|

|

|

239 |

|

|

|

175 |

|

| Western Canada ($/Msf–7/16”) |

|

|

265 |

|

|

|

242 |

|

|

|

158 |

|

|

|

233 |

|

|

|

156 |

|

| Europe (€/m3)(6) |

|

|

235 |

|

|

|

237 |

|

|

|

220 |

|

|

|

234 |

|

|

|

223 |

|

| (1) |

Non-IFRS measure; see Non-IFRS Financial Measures section. |

| (2) |

Basic and diluted earnings (loss) per share are the same except diluted earnings per share for 9 months 2016 is $1.42. |

| (3) |

Basic and diluted Adjusted earnings (loss) per share are the same except diluted Adjusted earnings per share for Q3 2016 is $0.67 and for the 9 months 2016 is $1.39. |

| (4) |

Dividends declared per share stated in Canadian dollars. |

| (5) |

Includes current and non-current long-term debt. |

| (6) |

European indicative average OSB price represents the gross delivered price to the largest continental market. |

Sales

Total sales in the quarter were $453 million,

compared to $447 million in the previous quarter and $378 million in the same quarter last year. Year-to-date, sales were $1,284 million versus $1,094 million in the same period of 2015. Quarter-over-quarter, total sales increased by $6 million or

1%. In North America, sales increased by 5% due to higher OSB prices that were partially offset by 2% lower shipment volumes. In Europe, sales decreased by 10% primarily due to the translation impact of the weaker Pound Sterling versus the US

dollar, as 5% lower shipment volumes were offset by higher average prices. Year-over-year, sales increased by $75 million or 20%. In North America, sales increased by 38% due to significantly higher OSB prices and 4% higher shipment volumes. In

Europe, sales decreased by 18% primarily due to the translation impact of the weaker Pound Sterling versus the US dollar, as 3% lower shipment volumes were offset by higher average prices. Year-to-date, sales increased by $190 million or 17%.

In North America, sales increased by 30% due to higher OSB prices and 6% higher shipment volumes. In Europe, sales decreased by

Some of the statements included in this MD&A constitute forward-looking statements that are based on various assumptions and are subject to various risks.

See the cautionary statement contained in the Forward-Looking Statements section.

6

10% due to the translation impact of the weaker Pound Sterling versus the US dollar partially offset by 1% higher shipment volumes.

Markets

In North America, demand from US housing

continues to improve. Year-to-date, US housing starts were up 4% versus the same period in 2015. Single-family starts (which use approximately three times more OSB than multi-family) increased by 9% and single-family permits were 8% higher. The

seasonally-adjusted annualized rate was 1.05 million in September with permits at 1.23 million. The consensus forecast from US housing economists stands at approximately 1.20 million starts in 2016, which suggests an 8% improvement over

last year. Despite the significant rebound in new home construction since the low of 0.55 million in 2009, US housing starts remain below the long-term annual average of 1.5 million.

North American benchmark OSB prices increased significantly in the third quarter of 2016 versus both the previous quarter and the same quarter last year as

new home construction activity and OSB demand continued to improve. OSB prices continued to rise through July before leveling out in August and September. The North Central benchmark price averaged $301 per Msf (7/16-inch basis) for the quarter, and the spread between North Central and the South East and Western Canadian regions (where 65% of

Norbord’s North American capacity is located) increased to approximately $40 (from approximately $20 in the previous quarter) on seasonal demand variations between regions. The table below summarizes benchmark OSB prices by region for the

relevant quarters:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| North American Region |

|

% of Norbord’s estimated

annual operating capacity(1) |

|

|

Q3 2016

($/Msf-7/16”) |

|

|

Q2 2016

($/Msf-7/16”) |

|

|

Q3 2015

($/Msf-7/16”) |

|

| North Central |

|

|

16 |

% |

|

$ |

301 |

|

|

$ |

264 |

|

|

$ |

204 |

|

| South East |

|

|

33 |

% |

|

|

256 |

|

|

|

245 |

|

|

|

176 |

|

| Western Canada |

|

|

32 |

% |

|

|

265 |

|

|

|

242 |

|

|

|

158 |

|

| (1) |

Excludes Val-d’Or, Quebec and Huguley, Alabama mills currently curtailed which represents 12% of estimated annual capacity. |

In Europe, panel demand remains strong in the Company’s core UK and German markets but reported prices in US dollar terms were impacted by the

significant devaluation of the Pound Sterling following the “Brexit” referendum. In local currency terms, quarter-over-quarter, average prices for OSB, particleboard and MDF were modestly higher in the UK while continental OSB

prices were modestly lower. Year-over-year was the opposite, with average panel prices modestly lower in the UK and OSB prices modestly higher on the continent.

Historically, the UK has been a net importer of panel products and Norbord is the largest domestic producer. A weaker Pound Sterling relative to the Euro

is advantageous to Norbord’s primarily UK-based operations as it improves sales opportunities within the UK and supports Norbord’s export program into the continent. The Pound Sterling averaged 1.18 during the third quarter of 2016,

compared to an average of 1.13 in the previous quarter and 1.40 in the same quarter last year.

Operating Results

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA (US $ millions) |

|

Q3

2016 |

|

|

Q2

2016 |

|

|

Q3

2015 |

|

|

9 mos

2016 |

|

|

9 mos

2015 |

|

| North America |

|

$ |

106 |

|

|

$ |

85 |

|

|

$ |

22 |

|

|

$ |

244 |

|

|

$ |

44 |

|

| Europe |

|

|

10 |

|

|

|

11 |

|

|

|

11 |

|

|

|

31 |

|

|

|

28 |

|

| Unallocated |

|

|

(2 |

) |

|

|

(2 |

) |

|

|

(3 |

) |

|

|

(6 |

) |

|

|

(7 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

|

$ |

114 |

|

|

$ |

94 |

|

|

$ |

30 |

|

|

$ |

269 |

|

|

$ |

65 |

|

Norbord generated Adjusted EBITDA of $114 million in the third quarter of 2016, compared to $94 million in the second quarter

of 2016 and $30 million in the third quarter of 2015. Adjusted EBITDA was $269 million

Some of the statements included in this MD&A constitute forward-looking statements that are based on various assumptions and are subject to various risks.

See the cautionary statement contained in the Forward-Looking Statements section.

7

year-to-date compared to $65 million in the same period of 2015. The higher Adjusted EBITDA versus all comparative periods was primarily due to significantly higher North American OSB prices.

Adjusted EBITDA Variance

The components of

the Adjusted EBITDA change are summarized in the variance table below:

|

|

|

|

|

|

|

|

|

|

|

|

|

| (US $ millions) |

|

Q3 2016

vs.

Q2 2016 |

|

|

Q3 2016

vs.

Q3 2015 |

|

|

9 mos 2016

vs.

9 mos 2015 |

|

| Adjusted EBITDA – current period |

|

$ |

114 |

|

|

$ |

114 |

|

|

$ |

269 |

|

| Adjusted EBITDA – comparative period |

|

|

94 |

|

|

|

30 |

|

|

|

65 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Variance |

|

|

20 |

|

|

|

84 |

|

|

|

204 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Mill nets(1) |

|

|

23 |

|

|

|

87 |

|

|

|

169 |

|

| Volume(2) |

|

|

(5 |

) |

|

|

(1 |

) |

|

|

17 |

|

| Key input prices(3) |

|

|

(3 |

) |

|

|

5 |

|

|

|

19 |

|

| Key input usage(3) |

|

|

— |

|

|

|

1 |

|

|

|

10 |

|

| Mill profit share and bonus |

|

|

— |

|

|

|

(3 |

) |

|

|

(7 |

) |

| Other operating costs and foreign

exchange(4) |

|

|

5 |

|

|

|

(5 |

) |

|

|

(4 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

|

$ |

20 |

|

|

$ |

84 |

|

|

$ |

204 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1) |

The mill nets variance represents the estimated impact of change in realized pricing across all products. Mill nets are calculated as sales (net of outbound freight costs) divided by shipment volume. |

| (2) |

The volume variance represents the impact of shipment volume changes across all products. |

| (3) |

The key inputs include fibre, resin, wax and energy. |

| (4) |

The other operating costs and foreign exchange category covers all remaining variances including labour and benefits, and maintenance. |

North America

Norbord’s North American

operations generated $106 million in Adjusted EBITDA in the third quarter of 2016 versus $85 million in the second quarter of 2016 and $22 million in the third quarter of 2015. Year-to-date, North American operations generated $244 million versus

$44 million in the same period last year. Quarter-over-quarter, the increase in Adjusted EBITDA of $21 million is primarily due to higher OSB prices partially offset by lower shipment volumes, higher supplies and maintenance costs and higher resin

and energy prices. Year-over-year, the increase in Adjusted EBITDA of $84 million is primarily due to higher OSB prices, lower resin prices and improved raw material usages which more than offset higher supplies and maintenance costs and higher

profit share costs attributed to higher earnings. Year-to-date, the increase in Adjusted EBITDA of $200 million is primarily due to higher OSB prices as well as higher shipment volumes, lower resin and energy prices, improved raw material usages and

the foreign exchange benefit of a weaker Canadian dollar with a partial offset from higher supplies and maintenance costs and higher profit share costs attributed to higher earnings.

Norbord’s North American OSB cash production costs per unit (excluding mill profit share) increased by 2% versus the second quarter of 2016 and 1% versus

the third quarter of 2015 but decreased 3% year-to-date. Quarter-over-quarter, unit costs increased as a result of higher supplies and maintenance costs, lower volume and higher resin and energy prices. Year-over-year, the higher unit cost was

primarily driven by higher supplies and maintenance costs partially offset by lower resin prices and improved raw material usages. Year-to-date, unit costs were lower as a result of higher production volume, lower resin and energy prices, improved

raw material usages and the foreign exchange benefit of a weaker Canadian dollar, partially offset by higher supplies and maintenance costs.

Production

has remained indefinitely suspended at the Huguley, Alabama mill since the first quarter of 2009, and at the Val-d’Or, Quebec mill since the third quarter of 2012. Norbord does not currently expect to restart its curtailed mill in

Val-d’Or, Quebec in 2016, but will continue to monitor market conditions. As previously announced, Norbord continues to rebuild the press line at the curtailed Huguley, Alabama mill to prepare it for future restart. The Company has not set a

restart date and will only do so when it is sufficiently clear that

Some of the statements included in this MD&A constitute forward-looking statements that are based on various assumptions and are subject to various risks.

See the cautionary statement contained in the Forward-Looking Statements section.

8

customers require more product. These two mills represent 12% of Norbord’s annual estimated capacity in North America.

Excluding the indefinitely curtailed mills (Huguley, Alabama and Val-d’Or, Quebec), Norbord’s operating mills produced at 95% of their stated

capacity in the third quarter of 2016 compared to 96% in the second quarter of 2016 and 92% in the third quarter of 2015. During the quarter, one of Norbord’s North American mills achieved a quarterly production record. Quarter-over-quarter,

capacity utilization was in line due to the loss of approximately three weeks of production in the second quarter due to the High Level fire and lower productivity in the third quarter. Year-over-year, capacity utilization increased due primarily to

fewer maintenance shutdown days and production curtailments.

Europe

Norbord’s European operations generated $10 million in Adjusted EBITDA in the third quarter of 2016, down from $11 million in both the second quarter of

2016 and the third quarter of 2015. Year-to-date, European operations generated $31 million in Adjusted EBITDA versus $28 million in 2015. Quarter-over-quarter, Adjusted EBITDA decreased by $1 million as a result of the translation impact of a

weaker Pound Sterling, with lower shipment volumes and higher resin and energy prices offset by higher average panel prices. Year-over-year, Adjusted EBITDA decreased by $1 million due to the translation impact of a weaker Pound Sterling

with lower shipment volumes offset by the lower resin and energy prices. Year-to-date, Adjusted EBITDA increased by $3 million despite the negative translation impact of a weaker Pound Sterling as lower resin and energy prices and improved raw

material usages were only partially offset by lower panel prices.

The European mills produced at 99% of stated capacity in the quarter compared to 104%

in the second quarter of 2016 and 99% in the third quarter of 2015. During the quarter, two of Norbord’s European mills achieved a quarterly production record. Quarter-over-quarter, capacity utilization decreased due to lost production days

following a fatality at the Cowie, Scotland mill. Year-over-year, capacity utilization was in line as improved productivity was offset by the lost production days.

Margin Improvement Program (MIP)

Margin

improvement is a key operating focus for the Company. The Company realized MIP gains, measured relative to 2015 at constant prices and exchange rates, of $10 million in the first nine months of 2016. Contributions to MIP included improved

productivity and raw material usage reduction initiatives. Merger synergies and returns on the Company’s recent capital investments (such as fines screening technology) also contributed to the MIP gains.

FINANCE COSTS, COSTS ON AINSWORTH NOTES, DEPRECIATION AND AMORTIZATION, AND INCOME TAX

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (US $ millions) |

|

Q3

2016 |

|

|

Q2

2016 |

|

|

Q3

2015 |

|

|

9 mos

2016 |

|

|

9 mos

2015 |

|

| Finance costs |

|

$ |

(13 |

) |

|

$ |

(13 |

) |

|

$ |

(14 |

) |

|

$ |

(39 |

) |

|

$ |

(41 |

) |

| Foreign exchange loss on Ainsworth Notes |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(28 |

) |

| Gain on derivative financial instrument on Ainsworth Notes |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

4 |

|

| Costs on early extinguishment of Ainsworth Notes |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(25 |

) |

| Depreciation and amortization |

|

|

(23 |

) |

|

|

(24 |

) |

|

|

(22 |

) |

|

|

(68 |

) |

|

|

(65 |

) |

| Income tax (expense) recovery |

|

|

(19 |

) |

|

|

(10 |

) |

|

|

(3 |

) |

|

|

(32 |

) |

|

|

33 |

|

Some of the statements included in this MD&A constitute forward-looking statements that are based on various assumptions and are subject to various risks.

See the cautionary statement contained in the Forward-Looking Statements section.

9

Finance Costs

Finance costs include interest expense on long-term debt and program fees on the accounts receivable securitization, and are consistent across all comparative

periods.

Foreign Exchange Loss on Ainsworth Notes

The Ainsworth Notes were denominated in US dollars and Ainsworth’s functional currency was Canadian dollars prior to the Merger. As a result, upon

revaluation to Canadian dollars, Ainsworth recorded foreign exchange losses due to the strengthening of the US dollar. In the second quarter of 2015, these notes were redeemed prior to maturity.

Gain on Derivative Financial Instrument and Costs on Early Extinguishment of Ainsworth Notes

The Ainsworth Notes contained an embedded call option and this derivative was recorded initially at fair value with subsequent revaluation gains and losses

recorded in earnings. This derivative was extinguished when the Ainsworth Notes were redeemed prior to maturity.

Depreciation and Amortization

The Company uses the units-of-production method to depreciate its production equipment and fluctuations in depreciation expense reflect relative

changes in production levels by mill. Amortization expense is in line with the prior year.

Income Tax

A tax expense of $19 million was recorded on pre-tax income of $74 million in the third quarter of 2016. Year-to-date, a tax expense of $32 million was

recorded on pre-tax income of $154 million. The effective tax rate differs from the statutory rate principally due to rate differences on foreign activities, fluctuations in relative currency values and the recognition of certain income tax

recoveries.

LIQUIDITY AND CAPITAL RESOURCES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (US $ millions, except per share information, unless otherwise noted) |

|

Q3

2016 |

|

|

Q2

2016 |

|

|

Q3

2015 |

|

|

9 mos

2016 |

|

|

9 mos

2015 |

|

| Cash provided by (used for) operating activities |

|

$ |

97 |

|

|

$ |

83 |

|

|

$ |

23 |

|

|

$ |

183 |

|

|

$ |

(32 |

) |

| Cash provided by (used for) operating activities per share |

|

|

1.13 |

|

|

|

0.97 |

|

|

|

0.27 |

|

|

|

2.14 |

|

|

|

(0.38 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating working capital |

|

|

156 |

|

|

|

163 |

|

|

|

145 |

|

|

|

|

|

|

|

|

|

| Total working capital |

|

|

229 |

|

|

|

174 |

|

|

|

147 |

|

|

|

|

|

|

|

|

|

| Investment in property, plant and equipment & intangible assets |

|

|

29 |

|

|

|

23 |

|

|

|

15 |

|

|

|

63 |

|

|

|

43 |

|

| Net debt to capitalization, market basis |

|

|

29 |

% |

|

|

31 |

% |

|

|

32 |

% |

|

|

|

|

|

|

|

|

| Net debt to capitalization, book basis |

|

|

45 |

% |

|

|

48 |

% |

|

|

51 |

% |

|

|

|

|

|

|

|

|

At period-end, the Company had unutilized liquidity of $420 million, comprising $74 million in cash, $221 million in revolving

bank lines and $125 million undrawn under its accounts receivable securitization program, which the Company believes is sufficient to fund expected short-term cash requirements.

Senior Secured Notes Due 2017

The Company’s $200

million senior secured notes due February 2017 bear an interest rate that varies with the Company’s credit ratings. The interest rate has been 7.70% since August 15, 2013. The Company intends to permanently repay these notes at maturity

using cash on hand, cash generated from operations and if necessary, by drawing upon the accounts receivable securitization program.

Senior Secured

Notes Due 2020

The Company’s $240 million senior secured notes due December 2020 bear an interest rate of 5.375%.

Some of the statements included in this MD&A constitute forward-looking statements that are based on various assumptions and are subject to various risks.

See the cautionary statement contained in the Forward-Looking Statements section.

10

Senior Secured Notes Due 2023

The Company’s $315 million senior secured notes due April 2023 bear an interest rate of 6.25%.

Revolving Bank Lines

The Company has an aggregate

commitment of $245 million under committed revolving bank lines which bears interest at money market rates plus a margin that varies with the Company’s credit rating. During the year, the Company amended these bank lines to reset the

tangible net worth covenant to $500 million and extend the maturity date to May 2019. The bank lines are secured by a first lien on the Company’s North American OSB inventory and property, plant and equipment. This lien is shared pari

passu with the holders of the 2017, 2020 and 2023 senior secured notes.

The bank lines contain two quarterly financial covenants: minimum tangible net

worth of $500 million and maximum net debt to capitalization, book basis, of 65%. For the purposes of the tangible net worth calculation, the following adjustments have been made as at period-end:

| |

• |

|

the IFRS transitional adjustments to shareholders’ equity of $21 million at January 1, 2011 are added back; |

| |

• |

|

changes to other comprehensive income subsequent to January 1, 2011 is excluded; |

| |

• |

|

intangible assets (other than timber rights and software acquisition and development costs) are excluded; and |

| |

• |

|

the impact of the change in functional currency of Ainsworth on shareholders’ equity of $155 million is excluded. |

Net debt for financial covenant purposes includes total debt, principal amount excluding any drawings on the accounts receivable securitization program, less

cash, plus letters of credit issued and any bank advances. At period-end, the Company’s tangible net worth was $848 million and net debt for financial covenant purposes was $705 million. Net debt to capitalization, book basis, was 45%. The

Company was in compliance with the financial covenants at period-end.

Norbord’s capital structure at period-end consisted of the following:

|

|

|

|

|

|

|

|

|

| (US $ millions) |

|

Sep 24, 2016 |

|

|

Dec 31, 2015 |

|

| Long-term debt, principal value |

|

$ |

755 |

|

|

$ |

755 |

|

| Add: Other long-term debt |

|

|

— |

|

|

|

30 |

|

| Less: Cash |

|

|

(74 |

) |

|

|

(9 |

) |

|

|

|

|

|

|

|

|

|

| Net debt |

|

|

681 |

|

|

|

776 |

|

| Less: Other long-term debt |

|

|

— |

|

|

|

(30 |

) |

| Add: Letters of credit |

|

|

24 |

|

|

|

5 |

|

|

|

|

|

|

|

|

|

|

| Net debt for financial covenant purposes |

|

|

705 |

|

|

|

751 |

|

|

|

|

|

|

|

|

|

|

| Shareholders’ equity |

|

|

593 |

|

|

|

519 |

|

| Less: Intangible assets(1) |

|

|

— |

|

|

|

(18 |

) |

| Add: Other comprehensive income

movement(2) |

|

|

79 |

|

|

|

47 |

|

| Add: Impact of Ainsworth changing functional currencies |

|

|

155 |

|

|

|

155 |

|

| Add: IFRS transitional adjustments |

|

|

21 |

|

|

|

21 |

|

|

|

|

|

|

|

|

|

|

| Tangible net worth for financial covenant purposes |

|

|

848 |

|

|

|

724 |

|

|

|

|

|

|

|

|

|

|

| Total capitalization |

|

$ |

1,553 |

|

|

$ |

1,475 |

|

|

|

|

|

|

|

|

|

|

| Net debt to capitalization, market basis |

|

|

29 |

% |

|

|

32 |

% |

| Net debt to capitalization, book basis |

|

|

45 |

% |

|

|

51 |

% |

| (1) |

Timber rights and software development costs were excluded from the definition of intangible assets when the bank lines were renewed in June 2016. |

| (2) |

Cumulative subsequent to January 1, 2011. |

Some of the statements included in this MD&A constitute forward-looking statements that are based on various assumptions and are subject to various risks.

See the cautionary statement contained in the Forward-Looking Statements section.

11

Accounts Receivable Securitization

The Company has a $125 million multi-currency accounts receivable securitization program with a third-party trust sponsored by a highly rated Canadian

financial institution. The program is revolving and has an evergreen commitment subject to termination on 12 months’ notice. Under the program, Norbord has transferred substantially all of its present and future trade accounts receivable

to the trust on a fully serviced basis for proceeds consisting of cash and deferred purchase price. However, the asset de-recognition criteria under IFRS have not been met and the transferred accounts receivable remain recorded as an asset.

At period-end, Norbord had transferred but continued to recognize $142 million in trade accounts receivable and the Company did not have any drawings relating

to this program. The level of trade accounts receivable transferred under the program fluctuates with the level of shipment volumes, product prices and foreign exchange rates. The amount Norbord chooses to draw under the program at any point in time

depends on the level of accounts receivable transferred, timing of cash settlements and fluctuates with the Company’s cash requirements. Any drawings are presented as other long-term debt on the balance sheet and are excluded from the net debt

to capitalization calculation for financial covenant purposes. The utilization charge, which is based on money market rates plus a margin, and other program fees are recorded as finance costs. Year-to-date, the utilization charge on drawings ranged

from 1.5% to 2.1%.

The securitization program contains no financial covenants. However, the program is subject to minimum credit rating requirements. The

Company must maintain a long-term issuer credit rating of at least single B(mid) or the equivalent. As at October 27, 2016, Norbord’s ratings were BB (DBRS), BB- (Standard & Poor’s Ratings Services) and Ba2 (Moody’s

Investors Service).

Other Liquidity and Capital Resources

Operating working capital, consisting of accounts receivable, inventory and prepaids less accounts payable and accrued liabilities, was $156 million at

period-end compared to $163 million at the end of the prior quarter and $145 million at September 26, 2015. The Company aims to continuously minimize the amount of capital held as operating working capital and takes actions to manage it at

minimal levels.

Quarter-over-quarter, operating working capital decreased by $7 million primarily due to higher accounts payable and accrued liabilities

and lower accounts receivable partially offset by higher prepaids. Higher accounts payable and accrued liabilities is due to the timing of payments, higher interest accrual due to the timing of coupon payments on the senior secured notes and higher

mill profit share accruals. Lower accounts receivable is attributable to partial collections on the insurance receivable related to the High Level fire and the timing of commodity tax refunds. Higher prepaids is primarily due to payment of annual

insurance premiums during the quarter.

Year-over-year, operating working capital increased by $11 million primarily due to higher accounts receivable and

higher inventory. Higher accounts receivable is mainly attributable to higher North American OSB prices and the remaining insurance receivable on the High Level fire. Higher inventory is a result of higher operating and maintenance supplies due to

the timing of maintenance shuts.

Total working capital, which includes operating working capital plus cash and income tax receivable less bank advances

and tax payable, was $229 million as at the end of the third quarter of 2016, compared to $174 million at June 25, 2016 and $147 million at September 26, 2015. Quarter-over-quarter, the increase is primarily attributed to higher cash

partially offset by the lower operating working capital. Year-over-year, the increase is primarily attributed to higher cash and higher operating working capital.

Operating activities generated $97 million of cash or $1.13 per share in the third quarter of 2016, compared to $83 million or $0.97 per share generated in

the prior quarter and $23 million or $0.27 per share generated in the third quarter of 2015. Year-to-date, operating activities provided $183 million of cash or $2.14 per share

Some of the statements included in this MD&A constitute forward-looking statements that are based on various assumptions and are subject to various risks.

See the cautionary statement contained in the Forward-Looking Statements section.

12

compared to $32 million or $0.38 per share consumed in the prior period. The higher generation of cash versus the comparative periods is mainly attributed to the higher Adjusted EBITDA in the

current period.

INVESTMENTS AND DIVESTITURES

Investments

Investment in property, plant and equipment

and intangible assets was $29 million in the third quarter of 2016 compared to $23 million in the second quarter and $15 million in the third quarter of 2015. The increase versus the prior quarters is primarily attributable to the Inverness project

(described below).

Norbord’s 2016 investment in property, plant and equipment and intangible assets is expected to be $75 million (excluding the

Inverness project, described below). The investment plan for the current year includes further process debottlenecking and manufacturing cost reduction projects under the Company’s multi-year capital reinvestment strategy. These

investments will be funded with cash on hand, cash generated from operations and, if necessary, drawings under the Company’s accounts receivable securitization program or committed revolving bank lines.

Inverness Project

In January 2016, the Board of

Directors approved the investment of $135 million over the next two years to modernize and expand the Company’s Inverness, Scotland OSB mill. On-site construction work commenced in the second quarter of 2016 and work was completed to move the

unused second press from the Grande Prairie, Alberta mill during the current quarter. Norbord expects the new line to start up in the second half of 2017, with no disruption to existing production capacity in the interim. Capital spending is

expected to be $45 million in 2016, of which $19 million has been incurred year-to-date. The investment will be funded with cash on hand, cash generated from operations and, if necessary, drawings under the Company’s accounts receivable

securitization program or committed revolving bank lines.

CAPITALIZATION

At October 27, 2016, there were 85.6 million common shares outstanding. In addition, 2.1 million stock options were outstanding, of which 65%

were fully vested.

Dividends

Norbord’s

variable dividend policy targets the payment to shareholders of a portion of free cash flow based upon the Company’s financial position, results of operations, cash flow, capital requirements and restrictions under the Company’s revolving

bank lines, as well as the market outlook for the Company’s principal products and broader market and economic conditions, among other factors. Under this policy, the Board of Directors (the Board) has declared the following dividends and has

adjusted the level twice to maintain flexibility in the Company’s capital structure as well as to fund growth and other attractive capital investment opportunities:

|

|

|

|

|

| (in CAD $) |

|

Quarterly dividend declared

per common share |

|

| Q2-2013 to Q4-2014 |

|

$ |

0.60 |

|

| Q1-2015 & Q2-2015 |

|

|

0.25 |

|

| Q3-2015 to Q3-2016 |

|

|

0.10 |

|

The Board retains the discretion to amend the Company’s dividend policy in any manner and at any time as it may deem

necessary or appropriate in the future. For these reasons, as well as others, the Board in its sole discretion can decide to increase, maintain, decrease, suspend or discontinue the payment of cash dividends in the future.

Some of the statements included in this MD&A constitute forward-looking statements that are based on various assumptions and are subject to various risks.

See the cautionary statement contained in the Forward-Looking Statements section.

13

FINANCIAL INSTRUMENTS

The Company utilizes various derivative financial instruments to manage risk and make better use of capital. The fair values of these instruments are reflected

on the Company’s balance sheet and are disclosed in note 12 to the condensed consolidated interim financial statements.

TRANSACTIONS WITH RELATED

PARTIES

In the normal course of operations, the Company enters into various transactions with related parties which have been measured at the exchange

amounts and are recognized in the consolidated financial statements. The following transactions have occurred between the Company and its related parties during the quarter.

The Company periodically engages the services of Brookfield for various financial, real estate and other business advisory services. Year-to-date, the fees

for services rendered were less than $1 million (2015 – less than $1 million).

Sales to Asian markets are handled by Interex Forest Products Ltd.

(Interex), a cooperative sales company over which Norbord, as a 25% shareholder, has significant influence. Year-to-date, net sales of $40 million (2015 – $36 million) were made to Interex. At period-end, $4 million (December 31, 2015 – $3

million) due from Interex was included in Accounts receivable.

SELECTED QUARTERLY INFORMATION

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

2016 |

|

|

2015 |

|

|

2014 |

|

| (US $ millions, except per share information, unless otherwise noted) |

|

Q3 |

|

|

Q2 |

|

|

Q1 |

|

|

Q4 |

|

|

Q3 |

|

|

Q2 |

|

|

Q1 |

|

|

Q4 |

|

| KEY PERFORMANCE METRICS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Return on capital employed (ROCE)(1) |

|

|

32 |

% |

|

|

26 |

% |

|

|

18 |

% |

|

|

15 |

% |

|

|

8 |

% |

|

|

5 |

% |

|

|

4 |

% |

|

|

4 |

% |

| Return on equity (ROE)(1) |

|

|

41 |

% |

|

|

31 |

% |

|

|

16 |

% |

|

|

11 |

% |

|

|

(3 |

)% |

|

|

(9 |

)% |

|

|

(10 |

)% |

|

|

(8 |

)% |

| Cash provided by (used for) operating activities |

|

|

97 |

|

|

|

83 |

|

|

|

3 |

|

|

|

56 |

|

|

|

23 |

|

|

|

(3 |

) |

|

|

(52 |

) |

|

|

9 |

|

| Cash provided by (used for) operating activities per share(1) |

|

|

1.13 |

|

|

|

0.97 |

|

|

|

0.04 |

|

|

|

0.66 |

|

|

|

0.27 |

|

|

|

(0.04 |

) |

|

|

(0.61 |

) |

|

|

0.11 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| SALES AND EARNINGS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Sales |

|

|

453 |

|

|

|

447 |

|

|

|

384 |

|

|

|

415 |

|

|

|

378 |

|

|

|

365 |

|

|

|

351 |

|

|

|

372 |

|

| Operating income (loss) |

|

|

87 |

|

|

|

67 |

|

|

|

39 |

|

|

|

33 |

|

|

|

8 |

|

|

|

(4 |

) |

|

|

(6 |

) |

|

|

(9 |

) |

| Adjusted EBITDA(1) |

|

|

114 |

|

|

|

94 |

|

|

|

61 |

|

|

|

57 |

|

|

|

30 |

|

|

|

19 |

|

|

|

16 |

|

|

|

14 |

|

| Earnings (loss) |

|

|

55 |

|

|

|

44 |

|

|

|

23 |

|

|

|

13 |

|

|

|

(9 |

) |

|

|

(23 |

) |

|

|

(37 |

) |

|

|

(26 |

) |

| Adjusted earnings (loss)(1) |

|

|

58 |

|

|

|

42 |

|

|

|

20 |

|

|

|

16 |

|

|

|

(4 |

) |

|

|

(12 |

) |

|

|

(14 |

) |

|

|

(16 |

) |

| PER COMMON SHARE EARNINGS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings (loss), basic and diluted |

|

|

0.64 |

|

|

|

0.51 |

|

|

|

0.27 |

|

|

|

0.15 |

|

|

|

(0.11 |

) |

|

|

(0.27 |

) |

|

|

(0.43 |

) |

|

|

(0.30 |

) |

| Adjusted earnings (loss), basic(1,2) |

|

|

0.68 |

|

|

|

0.49 |

|

|

|

0.23 |

|

|

|

0.19 |

|

|

|

(0.05 |

) |

|

|

(0.14 |

) |

|

|

(0.16 |

) |

|

|

(0.18 |

) |

| Dividends declared(3) |

|

|

0.10 |

|

|

|

0.10 |

|

|

|

0.10 |

|

|

|

0.10 |

|

|

|

0.10 |

|

|

|

0.25 |

|

|

|

0.25 |

|

|

|

0.60 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| KEY STATISTICS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Shipments (MMsf–3/8”) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|