UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-Q

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the quarterly period ended December 31, 2019 or

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the transition period from to

Commission File No. 0-19424

(Exact name of registrant as specified in its charter)

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | ||||

(Address of principal executive offices) | (Zip Code) | ||||

Registrant’s telephone number, including area code: (512 ) 314-3400

Securities registered pursuant to Section 12(b) of the Act

Title of each class | Trading Symbol(s) | Name of each exchange on which registered | |||

(NASDAQ Global Select Market) | |||||

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer | ☐ | ☒ | |

Non-accelerated Filer | ☐ | Smaller Reporting Company | |

Emerging Growth Company | |||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

APPLICABLE ONLY TO CORPORATE ISSUERS:

The only class of voting securities of the registrant issued and outstanding is the Class B Voting Common Stock, par value $.01 per share, all of which is owned by an affiliate of the registrant. There is no trading market for the Class B Voting Common Stock.

As of January 29, 2020, 52,651,188 shares of the registrant’s Class A Non-voting Common Stock ("Class A Common Stock"), par value $.01 per share, and 2,970,171 shares of the registrant’s Class B Voting Common Stock, par value $.01 per share, were outstanding.

EZCORP, Inc.

INDEX TO FORM 10-Q

PART I — FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

EZCORP, Inc. CONDENSED CONSOLIDATED BALANCE SHEETS (in thousands, except share and per share amounts) | |||||||||||

December 31, 2019 | December 31, 2018 | September 30, 2019 | |||||||||

(Unaudited) | |||||||||||

Assets: | |||||||||||

Current assets: | |||||||||||

Cash and cash equivalents | $ | $ | $ | ||||||||

Pawn loans | |||||||||||

Pawn service charges receivable, net | |||||||||||

Inventory, net | |||||||||||

Notes receivable, net | |||||||||||

Prepaid expenses and other current assets | |||||||||||

Total current assets | |||||||||||

Investments in unconsolidated affiliates | |||||||||||

Property and equipment, net | |||||||||||

Lease right-of-use asset | — | — | |||||||||

Goodwill | |||||||||||

Intangible assets, net | |||||||||||

Notes receivable, net | |||||||||||

Deferred tax asset, net | |||||||||||

Other assets | |||||||||||

Total assets | $ | $ | $ | ||||||||

Liabilities and equity: | |||||||||||

Current liabilities: | |||||||||||

Current maturities of long-term debt, net | $ | $ | $ | ||||||||

Accounts payable, accrued expenses and other current liabilities | |||||||||||

Customer layaway deposits | |||||||||||

Lease liability | — | — | |||||||||

Total current liabilities | |||||||||||

Long-term debt, net | |||||||||||

Deferred tax liability, net | |||||||||||

Lease liability | — | — | |||||||||

Other long-term liabilities | |||||||||||

Total liabilities | |||||||||||

Commitments and contingencies (Note 9) | |||||||||||

Stockholders’ equity: | |||||||||||

Class A Non-voting Common Stock, par value $.01 per share; shares authorized: 100 million; issued and outstanding: 52,886,122 as of December 31, 2019; 52,475,070 as of December 31, 2018; and 52,565,064 as of September 30, 2019 | |||||||||||

Class B Voting Common Stock, convertible, par value $.01 per share; shares authorized: 3 million; issued and outstanding: 2,970,171 | |||||||||||

Additional paid-in capital | |||||||||||

Retained earnings | |||||||||||

Accumulated other comprehensive loss | ( | ) | ( | ) | ( | ) | |||||

EZCORP, Inc. stockholders’ equity | |||||||||||

Noncontrolling interest | ( | ) | |||||||||

Total equity | |||||||||||

Total liabilities and equity | $ | $ | $ | ||||||||

See accompanying notes to unaudited interim condensed consolidated financial statements.

1

EZCORP, Inc. CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS | |||||||

Three Months Ended December 31, | |||||||

2019 | 2018 | ||||||

(Unaudited) | |||||||

(in thousands, except per share amounts) | |||||||

Revenues: | |||||||

Merchandise sales | $ | $ | |||||

Jewelry scrapping sales | |||||||

Pawn service charges | |||||||

Other revenues | |||||||

Total revenues | |||||||

Merchandise cost of goods sold | |||||||

Jewelry scrapping cost of goods sold | |||||||

Other cost of revenues | |||||||

Net revenues | |||||||

Operating expenses: | |||||||

Operations | |||||||

Administrative | |||||||

Depreciation and amortization | |||||||

Loss on sale or disposal of assets and other | |||||||

Total operating expenses | |||||||

Operating income | |||||||

Interest expense | |||||||

Interest income | ( | ) | ( | ) | |||

Equity in net loss of unconsolidated affiliates | |||||||

Impairment of investment in unconsolidated affiliates | |||||||

Other expense (income) | ( | ) | |||||

Income (loss) from continuing operations before income taxes | ( | ) | |||||

Income tax expense (benefit) | ( | ) | |||||

Income (loss) from continuing operations, net of tax | ( | ) | |||||

Loss from discontinued operations, net of tax | ( | ) | ( | ) | |||

Net income (loss) | ( | ) | |||||

Net loss attributable to noncontrolling interest | ( | ) | |||||

Net income (loss) attributable to EZCORP, Inc. | $ | $ | ( | ) | |||

Basic earnings (loss) per share attributable to EZCORP, Inc. — continuing operations | $ | $ | ( | ) | |||

Diluted earnings (loss) per share attributable to EZCORP, Inc. — continuing operations | $ | $ | ( | ) | |||

Weighted-average basic shares outstanding | |||||||

Weighted-average diluted shares outstanding | |||||||

See accompanying notes to unaudited interim condensed consolidated financial statements.

2

EZCORP, Inc. CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS) | |||||||

Three Months Ended December 31, | |||||||

2019 | 2018 | ||||||

(Unaudited) | |||||||

(in thousands) | |||||||

Net income (loss) | $ | $ | ( | ) | |||

Other comprehensive gain (loss): | |||||||

Foreign currency translation gain (loss), net of income tax expense for our investment in unconsolidated affiliate of $122 and $87 for the three months ended December 31, 2019 and 2018. | ( | ) | |||||

Comprehensive income (loss) | ( | ) | |||||

Comprehensive loss attributable to noncontrolling interest | ( | ) | |||||

Comprehensive income (loss) attributable to EZCORP, Inc. | $ | $ | ( | ) | |||

See accompanying notes to unaudited interim condensed consolidated financial statements.

EZCORP, Inc. CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY | ||||||||||||||||||||||||||

Common Stock | Additional Paid-in Capital | Retained Earnings | Accumulated Other Comprehensive Loss | Noncontrolling Interest | Total Equity | |||||||||||||||||||||

Shares | Par Value | |||||||||||||||||||||||||

(Unaudited, except balances as of September 30, 2018) | ||||||||||||||||||||||||||

(in thousands) | ||||||||||||||||||||||||||

Balances as of September 30, 2018 | $ | $ | $ | $ | ( | ) | $ | ( | ) | $ | ||||||||||||||||

Stock compensation | — | — | — | — | — | |||||||||||||||||||||

Release of restricted stock | — | — | — | — | ||||||||||||||||||||||

Taxes paid related to net share settlement of equity awards | — | — | ( | ) | — | — | — | ( | ) | |||||||||||||||||

Transfer of subsidiary shares to noncontrolling interest | — | — | — | — | ( | ) | — | |||||||||||||||||||

Foreign currency translation loss | — | — | — | — | ( | ) | — | ( | ) | |||||||||||||||||

Net loss | — | — | — | ( | ) | — | ( | ) | ( | ) | ||||||||||||||||

Balances as of December 31, 2018 | $ | $ | $ | $ | ( | ) | $ | ( | ) | $ | ||||||||||||||||

Common Stock | Additional Paid-in Capital | Retained Earnings | Accumulated Other Comprehensive Loss | Total Equity | ||||||||||||||||||

Shares | Par Value | |||||||||||||||||||||

(Unaudited, except balances as of September 30, 2019) | ||||||||||||||||||||||

(in thousands) | ||||||||||||||||||||||

Balances as of September 30, 2019 | $ | $ | $ | $ | ( | ) | $ | |||||||||||||||

Stock compensation | — | — | — | — | ||||||||||||||||||

Release of restricted stock | — | — | — | |||||||||||||||||||

Taxes paid related to net share settlement of equity awards | — | — | ( | ) | — | — | ( | ) | ||||||||||||||

Foreign currency translation gain | — | — | — | — | ||||||||||||||||||

Purchase and retirement of treasury stock | ( | ) | ( | ) | ( | ) | ( | ) | — | ( | ) | |||||||||||

Net income | — | — | — | — | ||||||||||||||||||

Balances as of December 31, 2019 | $ | $ | $ | $ | ( | ) | $ | |||||||||||||||

See accompanying notes to unaudited interim condensed consolidated financial statements.

3

EZCORP, Inc. CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS | |||||||

Three Months Ended December 31, | |||||||

2019 | 2018 | ||||||

(Unaudited) | |||||||

(in thousands) | |||||||

Operating activities: | |||||||

Net income (loss) | $ | $ | ( | ) | |||

Adjustments to reconcile net income (loss) to net cash flows from operating activities: | |||||||

Depreciation and amortization | |||||||

Amortization of debt discount and deferred financing costs | |||||||

Amortization of lease right-of-use asset | — | ||||||

Accretion of notes receivable discount and deferred compensation fee | ( | ) | ( | ) | |||

Deferred income taxes | |||||||

Impairment of investment in unconsolidated affiliate | |||||||

Other adjustments | |||||||

Stock compensation expense | |||||||

Loss from investments in unconsolidated affiliates | |||||||

Changes in operating assets and liabilities, net of business acquisitions: | |||||||

Service charges and fees receivable | ( | ) | ( | ) | |||

Inventory | ( | ) | |||||

Prepaid expenses, other current assets and other assets | ( | ) | ( | ) | |||

Accounts payable, accrued expenses and other liabilities | ( | ) | ( | ) | |||

Customer layaway deposits | ( | ) | |||||

Income taxes | ( | ) | ( | ) | |||

Net cash (used in) provided by operating activities | ( | ) | |||||

Investing activities: | |||||||

Loans made | ( | ) | ( | ) | |||

Loans repaid | |||||||

Recovery of pawn loan principal through sale of forfeited collateral | |||||||

Additions to property and equipment, net | ( | ) | ( | ) | |||

Acquisitions, net of cash acquired | ( | ) | |||||

Principal collections on notes receivable | |||||||

Net cash used in investing activities | ( | ) | ( | ) | |||

Financing activities: | |||||||

Taxes paid related to net share settlement of equity awards | ( | ) | ( | ) | |||

Payout of deferred consideration | ( | ) | |||||

Proceeds from borrowings, net of issuance costs | ( | ) | |||||

Payments on borrowings | ( | ) | ( | ) | |||

Repurchase of common stock | ( | ) | |||||

Net cash used in financing activities | ( | ) | ( | ) | |||

Effect of exchange rate changes on cash and cash equivalents and restricted cash | ( | ) | |||||

Net (decrease) increase in cash, cash equivalents and restricted cash | ( | ) | |||||

Cash, cash equivalents and restricted cash at beginning of period | |||||||

Cash, cash equivalents and restricted cash at end of period | $ | $ | |||||

Non-cash investing and financing activities: | |||||||

Pawn loans forfeited and transferred to inventory | $ | $ | |||||

See accompanying notes to unaudited interim condensed consolidated financial statements.

4

EZCORP, Inc.

Notes to Interim Condensed Consolidated Financial Statements (Unaudited)

December 31, 2019

NOTE 1: ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Description of Business

When used in this report, the terms “we,” “us,” “our,” “EZCORP” and the “Company” mean EZCORP, Inc. and its consolidated subsidiaries, collectively.

We are a leading provider of pawn loans in the United States and Latin America. Pawn loans are non-recourse loans collateralized by tangible property. We also sell merchandise, primarily collateral forfeited from pawn lending operations and used merchandise purchased from customers, and operate a small number of financial services stores in Canada.

Basis of Presentation

The accompanying unaudited interim condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States (“GAAP”) for interim financial information and with the instructions to Form 10-Q and Article 10 of Regulation S-X. Accordingly, they do not include all the information and footnotes required by generally accepted accounting principles for complete financial statements. Our management has included all adjustments it considers necessary for a fair presentation which are of a normal, recurring nature. All intercompany accounts and transactions have been eliminated in consolidation.

The accompanying financial statements should be read in conjunction with the consolidated financial statements and notes included in our Annual Report on Form 10-K for the year ended September 30, 2019. The balance sheet as of September 30, 2019 has been derived from the audited financial statements at that date but does not include all of the information and footnotes required by GAAP for complete financial statements.

Our business is subject to seasonal variations, and operating results for the three months ended December 31, 2019 and 2018 (the "current quarter" and "prior-year quarter," respectively) are not necessarily indicative of the results of operations for the full fiscal year.

There have been no changes in significant accounting policies as described in our Annual Report on Form 10-K for the year ended September 30, 2019, other than those described below and in Note 10.

Use of Estimates and Assumptions

The preparation of these financial statements requires us to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenues and expenses and related disclosure of contingent assets and liabilities. On an ongoing basis, we evaluate our estimates and judgments, including those related to revenue recognition, inventories, loan loss allowances, long-lived and intangible assets, share-based compensation, income taxes, contingencies and litigation. We base our estimates on historical experience, observable trends and various other assumptions that we believe are reasonable under the circumstances. We use this information to make judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ materially from these estimates under different assumptions or conditions.

Recently Adopted Accounting Policies

In February 2016, the FASB issued ASU 2016-02, Leases (Topic 842). This Accounting Standards Update ("ASU") requires companies to generally recognize on the balance sheet operating and financing lease liabilities and corresponding right-of-use assets. The provisions of this ASU are effective as of the beginning of our fiscal 2020 on October 1, 2019. We adopted this ASU using the optional prospective transition method provided under ASU 2018-11, Leases, (Topic 842): Targeted Improvement as of October 1, 2019. We additionally elected the package of practical expedients under Accounting Standards Codification (“ASC”) 842-10-65-1(f) as well as the practical expedient not to separate lease and non-lease components for all real estate leases under ASC 842-10-15-37. Further, we have elected an accounting policy not to record right-of-use assets and lease liabilities for all leases which have a duration of less than 12-months. See Note 4 for additional discussion.

Recently Issued Accounting Pronouncements

• | In June 2016, the FASB issued ASU 2016-13, Financial Instruments — Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments. This ASU, along with subsequently issued related ASUs, requires financial assets (or groups of financial assets) measured at amortized cost basis to be presented at the net amount expected to be |

5

collected, among other provisions. Early adoption is permitted for fiscal years beginning after December 15, 2018, including interim periods within those fiscal years. A reporting entity should generally apply the amendment on a modified retrospective basis through a cumulative-effect adjustment to retained earnings as of the beginning of the first reporting period in which the amendment is effective. We have not identified any impacts to our financial statements that we believe will be material as a result of the adoption of the ASU, although we continue to evaluate the impact of adoption. We believe we are following an appropriate timeline to allow for proper recognition, presentation and disclosure upon adoption of this ASU which is effective for the first quarter of our fiscal 2021.

Please refer to Note 1 of Notes to Consolidated Financial Statements included in "Part II, Item 8 — Financial Statements and Supplementary Data" of our Annual Report on Form 10-K for the year ended September 30, 2019 for discussion of our significant accounting policies and other accounting pronouncements issued but not yet adopted.

NOTE 2: ACQUISITIONS

In June 2019, we acquired assets related to seven pawn stores operating under the name "Metro Pawn" in Nevada, entering the Reno market and expanding our presence in the Las Vegas metropolitan area, for an aggregate purchase price of $7.0 million in cash, of which $3.9 million was recorded as goodwill. In December 2018, we acquired assets related to five pawn stores in Mexico for an aggregate purchase price of $0.3 million in cash, of which $0.1 million was recorded as goodwill. We expect substantially all goodwill attributable to the fiscal 2019 acquisitions to be deductible for tax purposes. We have concluded that these acquisitions were immaterial to our overall consolidated financial results and, therefore, have omitted information that would otherwise be required.

NOTE 3: EARNINGS PER SHARE

Components of basic and diluted earnings per share and excluded antidilutive potential common shares are as follows:

Three Months Ended December 31, | |||||||

2019 | 2018 | ||||||

(in thousands, except per share amounts) | |||||||

Net income (loss) from continuing operations attributable to EZCORP (A) | $ | $ | ( | ) | |||

Loss from discontinued operations, net of tax (B) | ( | ) | ( | ) | |||

Net income (loss) attributable to EZCORP (C) | $ | $ | ( | ) | |||

Weighted-average outstanding shares of common stock (D) | |||||||

Dilutive effect of restricted stock* | |||||||

Weighted-average common stock and common stock equivalents (E) | |||||||

Basic earnings (loss) per share attributable to EZCORP: | |||||||

Continuing operations (A / D) | $ | $ | ( | ) | |||

Discontinued operations (B / D) | |||||||

Basic earnings (loss) per share (C / D) | $ | $ | ( | ) | |||

Diluted earnings (loss) per share attributable to EZCORP: | |||||||

Continuing operations (A / E) | $ | $ | ( | ) | |||

Discontinued operations (B / E) | |||||||

Diluted earnings (loss) per share (C / E) | $ | $ | ( | ) | |||

Potential common shares excluded from the calculation of diluted earnings per share above*: | |||||||

Restricted stock** | |||||||

* | See Note 7 for discussion of the terms and conditions of the potential impact of the 2019 Convertible Notes Warrants, 2024 Convertible Notes and 2025 Convertible Notes. As required by ASC 260-10-45-19, amount excludes all potential common shares for periods when there is a loss from continuing operations. |

** | Includes antidilutive share-based awards as well as performance-based and market conditioned share-based awards that are contingently issuable, but for which the condition for issuance has not been met as of the end of the reporting period. |

6

NOTE 4: LEASES

As described in Note 1, we adopted ASU 2016-02, Leases (Topic 842) as of October 1, 2019. We lease our pawn locations and corporate offices under operating leases and determine if an arrangement is or contains a lease at inception. After an initial lease term of generally three to ten years, our real property lease agreements typically allow renewals in three to five-year increments. We generally account for the initial lease term of our pawn locations as up to ten years , including renewal options. Our corporate office is leased through March 2029 with annually escalating rent and includes two five-year extension options at the end of the initial lease term. Our pawn location lease agreements generally include rent escalations throughout the initial lease term, with certain future rental payments contingent on increases in a consumer price index, included in variable lease expense. Many leases include both lease and non-lease components, which we have elected not to account for separately. Lease components generally include rent, taxes and insurance, while non-lease components generally include common area or other maintenance.

The weighted-average remaining lease term for operating leases as of December 31, 2019 was 6.02 years. As our leases generally do not include an implicit rate, we compute our incremental borrowing rate based on information available at the lease commencement date applying the portfolio approach to groups of leases with similar characteristics. We used incremental borrowing rates that match the duration of the remaining lease terms of our operating leases on a fully collateralized basis upon adoption as of October 1, 2019 to initially measure our lease liability. The weighted average incremental borrowing rate used to measure our lease liability as of December 31, 2019 was 8.44 %.

The details of our right-of-use asset and lease liability recognized upon adoption of ASC 842 computed based on the consumer price index and foreign currency exchange rate as applicable then in effect and excluding executory costs on October 1, 2019 are as follows (in thousands):

Right-of-use asset | $ | ||

Straight-line rent accrual | ( | ) | |

$ | |||

Lease liability, current | $ | ||

Lease liability, non-current | |||

$ | |||

Lease expense is recognized on a straight-line basis over the lease term with variable lease expense recognized in the period in which the costs are incurred. The components of lease expense included in "Operations" and "Administrative" expense, based on the underlying lease use, in our condensed consolidated statements of operations for the three months ended December 31, 2019 are as follows (in thousands):

Operating lease expense | $ | ||

Variable lease expense | |||

$ | |||

Maturity of our lease liabilities as of December 31, 2019 is as follows (in thousands):

Nine months ending September 30, 2020 | $ | ||

Fiscal 2021 | |||

Fiscal 2022 | |||

Fiscal 2023 | |||

Fiscal 2024 | |||

Thereafter | |||

$ | |||

Less: Portion representing interest | ( | ) | |

$ | |||

7

Prior to our adoption of ASC 842, future minimum undiscounted rentals due under non-cancelable leases as of September 30, 2019 for each subsequent fiscal year were as follows (in thousands):

2020 | $ | ||

2021 | |||

2022 | |||

2023 | |||

2024 | |||

Thereafter | |||

$ | |||

We present the changes in our lease right-of-use asset and lease liabilities gross in our condensed consolidated statements of cash flows. The supplemental cash flow information relating to our operating leases for the three months ended December 31, 2019 is as follows (in thousands):

Lease right-of-use assets obtained in exchange for operating lease liabilities subsequent to adoption of ASC 842 | $ | ||

NOTE 5: STRATEGIC INVESTMENTS

As of December 31, 2019, we owned 214,183,714 shares, or approximately 34.75 %, of Cash Converters International Limited ("Cash Converters International"). The following tables present summary financial information for Cash Converters International’s most recently reported results after translation to U.S. dollars:

June 30, | |||||||

2019 | 2018 | ||||||

(in thousands) | |||||||

Current assets | $ | $ | |||||

Non-current assets | |||||||

Total assets | $ | $ | |||||

Current liabilities | $ | $ | |||||

Non-current liabilities | |||||||

Shareholders’ equity | |||||||

Total liabilities and shareholders’ equity | $ | $ | |||||

Fiscal Year Ended June 30, | |||||||

2019 | 2018 | ||||||

(in thousands) | |||||||

Gross revenues | $ | $ | |||||

Gross profit | |||||||

Net (loss) profit | ( | ) | |||||

On October 21, 2019, Cash Converters International agreed to settle a class action lawsuit previously filed on behalf of borrowers residing in Queensland, Australia who took out personal loans from Cash Converters International between July 30, 2009 and June 30, 2013. Cash Converters International agreed to pay AUD $42.5 million, subject to court approval. We recorded a charge, net of tax, of $7.1 million for our proportionate share of the settlement in the current quarter related to this event, in addition to our regularly included share of earnings from Cash Converters International. Cash Converters International has indicated that it expects to pay the settlement amount with cash on hand and cash flow from operations.

NOTE 6: FAIR VALUE MEASUREMENTS

Our assets and liabilities discussed below are classified in one of the following three categories based on the inputs used to develop their fair values: Level 1 — Quoted market prices in active markets for identical assets or liabilities; Level 2 — Other observable market-based inputs or unobservable inputs that are corroborated by market data; and Level 3 — Unobservable

inputs that are not corroborated by market data. We have elected not to measure at fair value any eligible items for which fair value measurement is optional. There were no transfers in or out of Level 1, Level 2 or Level 3 for financial assets or liabilities measured at fair value on a recurring basis during the periods presented.

The tables below present our financial assets and liabilities that were not measured at fair value on a recurring basis:

Carrying Value | Estimated Fair Value | |||||||||||||||||||

December 31, 2019 | December 31, 2019 | Fair Value Measurement Using | ||||||||||||||||||

Level 1 | Level 2 | Level 3 | ||||||||||||||||||

(in thousands) | ||||||||||||||||||||

Financial assets: | ||||||||||||||||||||

Notes receivable from Grupo Finmart, net | $ | $ | $ | $ | $ | |||||||||||||||

2.89% promissory note receivable due April 2024 | ||||||||||||||||||||

Investments in unconsolidated affiliates | ||||||||||||||||||||

Financial liabilities: | ||||||||||||||||||||

2024 Convertible Notes | $ | $ | $ | $ | $ | |||||||||||||||

2025 Convertible Notes | ||||||||||||||||||||

8.5% unsecured debt due 2024 | ||||||||||||||||||||

CASHMAX secured borrowing facility | ( | ) | ||||||||||||||||||

Carrying Value | Estimated Fair Value | |||||||||||||||||||

December 31, 2018 | December 31, 2018 | Fair Value Measurement Using | ||||||||||||||||||

Level 1 | Level 2 | Level 3 | ||||||||||||||||||

(in thousands) | ||||||||||||||||||||

Financial assets: | ||||||||||||||||||||

Notes receivable from Grupo Finmart, net | $ | $ | $ | $ | $ | |||||||||||||||

Investments in unconsolidated affiliates | ||||||||||||||||||||

Financial liabilities: | ||||||||||||||||||||

2019 Convertible Notes | $ | $ | $ | $ | $ | |||||||||||||||

2024 Convertible Notes | ||||||||||||||||||||

2025 Convertible Notes | ||||||||||||||||||||

8.5% unsecured debt due 2024 | ||||||||||||||||||||

CASHMAX secured borrowing facility | ||||||||||||||||||||

Carrying Value | Estimated Fair Value | |||||||||||||||||||

September 30, 2019 | September 30, 2019 | Fair Value Measurement Using | ||||||||||||||||||

Level 1 | Level 2 | Level 3 | ||||||||||||||||||

(in thousands) | ||||||||||||||||||||

Financial assets: | ||||||||||||||||||||

Notes receivable from Grupo Finmart, net | $ | $ | $ | $ | $ | |||||||||||||||

2.89% promissory note receivable due April 2024 | ||||||||||||||||||||

Investments in unconsolidated affiliates | ||||||||||||||||||||

Financial liabilities: | ||||||||||||||||||||

2024 Convertible Notes | $ | $ | $ | $ | $ | |||||||||||||||

2025 Convertible Notes | ||||||||||||||||||||

8.5% unsecured debt due 2024 | ||||||||||||||||||||

CASHMAX secured borrowing facility | ( | ) | ||||||||||||||||||

8

We estimate that the carrying value of our cash and cash equivalents, pawn loans, pawn service charges receivable, current consumer loans, fees and interest receivable and other debt approximate fair value. We consider our cash and cash equivalents to be measured using Level 1 inputs and our pawn loans, pawn service charges receivable, consumer loans, fees and interest receivable and other debt to be measured using Level 3 inputs. Significant increases or decreases in the underlying assumptions used to value pawn loans, pawn service charges receivable, consumer loans, fees and interest receivable and other debt could significantly increase or decrease these fair value estimates.

We measured the fair value of the remaining deferred compensation fee due in fiscal 2020 from the sale of Prestaciones Finmart, S.A.P.I. de C.V., SOFOM, E.N.R. ("Grupo Finmart") to Alpha Holding, S.A. de C.V. (“AlphaCredit”) in September 2016 as of December 31, 2019 under a discounted cash flow approach considering the estimated credit ratings for Grupo Finmart and AlphaCredit, with discount rates of primarily 7 %. Certain of the significant inputs used for the valuation were not observable in the market. Significant increases or decreases in the underlying assumptions used to value the notes receivable could significantly increase or decrease these fair value estimates. We remain obligated to indemnify AlphaCredit for any tax obligations arising from the Grupo Finmart business that are attributable to periods prior to the completion of the sale in September 2016, referred to as “pre-closing taxes.” Those obligations continue until the expiration of the statute of limitations applicable to the pre-closing periods. In August 2019, AlphaCredit notified us of a potential indemnity claim for certain pre-closing taxes, but the nature, extent and validity of such claim has yet to be determined. We review the financial statements of Grupo Finmart and AlphaCredit including the calculation of synthetic credit spreads as described above in making our determination that the Parent Loan Notes are collectible on an ongoing basis.

The equity method of accounting is followed for our 13 % ownership in a previously consolidated variable interest entity ("RDC") over which we no longer have the power to direct the activities that most significantly affect its economic performance. We believe that its fair value approximates carrying value although such fair value is highly variable and includes significant unobservable inputs.

We measured the fair value of the 2024 and 2025 Convertible Notes using quoted price inputs. The notes are not actively traded, and thus the price inputs represent a Level 2 measurement. As the quoted price inputs are highly variable from day to day, the fair value estimates disclosed above could significantly increase or decrease.

NOTE 7: DEBT

The following tables present our debt instruments outstanding, contractual maturities and interest expense:

December 31, 2019 | December 31, 2018 | September 30, 2019 | |||||||||||||||||||||||||||||||||

Gross Amount | Debt Discount and Issuance Costs | Carrying Amount | Gross Amount | Debt Discount and Issuance Costs | Carrying Amount | Gross Amount | Debt Discount and Issuance Costs | Carrying Amount | |||||||||||||||||||||||||||

(in thousands) | |||||||||||||||||||||||||||||||||||

2019 Convertible Notes | $ | $ | $ | $ | $ | ( | ) | $ | $ | $ | $ | ||||||||||||||||||||||||

2019 Convertible Notes Embedded Derivative | |||||||||||||||||||||||||||||||||||

2024 Convertible Notes | ( | ) | ( | ) | ( | ) | |||||||||||||||||||||||||||||

2025 Convertible Notes | ( | ) | ( | ) | ( | ) | |||||||||||||||||||||||||||||

8.5% unsecured debt due 2024* | |||||||||||||||||||||||||||||||||||

CASHMAX secured borrowing facility* | ( | ) | ( | ) | ( | ) | ( | ) | ( | ) | |||||||||||||||||||||||||

Total | $ | $ | ( | ) | $ | $ | $ | ( | ) | $ | $ | $ | ( | ) | $ | ||||||||||||||||||||

Less current portion | ( | ) | |||||||||||||||||||||||||||||||||

Total long-term debt | $ | $ | ( | ) | $ | $ | $ | ( | ) | $ | $ | $ | ( | ) | $ | ||||||||||||||||||||

* | Amount translated from Guatemalan quetzals and Canadian dollars as of applicable period end. Certain disclosures omitted due to materiality considerations. |

9

Schedule of Contractual Maturities | |||||||||||||||||||

Total | Less Than 1 Year | 1 - 3 Years | 3 - 5 Years | More Than 5 Years | |||||||||||||||

(in thousands) | |||||||||||||||||||

2024 Convertible Notes* | |||||||||||||||||||

2025 Convertible Notes* | |||||||||||||||||||

8.5% unsecured debt due 2024 | |||||||||||||||||||

CASHMAX secured borrowing facility | |||||||||||||||||||

$ | $ | $ | $ | $ | |||||||||||||||

* | Excludes the potential impact of embedded derivatives. |

Three Months Ended December 31, | |||||||

2019 | 2018 | ||||||

(in thousands) | |||||||

2019 Convertible Notes: | |||||||

Contractual interest expense | $ | $ | |||||

Amortization of debt discount and deferred financing costs | |||||||

Total interest expense | $ | $ | |||||

2024 Convertible Notes: | |||||||

Contractual interest expense | $ | $ | |||||

Amortization of debt discount and deferred financing costs | |||||||

Total interest expense | $ | $ | |||||

2025 Convertible Notes: | |||||||

Contractual interest expense | $ | $ | |||||

Amortization of debt discount and deferred financing costs | |||||||

Total interest expense | $ | $ | |||||

In May 2018, we issued $172.5 million aggregate principal amount of 2.375 % Convertible Senior Notes Due 2025 (the “2025 Convertible Notes”). The 2025 Convertible Notes were issued pursuant to an indenture dated May 14, 2018 (the "2018 Indenture") by and between us and Wells Fargo Bank, National Association, as the original trustee. The 2025 Convertible Notes were issued in a private offering under Rule 144A under the Securities Act of 1933. The 2025 Convertible Notes pay interest semi-annually in arrears at a rate of 2.375 % per annum on May 1 and November 1 of each year, commencing November 1, 2018, and mature on May 1, 2025 (the "2025 Maturity Date"), unless converted, redeemed or repurchased in accordance with their terms prior to such date. The carrying amount of the 2025 Convertible Notes as a separate equity-classified instrument (the “2025 Convertible Notes Embedded Derivative”) included in “Additional paid-in capital” in our condensed consolidated balance sheets of December 31, 2019 was $39.0 million. The effective interest rate for the three months ended December 31, 2019 was approximately 9 %. As of December 31, 2019, the remaining unamortized debt discount and issuance costs will be amortized through the 2025 Maturity Date assuming no early conversion.

The 2025 Convertible Notes are convertible into cash or shares of Class A Non-voting Common Stock ("Class A Common Stock"), or any combination thereof, at our option subject to satisfaction of certain conditions and during the periods described in the 2018 Indenture, based on an initial conversion rate of 62.8931 shares of Class A Common Stock per $1,000 principal amount of 2025 Convertible Notes (equivalent to an initial conversion price of $15.90 per share of our Class A Common Stock). We account for the Class A Common Stock issuable upon conversion under the treasury stock method. To the extent our average share price is over $15.90 per share for any fiscal quarter or year-to-date period, we are required to recognize incremental dilution of our earnings per share.

If, among other triggers described in the 2018 Indenture, the market price of our Class A Common Stock meets the threshold based on at least 20 of the final 30 trading days of the quarter for the 2025 Convertible Notes to become convertible at the option of the holders during the subsequent quarter, we may be required to classify the 2025 Convertible Notes as current on our condensed consolidated balance sheets for each quarter in which such triggers are met. The stock trading price condition

10

and other triggers are measured on a quarter-by-quarter basis and were not met as of December 31, 2019. As of December 31, 2019, the if-converted value of the 2025 Convertible Notes did not exceed the principal amount.

In July 2017, we issued $143.75 million aggregate principal amount of 2.875 % Convertible Senior Notes Due 2024 (the “2024 Convertible Notes”). The 2024 Convertible Notes were issued pursuant to an indenture dated July 5, 2017 (the "2017 Indenture") by and between us and Wells Fargo Bank, National Association, as the original trustee. The 2024 Convertible Notes were issued in a private offering under Rule 144A under the Securities Act of 1933. The 2024 Convertible Notes pay interest semi-annually in arrears at a rate of 2.875 % per annum on January 1 and July 1 of each year, commencing January 1, 2018, and mature on July 1, 2024 (the "2024 Maturity Date"), unless converted, redeemed or repurchased in accordance with their terms prior to such date. The carrying amount of the 2024 Convertible Notes as a separate equity-classified instrument (the “2024 Convertible Notes Embedded Derivative”) included in “Additional paid-in capital” in our condensed consolidated balance sheets of December 31, 2019 was $25.3 million. The effective interest rate for the three months ended December 31, 2019 was approximately 9 %. As of December 31, 2019, the remaining unamortized debt discount and issuance costs will be amortized through the 2024 Maturity Date assuming no early conversion.

The 2024 Convertible Notes are convertible into cash or shares of Class A Common Stock, or any combination thereof, at our option subject to satisfaction of certain conditions and during the periods described in the 2017 Indenture, based on an initial conversion rate of 100 shares of Class A Common Stock per $1,000 principal amount of 2024 Convertible Notes (equivalent to an initial conversion price of $10.00 per share of our Class A Common Stock). We account for the Class A Common Stock issuable upon conversion under the treasury stock method. To the extent our average share price is over $10.00 per share for any fiscal quarter, we are required to recognize incremental dilution of our earnings per share.

If, among other triggers described in the 2017 Indenture, the market price of our Class A Common Stock meets the threshold based on at least 20 of the final 30 trading days of the quarter for the 2024 Convertible Notes to become convertible at the option of the holders during the subsequent quarter, we may be required to classify the 2024 Convertible Notes as current on our condensed consolidated balance sheets for each quarter in which such triggers are met. The stock trading price condition and other triggers are measured on a quarter-by-quarter basis and were not met as of December 31, 2019. As of December 31, 2019, the if-converted value of the 2024 Convertible Notes did not exceed the principal amount.

In June 2014, we issued $200 million aggregate principal amount of 2.125 % Cash Convertible Senior Notes Due 2019 (the "2019 Convertible Notes"), with an additional $30 million principal amount of 2019 Convertible Notes issued in July 2014. In July 2017, we used $34.4 million of net proceeds from the 2024 Convertible Notes offering to repurchase and retire $35.0 million aggregate principal amount of 2019 Convertible Notes. The 2019 Convertible Notes paid interest semi-annually in arrears at a rate of 2.125 % per annum on June 15 and December 15 of each year. The 2019 Convertible Notes matured on June 15, 2019 (the "2019 Maturity Date"), and the remaining $195.0 million aggregate principal amount outstanding plus accrued interest was repaid using cash on hand.

2019 Convertible Notes Warrants

In connection with the issuance of the 2019 Convertible Notes, we also sold net-share-settled warrants (the “2019 Convertible Notes Warrants”). The 2019 Convertible Notes Warrants allow for the purchase of up to approximately 14.3 million shares of our Class A Common Stock at a strike price of $20.83 per share. We account for the Class A Common Stock issuable upon exercise under the treasury stock method. As a result of the 2019 Convertible Notes Warrants, we will experience dilution to our diluted earnings per share if our average closing stock price exceeds $20.83 for any fiscal quarter before expiration of the warrants. The unexpired 2019 Convertible Notes Warrants expire on various dates from January 2020 through April 2020 and, if exercised, must be settled in net shares of our Class A Common Stock. Therefore, upon expiration of the 2019 Convertible Notes Warrants, we would issue shares of Class A Common Stock to the purchasers of the 2019 Convertible Notes Warrants that represent the value by which the price of the Class A Common Stock exceeds the strike price stipulated within the particular warrant agreement, if any. As of December 31, 2019, there were a maximum of 5.0 million shares of Class A Common Stock issuable under the 2019 Convertible Notes Warrants outstanding.

11

CASHMAX Secured Borrowing Facility

In November 2018, we entered into a receivables securitization facility with a third-party lender (the "lender") to provide funding for installment loan originations in our Canadian CASHMAX business. Under the facility, a variable interest entity (the "trust") has the right, subject to various conditions, to borrow up to CAD $25 million from the lender (the "third-party loan") and use the proceeds to purchase interests in installment loan receivables generated by CASHMAX. The trust uses collections on the transferred receivables to pay various amounts in accordance with an agreed priority arrangement, including expenses, its obligations under the third-party loan and, to the extent available, amounts owned to CASHMAX with respect to the purchase price of the transferred receivables and CASHMAX's retained interest in the receivables. CASHMAX has no obligation with respect to the third-party loan or the transferred receivables except to (a) service the underlying installment loans on behalf of the trust and (b) pay amounts owing under or repurchase the underlying installment loans in the event of a breach by CASHMAX or in certain other limited circumstances. The facility is nonrecourse to EZCORP, allowed borrowing through November 2019, and fully matures in November 2021. Our obligation under the facility as of December 31, 2019 was $0.4 million.

NOTE 8: COMMON STOCK AND STOCK COMPENSATION

Common Stock Repurchase Program

In December 2019, our Board of Directors authorized the repurchase of up to $60.0 million of our Class A Common Stock over three years . During the current quarter, we repurchased and retired 142,409 shares of our Class A Common Stock for $963,000 , which amount was allocated between "Additional paid-in capital" and "Retained earnings" in our condensed consolidated balance sheets.

Stock Compensation

As of September 30, 2019, the EZCORP, Inc. 2010 Long-Term Incentive Plan, which has been approved by our Board of Directors, permitted grants of options, restricted stock awards and stock appreciation rights covering up to 5,485,649 shares of our Class A Common Stock.

In the current quarter, we granted a total of 222,912 restricted stock awards to our nine non-employee directors. These awards vest on September 30, 2020 and are subject only to service conditions.

The number of long-term incentive award shares and units granted are generally determined based on our share price as of the beginning of the fiscal year, which was $6.46 for fiscal 2020 awards.

NOTE 9: CONTINGENCIES

Currently and from time to time, we are involved in various claims, suits, investigations and legal proceedings, including the lawsuit described below. While we are unable to determine the ultimate outcome of any current litigation or regulatory actions (except as noted below), we believe their resolution will not have a material adverse effect on our financial condition, results of operations or liquidity.

Federal Securities Litigation — In July 2015 and August 2015, two substantially identical lawsuits were filed in the United States District Court for the Western District of Texas. Those lawsuits were subsequently consolidated into a single action under the caption In re EZCORP, Inc. Securities Litigation (Master File No. 1:15-cv-00608-SS). The original complaint related to the Company’s announcement on July 17, 2015 that it will restate its financial statements for fiscal 2014 and the first quarter of fiscal 2015, and alleged generally that the Company issued materially false or misleading statements concerning the Company, its finances, business operations and prospects and that the Company misrepresented the financial performance of the Grupo Finmart business.

In January 2016, the plaintiffs filed an Amended Class Action Complaint (the "Amended Complaint"), which asserted that the Company and Mark E. Kuchenrither, our former Chief Financial Officer, violated Section 10(b) of the Securities Exchange Act and Rule 10b-5, issued materially false or misleading statements concerning the Company and its internal controls, specifically regarding the financial performance of Grupo Finmart. The plaintiffs also allege that Mr. Kuchenrither, as a controlling person of the Company, violated Section 20(a) of the Securities Exchange Act.

In October 2016, the Court granted the defendants’ motion to dismiss and dismissed the Amended Complaint without prejudice. In November 2016, the plaintiffs filed a Second Amended Consolidated Class Action Complaint (“Second Amended Complaint”), raising the same claims previously dismissed by the Court, but reducing the class period (November 7, 2013 to October 20, 2015 instead of November 6, 2012 to October 20, 2015). In May 2017, the Court granted the defendants’ motion to dismiss with regard to claims related to accounting errors relating to Grupo Finmart’s bad debt reserve calculations for

12

“nonperforming” loans, but denied the motion to dismiss with regard to claims relating to accounting errors related to certain sales of loan portfolios to third parties.

Following discovery on the surviving claims, the plaintiff filed a Motion for Leave to File a Third Amended Complaint, seeking to revive the "nonperforming" loan claims that the Court previously dismissed, and on July 26, 2018, the Court granted the plaintiff's motion for leave to amend, thus accepting the Third Amended Consolidated Class Action Complaint. The Court issued an order certifying the class and approving the class representative and class counsel in February 2019, and we appealed that order to the U.S. Fifth Circuit Court of Appeals, which appeal was granted in March 2019.

On May 30, 2019, the parties agreed to a mediated settlement of all remaining claims, and on June 18, 2019 entered into a Stipulation and Agreement of Settlement reflecting the terms of the agreed settlement, which called for the payment of $4.9 million by the defendants. Following a settlement fairness hearing on December 6, 2019, the Court entered a judgment approving the agreed settlement and dismissing the claims asserted against the defendants. The settlement amount (which was covered by applicable directors' and officers' liability insurance) has been disbursed as provided in the approved settlement.

13

NOTE 10: SEGMENT INFORMATION

During the first quarter of fiscal 2020, we revised the financial information our chief operating decision maker (currently our chief executive officer) reviews for operational decision-making purposes and for allocation of capital to include the separate financial results of our Lana business. Our historical segment results have been recast to conform to current presentation. We currently report our segments as follows: U.S. Pawn — all pawn activities in the United States; Latin America Pawn — all pawn activities in Mexico and other parts of Latin America; Lana — our differentiated customer-centric engagement platform; and Other International — primarily our equity interest in the net income of Cash Converters International and consumer finance activities in Canada. There are no inter-segment revenues presented below, and the amounts below were determined in accordance with the same accounting principles used in our condensed consolidated financial statements. While we expect the operations of the Lana segment to have a positive impact on our pawn loan redemption rates and therefore our pawn service charges and yield, the pawn service charges will all be reported in our pawn segments rather than allocated to the Lana segment. Only discrete revenues related to the Lana segment will be reported in the Lana segment results.

Three Months Ended December 31, 2019 | |||||||||||||||||||||||||||

U.S. Pawn | Latin America Pawn | Lana | Other International | Total Segments | Corporate Items | Consolidated | |||||||||||||||||||||

(in thousands) | |||||||||||||||||||||||||||

Revenues: | |||||||||||||||||||||||||||

Merchandise sales | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||

Jewelry scrapping sales | |||||||||||||||||||||||||||

Pawn service charges | |||||||||||||||||||||||||||

Other revenues | |||||||||||||||||||||||||||

Total revenues | |||||||||||||||||||||||||||

Merchandise cost of goods sold | |||||||||||||||||||||||||||

Jewelry scrapping cost of goods sold | |||||||||||||||||||||||||||

Other cost of revenues | |||||||||||||||||||||||||||

Net revenues | |||||||||||||||||||||||||||

Segment and corporate expenses (income): | |||||||||||||||||||||||||||

Operations | |||||||||||||||||||||||||||

Administrative | |||||||||||||||||||||||||||

Depreciation and amortization | |||||||||||||||||||||||||||

Loss on sale or disposal of assets and other | |||||||||||||||||||||||||||

Interest expense | ( | ) | |||||||||||||||||||||||||

Interest income | ( | ) | ( | ) | ( | ) | ( | ) | |||||||||||||||||||

Equity in net loss of unconsolidated affiliates | |||||||||||||||||||||||||||

Other expense (income) | ( | ) | |||||||||||||||||||||||||

Segment contribution (loss) | $ | $ | $ | ( | ) | $ | ( | ) | $ | ||||||||||||||||||

Income from continuing operations before income taxes | $ | $ | ( | ) | $ | ||||||||||||||||||||||

14

Three Months Ended December 31, 2018 | |||||||||||||||||||||||||||

U.S. Pawn | Latin America Pawn | Lana | Other International | Total Segments | Corporate Items | Consolidated | |||||||||||||||||||||

(in thousands) | |||||||||||||||||||||||||||

Revenues: | |||||||||||||||||||||||||||

Merchandise sales | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||

Jewelry scrapping sales | |||||||||||||||||||||||||||

Pawn service charges | |||||||||||||||||||||||||||

Other revenues | |||||||||||||||||||||||||||

Total revenues | |||||||||||||||||||||||||||

Merchandise cost of goods sold | |||||||||||||||||||||||||||

Jewelry scrapping cost of goods sold | |||||||||||||||||||||||||||

Other cost of revenues | |||||||||||||||||||||||||||

Net revenues | |||||||||||||||||||||||||||

Segment and corporate expenses (income): | |||||||||||||||||||||||||||

Operations | |||||||||||||||||||||||||||

Administrative | |||||||||||||||||||||||||||

Depreciation and amortization | |||||||||||||||||||||||||||

Loss on sale or disposal of assets and other | |||||||||||||||||||||||||||

Interest expense | |||||||||||||||||||||||||||

Interest income | ( | ) | ( | ) | ( | ) | ( | ) | |||||||||||||||||||

Equity in net loss of unconsolidated affiliates | |||||||||||||||||||||||||||

Impairment of investments in unconsolidated affiliates | |||||||||||||||||||||||||||

Other (income) expense | ( | ) | ( | ) | ( | ) | ( | ) | |||||||||||||||||||

Segment contribution (loss) | $ | $ | $ | ( | ) | $ | ( | ) | $ | ||||||||||||||||||

Loss from continuing operations before income taxes | $ | $ | ( | ) | $ | ( | ) | ||||||||||||||||||||

15

NOTE 11: SUPPLEMENTAL CONSOLIDATED FINANCIAL INFORMATION

Supplemental Consolidated Financial Information

The following table provides supplemental information on net amounts included in our condensed consolidated balance sheets:

December 31, 2019 | December 31, 2018 | September 30, 2019 | |||||||||

(in thousands) | |||||||||||

Cash and cash equivalents | $ | $ | $ | ||||||||

Restricted cash | |||||||||||

Cash and cash equivalents and restricted cash | $ | $ | $ | ||||||||

Gross pawn service charges receivable | $ | $ | $ | ||||||||

Allowance for uncollectible pawn service charges receivable | ( | ) | ( | ) | ( | ) | |||||

Pawn service charges receivable, net | $ | $ | $ | ||||||||

Gross inventory | $ | $ | $ | ||||||||

Inventory reserves | ( | ) | ( | ) | ( | ) | |||||

Inventory, net | $ | $ | $ | ||||||||

Prepaid expenses and other | $ | $ | $ | ||||||||

Accounts receivable and other | |||||||||||

Income taxes receivable | |||||||||||

Restricted cash | |||||||||||

2019 Convertible Notes Hedges | |||||||||||

Prepaid expenses and other current assets | $ | $ | $ | ||||||||

Property and equipment, gross | $ | $ | $ | ||||||||

Accumulated depreciation | ( | ) | ( | ) | ( | ) | |||||

Property and equipment, net | $ | $ | $ | ||||||||

Accounts payable | $ | $ | $ | ||||||||

Accrued expenses and other | |||||||||||

Accounts payable, accrued expenses and other current liabilities | $ | $ | $ | ||||||||

ITEM 2. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The discussion in this section contains forward-looking statements that are based on our current expectations. Actual results could differ materially from those expressed or implied by the forward-looking statements due to a number of risks, uncertainties and other factors, including those identified in "Part I, Item 1A — Risk Factors" of our Annual Report on Form 10-K for the year ended September 30, 2019, as supplemented by the information set forth in “Part I, Item 3 — Quantitative and Qualitative Disclosures about Market Risk.”

Overview and Financial Highlights

EZCORP is a Delaware corporation headquartered in Austin, Texas. We are a leading provider of pawn loans in the United States and Latin America.

Our vision is to be the market leader in North America in responsibly and respectfully meeting our customers' desire for access to cash when they want it. That vision is supported by four key imperatives:

• | Market Leading Customer Satisfaction; |

• | Exceptional Staff Engagement; |

• | Most Efficient Provider of Cash; and |

16

• | Attractive Shareholder Returns. |

At our pawn stores, we offer pawn loans, which are nonrecourse loans collateralized by tangible personal property, and sell merchandise to customers looking for good value. The merchandise we sell consists of second-hand collateral forfeited from our pawn lending activities or purchased from customers.

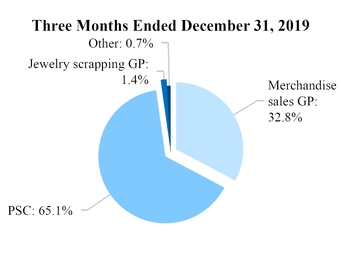

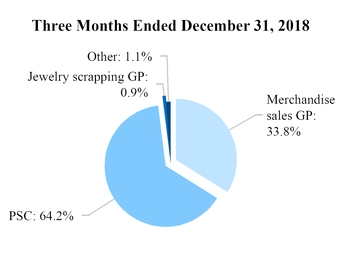

We remain focused on optimizing our balance of pawn loans outstanding (“PLO”) and the resulting higher pawn service charges (“PSC”). The following charts present sources of net revenues, including PSC, merchandise sales gross profit ("Merchandise sales GP") and jewelry scrapping gross profit ("Jewelry scrapping GP"):

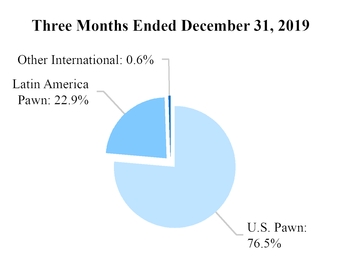

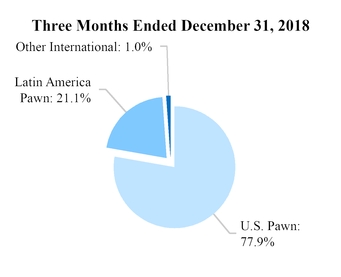

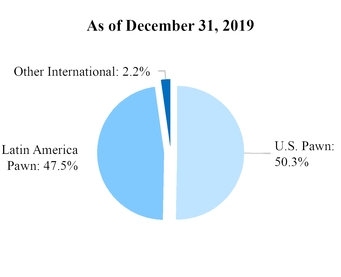

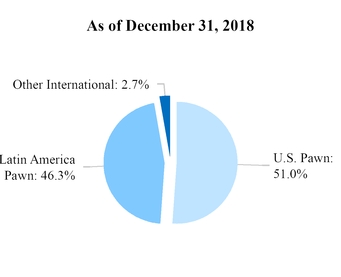

The following charts present sources of net revenues by geographic disbursement:

17

The following charts present store counts by geographic disbursement:

Pawn Activities

At our pawn stores, we offer pawn loans, which are typically small, nonrecourse loans collateralized by tangible personal property. We earn pawn service charges on our pawn loans, which varies by state and loan size. Collateral for our pawn loans consists of tangible personal property, generally jewelry, consumer electronics, tools, sporting goods and musical instruments. Security for our pawn loans is provided via the estimated resale value of the collateral and the perceived probability of the loan’s redemption.

Our ability to offer quality second-hand goods at prices significantly lower than original retail prices attracts value-conscious customers. The gross profit on sales of inventory depends primarily on our assessment of the loan or purchase value at the time the property is either accepted as loan collateral or purchased and our ability to sell that merchandise in a timely manner. As a significant portion of our inventory and sales involve gold and jewelry, our results can be heavily influenced by the market price of gold.

Growth and Expansion

We plan to expand the number of locations we operate through opening new (“de novo”) locations and through acquisitions in both Latin America and the United States and potential new markets. Our ability to add new stores is dependent on several variables, such as projected achievement of internal investment hurdles, the availability of acceptable sites or acquisition candidates, the alignment of acquirer/seller price expectations, the regulatory environment, local zoning ordinances, access to capital and the availability of qualified personnel.

Seasonality and Quarterly Results

Historically, pawn service charges are highest in our fourth fiscal quarter (July through September) due to a higher average loan balance during the summer lending season in the United States and lowest in our third fiscal quarter (April through June) following the tax refund season in the United States. Merchandise sales are highest in our first and second fiscal quarters (October through March) due to the holiday season, jewelry sales in the United States surrounding Valentine’s Day and the availability of tax refunds in the United States. Most of our customers in Latin America receive additional compensation from their employers in December, and many receive additional compensation in June or July, applying downward pressure on loan balances and fueling some merchandise sales in those periods. As a net effect of these and other factors and excluding discrete charges, our consolidated profit before tax is generally highest in our first fiscal quarter (October through December) and lowest in our third fiscal quarter (April through June).

Segments

During the first quarter of fiscal 2020, we revised the financial information our chief operating decision maker (currently our chief executive officer) reviews for operational decision-making purposes and for allocation of capital to include the separate financial results of our Lana business. Our historical segment results have been recast to conform to current presentation. We currently report our segments as follows: U.S. Pawn - all pawn activities in the United States; Latin America Pawn - all pawn

18

activities in Mexico and other parts of Latin America; Lana - our customer-centric digital engagement platform; and Other International - primarily our equity interest in the net income of Cash Converters International and consumer finance activities in Canada. While we expect the operations of the Lana segment to have a positive impact on our pawn loan redemption rates and therefore our pawn service charges and yield, the pawn service charges will all be reported in our pawn segments rather than allocated to the Lana segment. Only discrete revenues related to the Lana segment will be reported in the Lana segment results. As a digital offering, Lana has no separate physical store locations.

Leases

As of October 1, 2019, we adopted Accounting Standards Update ("ASU"), Leases (Topic 842). This ASU required companies to generally recognize on the balance sheet operating and financing lease liabilities and corresponding right-of-use assets. We recorded a net right-of-use asset of $237.5 million and a net lease liability of $246.0 million.

Store Data by Segment

Three Months Ended December 31, 2019 | |||||||||||

U.S. Pawn | Latin America Pawn | Other International | Consolidated | ||||||||

As of September 30, 2019 | 512 | 480 | 22 | 1,014 | |||||||

New locations opened | — | 4 | — | 4 | |||||||

As of December 31, 2019 | 512 | 484 | 22 | 1,018 | |||||||

Three Months Ended December 31, 2018 | |||||||||||

U.S. Pawn | Latin America Pawn | Other International | Consolidated | ||||||||

As of September 30, 2018 | 508 | 453 | 27 | 988 | |||||||

New locations opened | — | 4 | — | 4 | |||||||

Locations acquired | — | 5 | — | 5 | |||||||

As of December 31, 2018 | 508 | 462 | 27 | 997 | |||||||

19

Results of Operations

Three Months Ended December 31, 2019 vs. Three Months Ended December 31, 2018

These tables, as well as the discussion that follows, should be read with the accompanying condensed consolidated financial statements and related notes. All comparisons, unless otherwise noted, are to the prior-year quarter.

U.S. Pawn

The following table presents selected summary financial data for the U.S. Pawn segment:

Three Months Ended December 31, | Change | ||||||||

2019 | 2018 | ||||||||

(in thousands) | |||||||||

Net revenues: | |||||||||

Pawn service charges | $ | 64,090 | $ | 64,225 | —% | ||||

Merchandise sales | 95,354 | 95,103 | —% | ||||||

Merchandise sales gross profit | 33,990 | 35,955 | (5)% | ||||||

Gross margin on merchandise sales | 36 | % | 38 | % | (200)bps | ||||

Jewelry scrapping sales | 6,117 | 6,552 | (7)% | ||||||

Jewelry scrapping sales gross profit | 1,362 | 1,042 | 31% | ||||||

Gross margin on jewelry scrapping sales | 22 | % | 16 | % | 600bps | ||||

Other revenues | 36 | 48 | (25)% | ||||||

Net revenues | 99,478 | 101,270 | (2)% | ||||||

Segment operating expenses: | |||||||||

Operations | 68,059 | 67,937 | —% | ||||||

Depreciation and amortization | 2,865 | 3,035 | (6)% | ||||||

Segment operating contribution | 28,554 | 30,298 | (6)% | ||||||

Other segment expense | — | 2,853 | (100)% | ||||||

Segment contribution | $ | 28,554 | $ | 27,445 | 4% | ||||

Other data: | |||||||||

Net earning assets (a) | $ | 305,336 | $ | 299,160 | 2% | ||||

Inventory turnover | 1.8 | 1.8 | —% | ||||||

Average monthly ending pawn loan balance per store (b) | $ | 301 | $ | 304 | (1)% | ||||

Monthly average yield on pawn loans outstanding | 14 | % | 14 | % | — | ||||

Pawn loan redemption rate | 84 | % | 83 | % | 100bps | ||||

(a) | Balance includes pawn loans and inventory. |

(b) | Balance is calculated based upon the average of the monthly ending balances during the applicable period. |

Segment contribution increased $1.1 million, or 4%, to $28.6 million. While net revenues decreased $1.8 million, or 2%, to $99.5 million, total expenses decreased $2.9 million to $70.9 million due primarily to a $2.9 million prior-period recognition of an uncollectible receivable balance from a bankrupt refining partner with no comparable charge in the current period. Operations expense was flat to the prior-year quarter, with a slight improvement in depreciation and amortization.

20

The change in net revenue attributable to same stores and new stores added since the prior-year quarter is summarized as follows:

Change in Net Revenue | |||||||||||

Pawn Service Charges | Merchandise Sales Gross Profit | Total | |||||||||

(in millions) | |||||||||||

Same stores | $ | (0.5 | ) | $ | (2.3 | ) | $ | (2.8 | ) | ||

New stores and other | 0.4 | 0.3 | 0.7 | ||||||||

Total | $ | (0.1 | ) | $ | (2.0 | ) | $ | (2.1 | ) | ||

Change in jewelry scrapping sales gross profit and other revenues | 0.3 | ||||||||||

Total change in net revenue | $ | (1.8 | ) | ||||||||

Pawn service charges were flat as acquired stores offset a 1% decrease in average ending monthly pawn loan balances outstanding during the current quarter.

Merchandise sales were flat with gross margin on merchandise sales down 200 basis points to 36%, the low end of our target range. The decline in gross margin was due to holiday sales promotions and our continued efforts to reduce general merchandise inventory aged greater than 360 days, which ended the quarter at 6.8% of total general merchandise inventory, improved from 8.9% at the end of the prior-year quarter. As a result, merchandise sales gross profit decreased 5% to $34.0 million.

Jewelry scrapping sales gross profit increased 31% to $1.4 million due primarily to higher scrapping margins as a result of increased gold market prices. Scrap sales margins increased 600 basis points to 22%. Scrap volume decreased year-over-year as we continue to focus on retail sales for jewelry disposition.

Non-GAAP Financial Information

In addition to the financial information prepared in conformity with accounting principles generally accepted in the United States ("GAAP"), we provide certain other non-GAAP financial information on a constant currency basis ("constant currency"). We use constant currency results to evaluate our Latin America Pawn operations, which are denominated primarily in Mexican pesos, Guatemalan quetzals and other Latin American currencies. We believe that presentation of constant currency results is meaningful and useful in understanding the activities and business metrics of our Latin America Pawn operations and reflect an additional way of viewing aspects of our business that, when viewed with GAAP results, provide a more complete understanding of factors and trends affecting our business. We provide non-GAAP financial information for informational purposes and to enhance understanding of our GAAP consolidated financial statements. We use this non-GAAP financial information to evaluate and compare operating results across accounting periods. Readers should consider the information in addition to, but not instead of or superior to, our financial statements prepared in accordance with GAAP. This non-GAAP financial information may be determined or calculated differently by other companies, limiting the usefulness of those measures for comparative purposes.

Constant currency results reported herein are calculated by translating consolidated balance sheet and consolidated statement of operations items denominated in local currency to U.S. dollars using the exchange rate from the prior-year comparable period, as opposed to the current period, in order to exclude the effects of foreign currency rate fluctuations. We used the end-of-period rate for balance sheet items and the average closing daily exchange rate on a monthly basis during the appropriate period for statement of operations items. Our statement of operations constant currency results reflect the monthly exchange rate fluctuations and so are not directly calculable from the above rates. Constant currency results, where presented, also exclude the foreign currency gain or loss. The end-of-period and approximate average exchange rates for each applicable currency as compared to U.S. dollars as of and for the three months ended December 31 were as follows:

December 31, | Three Months Ended December 31, | |||||||||||

2019 | 2018 | 2019 | 2018 | |||||||||

Mexican peso | 18.9 | 19.6 | 19.2 | 19.8 | ||||||||

Guatemalan quetzal | 7.5 | 7.7 | 7.5 | 7.6 | ||||||||

Honduran lempira | 24.4 | 24.2 | 24.3 | 24.0 | ||||||||

Peruvian sol | 3.3 | 3.4 | 3.3 | 3.3 | ||||||||

21

Latin America Pawn

The following table presents selected summary financial data for the Latin America Pawn segment, including constant currency results, after translation to U.S. dollars from its functional currencies noted above under “Results of Operations — Non-GAAP Financial Information."

Three Months Ended December 31, | |||||||||||||||

2019 (GAAP) | 2018 (GAAP) | Change (GAAP) | 2019 (Constant Currency) | Change (Constant Currency) | |||||||||||

(in USD thousands) | (in USD thousands) | ||||||||||||||

Net revenues: | |||||||||||||||

Pawn service charges | $ | 20,635 | $ | 19,294 | 7% | $ | 20,197 | 5% | |||||||

Merchandise sales | 31,374 | 25,921 | 21% | 30,526 | 18% | ||||||||||

Merchandise sales gross profit | 8,662 | 7,957 | 9% | 8,434 | 6% | ||||||||||

Gross margin on merchandise sales | 28 | % | 31 | % | (300)bps | 28 | % | (300)bps | |||||||

Jewelry scrapping sales | 3,411 | 2,729 | 25% | 3,366 | 23% | ||||||||||

Jewelry scrapping sales gross profit | 412 | 189 | 118% | 407 | 115% | ||||||||||

Gross margin on jewelry scrapping sales | 12 | % | 7 | % | 500bps | 12 | % | 500bps | |||||||

Other revenues | 25 | 42 | (40)% | 24 | (43)% | ||||||||||

Net revenues | 29,734 | 27,482 | 8% | 29,062 | 6% | ||||||||||

Segment operating expenses: | |||||||||||||||

Operations | 19,983 | 18,196 | 10% | 19,573 | 8% | ||||||||||

Depreciation and amortization | 1,889 | 1,422 | 33% | 1,844 | 30% | ||||||||||

Segment operating contribution | 7,862 | 7,864 | —% | 7,645 | (3)% | ||||||||||

Other segment (income) expense (a) | (265 | ) | 1,073 | * | (202 | ) | * | ||||||||

Segment contribution | $ | 8,127 | $ | 6,791 | 20% | $ | 7,847 | 16% | |||||||

Other data: | |||||||||||||||

Net earning assets (b) | $ | 77,619 | $ | 70,246 | 10% | $ | 75,327 | 7% | |||||||

Inventory turnover | 2.7 | 2.6 | 4% | 2.7 | 4% | ||||||||||

Average monthly ending pawn loan balance per store (c) | $ | 119 | $ | 121 | (2)% | $ | 116 | (4)% | |||||||

Monthly average yield on pawn loans outstanding | 16 | % | 15 | % | 100bps | 16 | % | 100bps | |||||||

Pawn loan redemption rate (d) | 79 | % | 78 | % | 100bps | 79 | % | 100bps | |||||||

* | Represents a percentage computation that is not mathematically meaningful. |

(a) | Fiscal 2020 constant currency amount excludes net GAAP basis foreign currency transaction gains of $0.1 million resulting from movement in exchange rates. The net foreign currency transaction gains for fiscal 2019 of $0.1 million are included in the above results. |

(b) | Balance includes pawn loans and inventory. |

(c) | Balance is calculated based upon the average of the monthly ending balances during the applicable period. |

(d) | Rate is solely inclusive of results from Mexico Pawn. |

22

Segment contribution increased $1.3 million, or 20%, to $8.1 million (16% on a constant currency basis) with net revenue growth of $2.3 million, or 8% ($1.6 million, or 6%, on a constant currency basis), to $29.7 million. Operations expense increased $1.8 million, or 10% ($1.4 million, or 8% on a constant currency basis), to $20.0 million due primarily to 22 new store openings, along with relocations and expansions of existing stores.

The change in net revenue attributable to same stores and new stores added since the prior-year quarter is summarized as follows:

Change in Net Revenue | |||||||||||

Pawn Service Charges | Merchandise Sales Gross Profit | Total | |||||||||

(in millions) | |||||||||||

Same stores | $ | 0.9 | $ | 0.5 | $ | 1.4 | |||||

New stores and other | 0.4 | 0.3 | 0.7 | ||||||||

Total | $ | 1.3 | $ | 0.8 | $ | 2.1 | |||||

Change in jewelry scrapping sales gross profit and other revenues | 0.2 | ||||||||||

Total change in net revenue | $ | 2.3 | |||||||||

Change in Net Revenue (Constant Currency) | |||||||||||

Pawn Service Charges | Merchandise Sales Gross Profit | Total | |||||||||

(in millions) | |||||||||||

Same stores | $ | 0.5 | $ | 0.3 | $ | 0.8 | |||||

New stores and other | 0.4 | 0.2 | 0.6 | ||||||||

Total | $ | 0.9 | $ | 0.5 | $ | 1.4 | |||||

Change in jewelry scrapping sales gross profit and other revenues | 0.2 | ||||||||||

Total change in net revenue | $ | 1.6 | |||||||||

Pawn service charges increased 7% (5% on a constant currency basis). The average ending monthly pawn loan balance outstanding during the current quarter was down 2% (4% on a constant currency basis), offset by the addition of 22 new stores since the end of the prior-year quarter. Pawn loan yield and redemption rates improved 100 basis points each, to 16% and 79%, respectively, reflecting improved lending guidance from our point-of-sale system.

Merchandise sales increased 21% (18% on a constant currency basis), largely attributable to a revised incentive program for store team members implemented in fiscal 2020, with an offsetting 300 basis point decline in margins. As a result of these factors and foreign currency impacts, merchandise sales gross profit was up 9% to $8.7 million (6% to $8.4 million on a constant currency basis).

Social welfare programs recently implemented in Mexico have provided additional cash to a portion of our customers, contributing to the lower loan demand and increased sales volume. These programs are directed towards a variety of citizens such as the elderly, disabled, single mothers, certain farmers, micro-businesses and certain students. Based on government announcements, we anticipate these programs will continue on an ongoing basis, but expect our customers’ needs to return to more traditional patterns in six to twelve months.

Jewelry scrapping sales increased 25% (23% on a constant currency basis) on greater volume, with a 500 basis point increase in margin to 12% as we benefited from an overall increase in commodity gold prices.

Other segment expenses compared favorably as a result of a prior-year quarter reserve of $1.5 million against a receivable balance deemed uncollectible from a refiner.

Operations expense increased 10% (8% on a constant currency basis). Same store operations expense increased 7%, with the remainder of the increase attributable to a 5% increase in ending store count over the prior-year quarter and costs to open de novo stores. Depreciation and amortization increased 33% (30% on a constant currency basis) from the addition of stores and capital investment in existing and acquired operations.

23

Lana

The following table presents selected financial data for the Lana segment:

Three Months Ended December 31, | Percentage Change | ||||||||

2019 | 2018 | ||||||||

(in thousands) | |||||||||

Operations expense and other | $ | 1,325 | $ | 2,090 | (37)% | ||||

Segment loss | $ | (1,325 | ) | $ | (2,090 | ) | (37)% | ||

We launched our customer-centric digital engagement platform (“Lana”) in the current quarter, initially serving customers in select Florida locations. This platform currently offers the ability for customers at select locations to remotely extend their pawn loans through digital payments using their Lana account, and will allow us to leverage our existing store and pawn customer base to expand customer acquisition and retention and enable rapid deployment of new products. Discrete revenues to date are minimal as the product offering launched late in the current quarter, and all fees from pawn loan extensions, including those made through the Lana platform, are reported in the pawn segments.

Other International

The following table presents selected financial data for the Other International segment after translation to U.S. dollars from its functional currency of primarily Australian and Canadian dollars:

Three Months Ended December 31, | Percentage Change | ||||||||

2019 | 2018 | ||||||||

(in thousands) | |||||||||

Net revenues: | |||||||||

Consumer loan fees, interest and other | $ | 1,392 | $ | 1,781 | (22)% | ||||