0000876437DEF 14AFALSE00008764372022-01-012022-12-31iso4217:USD00008764372021-01-012021-12-3100008764372020-01-012020-12-31iso4217:USDxbrli:sharesxbrli:pure000087643712022-01-012022-12-310000876437ecd:PeoMembermtg:EquityAwardAdjustmentsMember2022-01-012022-12-310000876437mtg:PensionBenefitsAdjustmentsMemberecd:PeoMember2022-01-012022-12-310000876437ecd:PeoMembermtg:EquityAwardAdjustmentsMember2021-01-012021-12-310000876437mtg:PensionBenefitsAdjustmentsMemberecd:PeoMember2021-01-012021-12-310000876437ecd:PeoMembermtg:EquityAwardAdjustmentsMember2020-01-012020-12-310000876437mtg:PensionBenefitsAdjustmentsMemberecd:PeoMember2020-01-012020-12-310000876437mtg:EquityAwardAdjustmentsMemberecd:NonPeoNeoMember2022-01-012022-12-310000876437mtg:PensionBenefitsAdjustmentsMemberecd:NonPeoNeoMember2022-01-012022-12-310000876437mtg:EquityAwardAdjustmentsMemberecd:NonPeoNeoMember2021-01-012021-12-310000876437mtg:PensionBenefitsAdjustmentsMemberecd:NonPeoNeoMember2021-01-012021-12-310000876437mtg:EquityAwardAdjustmentsMemberecd:NonPeoNeoMember2020-01-012020-12-310000876437mtg:PensionBenefitsAdjustmentsMemberecd:NonPeoNeoMember2020-01-012020-12-310000876437mtg:EquityAwardsGrantedDuringTheYearMemberecd:PeoMember2022-01-012022-12-310000876437mtg:EquityAwardsGrantedDuringTheYearMemberecd:PeoMember2021-01-012021-12-310000876437mtg:EquityAwardsGrantedDuringTheYearMemberecd:PeoMember2020-01-012020-12-310000876437mtg:EquityAwardsGrantedDuringTheYearMemberecd:NonNeosMember2022-01-012022-12-310000876437mtg:EquityAwardsGrantedDuringTheYearMemberecd:NonNeosMember2021-01-012021-12-310000876437mtg:EquityAwardsGrantedDuringTheYearMemberecd:NonNeosMember2020-01-012020-12-310000876437ecd:PeoMembermtg:EquityAwardsReportedValueMember2022-01-012022-12-310000876437ecd:PeoMembermtg:EquityAwardsReportedValueMember2021-01-012021-12-310000876437ecd:PeoMembermtg:EquityAwardsReportedValueMember2020-01-012020-12-310000876437ecd:NonNeosMembermtg:EquityAwardsReportedValueMember2022-01-012022-12-310000876437ecd:NonNeosMembermtg:EquityAwardsReportedValueMember2021-01-012021-12-310000876437ecd:NonNeosMembermtg:EquityAwardsReportedValueMember2020-01-012020-12-310000876437mtg:EquityAwardsGrantedInPriorYearsVestedMemberecd:PeoMember2022-01-012022-12-310000876437mtg:EquityAwardsGrantedInPriorYearsVestedMemberecd:PeoMember2021-01-012021-12-310000876437mtg:EquityAwardsGrantedInPriorYearsVestedMemberecd:PeoMember2020-01-012020-12-310000876437mtg:EquityAwardsGrantedInPriorYearsVestedMemberecd:NonNeosMember2022-01-012022-12-310000876437mtg:EquityAwardsGrantedInPriorYearsVestedMemberecd:NonNeosMember2021-01-012021-12-310000876437mtg:EquityAwardsGrantedInPriorYearsVestedMemberecd:NonNeosMember2020-01-012020-12-310000876437ecd:PeoMembermtg:EquityAwardsGrantedInPriorYearsUnvestedMember2022-01-012022-12-310000876437ecd:PeoMembermtg:EquityAwardsGrantedInPriorYearsUnvestedMember2021-01-012021-12-310000876437ecd:PeoMembermtg:EquityAwardsGrantedInPriorYearsUnvestedMember2020-01-012020-12-310000876437ecd:NonNeosMembermtg:EquityAwardsGrantedInPriorYearsUnvestedMember2022-01-012022-12-310000876437ecd:NonNeosMembermtg:EquityAwardsGrantedInPriorYearsUnvestedMember2021-01-012021-12-310000876437ecd:NonNeosMembermtg:EquityAwardsGrantedInPriorYearsUnvestedMember2020-01-012020-12-310000876437mtg:EquityAwardAdjustmentsMemberecd:NonNeosMember2022-01-012022-12-310000876437mtg:EquityAwardAdjustmentsMemberecd:NonNeosMember2021-01-012021-12-310000876437mtg:EquityAwardAdjustmentsMemberecd:NonNeosMember2020-01-012020-12-310000876437mtg:PensionAdjustmentsChangeInPensionValueMemberecd:PeoMember2022-01-012022-12-310000876437mtg:PensionAdjustmentsChangeInPensionValueMemberecd:PeoMember2021-01-012021-12-310000876437mtg:PensionAdjustmentsChangeInPensionValueMemberecd:PeoMember2020-01-012020-12-310000876437mtg:PensionAdjustmentsChangeInPensionValueMemberecd:NonPeoNeoMember2022-01-012022-12-310000876437mtg:PensionAdjustmentsChangeInPensionValueMemberecd:NonPeoNeoMember2021-01-012021-12-310000876437mtg:PensionAdjustmentsChangeInPensionValueMemberecd:NonPeoNeoMember2020-01-012020-12-310000876437mtg:PensionAdjustmentsServiceCostMemberecd:PeoMember2022-01-012022-12-310000876437mtg:PensionAdjustmentsServiceCostMemberecd:PeoMember2021-01-012021-12-310000876437mtg:PensionAdjustmentsServiceCostMemberecd:PeoMember2020-01-012020-12-310000876437mtg:PensionAdjustmentsServiceCostMemberecd:NonPeoNeoMember2022-01-012022-12-310000876437mtg:PensionAdjustmentsServiceCostMemberecd:NonPeoNeoMember2021-01-012021-12-310000876437mtg:PensionAdjustmentsServiceCostMemberecd:NonPeoNeoMember2020-01-012020-12-310000876437mtg:PensionAdjustmentsChangeInLiabilityDueToAmendmentsMemberecd:PeoMember2022-01-012022-12-310000876437mtg:PensionAdjustmentsChangeInLiabilityDueToAmendmentsMemberecd:PeoMember2021-01-012021-12-310000876437mtg:PensionAdjustmentsChangeInLiabilityDueToAmendmentsMemberecd:PeoMember2020-01-012020-12-310000876437mtg:PensionAdjustmentsChangeInLiabilityDueToAmendmentsMemberecd:NonPeoNeoMember2022-01-012022-12-310000876437mtg:PensionAdjustmentsChangeInLiabilityDueToAmendmentsMemberecd:NonPeoNeoMember2021-01-012021-12-310000876437mtg:PensionAdjustmentsChangeInLiabilityDueToAmendmentsMemberecd:NonPeoNeoMember2020-01-012020-12-310000876437mtg:PensionAdjustmentsPaymentsMemberecd:PeoMember2022-01-012022-12-310000876437mtg:PensionAdjustmentsPaymentsMemberecd:PeoMember2021-01-012021-12-310000876437mtg:PensionAdjustmentsPaymentsMemberecd:PeoMember2020-01-012020-12-310000876437mtg:PensionAdjustmentsPaymentsMemberecd:NonPeoNeoMember2022-01-012022-12-310000876437mtg:PensionAdjustmentsPaymentsMemberecd:NonPeoNeoMember2021-01-012021-12-310000876437mtg:PensionAdjustmentsPaymentsMemberecd:NonPeoNeoMember2020-01-012020-12-31000087643722022-01-012022-12-31000087643732022-01-012022-12-31000087643742022-01-012022-12-31000087643752022-01-012022-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

| | | |

| Filed by the Registrant [X] | |

| Filed by a Party other than the Registrant [ ] |

| Check the appropriate box: |

| [ ] Preliminary Proxy Statement | |

| [ ] Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| [X] Definitive Proxy Statement | |

| [ ] Definitive Additional Materials | |

| [ ] Soliciting Material under §240.14a-12 | |

| | | | | | | | | | | | |

| MGIC Investment Corporation |

| (Name of Registrant as Specified In Its Charter) |

| |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

| Payment of Filing Fee (Check the appropriate box): |

| [X] | No fee required |

| [ ] | Fee paid previously with preliminary materials |

| [ ] | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11 |

MGIC Investment Corporation

Notice of 2023 Annual Meeting of Shareholders

| | | | | | | | |

| When: | Items of Business: |

| | |

| Thursday, April 27, 2023, at 9:00 a.m. Central time. Admittance to the webcast begins at 8:45 a.m. | 1 | Election of twelve directors |

| |

| 2 | Advisory vote to approve named executive officer compensation |

| |

| Where: | 3 | Advisory vote on the frequency of future advisory votes on executive compensation |

Via webcast at www.virtualshareholdermeeting.com/MTG2023 | | |

| 4 | Ratification of appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 2023 |

| |

| 5 | Any other matters that properly come before the meeting |

| | |

Your vote is very important. Whether or not you plan to attend our Annual Meeting, we encourage you to read our proxy materials and to vote as soon as possible using one of the methods described beginning on page 70. | | |

| By Order of the Board of Directors, |

|

| Paula C. Maggio |

| Executive Vice President, General Counsel and Secretary |

| March 24, 2023 |

| | |

| OUR PROXY STATEMENT AND 2022 ANNUAL REPORT TO SHAREHOLDERS ARE AVAILABLE AT HTTPS://MATERIALS.PROXYVOTE.COM/552848. |

Table of Contents

| | | | | |

Item 2 – Advisory Vote to Approve Our Executive Compensation (Continued) | |

| |

| |

| |

| |

2022 Grants of Plan-Based Awards | |

Outstanding Equity Awards at 2022 Fiscal Year-End | |

2022 Stock Vested | |

| |

| |

| |

2022 CEO Pay Ratio | |

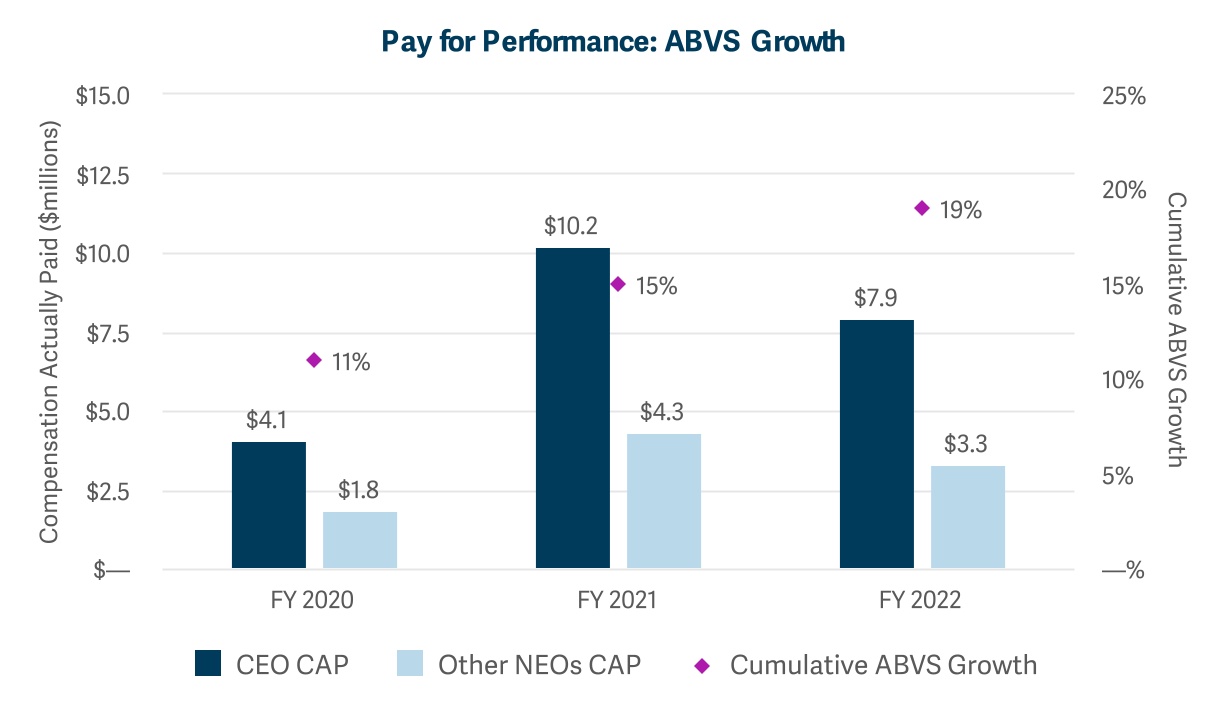

2022 Pay for Performance | |

| | | | | |

Item 3 – Advisory Vote on the Frequency of Future Advisory Votes on Executive Compensation | |

| | | | | |

Item 4 – Ratification of Appointment of Independent Registered Public Accounting Firm | |

| |

| |

| Stock Ownership | |

About the Meeting and Proxy Materials | |

| Appendix A – Glossary of Terms and Acronyms | App A - 1 |

| Appendix B – Explanation and Reconciliation of Non-GAAP Financial Measures | App |

| | | | | |

| MGIC Investment Corporation

P.O. Box 488

MGIC Plaza, 270 East Kilbourn Avenue

Milwaukee, WI 53201 |

Proxy Statement

Our Board of Directors is soliciting proxies for the Annual Meeting of Shareholders to be held Thursday, April 27, 2023 at 9:00 a.m. Central time, via webcast at www.virtualshareholdermeeting.com/MTG2023, and at any postponement or adjournment of the meeting. In this Proxy Statement we sometimes refer to MGIC Investment Corporation as “the Company,” “we” or “us.” This Proxy Statement and the enclosed form of proxy are being mailed to shareholders beginning on March 24, 2023. If you have any questions about attending our Annual Meeting, you can call Investor Relations at (414) 347-2635.

Proxy Summary

This summary highlights information contained elsewhere in our Proxy Statement and does not contain all of the information you should consider. Please review the Company’s complete Proxy Statement before voting. Please refer to our Glossary of Terms and Acronyms in Appendix A to this Proxy Statement for definitions of certain capitalized terms. Voting Matters and Board Recommendation

| | | | | | | | | | | |

| Proposal | Voting Matter | More Information | Board Vote Recommendation |

| 1 | Election of Twelve Directors | | FOR each Director Nominee |

| 2 | Advisory Vote on Executive Compensation | | FOR |

3 | Advisory Vote on the Frequency of Future Advisory Votes on Executive Compensation | | 1 YEAR |

4 | Ratification of Independent Registered Public Accounting Firm | | FOR |

Our Business Strategies and 2022 Highlights

Through our subsidiary, Mortgage Guaranty Insurance Corporation (MGIC), we are a leading provider of mortgage insurance to lenders throughout the United States and to Fannie Mae and Freddie Mac (the GSEs). Our business strategies are to 1) maximize the value we create through our mortgage credit enhancement activities; 2) differentiate ourselves through our customer experience; 3) establish a competitive advantage through our digital and analytical capabilities; 4) excel at acquiring, managing and distributing mortgage credit risk and the related capital; 5) maintain financial strength through economic

MGIC Investment Corporation – 2023 Proxy Statement │ 1

cycles; and 6) foster an environment that embraces diversity and best positions our people to succeed. As we discuss in the Compensation Discussion & Analysis (CD&A), the compensation of our Named Executive Officers (NEOs) is tied to our financial performance and to performance against business objectives that directly support these business strategies.

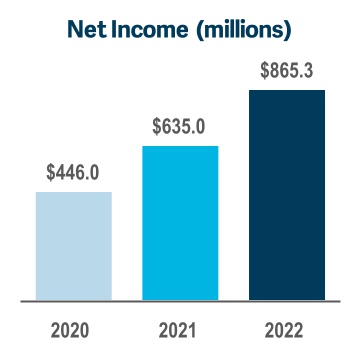

We began 2022 with uncertainty about inflation and interest rates. Additionally, the volume of mortgage originations was expected to be 30% lower in 2022 than in 2021. Home prices increased by 17.9% in 2021, but in 2022 the rate of appreciation slowed (seasonally-adjusted Purchase-Only U.S. Home Price Index of the FHFA) and interest rates increased steadily. Despite these headwinds, we demonstrated strong performance, including against performance measures that are considered in determining the annual bonus and long-term equity compensation of our NEOs.

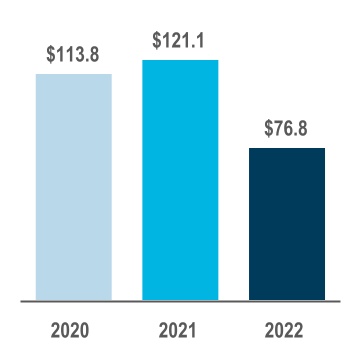

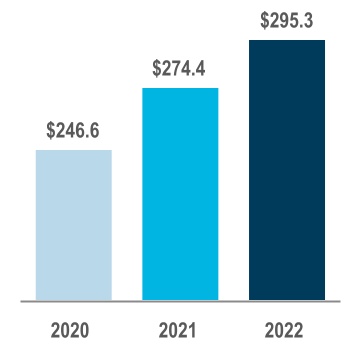

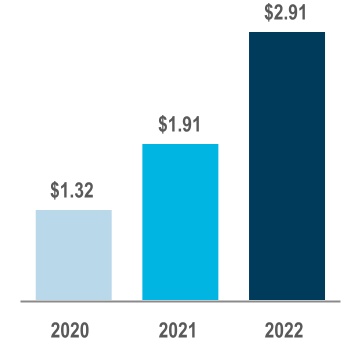

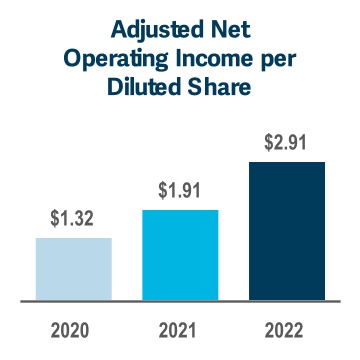

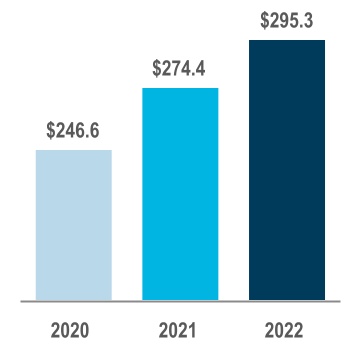

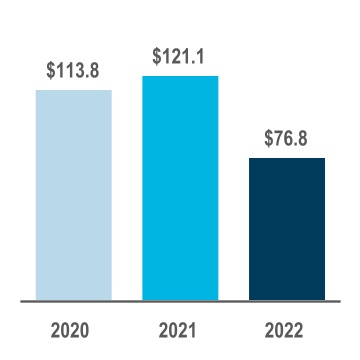

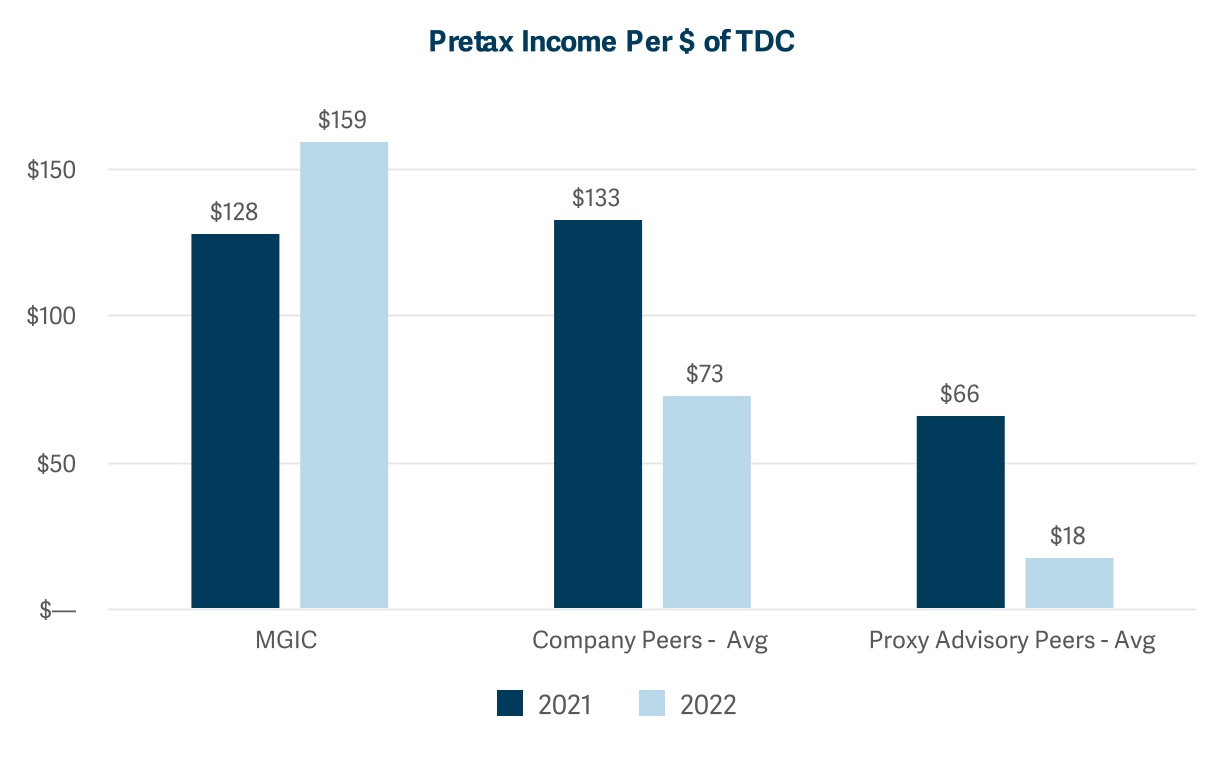

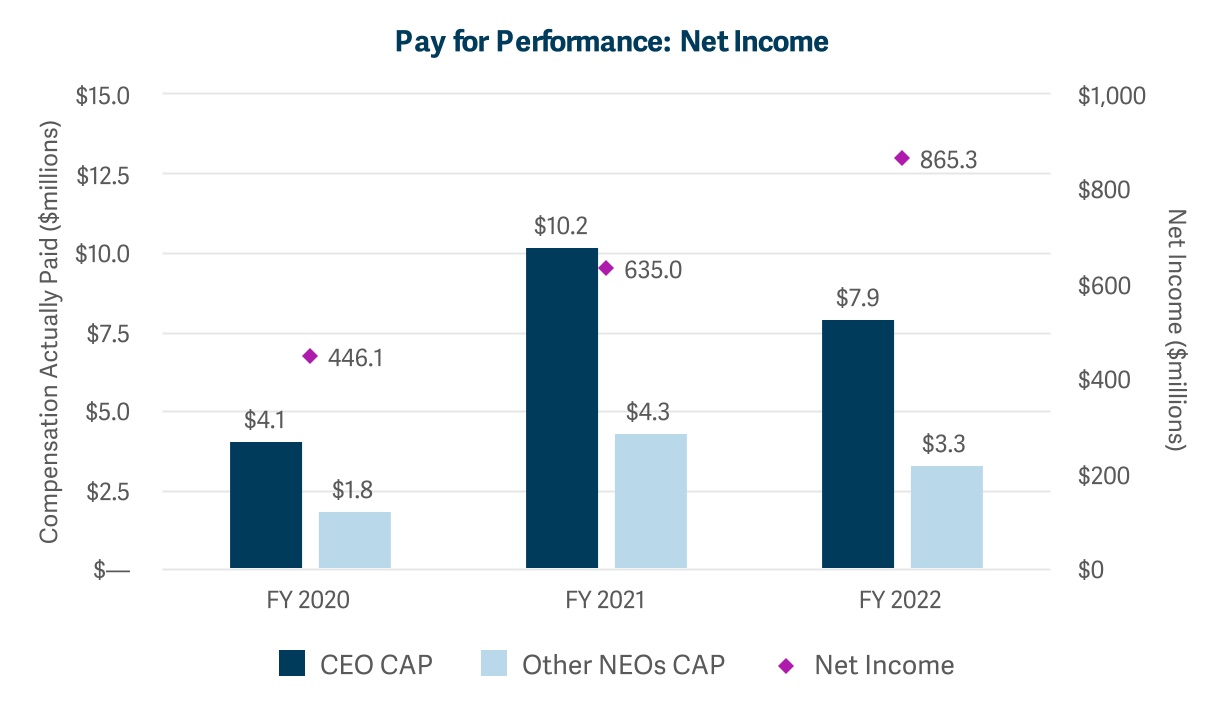

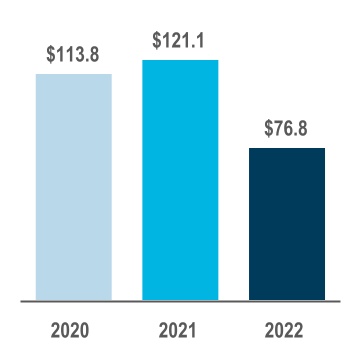

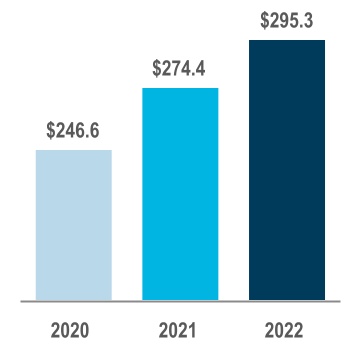

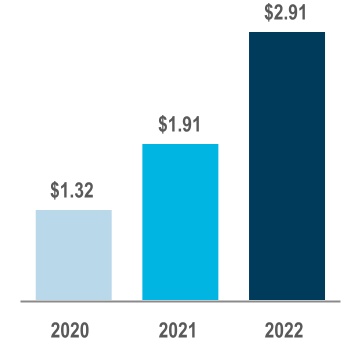

We earned record net income of $865 million on revenues of $1.2 billion. As shown by the metrics below, in 2022, our new insurance written was $76.8 billion, reflective of our performance and the market size; our insurance in force reached an all-time high of $295 billion; and our adjusted net operating income per diluted share grew by 51%. These metrics, among others, were considered when determining the 2022 bonuses of our NEOs and our success in advancing our business strategies.

New Insurance Written (NIW)

(billions)1

Insurance in Force (IIF)

(billions)2

Adjusted Net Operating Income per Diluted Share3

| | | | | |

| 1 | For purposes of the bonus plan, NIW includes (i) traditional loan level insurance, (ii) loan level insurance executed through a managing agent or directly with a GSE or other entity, and (iii) credit risk transfer (calculated as 1/3 of the unpaid principal balance of the loans committed to be insured by us during the year). NIW received credit for bonus purposes only if its expected risk-adjusted return on capital exceeded the Company's hurdle rate. Because the NIW for the bonus plan includes a more comprehensive definition of NIW when compared to the primary NIW disclosed for financial reporting purposes, NIW figures shown in our financial reporting differ slightly from what is shown in this Proxy Statement. |

| 2 | For purposes of the bonus plan, IIF is the unpaid principal balance, as reported to us, of the loans insured by us, as of the end of the year, adjusted for financial impacts of GSE-mandated mortgage insurance cancellations inconsistent with prior business practices. |

| 3 | This is a non-GAAP measure of performance. For a description of how we calculate this measure and for a reconciliation of this measure to its nearest comparable GAAP measure, see Appendix B to this Proxy Statement. |

2 │ MGIC Investment Corporation – 2023 Proxy Statement

Following are several additional 2022 accomplishments that furthered our business strategies.

| | | | | | | | |

| Business Strategy | | Results |

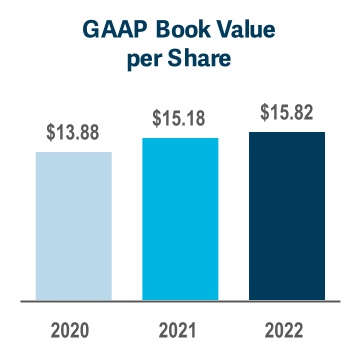

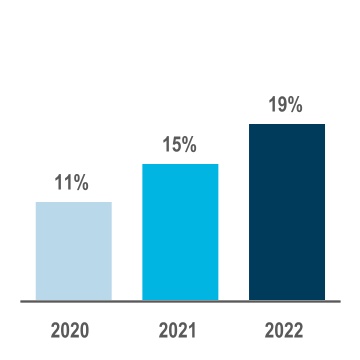

| Maximize value created through mortgage credit enhancement activities | è | Earned $865 million of net income on $1.2 billion of revenues, compared to $635 million in 2021. Earned a 17.8% return on beginning shareholders' equity. Increased book value per common share by 4.2%. |

| Differentiate through customer experience | è | Transitioned our sales team to three regions from four. Our sales team continues to be a core and sustainable strength - it is a brand built over decades. Created a Customer Experience team to further modernize and differentiate the value we provide to our customers. |

| Establish competitive advantage through digital and analytical capabilities | è | Developed models to better forecast the mortgage insurance market and the Company's performance. Continued enhancement to our risk-based pricing tool, MiQ, to better compete in an increasingly dynamic market. Established new governance to oversee technological investment and lead an enterprise-wide business prioritization process. |

| Excel at acquiring, managing and distributing mortgage credit risk and related capital | è | Expanded our reinsurance program by: •Executing a 15% quota share reinsurance agreement covering the majority of our 2022 and 2023 NIW. •Entering into a $473.6 million excess of loss reinsurance agreement executed through an insurance linked note transaction. •Placing first forward-commitment excess of loss reinsurance agreement providing up to $175 million in limit covering 2022 NIW. These transactions allowed us to better manage our risk profile and provided a source of capital relief. |

MGIC Investment Corporation – 2023 Proxy Statement │ 3

| | | | | | | | |

| Business Strategy | | Results |

| Maintain financial strength through economic cycles | è | Moody's Investors Service upgraded MGIC's financial strength rating to A3 and the Issuer Credit Rating of MGIC Investment Corporation was upgraded to Baa3. Maintained financial strength and capital flexibility while paying shareholder dividends of $0.36 per share for the year, a 29% increase from 2021. Repurchased 8.7% of our shares outstanding at the beginning of the year. Repurchased $89.1 million principal balance of our outstanding 9% Junior Convertible Debentures, which eliminated approximately 6.8 million potentially dilutive shares. Our debt-to-capital ratio was 10.7 at year-end 2022, compared to 15.7 at year end 2021. Our capital is well in excess of the requirements of the GSEs and state regulators. |

| Foster an environment that embraces diversity and best positions people to succeed | è | Continued to provide a competitive package of benefits that recognize the unique needs of our workforce and their families. Introduced new Career Framework designed to increase competitiveness for new talent. Expanded annual bonus program to include non-exempt co-workers and adjusted bonus calculations to help co-workers better share in Company successes. Expanded our diversity, equity and inclusion work: •Established a Diversity, Equity and Inclusion (DEI) Council. •Launched a DEI site on our company intranet. •Hosted facilitated DEI training sessions for all officers. •Introduced a company-wide DEI observance schedule. |

4 │ MGIC Investment Corporation – 2023 Proxy Statement

Board Nominees

| | | | | | | | | | | | | | | | | | | | | | | |

| Name | Age1 | Director Since | Primary Occupation | Independent | Committee Memberships2 |

| Analisa M. Allen | 64 | 2020 | Consultant with Gerson Lehrman Group; Former CIO of Data & Analytics and CIO for Home Lending Technology of JP Morgan Chase's consumer bank | Yes | • BT&T • Risk Management |

| Daniel A. Arrigoni | 72 | 2013 | Former President and CEO

of U.S. Bank Home Mortgage Corp. | Yes | • MDNG • Risk Management |

C. Edward Chaplin ▲ | 66 | 2014 | Former President and CFO of MBIA Inc. | Yes | • Audit (C) • Securities Inv. |

| Curt S. Culver | 70 | 1999 | Chairman of the Board and former CEO of MGIC Investment Corp. | No | • Executive |

| Jay C. Hartzell ▲ | 53 | 2019 | President of the University of Texas at Austin | Yes | • Audit

• Risk Management |

| Timothy A. Holt | 70 | 2012 | Former SVP and Chief Investment Officer of Aetna, Inc. | Yes | • MDNG • Securities Inv. (C) |

| Jodeen A. Kozlak | 60 | 2018 | Founder and CEO of Kozlak Capital Partners, LLC; Former Global SVP of Human Resources of Alibaba Group | Yes | • BT&T (C) • MDNG |

Michael E. Lehman | 72 | 2001 | Lead Independent Director of MGIC Investment Corp; Former EVP and CFO of Sun Microsystems, Inc. | Yes | • BT&T • Executive • MDNG (C) |

Teresita M. Lowman ▲ | 58 | 2022 | Strategic Advisor to Launch Factory; Former VP of DXC Technology Company | Yes | • Audit • BT&T |

| Timothy J. Mattke | 47 | 2019 | CEO of MGIC Investment Corp. | No | • Executive (C) |

| Sheryl L. Sculley ▲ | 70 | 2019 | Consultant with Strategic Partnerships, Inc.; Adjunct Professor at the University of Texas at Austin; Former City Manager of the City of San Antonio, Texas | Yes | • Audit • Securities Inv. |

| Mark M. Zandi | 63 | 2010 | Chief Economist of Moody's

Analytics, Inc. | Yes | • Risk Management (C) • Securities Inv. |

| 1 | | As of March 24, 2023 |

| 2 | | BT&T = Business Transformation and Technology; MDNG = Management Development, Nominating and Governance |

| ▲ | = | Audit Committee Financial Expert |

| C | = | Committee Chair |

MGIC Investment Corporation – 2023 Proxy Statement │ 5

Corporate Sustainability Highlights

As pioneers of the modern form of private mortgage insurance 65 years ago, MGIC has helped millions of families achieve homeownership sooner. This is a touchstone we come back to when we think about the work we do, how we do it, and why we do it. Homeownership can be a powerful vehicle for financial stability and generational wealth, which means that our impact – and our responsibility – extends well beyond the walls of our company, beyond our investors, beyond our customers, even beyond the consumers who use our product. Our work supports resilient communities and the social fabric at large.

Keeping this holistic picture in mind is critical to doing well by each of the audiences to whom we are accountable. Our initiatives benefit greatly from our highly-engaged Board of Directors, who provide essential vision and oversight, in partnership with the members of our Corporate Sustainability Executive Council, who advance these efforts at the management level, cascading our priorities down through functional areas of our business.

In our Corporate Sustainability Report, published on our website, you can see how our commitment bears out across the work we do, from our internal approach to human capital to our external considerations for environmental and social impact, including, most notably, our efforts in the affordable housing space. We are not including the information contained in that report as a part of, or incorporating it by reference into, this Proxy Statement.

Compensation Highlights

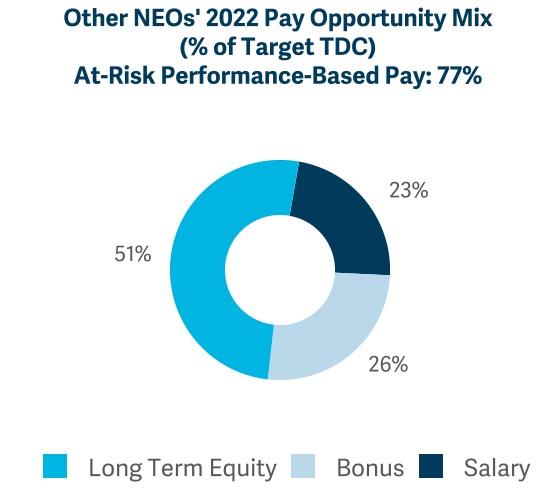

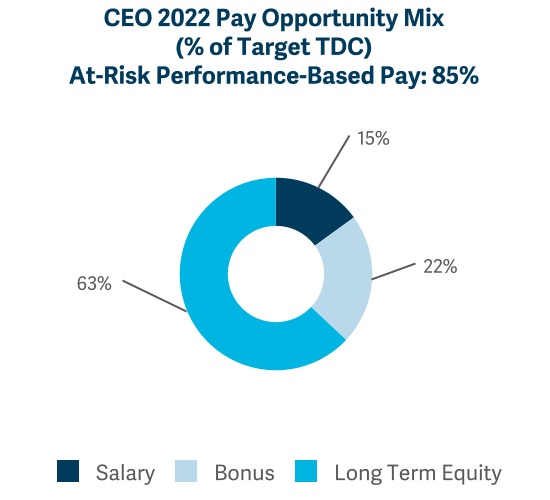

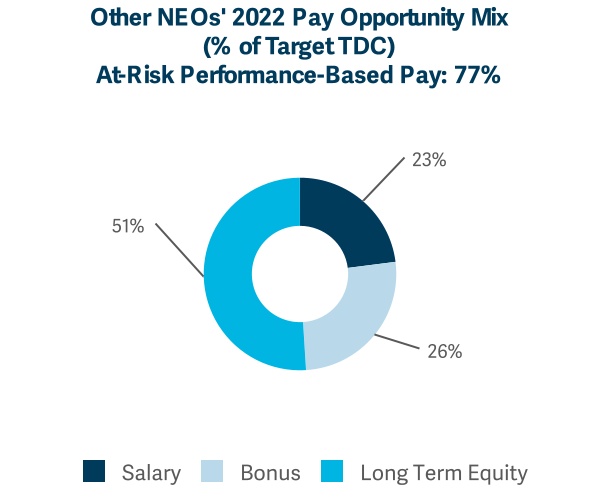

Pay Opportunity Mix. At-risk performance-based compensation represented a significant majority of the 2022 total direct compensation (TDC) opportunity of our NEOs.

Long-Term Equity Incentives. To align our long-term equity awards with the interests of shareholders, 100% of the long-term equity awards granted in February 2022 to our NEOs are performance-based and cliff vest after three years based on achievement of a three-year cumulative adjusted book value (ABV) per share growth goal.

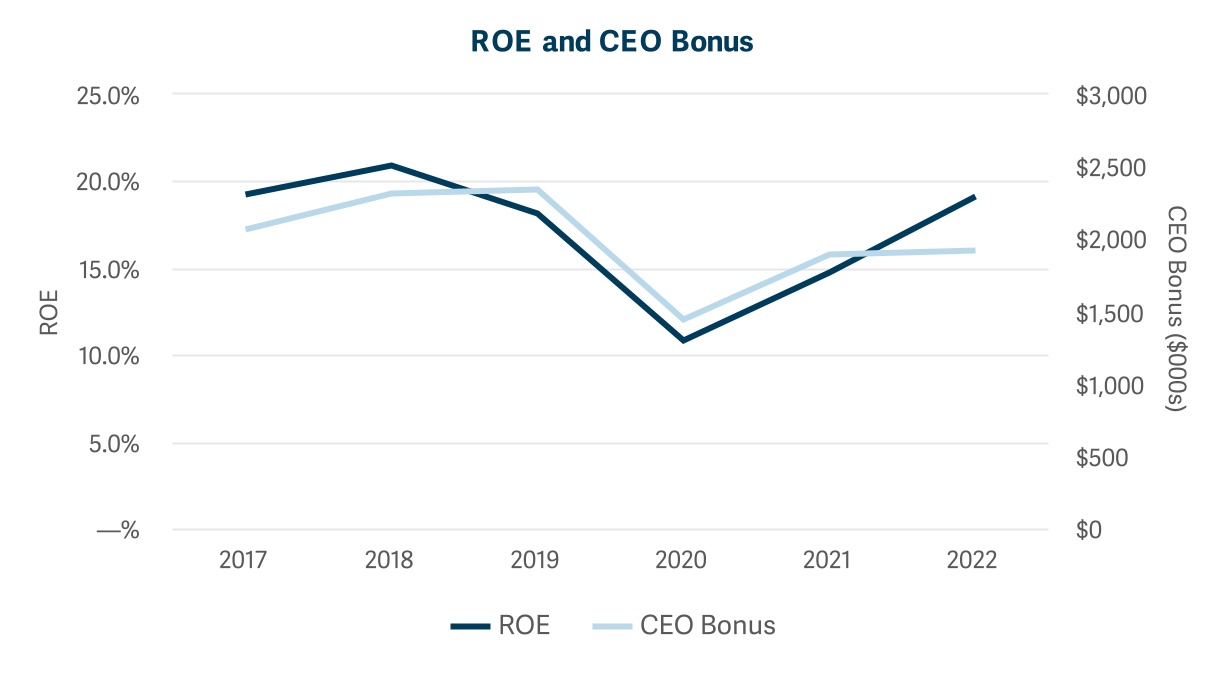

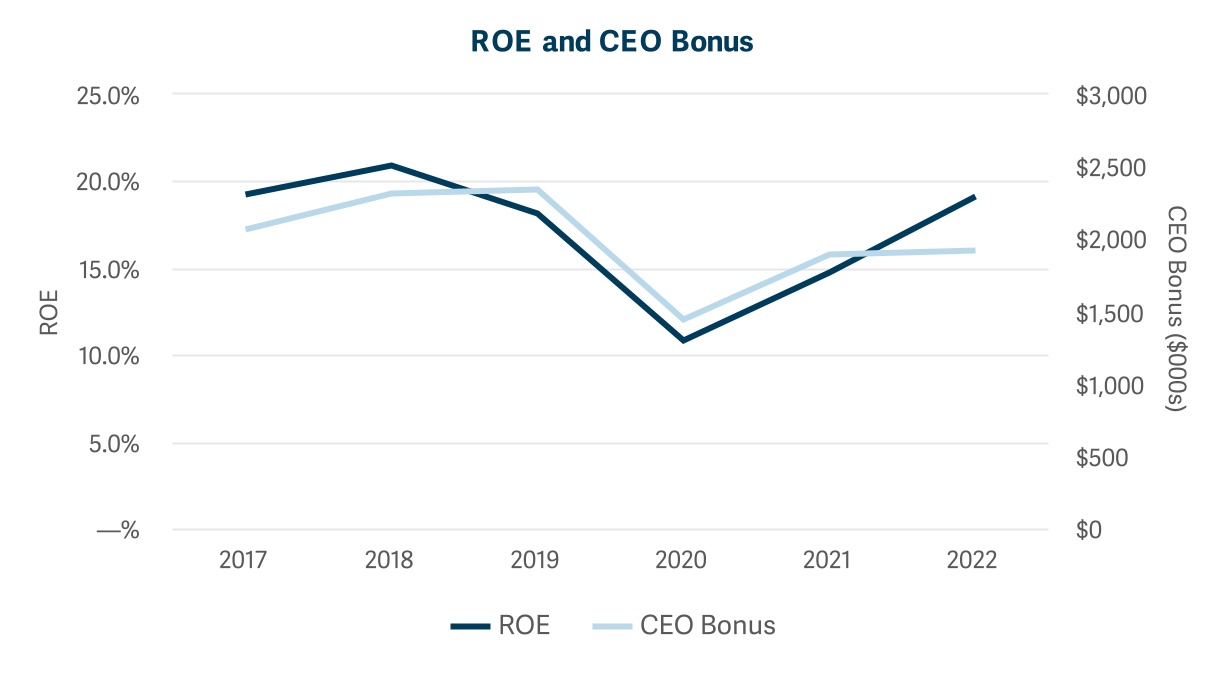

Performance-Based Bonus. Our bonus program is designed to strongly align pay with our performance. Bonus payouts for 2022 were based on our achievement against three financial performance goals (return on equity (ROE), NIW and IIF), and performance against three specific business objectives.

Best Practices. Our compensation program is grounded in best practices, which include strong stock ownership guidelines for NEOs, no hedging or pledging of our stock, a long-standing “clawback” policy, limited change in control benefits (with no tax gross-ups) and modest perquisites.

6 │ MGIC Investment Corporation – 2023 Proxy Statement

Corporate Governance and Board Matters

The Board of Directors oversees the management of the Company and our business. The Board selects our CEO, who in conjunction with our senior management team, is responsible for operating our business.

Corporate Governance Guidelines and

Code of Conduct and Ethics

The Board has adopted Corporate Governance Guidelines, which set forth a framework for our governance. The Guidelines cover the Board’s composition, leadership, meeting process, director independence, Board membership criteria, limitations on other directorships, committee structure, succession planning and director compensation. Among other things, the Board meets in executive session outside the presence of any member of our management during at least two Board meetings annually and at any additional times determined by the Board or the Lead Director. Mr. Lehman presides at these sessions and has served as the Board’s Lead Director since July 2020. See “Board Leadership” for information about the Lead Director’s responsibilities and authority. The Corporate Governance Guidelines provide that a director shall not be nominated by the Board for re‑election if at the date of the Annual Meeting of Shareholders, the director is age 74 or more. The Corporate Governance Guidelines also provide that a director who retires from his or her principal employment or joins a new employer shall offer to resign from the Board. Unless the Board determines that a Chief Executive Officer who is Chairman of the Board should continue as Chairman of the Board after his or her tenure as Chief Executive Officer, a director who is an officer of the Company or a subsidiary and leaves the Company shall resign from the Board. In 2014, the Board determined that Mr. Culver should become non-executive Chairman of the Board upon retirement from his position as Chief Executive Officer in 2015.

We have a Code of Conduct and Ethics emphasizing our commitment to conducting our business in accordance with legal requirements and high ethical standards. The Code applies to all employees, including our executive officers, and is also applicable to our directors. Certain portions of the Code that apply to transactions with our executive officers, directors, and their immediate family members are described under “Other Matters – Related Person Transactions” below. These descriptions are subject to the actual terms of the Code.

Our Corporate Governance Guidelines and our Code of Conduct and Ethics are available on our website (http://mtg.mgic.com) under the “Leadership & Governance; Documents” links. Written copies of these documents are available to any shareholder who submits a written request to our Secretary. We intend to disclose on our website any waivers from, or amendments to, our Code of Business Conduct that are subject to disclosure under applicable rules and regulations.

Director Independence

Our Corporate Governance Guidelines regarding director independence provide that a director is not independent if the director has any specified disqualifying relationship with us. The disqualifying relationships are equivalent to those of the independence rules of the New York Stock Exchange (NYSE), except that our disqualification for board interlocks is more stringent than under the NYSE rules. Also, for a director to be independent under the Guidelines, the director may not have any material relationship with us. For purposes of determining whether a disqualifying or material relationship exists, we consider relationships with MGIC Investment Corporation and its consolidated subsidiaries.

The Board has determined that all of our directors except for Mr. Culver, our former CEO, and Mr. Mattke, our current CEO, are independent under the Guidelines and the NYSE rules. The Board made its

MGIC Investment Corporation – 2023 Proxy Statement │ 7

CORPORATE GOVERNANCE AND BOARD MATTERS

independence determinations by considering whether any disqualifying relationships existed during the periods specified under the Guidelines and the NYSE rules. To determine that there were no material relationships, the Board applied categorical standards that it had adopted and incorporated into our Corporate Governance Guidelines. All independent directors met these standards. Under these standards, a director is not independent if payments under transactions between us and a company of which the director is an executive officer or 10% or greater owner exceeded the greater of $1 million or 1% of the other company’s gross revenues. Payments made to and payments made by us are considered separately, and this quantitative threshold is applied to transactions that occurred in each of the three most recent fiscal years of the other company. Also under these standards, a director is not independent if during our last three fiscal years the director:

•was an executive officer or member of a law firm or investment banking firm providing services to us;

•was an executive officer of a charity to which we made contributions; or

•received any direct compensation from us other than as a director, or if during such period a member of the director’s immediate family received compensation from us.

In making its independence determinations, the Board considered payments we made to Moody’s Analytics (of which Dr. Zandi is an executive officer) for research and subscription services for Moody’s Economy.com and related publications, and payments to Moody’s Investors Service for credit rating services. These transactions were below the quantitative threshold contained in our Corporate Governance Guidelines and were entered into in the ordinary course of business by us, Moody’s Analytics and Moody’s Investors Service.

Related Person Transactions

Among other things, our Code of Conduct and Ethics prohibits us from entering into transactions in which our executive officers, chief accounting officer, or any their respective immediate family members have a material personal financial interest (either directly or through a company with which the officer has a material relationship) unless all of the following conditions are satisfied:

•the terms of the contract or transaction are fair and equitable, at arm’s length and are not detrimental to our interests;

•the existence and nature of the interests of the officer are fully disclosed to and approved by the Audit Committee; and

•the interested officer has not participated on our behalf in the consideration, negotiation or approval of the contract or transaction.

The Code defines a material interest as one in which our officer or officer's immediate family member is a director or officer of the counterparty to the transaction, or our officer or a member of our officer’s immediate family has a financial interest in such counterparty or any of its affiliates that in the aggregate at least 10% of the value of such counterparty or the consolidated value of the organization's affiliates. Our Audit Committee does not consider payments and benefits arising in the ordinary course of employment with us, or through services as a director, to be “transactions” subject to its approval.

In addition, the Code requires Audit Committee approval of all transactions with any director or a member of the director’s immediate family, other than transactions involving the provision of goods or services in the ordinary course of business of both parties. The Code contemplates that our non-management directors will disclose all transactions between us and parties related to the director, even if they are in the ordinary course of business.

Under its Charter, the Audit Committee is responsible to conduct a review and oversee all related party transactions for potential conflicts of interest and prohibit such transactions if the Committee determines them to be inconsistent with the interests of the Company. For purposes of the Charter,

8 │ MGIC Investment Corporation – 2023 Proxy Statement

CORPORATE GOVERNANCE AND BOARD MATTERS

“related party transaction” means a transaction in which the Company (or its affiliates) is a participant, the amount exceeds $120,000, and in which one of the following had or will have a direct or indirect material interest: an executive officer, director, or director nominee, or their immediate family members or persons sharing their households, or 5% shareholders.

Board Leadership

Mr. Culver serves as non-executive Chairman of the Board and Mr. Lehman serves as Lead Director. Under this structure, the Chairman chairs Board meetings, where the Board discussion includes strategic and business issues. The Board believes that this approach is appropriate because Mr. Culver, as the Company's former CEO, is very familiar with our business and strategic plans as reviewed by the Board. Mr. Culver joined the Company in 1985, and served as Chief Executive Officer from 2000 until his retirement in 2015, when he became our non-executive Chairman of the Board.

Because the Board also believes that strong, independent Board leadership is a critical aspect of effective corporate governance, the Board maintains the position of Lead Director. The Lead Director is an independent director selected by the independent directors. The Lead Director’s responsibilities and authority include:

•presiding at all meetings of the Board at which the Chairman is not present;

•having the authority to call and lead executive sessions of directors without the presence of any director who is an officer (or if determined by the Board, a former officer) (the Board meets in executive session during at least two Board meetings each year);

•serving as a conduit between the CEO and the independent directors to the extent requested by the independent directors;

•serving as a conduit for the Board’s informational needs, including proposing topics for Board meeting agendas; and

•being available, if requested by major shareholders, for consultation and communication.

The Board believes that a leader intimately familiar with our business and strategic plans serving as Chairman, together with an experienced and engaged Lead Director, is the most appropriate leadership structure for the Board at this time. The Board periodically reviews the structure of the Board and the Board’s leadership.

Communicating with the Board

Shareholders and other interested persons can communicate with members of the Board, non-management members of the Board as a group or the Lead Director, by sending a written communication to our Secretary, addressed to: MGIC Investment Corporation, Secretary, P.O. Box 488, Milwaukee, WI 53201. The Secretary will pass along any such communication, other than a solicitation for a product or service, to the Lead Director.

MGIC Investment Corporation – 2023 Proxy Statement │ 9

CORPORATE GOVERNANCE AND BOARD MATTERS

Director Selection

The Board believes that the Board, as a whole, should possess a combination of skills, professional experience, and diversity of backgrounds necessary to oversee our business. In addition, the Board believes there are certain attributes every director should possess, as reflected in the Board’s membership criteria. Accordingly, the Board and the Management Development, Nominating and Governance Committee (the Committee) consider the qualifications of directors and director candidates individually and in the broader context of the Board’s overall composition and our current and future needs.

The Committee is responsible for developing Board membership criteria and recommending these criteria to the Board. The criteria, which are set forth in our Corporate Governance Guidelines, include an inquiring and independent mind, sound and considered judgment, high standards of ethical conduct and integrity, well-respected experience at senior levels of business, academia, government or other fields, ability to commit sufficient time and attention to Board activities, anticipated tenure on the Board, and whether an individual will enable the Board to continue to have a substantial majority of independent directors. In addition, the Committee in conjunction with the Board, periodically evaluates the composition of the Board to assess the skills and experience that are currently represented on the Board, as well as the skills and experience that the Board will find valuable in the future. The Committee seeks a variety of occupational and personal backgrounds on the Board in order to obtain a range of viewpoints and perspectives and enable the Board to have access to a diverse body of talent and expertise relevant to our activities. The Committee also seeks to enhance the diversity of the Board in other areas, such as geography, age, race, gender and ethnicity. The Committee’s and the Board’s evaluation of the Board’s composition enables the Board to consider the skills and experience it seeks in the Board as a whole, and in individual directors, as our needs evolve and change over time and to assess the effectiveness of the Board’s efforts at pursuing diversity. In identifying director candidates from time to time, the Committee may establish specific skills and experience that it believes we should seek in order to constitute a balanced and effective board.

The table below summarizes certain skills and experiences considered important by the Board, how those skills and experiences are relevant to the Company and its business strategies, and how they are represented in the board members standing for election at the Annual Meeting of Shareholders. The Committee evaluates new director candidates considering these skills and experiences, and the criteria listed above, as well as other factors the Committee deems relevant, through background reviews, input from other members of the Board and our executive officers, and personal interviews with the candidates attended by at least the Committee Chair. The Committee will evaluate director candidates recommended by shareholders using the same process and criteria that apply to candidates from other sources.

10 │ MGIC Investment Corporation – 2023 Proxy Statement

CORPORATE GOVERNANCE AND BOARD MATTERS

| | | | | | | | |

| Skills and Experience | Relevance to MGIC | Board Composition |

| Accounting | We operate in a complex financial and regulatory environment. | 5 of 12 directors

☑☑☑☑☑☐☐☐☐☐☐☐ |

| Chief Executive Officer | Experience at the highest level of an organization provides expertise that will foster participation in the development and implementation of the Company's business strategies. | 5 of 12 directors

☑☑☑☑☑☐☐☐☐☐☐☐ |

| Data & Analytics | Experience with the use of structured and unstructured data, as well as the tools and processes necessary to enable the development of actionable insights via advanced quantitative and statistical methods is important as we continue to pursue our strategic initiatives. | 4 of 12 Directors

☑☑☑☑☐☐☐☐☐☐☐☐ |

| Financial | Knowledge of finance or financial reporting and experience with debt and capital markets transactions is important to executing our business strategies. | 11 of 12 directors

☑☑☑☑☑☑☑☑☑☑☑☐ |

| Housing Markets / Risk Management | A main component of our business involves taking and managing risk associated with the housing markets. | 11 of 12 directors

☑☑☑☑☑☑☑☑☑☑☑☐ |

| Human Resources | As a financial services firm, human capital represents an important asset. Knowledge of human resources matters is important to executing our business strategies. | 10 of 12 directors

☑☑☑☑☑☑☑☑☑☑☐☐ |

| Insurance | Insurance industry experience provides understanding of our business and strategies. | 6 of 12 directors

☑☑☑☑☑☑☐☐☐☐☐☐ |

| Investments | We manage a large and long-term investment portfolio to support our obligations to pay future claims of our policyholders. | 10 of 12 directors

☑☑☑☑☑☑☑☑☑☑☐☐ |

Public Co. Executive Experience | As a complex, publicly-held company, practical insight into shareholder concerns and governance matters is important. | 10 of 12 directors

☑☑☑☑☑☑☑☑☑☑☐☐ |

| Regulatory / Public Affairs | Our business requires compliance with a variety of federal, state and GSE requirements, and involves relationships with various government and non-government organizations. | 9 of 12 directors

☑☑☑☑☑☑☑☑☑☐☐☐ |

| Technology / Cyber | We continue to undergo a business process transformation involving upgrades to our technology and to manage our cybersecurity risks. | 4 of 12 Directors

☑☑☑☑☐☐☐☐☐☐☐☐ |

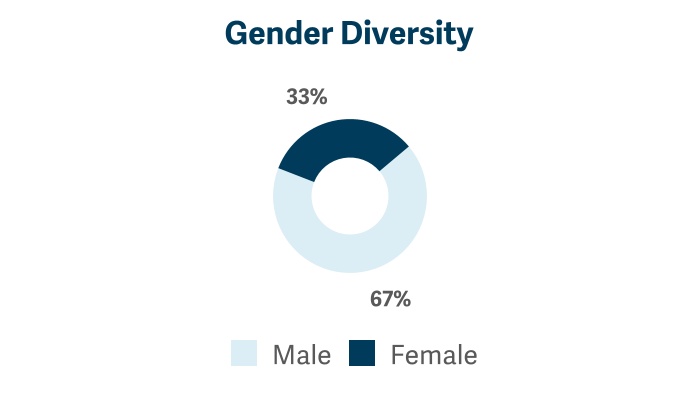

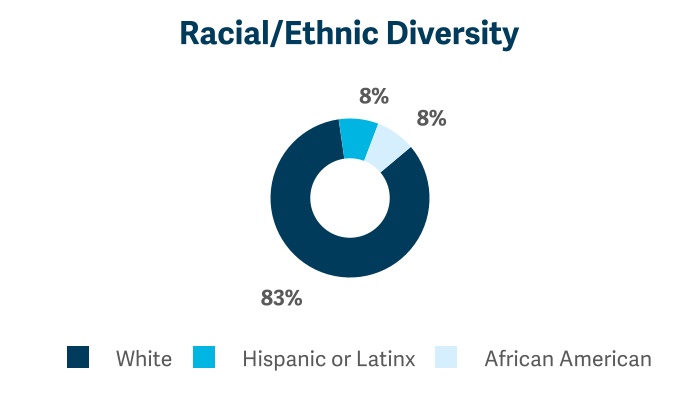

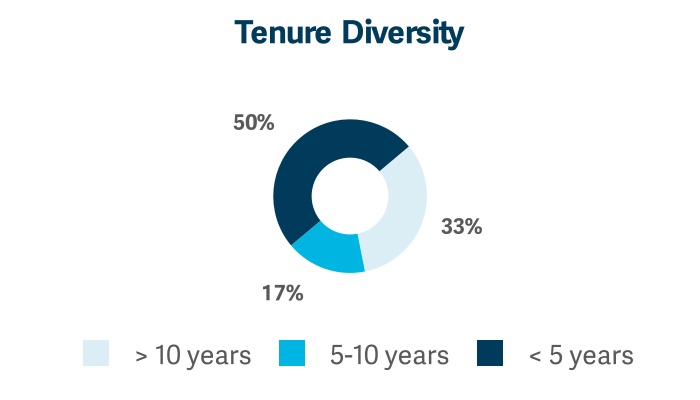

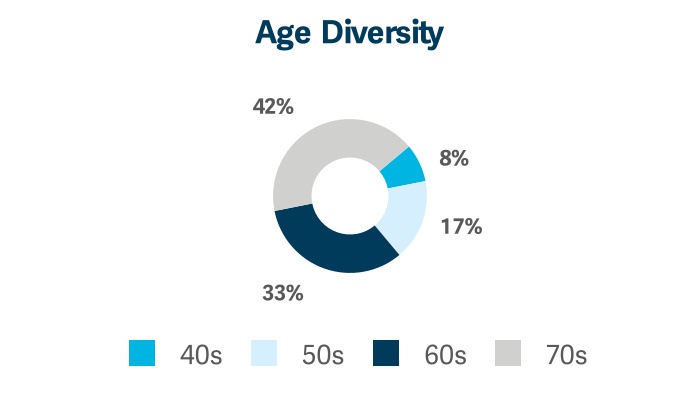

We have continued to refresh and diversify our Board over the last five years as six new independent directors joined our Board, two directors did not stand for re-election due to the age-related retirement policy in our Corporate Governance Guidelines, two directors did not stand for re-election for personal reasons, our new CEO joined the Board and our former CEO retired from the Board. As a result of the changes in our Board composition over the five-year period, and the changes proposed to occur at the 2023 Annual Meeting of Shareholders, our Board has increased its gender and racial diversity from 27% to 42%. The following table and charts reflect the tenure, ages and diversity of the board members standing for election at the Annual Meeting of Shareholders.

| | | | | | | | |

| Board Diversity Matrix (as of March 24, 2023) | Female | Male |

African American or Black | 0 | 1 |

Hispanic or Latinx | 1 | 0 |

White | 3 | 7 |

Total | 4 | 8 |

MGIC Investment Corporation – 2023 Proxy Statement │ 11

CORPORATE GOVERNANCE AND BOARD MATTERS

Oversight of Risk and Corporate Sustainability Matters

Management

Our senior management is charged with identifying and managing the risks facing our business and operations. The Company's Senior Management Oversight Committee (SMOC) serves as its primary risk management governance organization. The SMOC oversees the Company’s enterprise risk management framework; maintains an enterprise view of risk across a set of identified key risks that may exist from time to time; and provides support and reporting to the Board's Risk Management Committee.

The Company's Corporate Sustainability Executive Council supports the Company's on-going initiatives related to environmental, health and safety, corporate social responsibility, corporate governance, sustainability, and other public policy matters relevant to the Company. In performing this general responsibility, the Council has discretion to: adopt the Company’s general strategy with respect to corporate sustainability matters; identify current and emerging corporate sustainability issues that may affect the Company’s business, strategy, operations, performance, or public image; make recommendations regarding policies, practices, procedures, or disclosures to address corporate sustainability matters; oversee the Company’s internal and external reporting and disclosures surrounding corporate sustainability matters; and advise on material concerns of shareholders or stakeholders regarding corporate sustainability matters. The Corporate Sustainability Executive Council makes regular reports to the Company's senior leaders and to the relevant Committee(s) of the Board of Directors of the Company.

12 │ MGIC Investment Corporation – 2023 Proxy Statement

CORPORATE GOVERNANCE AND BOARD MATTERS

Board of Directors and Committees

The Board of Directors is responsible for oversight of how our senior management addresses risks, including those associated with corporate sustainability matters, to the extent they are material. In this regard, the Board seeks to understand the material risks we face and to allocate, among the full Board and its committees, responsibilities for overseeing how management addresses the risks, including the risk management systems and processes that management uses for this purpose. Overseeing risk is an ongoing process. Accordingly, the Board periodically considers risk throughout the year and also with respect to specific proposed actions. Each of the Board's committees (other than the Executive Committee) meet regularly, play significant roles in carrying out the risk and corporate sustainability oversight functions, and report back to the full Board. Each of their roles in the oversight of the Company's risk is described below under "Board Meetings and Committees."

We believe that our leadership structure, discussed in “Board Leadership” above, supports the risk oversight function of the Board. Our former CEO serves as Chairman of the Board and has a wealth of experience with the risks of our Company and industry. Our current CEO is a director who keeps the Board informed about the risks we face. In addition, independent directors chair the various committees involved with risk oversight and there is open communication between senior management and directors.

Board Meetings and Committees

The Board of Directors held five meetings during 2022. Each director elected at our 2022 Annual Meeting of Shareholders attended at least 75% of the meetings of the Board and committees of the Board on which he or she served. The Annual Meeting of Shareholders is scheduled in conjunction with a Board meeting and, as a result, directors are expected to attend the Annual Meeting. The 2022 Annual Meeting of Shareholders was attended by each of the directors who stood for election at the Meeting.

The Board has six standing committees: Audit; Business Transformation and Technology; Management Development, Nominating and Governance; Risk Management; Securities Investment; and Executive. Information regarding these committees is provided below. With the exception of the Executive Committee, each committee consists entirely of independent directors and the charters for those committees are available on our website (http://mtg.mgic.com) under the “Leadership & Governance; Documents” links. Written copies of these charters are available to any shareholder who submits a written request to our Secretary. The functions of the Executive Committee are established under our Bylaws and are described below.

MGIC Investment Corporation – 2023 Proxy Statement │ 13

CORPORATE GOVERNANCE AND BOARD MATTERS

Current committee membership and the number of 2022 committee meetings are set forth below.

| | | | | | | | | | | | | | | | | | | | |

| Audit | Business Transformation

& Technology | Executive | Management Development, Nominating and Governance | Risk Management | Securities Investment |

| Analisa M. Allen | | l | | | l | |

| Daniel A. Arrigoni | | | | l | l | |

| C. Edward Chaplin | C | | | | | l |

| Curt S. Culver | | | l | | | |

| Jay C. Hartzell | l | | | | l | |

| Timothy A. Holt | | | | l | | C |

| Jodeen A. Kozlak | | C | | l | | |

| Michael E. Lehman | | l | l | C | | |

Teresita M. Lowman | l | l | | | | |

| Timothy J. Mattke | | | C | | | |

Gary A. Poliner1 | l | | | | l | l |

| Sheryl L. Sculley | l | | | | | l |

| Mark M. Zandi | | | | | C | l |

2022 Meetings | 10 | 3 | 0 | 5 | 5 | 4 |

| C = Chairman | | | | | | |

1 Mr. Poliner decided not to stand for re-election at the 2023 Annual Meeting of Shareholders. Mr. Poliner's decision was not due to any disagreement on any matter relating to the Company's operations, policies or practices. Mr. Poliner served as Audit Committee Chairperson during 2022.

Audit Committee

Key Responsibilities:

•Oversee the integrity of our financial statements

•Oversee the effectiveness of our system of internal controls over accounting and financial reporting, and disclosure controls and procedures

•Appoint, retain and oversee the independent registered public accountant, and evaluate its qualifications, independence and performance

•Oversee the performance of our internal audit function

•Oversee our compliance with legal and regulatory requirements

•Review related party transactions, as further described above under "Related Person Transactions."

Risk Oversight Role:

•Oversee our processes for assessing risks (other than risks overseen by other committees) and the effectiveness of our system of internal controls. Meet with the Chief Risk Officer and the Chairman of the Risk Management Committee to discuss and review in a general manner the Risk Management Committee's oversight of the Company's enterprise risk management framework

•Oversee process, fraud, compliance and reserving risks

14 │ MGIC Investment Corporation – 2023 Proxy Statement

CORPORATE GOVERNANCE AND BOARD MATTERS

All members of the Audit Committee meet the heightened independence criteria that apply to Audit Committee members under SEC and NYSE rules. The Board has determined that Mr. Chaplin, Dr. Hartzell and Mses. Lowman and Sculley are “audit committee financial experts” as defined in SEC rules.

Business Transformation and Technology Committee

Key Responsibilities:

•Oversee the Company's information technology strategy, including reviewing its strategy and initiatives, the strategy for developing and maintaining market-competitive information technology capabilities, and major information technology trends that pose risks or opportunities for the Company

•Oversee how information technology supports the Company's business strategies

•Oversee major business transformation projects

Risk Oversight Role:

•Oversee risks associated with the Company's technology capabilities

•Oversee cybersecurity (including data security) and business continuity risks

Management Development, Nominating and Governance Committee

Key Responsibilities:

•Oversee our executive compensation program, including approving corporate goals relating to compensation for our CEO, determining our CEO’s annual compensation, approving compensation for our other senior executives and making recommendations to the Board regarding incentive compensation plans and equity-based plans for the CEO and senior management

•Evaluate the annual performance of the CEO and oversee the CEO succession planning process

•Make recommendations to the Board regarding the compensation of directors

•Review our Corporate Governance Guidelines and oversee the Board’s self-evaluation and director orientation processes

•Identify new director candidates through recommendations from Committee members, other Board members and our executive officers; consider candidates recommended by shareholders (see “What are the deadlines for submission of shareholder proposals, or for nominating or recommending a director candidate for nomination, for the next Annual Meeting?” below); and make recommendations to the Board to fill open director and committee member positions

Risk Oversight Role:

•Oversee corporate governance matters

•Oversee operational risks related to human capital, which include risks associated with human capital management policies such as executive compensation; succession planning; management recruitment, retention, training and development; workforce planning, recruitment, morale and talent; diversity and inclusion strategies and initiatives; and work environment, including health and safety

All members of the Management Development, Nominating and Governance Committee meet the heightened independence criteria that apply to compensation committee members under the rules of the SEC and NYSE.

MGIC Investment Corporation – 2023 Proxy Statement │ 15

CORPORATE GOVERNANCE AND BOARD MATTERS

Risk Management Committee

Key Responsibilities:

•Oversee the administration of our enterprise risk management framework, including:

◦The capabilities of, and the resources allocated to, enterprise risk management

◦The methodologies, policies, systems and processes established by management to identify, assess, measure, monitor, mitigate, limit, report on, and establish risk profiles for, the key risks that are inherent in our business activities and strategies

◦The enterprise-wide assessment of key current and potential future risks regularly conducted by management

◦Coordinate with the Board and other Board Committees to assign oversight responsibilities for all identified key risks to the Board and other Committees

◦Review significant regulatory reports or disclosures required by law relating to the risk management program of the Company

Risk Oversight Role:

•Oversee the Company's enterprise risk management framework, including the Company's view of risk on an enterprise-wide basis

•Oversee the following key Company risks: pricing, underwriting, mortgage credit, climate change, model, compliance with the Private Mortgage Insurer Eligibility Requirements of Fannie Mae and Freddie Mac, and reinsurer counterparty risks

Securities Investment Committee

Key Responsibilities:

•Oversee management of our investment portfolio and the investment portfolios of the Company’s employee benefit plans by those persons (employees of the Company or external asset managers) who are managing such assets on a day-to-day basis

•Make recommendations to the Board with respect to our retirement benefit plans that are available to employees generally

•Capital management (other than external reinsurance), including repurchase of common stock and debt, and external funding

Risk Oversight Role:

•Oversee risks related to our investment portfolio and capital management, which include market risk; investment portfolio counterparty risk; capital risk related to our capital structure, access to capital and credit rating; and liquidity risk

•Oversight of risks related to our investment portfolio may include consideration of ESG factors

Executive Committee

The Executive Committee provides an alternative to convening a meeting of the entire Board should a matter arise between Board meetings that requires Board authorization. The Committee is established under our Bylaws and has all authority that the Board may exercise with the exception of certain matters that under the Wisconsin Business Corporation Law are reserved to the Board itself.

16 │ MGIC Investment Corporation – 2023 Proxy Statement

Nominees for Director

For Term Ending at the Annual Meeting in 2024

Each nominee listed below is a director of the Company who was previously elected by the shareholders. In evaluating directors for (re)nomination to the Board, the Management Development, Nominating and Governance Committee considered a variety of factors. These included the Board membership criteria described under “Director Selection” above and past performance on the Board based on any feedback from other Board members.

Information about our director nominees appears below. The biographical information is as of March 24, 2023, and for each director includes a discussion about the skills and qualifications that the Board views as supporting the director’s continued service on the Board.

| | | | | | | | | | | |

| | | |

| Analisa M. Allen Director Since: 2020 Age: 64 | Committees: •Business Transformation & Technology •Risk Management | |

Analisa M. Allen is an information technology consultant with the Gerson Lehrman Group. She is the former Chief Information Officer of Data & Analytics (2017-2019) and the former Chief Information Officer for Home Lending Technology (2015-2017), in each case for the consumer bank at JP Morgan Chase & Co. Ms. Allen has also held several leadership positions with Goldman Sachs & Co., a firm she served for a total of 24 years, where she was responsible for business planning and technical strategy, including as Managing Director, Co-Head of Global Operations Technology (2008-2015) and Managing Director, Global Regulatory, Risk and Control Head (2006-2013).

Ms. Allen brings to the Board extensive information technology and leadership experience, including in highly regulated industries. |

| | | |

| | | |

| Daniel A. Arrigoni Director Since: 2013 Age: 72 | Committees: •Management Development, Nominating and Governance •Risk Management | |

Daniel A. Arrigoni was President and Chief Executive Officer of U.S. Bank Home Mortgage Corp., one of the largest originators and servicers of home loans in the U.S., until his retirement in 2013. Prior to his retirement, Mr. Arrigoni also served as an Executive Vice President of U.S. Bank, N.A. Mr. Arrigoni led the mortgage company for U.S. Bank and its predecessor companies since 1996. Mr. Arrigoni has over 40 years of experience in the residential mortgage and banking industries.

Mr. Arrigoni brings to the Board a broad understanding of the mortgage business and its regulatory environment, skill in assessing and managing credit risk, and significant finance experience, each gained from his many years of executive management in the residential mortgage and banking industries. |

| | | |

MGIC Investment Corporation – 2023 Proxy Statement │ 17

| | | | | | | | | | | |

| | | |

| C. Edward Chaplin Director Since: 2014 Age: 66 | Committees: •Audit (Chair) •Securities Investment | Public Directorships: •Brighthouse Financial, Inc. |

C. Edward Chaplin was President and Chief Financial Officer at MBIA Inc., a provider of financial guarantee insurance and the largest municipal bond-only insurer, from 2008 until 2016, and remained with MBIA as Executive Vice President until his January 1, 2017 retirement. He joined MBIA in 2006 as its Chief Financial Officer, after having served as a member of its Board of Directors from 2003 until 2006. Prior to joining MBIA, Mr. Chaplin was Senior Vice President and Treasurer of Prudential Financial Inc., a firm he joined in 1983 and for which he held various senior management positions, including Regional Vice President of Prudential Mortgage Capital Company.

Mr. Chaplin brings to the Board a deep understanding of the insurance and real estate industries, management and leadership skills, and financial expertise. |

| | | |

| | | |

| Curt S. Culver Chairman of the Board Director Since: 1999 Age: 70 | Committees: •Executive | Public Directorships: •WEC Energy Group, Inc. and its subsidiary Wisconsin Electric Power Company |

Curt S. Culver was our Chairman of the Board from 2005 until his retirement as our Chief Executive Officer in 2015. He has served as our non-executive Chairman of the Board since 2015. He was our Chief Executive Officer from 2000 and was the Chief Executive Officer of Mortgage Guaranty Insurance Corporation (MGIC) from 1999, in both cases until his retirement, and he held senior executive positions with us and MGIC for more than five years before he became Chief Executive Officer.

Mr. Culver brings to the Board extensive knowledge of our business and operations and a long-term perspective on our strategy. |

| | | |

| | | |

| Jay C. Hartzell Director Since: 2019 Age: 53 | Committees: •Audit •Risk Management | |

Jay C. Hartzell is President of the University of Texas at Austin. Prior to being named President of the University in 2020, he was Dean of its McCombs School of Business, a position he held since 2016. He joined the University of Texas in 2001 and held several key administrative roles at the McCombs School before being named Dean, including Senior Associate Dean for Academic Affairs, Chair of the Finance Department, and Executive Director of the School’s Real Estate Finance and Investment Center. Prior to joining the University of Texas, Dr. Hartzell taught at the Stern School of Business at New York University.

As a senior university administrator and an experienced academic, Dr. Hartzell provides our Board with expertise on business organization, governance, real estate finance and corporate finance matters. |

| | | |

18 │ MGIC Investment Corporation – 2023 Proxy Statement

| | | | | | | | | | | |

| | | |

| Timothy A. Holt Director Since: 2012 Age: 70 | Committees: •Management Development, Nominating & Governance •Securities Investment (Chair) | Public Directorships: •Virtus Investment Partners, Inc.

|

Timothy A. Holt was an executive committee member and Senior Vice President and Chief Investment Officer of Aetna, Inc., a diversified health care benefits company, when he retired in 2008 after 30 years of service. From 2004 through 2007, he also served as Chief Enterprise Risk Officer of Aetna. Prior to being named Chief Investment Officer in 1997, Mr. Holt held various senior management positions with Aetna, including Chief Financial Officer of Aetna Retirement Services and Vice President, Finance and Treasurer of Aetna.

Mr. Holt brings to the Board investment expertise, skill in assessing and managing investment and credit risk, broad-based experience in a number of areas relevant to our business, including insurance, and senior executive experience gained at a major public insurance company. |

| |

| | | |

| Jodeen A. Kozlak Director Since: 2018 Age: 60 | Committees: •Business Transformation & Technology (Chair) •Management Development, Nominating & Governance | Public Directorships: •C.H. Robinson Worldwide, Inc. •KB Home •Leslie's Inc. |

Jodeen A. Kozlak is the founder of Kozlak Capital Partners, LLC, a private consulting firm, and has served as its CEO since 2017. Ms. Kozlak previously served as the Global Senior Vice President of Human Resources of Alibaba Group, a multinational conglomerate (2016-2017). Ms. Kozlak also previously served as the Executive Vice President and Chief Human Resources Officer of Target Corporation, one of the largest retailers in the U.S. (2007-2016), and held other senior leadership roles in her 15-year career there. Prior to joining Target, Ms. Kozlak was a partner in a private law practice.

Ms. Kozlak brings to the Board significant executive management experience. Through her service as Executive Vice President and Chief Human Resources Officer at a Fortune 100 company, Ms. Kozlak has developed significant knowledge and expertise in the area of human capital development and a deep understanding of executive compensation and business transformation within a public company. |

| |

| | | |

| Michael E. Lehman Lead Independent Director Director Since: 2001 Age: 72 | Committees: •Business Transformation & Technology •Executive •Management Development, Nominating and Governance (Chair) | Public Directorships: •Astra Space, Inc.

|

Michael E. Lehman served the University of Wisconsin in various capacities from March 2016 until October 2021, including as Interim Chief Operating Officer of the Wisconsin School of Business, Special Advisor to the Chancellor, Interim Vice Provost for Information Technology, Chief Information Officer and Interim Vice Chancellor for Finance and Administration. He had previously been a consultant (2014-2016); Interim Chief Financial Officer at Ciber Inc., a global information technology company (2013-2014); Chief Financial Officer of Arista Networks, a cloud networking firm (2012-2013); and Chief Financial Officer of Palo Alto Networks, a network security firm (2010-2012). Earlier in his career, he was the Executive Vice President and Chief Financial Officer of Sun Microsystems, Inc., a provider of computer systems and professional support services.

Mr. Lehman brings to the Board financial and accounting knowledge gained through his service as chief financial officer of a large, multinational public company; skills in addressing the range of financial issues facing a large company with complex operations; senior executive and operational experience; as well as technology and cybersecurity experience. |

| | | |

MGIC Investment Corporation – 2023 Proxy Statement │ 19

| | | | | | | | | | | |

| | | |

| Teresita M. Lowman Director Since: 2022 Age: 58 | Proposed Committees: •Audit •Business Transformation & Technology

| Public Directorships: •One Stop Systems, Inc.

|

Teresita (Sita) M. Lowman is a Strategic Advisor to Launch Factory, an incubator of technology start-up companies, a role she assumed in April 2021. She previously served at DXC Technology Company, a multi-billion-dollar Fortune 500 information technology services company, from 2017 until October 2021, most recently as the Vice President and General Manager of its America’s Microsoft Dynamics Portfolio, and in other leadership roles before then. She earlier served in leadership roles at Hewlett Packard Enterprise, Nortel Networks and Texas Instruments Defense Group (acquired by Raytheon). Ms. Lowman brings to the Board significant leadership experience in the information technology and cloud enterprise industries. Her expertise includes business transformation, cloud computing, data analytics, risk management and business continuity. |

| | | |

| | | |

| Timothy J. Mattke Director Since: 2019 Age: 47 | Committees: •Executive (Chair) | |

Timothy J. Mattke has been our Chief Executive Officer since 2019. He served as our Executive Vice President and Chief Financial Officer from 2014 to 2019, and our Controller from 2009 to 2014. Before then, he held other positions within the Accounting and Finance Departments. Before joining the Company in 2006, Mr. Mattke had been with PricewaterhouseCoopers LLP.

Mr. Mattke brings to the Board extensive knowledge of our industry, business and operations; financial acumen; a long-term perspective on our strategy; and the ability to lead our Company as the mortgage finance system and the mortgage insurance industry evolve. |

| |

| | | |

| Sheryl L. Sculley Director Since: 2019 Age: 70 | Committees: •Audit •Securities Investment | |

Sheryl L. Sculley is the former City Manager of the City of San Antonio Texas, the Chief Executive Officer of the municipal corporation, a position she held from 2005 until her retirement in April 2019. Prior to serving in that role, Ms. Sculley had been the Assistant City Manager (Chief Operating Officer) of Phoenix, Arizona from 1989 until 2005, the City Manager (Chief Executive Officer) of Kalamazoo, Michigan from 1984 until 1989 and in other city management roles before then. Today she is a consultant with Strategic Partnerships, Inc. and an adjunct professor at the University of Texas LBJ School of Public Affairs.

Ms. Sculley’s experience as a Chief Executive Officer leading large municipalities provides our Board with expertise on management, investment, financial and human resources matters. |

| | | |

| | | |

20 │ MGIC Investment Corporation – 2023 Proxy Statement

| | | | | | | | | | | |

| Mark M. Zandi Director Since: 2010 Age: 63 | Committees: •Risk Management (Chair) •Securities Investment | |

Mark M. Zandi, since 2007, has been Chief Economist of Moody’s Analytics, Inc., where he directs economic research. Moody’s Analytics is a leading provider of economic research, data and analytical tools. It is a subsidiary of Moody’s Corporation that is separately managed from Moody’s Investors Service, the rating agency subsidiary of Moody’s Corporation. Dr. Zandi is a trusted adviser to policymakers and an influential source of economic analysis for businesses, journalists and the public, and he frequently testifies before Congress on economic matters.

Dr. Zandi, with his economics and residential real estate industry expertise, brings to the Board a deep understanding of the economic factors that shape our industry. In addition, Dr. Zandi has expertise in the legislative and regulatory processes relevant to our business. |

| | | |

Item 1 – Election of Directors

Item 1 consists of the election of directors. The Board, upon the recommendation of the Management Development, Nominating and Governance Committee, has nominated Analisa M. Allen, Daniel A. Arrigoni, C. Edward Chaplin, Curt S. Culver, Jay C. Hartzell, Timothy A. Holt, Jodeen A. Kozlak, Michael E. Lehman, Teresita M. Lowman, Timothy J. Mattke, Sheryl L. Sculley and Mark M. Zandi for re-election to the Board to serve until our 2024 Annual Meeting of Shareholders. If any nominee is not available for election, proxies will be voted for another person nominated by the Board or the size of the Board will be reduced.

Shareholder Vote Required

Our Articles of Incorporation contain a majority vote standard for the election of directors in uncontested elections. Under this standard, each of the twelve nominees must receive a “majority vote” at the meeting to be elected a director. A “majority vote” means that when there is a quorum present, more than 50% of the votes cast in the election of the director are cast “for” the director, with votes cast being equal to the total of the votes “for” the election of the director plus the votes “withheld” from the election of the director. Therefore, under our Articles of Incorporation, a “withheld” vote is effectively a vote “against” a nominee. Broker non-votes will be disregarded in the calculation of a “majority vote.” Any incumbent director who does not receive a majority vote (but whose term as a director nevertheless would continue under Wisconsin law until his or her successor is elected) is required to send our Board a resignation. The effectiveness of any such resignation is contingent upon Board acceptance. The Board will accept or reject a resignation in its discretion after receiving a recommendation made by our Management Development, Nominating and Governance Committee and will promptly publicly disclose its decision regarding the director’s resignation (including the reason(s) for rejecting the resignation, if applicable).

| | |

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR EACH OF THE TWELVE NOMINEES. SIGNED PROXY CARDS AND VOTING INSTRUCTION FORMS WILL BE VOTED FOR THE NOMINEES UNLESS A SHAREHOLDER GIVES OTHER INSTRUCTIONS ON THE PROXY CARD OR VOTING INSTRUCTION FORM. |

MGIC Investment Corporation – 2023 Proxy Statement │ 21

Compensation of Directors

Non-Employee Director Compensation Program

Under our Corporate Governance Guidelines, compensation of non-employee directors is reviewed periodically by the Management Development, Nominating and Governance Committee. Mr. Mattke is our CEO and receives no additional compensation for service as a director, and he is not eligible to participate in any of the following programs or plans. The following table describes the components of the non-employee director compensation program in effect during 2022. Changes to the program for 2023 are discussed below.

| | | | | | | | |

| Compensation Component | | Compensation |

| Annual Retainer – Chairman of the Board | | $250,000, which may be elected to be deferred and either converted into cash-settled share units or credited to a bookkeeping account to which interest is credited. |

| Annual Retainer – Non-Chairman Directors | | $125,000, which may be elected to be deferred and either converted into cash-settled share units or credited to a bookkeeping account to which interest is credited. |

| Annual Retainer – Equity | | $125,000 in stock-settled RSUs that vest immediately but are not settled for approximately one year. Such settlement may be deferred at the option of the director. |

| Annual Retainer – Lead Director | | $25,000 |

| Annual Retainer – Committee Chair | | $25,000 for the Audit Committee

$25,000 for the Management Development, Nominating and Governance Committee

$15,000 for other committees1 |

| Annual Retainer – Committee Member | | $15,000 for Audit Committee

$5,000 for other committees1 |

Stock Ownership Guidelines2 | | Ownership of a number of shares of Common Stock with a value of $375,000, including deferred share units that have vested or are scheduled to vest within one year. Directors are expected to meet the guideline within five years of joining the Board. |

| Expense Reimbursement | | Subject to certain limits, we reimburse directors, and for meetings not held on our premises, their spouses, for travel, lodging and related expenses incurred in connection with attending Board and Committee meetings. |

| Directors & Officers Insurance | | We pay premiums for D&O liability insurance under which the directors are insureds. |

1 Excludes the Executive Committee. Other than the Executive Committee, directors who are members of management do not serve on any committees but may attend committee meetings.

2 Each of our non-employee directors satisfies this guideline.

22 │ MGIC Investment Corporation – 2023 Proxy Statement

COMPENSATION OF DIRECTORS

Deferred Compensation Plan and Annual Grant of Share Units

Under the Deferred Compensation Plan for Non-Employee Directors (the Deferred Compensation Plan), our non-employee directors can elect to defer payment of all or part of their retainers until the director’s death, disability, termination of service as a director or to another date specified by the director. A director who elects to defer payments may have his or her deferred compensation bookkeeping account credited quarterly with interest accrued at an annual rate equal to the six-month U.S. Treasury Bill rate determined at the closest preceding January 1 and July 1 of each year, or may elect to have the payments deferred during a quarter translated into share units. Each share unit is equal in value to one share of our Common Stock. If a director defers payments into share units, dividend equivalents in the form of additional share units are credited to the director’s account as of the date of payment of cash dividends on our Common Stock.

Under the Deferred Compensation Plan, in 2022, we also provided to each director the annual equity retainer described above, which is a grant of restricted stock units to be ultimately settled in shares of the Corporation's common stock. In February 2022, non-management directors other than Ms. Lowman were granted restricted share units valued at $125,000. Ms. Lowman was granted restricted share units valued at $96,300 at the time she joined the Board in April 2022. Each director's shares vested at the time of grant and were settled on February 15, 2023, unless the director elected a later settlement date. The directors could elect to have their restricted share units settled in up to ten annual installments beginning shortly after departure from the Board, or on another date specified by the director that was after February 15, 2023. Dividends in the form of additional restricted stock units are credited to the director as of the date of payment of cash dividends on our Common Stock.

2023 Director Compensation Program Changes

In January 2023, the Board approved the following changes to the director compensation program to better align it with market practices:

•The annual cash retainers for committee Chairpersons were increased to $40,000 for the Audit Committee, $35,000 for the Management Development, Nominating and Governance Committee, and $20,000 for other committees (excluding the Executive Committee).

MGIC Investment Corporation – 2023 Proxy Statement │ 23

COMPENSATION OF DIRECTORS

2022 Director Compensation

The following table shows the compensation paid to each of our non-management directors in 2022. Mr. Mattke, our CEO, was also a director in 2022 but received no compensation for service as a director.

| | | | | | | | | | | | | | | | | | | | |

| Name | | Fees Earned or

Paid in Cash

($) | | Total Stock Awards

($)1 | | Total

($) |

| Analisa M. Allen | | $ | 137,500 | | | $ | 125,000 | | | $ | 262,500 | |

| Daniel A. Arrigoni | | 145,000 | | | 125,000 | | | 270,000 | |

| C. Edward Chaplin | | 135,000 | | | 125,000 | | | 260,000 | |

| Curt S. Culver | | 250,000 | | | 125,000 | | | 375,000 | |

| Jay C. Hartzell | | 145,000 | | | 125,000 | | | 270,000 | |

| Timothy A. Holt | | 145,000 | | | 125,000 | | | 270,000 | |

| Jodeen A. Kozlak | | 145,000 | | | 125,000 | | | 270,000 | |

| Michael E. Lehman | | 182,500 | | | 125,000 | | | 307,500 | |

Melissa B. Lora2 | | 72,500 | | | 125,000 | | | 197,500 | |

Teresita M. Lowman | | 97,500 | | | 96,300 | | | 193,800 | |

| Gary A. Poliner | | 160,000 | | | 125,000 | | | 285,000 | |

| Sheryl L. Sculley | | 145,000 | | | 125,000 | | | 270,000 | |

| Mark M. Zandi | | 140,000 | | | 125,000 | | | 265,000 | |

1 The amount shown in this column for each director represents the grant date fair value of the restricted stock units granted to non-employee directors in 2022 under our Deferred Compensation Plan, computed in accordance with FASB Accounting Standard Codification (ASC) Topic 718. The value of restricted stock unit is equal to the value of our Common Stock on the grant date. See “Non-Employee Director Compensation Program — Deferred Compensation Plan and Annual Grant of Share Units” above for more information about these grants. The aggregate number of vested and unvested stock awards outstanding as of March 10, 2022, for each director, is described under “Stock Ownership Information.”

2 Ms. Lora did not stand for re-election at our 2022 Annual Meeting. In recognition of her service on our Board, we made a contribution of $25,000 to a charity that she designated. This contribution was not solicited by Ms. Lora, was not made under any agreement with her, and is not included in the table.

24 │ MGIC Investment Corporation – 2023 Proxy Statement

Executive Compensation

Item 2 – Advisory Vote to Approve our Named Executive Officer Compensation

As a matter of good governance and as required by Section 14A of the Securities Exchange Act, we are asking shareholders to approve, on an advisory basis, the compensation of our named executive officers (NEOs) as disclosed in this Proxy Statement.

While this vote is advisory and is not binding, the Board and the Committee will review and consider the voting results when making future decisions regarding compensation of our NEOs. See “Investor Outreach and Consideration of Last Year’s ‘Say on Pay’ Vote” in the Executive Summary to our CD&A.

Shareholder Vote Required

Approval of the compensation of our NEOs requires the affirmative vote of a majority of the votes cast on this matter. Abstentions and broker non-votes will not be counted as votes cast.

| | |

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR THE APPROVAL OF THE COMPENSATION OF OUR NEOs. SIGNED PROXY CARDS AND VOTING INSTRUCTION FORMS WILL BE VOTED FOR THE APPROVAL OF THE NEO COMPENSATION UNLESS A SHAREHOLDER GIVES OTHER INSTRUCTIONS ON THE PROXY CARD OR VOTING INSTRUCTION FORM. |

Compensation Discussion and Analysis

In this CD&A, we describe the objectives and components of our executive compensation program for our NEOs, and how we make compensation decisions. Please refer to our Glossary of Terms and Acronyms in Appendix A for definitions of certain capitalized terms and acronyms. Our 2022 NEOs are shown in the table below:

| | | | | |

| Name | Title |

| Timothy J. Mattke | Chief Executive Officer |

| Salvatore A. Miosi | President and Chief Operating Officer |

| Nathaniel H. Colson | Executive Vice President and Chief Financial Officer |

James J. Hughes1 | Executive Vice President – Sales and Business Development |

| Paula C. Maggio | Executive Vice President, General Counsel and Secretary |

1 On January 17, 2023, Mr. Hughes provided notice of his intent to retire, effective August 1, 2023. On April 1, 2023, Mr. Hughes will step down from his role as Executive Vice-President - Sales and Business Development and serve as a Special Advisor to the CEO until his retirement date.

MGIC Investment Corporation – 2023 Proxy Statement │ 25

Executive Summary — COMPENSATION DISCUSSION & ANALYSIS

Executive Summary

Key Takeaways

Despite headwinds, we continued to demonstrate strong performance in 2022