UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For The Fiscal Year Ended December 31, 2013

Commission File No. 001-31354

|

Lapolla Industries, Inc. |

(Exact Name of Registrant as Specified in Its Charter)

|

Delaware (State of Incorporation) |

13-3545304 (I.R.S. Employer Identification No.) | |

|

Intercontinental Business Park 15402 Vantage Parkway East, Suite 322 Houston, Texas (Address of Principal Executive Offices) |

77032 (Zip Code) |

(281) 219-4700

(Registrant’s Telephone Number)

Securities registered pursuant to Section 12 (b) of the Act: None

Securities registered pursuant to Section 12 (g) of the Act:

| Common Stock, $.01 par value and Warrants |

| (Title of Each Class) |

Indicate by check mark if the Registrant is a well-known seasoned issuer as defined in Rule 405 of the Securities Act. YES ¨ NO þ

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES ¨ NO þ

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months, and (2) has been subject to such filing requirements for the past 90 days. YES þ NO ¨

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). YES þ NO ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See the definitions of “large accelerated filer”, “accelerated filer”, and “smaller reporting company” in Rule 12b-2 of the Exchange Act (Check one):

| Large Accelerated Filer ¨ | Accelerated Filer ¨ | Non-Accelerated Filer ¨ | Smaller Reporting Company þ |

Indicate by check mark whether the Registrant is a shell company (as defined by Rule 12b-2 of the Exchange Act). YES ¨ NO þ

As of June 30, 2013, the aggregate market value of the Registrant’s common stock held by non-affiliates of the Registrant was approximately $9,159,900 based on the closing sales price as quoted on the OTC Markets.

Common Stock outstanding as of March 20, 2014 — 114,620,620 shares.

DOCUMENTS INCORPORATED BY REFERENCE

None.

LAPOLLA INDUSTRIES, INC.

FORM 10-K

FOR THE YEAR ENDED DECEMBER 31, 2013

INDEX

| Page | |||

| PART I | |||

| Item 1. | Business | 1 | |

| Item 1A. | Risk Factors | 3 | |

| Item 2. | Properties | 4 | |

| Item 3. | Legal Proceedings | 5 | |

| PART II | |||

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 6 | |

| Item 6. | Selected Financial Data | 7 | |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 9 | |

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | 14 | |

| Item 8. | Financial Statements and Supplementary Data | 14 | |

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 14 | |

| Item 9A. | Controls and Procedures | 14 | |

| Item 9B. | Other Information | 14 | |

| PART III | |||

| Item 10. | Directors, Executive Officers and Corporate Governance | 15 | |

| Item 11. | Executive Compensation | 17 | |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholders Matters | 23 | |

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | 23 | |

| Item 14. | Principal Accountant Fees and Services | 26 | |

| PART IV | |||

| Item 15. | Exhibits and Financial Statement Schedules | 26 | |

| SIGNATURES | 27 | ||

| SCHEDULE II – VALUATION AND QUALIFYING ACCOUNTS | 28 | ||

| INDEX OF EXHIBITS | 29 | ||

(i)

FORWARD LOOKING STATEMENTS

Statements made by us in this report that are not historical facts constitute "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995.These forward-looking statements are necessarily estimates reflecting the best judgment of management and express our opinions about trends and factors which may impact future operating results. You can identify these and other forward-looking statements by the use of words such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “intends,” “potential,” “continue,” or the negative of such terms, or other comparable terminology. Such statements rely on a number of assumptions concerning future events, many of which are outside of our control, and involve risks and uncertainties that could cause actual results to differ materially from opinions and expectations. Any such forward-looking statements, whether made in this report or elsewhere, should be considered in context with the various disclosures made by us about our businesses including, without limitation, the risk factors discussed below. Although we believe our expectations are based on reasonable assumptions, judgments, and estimates, forward-looking statements involve known and unknown risks, uncertainties, contingencies, and other factors that could cause our or our industry's actual results, level of activity, performance or achievement to differ materially from those discussed in or implied by any forward-looking statements made by or on the Company and could cause our financial condition, results of operations, or cash flows to be materially adversely affected. Except as required under the federal securities laws and the rules and regulations of the U.S. Securities and Exchange Commission (“SEC”), we do not have any intention or obligation to update publicly any forward-looking statements, whether as a result of new information, future events, changes in assumptions, or otherwise.

PART I

As used in this report, “Lapolla” and the “Company” or “Us” or “We” refer to Lapolla Industries, Inc., unless the context otherwise requires. Our Internet website address is www.lapolla.com. We make our periodic and current reports, together with amendments to these reports, available on our website, free of charge, as soon as reasonably practicable after such material is electronically filed with, or furnished to, the SEC. The information on our website is not incorporated by reference in this Annual Report on Form 10-K.

Item 1. Business.

General Overview

Lapolla is a leading United States based manufacturer and global distributor of foam, coatings, and equipment, focused on developing and commercializing foams and coatings targeted at commercial and industrial and residential applications in the insulation and construction industries. Being back integrated in both foam and coating systems puts Lapolla in a strong competitive position as both product lines reduce energy consumption and ultimately lead to direct savings for consumers. Our products address growing consumer awareness of the building envelope. The building envelope is the separation between the interior and the exterior environments of a building and serves as the outer shell to protect the indoor environment as well as to facilitate its climate control. We provide superior insulation, an air barrier, and a vapor barrier with our products.

Operating Segments

We operate our business on the basis of two reportable segments — Foams and Coatings. The Foam segment involves producing building envelope insulation foam for interior application and roofing systems. The Coatings segment involves producing protective elastomeric coatings and primers. Both segments involve supplying equipment and related ancillary items used for application of our products. The following table sets forth, for the years indicated, sales for our Foam and Coatings segments:

| 2013 | 2012 | |||||||

| Foams | $ | 61,080,736 | $ | 58,871,570 | ||||

| Coatings | $ | 10,096,235 | $ | 11,512,257 | ||||

Foam Segment

Our foam business involves supplying spray foam insulation and roofing foam to the construction industry. Spray foam insulation applications consist of perimeter wall, crawl space, and attic space for commercial, industrial, and residential applications. Roofing applications consist of new and retrofit commercial, industrial, and residential applications. Lapolla provides open and closed cell spray foam for insulation, as well as closed cell technology for roofing applications. We have attained, and continue to attain, third party credentials for our spray foam systems, which enables greater acceptance of our proprietary foam products in our target markets globally. This segment also supplies adhesives and equipment for applications. We use our own distribution facility, as well as public warehousing in strategic local areas in our target markets to better serve our customers. Performance, availability, product credentials, approvals, technical and customer service, and pricing are major competitive factors in the spray foam business.

Coating Segment

Our coatings business involves supplying protective coatings for roofing systems for new and retrofit commercial and industrial applications to the roofing industry. We use our own distribution facility, as well as public warehousing in strategic local areas in our target markets to better serve our customers. Product credentials, approvals and performance, pricing, technology, technical customer service, and availability are major competitive factors in our coatings business.

See also Note 20, “Business Segments and Geographical Areas Information,” in the notes to the financial statements listed under Item 15 of Part IV of this report.

1

Non-GAAP Financial Measures

We present our non-GAAP financial measures EBITDA and Adjusted EBITDA in this Annual Report. For a description of how we define EBITDA and Adjusted EBITDA, see below and Part I, Item 6 – Selected Financial Data. A reconciliation of EBITDA and Adjusted EBITDA to the GAAP measures most directly comparable thereto, is presented below and in Part I, Item 6 – Selected Financial Data.

EBITDA

We define EBITDA as net income or loss before interest, income taxes, depreciation and amortization of other intangible assets. EBITDA is used as a supplemental financial measure by external users of our financial statements, such as investors, commercial banks, trade suppliers and research analysts, to assess:

| • | The financial performance of our assets, operations and return on capital without regard to financing methods, capital structure or historical cost basis; | ||

| • | The ability of our assets to generate cash sufficient to pay interest on our indebtedness and make distributions to our equity holders; and | ||

| • | The viability of acquisitions and capital expenditure projects. |

EBITDA is not prepared in accordance with GAAP. EBITDA should not be considered an alternative to net income or loss, operating income or loss, cash flow from operating activities or any other measure of financial performance or liquidity presented in accordance with GAAP. EBITDA excludes some, but not all, items that affect net income or loss and operating income or loss.

Adjusted EBITDA

We utilize Adjusted EBITDA to assist it in reviewing financial results and for management incentives. Adjusted EBITDA is defined as EBITDA increased by total share based compensation included in net income or loss. Management believes that Adjusted EBITDA provides information that reflects our economic performance. Management reviews our monthly financial results on an Adjusted EBITDA basis. Adjusted EBITDA has no impact on reported volumes or sales.

Adjusted EBITDA is used as a supplemental financial measure by management to describe our operations and economic performance to the Company’s financial institutions:

| • | The economic results of our operations; | ||

| • | Repeatable operating performance that is not distorted by non-recurring items, certain other non-cash items, or market volatility. |

Adjusted EBITDA is not prepared in accordance with GAAP. Adjusted EBITDA should not be considered as an alternative to net income or loss, income or loss from operations, cash flows from operating activities or any other measure of financial performance or liquidity presented in accordance with GAAP.

International Operations

We are expanding globally. Our international presence represented approximately 13.7% and 5.8% of our total product sales for the year ended December 31, 2013 and 2012, respectively. This is a direct result of ongoing efforts to penetrate into new international market segments. We use independent distributors to provide access to our products internationally in select target markets. International growth and revenues are expected to increase in 2014 and beyond. See also Note 20, “Business Segments and Geographical Areas Information,” in the notes to the financial statements listed under Item 15 of Part IV of this report.

Sales and Marketing

We maintain a growing global sales force. Sales are concentrated on contractors and distributors in the insulation and roofing industries. Lapolla utilizes direct sales, independent representatives, distributors, and public bonded warehouses strategically positioned on a state, regional, or country basis to serve customers. Insulation foam and reflective roof coatings are aggressively growing through enhanced consumer awareness due to energy efficiency programs promoted by governmental agencies, energy companies, and private organizations. Some of these programs in the United States include the American Recovery and Reinvestment Act of 2009, Cool Roof Rating Council, Energy Star and state and utility company funded rebates to energy conscious building owners for following very specific recommendations, using R-value, reflectivity and emissivity as the general goal in reducing the environmental impact of the “heat island effect”. Lapolla places a high priority on sales trending to create preparedness and processes to better serve customers. Information is gathered from sales, customers, management experience and historical trending to predict needed supply for stock and warehousing to meet the needs of our customers on a timely basis. Public warehousing, distribution and direct sales allow us to supply our customers in a timely and efficient manner. The combined volumes of our products are disbursed throughout a broad customer base, which decreases vulnerability from the loss of one key customer.

Raw Materials

We place a high priority on forecasting material demand to meet customer demands in the most expedient and cost effective manner and manage cash flow. The primary materials being used to manufacture our foams and coatings are polyols, catalysts, resins, and titanium dioxide. The suppliers of the necessary raw materials are industry leaders in both the specific chemistries and basic in the manufacturing of the raw materials for supply. We maintain strong relationships and have commitments for continuing supply through times of shortage. A lengthy interruption of the supply of one of these materials could adversely affect our ability to manufacture and supply commercial product. With our volume potential, Lapolla continues to be a potentially lucrative target for vendors to assure their own growth and demand in 2014 and beyond. Our foam resins and acrylic coatings are manufactured in our Houston, Texas facility and we maintain sufficient manufacturing capacity to support our current forecasted demand as well as a substantial safety margin of additional capacity to meet peaks of demand and sales growth in excess of our current expectations.

2

Patents and Trademarks

We rely on our own proprietary technologies in our foam and coating segments for finished goods formulations. Additionally, we also rely on trade secrets and proprietary know-how that we seek to protect, in part, through confidentiality agreements with our partners, customers, employees and consultants. We market our products under various trademarks, for which we have registered and unregistered trademark protection. These trademarks are considered to be valuable because of their contribution to market identification of our products.

Competition

Competition is based on a combination of product credentials, approvals, price, technology, availability, performance, and limited warranties. Lapolla is expanding through aggressive sales and marketing, competitive pricing, a selective sales force comprised of direct salespersons, independent representatives, and distributors, building owner and contractor brand awareness, and acquisitions. Lapolla differentiates itself from competitors by offering personalized sales support and providing efficient response time on issues ranging from technical service to delivery of products. We are one of the largest suppliers of spray polyurethane foam for insulation and roofing foam nationally with global expansion underway. The foam manufacturing industry consists of a few large and medium sized manufacturing companies with global, national and regional presence primarily relying on distributors to service markets. We are able to access distribution channels and penetrate target markets through direct sales more effectively as a manufacturer of foam resins. Our products are supplied to large, medium and small insulation, roofing, and general contractors. Within the coatings industry, as manufacturers specifically focused on energy efficient acrylic coatings for roofing and construction as their primary line, Lapolla is a major player in a very fragmented market. Product credentials and approvals differentiate product lines and suppliers that are more readily suited to broad use and industry acceptance. We are currently listed with certain credentials and approvals to assure minimal restrictions in markets and uses. Lapolla utilizes advertising campaigns, articles in industry periodicals, trade show exposure, public relations, printed case studies, internet and website exposure, mailers and direct sales, distribution, and marketing to obtain greater product branding and recognition.

Employees

At December 31, 2013, we employed 73 full time individuals, none of which are represented by a union. We believe that our relations with our employees are generally very good.

Environmental Matters

We are subject to various national, federal, state, and local environmental laws and regulations and believe that our operations comply in all material respects where we have a business operation. No significant expenditures are anticipated in order to comply with environmental laws and regulations that would have a material impact on our Company in 2014. We are not aware of any litigation or significant financial obligations arising from current or past environmental practices that are likely to have a material adverse effect on our financial position. However, we cannot assure that environmental problems relating to properties operated by us will not develop in the future, and we cannot predict whether any such problems, if they were to develop, could require significant expenditures on our part. In addition, we are unable to predict what legislation or regulations may be adopted or enacted in the future with respect to environmental protection and waste disposal that may affect our product or services.

Seasonality

Lapolla’s business, taken as a whole, is materially affected by seasonal factors. Specifically, sales of our products tend to be lowest during the first and fourth fiscal quarters, with sales during the second and third fiscal quarters being comparable and marginally higher. Although our foam resins and acrylic coatings are restricted by cold temperatures, we have developed certain formulations that allow for a broader range of application in colder temperatures. By broadening and diversifying our foam and coating products to those that are less sensitive to temperature during application, we increase the likelihood of less seasonal downward sales trending during the winter months. Inclement weather does impede sales, but it also produces a pent up demand that can be realized in the subsequent short term.

Historical Information

We were incorporated in the state of Delaware on October 20, 1989 and underwent a variety of name changes and operations. For our current operations, we acquired 100% of the capital stock of Infiniti Paint Co., Inc., a Florida corporation, effective September 1, 2001, which was engaged in the business of developing, marketing, selling, and distributing acrylic roof coatings, roof paints, polyurethane foam systems, sealants, and roof adhesives in the Southeastern United States. On December 20, 2004, we changed our name from Urecoats Industries, Inc. to IFT Corporation. During the latter part of 2004, our Infiniti Subsidiary built and began operating a manufacturing plant in the Southeastern United States. On February 11, 2005, we acquired 100% of the capital stock of Lapolla Industries, Inc., an Arizona corporation, which was engaged in the business of manufacturing acrylic roof coatings and sealants, and distributing polyurethane foam systems in the Southwestern United States. On April 1, 2005, our Infiniti subsidiary merged with and into our Lapolla subsidiary whereas the existence of our Infiniti subsidiary ceased. On October 1, 2005, our Lapolla subsidiary merged with and into the Company, under its former name of IFT Corporation, whereas the existence of our Lapolla subsidiary ceased. On November 8, 2005, the Company changed its name to Lapolla Industries, Inc.

Item 1A. Risk Factors.

As a leading national manufacturer and supplier of foam and coatings, we operate in a business environment that includes certain risks. The risks described in this section could adversely affect our sales, operating results and financial condition. Although the factors listed below are considered to be the most significant factors, they should not be considered a complete statement of all potential risks and uncertainties. Unlisted factors may present significant additional obstacles which may adversely affect our business.

3

· Global Economic Conditions - The current stabilizing global economic environment described below should also be considered when reviewing each of the subsequent paragraphs setting forth the various aspects of our business, operations, and products. The inconsistent global economic recovery is causing unpredictable credit markets, irregular levels of liquidity, and rates of default and bankruptcy continue; however, increased consumer and business spending persists. Although the ultimate outcome of these events cannot be predicted, it may have a material adverse effect on the Company and our ability to borrow money in the credit markets and potentially to draw on our revolving credit facility or otherwise obtain financing on favorable terms. Similarly, current or potential customers and suppliers may no longer be in business, may be unable to fund purchases or determine to reduce purchases, all of which could lead to reduced demand for our products, reduced gross margins, and increased customer payment delays or defaults. Further, suppliers may not be able to supply us with needed raw materials on a timely basis, may increase prices or go out of business, which could result in our inability to meet customer demand in a timely manner or affect our gross margins. We are also limited in our ability to reduce costs to offset the results of a prolonged or severe economic downturn given certain fixed costs associated with our operations.

· Restrictions in our financing agreements could adversely affect our business, financial condition, and results of operations – We are dependent upon the earnings, cash flow generated by our operations, and financing instruments in order to maintain liquidity and meet our debt service obligations. The operating and financial restrictions and covenants in our financing agreements and any future financing agreements could restrict our ability to finance future operations or capital needs or to expand or pursue our business, which may, in turn, adversely affect our business, financial condition, and results of operations. The provisions of our financing agreements may affect our ability to obtain future financing for and pursue attractive business opportunities and our flexibility in planning for, and reacting to, changes in business conditions. In addition, a failure to comply with the provisions of our financing agreements could result in an event of default which could enable our lenders, subject to the terms and conditions of our financing agreements, to declare the outstanding principal of that debt, together with accrued interest, to be immediately due and payable. If we were unable to repay the accelerated amounts, our lenders could proceed against the collateral granted to them to secure such debt. If the payment of our debt is accelerated, defaults under our other debt instruments, if any, may be triggered and our assets may be insufficient to repay such debt in full. See also “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources.”

· Cost and Availability of Raw Materials - Our operating results are significantly affected by the cost of raw materials. We may not be able to fully offset the impact of force majeure events and higher raw material costs through price increases or productivity improvements. Certain raw materials are critical to our production processes, such as polyols, catalysts, and titanium dioxide. The Company has supply arrangements to meet the planned operating requirements for the future. However, an inability to obtain these critical raw materials at any future date would adversely impact our ability to produce products.

· Retention of Key Personnel - Our success depends upon our retention of key managerial, technical, and selling personnel. The loss of the services of key personnel might significantly delay or prevent the achievement of our development and strategic objectives. Competition for such highly skilled employees in our industry is high, and we cannot be certain that we will be successful in recruiting or retaining such personnel. We also believe that our success depends to a significant extent on the ability of our key personnel to operate effectively, both individually and as a group. If we are unable to identify, hire and integrate new employees in a timely and cost-effective manner, our operating results may suffer.

· Acquisitions - As part of our business strategy, we regularly consider and, as appropriate, make acquisitions of technologies, products and businesses that we believe are synergistic. Our primary acquisition criterion is sales volume in our core foam and coatings competencies. Acquisitions may involve risks and could result in difficulties in integrating the operations, personnel, technologies and products of the companies acquired, some of which may result in significant charges to earnings. If we are unable to successfully integrate our acquisitions with our existing businesses, we may not obtain the advantages that the acquisitions were intended to create, which may materially adversely affect our business, results of operations, financial condition and cash flows, our ability to develop and introduce new products and the market price of our stock. In connection with acquisitions, we could experience disruption in our business or employee base, or key employees of companies that we acquire may seek employment elsewhere, including with our competitors. Furthermore, the products of companies we acquire may overlap with our products or those of our customers, creating conflicts with existing relationships or with other commitments that are detrimental to the integrated businesses.

· SEC Reviews - The reports of publicly-traded companies are subject to review by the SEC from time to time for the purpose of assisting companies in complying with applicable disclosure requirements and to enhance the overall effectiveness of companies’ public filings, and comprehensive reviews of such reports are now required at least every three years under the Sarbanes-Oxley Act of 2002. SEC reviews may be initiated at any time. While we believe that our previously filed SEC reports comply, and we intend that all future reports will comply in all material respects with the published rules and regulations of the SEC, we could be required to modify or reformulate information contained in prior filings as a result of an SEC review. Any modification or reformulation of information contained in such reports could be significant and could result in material liability to us and have a material adverse impact on the trading price of our common stock.

· Product Liability Claims - Our products are intended for commercial and industrial use and application by industry professionals. If any of our products are misused or applied improperly and injury results, the injured party may be able to assert a product liability claim against us although we would likely have a right of offset against the party that misused or applied the product improperly. While we carry a limited amount of product liability insurance, it may not sufficiently shield us from any potential product liability claims even with the right of offset, and any uninsured or over the limits of our insurance claims could result in material liability to us and have a material adverse impact on the trading price of our common stock.

Item 2. Properties

The Company has operating leases as follows:

| Location | Description of Operations | Terms |

| Houston, Texas | Corporate, Customer Service, Distribution, Manufacturing, Marketing, Sales, Rig Assembly, Training | 01-01-2010 to 04-30-2017 |

| Englewood Cliffs, New Jersey | Sales | Month-to-Month |

Our present facilities are adequate for our currently known and projected near term needs.

4

Item 3. Legal Proceedings

Legal Proceedings

(a) Neil and Kristine Markey, et al., Plaintiffs v. Lapolla Industries, Inc., Delfino Insulation, et al, Defendants

A complaint initially entitled Neil and Kristine Markey, individually, and on behalf of all others similarly situated, Plaintiffs, vs. Lapolla industries, Inc., a Delaware corporation; Lapolla International, Inc., a Delaware corporation; and Delfino Insulation Company, Inc., a New York Corporation, Defendants, was filed in the United States District Court for the Eastern District of New York and served on or about October 10, 2012 and amended last on November 11, 2013 (“Markey Litigation”). Plaintiffs now bring this lawsuit only individually, having amended out any request for a class action. The complaint alleges, among other things, that Lapolla designs, labels, distributes, and manufactures spray polyurethane foam (“SPF”) insulation, which creates a highly toxic compound when applied as insulation resulting in exposure to harmful gases. Plaintiffs are seeking: (i) actual, compensatory, and punitive damages; (ii) injunctive relief; and (iii) attorney fees. Lapolla considers the allegations to be without merit and is vigorously defending the allegations. The outcome of this litigation cannot be determined at this time. See also (b) below.

(b) Lapolla Industries, Inc., Plaintiff v. Aspen Specialty Insurance Company, et al, Defendants

Lapolla filed a complaint entitled Lapolla Industries, Inc., Plaintiff, v. Aspen Specialty Insurance Company; Aspen Specialty Insurance Management, Inc., Defendants, in the United States District Court for the Eastern District of New York on November 29, 2012 in a dispute related to the Markey Litigation described in (a) above. The Complaint alleges that defendants initially wrongfully denied insurance coverage in the Markey Litigation, and later wrongfully conditionally agreed to provide insurance coverage. We are seeking declaratory relief as follows: (i) an order that pursuant to existing policies issued by Defendants insuring Lapolla that Defendants must defend Plaintiff in the Markey Litigation; (ii) an order declaring that Plaintiff may select its own legal counsel; (iii) damages in an amount to be determined based upon Defendants’ breach of good faith, plus interest; (iv) an award of reasonable attorney fees plus costs and expenses incurred by Lapolla; and (v) pre- and post-judgment statutory interest. The Eastern District of New York granted a motion to dismiss on September 18, 2013 finding that a total pollution exclusion clause barred defense coverage. On November 18, 2013, Lapolla appealed to the Second Circuit Court of Appeals where the parties have completed primary briefing. The outcome of this litigation cannot be determined at this time. See also (a) above.

(c) Robert and Cynthia Gibson, et al., Plaintiffs v. Lapolla Industries, Inc. and Air Tight Insulation of Mid-Florida, LLC, Defendants

A complaint entitled Robert and Cynthia Gibson, individually and on behalf of others similarly situated, Plaintiffs v. Lapolla Industries, Inc., a Delaware corporation, and Air Tight Insulation of Mid-Florida, LLC, Defendants, was filed in the United States District Court for the Middle District of Florida on April 22, 2003 and served on or about April 23, 2013 (“Gibson Litigation”). The Plaintiffs brought this lawsuit individually and on behalf of a nationwide class against the Defendants as well as two Florida subclasses. The complaint alleged, among other things, negligence in connection with the design, manufacture, distribution, and installation of Lapolla’s SPF, resulting in exposure to harmful gases, breach of express and implied warranties, and violation of various state statutes. Plaintiffs sought, among other things: (i) actual, compensatory, statutory, and punitive damages; (ii) injunctive relief; and (iii) attorney fees. On February 3, 2014, the court dismissed the federal court case without prejudice per the Gibson’s notice of voluntary dismissal. See also (e) below.

(d) Great American E & S Insurance Company, Plaintiff v. Lapolla Industries, Inc., Defendant

Great American E & S Insurance Company (“Plaintiff”) filed a Petition for Declaratory Judgment against Lapolla Industries, Inc. in the Judicial District Court of Harris County, Texas on July 13, 2013 and served on or about July 21, 2013. The Petition seeks a declaratory Judgment that Plaintiff has no duty to defend or indemnify Lapolla under a general liability policy issued to Lapolla with respect to, among other things, contamination claims asserted in the Gibson Litigation. The Gibson Litigation alleges, among other things, that Lapolla’s proprietary SPF is a defective and toxic substance creating irritants which cause damages to the persons in the homes in which the SPF is applied. In addition to describing the terms of the insurance policy, Plaintiff alleges that the insurance of Lapolla under the policy excludes and does not apply to, among other things, damages from pollution, pre-existing damages known to Lapolla for products manufactured, distributed, or sold by Lapolla, or any damage to Lapolla’s product, or repair of Lapolla’s product, and seeks reasonable attorney fees. On January 9, 2014, the trial court denied Plaintiff’s Motion for Final Summary Judgment, which sought a final declaration that Plaintiff had no duty to defend in the Gibson Litigation. On February 25, 2014, Plaintiff filed a motion seeking permission to make an interlocutory appeal to the court of appeals of the trial court’s order denying Plaintiff’s Motion for Final Summary Judgment. Lapolla considers the allegations to be without merit and is seeking declaration from the court that Great American does have a duty to defend and indemnify Lapolla in the Gibson Litigation. The outcome of this litigation cannot be determined at this time. See also (c) above and (e) below.

(e) Robert and Cynthia Gibson, individually, and as parents and natural guardians of Robert Harvey Lee Gibson, Plaintiffs v. Lapolla Industries, Inc. and Air Tight Insulation of Mid-Florida, LLC, Southern Foam Insulation, Inc., and Tailored Chemical Products, Inc., Defendants

On March 5, 2014, the Gibson’s re-filed their claims, which were previously pending in the federal district court in the Middle District of Florida, against Lapolla Industries, Inc. and Air Tight Insulation of Mid-Florida, LLC (See Item (c) above) and two new defendants, Southern Foam Insulation, Inc. and Tailored Chemical Products, Inc. The complaint was filed in the Circuit Court of the 18th Judicial Circuit in and for Seminole County, Florida and alleges, among other things, negligence, strict liability design defect, strict liability failure to warn, breach of express and implied warranties, unjust enrichment, and violation of Florida’s deceptive and unfair trade practices act, relating to the design, manufacture, distribution, and installation of Lapolla’s spray polyurethane foam insulation, resulting in personal injuries and real property damage. Plaintiffs seek, among other things: (i) actual, compensatory, statutory, and punitive damages; (ii) injunctive relief; (iii) medical monitoring, and (iv) attorney fees. Lapolla considers the allegations to be without merit and is vigorously defending the allegations. The outcome of this litigation cannot be determined at this time.

5

(f) Michael Commaroto, Kimberly S. Commaroto, and Gretchen Schlegel v. Pasquale Guzzo a/k/a Pasqualino Guzzo PDB Home Improvements, Perfect Wall, LLC, and Jozsef Finta

Pasquale Guzzo a/k/a Pasqualino Guzzo PDB Home Improvements (“Guzzo”) filed a third-party complaint against Lapolla Industries, Inc. in the Superior Court, Judicial District of Stamford/Norwalk, in Connecticut on January 3, 2013 (“Guzzo Litigation”). Guzzo is alleging Lapolla’s SPF product is a defective product under Connecticut law and seeking indemnification and attorney’s fees. On August 28, 2013, Michael Commaroto, Kimberly S. Commaroto, and Gretchen Schlegel (collectively “Plaintiffs”) filed an amended complaint against Lapolla also asserting the SPF is a defective product. Plaintiffs seek monetary damages, punitive damages, and attorney’s fees, among other relief. This matter was previously being handled by insurance coverage counsel with Evanston Insurance Company. Lapolla considers the allegations to be without merit and is vigorously defending the allegations. The outcome of this litigation cannot be determined at this time. See also (g) below.

(g) Evanston Insurance Company v. Lapolla Industries, Inc.

Evanston Insurance Company (“Evanston”) filed its first amended complaint for declaratory judgment against Lapolla Industries, Inc.. Evanston seeks a declaratory judgment that it has no duty to defend or indemnify Lapolla in the Guzzo Litigation. Lapolla made an appearance in the case on February 14, 2014. The court entered a scheduling order on February 27, 2014 for briefing on summary judgment motions, which is to be completed by May 23, 2014. Lapolla considers the allegations to be without merit and is seeking declaration from the court that Evanston does have a duty to defend and indemnify Lapolla. The outcome of this litigation cannot be determined at this time. See also (f) above.

(h) Various Lawsuits and Claims Arising in the Ordinary Course of Business

We are involved in various lawsuits and claims arising in the ordinary course of business, which are, in our opinion, immaterial both individually and in the aggregate with respect to our consolidated financial position, liquidity or results of operations.

PART II

Item 5. Market for the Company’s Common Equity, Related Stockholder Matters, and Issuer Purchases of Equity Securities

Market Information

The following table shows the quarterly price range of our common stock during the periods listed.

| 2013 | 2012 | |||||||||||||||

| Calendar Quarter | High | Low | High | Low | ||||||||||||

| First | $ | 0.34 | $ | 0.18 | $ | 0.49 | $ | 0.29 | ||||||||

| Second | $ | 0.32 | $ | 0.16 | $ | 0.42 | $ | 0.20 | ||||||||

| Third | $ | 0.48 | $ | 0.21 | $ | 0.30 | $ | 0.14 | ||||||||

| Fourth | $ | 0.75 | $ | 0.35 | $ | 0.22 | $ | 0.11 | ||||||||

Our common stock is traded on the NASDAQ O-T-C Bulletin Board under the symbol “LPAD”. As of March 20, 2014, there were approximately 2,340 holders of record, of which 392 are registered holders and 1,948 are beneficial holders, of our common stock. We did not declare any dividends on our common stock during the past two years and do not anticipate declaring such dividends in 2014.

Securities Authorized for Issuance Under Equity Compensation Plans

The following table summarizes information about our common stock that may be issued upon the exercise of options, warrants and rights under all equity compensation plans, as of December 31, 2013:

| Equity Compensation Plan Information | ||||||||||||

| Number of Securities | ||||||||||||

| Remaining Available for | ||||||||||||

| Number of Securities to | Weighted-Average | Future Issuance Under | ||||||||||

| Be Issued Upon Exercise | Exercise Price of | Equity Compensation Plans | ||||||||||

| Of Outstanding Options, | Outstanding Options, | (excluding Securities | ||||||||||

| Warrants and Rights | Warrants and Rights | Reflected in Column (a)) | ||||||||||

| Plan Category | (a) | (b) | (c) | |||||||||

| Equity Compensation Plans | ||||||||||||

| Approved by Security Holders (1) | 5,040,000 | $ | 0.60 | 4,960,000 | ||||||||

| Equity Compensation Plans Not | ||||||||||||

| Approved by Security Holders (2) | 4,004,417 | $ | 0.60 | — | ||||||||

| Total | 9,044,417 | $ | 0.60 | 4,960,000 | ||||||||

(1) Includes shares of our common stock issuable under our Equity Incentive Plan. For a description of this plan, refer to Note 19 – Share-Based Payment Arrangements, Equity Incentive Plan, of our Notes to Financial Statements included in our annual report on Form 10-K for the year ended December 31, 2013.

(2) Represents 160,000 restricted shares of common stock granted and reserved by the Company pursuant to a Director Compensation Plan (Refer to Note 19 – Share-Based Payment Arrangements, Director Plan, of our Notes to Financial Statements included in our annual report on Form 10-K for the year ended December 31, 2013 for a description of this plan); 237,238 restricted shares of common stock granted and reserved by the Company pursuant to an Advisory and Consultant Agreement with a Director (Refer to Note 19 – Share-Based Payment Arrangements, Advisor Plan, of our Notes to Financial Statements included in our annual report on Form 10-K for the year ended December 31, 2013 for a description of this plan), and 3,607,179 restricted shares of common stock granted and reserved by the Company pursuant to a Guaranty Agreement executed in connection with a financing for the benefit of the Company by the Chairman of the Board (Refer to Note 19 – Share-Based Payment Arrangements, Guaranty Plans, of our Notes to Financial Statements included in our annual report on Form 10-K for the year ended December 31, 2013 for a description of this plan).

6

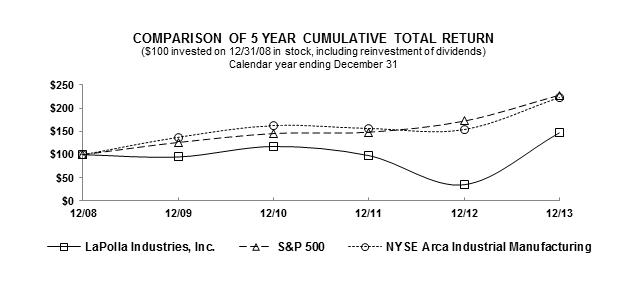

Performance Graph

Set forth below is a line graph comparing the yearly percentage change in the cumulative total stockholder return on our common stock with the cumulative total return of the S&P 500 Stock Index and the NYSE Arca Industrial Manufacturing Index for the period beginning December 31, 2008 and ending December 31, 2013. The graph assumes that all dividends have been reinvested. We did not declare any dividends during the past five years.

Recent Sales of Unregistered Securities.

During the quarterly period ended December 31, 2013, we issued, in private transactions in reliance on Section 4(2) of the Securities Act of 1933:

(a) An aggregate of 488,276 shares of restricted common stock, par value $.01 per share, to a director for advisory and consulting services, including shares issued for anti-dilution issuances, which transactions were valued and recorded in the aggregate at $279,376;

(b) An aggregate of 553,274 shares of restricted common stock, par value $.01 per share, to the Chairman of the Board and majority stockholder in connection with his personal guaranty for a Note Purchase Agreement, which transactions were valued and recorded at $173,745; and

(c) An aggregate of 160,000 shares of restricted common stock, par value $.01 per share, to non-employee directors pursuant to a director incentive plan for continuing Board of director services, which transactions were valued and recorded at $104,000.

Item 6. Selected Financial Data.

The following table presents selected historical consolidated financial and operating data derived from the audited historical consolidated financial statements of the Company as of the dates and for the periods indicated. In addition, the table presents our unaudited non-GAAP financial measure EBITDA and Adjusted EBITDA, which we use in our business as an important supplemental measure of our performance. We define and explain this measure under “Non-GAAP Financial Measures” and reconcile it to net income or loss, its most directly comparable financial measure calculated and presented in accordance with GAAP.

| Year Ended December 31, | ||||||||||||||||||||

| 2013 | 2012 | 2011 | 2010 | 2009 | ||||||||||||||||

| Summary of Operations | ||||||||||||||||||||

| Sales | $ | 71,176,971 | $ | 70,383,827 | $ | 86,219,712 | $ | 70,496,629 | $ | 50,026,470 | ||||||||||

| Operating Income (Loss) | (616,170 | ) | (3,317,304 | ) | (3,181,910 | ) | 3,098,810 | (880,578 | ) | |||||||||||

| Other (Income) Expense | 1,354,875 | 1,113,368 | 324,380 | 997,745 | 1,943,350 | |||||||||||||||

| Net Income (Loss) | (1,971,045 | ) | (4,430,672 | ) | (3,506,290 | ) | 2,101,064 | (2,823,927 | ) | |||||||||||

| Plus: Dividends on Preferred Stock | — | — | (668,945 | ) | (1,328,131 | ) | (817,025 | ) | ||||||||||||

| Net Income (Loss) Available to Common Stockholders | $ | (1,971,045 | ) | $ | (4,430,672 | ) | $ | (4,175,235 | ) | $ | 772,933 | $ | (3,640,952 | ) | ||||||

| Net Income (Loss) Per Share – Basic and Diluted: | ||||||||||||||||||||

| Net Income (Loss) Per Share – Basic | $ | (0.02 | ) | $ | (0.04 | ) | $ | (0.05 | ) | $ | 0.01 | $ | (0.06 | ) | ||||||

| Net Income (Loss) Per Share – Diluted | (0.02 | ) | (0.04 | ) | (0.05 | ) | 0.01 | (0.06 | ) | |||||||||||

| EBITDA (Unaudited) (1) | $ | 829,902 | $ | (2,075,814 | ) | $ | (1,752,248 | ) | $ | 4,648,711 | $ | 492,701 | ||||||||

| Adjusted EBITDA (Unaudited) (1) | $ | 2,149,632 | $ | (861,709 | ) | $ | (459,034 | ) | $ | 4,749,542 | $ | 1,031,537 | ||||||||

| Year-End Financial Position | ||||||||||||||||||||

| Long-Term Obligations (2) | 12,640,357 | 9,501,254 | 9,159,642 | 8,585,824 | 143,814 | |||||||||||||||

| Total Assets | $ | 22,054,160 | $ | 20,984,252 | $ | 28,117,250 | $ | 26,507,990 | $ | 22,785,327 | ||||||||||

(1) For a discussion of the non-GAAP financial measures EBITDA and Adjusted EBITDA, please read “Non-GAAP Financial Measures” below.

(2) Represents Total Other Liabilities on Balance Sheets as and for the periods then ended.

7

Non-GAAP Financial Measures

We present non-GAAP financial measures EBITDA and Adjusted EBITDA in this Annual Report. For a discussion of how we use EBITDA and Adjusted EBITDA, see below and refer also to Item 1 – Business, Non-GAAP Financial Measures. The GAAP measure most directly comparable to EBITDA and Adjusted EBITDA is net income or loss. The non-GAAP financial measures of EBITDA and Adjusted EBITDA should not be considered as an alternative to net income or loss or any other measure of financial performance or liquidity presented in accordance with GAAP. EBITDA and Adjusted EBITDA are not presentations made in accordance with GAAP and have important limitations as analytical tools. You should not consider EBITDA or Adjusted EBITDA in isolation or as substitutes for analysis of our results as reported under GAAP. Because EBITDA and Adjusted EBITDA exclude some, but not all, items that affect net income and is defined differently by different companies, our definitions of EBITDA and Adjusted EBITDA may not be comparable to similarly titled measures of other companies.

We recognize that the usefulness of EBITDA and Adjusted EBITDA as an evaluative tool may have certain limitations, including:

| • | EBITDA and Adjusted EBITDA do not include interest expense. Because we have borrowed money in order to finance our operations, interest expense is a necessary element of our costs and impacts our ability to generate profits and cash flows. Therefore, any measure that excludes interest expense may have material limitations; | ||

| • | EBITDA and Adjusted EBITDA do not include depreciation and amortization of other intangible assets expense. Because we use capital assets, depreciation and amortization of other intangible assets expense is a necessary element of our costs and ability to generate profits. Therefore, any measure that excludes depreciation and amortization of other intangible assets expense may have material limitations; | ||

| • | EBITDA and Adjusted EBITDA do not include provision for income taxes. Because the payment of income taxes is a necessary element of our costs, any measure that excludes income tax expense may have material limitations; | ||

| • | EBITDA and Adjusted EBITDA do not reflect capital expenditures or future requirements for capital expenditures or contractual commitments; | ||

| • | EBITDA and Adjusted EBITDA do not reflect changes in, or cash requirements for, working capital needs; and | ||

| • | EBITDA and Adjusted EBITDA do not allow us to analyze the effect of certain recurring and non-recurring items that may materially affect our net income or loss. |

The following table presents a reconciliation of EBITDA and Adjusted EBITDA to net income or loss, the most directly comparable GAAP financial measure, on a historical basis, as applicable, for each of the years indicated:

| Year Ended December 31, | ||||||||||||||||||||

| 2013 | 2012 | 2011 | 2010 | 2009 | ||||||||||||||||

| Reconciliation of EBITDA and Adjusted EBITDA to net income: | ||||||||||||||||||||

| Net Income (Loss): | $ | (1,971,045 | ) | $ | (4,430,672 | ) | $ | (3,506,290 | ) | $ | 2,101,064 | $ | (2,823,927 | ) | ||||||

| Additions / (Deductions): | ||||||||||||||||||||

| Interest Expense | 1,093,184 | 831,074 | 565,796 | 813,660 | 1,186,390 | |||||||||||||||

| Interest Expense – Related Party | 749,291 | 390,922 | — | 200 | 247,259 | |||||||||||||||

| Interest Expense – Amortization of Discount | 10,697 | — | — | 702,233 | 912,085 | |||||||||||||||

| Tax Expense (Benefit) | 69,522 | 92,060 | 182,269 | 163,408 | 126,984 | |||||||||||||||

| Depreciation | 453,827 | 539,487 | 556,409 | 481,894 | 478,785 | |||||||||||||||

| Amortization of Other Intangible Assets | 424,426 | 501,315 | 449,568 | 386,252 | 365,125 | |||||||||||||||

| EBITDA | $ | 829,902 | $ | (2,075,814 | ) | $ | (1,752,248 | ) | $ | 4,648,711 | $ | 492,701 | ||||||||

| Additions / (Deductions): | ||||||||||||||||||||

| Share Based Compensation (1) | 1,319,730 | 1,214,105 | 1,293,214 | 100,831 | 538,836 | |||||||||||||||

| Adjusted EBITDA | $ | 2,149,632 | $ | (861,709 | ) | $ | (459,034 | ) | $ | 4,749,542 | $ | 1,031,537 | ||||||||

(1) Represents non-cash share based compensation for the periods then ended. See Generally Note 19 – Share-Based Payment Arrangements of our Notes to Financial Statements included in our annual report on Form 10-K for the year ended December 31, 2013.

8

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations.

Management's Discussion and Analysis

of Financial Condition and Results of Operations for the Three-Year Period Ended December 31, 2013

Overview

This financial review presents our operating results for each of the three years in the period ended December 31, 2013, and our financial condition at December 31, 2013. Except for the historical information contained herein, the following discussion contains forward-looking statements which are subject to known and unknown risks, uncertainties and other factors that may cause our actual results to differ materially from those expressed or implied by such forward-looking statements. We discuss such risks, uncertainties and other factors throughout this report and specifically under Item 1A of Part I of this report, “Risk Factors.” In addition, the following review should be read in connection with the information presented in our financial statements and the related notes to our financial statements. We also include information below regarding our use of EBITDA and Adjusted EBITDA, which are non-GAAP financial measures of performance that have limitations and should not be considered as a substitute for net income or loss or cash provided by or used in operating activities. Refer to Part I, Item 1 – Business, Non-GAAP Financial Measures and Item 6 – Selected Financial Data for a complete discussion of our use of EBITDA and Adjusted EBITDA and a reconciliation to net income or loss for the periods presented. Refer to Note 1 – Summary of Significant Accounting Policies for further information regarding significant accounting policies and Note 20 – Business Segment Information in our financial statements listed under Item 15 of Part IV of this report for further information regarding our business segment structure. See also Note 1 in the notes to the financial statements listed under Item 15 of Part IV of this report for “Critical Accounting Policies”.

Overall Results of Operations

Sales

The following is a summary of sales for the years ending December 31:

| 2013 | 2012 | 2011 | ||||||||||

| Sales | $ | 71,176,971 | $ | 70,383,827 | $ | 86,219,712 | ||||||

Sales increased $793,144, or 1.1%, from 2012 to 2013, compared to a decrease of $15,835,885, or 18.4%, from 2011 to 2012. From 2012 to 2013, sales increased $2,209,166, or 3.8%, for our foams, and decreased $1,416,022, or 12.3%, for our coatings, due to higher demand for our foams attributed to cost conscious residential and commercial building owners transitioning from traditional fiberglass insulation to energy efficient SPF and lower demand for our coatings attributed to general market conditions, compared to a decrease of $12,721,151, or 17.8%, for our foams, and $3,114,734, or 21.3%, for our coatings, due to lower demand attributed to higher selling prices from 2011 to 2012. High and volatile energy prices continue to heighten the public’s interest for green building materials and sustainable energy solutions. Our AirTight SprayFoam division, which is a turn-key, equipment, startup, and training operation, provided additional market penetration for our foams, resulting in approximately $10.3 Million, $9.8Million, and $12.0 Million, in sales in 2013, 2012, and 2011, respectively. Pricing changes added approximately $1,037,468, $1,804,245 and $1,225,204 in sales, while sales volumes decreased approximately $244,324 and $14,031,631 and increased approximately $14,497,879, for 2013, 2012, and 2011, respectively.

Cost of Sales

Cost of sales decreased $1,260,811, or 2.2%, from 2012 to 2013, compared to a decrease of $13,628,546, or 19.2%, from 2011 to 2012. From 2012 to 2013, cost of sales increased $1,022,671, or 2.1%, for our foams, and decreased $2,283,482, or 24.5%, for our coatings, due primarily to an increase of $2,209,166, or 3.8%, in our foam sales, and a decrease of $1,416,022, or 12.3%, in our coatings sales. From 2011 to 2012, cost of sales decreased $10,707,610, or 18.2%, for our foams, and $2,920,936, or 23.9%, for our coatings, due primarily to decreases of $12,721,151, or 17.8%, and $3,114,734, or 21.3%, in our foam and coatings sales, respectively. We had a 13.5% decrease in freight costs and 1.6% increase in material costs from 2012 to 2013, compared to a 24.4% decrease in freight costs and 7.9% increase in material costs from 2011 to 2012. Freight costs decreased from 2011 through 2013 due to improved forecasting and planning methods and material costs increased due to higher prices charged by feedstock suppliers from 2011 through 2013.

Gross Profit

Gross profit increased $2,053,955, or 15.8%, from 2012 to 2013, primarily due to an increase of $2,209,166, or 3.8%, in foam sales from higher demand and a 13.5% decrease in freight costs, offset by a decrease of $1,416,022, or 12.3%, in coatings sales from lower demand and 1.6% increase in material costs, compared to a decrease of $2,207,339, or 14.5%, from 2011 to 2012, due to increases in raw material costs and sales volumes. Gross margin percentage increased 2.7% from 2012 to 2013 and increased 0.8% from 2011 to 2012 due to primarily decreased freight costs, and manufacturing efficiencies, offset by increased raw material costs.

Operating Expenses

Our total operating expenses are comprised of selling, general and administrative expenses, or SG&A, professional fees, depreciation, amortization of other intangible assets, and consulting fees. These total operating expenses decreased $647,179, or 4.0%, from 2012 to 2013, due to decreases of $1,119,477 for SG&A, $50,295 for depreciation, $76,889 for amortization of other intangible assets, and $37,997 for consulting fees, offset by an increase of $637,479 professional fees, compared to a decrease of $2,071,945, or 11.3%, from 2011 to 2012, due to decreases of $1,944,776 for SG&A, $165,141 for professional fees, and $72,052 for depreciation, offset by increases of $51,747 for amortization of other intangible assets and $58,277 for consulting fees.

9

SG&A decreased $1,119,477, or 7.7%, from 2012 to 2013, due to decreases of $62,674 for advertising, $301,136 for bad debts, $17,676 for insurances, $7,541 for investor relations, $272,932 for marketing and promotions, $666,380 for payroll and related employee benefits, and $60,522 for rents, offset by an increase of $13,385 for corporate office expenses, $122,676 for distribution, $15,907 for sales commissions, $105,625 for share based compensation, and $11,791 for travel and travel related services. The decrease of $62,674 in advertising was due to less utilization of print media, $272,932 in marketing and promotions was due to more streamlined programs with less give-a-ways, $301,136 in bad debts was due to increased use of credit insurance for bankruptcies and insolvencies, tightened credit policies, and more proactive collection procedures for accounts in default, and $666,380 in payroll and related employee benefits was primarily due to a freeze on general hiring and attrition. The increase of $122,676 in distribution was due to broadened use of public warehousing to penetrate target markets for quicker access to our products from customers, and $105,625 in share based compensation was due to the issuance of anti-dilution shares throughout the year due pursuant to an advisory and consulting agreement and an employee bonus. SG&A decreased $1,944,776, or 11.7%, from 2011 to 2012, due to decreases of $102,401 for advertising, $219,638 for bad debts, $429,378 for corporate office, $5,381 for distribution, $7,286 for investor relations, $77,623 for marketing and promotions, $613,710 for payroll and related employee benefits, $97,472 for rents, $205,023 for sales commissions, $79,110 for share based compensation, and $138,505 for travel and travel related services, offset by an increase of $30,752 for insurances. The decrease of $102,401 in advertising, $77,623 in marketing, and promotions, and $138,505 in travel and travel related services, was primarily due to more efficient management of those aspects of our business. The $219,638 decrease for bad debts related to increased use of credit insurance for bankruptcies and insolvencies, tightened credit procedures, and more aggressive collection procedures for defaulted accounts. The $429,378 decrease in corporate office expenses relates primarily to decreases of $49,023 in bank fees, $105,704 in corporate taxes, $67,168 in employee bonuses, $32,268 in utilities, $95,511 in miscellaneous expenses, $77,124 in temporary labor, offset by increases of $17,114 in collection fees, $46,074 in dues and subscriptions, and $28,852 in repairs and maintenance. The $613,710 decrease in payroll and related employee benefits was due to right sizing our workforce. The decrease of $97,472 in rents was due to the closing of the Georgia and Canada facilities based on the expansion of our Houston, Texas facility to handle the activities previously carried out in those facilities, including spray rig equipment and technical training operations. The $205,023 decrease in sales commissions was due to the 18.4% decrease in sales. The $79,110 decrease in share based compensation was due to a reduction in expensing of stock options and restricted stock awards to non-employee directors and consultants. The $30,752 increase in insurance relates to an increase in our insurance premiums.

Professional fees increased $637,479, or 145.3%, from 2012 to 2013, due primarily to litigation concerning some of our products and related insurance coverage, and enforcement of restrictive provisions in former employee agreements, compared to, a decrease of $165,141, or 27.3%, from 2011 to 2012, due to reductions in legal fees.

Depreciation expense decreased $50,295, or 22.4%, from 2012 to 2013, compared to, a decrease of $72,052, or 24.3%, from 2011 to 2012, due to reductions in depreciable assets.

Amortization of other intangible assets expense decreased $76,889, or 15.3%, from 2012 to 2013, due to full amortization of customer list and non-compete from a prior acquisition, compared to, an increase of $51,747, or 11.5%, from 2011 to 2012, due to a rise in product approvals and certifications.

Consulting fees decreased $37,997, or 7.4%, from 2012 to 2013, due to an overall reduction in outside consulting services, compared to, an increase of $58,277, or 12.8%, from 2011 to 2012, due to an advisory and consulting agreement entered into the first quarter of 2011.

Other Income (Expense)

Total other income (expense) is comprised of interest expense, interest expense – related party, interest expense – amortization of discount, (gain) or loss on derivative liability, (gain) or loss on extinguishment of debt, (gain) loss on sale of assets, and other, net. The total other income (expense) increased $241,507, or 21.7%, from 2012 to 2013, due to increases of $262,110 for interest expense, $358,369 for interest expense – related party, $10,697 for interest expense – amortization of discount, decreases of $23,206 in gain on derivative liability and $596 in gain on other income, net, and a loss of $22,131 on foreign currency, offset by an increase of $398,886 for gain on extinguishment of debt and $36,716 for gain on sales of assets, compared to, an increase of $788,988, or 243.2%, from 2011 to 2012, due to increases of $265,278 for interest expense, $390,922 for interest expense – related party, and decreases of $48,860 for gain on derivative liability, $34,900 for gain on sale of assets, $49,029 for gain on other, net.

Interest expense increased $262,110, or 31.5%, from 2012 to 2013, due to refinancing the Prior Enhanced Note and obtaining additional financing with the New Enhanced Note at the end of the second quarter of 2013, compared to, an increase of $265,278, or 46.9%, from 2011 to 2012, due to entering into a financing with Enhanced Capital at higher interest rates as a supplement to our existing bank financing.

Interest expense – related party increased $358,369, or 91.7%, from 2012 to 2013, of which $23,557 was for an increase in accrued interest in the note payable – related party between the Company and the Chairman of the Board for a full year of interest and $334,812 was for share based compensation classified as interest expense relating to restricted shares of common stock being issued to the Chairman of the Board in connection with his personal guarantees required from Enhanced Capital for refinancing the remaining balance on the Prior Enhanced Note and obtaining additional financing for working capital for the New Enhanced Note for the benefit of the Company, compared to, interest expense – related party totaling $390,922, from 2011 to 2012, of which $47,038 was accrued interest relating to the note payable – related party between the Company and Chairman of the Board which started at the beginning of the second quarter of 2013 and $343,884 was for share based compensation classified as interest expense relating to restricted shares of common stock issued to the Chairman of the Board in connection with his guaranty required from Enhanced Capital for financing supplemental to our existing bank financing for the benefit of the Company.

Interest expense – amortization of discount was $10,697, for 2013, due to the discount of $542,886 to be amortized over the term of the New Enhanced Note. There was no interest expense – amortization of discount in 2011 or 2012.

10

Gain on derivative liability decreased $23,206, or 26.1%, from 2012 to 2013, due to expiration of the underlying warrants at the end of the second quarter of 2013 giving rise to the derivative liability, compared to, a decrease of $48,860, or 35.5%, from 2011 to 2012, due primarily to the volatility in the Company's common stock in relation to the outstanding detachable warrants granted in connection with the Company's former replaced mezzanine styled debt instruments.

Gain on extinguishment of debt was $398,886, for 2013, due to the effective rate on the remaining balance of the Prior Enhanced Note refinanced during the fourth quarter of 2013 being higher than the New Enhanced Note. There was no gain on extinguishment of debt in 2011 or 2012.

Gain on sales of assets was $14,680, from 2012 to 2013, due to disposals of vehicles for more than book value, compared to, a loss on sales of assets, from 2011 to 2012, due to disposals of vehicles and equipment relating to closure of Canada facility at less than book value.

Other income, net decreased $22,727, from 2012 to 2013, due primarily to unfavorable Canadian foreign currency exchange fluctuations, compared to, $49,029, or 54.0%, from 2011 to 2012, due primarily to decreases in collection of finance charges related to extensions of credit on aged accounts receivable.

Net Income (Loss)

Net loss decreased $2,459,627 or 55.5%, from 2012 to 2013, due primarily to an increase of $2,053,955, or 15.8%, in gross profit, and a decrease of $1,119,477 or 7.7%, in SG&A, $50,295, or 22.4%, in depreciation, $76,889, or 15.3%, in amortization of other intangible assets, and $37,997, or 7.4%, in consulting fees, offset by an increase of $241,507, or 21.7%, in total other expense, and $637,479, or 145.3%, in professional fees, compared to, a net loss increase of $924,382, or 26.4%, from 2011 to 2012, due primarily to an increase of $788,988, or 243.2%, in total other expense, $51,747, or 11.5%, in amortization of other intangible assets, and $58,277, or 12.8%, in consulting fees, offset by a decrease of $2,207,339, or 14.5%, in gross profit, $1,944,776, or 11.7%, in SG&A, $165,141, or 27.3%, in professional fees, and $72,052, or 24.3%, in depreciation expense. Net loss per share decreased $0.02, or 50%, from 2012 to 2013, compared to, a decrease of $0.01, or 17.4%, from 2011 to 2012.

Results of Business Segments

The following is a summary of sales by segment for the years ending December 31:

| Segments | 2013 | 2012 | 2011 | |||||||||

| Foams | $ | 61,080,736 | $ | 58,871,570 | $ | 71,592,721 | ||||||

| Coatings | $ | 10,096,235 | $ | 11,512,257 | $ | 14,626,991 | ||||||

Foam Segment

Foam sales increased $2,209,166, or 3.8%, from 2012 to 2013, due to higher demand and selling prices, compared to, a decrease of $12,721,151, or 17.8%, from 2011 to 2012, due to decreased demand from higher selling prices. Foam equipment sales decreased $734,432, or 25.9%, from 2012 to 2013, due to competitive rig building factors, compared to, a decrease of $1,295,003, or 31.4%, from 2011 to 2012, due to lower demand. Foam cost of sales increased $1,022,671, or 2.1%, due to the increase in sales of $2,209,166, or 3.8% and 1.5% in raw material costs, from 2012 to 2013, compared to, a decrease of $10,707,610, or 18.2%, due to the decrease in sales of $12,721,151, or 17.8%, from 2011 to 2012. Foam gross profit increased $1,186,495, or 11.0%, from 2012 to 2013, due to increased sales of higher margin products and reduced expenses for freight and cost of sales from increased direct sales versus distribution sales, compared to, a decrease of $2,013,541, or 15.7%, from 2011 to 2012, due to lower sales volumes, offset by decreased freight costs. Foam gross margin percentage increased 1.3%, from 2012 to 2013, due primarily to increases in sales of higher margin products and purchasing power, compared to, a gross margin percentage increased 0.4%, from 2011 to 2012, due primarily to increases in selling prices. Foam segment profit increased $1,658,730 or 261.3%, from 2012 to 2013, due primarily to increases of $2,209,166, or 3.8%, in sales, and $1,186,495 or 11.0%, in gross profit, and a decrease of $472,235, or 4.7%, in segment operating costs, offset by an increase of $1,022,671, or 2.1%, in cost of sales due to higher sales volumes, compared to, a decrease of $1,070,778, or 62.8%, from 2011 to 2012, due primarily to decreases of $12,721,151, or 17.8%, in sales from lower demand, $10,707,610, or 18.2%, in cost of sales, $2,013,541, or 15.7%, in gross profit, offset by a decrease of $942,763, or 8.5%, in segment operating costs.

Coatings Segment

Coatings sales decreased $1,416,022, or 12.3%, from 2012 to 2013, due to decreased demand, compared to, a decrease of $3,114,734, or 21.3%, from 2011 to 2012, due to lower sales volumes from decreased demand. Coatings equipment sales decreased $48,111, or 100%, from 2012 to 2013, due to competition, compared to, a slight increase of $22,665, or 89.1%, from 2011 to 2012. Coatings cost of sales decreased $2,283,482, or 24.5%, from 2012 to 2013, due to the decrease in sales of $1,416,022, or 12.3%, and 1.9% increase in raw material costs, offset by decreases in freight costs, compared to, a decrease of $2,920,936, or 23.9%, from 2011 to 2012, due to the decrease in sales of $3,114,734, or 21.3%, offset by decreases in freight and raw materials costs. Coatings gross profit increased $867,460, or 39.6%, from 2012 to 2013, due to higher selling prices and a decrease in freight, offset by an increase in raw material costs, compared to, a decrease of $193,798, or 8.1%, from 2011 to 2012, due to higher selling prices and decreases in freight and raw material costs. Coatings gross margin percentage increased 11.3%, from 2012 to 2013, compared to, an increase of 2.7%, from 2011 to 2012, due primarily to higher selling prices. Coatings segment profit increased $1,260,832, or 642.8%, from 2012 to 2013, due primarily to higher selling prices, and a decrease of $393,372 or 19.7%, in segment operating costs, offset by lower raw material costs, compared to, an increase of $60,440, or 44.5%, from 2011 to 2012, due primarily to higher selling prices, lower raw material costs, and a decrease of $254,238, or 11.3%, in segment operating costs

11

Total Segments

Total segments sales increased $793,144, or 1.1%, from 2012 to 2013, due to an increase of $2,209,166, or 3.8%, in foam sales, offset by a decrease of $1,416,022, or 12.3%, in coatings sales, compared to, a decrease of $15,835,885, or 18.4%, from 2011 to 2012, due to decreases of $12,721,151, or 17.8%, in foams sales and $3,114,734, or 21.3%, in coatings sales. Total equipment sales decreased $782,543, or 27.2%, from 2012 to 2013, due to a decrease of $734,432, or 25.9%, in foam, and $48,111, or 100%, in coatings, compared to, a decrease of $1,272,338, or 30.7%, from 2011 to 2012, due to a decrease of $1,295,003, or 31.4%, in foams, and $22,665, or 89.1%, in coatings. Total cost of sales decreased $1,260,811, or 2.2%, from 2012 to 2013, due to a decrease of $2,283,482, or 24.5%, in coatings, offset by an increase of $1,022,671, or 2.1%, in foams, compared to, a decrease of $13,628,545, or 19.2%, from 2011 to 2012, due to a decrease of $10,707,610, or 18.2%, in foams, and $2,920,936, or 23.9%, in coatings. Total gross profits increased $2,053,955, or 15.8%, from 2012 to 2013, due to increases of $1,186,495, or 11.0%, in foam, and $867,460, or 39.6% in coatings, compared to, a decrease of $2,207,339, or 14.5%, from 2011 to 2012, due to decreases of $2,013,541, or 15.7%, in foam, and $193,798, or 8.1%, in coatings. Total gross margin percentage increased 2.7%, from 2012 to 2013, due to increases of 1.3% in foam, and 11.3% in coatings, compared to, an increases of 0.8%, from 2011 to 2012, due to increases of 0.4% in foam, and 2.7% in coatings. Total segments operating expenses decreased $865,607, or 7.1%, from 2012 to 2013, due to decreases of $472,235, or 4.7%, in foam, and $393,372 or 19.7%, in coatings, compared to, a decrease of $1,197,001, or 9.0%, from 2011 to 2012, due to decreases of $942,763, or 8.5%, in foam, and $254,238, or 11.3%, in coatings. Total segments profits increased $2,919,562, or 351.3%, from 2012 to 2013, due to increases of $1,658,730, or 261.3%, in foam, and $1,260,832, or 642.8%, in coatings, compared to, a decrease of $1,010,338, or 54.9%, from 2011 to 2012, due to a decrease of $1,070,778, or 62.8%, in foam, and an increase of $60,440, or 44.5%, in coatings.

Outlook for 2014

The Company’s outlook remains aggressive and positive, as we expect sales to continue to grow globally to record levels in 2014 and beyond. Our optimism is based on growing global consumer awareness about energy efficient foams and coatings and reductions in energy costs. The markets for our products are highly competitive; however, we believe that our competitive advantages are rooted in our management, product formulations, credentials, approvals, performance, pricing, and technical customer service. In addition, we offer the flexibility, quality of products and responsiveness that a smaller company dynamic can offer. This outlook is based on a number of assumptions relating to our business and operations which are subject to change, some of which are outside our control. A variation in our assumptions may result in a change in this outlook.

Liquidity and Capital Resources

We do not maintain any cash on hand by design. Instead, we maintain a $13 Million asset based bank financed Revolver Loan that includes an automatic cash sweep feature that identifies any cash available in our bank accounts at the end of a banking business day and then applies that cash to reduce our outstanding Revolver Loan balance for that day to fund our continuing operations. The reduction serves to decrease our daily interest expense to the extent cash is identified and swept over to reduce the Revolver Loan. Disbursements are paid daily by our bank from cash being made available under our Revolver Loan based on a borrowing base calculation prepared daily for funding. Cash available under our Revolver Loan based on the borrowing base calculation at December 31, 2013, 2012, and 2011, was $1,761,427, $224,720, and $1,246,443, respectively. On December 10, 2013, we borrowed $7.2 Million from two Enhanced Capital entities to refinance the remaining $3,346,762 balance outstanding on the Prior Enhanced Note and increase our working capital with the difference for the New Enhanced Note. Stockholders' Equity increased $63,564, or 5.3%, from 2012 to 2013, due to the increase of common stock par value $47,761 and additional paid in capital of $1,989,053 from issuances of restricted common stock to non-employee directors for share-based compensation and interest expense – related party, offset by the decrease of $2,460,453 from our comprehensive loss for the year, compared to, a decrease of $2,875,714, or 70.7%, from 2011 to 2012, due to the comprehensive loss of $4,433,703, offset by additions to common stock par value of $31,658 and additional paid in capital, net, of $1,526,330, from issuances of restricted common stock to non-employee directors for share-based compensation and interest expense – related party.

Management believes that the cash generated from operations and the Revolver Loan availability, subject to borrowing base limitations which may adversely impact our ability to raise capital, based on budgeted sales and expenses and implemented minimum sales margin and cost controls, are sufficient to fund operations, including capital expenditures, for the next 12 months. Notwithstanding the foregoing, we evaluate capital raising opportunities for private placements of debt or common or preferred stock from accredited sophisticated investors from time to time to not only gage market conditions but also to ensure additional capital is readily available to fund aggressive growth developments. If we raise additional capital from the sale of capital stock (except for permitted issuances) or debt (other than permitted indebtedness), we are required under the New Enhanced Note to prepay, including any prepayment penalty, the amount raised up to the amount outstanding under the New Enhanced Note as of the date of the closing of the transaction out of the net proceeds of the capital raised.