EXHIBIT 10.1

Confidential Materials Omitted and Filed Separately with the Securities and Exchange Commission Pursuant to a Request for Confidential Treatment under Rule 24b-2 of the Exchange Act of 1934, as amended. Confidential Portions are marked: [***].

CANCER RESEARCH UK

and

CANCER RESEARCH TECHNOLOGY LIMITED

and

ASTERIAS BIOTHERAPEUTICS, INC.

CLINICAL TRIAL AND OPTION AGREEMENT

|

|

Confidential Materials Omitted and Filed Separately with the Securities and Exchange Commission Pursuant to a Request for Confidential Treatment under Rule 24b-2 of the Exchange Act of 1934, as amended. Confidential Portions are marked: [***].

TABLE OF CONTENTS

|

1.

|

DEFINITIONS AND INTERPRETATION

|

2

|

|

2.

|

PROGRESS DEVELOPMENT WORK

|

12

|

|

3.

|

CONDUCT OF THE CLINICAL TRIAL AND SPONSORSHIP

|

15

|

|

4.

|

COMPANY’S OBLIGATIONS

|

17

|

|

5.

|

CONFIDENTIALITY/PUBLICATION

|

19

|

|

6.

|

INTELLECTUAL PROPERTY RIGHTS

|

21

|

|

7.

|

OPTION

|

25

|

|

8.

|

WARRANTIES AND LIMITS OF LIABILITY

|

26

|

|

9.

|

INDEMNITIES

|

27

|

|

10.

|

ASSIGNMENT

|

29

|

|

11.

|

TERM AND TERMINATION

|

29

|

|

12.

|

CONSEQUENCES OF TERMINATION

|

31

|

|

13.

|

DISPUTE RESOLUTION

|

32

|

|

14.

|

NOTICES

|

33

|

|

15.

|

WAIVER

|

34

|

|

16.

|

FORCE MAJEURE

|

34

|

|

17.

|

SEVERABILITY

|

35

|

|

18.

|

ENTIRE AGREEMENT

|

35

|

|

19.

|

AMENDMENT

|

35

|

|

20.

|

PUBLIC ANNOUNCEMENTS

|

35

|

|

21.

|

PAYMENTS

|

35

|

|

22.

|

DATA PROTECTION

|

36

|

|

23.

|

THIRD PARTY RIGHTS

|

36

|

|

24.

|

EXECUTION

|

36

|

|

Schedule 1

|

Company Patent Rights

|

|

Schedule 2

|

Report Synopsis Headings

|

|

Schedule 3

|

Safety Information

|

|

Schedule 4

|

Licence

|

|

Schedule 5

|

No Fault Compensation Scheme

|

|

Schedule 6

|

CRT Licence

|

|

Schedule 7

|

Third Party Licences and Payments

|

|

Schedule 8

|

Development Work Plan

|

|

Schedule 9

|

Additional Studies

|

|

Schedule 10

|

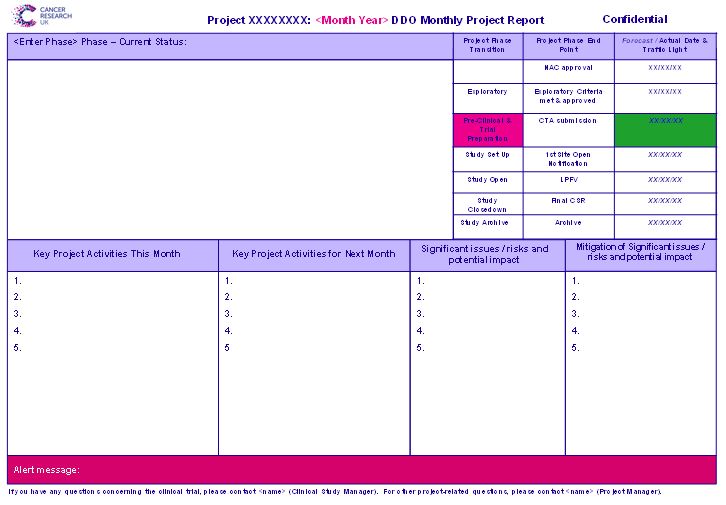

Form of Progress Report

|

|

Schedule 11

|

Clinical Protocol Summary

|

Confidential Materials Omitted and Filed Separately with the Securities and Exchange Commission Pursuant to a Request for Confidential Treatment under Rule 24b-2 of the Exchange Act of 1934, as amended. Confidential Portions are marked: [***].

THIS AGREEMENT is made the 8th day of September, 2014

BETWEEN:

CANCER RESEARCH UK a company limited by guarantee registered under number 4325234 and a charity registered under number 1089464 of Angel Building, 407 St. John Street, London, EC1V 4AD, England (the “Charity”);

CANCER RESEARCH TECHNOLOGY LIMITED a company registered in England and Wales with number 1626049 and registered office at Angel Building, 407 St. John Street, London, EC1V 4AD, England (“CRT”); and

ASTERIAS BIOTHERAPEUTICS, INC., a Delaware company with principal place of business at 230 Constitution Drive, Menlo Park, CA94025, USA (the “Company”).

WHEREAS:

| (A) | The Company has the right to conduct research and clinical testing on the IMP (as defined below). At this time, the Company does not intend to undertake any further development of the Product except as provided in this Agreement. |

| (B) | The Charity's charitable objects are to protect and promote the health of the public in particular by research into the nature, causes, diagnosis, prevention, treatment and cure of cancer, including development of findings of research into practical applications. |

| (C) | The Charity has expertise in the clinical evaluation of novel anti-cancer agents and considers that the Product has the potential to be a valuable drug that could be applied for the treatment of cancer. Accordingly, the Charity is interested in undertaking the development of the Product at its own cost. As the development is to be undertaken in pursuance of the Charity's charitable objects, the Charity will have the right to publish the results of such development work. |

| (D) | On completion of the Charity’s development work, the Company will have the option to take a licence to the results thereof with a view to the Company developing the Product further. If the Company does not wish to take a licence to such results, then CRT shall have the right to take a licence to the Company's rights in and to the Product and Related Products to enable it to find an alternative partner to develop them further. |

| (E) | CRT is a wholly owned subsidiary of the Charity and is, by arrangement with the Charity, responsible for the management, exploitation and commercialisation of intellectual property generated by the Charity or using funding from the Charity and the Charity has assigned and will assign such intellectual property to CRT for such purpose. CRT remits all its taxable profits to the Charity. |

| (F) | The Company, CRT and the Charity have therefore agreed to enter into this Agreement to enable the Charity to undertake the development of the IMP subject to the following terms and conditions: |

1

Confidential Materials Omitted and Filed Separately with the Securities and Exchange Commission Pursuant to a Request for Confidential Treatment under Rule 24b-2 of the Exchange Act of 1934, as amended. Confidential Portions are marked: [***].

NOW IT IS HEREBY AGREED as follows:

|

1.

|

DEFINITIONS AND INTERPRETATION

|

|

1.1

|

In this Agreement the words and phrases set out below shall, unless the context requires otherwise, have the corresponding meaning attributed to them below. In addition, any words and phrases in this Agreement which are not defined below, but which are defined in the CTD, shall have the meaning attributed to them in the CTD.

|

|

“Additional Studies”

|

means any biomarker, manufacturing, purity, toxicology, imaging or combination studies, or any other exploratory or pre-clinical in vitro or in vivo studies commenced after the Effective Date and associated with any part of the Product, or carried out in support of the clinical trial conducted pursuant to this Agreement, where such studies are performed by or on behalf of the Charity, including those described in Schedule 9 (as the same may be amended from time to time by the Charity).

|

|

“Affiliate”

|

means an entity that, whether now or in the future, Controls, is Controlled by or is under common Control with a Party. For the purpose of this definition only, “Control” means the possession (directly or indirectly) of fifty per cent or more of the voting stock or other equity interest of a subject entity with the power to vote, or the power in fact to control the management decisions of such entity through the ownership of securities or by contract or otherwise and “Controls” and “Controlled by” shall be construed accordingly.

|

|

“this Agreement”

|

means this agreement and each of the Schedules to it as amended from time to time in accordance with Clause 19.

|

|

“Case Report Forms”

|

means a record of the data and other information gathered on each Clinical Trial Subject pursuant to the Protocol.

|

|

“Cell Line”

|

means ***.

|

|

“Charity’s Standard

Operating Procedures” |

means the documents in use by the Drug Development Office of the Charity from time to time that are designated as standard operating procedures and which describe the procedures that must be followed to complete various tasks.

|

|

“Chief Investigator”

|

means the person who will lead and co-ordinate the work of the Clinical Trial overall where the Clinical Trial is to be carried out at more than one site.

|

|

“Clinical Trial”

|

means the Phase I/II clinical trial described in the Protocol to be conducted under the Sponsorship of the Charity, the manufacture of IMP to be conducted by the Charity, and any Additional Studies.

|

|

“Clinical Trial Database

Lock Date”

|

means the date when the clinical research database relating to the Clinical Trial is locked (after the Clinical Trial Results have been cleaned but excluding any Long Term Survival Data) in accordance with the Charity’s Standard Operating Procedures.

|

2

Confidential Materials Omitted and Filed Separately with the Securities and Exchange Commission Pursuant to a Request for Confidential Treatment under Rule 24b-2 of the Exchange Act of 1934, as amended. Confidential Portions are marked: [***].

|

“Clinical Trial Legislation”

|

means all laws and regulations from time to time in force applicable to the performance of the Clinical Trial, including the CTD, the Human Rights Act 1998, the Data Protection Act 1998, the Medicines Act 1968, the Medicines for Human Use (Clinical Trials) Regulations 2004, and the Human Tissue Act 2004.

|

|

“Clinical Trial LPFV

Date” |

means the date when the final Clinical Trial Subject in the Clinical Trial attends their first study visit. The Clinical Trial LPFV Date may be further defined in the Protocol.

|

|

“Clinical Trial Results”

|

means all Know-How, data, information and results Controlled by the Charity or CRT and arising from the Clinical Trial, including the contents of each Progress Report, the Final Report, Case Report Forms and associated Data Listings and any other updates that may be agreed by the Parties from time to time.

|

|

“Clinical Trial Subject”

|

means any person who is enrolled in the Clinical Trial either as a recipient or planned recipient of the Investigational Medicinal Product or as a control.

|

|

“Commencement Date”

|

means the date first written above.

|

|

“Company Combination

Patent Rights” |

means those Patent Rights owned by or licensed to the Company which claim the use of the Product in combination with one or more other anti-cancer agents or therapies and all Patent Rights deriving priority from them.

|

|

“Company Intellectual

Property” |

means the Company Patent Rights, and all rights in the Company Know-How, the Investigational Medicinal Product and the Company Materials.

|

|

“Company Know-How”

|

means such Know-How in the Company’s possession relating to the Product and/or Investigational Medicinal Product (and any constituents thereof), including: (i) any safety and toxicological data; (ii) information relating to the manufacturing/production; (iii) information relating to quality; (iv) information relating to safe and proper handling, storage and use; (v) information that the Company is required to disclose to the Charity pursuant to the Technology Transfer Plan; and (vi) any other data which is relevant to the efficient performance of the Clinical Trial and/or would make the Investigational Medicinal Product in any way easier to make; and (vii) any other data that would make the Product more useful, more valuable or in any way improve its prospects for development or commercialisation.

|

|

“Company Materials”

|

means the Cell Line and other Materials to be provided by the Company to the Charity pursuant to this Agreement including those set out the Technology Transfer Plan.

|

3

Confidential Materials Omitted and Filed Separately with the Securities and Exchange Commission Pursuant to a Request for Confidential Treatment under Rule 24b-2 of the Exchange Act of 1934, as amended. Confidential Portions are marked: [***].

|

“Company Owned

Intellectual Property”

|

means the Company Owned Patent Rights, and the Company’s rights in the Company Materials, Investigational Medical Product and the Company Know-How

|

|

“Company Owned Patent Rights”

|

means (i) those Patent Rights listed in Schedule 1A; (ii) those Patent Rights owned by the Company (including those arising after the Commencement Date) which would be infringed by the unauthorised manufacture, use or sale in, or importation into, the relevant country of the Product, Related Products and/or Investigational Medicinal Product; and (iii) all Patent Rights deriving priority from (i) and (ii).

|

|

“Company Patent Rights”

|

means (i) those Patent Rights listed in Schedule 1; (ii) those Patent Rights owned by or licensed to the Company (including those arising after the Commencement Date) which would be infringed by the unauthorised manufacture, use or sale in, or importation into, the relevant country of the Product, Related Products and/or Investigational Medicinal Product; and (iii) all Patent Rights deriving priority from (i) and (ii).

|

|

“Confidential Information”

|

means all information designated as confidential by any Party in writing, together with all other information which relates to the business, affairs, technology, products, developments, trade secrets, Know-How, manufacturing methods, product specifications personnel, customers, agents, distributors and suppliers of any Disclosing Party, or information which may reasonably be regarded as the confidential information of the Disclosing Party. Subject to the terms of any licence agreement entered into in relation to them, the Clinical Trial Results shall be the Confidential Information of the Charity and CRT.

|

|

“Control”

|

means, with respect to Intellectual Property Rights, possession of the ability (whether through ownership or licence, other than a licence granted under this Agreement) to grant the licences or sublicences or make the assignments as provided herein without violating the terms of any agreement or other arrangement with any third party.

|

|

“Contributors”

|

means the Chief Investigator, the Principal Investigator(s), the Sub-Investigators, the Experts, the NHS Trust(s) involved in the Clinical Trial, any sub-contractor of the Charity and/or any academic or not-for-profit entity involved in the Clinical Trial.

|

4

Confidential Materials Omitted and Filed Separately with the Securities and Exchange Commission Pursuant to a Request for Confidential Treatment under Rule 24b-2 of the Exchange Act of 1934, as amended. Confidential Portions are marked: [***].

|

“Costs”

|

means all actual prepaid and committed costs and expenses incurred from time to time in connection with the Clinical Trial, including, for the avoidance of doubt, the internal personnel costs of the Charity and the Charity’s Biotherapeutics Development Unit (BDU).

|

|

“CTD”

|

means the European Clinical Trials Directive (Directive 2001/20/EC) and national legislation implementing such Directive, as the same may be amended from time to time.

|

|

“Data Listings”

|

means the computer generated data listings produced by the Charity detailing all anonymised patient data collected under the Clinical Trial other than the Long Term Survival Data.

|

|

“Declaration of Helsinki”

|

means the 2008 version of the Helsinki Declaration of the World Medical Association.

|

|

“Development Work”

|

means the process development and manufacturing scale-up work to be carried out by the Company to determine a Product Manufacturing Process.

|

|

“Development Work Plan”

|

means the work plan in Schedule 8 setting out the Development Work along with the projected timelines for that work and any amendments to the same made in accordance with Clause 2.3.

|

|

“Disclosing Party”

|

has the meaning specified in Clause 5.1.

|

|

“Duke Licence”

|

means the License Agreement between Duke University and Merix Bioscience, effective January 10, 2000, as amended effective July 28, 2003,

|

|

“Ethics Committee”

|

has the meaning given to it in the CTD.

|

|

“Exclusive Results”

|

means those Clinical Trial Results and the Intellectual Property Rights therein that directly relate to and only to the Product and Related Products. Exclusive Results shall not include any assay methodology, formulation-related results or biomarker results which do not directly relate to and only to the Product and/or Related Products.

|

|

“Exercise Notice”

|

has the meaning specified in Clause 7.1.

|

|

“Expert”

|

means any member of the Charity’s expert committees or any other person not being an employee of the Charity whom the Charity may engage from time to time to advise the Charity on the Clinical Trial or to assist with the Product Manufacturing Process at the Charity’s Biotherapeutics Development Unit.

|

|

“Field”

|

means use of the Product in immunotherapy applications using ***

|

5

Confidential Materials Omitted and Filed Separately with the Securities and Exchange Commission Pursuant to a Request for Confidential Treatment under Rule 24b-2 of the Exchange Act of 1934, as amended. Confidential Portions are marked: [***].

|

“Final Report”

|

means a Report Synopsis, unless, pursuant to Clause 3.11, a Full Clinical Study Report is prepared by the Charity instead of a Report Synopsis.

|

|

“Financial Year”

|

means the period commencing on January 1 and ending on December 31.

|

|

“Full Clinical

Study Report” |

means a full clinical study report in relation to the Clinical Trial written by or on behalf of the Charity in accordance with the Charity’s Standard Operating Procedures and which meets the standards of the ICH Guidelines for Structure and Content of Clinical Study reports as per ICH Topic E3 dated July 1996 except that Long Term Survival Data will not be included in the report.

|

|

“Full CS Report Fee”

|

has the meaning given to it in Clause 3.11.

|

|

“Good Manufacturing

Practice” |

means the principles and guidelines of good manufacturing practice in respect of medicinal products for human use and investigational medicinal products for human use as defined in: (i) the CTD; (ii) European Community Directive 2003/94/EC; (iii) European Community Directive 2005/28/EC; (iv) Eudralex Volume 4: ‘EU Guidelines to Good Manufacturing Practice, Medicinal Products for Human and Veterinary Use, Part II Basic Requirements for Active Substances used as Starting Materials’, ICHQ7a Good Manufacturing Practice Guidance for Active Pharmaceutical Ingredients and ‘EU Guidelines to Good Manufacturing Practice Medicinal Products for Human and Veterinary Use, Annex 13: Investigational Medicinal Products’; and (v) any national legislation implementing the aforementioned Directives and any relevant guidance relating thereto.

|

|

“hTERT Antigen”

|

means a human telomerase antigen.

|

|

“hTERT Licensed

Patents” |

means the patent rights listed in Schedule 1B, which were licensed to Company under the hTERT Licence.

|

|

“hTERT Licence”

|

means the Exclusive Sublicense Agreement between Geron Corporation and Company, effective October 1, 2013, a copy of which has been provided to the Charity.

|

|

“ICH GCP”

|

means the latest version from time to time of the International Conference on Harmonisation (ICH) Tripartite Guidelines, Good Clinical Practice (CPMP/ICH/135/95) together with such other good clinical practice requirements as are specified in the CTD and in Commission Directive 2005/28/EC and in any other regulations relating to medicinal products for human use and in any guidance published by the European Commission pursuant to such Directives or regulations.

|

6

Confidential Materials Omitted and Filed Separately with the Securities and Exchange Commission Pursuant to a Request for Confidential Treatment under Rule 24b-2 of the Exchange Act of 1934, as amended. Confidential Portions are marked: [***].

|

“Immunomic/JHU

Licensed Patents” |

means the patent rights listed in Schedule 1G, which were licensed to Immunomic Therapeutics under the JHU License, and subsequently sublicensed to Company as result of the Immunomic License. |

| “Immunomic Licence” | means the Exclusive License Agreement between Geron Corporation and Immunomic Therapeutics Inc effective October 31, 2006, which was subsequently assigned by Geron Corporation to Company effective October 1, 2013, a copy of which has been provided to the Charity. |

| “Independent Opinion” | means the opinion of an independent expert in the field of valuation of intellectual property in a similar field to the Company Intellectual Property, appointed by agreement between the Parties or in default of such agreement within twenty one (21) days of a Party seeking in writing to the others to appoint such expert, by the President for the time being of the Association of the British Pharmaceutical Industry (ABPI) in England and Wales, referred to at Clause 13.1. |

|

“Intellectual Property

Rights” |

means all Patent Rights, Know-How, copyright, database rights, design rights, moral rights, rights in trade names, logos and trade and service marks, domain names, rights in Materials and all rights or forms of protection of a similar nature or having equivalent or similar effect to any of them which may subsist anywhere in the world, whether or not any of them are registered, including any application for registration of any of them. |

| “Investigational MedicinalProduct” or “IMP” | means the pharmaceutical formulation of the Product suitable for use in the Clinical Trial. |

|

“Investigational Medicinal

Product Dossier” |

means a dossier relating to the Investigational Medicinal Product which accompanies a request for clinical trial authorisation to conduct the Clinical Trial from a Regulatory Authority. The Investigational Medicinal Product Dossier shall include a specification of the IMP. |

| “Isis Licensed Patents” | means the patent rights listed in Schedule 1D, which were licensed to Company under the Isis Licence. |

| “Isis Licence” | means the Exclusive License Agreement between Geron Corporation and Isis Innovation Limited effective March 23, 2006, which was subsequently assigned by Geron Corporation to Company effective October 1, 2013, a copy of which has been provided to the Charity. |

7

Confidential Materials Omitted and Filed Separately with the Securities and Exchange Commission Pursuant to a Request for Confidential Treatment under Rule 24b-2 of the Exchange Act of 1934, as amended. Confidential Portions are marked: [***].

|

“JHU Licence”

|

means the Exclusive License Agreement between Johns Hopkins University and Immunomic Therapeutics effective September 26, 2006.

|

| “Know-How” | means all technical and other information which is not in the public domain, including information comprising or relating to concepts, discoveries, data, designs, formulae, ideas, inventions, methods, models, designs for experiments and tests and results of experimentation and testing, processes, specifications and techniques, laboratory records, clinical data, reports, manufacturing data and information contained in submissions to Regulatory Authorities. |

| “Licence” | means a licence to the Clinical Trial Results and any Intellectual Property Rights therein in the form attached at Schedule 4. Such licence shall be exclusive in respect of the Exclusive Results, and non-exclusive in relation to the Non-Exclusive Results. For the avoidance of doubt, neither CRT nor the Charity shall have any obligation to supply any Materials to the Company pursuant to any Licence. |

| “Long Term Survival Data” | means any ongoing survival data for Clinical Trial Subjects that the Charity collects after the completion of the interventional component of the Clinical Trial. |

| “Losses” | means losses, damages, costs and expenses (including reasonable legal costs and expenses). |

| “Materials” | means any chemical or biological substances including any: organic or inorganic element or compound; nucleotide or nucleotide sequence including DNA and RNA sequences gene; vector or construct including plasmids, phages, bacterial vectors, bacteriophages and viruses; host organism including bacteria, fungi, algae, protozoa and hybridomas; eukaryotic or prokaryotic cell line or expression system or any development strain or product of that cell line or expression systems; protein including any peptide or amino acid sequence, enzyme, antibody or protein conferring targeting properties and any fragment of a protein or a peptide enzyme or antibody; drug or pro-drug; assay or reagent; any plasma or tissue; or any other genetic or biological material or micro-organism or any transgenic animal. |

|

“Merix/Duke Licensed

Patents” |

means the patent rights listed in Schedule 1E, which were licensed to Merix Bioscience under the Duke License, and were subsequently sublicensed to Company under the Merix License. |

|

“Merix/Rockefeller

Licensed Patents” |

means the patent rights listed in Schedule 1F, which were licensed to Merix Bioscience under the Rockefeller License, and were subsequently sublicensed to Company under the Merix License.

|

8

Confidential Materials Omitted and Filed Separately with the Securities and Exchange Commission Pursuant to a Request for Confidential Treatment under Rule 24b-2 of the Exchange Act of 1934, as amended. Confidential Portions are marked: [***].

| “Merix Licence” | means the Exclusive License Agreement between Geron Corporation and Merix Bioscience (now Argos Therapeutics) effective March 6, 2004, and subsequently assigned by Geron Corporation to Company effective October 1, 2013, a copy of which has been provided to the charity. |

| “Non-Exclusive Results” | means those Clinical Trial Results that are not Exclusive Results (and all Intellectual Property Rights therein), including all assay methodology, formulation-related results or biomarker results. |

| “Option” | has the meaning specified in Clause 7.1. |

| “Option Fee” | means the sum of *** less the amount of any Full CS Report Fee actually paid by the Company to CRT under Clause 3.11 and excluding VAT or other applicable sales tax. |

| “Option Period” | has the meaning specified in Clause 7.1. |

| “Party” | means any party to this Agreement and “Parties” means all of them. |

| “Patent Rights” | means any patent applications, patents, author certificates, inventor certificates, utility models, and all foreign counterparts of them and includes all divisionals, renewals, continuations, continuations-in-part, extensions, reissues, substitutions, confirmations, registrations, revalidations and additions of or to them, as well as any Supplementary Protection Certificate, or any like form of protection (including any pediatric, orphan drug or other exclusivity granted by a Regulatory Authority beyond the expiry of the original patent expiration date). |

| “Principal Investigator” | means the person who will lead and co-ordinate the work of the Clinical Trial at a particular Clinical Trial site. |

|

“Post Development

Meeting” |

has the meaning given in Clause 2.7. |

| “Product” | means the Company’s cell based therapeutic agent known as AST-VAC2 which comprises ***. |

|

“Product Manufacturing

Process” |

means a reproducible process for the manufacture and quality testing of the IMP in accordance with Good Manufacturing Practice and which meets the requirements in the Transfer Criteria and the process specifications in the Technology Transfer Plan on a scale and standard suitable to enable the Charity to produce sufficient quantities of IMP to conduct the Clinical Trial. |

| “Progress Report” | means a report on the status of the Clinical Trial in the format set out in Schedule 10, or in such other format as is the Charity’s standard practice at the relevant time in respect of a clinical trial at the same stage, and of the same scope, as the Clinical Trial. |

9

Confidential Materials Omitted and Filed Separately with the Securities and Exchange Commission Pursuant to a Request for Confidential Treatment under Rule 24b-2 of the Exchange Act of 1934, as amended. Confidential Portions are marked: [***].

| “Protocol” | means the clinical trial protocol to be prepared by the Charity and the Chief Investigator in accordance with the criteria described in Schedule 11, as may be amended from time to time by the Charity in accordance with Clause 3.6. |

| “Recipient Party” | has the meaning specified in Clause 5.2. |

| “Regulatory Authority” | means any local, national or supra-national agency, authority, department, inspectorate, minister, ministry official or public or statutory person (whether autonomous or not) or any government of any country as shall have jurisdiction over the Clinical Trial or any part of it or over any activity of the Parties in connection with the Clinical Trial. Regulatory Authority includes, but is not limited to, the United Kingdom Medicines and Healthcare products Regulatory Agency (MHRA), the United States Food and Drug Administration (FDA) and the European Medicines Agency (EMEA). |

| “Related Product” | means a cell based therapeutic agent which is not a Product but which ***. |

| “Report Synopsis” | a summary of the results of the Clinical Trial written by or on behalf of the Charity in accordance with the Charity’s Standard Operating Procedures in a form substantially similar to the format set out in Schedule 2 and the format of the clinical study synopsis set out in Annex I of ICH Topic E3 of the ICH Guidelines for Structure and Content of Clinical Study reports dated July 1996. The Report Synopsis shall not include or contain any additional documents or any appendices, exhibits or annexes nor shall it include or contain any Data Listings, Case Report Forms or any raw data comprised within the Clinical Trial Results or cover any Long Term Survival Data. |

| “Rockefeller Licence” | means the License Agreement between Rockefeller University and Merix Bioscience, effective June 27, 2001, as amended June 29, 2001. |

| “Specification” | means the specification of the IMP detailed in the Investigational Medicinal Product Dossier. |

| “Signature Period” | means the period of *** commencing on: |

|

(i)

|

in the event that the Charity does not prepare a Full Clinical Study Report pursuant to Clause 3.11, the Company’s receipt of the Data Listings pursuant to Clause 7.3; or

|

| (ii) | in the event that the Charity prepares a Full Clinical Study Report pursuant to Clause 3.11, the date of the Exercise Notice. |

10

Confidential Materials Omitted and Filed Separately with the Securities and Exchange Commission Pursuant to a Request for Confidential Treatment under Rule 24b-2 of the Exchange Act of 1934, as amended. Confidential Portions are marked: [***].

| “Sub-Investigator” | means a clinician appointed and supervised by the Chief Investigator or Principal Investigator to assist in the carrying out of the Clinical Trial at the same trial site as the Principal Investigator. |

|

“Supplementary

Protection Certificate” |

means a right based on a patent pursuant to which the holder of the right is entitled to exclude third parties from using, making, having made, selling or otherwise disposing or offering to dispose of, importing or keeping the product to which the right relates, such as supplementary protection certificates in Europe, and any similar right anywhere in the world. |

|

“Technology Transfer

Plan” |

has the meaning given in Clause 2.6. |

| “Third Party Licences” | means those licences listed in Schedule 7 |

|

“Third Party Licence Payments”

|

means those milestone, royalty and other payments listed in Schedule 7B in respect of the Third Party Licences.

|

| “Tobacco Party” | means: (i) any entity who develops, sells or manufactures tobacco products; and/ or (ii) any entity which makes the majority of its profits from the importation, marketing, sale or disposal of tobacco products. Furthermore, Tobacco Party shall include any entity that is an Affiliate of any entity referred to in (i) or (ii); |

|

“Transfer Approval Notice”

|

has the meaning given in Clause 2.7.

|

| “Transfer Criteria” | means criteria to be agreed between the Parties as described in Clause 2.1 that if met thereby demonstrate to the Charity that the Product Manufacturing Process for the IMP that is to be developed by the Company under the Development Work has been scaled-up to the required level and meets the required quality, validation, price and other technical, scientific and quality requirements as further described in Clause 2.1. |

|

“University of Western

Ontario Licensed

Patents” |

means the patent rights listed in Schedule 1C, which were licensed to Company under the University of Western Ontario Licence.

|

|

“University of Western

Ontario Licence” |

means the Exclusive License Agreement between Geron Corporation and The University of Western Ontario effective January 30, 2009, and subsequently assigned by Geron Corporation to Company effective October 1, 2013, a copy of which has been provided to the Charity. |

|

“WARF Intellectual

Property” |

means the rights in the WARF Patents and Wisconsin Materials listed in Schedule 1H, which were licensed to the Company in the WARF Licence. |

11

Confidential Materials Omitted and Filed Separately with the Securities and Exchange Commission Pursuant to a Request for Confidential Treatment under Rule 24b-2 of the Exchange Act of 1934, as amended. Confidential Portions are marked: [***].

| “WARF Licence” | means the Non-Exclusive License Agreement between Company and the Wisconsin Alumni Research Foundation, effective October 7, 2013, a redacted copy of which has been provided to the Charity. |

|

1.2

|

In this Agreement:

|

|

1.2.1

|

unless the context requires otherwise, all references to a particular Clause, paragraph or Schedule shall be references to that clause, paragraph or schedule, of or to this Agreement;

|

|

1.2.2

|

the table of contents and headings are inserted for convenience only and shall be ignored in construing this Agreement;

|

|

1.2.3

|

unless the contrary intention appears, words importing the masculine gender shall include the feminine and vice versa and words in the singular include the plural and vice versa;

|

|

1.2.4

|

unless the contrary intention appears, words denoting persons shall include any individual, partnership, company, corporation, joint venture, trust, association, organisation or other entity, in each case whether or not having separate legal personality;

|

|

1.2.5

|

reference to any statute or regulation includes any modification or re-enactment of that statute or regulation, provided that the modification or re-enactment does not diminish the rights or extend the obligations of any Party; and

|

|

1.2.6

|

references to the words “include” or “including” shall be construed without limitation to the generality of the preceding words.

|

|

2.

|

PROCESS DEVELOPMENT WORK

|

|

2.1

|

As soon as is reasonably practicable (and within thirty (30) days of the Commencement Date), the Parties shall meet (either in person or by teleconference) to introduce the key members of their respective teams and to discuss the initial Development Work Plan and agree the actions and timeline for formulating the Transfer Criteria. The Parties shall endeavour to have the Transfer Criteria in an agreed form as soon as practicable, but in any event by no later than three months before the date when the Development Work is anticipated to be completed as shown in the Development Work Plan (as that may be amended from time to time). Without intending this to be an exhaustive list, the scope of the Transfer Criteria shall include specific and measurable criteria for: adequate documentation of processes and conditions for product manufacture, QA and quality control; process reproducibility and success rates; cost of manufacture; process yields; process timelines and staffing requirements; GMP compliance at each stage of the Product Manufacturing Process through to preparing the IMP for patient use; IMP purity levels and ranges; and cost and availability of any special equipment or facilities required for performance of the Product Manufacturing Process, preparation of the prepared dose, and/or product release testing. The Company will carry out the Development Work at its own cost and in accordance with the Development Work Plan and the terms of this Agreement. It is understood that the Development Work Plan is likely to evolve as the Company moves through the Development Work and that the Company may need to update the Development Work Plan including the projected timings that form part of the same. The Development Work Plan, including all drafts, iterations, and revisions of the Development Work Plan, shall be the Company’s Confidential Information.

|

12

Confidential Materials Omitted and Filed Separately with the Securities and Exchange Commission Pursuant to a Request for Confidential Treatment under Rule 24b-2 of the Exchange Act of 1934, as amended. Confidential Portions are marked: [***].

|

2.2

|

The Company shall provide to the Charity written monthly updates on progress against the Development Work Plan (for clarity, such updates may be in the form of presentation slides from joint project team meetings) and any necessary updates to the Development Work Plan along with any information or data which is reasonably necessary for the Charity to fully understand the then current status of the Development Work and the steps being taken to achieve the desired outcomes. The Company shall give due consideration to any comments or suggestions provided by the Charity on updates to the Development Work Plan (including making any amendments to the updated Development Work Plan which are reasonably requested by the Charity and which would impact on the Charity’s ability to carry out the Product Manufacturing Process at its Biotherapeutics Development Unit).

|

|

2.3

|

As the Company carries out the Development Work the Parties may also wish to amend or refine the Transfer Criteria to reflect the results of the Development Work. Either the Charity or the Company may propose changes to the Transfer Criteria with the objective of ensuring that the Transfer Criteria represent a fair and measurable set of standards that it would be reasonable for the Charity to expect to be met to show that the Product Manufacturing Process is fit for purpose prior to transfer to the Charity. Each of the Charity and the Company will consider changes to the Transfer Criteria requested by the other in good faith and shall not unreasonably withhold its agreement to a change. Any agreed changes to the Transfer Criteria will be recorded in writing and signed by the Charity and the Company.

|

|

2.4

|

The Company may sub-contract activities to be performed under the Development Work Plan provided that:

|

|

2.4.1

|

the Company informs the Charity of the identity of any proposed sub-contractor and, in the event that the Charity (acting reasonably) expresses any concerns with the proposed sub-contractor, takes such concerns into consideration prior to entering into a formal agreement with the sub-contractor to carry out any Development Work;

|

|

2.4.2

|

the Company will remain fully responsible for the performance of all of the Company’s obligations under this Agreement;

|

|

2.4.3

|

the terms of any sub-contract will allow the Company to fulfill its obligations under this Agreement, including with respect to acquiring necessary Intellectual Property Rights and confidentiality obligations;

|

|

2.4.4

|

no Tobacco Party shall be permitted to conduct any activities under the Development Work or otherwise in connection with the Clinical Trial; and

|

|

2.4.5

|

within twenty (20) days of entering into any subcontract, the Company shall provide the Charity with a true copy of the statement of work of that subcontract (which may be redacted as to terms not applicable to the Company’s compliance hereunder).

|

|

2.5

|

As the Development Work progresses and prior to the Post Development Meeting the Company will work with the Charity to develop a “Technology Transfer Plan” setting out how the Parties will transfer the Product Manufacturing Process from the Company to the Charity’s Biotherapeutics Development Unit and the responsibilities of each Party during and after that transfer and will include (to the extent not already covered by the Transfer Criteria):

|

13

Confidential Materials Omitted and Filed Separately with the Securities and Exchange Commission Pursuant to a Request for Confidential Treatment under Rule 24b-2 of the Exchange Act of 1934, as amended. Confidential Portions are marked: [***].

|

2.5.1

|

A description of the scope of the Technology Transfer Plan that includes a table setting out the roles, responsibilities and deliverables to be supplied by each of the Company and the Charity;

|

|

2.5.2

|

Documentation requirements (define which stages require a technical or analytical summary report, documents required for importation into the UK/EU of the Cell Line, certificates of analysis and compliance, etc);

|

|

2.5.3

|

A process description with operating parameters for the Product Manufacturing Process (this needs to be detailed with each manipulation described);

|

|

2.5.4

|

A sampling plan for use during the Product Manufacturing Process and for the final IMP with quality control test acceptance criteria (define success of tech transfer);

|

|

2.5.5

|

Transfer of Company Know-How and training requirements for Charity staff including:

|

|

(a)

|

the Charity making suitably qualified employees available to spend such time at the Company prior to transfer of the Product Manufacturing Process as reasonably required to learn the how the Product Manufacturing Process is carried out at the Company (anticipated at the Commencement Date to be in the region of two (2) Charity staff working on site with the Company for up to eight (8) weeks);

|

|

(b)

|

The Company making suitably qualified employees available to provide such on-site scientific and technical guidance at the Charity’s Biotherapeutics Development Unit during and/or after transfer of the Product Manufacturing Process as reasonably required to ensure that the Product Manufacturing Process can be carried out at Biotherapeutics Development Unit on a scale and standard suitable to enable the Charity to produce sufficient quantities of IMP to conduct the Clinical Trial (anticipated at the Commencement Date to be in the region of one (1) Company staff member working on site with the Charity for four up to (4) weeks);

|

|

2.5.6

|

The Company Materials to be provided by the Company as part of the transfer of the Product Manufacturing Process, along with the quantities and specifications of such Company Materials and timing for provision;

|

|

2.5.7

|

A list of equipment requirements to enable the Charity to carry out the Product Manufacture Process;

|

The first draft of the Technology Transfer Plan was provided to the Charity by the Company on 5th August 2014.

|

2.6

|

The Company will notify the Charity in writing on completion of the Development Work. Within thirty (30) days after the Company provides such notice the Parties shall meet either in person or by teleconference (the “Post Development Meeting”) to review whether the Transfer Criteria have been achieved and the Company has demonstrated to the Charity’s reasonable satisfaction that the Product Manufacturing Process can be carried out on a scale and standard suitable to enable the Charity to produce sufficient quantities of IMP to conduct the Clinical Trial. Where this is the case the Charity will promptly provide the Company with written notice of approval of the Product Manufacturing Process (“Transfer Approval Notice”) and the Charity and the Company will finalise the Technology Transfer Plan. Without intending to affect the generality of foregoing it is agreed that as part of the joint review by the Parties, the Company shall make available to the Charity a report including data and conclusions generated by the Company in undertaking the Development Work. Once agreed by both the Company and the Charity the Technology Transfer Plan shall be circulated for approval and signature by the Company and the Charity.

|

14

Confidential Materials Omitted and Filed Separately with the Securities and Exchange Commission Pursuant to a Request for Confidential Treatment under Rule 24b-2 of the Exchange Act of 1934, as amended. Confidential Portions are marked: [***].

|

2.7

|

If the Parties decide at the Post Development Meeting that the Transfer Criteria have not been met (or waived by the Charity) or the Company has otherwise not demonstrated to the Charity’s reasonable satisfaction that the Product Manufacturing Process can be carried out on a scale and standard suitable to enable the Charity to produce sufficient quantities of IMP to conduct the Clinical Trial, then the Parties shall record that decision in writing and agree what further Development Work is required. On notice by the Company that it has completed any such further Development Work the Charity and Company will hold a further Post Development Meeting in accordance with Clause 2.6.

|

|

2.8

|

Once signed by each Party pursuant to Clause 2.6 the Charity and the Company will use commercially reasonable efforts to carry out the Technology Transfer Plan.

|

|

2.9

|

The Product Manufacturing Process, including all drafts, iterations, and revisions, shall be the Company’s Confidential Information.

|

|

3.

|

CONDUCT OF THE CLINICAL TRIAL AND SPONSORSHIP

|

|

3.1

|

Subject to: (i) the Company’s compliance with its obligations hereunder including the successful completion of the Development Work; and (ii) the Ethics Committee and the Regulatory Authority granting consent for the Clinical Trial, the Charity will use its reasonable endeavours to carry out or procure the carrying out of the Clinical Trial in accordance with the Protocol.

|

|

3.2

|

Once the Clinical Trial has been opened to Clinical Trial Subjects, the Charity shall use reasonable endeavours to provide to the Company at least one Progress Report per month (or with the frequency that is the Charity’s standard practice at the relevant time in respect of a clinical trial at the same stage, and of the same scope, as the Clinical Trial, but no less frequently than quarterly). The Company may use the Progress Reports for the purpose of determining whether or not to exercise the Option. All Progress Reports and any supplementary information provided under them shall be the Confidential Information of the Charity and the provisions of Clause 5 shall apply. The Company acknowledges that information or data provided under this Clause 3.2 may not be verified, clean or accurate, and is provided “as is”. Without prejudice to the generality of Clause 8.7, neither CRT nor the Charity make any representation or warranty (express or implied) of any nature in respect of such data or information, including as to its accuracy, quality, usefulness or comprehensiveness.

|

|

3.3

|

The Charity may, at its sole discretion: (i) sub-contract to third parties including Contributors any part of the Clinical Trial; and (ii) engage such Experts and such persons to fulfil the roles of Chief Investigator and/or Principal Investigator or to assist with the Product Manufacturing Process at the Charity’s Biotherapeutics Development Unit as the Charity deems appropriate.

|

|

3.4

|

The Charity shall, at its own expense, be responsible for seeking approval of the Clinical Trial and the Protocol from the Regulatory Authority and Ethics Committee prior to commencing the Clinical Trial. For the avoidance of doubt, the Charity shall not be held liable or responsible for any failure and/or refusal by the Ethics Committee or the Regulatory Authority to grant consent for the Clinical Trial or any change required therein.

|

15

Confidential Materials Omitted and Filed Separately with the Securities and Exchange Commission Pursuant to a Request for Confidential Treatment under Rule 24b-2 of the Exchange Act of 1934, as amended. Confidential Portions are marked: [***].

|

3.5

|

The Charity shall use reasonable endeavours to carry out, or procure the carrying out of, the Clinical Trial in accordance with relevant aspects of:

|

|

3.5.1

|

Clinical Trial Legislation; and

|

|

3.5.2

|

ICH GCP and the Declaration of Helsinki.

|

|

3.6

|

The Charity shall have control of the preparation and approval of the Protocol, which shall conform in scope with the provisions of Schedule 11 unless otherwise mutually agreed between the Parties. The Charity may acting reasonably amend the Protocol and/or change the third party undertaking any part of the Clinical Trial in accordance with the provisions of Clauses 3.6.1 and 3.6.2, provided that such Protocol or change to the Protocol has first been approved by the Ethics Committee and, if required by law or regulation, the Regulatory Authority and further provided that;

|

|

3.6.1

|

prior to submission for Ethics Committee approval, the Charity shall provide to the Company a copy of the first final version of the Protocol at least fourteen (14) days before seeking Ethics Committee approval and give due consideration to any comments received from the Company by the Charity within such time.

|

|

3.6.2

|

the Charity shall notify the Company in writing of any proposed changes to the Protocol that has been approved by the Ethics Commitee at least fourteen (14) days before seeking Ethics Committee approval for such changes, and shall give due consideration to any comments that the Company might make within such time. In an emergency (such as patient safety needs) the said fourteen (14) day time period may be reduced to such time period as the Charity is actually able to give to the Company in the circumstances and the Charity may, if in its reasonable opinion it is required, submit such changes to the Ethics Committee prior to notifying the Company of such;

|

The Charity will try to reach a consensus with the Company on all issues arising out of the Company’s review of any Protocol pursuant to this Clause 3.6.2, but the Charity shall have the final decision save in the case where the Charity proposes to change the cancerindication, primary endpoints, to remove the monitoring of immune responses to hTERT antigen or HLA alloantigens, or to reduce the patient numbers, number of administrations per patient or dose per administration in any such case by more than *** as compared to the Protocol that has been approved by the Ethics Committee or if at the relevant time none has been approved by the Ethics Committee then the Protocol Summary in Schedule 11 in which circumstances (acting reasonably) the approval of Company shall be required.

|

3.6.3

|

in the event that the Ethics Committee and/or the Regulatory Authority does not approve the original Protocol, or if the Company, the Ethics Committee and/or the Regulatory Authority disapprove of any amendment to the Protocol, the Charity shall have the right to terminate this Agreement forthwith upon written notice to the Company.

|

|

3.7

|

The Charity shall have sole responsibility for the conduct and control of the Clinical Trial and shall accept the obligations of the sponsor of the Clinical Trial in accordance with the requirements of the Medicines for Human Use (Clinical Trials) Regulations 2004.

|

16

Confidential Materials Omitted and Filed Separately with the Securities and Exchange Commission Pursuant to a Request for Confidential Treatment under Rule 24b-2 of the Exchange Act of 1934, as amended. Confidential Portions are marked: [***].

|

3.8

|

The Charity shall use reasonable endeavours to procure that Clinical Trial Subjects are recruited in accordance with the selection procedures and criteria set out in the Protocol.

|

|

3.9

|

The Charity shall provide the Company with safety information in accordance with the procedures and timeframes set out in Schedule 3. For the avoidance of doubt the Charity shall also be permitted to provide all safety information to CRT.

|

|

3.10

|

The Charity shall promptly advise the Company, in writing, of the occurrence of the Clinical Trial LPFV Date.

|

|

3.11

|

The Company may elect to receive a Full Clinical Study Report instead of a Report Synopsis by:

|

|

3.11.1

|

providing the Charity with written notice of its election to receive a Full Clinical Study Report, which written notice must be received by the Charity before the expiration of fourteen (14) days from the date the Charity advised the Company of the occurrence of the Clinical Trial LPFV Date; and

|

|

3.11.2

|

paying the Charity the sum of *** excluding VAT or other applicable sales tax (the “Full CS Report Fee”) within twenty one (21) days after service of such notice.

|

If the Company does not serve a written notice and pay the Full CS Report Fee as specified in this Clause 3.11, the Charity shall prepare a Report Synopsis and shall have no obligation to prepare or provide the Company with a Full Clinical Study Report.

|

3.12

|

The Charity shall provide the Final Report to the Company and CRT within *** after the Clinical Trial Database Lock Date.

|

|

3.13

|

The Charity shall only use the Investigational Medicinal Product for the purposes of carrying out the Clinical Trial and shall not permit any third party to use the Investigational Medicinal Product except as required for the purpose of carrying out the Clinical Trial or as set out in this Agreement.

|

|

4.

|

COMPANY’S OBLIGATIONS

|

|

4.1

|

The Company shall, at the Company’s sole cost, provide the Charity with:

|

|

4.1.1

|

such quantities of the Company Materials as are specified in Technology Transfer Plan or, where no quantities are specified, such quantities as the Charity may reasonably request to enable the Charity to carry out the Clinical Trial;

|

|

4.1.2

|

all Company Know-How that it deems reasonably relevant to the Charity’s efforts hereunder as soon as practicable following the Commencement Date;

|

|

4.1.3

|

any other information in the Company’s Control pertaining to the safety of the IMP or which in the reasonable opinion of the Company may have a bearing on the conduct of the Clinical Trial as soon as the same comes to the attention of the Company;

|

|

4.1.4

|

such scientific and technical guidance as the Charity may reasonably request to enable the Charity and the Contributors to conduct and manage the Clinical Trial in a safe and proper manner, provided however, that Company shall not without its prior consent be obligated to provide scientific and technical guidance other than that described in the Tech Transfer Plan in excess of *** in total cost;

|

17

Confidential Materials Omitted and Filed Separately with the Securities and Exchange Commission Pursuant to a Request for Confidential Treatment under Rule 24b-2 of the Exchange Act of 1934, as amended. Confidential Portions are marked: [***].

|

4.1.5

|

all information (including information for inclusion in the Investigational Medicinal Product Dossier) and co-operation reasonably requested by the Charity at any time from the Commencement Date to enable the Charity to compile an Investigational Medicinal Product Dossier; provided that such requested information is in the Company’s Control. In the case of co-operation requested under this Clause 4.1.5, the Company shall procure (at its own cost) that any subcontractor which has performed activities or produced documents on its behalf under this Agreement is made available to the Charity on such notice, for such time and with such frequency as may be reasonably requested by the Charity. The Company shall provide information requested by the Charity within fourteen (14) days of request (or such other period as may be reasonable given the nature of the request);

|

|

4.1.6

|

all data and documentation to be provided by the Company to the Charity pursuant to the Technology Transfer Plan in the manner, and at the times, set out in the Technology Transfer Plan. If the Technology Transfer Plan does not set out specific times for certain categories of data and documentation to be provided, the Company shall provide all such data and documentation in its possession or Control at the Commencement Date (to the extent not already provided), within thirty (30) days of the Commencement Date and thereafter shall provide all such data and documentation on an ongoing basis in accordance with Clause 4.2.

|

|

4.2

|

The Company shall provide to the Charity any and all data, documentation, information and Know-How described in Clauses 4.1.1 to 4.1.6 on an ongoing basis within a reasonable time after the same comes to the Company’s attention (if already in the Company’s Control), or into the Company’s Control, after the Commencement Date.

|

|

4.3

|

The Company shall provide the Charity with safety information in accordance with the procedures and timeframes set out in Schedule 3. For avoidance of doubt, the Charity shall be entitled to pass such safety information to CRT.

|

|

4.4

|

The Company will keep the Charity informed of the scope and results of any pre-clinical or other non-clinical studies being undertaken by or with third parties in relation to the Product. If the Company is intending to transfer the Product or undertake any new research in relation to the Product with a third party it will consult with the Charity on the scope of the intended research and the identity of the third party and take into good faith consideration any comments the Charity may have in respect to the same. This Clause should not be interpreted to limit any restrictions on the Company’s use of the Product or any Related Product under Clause 6.1 or elsewhere in this Agreement.

|

|

4.5

|

The Company shall submit to CRT:

|

|

4.5.1

|

a copy of its detailed operating budget (including a quarterly cash flow and expenditure forecast) for development of the Product in respect of each Financial Year as adopted by the Company’s board (the “Annual Budget”), at least thirty (30) days prior to the commencement of the Financial Year to which the Annual Budget relates;

|

|

4.5.2

|

quarterly management accounts of the Company (to include, inter alia, a (consolidated) profit and loss account, balance sheet and cash flow statement and shall indicate where such management accounts differ to any material extent from the Annual Budget for such period), within five (5) business days after the date by which such financial statements are filed with the United States Securities and Exchange Commission for such period, but in no event later than fifty (50) days after quarter close for the first three financial quarters and ninety five (95) days after close of the financial year. Such quarterly management accounts shall be prepared in accordance with United States generally accepted accounting principles consistently applied.

|

18

Confidential Materials Omitted and Filed Separately with the Securities and Exchange Commission Pursuant to a Request for Confidential Treatment under Rule 24b-2 of the Exchange Act of 1934, as amended. Confidential Portions are marked: [***].

|

4.6

|

The Company will maintain and will not terminate the Third Party Licences and will be solely responsible for any and all payments due under the Third Party Licences that may become due as a result of the grant of rights to the Charity under this Agreement or the carrying out the Clinical Trial in accordance with this Agreement.

|

|

5.

|

CONFIDENTIALITY/PUBLICATION

|

|

5.1

|

Subject to Clause 5.5, each Party shall keep confidential and not disclose to any third party (other than the Experts, Contributors, Ethics Committee, Regulatory Authority, and staff involved in carrying out the Clinical Trial on a need to know basis) any Confidential Information disclosed to it by another Party (the “Disclosing Party”) without the prior written consent of the Disclosing Party. For the avoidance of doubt, the Charity shall be permitted to disclose Confidential Information disclosed to it to CRT and CRT shall be permitted to disclose Confidential Information disclosed to it to the Charity. Any party to whom Confidential Information is disclosed in accordance with this Clause 5.1 shall be:

|

|

5.1.1

|

subject to no less onerous obligations than those contained in this Clause 5 to keep such information confidential; and

|

|

5.1.2

|

advised of its confidential nature.

|

|

5.2

|

The obligations of confidence referred to in Clause 5.1 shall not apply to any part of the Confidential Information which can be proved by evidence in writing:

|

|

5.2.1

|

was known to the recipient Party (the “Recipient Party”) before its disclosure by the Disclosing Party;

|

|

5.2.2

|

was available to the public before that date or was otherwise in the public domain;

|

|

5.2.3

|

becomes available to the public or enters the public domain after that date otherwise than as a result of an act or default of the Recipient Party;

|

|

5.2.4

|

is received by the Recipient Party from a third party not bound to the Disclosing Party by any obligation of secrecy;

|

|

5.2.5

|

is independently developed or generated by the Recipient Party in circumstances where it has not been derived directly or indirectly from the Disclosing Party’s Confidential Information; or

|

|

5.2.6

|

is required to be disclosed by: (i) any law or statute or any rule or regulation of any Regulatory Authority or other government or administrative agency or authority, (ii) a Regulatory Authority; or (iii) an order of any court, provided however, that in each such event the Recipient Party required to disclose the Confidential Information shall give prompt notice to the Disclosing Party of such requirement so that such Disclosing Party may seek a protective order or other appropriate remedy to the extent of such disclosure.

|

19

Confidential Materials Omitted and Filed Separately with the Securities and Exchange Commission Pursuant to a Request for Confidential Treatment under Rule 24b-2 of the Exchange Act of 1934, as amended. Confidential Portions are marked: [***].

|

5.3

|

The obligations of the Parties under Clause 5.1 shall survive the expiry or termination of this Agreement for whatever reason for a period of ten (10) years from the date of such expiry or termination.

|

|

5.4

|

Each of the Parties agrees that the provisions of this Clause 5 are fair and reasonable and that money damages are not a sufficient remedy for any breach of this Clause 5 and therefore, in addition to all other remedies, all Parties shall be entitled to seek injunctive or other equitable relief as a remedy for such breach.

|

|

5.5

|

Notwithstanding any confidentiality obligations assumed by the Parties hereunder, the Parties acknowledge the importance of publications to the academic standing of the Charity and the Contributors and the capital raising, transactional, and licensing prospects and reporting and disclosure obligations of the Company under United States and other securities laws, and progress reporting obligations to licensors and sublicensors under Third Party Licences. Accordingly, the Parties have agreed as follows as regards publication of Clinical Trial Results and Progress Reports:

|

|

5.5.1

|

The Charity shall use reasonable endeavours to publish, or procure the publication by the Contributors of, the Clinical Trial Results in a timely manner in accordance with generally accepted academic practice, whether during the course of or after completion of the Clinical Trial;

|

|

5.5.2

|

The Company may disclose the content of Progress Reports only to the extent required for (a) satisfying mandatory reporting and disclosure obligations under United States and other securities laws; or (b) to existing licensors or sublicensors of the Company in order to comply with reporting obligations in existence as at the date of this agreement under Third Party Licences, provided that in the case of (b) the disclosure will exclude all information regarding clinical responses and shall be limited to only information regarding the clinical indication, anticipated timelines of the trial, the number of patients dose, and such other information of a similar nature as may be reasonably required by the Third Party Licence;

|

|

5.5.3

|

In the event that the Company wishes to disclose the content of Progress Reports to a third party in connection with capital raising, financing, transactional, and/or licensing activities or prospects for the benefit of the Company, it shall give notice to the Charity, including details of the content of the proposed disclosure and the reason for wishing to make such disclosure, and obtain the Charity’s approval before proceeding with the disclosure. The Company shall inform Charity of the identity of the third party in its notice unless it is prevented from doing so due to express confidentiality restrictions owed to the third party, in which case the Company shall state the main business area within which the third party operates; and

|

|

5.5.4

|

It is further provided that any disclosure of the content of Progress Reports by the Company shall be subject to the following conditions: (a) all recipients shall be informed in writing beforehand of the confidential nature of the information being disclosed and shall have agreed in writing to obligations of confidentiality in favour of the Company no less onerous than those contained in this Clause 5 (but without any right of further disclosure) to keep such information confidential; and (b) only the content of the documents containing the relevant information which has been processed into a suitable format may be disclosed but not copies of the actual documents themselves. Condition (a) above shall not apply to a disclosure by the Company for the purpose mentioned in Clause 5.5.2(a).

|

20

Confidential Materials Omitted and Filed Separately with the Securities and Exchange Commission Pursuant to a Request for Confidential Treatment under Rule 24b-2 of the Exchange Act of 1934, as amended. Confidential Portions are marked: [***].

|

5.6

|

The Charity will include provisions in its contracts with the Contributor(s) that require such Contributor(s) to notify the Charity in advance of submission of any abstract, presentation or manuscript incorporating Clinical Trial Results that the Contributor(s) wish to publish or have published or to present or have presented.

|

|

5.7

|

Upon receipt of such notification from a Contributor or if the Charity wishes itself to publish or have published or to present or have presented an abstract, presentation or manuscript incorporating Clinical Trial Results the Charity shall so notify the Company and CRT and provide (in so far as it is able to do so in the case of a Contributor’s notification) in response to the Company’s and/or CRT’s reasonable request a copy or summary thereof at least seven (7) days prior to submission for publication of an abstract or presentation or at least thirty (30) days prior to submission for publication of a manuscript (or twenty one (21) days prior to submission for publication of a manuscript in the case of a Contributor’s notification). Any such copy or summary shall provide sufficient details to enable the Company and CRT to ascertain whether it contains Confidential Information of the Company or CRT respectively or whether Patent Rights or other proprietary protection should be sought.

|

|

5.8

|

The Company and CRT shall review and make any comments on such intended publication or presentation of an abstract to the Charity within seven (7) days and/or shall review and make any comments on such intended publication or presentation of a manuscript within thirty (30) days. The Company and/or CRT may request that:

|

|

5.8.1

|

Confidential Information of the Company (not including Clinical Trial Results nor information directly relating to the Investigational Medicinal Product) or Confidential Information of CRT (not including Clinical Trial Results) be removed from the proposed publication or presentation; and/or

|

|

5.8.2

|

any such publication or presentation be delayed if in the Company’s or CRT’s reasonable opinion it is necessary to delay publication or presentation in order to file a patent application or application for other proprietary protection in respect of any invention made in the course of the Clinical Trial. Any such delay will be kept to the minimum period practicable and will in no event extend beyond thirty (30) days from the date the proposed publication or presentation was provided to the Company.

|

In the event of a request pursuant to Clauses 5.8.1 or 5.8.2, the Company or CRT (as the case may be) shall provide the Charity with a written explanation of the reasons why it believes information should be removed or a delay is necessary. For the avoidance of doubt, any Patent Rights filed pursuant to Clause 5.8.2 shall be filed in CRT’s name.

|

5.9

|

The Charity and CRT shall be entitled to publish information in relation to the proposed Clinical Trial, including that it is or will be a trial conducted by the Clinical Development Partnerships initiative set up by the Charity and CRT, the pre-requisites for patient recruitment, a brief description of the Clinical Trial, including the name of the Company, the reference number and class of the Investigational Medicinal Product and the location(s) at which the trial is taking place.

|

|

6.

|

INTELLECTUAL PROPERTY RIGHTS

|

|

6.1

|

The Company hereby grants to the Charity:

|

21

Confidential Materials Omitted and Filed Separately with the Securities and Exchange Commission Pursuant to a Request for Confidential Treatment under Rule 24b-2 of the Exchange Act of 1934, as amended. Confidential Portions are marked: [***].

|

6.1.1

|

a *** in the Field under the Company Owned Intellectual Property; and

|

|

6.1.2

|

a *** in the Field under the hTERT Licensed Patents; and

|

|

6.1.3

|

a *** in the Field under the University of Western Ontario Licensed Patents; and

|

|

6.1.4

|

a *** in the Field under the Isis Licensed Patents; and

|

|

6.1.5

|

a *** in the Field under the Merix/Duke Licensed Patents; and

|

|

6.1.6

|

a *** in the Field on consent of Johns Hopkins University (as described in Section 2.2 of the JHU License) under the Immunomic/JHU Licensed Patents; and

|

|

6.1.7

|

a *** in the Field under the WARF Intellectual Property

|

in each case subject to the terms and conditions for such sub-licence described in Schedule 7A, on a royalty-free basis, and for the purpose of preparing for and carrying out (and having prepared or carried out for the Charity) the Clinical Trial. In addition the Company hereby grants to the Charity a non-exclusive, royalty free licence under the Company Intellectual Property (including the right to use Company Materials), subject to the terms and conditions for each sub-licence described in Schedule 7A, for the Charity and scientists funded by the Charity to adapt and use the Product Manufacturing Process and make and have made Products and Related Products for non-commercial research purposes, provided that such research will not include clinical research without the prior written consent of the Company on a case-by-case basis. Such license under the Immunomic/JHU Licensed Patents shall include only rights relating to use of ***.

In the event the Charity reasonably determines that its Contributors require any additional sub-licence under any Third Party Licence in order to perform their activities in support of the Clinical Trial, at the Charity’s request the Company agrees to use its reasonable endeavours to obtain the necessary consents under the relevant Third Party Licences to enable the Charity to grant the additional sub-licences to the Contributors or if such consent is refused in any case or in the Company’s reasonable opinion is unlikely to be granted then, if it is so permitted under the relevant Third Party Licence, the Company agrees to directly sublicense the Contributors as appropriate.

During the term of this Agreement, the Company shall not be entitled to (and shall not authorise any of its Affiliates or any other third party to) conduct any clinical trials in respect of the Product or, save as the Parties may agree otherwise pursuant to Clause 6.2 below, any Related Product.

If, within *** of the Effective Date, the licensor or sublicensor of a Third Party Licence requires that a provision of a Third Party Licence be added to this Agreement on the basis that the Third Party Licence requires that the provision be included in a sublicence, the Charity, CRT and the Company shall so amend this Agreement; provided, however that if the Charity reasonably determines that the provision, if added to this Agreement, would impose upon the Charity an obligation that is not acceptable to the Charity or an obligation that would be illegal for the Charity to perform under the laws of England, then the Charity may terminate this Agreement upon *** written notice to the Company.

22

Confidential Materials Omitted and Filed Separately with the Securities and Exchange Commission Pursuant to a Request for Confidential Treatment under Rule 24b-2 of the Exchange Act of 1934, as amended. Confidential Portions are marked: [***].

Notwithstanding anything to the contrary above in this Clause 6.1, or elsewhere in this Agreement, the Company acknowledges, agrees and warrants that the Charity is entitled to lawfully sub-contract in accordance with Clause 3.3 above any of the work that is contemplated by this Agreement (including work that is preparatory to any such work) without requiring any further or other consents from the Company or any third party.

As regards the Intellectual Property Rights that have been licensed to the Charity under clauses 6.1.4, 6.1.6 and 6.1.7 above, the Parties acknowledge the consent letters set out in the table at the top of Schedule 7 that have been obtained from the relevant head licensors. Without affecting the Charity’s rights above in this Clause 6.1:

|

(a)

|