UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-06336

Franklin Templeton International Trust

(Exact name of registrant as specified in charter)

One Franklin Parkway,

San Mateo, CA 94403-1906

(Address of principal executive offices) (Zip code)

Craig S. Tyle,

One Franklin Parkway,

San Mateo, CA 94403-1906

(Name and address of agent for service)

Registrant’s telephone number, including area code: 650 312-2000

Date of fiscal year end: 10/31

Date of reporting period: 4/30/19

| Item 1. | Reports to Stockholders. |

Internet Delivery of Fund Reports Unless You Request Paper Copies: Effective January 1, 2021, as permitted by the SEC, paper copies of the Fund’s shareholder reports will no longer be sent by mail, unless you specifically request them from the Fund or your financial intermediary. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. If you have not signed up for electronic delivery, we would encourage you to join fellow shareholders who have. You may elect to receive shareholder reports and other communications electronically from the Fund by calling (800) 632-2301 or by contacting your financial intermediary.

You may elect to continue to receive paper copies of all your future shareholder reports free of charge by contacting your financial intermediary or, if you invest directly with a Fund, calling (800) 632-2301 to let the Fund know of your request. Your election to receive reports in paper will apply to all funds held in your account.

Franklin Templeton

Successful investing begins with ambition. And achievement only comes when you reach for it. That’s why we continually strive to deliver better outcomes for investors. No matter what your goals are, our deep, global investment expertise allows us to offer solutions that can help.

During our more than 70 years of experience, we’ve managed through all kinds of markets—up, down and those in between. We’re always preparing for what may come next. It’s because of this, combined with our strength as one of the world’s largest asset managers that we’ve earned the trust of millions of investors around the world.

Dear Shareholder:

CFA® is a trademark owned by CFA Institute.

| Not FDIC Insured | | | May Lose Value | | | No Bank Guarantee |

| franklintempleton.com | Not part of the semiannual report | 1 | ||||

| 2 | Semiannual Report | franklintempleton.com | ||||

1. Source: Morningstar.

The index is unmanaged and includes reinvestment of any income or distributions. It does not reflect any fees, expenses or sales charges. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

2. Source: Central Statistics Office, India.

See www.franklintempletondatasources.com for additional data provider information.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI). The SOI begins on page 14.

| franklintempleton.com | Semiannual Report | 3 | ||||

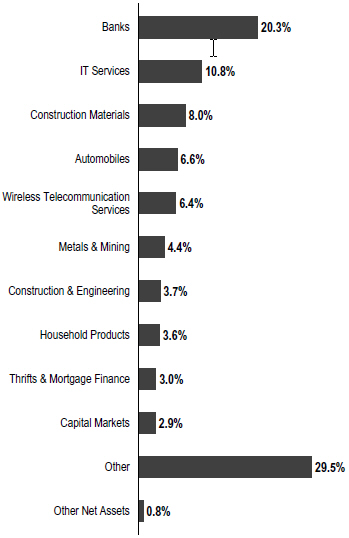

FRANKLIN INDIA GROWTH FUND

| 4 | Semiannual Report | franklintempleton.com | ||

FRANKLIN INDIA GROWTH FUND

| franklintempleton.com | Semiannual Report | 5 | ||||

FRANKLIN INDIA GROWTH FUND

| 6 | Semiannual Report | franklintempleton.com | ||

FRANKLIN INDIA GROWTH FUND

Performance Summary as of April 30, 2019

The performance table does not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses. Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities.

Performance as of 4/30/191

Cumulative total return excludes sales charges. Average annual total return includes maximum sales charges. Sales charges will vary depending on the size of the investment and the class of share purchased. The maximum is 5.50% and the minimum is 0%. Class A: 5.50% maximum initial sales charge; Advisor Class: no sales charges. For other share classes, visit franklintempleton.com.

| Share Class | Cumulative Total Return2 |

Average Annual Total Return3 |

||||||

|

A4 6-Month |

+17.83% | +11.34% | ||||||

| 1-Year |

-5.52% | -10.69% | ||||||

| 5-Year |

+55.84% | +8.04% | ||||||

| 10-Year |

+180.34% | +10.24% | ||||||

|

Advisor 6-Month |

+17.99% | +17.99% | ||||||

| 1-Year |

-5.31% | -5.31% | ||||||

| 5-Year |

+57.84% | +9.56% | ||||||

| 10-Year |

+187.97% | +11.16% | ||||||

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

See page 8 for Performance Summary footnotes.

| franklintempleton.com | Semiannual Report | 7 | ||||

FRANKLIN INDIA GROWTH FUND

PERFORMANCE SUMMARY

Distributions (11/1/18–4/30/19)

| Share Class | Long-Term Capital Gain |

|||

| A |

$0.5656 | |||

| C |

$0.5656 | |||

| R6 |

$0.5656 | |||

| Advisor |

$0.5656 | |||

Total Annual Operating Expenses5

| Share Class | With Fee Waiver |

Without Fee Waiver |

||||||

| A |

1.65% | 2.06% | ||||||

| Advisor |

1.40% | 1.81% | ||||||

Each class of shares is available to certain eligible investors and has different annual fees and expenses, as described in the prospectus.

All investments involve risks, including possible loss of principal. Special risks are associated with foreign investing, including currency fluctuations, economic instability and political developments. Investments in developing markets involve heightened risks related to the same factors, in addition to risks associated with these companies’ smaller size, lesser liquidity and the potential lack of established legal, political, business and social frameworks to support securities markets in the countries in which they operate. The Fund relies on the income tax treaty between India and the Republic of Mauritius for relief from certain Indian taxes. As a result of recent treaty renegotiations, effective April 1, 2017, India began imposing taxes on short-term capital gains realized from the alienation of shares in an Indian company acquired on or after that date. The imposition of taxes by India as a result of the recent treaty renegotiations, or for any other reason, such as legislative changes or changes in the requirements to establish a residency in Mauritius are expected to result in higher taxes and lower returns for the Fund and may affect the Fund’s ability to achieve its investment goal. Other future changes to the Treaty or additional legislative changes may also affect the Fund’s returns. Because the Fund invests its assets primarily in companies in a specific country or region the Fund may also experience greater volatility than a fund that is more broadly diversified geographically. The Fund is designed for the aggressive portion of a well-diversified portfolio. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

1. The Fund has an expense reduction contractually guaranteed through 2/29/20. Fund investment results reflect the expense reduction; without this reduction, the results would have been lower.

2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the average annual change in value of an investment over the periods indicated. Return for less than one year, if any, has not been annualized.

4. Prior to 9/10/18, these shares were offered at a higher initial sales charge of 5.75%, thus actual returns would have differed. Total returns with sales charges have been restated to reflect the current maximum initial sales charge of 5.50%.

5. Figures are as stated in the Fund’s current prospectus and may differ from the expense ratios disclosed in the Your Fund’s Expenses and Financial Highlights sections in this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

| 8 | Semiannual Report | franklintempleton.com | ||

FRANKLIN INDIA GROWTH FUND

As a Fund shareholder, you can incur two types of costs: (1) transaction costs, including sales charges (loads) on Fund purchases and redemptions; and (2) ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses. The table below shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The table below provides information about actual account values and actual expenses in the columns under the heading “Actual.” In these columns the Fund’s actual return, which includes the effect of Fund expenses, is used to calculate the “Ending Account Value” for each class of shares. You can estimate the expenses you paid during the period by following these steps (of course, your account value and expenses will differ from those in this illustration): Divide your account value by $1,000 (if your account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6). Then multiply the result by the number in the row for your class of shares under the headings “Actual” and “Expenses Paid During Period” (if Actual Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50). In this illustration, the actual expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Under the heading “Hypothetical” in the table, information is provided about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. This information may not be used to estimate the actual ending account balance or expenses you paid for the period, but it can help you compare ongoing costs of investing in the Fund with those of other funds. To do so, compare this 5% hypothetical example for the class of shares you hold with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transactional costs. Therefore, information under the heading “Hypothetical” is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transactional costs were included, your total costs would have been higher.

| Actual (actual return after expenses) |

Hypothetical (5% annual return before expenses) |

||||||||||||||||||||||||||||||||||||||||||||

| Share Class |

Beginning Account Value 11/1/18 |

Ending Account Value 4/30/19 |

Expenses Paid During 11/1/18–4/30/191,2 |

Ending Account Value 4/30/19 |

Expenses Paid During Period 11/1/18–4/30/191,2 |

Net Annualized Expense Ratio2 | |||||||||||||||||||||||||||||||||||||||

| A |

$ | 1,000 | $ | 1,178.30 | $ | 8.91 | $ | 1,016.61 | $ | 8.25 | 1.65 | % | |||||||||||||||||||||||||||||||||

| C |

$ | 1,000 | $ | 1,174.40 | $ | 12.94 | $ | 1,012.89 | $ | 11.98 | 2.40 | % | |||||||||||||||||||||||||||||||||

| R6 |

$ | 1,000 | $ | 1,180.60 | $ | 6.70 | $ | 1,018.65 | $ | 6.21 | 1.24 | % | |||||||||||||||||||||||||||||||||

| Advisor |

$ | 1,000 | $ | 1,179.90 | $ | 7.57 | $ | 1,017.85 | $ | 7.00 | 1.40 | % | |||||||||||||||||||||||||||||||||

1. Expenses are equal to the annualized expense ratio for the six-month period as indicated above—in the far right column—multiplied by the simple average account value over the period indicated, and then multiplied by 181/365 to reflect the one-half year period.

2. Reflects expenses after fee waivers and expense reimbursements.

| franklintempleton.com | Semiannual Report | 9 | ||||

FRANKLIN TEMPLETON INTERNATIONAL TRUST

Franklin India Growth Fund

| Six Months Ended | ||||||||||||||||||||||||

| April 30, 2019 | Year Ended October 31, | |||||||||||||||||||||||

| (unaudited) | 2018 | 2017 | 2016 | 2015 | 2014 | |||||||||||||||||||

| Class A | ||||||||||||||||||||||||

| Per share operating performancea | ||||||||||||||||||||||||

| (for a share outstanding throughout the period) |

||||||||||||||||||||||||

| Net asset value, beginning of period |

$12.16 | $15.52 | $13.52 | $12.23 | $12.37 | $8.55 | ||||||||||||||||||

| Income from investment operationsb: |

||||||||||||||||||||||||

| Net investment income (loss)c |

(0.09 | ) | (0.10 | ) | (0.11 | ) | 0.02 | d | (0.10 | ) | 0.02 | e | ||||||||||||

| Net realized and unrealized gains (losses) |

2.24 | (2.81 | ) | 2.11 | 1.27 | 0.04 | 3.80 | |||||||||||||||||

| Total from investment operations |

2.15 | (2.91 | ) | 2.00 | 1.29 | (0.06 | ) | 3.82 | ||||||||||||||||

| Less distributions from: |

||||||||||||||||||||||||

| Net investment income |

— | — | — | — | (0.08 | ) | — | |||||||||||||||||

| Net realized gains |

(0.57 | ) | (0.45 | ) | — | — | — | — | ||||||||||||||||

| Total distributions |

(0.57 | ) | (0.45 | ) | — | — | (0.08 | ) | — | |||||||||||||||

| Net asset value, end of period |

$13.74 | $12.16 | $15.52 | $13.52 | $12.23 | $12.37 | ||||||||||||||||||

| Total returnf |

17.83% | (19.23)% | 14.79% | 10.55% | (0.49)% | 44.68% | ||||||||||||||||||

| Ratios to average net assetsa,g | ||||||||||||||||||||||||

| Expenses before waiver and payments by affiliates |

2.21% | 2.06% | 2.15% | 2.14% | 2.08% | 2.25% | ||||||||||||||||||

| Expenses net of waiver and payments by affiliates |

1.65% | h | 1.62% | h | 1.65% | h | 1.65% | 1.69% | 1.65% | |||||||||||||||

| Net investment income (loss) |

(1.32)% | (0.67)% | (0.78)% | 0.15% | d | (0.77)% | 0.22% | e | ||||||||||||||||

| Supplemental data | ||||||||||||||||||||||||

| Net assets, end of period (000’s) |

$58,007 | $55,287 | $78,079 | $61,347 | $66,035 | $53,230 | ||||||||||||||||||

| Portfolio turnover ratei |

15.08% | 26.33% | 39.65% | 21.54% | 46.88% | 35.48% | ||||||||||||||||||

aThe per share amounts and ratios include income and expenses of the Portfolio.

bThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

cBased on average daily shares outstanding.

dNet investment income (loss) per share includes approximately $0.09 per share related to a corporate action in connection with certain Portfolio holdings. Excluding this amount, the ratio of net investment income to average net assets would have been (0.61)%.

eNet investment income per share includes approximately $0.02 per share related to income received in the form of special dividends in connection with certain Portfolio holdings. Excluding this amount, the ratio of net investment income to average net assets would have been 0.04%.

fTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable, and is not annualized for periods less than one year.

gRatios are annualized for periods less than one year.

hBenefit of expense reduction rounds to less than 0.01%.

iIncludes the Portfolio’s rate of turnover.

| 10 | Semiannual Report | The accompanying notes are an integral part of these financial statements. | franklintempleton.com | ||

FRANKLIN TEMPLETON INTERNATIONAL TRUST

FINANCIAL HIGHLIGHTS

Franklin India Growth Fund (continued)

| Six Months Ended | ||||||||||||||||||||||||

| April 30, 2019 | Year Ended October 31, | |||||||||||||||||||||||

| (unaudited) | 2018 | 2017 | 2016 | 2015 | 2014 | |||||||||||||||||||

| Class C | ||||||||||||||||||||||||

| Per share operating performancea | ||||||||||||||||||||||||

| (for a share outstanding throughout the period) |

||||||||||||||||||||||||

| Net asset value, beginning of period |

$11.29 | $14.54 | $12.77 | $11.64 | $11.81 | $8.22 | ||||||||||||||||||

| Income from investment operationsb: |

||||||||||||||||||||||||

| Net investment income (loss)c |

(0.12 | ) | (0.20 | ) | (0.20 | ) | (0.07 | )d | (0.18 | ) | (0.05 | )e | ||||||||||||

| Net realized and unrealized gains (losses) |

2.06 | (2.60 | ) | 1.97 | 1.20 | 0.05 | 3.64 | |||||||||||||||||

| Total from investment operations |

1.94 | (2.80 | ) | 1.77 | 1.13 | (0.13 | ) | 3.59 | ||||||||||||||||

| Less distributions from: |

||||||||||||||||||||||||

| Net investment income |

— | — | — | — | (0.04 | ) | — | |||||||||||||||||

| Net realized gains |

(0.57 | ) | (0.45 | ) | — | — | — | — | ||||||||||||||||

| Total distributions |

(0.57 | ) | (0.45 | ) | — | — | (0.04 | ) | — | |||||||||||||||

| Net asset value, end of period |

$12.66 | $11.29 | $14.54 | $12.77 | $11.64 | $11.81 | ||||||||||||||||||

| Total returnf |

17.44% | (19.85)% | 13.86% | 9.71% | (1.14)% | 43.67% | ||||||||||||||||||

| Ratios to average net assetsa,g | ||||||||||||||||||||||||

| Expenses before waiver and payments by affiliates |

2.96% | 2.81% | 2.90% | 2.89% | 2.79% | 2.95% | ||||||||||||||||||

| Expenses net of waiver and payments by affiliates |

2.40% | h | 2.37% | h | 2.40%h | 2.40% | 2.40% | 2.35% | ||||||||||||||||

| Net investment income (loss) |

(2.07)% | (1.42)% | (1.53)% | (0.60)% | d | (1.48)% | (0.48)% | e | ||||||||||||||||

| Supplemental data | ||||||||||||||||||||||||

| Net assets, end of period (000’s) |

$15,775 | $15,481 | $24,039 | $17,291 | $17,754 | $11,655 | ||||||||||||||||||

| Portfolio turnover ratei |

15.08% | 26.33% | 39.65% | 21.54% | 46.88% | 35.48% | ||||||||||||||||||

aThe per share amounts and ratios include income and expenses of the Portfolio.

bThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

cBased on average daily shares outstanding.

dNet investment income (loss) per share includes approximately $0.09 per share related to a corporate action in connection with certain Portfolio holdings. Excluding this amount, the ratio of net investment income to average net assets would have been (1.36)%.

eNet investment income (loss) per share includes approximately $0.02 per share related to income received in the form of special dividends in connection with certain Portfolio holdings. Excluding this amount, the ratio of net investment income to average net assets would have been (0.66)%.

fTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable, and is not annualized for periods less than one year.

gRatios are annualized for periods less than one year.

hBenefit of expense reduction rounds to less than 0.01%.

iIncludes the Portfolio’s rate of turnover.

| franklintempleton.com | The accompanying notes are an integral part of these financial statements. | Semiannual Report | 11 | ||||

FRANKLIN TEMPLETON INTERNATIONAL TRUST

FINANCIAL HIGHLIGHTS

Franklin India Growth Fund (continued)

| Six Months Ended | ||||||||||||||||||||||||

| April 30, 2019 | Year Ended October 31, | |||||||||||||||||||||||

| (unaudited) | 2018 | 2017 | 2016 | 2015 | 2014 | |||||||||||||||||||

| Class R6 | ||||||||||||||||||||||||

| Per share operating performancea | ||||||||||||||||||||||||

| (for a share outstanding throughout the period) |

||||||||||||||||||||||||

| Net asset value, beginning of period |

$12.62 | $15.92 | $13.89 | $12.51 | $12.63 | $8.68 | ||||||||||||||||||

| Income from investment operationsb: |

||||||||||||||||||||||||

| Net investment income (loss)c |

(0.06 | ) | (0.04 | ) | (0.05 | ) | 0.07 | d | (0.04 | ) | 0.07 | e | ||||||||||||

| Net realized and unrealized gains (losses) |

2.32 | (2.81 | ) | 2.08 | 1.31 | 0.03 | 3.88 | |||||||||||||||||

| Total from investment operations |

2.26 | (2.85 | ) | 2.03 | 1.38 | (0.01 | ) | 3.95 | ||||||||||||||||

| Less distributions from: |

||||||||||||||||||||||||

| Net investment income |

— | — | — | — | (0.11 | ) | — | |||||||||||||||||

| Net realized gains |

(0.57 | ) | (0.45 | ) | — | — | — | — | ||||||||||||||||

| Total distributions |

(0.57 | ) | (0.45 | ) | — | — | (0.11 | ) | — | |||||||||||||||

| Net asset value, end of period |

$14.31 | $12.62 | $15.92 | $13.89 | $12.51 | $12.63 | ||||||||||||||||||

| Total returnf |

18.06% | (18.87)% | 14.61% | 11.03% | (0.07)% | 45.51% | ||||||||||||||||||

| Ratios to average net assetsa,g | ||||||||||||||||||||||||

| Expenses before waiver and payments by affiliates |

1.78% | 1.78% | 1.66% | 1.67% | 1.63% | 1.80% | ||||||||||||||||||

| Expenses net of waiver and payments by affiliates |

1.24% | h | 1.21% | h | 1.21% | h | 1.24% | 1.24% | 1.20% | |||||||||||||||

| Net investment income (loss) |

(0.91)% | (0.26)% | (0.34)% | 0.56% | d | (0.32)% | 0.67% | e | ||||||||||||||||

| Supplemental data | ||||||||||||||||||||||||

| Net assets, end of period (000’s) |

$4,244 | $4,038 | $85 | $12,592 | $12,102 | $740 | ||||||||||||||||||

| Portfolio turnover ratei |

15.08% | 26.33% | 39.65% | 21.54% | 46.88% | 35.48% | ||||||||||||||||||

aThe per share amounts and ratios include income and expenses of the Portfolio.

bThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

cBased on average daily shares outstanding.

dNet investment income (loss) per share includes approximately $0.09 per share related to a corporate action in connection with certain Portfolio holdings. Excluding this amount, the ratio of net investment income to average net assets would have been (0.20)%.

eNet investment income per share includes approximately $0.02 per share related to income received in the form of special dividends in connection with certain Portfolio holdings. Excluding this amount, the ratio of net investment income to average net assets would have been 0.49%.

fTotal return is not annualized for periods less than one year.

gRatios are annualized for periods less than one year.

hBenefit of expense reduction rounds to less than 0.01%.

iIncludes the Portfolio’s rate of turnover.

| 12 | Semiannual Report | The accompanying notes are an integral part of these financial statements. | franklintempleton.com | ||

FRANKLIN TEMPLETON INTERNATIONAL TRUST

FINANCIAL HIGHLIGHTS

Franklin India Growth Fund (continued)

| Six Months Ended | ||||||||||||||||||||||||

| April 30, 2019 | Year Ended October 31, | |||||||||||||||||||||||

| (unaudited) | 2018 | 2017 | 2016 | 2015 | 2014 | |||||||||||||||||||

| Advisor Class | ||||||||||||||||||||||||

| Per share operating performancea | ||||||||||||||||||||||||

| (for a share outstanding throughout the period) |

||||||||||||||||||||||||

| Net asset value, beginning of period |

$12.50 | $15.90 | $13.83 | $12.48 | $12.60 | $8.68 | ||||||||||||||||||

| Income from investment operationsb: |

||||||||||||||||||||||||

| Net investment income (loss)c |

(0.07 | ) | (0.06 | ) | (0.08 | ) | 0.05 | d | (0.06 | ) | 0.05 | e | ||||||||||||

| Net realized and unrealized gains (losses) |

2.30 | (2.89 | ) | 2.15 | 1.30 | 0.04 | 3.87 | |||||||||||||||||

| Total from investment operations |

2.23 | (2.95 | ) | 2.07 | 1.35 | (0.02 | ) | 3.92 | ||||||||||||||||

| Less distributions from: |

||||||||||||||||||||||||

| Net investment income |

— | — | — | — | (0.10 | ) | — | |||||||||||||||||

| Net realized gains |

(0.57 | ) | (0.45 | ) | — | — | — | — | ||||||||||||||||

| Total distributions |

(0.57 | ) | (0.45 | ) | — | — | (0.10 | ) | — | |||||||||||||||

| Net asset value, end of period |

$14.16 | $12.50 | $15.90 | $13.83 | $12.48 | $12.60 | ||||||||||||||||||

| Total returnf |

17.99% | (19.02)% | 14.97% | 10.82% | (0.11)% | 45.16% | ||||||||||||||||||

| Ratios to average net assetsa,g | ||||||||||||||||||||||||

| Expenses before waiver and payments by affiliates |

1.96% | 1.81% | 1.90% | 1.89% | 1.79% | 1.95% | ||||||||||||||||||

| Expenses net of waiver and payments by affiliates |

1.40% | h | 1.37% | h | 1.40% | h | 1.40% | 1.40% | 1.35% | |||||||||||||||

| Net investment income (loss) |

(1.07)% | (0.42)% | (0.53)% | 0.40% | d | (0.48)% | 0.52% | e | ||||||||||||||||

| Supplemental data | ||||||||||||||||||||||||

| Net assets, end of period (000’s) |

$25,012 | $32,883 | $51,499 | $24,723 | $34,113 | $41,740 | ||||||||||||||||||

| Portfolio turnover ratei |

15.08% | 26.33% | 39.65% | 21.54% | 46.88% | 35.48% | ||||||||||||||||||

aThe per share amounts and ratios include income and expenses of the Portfolio.

bThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

cBased on average daily shares outstanding.

dNet investment income (loss) per share includes approximately $0.09 per share related to a corporate action in connection with certain Portfolio holdings. Excluding this amount, the ratio of net investment income to average net assets would have been (0.36)%.

eNet investment income per share includes approximately $0.02 per share related to income received in the form of special dividends in connection with certain Portfolio holdings. Excluding this amount, the ratio of net investment income to average net assets would have been 0.34%.

fTotal return is not annualized for periods less than one year.

gRatios are annualized for periods less than one year.

hBenefit of expense reduction rounds to less than 0.01%.

iIncludes the Portfolio’s rate of turnover.

| franklintempleton.com | The accompanying notes are an integral part of these financial statements. | Semiannual Report | 13 | ||||

FRANKLIN TEMPLETON INTERNATIONAL TRUST

Statement of Investments, April 30, 2019 (unaudited)

Franklin India Growth Fund

| Shares | Value | |||||||

| Common Stocks 5.4% |

||||||||

| Internet & Direct Marketing Retail 1.6% |

||||||||

| aMakeMyTrip Ltd. (India) |

66,800 | $ | 1,684,028 | |||||

|

|

|

|||||||

| IT Services 3.8% |

||||||||

| Cognizant Technology Solutions Corp., A (United States) |

53,500 | 3,903,360 | ||||||

|

|

|

|||||||

| Total Common Stocks (Cost $5,215,435) |

5,587,388 | |||||||

|

|

|

|||||||

| Management Investment Companies (Cost $46,896,813) 93.7% |

||||||||

| Diversified Financial Services 93.7% |

||||||||

| a,bFT (Mauritius) Offshore Investments Ltd. (India) |

5,773,463 | 96,506,017 | ||||||

|

|

|

|||||||

| Total Investments (Cost $52,112,248) 99.1% |

102,093,405 | |||||||

| Other Assets, less Liabilities 0.9% |

944,710 | |||||||

|

|

|

|||||||

| Net Assets 100.0% |

$ | 103,038,115 | ||||||

|

|

|

|||||||

a Non-income producing.

b The dollar value, number of shares or principal amount, and names of all Portfolio holdings are listed in the Portfolio’s SOI, beginning on page 25.

| 14 | Semiannual Report | The accompanying notes are an integral part of these financial statements. | franklintempleton.com | ||

FRANKLIN TEMPLETON INTERNATIONAL TRUST

Statement of Assets and Liabilities

April 30, 2019 (unaudited)

Franklin India Growth Fund

| Assets: |

| |||

| Investments in securities: |

| |||

| Cost - Unaffiliated issuers |

$ | 5,215,435 | ||

|

|

|

|||

| Value - Unaffiliated issuers |

$ | 5,587,388 | ||

| Investment in Portfolio (Note 1) |

96,506,017 | |||

| Cash |

359,290 | |||

| Receivables: |

||||

| Investment securities sold |

744,912 | |||

| Capital shares sold |

22,872 | |||

| Affiliates |

13,308 | |||

| Other assets |

99 | |||

|

|

|

|||

| Total assets |

103,233,886 | |||

|

|

|

|||

| Liabilities: |

| |||

| Payables: |

||||

| Capital shares redeemed |

96,713 | |||

| Distribution fees |

25,310 | |||

| Transfer agent fees |

19,490 | |||

| Trustees’ fees and expenses |

1,119 | |||

| Professional fees |

39,715 | |||

| Accrued expenses and other liabilities |

13,424 | |||

|

|

|

|||

| Total liabilities |

195,771 | |||

|

|

|

|||

| Net assets, at value |

$ | 103,038,115 | ||

|

|

|

|||

| Net assets consist of: |

| |||

| Paid-in capital |

$ | 78,248,515 | ||

| Total distributable earnings (loss) |

24,789,600 | |||

|

|

|

|||

| Net assets, at value |

$ | 103,038,115 | ||

|

|

|

|||

| Class A: |

| |||

| Net assets, at value |

$ | 58,007,323 | ||

|

|

|

|||

| Shares outstanding |

4,221,950 | |||

|

|

|

|||

| Net asset value per sharea |

$13.74 | |||

|

|

|

|||

| Maximum offering price per share (net asset value per share ÷ 94.50%) |

$14.54 | |||

|

|

|

|||

| Class C: |

| |||

| Net assets, at value |

$ | 15,775,123 | ||

|

|

|

|||

| Shares outstanding |

1,246,370 | |||

|

|

|

|||

| Net asset value and maximum offering price per sharea |

$12.66 | |||

|

|

|

|||

| Class R6: |

| |||

| Net assets, at value |

$ | 4,243,996 | ||

|

|

|

|||

| Shares outstanding |

296,557 | |||

|

|

|

|||

| Net asset value and maximum offering price per share |

$14.31 | |||

|

|

|

|||

| Advisor Class: |

| |||

| Net assets, at value |

$ | 25,011,673 | ||

|

|

|

|||

| Shares outstanding |

1,766,625 | |||

|

|

|

|||

| Net asset value and maximum offering price per share |

$14.16 | |||

|

|

|

|||

aRedemption price is equal to net asset value less contingent deferred sales charges, if applicable.

| franklintempleton.com | The accompanying notes are an integral part of these financial statements. | Semiannual Report | 15 | ||||

FRANKLIN TEMPLETON INTERNATIONAL TRUST

FINANCIAL STATEMENTS

Statement of Operations

for the six months ended April 30, 2019 (unaudited)

Franklin India Growth Fund

| Net investment income allocated from Portfolio: |

| |||

| Dividends:a |

||||

| Unaffiliated issuers |

$ | 180,590 | ||

| Expenses |

(604,658 | ) | ||

|

|

|

|||

| Net investment income allocated from Portfolio |

(424,068 | ) | ||

|

|

|

|||

| Expenses: |

| |||

| Management fees (Note 3a) |

206,145 | |||

| Distribution fees: (Note 3c) |

| |||

| Class A |

71,228 | |||

| Class C |

78,868 | |||

| Transfer agent fees: (Note 3e) |

| |||

| Class A |

57,797 | |||

| Class C |

15,993 | |||

| Class R6 |

418 | |||

| Advisor Class |

31,807 | |||

| Custodian fees (Note 4) |

3,351 | |||

| Reports to shareholders |

19,741 | |||

| Registration and filing fees |

47,346 | |||

| Professional fees |

58,884 | |||

| Trustees’ fees and expenses |

4,140 | |||

| Other |

6,806 | |||

|

|

|

|||

| Total expenses |

602,524 | |||

| Expense reductions (Note 4) |

(29 | ) | ||

| Expenses waived/paid by affiliates (Note 3f) |

(301,332 | ) | ||

|

|

|

|||

| Net expenses |

301,163 | |||

|

|

|

|||

| Net investment income (loss) |

(725,231 | ) | ||

|

|

|

|||

| Realized and unrealized gains (losses) on investments allocated from Portfolio: |

| |||

| Net realized gain (loss) from: |

||||

| Investments:b |

||||

| Unaffiliated issuers |

6,276,436 | |||

| Foreign currency transactions |

78,202 | |||

|

|

|

|||

| Net realized gain (loss) |

6,354,638 | |||

|

|

|

|||

| Net change in unrealized appreciation (depreciation) on: |

||||

| Investments:c |

||||

| Unaffiliated issuers |

12,613,521 | |||

| Translation of other assets and liabilities denominated in foreign currencies |

17,136 | |||

| Change in deferred taxes on unrealized appreciation |

(631,594 | ) | ||

|

|

|

|||

| Net change in unrealized appreciation (depreciation) |

11,999,063 | |||

|

|

|

|||

| Net realized and unrealized gain (loss) on investments allocated from Portfolio |

18,353,701 | |||

|

|

|

|||

| Net increase (decrease) in net assets resulting from operations |

$ | 17,628,470 | ||

|

|

|

|||

aIncludes $24,060 of dividend income from investments held directly by Franklin India Growth Fund.

bIncludes $(108,040) of net realized losses from investments held directly by Franklin India Growth Fund.

cIncludes $398,226 of change in unrealized appreciation on investments held directly by Franklin India Growth Fund.

| 16 | Semiannual Report | The accompanying notes are an integral part of these financial statements. | franklintempleton.com | ||

FRANKLIN TEMPLETON INTERNATIONAL TRUST

FINANCIAL STATEMENTS

Statements of Changes in Net Assets

Franklin India Growth Fund

| Six Months Ended April 30, 2019 (unaudited) |

Year Ended October 31, 2018 |

|||||||

| Increase (decrease) in net assets: |

||||||||

| Operations: |

||||||||

| Net investment income (loss) |

$ (725,231 | ) | $ (1,045,090 | ) | ||||

| Net realized gain (loss) |

6,354,638 | 6,613,342 | ||||||

| Net change in unrealized appreciation (depreciation) |

11,999,063 | (34,184,234 | ) | |||||

|

|

|

|||||||

| Net increase (decrease) in net assets resulting from operations |

17,628,470 | (28,615,982 | ) | |||||

|

|

|

|||||||

| Distributions to shareholders: |

||||||||

| Class A |

(2,548,402 | ) | (2,294,474 | ) | ||||

| Class C |

(742,437 | ) | (763,862 | ) | ||||

| Class R6 |

(173,995 | ) | (141,681 | ) | ||||

| Advisor Class |

(1,509,921 | ) | (1,337,030 | ) | ||||

|

|

|

|||||||

| Total distributions to shareholders |

(4,974,755 | ) | (4,537,047 | ) | ||||

|

|

|

|||||||

| Capital share transactions: (Note 2) |

||||||||

| Class A |

(4,155,487 | ) | (5,873,256 | ) | ||||

| Class C |

(1,529,928 | ) | (3,301,016 | ) | ||||

| Class R6 |

(319,177 | ) | 5,205,014 | |||||

| Advisor Class |

(11,299,109 | ) | (8,891,577 | ) | ||||

|

|

|

|||||||

| Total capital share transactions |

(17,303,701 | ) | (12,860,835 | ) | ||||

|

|

|

|||||||

| Net increase (decrease) in net assets |

(4,649,986 | ) | (46,013,864 | ) | ||||

| Net assets: |

||||||||

| Beginning of period |

107,688,101 | 153,701,965 | ||||||

|

|

|

|||||||

| End of period |

$103,038,115 | $107,688,101 | ||||||

|

|

|

|||||||

| franklintempleton.com | The accompanying notes are an integral part of these financial statements. | Semiannual Report | 17 | ||||

FRANKLIN TEMPLETON INTERNATIONAL TRUST

Notes to Financial Statements (unaudited)

Franklin India Growth Fund

| 18 | Semiannual Report | franklintempleton.com | ||

FRANKLIN TEMPLETON INTERNATIONAL TRUST

NOTES TO FINANCIAL STATEMENTS (UNAUDITED)

Franklin India Growth Fund (continued)

2. Shares of Beneficial Interest

At April 30, 2019, there were an unlimited number of shares authorized (without par value). Transactions in the Fund’s shares were as follows:

| Six Months Ended | Year Ended | |||||||||||||||

| April 30, 2019 | October 31, 2018 | |||||||||||||||

| Shares | Amount | Shares | Amount | |||||||||||||

| Class A Shares: | ||||||||||||||||

| Shares solda |

407,158 | $ | 5,302,997 | 1,509,935 | $ | 22,666,277 | ||||||||||

| Shares issued in reinvestment of distributions |

196,252 | 2,492,396 | 143,840 | 2,235,268 | ||||||||||||

| Shares redeemed |

(927,288 | ) | (11,950,880 | ) | (2,138,958 | ) | (30,774,801 | ) | ||||||||

| Net increase (decrease) |

(323,878 | ) | $ | (4,155,487 | ) | (485,183 | ) | $ | (5,873,256 | ) | ||||||

| franklintempleton.com | Semiannual Report | 19 | ||||

FRANKLIN TEMPLETON INTERNATIONAL TRUST

NOTES TO FINANCIAL STATEMENTS (UNAUDITED)

Franklin India Growth Fund (continued)

2. Shares of Beneficial Interest (continued)

| Six Months Ended | Year Ended | |||||||||||||||

| April 30, 2019 | October 31, 2018 | |||||||||||||||

| Shares | Amount | Shares | Amount | |||||||||||||

| Class C Shares: | ||||||||||||||||

| Shares sold |

48,311 | $ | 582,323 | 322,893 | $ | 4,572,041 | ||||||||||

| Shares issued in reinvestment of distributions |

61,040 | 716,005 | 49,122 | 712,764 | ||||||||||||

| Shares redeemeda |

(234,749 | ) | (2,828,256 | ) | (653,680 | ) | (8,585,821 | ) | ||||||||

| Net increase (decrease) |

(125,398 | ) | $ | (1,529,928 | ) | (281,665 | ) | $ | (3,301,016 | ) | ||||||

| Class R6 Shares: | ||||||||||||||||

| Shares sold |

26,210 | $ | 354,196 | 457,178 | $ | 7,334,773 | ||||||||||

| Shares issued in reinvestment of distributions |

13,165 | 173,907 | 8,816 | 141,681 | ||||||||||||

| Shares redeemed |

(62,753 | ) | (847,280 | ) | (151,417 | ) | (2,271,440 | ) | ||||||||

| Net increase (decrease) |

(23,378 | ) | $ | (319,177 | ) | 314,577 | $ | 5,205,014 | ||||||||

| Advisor Class Shares: | ||||||||||||||||

| Shares sold |

317,858 | $ | 4,244,415 | 1,166,114 | $ | 17,702,844 | ||||||||||

| Shares issued in reinvestment of distributions |

99,233 | 1,297,968 | 75,218 | 1,198,967 | ||||||||||||

| Shares redeemed |

(1,280,762 | ) | (16,841,492 | ) | (1,849,657 | ) | (27,793,388 | ) | ||||||||

| Net increase (decrease) |

(863,671 | ) | $ | (11,299,109 | ) | (608,325 | ) | $ | (8,891,577 | ) | ||||||

aMay include a portion of Class C shares that were automatically converted to Class A.

3. Transactions with Affiliates

Franklin Resources, Inc. is the holding company for various subsidiaries that together are referred to as Franklin Templeton. Certain officers and trustees of the Trust are also officers and/or directors of the Portfolio and of the following subsidiaries:

| Subsidiary | Affiliation | |

| Franklin Advisers, Inc. (Advisers) |

Investment manager | |

| Templeton Asset Management Ltd. (TAML) |

Investment manager | |

| Franklin Templeton Services, LLC (FT Services) |

Administrative manager | |

| Franklin Templeton Distributors, Inc. (Distributors) |

Principal underwriter | |

| Franklin Templeton Investor Services, LLC (Investor Services) |

Transfer agent | |

a. Management Fees

The Fund pays an investment management fee to Advisers (directly and/or indirectly through the Portfolio). The total management fee is paid based on the average daily net assets of the Fund as follows:

| Annualized Fee Rate | Net Assets | |

| 1.300% | Up to and including $1 billion | |

| 1.250% | Over $1 billion, up to and including $5 billion | |

| 1.200% | Over $5 billion, up to and including $10 billion | |

| 1.150% | Over $10 billion, up to and including $15 billion | |

| 1.100% | Over $15 billion, up to and including $20 billion | |

| 1.050% | In excess of $20 billion | |

Under a subadvisory agreement, TAML, an affiliate of Advisers, provides subadvisory services to the Fund. The subadvisory fee is paid by Advisers based on the Fund’s average daily net assets, and is not an additional expense of the Fund.

| 20 | Semiannual Report | franklintempleton.com | ||

FRANKLIN TEMPLETON INTERNATIONAL TRUST

NOTES TO FINANCIAL STATEMENTS (UNAUDITED)

Franklin India Growth Fund (continued)

b. Administrative Fees

Under an agreement with Advisers, FT Services provides administrative services to the Fund. The fee is paid by Advisers based on the Fund’s average daily net assets, and is not an additional expense of the Fund.

c. Distribution Fees

The Board has adopted distribution plans for each share class, with the exception of Class R6 and Advisor Class shares, pursuant to Rule 12b-1 under the 1940 Act. Under the Fund’s Class A reimbursement distribution plan, the Fund reimburses Distributors for costs incurred in connection with the servicing, sale and distribution of the Fund’s shares up to the maximum annual plan rate. Under the Class A reimbursement distribution plan, costs exceeding the maximum for the current plan year cannot be reimbursed in subsequent periods. In addition, under the Fund’s Class C compensation distribution plan, the Fund pays Distributors for costs incurred in connection with the servicing, sale and distribution of the Fund’s shares up to the maximum annual plan rate. The plan year, for purposes of monitoring compliance with the maximum annual plan rates, is February 1 through January 31.

The maximum annual plan rates, based on the average daily net assets, for each class, are as follows:

| Class A |

0.35 | % | ||

| Class C |

1.00 | % |

The Board has set the current rate at 0.25% per year for Class A shares until further notice and approval by the Board.

d. Sales Charges/Underwriting Agreements

Front-end sales charges and contingent deferred sales charges (CDSC) do not represent expenses of the Fund. These charges are deducted from the proceeds of sales of Fund shares prior to investment or from redemption proceeds prior to remittance, as applicable. Distributors has advised the Fund of the following commission transactions related to the sales and redemptions of the Fund’s shares for the period:

| Sales charges retained net of commissions paid to unaffiliated brokers/dealers |

$ | 5,880 | ||

| CDSC retained |

$ | (137 | ) |

e. Transfer Agent Fees

Each class of shares pays transfer agent fees to Investor Services for its performance of shareholder servicing obligations. The fees are based on an annualized asset based fee of 0.02% plus a transaction based fee. In addition, each class reimburses Investor Services for out of pocket expenses incurred and, except for Class R6, reimburses shareholder servicing fees paid to third parties. These fees are allocated daily based upon their relative proportion of such classes’ aggregate net assets. Class R6 pays Investor Services transfer agent fees specific to that class.

For the period ended April 30, 2019, the Fund paid transfer agent fees of $106,015, of which $51,426 was retained by Investor Services.

f. Waiver and Expense Reimbursements

Advisers and Investor Services have contractually agreed in advance to waive or limit their respective fees and to assume as their own expense certain expenses otherwise payable by the Fund so that the expenses (excluding distribution fees and certain non-routine expenses or costs, including those relating to litigation, indemnification, reorganizations, and liquidations) for Class A, Class C and Advisor Class of the Fund do not exceed 1.40%, and for Class R6 do not exceed 1.25%, based on the average net assets of each class until February 29, 2020. Total expenses waived or paid are not subject to recapture subsequent to the Fund’s fiscal year end.

| franklintempleton.com | Semiannual Report | 21 | ||||

FRANKLIN TEMPLETON INTERNATIONAL TRUST

NOTES TO FINANCIAL STATEMENTS (UNAUDITED)

Franklin India Growth Fund (continued)

3. Transactions with Affiliates (continued)

f. Waiver and Expense Reimbursements (continued)

Prior to March 1, 2019, expenses (excluding certain fees and expenses as previously disclosed) for Class R6 were limited to 1.23% based on the average net assets of the class.

4. Expense Offset Arrangement

The Fund has entered into an arrangement with its custodian whereby credits realized as a result of uninvested cash balances are used to reduce a portion of the Fund’s custodian expenses. During the period ended April 30, 2019, the custodian fees were reduced as noted in the Statement of Operations.

5. Income Taxes

For tax purposes, the Fund may elect to defer any portion of a post-October capital loss or late-year ordinary loss to the first day of the following fiscal year. At October 31, 2018, the Fund deferred late-year ordinary losses of $705,806.

At April 30, 2019, the cost of investments and net unrealized appreciation (depreciation) for income tax purposes were as follows:

| Cost of investments |

$ | 81,507,595 | ||

|

|

|

| ||

| Unrealized appreciation |

$ | 32,570,557 | ||

| Unrealized depreciation |

(11,838,312 | ) | ||

|

|

|

| ||

| Net unrealized appreciation (depreciation) |

$ | 20,732,245 | ||

|

|

|

| ||

The Portfolio is a disregarded entity for United States federal income tax purposes.

Differences between income and/or capital gains as determined on a book basis and a tax basis are primarily due to differing treatment of passive foreign investment company shares.

6. Investment Transactions

Purchases and sales of investments including transactions from the Portfolio (excluding short term securities) for the period ended April 30, 2019, aggregated $16,160,995 and $38,217,429, respectively.

7. Concentration of Risk

Investing in Indian equity securities through the Portfolio may include certain risks and considerations not typically associated with investing in U.S. securities, such as fluctuating currency values, less liquidity, expropriation, confiscatory taxation, nationalization, exchange control regulations (including currency blockage), differing legal standards and changing local and regional economic, political and social conditions, which may result in greater market volatility.

8. Upcoming Liquidation

On May 21, 2019, the Board for the Fund approved a proposal to liquidate the Fund. Effective at close of market on June 24, 2019, the Fund closed to all new investors, with limited exceptions. The Fund is scheduled to liquidate on or about September 13, 2019.

| 22 | Semiannual Report | franklintempleton.com | ||

FRANKLIN TEMPLETON INTERNATIONAL TRUST

NOTES TO FINANCIAL STATEMENTS (UNAUDITED)

Franklin India Growth Fund (continued)

9. Credit Facility

The Fund, together with other U.S. registered and foreign investment funds (collectively, Borrowers), managed by Franklin Templeton, are borrowers in a joint syndicated senior unsecured credit facility totaling $2 billion (Global Credit Facility) which matures on February 7, 2020. This Global Credit Facility provides a source of funds to the Borrowers for temporary and emergency purposes, including the ability to meet future unanticipated or unusually large redemption requests.

Under the terms of the Global Credit Facility, the Fund shall, in addition to interest charged on any borrowings made by the Fund and other costs incurred by the Fund, pay its share of fees and expenses incurred in connection with the implementation and maintenance of the Global Credit Facility, based upon its relative share of the aggregate net assets of all of the Borrowers, including an annual commitment fee of 0.15% based upon the unused portion of the Global Credit Facility. These fees are reflected in other expenses in the Statement of Operations. During the period ended April 30, 2019, the Fund did not use the Global Credit Facility.

10. Fair Value Measurements

The Fund follows a fair value hierarchy that distinguishes between market data obtained from independent sources (observable inputs) and the Fund’s own market assumptions (unobservable inputs). These inputs are used in determining the value of the Fund’s financial instruments and are summarized in the following fair value hierarchy:

| • | Level 1 – quoted prices in active markets for identical financial instruments |

| • | Level 2 – other significant observable inputs (including quoted prices for similar financial instruments, interest rates, prepayment speed, credit risk, etc.) |

| • | Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of financial instruments) |

The input levels are not necessarily an indication of the risk or liquidity associated with financial instruments at that level.

At April 30, 2019, all of the Fund’s investments in financial instruments carried at fair value were valued using Level 1 inputs. For detailed categories, see the accompanying Statement of Investments.

11. Subsequent Events

The Fund has evaluated subsequent events through the issuance of the financial statements and determined that no events have occurred that require disclosure, other than those already disclosed in the financial statements.

| franklintempleton.com | Semiannual Report | 23 | ||||

FT (MAURITIUS) OFFSHORE INVESTMENTS LIMITED

Financial Highlights

(Expressed in U.S. Dollars)

| Six Months Ended | ||||||||||||||||||||||||

| April 30, 2019 | Year Ended October 31, | |||||||||||||||||||||||

| (unaudited) | 2018 | 2017 | 2016 | 2015 | 2014 | |||||||||||||||||||

| Per share operating performance | ||||||||||||||||||||||||

| (for a share outstanding throughout the period) |

||||||||||||||||||||||||

| Net asset value, beginning of period |

$14.01 | $17.36 | $15.06 | $13.43 | $13.49 | $ 9.19 | ||||||||||||||||||

| Income from investment operationsa: |

||||||||||||||||||||||||

| Net investment income (loss)b |

(0.07 | ) | (0.03 | ) | (0.04 | ) | 0.10 | c | (0.02 | ) | 0.09 | d | ||||||||||||

| Net realized and unrealized gains (losses) |

2.78 | (3.32 | ) | 2.34 | 1.53 | (0.04 | ) | 4.21 | ||||||||||||||||

| Total from investment operations |

2.71 | (3.35 | ) | 2.30 | 1.63 | (0.06 | ) | 4.30 | ||||||||||||||||

| Net asset value, end of period |

$16.72 | $14.01 | $17.36 | $15.06 | $13.43 | $13.49 | ||||||||||||||||||

| Total returne |

19.34% | (19.30)% | 15.27% | 12.14% | (0.44)% | 46.79% | ||||||||||||||||||

| Ratios to average net assetsf | ||||||||||||||||||||||||

| Expenses |

1.19% | 1.14% | 1.14% | 1.14% | 1.10% | 1.12% | ||||||||||||||||||

| Net investment income (loss) |

(0.88)% | (0.16)% | (0.25)% | 0.71% | c | (0.16)% | 0.80% | d | ||||||||||||||||

| Supplemental data | ||||||||||||||||||||||||

| Net assets, end of period (000’s) |

$96,506 | $99,388 | $148,914 | $113,405 | $126,895 | $105,258 | ||||||||||||||||||

| Portfolio turnover rate |

15.97% | 24.57% | 40.10% | 21.54% | 46.88% | 35.48% | ||||||||||||||||||

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Portfolio’s shares in relation to income earned and/or fluctuating fair value of the investments of the Portfolio.

bBased on average daily shares outstanding.

cNet investment income per share includes approximately $0.10 per share related to a corporate action in connection with certain Portfolio holdings. Excluding this amount, the ratio of net investment income to average net assets would have been (0.07)%.

dNet investment income per share includes approximately $0.02 per share related to income received in the form of special dividends in connection with certain Portfolio holdings. Excluding this amount, the ratio of net investment income to average net assets would have been 0.62%.

eTotal return is not annualized for periods less than one year.

fRatios are annualized for periods less than one year.

| 24 | Semiannual Report | The accompanying notes are an integral part of these financial statements. | franklintempleton.com | ||

FT (MAURITIUS) OFFSHORE INVESTMENTS LIMITED

Statement of Investments, April 30, 2019 (unaudited)

(Expressed in U.S. Dollars)

| Shares/ Rights |

Value | |||||||

| Common Stocks and Other Equity Interests 100.2% |

| |||||||

| India 100.2% |

||||||||

| Auto Components 1.1% |

||||||||

| Bharat Forge Ltd. |

156,653 | $ | 1,062,205 | |||||

|

|

|

|||||||

| Automobiles 7.0% |

||||||||

| Eicher Motors Ltd. |

6,015 | 1,759,090 | ||||||

| Mahindra & Mahindra Ltd. |

102,629 | 950,888 | ||||||

| aTata Motors Ltd. |

1,035,777 | 3,187,029 | ||||||

| aTata Motors Ltd., A |

609,129 | 894,710 | ||||||

|

|

|

|||||||

| 6,791,717 | ||||||||

|

|

|

|||||||

| Banks 21.6% |

||||||||

| aAxis Bank Ltd. |

357,250 | 3,933,510 | ||||||

| HDFC Bank Ltd. |

217,770 | 7,246,128 | ||||||

| ICICI Bank Ltd. |

398,335 | 2,330,632 | ||||||

| Kotak Mahindra Bank Ltd. |

369,825 | 7,362,569 | ||||||

|

|

|

|||||||

| 20,872,839 | ||||||||

|

|

|

|||||||

| Beverages 2.0% |

||||||||

| aUnited Spirits Ltd. |

245,065 | 1,974,327 | ||||||

|

|

|

|||||||

| Building Products 1.5% |

||||||||

| Kajaria Ceramics Ltd. |

171,993 | 1,469,474 | ||||||

|

|

|

|||||||

| Capital Markets 3.1% |

||||||||

| Crisil Ltd. |

50,000 | 1,029,154 | ||||||

| Motilal Oswal Financial Services Ltd. |

191,821 | 1,958,917 | ||||||

|

|

|

|||||||

| 2,988,071 | ||||||||

|

|

|

|||||||

| Chemicals 2.5% |

||||||||

| Asian Paints Ltd. |

112,505 | 2,363,514 | ||||||

|

|

|

|||||||

| Construction & Engineering 3.9% |

||||||||

| Larsen & Toubro Ltd. |

145,926 | 2,825,513 | ||||||

| Voltas Ltd. |

108,946 | 942,779 | ||||||

|

|

|

|||||||

| 3,768,292 | ||||||||

|

|

|

|||||||

| Construction Materials 8.5% |

||||||||

| Grasim Industries Ltd. |

95,447 | 1,235,040 | ||||||

| Shree Cement Ltd. |

9,217 | 2,618,919 | ||||||

| UltraTech Cement Ltd. |

65,979 | 4,373,653 | ||||||

|

|

|

|||||||

| 8,227,612 | ||||||||

|

|

|

|||||||

| Consumer Finance 1.4% |

||||||||

| Repco Home Finance Ltd. |

220,866 | 1,323,667 | ||||||

|

|

|

|||||||

| Electrical Equipment 1.0% |

||||||||

| Havell’s India Ltd. |

87,869 | 977,325 | ||||||

|

|

|

|||||||

| Entertainment 1.1% |

||||||||

| PVR Ltd. |

41,382 | 1,051,350 | ||||||

|

|

|

|||||||

| Food Products 0.5% |

||||||||

| aTata Global Beverages Ltd. |

170,873 | 513,254 | ||||||

|

|

|

|||||||

| Health Care Providers & Services 0.5% |

||||||||

| a,bNarayana Hrudayalaya Ltd., Reg S |

160,287 | 465,807 | ||||||

|

|

|

|||||||

| Hotels, Restaurants & Leisure 1.8% |

||||||||

| Indian Hotels Co. Ltd. |

782,708 | 1,734,619 | ||||||

|

|

|

|||||||

| franklintempleton.com | Semiannual Report | 25 | ||||

FT (MAURITIUS) OFFSHORE INVESTMENTS LIMITED

STATEMENT OF INVESTMENTS (UNAUDITED)

(Expressed in U.S. Dollars)

| Shares/ Rights |

Value | |||||||

| Common Stocks and Other Equity Interests (continued) |

| |||||||

| India (continued) |

||||||||

| Household Durables 2.7% |

||||||||

| Crompton Greaves Consumer Electricals Ltd. |

756,570 | $ | 2,581,574 | |||||

|

|

|

|||||||

| Household Products 3.8% |

||||||||

| Hindustan Unilever Ltd. |

146,037 | 3,685,575 | ||||||

|

|

|

|||||||

| Insurance 2.4% |

||||||||

| bICICI Lombard General Insurance Co. Ltd., Reg S |

65,956 | 1,035,407 | ||||||

| bICICI Prudential Life Insurance Co. Ltd., Reg S |

239,727 | 1,271,141 | ||||||

|

|

|

|||||||

| 2,306,548 | ||||||||

|

|

|

|||||||

| IT Services 7.5% |

||||||||

| eClerx Services Ltd. |

32,052 | 527,258 | ||||||

| HCL Technologies Ltd. |

32,752 | 556,479 | ||||||

| Infosys Ltd. |

467,587 | 5,044,316 | ||||||

| Tata Consultancy Services Ltd. |

34,636 | 1,124,090 | ||||||

|

|

|

|||||||

| 7,252,143 | ||||||||

|

|

|

|||||||

| Machinery 1.9% |

||||||||

| Cummins India Ltd. |

171,029 | 1,784,402 | ||||||

| SKF India Ltd. |

1,607 | 45,568 | ||||||

|

|

|

|||||||

| 1,829,970 | ||||||||

|

|

|

|||||||

| Metals & Mining 4.7% |

||||||||

| Hindalco Industries Ltd. |

725,694 | 2,146,959 | ||||||

| Tata Steel Ltd. |

295,250 | 2,362,102 | ||||||

| Tata Steel Ltd., partly paid shares |

11,311 | 13,187 | ||||||

|

|

|

|||||||

| 4,522,248 | ||||||||

|

|

|

|||||||

| Multiline Retail 2.0% |

||||||||

| Trent Ltd. |

375,536 | 1,917,931 | ||||||

|

|

|

|||||||

| Personal Products 2.3% |

||||||||

| Godrej Consumer Products Ltd. |

239,246 | 2,239,013 | ||||||

|

|

|

|||||||

| Pharmaceuticals 0.6% |

||||||||

| Dr Reddy’s Laboratories Ltd. |

12,666 | 533,532 | ||||||

|

|

|

|||||||

| Professional Services 1.6% |

||||||||

| aTeamLease Services Ltd. |

36,399 | 1,551,166 | ||||||

|

|

|

|||||||

| Real Estate Management & Development 1.9% |

||||||||

| Oberoi Realty Ltd. |

256,546 | 1,868,649 | ||||||

|

|

|

|||||||

| Textiles, Apparel & Luxury Goods 1.1% |

||||||||

| Titan Co. Ltd. |

61,569 | 1,024,176 | ||||||

|

|

|

|||||||

| Thrifts & Mortgage Finance 3.3% |

||||||||

| Housing Development Finance Corp. Ltd. |

109,612 | 3,139,854 | ||||||

|

|

|

|||||||

| 26 | Semiannual Report | franklintempleton.com | ||

FT (MAURITIUS) OFFSHORE INVESTMENTS LIMITED

STATEMENT OF INVESTMENTS (UNAUDITED)

(Expressed in U.S. Dollars)

| Shares/ Rights |

Value | |||||||

| Common Stocks and Other Equity Interests (continued) |

| |||||||

| India (continued) |

||||||||

| Wireless Telecommunication Services 6.9% |

||||||||

| Bharti Airtel Ltd. |

927,683 | $ | 4,266,327 | |||||

| aBharti Airtel Ltd., rts., 5/17/19 |

263,074 | 378,858 | ||||||

| aVodafone Idea Ltd. |

8,884,229 | 1,970,815 | ||||||

|

|

|

|||||||

| 6,616,000 | ||||||||

|

|

|

|||||||

| Total Common Stocks and Other Equity Interests (Cost $75,960,238) |

96,652,452 | |||||||

| Other Assets, less Liabilities (0.2)% |

|

(146,435 | ) | |||||

|

|

|

|||||||

| Net Assets 100.0% |

|

$ | 96,506,017 | |||||

|

|

|

|||||||

aNon-income producing.

bSecurity was purchased pursuant to Regulation S under the Securities Act of 1933, which exempts from registration securities offered and sold outside of the United States. Such a security cannot be sold in the United States without either an effective registration statement filed pursuant to the Securities Act of 1933, or pursuant to an exemption from registration. These securities have been deemed liquid under guidelines approved by the Portfolio’s Board of Trustees. At April 30, 2019, the aggregate value of these securities was $2,772,355, representing 2.9% of net assets.

| franklintempleton.com | The accompanying notes are an integral part of these financial statements. | Semiannual Report | 27 | ||||

FT (MAURITIUS) OFFSHORE INVESTMENTS LIMITED

Financial Statements

(Expressed in U.S. Dollars)

Statement of Assets and Liabilities

April 30, 2019 (unaudited)

| Assets: |

| ||||

| Investments in securities: |

| ||||

| Cost - Unaffiliated issuers |

$75,960,238 | ||||

|

|

|

||||

| Value - Unaffiliated issuers |

$96,652,452 | ||||

| Cash |

182,810 | ||||

| Foreign currency, at value (cost $2,398,753) |

2,404,625 | ||||

| Receivables: |

| ||||

| Investment securities sold |

111,693 | ||||

|

|

|

||||

| Total assets |

99,351,580 | ||||

|

|

|

||||

| Liabilities: |

| ||||

| Payables: |

|||||

| Investment securities purchased |

1,119,123 | ||||

| Capital shares redeemed |

744,912 | ||||

| Management fees |

78,458 | ||||

| Administrative fees |

6,083 | ||||

| Directors’ fees and expenses |

4,959 | ||||

| Deferred tax |

856,793 | ||||

| Accrued expenses and other liabilities |

35,235 | ||||

|

|

|

||||

| Total liabilities |

2,845,563 | ||||

|

|

|

||||

| Net assets, at value |

$96,506,017 | ||||

|

|

|

||||

| Shares outstanding |

5,773,463 | ||||

|

|

|

||||

| Net asset value per share |

$16.72 | ||||

|

|

|

||||

| 28 | Semiannual Report | The accompanying notes are an integral part of these financial statements. | franklintempleton.com | ||

FT (MAURITIUS) OFFSHORE INVESTMENTS LIMITED

FINANCIAL STATEMENTS

(Expressed in U.S. Dollars)

Statement of Operations

for the six months ended April 30, 2019 (unaudited)

| Investment income: |

| |||

| Dividends: |

||||

| Unaffiliated issuers |

$ | 156,530 | ||

|

|

|

|||

| Expenses: |

| |||

| Management fees (Note 3a) |

499,089 | |||

| Administrative fees (Note 3b) |

18,623 | |||

| Custodian fees |

47,497 | |||

| Reports to shareholders |

1,620 | |||

| Registration and filing fees |

266 | |||

| Professional fees. |

18,654 | |||

| Directors’ fees and expenses |

4,959 | |||

| Other |

13,950 | |||

|

|

|

|||

| Total expenses |

604,658 | |||

|

|

|

|||

| Net investment income (loss) |

(448,128 | ) | ||

|

|

|

|||

| Realized and unrealized gains (losses): |

| |||

| Net realized gain (loss) from: |

||||

| Investments: |

||||

| Unaffiliated issuers |

6,384,476 | |||

| Foreign currency transactions |

78,202 | |||

|

|

|

|||

| Net realized gain (loss) |

6,462,678 | |||

|

|

|

|||

| Net change in unrealized appreciation (depreciation) on: |

||||

| Investments: |

||||

| Unaffiliated issuers |

12,215,295 | |||

| Translation of other assets and liabilities denominated in foreign currencies |

17,136 | |||

| Change in deferred taxes on unrealized appreciation |

(631,594 | ) | ||

|

|

|

|||

| Net change in unrealized appreciation (depreciation) |

11,600,837 | |||

|

|

|

|||

| Net realized and unrealized gain (loss) |

18,063,515 | |||

|

|

|

|||

| Net increase (decrease) in net assets resulting from operations |

$ | 17,615,387 | ||

|

|

|

|||

| franklintempleton.com | The accompanying notes are an integral part of these financial statements. | Semiannual Report | 29 | ||||

FT (MAURITIUS) OFFSHORE INVESTMENTS LIMITED

FINANCIAL STATEMENTS

(Expressed in U.S. Dollars)

Statements of Changes in Net Assets

| Six Months Ended April 30, 2019 (unaudited) |

Year Ended October 31, 2018 |

|||||||

| Increase (decrease) in net assets: |

||||||||

| Operations: |

||||||||

| Net investment income (loss) |

$ | (448,128 | ) | $ | (232,146) | |||

| Net realized gain (loss) |

6,462,678 | 6,753,447 | ||||||

| Net change in unrealized appreciation (depreciation) |

11,600,837 | (33,396,457) | ||||||

|

|

|

|||||||

| Net increase (decrease) in net assets resulting from operations |

17,615,387 | (26,875,156) | ||||||

|

|

|

|||||||

| Capital share transactions (Note 2) |

(20,497,355 | ) | (22,650,449) | |||||

|

|

|

|||||||

| Net increase (decrease) in net assets |

(2,881,968 | ) | (49,525,605) | |||||

| Net assets: |

||||||||

| Beginning of period |

99,387,985 | 148,913,590 | ||||||

|

|

|

|||||||

| End of period |

$ | 96,506,017 | $ | 99,387,985 | ||||

|

|

|

|||||||

| 30 | Semiannual Report | The accompanying notes are an integral part of these financial statements. | franklintempleton.com | ||

FT (MAURITIUS) OFFSHORE INVESTMENTS LIMITED

Notes to Financial Statements (unaudited)

(Expressed in U.S. Dollars)

| franklintempleton.com | Semiannual Report | 31 | ||||

FT (MAURITIUS) OFFSHORE INVESTMENTS LIMITED

NOTES TO FINANCIAL STATEMENTS (UNAUDITED)

(Expressed in U.S. Dollars)

| 32 | Semiannual Report | franklintempleton.com | ||

FT (MAURITIUS) OFFSHORE INVESTMENTS LIMITED

NOTES TO FINANCIAL STATEMENTS (UNAUDITED)

(Expressed in U.S. Dollars)

2. Shares of Beneficial Interest

At April 30, 2019, there were an unlimited number of shares authorized (without par value). Transactions in the Portfolio’s shares were as follows:

| Six Months Ended April 30, 2019 |

Year Ended October 31, 2018 |

|||||||||||||||

| Shares | Amount | Shares | Amount | |||||||||||||

| Shares sold |

344,277 | $ | 5,176,756 | 1,112,629 | $ | 19,573,775 | ||||||||||

| Shares redeemed |

(1,667,210 | ) | (25,674,111 | ) | (2,596,225 | ) | (42,224,224 | ) | ||||||||

|

|

|

|||||||||||||||

| Net increase (decrease) |

(1,322,933 | ) | $ | (20,497,355 | ) | (1,483,596 | ) | $ | (22,650,449 | ) | ||||||

|

|

|

|||||||||||||||

3. Transactions with Affiliates

Franklin Resources, Inc. is the holding company of Franklin Advisers, Inc. (Advisers) which is the investment manager of the Portfolio.

a. Management Fees

The Portfolio pays an investment management fee to Advisers (directly and/or indirectly through the Fund). The total management fee is paid based on the average daily net assets of the Fund as follows:

| Annualized Fee Rate | Net Assets | |

| 1.300% |

Up to and including $1 billion | |

| 1.250% |

Over $1 billion, up to and including $5 billion | |

| 1.200% |

Over $5 billion, up to and including $10 billion | |

| 1.150% |

Over $10 billion, up to and including $15 billion | |

| 1.100% |

Over $15 billion, up to and including $20 billion | |

| 1.050% |

In excess of $20 billion | |

| franklintempleton.com | Semiannual Report | 33 | ||||

FT (MAURITIUS) OFFSHORE INVESTMENTS LIMITED

NOTES TO FINANCIAL STATEMENTS (UNAUDITED)

(Expressed in U.S. Dollars)

3. Transactions with Affiliates (continued)

b. Administrative Fees

The Portfolio pays an administrative fee to SANNE Mauritius, a Mauritius company, an annual fee of $30,000 plus reimbursement of certain expenses. Certain directors of the Portfolio are also officers and/or directors of SANNE Mauritius.

4. Investment Transactions

Purchases and sales of investments (excluding short term securities) for the period ended April 30, 2019, aggregated $16,160,995 and $37,247,457, respectively.

5. Concentration of Risk

Investing in Indian equity securities may include certain risks and considerations not typically associated with investing in U.S. securities, such as fluctuating currency values, less liquidity, expropriation, confiscatory taxation, nationalization, exchange control regulations (including currency blockage), differing legal standards and changing local and regional economic, political and social conditions, which may result in greater market volatility.

6. Fair Value Measurements

The Portfolio follows a fair value hierarchy that distinguishes between market data obtained from independent sources (observable inputs) and the Portfolio’s own market assumptions (unobservable inputs). These inputs are used in determining the value of the Portfolio’s financial instruments and are summarized in the following fair value hierarchy:

| • | Level 1 – quoted prices in active markets for identical financial instruments |

| • | Level 2 – other significant observable inputs (including quoted prices for similar financial instruments, interest rates, prepayment speed, credit risk, etc.) |

| • | Level 3 – significant unobservable inputs (including the Portfolio’s own assumptions in determining the fair value of financial instruments) |

The input levels are not necessarily an indication of the risk or liquidity associated with financial instruments at that level.

A summary of inputs used as of April 30, 2019, in valuing the Portfolio’s assets carried at fair value, is as follows:

| Level 1 | Level 2 | Level 3 | Total | |||||||||||||

| Assets: |

||||||||||||||||

| Investments in Securities:a |

||||||||||||||||

| Equity Investments:b |

||||||||||||||||

| Wireless Telecommunication Services |

$ | 6,237,142 | $ | 378,858 | $ | — | $ | 6,616,000 | ||||||||

| All Other Equity Investments |

90,036,452 | — | — | 90,036,452 | ||||||||||||

|

|

|

|||||||||||||||

| Total Investments in Securities |

$ | 96,273,594 | $ | 378,858 | $ | — | $ | 96,652,452 | ||||||||

|

|

|

|||||||||||||||

aFor detailed categories, see the accompanying Statement of Investments.

bIncludes common stocks as well as other equity interests.

| 34 | Semiannual Report | franklintempleton.com | ||

FT (MAURITIUS) OFFSHORE INVESTMENTS LIMITED

NOTES TO FINANCIAL STATEMENTS (UNAUDITED)

(Expressed in U.S. Dollars)

7. Subsequent Events

The Portfolio has evaluated subsequent events through the issuance of the financial statements and determined that no events have occurred that require disclosure, other than those already disclosed in the financial statements.

| franklintempleton.com | Semiannual Report | 35 | ||||

FRANKLIN TEMPLETON INTERNATIONAL TRUST

FRANKLIN INDIA GROWTH FUND

| 36 | Semiannual Report | franklintempleton.com | ||

FRANKLIN TEMPLETON INTERNATIONAL TRUST

FRANKLIN INDIA GROWTH FUND

SHAREHOLDER INFORMATION

| franklintempleton.com | Semiannual Report | 37 | ||||

FRANKLIN TEMPLETON INTERNATIONAL TRUST

FRANKLIN INDIA GROWTH FUND

SHAREHOLDER INFORMATION

| 38 | Semiannual Report | franklintempleton.com | ||

This page intentionally left blank.

This page intentionally left blank.

Authorized for distribution only when accompanied or preceded by a summary prospectus and/or prospectus. Investors should carefully consider a fund’s investment goals, risks, charges and expenses before investing. A prospectus contains this and other information; please read it carefully before investing.

To help ensure we provide you with quality service, all calls to and from our service areas are monitored and/or recorded.

| © 2019 Franklin Templeton Investments. All rights reserved. |

141 S 06/19 |

| Item 2. | Code of Ethics. |

(a) The Registrant has adopted a code of ethics that applies to its principal executive officers and principal financial and accounting officer.

(c) N/A

(d) N/A

(f) Pursuant to Item 13 (a) (1), the Registrant is attaching as an exhibit a copy of its code of ethics that applies to its principal executive officers and principal financial and accounting officer.

| Item 3. | Audit Committee Financial Expert. |

(a) (1) The Registrant has an audit committee financial expert serving on its audit committee.

(2) The audit committee financial expert is Mary C. Choksi and he is “independent” as defined under the relevant Securities and Exchange Commission Rules and Releases.

| Item 4. | Principal Accountant Fees and Services. N/A |

| Item 5. | Audit Committee of Listed Registrants. N/A |

| Item 6. | Schedule of Investments. N/A |

| Item 7. | Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies. N/A |

| Item 8. | Portfolio Managers of Closed-End Management Investment Companies. N/A |

| Item 9. | Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers. N/A |

| Item 10. | Submission of Matters to a Vote of Security Holders. |

There have been no changes to the procedures by which shareholders may recommend nominees to the Registrant’s Board of Trustees that would require disclosure herein.

| Item 11. | Controls and Procedures. |

(a) Evaluation of Disclosure Controls and Procedures. The Registrant maintains disclosure controls and procedures that are designed to