false--12-31Q320190000875320VERTEX PHARMACEUTICALS INC / MA00000.010.01500000000500000000255172000257265000255172000257265000P1M00002200000550000005000000.010.011000000100000000005400000120.01140.01160.01180.0129.07100.0140.0160.0180.01140.00160.00180.00189.38401206080100P5Y

0000875320

2019-01-01

2019-09-30

0000875320

2019-10-18

0000875320

us-gaap:ProductMember

2019-01-01

2019-09-30

0000875320

2018-07-01

2018-09-30

0000875320

2019-07-01

2019-09-30

0000875320

2018-01-01

2018-09-30

0000875320

us-gaap:ProductMember

2018-07-01

2018-09-30

0000875320

vrtx:CollaborativeandRoyaltyMember

2019-07-01

2019-09-30

0000875320

vrtx:CollaborativeandRoyaltyMember

2018-01-01

2018-09-30

0000875320

us-gaap:ProductMember

2018-01-01

2018-09-30

0000875320

vrtx:CollaborativeandRoyaltyMember

2018-07-01

2018-09-30

0000875320

vrtx:CollaborativeandRoyaltyMember

2019-01-01

2019-09-30

0000875320

us-gaap:ProductMember

2019-07-01

2019-09-30

0000875320

2019-09-30

0000875320

2018-12-31

0000875320

us-gaap:ParentMember

2019-07-01

2019-09-30

0000875320

us-gaap:AdditionalPaidInCapitalMember

2018-07-01

2018-09-30

0000875320

us-gaap:CommonStockMember

2019-06-30

0000875320

us-gaap:CommonStockMember

2018-09-30

0000875320

us-gaap:RetainedEarningsMember

2019-06-30

0000875320

us-gaap:CommonStockMember

2018-07-01

2018-09-30

0000875320

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2018-06-30

0000875320

us-gaap:AdditionalPaidInCapitalMember

2019-07-01

2019-09-30

0000875320

us-gaap:ParentMember

2018-07-01

2018-09-30

0000875320

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2018-07-01

2018-09-30

0000875320

us-gaap:ParentMember

2019-06-30

0000875320

us-gaap:AdditionalPaidInCapitalMember

2019-06-30

0000875320

us-gaap:CommonStockMember

2018-06-30

0000875320

us-gaap:RetainedEarningsMember

2018-09-30

0000875320

2018-06-30

0000875320

us-gaap:CommonStockMember

2019-09-30

0000875320

us-gaap:RetainedEarningsMember

2018-06-30

0000875320

2018-09-30

0000875320

us-gaap:CommonStockMember

2019-07-01

2019-09-30

0000875320

us-gaap:ParentMember

2018-06-30

0000875320

us-gaap:AdditionalPaidInCapitalMember

2018-06-30

0000875320

us-gaap:ParentMember

2018-09-30

0000875320

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2019-07-01

2019-09-30

0000875320

us-gaap:RetainedEarningsMember

2019-07-01

2019-09-30

0000875320

us-gaap:NoncontrollingInterestMember

2019-09-30

0000875320

us-gaap:NoncontrollingInterestMember

2019-06-30

0000875320

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2019-06-30

0000875320

2019-06-30

0000875320

us-gaap:RetainedEarningsMember

2018-07-01

2018-09-30

0000875320

us-gaap:AdditionalPaidInCapitalMember

2019-09-30

0000875320

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2019-09-30

0000875320

us-gaap:AdditionalPaidInCapitalMember

2018-09-30

0000875320

us-gaap:NoncontrollingInterestMember

2018-09-30

0000875320

us-gaap:NoncontrollingInterestMember

2018-06-30

0000875320

us-gaap:RetainedEarningsMember

2019-09-30

0000875320

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2018-09-30

0000875320

us-gaap:NoncontrollingInterestMember

2018-07-01

2018-09-30

0000875320

us-gaap:CommonStockMember

2017-12-31

0000875320

us-gaap:ParentMember

2019-01-01

2019-09-30

0000875320

us-gaap:ParentMember

2019-09-30

0000875320

us-gaap:ParentMember

2018-01-01

2018-09-30

0000875320

us-gaap:AdditionalPaidInCapitalMember

2018-01-01

2018-09-30

0000875320

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2017-12-31

0000875320

us-gaap:CommonStockMember

2019-01-01

2019-09-30

0000875320

us-gaap:AdditionalPaidInCapitalMember

2017-12-31

0000875320

us-gaap:RetainedEarningsMember

2018-01-01

0000875320

us-gaap:RetainedEarningsMember

2017-12-31

0000875320

us-gaap:ParentMember

2018-01-01

0000875320

2018-01-01

0000875320

us-gaap:NoncontrollingInterestMember

2017-12-31

0000875320

us-gaap:ParentMember

2018-12-31

0000875320

us-gaap:AdditionalPaidInCapitalMember

2018-12-31

0000875320

us-gaap:CommonStockMember

2018-01-01

2018-09-30

0000875320

us-gaap:ParentMember

2017-12-31

0000875320

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2018-01-01

0000875320

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2019-01-01

2019-09-30

0000875320

2019-01-01

0000875320

us-gaap:CommonStockMember

2018-12-31

0000875320

us-gaap:AdditionalPaidInCapitalMember

2019-01-01

2019-09-30

0000875320

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2018-12-31

0000875320

us-gaap:RetainedEarningsMember

2019-01-01

0000875320

us-gaap:NoncontrollingInterestMember

2018-01-01

2018-09-30

0000875320

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2018-01-01

2018-09-30

0000875320

us-gaap:RetainedEarningsMember

2019-01-01

2019-09-30

0000875320

us-gaap:NoncontrollingInterestMember

2018-12-31

0000875320

us-gaap:RetainedEarningsMember

2018-01-01

2018-09-30

0000875320

us-gaap:ParentMember

2019-01-01

0000875320

us-gaap:RetainedEarningsMember

2018-12-31

0000875320

2017-12-31

0000875320

us-gaap:AccountingStandardsUpdate201602Member

2019-01-01

0000875320

us-gaap:AccountingStandardsUpdate201602Member

us-gaap:RetainedEarningsMember

2019-01-01

0000875320

us-gaap:BuildingMember

2019-01-01

2019-09-30

0000875320

srt:EuropeMember

2019-01-01

2019-09-30

0000875320

srt:EuropeMember

2018-07-01

2018-09-30

0000875320

country:US

2019-01-01

2019-09-30

0000875320

us-gaap:NonUsMember

2019-07-01

2019-09-30

0000875320

us-gaap:NonUsMember

2018-01-01

2018-09-30

0000875320

us-gaap:NonUsMember

2019-01-01

2019-09-30

0000875320

country:US

2018-01-01

2018-09-30

0000875320

vrtx:OtherNonU.S.Member

2018-07-01

2018-09-30

0000875320

country:US

2019-07-01

2019-09-30

0000875320

vrtx:OtherNonU.S.Member

2019-01-01

2019-09-30

0000875320

vrtx:OtherNonU.S.Member

2019-07-01

2019-09-30

0000875320

vrtx:OtherNonU.S.Member

2018-01-01

2018-09-30

0000875320

us-gaap:NonUsMember

2018-07-01

2018-09-30

0000875320

srt:EuropeMember

2019-07-01

2019-09-30

0000875320

srt:EuropeMember

2018-01-01

2018-09-30

0000875320

country:US

2018-07-01

2018-09-30

0000875320

vrtx:ORKAMBIMember

2019-07-01

2019-09-30

0000875320

vrtx:KalydecoMember

2019-01-01

2019-09-30

0000875320

vrtx:KalydecoMember

2018-07-01

2018-09-30

0000875320

vrtx:SYMDEKOMember

2019-01-01

2019-09-30

0000875320

vrtx:ORKAMBIMember

2019-01-01

2019-09-30

0000875320

vrtx:ORKAMBIMember

2018-07-01

2018-09-30

0000875320

vrtx:SYMDEKOMember

2019-07-01

2019-09-30

0000875320

vrtx:SYMDEKOMember

2018-01-01

2018-09-30

0000875320

vrtx:KalydecoMember

2019-07-01

2019-09-30

0000875320

vrtx:KalydecoMember

2018-01-01

2018-09-30

0000875320

vrtx:ORKAMBIMember

2018-01-01

2018-09-30

0000875320

vrtx:SYMDEKOMember

2018-07-01

2018-09-30

0000875320

vrtx:ExonicsTherapeuticsMember

2019-07-16

2019-07-16

0000875320

vrtx:ExonicsTherapeuticsMember

2019-07-16

0000875320

vrtx:CysticFibrosisFoundationTherapeuticsIncorporatedMember

2016-01-01

2016-12-31

0000875320

vrtx:BioAxoneBiosciencesInc.Member

2018-07-01

2018-09-30

0000875320

vrtx:KymeraTherapeuticsMember

2019-05-01

2019-05-31

0000875320

vrtx:CTX001CoCoAgreementMember

2018-07-01

2018-09-30

0000875320

vrtx:BioAxoneBiosciencesInc.Member

2018-01-01

2018-09-30

0000875320

vrtx:CRISPRTherapeuticsAGMember

2019-01-01

2019-09-30

0000875320

srt:ScenarioForecastMember

vrtx:CRISPRTherapeuticsAGMember

2019-10-01

2019-12-31

0000875320

vrtx:CysticFibrosisFoundationTherapeuticsIncorporatedMember

2019-01-01

2019-09-30

0000875320

vrtx:CRISPRTherapeuticsAGMember

2019-07-01

2019-07-31

0000875320

vrtx:ExonicsTherapeuticsMember

vrtx:NonCompensatoryMember

2019-07-16

2019-07-16

0000875320

vrtx:ExonicsTherapeuticsMember

vrtx:CompensatoryMember

2019-07-16

2019-07-16

0000875320

vrtx:CTX001CoCoAgreementMember

2019-07-01

2019-09-30

0000875320

vrtx:CTX001CoCoAgreementMember

2018-01-01

2018-09-30

0000875320

vrtx:CRISPRTherapeuticsAGMember

2015-01-01

2015-12-31

0000875320

vrtx:CTX001CoCoAgreementMember

2019-01-01

2019-09-30

0000875320

vrtx:SemmaTherapeuticsInc.Member

us-gaap:SubsequentEventMember

2019-10-01

2019-10-31

0000875320

us-gaap:RestrictedStockMember

2018-01-01

2018-09-30

0000875320

us-gaap:RestrictedStockMember

2018-07-01

2018-09-30

0000875320

us-gaap:EmployeeStockOptionMember

2019-01-01

2019-09-30

0000875320

us-gaap:RestrictedStockMember

2019-07-01

2019-09-30

0000875320

us-gaap:EmployeeStockOptionMember

2018-07-01

2018-09-30

0000875320

us-gaap:EmployeeStockOptionMember

2019-07-01

2019-09-30

0000875320

us-gaap:RestrictedStockMember

2019-01-01

2019-09-30

0000875320

us-gaap:EmployeeStockOptionMember

2018-01-01

2018-09-30

0000875320

vrtx:RestrictedStockandRestrictedStockUnitsMember

2019-01-01

2019-09-30

0000875320

vrtx:RestrictedStockandRestrictedStockUnitsMember

2018-01-01

2018-09-30

0000875320

vrtx:RestrictedStockandRestrictedStockUnitsMember

2018-07-01

2018-09-30

0000875320

vrtx:RestrictedStockandRestrictedStockUnitsMember

2019-07-01

2019-09-30

0000875320

us-gaap:FairValueInputsLevel3Member

us-gaap:FairValueMeasurementsRecurringMember

2019-09-30

0000875320

us-gaap:FairValueInputsLevel3Member

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:CommercialPaperMember

2019-09-30

0000875320

us-gaap:ForeignExchangeForwardMember

us-gaap:FairValueInputsLevel2Member

us-gaap:OtherCurrentLiabilitiesMember

us-gaap:FairValueMeasurementsRecurringMember

2019-09-30

0000875320

us-gaap:ForeignExchangeForwardMember

us-gaap:PrepaidExpensesAndOtherCurrentAssetsMember

us-gaap:FairValueMeasurementsRecurringMember

2019-09-30

0000875320

us-gaap:ForeignExchangeForwardMember

us-gaap:PrepaidExpensesAndOtherCurrentAssetsMember

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

2019-09-30

0000875320

us-gaap:ForeignExchangeForwardMember

us-gaap:FairValueInputsLevel3Member

us-gaap:OtherCurrentLiabilitiesMember

us-gaap:FairValueMeasurementsRecurringMember

2019-09-30

0000875320

us-gaap:FairValueInputsLevel1Member

us-gaap:OtherCurrentLiabilitiesMember

us-gaap:FairValueMeasurementsRecurringMember

2019-09-30

0000875320

us-gaap:ForeignExchangeForwardMember

us-gaap:PrepaidExpensesAndOtherCurrentAssetsMember

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

2019-09-30

0000875320

us-gaap:ForeignExchangeForwardMember

us-gaap:OtherAssetsMember

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

2019-09-30

0000875320

us-gaap:FairValueInputsLevel3Member

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:USTreasurySecuritiesMember

2019-09-30

0000875320

us-gaap:FairValueInputsLevel3Member

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:MoneyMarketFundsMember

2019-09-30

0000875320

us-gaap:FairValueMeasurementsRecurringMember

2019-09-30

0000875320

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:CommercialPaperMember

2019-09-30

0000875320

us-gaap:FairValueInputsLevel3Member

us-gaap:OtherCurrentLiabilitiesMember

us-gaap:FairValueMeasurementsRecurringMember

2019-09-30

0000875320

us-gaap:ForeignExchangeForwardMember

us-gaap:FairValueInputsLevel2Member

us-gaap:OtherNoncurrentLiabilitiesMember

us-gaap:FairValueMeasurementsRecurringMember

2019-09-30

0000875320

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

2019-09-30

0000875320

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:CommercialPaperMember

2019-09-30

0000875320

us-gaap:FairValueInputsLevel3Member

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:EquitySecuritiesMember

2019-09-30

0000875320

us-gaap:ForeignExchangeForwardMember

us-gaap:OtherNoncurrentLiabilitiesMember

us-gaap:FairValueMeasurementsRecurringMember

2019-09-30

0000875320

us-gaap:ForeignExchangeForwardMember

us-gaap:OtherAssetsMember

us-gaap:FairValueInputsLevel3Member

us-gaap:FairValueMeasurementsRecurringMember

2019-09-30

0000875320

us-gaap:ForeignExchangeForwardMember

us-gaap:OtherCurrentLiabilitiesMember

us-gaap:FairValueMeasurementsRecurringMember

2019-09-30

0000875320

us-gaap:OtherCurrentLiabilitiesMember

us-gaap:FairValueMeasurementsRecurringMember

2019-09-30

0000875320

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:USTreasurySecuritiesMember

2019-09-30

0000875320

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:CorporateDebtSecuritiesMember

2019-09-30

0000875320

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:CorporateDebtSecuritiesMember

2019-09-30

0000875320

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:CommercialPaperMember

2019-09-30

0000875320

us-gaap:ForeignExchangeForwardMember

us-gaap:OtherAssetsMember

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

2019-09-30

0000875320

us-gaap:FairValueInputsLevel2Member

us-gaap:OtherCurrentLiabilitiesMember

us-gaap:FairValueMeasurementsRecurringMember

2019-09-30

0000875320

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:MoneyMarketFundsMember

2019-09-30

0000875320

us-gaap:ForeignExchangeForwardMember

us-gaap:PrepaidExpensesAndOtherCurrentAssetsMember

us-gaap:FairValueInputsLevel3Member

us-gaap:FairValueMeasurementsRecurringMember

2019-09-30

0000875320

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:EquitySecuritiesMember

2019-09-30

0000875320

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:USTreasurySecuritiesMember

2019-09-30

0000875320

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:USTreasurySecuritiesMember

2019-09-30

0000875320

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

2019-09-30

0000875320

us-gaap:ForeignExchangeForwardMember

us-gaap:FairValueInputsLevel1Member

us-gaap:OtherNoncurrentLiabilitiesMember

us-gaap:FairValueMeasurementsRecurringMember

2019-09-30

0000875320

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:EquitySecuritiesMember

2019-09-30

0000875320

us-gaap:ForeignExchangeForwardMember

us-gaap:FairValueInputsLevel1Member

us-gaap:OtherCurrentLiabilitiesMember

us-gaap:FairValueMeasurementsRecurringMember

2019-09-30

0000875320

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:MoneyMarketFundsMember

2019-09-30

0000875320

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:CorporateDebtSecuritiesMember

2019-09-30

0000875320

us-gaap:ForeignExchangeForwardMember

us-gaap:OtherAssetsMember

us-gaap:FairValueMeasurementsRecurringMember

2019-09-30

0000875320

us-gaap:ForeignExchangeForwardMember

us-gaap:FairValueInputsLevel3Member

us-gaap:OtherNoncurrentLiabilitiesMember

us-gaap:FairValueMeasurementsRecurringMember

2019-09-30

0000875320

us-gaap:FairValueInputsLevel3Member

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:CorporateDebtSecuritiesMember

2019-09-30

0000875320

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:MoneyMarketFundsMember

2019-09-30

0000875320

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:EquitySecuritiesMember

2019-09-30

0000875320

us-gaap:ForeignExchangeForwardMember

us-gaap:FairValueInputsLevel3Member

us-gaap:OtherNoncurrentLiabilitiesMember

us-gaap:FairValueMeasurementsRecurringMember

2018-12-31

0000875320

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:CommercialPaperMember

2018-12-31

0000875320

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:EquitySecuritiesMember

2018-12-31

0000875320

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:EquitySecuritiesMember

2018-12-31

0000875320

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:MoneyMarketFundsMember

2018-12-31

0000875320

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:EquitySecuritiesMember

2018-12-31

0000875320

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

2018-12-31

0000875320

us-gaap:FairValueInputsLevel3Member

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:CorporateDebtSecuritiesMember

2018-12-31

0000875320

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:CorporateDebtSecuritiesMember

2018-12-31

0000875320

us-gaap:ForeignExchangeForwardMember

us-gaap:FairValueInputsLevel3Member

us-gaap:OtherCurrentLiabilitiesMember

us-gaap:FairValueMeasurementsRecurringMember

2018-12-31

0000875320

us-gaap:ForeignExchangeForwardMember

us-gaap:PrepaidExpensesAndOtherCurrentAssetsMember

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

2018-12-31

0000875320

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:USTreasurySecuritiesMember

2018-12-31

0000875320

us-gaap:FairValueInputsLevel3Member

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:MoneyMarketFundsMember

2018-12-31

0000875320

us-gaap:FairValueInputsLevel3Member

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:USTreasurySecuritiesMember

2018-12-31

0000875320

us-gaap:ForeignExchangeForwardMember

us-gaap:OtherAssetsMember

us-gaap:FairValueMeasurementsRecurringMember

2018-12-31

0000875320

us-gaap:ForeignExchangeForwardMember

us-gaap:FairValueInputsLevel1Member

us-gaap:OtherNoncurrentLiabilitiesMember

us-gaap:FairValueMeasurementsRecurringMember

2018-12-31

0000875320

us-gaap:ForeignExchangeForwardMember

us-gaap:OtherAssetsMember

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

2018-12-31

0000875320

us-gaap:ForeignExchangeForwardMember

us-gaap:OtherCurrentLiabilitiesMember

us-gaap:FairValueMeasurementsRecurringMember

2018-12-31

0000875320

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:USTreasurySecuritiesMember

2018-12-31

0000875320

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

2018-12-31

0000875320

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:MoneyMarketFundsMember

2018-12-31

0000875320

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:CommercialPaperMember

2018-12-31

0000875320

us-gaap:ForeignExchangeForwardMember

us-gaap:FairValueInputsLevel2Member

us-gaap:OtherNoncurrentLiabilitiesMember

us-gaap:FairValueMeasurementsRecurringMember

2018-12-31

0000875320

us-gaap:ForeignExchangeForwardMember

us-gaap:PrepaidExpensesAndOtherCurrentAssetsMember

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

2018-12-31

0000875320

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:CorporateDebtSecuritiesMember

2018-12-31

0000875320

us-gaap:ForeignExchangeForwardMember

us-gaap:PrepaidExpensesAndOtherCurrentAssetsMember

us-gaap:FairValueMeasurementsRecurringMember

2018-12-31

0000875320

us-gaap:FairValueInputsLevel3Member

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:CommercialPaperMember

2018-12-31

0000875320

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:CommercialPaperMember

2018-12-31

0000875320

us-gaap:ForeignExchangeForwardMember

us-gaap:OtherAssetsMember

us-gaap:FairValueInputsLevel3Member

us-gaap:FairValueMeasurementsRecurringMember

2018-12-31

0000875320

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:CorporateDebtSecuritiesMember

2018-12-31

0000875320

us-gaap:FairValueMeasurementsRecurringMember

2018-12-31

0000875320

us-gaap:ForeignExchangeForwardMember

us-gaap:OtherNoncurrentLiabilitiesMember

us-gaap:FairValueMeasurementsRecurringMember

2018-12-31

0000875320

us-gaap:FairValueInputsLevel3Member

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:EquitySecuritiesMember

2018-12-31

0000875320

us-gaap:ForeignExchangeForwardMember

us-gaap:PrepaidExpensesAndOtherCurrentAssetsMember

us-gaap:FairValueInputsLevel3Member

us-gaap:FairValueMeasurementsRecurringMember

2018-12-31

0000875320

us-gaap:ForeignExchangeForwardMember

us-gaap:OtherAssetsMember

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

2018-12-31

0000875320

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:USTreasurySecuritiesMember

2018-12-31

0000875320

us-gaap:ForeignExchangeForwardMember

us-gaap:FairValueInputsLevel2Member

us-gaap:OtherCurrentLiabilitiesMember

us-gaap:FairValueMeasurementsRecurringMember

2018-12-31

0000875320

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:MoneyMarketFundsMember

2018-12-31

0000875320

us-gaap:ForeignExchangeForwardMember

us-gaap:FairValueInputsLevel1Member

us-gaap:OtherCurrentLiabilitiesMember

us-gaap:FairValueMeasurementsRecurringMember

2018-12-31

0000875320

us-gaap:FairValueInputsLevel3Member

us-gaap:FairValueMeasurementsRecurringMember

2018-12-31

0000875320

us-gaap:AvailableforsaleSecuritiesMember

2019-09-30

0000875320

us-gaap:CashEquivalentsMember

2019-09-30

0000875320

us-gaap:AvailableforsaleSecuritiesMember

2018-12-31

0000875320

us-gaap:CashEquivalentsMember

2018-12-31

0000875320

us-gaap:EquitySecuritiesMember

2018-12-31

0000875320

us-gaap:OtherAssetsMember

2019-09-30

0000875320

us-gaap:EquitySecuritiesMember

2019-09-30

0000875320

us-gaap:CorporateDebtSecuritiesMember

2018-12-31

0000875320

us-gaap:USTreasurySecuritiesMember

2018-12-31

0000875320

us-gaap:CorporateDebtSecuritiesMember

2019-09-30

0000875320

vrtx:CashAndMoneyMarketFundsMember

2019-09-30

0000875320

us-gaap:USTreasurySecuritiesMember

2019-09-30

0000875320

us-gaap:EquitySecuritiesMember

2018-01-01

2018-12-31

0000875320

us-gaap:CommercialPaperMember

2018-12-31

0000875320

us-gaap:CommercialPaperMember

2019-09-30

0000875320

us-gaap:EquitySecuritiesMember

2019-07-01

2019-09-30

0000875320

vrtx:CashAndMoneyMarketFundsMember

2018-12-31

0000875320

us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember

2019-01-01

2019-09-30

0000875320

us-gaap:AccumulatedTranslationAdjustmentMember

2018-12-31

0000875320

us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember

2019-01-01

2019-09-30

0000875320

us-gaap:AccumulatedTranslationAdjustmentMember

2019-01-01

2019-09-30

0000875320

us-gaap:AccumulatedTranslationAdjustmentMember

2019-09-30

0000875320

us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember

2019-09-30

0000875320

us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember

2018-12-31

0000875320

us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember

2018-12-31

0000875320

us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember

2019-09-30

0000875320

us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember

2018-01-01

2018-09-30

0000875320

us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember

2018-01-01

2018-09-30

0000875320

us-gaap:AccumulatedTranslationAdjustmentMember

2017-12-31

0000875320

us-gaap:AccumulatedTranslationAdjustmentMember

2018-09-30

0000875320

us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember

2017-12-31

0000875320

vrtx:AccumulatedNetEquityInvestmentGainLossAttributabletoParentMember

2017-12-31

0000875320

us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember

2018-09-30

0000875320

us-gaap:AccumulatedTranslationAdjustmentMember

2018-01-01

2018-09-30

0000875320

vrtx:AccumulatedNetEquityInvestmentGainLossAttributabletoParentMember

2018-09-30

0000875320

us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember

2018-09-30

0000875320

vrtx:AccumulatedNetEquityInvestmentGainLossAttributabletoParentMember

2018-01-01

2018-09-30

0000875320

us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember

2017-12-31

0000875320

us-gaap:OtherCurrentLiabilitiesMember

us-gaap:ForeignExchangeForwardMember

us-gaap:CashFlowHedgingMember

us-gaap:DesignatedAsHedgingInstrumentMember

2018-12-31

0000875320

us-gaap:OtherAssetsMember

us-gaap:ForeignExchangeForwardMember

us-gaap:CashFlowHedgingMember

us-gaap:DesignatedAsHedgingInstrumentMember

2018-12-31

0000875320

us-gaap:ForeignExchangeForwardMember

us-gaap:CashFlowHedgingMember

us-gaap:DesignatedAsHedgingInstrumentMember

2018-12-31

0000875320

us-gaap:OtherNoncurrentLiabilitiesMember

us-gaap:ForeignExchangeForwardMember

us-gaap:CashFlowHedgingMember

us-gaap:DesignatedAsHedgingInstrumentMember

2018-12-31

0000875320

us-gaap:PrepaidExpensesAndOtherCurrentAssetsMember

us-gaap:ForeignExchangeForwardMember

us-gaap:CashFlowHedgingMember

us-gaap:DesignatedAsHedgingInstrumentMember

2018-12-31

0000875320

us-gaap:ForeignExchangeForwardMember

us-gaap:NondesignatedMember

us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember

us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember

2019-01-01

2019-09-30

0000875320

us-gaap:ForeignExchangeForwardMember

us-gaap:NondesignatedMember

us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember

us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember

2018-07-01

2018-09-30

0000875320

us-gaap:ForeignExchangeForwardMember

us-gaap:NondesignatedMember

us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember

us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember

2018-01-01

2018-09-30

0000875320

us-gaap:ProductMember

us-gaap:ForeignExchangeForwardMember

us-gaap:DesignatedAsHedgingInstrumentMember

us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember

us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember

2019-01-01

2019-09-30

0000875320

us-gaap:ProductMember

us-gaap:ForeignExchangeForwardMember

us-gaap:DesignatedAsHedgingInstrumentMember

us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember

us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember

2018-07-01

2018-09-30

0000875320

us-gaap:ProductMember

us-gaap:ForeignExchangeForwardMember

us-gaap:DesignatedAsHedgingInstrumentMember

us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember

us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember

2019-07-01

2019-09-30

0000875320

us-gaap:ProductMember

us-gaap:ForeignExchangeForwardMember

us-gaap:DesignatedAsHedgingInstrumentMember

us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember

us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember

2018-01-01

2018-09-30

0000875320

us-gaap:ForeignExchangeForwardMember

us-gaap:NondesignatedMember

us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember

us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember

2019-07-01

2019-09-30

0000875320

us-gaap:ForeignExchangeForwardMember

us-gaap:CashFlowHedgingMember

us-gaap:NondesignatedMember

2019-09-30

0000875320

us-gaap:ForeignExchangeForwardMember

us-gaap:NondesignatedMember

2019-07-01

2019-09-30

0000875320

srt:MaximumMember

us-gaap:ForeignExchangeForwardMember

us-gaap:CashFlowHedgingMember

2019-01-01

2019-09-30

0000875320

us-gaap:ForeignExchangeForwardMember

us-gaap:CashFlowHedgingMember

us-gaap:DesignatedAsHedgingInstrumentMember

2019-09-30

0000875320

currency:EUR

us-gaap:ForeignExchangeForwardMember

us-gaap:CashFlowHedgingMember

us-gaap:DesignatedAsHedgingInstrumentMember

2019-09-30

0000875320

currency:CAD

us-gaap:ForeignExchangeForwardMember

us-gaap:CashFlowHedgingMember

us-gaap:DesignatedAsHedgingInstrumentMember

2018-12-31

0000875320

currency:GBP

us-gaap:ForeignExchangeForwardMember

us-gaap:CashFlowHedgingMember

us-gaap:DesignatedAsHedgingInstrumentMember

2018-12-31

0000875320

currency:CAD

us-gaap:ForeignExchangeForwardMember

us-gaap:CashFlowHedgingMember

us-gaap:DesignatedAsHedgingInstrumentMember

2019-09-30

0000875320

currency:AUD

us-gaap:ForeignExchangeForwardMember

us-gaap:CashFlowHedgingMember

us-gaap:DesignatedAsHedgingInstrumentMember

2019-09-30

0000875320

currency:GBP

us-gaap:ForeignExchangeForwardMember

us-gaap:CashFlowHedgingMember

us-gaap:DesignatedAsHedgingInstrumentMember

2019-09-30

0000875320

currency:AUD

us-gaap:ForeignExchangeForwardMember

us-gaap:CashFlowHedgingMember

us-gaap:DesignatedAsHedgingInstrumentMember

2018-12-31

0000875320

currency:EUR

us-gaap:ForeignExchangeForwardMember

us-gaap:CashFlowHedgingMember

us-gaap:DesignatedAsHedgingInstrumentMember

2018-12-31

0000875320

us-gaap:OtherCurrentLiabilitiesMember

us-gaap:ForeignExchangeForwardMember

us-gaap:DesignatedAsHedgingInstrumentMember

2019-09-30

0000875320

us-gaap:OtherNoncurrentLiabilitiesMember

us-gaap:ForeignExchangeForwardMember

us-gaap:DesignatedAsHedgingInstrumentMember

2019-09-30

0000875320

us-gaap:PrepaidExpensesAndOtherCurrentAssetsMember

us-gaap:ForeignExchangeForwardMember

us-gaap:CashFlowHedgingMember

us-gaap:DesignatedAsHedgingInstrumentMember

2019-09-30

0000875320

us-gaap:OtherAssetsMember

us-gaap:ForeignExchangeForwardMember

us-gaap:CashFlowHedgingMember

us-gaap:DesignatedAsHedgingInstrumentMember

2019-09-30

0000875320

srt:MinimumMember

us-gaap:ForeignExchangeForwardMember

us-gaap:CashFlowHedgingMember

2019-01-01

2019-09-30

0000875320

srt:MinimumMember

us-gaap:LineOfCreditMember

us-gaap:BaseRateMember

2019-09-30

0000875320

us-gaap:LineOfCreditMember

2019-09-30

0000875320

us-gaap:LineOfCreditMember

2019-09-01

2019-09-30

0000875320

srt:MaximumMember

us-gaap:LineOfCreditMember

us-gaap:EurodollarMember

2019-09-30

0000875320

srt:MaximumMember

us-gaap:LineOfCreditMember

us-gaap:BaseRateMember

2019-09-30

0000875320

srt:MinimumMember

us-gaap:LineOfCreditMember

us-gaap:EurodollarMember

2019-09-30

0000875320

vrtx:FanPierLeasesMember

2018-12-31

0000875320

vrtx:SanDiegoLeaseMember

2018-12-31

0000875320

vrtx:OtherOperatingLeasesMember

2018-12-31

0000875320

2018-01-01

2018-12-31

0000875320

vrtx:SanDiegoLeaseMember

2015-12-31

0000875320

vrtx:SanDiegoLeaseMember

2015-01-01

2015-12-31

0000875320

srt:MinimumMember

2018-01-01

2018-12-31

0000875320

srt:MaximumMember

2018-01-01

2018-12-31

0000875320

vrtx:FanPierLeasesMember

2011-01-01

2011-12-31

0000875320

us-gaap:BuildingMember

2018-01-01

2018-12-31

0000875320

vrtx:FanPierLeasesMember

2011-12-31

0000875320

vrtx:SellingGeneralAndAdministrativeExpenseMember

2019-01-01

2019-09-30

0000875320

vrtx:SellingGeneralAndAdministrativeExpenseMember

2018-07-01

2018-09-30

0000875320

us-gaap:EmployeeStockOptionMember

2018-01-01

2018-09-30

0000875320

us-gaap:CostOfSalesMember

2018-01-01

2018-09-30

0000875320

vrtx:EmployeeRestrictedStockOptionMember

2019-07-01

2019-09-30

0000875320

vrtx:EmployeeStockPurchasePlanMember

2018-07-01

2018-09-30

0000875320

us-gaap:ResearchAndDevelopmentExpenseMember

2019-07-01

2019-09-30

0000875320

us-gaap:ResearchAndDevelopmentExpenseMember

2019-01-01

2019-09-30

0000875320

us-gaap:EmployeeStockOptionMember

2018-07-01

2018-09-30

0000875320

vrtx:SellingGeneralAndAdministrativeExpenseMember

2018-01-01

2018-09-30

0000875320

vrtx:EmployeeRestrictedStockOptionMember

2019-01-01

2019-09-30

0000875320

vrtx:EmployeeStockPurchasePlanMember

2018-01-01

2018-09-30

0000875320

us-gaap:ResearchAndDevelopmentExpenseMember

2018-07-01

2018-09-30

0000875320

vrtx:EmployeeStockPurchasePlanMember

2019-01-01

2019-09-30

0000875320

vrtx:SellingGeneralAndAdministrativeExpenseMember

2019-07-01

2019-09-30

0000875320

vrtx:EmployeeRestrictedStockOptionMember

2018-01-01

2018-09-30

0000875320

us-gaap:CostOfSalesMember

2018-07-01

2018-09-30

0000875320

vrtx:EmployeeStockPurchasePlanMember

2019-07-01

2019-09-30

0000875320

us-gaap:ResearchAndDevelopmentExpenseMember

2018-01-01

2018-09-30

0000875320

us-gaap:CostOfSalesMember

2019-07-01

2019-09-30

0000875320

us-gaap:EmployeeStockOptionMember

2019-07-01

2019-09-30

0000875320

vrtx:EmployeeRestrictedStockOptionMember

2018-07-01

2018-09-30

0000875320

us-gaap:CostOfSalesMember

2019-01-01

2019-09-30

0000875320

us-gaap:EmployeeStockOptionMember

2019-01-01

2019-09-30

0000875320

vrtx:ExercisePriceRangefromDollars40.01toDollars60.00Member

2019-09-30

0000875320

vrtx:ExercisePriceRangefromDollars60.01toDollars80.00Member

2019-09-30

0000875320

vrtx:ExercisePriceRangefromDollars100.01toDollars120.00Member

2019-09-30

0000875320

vrtx:ExercisePriceRangefromDollars80.01toDollars100.00Member

2019-09-30

0000875320

vrtx:ExercisePriceRangeFromDollars29.07toDollars40.00Member

2019-09-30

0000875320

vrtx:ExercisePriceRangeFromDollars120.01toDollars140.0Member

2019-09-30

0000875320

vrtx:ExercisePriceRangeFromDollars160.01toDollars180.00Member

2019-01-01

2019-09-30

0000875320

vrtx:ExercisePriceRangeFromDollars160.01toDollars180.00Member

2019-09-30

0000875320

vrtx:ExercisePriceRangeFromDollars180.01toDollars189.38Member

2019-09-30

0000875320

vrtx:ExercisePriceRangeFromDollars140.01toDollars160.0Member

2019-09-30

0000875320

vrtx:ExercisePriceRangeFromDollars29.07toDollars40.00Member

2019-01-01

2019-09-30

0000875320

vrtx:ExercisePriceRangefromDollars60.01toDollars80.00Member

2019-01-01

2019-09-30

0000875320

vrtx:ExercisePriceRangeFromDollars140.01toDollars160.0Member

2019-01-01

2019-09-30

0000875320

vrtx:ExercisePriceRangefromDollars80.01toDollars100.00Member

2019-01-01

2019-09-30

0000875320

vrtx:ExercisePriceRangeFromDollars120.01toDollars140.0Member

2019-01-01

2019-09-30

0000875320

vrtx:ExercisePriceRangeFromDollars180.01toDollars189.38Member

2019-01-01

2019-09-30

0000875320

vrtx:ExercisePriceRangefromDollars100.01toDollars120.00Member

2019-01-01

2019-09-30

0000875320

vrtx:ExercisePriceRangefromDollars40.01toDollars60.00Member

2019-01-01

2019-09-30

0000875320

vrtx:ShareRepurchaseProgram2018Member

2019-09-30

0000875320

vrtx:ShareRepurchaseProgram2018Member

2018-01-31

0000875320

vrtx:ShareRepurchaseProgram2018Member

2018-01-01

2018-09-30

0000875320

vrtx:ShareRepurchaseProgram2018Member

2019-01-01

2019-09-30

0000875320

vrtx:ShareRepurchaseProgram2019Member

2019-01-01

2019-09-30

0000875320

vrtx:ShareRepurchaseProgram2019Member

2019-09-30

0000875320

vrtx:ShareRepurchaseProgram2019Member

2019-07-31

0000875320

vrtx:EmployeeStockPurchasePlanMember

2019-09-30

0000875320

vrtx:EmployeeRestrictedStockOptionMember

2019-09-30

0000875320

us-gaap:EmployeeStockOptionMember

2019-09-30

0000875320

us-gaap:PrepaidExpensesAndOtherCurrentAssetsMember

2018-12-31

0000875320

us-gaap:PrepaidExpensesAndOtherCurrentAssetsMember

2019-09-30

0000875320

us-gaap:PrepaidExpensesAndOtherCurrentAssetsMember

2018-09-30

0000875320

us-gaap:OtherAssetsMember

2017-12-31

0000875320

us-gaap:OtherAssetsMember

2018-12-31

0000875320

us-gaap:PrepaidExpensesAndOtherCurrentAssetsMember

2017-12-31

0000875320

us-gaap:OtherAssetsMember

2018-09-30

0000875320

vrtx:ExonicsTherapeuticsMember

2019-07-01

2019-07-31

iso4217:USD

xbrli:shares

vrtx:target

xbrli:shares

vrtx:segment

iso4217:USD

vrtx:lease

vrtx:building

utreg:sqft

vrtx:term_extension

xbrli:pure

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

________________________________________________________

FORM 10-Q

☒QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE QUARTERLY PERIOD ENDED SEPTEMBER 30, 2019

or

☐TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE TRANSITION PERIOD FROM TO

Commission file number 000-19319

____________________________________________

Vertex Pharmaceuticals Incorporated

(Exact name of registrant as specified in its charter)

Massachusetts

(State or other jurisdiction of

incorporation or organization)

50 Northern Avenue, Boston, Massachusetts

(Address of principal executive offices)

04-3039129

(I.R.S. Employer

Identification No.)

02210

(Zip Code)

Registrant’s telephone number, including area code (617) 341-6100

____________________________________________

|

| | | | |

Securities registered pursuant to Section 12(b) of the Act: |

Title of each class | | Trading Symbol | | Name of each exchange on which registered |

Common Stock, $0.01 Par Value Per Share | | VRTX | | The Nasdaq Global Select Market |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☒ Accelerated filer ☐ Non-accelerated filer ☐ Smaller reporting company ☐ Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

|

| | |

Common Stock, par value $0.01 per share | 257,149,588 | Outstanding at October 18, 2019 |

VERTEX PHARMACEUTICALS INCORPORATED

FORM 10-Q

FOR THE QUARTER ENDED SEPTEMBER 30, 2019

TABLE OF CONTENTS

|

| | |

| | Page |

|

| | |

| | |

| Condensed Consolidated Statements of Operations - Three and Nine Months Ended September 30, 2019 and 2018 | |

| Condensed Consolidated Statements of Comprehensive Income - Three and Nine Months Ended September 30, 2019 and 2018 | |

| Condensed Consolidated Balance Sheets - September 30, 2019 and December 31, 2018 | |

| Condensed Consolidated Statements of Shareholders' Equity and Noncontrolling Interest - Three and Nine Months Ended September 30, 2019 and 2018 | |

| Condensed Consolidated Statements of Cash Flows - Nine Months Ended September 30, 2019 and 2018 | |

| | |

| | |

| | |

| | |

|

| | |

| | |

| | |

| | |

| | |

“We,” “us,” “Vertex” and the “Company” as used in this Quarterly Report on Form 10-Q refer to Vertex Pharmaceuticals Incorporated, a Massachusetts corporation, and its subsidiaries.

“Vertex,” “KALYDECO®,” “ORKAMBI®,” “SYMDEKO®,” and “SYMKEVI®” are registered trademarks of Vertex. The trademark for “TRIKAFTATM” is pending in the United States and registered in the European Union. Other brands, names and trademarks contained in this Quarterly Report on Form 10-Q are the property of their respective owners.

We use the brand name for our products when we refer to the product that has been approved and with respect to the indications on the approved label. Otherwise, including in discussions of our cystic fibrosis development programs, we refer to our compounds by their scientific (or generic) name or VX developmental designation.

Part I. Financial Information

Item 1. Financial Statements

VERTEX PHARMACEUTICALS INCORPORATED

Condensed Consolidated Statements of Operations

(unaudited)

(in thousands, except per share amounts)

|

| | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2019 | | 2018 | | 2019 | | 2018 |

Revenues: | | | | | | | |

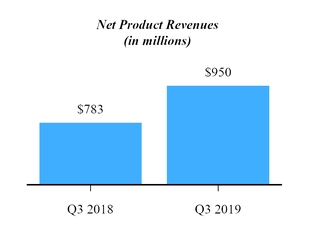

Product revenues, net | $ | 949,828 |

| | $ | 782,511 |

| | $ | 2,747,461 |

| | $ | 2,170,152 |

|

Collaborative and royalty revenues | — |

| | 2,024 |

| | 2,095 |

| | 7,339 |

|

Total revenues | 949,828 |

| | 784,535 |

| | 2,749,556 |

| | 2,177,491 |

|

Costs and expenses: | | | | | | | |

Cost of sales | 131,914 |

| | 111,255 |

| | 362,746 |

| | 287,250 |

|

Research and development expenses | 555,948 |

| | 330,510 |

| | 1,274,529 |

| | 978,595 |

|

Sales, general and administrative expenses | 159,674 |

| | 137,295 |

| | 463,221 |

| | 404,406 |

|

Change in fair value of contingent consideration | 2,959 |

| | — |

| | 2,959 |

| | — |

|

Restructuring income | — |

| | (174 | ) | | — |

| | (188 | ) |

Total costs and expenses | 850,495 |

| | 578,886 |

| | 2,103,455 |

| | 1,670,063 |

|

Income from operations | 99,333 |

| | 205,649 |

| | 646,101 |

| | 507,428 |

|

Interest income | 17,628 |

| | 10,543 |

| | 51,319 |

| | 24,381 |

|

Interest expense | (14,548 | ) | | (18,686 | ) | | (44,253 | ) | | (53,727 | ) |

Other (expense) income, net | (31,747 | ) | | (60,995 | ) | | 64,802 |

| | 89,662 |

|

Income before provision for income taxes | 70,666 |

| | 136,511 |

| | 717,969 |

| | 567,744 |

|

Provision for income taxes | 13,148 |

| | 8,055 |

| | 124,393 |

| | 5,737 |

|

Net income | 57,518 |

| | 128,456 |

| | 593,576 |

| | 562,007 |

|

Loss (income) attributable to noncontrolling interest | — |

| | 290 |

| | — |

| | (15,638 | ) |

Net income attributable to Vertex | $ | 57,518 |

| | $ | 128,746 |

| | $ | 593,576 |

| | $ | 546,369 |

|

| | | | | | | |

Amounts per share attributable to Vertex common shareholders: | | | | | | | |

Net income: | | | | | | | |

Basic | $ | 0.22 |

| | $ | 0.51 |

| | $ | 2.32 |

| | $ | 2.15 |

|

Diluted | $ | 0.22 |

| | $ | 0.50 |

| | $ | 2.28 |

| | $ | 2.11 |

|

Shares used in per share calculations: | | | | | | | |

Basic | 256,946 |

| | 254,905 |

| | 256,289 |

| | 254,096 |

|

Diluted | 260,473 |

| | 259,788 |

| | 260,182 |

| | 258,972 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

VERTEX PHARMACEUTICALS INCORPORATED

Condensed Consolidated Statements of Comprehensive Income

(unaudited)

(in thousands)

|

| | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2019 | | 2018 | | 2019 | | 2018 |

Net income | $ | 57,518 |

| | $ | 128,456 |

| | $ | 593,576 |

| | $ | 562,007 |

|

Changes in other comprehensive income: | | | | | | | |

Unrealized holding gains on marketable securities, net | 64 |

| | 224 |

| | 1,111 |

| | 137 |

|

Unrealized gains on foreign currency forward contracts, net of tax of $2.2 million, zero, $5.5 million and $0.5 million, respectively | 12,812 |

| | 4,029 |

| | 6,814 |

| | 29,062 |

|

Foreign currency translation adjustment | 9,172 |

| | 659 |

| | 10,263 |

| | 6,800 |

|

Total changes in other comprehensive income | 22,048 |

| | 4,912 |

| | 18,188 |

| | 35,999 |

|

Comprehensive income | 79,566 |

| | 133,368 |

| | 611,764 |

| | 598,006 |

|

Comprehensive loss (income) attributable to noncontrolling interest | — |

| | 290 |

| | — |

| | (15,638 | ) |

Comprehensive income attributable to Vertex | $ | 79,566 |

| | $ | 133,658 |

| | $ | 611,764 |

| | $ | 582,368 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

VERTEX PHARMACEUTICALS INCORPORATED

Condensed Consolidated Balance Sheets

(unaudited)

(in thousands, except per share amounts)

|

| | | | | | | |

| September 30, | | December 31, |

| 2019 | | 2018 |

Assets | | | |

Current assets: | | | |

Cash and cash equivalents | $ | 3,397,941 |

| | $ | 2,650,134 |

|

Marketable securities | 598,390 |

| | 518,108 |

|

Accounts receivable, net | 443,315 |

| | 409,688 |

|

Inventories | 162,306 |

| | 124,360 |

|

Prepaid expenses and other current assets | 175,142 |

| | 140,819 |

|

Total current assets | 4,777,094 |

| | 3,843,109 |

|

Property and equipment, net | 733,509 |

| | 812,005 |

|

Goodwill | 447,525 |

| | 50,384 |

|

Deferred tax assets | 1,415,511 |

| | 1,499,672 |

|

Operating lease assets | 60,929 |

| | — |

|

Other assets | 79,985 |

| | 40,728 |

|

Total assets | $ | 7,514,553 |

| | $ | 6,245,898 |

|

Liabilities and Shareholders’ Equity | | | |

Current liabilities: | | | |

Accounts payable | $ | 92,528 |

| | $ | 110,987 |

|

Accrued expenses | 1,173,783 |

| | 958,899 |

|

Other current liabilities | 122,583 |

| | 50,406 |

|

Total current liabilities | 1,388,894 |

| | 1,120,292 |

|

Long-term finance lease liabilities | 541,561 |

| | 581,550 |

|

Long-term operating lease liabilities | 62,978 |

| | — |

|

Long-term advance from collaborator | 85,084 |

| | 82,573 |

|

Long-term contingent consideration | 175,000 |

| | — |

|

Other long-term liabilities | 7,642 |

| | 26,280 |

|

Total liabilities | 2,261,159 |

| | 1,810,695 |

|

Commitments and contingencies | — |

| | — |

|

Shareholders’ equity: | | | |

Preferred stock, $0.01 par value; 1,000 shares authorized; none issued and outstanding | — |

| | — |

|

Common stock, $0.01 par value; 500,000 shares authorized, 257,265 and 255,172 shares issued and outstanding, respectively | 2,571 |

| | 2,546 |

|

Additional paid-in capital | 7,668,188 |

| | 7,421,476 |

|

Accumulated other comprehensive income | 18,847 |

| | 659 |

|

Accumulated deficit | (2,436,212 | ) | | (2,989,478 | ) |

Total shareholders’ equity | 5,253,394 |

| | 4,435,203 |

|

Total liabilities and shareholders’ equity | $ | 7,514,553 |

| | $ | 6,245,898 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

VERTEX PHARMACEUTICALS INCORPORATED

Condensed Consolidated Statements of Shareholders’ Equity and Noncontrolling Interest

(unaudited)

(in thousands)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended |

| Common Stock | | Additional

Paid-in Capital | | Accumulated

Other

Comprehensive (Loss) Income | | Accumulated Deficit | | Total Vertex

Shareholders’ Equity | | Noncontrolling

Interest | | Total

Shareholders’ Equity |

| Shares | | Amount | | | | | | |

Balance at June 30, 2018 | 254,883 |

| | $ | 2,542 |

| | $ | 7,357,042 |

| | $ | (4,605 | ) | | $ | (4,668,751 | ) | | $ | 2,686,228 |

| | $ | 28,655 |

| | $ | 2,714,883 |

|

Other comprehensive income, net of tax | — |

| | — |

| | — |

| | 4,912 |

| | — |

| | 4,912 |

| | — |

| | 4,912 |

|

Net income (loss) | — |

| | — |

| | — |

| | — |

| | 128,746 |

| | 128,746 |

| | (290 | ) | | 128,456 |

|

Repurchase of common stock | (515 | ) | | (5 | ) | | (91,999 | ) | | — |

| | — |

| | (92,004 | ) | | — |

| | (92,004 | ) |

Issuance of common stock under benefit plans | 1,243 |

| | 14 |

| | 92,779 |

| | — |

| | — |

| | 92,793 |

| | — |

| | 92,793 |

|

Stock-based compensation expense | — |

| | — |

| | 85,441 |

| | — |

| | — |

| | 85,441 |

| | — |

| | 85,441 |

|

Balance at September 30, 2018 | 255,611 |

| | $ | 2,551 |

| | $ | 7,443,263 |

| | $ | 307 |

| | $ | (4,540,005 | ) | | $ | 2,906,116 |

| | $ | 28,365 |

| | $ | 2,934,481 |

|

| | | | | | | | | | | | | | | |

Balance at June 30, 2019 | 256,671 |

| | $ | 2,565 |

| | $ | 7,564,331 |

| | $ | (3,201 | ) | | $ | (2,493,730 | ) | | $ | 5,069,965 |

| | $ | — |

| | $ | 5,069,965 |

|

Other comprehensive income, net of tax | — |

| | — |

| | — |

| | 22,048 |

| | — |

| | 22,048 |

| | — |

| | 22,048 |

|

Net income | — |

| | — |

| | — |

| | — |

| | 57,518 |

| | 57,518 |

| | — |

| | 57,518 |

|

Repurchases of common stock | (71 | ) | | — |

| | (12,105 | ) | | — |

| | — |

| | (12,105 | ) | | — |

| | (12,105 | ) |

Issuance of common stock under benefit plans | 665 |

| | 6 |

| | 30,006 |

| | — |

| | — |

| | 30,012 |

| | — |

| | 30,012 |

|

Stock-based compensation expense | — |

| | — |

| | 85,956 |

| | — |

| | — |

| | 85,956 |

| | — |

| | 85,956 |

|

Balance at September 30, 2019 | 257,265 |

| | $ | 2,571 |

| | $ | 7,668,188 |

| | $ | 18,847 |

| | $ | (2,436,212 | ) | | $ | 5,253,394 |

| | $ | — |

| | $ | 5,253,394 |

|

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended |

| Common Stock | | Additional

Paid-in Capital | | Accumulated

Other

Comprehensive (Loss) Income | | Accumulated Deficit | | Total Vertex

Shareholders’ Equity | | Noncontrolling

Interest | | Total

Shareholders’ Equity |

| Shares | | Amount | | | | | | |

Balance at December 31, 2017 | 253,253 |

| | $ | 2,512 |

| | $ | 7,157,362 |

| | $ | (11,572 | ) | | $ | (5,119,723 | ) | | $ | 2,028,579 |

| | $ | 13,727 |

| | $ | 2,042,306 |

|

Cumulative effect adjustment for adoption of new accounting guidance | — |

| | — |

| | — |

| | (24,120 | ) | | 33,349 |

| | 9,229 |

| | — |

| | 9,229 |

|

Other comprehensive income, net of tax | — |

| | — |

| | — |

| | 35,999 |

| | — |

| | 35,999 |

| | — |

| | 35,999 |

|

Net income | — |

| | — |

| | — |

| | — |

| | 546,369 |

| | 546,369 |

| | 15,638 |

| | 562,007 |

|

Repurchase of common stock | (1,283 | ) | | (13 | ) | | (211,025 | ) | | — |

| | — |

| | (211,038 | ) | | — |

| | (211,038 | ) |

Issuance of common stock under benefit plans | 3,641 |

| | 52 |

| | 250,368 |

| | — |

| | — |

| | 250,420 |

| | — |

| | 250,420 |

|

Stock-based compensation expense | — |

| | — |

| | 246,558 |

| | — |

| | — |

| | 246,558 |

| | — |

| | 246,558 |

|

Other VIE activity | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (1,000 | ) | | (1,000 | ) |

Balance at September 30, 2018 | 255,611 |

| | $ | 2,551 |

| | $ | 7,443,263 |

| | $ | 307 |

| | $ | (4,540,005 | ) | | $ | 2,906,116 |

| | $ | 28,365 |

| | $ | 2,934,481 |

|

| | | | | | | | | | | | | | | |

Balance at December 31, 2018 | 255,172 |

| | $ | 2,546 |

| | $ | 7,421,476 |

| | $ | 659 |

| | $ | (2,989,478 | ) | | $ | 4,435,203 |

| | $ | — |

| | $ | 4,435,203 |

|

Cumulative effect adjustment for adoption of new accounting guidance | — |

| | — |

| | — |

| | — |

| | (40,310 | ) | | (40,310 | ) | | — |

| | (40,310 | ) |

Other comprehensive income, net of tax | — |

| | — |

| | — |

| | 18,188 |

| | — |

| | 18,188 |

| | — |

| | 18,188 |

|

Net income | — |

| | — |

| | — |

| | — |

| | 593,576 |

| | 593,576 |

| | — |

| | 593,576 |

|

Repurchases of common stock | (931 | ) | | (9 | ) | | (167,945 | ) | | — |

| | — |

| | (167,954 | ) | | — |

| | (167,954 | ) |

Issuance of common stock under benefit plans | 3,024 |

| | 34 |

| | 144,523 |

| | — |

| | — |

| | 144,557 |

| | — |

| | 144,557 |

|

Stock-based compensation expense | — |

| | — |

| | 270,134 |

| | — |

| | — |

| | 270,134 |

| | — |

| | 270,134 |

|

Balance at September 30, 2019 | 257,265 |

| | $ | 2,571 |

| | $ | 7,668,188 |

| | $ | 18,847 |

| | $ | (2,436,212 | ) | | $ | 5,253,394 |

| | $ | — |

| | $ | 5,253,394 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

VERTEX PHARMACEUTICALS INCORPORATED

Condensed Consolidated Statements of Cash Flows

(unaudited)

(in thousands)

|

| | | | | | | |

| Nine Months Ended September 30, |

| 2019 | | 2018 |

Cash flows from operating activities: | | | |

Net income | $ | 593,576 |

| | $ | 562,007 |

|

Adjustments to reconcile net income to net cash provided by operating activities: | | | |

Stock-based compensation expense | 268,898 |

| | 246,104 |

|

Depreciation expense | 80,685 |

| | 53,594 |

|

Change in fair value of contingent consideration | 2,959 |

| | — |

|

Write-downs of inventories to net realizable value | 8,650 |

| | 13,089 |

|

Deferred income taxes | 94,175 |

| | 3,595 |

|

Unrealized gains on equity securities | (68,862 | ) | | (88,217 | ) |

Other non-cash items, net | (12,674 | ) | | 10,701 |

|

Changes in operating assets and liabilities: | | | |

Accounts receivable, net | (41,444 | ) | | (75,167 | ) |

Inventories | (45,280 | ) | | (24,461 | ) |

Prepaid expenses and other assets | (23,709 | ) | | 31,797 |

|

Accounts payable | (12,210 | ) | | 23,023 |

|

Accrued expenses | 255,699 |

| | 167,647 |

|

Other liabilities | 22,859 |

| | 31,996 |

|

Net cash provided by operating activities | 1,123,322 |

| | 955,708 |

|

Cash flows from investing activities: | | | |

Purchases of available-for-sale debt securities | (381,739 | ) | | (329,367 | ) |

Maturities of available-for-sale debt securities | 375,145 |

| | 308,406 |

|

Payment to acquire business, net of cash acquired | (245,824 | ) | | — |

|

Expenditures for property and equipment | (58,690 | ) | | (79,803 | ) |

Investment in equity securities | (27,219 | ) | | (60,490 | ) |

Net cash used in investing activities | (338,327 | ) | | (161,254 | ) |

Cash flows from financing activities: | | | |

Issuances of common stock under benefit plans | 144,630 |

| | 245,754 |

|

Repurchases of common stock | (155,953 | ) | | (207,038 | ) |

Payments on finance leases | (28,879 | ) | | — |

|

Advance from collaborator | 10,000 |

| | 7,500 |

|

Repayments of advanced funding | (4,316 | ) | | (3,714 | ) |

Proceeds related to capital lease and construction financing lease obligations | 1,002 |

| | 12,983 |

|

Payments on capital lease and construction financing lease obligations | — |

| | (24,658 | ) |

Other financing activities | (1,132 | ) | | (1,000 | ) |

Net cash (used in) provided by financing activities | (34,648 | ) | | 29,827 |

|

Effect of changes in exchange rates on cash | (4,009 | ) | | (4,756 | ) |

Net increase in cash and cash equivalents | 746,338 |

| | 819,525 |

|

Cash, cash equivalents and restricted cash—beginning of period | 2,658,253 |

| | 1,667,526 |

|

Cash, cash equivalents and restricted cash—end of period | $ | 3,404,591 |

| | $ | 2,487,051 |

|

| | | |

Supplemental disclosure of cash flow information: | | | |

Cash paid for interest | $ | 41,704 |

| | $ | 50,017 |

|

Cash paid for income taxes | $ | 22,838 |

| | $ | 10,316 |

|

Capitalization of costs related to construction financing lease obligation | $ | — |

| | $ | 3,389 |

|

Issuances of common stock from employee benefit plans receivable | $ | 13 |

| | $ | 5,509 |

|

Accrued share repurchase liability | $ | 12,001 |

| | $ | 4,000 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

VERTEX PHARMACEUTICALS INCORPORATED

Notes to Condensed Consolidated Financial Statements

(unaudited)

A. Basis of Presentation and Accounting Policies

Basis of Presentation

The accompanying condensed consolidated financial statements are unaudited and have been prepared by Vertex Pharmaceuticals Incorporated (“Vertex” or the “Company”) in accordance with accounting principles generally accepted in the United States of America (“GAAP”).

The condensed consolidated financial statements reflect the operations of the Company and its wholly-owned subsidiaries. The Company's condensed consolidated financial statements for the interim period ended September 30, 2018 also include the financial results of BioAxone Biosciences, Inc. (“BioAxone”), a variable interest entity (“VIE”) that the Company consolidated from 2014 through December 31, 2018. All material intercompany balances and transactions have been eliminated. The Company operates in one segment, pharmaceuticals. The Company has reclassified certain items from the prior year’s condensed consolidated financial statements to conform to the current year’s presentation.

Certain information and footnote disclosures normally included in the Company’s 2018 Annual Report on Form 10-K have been condensed or omitted. These interim financial statements, in the opinion of management, reflect all normal recurring adjustments necessary for a fair presentation of the financial position and results of operations for the interim periods ended September 30, 2019 and 2018.

The results of operations for the interim periods are not necessarily indicative of the results of operations to be expected for the full fiscal year. These interim financial statements should be read in conjunction with the audited financial statements for the year ended December 31, 2018, which are contained in the Company’s 2018 Annual Report on Form 10-K.

Use of Estimates

The preparation of condensed consolidated financial statements in accordance with GAAP requires management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the condensed consolidated financial statements, and the amounts of revenues and expenses during the reported periods. Significant estimates in these condensed consolidated financial statements have been made in connection with the calculation of revenues, research and development expenses, goodwill, intangible assets, deferred tax asset valuation allowances, fair value of contingent consideration and the provision for income taxes. The Company bases its estimates on historical experience and various other assumptions, including in certain circumstances future projections that management believes to be reasonable under the circumstances. Actual results could differ from those estimates. Changes in estimates are reflected in reported results in the period in which they become known.

Recently Adopted Accounting Standards

Leases

In 2016, the FASB issued ASU No. 2016-02, Leases (Topic 842) (“ASC 842”), which amends a number of aspects of lease accounting and requires entities to recognize right-of-use assets and liabilities on the balance sheet. ASC 842 became effective on January 1, 2019. The Company has finalized its review of its portfolio of existing leases and current accounting policies and has concluded that the amended guidance results in the recognition of additional assets and corresponding liabilities on its balance sheets. The Company also has finalized changes to its controls to address the adoption and ongoing lease accounting and related disclosure requirements of the new standard.

Until December 31, 2018, the Company applied build-to-suit accounting and was the deemed owner of its leased corporate headquarters in Boston and research site in San Diego, for which it was recognizing depreciation expense over the buildings’ useful lives and imputed interest on the corresponding construction financing lease obligations. Under the amended guidance that became effective January 1, 2019, the Company accounts for these buildings as finance leases, resulting in increased depreciation expense over the respective lease terms of approximately 15 years, which are significantly shorter than the buildings’ useful lives of 40 years. The Company also expects a reduction in its imputed interest expense in the initial years of each finance lease term.

VERTEX PHARMACEUTICALS INCORPORATED

Notes to Condensed Consolidated Financial Statements

(unaudited)

In July 2018, the FASB issued ASU No. 2018-11, Leases (Topic 842): Targeted Improvements (“ASU 2018-11”), which offered a transition option to entities adopting ASC 842. Under ASU 2018-11, entities could elect to apply ASC 842 using a modified-retrospective adoption approach resulting in a cumulative effect adjustment to accumulated deficit at the beginning of the year in which the new lease standard is adopted, rather than adjustments to the earliest comparative period presented in their financial statements. The Company adopted ASC 842 using the modified-retrospective method. As of January 1, 2019, the Company recorded a cumulative effect adjustment to increase its “Accumulated deficit” by $40.3 million related to the adjustments to its build-to-suit leases described in the previous paragraph.

The Company elected the package of transition practical expedients for leases that commenced prior to January 1, 2019, allowing it not to reassess (i) whether any expired or existing contracts contain leases, (ii) the lease classification for any expired or existing leases and (iii) the initial indirect costs for any existing leases.

Additionally, the Company recorded, upon adoption of ASC 842 on January 1, 2019, operating lease assets of $61.7 million and corresponding liabilities of $71.9 million related to its real estate leases that are not treated as finance leases under ASC 842. The difference between these assets and liabilities is primarily attributable to prepaid or accrued lease payments. The Company also reclassified amounts that were recorded as “Capital lease obligations, current portion” and “Capital lease obligations, excluding current portion” as of December 31, 2018 to “Other current liabilities” and “Long-term finance lease liabilities,” respectively, on January 1, 2019. These adjustments had no impact on the Company’s condensed consolidated statement of operations and had no impact on the Company’s accumulated deficit.

The cumulative effect of applying ASC 842 on the Company’s condensed consolidated balance sheet as of January 1, 2019 was as follows:

|

| | | | | | | | | | | |

| Balance as of | | | | Balance as of |

| December 31, 2018 ^ | | Adjustments | | January 1, 2019 |

Assets | (in thousands) |

Prepaid expenses and other current assets | $ | 140,819 |

| | $ | (2,930 | ) | | $ | 137,889 |

|

Property and equipment, net | 812,005 |

| | (53,920 | ) | | 758,085 |

|

Deferred tax assets | 1,499,672 |

| | 11,236 |

| | 1,510,908 |

|

Operating lease assets | — |

| | 61,674 |

| | 61,674 |

|

Total assets | $ | 6,245,898 |

| | $ | 16,060 |

| | $ | 6,261,958 |

|

Liabilities and Shareholders’ Equity | | | | | |

Capital lease obligations, current portion | $ | 9,817 |

| | $ | (9,817 | ) | | $ | — |

|

Other current liabilities | 40,589 |

| | 34,304 |

| | 74,893 |

|

Capital lease obligations, excluding current portion | 19,658 |

| | (19,658 | ) | | — |

|

Construction financing lease obligation, excluding current portion | 561,892 |

| | (561,892 | ) | | — |

|

Long-term finance lease liabilities | — |

| | 569,487 |

| | 569,487 |

|

Long-term operating lease liabilities | — |

| | 64,849 |

| | 64,849 |

|

Other long-term liabilities | 26,280 |

| | (20,903 | ) | | 5,377 |

|

Accumulated deficit | (2,989,478 | ) | | (40,310 | ) | | (3,029,788 | ) |

Total liabilities and shareholders’ equity | $ | 6,245,898 |

| | $ | 16,060 |

| | $ | 6,261,958 |

|

^ As reported in the Company’s 2018 Annual Report on Form 10-K. |

Please refer to Note K, “Leases,” for further information regarding the Company’s leases as well as certain disclosures required by ASC 842.

Derivatives and Hedging

In 2017, the FASB issued ASU 2017-12, Derivatives and Hedging (Topic 815) (“ASU 2017-12”), which helps simplify certain aspects of hedge accounting and enables entities to more accurately present their risk management activities in their financial statements. ASU 2017-12 became effective January 1, 2019. The adoption of ASU 2017-12 did not have a significant effect on the Company’s condensed consolidated financial statements.

VERTEX PHARMACEUTICALS INCORPORATED

Notes to Condensed Consolidated Financial Statements

(unaudited)

Recently Issued Accounting Standards

Internal-Use Software

In 2018, the FASB issued ASU 2018-15, Intangibles—Goodwill and Other—Internal-Use Software (Subtopic 350-40): Customer’s Accounting for Implementation Costs Incurred in a Cloud Computing Arrangement That Is a Service Contract (“ASU 2018-15”), which clarifies the accounting for implementation costs in cloud computing arrangements. ASU 2018-15 is effective on January 1, 2020. Early adoption is permitted. The Company currently is evaluating the impact the adoption of ASU 2018-15 may have on its condensed consolidated financial statements.

Fair Value Measurement

In 2018, the FASB issued ASU 2018-13, Fair Value Measurement (Topic 820): Disclosure Framework-Changes to the Disclosure Requirements for Fair Value Measurement (“ASU 2018-13”), which modifies the disclosure requirements for fair value measurements. ASU 2018-13 is effective on January 1, 2020. Early adoption is permitted. The Company currently is evaluating the impact the adoption of ASU 2018-13 may have on its disclosures.

Credit Losses

In 2016, the FASB issued ASU 2016-13, Financial Instruments - Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments (“ASU 2016-13”), which requires entities to record expected credit losses for certain financial instruments, including trade receivables, as an allowance that reflects the entity's current estimate of credit losses expected to be incurred. For available-for-sale debt securities in unrealized loss positions, ASU 2016-13 requires allowances to be recorded instead of reducing the amortized cost of the investment. ASU 2016-13 is effective on January 1, 2020. Early adoption is permitted. The Company currently is evaluating the impact the adoption of ASU 2016-13 may have on its condensed consolidated financial statements.

For a discussion of other recent accounting pronouncements please refer to Note A, “Nature of Business and Accounting Policies—Recent Accounting Pronouncements,” in the Company’s 2018 Annual Report on Form 10-K.

Summary of Significant Accounting Policies

The Company’s significant accounting policies are described in Note A, “Nature of Business and Accounting Policies,” in its 2018 Annual Report on Form 10-K. The Company is disclosing changes in its accounting policies related to guidance that became effective January 1, 2019 in this Quarterly Report on Form 10-Q. Specifically, the Company has included its policy pursuant to its adoption of ASC 842 below.

Leases

At the inception of an arrangement, the Company determines whether the arrangement contains a lease. If a lease is identified in an arrangement, the Company recognizes a right-of-use asset and liability on its balance sheet and determines whether the lease should be classified as a finance or operating lease. The Company does not recognize assets or liabilities for leases with lease terms of less than 12 months.