Pay vs Performance Disclosure - USD ($)

|

12 Months Ended |

Mar. 30, 2024 |

Mar. 25, 2023 |

Mar. 26, 2022 |

Mar. 27, 2021 |

| Pay vs Performance Disclosure |

|

|

|

|

| Pay vs Performance Disclosure, Table |

The following table sets forth the compensation for our principal executive officer (the “PEO”) and the average compensation for our other Named Executive Officers (“non-PEO NEOs”), both as reported in the Summary Compensation Table in this Proxy Statement and with certain adjustments to reflect the “compensation actually paid” to such individuals, as defined under the SEC’s pay versus performance disclosure rules, for each of fiscal year 2024, 2023, 2022 and 2021. For further information concerning our philosophy and how we align executive compensation with Company financial performance, refer to the CD&A in this Proxy Statement.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Summary

Compensation

Table Total for

PEO |

|

Compensation

“Actually

Paid” to PEO |

|

Average

Summary

Compensation

Table Total for

non-PEO

NEOs |

|

Average

Compensation

“Actually

Paid” to non-

PEO NEOs |

|

Value of Initial Fixed

$100 Investment Based

On: |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| 2024 |

|

|

$ |

1,652,413 |

|

|

|

$ |

619,403 |

|

|

|

$ |

1,031,908 |

|

|

|

$ |

300,737 |

|

|

|

|

86 |

|

|

|

|

258 |

|

|

|

$ |

37,571 |

|

|

|

$ |

1,276,789 |

|

|

|

|

|

|

|

|

|

|

| 2023 |

|

|

$ |

1,559,720 |

|

|

|

$ |

1,492,150 |

|

|

|

$ |

935,240 |

|

|

|

$ |

887,887 |

|

|

|

|

130 |

|

|

|

|

188 |

|

|

|

$ |

39,048 |

|

|

|

$ |

1,325,382 |

|

|

|

|

|

|

|

|

|

|

| 2022 |

|

|

$ |

4,554,904 |

|

|

|

$ |

3,125,422 |

|

|

|

$ |

1,198,786 |

|

|

|

$ |

868,745 |

|

|

|

|

114 |

|

|

|

|

194 |

|

|

|

$ |

61,568 |

|

|

|

$ |

1,359,328 |

|

|

|

|

|

|

|

|

|

|

| 2021 |

|

|

$ |

1,298,669 |

|

|

|

$ |

1,696,771 |

|

|

|

$ |

700,640 |

|

|

|

$ |

847,295 |

|

|

|

|

168 |

|

|

|

|

188 |

|

|

|

$ |

34,319 |

|

|

|

$ |

1,125,721 |

| The following table shows the executives who were included in columns B and C as our PEOs for fiscal years 2021 through 2024:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| M. Broderick |

|

|

|

|

|

|

|

|

X |

|

|

|

|

X |

|

|

|

|

X |

|

|

|

|

|

|

| B. Ponton |

|

|

|

X |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| R. Mellor |

|

|

|

X |

|

|

|

|

X |

|

|

|

|

|

|

|

|

|

|

| The following table shows the executives who were included in columns D and E as our non-PEO NEOs for fiscal years 2021 through 2024:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| B. D’Ambrosia |

|

|

|

X |

|

|

|

|

X |

|

|

|

|

X |

|

|

|

|

X |

|

|

|

|

|

|

| M. Mulholland |

|

|

|

X |

|

|

|

|

X |

|

|

|

|

X |

|

|

|

|

X |

|

|

|

|

|

|

| M. Henson |

|

|

|

|

|

|

|

|

X |

|

|

|

|

X |

|

|

|

|

X |

|

|

|

|

|

|

| R. Rajkowski |

|

|

|

X |

|

|

|

|

X |

|

|

|

|

X |

|

|

|

|

|

|

|

|

|

|

|

| D. Tripoli |

|

|

|

X |

|

|

|

|

|

|

|

|

|

X |

|

|

|

|

|

|

|

|

|

|

|

| C. Donovan |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

X |

| Compensation Actually Paid to PEO and Average Compensation Actually Paid to Non-PEO NEOs (Columns C and E) Columns C and E, respectively, include the amount of Compensation Actually Paid to our CEO and average of our other NEOs (according to SEC rules). The amounts are not current cash payments. Our retirement benefits are paid only after retirement and our long-term incentives’ value vary with company performance (including stock price) until they are vested or exercised (in the case of options). The following table shows adjustments made to total compensation for each year to determine the Compensation Actually Paid:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Summary Compensation

Table Total |

|

Minus summary

compensation

table value of

stock awards |

|

Minus summary

compensation

table value of

option awards |

|

plus pay versus

performance value

of equity awards |

|

equals compensation

actually paid |

|

|

|

|

|

|

| PEO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 2024 |

|

|

$ |

1,652,413 |

|

|

|

$ |

600,005 |

|

|

|

$ |

245,588 |

|

|

|

($ |

187,417 |

) |

|

|

$ |

619,403 |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 2024 |

|

|

$ |

1,031,908 |

|

|

|

$ |

389,579 |

|

|

|

$ |

128,318 |

|

|

|

($ |

213,274 |

) |

|

|

$ |

300,737 |

|

| |

• |

|

Summary Compensation Table Value of Stock Awards and Option Awards includes the total grant date fair value of equity awards reported in the Stock Awards and Option Awards columns in the Summary Compensation Table. |

| |

• |

|

Pay Versus Performance Value of Equity Awards includes the following: |

| |

- |

For awards granted in the applicable year, the fair value: |

| |

• |

|

At year-end for awards that are outstanding and unvested |

| |

• |

|

As of the vesting date for awards that vest in the applicable year |

| |

- |

For awards granted in prior years, the change in fair value: |

| |

• |

|

From the beginning of the year to the end of the year for awards that remain outstanding and unvested |

| |

• |

|

From the beginning of the year to the vesting date for awards that vest in the applicable year |

| |

• |

|

From the beginning of the year to zero for awards that fail to vest |

| |

• |

|

Fair values as of each measurement date were determined in accordance with ASC 718 as follows: |

| |

- |

Stock awards are valued based on the stock price on the relevant valuation date. Performance share awards are also adjusted to reflect the probable outcome of the performance conditions. |

| |

- |

Stock options were valued using the Black-Scholes model at grant date and are valued using the lattice valuation model at each subsequent valuation period. The lattice valuation model was deemed most appropriate because it is better able to value stock options at varying levels of stock price relative to the option exercise price. |

| |

- |

See Note 10 in our financial statements in the Form 10-K for the year ended March 30, 2024, as filed with the SEC for additional details on the valuation assumptions used at grant. | The following table shows the amounts included in the Pay Versus Performance Value of Equity Awards.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Year end fair

value of

equity

awards

granted

during

applicable

year |

|

change in FV

as of year

end of any

prior year

awards that

remain

unvested at

year end |

|

change in

fair value as

of the

vesting date

of any prior

year awards

that vested

during

applicable

year |

|

Fair value of

awards as

of vesting

date that

were

granted and

vested

during the

year |

|

subtract

the FV as

of the prior

FY for

awards

that did

not vest

(failed to

vest) |

|

add the amount

of dividend or

other earnings

paid on stock

or option

awards PRIOR

to vesting that

are not

otherwise

included in

total comp for

the FY |

|

Pay versus

Performance

Value of Equity

awards |

|

|

|

|

|

|

|

|

| PEO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 2024 |

|

|

$ |

670,220 |

|

|

|

$ |

(746,594 |

) |

|

|

$ |

(55,043 |

) |

|

|

|

— |

|

|

|

$ |

(56,000 |

) |

|

|

|

— |

|

|

|

$ |

(187,417 |

) |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 2024 |

|

|

$ |

297,884 |

|

|

|

$ |

(422,104 |

) |

|

|

$ |

(107,328 |

) |

|

|

|

46,800 |

|

|

|

$ |

(28,526 |

) |

|

|

|

— |

|

|

|

$ |

(213,274 |

) |

|

|

|

|

| Company Selected Measure Name |

Revenue

|

|

|

|

| Named Executive Officers, Footnote |

The following table shows the executives who were included in columns B and C as our PEOs for fiscal years 2021 through 2024:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| M. Broderick |

|

|

|

|

|

|

|

|

X |

|

|

|

|

X |

|

|

|

|

X |

|

|

|

|

|

|

| B. Ponton |

|

|

|

X |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| R. Mellor |

|

|

|

X |

|

|

|

|

X |

|

|

|

|

|

|

|

|

|

|

| The following table shows the executives who were included in columns D and E as our non-PEO NEOs for fiscal years 2021 through 2024:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| B. D’Ambrosia |

|

|

|

X |

|

|

|

|

X |

|

|

|

|

X |

|

|

|

|

X |

|

|

|

|

|

|

| M. Mulholland |

|

|

|

X |

|

|

|

|

X |

|

|

|

|

X |

|

|

|

|

X |

|

|

|

|

|

|

| M. Henson |

|

|

|

|

|

|

|

|

X |

|

|

|

|

X |

|

|

|

|

X |

|

|

|

|

|

|

| R. Rajkowski |

|

|

|

X |

|

|

|

|

X |

|

|

|

|

X |

|

|

|

|

|

|

|

|

|

|

|

| D. Tripoli |

|

|

|

X |

|

|

|

|

|

|

|

|

|

X |

|

|

|

|

|

|

|

|

|

|

|

| C. Donovan |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

X |

|

|

|

|

|

| Peer Group Issuers, Footnote |

Columns F and G are the cumulative total shareholder return of a $100 investment from the beginning of fiscal year 2021 through the end of each of the years indicated for the Company (column F) and the S&P Composite Specialty Retail Index (column G). Total shareholder return includes share price appreciation and assumes dividend reinvestment.

|

|

|

|

| PEO Total Compensation Amount |

$ 1,652,413

|

$ 1,559,720

|

$ 4,554,904

|

$ 1,298,669

|

| PEO Actually Paid Compensation Amount |

$ 619,403

|

1,492,150

|

3,125,422

|

1,696,771

|

| Adjustment To PEO Compensation, Footnote |

The following table shows adjustments made to total compensation for each year to determine the Compensation Actually Paid:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Summary Compensation

Table Total |

|

Minus summary

compensation

table value of

stock awards |

|

Minus summary

compensation

table value of

option awards |

|

plus pay versus

performance value

of equity awards |

|

equals compensation

actually paid |

|

|

|

|

|

|

| PEO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 2024 |

|

|

$ |

1,652,413 |

|

|

|

$ |

600,005 |

|

|

|

$ |

245,588 |

|

|

|

($ |

187,417 |

) |

|

|

$ |

619,403 |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 2024 |

|

|

$ |

1,031,908 |

|

|

|

$ |

389,579 |

|

|

|

$ |

128,318 |

|

|

|

($ |

213,274 |

) |

|

|

$ |

300,737 |

|

| |

• |

|

Summary Compensation Table Value of Stock Awards and Option Awards includes the total grant date fair value of equity awards reported in the Stock Awards and Option Awards columns in the Summary Compensation Table. |

| |

• |

|

Pay Versus Performance Value of Equity Awards includes the following: |

| |

- |

For awards granted in the applicable year, the fair value: |

| |

• |

|

At year-end for awards that are outstanding and unvested |

| |

• |

|

As of the vesting date for awards that vest in the applicable year |

| |

- |

For awards granted in prior years, the change in fair value: |

| |

• |

|

From the beginning of the year to the end of the year for awards that remain outstanding and unvested |

| |

• |

|

From the beginning of the year to the vesting date for awards that vest in the applicable year |

| |

• |

|

From the beginning of the year to zero for awards that fail to vest |

| |

• |

|

Fair values as of each measurement date were determined in accordance with ASC 718 as follows: |

| |

- |

Stock awards are valued based on the stock price on the relevant valuation date. Performance share awards are also adjusted to reflect the probable outcome of the performance conditions. |

| |

- |

Stock options were valued using the Black-Scholes model at grant date and are valued using the lattice valuation model at each subsequent valuation period. The lattice valuation model was deemed most appropriate because it is better able to value stock options at varying levels of stock price relative to the option exercise price. |

| |

- |

See Note 10 in our financial statements in the Form 10-K for the year ended March 30, 2024, as filed with the SEC for additional details on the valuation assumptions used at grant. | The following table shows the amounts included in the Pay Versus Performance Value of Equity Awards.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Year end fair

value of

equity

awards

granted

during

applicable

year |

|

change in FV

as of year

end of any

prior year

awards that

remain

unvested at

year end |

|

change in

fair value as

of the

vesting date

of any prior

year awards

that vested

during

applicable

year |

|

Fair value of

awards as

of vesting

date that

were

granted and

vested

during the

year |

|

subtract

the FV as

of the prior

FY for

awards

that did

not vest

(failed to

vest) |

|

add the amount

of dividend or

other earnings

paid on stock

or option

awards PRIOR

to vesting that

are not

otherwise

included in

total comp for

the FY |

|

Pay versus

Performance

Value of Equity

awards |

|

|

|

|

|

|

|

|

| PEO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 2024 |

|

|

$ |

670,220 |

|

|

|

$ |

(746,594 |

) |

|

|

$ |

(55,043 |

) |

|

|

|

— |

|

|

|

$ |

(56,000 |

) |

|

|

|

— |

|

|

|

$ |

(187,417 |

) |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 2024 |

|

|

$ |

297,884 |

|

|

|

$ |

(422,104 |

) |

|

|

$ |

(107,328 |

) |

|

|

|

46,800 |

|

|

|

$ |

(28,526 |

) |

|

|

|

— |

|

|

|

$ |

(213,274 |

) |

|

|

|

|

| Non-PEO NEO Average Total Compensation Amount |

$ 1,031,908

|

935,240

|

1,198,786

|

700,640

|

| Non-PEO NEO Average Compensation Actually Paid Amount |

$ 300,737

|

887,887

|

868,745

|

847,295

|

| Adjustment to Non-PEO NEO Compensation Footnote |

The following table shows adjustments made to total compensation for each year to determine the Compensation Actually Paid:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Summary Compensation

Table Total |

|

Minus summary

compensation

table value of

stock awards |

|

Minus summary

compensation

table value of

option awards |

|

plus pay versus

performance value

of equity awards |

|

equals compensation

actually paid |

|

|

|

|

|

|

| PEO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 2024 |

|

|

$ |

1,652,413 |

|

|

|

$ |

600,005 |

|

|

|

$ |

245,588 |

|

|

|

($ |

187,417 |

) |

|

|

$ |

619,403 |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 2024 |

|

|

$ |

1,031,908 |

|

|

|

$ |

389,579 |

|

|

|

$ |

128,318 |

|

|

|

($ |

213,274 |

) |

|

|

$ |

300,737 |

|

| |

• |

|

Summary Compensation Table Value of Stock Awards and Option Awards includes the total grant date fair value of equity awards reported in the Stock Awards and Option Awards columns in the Summary Compensation Table. |

| |

• |

|

Pay Versus Performance Value of Equity Awards includes the following: |

| |

- |

For awards granted in the applicable year, the fair value: |

| |

• |

|

At year-end for awards that are outstanding and unvested |

| |

• |

|

As of the vesting date for awards that vest in the applicable year |

| |

- |

For awards granted in prior years, the change in fair value: |

| |

• |

|

From the beginning of the year to the end of the year for awards that remain outstanding and unvested |

| |

• |

|

From the beginning of the year to the vesting date for awards that vest in the applicable year |

| |

• |

|

From the beginning of the year to zero for awards that fail to vest |

| |

• |

|

Fair values as of each measurement date were determined in accordance with ASC 718 as follows: |

| |

- |

Stock awards are valued based on the stock price on the relevant valuation date. Performance share awards are also adjusted to reflect the probable outcome of the performance conditions. |

| |

- |

Stock options were valued using the Black-Scholes model at grant date and are valued using the lattice valuation model at each subsequent valuation period. The lattice valuation model was deemed most appropriate because it is better able to value stock options at varying levels of stock price relative to the option exercise price. |

| |

- |

See Note 10 in our financial statements in the Form 10-K for the year ended March 30, 2024, as filed with the SEC for additional details on the valuation assumptions used at grant. | The following table shows the amounts included in the Pay Versus Performance Value of Equity Awards.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Year end fair

value of

equity

awards

granted

during

applicable

year |

|

change in FV

as of year

end of any

prior year

awards that

remain

unvested at

year end |

|

change in

fair value as

of the

vesting date

of any prior

year awards

that vested

during

applicable

year |

|

Fair value of

awards as

of vesting

date that

were

granted and

vested

during the

year |

|

subtract

the FV as

of the prior

FY for

awards

that did

not vest

(failed to

vest) |

|

add the amount

of dividend or

other earnings

paid on stock

or option

awards PRIOR

to vesting that

are not

otherwise

included in

total comp for

the FY |

|

Pay versus

Performance

Value of Equity

awards |

|

|

|

|

|

|

|

|

| PEO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 2024 |

|

|

$ |

670,220 |

|

|

|

$ |

(746,594 |

) |

|

|

$ |

(55,043 |

) |

|

|

|

— |

|

|

|

$ |

(56,000 |

) |

|

|

|

— |

|

|

|

$ |

(187,417 |

) |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 2024 |

|

|

$ |

297,884 |

|

|

|

$ |

(422,104 |

) |

|

|

$ |

(107,328 |

) |

|

|

|

46,800 |

|

|

|

$ |

(28,526 |

) |

|

|

|

— |

|

|

|

$ |

(213,274 |

) |

|

|

|

|

| Compensation Actually Paid vs. Total Shareholder Return |

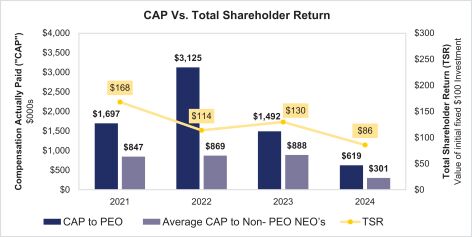

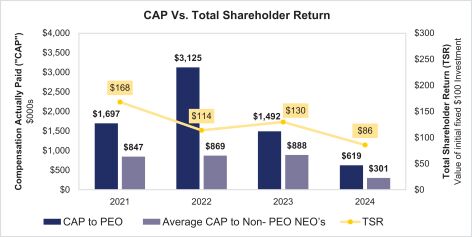

As shown in the chart below, the PEO and other NEO CAP amounts are aligned with the Company’s TSR. This is due primarily to the Company’s use of equity incentives, which are tied directly to stock price in addition to the Company’s financial performance. The Fiscal Year 2022 PEO CAP is higher primarily due to the equity awards granted to the Company’s new CEO in that year.

|

|

|

|

| Compensation Actually Paid vs. Net Income |

As shown in the chart below, the Company’s net income has fluctuated each year while the NEO CAP has not varied significantly, primarily due to the significant emphasis the Company places on equity incentives. The PEO CAP did increase significantly in Fiscal Year 2022, primarily due to the equity awards granted to the Company’s new CEO. The PEO and non-PEO CAP decreased more than net income from Fiscal Year 2023 to Fiscal 2024 because of a decrease in the Company’s stock price during Fiscal 2024. In addition, when determining incentive plan payouts, the Company does use pre-tax income which closely correlates to net income.

|

|

|

|

| Compensation Actually Paid vs. Company Selected Measure |

As shown in the chart below, the Company’s revenue trend has been in line with the NEO CAP each year. The PEO CAP did increase significantly in Fiscal Year 2022, primarily due to the equity awards granted to the Company’s new CEO. The PEO and non-PEO CAP decreased more than revenue from Fiscal Year 2023 to Fiscal 2024 because of a decrease in the Company’s stock price during Fiscal 2024. In addition, the Company does use comparable store sales increases when determining incentive plan payouts, which is closely tied to revenue.

|

|

|

|

| Total Shareholder Return Vs Peer Group |

As shown in the chart below, the PEO and other NEO CAP amounts are aligned with the Company’s TSR. This is due primarily to the Company’s use of equity incentives, which are tied directly to stock price in addition to the Company’s financial performance. The Fiscal Year 2022 PEO CAP is higher primarily due to the equity awards granted to the Company’s new CEO in that year.

|

|

|

|

| Tabular List, Table |

Financial Performance Measures As discussed in the CD&A above, our executive compensation program and compensation decisions reflect the guiding principle of aligning long-term performance with shareholder interests. The metrics used within our incentive plans are selected to support these objectives. The most important financial performance measures used by the Company during the most recently completed fiscal year include:

| |

• |

|

Pre-tax Return on Invested Capital |

|

|

|

|

| Total Shareholder Return Amount |

$ 86

|

130

|

114

|

168

|

| Peer Group Total Shareholder Return Amount |

258

|

188

|

194

|

188

|

| Net Income (Loss) |

$ 37,571,000

|

$ 39,048,000

|

$ 61,568,000

|

$ 34,319,000

|

| Company Selected Measure Amount |

1,276,789,000

|

1,325,382,000

|

1,359,328,000

|

1,125,721,000

|

| Measure:: 1 |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Name |

Revenue

|

|

|

|

| Measure:: 2 |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Name |

Pre-Tax Net Income

|

|

|

|

| Measure:: 3 |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Name |

Pre-tax Return on Invested Capital

|

|

|

|

| M. Broderick [Member] |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| PEO Name |

M. Broderick

|

|

|

|

| B. Ponton [Member] |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| PEO Name |

B. Ponton

|

|

|

|

| R. Mellor [Member] |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| PEO Name |

R. Mellor

|

|

|

|

| PEO | STOCK awards [Member] |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Adjustment to Compensation, Amount |

$ 600,005

|

|

|

|

| PEO | OPTION awards [Member] |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Adjustment to Compensation, Amount |

245,588

|

|

|

|

| PEO | Equity awards [Member] |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Adjustment to Compensation, Amount |

(187,417)

|

|

|

|

| PEO | Year end fair value of equity awards granted during applicable year [Member] |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Adjustment to Compensation, Amount |

670,220

|

|

|

|

| PEO | change in FV as of year end of any prior year awards that remain unvested at year end [Member] |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Adjustment to Compensation, Amount |

(746,594)

|

|

|

|

| PEO | change in fair value as of the vesting date of any prior year awards that vested during applicable year [Member] |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Adjustment to Compensation, Amount |

(55,043)

|

|

|

|

| PEO | FV as of the prior FY for awards that did not vest (failed to vest) [Member] |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Adjustment to Compensation, Amount |

(56,000)

|

|

|

|

| Non-PEO NEO | STOCK awards [Member] |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Adjustment to Compensation, Amount |

389,579

|

|

|

|

| Non-PEO NEO | OPTION awards [Member] |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Adjustment to Compensation, Amount |

128,318

|

|

|

|

| Non-PEO NEO | Equity awards [Member] |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Adjustment to Compensation, Amount |

(213,274)

|

|

|

|

| Non-PEO NEO | Year end fair value of equity awards granted during applicable year [Member] |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Adjustment to Compensation, Amount |

297,884

|

|

|

|

| Non-PEO NEO | change in FV as of year end of any prior year awards that remain unvested at year end [Member] |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Adjustment to Compensation, Amount |

(422,104)

|

|

|

|

| Non-PEO NEO | change in fair value as of the vesting date of any prior year awards that vested during applicable year [Member] |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Adjustment to Compensation, Amount |

(107,328)

|

|

|

|

| Non-PEO NEO | Fair value of awards as of vesting date that were granted and vested during the year [Member] |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Adjustment to Compensation, Amount |

46,800

|

|

|

|

| Non-PEO NEO | FV as of the prior FY for awards that did not vest (failed to vest) [Member] |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Adjustment to Compensation, Amount |

$ (28,526)

|

|

|

|