form10k.htm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For The Fiscal Year Ended December 31, 2011

Commission File No. 001-31354

Lapolla Industries, Inc.

(Exact Name of Registrant as Specified in Its Charter)

|

Delaware

|

|

13-3545304

|

| (State of Incorporation) |

|

(I.R.S. Employer Identification No.) |

| |

|

|

| Intercontinental Business Park |

|

|

| 15402 Vantage Parkway East, Suite 322 |

|

|

| Houston, Texas |

|

77032 |

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

(281) 219-4700

(Registrant’s Telephone Number)

Securities registered pursuant to Section 12 (b) of the Act: None

Securities registered pursuant to Section 12 (g) of the Act:

|

Common Stock, $.01 par value and Warrants

|

|

(Title of Each Class)

|

Indicate by check mark if the Registrant is a well-known seasoned issuer as defined in Rule 405 of the Securities Act. YES ¨ NO þ

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES ¨ NO þ

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months, and (2) has been subject to such filing requirements for the past 90 days. YES þ NO ¨

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). YES þ NO ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See the definitions of “large accelerated filer”, “accelerated filer”, and “smaller reporting company” in Rule 12b-2 of the Exchange Act (Check one):

|

Large Accelerated Filer ¨

|

Accelerated Filer ¨

|

Non-Accelerated Filer ¨

|

Smaller Reporting Company þ

|

Indicate by check mark whether the Registrant is a shell company (as defined by Rule 12b-2 of the Exchange Act). YES ¨ NO þ

As of June 30, 2011, the aggregate market value of the Registrant’s common stock held by non-affiliates of the Registrant was approximately $14,676,892 based on the closing sales price as quoted on the NASD OTC Bulletin Board.

Common Stock outstanding as of March 29, 2012 — 106,480,210 shares.

DOCUMENTS INCORPORATED BY REFERENCE

None.

LAPOLLA INDUSTRIES, INC.

FORM 10-K

FOR THE YEAR ENDED DECEMBER 31, 2011

| |

|

|

Page

|

|

PART I

|

|

| |

Item 1.

|

|

1

|

| |

Item 1A.

|

|

3

|

| |

Item 2.

|

|

3

|

| |

Item 3.

|

|

3

|

| |

|

|

|

|

PART II

|

|

| |

Item 5.

|

|

4

|

| |

Item 7.

|

|

5

|

| |

Item 7A.

|

|

10

|

| |

Item 8.

|

|

10

|

| |

Item 9.

|

|

10

|

| |

Item 9A.

|

|

10

|

| |

Item 9B.

|

|

10

|

| |

|

|

|

|

PART III

|

|

| |

Item 10.

|

|

11

|

| |

Item 11.

|

|

13

|

| |

Item 12.

|

|

18

|

| |

Item 13.

|

|

19

|

| |

Item 14.

|

|

20

|

| |

|

|

|

|

PART IV

|

|

| |

Item 15.

|

|

21

|

| |

|

|

|

|

|

22

|

|

|

23

|

|

|

24

|

FORWARD LOOKING STATEMENTS

Statements made by us in this report that are not historical facts constitute "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995.These forward-looking statements are necessarily estimates reflecting the best judgment of management and express our opinions about trends and factors which may impact future operating results. You can identify these and other forward-looking statements by the use of words such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “intends,” “potential,” “continue,” or the negative of such terms, or other comparable terminology. Such statements rely on a number of assumptions concerning future events, many of which are outside of our control, and involve risks and uncertainties that could cause actual results to differ materially from opinions and expectations. Any such forward-looking statements, whether made in this report or elsewhere, should be considered in context with the various disclosures made by us about our businesses including, without limitation, the risk factors discussed below. Although we believe our expectations are based on reasonable assumptions, judgments, and estimates, forward-looking statements involve known and unknown risks, uncertainties, contingencies, and other factors that could cause our or our industry's actual results, level of activity, performance or achievement to differ materially from those discussed in or implied by any forward-looking statements made by or on the Company and could cause our financial condition, results of operations, or cash flows to be materially adversely affected. Except as required under the federal securities laws and the rules and regulations of the U.S. Securities and Exchange Commission (“SEC”), we do not have any intention or obligation to update publicly any forward-looking statements, whether as a result of new information, future events, changes in assumptions, or otherwise.

PART I

As used in this report, “Lapolla” and the “Company” or “Us” or “We” refer to Lapolla Industries, Inc., unless the context otherwise requires. Our Internet website address is www.lapollaindustries.com. We make our periodic and current reports, together with amendments to these reports, available on our website, free of charge, as soon as reasonably practicable after such material is electronically filed with, or furnished to, the SEC. The information on our website is not incorporated by reference in this Annual Report on Form 10-K.

General Overview

Lapolla is a leading manufacturer and distributor of foam, coatings, and equipment, focused on developing and commercializing foam and coatings targeted at commercial and industrial and residential applications in the insulation and construction industries. Being back integrated in both foam and coating systems puts Lapolla in a strong competitive position as both product lines reduce energy consumption and ultimately lead to direct savings for consumers. Our products address growing consumer awareness of the building envelope. The building envelope is the separation between the interior and the exterior environments of a building and serves as the outer shell to protect the indoor environment as well as to facilitate its climate control. We provide superior insulation, an air barrier, and a vapor barrier with our products. We invest substantial resources to acquire, develop and commercialize a variety of foam and coatings products and related sales and marketing programs on a regular basis.

Operating Segments

We operate our business on the basis of two reportable segments — Foam and Coatings. The Foam segment involves producing building envelope insulation foam for interior application and roofing systems. The Coatings segment involves producing protective elastomeric coatings and primers. Both segments involve supplying equipment and related ancillary items used for application of our products. The following table sets forth, for the years indicated, sales for our Foam and Coatings segments:

| |

|

2011

|

|

|

2010

|

|

|

Foam

|

|

$ |

71,592,721 |

|

|

$ |

61,597,220 |

|

|

Coatings

|

|

$ |

14,626,991

|

|

|

$ |

8,899,409 |

|

Foam Segment

Our foam business involves supplying spray foam insulation and roofing foam to the construction industry. Spray foam insulation applications consist of perimeter wall, crawl space, and attic space commercial and industrial, and residential, applications. Roofing applications consist of new and retrofit commercial and industrial, and residential, applications. Opening up our own Foam Resin Plant in 2007 enabled Lapolla to benefit from the economics of manufacturing spray polyurethane foam systems and new sales opportunities through previously unavailable channels (e.g. distribution) arose. Lapolla provides open and closed cell spray foam for insulation, as well as closed cell technology for roofing applications. We have attained certain, and continue to attain, third party credentials for our in-house manufactured spray foam systems, which enables greater acceptance of our proprietary foam products in our target markets. This segment also supplies adhesives and equipment for applications. We use our own distribution facilities, as well as public warehousing in certain local markets nationally to better serve our customers. Performance, availability, product credentials, approvals, technical and customer service, and pricing are major competitive factors in the spray foam business.

Coatings Segment

Our coatings business involves supplying a variety of protective coatings for roofing systems for new and retrofit commercial and industrial applications to the roofing industry. We use our own distribution facilities, as well as public warehousing in certain local markets nationally to better serve our customers. Product credentials, approvals and performance, pricing, technology, technical customer service, and availability are major competitive factors in our coatings business.

See also Note 20, “Business Segment Information,” in the notes to the financial statements listed under Item 15 of Part IV of this report.

International Operations

Our international sales, consisting primarily of our Canadian operations, represented approximately 12.7% and 12.4% of our total product sales for the year ended December 31, 2011 and 2010, respectively. We have a registered branch office in Mississauga, Ontario operated by a resident management team to serve customers in the Canadian markets. We are also aggressively pursuing international business and have entered into relationships with distributors in various European countries. We expect 2012 and beyond to reflect increased international growth and revenues.

Sales and Marketing

We maintain a growing national and limited international sales and marketing focus. Sales are concentrated on distributors and contractors in the insulation and roofing industries. Lapolla utilizes direct sales, independent representatives, distributors, and public bonded warehouses strategically positioned on a state, regional, or country basis to serve customers. Insulation foam and reflective roof coatings are aggressively growing through enhanced consumer awareness due to nationally promoted programs from federal, state, municipal and other government agencies, energy companies, and private organizations. Some of these programs include the American Recovery and Reinvestment Act of 2009, Cool Roof Rating Council, Energy Star and state and utility company funded rebates to energy conscious building owners for following very specific recommendations, using reflectivity and emmissivity as the general goal in reducing the environmental impact of the “heat island effect”. Lapolla places a high priority on sales trending to create preparedness and processes to better serve customers. Information is gathered from sales, customers, management experience and historical trending to predict needed supply for stock and warehousing to meet the needs of our customers on a timely basis. Public warehousing, distribution and direct sales allow us to supply our customers in a timely and efficient fashion. The combined volumes of our products are disbursed throughout a broad customer base. This broad base assures lack of vulnerability to the loss of one key customer.

Raw Materials

We place a high priority on forecasting material demand to meet customer demands in the most expedient and cost effective manner. The primary materials being used to manufacture our foam and coatings products are polyols, catalysts, resins, and titanium dioxide. The suppliers of the necessary raw materials are industry leaders in both the specific chemistries and basic in the manufacturing of the raw materials for supply. We maintain strong relationships and have commitments for continuing supply through times of shortage. A lengthy interruption of the supply of one of these materials could adversely affect our ability to manufacture and supply commercial product. With our volume potential, Lapolla continues to be a potentially lucrative target for vendors to assure their own growth and demand in 2012 and beyond. Our foam resins and acrylic coatings are manufactured in our Houston, Texas facility. We maintain sufficient manufacturing capacity at this facility to support our current forecasted demand as well as a substantial safety margin of additional capacity to meet peaks of demand and sales growth in excess of our current expectations.

Patents and Trademarks

We rely on our own proprietary technologies in our foam and coatings segments for finished goods formulations. Additionally, we also rely on trade secrets and proprietary know-how that we seek to protect, in part, through confidentiality agreements with our partners, customers, employees and consultants. We market our products under various trademarks, for which we have registered and unregistered trademark protection in the United States. These trademarks are considered to be valuable because of their contribution to market identification of our products.

Competition

Competition is based on a combination of product credentials, approvals, price, technology, availability, performance, and limited warranties. Lapolla is expanding through aggressive sales and marketing, competitive pricing, a selective sales force comprised of direct salespersons, independent representatives, and distributors, building owner and contractor brand awareness, and acquisitions. Lapolla differentiates itself from competitors by offering personalized sales support and providing efficient response time on issues ranging from technical service to delivery of products. We are one of the largest suppliers of spray polyurethane foam for insulation and roofing foam nationally with global expansion plans underway. The foam manufacturing industry consists of a few large and medium sized manufacturing companies with global, national and regional presence primarily relying on distributors to service markets. We are able to access distribution channels and penetrate target markets through direct sales more effectively as a manufacturer of foam resins. Our products are supplied primarily to large, medium and small insulation, roofing, and general contractors. Within the coatings industry, as manufacturers specifically focused on energy efficient acrylic coatings for roofing and construction as their primary line, Lapolla is a major player in a very fragmented market. Product credentials and approvals differentiate product lines and suppliers that are more readily suited to broad use and industry acceptance. We are currently listed with certain credentials and approvals to assure minimal restrictions in markets and uses. Lapolla utilizes advertising campaigns, articles in industry periodicals, trade show exposure, public relations, printed case studies, internet and website exposure, mailers and direct sales, distribution, and marketing to obtain greater product branding and recognition.

Employees

At December 31, 2011, we employed 88 full time individuals, none of which are represented by a union. We believe that our relations with our employees are generally very good.

Environmental Matters

We are subject to federal, state, and local environmental laws and regulations and believe that our operations comply in all material respects where we have a business presence. No significant expenditures are anticipated in order to comply with environmental laws and regulations that would have a material impact on our Company in 2012. We are not aware of any pending litigation or significant financial obligations arising from current or past environmental practices that are likely to have a material adverse effect on our financial position. However, we cannot assure that environmental problems relating to properties operated by us will not develop in the future, and we cannot predict whether any such problems, if they were to develop, could require significant expenditures on our part. In addition, we are unable to predict what legislation or regulations may be adopted or enacted in the future with respect to environmental protection and waste disposal that may affect our product or services.

Seasonality

Lapolla’s business, taken as a whole, is materially affected by seasonal factors. Specifically, sales of our products tend to be lowest during the first and fourth fiscal quarters, with sales during the second and third fiscal quarters being comparable and marginally higher. Although our foam resins and acrylic coatings are restricted by cold temperatures, we have developed certain formulations that allow for a broader range of application in colder temperatures. By broadening and diversifying our foam and coatings products to those that are less sensitive to temperature during application, we increase the likelihood of less seasonal downward sales trending during the winter months. Inclement weather does impede sales, but it also produces a pent up demand that can be realized in the subsequent short term.

Historical Information

We were incorporated in the state of Delaware on October 20, 1989 and underwent a variety of name changes and operations. For our current operations, we acquired 100% of the capital stock of Infiniti Paint Co., Inc., a Florida corporation, effective September 1, 2001, which was engaged in the business of developing, marketing, selling, and distributing acrylic roof coatings, roof paints, polyurethane foam systems, sealants, and roof adhesives in the Southeastern United States. On December 20, 2004, we changed our name from Urecoats Industries, Inc. to IFT Corporation. During the latter part of 2004, our Infiniti Subsidiary built and began operating a manufacturing plant in the Southeastern United States. On February 11, 2005, we acquired 100% of the capital stock of Lapolla Industries, Inc., an Arizona corporation, which was engaged in the business of manufacturing acrylic roof coatings and sealants, and distributing polyurethane foam systems in the Southwestern United States. On April 1, 2005, our Infiniti subsidiary merged with and into our Lapolla subsidiary whereas the existence of our Infiniti subsidiary ceased. On October 1, 2005, our Lapolla subsidiary merged with and into the Company, under its former name of IFT Corporation, whereas the existence of our Lapolla subsidiary ceased. On November 8, 2005, the Company changed its name to Lapolla Industries, Inc.

As a leading national manufacturer and supplier of foam and coatings, we operate in a business environment that includes certain risks. The risks described in this section could adversely affect our sales, operating results and financial condition. Although the factors listed below are considered to be the most significant factors, they should not be considered a complete statement of all potential risks and uncertainties. Unlisted factors may present significant additional obstacles which may adversely affect our business.

· Global Economic Conditions - The current stabilizing global economic crisis described below should also be considered when reviewing each of the subsequent paragraphs setting forth the various aspects of our business, operations, and products. The inconsistent global economic recovery is causing unpredictable credit markets, irregular levels of liquidity, and rates of default and bankruptcy continue; however, increased consumer and business spending persists. Although the ultimate outcome of these events cannot be predicted, it may have a material adverse effect on the Company and our ability to borrow money in the credit markets and potentially to draw on our revolving credit facility or otherwise obtain financing on favorable terms. Similarly, current or potential customers and suppliers may no longer be in business, may be unable to fund purchases or determine to reduce purchases, all of which could lead to reduced demand for our products, reduced gross margins, and increased customer payment delays or defaults. Further, suppliers may not be able to supply us with needed raw materials on a timely basis, may increase prices or go out of business, which could result in our inability to meet customer demand in a timely manner or affect our gross margins. We are also limited in our ability to reduce costs to offset the results of a prolonged or severe economic downturn given certain fixed costs associated with our operations.

· Cost and Availability of Raw Materials - Our operating results are significantly affected by the cost of raw materials. We may not be able to fully offset the impact of force majeure events and higher raw material costs through price increases or productivity improvements. Certain raw materials are critical to our production processes, such as polyols, catalysts, and titanium dioxide. The Company has supply arrangements to meet the planned operating requirements for the future. However, an inability to obtain these critical raw materials at any future date would adversely impact our ability to produce products.

· Retention of Key Personnel - Our success depends upon our retention of key managerial, technical, and selling personnel. The loss of the services of key personnel might significantly delay or prevent the achievement of our development and strategic objectives. Competition for such highly skilled employees in our industry is high, and we cannot be certain that we will be successful in recruiting or retaining such personnel. We also believe that our success depends to a significant extent on the ability of our key personnel to operate effectively, both individually and as a group. If we are unable to identify, hire and integrate new employees in a timely and cost-effective manner, our operating results may suffer.

· Acquisitions - As part of our business strategy, we regularly consider and, as appropriate, make acquisitions of technologies, products and businesses that we believe are synergistic. Our primary acquisition criterion is sales volume in our core foam and coatings competencies. Acquisitions may involve risks and could result in difficulties in integrating the operations, personnel, technologies and products of the companies acquired, some of which may result in significant charges to earnings. If we are unable to successfully integrate our acquisitions with our existing businesses, we may not obtain the advantages that the acquisitions were intended to create, which may materially adversely affect our business, results of operations, financial condition and cash flows, our ability to develop and introduce new products and the market price of our stock. In connection with acquisitions, we could experience disruption in our business or employee base, or key employees of companies that we acquire may seek employment elsewhere, including with our competitors. Furthermore, the products of companies we acquire may overlap with our products or those of our customers, creating conflicts with existing relationships or with other commitments that are detrimental to the integrated businesses.

· SEC Reviews - The reports of publicly-traded companies are subject to review by the SEC from time to time for the purpose of assisting companies in complying with applicable disclosure requirements and to enhance the overall effectiveness of companies’ public filings, and comprehensive reviews of such reports are now required at least every three years under the Sarbanes-Oxley Act of 2002. SEC reviews may be initiated at any time. While we believe that our previously filed SEC reports comply, and we intend that all future reports will comply in all material respects with the published rules and regulations of the SEC, we could be required to modify or reformulate information contained in prior filings as a result of an SEC review. Any modification or reformulation of information contained in such reports could be significant and could result in material liability to us and have a material adverse impact on the trading price of our common stock.

The Company has operating leases as follows:

|

Location

|

|

Description of Operations

|

|

Terms

|

|

Houston, Texas

|

|

Corporate, Customer Service, Distribution, Manufacturing, Marketing, Sales, Rig Assembly, Training

|

|

01-01-2010 to 04-30-2016

|

|

Ontario, Canada

|

|

Customer Service, Distribution, Sales, and Training

|

|

11-10-2010 to 11-09-2014

|

|

Englewood Cliffs, New Jersey

|

|

Sales

|

|

Month-to-Month

|

|

Rutledge, Georgia

|

|

Relocated Operations to Houston, Texas

|

|

07-01-2008 to 12-31-2012

|

Our present facilities are adequate for our currently known and projected near term needs.

Legal Proceedings

We are involved in various lawsuits and claims arising in the ordinary course of business. These matters are, in our opinion, immaterial both individually and in the aggregate with respect to our financial position, liquidity or results of operations.

PART II

Market Information

The following table shows the quarterly price range of our common stock during the periods listed.

| |

|

2011

|

|

|

2010

|

|

|

Calendar Quarter

|

|

High

|

|

|

Low

|

|

|

High

|

|

|

Low

|

|

|

First

|

|

$ |

0.72 |

|

|

$ |

0.51 |

|

|

$ |

0.66 |

|

|

$ |

0.36 |

|

|

Second

|

|

$ |

0.99 |

|

|

$ |

0.52 |

|

|

$ |

0.66 |

|

|

$ |

0.42 |

|

|

Third

|

|

$ |

0.76 |

|

|

$ |

0.45 |

|

|

$ |

0.75 |

|

|

$ |

0.48 |

|

|

Fourth

|

|

$ |

0.60 |

|

|

$ |

0.33 |

|

|

$ |

0.65 |

|

|

$ |

0.46 |

|

Our common stock is traded on the NASDAQ O-T-C Bulletin Board under the symbol “LPAD”. As of March 29, 2012, there were approximately 2,800 holders of record, of which 405 are registered holders and 2,395 are beneficial folders, of our common stock. We did not declare any dividends on our common stock during the past two years and do not anticipate declaring such dividends in 2012.

Securities Authorized for Issuance Under Equity Compensation Plans

The following table summarizes information about our common stock that may be issued upon the exercise of options, warrants and rights under all equity compensation plans, as of December 31, 2011:

|

Equity Compensation Plan Information

|

|

| |

|

|

|

|

|

|

|

Number of Securities

|

|

| |

|

|

|

|

|

|

|

Remaining Available for

|

|

| |

|

Number of Securities to

|

|

|

Weighted-Average

|

|

|

Future Issuance Under

|

|

| |

|

Be Issued Upon Exercise

|

|

|

Exercise Price of

|

|

|

Equity Compensation Plans

|

|

| |

|

Of Outstanding Options,

|

|

|

Outstanding Options,

|

|

|

(excluding Securities

|

|

| |

|

Warrants and Rights

|

|

|

Warrants and Rights

|

|

|

Reflected in Column (a))

|

|

|

Plan Category

|

|

(a)

|

|

|

(b)

|

|

|

(c)

|

|

|

Equity Compensation Plans

|

|

|

|

|

|

|

|

|

|

|

Approved by Security Holders (1)

|

|

|

6,948,333 |

|

|

$ |

0.60 |

|

|

|

3,051,667 |

|

|

Equity Compensation Plans Not

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Approved by Security Holders (2)

|

|

|

2,980,000 |

|

|

$ |

0.59 |

|

|

|

— |

|

|

Total

|

|

|

9,928,333 |

|

|

$ |

0.60 |

|

|

|

3,051,667 |

|

(1) Includes shares of our common stock issuable under our Equity Incentive Plan. For a description of this plan, refer to Note 18 – Share-Based Payment Arrangements, Equity Incentive Plan, of our Notes to Financial Statements included in our annual report on Form 10-K for the year ended December 31, 2011.

(2) Represents 2,500,000 outstanding detachable Warrants issued by the Company in connection with certain prior financing agreements with ComVest (Refer to the Footnotes in the Stockholders Holding 5% or More section for more detailed information) and 480,000 outstanding restricted shares of common stock granted by the Company pursuant to a Director Plan (Refer to Note 18 – Share-Based Payment Arrangements, Director Plan, of our Notes to Financial Statements included in our annual report on Form 10-K for the year ended December 31, 2011 for a description of this plan).

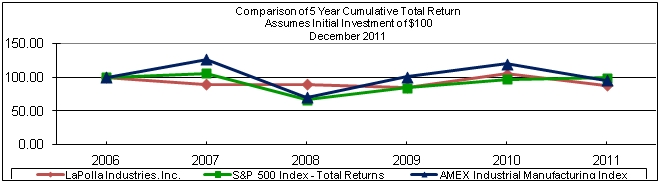

Performance Graph

Set forth below is a line graph comparing the yearly percentage change in the cumulative total stockholder return on our common stock with the cumulative total return of the S&P 500 Stock Index and the AMEX Industrial Manufacturing Index for the period beginning December 31, 2005 and ending December 31, 2011. The graph assumes that all dividends have been reinvested. We did not declare any dividends during the past five years.

Recent Sales of Unregistered Securities.

In private transactions relying on Section 4(2) of the Securities Exchange Act of 1933, as amended, we issued and/or exchanged an aggregate of 25,401,112 shares of our restricted common stock to directors and our majority stockholder. Refer to Note 17 - Securities Transactions, Items (a) through (d) in the Notes to the Financial Statements listed under Item 15 of Part IV of this report for more detailed information.

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations.

Management's Discussion and Analysis

of Financial Condition and Results of Operations for the Three-Year Period Ended December 31, 2011

Overview

This financial review presents our operating results for each of the three years in the period ended December 31, 2011, and our financial condition at December 31, 2011. Except for the historical information contained herein, the following discussion contains forward-looking statements which are subject to known and unknown risks, uncertainties and other factors that may cause our actual results to differ materially from those expressed or implied by such forward-looking statements. We discuss such risks, uncertainties and other factors throughout this report and specifically under Item 1A of Part I of this report, “Risk Factors.” In addition, the following review should be read in connection with the information presented in our financial statements and the related notes to our financial statements. Refer to Item 8 of this Form 10-K, Note 1 – Summary of Significant Accounting Policies for further information regarding significant accounting policies and Note 20 – Business Segment Information in our financial statements listed under Item 15 of Part IV of this report for further information regarding our business segment structure.

Overall Results of Operations

Sales

The following is a summary of sales for the years ending December 31:

| |

|

2011

|

|

|

2010

|

|

|

2009

|

|

|

Sales

|

|

$ |

86,219,712

|

|

|

$ |

70,496,629 |

|

|

$ |

50,026,470 |

|

Sales increased $15,723,082, or 22.3%, from 2010 to 2011, compared to an increase of $20,470,159, or 40.9%, from 2009 to 2010. From 2010 to 2011, sales increased $9,995,501, or 16.2%, for our foams, and $5,727,581, or 64.4%, for our coatings, compared to an increase of $18,516,479, or 43.0%, for our foams, and $1,953,680, or 28.1%, for our coatings, due to higher demand attributed to cost conscious residential and commercial building owners transitioning from traditional fiberglass insulation and roofing systems to energy efficient SPF and acrylic coatings. High and volatile energy prices continue to heighten the public’s interest for green building materials and sustainable energy solutions. Our AirTight SprayFoam division, which is a turn-key, equipment, startup, and training operation, provided additional market penetration for our foams, resulting in approximately $12.0 Million, $11.4 Million, and $8.5 Million, in sales in 2011, 2010, and 2009, respectively. Pricing changes added approximately $1,225,204 and reduced approximately $1,152,907 and $122,316, in sales, while sales volumes added approximately $14,497,879, $19,317,252, and $2,007,604, for 2011, 2010, and 2009, respectively.

Cost of Sales

Cost of sales increased $17,248,132, or 32.1%, from 2010 to 2011, compared to an increase of $16,244,543, or 43.3%, from 2009 to 2010. From 2010 to 2011, cost of sales increased $11,903,905, or 25.4%, for our foams, and $5,344,227, or 77.4%, for our coatings, due primarily to increases of $9,995,501, or 16.2%, and $5,727,581, or 64.4%, in our foam and coatings sales, respectively. We had a 60.8% and 58.6% increase in freight costs, along with a 5.8% and 2.9% increase in material costs, in 2011 and 2010. Freight and material costs increased in 2011 due primarily to sales volumes, extraordinary increases in raw material costs from global allocation, unusual geopolitical circumstances, and profit taking by feedstock suppliers, and in 2010 due primarily to increased sales volumes. From 2009 to 2010, cost of sales increased $14,884,604, or 46.5%, for our foams, and $1,359,940, or 24.5%, for our coatings, due primarily to increases of $18,516,479, or 43.0%, and $1,953,680, or 28.1%, in our foam and coatings sales, respectively. We had a 15.5% decrease in freight costs, along with a 2.7% decrease in material costs, in 2009.

Gross Profit

Our gross profit decreased $1,525,050, or 9.1%, from 2010 to 2011, due to extraordinary increases in raw material costs from global allocation, unusual geopolitical circumstances, and profit taking by feedstock suppliers, offset by sales growth, compared to an increase of $4,225,616, or 33.9% from 2009 to 2010, due to our sales growth. Gross margin percentage decreased 9.1% from 2010 to 2011 and 1.2% from 2009 to 2010 due primarily to increased freight costs and raw materials costs, offset by manufacturing efficiencies.

Operating Expenses

Our total operating expenses are comprised of selling, general and administrative expenses, or SG&A, professional fees, depreciation, amortization of other intangible assets, and consulting fees. These total operating expenses increased $4,755,668, or 25.9%, from 2010 to 2011, due to increases of $4,216,991 for SG&A, $224,243 for professional fees, $63,316 for amortization of other intangible assets, and a decrease of $14,884 for depreciation expense, compared to, $246,229, or 1.8% from 2009 to 2010, due to increases of $92,633 for SG&A, $78,036 for professional fees, $27,567 for depreciation, $21,127 for amortization of other intangible assets, and $26,866 for consulting fees.

SG&A increased $4,216,991, or 25.5%, from 2010 to 2011, due to increases of $22,176 for advertising, $588,544 for bad debts, $303,448 for corporate office, $151,028 for distribution, $31,184 for insurances, $306,695 for marketing and promotions, $1,124,039 for payroll and related employee benefits, $124,965 for rents, $48,595 for sales commissions, $1,192,384 for share based compensation, and $336,472 for travel and travel related services, offset by a decrease of $12,539 for investor relations. The $588,544 increase for bad debts related to an increase in select customer bankruptcies and defaults due to lingering stressors from the tightened credit markets and recession. The $303,448 increase in corporate office expenses relates primarily to increases of $162,698 in bank fees, $30,451 in cellular phones, $56,732 in collection fees, $31,409 in dues and subscriptions, $102,072 in miscellaneous expense, $72,554 in temporary labor, partially offset by a reversal of $164,119 in accrued executive management EBITDA bonus due to the established criteria not being met in 2011, and a decrease of $31,388 in lease expense. The $151,028 increase in distribution expenses relates to increased sales volumes through previously established outside warehouses and using additional outside warehouses to better serve customers. The $31,184 increase in insurance relates to an increase in our credit insurance premium. The $306,695 increase for marketing, promotions, and trade shows, was from an increase in attendance at major industry trade shows and larger volume of printed marketing and give-a-way promotional items from broader sales efforts. The $1,124,039 increase in payroll and related employee benefits was due to hiring of additional sales personnel and middle management to manage the 22.3% increase in sales volumes and to meet anticipated growth forecasts. The increase of $124,965 in rents was due to expansion of our Houston, Texas facility to include space for spray rig building and technical training and our Ontario, Canada facility to include more space for warehousing and technical training. The $48,595 increase in sales commissions was due to the 22.3% increase in sales. The $1,192,384 increase in share based compensation due to expensing of stock options and restricted stock awards to non-employee directors and consultants. The $336,472 increase for travel and travel related services related to increased attendance at trade shows and international expansion efforts. SG&A increased $92,633, or 0.8%, from 2009 to 2010 due to increases of $67,357 for advertising, $487,364 for sales commissions, $238,881 for corporate, $10,174 for investor relations, $891,800 for payroll and related employee benefits, and $56,835 for travel and related services, offset by decreases of $649,691 for bad debts, $23,506 for distribution, $174,810 for insurances, $360,660 for marketing, promotions, and trade shows, $13,107 for rents, and $438,005 for share based compensation. The $487,364 increase in sales commissions was due to the 40.9% increase in sales. The $238,881 increase in corporate was primarily due to the establishment of the executive management EBITDA bonus program in 2010. The $892,800 increase in payroll and related employee benefits was due to increases in salaries and hiring of additional sales personnel to manage the 40.9% increase in sales volumes. The $649,691 decrease in bad debts in 2010 was due to an improved economic environment, tighter credit controls, and increased use of credit insurance. The $174,810 decrease in insurances was from reduced loss ratios under our various insurances, resulting in more competitive renewal costs. The $360,660 decrease in marketing, promotions, and trade shows, was from implementation of more efficient strategies. The $438,005 decrease in share based compensation resulted from a reduction in outstanding stock option and restricted common stock incentive grants.

Professional fees increased $244,240, or 68.0%, from 2010 to 2011, compared to, an increase of $78,036, or 27,7%, from 2009 to 2010, primarily due to increased legal fees related to review of various board, executive, and international business agreements.

Depreciation expense decreased $14,882, or 5.0%, from 2010 to 2011, due to a decrease in depreciable assets, compared to, an increase of $27,567, or 9.7% from 2009 to 2010 due to an increase in depreciable assets, primarily vehicles for our growing sales force.

Amortization of other intangible assets expense increased $63,316, or 14.1%, compared to, $21,126, or 5.8%, from 2009 to 2010, due to an increase in amortizable assets primarily approvals and certifications.

Consulting fees increased $246,003, or 54.0%, from 2010 to 2011, due to the Company entering into an advisory and consulting agreement with a non-employee director in the first quarter of 2011, compared to, an increase of $26,866, or 14.7%, from 2009 to 2010, due to retaining outside professionals for advisory and information technology services.

Other Income (Expense)

Our total other income (expense) are comprised of interest expense, interest expense – related party, interest expense – amortization of discount, gain or loss on derivative liability, (gain) loss on sale of assets, and other, net.

The total other income (expense) decreased $673,365, or 207.6%, from 2010 to 2011, due to decreases of $247,864 for interest expense, $200 for interest expense – related party, $702,232 for interest expense – amortization of discount, a $4,051 gain on the sale of an asset, offset by a decrease of $141,902 in gain on our derivative liability and $139,082 in other, net, compared to, a decrease $945,605, or 48.7%, from 2009 to 2010, due to decreases of $372,730 for interest expense, $247,059 for interest expense - related party, and $209,853 for interest expense - amortization of discount, and an increase of $154,765 for other, net, offset by a reduction of $38,801 in gain on derivative liability.

Interest expense decreased $247,864, or 43.8%, from 2010 to 2011, due to the Company maintaining asset based bank financing at competitive interest rates, compared to, a decrease of $372,730, or 31.4%, from 2009 to 2010, due to the Company obtaining asset based bank financing at competitive interest rates during the latter half of 2010 which replaced more expensive mezzanine styled credit instruments.

Interest expense – related party was $-0-, from 2010 to 2011, due to no outstanding related party loans, compared to, a decrease of $247,059, or 99.9%, from 2009 to 2010, due to a decrease in capital utilized from related party loans provided by our Chairman of the Board.

Interest expense – amortization of discount was $-0-, from 2010 to 2011, due to no outstanding mezzanine credit, compared to, a decrease of $209,853, or 23.0%, from 2009 to 2010, due to the Company paying off its mezzanine styled debt during the latter part of 2010 in connection with obtaining asset based bank financing on more favorable terms.

Gain on derivative liability decreased $141,902, or 103.0%, from 2010 to 2011, compared to a decrease of $38,801, or 12.2%, from 2009 to 2010, due primarily to the volatility in the Company's common stock in relation to the outstanding detachable warrants granted in connection with the Company's former mezzanine styled debt instruments.

Gain on sales of assets increased $4,051, or 31.5%, from 2010 to 2011, due to sale of depreciable vehicles and equipment for more than book value, compared to, a gain of $8,813, from 2009 to 2010, due to sale of a depreciable vehicle for more than book value.

Other income decreased $139,082, or 153.1%, from 2010 to 2011, due primarily to an decrease in collection of finance charges related to extensions of credit on aged accounts receivable, compared to, an increase of $154,765, or 184.3%, from 2009 to 2010, due primarily to an increase in collection of finance charges related to extensions of credit on aged accounts receivable.

Net Income (Loss)

Net loss was $3,506,290, from 2010 to 2011, due primarily to an increase in cost of sales of $17,248,132, or 32.1%, from an increase of 60.8% in freight costs and 5.8% in material costs, total operating expenses of $4,755,668, or 25.9%, from an increase of 25.5% in SG&A (which includes non-cash share based compensation of $1,192,384), 40.4% in professional fees, and 54.0% in consulting fees, offset by a decrease of $673,363 in other, net, from a decrease of 43.8% in interest expense, 100% in interest expense – amortization of discount, 103.0% in gain on derivative liability, and 207.6% in other income, compared to, net income of $2,101,064 for 2010, compared to a net loss of $2,823,927 for 2009, due primarily to a $20,470,159, or 40.9% increase in sales resulting in a $4,225,616, or 33.9%, increase in gross profit, decreases of $649,691, or 60.5%, in bad debts, $174,810, or 31.2%, in insurance costs, $360,660, or 28.0%, in marketing, promotions, and trade shows, $438,005, or 81.3%, in share based compensation, $372,730, or 31.4%, in interest expense, $247,059, or 99.9%, in interest expense - related party, $209,853, or 23.0%, in interest expense - amortization of discount, and $154,765, or 173.8%, in other income. Net loss per share was $0.04 for 2011, compared to net income per share of $0.03 for 2010 and net loss per share of $0.06 for 2009.

Net Income (Loss) Available to Common Stockholders

Net loss available to common stockholders and related loss per share was $4,175,235 and $0.05 for 2011, net income available to common stockholders and related income per share was $772,934 and $0.01 for 2010, and net loss available to common stockholders and related loss per share was $3,640,952 and $0.06 for 2009. We had a $659,186, or 49.6%, decrease in our preferred stock dividends from 2010 to 2011, due to a decrease in the amount of Series D Preferred Stock outstanding during 2011, compared to, a $511,106, or 62.6%, increase in our preferred stock dividends from 2009 to 2010, due to an increase in the amount of Series D Preferred Stock outstanding during 2010.

Results of Business Segments

The following is a summary of sales by segment for the years ending December 31:

|

Segments

|

|

2011

|

|

|

2010

|

|

|

2009

|

|

|

Foam

|

|

$ |

71,592,721 |

|

|

$ |

61,597,220 |

|

|

$ |

43,080,741 |

|

|

Coatings

|

|

$ |

14,626,991

|

|

|

$ |

8,899,409 |

|

|

$ |

6,945,729 |

|

Foam Segment

Foam sales increased $9,995,501, or 16.2%, from 2010 to 2011, compared to, an increase of $18,516,479, or 43.0%, from 2009 to 2010, due to energy conscious building owners and consumers continuing to seek relief from costly energy prices, as spray polyurethane foam (SPF) gains market share from the paradigm shift away from traditional insulation systems such as fiberglass. AirTight furthered our market penetration into the foam segment through its start-up training and rig building operations. Foam equipment sales increased $237,504, or 6.6%, from 2010 to 2011, compared to, an increase of $1,574,577, or 76.9%, from 2009 to 2010. Foam cost of sales increased $11,903,905, or 25.4%, from 2010 to 2011, due primarily to increased sales volumes, higher freight and raw material costs, partially offset by manufacturing efficiencies, compared to, an increase of $14,884,604, or 46.5%, from 2009 to 2010, due primarily to increased sales volumes and higher freight costs, partially offset by manufacturing efficiencies. Foam gross profit decreased $1,908,404, or 13.0%, from 2010 to 2011, due to extraordinary increases in raw material costs from global allocation, unusual geopolitical circumstances, and profit taking by feedstock suppliers, offset by sales growth, compared to, an increase of $3,631,875, or 32.8%, from 2009 to 2010, due to our sales growth. Foam gross margin percentage decreased 13.0% from 2010 to 2011, due primarily to increased raw material and freight costs and the inability to pass on these increased costs to our customers due to market softness during 2011, compared to, a decrease of 1.8%, primarily from higher freight costs. Foam segment profit decreased $3,290,157, or 65.9%, from 2010 to 2011, primarily due to an increase of $9,995,501, or 16.2% from aggressive sales growth, offset by an increase of $11,903,905, or 25.4%, in cost of sales from higher freight and raw material costs and $1,381,753, or 14.2%, in segment operating costs, compared to, an increase of $3,745,166, or 299.5%, from 2009 to 2010, primarily due to a $18,516,479, or 43.0%, increase in sales.

Coatings Segment

Coatings sales increased $5,727,581, or 64.4%, from 2010 to 2011, compared to, an increase of $1,953,680, or 28.1%, from 2009 to 2010, due to increased demand from general economic improvements and loosening of credit markets. Coating equipment sales decreased 324,946, or 92.7%, from 2010 to 2011, compared to an increase of $147,343, or 72.6%, from 2009 to 2010. Coatings cost of sales increased $5,344,227, or 77.4%, from 2010 to 2011, due primarily to increased sales volumes, higher freight and raw material costs, partially offset by manufacturing efficiencies, compared to, an increase of $1,359,939, or 24.5%, from 2009 to 2010, due to increased sales volumes and higher material costs. Coatings gross profit increased $383,354, or 19.2%, from 2010 to 2011, due to higher sales volumes, offset by higher raw material costs and a gross margin decrease of 6.2% primarily from higher freight and raw material costs, compared to, an increase of $593,741, or 42.2%, from 2009 to 2010, due to higher sales volumes and a gross margin percentage increase of 2.2%, primarily from manufacturing efficiencies, partially offset by higher material costs. Coating segment profit decreased $542,779, or 80%, from 2010 to 2011, due to higher freight and raw material costs, and an increase of $926,133, or 70.1%, in segment operating costs, compared to an increase of $776,160, or 544.6%, from 2009 to 2010, due to higher sales volumes.

Total Segments

Total sales increased $15,723,082, or 22.3%, from 2010 to 2011, compared to, an increase of $20,470,159, or 40.9%, from 2009 to 2010. Total equipment sales decreased $87,442, or 2.2%, from 2010 to 2011, compared to, an increase of $1,721,920, or 76.5%, from 2009 to 2010. Total cost of sales increased $17,248,132, or 32.1%, from 2010 to 2011, compared to, an increase of $16,244,543, or 43.3%, from 2009 to 2010. Total gross profits decreased $1,525,050, or 9.1%, and gross margin percentage decreased 6.1%, from 2010 to 2011, compared to, an increase of $4,225,616, or 33.9%, and gross margin percentage decreased 1.2%, from 2009 to 2010. Total segment operating expenses increased $2,307,886, or 20.9%, from 2010 to 2011. Total segment profits decreased $3,832,936, or 67.5%, from 2010 to 2011, compared to, an increase of $4,566,157, or 412.1%, from 2009 to 2010.

Outlook for 2012

The Company’s outlook remains very aggressive and positive, as we expect sales to continue to grow to record levels in 2012. Our optimism is based on our market share gains in the insulation and construction markets which are driven by growing consumer awareness about energy efficient foams and coatings. The markets for our products are highly competitive; however, we believe that our competitive advantages are rooted in our product formulations, credentials, approvals, performance, pricing, and technical customer service. In addition, we offer the flexibility, quality of products and responsiveness that a smaller company can offer. This outlook is based on a number of assumptions relating to our business and operations which are subject to change, some of which are outside our control. A variation in our assumptions may result in a change in this outlook.

Liquidity and Capital Resources

Cash on hand was $-0-, $298, and $400,821, for 2011, 2010, and 2009, respectively. The Company established a new Revolver Loan in 2010 which provides and automatic sweep of our bank accounts to facilitate draw downs and minimize interest expense. We did not have an automatic sweep feature in place under our prior mezzanine debt and paid down our former revolving credit note on a periodic basis. Stockholders' Equity decreased $2,239,754, or 35.5%, from 2010 to 2011, due to the comprehensive loss of $3,597,796 and accrued preferred stock dividends of $668,945, offset by the issuance of $315,000 in preferred stock and $418,773 in common stock, and $1,293,214 in share-based compensation, compared to, an increase of $2,546,362, or 67.7%, from 2009 to 2010, due to comprehensive income of $2,078,489, issuance of an aggregate of $1,406,870 in preferred stock and $388,304 for common stock, and $100,831 in share based compensation, offset by $1,328,131 in accrued preferred stock dividends and a $100,000 voluntary redemption of preferred stock. During 2011, we increased our Revolver Loan commitment to $13 Million, paid down our Term Loan by an additional $1,250,000, and withstood increased freight and material costs due primarily to record sales volumes, extraordinary increases in raw material costs from global allocation, unusual geopolitical circumstances, and profit taking by feedstock suppliers. During 2010, we refinanced our mezzanine styled credit instruments, which matured on August 31, 2010, with asset based bank financing on substantially improved financial terms. Our new bank financing provided us with a Term Loan of $2.5 Million, which was used to pay off our matured convertible term loan and, a Revolver Loan for $10 Million, which was used to pay off our prior matured revolving loan and make available working capital to meet our continuing operating requirements. We continue to experience record sales growth into 2012, and the associated increases in accounts receivable, inventory, and expenses to support our incline may require additional cash liquidity. Management believes that the cash on hand, cash generated from operations and the Revolver Loan, subject to borrowing base limitations (as described below) from our banking institution, will be sufficient to fund operations, including any capital expenditures (budgeted $250,000), through fiscal 2012. Notwithstanding the foregoing, we are seeking to raise additional capital through private placements of debt, or common or preferred stock with accredited sophisticated investors, to fund our aggressive strategic growth plans globally. If the Company chooses to raise additional capital, anti-dilution provisions under the outstanding detachable warrants issued in connection with our prior mezzanine styled financing may be triggered if any security sold is convertible into or exchangeable for our common stock based on the price of the common stock sold. Moreover, pursuant to our bank financing Loan Agreement, we must prepay any amount outstanding under the Term Loan out of the net proceeds of the capital raised ($937,500 at December 31, 2011). The Loan Agreement limitation may adversely impact our ability to raise additional capital.

Net cash provided by operations was $272,799 in 2011, compared to, 2,749,855 in 2010. The cash provided by operations for 2011 as compared to cash used in 2010 was attributable to the net loss of $3,506,290 for the year, including the effect of adjustments to reconcile net loss to cash provided by or used in operating activities and adjusting for non-cash items, primarily decreases of $702,233 in amortization of discount on convertible term and revolving credit notes due to paying off those notes with a new banking relationship in 2010, and a $12,864 gain on disposal of an asset, offset by increases of $74,515 in depreciation, $63,316 in amortization of other intangible assets related to approvals and certifications, $338,544 in provision for losses on accounts receivable due to certain customer bankruptcies or insolvencies resulting from general economic conditions, $1,192,383 in share based compensation relating to vesting shares of common stock pursuant to a consultant/advisory agreement entered into between the company and a director in February 2011, and $141,902 in gain on derivative liability. The foregoing was augmented by increases of $1,289,857 in trade receivables, $869,104 in inventories, $170,775 in prepaid expenses and other current assets, $593,430 in deposits and other non-current assets, $3,957,760 in accounts payable, and $166,610 in accrued expenses and other current liabilities, due to an increase of $15,723,082 in sales. Net cash provided by operations was $2,749,855 in 2010, compared to, net cash used by our operations of $2,688,144 in 2009. The cash provided by operations for 2010 as compared to cash used in 2009 was attributable to net income of $2,101,064 for the year, including the effect of adjustments to reconcile net income to cash provided by or used in operating activities and adjusting for non-cash items, primarily decreases of $720,279 in provision for losses on accounts receivable due to improved economic conditions, better utilization of credit insurance, and tightened credit controls, $209,853 in amortization of discount on convertible note and revolving credit note due to both being paid off in 2010, and $438,005 in share-based compensation due to renegotiation of the CEO and President's employment agreement in 2010 which stopped certain canceled unvested stock options from being expensed. The foregoing was augmented by increases of $3,175,303 in trade receivables, $878,852 in inventories, $368,358 in prepaid expenses and other current assets, $386,232 in deposits and other non-current assets, $2,771,464 in accounts payable, and $870,530 in accrued expenses and other current liabilities, due to an increase of $20,470,159 in sales. Net cash used in operations was $2,688,144 in 2009, reflecting a decrease of $4,689,326 when compared to the net cash used of $7,377,470 in 2008.

Contractual Obligations

| |

|

Payments Due By Period

|

|

| |

|

Less Than

|

|

|

1 to 3

|

|

|

4 to 5

|

|

|

More Than

|

|

|

|

|

| |

|

1 Year

|

|

|

Years

|

|

|

Years

|

|

|

5 Years

|

|

|

Total

|

|

|

Term Loan

|

|

$ |

937,500 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

937,500 |

|

|

Revolving Loan

|

|

|

— |

|

|

|

9,133,155 |

|

|

|

— |

|

|

|

— |

|

|

|

9,133,155 |

|

|

Long-Term Debt Obligations

|

|

|

44,560 |

|

|

|

26,478 |

|

|

|

— |

|

|

|

— |

|

|

|

71,038 |

|

|

Estimated Interest Payments on Long-Term Debt and Loan Obligations

|

|

|

433,855 |

|

|

|

277,268 |

|

|

|

— |

|

|

|

— |

|

|

|

711,123 |

|

|

Purchase Order Obligations

|

|

|

92,638 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

92,638 |

|

|

Operating Lease Obligations

|

|

|

510,019 |

|

|

|

1,324,325 |

|

|

|

183,219 |

|

|

|

— |

|

|

|

2,017,563 |

|

|

Total

|

|

$ |

2,018,572 |

|

|

$ |

10,761,226 |

|

|

$ |

183,219 |

|

|

$ |

— |

|

|

$ |

12,963,017 |

|

The information provided in the table above relates to bank credit instruments, vehicle notes, purchase obligations, and operating leases.

The Company has three material debt covenants to comply with: (i) Capital expenditures are limited to $625,000 on an annual basis, (ii) A borrowing base calculation defined as an amount determined by a detailed calculation equal to 85% of eligible accounts receivable, plus 55% of eligible inventory cannot be exceeded (“Borrowing Base”); and (iii) a Fixed Charge Coverage Ratio of at least 1.1 to 1.0. The Company and Lender entered into an amendment dated August 17, 2011 to the Loan Agreement, changing the Availability Reserve to $250,000, and, effective June 30, 2011, the definition of EBITDA to include “non-cash stock-based compensation expense”, and the Fixed Charge Coverage Ratio from 1.1 to 1.0 to 0.8 to 1.0 for June 2011, 0.95 to 1.0 for July 2011, and 1.1 to 1.0 for August 2011 and thereafter. The Company and Lender entered into an amendment dated November 18, 2011 to the Loan Agreement, including a Basic Reserve of $650,000 as part of the Availability Reserve, which Basic Reserve may adjust upward based on a fixed coverage charge ratio formula tested monthly, beginning November 1, 2011 and ending no later than April 30, 2012, and, effective August 31, 2011, changing the fixed charge coverage ratio from 1.1 to 1.0 to 0.95 to 1.0 for August 2011, 0.65 to 1.0 for September 2011, 0.85 to 1.0 for October 2011, 0.70 to 1.0 for November 2011 and December 2011, 0.50 to 1.0 for January 2012 and February 2012, 0.60 to 1.0 for March 2012, 0.85 to 1.0 for April 2012, and 1.1 to 1.0 for May 2012 and thereafter, and Applicable Margin was change on the Base Rate Revolver Loan to 2.25%, LIBOR Revolver Loans to 3.25%, and LIBOR Term Loans to 4.0%. The Company was not initially in compliance with all of the material debt covenants at December 31, 2011. The Company and Lender entered into an amendment dated April 16, 2012 to the Loan Agreement: (a) increasing the Basic Reserve to $1 Million on any day on or after June 30, 2012, (b) allowing an EBITDA deficit of $200,000 for the month of March 2012, and (c) effective December 31, 2011, maintaining a fixed charge coverage ratio, tested monthly as of the date of each calendar month beginning on April 30, 2012 and continuing thereafter (i) with respect to any such test date on or before December 31, 2012, for the period January 1, 2012 through such test date, and (ii) thereafter, for the most recently completed 12 calendar months, of at least the ratio of 0.10 to 1.0 for April 30, 2012, 0.40 to 1.0 for May 31, 2012, 0.75 to 1.0 for June 30, 2012, and 1.1 to 1.0 for July 2012 and thereafter. As a result of the amendment, the Company was in compliance with its debt covenants at December 31, 2011. There is also a restriction on the payment of preferred stock dividends (Distribution) under the Bank Loans. The Company is required to submit its Borrowing Base calculation to its financing institution daily. If, at any time, the Company’s Borrowing Base calculation is less than the amount outstanding under the Revolver Loan, and that amount remains unpaid or is not increased from future Borrowing Base calculations to an amount equal to the balance outstanding under the Revolver Loan at any given time, the financing institution, in its discretion, may accelerate any and all amounts outstanding under the Bank Loans.

Net cash used in investing activities was $442,005 in 2011, reflecting a decrease of $344,711 when compared to $786,716 in 2010. We invested $458,066 in property, plant and equipment in 2011, of which $398 was for vehicles, $79,975 for leasehold improvements and $58,191 for office furniture and equipment, as well as $103,950 for machinery and equipment, relating to expansion of our Houston facility to include spray rig assembly operations, and $247,906 for computers and software to upgrade and expand our information technology systems and redundancy. Net cash used in investing activities was $786,716 in 2010, reflecting an increase of $460,362 when compared to $326,353 in 2009. We invested $606,544 in property, plant and equipment in 2010, of which $157,634 was for vehicles for our CEO and President and sales personnel, $32,434 was for leasehold improvements, $68,510 was for office furniture and equipment, $154,834 was for computers and software to upgrade servers and accounting software, and $152,406 was for machinery and equipment for improvements to our manufacturing facilities, as well as $180,172 for the adjusted purchase price of the AirTight’s assets acquired in July 2008.

Net cash provided by financing activities was $260,415 in 2011, compared to, net cash used in financing activities of $2,341,087 in 2010. We borrowed $1,554,893, net, from our Revolver Loan and used it to make principal repayments of $1,250,000 on our Term Loan, principal repayments of $44,477 on our long term debt, and $260,415 in our continuing operations. Net cash used in financing activities was $2,341,086 in 2010, compared to, net cash provided by financing activities of $3,376,066 in 2009. Under our prior mezzanine styled credit instruments, we borrowed $800,000 under the revolving credit note and subsequently paid off the $9,330,191 balance on the matured revolving credit note and $2,500,000 balance on the matured convertible term note upon attaining replacement financing, which included a $2,500,000 Term Loan and $10,000,000 Revolver Loan, with a banking institution on September 1, 2010. We made principal repayments of $101,656 on our long term debt, and paid $875,000 for preferred stock dividends to our Chairman of the Board and $100,000 for the voluntary redemption of 100 shares of our preferred stock by a director.

Indemnification

Our Restated Certificate of Incorporation, as amended from time to time, provides that we will indemnify, to the fullest extent permitted by the Delaware General Corporation Law, each person that is involved in or is, or is threatened to be, made a party to any action, suit or proceeding by reason of the fact that he or she, or a person of whom he or she is the legal representative, is or was a director or officer of the Company or was serving at our request as a director, officer, employee or agent of another corporation or of a partnership, joint venture, trust or other enterprise. We have purchased insurance policies covering personal injury, property damage and general liability intended to reduce our exposure for indemnification and to enable us to recover a portion of any future amounts paid.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk

Market Risk

We do not issue or invest in financial instruments or their derivatives for trading or speculative purposes. Although we maintain limited operations in Canada and sell to select distributors in certain other international markets, our operations are primarily conducted in the United States, and, as such, we are not subject to material foreign currency exchange risks at this time. We have outstanding debt and related interest expense, however, market risk in interest rate exposure in the United States and Canada is currently not material to our operations. We primarily utilize letters of credit and credit insurance to mitigate any risk of collection in our limited business outside of the United States and Canada.

Item 8. Financial Statements and Supplementary Data

The information required by this Item is incorporated herein by reference to the financial statements set forth in Item 15 of Part IV of this report, “Exhibits and Financial Statement Schedules.”

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

None.

Item 9A. Controls and Procedures

(a) Evaluation of Disclosure Controls and Procedures

We maintain disclosure controls and procedures that are designed to ensure that information required to be disclosed in our Exchange Act reports is recorded, processed, summarized and reported within the time periods specified in the SEC’s rules and forms, and that such information is accumulated and communicated to our management, including our Principal Executive Officer and our Principal Financial Officer, as appropriate, to allow timely decisions regarding required disclosures. Our management, including our Principal Executive Officer and our Principal Financial Officer, does not expect that our disclosure controls or procedures will prevent all error and all fraud. A control system, no matter how well conceived and operated, can provide only reasonable, not absolute, assurance that the objectives of the control system are met. Further, the benefits of controls must be considered relative to their costs. Because of the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that all control issues and instances of fraud, if any, have been detected. These inherent limitations include the realities that judgments in decision-making can be faulty, and that breakdowns can occur because of simple error or mistake. Additionally, controls can be circumvented by the individual acts of some persons, by collusion of two or more people, or by management override of the control. The design of any system of controls is also based in part upon certain assumptions about the likelihood of future events, and there can be no assurance that any design will succeed in achieving its stated goals under all potential future conditions. Because of the inherent limitations in a cost-effective control system, misstatements due to error or fraud may occur and not be detected. We carried out an evaluation, under the supervision and with the participation of our management, including our Principal Executive Officer and our Principal Financial Officer, of the effectiveness of the design and operation of our disclosure controls and procedures as of December 31, 2011, the end of the annual period covered by this report. The evaluation of our disclosure controls and procedures included a review of the disclosure controls’ and procedures’ objectives, design, implementation and the effect of the controls and procedures on the information generated for use in this report. In the course of our evaluation, we sought to identify data errors, control problems or acts of fraud and to confirm the appropriate corrective actions, including process improvements, were being undertaken. Based on the foregoing, our Principal Executive Officer and our Principal Financial Officer concluded that, as of the end of the period covered by this report, our disclosure controls and procedures were effective and operating at the reasonable assurance level.

(b) Management’s Report on Internal Control Over Financial Reporting

We are responsible for establishing and maintaining adequate internal control over financial reporting, as is defined in the Exchange Act, pursuant to the SEC’s rules and regulations. We maintain a system of internal control over financial reporting based on criteria established by Committee of Sponsoring Organizations of the Treadway Commission ("COSO"). These internal controls are designed to provide reasonable assurance that reported financial information is presented fairly, disclosures are adequate and the judgments inherent in the preparation of financial statements are reasonable. There are inherent limitations in the effectiveness of any system of internal control, including the possibility of human error and overriding of controls. Consequently, an effective internal control system can only provide reasonable, not absolute, assurance, with respect to reporting financial information. We conducted an evaluation of the effectiveness of our internal control over financial reporting based on COSO. Based on this evaluation, we concluded our internal control over financial reporting was, as of December 31, 2011, the end of the annual period covered by this report, effective. There were no changes in our internal control over financial reporting during our fourth fiscal quarter that materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

Item 9B. Other Information

The Company entered into an Executive Employment Agreement with Harvey L. Schnitzer, as Chief Operating Officer (“Schnitzer Agreement”). The Schnitzer Agreement became effective on April 5, 2012 and ends December 31, 2014 (“Term”). Mr. Schnitzer’s annual base salary is $200,000. He is eligible for a varying EBITDA based annual bonus if the Company’s Budgeted Earnings are achieved during any given year. Mr. Schnitzer is entitled to a change in control bonus equal to 50% of his annual base salary if the change in control occurs during his first 12 months of employment or 100% of his annual base salary if it occurs after the first 12 months during his Term or 6 months after the end of his Term. If Mr. Schnitzer is terminated by the Company without cause during the Term, he is entitled to: (a) severance equal to the lesser of 8 months annual base salary or the annual base salary for the remainder of the Term, (b) the product of the value of any equity based awards which he can show he reasonably would have received had he remained employed by the Company through the end of that calendar year, or 8 months after the termination date, whichever is greater, multiplied by a fraction, the numerator of which is the number of days in the calendar year in which the date of termination occurs through the termination date and the denominator is 365, but only to the extent not previously vested, exercised and/or paid, and (c) 8 months of continuous health and dental benefits. If Mr. Schnitzer is terminated following a change in control, he is entitled to: (a) his annual base salary for the remainder of the Term. The Schnitzer Agreement includes noncompetition, ownership of developments, and other rights provisions.

PART III

Directors and Executive Officers

Set forth below are descriptions of the backgrounds of each incumbent nominee, their ages, and their principal occupations for at least the past five years and their public-company directorships as of the record date. There are no familial relationships among any of our directors or among any of our directors and executive officers.

|

Richard J. Kurtz

|

72

|

Director since November 23, 1998

|

| |

|

|

|

Chairman of the Board

|

|

Mr. Kurtz has been chief executive officer of the Kamson Corporation, a privately held corporation, in business for the past 34 years. The Kamson Corporation has its principal executive offices located in Englewood Cliffs, New Jersey and currently owns and operates eighty one (81) investment properties in the Northeastern U.S. Mr. Kurtz is a graduate of the University of Miami and a member of its President's Club. Most notably, the Chamber of Commerce in Englewood Cliffs and the Boy Scouts of America chose him Man of the Year. Mr. Kurtz resides in Alpine, New Jersey and is currently vice president and a member of the Board of Directors for the Jewish Community Center on the Palisades in Tenafly, New Jersey. He is also an elected member of the Board of Trustees and Foundation Board for the Englewood Hospital and Medical Center of New Jersey and the Board of Governors for the Jewish Home and Rehabilitation Center.

|

|

Jay C. Nadel

|

54

|

Director since January 16, 2007

|

|

Mr. Nadel is chairman of the board of Englewood Hospital and Medical Center since September 2006. In addition to being an independent consultant since 2004, Mr. Nadel is an employee of Sloan Securities since January 2006. As a CPA and senior financial services executive, Mr. Nadel has extensive business management and operations experience. From 2002 to 2004, he was executive vice president of Bank of New York’s Clearing Services where he oversaw strategic planning; from 1986 to 2001, he was a partner in the investment firm of Weiss, Peck & Greer/Robeco, wherein he was chairman of the operations committee and managing director of the firm’s Clearing Services Division; and from 1980 to 1986, he was a manager at KPMG Peat Marwick, New York, where he provided audit services. Mr. Nadel is a Certified Public Accountant since 1980 and has a Bachelor of Science degree from the University of Maryland.

|

|

Lt. Gen. Arthur J. Gregg (US Army) (Ret.)

|

84

|

Director since February 21, 2000

|

|