UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||

|

For the Fiscal Year Ended: | ||

| OR | ||

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||

|

For the transition period from: __________ to __________

|

Commission File No.

(Exact Name of Registrant as Specified in its Charter)

| (State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification Number) |

(Address of Principal Executive Offices, Including Zip Code)

Registrant’s Telephone Number, including area

code:

Securities Registered Pursuant to Section 12(b) of the Act:

| Title of Each Class | Name of Exchange on Which Registered | |

| None | N/A |

Securities Registered Pursuant to Section 12(g) of the Act:

Common Stock, No Par Value

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

☐ YES ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

☐ YES ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

☒ ☐ NO

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit).

☒ ☐ NO

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |

| ☐ | Smaller reporting company | |||

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act)

☐ YES

☒

The aggregate market value of the approximately 30,000,000 shares of voting

stock held by non-affiliates of the Registrant as of June 30, 2022 approximated $

DOCUMENTS INCORPORATED BY REFERENCE

None

FORWARD-LOOKING STATEMENTS

THE RISK FACTORS BELOW ARE FURTHER HEIGHTENED BY THE COVID-19 PANDEMIC AND RESULTING ECONOMIC DOWNTURN AND OTHER RELATED CRISES AS DISCUSSED BELOW.

This Annual Report on Form 10-K (and the documents incorporated herein by reference) contain forward-looking statements, within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), that involve substantial risks and uncertainties. Forward-looking statements generally can be identified by the use of forward-looking terminology such as "may," "will," "expect," "intend," "estimate," "anticipate," "project," "predict," "plan," "believe," or "continue," or the negative thereof or variations thereon and/or references to goals, targets, projections or similar terminology. The expectations reflected in forward-looking statements may prove to be incorrect.

Important factors that could cause actual results to differ materially from our expectations include, but are not limited to, the following (not set forth in any order that ranks priority or magnitude):

| · | failure of the political, legal, regulatory and economic climate to support funding of environmental clean-up and enforcement of environmental rules and regulations; |

| · | changes in the public's perceptions of large scale livestock agriculture/CAFOs, consumption of meat and dairy, environmental protection and other related issues; cybercrimes/ hacking (actual and potential) of the Company’s online presence and limited operational computer systems; the Company’s <biontech.com domain was hacked/stolen during 2021 and the Company migrated to the bionenviro.com domain name. The Company initiated litigation seeking its recovery and other relief, recovered and subsequently sold the <biontech.com> domain. See Item 3 “Legal Proceedings” and Note 9 to Financial Statements, “Litigation ” ; |

| · | the Company's extremely limited financial and management resources which need to be augmented and limited ability to raise additional needed funds and/or hire needed personnel; |

| · | unsatisfactory wrap-up of the business activities of Bion PA-1 LLC (“PA1”) and/or resolution of PA-1’s negotiations with the Pennvest Infrastructure Authority (“Pennvest”) regarding PA1’s Pennvest Loan (presently in default) and the Kreider 1 System (see “Part I, Items 1 and Item 7 and “Notes to Financial Statements” below); |

| · | continued delays in (and/or failure of) development of markets (or other means of monetization) for nutrient reductions and other environmental benefits from agriculture and CAFOs and related waste treatment facilities; including failure of markets for nutrient (nitrogen and phosphorus) reductions to develop sufficient breadth and depth; |

| · | potential delays in constructing the Company’s Initial System, the Dalhart Project other Gen3Tech system installation and/or further delays in the Kreider 2 project and other potential Projects (capitalized items defined in the Item 1 narrative below); |

| · | the ability of the Company to implement its business strategy; |

| · | the extent of the Company's success in the development of of Gen3Tech joint ventures (“JVs”) and development/operation of Projects and retrofit/remediation of existing livestock facilities(“Retrofits”) and/or reaching the goals and targets set forth below, especially in light of the fact that at this date the Company has not yet developed its first Gen3Tech JV project and that the resources (CAPEX/personnel/expertise) required for development and operation of such projects will need to be sourced from outside the Company which has very limited resources in each listed category.; |

| · | dependence upon key personnel and the ability of the Company to keep its existing personnel and their accumulated expertise including the substantial risk of illness or death of one or more key personnel (most of whom are over 70 years of age and/or have existing health vulnerabilities that are exacerbated by the COVID-19 pandemic) and the need to obtain the services of additional personnel as employees and/or consultants as the Company’s business progresses; |

| · | engineering, mechanical or technological difficulties with operational equipment including potential mechanical failure or under-performance of equipment; operating variances from expectations; |

| · | the substantial capital expenditures required for the Company’s proposed JVs and development/construction of the Company's proposed Projects and facilities and the related need to fund such capital requirements through commercial banks and/or public or private securities markets; |

| · | the need to develop and re-develop technology and related applications; |

| 1 |

| · | operating hazards attendant to the environmental clean-up, CAFO and renewable energy production, fertilizer and/or food retailing and biofuel industries; |

| · | seasonal and climatic conditions; |

| · | decreased availability and increased cost of material and equipment (including those caused by the COVID-19 pandemic); |

| · | the strength and financial resources of the Company's potential competitors; |

| · | general economic, Covid-19 pandemic (see Item 7. “Management's Discussion And Analysis Of Financial Condition and Results Of Operations” and Note 1 to Financial Statements, “Covid-19 pandemic related matters”) and capital market conditions; |

| · | industry risks, including environmental related problems; |

| · | delays in anticipated permit approval and/or start-up dates; |

| · | the limited liquidity of the Company's equity securities; limited availability of capital on acceptable terms for small public companies like Bion in the current financial markets; and |

| · | the Company’s limited ability to comply with current and rapidly evolving ESG (environmental, social and governance) related items to date (which is due in large part to the Company’s small size and the fact that the Company has engaged in almost no new hiring ‘in house’ during the past decade combined with the Company’s limited financial capacity and the particular industry segments in which the Company is working) may inhibit the Company’s ability to raise capital and increase its shareholder base. |

We do not undertake and specifically disclaim any obligation to publicly release the results of any revisions that may be made to any forward-looking statements to reflect the occurrence of anticipated or unanticipated events or circumstances after the date of such statements.

| 2 |

PART I

ITEM 1. BUSINESS.

GENERAL

Bion Environmental Technologies, Inc.'s ("Bion," "Company," "We," "Us," or "Our") was incorporated in 1987 in the State of Colorado. Bion’s mission is to create extraordinary value for our shareholders and employees (all of whom own securities in the Company) while delivering premium, sustainable products to our customers (and other stakeholders) through ventures developing profitable, transparent, and sustainable solutions for livestock agriculture.

Our patented and proprietary technology provides advanced waste treatment and resource recovery for large-scale livestock production facilities (also known as “Concentrated Animal Feeding Operations” or “CAFOs"). Livestock production and its waste, particularly from CAFOs, has been identified as one of the greatest soil, air, and water quality problems in the U.S. today. Application of our third generation technology and business/technology platform (“Gen3Tech”) can largely mitigate these environmental problems, while simultaneously improving operational/ resource efficiencies by recovering high-value co-products from the CAFOs’ waste stream. These waste stream ‘assets’ – including primarily nutrients and methane – have traditionally been wasted or underutilized and are the same ‘pollutants’ that today fuel harmful algae blooms, contaminate groundwater, and exacerbate climate change.

During the first half of 2022 Bion began marketing our sustainable beef opportunity to retailers, food service distributors and the meat industry in the U.S. In general, the response has been favorable. During July 2023, Bion announced a letter of intent (“Ribbonwire LOI”) to develop its first large-scale commercial project, a 15,000-head sustainable beef cattle feeding operation together with the Ribbonwire Ranch, in Dalhart, Texas (with a provision to expand to 60,000 head) (“Dalhart Project”). The Dalhart Project will be developed to produce blockchain-verified, sustainable beef (with reduced the stress on cattle caused by extreme weather and temperatures and resulting higher feed/weight gain efficiency) while remediating the environmental impacts associated usually associated with cattle CAFOs. Bion’s patented technology will treat the waste stream and recover/refine valuable coproducts that include clean water, renewable natural gas (RNG), photovoltaic solar electricity, organic fertilizer and potentially other products. We anticipate converting the Ribbonwire LOI into a definitive agreement with Ribbonwire Ranch and creating distribution agreements with key retailers and food service distributors during the current fiscal year.

Bion’s business model and technology platform can create the opportunity for joint ventures (in various contractual forms)(“JVs”) between the Company and large livestock/food/fertilizer industry participants based upon the supplemental cash flow generated by implementation of our Gen3Tech business model, which cash flows will support the costs of technology implementation (including servicing related debt). We anticipate this will result in substantial long-term value for Bion. In the context of such JVs, we believe that the verifiable sustainable branding opportunities (conventional and organic) in meat will represent the single largest enhanced revenue contributor provided by Bion to the JVs (and Bion licensees). The Company believes that the largest portion of its business with be conducted through such JVs, but a material portion may involve licensing and or other approaches.

Bion’s Gen3Tech was designed to capture and stabilize these assets and produce renewable energy, fertilizer products, and clean water as part of the process of raising verifiably sustainable livestock. All steps and stages in the treatment process will be third-party verified, providing the basis for additional revenues, including renewable energy-related credits and, eventually, payment for ecosystem services, such as nutrient credits as described below. The same verified data will be used to substantiate the claims of a USDA-certified sustainable brand that will support premium pricing for the meat/ animal protein products that are produced in Bion facilities.

Our business plan is focused on executing multiple agreements and letters of intent related to the “Bion Beef Opportunity” and commencing development of multiple sustainable beef joint venture projects over the next twelve-eighteen (12-18) months while moving forward with the Initial Project (see below) and the Dalhart Project. Bion also intends to pursue other opportunities in the livestock industry enabled by our Gen3Tech business model. The Ribbonwire LOI announcement has generated significant interest within the livestock industry (among ranchers, feedlot operators, farmers and other AG industry parties) and food distribution and retail industry. We believe that this interest, combined with consumer interest in ‘sustainable products’ and the growing enthusiasm among some livestock industry parties for environmental/sustainable/regenerative practices, provides Bion (and its partners/venturers) with an opportunity to move forward with a truly sustainable solution in this industry segment.

During the next six months, the Company intends to construct and begin operations of phase 1 of our Initial Project located near Fair Oaks, Indiana. Bion expects the Initial Project to provide data that illustrates the effectiveness of our Gen3Tech in a commercial setting by the end of the 2nd quarter in 2023 which will support development of the Dalhart Project (and other projects) during 2023 and thereafter. We believe this data will also provide additional potential stakeholders (cattle producers, cattle feeders, packers, distributors, retailers and financial institutions) with the information they need to proceed with confidence in collaborating with Bion on multiple new projects (see below).

| 3 |

Bion is now focused primarily on: i) development/construction of the Initial Project, our initial commercial-scale Gen3Tech installation (see below and Notes to Financial Statements , ii) development/construction of the Dalhart Project, iii) developing applications and markets for its sustainable (conventional and organic) animal protein products and its low carbon organic fertilizer products , iv) discussions regarding initiation and development of agreements and joint ventures (“JVs” as discussed below) (and related projects) based on the augmented capabilities of our Gen3Tech business platform (in the sustainable beef and other livestock segments), while (v) continuing to pursue business opportunities related to large retrofit projects (such as the Kreider poultry project JV described below) and vi) ongoing R&D activities.

At present, there is essentially no traceable and verifiable ‘sustainable beef’ available to the US market except for niche products. In response to consumer demand for transparency and sustainability, Bion expects the meat industry in general, and beef specifically, to evolve towards using new technologies to deliver these attributes in their products. While we anticipate a faster adoption of tracking, verification and sustainability technologies in other perishable food categories like produce and dairy due to their harvest and production techniques, meat industry leaders have also announced their willingness to move forward with initiatives in this area. Bion predicts that within approximately five years, consumers will be able to track and verify claims including sustainability on 25% (or more) of the products merchandised in the meat department. Bion believes that the retail market share of verifiably sustainable beef in the US will approach 7-10 % within three (3) years (end of 2025) and 25% in five (5) years (end of 2027) (approximately 2,000,000 cattle annually) (and more thereafter). If Bion can successfully execute on its sustainable beef business plan, facilities utilizing Bion’s Gen3Tech platform will provide one-third (1/3) or more of that of the premium market segment (and a higher portion of meat that is actually traceable and verifiably sustainable). Our goal is to have multiple sustainable beef projects under development (within 3-5 distinct JVs) by the end of 2023. Our first commercial project is likely to be the Dalhart Project but we anticipate commencing additional sustainable beef projects during 2023 as well. Our current target is to have at least three (3) facility modules (15,000 head per module)(“Modules”) in development/under construction during 2023 in three (3) different JVs with the initial barns being populated with livestock by fall/winter 2024-25. Further expansion in the number of distinct JVs is projected through 2025 aiming at 5-10 JVs in process --- each of which JVs will be pursuing development of multiple Modules with targets of 12-15 populated Modules by the end of 2025 (approximately 2%-3% of the US beef market) and 30-45 Modules constructed and populated by 2027-28 (approximately 6%-8% of the US beef market) with further expansion thereafter. Bion’s current goal is that its Gen3Tech platform will be utilized to produce 33% of the verifiable “sustainable beef” category at the end of the period (which will equal approximately 2 million cattle annually)(45 Modules).

There is no assurance that the Company will reach or approach the goals/targets set forth above. Reaching such goals/targets will require access to very large amounts of capital (equity and debt) as each module is projected to cost in excess of $50 million to construct and require mobilization of substantial personnel, technical resources and management skills. The Company does not possess either the financial or personnel resources required internally and will need to source such resources from outside itself.

During this five (5) year period, the Company also anticipates having additional Gen3Tech projects underway in the pork/dairy/egg sectors of the US animal protein market.

| 4 |

HISTORY, BACKGROUND AND CURRENT ACTIVITIES

Since the Company’s inception, Bion has designed and developed advanced waste treatment systems for livestock. The first and second generations of Bion’s technology platform were biological systems, primarily focused on nutrient control. Over 30 of these systems were deployed at New York dairies, Florida food processing facilities and dairies, North Carolina hog farms, a Texas dairy and a Pennsylvania dairy (“Kreider 1 Project”). The systems were highly effective at their intended purpose: capturing nitrogen and phosphorus. They produced BionSoil as a byproduct, which was a remarkably effective soil amendment/ fertilizer product, but whose value was not enough to support a viable business model. As such, these early technology iterations were entirely dependent on either implementation of new regulations requiring waste treatment, or subsidy/ incentive programs that would provide ‘payment for ecosystem services’. By the mid-2010’s, it became apparent that neither of these options were imminent or even assured, so the Company initiated the steps to reimagine and redesign its technology.

From 2016 to 2021 fiscal years, the Company focused most of its activities and resources on developing, testing and demonstrating the third generation of its technology and technology platform (“Gen3Tech”) that was developed with an emphasis producing more valuable co-products from the waste treatment process, including renewable natural gas and ammonium bicarbonate, a low-carbon, organic ’pure’ nitrogen fertilizer product while raising sustainable livestock.

The $175 billion U.S. livestock industry is under intense scrutiny for its environmental and public health impacts – its ‘environmental sustainability’-- at the same time it is struggling with declining revenues and margins (derived in part from clinging to its historic practices and resulting limitations and impacts) which threaten its ‘economic sustainability’. Its failure to adequately respond to consumer concerns including food safety, environmental impacts, and inhumane treatment of animals have provided impetus for plant-based alternatives such as Beyond Meat and Impossible Burger (and many others) being marketed as “sustainable” alternatives for this growing consumer segment of the market.

The Company believes that its Gen3Tech, in addition to providing superior environmental remediation, creates opportunities for large scale production of i) verifiably sustainable-branded livestock products and ii) verifiably sustainable organic-branded livestock products, both of which will command premium pricing (in part due to ongoing monitoring and third-party verification of environmental performance which will provide meaningful assurances to both consumers and regulatory agencies). Each of these two distinct market segments (which the Company intends to pursue in parallel) presents a large production/marketing opportunity for Bion. Our Gen3Tech will also produce (as co-products) biogas, solar photovoltaic electricity in appropriate locations, and valuable low carbon organic fertilizer products, which can be utilized in the production of organic grains for use as feed for raising organic livestock (some of which may be utilized in the Company’s JV projects) and/or marketed to the growing organic fertilizer market.

During July 2022, the Company entered into a letter of intent with Ribbonwire Ranch (Dalhart, Texas) (“Ribbonwire LOI”) setting forth the parties’ intention to negotiate a joint venture agreement (“JVA”) and enter into a joint venture (“JV”) to develop and operate an initial 15,000 head integrated, sustainable beef facility on RWR property (“Dalhart Project”) including:

| a) | innovative cattle barns (with slatted floors to facilitate movement of manure to the anaerobic digester and potentially solar PV generation on the rooftops which barns will improve the living conditions of the animals while increasing feeding/weight gain efficiency, |

| b) | ‘customized’ anaerobic digestion systems (including pretreatment to increase renewable natural gas (‘RNG’) production and an RNG cleaning system (which will include capture/recycling of the CO2) to allow pipeline sales and monetization of related environmental credits, |

| c) | a Bion Gen3Tech module (which will utilize the recycled CO2 to increase ammonium bicarbonate recovery) for the production of ammonium bicarbonate fertilizer for use in organic crop production (plus residual organic solids and clean water), |

| d) | which will produce verifiably sustainable beef products with USDA certified branding. |

| 5 |

The Dalhart Project will include expansion capability up to 60,000 head of cattle, in aggregate, located at/around/contiguous to the initial facilities on Ribbonwire property.

The opportunity presented by the Ribbonwire LOI to commercialize the Company’s Gen3Tech and business model matured more quickly than anticipated (reflecting strong industry and public momentum in favor of verifiably sustainable food ventures). As a result, we have shifted our plans to focus resources and make our initial 15,000 head operation in Dalhart, TX a reality as soon as possible.

To place the Ribbonwire LOI and the Dalhart Project in the context of Company’s business plan (and our prior public disclosure), if the contemplated venture moves forward on the timelines set forth in the Ribbonwire LOI, active development of the Dalhart Project will commence early in the second quarter of 2023.

Prior to such activity, the Company intends to construct and operate the initial phase of the previously announced Gen3Tech demonstration project near Fair Oaks, Indiana (“Initial Project”): i) to validate our existing data and modeling at commercial scale and ii) to optimize the Bion Gen3Tech module for finalization of design parameters and fabrication details of our planned 15,000 head commercial facilities (including the Dalhart Project). For the purposes of this initial phase, the Company, in order to accelerate the data acquisition phase, intends to utilize anaerobic digester effluent from the nearby/contiguous Fair Oaks dairy. Construction and related activities of this demonstration project have commenced with main module assembly on site targeted to commence during January 2023 (somewhat delayed due to supply chain constraints) followed by operations through the first half of 2023 to generate the required information. Thereafter, the Company will evaluate what, if any, additional facilities and testing will take place at that location.

The Initial Project is not being developed at economic commercial scale or with an expectation of profitability due to its limited scale. However, successful installation, commissioning, and operations will demonstrate scalability, determine operating parameters at scale, and provide ongoing production and engineering capabilities, all being critical steps that must be accomplished before developing large projects with JV partners.

The Company anticipates that it will negotiate additional letters of intent and enter into additional joint ventures related to the development of further commercial-scale sustainable beef projects over the next 6-18 months in addition to the Dalhart Project.

As previously disclosed, during late September 2021, Bion entered into a lease for the development site of the Initial Project, our initial commercial scale Gen3Tech project, which Initial Project will be located on approximately four (4) acres of leased land near Fair Oaks, Indiana, and a related agreement regarding disposal of certain manure effluent with the Curtis Creek Dairy unit of Fair Oaks Farms (“FOF”). Design and pre-development work commenced during August 2021 and preliminary surveying, site engineering and other work is now underway along with site-specific engineering and design work. The Initial Project was initially planned to be an environmentally sustainable beef cattle feeding facility, equipped with state-of-the-art housing and Bion’s 3G-Tech platform to provide waste treatment and resource recovery. Bion has designed the project to house and feed approximately 300 head of beef cattle. If all phases of the Initial Project are constructed, the facility will include Bion’s Gen3Tech platform including: i) covered barns (possibly including roof top solar photovoltaic generation), ii) anaerobic digestion for renewable energy recovery, iii) livestock waste treatment and resource recovery technology, iv) Bion’s ammonium bicarbonate recovery and crystallization technology and iv) data collection software to document system efficiencies and environmental benefits (with the Bion Gen3Tech facilities capable of treating the waste from approximately 1,500 head). The facility will be large enough to demonstrate engineering capabilities of Bion’s Gen3Tech at commercial scale, but small enough that it can be constructed and commissioned relatively quickly. Originally, construction and onsite assembly operations were targeted to commence sometime late in 2022, however, supply chain backlogs have delayed likely delivery dates for core modules of the Bion system to the site until sometime during January 2023. 3G1 has been moving forward with the development process of the Initial Project. See Note 3 “Property and Equipment” and Note 12 “Subsequent Events” (for activities since the start of the first quarter of the 2023 fiscal year).

The Initial Project is not being developed at economic commercial scale or with an expectation of profitability due to its limited scale. However, successful installation, commissioning, and operations will demonstrate scalability, determine operating parameters at scale, and provide ongoing production and engineering capabilities, all being critical steps that must be accomplished before developing large projects with JV partners.

| 6 |

Specifically, the Initial Project is being developed to provide and/or accomplish the following:

| i. | Proof of Gen3Tech platform scalability |

| - | Document system efficiency and environmental benefits and enable final engineering modifications to optimize each unit process within the Bion Gen3Technology platform. |

| - | Environmental benefits will include (without limitation) renewable energy production (natural gas recovery from AD and solar electric from integrated roof top photovoltaic generation); nutrient recovery and conversion to stable organic fertilizer; pathogen destruction; water recovery and reuse; air emission reductions. |

| ii. | Use Bion’s data collection system to support 3rd party verified system efficiency requirement to qualify for USDA Process-Verified-Program (PVP): certification of sustainable branded beef (and potentially pork) product metrics. |

| iii. | Produce sufficient ammonium bicarbonate nitrogen fertilizer (“AD Nitrogen”) for commercial testing by potential joint venture partners and/or purchasers and for university growth trials. |

| iv. | Produce sustainable beef products for initial test marketing efforts. |

On January 28, 2022 Bion Environmental Technologies, Inc. (‘Bion’), on behalf of Bion 3G1 LLC (‘3G1’), a wholly-owned subsidiary, entered into a Purchase Order Agreement with Buflovak and Hebeler Process Solutions (collectively ‘Buflovak’) in the amount of $2,665,500 (and made the initial 25% payment ($665,375)) for the core of the ‘Bion System’ portion (without the crystallization modules which will be ordered and fabricated pursuant to subsequent agreements) of the previously announced Gen3Tech Initial Project. This Purchase Order encompasses the core of Bion’s Gen3Technology.

On March 21, 2022 the Company received progress notice re completion of certain work in process and an invoice from Buflovak for the next 25% payment ($665,375) which was paid during the 2022 fiscal year. On June 6, 2022, the Company received progress notice re completion of certain work in process and an invoice from Buflovak for the third 25% payment ($665,375) which was paid on July 5, 2022 bringing the aggregate payments to $1,996,125 as of the date of this report. Buflovak has worked with the Company on design and testing of its Gen3Tech over several years. 3G1 is working in concert with Integrated Engineering Services, the primary site engineering firm for the facility, on the integration of all project components/modules at the Initial Project site. Additional agreements have been entered into various professional services providers (engineers, surveyors, etc.) for work related to the Initial Project.

The Initial Project will be carried out in stages with phase one focused on portions of items i. and iii. set forth above.

Upon completing the primary goals of phase 1 of the Initial Project (coupled with obtaining organic certifications(s) for our solid ammonium bicarbonate fertilizer product line), Bion expects to be ready to move forward with its plans for development of much larger facilities including the Dalhart Project including final design of its Gen3Tech modules. The Company anticipates that discussions and negotiations it has begun (together with additional opportunities that will be generated over the next 6-12 months) regarding potential JVs with strategic partners in the financial, livestock and food distribution industries to develop large scale projects will continue during the development/construction of the Initial Project with a 2023 goal of establishing multiple JV’s for large scale projects that will produce sustainable and/or sustainable-organic corn-fed beef. These products will be supported by a USDA PVP-certified sustainable brand that will, initially, highlight reductions in carbon and nutrient footprint, as well as pathogen reductions associated with foodborne illness and antibiotic resistance, along with the organic designation where appropriate. Bion has successfully navigated the USDA PVP application process previously, having received conditional approval of its 2G Tech platform (pending resubmission and final site audits), and is confident it will be successful in qualifying its Gen3Tech platform.

After the basic technology start-up milestones of the Initial Project (primarily optimization and steady-state operations of the core modules of our Gen3Tech platform) have been met, the Company will determine whether to complete the entire Initial Project as originally designed at that location or the relocate the core modules to an alternative permanent location. The Company is in discussion with the University of Nebraska-Lincoln to jointly develop an integrated beef facility based on Bion’s Gen3Tech and business model at its Klosterman Feedyard Innovation Center (“KFIC”) (or other mutually agreed upon location) which facility will include innovative barns, an anaerobic digester and a Bion Gen3Tech system to conduct ongoing research and development related thereto and the KFIC is a possible site for the long-term re-location of the core modules. This venture, if it moves forward, is anticipated to include joint preparation of applications for grants and other funding from the USDA (‘climate smart’ program, rural development, etc.) and other sources. The Company will also evaluate re-locating the core module of the Initial Project to Dalhart, Texas, where it might be integrated into the first phases of the Dalhart Project.

The Company’s initial ammonium bicarbonate liquid product completed its Organic Materials Review Institute (“OMRI”) application and review process with approval during May 2020. Applications for our first solid ammonium bicarbonate product line have been filed with OMRI, the California Department of Food & Agriculture (“CDFA”) and the Iowa Organic Program (“IOP”) and are in the review processes (which is likely to require an extended period of time and multiple procedural steps, in part due to the novel nature of our Gen3Tech in the context of organic certifications). See “Organic Fertilizer Listing/Certification Process” below.

| 7 |

Additionally, the Company believes there will also be opportunities to proceed with selected ‘retrofit projects’ of existing facilities (see ‘Gen3Tech Kreider 2 Poultry Project’ below as an example) in the swine, dairy and poultry industries utilizing our Gen3Tech.

Bion believes that substantial unmet demand currently exists– potentially very large – for ‘real’ meat/ dairy/ egg products that offer the verifiable/believable sustainability consumers seek, but with the taste and texture they have come to expect from American beef and pork, dairy and poultry. Numerous studies demonstrate the U.S. consumers’ preferences for sustainability. For example, 2019 NYU Stern’s Center for Sustainable Business study found that ‘products marketed as sustainable grew 5.6 times faster than those that were not…’ and that ‘…in more than 90 percent of consumer-packaged-goods (CPG) categories, sustainability-marketed products grew faster than their conventional counterparts.’ Sales growth of plant-based alternatives, including both dairy and more recently ground meat (Beyond Meat, Impossible Foods, etc.) have shown that a certain segment of consumers is choosing seemingly sustainable food product offerings, and are also willing to pay a premium for it. Numerous studies also support the consumers’ ‘willingness-to-pay’ (WTP) for sustainable choices, including a recent meta-analysis of 80 worldwide studies with results that calculate the overall WTP premium for sustainability is 29.5 percent on average.

As one of the largest contributors to some of the greatest air and water quality problems in America, it is clear that livestock waste cleanup, at scale, represents one of the greatest opportunities we have to reduce negative environmental impacts of the food supply chain on air and water quality. Bion’s Gen3Tech platform, along with its business model, enables the cleanup of the ‘dirtiest’ part of the food supply chain: animal protein production and creates the opportunity to produce and market verifiably sustainable organic and conventional ‘real meat’ products that can participate in the growth and premium pricing that appears to be readily available for the ‘right’ products.

Gen3Tech Beef Business Model

Bion believes that at least a premium segment of the U.S. beef industry (and potentially other livestock industry groups) is at the doorstep of a transformative opportunity to address the growing demand for sustainable food product offerings, while pushing back against today’s anti-meat messaging. At $66 billion/year (2021 wholesale/farmgate value), the beef industry is a fragmented, commodity industry whose practices date back decades. In 1935 inflation-adjusted terms, beef is 63% more expensive today, while pork and chicken, which are now primarily raised in covered barns, at CAFOs with highly integrated supply chains, are 12% and 62% cheaper, respectively. In recent years, the beef industry has come under increasing fire from advocacy groups, regulatory agencies, institutional investors, and ultimately, their own consumers, over concerns that include climate change, water pollution, food safety, and the treatment of animals and workers.

Advocacy groups targeting livestock and the beef industry have recently been joined by competitors that produce animal protein alternatives in seeking to exploit the industry’s environmental and economic weaknesses. Their global anti-meat messaging has had a substantial chilling effect on the relationships the beef industry has with its institutional investors; retail distributors, such as fast-food restaurants; and mostly, its consumers. Led by the United Nations Food and Agriculture Organization, a coordinated anti-meat messaging campaign has targeted consumers worldwide, primarily focused on the industry’s impacts on climate change. Meat alternatives, especially plant-based protein producers like Beyond Meat and Impossible Foods, are being heavily promoted by themselves and the media, and initially enjoyed steady sales growth until sales began flattening over the past 12-18 months. A 2018 NielsenIQ Homescan survey last year found that 39% of Americans are actively trying to eat more plant-based foods. Some of the recent growth in plant-based proteins results from increasing lactose intolerance and other health concerns; however, most of that growth is attributed to consumers’ growing concerns for the environmental impacts of real meat and dairy. Several large US companies that have traditionally focused on livestock production, including Cargill, ADM, Perdue Foods, and Tyson, have recently entered the plant protein space. In terms of changing customer preferences, ‘saving the planet’ has proven to be a more compelling argument than the traditional animal activism/ welfare pitch. To date, the primary beef ‘industry response’ to this has been grass-fed beef, which is regarded as a generally more sustainable offering than grain-fed (largely without empirical evidence) plus a patina of initiatives invoking the vague term ‘regenerative’ agriculture. However grass-fed beef has had only limited acceptance in U.S. markets, because it is less flavorful and tougher than the traditional corn-fed beef consumers have grown to enjoy.

It should be noted that these plant-based protein producers are primarily expected to be able to serve the ground/ processed meat market, segment which represents only about 10 percent of the overall animal protein market. Further, there has recently been pushback to these plant-based products, focusing on their highly processed nature and unproven health benefits, scalability/ pricing, and their uncertain carbon footprint. There have also been several companies recently enter the cellular and 3D-printed meat arena. While facing myriad technical and economic challenges and further out on the development timeline, some people believe cellular agriculture (aka cultured, clean, lab-grown, cultivated) meat may have the potential to service a much larger percentage of the market than plant-based protein, including cuts like steaks, chops and roasts, but the likely cost and timeline for availability remain very uncertain at this point.

Each of these items supports Bion’s belief that there is a potentially very large opportunity to supply premium verifiably sustainable beef products that address these consumer concerns. We believe that the real meat/beef products that can be cost-effectively produced today using our Gen3Tech platform, both sustainable and/or sustainable organic, can provide an affordable product that satisfies the consumer’s desire for sustainability, while providing the superior taste and texture those consumers have grown to prefer.

While the beef industry has largely continued historic practices, the dairy industry has housed milk cows in barns and has been processing cow waste through anaerobic digesters (ADs) to generate energy for years. In recent years the renewable biogas (RNG) from the dairy ADs has become increasingly lucrative due to related environmental credits .

| 8 |

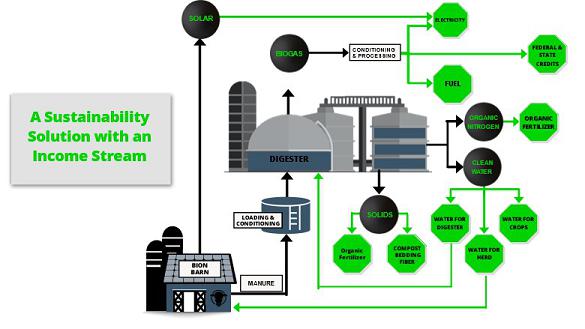

Bion‘s sustainable beef business model, based on our Gen3Tech platform, will develop and operate large scale facilities that: a) utilize custom designed barns which enable a more controlled and monitored husbandry environment (and photovoltaic solar electricity generation utilizing the rooftops), b) with continual manure transfer to ADs, c) which produce RNG and related environmental revenues, and d) then channel the AD waste (including CO2 recovered from the RNG processing/cleanup) through a series of patented technologies to refine the waste into its various components. The diagram below depicts a simplified facility schematic/flow chart:

This overall business model unites several interrelated businesses driven by Bion’s technology and augments and aggregates multiple revenue streams as described below. See “Technology and Technology Platform” below for descriptions of the 4 major categories of products/revenue streams which Bion anticipates from its Gen3Tech beef facilities: a) premium ‘sustainable branded’ beef, b) renewable energy and energy/environmental/carbon-related credits, c) organic fertilizer products and d) nutrient credits.

Sustainable Beef

Bion’s goal is to be first to market with meaningfully verified sustainable beef products that can be produced at sufficient scale to service national market demand. The cattle produced at a Bion facility will have a substantially lower carbon footprint, dramatically reduced nutrient impacts to water and air, and an almost total pathogen kill in the waste stream. Further, the economics of producing these cattle (including the cost of the facility/technology upgrade) will be greatly enhanced by the revenue realized from the recovery of valuable resources, including renewable energy, high-value fertilizer products, and clean water.

A Bion sustainable beef facility (see diagram above) will be comprised of covered barns with slotted floors (allowing the waste to pass through) which will reduce ammonia volatilization and loss to the atmosphere, as well as odors, thereby improving animal health and human working conditions while preventing air/soil/water pollution. The manure will be collected and moved directly to customized anaerobic digestion facilities which will produce renewable natural gas (and re-cycle CO2 from the gas cleaning process). Covered barns will reduce weather impacts on the livestock and have been demonstrated to promote improved general health and weight gain in the cattle housed in them. The barns’ very large roof surface area will be utilized (in appropriate geographical locations) for the installation of photovoltaic solar generation systems to produce electricity for the facility, as well as export to the grid. The barn roofs will also be configured to capture rainwater, which, coupled with the water recovered from the treatment process, will reduce the projects’ reliance on current water supplies.

Waste treatment and resource recovery will be provided by Bion’s Gen3Tech platform, which Bion believes offers the most comprehensive solution for livestock waste available today. In addition to direct environmental benefits, every pound of nitrogen that is captured, upcycled, and returned to the agricultural nitrogen cycle as high-quality fertilizer (vs lost to contaminate downstream waters), is also a pound of nitrogen that will not have to be produced as synthetic urea or anhydrous ammonia, with their tremendous carbon cost. System performance and environmental benefits will be monitored and verified through third parties, with USDA PVP certification of the sustainable brand that Bion also believes will be the most comprehensive available in the market.

Recently there have been efforts to establish sustainable brands (including USDA PVP certification) for a number of small-scale livestock producers (largely in the grass fed beef category). To date, the reach and extent of such efforts is limited and it is difficult to determine their effectiveness. Additionally, there have been public announcements of initiatives related to beef sustainability (largely focused on the ‘cow-calf’ segment of the livestock chain) in procurement by major beef processing companies, but a closer look finds that most consist largely of ‘green washing’ public proclamations in the wake of environmental and social criticism that re-package prior initiatives and lack any significant new substance.

| 9 |

At present, there is essentially no traceable and verifiable ‘sustainable beef’ available to the US market except for niche products. In response to consumer demand for transparency and sustainability, Bion expects the meat industry in general, and beef specifically, to evolve towards using new technologies to deliver these attributes in their products. While we anticipate a faster adoption of tracking, verification and sustainability technologies in other perishable food categories like produce and dairy due to their harvest and production techniques, meat industry leaders have also announced their willingness to move forward with initiatives in this area. Bion predicts that within approximately five years, consumers will be able to track and verify claims including sustainability on 25% (or more) of the products merchandised in the meat department. Bion believes that the retail market share of verifiably sustainable beef in the US will approach 7-10 % within three (3) years (end of 2025) and 25% in five (5) years (end of 2027) (approximately 2,000,000 cattle annually). If Bion can successfully execute on its sustainable beef business plan, facilities utilizing Bion’s Gen3Tech platform will provide one-third (1/3) or more of that of the premium market segment (and a higher portion of meat that is actually traceable and verifiably sustainable). Our goal is to have multiple sustainable beef projects under development (within 3-5 distinct JVs) by the end of 2023. Our first commercial project is likely to be the Dalhart Project but we anticipate commencing additional sustainable beef projects during 2023 as well. Our current target is to have at least three (3) facility modules (15,000 head per module)(“Modules”) in development/under construction during 2023 in three (3) different JVs with the initial barns being populated with livestock by fall/winter 2024-25. Further expansion in the number of distinct JVs is projected through 2025 aiming at 5-10 JVs in process --- each of which JVs will be pursuing development of multiple Modules -- with targets of 12-15 populated Modules by the end of 2025 (approximately 2%-3%% of the US beef market) and 30-45 Modules constructed and populated by 2027-28 (approximately 6%-8% of the US beef market) with further expansion thereafter. Bion’s current goal is that its Gen3Tech platform will be utilized to produce 33% of the verifiable “sustainable beef” category at the end of the period (which will equal approximately 2 million cattle annually)(45 Modules).

There is no assurance that the Company will reach or approach the goals/targets set forth above. Reaching such goals/targets will require access to very large amounts of capital (equity and debt) as each module is projected to cost in excess of $50 million to construct and require mobilization of substantial personnel, technical resources and management skills. The Company does not possess either the financial or personnel resources required internally and will need to source such resources from outside itself.

Some portion of which sustainable beef will likely be organic (see below).

Sustainable Organic Beef

Bion believes it has a unique opportunity to produce, at scale, affordable corn-fed organic beef that is also certified as sustainable. In addition to the sustainable practices described above, organic-sourced beef cows would be finished on organic corn, which would be produced using the ammonium bicarbonate fertilizer captured by the Gen3Tech platform. Bion believes its meat products will meet consumer demands with respect to sustainability and safety (organic) and provide the tenderness and taste American consumers have come to expect from premium conventional American beef. Such products are largely unavailable in the market today. We believe Bion’s unique ability to produce the fertilizer needed to grow a supply of relatively low-cost organic corn, and the resulting opportunity to produce organic beef, will dramatically differentiate us from potential competitors. This organic opportunity is dependent on successfully establishing Bion’s fertilizer products as acceptable for use in organic grain production.

| 10 |

Today, organic beef demand is limited and mostly supplied with grass-fed cattle. While organic ground/ chopped meat has enjoyed success in U.S. markets, grass-fed steaks have seen limited acceptance, mostly resulting from consumer issues with taste and texture. In other words, it’s tough. Regardless, such steaks sell for a significant premium over conventional beef. A grain-finished organic beef product is largely unavailable in the marketplace today due to the higher costs of producing organic corn and grain. The exception is offerings that are very expensive from small ‘boutique’ beef producers. Like all plants, corn requires nitrogen to grow. Corn is especially sensitive to a late-season application of readily available nitrogen – the key to maximizing yields. With non-organic field corn, this nitrogen is supplied by an application of a low-cost synthetic fertilizer, such as urea or anhydrous ammonia. However, the cost for suitable nitrogen fertilizer that can be applied late-season in organic corn production is so high that the late-season application becomes uneconomical, resulting in substantially lower yields – a widely recognized phenomena known as the ‘yield gap’ in organic production. The yield gap results in higher costs for organic corn that, in turn, make it uneconomical to feed that corn to livestock. As is the case for sustainable but not organic beef, Bion believes there is a potentially large unmet demand for affordable beef products that are both sustainable AND organic, but with the taste and texture consumers have come to expect from American beef. Bion’s ability to produce the low-cost nitrogen fertilizer that can close the organic yield (and affordability) gap puts the Company in a unique, if not exclusive at this time, position to participate in JV’s that will benefit from this opportunity starting next year.

The demonstrated willingness of consumers to purchase sustainable products (along with numerous research and marketing studies confirming consumers are seeking, and are willing to pay a premium for, sustainable products)---in combination with the threat to the livestock industry market (primarily beef and pork) posed by plant-based alternatives (heightened by pandemic conditions)--- has succeeded in focusing the large scale livestock industry on how to meet the plant-based market challenge by addressing the consumer sustainability issues. The consumer demand for sustainability appears to be a real and lasting trend, but consumers remain skeptical of generalized claims of ‘sustainability’. To date, a large portion of the industry responses to this trend have been at a superficial level or consist of ‘green washing’, a deceptive marketing practice where companies promote non-substantive initiatives. Real sustainability for the livestock industry will require implementation of advanced waste treatment technology at or near the CAFOs – where most of the negative environmental impacts take place.

Organic Fertilizer Listing/Certification Process

The Company has focused a large portion of its activities on developing, testing and demonstrating the 3rd generation of its technology and technology platform (“Gen3Tech”) with emphasis on increasing the efficiency of production of valuable co-products from the waste treatment process, including ammonia nitrogen in the form of low carbon and/or organically certified ammonium bicarbonate products. The Company’s initial ammonium bicarbonate liquid product completed its Organic Materials Review Institute (“OMRI”) application and review process with approval during May 2020.

Applications for our first solid form of concentrated ammonia, soluble nitrogen fertilizer product line have been filed with OMRI (filed during May 2021), the Iowa Organic Program (“IOP”)(filed during March 2022) and the California Department of Food & Agriculture (“CDFA”)(filed during May 2022) and are each in the review process. The review processes are requiring extended periods of time and multiple procedural steps with each entity in part due to the novel nature of Bion’s Gen3Tech and our solid ammonium bicarbonate product in the context of organic certifications. The OMRI application has proceeded through multiple stages of review and rebuttal/appeal without receiving a positive result to date. The Company anticipates has recently filed a new appeal to the most recent determinations. The Company’s CDFA has received initial comments regarding our solid ammonium bicarbonate product line and we anticipate providing CDFA with the requested updated information and clarifications during the next 60 days. The Company’s product line is novel in part due to the fact that there is not a formal listing category for a solid form of concentrated ammonia, soluble nitrogen fertilizers and there is no clear guidance at present from internal policy manuals on how to categorize this product and the process that produced it. There is also no clear guidance at present from either the NOP or the National Organic Standards Board (“NOSB”) (which is currently involved in a related review and recommendations process regarding ‘high nitrogen liquid fertilizers’ derived from ammonia from manure). The Company and its representatives, along with a number of other stakeholders, are involved in discussions regarding resolution of these matters at all three levels. The Company anticipates positive resolution of this matter with one or more listings/certifications of this product line well prior to operational dates for the Company’s initial large scale JV Gen3Tech projects.

| 11 |

Gen3Tech Kreider 2 Poultry Project

Bion has done extensive pre-development work related to a waste treatment/renewable energy production facility to treat the waste from KF’s approximately 6+ million chickens (planned to expand to approximately 9-10 million) (and potentially other poultry operations and/or other waste streams) ('Kreider Renewable Energy Facility' or ‘Kreider 2 Project’). On May 5, 2016, the Company executed a stand-alone joint venture agreement (“JVA”) with Kreider Farms covering all matters related to development and operation of Kreider 2 system to treat the waste streams from Kreider’s poultry facilities in Bion PA2 LLC (“PA2”). During May 2011 the PADEP certified a smaller version of the Kreider 2 Project (utilizing our 2nd generation technology) under the old EPA’s Chesapeake Bay model. The Company anticipates that if and when new designs are finalized utilizing our Gen3Tech, a larger Kreider 2 Project will be re-certified for a far larger number of credits (management’s current estimates are between 2-4 million (or more) nutrient reduction credits for treatment of the waste stream from Kreider’s poultry pursuant to the amended EPA Chesapeake Bay model and agreements between the EPA and PA). Note that this Project may also be expanded in the future to treat wastes from other local and regional CAFOs (poultry and/or dairy---including the Kreider Dairy) and/or additional Kreider poultry expansion (some of which may not qualify for nutrient reduction credits). The Company has commenced discussions with Kreider Farms regarding updating the JVA to reflect the capabilities of our Gen3Tech platform and anticipates executing an amended (or new) JVA during the current fiscal year. The Company anticipates that if and when PA2 re-commences work on the Kreider 2 Project, it will submit a new application based on our Gen3Tech. Site specific design and engineering work for this facility have not commenced, and the Company does not yet have financing in place for the Kreider 2 Project. This opportunity is being pursued through PA2. If there are positive developments related to the market for nutrient reductions in Pennsylvania, of which there is no assurance, the Company intends to pursue development, design and construction of the Kreider 2 Project with a goal of achieving operational status for its initial modules during the following calendar year. The economics (potential revenues and profitability) of the Kreider 2 Project, despite its proposed use of Bion’s Gen3Tech for increased recovery of marketable by-products and sustainable branding, are based in material part the long-term sale of nutrient (nitrogen and/or phosphorus) reduction credits to meet the requirements of the Chesapeake Bay environmental clean-up. However, liquidity in the Pennsylvania nutrient credit market has not yet developed significant breadth and depth, which lack of liquidity has negatively impacted Bion’s business plans and will most likely delay PA2’s Kreider 2 Project and other proposed projects in Pennsylvania.

Bion believes that the Kreider 2 Project and/or subsequent Bion Projects in PA and the Chesapeake Bay Watershed will eventually generate revenue from the sale of: a) nutrient reductions (credits or in other form), b) renewable energy (and related credits), c) sales of fertilizer products, and/or d) potentially, in time, credits for the reduction of greenhouse gas emissions, plus e) license fees/premiums related to a ‘sustainable brand’. The Covid-19 pandemic has delayed legislative efforts in Pennsylvania needed to commence its development. However, the Company is currently engaged in dialogue with the regional EPA office and the Chesapeake Bay Program Office regarding the potential of the Company’s Gen3Tech Kreider2 Project (and other potential projects) to enable Pennsylvania to move forward toward meeting its Chesapeake Bay clean-up goals. We believe that the potential market is very large, but it is not possible to predict the exact timing and/or magnitude of these potential markets at this time.

Technology Deployment: Bion Gen3Tech

Widespread deployment of waste treatment technology, and the sustainability it enables, is largely dependent upon generating sufficient additional revenues to offset the capital and operating costs associated with technology adoption. Bion’s Gen3Tech business platform has been developed to create opportunities for such augmented revenue streams, while providing third party verification of sustainability claims. The Gen3Tech platform has been designed to maximize the value of co-products produced during the waste treatment/recovery processes, including pipeline-quality renewable natural gas (biogas) and commercial fertilizer products approved for organic production. All processes will be verifiable by third parties (including regulatory authorities and certifying boards) to comply with environmental regulations and trading programs and meet the requirements for: a) renewable energy and carbon credits, b) organic certification of the fertilizer coproducts and c) USDA PVP certification of an ‘Environmentally Sustainable’ brand (see discussion below), and d) payment for verified ecosystem services. The Company’s first patent on its Gen3Tech was issued during 2018. In August 2020, the Company received a Notice of Allowance on its third patent which significantly expands the breadth and depth of the Company’s Gen3Tech coverage, and the Company has additional applications pending and/or planned.

| 12 |

Bion’s business model and technology platform can create the opportunity for joint ventures s (in various contractual forms) (“JVs”) between the Company and large livestock/food/fertilizer industry participants based upon the supplemental cash flow generated by implementation of our Gen3Tech business model, which cash flows will support the costs of technology implementation (including servicing related debt). We anticipate this will result in substantial long term value for Bion. In the context of such JVs, we believe that the verifiable sustainable branding opportunities (conventional and organic) in meat will represent the single largest enhanced revenue contributor provided by Bion to the JVs (and Bion licensees). The Company believes that the largest portion of its business with be conducted through such JVs, but a material portion may involve licensing and or other approaches.

In parallel with technology development, Bion has worked (which work continues) to implement market-driven strategies designed to stimulate private-sector participation in the overall U.S. nutrient and carbon reduction strategy. These market-driven strategies can generate “payment for ecosystem services”, in which farmers or landowners are rewarded for managing their land and operations to provide environmental benefits that will generate additional revenues. Existing renewable energy credits for the production and use of biogas are an example of payment for ecosystem services. Another such strategy is nutrient trading (or water quality trading), which will potentially create markets (in Pennsylvania and other states) that will utilize taxpayer funding for the purchase of verified pollution reductions from agriculture (“nutrient credits”) by the state (or others) through competitively-bid procurement programs. Such credits can then be used as a ‘qualified offset’ by an individual state (or municipality) to meet its federal clean water mandates at significantly lower cost to the taxpayer. Market-driven strategies, including competitive procurement of verified credits, is supported by U.S. EPA, the Chesapeake Bay Commission, national livestock interests, and other key stakeholders. Legislation in Pennsylvania to establish the first such state competitive procurement program passed the Pennsylvania Senate by a bi-partisan majority during March 2019 but has not yet crossed the hurdles required for actual adoption. The Covid-19 pandemic and related financial/budgetary crises have slowed progress for this and other policy initiatives and, as a result, it is not currently possible to project the timeline for completion (or meaningful progress) of this and other similar initiatives (see discussion below).

The livestock industry and its markets are already changing. With our commercial-ready technology and business model, Bion believes it has a ‘first-mover advantage’ over others that will seek to exploit the opportunities that will arise from the industry’s inevitable transformation. Bion anticipates moving forward with the development process of its initial commercial installations utilizing its Gen3Tech, during the current 2023 fiscal year. We believe that Bion’s Gen3Tech platform and business model can provide a pathway to true economic and environmental sustainability with ‘win-win’ benefits for at least a premium sector of the livestock industry, the environment, and the consumer, an opportunity which the Company intends to pursue.

The Livestock Problem

The livestock industry is under tremendous pressure from regulatory agencies, a wide range of advocacy groups, institutional investors and the industry’s own consumers, to adopt sustainable practices. Environmental cleanup is inevitable and has already begun - and policies have already begun to change, as well. Bion’s Gen3Tech was developed for implementation on large scale livestock production facilities, where scale drives both lower treatment costs and efficient co-products production, as well as dramatic environmental improvements. We believe that scale, coupled with Bion’s verifiable treatment technology platform, will create a transformational opportunity to integrate clean production practices at (or close to) the point of production—the primary source of the industry’s environmental impacts. Bion intends to assist the forward-looking segment of the livestock industry to bring animal protein production in line with 21st Century consumer demands for meaningful sustainability.

In the U.S. (according to the USDA’s 2017 agricultural census) there are over 9 million dairy cows, 90 million beef cattle, 60 million swine and more than 2 billion poultry which provides an indication of both the scope of the problem addressed by Bion’s technology, as well as the size of Bion’s opportunity. Environmental impacts from livestock production include surface and groundwater pollution, greenhouse gas emissions, ammonia, and other air pollution, excess water use, and pathogens related to foodborne illnesses and antibiotic resistance. While the most visible and immediate problems are related to nutrient runoff and its effects on water quality, the industry has recently been targeted by various stakeholder groups for its impacts on climate change.

Estimates of total annual U.S. livestock manure waste vary widely, but start around a billion tons, between 100 and 130 times greater than human waste. However, while human waste is generally treated by septic or municipal wastewater plants, livestock waste – raw manure – is spread on our nation’s croplands for its fertilizer value. Large portions of U.S. feed crop production (and most organic crop production) are fertilized, in part, in this manner. Under current manure management practices, 80% or more of total nitrogen from manure, much of it in the form of ammonia, escapes during storage, transportation, and during and after soil application, representing both substantial lost value and environmental costs.

| 13 |

More than half of the nitrogen impacts from livestock waste come from airborne ammonia emissions, which are extremely volatile, reactive and mobile. Airborne ammonia nitrogen eventually settles back to the ground through atmospheric deposition - it ‘rains’ everywhere. While some of this nitrogen is captured and used by plants, most of it runs off and enters surface waters or percolates down to groundwater. It is now well-established that most of the voluntary conservation practices, such as vegetated buffers that ‘filter’ runoff (often referred to as “BMPs” or “Best Management Practices” that have traditionally been implemented to attempt to mitigate nutrient runoff), are considerably less effective than was previously believed to be the case. This is especially true with regard to addressing the volatile and mobile nitrogen from ammonia emissions, because BMPs are primarily focused on surface water runoff, directly from farm fields in current production, versus the re-deposition that takes place everywhere or groundwater flow.

Runoff from livestock waste has been identified in most of our major watersheds as a primary source of excess nutrients that fuel algae blooms in both fresh and saltwater. Over the last several years, algae blooms have become increasingly toxic to both humans and animals, such as the Red Tides on the Florida and California coasts, and the Lake Erie algae bloom that cut off the water supply to Toledo, Ohio, residents in 2014. When the nutrient runoff subsides, it leaves the algae blooms with no more ‘food’ and the blooms die. The algae’s decomposition takes oxygen from the water, leading to ‘dead zones’ in local ponds, lakes, and ultimately, the Great Lakes, as well as the Chesapeake Bay, Gulf of Mexico, and other estuary waters. Both the toxic algae blooms and the low/no-oxygen dead zones devastate marine life, from shrimp and fish to higher mammals, including dolphins and manatees. U.S. EPA already considers excess nutrients “one of America’s most widespread, costly and challenging environmental problems”. Nutrient runoff is expected to worsen dramatically in the coming decades due to rising temperatures and increasing rainstorm intensity as a result of climate change.

Nitrate-contaminated groundwater is of growing concern in agricultural regions nationwide, where it has been directly correlated with nutrient runoff from upstream agricultural operations using raw manure as fertilizer. Pennsylvania, Wisconsin, California and Washington, and others, now have regions where groundwater nitrate levels exceed EPA standards for safe drinking water. High levels of nitrate can cause blue baby syndrome (methemoglobinemia) in infants and affect women who are or may become pregnant, and it has been linked to thyroid disease and colon cancer. EPA has set an enforceable standard called a maximum contaminant level (MCL) in water for nitrates at 10 parts per million (ppm) (10 mg/L) and for nitrites at 1 ppm (1 mg/L). Federal regulations require expensive pretreatment for community water sources that exceed the MCL; however, private drinking water wells are not regulated, and it is the owners’ responsibility to test and treat their wells. Additionally, groundwater flows also transport this volatile nitrogen downstream where, along its way, it intermixes with surface water, further exacerbating the runoff problem. Like atmospheric deposition, the current conservation practices we rely on to reduce agricultural runoff are largely bypassed by this subsurface flow.

Additionally, in arid climates, such as California, airborne ammonia emissions from livestock manure contribute to air pollution as a precursor to PM2.5 formation, small inhalable particulate matter that is a regulated air pollutant with significant public health risks. Whether airborne or dissolved in water, ammonia can only be cost-effectively controlled and treated at the source-- before it has a chance to escape into the environment where it becomes extremely expensive to ‘chase’, capture and treat.

High phosphorus concentrations in soils fertilized with raw manure are another growing problem. The ratio of nitrogen to phosphorus in livestock waste is fixed, and because manure application rates are calculated based on nitrogen requirements, often phosphorus is overapplied as an unintended consequence. Phosphorus accumulation in agricultural soils reduces its productivity, increases the risk of phosphorus runoff, and represents a waste of a finite resource. Decoupling the nitrogen from the phosphorus would allow them to be precision-applied, independently of each other, when and where needed.

The livestock industry has recently come under heavy fire for its impacts on climate change, which has become a rallying cry for the anti-meat campaign discussed above. Estimates of the magnitude of those impacts vary widely, but the general consensus is that globally, livestock account for 14.5 percent of greenhouse emissions. In the U.S. however, that number drops to 4.2 percent, due to the increased efficiencies of American beef production. The greatest impacts come from direct emissions of methane from enteric fermentation (belches), methane and nitrous oxide emissions from the manure, with arguably the largest being the massive carbon footprint of the synthetic nitrogen fertilizers used to grow the grains to feed the livestock.

For decades the livestock industry has overlooked and/or socialized its environmental problems and costs. Today, the impacts of livestock production on public health and the environment can no longer be ignored and are coming under increasing scrutiny from environmental groups and health organizations, regulatory agencies and the courts, the media, consumers, and activist institutional investors. The result has been a significant and alarming loss of market share to plant-based protein and other alternative products. Bion’s Gen3Tech platform was designed to resolve these environmental issues and bring the industry in line with twenty-first century consumer expectations.

Technology and Technology Platform

Bion has invested decades of work and substantial capital on the development of our technology and technology platform since 1989. The predecessor to Bion’s Gen3Tech platform, our patented second-generation technology (“2G Tech”), was proven at commercial scale and was reviewed and qualified for federal loan guarantees under USDA’s Technical Assessment program. Bion’s 2G Tech dairy project (“Kreider 1” or “KF1”), located at Kreider Farms in Pennsylvania (“PA”) received the first verified /measurable nutrient reduction credits from a non-point source livestock facility in the U.S. and its nutrient reductions were verified by the Pennsylvania Department of Environmental Protection (“DEP”) during 2012.

| 14 |

A key attribute of Bion’s 2G Tech (now supplanted by our Gen3Tech) was that nutrient and other pollution reductions could be measured, providing a level of verification on par with a municipal wastewater treatment plant, which created the opportunity for the nutrient reductions to be used as “qualified offsets” to EPA-mandated requirements. While it was an engineering success, Kreider 1 has failed financially because the 2G Tech platform was almost wholly dependent for revenue from anticipated demand for nutrient credits, based on PA’s mandated nitrogen reductions under the Chesapeake Bay Strategy and their proposed nutrient trading program that did not materialize. Bion began development of its Gen3Tech platform when it became apparent there was significant opposition to the trading program (and private sector participation in clean water activities, generally) from entrenched clean water interests. The Company is no longer implementing Projects based on its 2G Tech and the Kreider 1 project has been shut down.

Bion’s Gen3Tech was developed to avoid the dependence of our 2G Tech systems on the sale of water quality trading credits in order to develop profitable projects. The Gen3Tech platform has been designed to maximize revenues from co-products, including biogas and fertilizer products, achieve premium pricing from USDA PVP-certified ‘environmentally sustainable’ retail branding of the animal protein products it supports, as well as generate verified credits for still-developing water quality trading programs. The first patent on the Gen3Tech was filed in 2015 for an ammonia recovery process that produces ammonium bicarbonate (a commercial fertilizer) without external chemical additives, thereby providing the basis for organic certification. A Notice of Allowance from the US Patent and Trademark Office (“USPTO”) was received during August 2018 related to this patent application and the patent was subsequently issued. Since July 2017 Bion has filed for extensions of this patent application to provide broadened protections and to cover improvements to the process developed in the interim. During August 2020 the Company received a Notice of Allowance’ for our third patent related to our Gen3Tech and additional related applications are pending and/or planned (See “Patents”.) The Gen3Tech platform incorporates Bion’s patented and proprietary technology while utilizing existing commercial evaporation and distillation process equipment (with decades of reliability and service history) that is customized for Bion’s specific applications.

Gen3Tech Platform

Our Gen3Tech platform is the basis for a JV business model with four primary distinct revenue streams: 1) pipeline quality renewable natural gas and related carbon and other environmental credits, 2) premium organic fertilizer products, 3) nutrient reduction credits, and 4) premium pricing/license fees for verifiably sustainable, USDA PVP-certified ‘Environmentally Sustainable’ branded meat at the retail level. Carbon and nutrient credit revenues will be supported by third-party verification of the waste treatment processes that simultaneously capture methane and nutrients, while producing renewable energy and fertilizer products from them with relatively limited incremental cost to Bion. The same verified data will also provide the backbone for the USDA PVP-certified sustainable brand, again with limited incremental cost.

| 1) | Renewable energy- and carbon-related credits: |