00008765232023FYfalsehttp://fasb.org/us-gaap/2023#AccountingStandardsUpdate202006MemberP3YP2YP2Y0.08903130.06289310.1P1Yhttp://fasb.org/us-gaap/2023#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2023#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2023#AccountsPayableAndAccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#AccountsPayableAndAccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesNoncurrent00008765232022-10-012023-09-3000008765232023-03-31iso4217:USD0000876523us-gaap:CommonClassAMember2023-11-08xbrli:shares0000876523us-gaap:CommonClassBMember2023-11-0800008765232023-09-3000008765232022-09-300000876523us-gaap:CommonClassAMember2022-09-30iso4217:USDxbrli:shares0000876523us-gaap:CommonClassAMember2023-09-300000876523us-gaap:CommonClassBMember2022-09-300000876523us-gaap:CommonClassBMember2023-09-300000876523ezpw:MerchandiseMember2022-10-012023-09-300000876523ezpw:MerchandiseMember2021-10-012022-09-300000876523ezpw:MerchandiseMember2020-10-012021-09-300000876523ezpw:JewelryScrappingMember2022-10-012023-09-300000876523ezpw:JewelryScrappingMember2021-10-012022-09-300000876523ezpw:JewelryScrappingMember2020-10-012021-09-300000876523ezpw:PawnServiceMember2022-10-012023-09-300000876523ezpw:PawnServiceMember2021-10-012022-09-300000876523ezpw:PawnServiceMember2020-10-012021-09-300000876523us-gaap:ProductAndServiceOtherMember2022-10-012023-09-300000876523us-gaap:ProductAndServiceOtherMember2021-10-012022-09-300000876523us-gaap:ProductAndServiceOtherMember2020-10-012021-09-3000008765232021-10-012022-09-3000008765232020-10-012021-09-300000876523us-gaap:CommonStockMember2020-09-300000876523us-gaap:AdditionalPaidInCapitalMember2020-09-300000876523us-gaap:RetainedEarningsMember2020-09-300000876523us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-09-3000008765232020-09-300000876523us-gaap:AdditionalPaidInCapitalMember2020-10-012021-09-300000876523ezpw:CurrentAcquisitionMemberus-gaap:CommonStockMember2020-10-012021-09-300000876523ezpw:CurrentAcquisitionMemberus-gaap:AdditionalPaidInCapitalMember2020-10-012021-09-300000876523ezpw:CurrentAcquisitionMember2020-10-012021-09-300000876523ezpw:PriorPeriodAcquisitionMemberus-gaap:CommonStockMember2020-10-012021-09-300000876523us-gaap:AdditionalPaidInCapitalMemberezpw:PriorPeriodAcquisitionMember2020-10-012021-09-300000876523ezpw:PriorPeriodAcquisitionMember2020-10-012021-09-300000876523us-gaap:CommonStockMember2020-10-012021-09-300000876523us-gaap:RetainedEarningsMember2020-10-012021-09-300000876523us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-10-012021-09-300000876523us-gaap:CommonStockMember2021-09-300000876523us-gaap:AdditionalPaidInCapitalMember2021-09-300000876523us-gaap:RetainedEarningsMember2021-09-300000876523us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-09-3000008765232021-09-300000876523us-gaap:AdditionalPaidInCapitalMember2021-10-012022-09-300000876523us-gaap:CommonStockMember2021-10-012022-09-300000876523us-gaap:AdditionalPaidInCapitalMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2021-09-300000876523srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:RetainedEarningsMember2021-09-300000876523srt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2021-09-300000876523us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-10-012022-09-300000876523us-gaap:RetainedEarningsMember2021-10-012022-09-300000876523us-gaap:CommonStockMember2022-09-300000876523us-gaap:AdditionalPaidInCapitalMember2022-09-300000876523us-gaap:RetainedEarningsMember2022-09-300000876523us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-09-300000876523us-gaap:AdditionalPaidInCapitalMember2022-10-012023-09-300000876523us-gaap:CommonStockMember2022-10-012023-09-300000876523us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-10-012023-09-300000876523us-gaap:RetainedEarningsMember2022-10-012023-09-300000876523us-gaap:CommonStockMember2023-09-300000876523us-gaap:AdditionalPaidInCapitalMember2023-09-300000876523us-gaap:RetainedEarningsMember2023-09-300000876523us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-09-30ezpw:store0000876523country:USezpw:PawnStoresMember2023-09-300000876523ezpw:PawnStoresMembercountry:MX2023-09-300000876523ezpw:PawnStoresMemberezpw:GuatemalaElSalvadorHondurasAndPeruMember2023-09-300000876523ezpw:CashConvertersInternationalLimitedMember2023-09-30xbrli:pureezpw:country0000876523ezpw:PawnStoresMember2023-09-300000876523ezpw:PawnStoresFloridaMember2023-09-300000876523us-gaap:GeographicDistributionForeignMembercountry:MXsrt:ReportableGeographicalComponentsMember2023-09-300000876523us-gaap:GeographicDistributionForeignMembercountry:MXsrt:ReportableGeographicalComponentsMember2022-09-300000876523ezpw:BajioMember2022-10-012023-09-300000876523ezpw:GrupoFinmartMember2023-09-300000876523ezpw:CashConvertersInternationalLimitedMember2022-10-012023-09-300000876523ezpw:RichDataCorporationRDCMember2023-09-300000876523srt:MinimumMember2023-09-300000876523srt:MaximumMember2023-09-300000876523ezpw:CorporateOfficeLeaseTwoFiveYearExtensionOptionsMember2022-10-012023-09-30ezpw:extensionOption0000876523ezpw:CorporateOfficeLeaseTwoFiveYearExtensionOptionsMember2023-09-300000876523us-gaap:BuildingMember2023-09-300000876523us-gaap:PropertyPlantAndEquipmentOtherTypesMembersrt:MinimumMember2023-09-300000876523srt:MaximumMemberus-gaap:PropertyPlantAndEquipmentOtherTypesMember2023-09-300000876523us-gaap:LeaseholdImprovementsMember2023-09-300000876523us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2023-09-300000876523ezpw:DigitalAdvertisingMember2022-10-012023-09-300000876523ezpw:DigitalAdvertisingMember2021-10-012022-09-30ezpw:vote0000876523us-gaap:AccountingStandardsUpdate202006Membersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2021-10-012022-09-300000876523srt:ScenarioPreviouslyReportedMember2021-09-300000876523us-gaap:AccountingStandardsUpdate202006Membersrt:RestatementAdjustmentMember2021-09-300000876523ezpw:CostSavingsInitiativePlanMember2023-09-300000876523ezpw:CostSavingsInitiativePlanMember2022-09-300000876523us-gaap:OtherRestructuringMemberezpw:CostSavingsInitiativePlanMember2022-09-300000876523us-gaap:OtherRestructuringMemberezpw:CostSavingsInitiativePlanMember2023-09-300000876523ezpw:CostSavingsInitiativePlanMemberus-gaap:FacilityClosingMember2022-09-300000876523ezpw:CostSavingsInitiativePlanMember2021-10-012022-09-300000876523ezpw:CostSavingsInitiativePlanMember2022-10-012023-09-300000876523ezpw:CostSavingsInitiativePlanMemberus-gaap:FacilityClosingMember2020-10-012021-09-300000876523ezpw:BajioMember2021-06-080000876523ezpw:BajioMembercountry:MX2021-06-082021-06-080000876523ezpw:BajioMember2021-06-082021-06-08ezpw:payment0000876523ezpw:BajioMember2021-07-012021-09-300000876523ezpw:BajioMember2021-10-012021-12-310000876523ezpw:BajioMember2021-09-300000876523ezpw:BajioMember2022-06-300000876523ezpw:BajioMember2022-07-012022-07-310000876523ezpw:BajioMember2022-01-012022-03-310000876523ezpw:BajioMember2023-09-300000876523ezpw:BajioMember2022-09-300000876523ezpw:BajioMember2020-10-012021-09-300000876523ezpw:BajioMember2021-06-092021-06-090000876523us-gaap:ConvertibleDebtSecuritiesMember2022-10-012023-09-300000876523us-gaap:ConvertibleDebtSecuritiesMember2021-10-012022-09-300000876523us-gaap:ConvertibleDebtSecuritiesMember2020-10-012021-09-300000876523us-gaap:RestrictedStockMember2022-10-012023-09-300000876523us-gaap:RestrictedStockMember2021-10-012022-09-300000876523us-gaap:RestrictedStockMember2020-10-012021-09-300000876523ezpw:A2025ConvertibleNotesMember2022-10-012023-09-300000876523ezpw:CashConvertersInternationalLimitedMember2021-10-012021-10-010000876523ezpw:CashConvertersInternationalLimitedMember2021-10-010000876523ezpw:CashConvertersInternationalLimitedMember2022-03-102022-03-100000876523ezpw:CashConvertersInternationalLimitedMember2022-03-100000876523ezpw:CashConvertersInternationalLimitedMember2022-04-052022-04-050000876523ezpw:CashConvertersInternationalLimitedMember2022-04-050000876523ezpw:CashConvertersInternationalLimitedMember2022-09-152022-09-150000876523ezpw:CashConvertersInternationalLimitedMember2022-09-150000876523ezpw:CashConvertersInternationalLimitedMember2022-11-022022-11-020000876523ezpw:CashConvertersInternationalLimitedMember2022-11-020000876523ezpw:CashConvertersInternationalLimitedMember2021-10-012021-10-310000876523ezpw:CashConvertersInternationalLimitedMember2022-04-012022-04-300000876523ezpw:CashConvertersInternationalLimitedMember2022-11-012022-11-300000876523ezpw:CashConvertersInternationalLimitedMember2023-04-012023-04-300000876523ezpw:CashConvertersInternationalLimitedMember2023-06-300000876523ezpw:CashConvertersInternationalLimitedMember2022-06-300000876523ezpw:CashConvertersInternationalLimitedMember2022-10-012023-06-300000876523ezpw:CashConvertersInternationalLimitedMember2021-10-012022-06-300000876523ezpw:CashConvertersInternationalLimitedMember2020-10-012021-06-300000876523ezpw:CashConvertersInternationalLimitedMember2021-10-012022-09-300000876523ezpw:CashConvertersInternationalLimitedMember2020-10-012021-09-300000876523ezpw:FoundersOneLLCMember2021-10-012021-10-310000876523ezpw:FoundersOneLLCMemberezpw:SimpleManagementGroupIncMember2021-10-012021-10-310000876523ezpw:FoundersOneLLCMember2022-12-022022-12-020000876523ezpw:FoundersOneLLCMember2022-12-020000876523ezpw:FoundersOneLLCMemberezpw:SimpleManagementGroupIncMember2022-12-020000876523ezpw:FoundersOneLLCMember2023-09-300000876523us-gaap:SubsequentEventMemberezpw:FoundersOneLLCMember2023-10-012023-10-310000876523us-gaap:SubsequentEventMemberezpw:FoundersOneLLCMember2023-10-310000876523ezpw:SecuredPromissoryNotes289Due2024Member2022-10-012023-09-300000876523ezpw:SecuredPromissoryNotes289Due2024Memberus-gaap:CarryingReportedAmountFairValueDisclosureMember2023-09-300000876523us-gaap:EstimateOfFairValueFairValueDisclosureMemberezpw:SecuredPromissoryNotes289Due2024Member2023-09-300000876523us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel1Memberezpw:SecuredPromissoryNotes289Due2024Member2023-09-300000876523us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Memberezpw:SecuredPromissoryNotes289Due2024Member2023-09-300000876523us-gaap:FairValueInputsLevel3Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberezpw:SecuredPromissoryNotes289Due2024Member2023-09-300000876523ezpw:SecuredPromissoryNote1200ReceivableFromFoundersMember2022-10-012023-09-300000876523ezpw:SecuredPromissoryNote1200ReceivableFromFoundersMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2023-09-300000876523us-gaap:EstimateOfFairValueFairValueDisclosureMemberezpw:SecuredPromissoryNote1200ReceivableFromFoundersMember2023-09-300000876523us-gaap:EstimateOfFairValueFairValueDisclosureMemberezpw:SecuredPromissoryNote1200ReceivableFromFoundersMemberus-gaap:FairValueInputsLevel1Member2023-09-300000876523us-gaap:EstimateOfFairValueFairValueDisclosureMemberezpw:SecuredPromissoryNote1200ReceivableFromFoundersMemberus-gaap:FairValueInputsLevel2Member2023-09-300000876523us-gaap:FairValueInputsLevel3Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberezpw:SecuredPromissoryNote1200ReceivableFromFoundersMember2023-09-300000876523ezpw:InvestmentInUnconsolidatedAffiliateMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2023-09-300000876523ezpw:InvestmentInUnconsolidatedAffiliateMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-09-300000876523ezpw:InvestmentInUnconsolidatedAffiliateMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel1Member2023-09-300000876523ezpw:InvestmentInUnconsolidatedAffiliateMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Member2023-09-300000876523us-gaap:FairValueInputsLevel3Memberezpw:InvestmentInUnconsolidatedAffiliateMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-09-300000876523ezpw:A2.875ConvertibleSeniorNotesDue2024Memberus-gaap:CarryingReportedAmountFairValueDisclosureMember2023-09-300000876523us-gaap:EstimateOfFairValueFairValueDisclosureMemberezpw:A2.875ConvertibleSeniorNotesDue2024Member2023-09-300000876523us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel1Memberezpw:A2.875ConvertibleSeniorNotesDue2024Member2023-09-300000876523us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Memberezpw:A2.875ConvertibleSeniorNotesDue2024Member2023-09-300000876523us-gaap:FairValueInputsLevel3Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberezpw:A2.875ConvertibleSeniorNotesDue2024Member2023-09-300000876523ezpw:ConvertibleSeniorNotes2.375Due2025Memberus-gaap:CarryingReportedAmountFairValueDisclosureMember2023-09-300000876523ezpw:ConvertibleSeniorNotes2.375Due2025Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-09-300000876523ezpw:ConvertibleSeniorNotes2.375Due2025Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel1Member2023-09-300000876523ezpw:ConvertibleSeniorNotes2.375Due2025Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Member2023-09-300000876523us-gaap:FairValueInputsLevel3Memberezpw:ConvertibleSeniorNotes2.375Due2025Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-09-300000876523ezpw:ConvertibleSeniorNotes3750Due2029Memberus-gaap:CarryingReportedAmountFairValueDisclosureMember2023-09-300000876523us-gaap:EstimateOfFairValueFairValueDisclosureMemberezpw:ConvertibleSeniorNotes3750Due2029Member2023-09-300000876523us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel1Memberezpw:ConvertibleSeniorNotes3750Due2029Member2023-09-300000876523us-gaap:EstimateOfFairValueFairValueDisclosureMemberezpw:ConvertibleSeniorNotes3750Due2029Memberus-gaap:FairValueInputsLevel2Member2023-09-300000876523us-gaap:FairValueInputsLevel3Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberezpw:ConvertibleSeniorNotes3750Due2029Member2023-09-300000876523ezpw:SecuredPromissoryNotes289Due2024Member2021-10-012022-09-300000876523ezpw:SecuredPromissoryNotes289Due2024Memberus-gaap:CarryingReportedAmountFairValueDisclosureMember2022-09-300000876523us-gaap:EstimateOfFairValueFairValueDisclosureMemberezpw:SecuredPromissoryNotes289Due2024Member2022-09-300000876523us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel1Memberezpw:SecuredPromissoryNotes289Due2024Member2022-09-300000876523us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Memberezpw:SecuredPromissoryNotes289Due2024Member2022-09-300000876523us-gaap:FairValueInputsLevel3Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberezpw:SecuredPromissoryNotes289Due2024Member2022-09-300000876523ezpw:InvestmentInUnconsolidatedAffiliateMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2022-09-300000876523ezpw:InvestmentInUnconsolidatedAffiliateMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2022-09-300000876523ezpw:InvestmentInUnconsolidatedAffiliateMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel1Member2022-09-300000876523ezpw:InvestmentInUnconsolidatedAffiliateMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Member2022-09-300000876523us-gaap:FairValueInputsLevel3Memberezpw:InvestmentInUnconsolidatedAffiliateMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2022-09-300000876523ezpw:A2.875ConvertibleSeniorNotesDue2024Memberus-gaap:CarryingReportedAmountFairValueDisclosureMember2022-09-300000876523us-gaap:EstimateOfFairValueFairValueDisclosureMemberezpw:A2.875ConvertibleSeniorNotesDue2024Member2022-09-300000876523us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel1Memberezpw:A2.875ConvertibleSeniorNotesDue2024Member2022-09-300000876523us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Memberezpw:A2.875ConvertibleSeniorNotesDue2024Member2022-09-300000876523us-gaap:FairValueInputsLevel3Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberezpw:A2.875ConvertibleSeniorNotesDue2024Member2022-09-300000876523ezpw:ConvertibleSeniorNotes2.375Due2025Memberus-gaap:CarryingReportedAmountFairValueDisclosureMember2022-09-300000876523ezpw:ConvertibleSeniorNotes2.375Due2025Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2022-09-300000876523ezpw:ConvertibleSeniorNotes2.375Due2025Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel1Member2022-09-300000876523ezpw:ConvertibleSeniorNotes2.375Due2025Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Member2022-09-300000876523us-gaap:FairValueInputsLevel3Memberezpw:ConvertibleSeniorNotes2.375Due2025Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2022-09-300000876523ezpw:SecuredPromissoryNotes289Due2024Member2019-03-310000876523ezpw:SecuredPromissoryNotes289Due2024Member2019-04-300000876523ezpw:SecuredPromissoryNotes289Due2024Member2019-04-012019-04-300000876523ezpw:SecuredPromissoryNote1200ReceivableFromFoundersMember2022-12-310000876523us-gaap:SubsequentEventMemberezpw:SecuredPromissoryNote1200ReceivableFromFoundersMember2023-10-012023-10-310000876523us-gaap:LandMember2023-09-300000876523us-gaap:LandMember2022-09-300000876523us-gaap:LandBuildingsAndImprovementsMember2023-09-300000876523us-gaap:LandBuildingsAndImprovementsMember2022-09-300000876523ezpw:FurnitureAndEquipmentMember2023-09-300000876523ezpw:FurnitureAndEquipmentMember2022-09-300000876523us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2022-09-300000876523us-gaap:ConstructionInProgressMember2023-09-300000876523us-gaap:ConstructionInProgressMember2022-09-3000008765232020-01-012020-03-310000876523ezpw:U.S.PawnSegmentMember2020-01-012020-03-310000876523ezpw:LatinAmericaPawnSegmentMember2020-01-012020-03-310000876523ezpw:U.S.PawnSegmentMember2021-09-300000876523ezpw:LatinAmericaPawnSegmentMember2021-09-300000876523ezpw:U.S.PawnSegmentMember2021-10-012022-09-300000876523ezpw:LatinAmericaPawnSegmentMember2021-10-012022-09-300000876523ezpw:U.S.PawnSegmentMember2022-09-300000876523ezpw:LatinAmericaPawnSegmentMember2022-09-300000876523ezpw:U.S.PawnSegmentMember2022-10-012023-09-300000876523ezpw:LatinAmericaPawnSegmentMember2022-10-012023-09-300000876523ezpw:U.S.PawnSegmentMember2023-09-300000876523ezpw:LatinAmericaPawnSegmentMember2023-09-300000876523ezpw:HoustonTexasMember2022-10-012022-12-310000876523ezpw:LasVegasNevadaMember2022-10-012022-12-3100008765232022-10-012022-12-310000876523ezpw:NashvilleTennesseeMember2023-07-012023-09-300000876523ezpw:SanAntonioTexasMember2023-07-012023-09-3000008765232023-07-012023-09-300000876523us-gaap:TradeNamesMember2023-09-300000876523us-gaap:TradeNamesMember2022-09-300000876523ezpw:PawnLicensesMember2023-09-300000876523ezpw:PawnLicensesMember2022-09-300000876523us-gaap:ComputerSoftwareIntangibleAssetMember2023-09-300000876523us-gaap:ComputerSoftwareIntangibleAssetMember2022-09-300000876523us-gaap:OtherIntangibleAssetsMember2023-09-300000876523us-gaap:OtherIntangibleAssetsMember2022-09-300000876523us-gaap:ComputerSoftwareIntangibleAssetMember2021-10-012022-09-300000876523us-gaap:SeniorNotesMemberezpw:ConvertibleSeniorNotes3750Due2029Member2023-09-300000876523us-gaap:SeniorNotesMemberezpw:ConvertibleSeniorNotes3750Due2029Member2022-09-300000876523us-gaap:SeniorNotesMemberezpw:ConvertibleSeniorNotes2.375Due2025Member2023-09-300000876523us-gaap:SeniorNotesMemberezpw:ConvertibleSeniorNotes2.375Due2025Member2022-09-300000876523us-gaap:SeniorNotesMemberezpw:A2.875ConvertibleSeniorNotesDue2024Member2023-09-300000876523us-gaap:SeniorNotesMemberezpw:A2.875ConvertibleSeniorNotesDue2024Member2022-09-300000876523us-gaap:SeniorNotesMember2023-09-300000876523us-gaap:SeniorNotesMemberezpw:ConvertibleSeniorNotes3750Due2029Member2022-10-012023-09-300000876523us-gaap:SeniorNotesMemberezpw:ConvertibleSeniorNotes3750Due2029Member2021-10-012022-09-300000876523us-gaap:SeniorNotesMemberezpw:ConvertibleSeniorNotes3750Due2029Member2020-10-012021-09-300000876523us-gaap:SeniorNotesMemberezpw:ConvertibleSeniorNotes2.375Due2025Member2022-10-012023-09-300000876523us-gaap:SeniorNotesMemberezpw:ConvertibleSeniorNotes2.375Due2025Member2021-10-012022-09-300000876523us-gaap:SeniorNotesMemberezpw:ConvertibleSeniorNotes2.375Due2025Member2020-10-012021-09-300000876523us-gaap:SeniorNotesMemberezpw:A2.875ConvertibleSeniorNotesDue2024Member2022-10-012023-09-300000876523us-gaap:SeniorNotesMemberezpw:A2.875ConvertibleSeniorNotesDue2024Member2021-10-012022-09-300000876523us-gaap:SeniorNotesMemberezpw:A2.875ConvertibleSeniorNotesDue2024Member2020-10-012021-09-300000876523us-gaap:SeniorNotesMemberezpw:ConvertibleSeniorNotes3750Due2029Member2022-12-310000876523us-gaap:SeniorNotesMemberezpw:ConvertibleSeniorNotes3750Due2029Member2022-12-120000876523us-gaap:SeniorNotesMemberezpw:ConvertibleSeniorNotes3750Due2029Memberezpw:DebtConversionConditionOneMember2022-12-122022-12-12ezpw:day0000876523ezpw:DebtConversionConditionTwoMemberus-gaap:SeniorNotesMemberezpw:ConvertibleSeniorNotes3750Due2029Member2022-12-122022-12-120000876523us-gaap:DebtInstrumentRedemptionPeriodOneMemberus-gaap:SeniorNotesMemberezpw:ConvertibleSeniorNotes3750Due2029Memberezpw:DebtConversionConditionOneMember2022-12-122022-12-120000876523ezpw:A2.875ConvertibleSeniorNotesDue2024Memberezpw:NotesRepurchasesMember2022-12-310000876523us-gaap:SeniorNotesMemberezpw:A2.875ConvertibleSeniorNotesDue2024Member2017-07-050000876523ezpw:NotesRepurchasesMemberezpw:ConvertibleSeniorNotes2.375Due2025Member2022-12-310000876523us-gaap:SeniorNotesMemberezpw:ConvertibleSeniorNotes2.375Due2025Member2018-05-1400008765232022-12-012022-12-310000876523us-gaap:SeniorNotesMemberezpw:ConvertibleSeniorNotes2.375Due2025Memberezpw:DebtConversionConditionOneMember2018-05-142018-05-140000876523ezpw:DebtConversionConditionTwoMemberus-gaap:SeniorNotesMemberezpw:ConvertibleSeniorNotes2.375Due2025Member2018-05-142018-05-140000876523us-gaap:DebtInstrumentRedemptionPeriodOneMemberus-gaap:SeniorNotesMemberezpw:ConvertibleSeniorNotes2.375Due2025Member2018-05-142018-05-140000876523us-gaap:SeniorNotesMemberezpw:A2.875ConvertibleSeniorNotesDue2024Memberezpw:DebtConversionConditionOneMember2017-07-052017-07-050000876523ezpw:DebtConversionConditionTwoMemberus-gaap:SeniorNotesMemberezpw:A2.875ConvertibleSeniorNotesDue2024Member2017-07-052017-07-050000876523us-gaap:DebtInstrumentRedemptionPeriodOneMemberus-gaap:SeniorNotesMemberezpw:A2.875ConvertibleSeniorNotesDue2024Memberezpw:DebtConversionConditionOneMember2017-07-052017-07-050000876523ezpw:ConvertibleSeniorNotes3750Due2029Memberus-gaap:CommonClassAMember2022-12-012022-12-310000876523us-gaap:SeniorNotesMemberezpw:ConvertibleSeniorNotes2.375Due2025Member2018-05-142018-05-140000876523us-gaap:SeniorNotesMemberezpw:A2.875ConvertibleSeniorNotesDue2024Member2017-07-052017-07-050000876523us-gaap:CommonClassAMember2022-05-030000876523us-gaap:CommonClassAMember2022-05-032022-05-030000876523us-gaap:CommonClassAMember2022-05-032023-09-300000876523ezpw:CommonStockRepurchaseProgramMemberus-gaap:CommonClassAMember2022-10-012023-09-300000876523ezpw:LongTermIncentivePlan2022Memberus-gaap:CommonClassAMember2022-03-010000876523ezpw:LongTermIncentivePlan2022Memberus-gaap:CommonClassAMember2022-10-310000876523us-gaap:SubsequentEventMemberezpw:LongTermIncentivePlan2022Memberus-gaap:CommonClassAMember2023-11-150000876523us-gaap:RestrictedStockMemberezpw:LongTermIncentivePlan2022Membersrt:MinimumMember2022-03-012022-03-010000876523srt:MaximumMemberus-gaap:RestrictedStockMemberezpw:LongTermIncentivePlan2022Member2022-03-012022-03-010000876523ezpw:NonemployeeDirectorsMemberus-gaap:RestrictedStockMember2023-03-012023-03-31ezpw:director0000876523ezpw:NonEmployeeDirectorOneMemberus-gaap:RestrictedStockMember2023-03-012023-03-310000876523ezpw:NonEmployeeDirectorFourMemberus-gaap:RestrictedStockMember2023-03-012023-03-310000876523ezpw:NonEmployeeDirectorTwoMemberus-gaap:RestrictedStockMember2023-03-012023-03-310000876523ezpw:NonEmployeeDirectorFiveMemberus-gaap:RestrictedStockMember2023-03-012023-03-310000876523ezpw:NonEmployeeDirectorThreeMemberus-gaap:RestrictedStockMember2023-03-012023-03-310000876523ezpw:NonemployeeDirectorsMemberus-gaap:RestrictedStockMember2022-03-012022-03-310000876523ezpw:NonEmployeeDirectorTwoMemberus-gaap:RestrictedStockMember2022-03-012022-03-310000876523ezpw:NonEmployeeDirectorFourMemberus-gaap:RestrictedStockMember2022-03-012022-03-310000876523ezpw:NonEmployeeDirectorThreeMemberus-gaap:RestrictedStockMember2022-03-012022-03-310000876523ezpw:NonEmployeeDirectorOneMemberus-gaap:RestrictedStockMember2022-03-012022-03-310000876523ezpw:NonEmployeeDirectorFiveMemberus-gaap:RestrictedStockMember2022-03-012022-03-310000876523ezpw:NonemployeeDirectorsMemberus-gaap:RestrictedStockMember2021-02-012021-02-280000876523ezpw:NonEmployeeDirectorOneMemberus-gaap:RestrictedStockMember2021-02-012021-02-280000876523ezpw:NonEmployeeDirectorTwoMemberus-gaap:RestrictedStockMember2021-02-012021-02-280000876523ezpw:NonEmployeeDirectorFourMemberus-gaap:RestrictedStockMember2021-02-012021-02-280000876523ezpw:NonEmployeeDirectorThreeMemberus-gaap:RestrictedStockMember2021-02-012021-02-280000876523ezpw:NonemployeeDirectorsMemberus-gaap:RestrictedStockMember2020-12-012020-12-310000876523ezpw:NonEmployeeDirectorSevenMemberus-gaap:RestrictedStockMember2020-12-012020-12-310000876523ezpw:NonEmployeeDirectorOneMemberus-gaap:RestrictedStockMember2020-12-012020-12-310000876523ezpw:NonEmployeeDirectorThreeMemberus-gaap:RestrictedStockMember2020-12-012020-12-310000876523ezpw:NonEmployeeDirectorSixMemberus-gaap:RestrictedStockMember2020-12-012020-12-310000876523ezpw:NonEmployeeDirectorFiveMemberus-gaap:RestrictedStockMember2020-12-012020-12-310000876523ezpw:NonEmployeeDirectorNineMemberus-gaap:RestrictedStockMember2020-12-012020-12-310000876523ezpw:NonEmployeeDirectorEightMemberus-gaap:RestrictedStockMember2020-12-012020-12-310000876523ezpw:NonEmployeeDirectorTwoMemberus-gaap:RestrictedStockMember2020-12-012020-12-310000876523ezpw:NonEmployeeDirectorFourMemberus-gaap:RestrictedStockMember2020-12-012020-12-310000876523ezpw:NonemployeeDirectorsMemberus-gaap:RestrictedStockMember2021-02-182021-02-180000876523ezpw:NonemployeeDirectorsMember2021-02-182021-02-180000876523ezpw:NonemployeeDirectorsMemberus-gaap:RestrictedStockMember2021-03-312021-03-310000876523ezpw:EmployeeMemberus-gaap:RestrictedStockUnitsRSUMemberezpw:FiscalYear2023AwardsMember2022-10-012022-10-310000876523ezpw:EmployeeMemberus-gaap:RestrictedStockUnitsRSUMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMemberezpw:FiscalYear2023AwardsMember2022-10-012022-10-310000876523ezpw:EmployeeMemberus-gaap:RestrictedStockUnitsRSUMemberus-gaap:ShareBasedCompensationAwardTrancheOneMemberezpw:FiscalYear2023AwardsMember2022-10-012022-10-310000876523ezpw:EmployeeMemberus-gaap:ShareBasedCompensationAwardTrancheThreeMemberus-gaap:RestrictedStockUnitsRSUMemberezpw:FiscalYear2023AwardsMember2022-10-012022-10-310000876523us-gaap:PerformanceSharesMemberezpw:EmployeeMemberezpw:FiscalYear2023AwardsMember2022-10-012022-10-310000876523ezpw:EmployeeMemberezpw:CumulativePerformanceMemberezpw:FiscalYear2023AwardsMember2022-10-012022-10-310000876523ezpw:EmployeeMemberus-gaap:RestrictedStockMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMemberezpw:FiscalYear2023AwardsMember2022-10-012022-10-310000876523ezpw:EmployeeMemberus-gaap:RestrictedStockMemberus-gaap:ShareBasedCompensationAwardTrancheOneMemberezpw:FiscalYear2023AwardsMembersrt:MinimumMember2022-10-012022-10-310000876523srt:MaximumMemberezpw:EmployeeMemberus-gaap:RestrictedStockMemberus-gaap:ShareBasedCompensationAwardTrancheOneMemberezpw:FiscalYear2023AwardsMember2022-10-012022-10-310000876523ezpw:EmployeeMemberus-gaap:ShareBasedCompensationAwardTrancheThreeMemberus-gaap:RestrictedStockMemberezpw:FiscalYear2023AwardsMember2022-10-012023-09-300000876523ezpw:EmployeeMemberezpw:CumulativePerformanceMemberus-gaap:ShareBasedCompensationAwardTrancheOneMemberezpw:FiscalYear2023AwardsMember2022-10-012022-10-310000876523ezpw:EmployeeMemberus-gaap:RestrictedStockMemberezpw:FiscalYear2023AwardsMember2022-10-012023-09-300000876523ezpw:FiscalYear2022AwardsMemberezpw:EmployeeMemberus-gaap:RestrictedStockMember2021-10-012021-11-300000876523ezpw:FiscalYear2022AwardsMemberezpw:EmployeeMemberus-gaap:RestrictedStockMember2021-10-012022-09-300000876523ezpw:FiscalYear2022AwardsMemberezpw:EmployeeMemberus-gaap:RestrictedStockMemberus-gaap:ShareBasedCompensationAwardTrancheOneMembersrt:MinimumMember2022-10-012023-09-300000876523ezpw:FiscalYear2022AwardsMembersrt:MaximumMemberezpw:EmployeeMemberus-gaap:RestrictedStockMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2022-10-012023-09-300000876523ezpw:FiscalYear2022AwardsMemberezpw:EmployeeMemberus-gaap:RestrictedStockMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMember2021-10-012022-09-300000876523ezpw:FiscalYear2022AwardsMemberezpw:EmployeeMemberus-gaap:ShareBasedCompensationAwardTrancheThreeMemberus-gaap:RestrictedStockMember2022-10-012023-09-300000876523ezpw:FiscalYear2022AwardsMemberezpw:EmployeeMemberus-gaap:RestrictedStockMember2021-10-012021-10-310000876523ezpw:EmployeeMemberus-gaap:RestrictedStockMemberezpw:FiscalYear2021AwardsMember2021-02-012021-02-280000876523ezpw:EmployeeMemberus-gaap:RestrictedStockMemberezpw:FiscalYear2021AwardsMember2022-10-012023-09-300000876523ezpw:EmployeeMemberus-gaap:RestrictedStockMemberezpw:FiscalYear2021AwardsMember2020-10-012021-09-300000876523ezpw:EmployeeMemberus-gaap:RestrictedStockMemberezpw:FiscalYear2021AwardsMember2021-10-012022-09-300000876523ezpw:EmployeeMemberus-gaap:RestrictedStockMemberezpw:FiscalYear2021AwardsMemberus-gaap:ShareBasedCompensationAwardTrancheOneMembersrt:MinimumMember2022-10-012023-09-300000876523srt:MaximumMemberezpw:EmployeeMemberus-gaap:RestrictedStockMemberezpw:FiscalYear2021AwardsMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2022-10-012023-09-300000876523ezpw:EmployeeMemberus-gaap:RestrictedStockMemberezpw:FiscalYear2021AwardsMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2020-10-012021-09-300000876523ezpw:EmployeeMemberus-gaap:RestrictedStockMemberezpw:FiscalYear2021AwardsMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMember2021-10-012022-09-300000876523ezpw:EmployeeMemberus-gaap:ShareBasedCompensationAwardTrancheThreeMemberus-gaap:RestrictedStockMemberezpw:FiscalYear2021AwardsMember2022-10-012023-09-300000876523ezpw:LongTermIncentivePlan2010Memberezpw:EmployeeMemberus-gaap:RestrictedStockMember2021-01-012021-01-310000876523ezpw:EmployeeMemberus-gaap:RestrictedStockMemberezpw:FiscalYear2020AwardsMember2020-10-012021-09-300000876523ezpw:EmployeeMemberus-gaap:RestrictedStockMemberezpw:FiscalYear2020AwardsMember2019-10-012020-09-300000876523ezpw:EmployeeMemberus-gaap:RestrictedStockMemberezpw:FiscalYear2020AwardsMember2021-10-012022-09-300000876523ezpw:EmployeeMemberus-gaap:RestrictedStockMemberus-gaap:ShareBasedCompensationAwardTrancheOneMembersrt:MinimumMemberezpw:FiscalYear2020AwardsMember2021-10-012022-09-300000876523srt:MaximumMemberezpw:EmployeeMemberus-gaap:RestrictedStockMemberus-gaap:ShareBasedCompensationAwardTrancheOneMemberezpw:FiscalYear2020AwardsMember2021-10-012022-09-300000876523ezpw:EmployeeMemberus-gaap:RestrictedStockMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMemberezpw:FiscalYear2020AwardsMember2020-10-012021-09-300000876523ezpw:EmployeeMemberus-gaap:ShareBasedCompensationAwardTrancheThreeMemberus-gaap:RestrictedStockMemberezpw:FiscalYear2020AwardsMember2021-10-012022-09-300000876523ezpw:LongTermIncentivePlan2010Memberezpw:EmployeeMemberus-gaap:RestrictedStockMember2018-12-012018-12-310000876523ezpw:EmployeeMemberezpw:FiscalYear2019AwardsMemberus-gaap:RestrictedStockMember2018-10-012019-09-300000876523ezpw:EmployeeMemberezpw:FiscalYear2019AwardsMemberus-gaap:RestrictedStockMember2020-10-012021-09-300000876523ezpw:EmployeeMemberezpw:FiscalYear2019AwardsMemberus-gaap:RestrictedStockMember2019-10-012020-09-300000876523ezpw:EmployeeMemberezpw:FiscalYear2019AwardsMemberus-gaap:RestrictedStockMember2020-11-012020-11-300000876523ezpw:LongTermIncentivePlan2010Memberezpw:EmployeeMemberus-gaap:RestrictedStockMember2020-11-012020-11-300000876523ezpw:LongTermIncentivePlan2010Memberezpw:EmployeeMemberus-gaap:RestrictedStockMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2020-11-012020-11-300000876523ezpw:LongTermIncentivePlan2010Memberezpw:EmployeeMemberus-gaap:RestrictedStockMember2020-10-012021-09-300000876523ezpw:RestrictedStockandPhantomShareUnitsMember2023-09-300000876523ezpw:RestrictedStockandPhantomShareUnitsMember2022-10-012023-09-300000876523us-gaap:RestrictedStockMember2022-09-300000876523us-gaap:RestrictedStockMember2022-10-012023-09-300000876523us-gaap:RestrictedStockMember2023-09-300000876523us-gaap:RestrictedStockMember2021-10-012022-09-300000876523us-gaap:RestrictedStockMember2020-10-012021-09-300000876523ezpw:RestrictedStockandPhantomShareUnitsMember2021-10-012022-09-300000876523ezpw:RestrictedStockandPhantomShareUnitsMember2020-10-012021-09-300000876523us-gaap:DomesticCountryMember2023-09-300000876523us-gaap:ForeignCountryMember2023-09-300000876523ezpw:CorporateOfficeLeaseTwoFiveYearExtensionOptionsMember2014-12-310000876523ezpw:CorporateOfficeLeaseTwoFiveYearExtensionOptionsMember2014-12-012014-12-310000876523ezpw:CorporateOfficeLeaseTwoFiveYearExtensionOptionsMember2017-09-300000876523ezpw:CorporateOfficeLeaseTwoFiveYearExtensionOptionsMember2016-09-3000008765232019-10-012020-09-300000876523ezpw:CorporateOfficeLeaseMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsNonrecurringMember2023-09-300000876523ezpw:CorporateOfficeLeaseMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsNonrecurringMember2023-09-300000876523us-gaap:FairValueInputsLevel3Memberezpw:CorporateOfficeLeaseMemberus-gaap:FairValueMeasurementsNonrecurringMember2023-09-300000876523ezpw:CorporateOfficeLeaseMemberus-gaap:FairValueMeasurementsNonrecurringMember2023-09-300000876523ezpw:CorporateOfficeLeaseMember2022-10-012023-09-300000876523ezpw:RegionalOfficesSubleaseMember2015-03-31ezpw:segment0000876523us-gaap:OperatingSegmentsMemberezpw:U.S.PawnSegmentMemberezpw:MerchandiseMember2022-10-012023-09-300000876523us-gaap:OperatingSegmentsMemberezpw:LatinAmericaPawnSegmentMemberezpw:MerchandiseMember2022-10-012023-09-300000876523ezpw:OtherInvestmentsSegmentMemberus-gaap:OperatingSegmentsMemberezpw:MerchandiseMember2022-10-012023-09-300000876523us-gaap:OperatingSegmentsMemberezpw:MerchandiseMember2022-10-012023-09-300000876523us-gaap:CorporateNonSegmentMemberezpw:MerchandiseMember2022-10-012023-09-300000876523us-gaap:OperatingSegmentsMemberezpw:U.S.PawnSegmentMemberezpw:JewelryScrappingMember2022-10-012023-09-300000876523us-gaap:OperatingSegmentsMemberezpw:JewelryScrappingMemberezpw:LatinAmericaPawnSegmentMember2022-10-012023-09-300000876523ezpw:OtherInvestmentsSegmentMemberus-gaap:OperatingSegmentsMemberezpw:JewelryScrappingMember2022-10-012023-09-300000876523us-gaap:OperatingSegmentsMemberezpw:JewelryScrappingMember2022-10-012023-09-300000876523ezpw:JewelryScrappingMemberus-gaap:CorporateNonSegmentMember2022-10-012023-09-300000876523us-gaap:OperatingSegmentsMemberezpw:U.S.PawnSegmentMemberezpw:PawnServiceMember2022-10-012023-09-300000876523us-gaap:OperatingSegmentsMemberezpw:PawnServiceMemberezpw:LatinAmericaPawnSegmentMember2022-10-012023-09-300000876523ezpw:OtherInvestmentsSegmentMemberus-gaap:OperatingSegmentsMemberezpw:PawnServiceMember2022-10-012023-09-300000876523us-gaap:OperatingSegmentsMemberezpw:PawnServiceMember2022-10-012023-09-300000876523ezpw:PawnServiceMemberus-gaap:CorporateNonSegmentMember2022-10-012023-09-300000876523us-gaap:OperatingSegmentsMemberezpw:U.S.PawnSegmentMemberus-gaap:ProductAndServiceOtherMember2022-10-012023-09-300000876523us-gaap:OperatingSegmentsMemberezpw:LatinAmericaPawnSegmentMemberus-gaap:ProductAndServiceOtherMember2022-10-012023-09-300000876523ezpw:OtherInvestmentsSegmentMemberus-gaap:OperatingSegmentsMemberus-gaap:ProductAndServiceOtherMember2022-10-012023-09-300000876523us-gaap:OperatingSegmentsMemberus-gaap:ProductAndServiceOtherMember2022-10-012023-09-300000876523us-gaap:CorporateNonSegmentMemberus-gaap:ProductAndServiceOtherMember2022-10-012023-09-300000876523us-gaap:OperatingSegmentsMemberezpw:U.S.PawnSegmentMember2022-10-012023-09-300000876523us-gaap:OperatingSegmentsMemberezpw:LatinAmericaPawnSegmentMember2022-10-012023-09-300000876523ezpw:OtherInvestmentsSegmentMemberus-gaap:OperatingSegmentsMember2022-10-012023-09-300000876523us-gaap:OperatingSegmentsMember2022-10-012023-09-300000876523us-gaap:CorporateNonSegmentMember2022-10-012023-09-300000876523us-gaap:OperatingSegmentsMemberezpw:U.S.PawnSegmentMemberezpw:MerchandiseMember2021-10-012022-09-300000876523us-gaap:OperatingSegmentsMemberezpw:LatinAmericaPawnSegmentMemberezpw:MerchandiseMember2021-10-012022-09-300000876523ezpw:OtherInvestmentsSegmentMemberus-gaap:OperatingSegmentsMemberezpw:MerchandiseMember2021-10-012022-09-300000876523us-gaap:OperatingSegmentsMemberezpw:MerchandiseMember2021-10-012022-09-300000876523us-gaap:CorporateNonSegmentMemberezpw:MerchandiseMember2021-10-012022-09-300000876523us-gaap:OperatingSegmentsMemberezpw:U.S.PawnSegmentMemberezpw:JewelryScrappingMember2021-10-012022-09-300000876523us-gaap:OperatingSegmentsMemberezpw:JewelryScrappingMemberezpw:LatinAmericaPawnSegmentMember2021-10-012022-09-300000876523ezpw:OtherInvestmentsSegmentMemberus-gaap:OperatingSegmentsMemberezpw:JewelryScrappingMember2021-10-012022-09-300000876523us-gaap:OperatingSegmentsMemberezpw:JewelryScrappingMember2021-10-012022-09-300000876523ezpw:JewelryScrappingMemberus-gaap:CorporateNonSegmentMember2021-10-012022-09-300000876523us-gaap:OperatingSegmentsMemberezpw:U.S.PawnSegmentMemberezpw:PawnServiceMember2021-10-012022-09-300000876523us-gaap:OperatingSegmentsMemberezpw:PawnServiceMemberezpw:LatinAmericaPawnSegmentMember2021-10-012022-09-300000876523ezpw:OtherInvestmentsSegmentMemberus-gaap:OperatingSegmentsMemberezpw:PawnServiceMember2021-10-012022-09-300000876523us-gaap:OperatingSegmentsMemberezpw:PawnServiceMember2021-10-012022-09-300000876523ezpw:PawnServiceMemberus-gaap:CorporateNonSegmentMember2021-10-012022-09-300000876523us-gaap:OperatingSegmentsMemberezpw:U.S.PawnSegmentMemberus-gaap:ProductAndServiceOtherMember2021-10-012022-09-300000876523us-gaap:OperatingSegmentsMemberezpw:LatinAmericaPawnSegmentMemberus-gaap:ProductAndServiceOtherMember2021-10-012022-09-300000876523ezpw:OtherInvestmentsSegmentMemberus-gaap:OperatingSegmentsMemberus-gaap:ProductAndServiceOtherMember2021-10-012022-09-300000876523us-gaap:OperatingSegmentsMemberus-gaap:ProductAndServiceOtherMember2021-10-012022-09-300000876523us-gaap:CorporateNonSegmentMemberus-gaap:ProductAndServiceOtherMember2021-10-012022-09-300000876523us-gaap:OperatingSegmentsMemberezpw:U.S.PawnSegmentMember2021-10-012022-09-300000876523us-gaap:OperatingSegmentsMemberezpw:LatinAmericaPawnSegmentMember2021-10-012022-09-300000876523ezpw:OtherInvestmentsSegmentMemberus-gaap:OperatingSegmentsMember2021-10-012022-09-300000876523us-gaap:OperatingSegmentsMember2021-10-012022-09-300000876523us-gaap:CorporateNonSegmentMember2021-10-012022-09-300000876523us-gaap:OperatingSegmentsMemberezpw:U.S.PawnSegmentMemberezpw:MerchandiseMember2020-10-012021-09-300000876523us-gaap:OperatingSegmentsMemberezpw:LatinAmericaPawnSegmentMemberezpw:MerchandiseMember2020-10-012021-09-300000876523ezpw:OtherInvestmentsSegmentMemberus-gaap:OperatingSegmentsMemberezpw:MerchandiseMember2020-10-012021-09-300000876523us-gaap:OperatingSegmentsMemberezpw:MerchandiseMember2020-10-012021-09-300000876523us-gaap:CorporateNonSegmentMemberezpw:MerchandiseMember2020-10-012021-09-300000876523us-gaap:OperatingSegmentsMemberezpw:U.S.PawnSegmentMemberezpw:JewelryScrappingMember2020-10-012021-09-300000876523us-gaap:OperatingSegmentsMemberezpw:JewelryScrappingMemberezpw:LatinAmericaPawnSegmentMember2020-10-012021-09-300000876523ezpw:OtherInvestmentsSegmentMemberus-gaap:OperatingSegmentsMemberezpw:JewelryScrappingMember2020-10-012021-09-300000876523us-gaap:OperatingSegmentsMemberezpw:JewelryScrappingMember2020-10-012021-09-300000876523ezpw:JewelryScrappingMemberus-gaap:CorporateNonSegmentMember2020-10-012021-09-300000876523us-gaap:OperatingSegmentsMemberezpw:U.S.PawnSegmentMemberezpw:PawnServiceMember2020-10-012021-09-300000876523us-gaap:OperatingSegmentsMemberezpw:PawnServiceMemberezpw:LatinAmericaPawnSegmentMember2020-10-012021-09-300000876523ezpw:OtherInvestmentsSegmentMemberus-gaap:OperatingSegmentsMemberezpw:PawnServiceMember2020-10-012021-09-300000876523us-gaap:OperatingSegmentsMemberezpw:PawnServiceMember2020-10-012021-09-300000876523ezpw:PawnServiceMemberus-gaap:CorporateNonSegmentMember2020-10-012021-09-300000876523us-gaap:OperatingSegmentsMemberezpw:U.S.PawnSegmentMemberus-gaap:ProductAndServiceOtherMember2020-10-012021-09-300000876523us-gaap:OperatingSegmentsMemberezpw:LatinAmericaPawnSegmentMemberus-gaap:ProductAndServiceOtherMember2020-10-012021-09-300000876523ezpw:OtherInvestmentsSegmentMemberus-gaap:OperatingSegmentsMemberus-gaap:ProductAndServiceOtherMember2020-10-012021-09-300000876523us-gaap:OperatingSegmentsMemberus-gaap:ProductAndServiceOtherMember2020-10-012021-09-300000876523us-gaap:CorporateNonSegmentMemberus-gaap:ProductAndServiceOtherMember2020-10-012021-09-300000876523us-gaap:OperatingSegmentsMemberezpw:U.S.PawnSegmentMember2020-10-012021-09-300000876523us-gaap:OperatingSegmentsMemberezpw:LatinAmericaPawnSegmentMember2020-10-012021-09-300000876523ezpw:OtherInvestmentsSegmentMemberus-gaap:OperatingSegmentsMember2020-10-012021-09-300000876523us-gaap:OperatingSegmentsMember2020-10-012021-09-300000876523us-gaap:CorporateNonSegmentMember2020-10-012021-09-300000876523us-gaap:OperatingSegmentsMemberezpw:U.S.PawnSegmentMember2023-09-300000876523us-gaap:OperatingSegmentsMemberezpw:LatinAmericaPawnSegmentMember2023-09-300000876523us-gaap:OperatingSegmentsMemberezpw:CashConvertersSegmentMember2023-09-300000876523ezpw:OtherInvestmentsSegmentMemberus-gaap:OperatingSegmentsMember2023-09-300000876523us-gaap:CorporateNonSegmentMember2023-09-300000876523us-gaap:OperatingSegmentsMemberezpw:U.S.PawnSegmentMember2022-09-300000876523us-gaap:OperatingSegmentsMemberezpw:LatinAmericaPawnSegmentMember2022-09-300000876523us-gaap:OperatingSegmentsMemberezpw:CashConvertersSegmentMember2022-09-300000876523ezpw:OtherInvestmentsSegmentMemberus-gaap:OperatingSegmentsMember2022-09-300000876523us-gaap:CorporateNonSegmentMember2022-09-300000876523country:US2022-10-012023-09-300000876523country:US2021-10-012022-09-300000876523country:US2020-10-012021-09-300000876523country:MX2022-10-012023-09-300000876523country:MX2021-10-012022-09-300000876523country:MX2020-10-012021-09-300000876523srt:LatinAmericaMember2022-10-012023-09-300000876523srt:LatinAmericaMember2021-10-012022-09-300000876523srt:LatinAmericaMember2020-10-012021-09-300000876523country:CA2022-10-012023-09-300000876523country:CA2021-10-012022-09-300000876523country:CA2020-10-012021-09-300000876523country:US2023-09-300000876523country:US2022-09-300000876523country:MX2023-09-300000876523country:MX2022-09-300000876523srt:LatinAmericaMember2023-09-300000876523srt:LatinAmericaMember2022-09-300000876523us-gaap:InventoryValuationReserveMember2022-09-300000876523us-gaap:InventoryValuationReserveMember2022-10-012023-09-300000876523us-gaap:InventoryValuationReserveMember2023-09-300000876523us-gaap:InventoryValuationReserveMember2021-09-300000876523us-gaap:InventoryValuationReserveMember2021-10-012022-09-300000876523us-gaap:InventoryValuationReserveMember2020-09-300000876523us-gaap:InventoryValuationReserveMember2020-10-012021-09-300000876523ezpw:AllowanceForUncollectiblePawnServiceChargesReceivableMember2022-09-300000876523ezpw:AllowanceForUncollectiblePawnServiceChargesReceivableMember2022-10-012023-09-300000876523ezpw:AllowanceForUncollectiblePawnServiceChargesReceivableMember2023-09-300000876523ezpw:AllowanceForUncollectiblePawnServiceChargesReceivableMember2021-09-300000876523ezpw:AllowanceForUncollectiblePawnServiceChargesReceivableMember2021-10-012022-09-300000876523ezpw:AllowanceForUncollectiblePawnServiceChargesReceivableMember2020-09-300000876523ezpw:AllowanceForUncollectiblePawnServiceChargesReceivableMember2020-10-012021-09-300000876523us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2022-09-300000876523us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2022-10-012023-09-300000876523us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2023-09-300000876523us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2021-09-300000876523us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2021-10-012022-09-300000876523us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2020-09-300000876523us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2020-10-012021-09-300000876523us-gaap:SubsequentEventMemberezpw:SecuredPromissoryNote1200ReceivableFromFoundersMember2023-10-310000876523ezpw:CashConvertersInternationalLimitedMemberus-gaap:SubsequentEventMember2023-10-012023-10-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| | | | | | | | |

| ☑ | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended September 30, 2023 or

| | | | | | | | |

| ☐ | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File No. 0-19424

EZCORP, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | |

| Delaware | 74-2540145 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| | | | | |

| 2500 Bee Cave Road | Bldg One | Suite 200 | Rollingwood | TX | 78746 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (512) 314-3400

Securities Registered Pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol(s) | | Name of Each Exchange on Which Registered |

| Class A Non-voting Common Stock, $.01 par value per share | | EZPW | | The NASDAQ Stock Market |

| | | | | (NASDAQ Global Select Market) |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☑

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | ☐ | Accelerated filer | ☑ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☑

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

The only class of voting securities of the registrant issued and outstanding is the Class B Voting Common Stock, par value $.01 per share, all of which is owned by an affiliate of the registrant. There is no trading market for the Class B Voting Common Stock. The aggregate market value of the Class A Non-Voting Common Stock held by non-affiliates of the registrant was $440 million, based on the closing price on the NASDAQ Stock Market on March 31, 2023.

As of November 8, 2023, 51,746,892 shares of the registrant’s Class A Non-Voting Common Stock, par value $.01 per share, and 2,970,171 shares of the registrant’s Class B Voting Common Stock, par value $.01 per share, were outstanding.

Documents incorporated by reference: None

EZCORP, INC.

FISCAL YEAR ENDED SEPTEMBER 30, 2023

PART I

This report contains forward-looking statements that reflect our future plans, estimates, beliefs and expected performance. Our actual results may differ materially from those currently anticipated and expressed or implied by those forward-looking statements because of a number of risks and uncertainties, including those discussed under “Part I, Item 1A — Risk Factors.” We caution that assumptions, expectations, projections, intentions or beliefs about future events may, and often do, vary from actual results, and the differences can be material. See also “Part II, Item 7 — Management's Discussion and Analysis of Financial Condition and Results of Operations — Cautionary Statement Regarding Risks and Uncertainties That May Affect Future Results.”

Unless otherwise specified, references to the “Company,” “we,” “our,” “us” and “EZCORP” refer to EZCORP, Inc. and its consolidated subsidiaries, collectively. References to a “fiscal” year refer to our fiscal year ended September 30 of the specified year. For example, “fiscal 2023” refers to the fiscal year ended September 30, 2023. All currency amounts preceded with “$” are stated in U.S. dollars, except as otherwise indicated.

ITEM 1. BUSINESS

Purpose, Vision and Strategy

EZCORP, Inc. is a leading provider of pawn services in the United States (“U.S.”) and Latin America with 1,231 locations and more than 7,500 Team Members. We are a Delaware corporation headquartered in Austin, Texas.

Our purpose statement:

“We exist to serve our customers’ short-term cash and pre-owned retail needs, helping them to live and enjoy their lives.

We are driven by a diverse team with a passion for pawn who are motivated to be their best — because our customers, families, stakeholders, and the communities and environment in which we live deserve it.”

This purpose is supported by a customer-centric strategy that includes the following:

•Providing fast, easy and simple access to cash;

•Serving our customers in a friendly and respectful way;

•Always being competitive and fair;

•Passionately serving customer needs;

•Building enduring relationships; and

•Recognizing and rewarding customer loyalty.

That strategy consists of three fundamental pillars:

•Strengthen the Core — Relentless focus on superior execution and operational excellence in our pawn business.

•Cost Efficiency and Simplification — Shape a culture of cost efficiency through ongoing focus on simplification and optimization.

•Innovate and Grow — Broaden customer engagement to serve more customers more frequently in more locations.

And we rely on four foundational capabilities to execute our strategy and achieve our purpose:

•Team Members — We enable diverse, engaged and tenured teams with a true passion for pawnbroking.

•IT and Data Modernization — We modernize our IT and data assets to capitalize on growth opportunities and create greater value at every customer interaction.

•Risk Management and Building a Culture of Compliance — We are continually focused on strengthening our capabilities to manage operational, financial, regulatory, compliance, information security and reputational risk.

•Environment, Social and Governance (ESG) — We prioritize developing the foundational elements of a comprehensive and integrated sustainability program.

Overview of Our Business

At September 30, 2023, we operated a total of 1,231 locations, consisting of:

•529 U.S. pawn stores (operating primarily as EZPAWN or Value Pawn & Jewelry);

•549 Mexico pawn stores (operating primarily as Empeño Fácil and Cash Apoyo Efectivo); and

•153 pawn stores in Guatemala, El Salvador and Honduras (operating as GuatePrenda and MaxiEfectivo).

At our pawn stores, we advance cash against the value of collateralized tangible personal property and sell merchandise to customers looking for good value. The merchandise we sell primarily consists of pre-owned collateral forfeited from our pawn activities or merchandise purchased from customers. By store count, we are the second largest pawn store owner and operator in the U.S. and one of the largest in Latin America. We also offer web-based applications named EZ+ that allow customers to manage their pawn transactions, layaways and loyalty rewards online.

In addition to our core pawn business in the U.S. and Latin America, we have made the following strategic investments:

•We own 43.7% of Cash Converters International Limited (“Cash Converters”), a publicly traded company (ASX: CCV) headquartered in Perth, Western Australia. Cash Converters and its controlled companies comprise a diverse group generating revenues from franchising, store operations, personal finance (including pawn transactions) and vehicle finance in over 600 stores across 14 countries.

•We own a preferred interest in Founders One, LLC (“Founders”) that has majority ownership in Simple Management Group, Inc. (“SMG”), which owns and operates 95 pawn stores in the U.S., Caribbean and Central America, with plans to build and acquire more stores in that region.

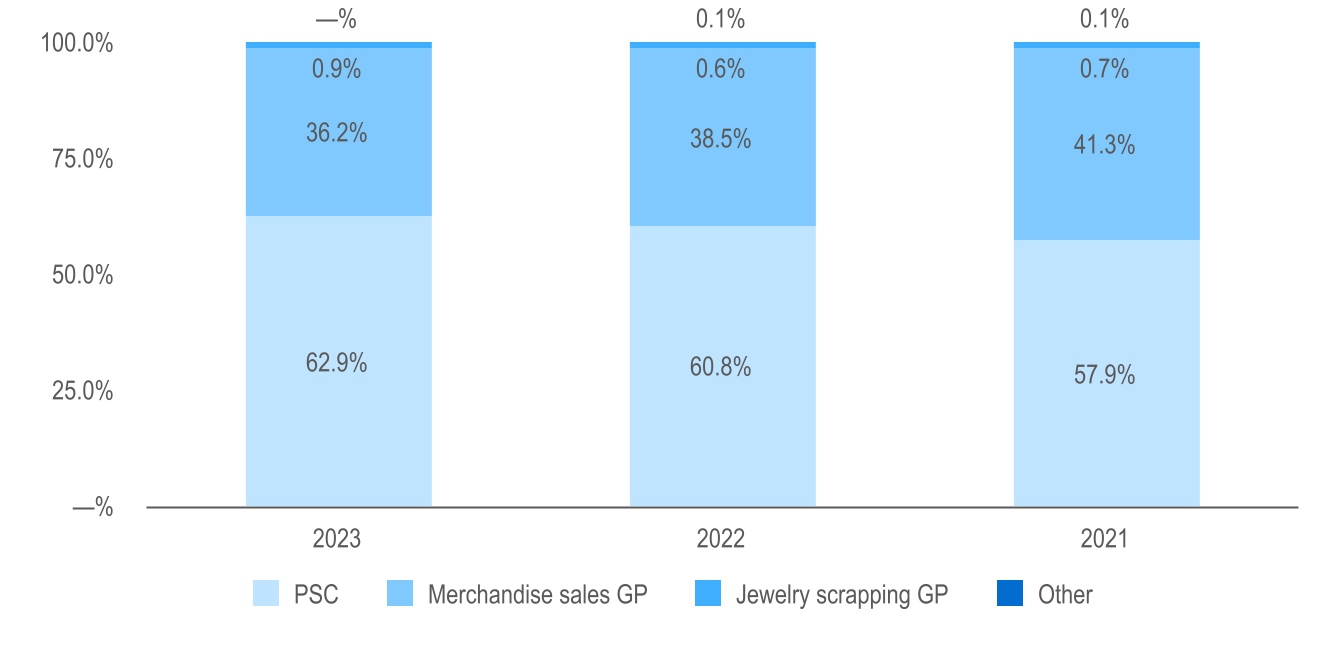

We generate revenues primarily from pawn service charges (“PSC”) on pawn loans outstanding (“PLO”), merchandise sales and jewelry scrapping. We remain focused on optimizing our balance of PLO and the resulting higher PSC. The following chart presents sources of gross profit, including PSC, merchandise sales gross profit (“Merchandise sales GP”) and jewelry scrapping gross profit (“Jewelry scrapping GP”) for fiscal 2023, fiscal 2022 and fiscal 2021:

The following charts present sources of gross profit by geography for fiscal 2023, fiscal 2022 and fiscal 2021:

Segment and Geographic Information

We conduct our business globally and manage our business by geography. Our business is organized into the following reportable segments:

•U.S. Pawn, which includes our EZPAWN, Value Pawn & Jewelry and other branded pawn operations in the United States;

•Latin America Pawn, which includes our Empeño Fácil, Cash Apoyo Efectivo (“CAE”) and other branded pawn operations in Mexico, as well as our GuatePrenda and MaxiEfectivo pawn operations in Guatemala, El Salvador and Honduras (referred to as “GPMX”);

•Cash Converters, which includes our equity interest in the net loss (income) of Cash Converters; and

•Other Investments, which includes our investments in Rich Data Corporation (“RDC”) and our investment in and notes receivable from Founders.

The following table presents store data by segment:

| | | | | | | | | | | | | | | | | | | | | | | |

| | Company-owned Stores |

| | U.S. Pawn | | Latin America Pawn | | Other Investments | | Consolidated |

| | | | | | | |

As of September 30, 2020 | 505 | | | 500 | | | — | | | 1,005 | |

| New locations opened | — | | | 15 | | | — | | | 15 | |

| Locations acquired | 11 | | | 128 | | | — | | | 139 | |

| Locations sold, combined or closed | — | | | (11) | | | — | | | (11) | |

As of September 30, 2021 | 516 | | | 632 | | | — | | | 1,148 | |

| New locations opened | — | | | 28 | | | — | | | 28 | |

| Locations acquired | 3 | | | — | | | — | | | 3 | |

| Locations sold, combined or closed | (4) | | | — | | | — | | | (4) | |

As of September 30, 2022 | 515 | | | 660 | | | — | | | 1,175 | |

| New locations opened | 3 | | | 44 | | | — | | | 47 | |

| Locations acquired | 12 | | | — | | | — | | | 12 | |

| Locations sold, combined or closed | (1) | | | (2) | | | — | | | (3) | |

As of September 30, 2023 | 529 | | | 702 | | | — | | | 1,231 | |

For additional information about our segments and geographic areas, see Note 14: Segment Information of Notes to Consolidated Financial Statements included in “Part II, Item 8 — Financial Statements and Supplemental Data.”

Pawn Activities

At our pawn stores, we advance cash against the value of collateralized tangible personal property. We earn pawn service charges (“PSC”) for those cash advances, and the PSC rate varies by state and transaction size. At the time of the transaction, we take possession of the pawned collateral, which consists of tangible personal property, generally jewelry, consumer electronics, tools, sporting goods and musical instruments. If the customer chooses to redeem their pawn, they will repay the amount advanced plus any accrued PSC. If the customer chooses not to redeem their pawn, the pawned collateral becomes our inventory, which we sell in our retail merchandise sales activities or, in some cases, scrap for its inherent gold or precious stone content. Consequently, the success of our pawn business is largely dependent on our ability to accurately assess the probability of pawn redemption and the estimated resale or scrap value of the collateralized personal property.

As of September 30, 2023, we had a closing PLO balance of $245.8 million. In fiscal 2023, PSC accounted for approximately 37% of our total revenues and 63% of our gross profit.

In the U.S., PSC rates generally vary between 13% and 25% per month as permitted by applicable law, and the pawn term generally ranges between 30 and 90 days. Individual pawn transactions typically average between $160 and $180.

In Mexico, PSC rates generally vary between 15% and 21% per month as permitted by applicable law, and the pawn primary term is 30 days. Individual pawn transactions typically average between 1,100 and 1,500 Mexican pesos, or approximately $60 to $80 on average using the average exchange rate for fiscal 2023.

In GPMX, PSC rates generally vary between 12% and 18% per month as permitted by applicable law, and the pawn primary term is 30 days. Individual pawn transactions are made in the local currency of the country and typically average between $110 and $130 using the average exchange rates for fiscal 2023. The average transaction amounts tend to be higher in the GPMX countries than in Mexico due to the higher concentration of jewelry used as pawn collateral.

If a customer chooses not to redeem, renew or extend their pawn, the pawn collateral is forfeited and becomes inventory available for sale. We do not record losses or charge-offs when the pawned collateral is forfeited because the amount advanced for the unpaid pawn becomes the inventory carrying cost of the forfeited collateral. The difference between the subsequent sale of the forfeited collateral and the amount of the pawn (offset by any inventory reserve) is reflected in merchandise sales gross margin.

Our ability to offer quality pre-owned goods at prices significantly lower than original retail prices attracts value-conscious customers. The gross profit on sales of inventory depends primarily on our assessment of the estimated resale or scrap value at the time the property is either accepted as pawn collateral or purchased and our ability to sell that merchandise in a timely manner. As a significant portion of our inventory and sales involve gold and jewelry, our results can be influenced by the market price of gold and diamonds.

Customers in the U.S. and the majority of our Latin America stores may purchase a product protection plan that allows them to exchange certain general merchandise (non-jewelry) sold through our retail pawn operations within six months of purchase. In the U.S., we also offer a jewelry VIP package, which guarantees customers a minimum future pawn advance amount on the item sold, allows them full credit if they trade in the item to purchase a more expensive piece of jewelry and provides minor repair service on the item sold. Customers may also purchase an item on layaway by paying a minimum layaway deposit of typically 10% of the item’s sale price, in addition to an upfront fee. We hold items on layaway for a 90-to-180-day period, during which the customer is required to pay the balance of the sales price through a series of installment payments. If a payment is missed, we hold the item for up to 30 days, after which it is returned to active inventory for sale.

Operations and Risk Management

Our pawn operations are designed to provide the optimum level of support to the store teams, providing coaching, mentoring and problem solving to identify opportunities to better serve our customers and position us to be the leader in customer service and satisfaction.

Our risk management structure consists of asset protection, compliance and internal audit departments, which monitor the inventory system, lending practices, regulatory compliance and compliance with our policies and procedures. We perform full physical audits of inventory at each store at least annually, and more often in higher risk stores or those experiencing higher shrinkage. Inventory counts are completed daily for jewelry and firearms, and other inventory categories more susceptible to theft are cycle counted multiple times annually. We record shrink adjustments for known losses at the conclusion of each inventory count. These adjustments are recorded as estimates during interim periods and as discovered during cycle counts.

Human Capital Management

Engagement Survey

We performed a Global Employee Engagement Survey, administered by Glint, in April 2023, and had a 91% participation rate with an overall engagement score of 84. Our engagement score is nine points higher than the global benchmark, which contains data from over 900 companies of varying size across a variety of industries (Finance, Healthcare, Manufacturing, Professional Services, Retail, Technology and Utilities) and includes results from over eight million respondents located in over 150 countries.

Our top strengths were Career, Customer Focus and Continuous Improvement. Our focus areas for improvement included Team, Valued Teammate and Work-Life Balance. Team Members provided over 11,500 comments with mixed sentiment, 29% positive, 38% neutral and 33% negative. To ensure we address issues raised in the survey, all people leaders at the District Manager and above level will have Engagement Objectives for fiscal 2024 guided by actions that will yield the greatest business and Team Member impact.

Talent Management and Development

We employ more than 7,500 Team Members across all our geographies, including over 3,400 in United States, approximately 3,300 in Mexico and 800 in Central America. We seek to hire and promote Team Members to lead the way today and to step into greater roles in the future. We achieve this goal through Training and Development programs that Team Members can use to plan their careers and identify future growth opportunities. We engage Team Members at all levels so we can understand their professional and personal goals, identify high potential future leaders to strengthen our internal bench, support them in their journey and retain our talent.

In our pawn stores we provide:

•An onboarding program that blends online and hands-on training in the art and science of pawnbroking;

•Career path programs aligned with our talent and succession strategy, emphasizing career progression and individual development programs; and

•A learning experience that unlocks and accelerates Team Member potential as well as business growth.

Our investment in store-level Team Members produced tangible results during fiscal 2023:

•High scoring questions in our 2023 Global Employee Engagement Survey included “I know the career path(s) available to me at EZCORP” (with an 89% favorability rating) and “I have good opportunities to learn and develop at EZCORP” (with an 86% favorability rating).

•Over 70% of managerial positions were filled via internal promotion.

In our Corporate Support Center, we reinforced the utilization of our career and competency framework to build individual development plans to guide the career paths of corporate Team Members and to prepare them for future roles.

Culture and Ethics

Culture is critical to our long-term success and to our ability to attract, develop and retain the top talent needed to accomplish our Purpose, Vision and Strategy.

Our values — People, Pawn, Passion — define our priorities as a business, and our Guiding Principles — Leadership, Customer Service, Accountability, Respect, Diversity and Sustainability — characterize the expectations for how we interact with Team Members, customers and communities. Various tools are used globally to demonstrate commitment to our principles, values and positive culture, including a plain-language Code of Conduct and supporting policies, annual training on expectations and clear communications from executive management reinforcing ethical behavior and a positive culture.

To support our ethical business practices, we maintain an Ethics Hotline available to all Team Members and external stakeholders to report (anonymously if desired) any matter of concern. Communications to the hotline (which is managed by an independent third party) are routed to appropriate functions (whether Human Resources, Legal or Compliance), and in some cases directly to the Board of Directors, for investigation and resolution. In addition, any shareholder or other interested party may send communications to the Board of Directors, either individually or as a group, through a process that is outlined in the Investor Relations section of our website.

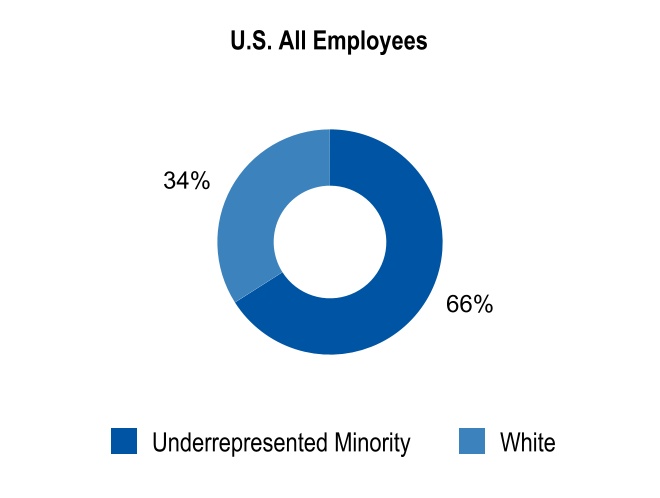

Diversity and Inclusion

At EZCORP, we foster an environment that values diversity, inclusion and development for all. In our 2023 Global Employee Engagement Survey, 83% of participants responded positively to the question, “I feel a sense of belonging at EZCORP.” In fiscal 2023, we continued to further our Diversity and Inclusion strategy by focusing on the following initiatives:

•Commitment and Accountability — Demonstrate commitment and accountability through corporate policy, communications and actions.

•Workplace Inclusion — Foster work environments that value diversity and inclusion and encourage collaboration, flexibility and fairness.

•Diverse Workforce — Recruit and promote from diverse, qualified candidate pools to increase diversity of perspectives and experiences.

Sponsor affinity groups to foster an inclusive and supportive environment, where Team Members with shared characteristics, experiences or interests can connect, collaborate and contribute effectively. The Women’s Empowerment, Black Empowerment and Hispanic Organization for Leadership Advocacy (HOLA) affinity groups in the U.S. and the Women’s Empowerment and Working Parents affinity groups in Latin America all aim to enhance diversity, equity and inclusion efforts by providing a platform for open dialogue, resource-sharing, professional development and cultural enrichment.

•Sustainability — Identify and eliminate systemic barriers by embedding diversity and inclusion in all human capital life cycle policies and practices.

Fiscal 2023 U.S. Race and Ethnicity Demographics (1) (2)

Fiscal 2023 Global Gender Demographics (2)

(1) The term underrepresented minority is used to describe diverse populations, including African American, Hispanic, Asian and Native American Team Members who self-identified their race and ethnicity at hire.

(2) The term Management is used to describe Team Members with one or more direct reports.

Total Rewards

Our compensation programs are designed to align the compensation of Team Members with individual and Company performance and to provide the proper incentives to attract, retain and motivate Team Members to achieve results.

The structure of our compensation programs balances incentive earnings for both short-term and long-term performance. Specifically:

•We provide wages and incentive plans that are competitive and consistent with positions, skill levels, experience, knowledge and geographic location. Additionally, on an annual basis (U.S.) gender and racial/ethnic analysis is performed to ensure pay equity.

•We engage a nationally recognized outside compensation and benefits consulting firm to independently evaluate the effectiveness of our executive compensation and to provide benchmarking against our selected peer group, which includes direct competitors in the pawn industry and similarly-sized companies from relevant industries that serve similar customer bases, operate in the retail or consumer finance industries and typically have similar operating dynamics.

•We align our executives’ long-term equity compensation with our shareholders’ interests by linking realizable pay with stock performance.

•All employees are eligible for paid time off, retirement savings plan and Company-paid life insurance.

Health and Safety

Our commitment to our Team Members is to provide a safe and injury-free workplace. We continue to invest in programs designed to improve physical, mental and social well-being.

Management and Oversight

The People and Compensation Committee of the Board of Directors has primary responsibility for analyzing, advising and (as appropriate) approving executive compensation. The committee is also responsible for organizational development matters and otherwise assisting the Board of Directors in its overall responsibility to enable EZCORP to attract, retain, develop and motivate qualified executives who will contribute to the long-term success of the Company.

The committee actively participates in the executive recruitment and selection process. Committee members are instrumental in the executive talent management and succession processes, including the review and attainment of annual objectives for our executive officers. All Executive Officers have a minimum of one objective related to People, generally broken into the areas of Employee Engagement Scores, Voluntary Attrition and Inclusion.

Environmental, Social and Governance (ESG)

EZCORP is committed to meeting our customers’ needs in a responsible manner, and in that regard, we have aligned purpose, vision, values, guiding principles and business strategy with environmental, social and governance sustainability factors.

Our pawnbroking and related retail sales activities inherently contribute to the “circular economy” and promote environmental sustainability. We provide unique options for our customers to satisfy their needs for cash — options that are not offered by traditional lenders such as banks and credit unions, credit card providers, or installment and short-term lenders. For many of our customers, pawn transactions provide an essential and financially responsible lifeline for meeting their unexpected expenses. Our retail activities rely primarily on local sourcing of pre-owned merchandise and the recirculation of those items back into the neighborhoods we serve. In short, our business is unique, essential and sustainable.

Environmental Sustainability

Our business contributes to overall environmental sustainability in the following ways:

•Our business is fundamentally a neighborhood business, where each store principally serves the surrounding neighborhood. This “local” focus reduces the need of our customers to travel long distances to access our products and services and eliminates the need for delivery services.

•Each of our stores serves as its own “supply chain.” We take in pre-owned merchandise, either through pawn or purchases from customers, and then sell that merchandise (after forfeiture, in the case of pawn transactions) generally in the same store. Thus, we do not maintain or rely on mass supply, distribution or warehousing facilities.

•Virtually all of the merchandise we sell is pre-owned, which contributes to pre-owned goods recycling and the circular economy. In fiscal 2023, we sold approximately 5.4 million pre-owned items, including over 3.2 million items in the consumer electronics, camera and household goods categories, 1.1 million other general merchandise items (such as tools and musical instruments) and 0.8 million jewelry items. In addition, through our jewelry scrapping activities, we recycle significant volumes of gold and diamonds. All of these activities effectively extend the useful life of many products, reducing waste and lessening the demand for new manufacturing and mining.

•Our store operations themselves leave a relatively small carbon footprint when compared to big-box or other mass retailers that rely on manufacturers and extensive supply chain and distribution channels. Our stores are relatively small (generally 3,300 square feet or less). To reduce energy consumption, we have installed energy-efficient LED lighting in 78% of our U.S. stores and 60% of Latin America stores.

•In all of our facilities, including our corporate support offices, we promote environmental stewardship by reducing consumption, recycling paper products (approximately 1.24 million pounds across all U.S. locations during fiscal 2023) and responsibly disposing of end-of-life computers, electronics and related accessories through recycling or other sound e-waste processing. Our corporate office in Austin, Texas is LEED Certified Silver status.

Social Responsibility

Our business promotes social responsibility in the following ways:

•Our business serves as an essential and responsible financial resource for many unbanked and or underserved consumers who have limited access to traditional forms of capital or credit and comprise a large majority of our customer base. We improve the reach and access to financial services through neighborhood-based stores, supported by digital offerings. We provide instant access to cash in transactions that generally average around $180 or less. Our pawn transactions are simple, transparent, regulated and safe, and funding approval is based on the valuation of the collateral item, not on the credit worthiness of the customer. The customer is under no legal obligation to repay the amount advanced; we do not engage in collection efforts or take other legal actions against our customers; and we do not report transaction histories to external credit agencies. Rather, the customer may choose to repay the amount advanced or forfeit the collateralized merchandise.

•Customer satisfaction measurement and feedback are key factors in improving our customer service and Team Member engagement. To capture direct customer feedback, we have enabled Google Reviews across all stores and have received over 195,000 Google reviews with an average satisfaction rating of 4.8 out of 5 across U.S and Latin America.

•We offer customers multiple payment options, including cross-store, over-the-phone and web-based and mobile platforms, reducing their need to travel to the stores to make payments. Online payments are accepted on layaway, pawn extension and bulk payments, with electronic payment receipts delivered on these transactions.

•We have refreshed the mission of EZCORP Foundation, our philanthropic arm that is focused on making a difference in communities where we live and operate by supporting charitable organizations that align with our operating values of People, Pawn and Passion. Current initiatives include supporting financial literacy efforts, working to eradicate food insecurity, empowering young people to succeed and other poverty intervention activities.

•For a discussion of our Diversity and Inclusion initiatives, see “Human Capital Management — Diversity and Inclusion” above.

Governance

At EZCORP, we believe that “The Way We Do Business is as Important as the Business We Do.” That belief underlies our Code of Conduct, which outlines our expectations and provides guidance on how our Team Members can carry out their daily activities ethically and responsibly. Our ethical principles include Honesty, Integrity, Reliability, Loyalty, Respect, Responsibility, Fairness, Caring, Leadership and Diversity, and these principles form the foundation for how we govern our business.

•Even though we are a “Controlled Company” under the Nasdaq Listing Rules, we maintain the governance standards required of all publicly-listed Nasdaq companies, including:

•Independent directors comprise a majority of our Board of Directors. Four of the seven members of our Board of Directors meet all of the “independence” requirements set forth in the Nasdaq Listing Rules, and none of the independent directors have any past or existing relationship with our controlling stockholder outside of their Board service.

•All of our standing Board committees (Audit Committee, People and Compensation Committee and Nominating Committee) are comprised of solely independent directors.

•We satisfy Nasdaq’s board diversity rules, with two of our seven Board members being diverse directors, one of whom self-identifies as female and an underrepresented minority and one whom self-identifies as an underrepresented minority.

For further discussion of our corporate governance standards, see “Part III, Item 10 — Directors, Executive Officers and Corporate Governance.”

•Our pawn operations are licensed and supervised in all jurisdictions in which we operate. We maintain a strong compliance culture that is monitored and overseen by our Board of Directors and supported by seasoned regulatory and compliance teams.

•Protecting the privacy, integrity and security of our customers’ data and our enterprise network is a top priority that is also monitored and overseen by our Board of Directors. We maintain a separate IT Security team that is responsible for the design and implementation of our cyber risk strategy, including deployment of systems, enterprise-wide training, monitoring and reporting of threat incidents and response preparedness.

Growth and Expansion