EX-10.4

Exhibit 10.4

THIS EXHIBIT HAS BEEN REDACTED AND IS THE SUBJECT OF A CONFIDENTIAL TREATMENT REQUEST. REDACTED MATERIAL IS MARKED WITH “*” AND BRACKETS AND HAS

BEEN FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION.

ROBOTIC DEVELOPMENT AND SUPPLY AGREEMENT

This Robotic Development and Supply Agreement (“Agreement”) is made as of this 13th day of February, 2014 (“Effective

Date”), by and between Microline Surgical, Inc. of 800 Cummings Center, Suite 166T, Beverly, MA 01915 (“Microline”) and TransEnterix Surgical, Inc. of 635 Davis Drive, Suite 300, Durham, North Carolina 27713

(“TransEnterix”).

WHEREAS, Microline develops and sells flexible and rigid sealing instruments for use in surgical

procedures;

WHEREAS, TransEnterix previously agreed to have Microline develop and supply a fully disposable flexible sealing product and

power supply (known as FVS and UPS Products) in a Development and Supply Agreement dated November 4, 2011 (the “Original Agreement”);

WHEREAS, the parties are amending the Original Agreement by entering into Amendment No. 1 to the Original Agreement;

WHEREAS, TransEnterix is developing and launching its SurgiBot® surgical platform,

and wishes to engage Microline to develop a flexible sealer product for its Robotic System (as defined below) for exclusive use in the Field with the Robotic System; and

WHEREAS, following the development of such FSP Product (as defined below), Microline shall supply such FSP Product, along with the Power

Supply Product (as defined below), to TransEnterix on the terms and conditions set forth herein;

NOW THEREFORE in consideration of the

foregoing premises and for good and valuable consideration (the receipt and sufficiency of which is hereby acknowledged by the parties), the parties hereby agree as follows:

(a) “Affiliates” shall mean a person or entity that

directly, or indirectly through one or more intermediaries, controls or is controlled by, or is under common control with, the person specified. For purposes of this definition, the terms “control,” “controlled by” and

“under common control with” shall mean the possession, directly or indirectly, of the power to direct or cause the direction of the management or policies of such person and, in the case of an entity, shall require (a) in the case of

a corporate entity, direct or indirect ownership of at least a majority of the stock or shares having the right to vote for the election of directors, and (b) in the case of a non-corporate entity, direct or indirect ownership of at least a

majority of the equity interests with the power to direct the management and policies of such non-corporate entity.

(b) “Animal

Testing “ shall mean burst pressure testing of the FSP Product using explanted vessels, and simulated use testing of the FSP Product in a live animal model.

(c) “Control” shall mean with respect to any Technology or Intellectual Property Right, the possession (whether by ownership

or license, other than by a license granted pursuant

THIS EXHIBIT HAS BEEN REDACTED AND IS THE SUBJECT OF A CONFIDENTIAL TREATMENT REQUEST. REDACTED MATERIAL

IS MARKED WITH “*” AND BRACKETS AND HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION.

to this Agreement) by a party of the ability to grant to the other party access, ownership, a license and/or a sublicense under such Technology or Intellectual Property Right without violating

the terms of any agreement or other arrangement with any third party as of the time such party would first be required hereunder to grant the other party such access, ownership, license, or sublicense.

(d) “Deliverable” shall mean any of the items to be delivered by Microline to TransEnterix pursuant to the Work Plan,

including the PoPP1, PoPP2, and Pilot Product Units.

(e) [Intentionally omitted.]

(f) “Design Review” shall mean a meeting between Microline and TransEnterix where a detailed review of the FSP Product device

design and any relevant document deliverables occurs. The Design Review is not considered complete until the Project Directors agree in writing that the design or documentation changes resulting from the review are complete and that the reviewed FSP

Product device design is considered acceptable.

(g) “FDA” shall mean the United States Food and Drug Administration and

any successor agency thereto.

(h) “FDA Clearance [******] mm or [**] mm” shall mean Microline’s 510(k) clearance by

the FDA for marketing and sale in the United States of the FSP Product developed by Microline hereunder, with a [*****************************] indication and for use with the Robotic System.

(i) “FDA Clearance [**]” shall mean a 501(k) clearance by the FDA for marketing and sale in the United States of the FSP

Product developed hereunder, with a [************************************] indication and for use with the Robotic System.

(j)

“FDA Submission [*****] mm or [**] mm” shall mean Microline’s submission to the FDA of a request for 510(k) clearance for marketing and sale in the United States of the FSP Product developed hereunder, with

a [******************************** ****] indication and for use with the Robotic System.

(k) “Field” shall mean

open, minimally invasive and laparoscopic surgery.

(l) “FSP Design Freeze” shall mean the reasonable completion of the

design and Design Review for the final iteration of the FSP Product, where the Project Directors agree that the resulting device should meet all of the FSP Product Specifications. This assessment is made based upon the review of (i) PoPP2 test

data (or such other test data as required) and (ii) design modifications made to reasonably address specification failures in PoPP2 (or any subsequent proof of principle prototype iterations).

(m) “FSP Launch Date” shall mean the date on which all Milestones have been met and Pilot Product Acceptance has occurred.

- 2 -

THIS EXHIBIT HAS BEEN REDACTED AND IS THE SUBJECT OF A CONFIDENTIAL TREATMENT REQUEST. REDACTED MATERIAL

IS MARKED WITH “*” AND BRACKETS AND HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION.

(n) “FSP Product” shall mean the fully disposable flexible vessel sealing

product that (i) utilizes the Power Supply Products, (ii) is designed and intended for use with the Robotic System and (iii) is designed in accordance with the FSP Product Specifications.

(o) “FSP Product Specifications” shall mean the written requirements and specifications for the FSP Product to be developed

hereunder, as agreed to in writing by the Parties pursuant to Section 2(f) and as subsequently amended by mutual agreement of the Parties.

(p) “Good Manufacturing Practices” shall mean all rules and standards contained in the then-current “Good Laboratory

Practices,” and/or “Good Manufacturing Practices,” as promulgated by the FDA or by any other Governmental Authority having jurisdiction over the development, marketing or sale of any Supply Product.

(q) “Governmental Authority” shall mean any nation, territory, or government (or union thereof), foreign, domestic, or

multinational, any state, local, or other political subdivision thereof, and any bureau, court, tribunal, board, commission, department, agency, or other entity exercising executive, legislative, judicial, regulatory, or administrative functions of

government, including all taxing authorities and all European notified bodies, including notified bodies within the sense of Article 16 of the European Union Medical Device Directive 93/42/EEC, and all other entities exercising regulatory authority

over medical products or devices.

(r) “Intellectual Property Rights” shall mean all intellectual property rights in any

jurisdiction worldwide, including: (i) Patent Rights; (ii) rights associated with Technology that are works of authorship including copyrights, copyright applications, and copyright registrations; (iii) rights relating to the

protection of Technology as trade secrets, know-how or confidential information; and (iv) rights in any trade names, trademarks, service marks, domain names, logos, trade dress and brand features.

(s) “Marketing Requirements Document” shall mean the description of the requirements for the development of the FSP Product

as initially set forth on Exhibit A, and as reviewed and updated in writing by mutual agreement of the Project Directors.

(t)

“Milestone” shall mean each of the events listed in Section 10, which include, in addition to the Effective Date of this Agreement, Kick-Off Meeting, Design Review and sign off on Supply Product Specification, Proof of

Principle Prototype 1, Proof of Principle Prototype 2, FSP Design Freeze, FDA Clearance [**], FDA Submission [******] mm or [**] mm, and FDA Clearance [*****] mm or [**] mm.

(u) “Patent Rights” shall mean all patents, patent applications and inventions on which patent applications are filed and all

patents issuing therefrom worldwide, together with any extensions, registrations, confirmations, reissues, continuations, divisionals, continuations, continuations-in-part, reexamination certificates, substitutions or renewals, supplemental

protection certificates, term extensions (under applicable patent law or other law), provisional rights and certificates of inventions.

- 3 -

THIS EXHIBIT HAS BEEN REDACTED AND IS THE SUBJECT OF A CONFIDENTIAL TREATMENT REQUEST. REDACTED MATERIAL

IS MARKED WITH “*” AND BRACKETS AND HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION.

(v) “Pilot Product Acceptance” shall mean acceptance by TransEnterix of the

Pilot Product Units, which acceptance shall not be unreasonably withheld, and which acceptance shall be made if the Pilot Product Units are acceptable for use in accordance with instructions for use and substantially meet the tissue sealing product

specifications within the Supply Product Specifications agreed upon by the Project Directors.

(w) “Pilot Product Units”

shall mean one-hundred (100) sterile units of the FSP Product in compliance with the Warranties, for initial clinical demand, that are to be delivered to TransEnterix pursuant to the Work Plan.

(x) “Power Supply Product” shall mean the Microline Universal Power Supply product conforming to the applicable Supply

Product Specification and consistent with the Marketing Requirements Document.

(y) “Program Executives” shall mean

Sharad Joshi or his successor as Chief Executive Officer for Microline, and Todd M. Pope or his successor as Chief Executive Officer for TransEnterix.

(z) “Profit Margin” shall mean [*********************] of then-current Transfer Price for a Supply Product.

(aa) “Project” shall mean the development work to be performed by Microline pursuant to this Agreement.

(bb) “Project Directors” shall initially mean Richard M. Mueller and Chris Devlin and their successors agreed to by the

Program Executives.

(cc) “Project Technology” shall mean any Technology conceived, created, made or reduced to practice

during the Term solely or jointly by or on behalf of Microline or TransEnterix, in each case directly arising out of the performance of this Agreement.

(dd) “Proof of Principle Prototype 1” or “PoPP1” shall mean the completion of the design, Design Review,

fabrication and testing (including Animal Testing) of the first iteration of FSP Product prototypes. [*************************************** **********************************************************************************************************

********************************************************************************************************** **********************************************************.]

|

| (ee) “Proof of Principle Prototype 2” or “PoPP2” shall mean the completion of the design, Design Review, fabrication and

testing (including Animal Testing) of the second iteration of FSP Product prototypes.[******************************************* ***********************************************************************************************************

*********************************************************************************************************** ***********************************************************************************************************

*********************************************************************************************************** ***************************************************************************.] |

- 4 -

THIS EXHIBIT HAS BEEN REDACTED AND IS THE SUBJECT OF A CONFIDENTIAL TREATMENT REQUEST. REDACTED MATERIAL

IS MARKED WITH “*” AND BRACKETS AND HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION.

(ff) “Regulatory Approval” shall mean FDA Clearance [******] mm or [**] mm.

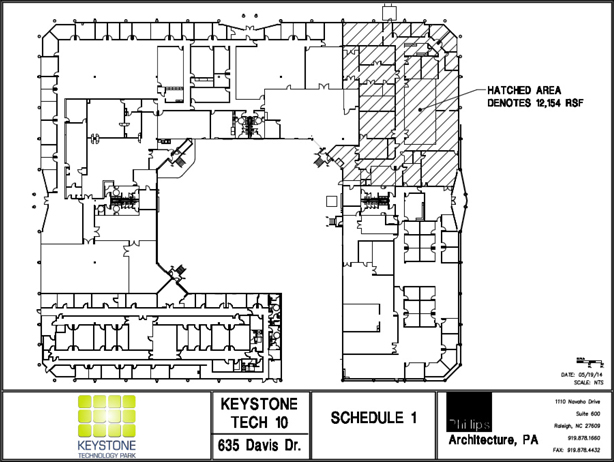

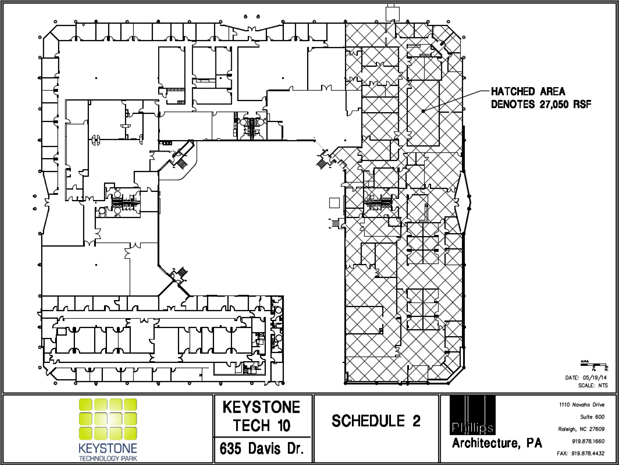

(gg) “Robotic System” shall mean TransEnterix’s robotic surgical system, with the characteristics described on

Exhibit B.

(hh) “Supply Products” shall mean the FSP Products and the Power Supply Products.

(ii) “Supply Product Specifications” shall mean the FSP Product Specifications and the specifications for the Power Supply

Product in each case as developed by the Project Directors and consistent with the requirements set forth in the Marketing Requirements Document, and as agreed to by the Project Directors in writing.

(jj) “Technology” shall mean any invention, conception, process, composition, device, apparatus, discovery, improvement

thereon or other technology, whether or not patented or patentable or otherwise protectable by Intellectual Property Rights.

(kk)

“Transfer Price” for a Supply Product for a given period shall mean the transfer price indicated on Exhibit D for such Supply Product and period.

(ll) “Work Plan” shall mean the Work Plan, including the timeline and Work Plan Budget, for development of the FSP Product as

mutually agreed-upon by the parties and attached as Exhibit C, as such Exhibit may be updated and amended upon mutual written agreement of the parties (acting through the Program Executives) as provided in this Agreement.

(a) Supply Product Specifications and Marketing Requirements

Document. The parties will mutually agree to and approve Supply Product Specifications and Marketing Requirements Documents. Prior to the Kick-Off Meeting required under Section 2(f), Microline shall develop, with collaborative input by

TransEnterix, proposed Supply Product Specifications that are consistent with the Marketing Requirements Document. It is understood and agreed to by the Parties that while the Supply Product Specifications shall be developed through collaboration

between the parties, Microline shall be considered the developer of the Supply Product Specifications for all regulatory purposes. TransEnterix must provide a clear set of technical specifications of the Robotic System that affect the Supply Product

Specifications before Supply Product Specifications are finalized.

(b) Agreement to Develop. Microline shall, in consideration of

the payments to be made by TransEnterix pursuant to this Agreement, use commercially reasonable efforts to (i) design and develop an FSP Product, for use with the Robotic System, that is consistent with the Marketing Requirements Document and

in accordance with the FSP Product Specification, (ii) deliver the Deliverables as set forth in the Work Plan, including the prototypes and Pilot Product Units, and (iii) otherwise comply with its obligations in the Work Plan and the

Marketing Requirements Document.

- 5 -

THIS EXHIBIT HAS BEEN REDACTED AND IS THE SUBJECT OF A CONFIDENTIAL TREATMENT REQUEST. REDACTED MATERIAL

IS MARKED WITH “*” AND BRACKETS AND HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION.

(c) TransEnterix’s Obligations. TransEnterix shall make test fixtures and

breadboards available to Microline at mutually agreed points in the Work Plan so it can test for compatibility and interactions with the Robotic System. TransEnterix will certify the test fixtures and breadboards and in any event supply them to

Microline so as not to delay development of the FSP Product or Power Supply Product. TransEnterix shall otherwise use its commercially reasonable efforts to perform any responsibilities allocated to it in the Work Plan.

(d) Project Directors. Each Project Director shall be responsible for representing the interests of the corresponding party with

respect to the management of the Project. The parties acknowledge and agree that the Project Directors shall have the authority to amend the Marketing Requirements Document, and the Supply Product Specifications, on behalf of the parties upon mutual

agreement.

(e) Design Meetings. The Project Directors shall meet periodically to discuss the status of the Project at such times

and in such locations or forms (e.g., telephone or video conference) as the parties shall agree. At such meetings, the parties shall review the progress of the Project as against the Work Plan and any potential technical difficulties or potential

need to revise the Work Plan, the Marketing Requirements Document, or the Supply Product Specifications. The Microline Project Director shall be responsible for recording the minutes of each meeting. Such minutes shall be circulated within ten

(10) business days following the meeting for review and comment. Such minutes shall be deemed approved by both of the parties unless a party objects to the accuracy of such minutes by providing written notice to the other party’s Project

Director within ten (10) business days of receipt of such minutes.

(f) Kick-Off Meeting. The first meeting of the Project

Directors (the “Kick-Off Meeting”) may take place before or as soon as practicable following the Effective Date; provided that the parties shall endeavor to hold such Kick-Off Meeting within thirty (30) days after the

Effective Date or on such other date as mutually agreed to by the parties. During the Kick-Off Meeting, the parties shall (i) review each of the Work Plan, the Marketing Requirements Document, and the Supply Product Specifications developed by

the parties under Section 2(a), and (ii) develop and agree to a detailed statement of work (the “SOW”) which shall become part of the Work Plan. Promptly after the Kick-Off Meeting, Microline shall update the FSP Product

Specification, Power Supply Product Specification, Work Plan (including by incorporating the SOW) and/or Marketing Requirements Document to reflect any changes agreed to by the parties during the Kick-Off Meeting, and the same shall be delivered to

the Program Executives for written approval.

(g) Changes to Marketing Requirements Document, Supply Product Specifications or Work

Plan. Except as provided herein, no changes to the Work Plan, Supply Product Specifications, or Marketing Requirements Document shall be permitted without the written consent of both parties. If either party wishes to propose a change to any

such document, it shall submit a written request for such change, describing all anticipated changes in fees, costs, feasibility or delivery schedule that will result from such change. The parties shall then negotiate in good faith the requested

change, but neither party shall be under any obligation to agree to any change, and if the parties fail to agree to a change the Project shall continue unamended.

- 6 -

THIS EXHIBIT HAS BEEN REDACTED AND IS THE SUBJECT OF A CONFIDENTIAL TREATMENT REQUEST. REDACTED MATERIAL

IS MARKED WITH “*” AND BRACKETS AND HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION.

(h) Development Costs. Microline shall use commercially reasonable efforts to design

and develop the FSP Product to be developed hereunder in accordance with the budget set forth in the Work Plan (“Work Plan Budget”). To the extent that Microline shall incur any capital costs or overruns not accounted for in the Work Plan

Budget, such expenses shall be the sole responsibility of Microline (and such overruns or costs shall not relieve Microline of any of its obligations to TransEnterix hereunder). Microline shall have the sole authority to select and manage vendors to

be used in connection with the project. TransEnterix will have the option to make direct payments to vendors for purchases of tooling specific to the FSP Supply Products. In such cases, TransEnterix shall additionally pay to the vendors the costs

for validations of such tooling made at such vendors’ facilities, whereas Microline shall be solely responsible for operation of the tooling and any costs associated with validations of such tooling made at the Microline facility.

(i) Subcontracting. Either party may subcontract its obligations under the Work Plan upon prior written notice to the other party. Each

party shall be responsible for any act or omission of any of its subcontractors in connection with such subcontractor’s performance of such party’s obligations under this Agreement. Each Party agrees to enter into an agreement with any

such subcontractors pursuant to which the subcontractor agrees to be bound by the confidentiality and intellectual property obligations of the parties set forth in Section 14 of this Agreement. TransEnterix may perform a quality system

assessment of any subcontractor who provides Microline with contract manufacturing services related to the Supply Products.

| 3. |

DELIVERABLES AND TESTING; REGULATORY APPROVAL |

(a) Deliverables. Microline shall

use commercially reasonable efforts to deliver Deliverables conforming to the Supply Product Specifications and Marketing Requirements Document to TransEnterix in accordance with the Work Plan (and the timeframes set forth therein). Upon delivery of

a Deliverable, Microline shall also deliver to TransEnterix copies of all associated design documentation, test data, reports, and any other information that is reasonably required by TransEnterix in order to understand and review such Deliverable.

(b) Review of Deliverables. Upon delivery to TransEnterix of the Pilot Product Units, TransEnterix shall promptly, but within no

more than fifteen (15) business days, (i) inspect, review and test and (ii) accept or reject such Pilot Product Units by written notice to Microline. Upon delivery to TransEnterix of any Deliverable (but not including the Pilot

Product Units or any Deliverable defined herein to require mutual satisfaction or agreement (e.g., FSP Design Freeze, PoPP1, PoPP2)), TransEnterix shall promptly, but within no more than ten (10) business days, (i) inspect, review and test

each Deliverable and (ii) accept or reject such Deliverable by written notice to Microline. Payment for any Deliverable with an associated Milestone payment under Section 10 shall be due as specified in Section 10(a). TransEnterix

shall accept all such Deliverables delivered in reasonable conformity with the material aspects of the Supply Product Specifications, Marketing Requirements Document, or Work Plan, as applicable, but may reject any Deliverable that fails to conform

to a reasonable degree with material aspects of such criteria. In the event TransEnterix rejects any such Deliverable, it shall provide the reasons for such rejection to Microline. Unless the parties agree to a longer timeframe and/or cost, as

applicable, Microline shall have up to forty-five (45) days following

- 7 -

THIS EXHIBIT HAS BEEN REDACTED AND IS THE SUBJECT OF A CONFIDENTIAL TREATMENT REQUEST. REDACTED MATERIAL

IS MARKED WITH “*” AND BRACKETS AND HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION.

such rejection to remedy any deficiencies in such Deliverable and to re-deliver such Deliverable to TransEnterix. The parties shall repeat the procedures described in this Section 3(b) until

the Deliverable, based on the good faith determination of TransEnterix, conforms to the Supply Product Specifications. Notwithstanding anything to the contrary in this Agreement, each Party shall be commercially reasonable in agreeing that a

Milestone or Deliverable has been met.

(c) Regulatory Approval. Microline shall apply for and use commercially reasonable efforts

to obtain at its expense Regulatory Approval, and corresponding 510(k) clearance for use of the Power Supply Product, in each case in the United States. Microline shall keep TransEnterix informed as to the status of its applications for such

Regulatory Approval and 510(k) clearance, and shall advise TransEnterix as to whether such applications are for the [******] mm or [**] mm [************] indication. As reasonably requested by TransEnterix, the Parties shall meet to negotiate

mutually acceptable amendments to the Work Plan and SOW to develop necessary extended Shelf Life (as defined in 6(a)), and the necessary information and documents for filing for such additional regulatory clearances in jurisdictions outside of the

United States at TransEnterix’s expense, including, without limitation, the technical file for CE/European approval. All cost increases associated with such amendments shall be reflected in a mutually agreed-upon amendment to the Work Plan.

TransEnterix shall cooperate with Microline relating to all material issues, amendments, supplements, and other matters described in this Section 3(c) respecting all regulatory approvals for the FSP Product developed hereunder. Upon such

mutually agreed-upon amendments, Microline shall use commercially reasonable efforts to obtain regulatory approvals for use of the FSP Product developed hereunder, and the Power Supply Product, in jurisdictions outside of the United States, as

agreed, at TransEnterix’s expense.

(d) TransEnterix shall use commercially reasonable efforts to, within five (5) months from

the Effective Date, freeze the aspects of the Robotic System that affect the FSP Product Specification (“Surgibot Design Freeze”). If Surgibot Design Freeze does not occur within five (5) months of the Effective Date, all subsequent

deadlines shall be extended by the length of time Surgibot Design Freeze is delayed. Microline’s obligations to meet the Milestones, the Deliverables and Pilot Product Acceptance are subject to the Robotic System receiving FDA clearance and

such Robotic System aspects not changing in the FDA-cleared Robotic System in a way that affects the FSP Product Specification.

(a) Purchase and Sale. During the Minimum Period (defined in

Section 4(c))), Microline agrees to manufacture and sell to TransEnterix all of its requirements for the Supply Products at the prices set forth on Exhibit D, in each case subject to the other terms and conditions of this Agreement.

(b) Forecasts. Subject to Section 4(c), each quarter, TransEnterix will provide Microline non-binding, rolling twelve

(12) month forecasts for its requirements for the Supply Products. Such forecasts shall become binding with respect to any given calendar quarter ninety (90) days prior to the commencement of such calendar quarter. Microline shall use

commercially reasonable efforts to accommodate such forecasts and provide the required Supply

- 8 -

THIS EXHIBIT HAS BEEN REDACTED AND IS THE SUBJECT OF A CONFIDENTIAL TREATMENT REQUEST. REDACTED MATERIAL

IS MARKED WITH “*” AND BRACKETS AND HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION.

Products in accordance with the forecasts provided by TransEnterix (timeframe and volume), subject to a reasonable maximum monthly order limit to be determined by the parties in good faith.

Notwithstanding the foregoing, (i) Microline shall meet TransEnterix’s volume requirements for the Supply Products in any given quarter provided that the volume for such quarter is not in excess of [******************] from the previous

quarter, and (ii) Microline shall provide the Supply Products to TransEnterix on the dates described in the binding forecasts. Microline covenants and agrees with TransEnterix to use its commercially reasonable efforts to accommodate any change

in the forecasts requested by TransEnterix (i.e., increases, decreases, timing of delivery, etc.).

(c) Product Minimums.

Notwithstanding anything to the contrary contained in this Agreement, during each of the [*************************] following the FSP Launch Date (collectively, the “Minimum Period”), TransEnterix shall purchase at least the

minimum number of Supply Products set forth on Exhibit E, which number shall be reduced by [****]% for each month’s delay in the FSP Launch Date from the date specified in the Work Plan that is caused solely by Microline (the

“Minimum Products”). Delays to the Work Plan that are caused by a delay in TransEnterix deliverables or by mutually agreed changes to FSP Product Specifications will not be counted towards this reduction in Minimum Products, but

instead will shift the Work Plan schedule accordingly. [*************************************************************************************************

************************************************************************************************************ ******************************************************************************************************

****************************************************.] During any Renewal Term (as such term is defined in Section 15(a)), TransEnterix shall purchase the cumulative minimum number of Supply Products set forth on Exhibit E for such

Renewal Term (the “Renewal Minimum Products”).[*****************************************************************

************************************************************************************************************ ************************************************************************************************************

*******************************************************************.]

(d) Improvements to Power Supply Products. Microline may

notify TransEnterix in writing of any improvement made by Microline to the Power Supply Products during the Term (“Improvements Notice”), which Improvements Notice shall contain a reasonably detailed description of such improvement.

If TransEnterix notifies Microline in writing (“Election Notice”) within thirty (30) days after the receipt of such Improvements Notice that TransEnterix desires to incorporate such improvement into the Power Supply Products

being supplied to TransEnterix hereunder, the parties shall negotiate in good faith an adjustment to the price of such Power Supply Products to reflect such improvement. To the extent that the parties cannot agree upon such an adjustment within

sixty (60) days following Microline’s receipt of the Election Notice, such adjustment shall be determined in accordance with Section 16(e).

(e) Inventory Reports. Within fifteen (15) days following each quarter during the Term, TransEnterix shall provide Microline with

an inventory report for such quarter in such form as Microline may reasonably request, along with a short summary of TransEnterix’s marketing and sales plans for the Supply Products.

- 9 -

THIS EXHIBIT HAS BEEN REDACTED AND IS THE SUBJECT OF A CONFIDENTIAL TREATMENT REQUEST. REDACTED MATERIAL

IS MARKED WITH “*” AND BRACKETS AND HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION.

| 5. |

SHIPPING, RISK OF LOSS, ACCEPTANCE |

(a) Shipment. Microline shall: (i) ship

Supply Products in accordance with Section 4(b) to TransEnterix’s address as specified in Section 16(i) or such other address specified by TransEnterix in writing; (ii) enclose a packing memorandum with each shipment and, when

more than one (1) package is shipped, identify the package containing the memorandum; (iii) forward bills of lading and shipping notices with invoices; and (iv) invoice TransEnterix by mailing or otherwise transmitting invoices,

bills, and notices to TransEnterix’s address as specified in Section 16(i).

(b) Shipping Point, Risk of Loss. Microline

shall pack the Supply Products in accordance with good commercial practice to avoid damage in transit. Supply Products ordered by TransEnterix shall be shipped by Microline FOB Beverly, Massachusetts, with the carrier and to TransEnterix’s

address as specified in Section 16(i) or such other address specified by TransEnterix in writing. The Supply Products shall be sent from Microline and received by TransEnterix sterile, finished, supply boxed and packaged with appropriate

TransEnterix labeling (unless otherwise specified by TransEnterix) so that TransEnterix can ship the Supply Products directly to its customers.

| 6. |

SUPPLY PRODUCT WARRANTIES |

(a) Supply Product Warranty. Microline represents and

warrants to TransEnterix that (i) all Supply Products (and the Pilot Product Units) will function with other Supply Products (i.e., the FSP Supply Product will function with the Power Supply Product supplied hereunder, and vice versa), conform

in all material respects to the applicable Supply Product Specifications, will conform with the applicable Regulatory Approval and will be free from any material defects in materials and workmanship for a period (the “Shelf Life”)

of twelve (12) months from the date of shipment from Microline to TransEnterix or such other duration agreed to in writing by the parties, (ii) Microline will transfer good title to the Supply Products to TransEnterix, and (iii) all

documentation supplied with the Supply Products will be complete and accurate (the warranties contained in Section 6(a)(i), (ii) and (iii) collectively, the “Warranties”).

(b) Inspection and Acceptance. Within fifteen (15) business days after delivery of a shipment of Supply Products, TransEnterix (or

its end user customer) shall conduct a visual inspection of the quantity and outside of the packaging of each unit of sale received in such shipment and may, at its option, test select units for conformance to Supply Product Specifications, and

shall provide written notice to Microline identifying any (a) Supply Product shortages or (b) Supply Products that substantially fail to conform with the Warranties (each of (a) and (b), a “Warranty Claim”). Except as

otherwise set forth below, any Supply Product for which a Warranty Claim has not been received by Microline within the fifteen (15) day period shall be deemed to have been accepted by TransEnterix. TransEnterix’s acceptance of such Supply

Product shall be deemed to waive any claims other than claims brought during the Shelf Life of such Supply Product arising solely out of such Supply Product’s substantial failure to

- 10 -

THIS EXHIBIT HAS BEEN REDACTED AND IS THE SUBJECT OF A CONFIDENTIAL TREATMENT REQUEST. REDACTED MATERIAL

IS MARKED WITH “*” AND BRACKETS AND HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION.

comply with any of the Warranties (and not arising solely out of TransEnterix’s or any end-user’s storage, handling, modification, misuse, marketing, export, import, advertising,

labeling, distribution or sale of such Supply Product) (a “Specifications Claim”).

(c) End-User Procedures.

Whenever TransEnterix shall sell a Supply Product it shall instruct the purchaser of such Supply Product to contact TransEnterix customer service for general support for such Supply Product. TransEnterix shall provide general support and maintenance

for such Supply Product; provided that if such Supply Product is returned to TransEnterix due to a Warranty Claim or a Specifications Claim, TransEnterix shall provide such Supply Product(s) to Microline within fifteen (15) business days

following receipt of such returned Supply Product(s) by TransEnterix. Upon verification of such claim in accordance with Section 7(e), Microline shall promptly repair or replace such Supply Product, at Microline’s sole cost and expense

provided that the Supply Product did not meet the Supply Product Specifications or Warranties and was used in accordance with instructions for use.

| 7. |

QUALITY, AUDIT AND RECORDS |

(a) Appointment of Quality Control Manager. Each

party shall appoint a responsible Quality Control Manager who shall be responsible for all communications with respect to quality control with the other party, including those relating to Supply Product qualification and inspection, testing and

quality control procedures.

(b) Quality Assurance. Microline shall adopt and maintain a quality system to ensure that all Supply

Products manufactured under this Agreement conform to the applicable approved Supply Product Specifications (the “QA System”). TransEnterix may annually perform a quality system assessment and product assessment (i.e. quality system

audit and product quality audit) at Microline’s facilities to assure conformance to quality system regulations and product specifications. Each party shall work together in good faith to resolve any issues related to quality and/or regulatory

requirements.

(c) Government Inspections. Microline agrees to provide access to its facilities at any time to FDA representatives

or, if applicable, representatives from any other Governmental Authorities (including notified bodies) having appropriate jurisdiction for inspection or other purposes, on any notice period required by the FDA or any other Governmental Authority. In

addition, if the facilities used by Microline to manufacture the Supply Products are the subject of an audit or inspection by the FDA or similar Governmental Authority, Microline shall notify TransEnterix and if possible under the circumstances,

TransEnterix shall have the right to be present during such audit or inspection.

(d) Records. Microline shall keep complete,

accurate and detailed original records pertaining to the manufacture of the Supply Products hereunder. Records shall be maintained for the longer of (i) any period required under applicable law; and (ii) a period of ten (10) years

after expiration or termination of this Agreement. Microline shall make available to TransEnterix such records without unreasonable delay to the extent reasonably requested and required by TransEnterix to comply with its regulatory and other legal

and reasonable business requirements.

- 11 -

THIS EXHIBIT HAS BEEN REDACTED AND IS THE SUBJECT OF A CONFIDENTIAL TREATMENT REQUEST. REDACTED MATERIAL

IS MARKED WITH “*” AND BRACKETS AND HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION.

(e) Microline Personnel. During the Shelf Life of each Supply Product delivered

hereunder, Microline shall provide, at the request of TransEnterix and at no additional cost to TransEnterix, technically competent personnel of Microline to assist in the identification and resolution of any performance problems with the Supply

Products in accordance with Microline’s regulatory procedures.

(f) Complaints and Corrective Action.

(i) TransEnterix will be the initial contact for all complaints from its customers. TransEnterix will record, log, and

maintain complaint files. TransEnterix will forward to Microline reports of complaints within ten (10) business days of their receipt by TransEnterix. If the complaint is accompanied by or followed by return of the subject Supply Product

to TransEnterix, TransEnterix will return to Microline the Product that is the subject of the complaint; provided, TransEnterix may at its option perform an initial evaluation of the returned Product to determine the root cause of failure.

Microline shall make available all complaint investigation reports, customer communications and corrective actions associated with Supply Product complaint reports within sixty (60) days of receiving the TransEnterix report of complaint.

(ii) Microline will be responsible for filing all required regulatory reports with the appropriate Regulatory Authorities.

(g) Product Recalls. If, in the judgment of Microline or TransEnterix, any Supply Product defect or any government action requires a

recall of, or the issuance of an advisory letter regarding, any Supply Product, either Party shall undertake such recall or issue such advisory letter only after notification to and agreement with the other Party. Each Party shall notify the

other Party within five (5) business days of becoming aware (as such phrase is defined in 21 CFR 803) of any issue that could lead to a field action related to the Supply Products. The Parties shall endeavor to reach an

agreement prior to making any recall or issuing any advisory letter regarding the manner, text and timing of any publicity to be given in such matters in time to comply with any applicable legal or regulatory requirements, but such agreement will

not be a precondition to any action that either Party deems necessary to protect users of Supply Products or to comply with any applicable governmental orders or mandates. The Parties agree to provide reasonable assistance to one another in the

event of any recall or issuance of any advisory letter. Notwithstanding anything in this Agreement to the contrary, TransEnterix shall have the right to manage any Supply Product recall.

(h) Return of Products Safety Related or Not Safety Related. With regard to issues pertaining to quality, reliability, durability or

customer dissatisfaction, but not necessarily pertaining to safety related issues, whereby customer complaints indicate a known or inherent product fault, flaw, or deficiency not related to the Marketing Requirements, both parties shall work

together in good faith to resolve the issues. TransEnterix may return inventory of Supply Products to Microline for rework, repair, or replacement at Microline’s expense in the event of known and confirmed product faults, flaws, or deficiencies

whether related to product safety or not within a reasonable period of time but not to exceed thirty (30) days from the time of the return.

- 12 -

THIS EXHIBIT HAS BEEN REDACTED AND IS THE SUBJECT OF A CONFIDENTIAL TREATMENT REQUEST. REDACTED MATERIAL

IS MARKED WITH “*” AND BRACKETS AND HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION.

(a) Microline Exclusivity; Changes to FSP Product. Microline agrees

that it shall develop the FSP Product exclusively for, and supply the FSP Product exclusively to, TransEnterix for use with the Robotic System in the Field. TransEnterix acknowledges and agrees that nothing herein shall preclude Microline from

conducting any development efforts, or from using any Microline Background Technology, Microline Project Technology, or Intellectual Property Rights therein, in each case to research, develop or commercialize products (other than the FSP Product, or

any fully or partially reusable version thereof, specifically for use with the Robotic System in the Field). Microline covenants and agrees that it shall promptly refer all inquiries regarding the FSP Product for use with the Robotic System in the

Field to TransEnterix. Microline agrees that it will not supply the FSP Product for use with the Robotic System, or any other product specifically for use with the Robotic System, to any third party (other than TransEnterix), whether directly or

indirectly, for use in the Field. Microline acknowledges that any continuing and material breach of this Section 8(a) may cause TransEnterix irreparable harm for which damages may not be an adequate remedy, and accordingly Microline hereby

agrees that the issuance of an injunction or other equitable relief may be appropriate to restrain any such breach or threatened breach.

[******************************************************************************************************

*********************************************************************************************************** ***********************************************************************************************************

********************************************.]

(b) TransEnterix Exclusivity. During the Minimum Period, and except as set forth in

Section 8(c), TransEnterix agrees that it shall purchase all FSP Products and Power Supply Products, and any other vessel sealing devices and associated power supply products for use with the Robotic System, exclusively from Microline.

(c) Alternate Suppliers. In the event that either (i) Microline shall determine that it no longer has the capability to

manufacture Supply Products for TransEnterix or (ii) Microline fails to supply at least [**]% of the binding forecasts for [***] consecutive quarters (unless due to reasons beyond the reasonable control of Microline), in each case in accordance

with this Agreement, then either Microline shall provide written notice thereof to TransEnterix promptly after making such determination in Section 8(c)(i) or TransEnterix will provide notice of such failure to supply in Section 8(c)(ii)

(which Microline can reasonably dispute). Within sixty (60) days after such notice (or if disputed, after resolution of such dispute), Microline shall provide TransEnterix with written notice (the “Alternative Supplier Notice”)

identifying one or more third party manufacturer(s) (each, an “Alternative Supplier”) from which TransEnterix may purchase the Supply Products. If Microline fails to so deliver the Alternative Supplier Notice (or if the Alternative

Supplier(s) identified in the Alternative Supplier Notice cannot or will not deliver the Supply Products in accordance with TransEnterix’s minimum forecasts and at or less than the pricing set forth in this Agreement, in TransEnterix’s

reasonable discretion), then TransEnterix may choose one or more alternative suppliers in its sole discretion. Promptly after

- 13 -

THIS EXHIBIT HAS BEEN REDACTED AND IS THE SUBJECT OF A CONFIDENTIAL TREATMENT REQUEST. REDACTED MATERIAL

IS MARKED WITH “*” AND BRACKETS AND HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION.

the selection of an Alternative Supplier (or another alternative supplier chosen by TransEnterix pursuant to the immediately preceding sentence), Microline shall provide such alternative supplier

with sufficient information to permit such alternative supplier to manufacture the Supply Products and authorize said alternative supplier to manufacture Supply Products, including a limited non-exclusive, non-sublicensable license under Microline

Project Technology and Microline Background Technology solely to the extent necessary to manufacture Supply Products for TransEnterix.

| 9. |

COMMERCIALIZATION OF SUPPLY PRODUCTS |

(a) Commercialization of Supply Products.

Except as otherwise provided in this Agreement, TransEnterix shall have sole responsibility for, and sole discretion with respect to, the commercialization of the Supply Products as long as it does not alter or modify the Supply Products, and it

provides for the use of the Supply Products solely with its Robotic System in accordance with the applicable Regulatory Approval and other use specifications as provided by Microline.

(b) Use of Trademarks.

(i) TransEnterix Marks. All Supply Products ordered by TransEnterix under this Agreement shall bear solely such trademarks, service

marks, trade names and logo identifications owned by or licensed to TransEnterix as TransEnterix shall specify (the “TransEnterix Marks”); provided that all Supply Products shall bear the trademarks of Microline and/or its

Affiliates (the “Microline Marks”) as reasonably requested by Microline, which Microline Marks shall be displayed less prominently than the TransEnterix Marks. Microline shall have no right or license to use any TransEnterix Marks

(other than to affix them to the packaging and labeling of the Supply Products sold to TransEnterix under this Agreement). All goodwill relating to or developed with respect to any TransEnterix Marks shall belong exclusively to TransEnterix or its

Affiliates. Microline will not challenge the validity of any such TransEnterix Mark or use a mark that is deceptively similar to any of the TransEnterix Marks.

(ii) Microline Trademark License. Microline hereby grants to TransEnterix a non-exclusive, non-transferable, worldwide, royalty-free

license to use the Microline Marks in connection with TransEnterix’s marketing and sale of the Supply Products. All goodwill associated with the foregoing license shall inure to the benefit of Microline and its Affiliates, and Microline shall

have sole control of, and responsibility for, any applications and registrations for the Microline Marks. TransEnterix shall use the Microline Marks in accordance with Microline’s reasonable guidelines with respect to trademark usage of the

Microline Marks, as provided to TransEnterix upon reasonable prior notice.

(c) Labeling. Microline shall provide to TransEnterix

samples of the planned labeling or product literature at least ninety (90) days prior to the submission of the labeling to regulatory authorities in accordance with the FDA Clearance [******] mm or [**] mm, the FDA Clearance [**] and, if

applicable, CE Mark Technical File, or other similar regulatory market applications. Microline shall give full consideration to any comments received from TransEnterix with respect to such labeling and product literature. In addition, Microline

shall

- 14 -

THIS EXHIBIT HAS BEEN REDACTED AND IS THE SUBJECT OF A CONFIDENTIAL TREATMENT REQUEST. REDACTED MATERIAL

IS MARKED WITH “*” AND BRACKETS AND HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION.

provide to TransEnterix copies of the regulatory approved or cleared labeling to be used in connection with any FSP Supply Product at least thirty (30) days prior to the first commercial

sale of such Supply Product. Thereafter, TransEnterix shall provide Microline with notice describing any material change to any such labeling or product literature at least ninety (90) days prior to the first incorporation of such material

change, and Microline shall give full consideration to comments received from TransEnterix with respect to such material change.

(a) Payments for Development Milestones. In consideration of the work

to be conducted by Microline pursuant to the Work Plan, TransEnterix shall pay Microline non-refundable milestone payments as set forth below:

[**********************************************************************************;]

[************************************************************************************************* **********;]

[*************************************************************************************************

********************************************************;]

[************************************************************************************************* **;]

[***********************************************************************************;]

[************************************************************************************************* *********;]

[************************************************************************************************* **************************;]

[************************************************************************************************* *********************;]

(b) Supply Products.

(i) Microline shall invoice TransEnterix within thirty (30) days following each shipment of Supply Products in accordance with the

shipping terms set forth in Section 4 above. Prices shall be as set forth on Exhibit D, and TransEnterix shall pay all invoiced amounts in accordance with such pricing terms within thirty (30) days of receipt of an invoice therefor.

(ii) Each invoice shall contain (A) Microline’s name and the invoice date, (B) the type, price, and quantity of the Supply

Products actually delivered, (C) the name (where

- 15 -

THIS EXHIBIT HAS BEEN REDACTED AND IS THE SUBJECT OF A CONFIDENTIAL TREATMENT REQUEST. REDACTED MATERIAL

IS MARKED WITH “*” AND BRACKETS AND HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION.

applicable), title, phone number, and complete mailing address of the responsible official to whom payment shall be sent, and (D) other substantiating documentation or information as may

reasonably be required by TransEnterix from time to time.

| 11. |

REPRESENTATIONS AND WARRANTIES |

(a) Development Warranty. Microline represents

and warrants to TransEnterix that it will develop the FSP Products diligently, with reasonable skill and care, and using the services of appropriately skilled and trained workers, and in compliance with Good Manufacturing Practices and the QA

Procedures.

(b) Representations and Warranties of Microline. Microline represents and warrants that as of the Effective Date

(i) Microline has the full power, right and authority to enter into this Agreement, carry out its obligations under this Agreement, and grant the rights granted to TransEnterix hereunder; (ii) Microline has not previously granted and will

not in the future grant any rights in or to the Microline Background Technology (as defined in Section 12(a)), Microline Project Technology (as defined in Section 12(b)), FSP Products or the Power Supply Products to a third party which are

inconsistent with the rights granted to TransEnterix herein; (iii) Microline has not received any communications alleging that Microline’s use of Microline Background Technology relating to the FSP Products or Power Supply Products would

violate Intellectual Property Rights of any third party; and (iv) Microline shall comply in all material respects with all applicable laws.

(c) Representations and Warranties of TransEnterix. TransEnterix represents and warrants that as of the Effective Date, (i) it has

the full power, right and authority to enter into this Agreement and to carry out its obligations hereunder; (ii) TransEnterix has not previously granted and will not in the future grant any rights in or to the TransEnterix Background

Technology (as defined in Section 12(a)), TransEnterix Project Technology (as defined in Section 12(c)) or Robotic System to a third party which are inconsistent with the rights granted to Microline herein; (iii) TransEnterix will use

commercially reasonable efforts to seek to obtain all United States regulatory approvals from, to make all necessary and appropriate applications and other submissions to, and to prepare and maintain all records, studies and other documentation

needed to maintain and demonstrate compliance with the requirements of, the FDA and other United States Governmental Authorities for its business activities relating to the Robotic System; and (iv) TransEnterix has not received any

communications alleging that TransEnterix’s use of TransEnterix Background Technology relating to the Robotic System would violate Intellectual Property Rights of any third party; and (v) TransEnterix shall comply in all material respects

with all applicable laws.

(d) Exclusion of Any Other Warranties of Microline. The representations and warranties contained in this

Agreement are made in lieu of all other representations or warranties, express or implied, by Microline, whether oral or written. Microline hereby disclaims all implied warranties, including the warranties of merchantability and fitness for a

particular purpose.

- 16 -

THIS EXHIBIT HAS BEEN REDACTED AND IS THE SUBJECT OF A CONFIDENTIAL TREATMENT REQUEST. REDACTED MATERIAL

IS MARKED WITH “*” AND BRACKETS AND HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION.

| 12. |

INTELLECTUAL PROPERTY |

(a) Background Technology. Each party shall own and retain

all right, title and interest in and to all Technology, and all Intellectual Property Rights therein, Controlled by such party that does not constitute Project Technology or that is otherwise created prior to or independently from the Project

(“Microline Background Technology” and “TransEnterix Background Technology,” respectively). Microline Background Technology and TransEnterix Background Technology each includes all Technology Controlled by Microline

or TransEnterix, as the case may be, and disclosed to the other party for use in connection with the Project, together with any improvements to, or derivations of, such Technology.

(b) Microline Project Technology. Microline shall own all right, title and interest in and to all Project Technology, and all

Intellectual Property Rights therein, related to the FSP Products or the Power Supply Products or to the development efforts relating to such FSP Products or Power Supply Products (“Microline Project Technology”), but excluding all

TransEnterix Background Technology and TransEnterix Project Technology).

(c) TransEnterix Project Technology. TransEnterix shall

own all right, title and interest in and to the following Project Technology: (i) all Project Technology, and all Intellectual Property Rights therein, relating to Interface Features (defined below), and (ii) all Project Technology, and

all Intellectual Property Rights therein, that is an improvement to, a derivation of, or in the Robotic System (“TransEnterix Project Technology”). For the purposes of this Section 12(c), an “Interface Feature”

means any feature for mechanically, electrically or electronically coupling or connecting the FSP Product with the Robotic System, whether those components of the Interface Feature are included on the FSP Product or the Robotic System.

(d) Assignment of Technology. Subject to the licenses and other rights specifically set forth in this Agreement, to the extent either

party (such party, the “Assigning Party”) obtains any title or similar ownership interest in any Project Technology, or any Intellectual Property Rights therein, that is to be owned by the other party (the “Assigned

Party”) in accordance with the terms and conditions of this Agreement, the Assigning Party hereby assigns and, to the extent such assignment cannot be made at present, agrees promptly to assign, to the Assigned Party all of the Assigning

Party’s title and other ownership interest in and to such Project Technology and Intellectual Property Rights. The Assigning Party shall execute and procure such documents, including short-form assignments and assignments of patent applications

and patents, and take such other actions as may be reasonably requested from time to time by the Assigned Party to obtain for its own benefit appropriate protections for Intellectual Property Rights with respect to such Project Technology, or

otherwise to transfer or confirm the transfer, in whole or in part, as the case may be, of such Project Technology and the related Intellectual Property Rights for the benefit of the Assigned Party. Each party represents and covenants that all of

its employees, consultants and agents, and all third parties acting on behalf of such party in performing its obligations under this Agreement, shall be obligated under a binding written agreement to assign to such party all Project Technology and

Intellectual Property Rights conceived, created, made or reduced to practice by such employees, consultants, agents and third parties in connection with the Project.

- 17 -

THIS EXHIBIT HAS BEEN REDACTED AND IS THE SUBJECT OF A CONFIDENTIAL TREATMENT REQUEST. REDACTED MATERIAL

IS MARKED WITH “*” AND BRACKETS AND HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION.

(e) Prosecution and Enforcement of Project Technology. The owner of any Project

Technology (the “Owner”) shall have the sole right to prepare, file applications on and registrations for, prosecute, obtain, maintain, defend and enforce all Intellectual Property Rights in such Project Technology in such manner as

the Owner deems appropriate in its sole discretion, including incurring all expenses required for such purposes. Notwithstanding the foregoing, (i) Microline shall use commercially reasonable efforts to preserve, obtain and maintain all

Intellectual Property Rights for Microline Project Technology and for Microline Background Technology related to the FSP Products or the Power Supply Products and to file patent applications covering any inventions included within such technology,

in each case in its reasonable discretion and (ii) TransEnterix shall use commercially reasonable efforts to preserve, obtain and maintain all Intellectual Property Rights for TransEnterix Project Technology and for TransEnterix Background

Technology related to the Robotic System and to file patent applications covering any inventions included within such technology, in each case in its reasonable discretion. The non-Owner party shall cooperate fully at its own expense in those

activities by the Owner, which cooperation shall include, without limitation, (i) promptly executing all papers and instruments or requiring the non-Owner’s employees, agents and third parties acting on the non-Owner’s behalf to

execute such papers and instruments as are reasonable and appropriate so as to enable the Owner to prepare, file, prosecute, obtain, maintain, defend and enforce such Intellectual Property Rights, and (ii) promptly informing the Owner of

matters that may affect those activities (including any prior art that may be material to Patent Rights contained in the such Intellectual Property Rights).

(f) License Grants.

(i)

Subject to the terms and conditions of this Agreement, Microline hereby grants to TransEnterix a worldwide, non-exclusive license or sublicense (as the case may be) in the Field, without the right to sublicense except to subcontractors as permitted

by Section 2(h), under all Intellectual Property Rights Controlled by Microline to use the Microline Background Technology and Microline Project Technology, but only as necessary to exercise its rights to sell the Supply Products

purchased from Microline to distributors and end users or fulfill its obligations under this Agreement. The license granted pursuant to this Section 12(f)(i) is only transferable in accordance with the terms and conditions of

Section 16(c).

(ii) Subject to the terms and conditions of this Agreement, TransEnterix hereby grants to Microline a worldwide,

non-exclusive license or sublicense (as the case may be in the Field), without the right to sublicense except to subcontractors as permitted by Section 2(h), under all Intellectual Property Rights Controlled by TransEnterix, to use TransEnterix

Background Technology and TransEnterix Project Technology, but only as necessary to exercise its rights or fulfill its obligations under this Agreement. The license granted pursuant to this Section 12(f)(ii) is only transferable

in accordance with the terms and conditions of Section 16(c).

(g) No Implied Licenses.

(i) TransEnterix acknowledges and agrees that, as between the parties and notwithstanding anything to the contrary in this Agreement,

Microline owns all right, title and

- 18 -

THIS EXHIBIT HAS BEEN REDACTED AND IS THE SUBJECT OF A CONFIDENTIAL TREATMENT REQUEST. REDACTED MATERIAL

IS MARKED WITH “*” AND BRACKETS AND HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION.

interest in and to, including all Intellectual Property Rights pertaining to, all Microline Background Technology and Microline Project Technology, and that under this Agreement, TransEnterix

shall acquire no right, title or interest in or to any of the foregoing, by implication, estoppel or otherwise, other than the license rights expressly granted herein or as otherwise expressly provided herein.

(ii) Microline acknowledges and agrees that, as between the parties and notwithstanding anything to the contrary in this Agreement,

TransEnterix owns all right, title and interest in and to, including all Intellectual Property Rights pertaining to, all TransEnterix Background Technology and TransEnterix Project Technology, and that under this Agreement, Microline shall acquire

no right, title or interest in or to any of the foregoing, by implication, estoppel or otherwise, other than the license rights expressly granted herein or as otherwise expressly provided herein.

| 13. |

INDEMNIFICATION AND INSURANCE |

(a) Microline Product Liability Indemnification.

Microline shall defend, indemnify and hold harmless TransEnterix, its Affiliates, their permitted successors and assigns and their respective directors, officers, employees, and agents from and against all liabilities, damages, losses, settlements,

claims, actions, suits, penalties, fines, costs and expenses (including reasonable attorneys and professionals’ fees) (“Liabilities”) resulting from any and all claims by third parties for loss, damage or injury (including

death) caused by (i) any Warranty Claim or Specifications Claim, (ii) Microline’s material breach of this Agreement, (iii) Microline’s gross negligence or willful misconduct or (iv) any other defect to any Supply

Product directly attributable to Microline or its subcontractors or suppliers, except, in the case of clauses (i) through (iv), to the extent such Liabilities are caused by (A) the storage, handling, modification, misuse, marketing,

export, import, advertising, labeling, distribution or sale by TransEnterix of any Supply Product, (B) TransEnterix’s material breach of this Agreement, (C) TransEnterix’s gross negligence or willful misconduct or (D) any

TransEnterix product containing or used in conjunction with a Supply Product, including, without limitation, the Robotic System (“TransEnterix Product”).

(b) TransEnterix Product Liability Indemnification. TransEnterix shall defend, indemnify and hold harmless Microline, its Affiliates,

their permitted successors and assigns and their respective directors, officers, employees, and agents from and against all Liabilities resulting from any and all claims by third parties for loss, damage or injury (including death) caused by

(i) the storage, handling, modification, misuse, marketing, export, import, advertising, labeling, distribution or sale by TransEnterix of any Supply Product, (ii) TransEnterix’s material breach of this Agreement,

(iii) TransEnterix’s gross negligence or willful misconduct or (iv) any TransEnterix Product, except, in the case of clauses (i) through (iv), to the extent such Liabilities are caused by (A) any Warranty Claim or

Specifications Claim, (B) Microline’s material breach of this Agreement, (C) Microline’s gross negligence or willful misconduct or (D) any other defect to any Supply Product directly attributable to Microline or its

subcontractors or suppliers.

- 19 -

THIS EXHIBIT HAS BEEN REDACTED AND IS THE SUBJECT OF A CONFIDENTIAL TREATMENT REQUEST. REDACTED MATERIAL

IS MARKED WITH “*” AND BRACKETS AND HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION.

(c) Procedure. The parties will follow the following procedures with respect to any

indemnification provided pursuant to this Agreement:

(i) Any person claiming indemnification under this Agreement (the

“Indemnified Party”) will give Microline or TransEnterix, as the case may be (the “Indemnitor”), written notice of any claim promptly after receipt by such Indemnified Party of notice thereof. Any delay in giving

notice hereunder which does not materially prejudice the Indemnitor will not affect the Indemnified Party’s rights to indemnification hereunder. The Indemnitor will have the right to defend the Indemnified Party against any claim with counsel

of its choice reasonably satisfactory to the Indemnified Party so long as (A) the Indemnitor notifies the Indemnified Party in writing, within fifteen (15) days after the Indemnified Party has given notice of the claim, of the

Indemnitor’s election to defend the claim and of the identity of the Indemnitor’s counsel, (B) the Indemnitor provides the Indemnified Party with evidence reasonably acceptable to the Indemnified Party that the Indemnitor will have

the financial resources to defend against the claim and fulfill its indemnification obligations hereunder, (C) the claim involves only money damages and does not seek an injunction or other equitable relief, and (D) the Indemnitor conducts

the defense of the claim actively and diligently.

(ii) So long as the Indemnitor is conducting the defense of the claim in accordance

with clause (i) above, (A) the Indemnified Party may retain separate co-counsel at its sole cost and expense and participate in the defense of the claim, (B) the Indemnified Party will not consent to the entry of any judgment or enter

into any settlement with respect to the claim without the prior written consent of the Indemnitor (which consent shall not be unreasonably withheld) and (C) the Indemnitor will not consent to the entry of any judgment or enter into any

settlement with respect to the claim without the prior written consent of the Indemnified Party (which consent shall not be unreasonably withheld).

(iii) In the event any of the conditions in clause (i) above is or becomes unsatisfied, (A) the Indemnified Party may defend

against, and consent to the entry of any judgment or enter into any settlement with respect to, the claim in any manner it reasonably may deem appropriate (and the Indemnified Party need not consult with, or obtain any consent from, the Indemnitor

in connection therewith), (B) the Indemnitor will reimburse the Indemnified Party promptly and periodically for the costs of defending against the claim (including reasonable attorneys’ fees and expenses), and (C) the Indemnitor will

remain responsible for any Liabilities the Indemnified Party may suffer resulting from, arising out of, relating to, in the nature of, or caused by the claim to the fullest extent provided in this Section 13.

(d) Insurance.

(i)

Microline will procure and maintain at its expense comprehensive general liability insurance with a reputable insurer in amounts of not less than $3 million per incident and $5 million annual aggregate. Such comprehensive general liability insurance

will (a) provide product liability coverage, (b) provide broad form contractual liability coverage extending to Microline’s indemnification obligations under this Section 13, (c) contain no products or completed operations

exclusions, (d) be in occurrence form and (e) name TransEnterix as an additional insured. Microline will maintain such insurance during the Term and for a period of

- 20 -

THIS EXHIBIT HAS BEEN REDACTED AND IS THE SUBJECT OF A CONFIDENTIAL TREATMENT REQUEST. REDACTED MATERIAL

IS MARKED WITH “*” AND BRACKETS AND HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION.

at least five (5) years thereafter. Microline will provide TransEnterix with written evidence of such insurance upon the request of TransEnterix, and will provide TransEnterix with written

notice at least thirty (30) days prior to any cancellation, non-renewal, reduction or other material change in such insurance.

(ii)

TransEnterix will procure and maintain at its expense comprehensive general liability insurance with a reputable insurer in amounts of not less than $3 million per incident and $5 million annual aggregate. Such comprehensive general liability

insurance will (a) provide product liability coverage, (b) provide broad form contractual liability coverage extending to TransEnterix’s indemnification obligations under this Section 13, (c) contain no products or completed

operations exclusions, (d) be in occurrence form and (e) name Microline and its Affiliates as an additional insureds. TransEnterix will maintain such insurance during the Term and for a period of at least five (5) years thereafter.

TransEnterix will provide Microline with written evidence of such insurance upon the request of Microline, and will provide Microline with written notice at least thirty (30) days prior to any cancellation, non-renewal, reduction or other

material change in such insurance.

(a) “Confidential Information” means, as to any party

(the “Disclosing Party”), all confidential information provided by or on behalf of such party to the other party (the “Receiving Party”), including any Technology, the terms of this Agreement, and information

relating to its business operations or technology, whether disclosed orally or in writing and whether or not marked as being confidential, except any portion thereof which: (i) is known, and can be shown to have been known, by the Receiving

Party (other than from the Disclosing Party hereunder) before receipt thereof under this Agreement; (ii) is disclosed to the Receiving Party by a third person who has a right to make such disclosure without any obligation of confidentiality to

the Disclosing Party hereunder; (iii) is or becomes generally known to the public through no fault of the Receiving Party; or (iv) is independently developed by the Receiving Party, without access to other Confidential Information of the

Disclosing Party, as evidenced by the Receiving Party’s written records. Notwithstanding the foregoing, the Parties agree that TransEnterix Background Technology and TransEnterix Project Technology is the Confidential Information of

TransEnterix, and Microline Background Technology and Microline Project Technology is the Confidential Information of Microline.

(b)

Nondisclosure. Confidential Information of each Disclosing Party is the exclusive property of such Disclosing Party. Confidential Information of a Disclosing Party may be used by the Receiving Party only in connection with the performance of

any obligations or the exercise of any rights under this Agreement. Confidential Information of the Disclosing Party shall not be disclosed to a third party by the Receiving Party without the prior written consent of the Disclosing Party or as

authorized by this Agreement. Each Receiving Party will protect the confidentiality of the Confidential Information of the Disclosing Party with at least the same degree of care that it uses to protect the confidentiality of its own proprietary and

confidential information, including by entering into appropriate confidentiality agreements with employees, agents, independent contractors and subcontractors. Access to and use of Confidential Information will be restricted to those of

Microline’s and TransEnterix’s agents, employees or

- 21 -

THIS EXHIBIT HAS BEEN REDACTED AND IS THE SUBJECT OF A CONFIDENTIAL TREATMENT REQUEST. REDACTED MATERIAL

IS MARKED WITH “*” AND BRACKETS AND HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION.

contractors engaged in a use permitted under this Agreement and who have been apprised of the confidential nature of such information. Each Receiving Party will be responsible for any breaches of

this Section 14 by its agents, employees or contractors. Confidential Information may not be copied or reproduced without the Disclosing Party’s prior written consent, except as necessary for use in connection with this Agreement.

(c) Disclosure Upon Process. In the event either party receives a subpoena, or other validly-issued administrative or judicial process,

requesting that Confidential Information of the other party be disclosed, it will promptly notify the other party of such receipt and allow the other party appropriate time to apply for a protective order. The party receiving such request will

thereafter be entitled to comply with such subpoena or other process, only to the extent required by law.

(d) Publicity. The terms

and conditions of this Agreement shall be Confidential Information of both parties, and shall not be disclosed by either party without the prior written consent of the other, provided, however, that either party may in any event

provide and disclose this Agreement to third parties in connection with any proposed financing or other corporate transaction, subject to a usual and customary confidentiality agreement, or as required by law. In the event the terms of this

Agreement or the other Confidential Information are required to be disclosed by law, the disclosing party shall notify the non-disclosing party with sufficient advance notice to obtain any Microline internal approvals and give the non-disclosing

party an opportunity to review and comment. Except as otherwise described in this paragraph, neither party shall make any public announcement of this Agreement except by mutual written consent.

(e) Injunctive Relief. Each party acknowledges that any material breach of this Section 14 shall cause the other party irreparable

harm for which damages would not be an adequate remedy, and accordingly each party hereby agrees that the issuance of an injunction or other equitable relief is appropriate to restrain any such breach or threatened breach.

(a) Term. This Agreement shall be effective on the

Effective Date and shall continue in full force and effect until the expiration of the Minimum Period, unless terminated earlier as provided herein (the “Initial Term”). Unless terminated by either party by written notice given not

less than sixty (60) days prior to the expiration of the Initial Term or any then-current Renewal Term, the term of this Agreement shall automatically be extended for additional one (1) year periods (each, a “Renewal

Term,” and the Initial Term and any Renewal Term, the “Term”). Notwithstanding anything in this Agreement to the contrary, Microline covenants and agrees that it will not terminate this Agreement by written notice pursuant